saveyourassetsfirst3 |

- gold and silver withstand another raid/gold and silver open interest continues to rise

- Consolidation or Correction?

- Global Macro Notes: Reversal of Fortune

- A Return to Normalcy?: ETF Pullback Choices

- Mark Lackey: Will Growth Hamper Gold?

- Bullish Sentiment in Gold Abates

- India Gold Imports Hit Record As "Price Is No Longer A Factor"

- WATCH: Goldnomics – Saving Sound Money

- Gold Manipulation? – Important Gold Chart - 1000 Days of Average Intraday Prices

- Silver: From $30/oz to over $500 by 2020

- Enron was Ethical Compared to Government

- This indicator could be pointing to another BIG gold rally

- India Gold Imports Hit Record As "Price Is No Longer A Factor"

- There Is No Getting Around Gold

- Our Stage Is Being Set For A Markets’ Blow-Off Top

- Bullish Sentiment in Gold Abates

- How will this affect gold price?

- Silver and the Precious Metals Clock?

- Shanghai Gold Premium Hits $23/Oz, China Opens 1 Million Gold-Savings Accounts

- Harry Schultz’s last testament Commentary: Letter gives final investment allocation recommendation

- The Gold Standard Manifesto

- Precious Metals and the Dollar’s Next Big Move

- Shock the Monkey

- Global Wealth Shifts as Asians Stock Up On Bad Debt

- Gold Manipulation? 1,000 Days of Intraday Prices

- The China Dilemma

- Metals Rise as Fundamentals Remain Supportive

- Updating Parabolic Gold Predictions

- California's largest - 100oz - gold nugget to go to auction

- US National Debt: The Missing Years

- A Closer Look at the “Mercenary Method”

- Gold Seeker Closing Report: Gold and Silver Rise For Third Straight Day

- Long Shadows Cast Over Us Economy

- Should You Resist Gold’s Charms?

| gold and silver withstand another raid/gold and silver open interest continues to rise Posted: 12 Jan 2038 10:35 AM PST |

| Posted: 13 Jan 2011 05:15 AM PST We have taken the last few days to watch developments in all the various charts, indices, ratios and the trading in the gold and silver futures markets. Like everyone else, we are trying to decide whether the early year profit taking will remain dominant or if demand will once again ramp higher and overwhelm it. Our instinct, which we shared with Vultures in last Sunday's full Got Gold Report, is that we are due for a corrective phase for gold and silver. But we have to admit that our confidence in that assessment is not absolute. It's yet another reason we Vultures use trading stops in our short-term positioning rather than attempting to divine market tops. ... |

| Global Macro Notes: Reversal of Fortune Posted: 13 Jan 2011 04:27 AM PST

The Japanese have a proverb: "the reverse side also has a reverse side." That saying comes to mind reviewing recent action in the $USD. As we noted last week, the dollar had registered an upside breakout from a multi-month channel, threatening to set the tone for the year with an early climb. But then the breakout quickly reversed itself, as the situation in Europe — for the umpteenth time — morphed in investor's minds from "code red" to "crisis averted, everything's super." Europe's spot of indigestion was enough for us to take half profits (at a pre-established target) in EUO, the ultrashort euro ETF. By the time the reversal hit, our trend management rules had raised the second half of the position to a breakeven stop. (All entries and exits documented via executing broker and the Live Feed archives.) To our way of thinking, the fickle nature of recent price action — reversals of reversals and so on — cements the value of establishing a half profit target (HPT) on swing trade positions. In addition to creating more "elbow room" for the second half of the trade — which we can always pyramid again later — the HPT more than occasionally lets us book profits on moves that fizzle out.

Speaking of fizzling out, gold and silver are acting like the dog that didn't bark. With the $USD in such a sharp reversal, one would imagine more signs of life from the precious metals. This lack of responsiveness does not look healthy. Best guess: A new sense of complacency as to top down risks (Europe kicking the can, China still "ok") makes gold once again blase — and silver might just be tired.

An area of the market with contrarian upside potential is 7-10 year treasuries (IEF). Bonds are catching a bid today (Thursday) in part with help from the Fed, with 7-year treasurys the focus of an $8.412 billion purchase (via WSJ). Mid-range treasurys have a contrarian appeal because, in addition to the constructive pattern, no one really expects them to go up. With oil strengthening, the $USD weakening, and grain prices hitting 30-month highs, the mentality is tilting back towards inflation. But in the event of an equity market stumble, or if earnings season falls flat, treasurys could benefit from a renewed flight to safety bid. And given the pronounced weakness in U.S. wages, coupled with the discretionary income hit born of rising food and energy prices, at least a handful of contrarian observers still feel deflation is the greater risk.

In overall market terms, the battle of bulls vs. bears has been a bit like Facebook vs. MySpace: Completely and utterly one-sided. The bulls have stimulating governments backing their play — the bears, mere appeals to logic and prudence. (Weak beer, that.) While we have found a few selective areas of the market to profitably short — like restaurants — the majority of gains in recent weeks have come, unsurprisingly, from the long side of the trading book. Four names in which we have booked partial profits and hold long trending positions are Owens Illinois (OI), Agrium (AGU), the Revere Natural Gas ETF (FCG), and Trina Solar (TSL). We continue to seek attractive long and short opportunities on an absolute basis, while keeping a keen watch for the unexpected. |

| A Return to Normalcy?: ETF Pullback Choices Posted: 13 Jan 2011 02:59 AM PST As followers of this weekly ETF Pullback strategy (see Appendix below for explanation and performance data) have seen, we’ve lately had quite a ride going back and forth between exposure to developing countries and precious metals. This week’s list has both, but adds a couple of areas we haven’t seen lately, U.S. sector stakes. Here’s this week’s list:

This is last week’s list: Complete Story » |

| Mark Lackey: Will Growth Hamper Gold? Posted: 13 Jan 2011 02:46 AM PST |

| Bullish Sentiment in Gold Abates Posted: 13 Jan 2011 02:29 AM PST Wall Street Cheat Sheet submits: By Jordan Roy-Byrne An upward sloping consolidation in Gold (NYSE:GLD) that began in October has, despite a lack of any real losses, been enough to improve various sentiment indicators. Complete Story » |

