saveyourassetsfirst3 |

- What's the Potential Downside of Investing in Gold Bullion?

- Current Price Levels of Gold and Silver Are NOT Sustainable – Here's Why

- Gold and Silver: Time to Take Profits?

- Silver's Cheaper, But Not Its Options

- Dollar Pulls Back, But Effects Appear 'Transitory in Nature'

- No Change Likely in Swiss National Bank Forecast

- Producer Price Inflation Is Alive and Well

- JPM Getting Smaller in Silver

- Gold Over $1,400/oz Again, Supported by Inflation and Paper Currency Concerns

- This formerly iconic American city is in full collapse

- The most important trend in the world right now

- Charlie Rose interviews Munk, Hathaway, and James Grant on gold

- JPMorgan Admits That Millions of Silver Conspiracy Theorists Are Correct

- The Rise of Silver : World silver production by country

- Bonds Cave-In While Shares Go Indecisive Neutral

- Morgan quietly cuts silver futures position way back, FT reports

- The Politics of the Blue State Bankruptcy

- Gold & Silver Rise with Commodities as Beijing Sticks with “Anything-But-Rate-Hikes” Strategy

- Turks Latest - Numbers Don't Lie

- Market riggers are feeling the heat, so help GATA turn it up

- You Snooze, You'll Lose

- JP Morgan Admits To, Reduces Massive Silver Short Position

- 10 Signs That Confidence In U.S. Treasuries Is Dying And That Financial Armageddon May Be Approaching

- Lies, Lies, Lies

- Buy Silver…Again!

- Gold Tops $1,400 Again on Inflation & Currency Worries

- When The Going Gets Tough...

- Silver and gold advance/all commodities rise big time

- Meet the City Jade Men

- Buying And Selling Gold And Silver: New IRS Rules Start In January 2012

- The IMF and the ECB on Perfecting Stupidity

- Gold Seeker Closing Report: Gold and Silver Gain About 1% and 3%

- Not So Fast

- Central banks have rigged gold for decades, Rickards tells interviewer

| What's the Potential Downside of Investing in Gold Bullion? Posted: 14 Dec 2010 06:31 AM PST A look at the gold price over the past 177 years reveals that - surprise, surprise - gold could be the safest investment out there! Words: 1377 | ||

| Current Price Levels of Gold and Silver Are NOT Sustainable – Here's Why Posted: 14 Dec 2010 06:31 AM PST While most investors and traders are super bullish right now on precious metals (and I can hardly blame them, as I am very bullish long term on the metals sector as well) the fact of the matter is that the recent leg up in gold and silver is not sustainable. A pullback is way overdue. Despite all the reasons to be bullish even short term all of my indicators tell me this is NOT the time to be buying gold and silver. Words: 915 | ||

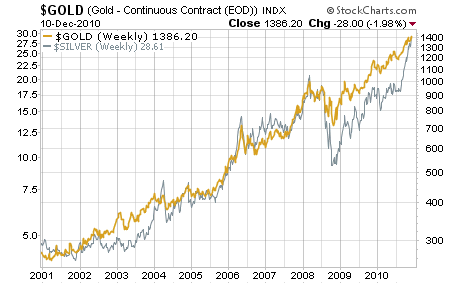

| Gold and Silver: Time to Take Profits? Posted: 14 Dec 2010 05:27 AM PST Graham Summers submits: One of the most common questions I receive on a daily basis is what investors should do with their gold and silver holdings. After all, the two precious metals have been on an absolute tear, rising roughly 460% and 500% respectively over the last 10 years.

Complete Story » | ||

| Silver's Cheaper, But Not Its Options Posted: 14 Dec 2010 05:06 AM PST Hard Assets Investor submits: By Brad Zigler Silver's often nicknamed "the poor man's gold" for the simple fact that its per-ounce price is so much less than that of the yellow metal's. Poor men, however, have been shelling out more to buy silver recently as the gold/silver ratio -- the price of gold bullion denominated in ounces of silver -- has nose-dived. Complete Story » | ||

| Dollar Pulls Back, But Effects Appear 'Transitory in Nature' Posted: 14 Dec 2010 04:47 AM PST Marc Chandler submits: The U.S. dollar's pullback has been attributed to three main factors. First, some are placing emphasis on Moody's warning that the Obama-Republican fiscal compromise increases the likelihood of a negative outlook within two years. While this is potentially worrisome, the market most directly impacted would be the Treasury market and it rallied after the Moody's announcement. If the Treasury market did not respond, this does not seem like a very satisfying explanation. Second, there is some speculation that at today's meeting the FOMC may decide to step up its bond purchases to protest the recent dramatic rise in rates. To the extent that this has indeed been weighing on the greenback, we suspect it will be lifted as the Fed has only begun its bond purchases. It could have chosen to increase the pace of purchases, but it did not. It seems highly unlikely that the Fed will change its asset purchase program in any substantial way at this juncture. Moreover, the Fed's statement from last month as whole is unlikely to deviate very much from last month. Core inflation remains soft and while the data has come in better than expected, clearly it has not been sufficient to bring down the critical unemployment rate. Complete Story » | ||

| No Change Likely in Swiss National Bank Forecast Posted: 14 Dec 2010 04:39 AM PST Marc Chandler submits: The Swiss National Bank ((SNB)) meets Thursday. A change in its monetary stance is not likely for several months at least. However, the SNB will provide new GDP and inflation forecasts that investors may find helpful. The Swiss government provided new forecasts today, ahead of the SNB. Growth this year is put at 2.7%, while the SNB's forecast is for 2.5%. The government raised its forecast for next year's GDP to 1.5% from 1.2%. It will be interesting to see if the SNB sees such a marked slowdown. The government expects 0.7% CPI this year and next. The SNB targets 3-month LIBOR in a 0-75 bp range. Within that range, it aims for 25 bp. The first step in the adjustment of monetary policy could be an increase toward the middle of the range. Although Swiss officials have express concern about the increase in real estate prices, on balance the strength of the Swiss franc and the deterioration of its export markets serve to keep the SNB on the sidelines. Switzerland will go to the polls in October 2011. It is currently governed by a grand coalition that all four major parties are represented. This will not prevent vociferous debating and campaigning. Of the G10 currencies, the Swiss franc is among the best performers, gaining 7.3% against the dollar and nearly 14% against the euro. The euro zone financial crisis and the perceived safe-haven appeal (including its substantial current account surplus--more than 7% of GDP) have underpinned it this year. Disclosure: No position Complete Story » | ||

