saveyourassetsfirst3 |

- Northern Tiger Attempts Gap Recovery - Hathor Drilling at Henday

- Plat breaks $1,800, Pal $800

- Should You Resist Gold’s Charms?

- Paper Currencies = Derivatives

- Will Growth Hamper Gold? - Mark Lackey

- Gold and Silvers Daily Review for January 12th, 2011

- update 12/01/2011

- Tiffany Sparkles, as Sales Rise

- Silver's Tactical Performance

- China Sets Stage for Vacuuming World's Silver

- FuelCell: A Forgotten Energy Technology

- Fear Subsides, Equity Prices Rise

- Bullion Demand Surges in Middle East and Asia - Gold Bar Shortage Sees Premiums Rise

- TOO SOON TO JUMP BACK IN

- Why gold could soar for another decade

- Porter Stansberry: You must prepare for a crisis NOW

- Global Economic Forecast

- China's first gold fund raises target $500 million

- Physical Gold Demand Exceeds Current Availability - Perth Mint

- Reserve Bank's gold sale cost us $5bn

- SILVER: What Happens When...

- John Williams Eyes Gold as Insurance Against Armageddon

- Gold & Silver Rise Again on "Robust" Asian Buying…

- Gold & USD. Tactics To Get Richer

- Why Silver Now?

- Perth Mint reports 'unrelenting' demand for gold on dip below $1,400

- The Falling Dollar And Debt Drives Gold And Silver

- Real Assets Preferred

- How to Get Trapped by Sovereign Debt

- The Biggest Resource Stories for 2011…and Beyond!

- The Benefits of Gold and Silver Not Lost on the Chinese Read more: The Benefits of Gold and Silver Not Lost on the Chinese http://dailyreckoning.com/the-benefits-of-gold-and-silver-not-lost-on-the-chinese/#ixzz1AmUB4Irf

- Silver and Gold Rally, But Still Aren’t in the “Mainstream” Read more: Silver and Gold Rally, But Still Aren’t in the “Mainstream” http://dailyreckoning.com/silver-and-gold-rally-but-still-arent-in-the-mainstream/#ixzz1AmT81LDF

- Cazenove’s Griffiths: “Not Owning Gold Is A Form Of Insanity And May Even Show Unhealthy Masochistic Tendencies”

- Precious Metals Enter a Higher Risk, Higher Return Potential Zone

- Gold and Honey

- Outlook 2011: Irreversible Upward Pressures

- Mainstream Hacks Deny Gold Fundamentals

- Hu's On First?

- Bullion Demand Surges in Middle East & Asia

- 10 Things That Would Be Different If The Federal Reserve Had Never Been Created

| Northern Tiger Attempts Gap Recovery - Hathor Drilling at Henday Posted: 12 Jan 2011 05:39 AM PST Vultures please log in and see in important new update in the Vulture Bargain section concerning NTR.V, HAT.V and FDC.V. To continue reading, login or click here to subscribe to a Got Gold Report Membership. | ||

| Posted: 12 Jan 2011 05:06 AM PST | ||

| Should You Resist Gold’s Charms? Posted: 12 Jan 2011 05:00 AM PST | ||

| Paper Currencies = Derivatives Posted: 12 Jan 2011 04:59 AM PST As the Wall Street Oligarchs move closer and closer to destroying the entire global financial system with their own greed-bloated casino (otherwise known as the derivatives market), this has had the unintended consequence of beginning to create awareness in the general public about what Warren Buffet dubbed "financial weapons of mass destruction". With the beginning of such awareness, it's now possible to discuss and explain how these paper instruments function – without immediately causing the eyes of most readers to glaze-over as they are overwhelmed with jargon. In their simplest form, "derivatives" are self-explanatory: they are financial instruments derived from something which exists in the real world. When Western bankers inflicted the derivatives market upon us, they billed it as a means to "increase liquidity and reduce risk". In fact, the bankers have used this totally opaque market to make the largest, most reckless bets in the history of humanity (i.e. to increase risk dramatically) – which is how this paper "bubble" has swollen to somewhere around the $1.5 quadrillion level (more than twenty times as large as the entire global economy). We can no longer attach precise numbers to this market, ever since the Bank for International Settlements changed its "definition" of this market – which magically shrunk it to 1/3rd its previous size, overnight. Of course with the BIS being nothing but a money-laundering institution to facilitate the bankers' involvement with the (illegal) drug-trade, it has never been a credible source for information. Previously, the BIS had always specialized in being a money-launderer for the (illegal) arms trade. This began with the creation of the BIS as a Western money-launderer to allow the U.S. to keep supplying Hitler with arms – after it was no longer "politically correct" to do so openly. Thus, we must take any/every "fact" presented to us by the BIS with an enormous "grain of salt". Prior to the BIS changing its definition, and during the Crash of '08, Wall Street banksters were steadily ramping-up their bets in this market. To suggest that such betting has dropped-off (after the supposed "U.S. economic recovery" began) totally lacks any plausibility. In short, the derivatives market is now nothing more than "the Mother of all Ponzi-schemes". It must implode, it will implode, and when it does, the banksters will simply get central banks to print-up $trillions in new "money" to "re-capitalize" themselves – with the "little people" being stuck with the bill. It is important to understand that the derivatives market is nothing but a huge scam, being deliberately pumped up further and further (until it bursts) in order for us to fully understand another one of the banksters "derivatives": paper currencies. | ||

| Will Growth Hamper Gold? - Mark Lackey Posted: 12 Jan 2011 04:59 AM PST The Gold Report submits: Has the U.S. economy turned the corner? Mark Lackey with Toronto-based financial services company Pope & Co. is forecasting modest growth and slight inflation. In this exclusive interview with The Gold Report, Mark explains why that shouldn't drive a continued correction in gold prices and shares some companies that are set to prosper—whether they've got an NI 43-101-compliant estimate or not. The Gold Report: Mark, when you worked for the Bank of Canada, you made regular forecasts on the U.S. economy. What is Pope & Co. expecting from the U.S. economy in 2011? Mark Lackey: We're expecting the gross domestic product in the second and third quarters to be in the 3% range with inflation around 1%. We're not looking for huge growth, but there could be some improvement in the labor market and in industrial production in a scenario with little inflation. Unlike some people who think deleveraging is going to continue and cause subpar growth in the U.S., we see potential growth of 2.5%–3.0%. That's not bad. Complete Story » | ||

| Gold and Silvers Daily Review for January 12th, 2011 Posted: 12 Jan 2011 04:53 AM PST | ||

| Posted: 12 Jan 2011 04:42 AM PST The model has adapted very well to the action in the USDX and the POG. We can clearly see the well defined triangle. Resistance and support can now be calculated to the dollar. *** Please consider a donation to keep the blog going! *** This posting includes an audio/video/photo media file: Download Now | ||

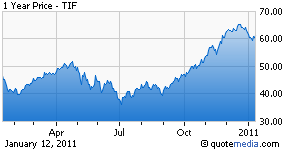

| Tiffany Sparkles, as Sales Rise Posted: 12 Jan 2011 04:09 AM PST Zacks.com submits:

Tiffany hinted that it witnessed robust sales of higher-end fine jewelry collections, diamond engagement rings and fashion gold jewelry during the holiday period of November and December 2010. However, the company did notify that it experienced limited sales growth in silver jewelry. Complete Story » | ||

| Posted: 12 Jan 2011 03:47 AM PST "Tactical performance" is a word we'll all have to grow accustomed to reading, as more and more weight of the markets is placed in the hands of investment managers or quick acting computer models. The best example of tactical performance was the first week of trading for the gold and silver markets, when there were numerous "tactical" changes to investment portfolios, as we just witnessed. Such reallocation (taking profits from winners, adding to undervalued losers) is big business, and fund managers like to make such portfolio revisions at a time most convenient: late December and early January. | ||

| China Sets Stage for Vacuuming World's Silver Posted: 12 Jan 2011 03:44 AM PST China's monetary policy is increasingly a main driver of gold and silver prices because so many Chinese can now afford metal investments and are willing to snap them up. Recently, though, China took one of the most aggressive steps to take control of the 2011 silver supply. This year, China anticipates it will allow its currency to advance some 5% against the dollar after previously allowing for only a 3.6% advance in 2010. Such a massive increase, many believe, could tip the metals scale. | ||

| FuelCell: A Forgotten Energy Technology Posted: 12 Jan 2011 03:26 AM PST Ian Wyatt submits: The concept of creating energy from nothing seems similar to the dream of Middle Age alchemists who tried to conjure up gold from thin air. Except for one thing - in the 21st Century, generating energy from non-fossil fuel sources is the real deal. Now there is wind power, solar power and other low-polluting ways to generate electricity - and all are important as demand for electric power puts pressure on the modern grid. The U.S. Energy Information Administration estimates that global electricity demand will reach 28.9 trillion kilowatt-hours by 2025, up from 18 trillion kWh in 2006. Complete Story » | ||

| Fear Subsides, Equity Prices Rise Posted: 12 Jan 2011 03:14 AM PST Calafia Beach Pundit submits: Yet again I post an update to this chart, which has captured quite well the underlying theme of the 2008-9 recession. The near-collapse of the global financial industry in late 2008 sent a tsunami of fear throughout the global financial markets and temporarily paralyzed global economies. Activity in many areas ground to a halt as consumers hoarded cash, institutional investors scrambled to sell risky assets, and everyone tried to deleverage. Fear was the common denominator, as captured by the Vix Index (the implied volatility of equity options), and it peaked in late October 2008. Equity prices continued declining, however, as new concerns were added, mainly the risk of a huge increase in future tax burdens caused by an unprecedented expansion of the federal government and a massive "stimulus" bill. The past two years have been all about the unwinding of fear and the scaling back of the concerns over future tax burdens. Money has been "de-hoarded" to some extent, retail sales have recovered to their previous high, the economy is 18 months into a recovery, jobs are being added, industrial production is expanding, capital spending is rising, and federal revenues are growing at a double-digit pace, the Vix Index is back down to 16, only marginally higher than one might expect it to be during "normal" times, and Congress has a new mandate to sharply curtail spending and avoid new taxes. We haven't made a full recovery yet, but it is clearly visible on the horizon. The S&P 500 is only 18% below its 2007 high, but the CBOE technology index has already surpassed its 2007 high by 13%, and consumer staple stocks are only a few inches below their all-time high. Complete Story » | ||

| Bullion Demand Surges in Middle East and Asia - Gold Bar Shortage Sees Premiums Rise Posted: 12 Jan 2011 01:24 AM PST | ||

| Posted: 11 Jan 2011 11:32 PM PST It's still too soon to jump back into the precious metals sector. Gold is now due for a yearly cycle correction. A correction of that degree should take gold down to $1300 or lower. Maybe even as low as the $1265 breakout level. February will mark the one year anniversary of the last yearly cycle low. So we are now deep in the timing band for that correction. Gold is now in a down trend so perhaps it is working its way down into that major cycle low now. In order to jump in front of that trend we either need to see something that looks like a major yearly cycle low OR we need to see the down trend reversed. As of last week gold had formed a weekly swing high. That swing has to be reversed before gold can continue higher. Barring a severe correction we would need to see the pattern of lower lows and lower highs reversed in the sector before it is safe to jump back in the pool. Patience is called for right now. Ideally we would see gold continue down into an obvious yearly cycle low. If that happens we will try to enter as close to the bottom as we can. Barring that the sector would have to break the pattern of lower lows and lower highs before we reload positions. This posting includes an audio/video/photo media file: Download Now | ||

| Why gold could soar for another decade Posted: 11 Jan 2011 11:27 PM PST From Resource Investor: Recently, I came across a clip from one of the business channels. The discussion was about "King Dollar" and gold. (The king dollar probably gives it away). Anyway, one of the guests quipped, "I'm on record that gold is a dumb trade. It is rising based on fear and confusion and when that subsides, the gold trade ends." First of all, gold has been rising for 10 years. It went down the 20 years prior. It is now in a structural bull market. This fact cannot be debated. There is no gold "trade" unless you are trying to make a few points next week or month. It is a bull market. Repeatedly, the mainstream news makes this mistake. Moreover, find me a gold bear that readily admits gold is in a bull market. You can't, because every bear refers to gold as... Read full article... More on gold: Jim Rogers: Don't buy gold now How to know when a gold correction is coming The No. 1 reason you must own gold and silver now | ||

| Porter Stansberry: You must prepare for a crisis NOW Posted: 11 Jan 2011 11:24 PM PST From Porter Stansberry in the S&A Digest: Ironically, the worsening crisis in Europe will give our own dollar a bit of a reprieve this year. In a crisis, investors will prefer the liquidity of short-term Treasurys to any other asset, including gold and silver. Look at the precious metals markets [last] week... The euro (FXE) fell almost 2% Wednesday. Silver (SLV) fell 7%. Gold (GLD) fell 4%. What went up? The U.S. dollar (UUP) rose 2%. Don't forget... in 2008, the dollar rallied tremendously. Gold and silver fell sharply. In a short-term panic, investors are still buying dollars, not gold or silver.  The collapse of the euro will cause all kinds of big problems this year and almost surely lead to a huge correction in commodities. Does that mean the U.S. dollar's problems are just a mirage? Nope. Sooner or later the U.S. will face a stark choice... If we let the euro fail, it will result in terrible short-term consequences. So the Fed will crank up the presses yet again. Quantitative easing 3 will be another $1 trillion effort, this time focused on buying European sovereign debt. The Fed must become the lender of last resort not only for the U.S., but for the world. That's the last step before its eventual collapse. After that point, people will no longer flee to Treasurys when a crisis erupts. They will flee to gold. What should you do about this? It's pretty simple. First, you should use the correction in silver and gold to stock up on physical bullion. Make sure you've got a year's living expenses (at least) in gold and silver bullion. Store a portion of it overseas. If you can, buy some real estate overseas. Look into getting a resident's permit or, even better, a foreign passport. If leaving isn't an option for you, then use this year to build some safeguards for yourself here. It could be buying a local farm... or maybe just planting a garden... or digging a well... or installing a big propane tank. Store a bit of food. Stockpile medicines. Buy a gun. Get some ammunition. Imagine what it would be like for you if the dollar wouldn't buy anything. Imagine what would happen if the 43 million Americans on food stamps couldn't eat. Plan your affairs accordingly. In regards to your portfolio, here's what I recommend, assuming you haven't done anything yet. First, research oil and gas companies. And research gold and silver companies. Research agricultural companies. You'll find this information in several of our publications, including my newsletter, Stansberry's Investment Advisory. Put together a wish list of companies that own the world's best trophy assets - food, energy, and sound money. Those are the key assets. There are others too, like transportation networks, refineries, key trans-shipment points. If the world's currencies collapse, what assets do you want to end up owning? That's the question to answer this year. Once you have made some good choices... wait. Wait? Yes. Wait. Wait for a correction. It will come this year. Wait for a crisis to buy. It will come. Wait for signs of massive volatility, like when the volatility index (VIX) - a key measure of fear in the market - shoots above 40 or 50. Wait for junk bonds to yield 15 or 20 percentage points more than U.S. Treasurys. It will happen. Just be patient. Then, go to your list of trophy assets/corporations. And get out of the U.S. dollar. By the time the big selloff in U.S. Treasurys has begun in earnest (let's say 18-24 months from now), you want to be 100% invested in gold and silver, high-quality short-term corporate debt, trophy equity, trophy real estate. But the key, as always, will be to move out of the dollar as it experiences the rare counter-cyclical rally - one of which is under way right now. Who will guide you in these trades? Who has the most experience on my staff for making these kinds of precision moves? Dr. David Eifrig. "Doc," as we call him, was a proprietary trader for Goldman Sachs and other top banks on Wall Street for more than a decade. Then, he went to med school. There isn't anyone smarter or more experienced available, perhaps anywhere. And you can get his expertise for a song. You don't have spend $100,000 on a hedge fund to use the same techniques. You just have to read Eifrig's trading service, Retirement Trader. It's specifically designed to bring you Wall Street's most sophisticated trading techniques. Don't you wonder how Goldman Sachs makes money on every trade it makes? Doc can show you. That's why 13 of the 13 positions he closed last year were winners. Yes, that's right. He made his readers money on every trade he closed. You may say to yourself, "I'm no trader. I'm an investor." And while that may normally work well for you, this year it won't. This year, you're going to have to deal with massive changes in the world's economies and markets. This year, you will have to be a trader to do well. And no one in the world is better to help you than Doc Eifrig. Try his service. It will make you money. But far more importantly, Doc will give you the tools and the knowledge you will need to prosper during this crisis. I would encourage everyone to read Doc's work. Crux Note: You can learn more about Doc's trading service here. More from Porter Stansberry: Porter Stansberry: This investment secret will change your life Porter Stansberry: One of the surest ways to make money this year Porter Stansberry: How I discovered the world's best money-making secret | ||