| India Gold Imports Hit Record As "Price Is No Longer A Factor" Posted: 13 Jan 2011 02:18 AM PST India Gold Imports Hit Record As "Price Is No Longer A Factor"  Submitted by Tyler Durden on 01/12/2011 10:39 -0500 All those who continue ridiculing gold, saying it has no utility, tend to forget one thing: it just happens to be the ultimate status symbol (especially for the nouveau riche). And who these days wants to demonstrate status (and has a lot of nouveau richness)? Why, the 2+ billion consumers who are benefiting from the biggest growth story in the world, i.e., China and India. According to the World Gold Council, gold demand in India in the last year reached a record. Per Bloomberg: "Purchases were about 800 metric tons, compared with 557 tons in 2009, Ajay Mitra, managing director for India and the Middle East at the producer-funded group, said today in a phone interview from Dubai." But how is that possible? After all gold prices surged in 2010 compared to 2009: is gold demand supposed to be inelastic? Surely you jest? Well, no: "Our assessment is demand will continue to be strong," [Mitra] said. "Price is no longer a factor."" Re-reading the bolded sentence a few times just may explain why PM distribution centers with actual physical inventories have suddenly become rarer than hen's teeth. From Bloomberg: Gold imports by India, the biggest bullion consumer, likely reached a record last year driven by investment demand, according to the World Gold Council.And that's just India. Next, throw China into the pot, mix, and let simmer... http://www.zerohedge.com/article/ind...-longer-factor |

| WATCH: Goldnomics – Saving Sound Money Posted: 13 Jan 2011 01:37 AM PST GoldNomics is an excellent must see short video about gold. It shows how gold has retained value throughout history and is an attractive alternative to cash today. Legendary investors, central banks and the astute are buying gold today. GoldNomics shows gold is an important safe haven asset and an essential investment and saving diversification in these uncertain times. The video was commissioned by GoldCore, the internationally respected investment specialist.

~TVR

|

| Gold Manipulation? – Important Gold Chart - 1000 Days of Average Intraday Prices Posted: 13 Jan 2011 01:33 AM PST gold.ie |

| Silver: From $30/oz to over $500 by 2020 Posted: 13 Jan 2011 12:44 AM PST |

| Enron was Ethical Compared to Government Posted: 13 Jan 2011 12:30 AM PST As we get nearer to the unavoidable Day of Reckoning, the State pulls out all stops to sell the fraud that we are improving/doing well/recovering/ or fill in your word of choice. There is no escape from an inevitable end that will likely produce a collapse of the dollar, the economy and the government. The [...] |

| This indicator could be pointing to another BIG gold rally Posted: 12 Jan 2011 11:53 PM PST By The Daily Crux: Well-known newsletter tracker Mark Hulbert is seeing some bullish signs in the gold market. Although gold has gone almost nowhere over the past few months – it's currently trading near the levels it was in late November – gold traders are about half as bullish as they were at that time. Hulbert says this is typically a bullish contrarian sign: "This is a textbook illustration of the kind of wall of worry bull markets like to climb." It normally takes a sharp correction to bring sentiment levels down from the levels of bullishness we saw late last year... But this time around, gold's "water-treading" action of the past few months appears to have done the job. Investors counting on a more significant pullback could be disappointed. Read full article... More on gold: This indicator could be pointing to a massive gold rally The long-awaited gold correction could be starting now Casey Research: Four big signs that it's time to sell your gold |

| India Gold Imports Hit Record As "Price Is No Longer A Factor" Posted: 12 Jan 2011 08:24 PM PST Image:  Today's first gold-related story is from Russian reader Alex Lvov...and it's a beauty. The zerohedge.com headline reads India Gold Imports Hit Record As "Price Is No Longer A Factor". This is a very short must read...and the link is here. |

| There Is No Getting Around Gold Posted: 12 Jan 2011 08:24 PM PST Image:  Lastly is this story that was posted over at gata.org yesterday...and I was only too happy to steal it for this column. It appeared in Forbes on January 11th...and the headline reads "There Is No Getting Around Gold". As the opening two sentences of this article state with stunning clarity: "Money has lacked a golden anchor for 40 years. It has proved a stupendous failure." Yes...it has. This short piece is a must read from one end to the other...and the link is read more |

| Our Stage Is Being Set For A Markets’ Blow-Off Top Posted: 12 Jan 2011 08:08 PM PST Bloomberg tells us big private equity firms are positioning their holdings for a massive number of IPO's to dump all their leveraged buyouts. This should blow a bubble in markets with a popping ending this fall. This unbridled leverage has to be absorbed while enduring very low interest rates as cash flow is eaten-up by structured interest and debts. This burden will be too great for the markets to manage particularly when Chopper Ben continues originating more notes, bonds, and bills out of thin air. Watch for QE's 2, 3, 4 with hopes of a five. He never makes it to number five; maybe not even through number four. Remember TARP was number one and we are now in number two. We see QE $500 Billion a quarter through fall followed by a late fall collapse in credit. Next, over the pond in Europe, futility runs rampant as central bankers continue to discuss with higher-pitched voices (no screams yet but getting there) whole new layers of debts using Euro-zone bonds. These have to be the height of unreasonable expectations as their true valuations are about five notches south of junk bonds. It is entirely possible Greece, Portugal, Ireland and Spain make an almost simultaneous cliff jump into sovereign debt default. With way too much debt and more unreasonable credit leverage backed by zero collateral, this has to be a death spiral. Germany had better run even faster to get away from this falling knife or, they go down with the zombie banks' notes, bonds bills, and vacant promises to pay. D-Day or Debt failure Day is nigh. These "Funny-Money" Euro-zone bonds are predicated on long term financial positioning and repayment. How can this happen with the highest labor costs in the world, no savings in many instances and an aging population? The stage is set in Europe for more expanded social violence. So far the riots have been mostly kids breaking windows and starting fires to protest losing all their free stuff. But as we mentioned in Trader Tracks last week, this is morphing into hardcore anarchists organizing and implementing nastier things. There were bombings and threats of worse offenses as these terrorists (as Obama's henchman Rham Emanuel used to say) "are taking advantage of a larger crisis." Bad economic times breed commies and criminals like rats. When an Obama aide whined pitifully that a congressional debt fight could be catastrophic it reminds us of the Henry (the TARP) Paulson incident lecturing us on systemic explosions if we didn't let him steal $700 Billion. Of course he did it but not until after he covered his derriere with legal paperwork exculpating hisself from 20 years in prison. With all of "Ol Hanks experience at Goldman Sachs, apparently his brass knows no limits. Taxpayer snatches become the prevalent norm as Hank wrote the book for his banker colleagues. Pension theft is next. The Achilles Heel on the expensively shod crooked bankers is the internet. This wild western tool of the masses is outing Elitist, crooked central and private bankers and their government henchmen throughout most western governments. The primary problem closing in on these money-grubbing dudes and dudettes is this; There is no where to hide. Mr. Internet has had a nasty habit of jumping-up into their lying faces at most inappropriate times. In the newspapers and radio-television media, watchdog editors kept a lid on this stuff. But, on the internet, the I-net open theory is let 'er rip and see where the bodies fall. Ask the Wiki-Leaks dude about this one; more ahead.