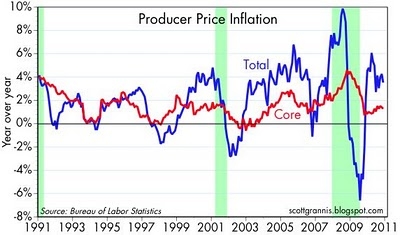

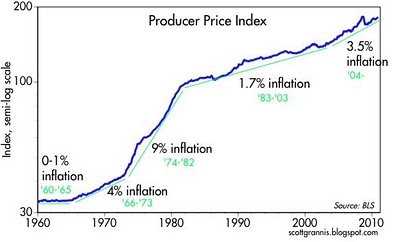

| Producer Price Inflation Is Alive and Well Posted: 14 Dec 2010 04:25 AM PST Calafia Beach Pundit submits: The November producer price index rose a bit more than expected, but as the above chart shows, over the past few years there hasn't been much change in the level of inflation according to this measure. Abstracting from the huge volatility of oil prices in 2008, producer prices have been rising at about a 3.5% rate for the past 6-7 years on average, while core prices (ex-food and energy) have been rising a little over 1% a year for the past two years. I note that even though this recovery has been sluggish, unemployment has been unusually high, and there has been an extraordinary amount of "slack" or idle resources, inflation has bounced back faster in the current recovery than it did following the 2001 recession. That's just more proof that inflation doesn't respond to the strength or weakness of the economy as the Fed's Phillips Curve Theory of Inflation suggests. This next chart puts things in a long-term perspective. It shows the producer price index on a semi-log scale, so the slope of the line becomes the inflation rate. I've indicated different inflation regimes on the chart, beginning with the early 1960s when inflation was as low, subdued and steady as it has ever been (and it's not a coincidence that the U.S. was on a strict gold standard at the time). Complete Story » | ||

| Posted: 14 Dec 2010 03:01 AM PST Vultures consider the quote below for today: (Bloomberg) -- JPMorgan Chase & Co. reduced a large position in the U.S. silver futures market, the Financial Times said, citing an unidentified person familiar with the matter. The decision was made to try to deflect public criticism of its dealings in silver, the FT said. The bank's silver positions would from now on be "materially smaller" than in the past, according to the paper. Two calls and an e-mail to Jennifer Zuccarelli, a New York-based spokeswoman at JPMorgan, were not immediately answered outside of office hours. – Retrieved from GoldCore.com Aye, but are they finished reducing that size? And, does that reduction of exposure to silver extend to other markets outside the glaring view of U.S. regulators? ... | ||

| Gold Over $1,400/oz Again, Supported by Inflation and Paper Currency Concerns Posted: 14 Dec 2010 01:26 AM PST | ||

| This formerly iconic American city is in full collapse Posted: 13 Dec 2010 11:54 PM PST From Mish’s Global Economic Trend Analysis: Detroit has been bankrupt for years. It simply refuses to admit it. Detroit's schools are bankrupt as well. A mere 25% of students graduate from high school. Yet in spite of hints and threats from mayors and budget commissions, and in spite of common sense talk of bankruptcy, Detroit has not pulled the bankruptcy trigger. In a futile attempt to stave off the inevitable one last time, Mayor Bing's latest plan is to cut off city services, including... Read full article… More on Detroit: Follow up to the "free money" Detroit outrage video Stansberry's follow up to the Detroit socialist disaster piece Stansberry: Detroit's socialist nightmare is America's future | ||

| The most important trend in the world right now Posted: 13 Dec 2010 11:41 PM PST From The Financial Collapse: In "What's It Going to Be?" I asked whether higher interest rates should be seen as a positive or negative for the U.S. housing market (and by extension, the economy), citing two conflicting mainstream media reports. I assume most regular visitors to Financial Armageddon quickly figured out which perspective was logical and realistic and which was delusional spin. With that in mind, it's worth noting that yields aren't just rising in the U.S.... they are ticking higher in... Read full article (with chart)... More on interest rates: This could kill the bull market in gold Bill Gross: Fed won't raise rates "for years" Ben Bernanke's "QE2" has been a collossal failure | ||

| Charlie Rose interviews Munk, Hathaway, and James Grant on gold Posted: 13 Dec 2010 09:06 PM PST Image:  Today's last offering is a gold-related interview that showed up on PBS. It's embedded in a GATA release headlined "Charlie Rose interviews Munk, Hathaway, and James Grant on gold". Charlie devoted a half hour to gold last Monday, interviewing Barrick Gold Chairman Peter Munk, Tocqueville Gold Fund manager John Hathaway, and Grant's Interest Rate Observer publisher James Grant. While the program never touched on government manipulation of the gold market, at least all three guests acknowledged gold's immutable function as money... | ||

| JPMorgan Admits That Millions of Silver Conspiracy Theorists Are Correct Posted: 13 Dec 2010 09:06 PM PST Central banks have rigged gold for decades: Jim Rickards. Gold, the biggest bull market of our lifetimes: Richard Russell. Hong Kong gold exchange to launch renminbi gold contract... and much, much more. ¤ Yesterday in Gold and SilverGold hit its Monday low [around $1,380 spot] at 8:00 a.m. Hong Kong time in early trading in the Far East. From that low, the gold price worked its way slowly higher... and was up ten bucks shortly before London opened for trading. From that point, gold basically traded sideways into the New York open at 8:20 a.m. Eastern time. The gold price made it through the $1,400 mark for a nanosecond moments after the London p.m. gold fix was in at 10:00 a.m. in New York... and didn't do much [or wasn't allowed to do much] after that point... and finished up less than 1% from its Friday close. This wasn't very good positive price action considering the fact that the world's reserve currency got absolutely smoked yesterday.

The silver chart looked pretty similar to the gold chart... except the price gain was more substantial. Silver's low was at the same time as gold's low... and its high [$29.73 spot] was pretty much the same time as gold's high. Ted Butler felt that JPMorgan was probably covering short positions... and maybe some of the Raptors were taking profits as well. But, with silver being the talk of the town these days, it won't be long before we're going to see upside price action that absolutely dwarfs the 3.03% gain we saw in silver yesterday. More on that in the 'Critical Reads' section.

The dollar rose about 20 basis points between the Far East open and 1:00 p.m. Hong Kong time during their Monday trading day... which is midnight in New York. This was the dollar's zenith... and it slowly headed lower... but really didn't pick up a head of steam until about 10:30 a.m. in London trading, with the low coming about 1:20 p.m. in New York, about eight hours later. From top to bottom, the world's reserve currency fell a hair under 120 basis points. That's a lot!

The HUI, which is pretty much tied to how the big cap gold stocks are doing, only finished up 1.04% on the day, which was well off its high. Fortunately, the silver shares did much better overall... and my own portfolio certainly reflected that again yesterday... as it has been doing every day since we hit the silver price 'bottom' last Wednesday. Yesterday's share price action in gold wasn't helped by the fact that the general equity markets rolled over hard starting shortly before 3:00 p.m. in New York.