| Posted: 11 Jan 2011 08:52 PM PST Here is the reality of our economy, the global system and what we could see next. Even if Obama had not been elected and had not installed during the last two years of legislation, eventually the bond markets would have gone into overload as they are right now. The die was cast years ago when the Middle Eastern wars and other wild wasteful spending became the norm. It all began with the Lynden Johnson Administration and his wider net of spend thrift un-affordable social welfare programs. These keep coming. In our view, we lost our last chance for economic recovery after the Nasdaq crash in 2000 when Greenspan opened the money spigots to avoid a recession. Now, instead, we have a full blown depression that could continue for at least another 5-10 years depending upon when the next world war begins. We predict the war that starts in later 2012 or, early 2013 could be a 100-year game changer. On this Monday of January 3, 2011, we find it interesting that on Bloomberg there is now great media chortling and trumpeting of Obama moving toward Reaganomics. Say what? It's too late. This should have been the norm years ago. We are thinking Bill Clinton had a woodshed meeting with the kid and told him the facts of political and economic life and what happens next. All we're going to get is lots of mayhem and lack of leadership, which I find very frightening considering world affairs and our enemies sensing substantial immediate weakness in American will power and nerve. Considering the Kid is from the south side of Chicago, we would have expected he had more guts to make the tougher international moves for America. Instead, we got a Wuss Fence Walker.

Here is our formula for saving the global economic system led by America. This plan will not be implemented under any circumstances due to lack of political will. 1. Reduce and cut all state and national budgets by -10% immediately. 2. Reduce staff at all state and national government by -10% immediately and again by -10% for each of the following two years. This would be a total staff reduction of -30% over three years. 3. Review major divisions of federal government for wider and long lasting reductions. For example the Department of Agriculture would probably do just fine with 5,000 employees instead of 100,000. 4. Reduce all government salaries by -10% for both state and federal employees while freezing wages at that new lower level for five years. Or, keep them reduced until the depression is officially over. 5. Eliminate entirely, Obama's health care plan and all of Medicare and Medicaid. Get the US Government entirely out of any health care plans. States' rules should implement health care 6. All federal employees should be offered benefits similar to private industry and should be required to pay for them as well as into Social Security, retirement and other benefit plans remaining comparable to the S&P 500 corporations. 7. The Federal Reserve should be shut-down over a period of 3-5 years. The global banks should be fully audited by outside auditors to find all the bad stuff hidden in subsidiaries and in back rooms. 8. Fannie and Freddie should be bankrupted immediately to cancel all the bad housing loans. 9. FHA should continue as the last and only federal housing guarantor along with Farm Home Loan. All the others should be eliminated including anything related to commercial buildings. 10. The student loan program should be canceled on the federal level leaving this to private banks and local lenders. 11. The bond markets are going to crash and the bondholders should eat the losses; that means big global banks go insolvent as their stolen TARP money is in government paper. 12. Corporate USA income tax should be reduced from 35% to 15%. Then after three years reduced again to 10%. Gaming deductions should be eliminated. All companies should pay annual taxes on 10% of net income reported. No exceptions. 13. The personal citizen's income tax on the federal level should be reduced to a flat tax of 10%. It could be implemented on a sliding scale over three years. 14. All legislative earmarks should be eliminated 100%. The merits of a bill should stand alone on a straight up or down vote. 15. For ten years, for each new law put into effect, two more laws must be eliminated at that same time. 16. If the big global banks fail; too bad let 'em fail. The fall-out will be harsh for a short period but then the smaller lenders would take-up the slack letting the system return to normal. 17. Federal subsidies to agriculture, sugar and other commodities should end over a three year period. 18. The American military should pullout of the Middle East and be drastically reduced. It could be done without endangering our nation. The majority of the defense budget goes to super costly weapons enriching the defense contractors. In our view stationing our troops in over 100 countries is not affordable. We have other means to protect America and the interests of our allies. 19. The World Bank, IMF and the United Nations should be immediately disbanded. They have created havoc and mayhem all over the world. These are tools of central and private banker One-Worlder's. 20. And finally, the US Constitution and Bill of Rights should be the bedrock of America. Rules past, present and future should adhere to these documents first. States' rights should never be violated. Our borders should be protected with federal troops immediately. We do not need any more new laws or rules. We must dump the politically correct crap and return to the founding principles of this great nation of the United States. If we do not, and I expect the political nerve is lacking, then we pay the price for several years of turmoil and potential revolution at home and world-wide. Decisions made in the USA will direct the course of Asia and Europe as well as Latin America. The US Dollar remains the reserve currency for 85% of the world. This cannot change in the immediate future. The dollar will weaken longer term but we think it takes several months-years to do so. The first half of 2011 appears stock-market-excellent with serious negative questions about all markets being posed in the second half. This posting includes an audio/video/photo media file: Download Now | ||

| China's first gold fund raises target $500 million Posted: 11 Jan 2011 08:24 PM PST Image:  Here's another story filed from Singapore yesterday. It's a Reuters piece posted over at yahoo.com in the Philippines...and the headline reads "China's first gold fund raises target $500 million". China's Lion Fund Management, which last month launched the first gold fund in the world's biggest producer of the metal, has met its goal of raising $500 million for the fund, the company said in a statement. All this money will be invested in gold-backed exchange-traded funds on the global market. Look out for this fund. | ||

| Physical Gold Demand Exceeds Current Availability - Perth Mint Posted: 11 Jan 2011 08:24 PM PST Image:  To back up what Ben Davies said in that King World News story above...is this piece posted over at Dow Jones Commodities News and filed from Singapore yesterday. The headline reads "Physical Gold Demand Exceeds Current Availability - Perth Mint". "Demand for gold bullion has been unrelenting since gold's price dropped below $1,400 an ounce. We cannot meet all the enquiries that we are getting," said Nigel Moffatt, Treasurer of the Perth Mint, one of the world's largest gold refiners and distributors. Demand for our coins and me | ||

| Reserve Bank's gold sale cost us $5bn Posted: 11 Jan 2011 08:24 PM PST Image:  Here's a story from yesterday's edition of The Australian from Sydney...and it warms the cockles of my heart no end. The headline reads "Reserve Bank's gold sale cost us $5bn". The first sentence reads "The Reserve Bank [of Australia] sold most of the nation's gold reserves more than a decade ago because the board believed its price would remain flat." Like Prime Minister Gordon Brown of England [and their gold] before him, this was not the real reason for the sale at all. Back in those days, there had been a go | ||

| Posted: 11 Jan 2011 05:00 PM PST Road to Roota | ||

| John Williams Eyes Gold as Insurance Against Armageddon Posted: 11 Jan 2011 05:00 PM PST | ||

| Gold & Silver Rise Again on "Robust" Asian Buying… Posted: 11 Jan 2011 04:42 PM PST | ||

| Gold & USD. Tactics To Get Richer Posted: 11 Jan 2011 04:30 PM PST | ||

| Posted: 11 Jan 2011 02:30 PM PST Investment Score | ||

| Perth Mint reports 'unrelenting' demand for gold on dip below $1,400 Posted: 11 Jan 2011 02:21 PM PST