We are persuaded there will be no banker-regulator-justice except for a few insider trading scams, which are more easily proven within the system. The big fish, when they get caught play "Let's Make A Deal" as they cut-off a slice from their ill-gotten gains to pay-off their aggressors donating them a few pay-off millions while telling us 'We neither confirm nor deny.' Nice bribery-escape-work if you can get it. Just steal big and give some back. Our Kid Prez and his progressive gangsters will be in the proverbial corner when the GOP's hold their feet to the fire on passage of the national budget; now long overdue. If the Repub's cannot get the debt reductions they envision, it might be economic Tango-Time with opposition for both major cuts and lower debt ceilings. From our view, we think this one should be great theatre next month as the squirmers and squirmees do lots of wriggling offering vacant threats as their vocal smoke rises to new levels. Do you really care if we see gridlock, wasteful spending stalled and lobbyists' favorite money projects' blocked? We sure wouldn't as an empty Washington D.C. might actually improve things and limit more idiotic damages for awhile. China stocks were off -14% last year in response to the governments trying to curb inflation in real estate and other types of speculation. We think they are realistically doing a better management job than Obama as they seem to be making sincere efforts with currency and interest rates' controls. Sadly, this probably can't work as the fires of inflation escaped from the China barn after their version of TARP (An estimated $600 Billion) was shoveled into the Chinese system during the first quarter of 2010. Some money fires are just too big to put out. Western analysts are worried China could dump their USA paper ruining the biggest Bondo-Scam in the world. They are not stupid and do not intend to shoot themselves in the trading foot. Rather, they are off-loading this confetti by using it to buy real hard assets and other useful stuff with intrinsic value. Wal-Mart buys 90% of their goods from China for resale throughout the world. Yet, Wal-Mart's sales are purportedly off -10% (in USA?) and the stock has been stuck at $50-$55 bucks a share since Teddy Roosevelt took office. Since we are more of a trader personally, than a fundamental investor, we should touch the topic of market confidence. No, we are not talking about the confidence men in New York or Washington but rather the personal feelings of those putting hard-earned cash into trades and investments of several varieties. A review of the roaring 20's in America would be a very good example. The US escaped from a real depression lasting only 18 months in 1920-1921. The First World War was over, the tragic 1918 global flu epidemic that killed 20 million had subsided and our country was not physically wrecked in the conflict. Europe felt the brunt both economically and physically; and the rise of the Nazis in Germany was the later, subsequent result. So, with new inventions expanding like the Model T, employment at great levels, refrigerators, electric lights and the first 1920's insinuations of "Buying on Time" with bank credit; the stage was set for Happy Days are here again. The outcome was the sky's the limit. Consumers and corporations had a perpetual buying holiday that morphed into a rabid stock market with everyone from the paperboy to the store clerk buying stocks. This is called El Supremo Confidence. Unbridled euphoria went nuts and there was only one way for shares, traders, investments, booze and the great expansion…all of them went straight up. Then, they collectively went off a cliff. There is a limit to the top of the sky and it was found in the fall of 1929 as credit and confidence both puckered-up simultaneously. Yet, confidence while dented did not greatly diminish and the buyers were back again in the early 1930's as President Hoover proclaimed the mess had ended. Same big mistake is in process in 2011 again! Well it didn't go up and in 1934-1935 those back in stocks for round two got whacked the second time. Now the confidence balloon had burst, there was no bottom in sight, cash was dear and the psychology of panic had hit home. No more confidence. Miseries of the Dirty 30's were in full swing from 1934 to 1936 but some of the stock market diehards were actually back in for round three with whatever they had left only to be slammed once again in 1937 as the market cracked another -45%. Three strikes and you're out. Watch for a modern new day repeat in the next crash rounds of numbers two and three in our current debacle. Lehman was round one. This 1937-1938 market dump was the final straw for most as folks said they never wanted to hear the word stock ever again. Most didn't either until after WW II was over and the GI's came home to get married, buy new homes and go into the factories for real jobs. There are numerous arguments over the duration of the depression and the length of the stock market crash and recovery. For most, they got wiped out and the markets didn't get real again for nearly three decades. That will indeed spoil your retirement if you are on the wrong end of the age cycle stick. Our current time line is not encouraging either. Housing is dead for a decade and stocks and credit for?? We have no idea how "Bad is Bad" relative to what lies ahead in our very existence. However, I can pretty much predict the next few months based upon history, cycles, Obamamaniacs, big government spending and the pitiful economic condition of the US and our other trading partners. Global Depression is not a picnic and we have only to re-visit previous outcomes in similar situations for answers. The post Civil War recession-depression lasted over 20 years. This one lasts as long as the current debts remain alive and unacknowledged.

This one, from what I can tell, is shaping-up like 1907 to 1918 which gave us the Panic of 1907 (Lehman disaster of 2007-2008) and the decrepit economy from 1908 to 1914 followed by WW I. We would suggest consumers, traders and all the rest gird-up for inflation and tax battles in 2011-2013. When 2012 rolls around, most intelligent people would reject out of hand any idea of becoming President of the United States. However, the ever-fool-ego theory prevails and there will be more than one arrogant enough with egos the size of the Washington Monument who deep in their twisted minds and hearts actually believe they can resolve our first 200 year extreme disaster. Abe Lincoln whom I deeply admire had a very rough time keeping the Union together and solving problems thatmany felt were hopeless. The next Prez in 2012 must be superman or a super Dudette to get us out of this scrape. Finally, when things appear to be the worst and most all seems to be lost, those with nothing to lose will finally figure a way. I only hope deep in my heart that my beloved America can become the nation it once was. And, that the menace of those who wrecked this country can be blocked, eliminated or whatever. I long for a return of my America that pulled-up so many millions of folks not only in the USA, but throughout the world with our gracious influence. We have gotten-off the tracks in many respects. It will take the iron will of our citizens to regain our former glory. It will take an even stronger will to eliminate the severe problems that caused it. This posting includes an audio/video/photo media file: Download Now |