The CME Delivery Report showed the smallest deliveries since the beginning of December... with only 4 gold and 28 silver contracts posted for delivery tomorrow. Nothing to see here. The GLD ETF did not have a report yesterday... but over at SLV, they showed a withdrawal of 1,612,743 ounces troy. Since there has been no negative price action to warrant such a large withdrawal... my guess is that this silver was needed elsewhere. In the week that was over at Switzerland's Zürcher Kantonalbank, they reported a 34,505 ounce increase in their gold ETF... plus a whopping increase of 1,918,804 ounces of silver! That amount of silver, dear reader, adds up to about 15% of all the silver that was produced on Planet Earth during the week! Ted wondered how long it took 'da boyz' to scrape that amount together. As always, I thank Carl Loeb for those numbers. The U.S. Mint had a rather large sales report yesterday. It showed that 14,000 ounces of gold eagles were sold... along with a rather large 750,000 ounces of silver into their silver eagle program. Month-to-date... 22,500 ounces of gold and 1,422,000 ounces of silver have disappeared in the mint's eagle program. I truly hope that you're getting your share! Not to be outdone on the silver scene... the Comex-approved depositories showed that a very chunky 1,245,654 ounces of silver were withdrawn from their warehouses on Friday, with most of it coming out of Brink's, Inc... and Scotia Mocatta. The link to this activity, which is worth a look, is here. With all this frantic in-out activity in silver, Ted Butler feels that there's a lot of 'robbing Peter to pay Paul' going on. I agree. Before getting to my rather large selection of stories, here's the Dow/Silver ratio graph that goes back to almost 'Day One' of the bull market in the precious metals. What once took 2,500 ounces to buy... can now be had for a hair under 400 ounces. I thank my friend Bryan Bishop for sharing it with us... and it's worth spending a couple of minutes on.

¤ Critical ReadsSubscribeMarket alarm as US fails to control biggest debt in historyAs I hinted at in the previous paragraph, I have a big pile of stories for you today... a lot of which are silver-related. Now that the metal is 'in play' world wide... it's just a matter of how much longer before this whole price-fixing racket by JPMorgan et al starts to unravel in earnest. I get a sense that the really big-money sharks are starting to circle what they now see as a mortally wounded beast. The chance to stick it to JPMorgan and the other New York bullion banks [and make boat loads of money at the same time] will be just too much for them to resist. It's payback time, boys... so go get 'em!!! But, before getting to all that, there are other issues that deserve your attention... as this past weekend was a busy one, news wise. My first story today [courtesy of Nick Laird] is from the Saturday edition of The Telegraph. The headline reads "Market alarm as US fails to control biggest debt in history". US Treasuries last week suffered their biggest two-day sell-off since the collapse of Lehman Brothers in September 2008. The borrowing costs of the government of the world's largest economy have now risen by a quarter over the past four weeks. I guess that's one of the reasons that the world's reserve currency took it on the chin yesterday. The link to the story is here.  A Bond Collapse Cometh???Along with the above story, Nick sent along this wonderful graph he headlined "A Bond Collapse Cometh???". Bill Gross isn't a happy camper after his bond fund was reported to have taken its biggest hit ever. The graph tells all.

Easter Egg Out Of The BIS: US Banks Are On The Hook To The PIIGS By Over $350 BillionToday's next offering comes from reader 'David in California'. It's a zerohedge.com piece that's headlined "Easter Egg Out Of The BIS: US Banks Are On The Hook To The PIIGS By Over $350 Billion". It's a short article with a lot of eye-opening graphs... and it's certainly worth a couple of minutes of your time... and the link is here.  Audit the Fed in 2011Here's a piece from Congressman Ron Paul's website that showed up as a GATA release last night that Chris Powell headlined "Transparency for the Fed is my main objective." Now that Ron is the chair of the congressional subcommittee that oversees the Federal Reserve, he outlines his plan of action in this short piece headlined "Audit the Fed in 2011". I feel that it's worth your time... and the link is here.  Rep. Ron Paul, Republican loner, comes in from the coldJust so you recognize how much things have changed for Ron Paul... here's a big story about him that showed up in yesterday's edition of The New York Times. The headline reads "Rep. Ron Paul, Republican loner, comes in from the cold". The article is subscriber protected... but can be found posted in the clear in this GATA release linked here.  CFTC Chief Feels Need for SpeedWashington state reader S.A. brings us our next read of the day. This is from yesterday's edition of The Wall Street Journal... and bears the headline "CFTC Chief Feels Need for Speed". The 'long knives' are out for CFTC chairman Gary Gensler, both inside and outside of his agency. Thursday's CFTC meeting should be an education... and we've only got two more days to go. The link to the story is here.  Secret Banking Derivative Cabal Redux, And Why HFT In CDS Has So Far Been A FailureThe next story is also a posting over at zerohedge.com that's courtesy of reader Phil Barlett. It's the Reader's Digest version of a 3,500 word essay that came out in the Sunday edition of The New York Times. The headline of nytimes.com article reads "A secretive banking elite rules trading in derivatives". It's very heavy reading... and the link to the GATA release on this, is here. But, unless your a derivatives wonk, you'll probably find the 'executive summary' over at zerohedge.com more to your liking. I certainly did. The headline reads "Secret Banking Derivative Cabal Redux, And Why HFT In CDS Has So Far Been A Failure". It very much worth reading, as the proprietor over at zerohedge.com is an expert in this field. The link is here.  The #1 Reason to be Scared Right Now...This next piece fits nicely into the above zerohedge.com story. It's courtesy of reader Peter Handley... and is a posting over at the Pragmatic Capitalism website. The story bears the alarming headline "The #1 Reason to be Scared Right Now...". The VIX is, once again, approaching record low levels. Is a major market correction in store for us? The link is here. | ||

| Bonds Cave-In While Shares Go Indecisive Neutral Posted: 13 Dec 2010 08:40 PM PST Chopper Ben is furiously printing and buying his own paper. He is not alone as other central bankers are doing the same thing. Meanwhile, bond offerings and sales over the globe head into the tank. Keep in mind we have corporate bonds, municipal bonds and central government bonds. Then, we have the European Central Bank unable to loan money to members by charter, buying their central bank bonds to provide back door support. Europe is failing more quickly into a cascade of crashing dominoes. Iceland fell first then number one in Europe was Greece. Next it was Ireland's turn soon to be followed by Portugal and then the two biggies; Spain and Italy. Bond failures in Spain and or Italy cannot be contained in our view. That is simply the end. Further, you have Germany being pressured to save all the others as they are the last man standing and then of course another biggie is the United Kingdom. It's too late. The die is cast and the end will not be denied. Expect a bond crash that takes down gold and other PM related trades. Then when the funds and institutions are denied most investment places they'll dive into gold, silver, PM funds and futures trading. The metal selling could be a normal, mild cycle. "What is fascinating is the S&P50-Day EMA is still holding as strong support despite being tested numerous times during recent trading. It isn't out of the question that we could still see a rally off of this support. However, the new declining trend channel that has formed tempers our enthusiasm-hence our neutrality. To clarify, the declining trend is not official. We have a top below a top, but we still need a low that is lower than the one two weeks ago; however, the declining tops line seems to be the dominant short-term feature." -Carl Swenson Decision Point S&P momentum is down but volume rebounded. A specious job's report this Wednesday morning spikes the shares higher. Most investors, traders and fund managers are in denial regarding the bond market collapse. It's a slower motion drop and sink into the fiscal mud. As the fallout accelerates, fear escalates and bad decisions will be next. Stick with precious metals and related shares-trades. However, a sell cycle in the middle of this is coming sooner rather than later. This PM buy cycle should last until 1-15 or 1-30-11. This posting includes an audio/video/photo media file: Download Now | ||