By James Campbell Dow Jones Newswires Tuesday, January 11, 2011 SINGAPORE -- Demand for gold bullion from Australia's Perth Mint has been unrelenting since gold's price dropped below $1,400 an ounce, a senior Mint official said Tuesday. "At the moment demand is such that we cannot meet all the enquiries that we are getting," said Nigel Moffatt, treasurer of the Perth Mint, one of the world's largest gold refiners and distributors. "Demand for our coins and medallions is strong, but the biggest demand is coming from banks and traders looking for kilo bars," he told Dow Jones Newswires. One-kilogram bars are the most popular trading instrument in Asia's physical market. Demand doesn't appear to be directly related to the upcoming Chinese Lunar New Year, with buying also coming from in from India, Moffatt said. "The way I see it at this point, it is because of the current correction in the price rather than anything else," he said. Spot gold has declined 3.1% since the start of 2011 to $1,376/oz during Asian trade Tuesday after hitting a low of $1,353/oz Friday. Moffatt said premiums for physical gold had "doubled" in the past week, but declined to provide any figures. Mitsui Global Precious Metals said in a report that gold was trading at premiums of up to $3 an ounce over the spot price in Hong Kong Monday | ||

| The Falling Dollar And Debt Drives Gold And Silver Posted: 11 Jan 2011 02:15 PM PST | ||

| Posted: 11 Jan 2011 02:11 PM PST --Before we get into today's regular reckoning, we again send our thoughts and prayers up to everyone in Queensland and New South Wales dealing with torrential rains and flooding. From all the staff here at the Daily Reckoning headquarters, we send our best wishes. Stay safe. --For readers outside Australia who are not familiar with the country's geography, Brisbane is a city of about 1 million Australians on the north east (Pacific) coast. It's about 2.5 hours north of Melbourne by airplane. Steady rains all summer have saturated the ground in Queensland. Heavy rains in the last 10 days have led to the flooding you see on TV. The flooding is expected to peak today and tomorrow as it hits Brisbane and its suburbs. --If you're from overseas and feel compelled to contribute to humanitarian or relief efforts, we suggest the Australian Red Cross. The Red Cross does relief work all over the world and will surely be on the scene in Queensland in the coming weeks. There will probably be more local relief efforts you can contribute to. And if you're affiliated with one or know about one, let us know and we'll pass it along (after making sure it's legitimate). --Since our beat here is finance and economics, let's take a look at the impact the flooding may have on the Australian economy and the world. Granted, it's not the most urgent story at the moment. But the flooding IS going to have an impact economically. What will it be? --You can see from the table below (via the Wall Street Journal) that Queensland accounts for a large percentage of Australian exports. In dollar terms, thermal and metallurgical coal are the two big bread winners. But it accounts for quite a bit of food production too, which you will probably notice in the coming weeks as the price of certain fruits and vegetables goes up in Australian stores.

--Australia is the world's top exporter of metallurgical coal (steel making, or coking coal) and the world's second largest exporter of thermal coal (power plants). Queensland exporters alone account for 60% of global seaborne coking coal exports. The Financial Times reports that the spot price for coking coal is now around $295 per tonne. That's a 30% premium to the quarterly contract price for coking coal. --Coal prices (both thermal and coking) have been trending up since the middle of last year. Thermal coal now sells for $140 per tonne, a 40% gain in the last twelve months. For Queensland right now, though, the biggest worry is not the reduced volume of thermal coal exports in the rest of this quarter. It's the supply of thermal coal for Queensland's own power plants. ---The Australian Financial Review reports that the floods could disrupt the supply of coal to the government's 1440 megawatt power station at Stanwell. The operators of the station say it usually has between 26–30 days of coal stockpiled just in case. However, thermal coal supplies to another power station at Swanbank might be affected after a landslide blocked the rail line that links the station with the coal mines that supply it. --These sorts of emergencies don't happen often. But when they do, it reminds you of how much we take modern, industrial-scale, coal-fired power for granted. The margin between convenience and emergency isn't that big, is it? Coal as a source of electric power is not going away any time soon. --Meanwhile, outside Australia, the disruption of coking coal exports is obviously going to drive prices higher. It should drive steel prices higher too. But will it drive Chinese steel production lower, leading to a dip in Chinese fixed-asset investment? Or will this spur the Chinese and others to look for non-Australian sources of high-quality coking coal? --Substitution happens when prices get too high. You can't make steal with mud. But you can find your coking coal somewhere else. This is the geographic kind of substitution. And politicians who take Australia's mineral wealth for granted and believe it can be the engine for infinite income redistribution should keep this in mind. --When it comes to individual companies and what to do about your investments, the Stock Doc-Diggers and Drillers editor Dr. Alex Cowie-is already on the case. And of course D&D readers will know that Alex tipped an Aussie-listed but African-based coal company last year. We'll let you know what he finds when we hear from him. --While the commodity story plays out here, the debt story plays out in Europe. As we mentioned earlier this week, Portugal is set to auction a heap of new government debt today. And the papers are full of stories about Portugal's impending bailout from its equally broke European neighbours. --What is the lesson? When a nation has unpayable debts, it seeks to "pay them" with currency debasement. This debasement leads to inflation. And if the debasement prompts repudiation of the currency by investors, it can lead to hyperinflation. Europe take note. America take note. Australians prepare. --Currency debasements have dietary consequences too. Algeria's government announced overnight that it was putting price controls and cutting prices on food staples. This came after big price increases for cooking oil and sugar. Reuter's has the full story. --You might wonder how the world's fourth-largest exporter of natural gas could have a food crisis. This is proof that the real crisis today is not that there isn't enough food in the world. It's that there are too many U.S. dollars. If you think there will be less of them in the future, think again. --The food crisis stems from the world's monetary crisis. And the world's monetary crisis stems from the fact that the U.S. dollar is losing its status as a world reserve currency because of the monetary and fiscal policies of the worst generation of American leadership in that country's history. --China knows this. Yesterday we learned that Chinese foreign exchange reserves—a huge part of which come from trade with the U.S.—are now just shy of $3 trillion. It was a 20% increase over last year. China makes. The world buys. --This creates an inflation problem for China domestically. It also creates pressure on China to revalue its currency and let it appreciate against other currencies. And just yesterday, various news outlets report that the Bank of China will begin allowing customers in New York to trade the Chinese currency. --"We're preparing for the day when remnimbi becomes fully convertible," said the New York branch manager Li Xiaojing. The first step to internationalising China's currency—so it can replace the dollar—is to let people trade it freely. This is one step closer to that. --But we're not there yet. And in the meantime, non-paper currencies like gold and silver and not financial assets like oil and energy are going to gain value against paper money. Floods, food crises, and debt crisis only highlight the distinction between financial and real assets. This is the year to migrate your wealth and definancialise your life. More on that tomorrow. Similar Posts: | ||

| How to Get Trapped by Sovereign Debt Posted: 11 Jan 2011 12:04 PM PST It's a new decade. Time for a new thought. A new idea. A new theme. When did we have our last new idea? Was it in this century? We can't remember. Fortunately, in the world of money the fewer ideas you have the better. Ideas are usually wrong. They are like mutations. Most are sterile. Dead ends. Most ideas are dead ends too. Because they are necessarily stupid. At any given time, both in past, present, and future, there are an infinite number of things going on. An idea is merely a way of understanding a little bit of them. You try to capture a part of what is going on...an important part, you hope, in a single metaphor. And you hope others will say: "Oh, that's what's going on!" But in order to put it into a containable, bounded thought...you have to ignore everything else. All the things that don't quite fit...all the things that make no sense...all the extraneous facts and circumstances. In fact, you have to ignore almost everything that is going on in order to focus on one idea that makes sense to you. Every idea is like a jealous mistress; she insists that you look only at her. As a result, you miss more than you see... But that doesn't stop us from having a good time with an idea from time to time. And we've got one today. We'll introduce it in a moment... First, let's take a look at the news. We begin by noticing that the English seem to have a better idea of what is going on in America than the Americans themselves. The London "Telegraph" reports:

And more thoughts... In the markets... The Dow fell 37 points yesterday. The price of gold rose $5. Nothing very important. The news this morning is dominated by Europe's debt woes. Portugal is the latest nation to suffer an attack by the bond vigilantes. Investors insist on 7% interest to fund Portugal's budget deficits. That's less than the 10% they want in exchange for lending to Greece, but it's 4% more than Germany pays. Most importantly, it's too much. Here's the problem with national debt. When you have too much of it, you're trapped. You can try austerity. You can try refinancing. You can try to "grow your way out." But at a certain level of debt, it's too late. You're already off the cliff. All you can do is fall. This is what happened to the Germans after WWI. The reparations demanded by France and Britain were so high that the Germans couldn't pay. And when they tried to pay, the outflow of capital so weakened their economy that they were even less able to pay. And imagine a bailout. The Chinese have come to rescue Portugal...and behind the Chinese stands the European bailout fund. But these friendly lenders are a menace. At the end of the operation, you're in worse shape than you were before. But maybe the bailouts give you time to "work your way out?" Possibly. But it depends on the circumstances. Greece, for example, owes an amount equal to 130% of GDP. All that debt has to be rolled over...often several times...before it could possibly be paid. Lenders want 10% interest to cover them against the risk of default. If all the debt carried a 10% coupon, it would take 13% of GDP to pay the interest alone. And if Greece could collect taxes at the same rate as in the US, it would take nearly 100% of all tax receipts just to keep up with the interest payments. Obviously, that wouldn't work. Greece is working its way INTO more debt, not out of it. The only way out is default, or "restructuring," to sugar coat the pill. And now the vigilantes have come ashore on the Iberian Peninsula. They are rampaging through Portugal. How long will it be before they cross the border into Spain? And then, into France? *** We met a friend for a drink last night. He's an American who has lived in Paris for twenty years. "I'm glad you're back here," he began. "There's no better place for an American to live than here in Paris. It's much better here than in the US. Almost everywhere in the US you have to get in your car and drive somewhere - to a mall - just to get a cup of coffee. That's no way to live. "It's much better here. Especially if you're an American. Because you can pretty much ignore all the nonsense that goes on here. If you're French, Paris isn't so much fun. French salaries, after all the social charges, are too low to enjoy it. Besides, the French have to know all the social codes and stick to them. But we can do what we want. They just dismiss us as crazy foreigners. And if you're French, you'll get all worked up about what goes on in the government or in your business. Running a business here is a nightmare. But I don't even read the local news. I've never paid any attention to what the government does. Why should I? I can't even vote here. "And if you're French you have to worry about the country going broke. There is no way they can continue to pay all those people who are retired. They seem to live forever...and they're very expensive. France is going broke. But it doesn't bother me... "Trouble is, America is going broke too." In terms of debt and deficits the country that most resembles France is the United States of America. Both are going broke. But so are many other "European" nations...and eventually, probably all of them. There are the nations of Europe. Then, there are the nations of Europeans - Argentina, Chile, Australia, New Zealand, Canada, and the US. The point is, most of them are going broke. Their model is exhausted. This was the social welfare model derived from Bismarck - take from workers; pay to non-workers. It was okay as long as the pool of workers was growing faster than the pool of non-workers. But that's no longer the case. Curiously, the nation furthest along on the road to bankruptcy is a non-European nation that picked up the model early, Japan. Already, there are more people retiring in Japan than there are people entering the workforce. Overall, the population is falling, while the number of people over 65 increases at 3% per year. In 1990, there were more than 4 people working for every retiree. Now there are barely two. Practically all the European nations, and all the nations lived in predominantly by people from Europe...as well as Japan...are headed down this dead-end road. *** We're back in Paris this week. What rotten weather! It is raining. It is cold. At 8AM it is still dark outside. So, we went for a cup of coffee at a café near the office. In one corner, a group of middle-aged men spoke a language we didn't recognize. At the bar, younger men were speaking in Arabic. A couple of Africans came in. They too were speaking in tongues we couldn't identify. Across from us was a red-haired man of about 35. We recognized him. He is the fellow who sits on the street all day. He doesn't beg. He doesn't talk. He doesn't even look; he spends the entire day staring at the sidewalk. He was the only other European in the café. A complete mad man. Regards, Bill Bonner. | ||

| The Biggest Resource Stories for 2011…and Beyond! Posted: 11 Jan 2011 12:04 PM PST I'm going to countdown three of 2010's biggest resource stories - not to reminisce about profitable investments from the year gone by, but to highlight what I believe will be very profitable investments in the year ahead... No. 3: The Continuing Gold Rush The gold price soared nearly 30% last year - punctuating a spectacular decade-long run that has seen the gold price quintuple! So has gold finally reach a "bubble phase?" Is the great gold bull market on its last legs? In a word, No! If gold is in a bubble, then it's one heck of a bubble. Not even the 2008, economy-wrecking market crash could pop it. Gold is not in a bubble; it's in a big bull market, plain and simple. As stories about quantitative easing and other forms of overt currency debasement crossed the newswires last year, investors became increasingly concerned about the value of the paper they call "wealth." Increasingly, these concerned investors have been shifting some of their wealth from paper to gold...and other hard assets. Plus, it's easier than ever to "own" gold (so to speak) via the rise of exchange-traded funds (ETFs) like SPDR Gold Trust (NYSE:GLD). With a click of your mouse, you can buy into the new gold rush - although in many respects it's better to buy real gold and take delivery, a point that I've made over and over. At the same time, the world's gold buyers are chasing declining mine output. That is, despite the rising price of gold, the world is likely past the point of Peak Gold output. All the output from new mines isn't replacing the decline in output from older mines. But demand is the main story in the gold market...demand for real money, not the paper kind. The monetary universe is changing in a fundamental way, with the price of gold serving as the barometer, thermometer and inclinometer. The cozy old economic order - post World War II, with the US dollar as the world's reserve currency - is passing away, and things won't ever go back to the long, lost "good old days." I've had endless discussions with skeptics about "why gold prices are rising." Of course, the skeptics can deny, up and down, the meaning of rising gold prices. But at the end of the day, investors and savers around the globe are becoming increasingly fearful of holding paper currencies. I won't even go into the monetary problems that national governments across the world are facing with fiat currencies. Just accept the fact that mankind's monetary default position is gold, and that's been the case for 5,000 years or more. Don't fight history. Here at Agora Financial, we've been recommending that readers buy gold since the late 1990s, when it was selling for under $300 per ounce. We still like it at $1,375 an ounce. When it comes to gold, there's one key idea to take into 2011: Gold is money. And gold makes better money than the government-issued kind. The big risk of owning currency and bonds is that any Tom, Dick & Harry - OK, the politicians and bankers - can create as much of it as they want. This year and next, your biggest risk is in not understanding that concept. No. 2: The Shale Gas Revolution Just a few years ago, the energy investment idea du jour was to build liquefied natural gas (LNG) terminals to handle future imports to the voracious US hydrocarbon market. Remember Cheniere Energy, once the darling of newsletter writers? Now there's talk of re-tooling some of America's LNG systems for the exportation of natural gas. Instead of bringing foreign gas to our shores, the newest idea is to liquefy natural gas in North America and export it to Europe and China. In terms of gas, the world has turned upside down. The world energy landscape has changed with new developments in extracting natural gas from shale beds and tight sands. Innovative extraction technologies have dramatically altered the economics of natural gas extraction in North America. South Africa's Sasol Corp., for example, is teaming up with Talisman (NYSE:TLM) to turn otherwise stranded gas into liquid fuel in northern British Columbia. It's a truly revolutionary process - a point that The New York Times made a few days after I mentioned this joint-venture to the subscribers of Outstanding Investments. Companies like Consol Energy (NYSE:CNX) and MarkWest Energy (NYSE:MWE) are also benefitting from US, Canadian and now global shale gas development. Even our friends the Chinese are coming to the US, to learn how we're cracking shale for gas, so they can duplicate the effort back in the Motherland. At the same time, the technology for freeing shale gas is finding its way into the oil patch, with companies like Venoco (NYSE:VQ) working to turn California's Monterey Shale into a vast new oil resource. There are a lot of hydrocarbon molecules out there. The trick is to harvest them. Forward-looking investors should not ignore the fact that shale gas development will provide enormous opportunities for the oil service guys, particularly Schlumberger (NYSE:SLB), Halliburton (NYSE:HAL) and Baker Hughes (NYSE:BHI). There's much more to come with the shale gas revolution. We're just in the early innings on this one. There's plenty of good investing ahead, and a lot of hydrocarbon molecules yet to be sucked out of the crust. No. 1: The Rare Earths Boom Rare earths are a group of exotic elements of the Periodic Table (Lanthanides, mostly), with unique electrical, magnetic, optical and other properties. Without them there's basically no clean tech, green tech, advanced electronics, electric cars, and much more. It's not that rare earths are geologically "rare." It's more that they're so darned hard to process in industrial quantities, and into high tolerance end products. That is, the end products are mostly in the nature of "designer molecules." Thus, doing the rare earths gig is far more than basic exploration, mining and crushing. Doing rare earths correctly involves being really good in chemistry and chemical engineering as well. There's nothing easy about it. The big rare earths story for 2010 was how an otherwise obscure sector of the mining and processing industry became a destination point for billions of dollars of new investment. As 2010 drew to a close, we were in a market mania, in some respects, with some rare earth stocks "melting up." The story was driven by China and its precipitous reductions in export quotas - front page news across the globe. You may have seen the statistic that China controls about 97% of the world's rare earths supply. Let's not quibble about the exact number - a few fractions one way or the other. And when China ratcheted down its rare earths quotas during 2010 - part of a long-range strategic industrial policy, I must add - it shook the Western world to its industrial foundations. It's all been a shock to the global trading system. This shock has produced some shockingly large gains in the shares of rare earth mining companies. A lot of these stocks have become very volatile and frothy. So caution is warranted. But the rare earth story is very real and very exciting. Don't miss this one! Regards, Byron King, Editor's Notes: Byron received his Juris Doctor from the University of Pittsburgh School of Law, was a cum laude graduate of Harvard University, served on the staff of the Chief of Naval Operations and as a field historian with the Navy. Our resident energy and oil expert, Byron is the editor of Outstanding Investments and Energy and Scarcity Investor. Similar Posts: | ||