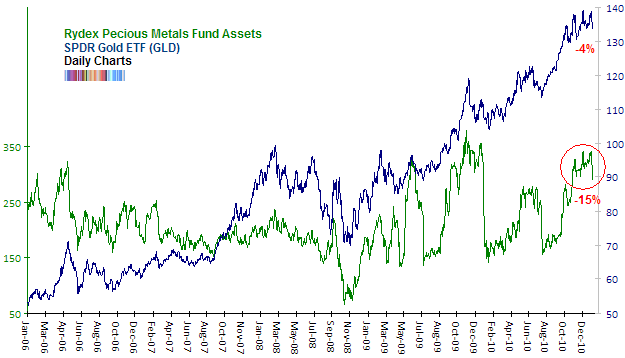

| Bullish Sentiment in Gold Abates Posted: 12 Jan 2011 06:33 PM PST An upward sloping consolidation in Gold that began in October has, despite a lack of any real losses, been enough to improve various sentiment indicators. Mark Hulbert of MarketWatch gives an update on his Gold sentiment indicator: Consider the average recommended gold market exposure among a subset of short-term gold market timers tracked by the Hulbert Financial Digest (as reflected by the Hulbert Gold Newsletter Sentiment Index, or HGNSI). This average currently stands at 33.6%, which means that the average short-term gold timer is allocating two-thirds of his or her gold-oriented portfolios to cash. Six weeks ago, in contrast, the HGNSI stood at 40.3%. A similar pattern to what we've experienced over the last six weeks is the declining bullishness witnessed since mid-September, some four months ago. At the time, with gold bullion trading below $1,300 — more than $100 below its current price — the HGNSI stood at 59.2%. That's nearly double where it stands today, despite bullion today being much higher. In other words, in the face of a four-month net increase in gold's price of over $100 per ounce, the average gold timer is today only slightly more than half as bullish. Babak (who is an excellent analyst of market sentiment) opines at TradersNarrative: The small correction (or more accurately, sideways consolidation) has actually provided wrung out a surprising amount of bullish sentiment. If we check in with the Rydex traders, we see that they have dramatically reduced their dedication to the precious metals sector:

The chart above compares the total assets of the sector fund (in millions) with the SPDR Gold ETF (GLD). The most recent correction is just the start of what is usually a much more protracted decline in assets. So far, we haven't seen a real abandonment of the sector from Rydex traders. On the plus side, the SPDR Gold ETF (GLD) is down about 4% from its recent high. In contrast, the total assets of the Rydex Precious Metals fund is down about 15% from its recent high. So we are seeing an asymmetrical reaction. But from a contrarian viewpoint that's just a good start. As well, the Bloomberg sentiment poll has also reacted to the fall in gold price. The bull ratio adjusted this week to 42% from more than double that the previous week. The last time it was lower was on December 17th 2010. Stealth Correction Finally, the COT data looks very healthy if you are a gold bull. During the sideways consolidation, commercial short positions (or speculative long positions) have decreased by 16% in the last three months while open interest has fallen 9% in the last two months. Although Gold has essentially failed to make a sustained new high in the last several months, sentiment indicators show a clear improvement from a contrary point of view. The speculators in the futures market have reduced their long positions, retail money has sold some and market timers are less bullish and only slightly bullish despite the fact that Gold is less than 5% off its high. Gold could be setting up for a big leg higher. What are the targets? How should you play it? Consider a free 14-day trial to our premium service. Our junior portfolio was up 86% in 2010 and we have new prospects who are potentially the big winners of 2011! Good Luck! Jordan Roy-Byrne, CMT Jordan@TheDailyGold.com TheDailyGold.com |

| How will this affect gold price? Posted: 12 Jan 2011 06:08 PM PST Any thoughts or feelings on how the move by China to make the yuan a global currency will affect gold prices? Article from Asian Wall Steet Journal as follows: New Move to Make Yuan a Global Currency (January 12, 2011) China has launched trading in its currency in the U.S. for the first time, an explicit endorsement by Beijing of the fast-growing market in the yuan and a significant step in the country's plan to foster global trading in its currency. The state-controlled Bank of China Ltd. is allowing customers to trade the yuan, also known as the renminbi, in the U.S., expanding the nascent offshore market for the currency which began last year in Hong Kong. China starts trading the yuan in the U.S., and a low-cost Indian carrier orders 180 jetliners from Airbus in a $15.6 billion deal. WSJ's Andrew LaVallee speaks to Heard on the Street Asia Editor Mohammed Hadi about these stories. The decision is the latest move by China to allow the yuan, whose value is still tightly controlled by the government, to become an international currency that can be used for trade and investment. "We're preparing for the day when renminbi becomes fully convertible," Li Xiaojing, general manager of Bank of China's New York branch, told The Wall Street Journal. He said the bank's goal is to become "the renminbi clearing center in America." Until the middle of last year, the buying and selling of yuan had largely been confined to mainland China by the country's strict capital controls. But in July, it opened the currency to trading in Hong Kong. Daily trading has since ballooned from zero to $400 million. Bank of China's move comes at a time of U.S. pressure on China to let its currency rise in value. America has blamed an unfairly valued yuan for exacerbating the U.S. trade deficit with China. But the preparations for convertibility are also a sign of Chinese strength, as China, now the world's second-largest national economy, recognizes that as a global power it must have a global currency. In time, a globally traded yuan could emerge as a store of value on par with the dollar, euro and yen. The decision comes ahead of next week's visit to Washington by Chinese President Hu Jintao, when China's exchange-rate policies are expected to once again be in the spotlight. While businesses and individuals in the U.S. can already trade yuan through Western banks such as HSBC Holdings PLC, the move by a Chinese-owned bank marks a stamp of approval by China on the expansion in yuan trading. Bank of China, which is 70%-owned by the government, now allows companies and individuals to buy and sell the Chinese currency through accounts with its U.S. branches. Bank of China limits the amount of yuan that can be converted by a U.S.-based individual customer to up to $4,000 a day. The restriction is designed to fend off speculation in the currency, bank officials say. But there is no limit, at least for now, on the amount that can be converted by businesses, so long as they are engaged in international trading. The bank has no restrictions on the ability by U.S.-based customers to convert the yuan back into dollars. The loosening of restrictions on trading yuan started in Hong Kong, a former British colony under Chinese sovereignty but with its own legal and financial systems. Anyone with a Hong Kong yuan account is now able to trade the currency. Bank of China's move could further open up the currency to trading and attract Chinese companies with offices in the U.S. "This is making yuan more accessible to individuals and corporations," says Robert Sinche, global head of foreign-exchange strategy at RBS Securities in Stamford, Conn. "But China has a long way to go before it has a fully convertible currency, and this is an inching step forward." Chinese regulators last month increased the number of exporters that can use the yuan to settle international transactions from a few hundred to nearly 70,000. Some analysts have predicted that it will be only a few years before 20% to 30% of China's $2.3 trillion in imports could be conducted in yuan rather than dollars. Today, less than 1% is done in yuan, according to London's Standard Chartered Bank. While offshore yuan trading has grown rapidly, it's still a fraction of the $4 trillion daily trading in currency markets world-wide and pales next to trading in the dollar, yen, euro and other currencies. Some skeptics say growth could be curtailed by new regulations announced by the Hong Kong Monetary Authority last month, which puts restrictions on banks' ability to offer yuan-related products in Hong Kong. Analysts say the regulations reflect China's interest in keeping speculators from betting on the yuan's movement and potentially causing disruptions to its economy. What Beijing is interested in, analysts say, is measured growth in yuan trading. Some experts caution that China could still back track. Nevertheless, some industry observers have called yuan trading outside mainland China a game-changer, as it is one step in allowing the yuan to ultimately float freely. For now, the offshore market acts as a parallel market and doesn't affect the official rate for the yuan set by Beijing. Bank of China officials say the bank will take into account both the onshore and the offshore yuan trading when setting the exchange rate of the currency for its customers in the U.S.. To trade yuan in the U.S. through Bank of China, a corporation or individual would need to open a yuan account with one of the bank's branches in New York or Los Angeles. An obstacle to the growth of the business, at least for now, is a lack of demand for the currency among American businesses, which by and large still use the dollar to settle cross-border transactions. McDonald's Corp. and Caterpillar Inc. recently became the first U.S. non-financial companies to sell debt priced in yuan in Hong Kong. Potential users of the yuan could be attracted to what some might see as a sure bet, since China has said it will continue to allow its currency to appreciate. However, there's still risk given the uncertainty over the pace of appreciation of the currency. Also, banks tend to charge relatively high service fees on yuan accounts. Mr. Li said the yuan business is "one of the top priorities" for Bank of China's U.S. operations. "We see bright future for the business," he said. The bank's Hong Kong subsidiary has been the sole clearing bank of renminbi banking business in Hong Kong for the past seven years. The yuan strengthened 3.3% against the dollar last year, as Beijing loosened its peg to the dollar during the summer amid increasing pressures from the U.S. and other trading partners to let its currency appreciate. The yuan's gains stalled after the Group of 20 meeting of the world major economies in November but have resumed as President Hu's visit to the U.S. approaches. Write to Lingling Wei at lingling.wei@wsj.com |