| Morgan quietly cuts silver futures position way back, FT reports Posted: 13 Dec 2010 05:07 PM PST | ||

| The Politics of the Blue State Bankruptcy Posted: 13 Dec 2010 04:37 PM PST Dollar Collapse | ||

| Gold & Silver Rise with Commodities as Beijing Sticks with “Anything-But-Rate-Hikes” Strategy Posted: 13 Dec 2010 04:30 PM PST | ||

| Turks Latest - Numbers Don't Lie Posted: 13 Dec 2010 03:13 PM PST http://www.fgmr.com/numbers-do-not-lie.html Hyperinflation Watch - December 13, 2010 -------------------------------------------------------------------------------- Numbers Don't Lie – December 13, 2010 – For several months I have been warning that hyperinflation of the US dollar is looming. The ominous signs of this impending currency train-wreck are becoming increasingly clear. For example, crude oil is threatening to break above $90 per barrel. Copper has broken through $4 per pound to a record high price. The prices of many other commodities are also in uptrends. These commodities are not in short supply. There is no shortage of oil or copper. Rather, these high prices are the result of too much money printing, which if not quickly stopped by returning to a sound money policy will ultimately lead to hyperinflation. Last week another important part of the hyperinflation puzzle fell into place. Long-term interest rates surged, continuing their sharp upward path that began two months ago. The 10-year T-note during this two month period has risen from 2.4% to end last week over 3.2%, a remarkable and therefore telling jump. This rise in long-term rates lays bare the flawed logic of the Federal Reserve's newly announced $600 billion so-called "Quantitative Easing" program supposedly designed to help the economy. This new round of money printing is not going to help ..... | ||

| Market riggers are feeling the heat, so help GATA turn it up Posted: 13 Dec 2010 01:37 PM PST As you read with delight tonight's Financial Times story about the difficulty in which J.P. Morgan Chase & Co. apparently has found itself with silver (http://www.gata.org/node/9419), it may be worth remembering the remark variously attributed to those most cynical statesmen Metternich and Talleyrand during the Congress of Vienna, which reorganized Europe in 1815. Told by an aide that the Russian ambassador had just died, Metternich -- or Talleyrand -- supposedly responded: "I wonder what his motive was." | ||

| Posted: 13 Dec 2010 12:03 PM PST --Sometimes you have to wonder if the giant rally in stocks since 2009 has all been engineered by insiders in the financial world to boost stock prices so they can sell into a rally...and then head for the hills with their diesel generations, tinned food, and stash of gold. Financial historians might describe the last few years as a world-wide asset pump and dump scheme led by the Fed (the pumper) and designed to benefit the financial industry (the dumpers). --It's a thought. --The big news yesterday was what didn't happen: China did not raise interest rates (although bank reserve requirements were raised late last week). Inflation in food prices has scared the Chinese monetary authorities/price fixers. In response, they've announced possible wage and price controls, which have worked so well everywhere else money supply and credit creation has run amok, from Latin America to Africa. --China's inflation problems stems from its dollar-peg and the creation of massive amounts of domestic credit (another $1 this year on top of $1 trillion last year). Since the developing world-and China in particular-are generating most of the global growth (while Europe and America struggle) investors were worried last week that China's efforts to cool domestic inflation would slow everyone down. --When China sneezes, everyone else shivers. Maybe that's the new 21st century normal. So come on China! Do your part for the planet and keep those factories belching out gewgaws and knick knacks! It's your solemn duty to the global system of debt-based consumption. Don't shirk it. --With no rate rise coming this week, Shanghai stocks zoomed up nearly 3% yesterday. Gold, palladium, silver, and oil were all up. Even U.S. bonds reversed themselves. Ten-year yields fell yesterday and prices recovered a bit. Good times are here again, for a few days. --The chart below-with special seasonal colours-shows that the All Ords beat Shanghai's rally to the punch by rallying first. December has been good to the Aussie market so far. And since July the All Ords (green line) and The Shanghai Composite (red line) have tracked each other fairly closely. Shanghai is fixing to cross its 50-day moving average. That would be technically bullish. --Yesterday's big Aussie winners were the Big Four banks. That tells you pretty much everything you need to know about what the big banking reforms will do: they'll lower funding costs for the big four and produce big profit margins. It's an even bigger bonus that ultimate liability for paying off depositors in a calamity can be fobbed off on the government via the Financial Claims Scheme. --The financialisation of Australian life continues. --You'd think investors would be a bit more worried, given how unsettled affairs are in every other part of the planet. And even here. The mining tax isn't done and dusted yet. A China credit bubble crash would be bearish for the big miners (which make up a large part of the ASX/200 in a market-cap weighted index). And the banks have had to offer up their depositors as collateral to secure funding in preparation/anticipation of another global liquidity crunch. Yet the chart below tells you no one is losing any sleep over any of this. Zzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzz --The ASX began publishing the VIX locally in the last few months, although it back-filled the data to 2008. In complicated terms, the VIX is a weighted average of implied volatility on widely traded options contracts. When premiums are large on options contracts, it tells you that investors are willing to pay more for insurance against an unexpected outcome (a big rise or fall in stock prices). --It's kind of an interesting question whether VIX is a leading or lagging indicator. When it rises, fear rises with it. Investors are uncertain of what investment outcomes to expect in the near future. Uncertainty and the possibility of losing money produces fear. --But is fear a reliable indicator that stocks are over-priced? Is it a self-fulfilling emotion? Or are investors fearful when they should be brave and bored when they should be fearful? A low reading on the VIX usually tells you that people are not particularly worried about anything in the future interrupting a very pleasant present. --This is when you should be most worried; when no one is especially worried. That's a one sided trade in favour of the lazy people. --Lazy, comfortable, complacent investors never see it coming. They don't see it coming because they aren't looking. They are too busy eating hot dogs and guzzling beer. To be fair, sometimes the blood-curdling, portfolio destroying event hits you from straight out of the blue like a cricket bat. With the VIX approaching a 52-week low, we'd be looking into the deep blue and watching for cricket bats to the head. We'd also be reluctant to be long over long weekends or the Christmas break. --By the way, a very good Chanticleer article in the weekend Australian Financial Review made the mistake of calling a China credit bubble a Black Swan. Why is that a mistake? As Nassim Taleb points out in The Black Swan, banking accidents are not a mystery at all and therefore not Black Swans, which by definition, are not events you can model for. --By contrast, you can be pretty certain that when a bank levers up and relies on an expanding balance sheet for growth, it's going to blow up eventually. For a bank to make more money, it has to take more risks. Profitable banks are risk-taking banks. And extremely profitable banks are usually the by-product of enormous leverage and even bigger risk-taking/speculation/bad lending/greed/theft/deception. --Maybe instead of finding ways for Australia's banks to secure more funding so they can put more Australians deep into housing debt which they'll never repay, the regulators could have a discussion about how to return banking to a boring, low-risk, business that serves the interest of depositors. And then the centre of gravity could be refocused on productive enterprise, rather than money shuffling. --This might prevent the banking sector from creating massive bubbles in the economy, hi-jacking public policy so the interest of financiers are put ahead of savers, and the general despondent financialisation of modern life that means perpetual debt for all of us as we chase house prices that are growing many times faster than incomes...until they crash. Similar Posts: | ||