| Posted: 11 Jan 2011 11:41 AM PST 01/11/11 Tampa, Florida – Junior Mogambo Ranger (JMR) Charles C. sent me a YouTube video of DrinkingWithBob talking about how New York is full of corrupt government crap that is eating New York – and this nation – alive, all of it paid for by bleeding the poor, who yesterday did not have enough money to get by, and today are worse off because they cannot pay the higher prices resulting from more government taxation and regulation to try to satisfy the idiotic leftist trash that has infested government and the schools, and who have made such a Gigantic Freaking Mess (GFM) of it all with their towering stupidity. Okay, he did not actually say that, but you get that impression when you hear the anger in his voice, highly reminiscent of a Mogambo Tirade Of Outrage (MTOO), in that he is yelling, "The truth is, we're freaking finished! The government has bankrupted this city, this state and this freaking country! Meanwhile, they keep freaking taxing us! "New York City is charging us for services they can no longer provide! It's like charging you to see a movie that they're not going to make! Or charging you to pay a toll to go over a bridge that doesn't freaking exist! It's ridiculous! It's freaking ridiculous!" he screams in his outrage. With a final exasperation, he looks into the camera and mockingly asks, "What's next? What's next? What's next?" Oddly enough, he answered his own question earlier in the video when he said, "Things are going to get a lot worse before they get a little bit better"! Apparently, Bob here doesn't know about how he ought to be getting gold, which means he is not reading Tyler Durden's work at zerohedge.com, who reports that "global assets barely generate enough cash to service global debt, let alone retire it," which means that "the only long-term outcome will be one of continued fiat devaluation and appreciation in hard currencies such as gold and silver." Apparently, this is not lost on the Chinese, as Bloomberg reports that "With 4 percent of the world's known gold reserves, China's mines may be exhausted within six years, the World Gold Council says." Part of the reason for this surprising playing-out of the mines may be the incredible increase in trade volume on the Shanghai Gold Exchange, which "surged 43 percent in the year to Oct. 31 from the same period in 2009." Looking ahead, the World Gold Council forecasts that China's "gold consumption may double in the next decade," which is an astonishing thing to say! The WGC is talking about doubling annual gold consumption in only ten years, which means a gigantic demand being satisfied by a relatively static supply, an astonishing mismatch that only "clear the market" if the price shoots up. And if the Chinese were really a smart bunch of dudes, they would be accumulating silver, too! Hell, in 1989, Ted Butler wrote to Dick Thornburgh, the Attorney General of the United States, that "In all of financial history, we have never witnessed, except in COMEX silver, a total short position that is greater than either total world stocks, total world annual production, or total world annual consumption." That was 21 years ago, and the situation is even more lopsidedly absurd today! Far, far more silver has been sold than even exists! How about THEM supply/demand mismatch apples? It is no wonder that I am known far and wide as a guy who disdains anyone NOT buying gold and silver, and who actually asks total strangers, "Are you buying gold and silver in response to the damnable Federal Reserve creating so much excess money that ruinous, catastrophic inflation in prices is guaranteed?" and if they answer, "No" then I yell at them and call them idiots, as in, "You are an idiot if you are not buying gold and silver because of the abominations of the Federal Reserve creating so much excess money, and that probably explains why you look so stupid!" So when I ask you if you have gold and silver, you better say, "Yes" or you know what I am going to say. And when you say, "yes, I have bought gold and silver" I will ask, "How was it?" Then you will say, "It was easy! Whee!" The Mogambo Guru | ||