| Silver and the Precious Metals Clock? Posted: 12 Jan 2011 04:49 PM PST Hi all, I have been a follower of the board for quite some time but this is my first post. Maybe a year or so ago someone posted a link to a precious metals clock in association with the US debt clock: http://www.usdebtclock.org/gold-precious-metals.html I had bookmarked the page with the idea to keep an eye on silver reserves. As of 11/23/10 silver reserves were 8,863,870,095 and checking again were lower in December. However as of today 1/13/11 the clock is showing better than $14 billion but still rolling down. Can anyone tell me what gives? |

| Shanghai Gold Premium Hits $23/Oz, China Opens 1 Million Gold-Savings Accounts Posted: 12 Jan 2011 04:44 PM PST |

| Harry Schultz’s last testament Commentary: Letter gives final investment allocation recommendation Posted: 12 Jan 2011 04:14 PM PST NEW YORK (MarketWatch) — After 45 years, Harry Schultz has just published the last issue of his International Harry Schultz Letter. He's superbearish but opportunistic. Schultz, now 87, is one of the legendary characters of the investment letter industry: a hard-driving promoter who specialized in bold, radical high-concept stands. ( See Sept. 16, 2010 column.) I named him Letter of the Year in 2008, because he indisputably predicted the Crash (a "financial tsunami") although paradoxically failed to benefit very much. ( See Dec. 28, 2008 column.) But Schultz is also a trader, with a great respect for short-term trends. In this respect, if no other, he's like the Aden sisters, to whose Aden Forecast he will be contributing occasional columns. ( See Dec. 30, 2010 column.) The International Harry Schultz Letter has been something of a tsunami itself, with dozens of recommendations and opinions on an amazing range of subjects. Its relationship with the Hulbert Financial Digest's monitoring system has been complex and sometimes strained. But one thing is clear: In recent years, HSL has done brilliantly. It's the third-best performer over the last past 12 months, up 39.65% by Hulbert Financial Digest count, versus 17.16% for the dividend-reinvested Wilshire 5000 Total Stock Market Index. Over the past ten years, the letter was up an annualized 8.94%, versus 2.5% annualized for the total return Wilshire 5000. In his last issue, Schultz does not attempt a grand summing-up. But he does observe this: "Roughly speaking, the mess we are in is the worst since 17th century financial collapse. Comparisons with the 1930's are ludicrous. We've gone far beyond that. And, alas, the courage & political will to recognize the mess & act wisely to reverse gears, is absent in U.S. leadership, where the problems were hatched & where the rot is by far the deepest." He writes favorably of investment advice given in a recent interview by former Reagan Office of Management and Budget Director David Stockman: "Stockman replied (to my huge surprise, coming from a former top government official) 'Get some gold, beans, water, anything that Bernanke can't destroy. Ron Paul is right. We're entering a global monetary conflagration. If a sell-off of U.S. bonds starts, it will be an Armageddon.'" About gold, Schultz retains his long-term bullishness. He quotes the respected Seeking Alpha service: "For gold to match the growth in US M1, M2, public debt & budget deficit, gold will have to reach $1,800, $2,400, $7,800 & $13,200, respectively. While I can't imagine gold going to $13k, these numbers tell me that calling gold a bubble is a bit premature. In my view, money supply, public debt & the budget deficit are in a bubble, not gold, not yet." Schultz's comment: "Wake me up at $2,400 gold." But Schultz also retains short-term flexibility. Looking at a chart of iShares MSCI EAFE Index ETF (EFA 58.93, +1.27, +2.20%) , he notes: "It's a stock market index for Europe, Australasia and the Far East. Chart shows massive bullish base. If it breaks upside, these areas are where we should buy some new investments. Some modest pre-emptive buying in stocks there, having good chart patterns, is justified." Schultz's final investment allocation recommendation: • 5-10% Stocks (nongolds). • 15-20% Commodities: via futures, commodity stocks &/or physical assets. • 50% gold stocks & bullion: 15% blue chips, 5% junior, 5% bullion via futures, 25-35% in physical bullion. • 0% currencies ("Close out ALL fiduciary time/call deposits, money market funds & municipal bonds, pension funds…") • 1-5% Cash in hand. ("Stored privately.") • 0-5% bear stock market protection via ETFs like ProShares UltraShort Dow30 (DXD 20.06, -0.02, -0.10%) . • 15-20% Government notes/bills/bonds ("In 3-6 month T-Bills/bonds only — buy these only in Swiss Francs, Australian dollars, Canadian dollars, Brazilian reals, Singapore dollars, Chinese Yuan only)." Harry Schultz's final words: "Good luck to us all." |

| Posted: 12 Jan 2011 04:00 PM PST |

| Precious Metals and the Dollar’s Next Big Move Posted: 12 Jan 2011 03:19 PM PST There is a potentially big setup in precious metals sector along with the dollar which looks like its about to unfold. Since mid-October of last year gold started to show signs of distribution selling. Only a month later in November silver started warning us that some big players were taking some profits off the table also. Distribution selling is easy to spot on the charts. In short you will see heavy volume selling accompanied with strong moves to the downside. Now if we look at the US Dollar chart we see the exact opposite price action. We see sharp rallies during October and November of last year. It's normal to say that gold and silver move inverse to the Dollar so this price action makes perfect sense. The interesting thing with the US Dollar is that in Nov-December it rallied breaking through a key resistance level and has been consolidating above support ever since. If this bullish pattern (bull flag) plays out, then it's just a matter of time before the dollar makes another strong rally upwards, which will put downward pressure on stocks and commodities. Take a look at the charts below… US Dollar Daily Chart The 50 period moving average has provided key support/resistance levels for the previous trends and if it holds true going forward then we are not far from another rally in the dollar. Gold Futures Daily Chart Silver Futures Daily Chart Precious Metals and Dollar Trading Conclusion: |

| Posted: 12 Jan 2011 03:08 PM PST

Mercenary Links Roundup for Wednesday, Jan 12th (below the jump).