| JP Morgan Admits To, Reduces Massive Silver Short Position Posted: 13 Dec 2010 11:48 AM PST Water, Meet Blood - JP Morgan Admits To, Reduces Massive Silver Short Position, Proves Millions Of Conspiracy Theorists Correct  Submitted by Tyler Durden on 12/13/2010 18:58 -0500 In the latest example that virtually every conspiracy theory is almost always inevitably proven to be fact, the Financial Times reports that JP Morgan, the firm targeted by thousands of "tin foil hat" wearing, conspiratorially-oriented "gold bugs", has cut back on its US silver futures. "JPMorgan has quietly reduced a large position in the US silver futures market which had been at the centre of a controversy about its impact on global prices for the precious metal." And in what can only be considered an unprecedented victory for all those who have over the past year agitated to putting JP Morgan out of business, most recently spearheded by the likes of Mike Krieger and Max Keiser, by forcing a massive short squeeze on its commodities trading desk, we learn that "the decision by JPMorgan was an attempt to deflect public criticism of the bank's dealings in silver, a person familiar with the matter said. The person added that the bank's position in silver would from now on be "materially smaller" than in the past." Of course, the latter is pure and total bullshit: as Bart Chilton indicated over the weekend, it is JP Morgan who at one point or another (and possibly very recently) controlled as much as 40% of the silver market, via a massive short. Attempting to make others believe that this short could be covered without pushing the price of the silver metal to over $100/ounce is an indication of either how stupid JPM believes the general population to be, or just how desperate the firm is to end the ongoing short squeeze onslaught. Either way, we are confident that this first unprecedented confirmation that a) JPM is indeed massively short silver and b) that it is hurting bad, will merely redouble efforts to put the world's biggest financial company out of business. Lastly, this means that silver is about to really blast off as the push to really hurt JPM takes off in earnest. From FT: The US regulator, the Commodity Futures Trading Commission, announced in September 2008 that it was investigating complaints of misconduct in the silver market, although it did not name specific entities.And while we revel in the knowledge that the short squeeze is causing massive pain for JPM, we are far more overjoyed that the days of Blythe Masters as head of JPM's commodities desk is coming to an end: any comparable massive admission of weakness by a trader is always and inevitably followed by some very high profile terminations. | ||

| Posted: 13 Dec 2010 11:46 AM PST

Faith in U.S. Treasury bonds is absolutely critical if the world financial system is going to continue to operate in a stable manner. In the post-World War 2 era, U.S. Treasuries have been largely viewed as the absolutely safest investment out there. So if there comes a point when the market for U.S. Treasuries completely collapses, it is going to cause unprecedented financial chaos. The worldwide derivatives market, which is already highly unstable, would almost certainly implode. Credit markets all over the globe would seize up. Global trade would quickly grind to a standstill. This isn't going to happen overnight (hopefully). Rather, the loss of confidence in U.S. Treasuries is something that is likely to take months or even years to play out. But once that confidence is gone, it is not something that will be able to be rebuilt easily. Think of it this way - once you drive a car off a cliff, is it easy to reconstruct it? Of course not. Well, that is where we are headed with U.S. Treasuries. The Federal Reserve is flooding the system with new dollars, Barack Obama and the U.S. Congress seem poised to pass a new tax deal which does not include corresponding spending cuts which will cause U.S. government budget deficits to become even more bloated, and there is a tremendous lack of faith both in U.S. political leaders and in the Federal Reserve at this point. The rest of the world is losing faith that the U.S. government is going to be able to handle all of the debt that it has accumulated. We may be approaching a "tipping point" soon. The following are 10 signs that confidence in U.S. Treasuries is dying.... #1 The financial community is extremely concerned that the tax deal that Barack Obama is pushing is going to dramatically increase U.S. government budget deficits over the next two years. On Monday, Moody's warned that if Barack Obama's tax deal with the Republicans becomes law, it will increase the likelihood that Moody's could soon be forced to slash the rating of U.S. government debt. #2 Already there are signs that some bond investors are looking for the exits. Last week, U.S. Treasuries suffered their largest two day sell-off since the collapse of Lehman Brothers back in September 2008. #3 The yield on 10-year Treasury bonds set a six-month high on Monday before pulling back a bit. Most analysts believe that Treasury yields are going to push significantly higher in coming weeks. #4 This trend of rising yields has been going on for a while. In fact, yields on 10-year Treasury bonds have been steadily rising since October 7th. #5 Even before the recent tax deal was announced there were already troubling signs regarding the growth of U.S. government debt. The U.S. government budget deficit rose to $150.4 billion in November, which was the largest November budget deficit ever recorded. #6 It is not just the new tax deal that has investors around the globe spooked. The truth is that the rest of the globe reacted very negatively to the new round of quantitative easing that the Federal Reserve announced back in November. The Federal Reserve is flooding the system with liquidity and the rest of the world is not amused. #7 The American people have less faith in the Federal Reserve and in the financial system than at any other point in recent memory. For example, a new Bloomberg National Poll has found that a majority of Americans now want the Federal Reserve to either be held more accountable or to be abolished entirely. #8 Investors all over the globe are starting to wake up and realize that America's debt problem is unsolvable. David Bloom, the currency chief at HSBC, raised eyebrows when he recently stated that "if yields are rising because people think America's fiscal situation is unsustainable, then its Armaggedon." #9 There is also a growing feeling among investors that the Federal Reserve simply does not care about the danger of inflation, and this is making bondholders very nervous. Stephen Lewis of Monument Securities recently put it this way....