| Posted: 11 Jan 2011 11:36 AM PST 01/11/11 St. Louis, Missouri – When I came in and turned on the currency screens, this morning, I saw that the Aussie dollar (AUD) has fallen about 1-cent overnight. Queensland flooding took a turn for the worse as parts of downtown Brisbane were evacuated overnight and rail freight operator QR National closed rail lines servicing mines northwest of Brisbane. Add to that the calls now for the Reserve Bank of Australia (RBA) to only raise rates 25 BPS in 2011, when it was previously thought that 50-75 Basis Points (1/2 to 3/4%) would be the call to charge for the RBA in 2011. I think this is just a knee-jerk reaction to worsening floods. Now… Add to that trading in the Aussie dollar, the calls from Brazilian Finance Minister Guido Mantega, who has said that he's "confident that the real's 2-year 37% currency rally is over." Let me tell you what this means, folks… If the Finance Minister (FM) thinks he can no longer lose money shorting his currency to weaken, then watch out, here comes the intervention like we've not seen before! And unless the markets want to take up the fight against the Brazilian government, then the end result will be a weaker real (BRL) versus the dollar. Up to now, the markets have played along with the Brazilian government… And why not? The markets have far deeper pockets to fight a central bank, especially the Brazilian Central Bank, for it's not like going up against Japan or China! And let's not forget that Brazil enjoys a very nice wide and positive yield differential versus the world… So, to keep up with the Joneses, or whatever you want to call it… Japan has announced that they too (like China) will buy Eurozone periphery country debt. This news allowed the euro (EUR) to gain versus the dollar to near 1.30… But soon that euphoria had cold water thrown on it, as Japan announced that they would use their current stock of euros in reserve to buy the bonds, instead of buying euros to purchase the bonds. So, it's a bittersweet announcement for the euro… Yes, another deep pocket investors has lined up to buy their beleaguered periphery countries' bonds, but, no new euros will be bought in the transaction… And with that, the euro quickly dropped 1/2-cent. Yesterday's price action in euros was interesting (to me, that is)… The single unit did slip below 1.29 briefly, but quickly recovered back above the 1.29 figure… So I sat here thinking to myself… Could 1.29 be a "base" for the euro? Hmmm… I guess we'll have to wait-n-see… I'm not getting that strong of a feeling about it here, like I did last year, when the euro was falling through the 1.20s and I said that 1.19 would be the low… (It did get to 1.1877 before turning around in June)… But… If we see more of this bouncing off 1.29, we could very well be seeing the euro's resistance line. Next up to the debt problem plate, batting third, is Portugal… Yes, now the markets have shifted their attention to Portugal's problems… The good thing here, is that eventually there will be no more European periphery country's to bash! So… Tomorrow, Portugal is planning a 10-year bond auction… This seems to be the trip-wire for these periphery countries, as Greece had to be bailed out 17-days after their failed 10-year bond auction last winter, and I don't think Ireland got the chance to issue bonds before they were bailed out. What's bad for Portugal is good for gold and silver, though. These precious metals are up this morning of the first time in a few days. Gold is up $6, and silver is up 28-cents. Speaking of silver… Did you happen to see the price and liquidity warning on the Bullionvault.com website? Here's a snippet… Our inbound silver deliveries have been delayed. We only sell bullion which is physically under our control, so we find ourselves currently unable to offer silver on our own market. Naturally, the market remains open for all our customers to quote their own prices; but as we ourselves currently have no silver to offer, there is a tendency to higher prices for both buyers and sellers. Buyers are advised to be appropriately cautious when confirming their order's limit price. We are advised silver be delivered on Tuesday 11th Jan 2011. Now… I know that Tuesday January 11th is today…and this warning is a couple of days old. But, isn't that the kind of news that a bullion bank that is short silver would NOT want to be hearing? Yes, siree Bob! You got that right! Because the demand for the metal must be HUGE to have caused a supply problem… And… It's the type of information that should send silver flying to the moon! But… Mysteriously, here we are, with silver not even starting its engines for the at flight to the moon. Every interview I do regarding gold and silver, I tell the interviewer that I don't have to guess at demand for metals, I can see it right on my trading desk, as the metals traders sit right next to me! The demand for physical gold and silver is crazy! However, gold and silver are not "mainstream" yet, which puts a lot of weight behind my thought that these two are not even close to a top. That's right… At your next cocktail party, or quilting get-together, ask to see a show of hands of those who own gold or silver… And not the ETF! You can't get gold and silver out of an ETF! I'm talking about physical metals! So… I see where the 10-year Treasury yield is back down to 3.29%… Still quite higher than the 2.63% we saw on November 11, 2010… I'm sure that this backing off of the 10-year Treasury's yield has something to do with QE2 (the second round of quantitative easing)… And if the bond vigilantes are really involved here, then one would expect the 10-year yield to rebound higher from here. If the bond vigilantes are not really involved here, then the thought that the Treasury Bubble was about to be popped will not come to fruition at this time. The US data cupboard is pretty barren today, with only the ABC Consumer Confidence report, which is a much smaller version of the actual Conference Board's Consumer Confidence… Tomorrow, we get the ball rolling with some real meat/data… The Monthly Budget Statement/Deficit will print, along with the Fed's Beige Book… Then on Thursday, the trade deficit for November prints along with PPI… So, a boring data day today, but we heat up as the week goes on. So… Once again, the president does his best to tick off our strongest ally (the UK)… Yesterday, President Obama called France "the US's strongest ally"… Now… I don't care about these little ditties to build up relationships, etc. I just found the statement to be a slap in the face to the UK…especially in the face of public statements that French President Sarkozy has made about the US and the way we're going about dealing with our financial mess. But, the real kicker with Sarkozy is his call to lessen the dollar's role as the reserve currency of the world… (And we buddy up with the guy?) That reminds me of the origin of the dollar's problems, besides the creation of the Federal Reserve in 1913… And that is when it was removed from the Bretton Woods Agreement, and was no longer backed by gold… If my memory serves me correctly, it was a Frenchman who pushed the envelope on getting the gold window closed back in August of 1971… That's right! The French President, Charles de Gaulle, called the US's bluff that they had enough gold in their vaults to back the debts they had racked up from the Vietnam War, and Johnson's "great society"… So, here we are 40 years later, and another French President is talking about lessening the dollar's role as the reserve currency of the world… Hmmm… Now there's lots of food for thought today, eh? Then there was this, in The Economist… China can be expected to pull ahead of the US as the world's biggest economy within 10 years, possibly as soon as 2019. Much of the hand-wringing about this historic shift is over matters of little importance. China can overtake America without any loss in American living standards, and a larger Chinese market should be quite good for developed nation economies. Hmmm… I don't agree with The Economist here, because if China takes over as the world's biggest economy they'll also have the reserve currency, and THAT WILL BE A LOSS OF AMERICAN LIVING STANDARDS! To recap… The dollar rally continues, but more against the Aussie dollar and Brazilian real this morning than the euro, as the euro has gained some strength overnight from a story that the Japanese will join China in buying Eurozone periphery country debt. Gold and silver are up this morning for the first time in over a week, as Portugal is due to auction 10-year bonds, which could be the harbinger of a bailout for Portugal. Chuck Butler | ||

| Posted: 11 Jan 2011 10:52 AM PST  Whoever said CNBC does not have good content – the biased station's European division actually has some very informed and interesting guests. Of particular note is yesterday's interview with Cazenove's technical strategist Robin Griffiths. And while the chartist tends to not be too happy with the recent stock market action (who is), the most notable item on the docket was Griffiths discussion of gold. And it was quite memorable: "I think not owning gold is a form of insanity, it may even show unhealthy masochistic tendencies, which might need medical attention. Real assets hedge paper money being printed into oblivion, so you've got to own gold and you've got to own other commodity-related investments still. Gold is far from being an overowned trade at the moment, far, far from it. Although it's been a top performer for each of the last ten years, it's still in a linear trend. Eventually it will go exponential and make more in the last little bit than the whole of the ten year trend." That pretty much covers it. | ||

| Precious Metals Enter a Higher Risk, Higher Return Potential Zone Posted: 11 Jan 2011 10:00 AM PST

This essay is based on the Premium Update posted on January 7th, 2011 2011 is sure to be a critical year for gold with several analysts predicting an end of the bull market. It may sound very strange, but it appears that the USD Index has been leading the way for precious metals and suggests higher prices are likely to be seen soon. The general stock market may enter a consolidation phase in the near-term but has had little influence on gold, silver and mining stocks recently. Recent declines in precious metals prices have been clearly seen from a short-term point of view. This may appear scary to some. Note, however, that if price declines are short lived, this means little to speculative long positions. Also, please keep in mind that in the past none of the major upswings ended in a consolidation pattern, which makes it less likely that the rally is completely over now. The long-term USD Index chart shows that the index level is currently above the declining resistance line. The consolidation has already taken place – in the 79 – 81 range, it is likely that index levels will continue to move up from where they are today – most likely to the area marked with red ellipse on the above chart. The short-term USD Index chart is perhaps the most important chart in this essay. Before moving on to the most important observation above, let's take a moment to study the cyclical turning points as they have worked almost perfectly. The recent local bottom is seen to be precisely aligned with the vertical black cyclical turning point line above. The main point here is the USD influence on precious metals. While it is not visible in the direct way (consequently the Correlation Matrix does not reflect that), the USD Index appears to be leading precious metals. The markets are moving in the same direction although the turnaround is slightly sooner in the USD Index. In early October, a bottom was seen and gold and silver bottomed as well. The dollar and precious metals declined in late October into early November and then rallied. Tops were reached a bit later followed by a quick decline in the USD Index and subsequent slower declines in the metals sector. Next the dollar rallied and reached a local top and precious metals soon followed. We now have seen the dollar recover from its December decline and with precious metals having declined also, the suggestion is that they will likely recover as well. This indirect influence from the USD Index is the only real influence seen upon metals from the currency markets at this time. Correlations between gold and other key indicators show that no direct implications from the dollar or from stocks are seen upon precious metals. There is however, an indirect influence from the USD Index, which was discussed in detail in an earlier section of this essay. This provides bullish implications for gold, silver and mining stocks. Speaking of silver, it has just been stopped by a long-term support level. Please take a look below for details. The first thing that comes to mind after briefly analyzing the above picture is that silver's price broke below the rising trend channel. This breakout is not seen as very significant, because the trading channel was broken to the upside several times in the past without profound implications. The price increase was stopped at a rising resistance level, noted in red in the above chart. This line is based on previous tops and is quite important since they are spread out over a long period. The RSI is presently close to the 50 level, which is worth noting. This was last seen when silver's price was in the $18 range and a huge rally followed. If a bigger move is still to be seen in silver, then we would want to see RSI close to this level. Consequently, it seems quite likely that bigger moves to the upside will be seen for silver, much as is possible for gold and its $1,600 target. The RSI level certainly makes this option quite feasible. Summing up, several mixed signals were seen last week but recent price declines do not appear to have bearish implications – at least not yet. Other factors point to higher prices for silver and the likely influence from gold will be a bullish factor as well. Although there may seem to be increased risk with volume levels increasing and gold's price declining, other signals from a technical analysis standpoint appear bullish. The target level of $1,600 still holds and the upside potential is actually even greater than what has been seen in the previous weeks. It's associated with bigger risk, so the risk to reward ratio did not change much, so Trader's don't need to make significant adjustments in their positions – at least not yet. To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time. Thank you for reading. Have a great and profitable week! P. Radomski Sunshine Profits provides professional support for precious metals Investors and Traders. All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. | ||

| Posted: 11 Jan 2011 10:00 AM PST Open letter to Thomas Hoenig, President, Federal Reserve Bank of Kansas City. Dear President Hoenig, On January 5, 2011, you were quoted on ABC NEWS as saying that "the gold standard is a very legitimate monetary system". The quotation went on: "We are not going to have fewer crises necessarily. You will have a longer period of price stability or price level stability, but I don't know that you will have lower unemployment, and I don't know that you will have fewer bank failures." | ||

| Outlook 2011: Irreversible Upward Pressures Posted: 11 Jan 2011 10:00 AM PST The good news is that gold is rising in value; the bad news is – well nearly everything else about the economy. | ||

| Mainstream Hacks Deny Gold Fundamentals Posted: 11 Jan 2011 10:00 AM PST There are those who dismiss gold entirely and there are those who are equally as ignorant and see gold in a bull market but think it is just a fad that will end as all bull markets do. | ||

| Posted: 11 Jan 2011 10:00 AM PST Gold prices remained hesitant to stage significant advances this morning, despite a weaker US dollar (down 0.29 to 80.52 on the index) and gains in the other precious metals and crude oil. | ||

| Bullion Demand Surges in Middle East & Asia Posted: 11 Jan 2011 10:00 AM PST Gold is marginally higher in US dollars while silver has risen by nearly 1% in all major currencies this morning. Risk appetite remains high as seen in higher Asian and European bourses. | ||

| 10 Things That Would Be Different If The Federal Reserve Had Never Been Created Posted: 11 Jan 2011 09:42 AM PST

Every single year, hundreds of billions of dollars in profits are made lending money to the U.S. government. But why in the world should the U.S. government be going into debt to anyone? Why can't the U.S. government just print more money whenever it wants? Well, that is not the way our system works. The U.S. government has given the power of money creation over to a consortium of international private bankers. Not only is this unconstitutional, but it is also one of the greatest ripoffs in human history. In 1922, Henry Ford wrote the following....

It is important to try to understand how the international banking elite became so fabulously wealthy. One of the primary ways that this was accomplished was by gaining control over the issuance of national currencies and by trapping large national governments in colossal debt spirals. The U.S. national debt problem simply cannot be fixed under the current system. U.S. government debt has been mathematically designed to expand forever. It is a trap from which there is no escape. Many liberals won't listen because they don't really care about ever paying off the debt, and most conservatives won't listen because they are convinced we can solve the national debt problem if we just get a bunch of "good conservatives" into positions of power, but the truth is that we have such a horrific debt problem because it was designed to be this way from the beginning. So how would America be different if we could go back to 1913 and keep the Federal Reserve Act from ever being passed? Well, the following are 10 things that would be different if the Federal Reserve had never been created.... #1 If the U.S. government had been issuing debt-free money all this time, the U.S. government could conceivably have a national debt of zero dollars. Instead, we currently have a national debt that is over 14 trillion dollars. #2 If the U.S. government had been issuing debt-free money all this time, the U.S. government would likely not be spending one penny on interest payments. Instead, the U.S. government spent over 413 billion dollars on interest on the national debt during fiscal 2010. This is money that belonged to U.S. taxpayers that was transferred to the U.S. government which in turn was transferred to wealthy international bankers and other foreign governments. It is being projected that the U.S. government will be paying 900 billion dollars just in interest on the national debt by the year 2019. #3 If the U.S. government could issue debt-free money, there would not even have to be a debate about raising "the debt ceiling", because such a debate would not even be necessary. #4 If the U.S. government could issue debt-free money, it is conceivable that we would not even need the IRS. You doubt this? Well, the truth is that the United States did just fine for well over a hundred years without a national income tax. But about the same time the Federal Reserve was created a national income tax was instituted as well. The whole idea was that the wealth of the American people would be transferred to the U.S. government by force and then transferred into the hands of the ultra-wealthy in the form of interest payments. #5 If the Federal Reserve did not exist, we would not be on the verge of national insolvency. The Congressional Budget Office is projecting that U.S. government debt held by the public will reach a staggering 716 percent of GDP by the year 2080. Remember when I used the term "debt spiral" earlier? Well, this is what a debt spiral looks like.... #6 If the Federal Reserve did not exist, the big Wall Street banks would not have such an overwhelming advantage. Most Americans simply have no idea that over the last several years the Federal Reserve has been giving gigantic piles of nearly interest-free money to the big Wall Street banks which they turned right around and started lending to the federal government at a much higher rate of return. I don't know about you, but if I was allowed to do that I could make a whole bunch of money very quickly. In fact, it has come out that the Federal Reserve made over $9 trillion in overnight loans to major banks, large financial institutions and other "friends" during the financial crisis of 2008 and 2009. #7 If the Federal Reserve did not exist, it is theoretically conceivable that we would have an economy with little to no inflation. Of course that would greatly depend on the discipline of our government officials (which is not very great at this point), but the sad truth is that our current system is always going to produce inflation. In fact, the Federal Reserve system was originally designed to be inflationary. Just check out the inflation chart posted below. The U.S. never had ongoing problems with inflation before the Fed was created, but now it is just wildly out of control.... #8 If the Federal Reserve had never been created, the U.S. dollar would not be a dying currency. Since the Federal Reserve was created, the U.S. dollar has lost well over 95 percent of its purchasing power. By constantly inflating the currency, it transfers financial power away from those already holding the wealth (the American people) to those that are able to create more currency and more government debt. Back in 1913, the total U.S. national debt was just under 3 billion dollars. Today, the U.S. government is spending approximately 6.85 million dollars per minute, and the U.S. national debt is increasing by over 4 billion dollars per day. #9 If the Federal Reserve did not exist, we would not have an unelected, unaccountable "fourth branch of government" running around that has gotten completely and totally out of control. Even some members of Congress are now openly complaining about how much power the Fed has. For example, Ron Paul told MSNBC last year that he believes that the Federal Reserve is now more powerful than Congress.....