01-12 Wednesday

|

| Global Wealth Shifts as Asians Stock Up On Bad Debt Posted: 12 Jan 2011 10:54 AM PST Yesterday, we promised a new idea. Alert readers may have noticed - we didn't deliver. But when you have a new idea you don't just throw it out like small change. It requires a certain amount of preparation...a bit of fanfare...a drum roll and a countdown. The subject yesterday was European debt. The bond vigilantes came ashore in Portugal, attacking Portuguese government bonds. They seemed to be heading for the Spanish border. All over Europe, the cry went up: "Can anyone stop them?" It was as if the Huns were at the doors of Vienna...or the Moors were massed at the walls of Poitiers. Where is Charles Martel when you need him? The funny thing about yesterday's news was that Japan had come to Europe's aid. Following China's lead, Japan said it would lend the poor Europeans some money. What are these strange benefactors up to? Why would Japan - with the highest debt load in the world...and barely able to finance its own deficits - lend to Europeans? But the Asian rescuers are just exchanging bad US-dollar debt for bad European debt. They must figure that they are up to their eyeballs in American paper...might as well diversify into some Euro trash as well. The other thing it signals is more shift of wealth, from the West to the East. Asians are now creditors to Europeans and Americas. That's just the way it works. The old world goes into debt to the new world. America is part of the Old World now. The Asians will now be calling the shots. Which brings us closer to our idea. But hold on...one second, Dear Reader... Let's look at yesterday's financial news. The Dow rose 34 points. Gold rose $10. Nothing much to talk about. But check out these headlines from The Wall Street Journal: "Job openings fall in tough market," says one. "Downturn's ugly trademark," begins another. "Steep, lasting drop in US wages." Now just hold on a cotton-pickin' minute. What happened to the recovery? It did just as we said it would do - it vanished. The Great Correction began in 2007. It is now in its 5th year. But it's not over. Case-Shiller, the real estate analysts, now report a that the "double- dip" in housing is here. Prices are falling again in many areas. Prices at the consumer level are not exactly falling...but they're not rising much either. The official CPI is flat at barely 1% increase per year. This isn't much comfort to the average household - which has higher food and energy bills (not included in the core CPI reading) to pay. But the low figures show us that we're still in a Great Correction, not an inflationary recovery. And, there were fewer job postings in November than the month before. And here's the bad news: if you lose your job, a pox will be on your house for generations. No kidding. According to a study by a Columbia economist, you are likely to earn less in your next job, if you get one. Not only that, fast forward to 2030 and you're likely to still be earning less than colleagues who weren't laid off. But it gets worse. Your children are likely to earn less too...and heck, maybe even your grandchildren. The article mentions a manufacturing manager with two masters degrees. He was earning good money until he lost his job. Now he's sweeping floors. He's a janitor earning $9 an hour. What good are those two masters degrees? Apparently, no good at all. Another of the people spotlighted by the WSJ hopes to beat unemployment by going back to school. More degrees will lead to better job prospects, she thinks. She should read the article. It doesn't seem to work that way. More education may not pay off. Why? Again, we return to our new theme...our new idea. And now...more of our thoughts... There are some activities that are positive sum activities. That is, they are productive. They increase the total of real wealth in a society. There are other activities that are zero sum activities...or even negative sum activities. War, for example. Excess legal wrangling. Paperwork. Too much time spent in schools. Too much support for the unemployed, the malingerers and the loafers. These things decrease the total of real wealth in a society. Sometimes people are bright, honest and hardworking. Sometimes they are lazy, shiftless and cunning. They always prefer to get wealth and status by the easiest means possible. In some societies, the best way is by working hard. In others, it is by being clever...becoming a lawyer...a banker...or a government hack. A new society...or a fresh economy (such as one that has just been flattened by war or hyperinflation)...or a new model for an economy...is generally a wealth-creating society. A free society is also generally a wealth creating society. People do what they want. If they want wealth, they are free to create it. But as societies (or economies) age, they become decadent, arthritic, and backward-looking. They shift from wealth creating to wealth shuffling...and then to wealth destroying. They evolve into societies that are more concerned with redistributing wealth than with creating it...more focused on the appearance of wealth creation than with the real thing. People shift with their societies. When hard work and creativity pays off...they become hardworking and creative. When connections and corruption pays, they are up to the job. That is true in almost all aspects of the society. Education, for example. In a new or free society people turn to education because they want to learn useful skills...or for the pure love of learning and contemplation. In decadent societies they covet degrees and diplomas - often in such drivel as "communications" and "political science," not to mention "gender studies" - and count on the paper to get them a cushy job where they don't really have to do anything. Since everyone believes "education" is such a good thing, there is little resistance to further spending by government and parents - even though the threshold of declining marginal utility for this type of education may have been passed long ago. This is also true of military spending. A little military spending may be a good thing - it protects the society from outside predators. But "defense" spending soon becomes totemic. Eventually, the decadent state is realizing a net negative return. The private entrepreneur switches from producing work boots at a 10% margin to furnishing the Pentagon with combat boots at a 20% margin. Not only is the productive economy squeezed to support the defense establishment, the over-financed military itself increases the odds of attack by foreign powers...and decreases the real defensive position of the society. Then, of course, there is the government itself. As Jefferson pointed out, a little of it may be a "necessary evil," but a lot of it is unnecessary, expensive, and a nuisance. Government does not create wealth. Governments shuffle wealth and stymie it. So, the more government you have, the less wealth-creation you have. Right now, America is beginning a transition. It is an old, decadent society...headed for bankruptcy...and trying to find a new model. One of the elements of that new model is lower wages. People who thought they should earn $100,000 a year because they have a masters degree are finding that their services are really only worth $9 an hour. More generally, people in the advanced, decadent societies - who are accustomed to earning 10 times as much as a person in China, India or Brazil - look over their shoulders and see the foreigners gaining on them. Americans' real wages, for example, are likely to be stagnant or falling for many years. Meanwhile wages in emerging markets are likely to double every 10 years or so. The latest figures from the US show national income still increasing at about 1.5% per year. Nominally. Before inflation. Adjust for the increased cost of energy and food (both of which are moving up fast...some setting new record highs) and the real income of the typical family in the US is actually falling. Tomorrow, we'll talk about the role of the Federal Reserve...the banks...and the financial industry... Stay tuned. Regards, Bill Bonner. |

| Gold Manipulation? 1,000 Days of Intraday Prices Posted: 12 Jan 2011 10:00 AM PST Gold and silver have fallen by less than 1% in all major currencies today. Asian equities were mixed with strong selling seen in India and European equities and US index futures are tentatively higher. |

| Posted: 12 Jan 2011 10:00 AM PST In a problematic global economy, China is being cast as the ultimate Asian Tiger. It is seen as challenging America from a military standpoint and even, eventually, of challenging the dollar's tottering role as the world's reserve currency. China is not doing much to combat these perceptions. In fact, its leaders are trying to make the yuan more liquid. (See article excerpt above.) They are signing trade deals that facilitate yuan liquidity as well, most notably with Russia and Brazil. This is |

| Metals Rise as Fundamentals Remain Supportive Posted: 12 Jan 2011 10:00 AM PST Gold rose for a third day, adding $6.32, or 0.46%, to settle at $1,387.85. Prices continue to claw back from a key technical support area. Gold has essentially been range-bound for the last three months as the sizzling gains from 2010 are digested. |

| Updating Parabolic Gold Predictions Posted: 12 Jan 2011 10:00 AM PST More and more economists, analysts and financial writers, 122 in fact, have taken the bold step of projecting the price at which gold will achieve its parabolic peak |

| California's largest - 100oz - gold nugget to go to auction Posted: 12 Jan 2011 09:09 AM PST And the guy found it on his own land with a metal detector... some people just have all the luck! :grin10: http://www.csmonitor.com/USA/2011/01...et-up-for-sale R. |

| US National Debt: The Missing Years Posted: 12 Jan 2011 09:00 AM PST If you are one of those people whose eyes are bugging out in disbelief at the bullish action in the stock market and are wondering who in their right mind would be buying common equities at the same time as inflation is rising, bond yields are rising, food riots are breaking out, unemployment is rising to 22% (according to shadowstats.com), and 43 million people are on food stamps, I have the answer: The Federal Reserve, which created a huge $100 billion pile of new credit in December, and is promising another $100 billion per month for the next six months!! I will dispense with my usual loud and disrespectful denunciation of the Federal Reserve and all those half-witted "economists" who subscribe to their laughable neo-Keynesian econometric stupidity, which, as I recall, they refer to as Dynamic Stochastic General Equilibrium theory. Or maybe it's Stochastic Dynamic General Equilibrium theory. Or maybe it's General Dynamic Stochastic Equilibrium theory. Or maybe it's Dynamic Equilibrium General Stochastic theory, a confusion incandescently emblematic of its pure arrogance, its idiot-savant trappings and its complete, dismal failure, as you can witness first-hand by merely putting down that delicious bagful of cookies and looking around at the economy, or look at the first paragraph above, which will tell you the same thing. This rise in the stock market is, I figure, just the spillover from the federal government borrowing and immediately spending so much money (on track for $2 trillion this year), now that tax revenues are falling at the same time as the Social Security surplus has dried up, which is Especially Bad News (EBN) since the despicable Congresses have always treated Social Security payments as general revenue, mostly because the same despicable Congresses mandated that Social Security not be a "pay as you go" endeavor, but instead tax away much more money than was "needed" so that there money would "be there" in the future when the Baby Boomers started collecting Social Security! Hahaha! What a scam! So, Congress spent the excess SS money because there was nothing else they could do with the money. Nevertheless, ergo, now, general revenue is down! To be fair, the Social Security surplus has been declining for years as it approached this "zero point," which explains why the national debt has been rising so that the Congress can continually spend more and more money, despite declining Social Security money at hand, so that now, although not surprisingly (although alarmingly), the national debt is comfortably over a massive, titanic $14 trillion, and it has, since 2008, been increasing at the, again unsurprisingly, and again alarmingly, consistent rate of $1 trillion every 7 months! By contrast, from 2002 to 2008, it consistently took about 20 months to add a trillion dollars to the national debt. From 1995 to 2000, it took the entire 5 years to add another trillion dollars to the national debt. The more astute Junior Mogambo Ranger (JMR) has noticed that there is a 2-year period of time suspiciously missing, namely 2000 to 2002, sort of like that "missing time" last Wednesday night between when I "should" have been home versus when I actually "was" home, and about which my wife seems especially vexed and about which I don't remember a thing, which explains why I came home in a taxi and crawled unsteadily into the house, reeking of alcohol, cigarettes and, apparently, urine, and I have no idea where my freaking car is, either, so leave me alone already, for crying out loud! Well, this is where it gets interesting, because while we do not know what happened Wednesday, if anything, we know exactly what happened to the national debt. From 2000 until mid-2001, the national debt was actually in a go-nowhere, yet volatile, slight downtrend, which handily explains why the stock market collapsed in early 2000 and did not stop until 2003, after losing almost half its value. Of course, there are many other factors involved, and the strict relationship between national debt and the stock market seems a little stretched to those who are not firmly in the camp of the Suspicious And Cynical Mogambo (SACM), who sees this all as just a part of a vast Chaos Theory web of things and people interconnected to all things and people, with less than 6 Degrees of Separation, as indeed are all things connected to all other things, such as all this new money, which also explains why inflation over that time has been running at a terrifying rate of almost 7%!!! Yikes!!! The double set of triple exclamation points is Secret Mogambo Code (SMC) for "Buy gold, silver and armaments with ceaseless abandon, because otherwise We're Freaking Doomed (WFD)!" And with that kind of simplicity, what can you say but, "Whee! This investing stuff is easy!"? The Mogambo Guru US National Debt: The Missing Years originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| A Closer Look at the “Mercenary Method” Posted: 12 Jan 2011 08:01 AM PST

Signups will occur in three stages: First for beta testers; second for those who expressed email interest (which you can still do via livefeed@); and finally via open registration for remaining slots. In conjunction with that, we'll soon be introducing a Live Feed "tutorial," complete with screenshots and detailed descriptions of how it works. Then we'll unveil the first installments of the MT Driver's Manual, which will take explanation of our methodology and process to a whole new level. Given the above, it seems logical to shed a little more light on the "Mercenary Method"…

And by the way, just why are we doing all this? Because at the end of the day, it's a winning proposition all around. While the prodigious amounts of material we share may seem a gift, believe it or not, the greatest gift is to ourselves. There is no substitute for rigorously clarifying and articulating one's day to day decision-making processes, and having the incentive to do so via receptive audience of supportive fellow traders. George Soros attributed hundreds of millions of dollars worth of performance to his Alchemy of Finance public journal experiment, later joking that the true royalties from the project (in the form of trading profits) counted as the highest honorarium a book author has ever received. In sum, we feel the same way about what we do… Quant Value Core The core of the Mercenary Method is captured in our Integrated Macro Analysis (IMA) series. If you haven't read that yet, we urge you to absorb all three parts. Moving on from that starting point, we can dig in a little more. One way to describe the bread and butter of what we do is the "quantitative value approach." Value quants, as some call them, developed a computerized process for going long value and short growth, based on the proven observation that value consistently outperforms growth over extended periods time. Beginning in the late 1990s, perhaps the most famous and successful of these was Cliff Asness of AQR capital. To clarify, we do not claim to be full-blown quants by any stretch of the imagination. We are not nearly computerized enough for that. In our flexibility, we are also happy to buy "growth" – and we can even buy "garbage," just for a trade, under exactly the right conditions. But the concept of a long side bias towards high quality, strong cash flow, attractively or reasonably valued names – juxtaposed with a short bias against overhyped, overvalued, overextended growth names driven by inflated expectations – is a fair description of our general long / short orientation. By and large we agree with Bernard Baruch's view that "Bears can only make money if the bulls push up stocks to where they are overpriced and unsound." Couple that with a willingness to own quality names showing positive momentum and there you have it. "Best in Class" Balance From this starting point, and using the principles of horizontal & vertical exposure, we then proceed to find absolute longs and shorts within the context of a balanced portfolio. By "absolute" we mean that, for an idea to go in the portfolio long or short, it must stand on its own merits in terms of fundamentals, technicals, and sentiment. Nothing is chosen for hedging purposes only. Operationally speaking, on a day to day basis we regularly hunt for what our friend and colleague Peter Brandt calls "best in class" chart formations. First we use a combination of top down and bottom up analysis (i.e. the market tower) to identify various industry groups and themes that look attractive from either a bullish or bearish perspective. Then we closely monitor this dynamic universe of names via data screens, visual scans, and automated signaling tools to find new long and short setups day in and day out.

Last but not least – very important actually – we regularly monitor net exposure levels and make decisions as to new longs and shorts based on the total composition of the portfolio. In other words, new positions are not added in a vacuum. They are considered in the context of what we already have on, what our current net exposure levels are, what current profit levels are, and so on. And of course, we also maintain an ability to use macro-level instruments (such as ETFs, forex and futures) to express opinions on broad sweeping top down themes as well. The regular operation of the Mercenary portfolio has a "quant" feel in that, like the quant value guys, we have the ability to manage a significant number of positions (sometimes 20 or more). We can do this via the implementation of automated position management rules – not fully automated, but to enough of a degree that a large number of positions can be handled without issue. (We'll explain these rules in more detail in the upcoming MT Driver's Manual.) An area where we significantly differ from the quants, though, is in our discretionary ability to manipulate net exposure levels as we see fit — sometimes dramatically so. For example, a fully computerized quant value fund might have a mandate to maintain 20% net long exposure at all times, and only adjust that ratio on a monthly or quarterly basis. We are much more flexible and discretionary, in that our net exposure levels can run the gamut from 200% long, to 200% short, to perfectly balanced or anywhere in between. We feel this flexibility gives us an edge, and seasoned intuition plays a key role in utilizing it. (As George Goodman's money manager mentor expressed in classic southern drawl: "A good dawg is wonnerful for huntin', can't do without him, but you doan give the gun to the dawg.") Negative Carry Optionality

A negative carry trade is one in which risk is limited, but you pay a cost to keep the position on – typically in the form of time erosion, as with the purchase of long-dated puts or credit default swaps. The most spectacular gains of recent years were all driven by negative carry trades.

Some hedge funds actually set up special segregated accounts, specifically to implement negative carry trades oriented to a big macro level idea. "If China blows up in the next 24 years, you could see a 500% total return on your investment. If it doesn't, our defined downside risk is 18% per year," and so on. We are a little different. Negative carry trades are not our bread and butter, but we do have the willingness to implement them, on an opportunistic basis, after our bread and butter methodology has produced the accumulated profit reserves to justify doing so. So, for example: Let us say that, hypothetically, nine months into the trading year we are up 16% (or 1600 basis points). Then further say we have a very high level of conviction that, for a combination of reasons, a major market dislocation could occur in the final three months of the year. Given our flexibility, this scenario might allow us to take, say, 400 basis points (4%) of our accumulated annual profit and invest it in a negative carry trade – a structured options position with defined downside risk – that plays out over a 12 week time frame. If we are right as to our fourth quarter convictions, the negative carry trade could then offer the potential of a 7 to 1 return (as gains on positions like these are very high), creating the opportunity to score a +40% year without placing excessive capital at risk. We particularly favor negative carry optionality because we are simultaneously risk-savvy and risk-averse. To us the ideal profile is one in which you first cut off the left side of the distribution (i.e. losing money) as swiftly and cleanly as possible. Then, once a cushion of profits has been accrued, you pursue reward to risk profiles that allow for the possibility of turning a solid year into a fantastic year, without excessive capital loss (profit giveback) if your convictions do not pan out. Through our bread and butter method of seeking out "best in class" long / short opportunities, consistently adjusting for balance and net exposure levels, and with the ability to express macro level convictions through profit-funded negative carry trades, we feel we can compete with the best in the world at this game. And this entire process, complete with thought processes, daily trade setups, and real trade executions in real time, is shared with Mercenary community members via the Live Feed. Not Magic, But Process Of course, all forms of trading and investing involve risk of loss, and past performance is no guarantee of future results. And yet, for those skeptical of the possibility of earning 30-40% annual returns with an asymmetric volatility profile – deliberate volatility on the upside, sharply limited volatility on the downside – may we remind you of the legendary Stan Druckenmiller's 30% returns over 30 years (with no losing years). That type of performance does not grow on trees, but a meaningful universe of traders has produced it… some with even higher compound annual returns than 30%, born of a willingness to take on more calculated risk (and endure the occasional annual loss). The great science fiction writer Arthur C. Clarke once observed that "Any sufficiently advanced technology is indistinguishable from magic." We do not believe in magic, but we do believe in complex emergent phenomena and the ability of a finely tuned whole to be much more than the sum of its parts. And as far as ingenuity, creativity, and the power of prudently applied leverage in achieving "magical" results are concerned, the following youtube clip shows what a truly motivated individual can do: |

| Gold Seeker Closing Report: Gold and Silver Rise For Third Straight Day Posted: 12 Jan 2011 07:12 AM PST Gold saw a $2.45 gain at $1386.95 in Asia before it chopped its way back lower in London and early New York trade to as low as $1376.63 by a little after 10AM EST, but it then rallied back higher in the last few hours of trade and ended near its earlier high with a gain of 0.12%. Silver climbed $0.27 to $29.81 and fell to $29.372 before it also rallied back higher and ended with a gain of 0.03%. |