#10 Over the next 12 months, the U.S. government is going to be rolling over trillions of dollars in debt along with all of the new borrowing that it is going to be doing. In fact, the U.S. government is somehow going to have to find a way to finance debt that is equivalent to 27.8 percent of GDP in 2011. For years our politicians have told us that "deficits don't matter", but the truth is that they do matter. The national debt of the United States is now the biggest debt in the history of the world by far, and yet most Americans do not seem to grasp the absolute financial horror that we are facing as a nation. In the end, debt is always painful. It can be a lot of fun to run out and buy a beautiful new house, a couple of brand new cars and to run your credit cards up to the max, but eventually it catches up with you. Well, the same thing is now happening to us on a national level. We are getting to the point where eventually we are not even going to be able to service the debt that we have already piled up. Once that happens we can either declare national bankruptcy or we can try to hyperinflate our way out of trouble. Meanwhile, the once great U.S. economic machine is dying as well. The only reason we have been able to survive with all of this debt as long as we have is because of how powerful our economy has been. But over the past couple of decades, the big global corporations that now dominate our economy have shipped thousands of factories and millions of jobs overseas. The mighty economic machine which is supposed to provide funds to pay off all of this debt is being dismantled right in front of our eyes. There was no way in the world that U.S. government debt was going to be sustainable even if our economy remained vibrant and healthy. The sad truth is that U.S. government debt is approximately 13 times larger than it was just 30 years ago. But now that the "real economy" is dying a savage death there is simply no hope that this thing is ever going to turn around. The only thing left to do is to take bets on when the implosion is going to happen. All of this "great tax cut debate" nonsense going on in Washington D.C. right now is just a bunch of incompetent politicians running around rearranging the deck chairs on the Titanic. Perhaps these tax cuts will provide enough of a short-term economic boost to get many of them re-elected in 2012. Meanwhile, our long-term economic problems continue to get a lot worse. It has become quite obvious that Barack Obama is completely clueless about the economy, and what is even sadder is that the "highly educated" Chairman of the Federal Reserve, Ben Bernanke, seems almost equally as clueless. Unfortunately, Americans have become so dumbed-down that they don't even realize that their leaders are incompetent. In fact, as sad as it is to say, most Americans you will meet on the street probably cannot even tell you what U.S. Treasuries are. Let us hope and pray that investors around the globe continue to have at least some confidence in U.S. Treasuries for at least a little while longer. When "financial Armageddon" finally does happen, it isn't going to be pleasant for any of us. So enjoy these happy economic times while you still have them, because at some point things are going to get a whole lot worse. | ||

| Posted: 13 Dec 2010 11:17 AM PST Let's begin by thinking about this, a quote from The Daily Bell: "The problem with where America is now is that the country has been built on one lie after another for the past decade and the lies show no signs of slowing down." And then, there's this from Charles Hugh Smith via Marc Faber: "[T]he status quo would collapse were systemic fraud and complicity banished... They have become the foundation of the US economy and financial system..." You will recall how Goldman Sachs wowed the whole world with its dazzling trading. Day in, day out...the traders at Goldman made money. The firm turned in "perfect" trading quarters, with not a single day showing a loss. Surely, one of the junior traders would have miscalculated at least once? Or a seasoned old pro, after a well-irrigated lunch, take his fat finger and hit the wrong button? Nope. Not once did Goldman's trading machine err. It was uncanny. Almost unnatural. Who was on the other side of those trades, we wondered? Trading is a zero sum game. One side wins. The other loses. So some poor schmuck must have taken a loss for every gain earned by Goldman's geniuses. Imagine him taking his lumps day after day...and still coming back for more. How could anyone stand so many losses? What kind of fighter could take that kind of beating and still be on his feet? And yet, there were no major new bankruptcies announced during that period. How was it possible? Who was losing all that money? We were perplexed. But now we know who the schmuck was...the poor sap was us! Had it not been for Senator Bernie Sanders from the Green Mountain State, who insisted that the Federal Reserve expose its shenanigans to the outside world, we would never have known what had happened to the Fed's $3.3 trillion in bailout cash. Now we know. Goldman helped itself 212 times - roughly every business day - during the 12 month period beginning in March '09, all the while telling the world that it needed no bailout. Lies, lies, lies... Corruption is not only at the top. Like a Christmas pudding steeped in rum, the whole economy - from top to bottom - reeks of it. Here's the latest proof from Bloomberg:

Let's see, how does that work again? Yeah, balance the books...says the noble citizen...but make sure it's at someone else's expense. Make the rich pay. That's how corruption works. People want something for nothing all the time. But only some of the time are they able to get it. Now, Goldman gets free money from the Fed. The taxpayers expect free money too. And so, the whole society lives a lie - that each man can live at the expense of someone else. But why CAN'T people live by taking money from the rich? Well, of course they can. For a while. Maybe even a long while. But not forever. And every time they spend someone else's money the less money there is left to spend. The rich are just as self-interested as everyone else. Take away their money and they dodge. They feint. They play dead. They hire lobbyists, bribe Congressmen and play the game. If that doesn't work, they hide their loot and flee. The problem with trying to live at the expense of others is that others don't like it much. They stop producing and try to live at someone else's expense too. And pretty soon, you have a nation of poor zombies...feeding on the little living flesh still left alive. "The idea that we can solve our structural-deficit problems merely by asking more of the well-off is totally unrealistic," said David Walker, who was US comptroller general from 1998 to 2008 and now leads a group advocating against deficits. "The math simply doesn't work." But that never stops the rabble from attempting it. "The one place Americans are willing to see sacrifice is in the wallets of the wealthy and Wall Street," Bloomberg News relates. "While Americans say they strongly support balancing the budget over the next 20 years, when offered a list of more than a dozen possible spending cuts or tax increases, majorities opposed every one of them except imposing a bigger burden on the rich. "A majority backs raising the cap on earnings covered by the tax on the Social Security retirement program above the current limit of $107,000. Two-thirds would means test Social Security and Medicare benefits. Six of 10 would end tax cuts for the highest-earning Americans. And 7 of 10 favor a tax on Wall Street profits. " Taxing the "rich" to fix the budget deficit is a ruse, a charade, a something-for-nothing game. Lies, lies, lies... The first lie was the biggest whopper of all - that you could get rich by spending money rather than saving it. The second was that the stock market would make you rich. All you had to do was to buy a well-balanced portfolio and hold for the long run. When that one ran into a wall, along came the lie that you couldn't lose money in real estate. There was also the lie that the free market would make people rich...and if it didn't, the authorities would force it to do so! Then there was the lie that an economy saturated in debt could be stimulated to heights of prosperity by splashing on more debt. And then there was the lie that you didn't need real money in the system; the authorities could manage a flexible, paper money system so as to help maintain full employment. And then, after half a century of adding cash and credit, when the Wall Street speculators cried and moaned, we were told that they were "too big to fail." They needed to be saved. Then came the lie that monetary and fiscal stimulus would lead to "recovery." When recovery didn't come, we were told that "quantitative easing" would do the trick - so they pumped hundreds of billions of dollars into Wall Street's failed institutions. When it didn't work, we got QEII. And now, the federal government is headed to bankruptcy. We are told not to worry. No need to change course. Tax. Spend. Overspend. Stimulate. The same goofballs, liars and incompetents who have brought us this far say they'll take care of us. Which is what we're worried about. Regards, Bill Bonner. | ||

| Posted: 13 Dec 2010 11:16 AM PST With the ongoing recession looming over the US and foreign economies, China seems to be coasting through with continuing growth through its exports. This trend does not seem likely to continue in the coming months. Below I will explain why and what steps you can take to secure your investment portfolios. A couple of weeks ago I was in Hong Kong attending the Roskill International Rare Earths Conference. I was "only" in Hong Kong, or "China Lite," as one jaded acquaintance put it. There's just no pleasing some people. It's as if the new airport, new bridges, new roads, new train station, new buildings and hustling, bustling, export-driven economics of Hong Kong just don't tell you enough. No. By some peoples' standards, you have to see the new airport, new bridges, new roads, new train station, new buildings and hustling, bustling, export-driven economics of Shanghai if you really want to experience the China story. Hong Kong offered plenty of stimulus for one long trip. So do I have any takeaways, besides a couple of nice suits from my new Hong Kong tailor? You bet! Over the past 20 years, the key enabler of China's development was strong, export-led growth. With Hong Kong handling much of the cargo, China exported its way to dramatic prosperity, fueled by boatloads of imported Western currency - dollars, yen, euros, etc. But that good fortune, and easy money from overseas, has come to a screeching, grinding halt. The global financial crisis has moved in for - apparently - the long haul. Here in the United States, we're not enduring a typical, post- World War II, run-of-the-mill business cycle recession. It's not just the economic equivalent of a "standing eight count" in boxing. No, I'd say that the US economy is hard down on the mat. Indeed, I believe that the current US economic situation is far graver than even the much-advertised Great Recession. When something recedes, that implies that it'll come back. If something recedes a lot, then it should come back in a big way, right? Thing is, I can't see how the US economy will come roaring back in any big way, and not anytime soon. During a US recession in the olden days, for example, businesses would lay people off from a plant and then call the workers back when times were better. Today, businesses have laid people off, but then, in many instances, closed the plant for good and sold all the machinery for scrap. Under these circumstances, there won't be any recalls. And if history is any guide, the United States cannot have an economic rebound without something like a recovery in housing. That's not happening, what with the banks still broken, lending stingy and the mortgage industry a total mess. Nor is there significant evidence that other Western economies are poised for a major comeback. Really, which other economies are rebounding? Ireland? Italy? Britain? Japan? Nope. Even the mighty German economy isn't growing fast, and they brag about it. So looking ahead, where's the continuing export-led growth for China? How can past patterns of trade and prosperity continue for China - and, by extension, for Hong Kong? Or stated differently, what does this mean for the future? It's likely that the slowdown of external demand will throttle back China's ability to grow at its recent, historic rates. But is the Chinese leadership prepared to process and adapt to this new reality? In the best light, the decline of foreign demand means the Chinese should channel less investment into their export model. The Chinese should redirect more investment toward internal consumption. That's easy to say. But will this happen? Can China internalize its growth? Well, to be fair, it's already happening to some extent. Many China-based operations - for example, companies like Foxconn and Toyota - are paying Chinese workers higher wages. This translates into more purchasing power at the Chinese grass-root level. But then we're also seeing stories about raging inflation in prices for food and energy at the Chinese retail level. And the vast multitude of Chinese people without the pay raises, who do not work for foreign companies, are stuck with the inflation as well. Point is, there's nothing easy for China in making the transition from massive investment in formerly booming export-led growth to a new focus on internal consumption. I believe that there's still a lot of thinking and planning in China that's stuck in the mind-set of economic boom times from the early part of this decade. We'll probably still see gross overinvestment in obsolete economic ideas coming out of China. Entire industries will pursue growth and expansion in markets that are no longer there. The world will face the consequences of resources filtering through a trade model that's no longer valid. So what does all this mean for investors? Well, it means that there's even less reason to trust in national currencies over the long haul. Sure, the local currency is how you keep score. It's what you get paid in. It's what you use to buy a house, pay bills, buy groceries, take a trip, etc. But looking forward, in any and every currency, inflation will nibble away at your wealth and savings. What can you do? You can't change the world, right? No, but it gets back to that idea that you still want to own physical gold and silver as core holdings in your portfolio. For the past couple of years, I've been saying "5-10% in precious metals, or more if it helps you sleep at night." I'm going to change that to "At LEAST 10% in precious metals, or more if it helps you sleep at night." I believe silver is probably a better play right now, with more upside than gold. I'd go for silver coins, without seeking any numismatic value. Just go for the Silver Eagles - bullion value - or any other high-quality metal issue from reputable mints. Regards, Byron King, Editor's Notes: Author Image for Byron King Byron King Byron received his Juris Doctor from the University of Pittsburgh School of Law, was a cum laude graduate of Harvard University, served on the staff of the Chief of Naval Operations and as a field historian with the Navy. Our resident energy and oil expert, Byron is the editor of Outstanding Investments and Energy and Scarcity Investor. Similar Posts: | ||

| Gold Tops $1,400 Again on Inflation & Currency Worries Posted: 13 Dec 2010 10:00 AM PST Market focus has shifted from the eurozone debt crisis to the massive fiscal challenges facing the US. The extension of the Bush tax cuts by the Obama administration may be positive for economic growth but will do nothing to help the fiscal situation. | ||

| Posted: 13 Dec 2010 10:00 AM PST An overnight foray to resistance levels near $1,410.00 was noted in gold prices as the US dollar slipped closer to the 79 mark on the index and speculators continued to enjoy an early Christmas courtesy of Chinese inaction on interest rates. | ||

| Silver and gold advance/all commodities rise big time Posted: 13 Dec 2010 09:52 AM PST | ||

| Posted: 13 Dec 2010 08:17 AM PST

Mercenary Links Roundup for Monday, Dec 13th (below the jump).

12-13 Monday

| ||

| Buying And Selling Gold And Silver: New IRS Rules Start In January 2012 Posted: 13 Dec 2010 08:04 AM PST | ||

| The IMF and the ECB on Perfecting Stupidity Posted: 13 Dec 2010 08:00 AM PST This week's winner of the coveted Mogambo Bluster And Incompetence Award (MBAIA) goes to Dominique Strauss-Kahn, the Managing Director of the International Monetary Fund. I will skip the part where I heap disdain on the IMF and say rude things like how I think that the IMF is a worthless bunch of incompetent, self-serving, socialist scumbags. And I will skip the part where I tried in vain to get in touch with this IMF moron so that I could inform him of his winning the prize, and invite him to fly here, at his expense, to pick it up. So he won't be coming, and it is too bad, too, because I already had the trophy, which is a plastic item molded to look like a pile of dog-poop, which I thought was both highly appropriate to the award, and very cheap, too, as I already had some left over from Halloween when I put them on the porch to discourage kids from coming up and knocking on my door. I figured that this "mine field" would discourage them from bothering me with their lame "Trick or Treat" routine, holding out their sacks for me to fill from my bowl of delicious candy, a cornucopia of yummy chocolates, nuts, nougats, peanut butters and caramels in a kaleidoscope of tempting colors and flavors, and all mine, mine, mine. Instead, I will get right to the part where I explain why Mr. Strauss-Kahn wins this prize. According to Bloomberg, Mr. Strauss-Kahn, who will hereinafter be referred to as Incompetent Blustering Bozo (IBB), said that (and I quote) "the European Central Bank is doing its job 'perfectly' in handling the region's debt crisis"! Hahaha! How could he not win? Hahaha! And now that the sheer incompetence of the ECB has succeeded in destroying the entire economy of Europe with its ridiculous monetary excesses to allow the funding of various socialist bunglings, you probably want to know, as I wanted to know, as all thinking people want to know, "What in the hell is the ECB doing so 'perfectly' that another laughable incompetent is compelled to comment upon it?" Well, it's funny you should ask, and personally satisfying that you should ask with such a rude and scornful tone to your voice, because the ECB said that the bank would leave its benchmark interest rate unchanged, which is now at approximately zero, and "will delay its withdrawal of emergency liquidity measures to combat 'acute' market tensions." Hmmm! "Combat acute market tensions." The phrase kept going over and over in my mind, as I intuitively sensed something potentially useful in that phrase. "Combat acute market tensions." Sure enough, the next day – the very next day! – my boss calls me into her office and wants to get all huffy with me, partly about how I am "accosting" my coworkers and telling them that they are "stupid" for not buying gold, silver and oil as protection against the terrible inflation in consumer prices as a result of the Federal Reserve creating so much new money. Mostly, however, she was "in my face" about how I keep losing money for the company, which I patiently explained was not my fault. It was, I explained, the fault of all my customers, who were all idiots, and all my staff, who were idiots, too, and who were always hatching their little schemes behind my back, undermining my authority and making me look bad as they plot to thwart me at every turn to turn my successes into failures, like I can't hear their constant secretive whispering, or see their furtive scurrying around, like the treacherous little rats they are. My boss is not convinced, of course, and so, in a flash of inspiration, I said, "The company must pump more money into my operation to combat acute market tensions, you moron, like the European Central Bank is doing, because the president of the International Monetary Fund said that to do so would be perfect! Perfect!" Well, it might be "perfect" for the ECB and the IMF, but around here it's a non-starter, and after a short discussion about who is the REAL moron around here (me), I was pretty discouraged. On my way back to my crummy little office, I suddenly realized that things were not so bad. I still had a plastic pile of dog poop as an asset, and I had the Federal Reserve creating massive amounts of money, to make the inflation, that will cause my gold, silver and oil to go up, which is another asset, and one that will soon make me rich enough to quit this stinking job and get away from a stupid boss that can't see a Fabulous Mogambo Plan when she sees one. And I also remembered that buying gold, silver and oil stocks is so easy, and suddenly the dark clouds of despair were lifted, and I merrily thought to myself, "Whee! This investing stuff is easy!" The Mogambo Guru The IMF and the ECB on Perfecting Stupidity originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||

| Gold Seeker Closing Report: Gold and Silver Gain About 1% and 3% Posted: 13 Dec 2010 07:19 AM PST Gold steadily rose throughout most of trade in Asia, London, and New York and ended near its 10AM EST high of $1399.20 with a gain of 0.95%. Silver followed a similar pattern and closed near its midmorning high of $29.692 with a gain of 3.39%. | ||

| Posted: 12 Dec 2010 09:33 PM PST We view all this talk about the ruination of the US Dollar with a grain of salt. Crude oil is the largest game in any town and oil is traded in dollars. While several of these other nations dislike holding falling dollars, they are relying way too much on the perceived strength of the other currencies. Yes, the dollar is weak and going weaker. However, as I check my real time screen this Monday morning the dollar is trading at 80.975 on or nearly one point above the base dollar price which has been its norm for years. Is the dollar going to sink? Yes, it will but some of the others like the Yuan, Ruble and Euro are going to sink much faster. In fact, we say the Euro is gone for good while the Ruble and Yuan march forward albeit at a slower pace and holding a much reduced value like the US Dollar. We've been looking at and studying this stuff for several years. The more we think about it the more we also believe the US Dollar might just survive in either its present form or something similar. Understand; the USA dollar, bonds, bills and notes are all managed by one central bank and government and they are THE dominant world power. This is not the case in Europe for the Euro. There, they have several languages, cultures, other currencies and widely disparate economies. For example, Greece and Germany now use the Euro for money. Yet, Greece is busted broke and is basically riding on welfare paid by Germany. This is not going to continue despite the ECU ministers recently forcing Germany to swallow a nasty welfare package for both Greece and Ireland. We say the German voters either get a government that safeguards their credit and money or they vote in a new group of politicians. They will demand it as they have a history with the Weimar inflation of 1921-1922. They are a smart, hard-working culture and have not forgotten what the 1920's event did to them in the 1930's and 1940's. Consumers, citizens, and the collective in beat-up societies will endure a lot of pain before they fight back. We can see the early signs of backlash in Iceland (they stiffed the Euro-bankers), and on December 7 Ireland votes on the aid package. That package screws the Sheeple while making whole the bondholders and those crooked bankers who instigated and promulgated mistakes. If the Irish vote no deal, this could open the door for other nations to go in that direction. This "no" decision by more than one country will encourage more of them to do the same. Then the international Ponzi scheme of Geithner, Bernanke, and the rest of their crooked cabal throughout the world gets smashed. How ironic that the toxic bonds they produced by sleight of hand along with their paper money, diluting values of pensioners and savers will come back to not only bite them in their collective derrieres, but destroy them financially. The USA global banks took stolen TARP funds and reinvested them in US Bonds and bills. That paper is headed for oblivion and destruction. It couldn't happen to a nicer bunch of crooks. Since the end is nigh anyway, we say the sooner it happens the better. The system gets a good flush down the bowl and we start all over again, all clean and sparkling new; hopefully with no Federal Reserve. This posting includes an audio/video/photo media file: Download Now | ||

| Central banks have rigged gold for decades, Rickards tells interviewer Posted: 12 Dec 2010 07:40 PM PST GATA |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment