Gold World News Flash |

- GoldSeek.com Radio Gold Nugget: Peter Schiff & Chris Waltzek

- The December 14, 2010 edition of Casey's Daily Dispatch, now available

- Inflation In History

- Figuring the Best Day to Buy Silver

- Reformer from NY Fed gets reformed himself ... by Goldman Sachs

- Gold Seeker Closing Report: Gold and Silver Gain While Fed Holds Steady

- Ron Paul, Head Of Monetary Policy Subcommittee: "Yes I Would End The Fed"

- Gold Daily and Silver Weekly Charts And One Possible Unfolding of the Endgame

- CalPERS Adopts New Investment Plan

- How Asian buyers use indirection to get gold and silver in London

- Bankers Secretly Meeting to Control the World?!? Yawn…

- Goldman Works Its Capture Magic, Hires 15 Year New York Fed Derivatives Reform Veteran

- What Trips Gold Up? - Answers to Your Letters - December 14, 2010

- Gold Price Barely Pierced it's 20 DMA and Bounced Up, Closing Up at $1,403.60

- Must Watch: Stockman Explains To Ratigan How In Thirty Years America Spent Enough Debt To LBO Itself, And Ended Up Bankrupt

- Gold Sleeper Trend You Must Know About

- TUESDAY Market Excerpts

- Gold makes record run

- Nevada Sunrise Closes First Tranche of Warrants from Its December 2009 Private Placement

- Why Gold Won’t Give Up

- United Mining Group (UMG) Completes Purchase Agreement on Contiguous Exploration Lands for its Crescent Silver Mine in Idaho

- Gold's Reaction To Central Banks And Rising Rates Urges Caution

- Something Smells Fishy

- Why Gold Won’t Give Up

- Private Sector Obliged to Work Off the Public Debt

- Economic Recovery Nonsense Continues

- France’s Sarkozy Joins Chorus to End Dollar Dominance

- KWN Source - “When That Happens, The Game is Over”

- The IMF and the ECB on Perfecting Stupidity

- Toppy Tuesday - Can the Dollar Fall Faster than our Indexes?

- Gold and You: Topping Out or Topping Up?

- Implications Of The Long Bond Price Collapse

- Graceland Updates 4am-7am

- The Biggest Obstacle

- JPM Getting Smaller in Silver

- Inflation And The Retail Sales Fantasy...

- Goldman's Take On The FOMC Statement

- JPMorgan Admits That Millions of Silver Conspiracy Theorists Are Correct

- Gold and Silver: Time to Take Profits?

- Gold: Don't be fooled by supposedly contrary indicators

- Silver's Cheaper, But Not Its Options

- Why Gold Investors are Still in the Minority

- Gene Arensberg: Is Morgan really getting smaller in silver, and, if so, why?

- Numbers Don’t Lie –

- Gold or Stocks: What to Hold During the Great Correction

- Morgan said to cut silver short, denies 90% claim on copper

- The Next Chapter in the End of America

- Weathering the Storm With a Diversified Portfolio

- Case for investing in gold remains strong

- Any bad press or damages from the suits on JP Morgan could facilitate more windows for shorting its stock.

| GoldSeek.com Radio Gold Nugget: Peter Schiff & Chris Waltzek Posted: 14 Dec 2010 07:00 PM PST |

| The December 14, 2010 edition of Casey's Daily Dispatch, now available Posted: 14 Dec 2010 06:56 PM PST |

| Posted: 14 Dec 2010 05:55 PM PST |

| Figuring the Best Day to Buy Silver Posted: 14 Dec 2010 05:19 PM PST |

| Reformer from NY Fed gets reformed himself ... by Goldman Sachs Posted: 14 Dec 2010 04:11 PM PST New York Fed Derivatives Reformer Lubke Joining Goldman Sachs, Memo Shows By Matthew Leising and Shannon D. Harrington http://www.bloomberg.com/news/2010-12-14/new-york-fed-s-theo-lubke-joins... NEW YORK -- Theo Lubke, who served for 15 years at the Federal Reserve Bank of New York and headed its efforts to reform the private derivatives market, joined Goldman Sachs Group Inc., according to a memo obtained by Bloomberg News. Lubke, 44, started this month as chief regulatory reform officer in Goldman Sachs' securities division, the memo said. The newly-created role will allow Lubke to "work closely with divisional and firm-wide leadership to implement regulatory reform legislation," according to the memo. Michael DuVally, a spokesman for Goldman Sachs in New York, confirmed the document. The most profitable securities firm in Wall Street history is hiring Lubke five months after Congress mandated the regulation of the $583 trillion over-the-counter derivatives market after swaps complicated efforts to resolve the financial crisis. The reforms threaten to cut the profit at dealers such as Goldman Sachs because they will make swaps prices known to the public. ... Dispatch continues below ... ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. In 2007 Lubke was appointed to his former role by Timothy Geithner, now treasury secretary, who was then president of the New York Fed. The central bank has pushed for changes in the credit-default swap market since 2005, when Geithner became concerned that an explosion of trading was threatening the ability of banks and regulators to manage and monitor risks that posed a threat to the financial system. He was reassigned as a senior vice president at the New York Fed in September to begin looking for a job outside the bank, a person familiar with the matter said at the time. "The Federal Reserve and New York Fed have strict conflict of interest policies for their staff, including departing employees," Jeffrey Smith, a spokesman for the New York Fed, said in an e-mailed statement. "In this instance, as in all cases, these policies were strictly followed." Senior Fed officials are prohibited for six months from attending any meetings with the central bank or from any contact with it on matters related to the area in which the official worked, according to a person familiar with the matter. Last year Lubke criticized Wall Street's control over the OTC derivatives market, where credit-default, interest-rate and other swaps are traded privately between banks and their customers. "It is simply unacceptable in today's environment that the design and structure of the OTC derivatives market can be controlled by a handful of large dealers," Lubke said at an International Swaps and Derivatives Association conference in Beijing in April 2009. The Dodd-Frank Act, which became law in July, requires most swaps to be guaranteed by clearinghouse and traded on exchanges or similar systems. Public prices may lead to compressed differences between what buyers and sellers want to pay for the contracts, known as the bid-offer spread, Howard Chen, a Credit Suisse Group AG analyst in New York, wrote in a Dec. 7 note to clients. That could be combated by increases in the rate of swaps trading and greater market efficiency that come from the new regulations, Chen said in the note. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| Gold Seeker Closing Report: Gold and Silver Gain While Fed Holds Steady Posted: 14 Dec 2010 04:00 PM PST Gold climbed as much as $11.05 to as high as $1408.05 in London before it fell in early New York trade and saw a loss of $5.35 at as low as $1391.65 by a little before 10AM EST, but it then rallied back higher in the last few hours of trade and ended near its earlier high with a gain of 0.48%. Silver rose to as high as $29.948 and dropped to as low as $29.17 before it also rallied back higher and ended with a gain of 0.44%. |

| Ron Paul, Head Of Monetary Policy Subcommittee: "Yes I Would End The Fed" Posted: 14 Dec 2010 02:47 PM PST In what is increasingly shaping up to be a showdown of epic proportions, the brand new chair of the Monetary Policy Subcommittee, Ron Paul, whose sole purpose in life for the past 20 years has been putting the Federal Reserve out to pasture, and returning to the gold standard, will soon spar with none other, than his, and every middle-class American's nemesis, the Chairman. And it could soon get even messier. In an interview with Fortune magazine's Nin-Hai Tseng, not only does the Texas doctor make it all too clear that he once again has presidential ambitions, but when asked whether he wants to end the Fed, gives the following brilliant reply: "Well, I don't expect to. The Fed's going to end itself when they destroy the system. So yes I would end the Fed but I would do it gradually and have a transition." Good luck Ron. However, there will be no gradual transition. If anything, it will be protracted, very much involuntary, and quite likely violent, as it would mark the end of a century-long scheme to transfer countless ounces (no pun intended) of tangible wealth to the ruling oligarchy in exchange for worthless and infinitely dilutable linen. Some of the other choice soundbites: Will you run for president in 2012? “Sure, there's always a chance. Probably depends on my mood come next January or February. I have not made up my mind. I have a lot of people supporters who are very anxious for me to do it. Right now I'm totally undecided.” Do you want to end the Fed? “Well, I don't expect to. The Fed's going to end itself when they destroy the system. So yes I would end the Fed but I would do it gradually and have a transition.” But some would consider ending the Fed is a bit extreme, don't you think? “No, I think printing money is extreme and crazy. I think the obscenity is allowing the Federal Reserve to print $3.3 trillion and we don't even know where it went. That to me is what's so extreme. And that's what the American people are waking up to. Government is extremely out of control. That is what I think everybody agrees on in the Tea Party movement.” Do you really think America could adopt the gold standard? How can this practically happen? “Look at how many people have money in exchange-traded funds for gold. Billions and billions of dollars. I've always considered myself being on the gold standard.” More from Fortune:

If there's anything to be said about U.S. Congressman Ron Paul, he sure is persistent. And lately, that inner flame that's helped him gain the reputation for sometimes being the "G.O.P. loner" appears to be paying off. The soft-spoken obstetrician has represented the 14th District of Texas on and off since 1977, spending much of his political career arguing that the Federal Reserve is evil for America and far too secretive. He doesn't see why there's so much faith in paper money, including the U.S. dollar. If Paul had it his way, there'd be a return to the gold standard. He even laid out his case in his book, End the Fed. What's more, Paul is a big believer in Austrian economic thought – the idea that government has no role in regulating the economy. And for years, he's supported keeping Congress from any action not explicitly authorized in the Constitution, or that he sees as wasteful spending, including – as a recent New York Times article highlighted – on issues as ceremonial as honoring Mother Teresa with the Congressional Gold Medal. No doubt Paul's views fall outside the mainstream. At times, his thoughts are arguably off-putting and easy to brush off as extremist political rhetoric. Even Libertarians don't always see eye-to-eye with the Texas politico. Lately though Paul's views are garnering the attention that he and supporters have long been waiting for. Earlier this month, Paul was picked to head the House subcommittee on domestic monetary policy. That means he will help oversee the body he's opposed to -- the Federal Reserve -- as well as currency and the dollar's value. If anything, it appears the timing somehow worked out for beliefs that Paul has held for decades. The congressman's backing has grown considerably with the rise of the Tea Party, whose frustrations with government bailouts of big banks and corporations following the financial crisis seem to fall in line with Paul's views. I caught up with Paul this week to talk about his new role, the Fed, how the world could possibly return to the gold standard and the 2012 presidential election. The following is a lightly edited transcript of our talk.

What are the Federal Reserve's shortcomings? They're doing a job that's impossible to do. So it's not a single person's fault. It's not just former Chairman Alan Greenspan or just current Chairman Ben Bernanke. It's the assumption that anybody knows what interest rates should be, or the assumption that they know what money supply should be, or the assumption that they can have stable prices or the assumption that they could deal with unemployment.

Do you think we're better off without a Central Bank? Sure, it's better off that we don't have depressions and inflations and financial chaos and the problems that we face. We of course wouldn't have this backdoor financing of big government fighting wars overseas and getting people to depend on the welfare state. None of that can happen without a Federal Reserve. What do you think of the Fed's latest move to start pumping $600 billion into the economy in hopes to boost the recovery through huge purchases of long-term bonds? I think it's terrible. They got us into trouble because there was too much quantitative easing. I mean it was a continuous inflation and artificially low interest rates that Bernanke gave us – he gave us all the bubbles so you can't solve all the problems of quantitative easing with more of it. So we had one, we're on number two. But actually we had it under Bernanke. They didn't call it that but it was essentially the same thing – massive monetary inflation with interest rates way lower than the market. So what do you think the economy would look like without the Fed? We'd probably have a much healthier economy – it wouldn't be so fragile. Nobody would be worrying about currency exchange rates and people wouldn't be in and out of currencies and spending all their energy doing what they're doing. Also, we wouldn't have a situation where the Fed creates money and hands it out for free and let's the banks make billions of dollars. And the poor people who are retired and have CDs get nothing and because of the downturn in the cycle, which the Fed creates, people lose their jobs and lose their houses. You wouldn't have any of that. This was all very clearly predicted by Austrian economic theory and it's come about and it's very disturbing to the Fed because they're going to have to recognize that their theories are completely wrong and they're not about to do that gracefully.

As chairman of the House subcommittee on domestic monetary policy, which among other things oversees the Federal Reserve, you've mentioned you will renew your push for a full audit of the Fed. What do you hope this will do? It would tell us who the beneficiaries are. They've released recently some information but they really didn't tell us exactly about everything and where the money has gone and what kind of collateral they have. The people in this country deserve to know who are the beneficiaries and their budget and what they hand out is bigger than the Congress, which is pretty amazing. They're off budget. They're not responsible to anybody. Who do you think the beneficiaries are? We don't know exactly but obviously banks and big corporations and foreign central banks and foreign governments. |

| Gold Daily and Silver Weekly Charts And One Possible Unfolding of the Endgame Posted: 14 Dec 2010 02:37 PM PST |

| CalPERS Adopts New Investment Plan Posted: 14 Dec 2010 01:47 PM PST Ron Trujillo of the Sacramento Business Journal reports, CalPERS adopts new investment plan:

I am glad to see that CalPERS is taking a strong look at risks they're taking. Beta will swamp the overall portfolio, but if they can do a better job protecting downside risk with this new asset allocation, then so much the better.

I would have put the prohibition of staff and board members to join a fund CalPERS invested with to five years or a minimum of three years. As for middlemen, get rid of them. CalPERS doesn't need them. Finally, John Emshwiller and Michael Corekery of the WSJ reports, Calpers Review Recommends Fee-Payment Change:

In this investment environment, it's hard to justify high fees and absolutely ridiculous to pay 2 & 20 for leveraged beta! The big fat fee days are over for hedge funds and PE funds. Even the best funds will feel the heat. You can download the report and recommendations by clicking here. Given that CalPERS is the largest US public pension plan, I wouldn't be surprised to see others following suit. Canadian public plans should also take notice as some of these recommendations might find their way up here one day. |

| How Asian buyers use indirection to get gold and silver in London Posted: 14 Dec 2010 01:41 PM PST 9:40p ET Tuesday, December 14, 2010 Dear Friend of GATA and Gold: Over at the King World News blog tonight, Eric King has excerpts from an intriguing interview with an anonymous London bullion market source about the indirection used by Asian buyers to obtain precious metal without exploding the price and causing commodity exchange default. The interview is headlined "When That Happens, the Game Is Over" and you can find it at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2010/12/14_K... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| Bankers Secretly Meeting to Control the World?!? Yawn… Posted: 14 Dec 2010 01:24 PM PST Revisiting the massive global oil scam... Last year, Phil calculated that this $2.5 Trillion dollar operation was 50 times the size of the Bernie Madoff ponzi scheme. "It's a number so large that, to put it in perspective, we will now begin measuring the damage done to the global economy in "Madoff Units" ($50Bn rip-offs). That's right - $2.5Tn is 50 TIMES the amount of money that Bernie Madoff scammed from investors in his lifetime, yet it is also LESS than the MONTHLY EXCESS price the global population has to pay for a barrel of oil..." Bankers Secretly Meeting to Control the World?!? Yawn…

"The Paper of Record," one of the few remaining news entities not controlled by Rupert Murdoch or some other Billionaire or major corporation, still has the guts to tell it like it is as they are actually pointing a finger right at the Gang of 12 (well 9 of them) and those not-so-secret meetings they have been having for years where they sit down and think of new and exciting ways to control the World. It takes a lot of guts to write an article like this, especially one which actually names ICE (I got my ass handed to me with legal BS when I dared mention them in conjunction with the word "manipulation." Fortunately they straightened me out and we now know that clearly there is no manipulation in the energy markets – can I have my Grandma back now?). Anyway, those fools at the NY Times have thrown caution to the wind without naming specific names using the phrase "giants LIKE JPM, GS and MS" – something I have learned to do as well because, if you don’t – THEY WILL GET YOU! And what are they saying about our friendly Banksters?:

According to the Times, the marketplace as it functions now “adds up to higher costs to all Americans,” said Gary Gensler, the chairman of the Commodity Futures Trading Commission, which regulates most derivatives. More oversight of the banks in this market is needed, he said. Big banks influence the rules governing derivatives through a variety of industry groups. The banks’ latest point of influence are clearinghouses like ICE Trust, which holds the monthly meetings with the nine bankers in New York.

Critics have called these banks the “derivatives dealers club,” and they warn that the club is unlikely to give up ground easily. The Times points out "Perhaps no business in finance is as profitable today as derivatives. Not making loans. Not offering credit cards. Not advising on mergers and acquisitions. Not managing money for the wealthy." The secrecy surrounding derivatives trading is a key factor enabling banks to make such large profits and the banks guard that secrecy very closely. In theory, the Dodd-Frank bill will eliminate much of the abuse that is going on in the derivatives market but already, the newly-elected House and Senate Republicans are looking to turn back to clock, which is apropos because, as Barry Ritholtz points out: it was the dreaded Commodity Futures Modernization Act that allowed the rampant shadow banking system to develop. Source: A Secretive Banking Elite Rules Trading in Derivatives by LOUISE STORY, NY Times See also: Michael Snyder's Derivatives: The Quadrillion Dollar Financial Casino Completely Dominated By The Big International Banks and Trillions In Secret Fed Bailouts For Global Corporations And Foreign Banks – Has The Federal Reserve Become A Completely Unaccountable Global Bailout Machine?. |

| Goldman Works Its Capture Magic, Hires 15 Year New York Fed Derivatives Reform Veteran Posted: 14 Dec 2010 12:44 PM PST If you can't beat them, might as well get paid by them. Such were the prevailing thoughts in the head of New York Fed veteran Theo Lubke, who after 15 years at Liberty 33, most recently as head of reform efforts in the private derivative market, famous due to its size of roughly €583 trillion which may or may not take the financial system down with it during the next market meltdown. And so, after realizing the derivatives reform is impossible, and further realizing that getting paid a grossly exaggerated government salary for what is basically a lobby job, Lubke has instead decided to get paid an even more exorbitant amount by everyone favorite monopolistic bloodsucking parasite. What is most ironic is that during an ISDA conference in Beijing in April 2009, Ludke said: “It is simply unacceptable in today’s environment that the design and structure of the OTC derivatives market can be controlled by a handful of large dealers.” Oh well - an average government salary is $119,982, an average Goldman Sachs salary is about 4 times greater, an infinite amount of hypocrisy - priceless. For everything else there is the taxpayer bailout debit card. More from Bloomberg:

In summary: in this latest example of supreme capture irony, the New York Fed, which is headed by a former Goldmanite, is shedding one its most connected figures in the ongoing regulatory legislation, to none other than Goldman itself: the firm which is in the top 3 of firms with greatest derivative exposure per the OCC. And so, the last gaping loophole in the farce of reg regorm known better as Do-nk, is closed, and things can proceed as they are for one more year before the now proverbial leaning house of dominoes falls for good, and instead of generously providing yet another financial rescue to the bankers following their biggest bonus year on record, this time the middle class may finally proceed with dispensing guillotines instead. |

| What Trips Gold Up? - Answers to Your Letters - December 14, 2010 Posted: 14 Dec 2010 12:00 PM PST What Trips Gold Up? - Answers to Your Letters - Casey's Daily Dispatch [LIST] [*]Sign Up Now! [*]| [*]RSS Feed [*]| [*]Print this [*]| [*]Visit the Archives [*]| [*]Email to a Friend [*]| [*]Back to All Publications [/LIST] December 14, 2010 | [url]www.CaseyResearch.com[/url] Dear Reader, I'm back from a whirlwind trip to the deep South for the wedding of my niece to what might be called a member of the "landed gentry." What an interesting trip. For one, though I lived in Louisiana for five years and have spent a fair amount of time in G... |

| Gold Price Barely Pierced it's 20 DMA and Bounced Up, Closing Up at $1,403.60 Posted: 14 Dec 2010 11:57 AM PST Gold Price Close Today : 1395.80 Change : 6.30 or 0.5% Silver Price Close Today : 29.759 Change : 0.160 cents or 0.5% Gold Silver Ratio Today : 46.90 Change : -0.041 or -0.1% Silver Gold Ratio Today : 0.02132 Change : 0.000018 or 0.1% Platinum Price Close Today : 1707.90 Change : 12.10 or 0.7% Palladium Price Close Today : 760.55 Change : 4.55 or 0.6% S&P 500 : 1,241.59 Change : 1.13 or 0.1% Dow In GOLD$ : $169.02 Change : $ (0.04) or 0.0% Dow in GOLD oz : 8.177 Change : -0.002 or 0.0% Dow in SILVER oz : 385.65 Change : 1.59 or 0.4% Dow Industrial : 11,476.54 Change : 47.98 or 0.4% US Dollar Index : 79.40 Change : 0.112 or 0.1% Both the GOLD PRICE and the SILVER PRICE show five day charts that clearly depict a five wave advance from the Friday low -- one that topped early today. Rest of today was passed in an A-B-C correction, but whether the C finished or not, I can't make up my mind. Looking at a longer term chart doesn't clear much up. Silver hammered at 30, but has it really done enough penance to be released to run wild again? And here's something spooky. Since the beginning of October silver has been cycling from low to low every 8 to 11 days. Looks odd, awfully regular. Don't know what that means. Back to what we do know. The SILVER PRICE bounced off its 20 day moving average (now 2800c) and has climbed from that 2797c intraday low to 2975.9c on today's Comex close, adding another 16c today. Yesterday it added 102.3c! Proportionately the longer term GOLD PRICE chart doesn't charm me quite as much as silver's, but it's strong, too. Gold barely pierced its 20 DMA (1378.65 today), and bounced up. Today the Comex bogged down and closed up $6.30 to $1,403.60, hitting that $1,405 resistance area we all know and love. The Spot GOLD/SILVER RATIO remains below my 47.5 target, closing today at 46.90, but you won't get very close to that trading physicals because wholesalers are discounting the silver, especially 90% coin. It's hard for me to swallow that the Ratio's indecision will last much longer, because it simply never does at peaks. Either it will rise or fall another jump, maybe to 45.5. If so, that says silver and gold will rise further before they peak. All this clearly reveals -- without details of course -- a sort of controlled panic behind the scenes, people quietly packing up their money and leaving the fiat dollar, euro, and yen behind. Serious money is pouring into silver and gold. The US Dollar index crawled and scratched to just over 80 (80.08) on Friday, but on Monday promptly fell 76 basis points, puking back it gains and much more besides. Today it recovered 11.2 basis points to reach 79.396, but this inspireth no one. The mere propinquity of the 200 DMA (79.76) was enough to make the Dollar faint. Now the scrofulous dollar has established a down trend with lower highs, one lower low, and what appears to be another shortly arriving. 50 DMA lies at 78.33, and one might conceive (if one were the sort who draws to inside straights) that the dollar might stop there. It had better, or twill drop to 78, maybe 76 or lower. Euro fell today but chart has the look of a rally. STOCKS today rose again. The Dow somewhere found 47.98 points to close 11,476.54. S&P 500, by no means as enthusiastic, added 1.13 to 1,241.59. No doubt there are many (considering what they pay them on Wall Street) who are predicting a recovery in stocks. And they are right, if you are willing to wait long enough, say 5 to 8 years. All I can see is a double top, and what might be the first half of a key reversal, with today's break into a new high for the move and rather dramatic fall off to a lower close. Yet that doesn't QUITE qualify as a Key Reversal, because it didn't close lower than yesterday. Still, it's weak. Stocks, remember, are to investments as deadly nightshade is to gift bouquets. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| Posted: 14 Dec 2010 11:18 AM PST After recently debunking the economic "recovery's" flagrantly misrepresented employment data, the OMB's David Stockman makes a third appearance in as many months (previously here and here), this time on Dylan Ratigan. And as always, it is a must see: key soundbite: "We have had a Fed engineered serial bubble, that has created the appearance of wealth, that has caused people to consume beyond their means through borrowing, and that has flushed the income and wealth of our society up to the top, as a result of the Fed turning the financial markets into a casino. These are pure casinos, they are not capital markets, they are not adding to the productive capacity of our economy, they simply are a bunch of robots trading with each other by the millisecond as a result of the Fed giving them zero cost overnight money, and giving them all kinds of hand signals on what to front-run." It is almost as if Stockman reads Zero Hedge... And he continues: "The Fed is destroying prosperity by funding demand that we can't support with earnings and productions, causing massive current accounts deficits and the flow of funds overseas and the build up in China, OPEC and Korea of massive dollar reserves which is a totally unsustainable, unsupportable system, and we are coming near the edge of where that can continue to remain stable." Ironically, Stockman is spot one when he notes that America incurred enough debt to have effectively LBOed itself. The net result, as every PE principal knows all too well, is a husk of an entity, whose most valuable assets have been bled dry. At this point, the last straw for America will be the inevitable rise in interest rates (at some point over the next five years, the Fed and Treasury will have to sell a combined $5 trillion in debt - that alone will destroy the supply/demand equilibrium and send rates surging) which will result in either debt repudiation or outright bankruptcy. The only good outcome is that the great experiment of LBOing America by the kleptocratic elite is coming to its sad conclusion. Some other facts:

Full clip:

Visit msnbc.com for breaking news, world news, and news about the economy |

| Gold Sleeper Trend You Must Know About Posted: 14 Dec 2010 10:19 AM PST |

| Posted: 14 Dec 2010 10:12 AM PST Gold edges higher before FOMC statement The COMEX February gold futures contract closed up $6.30 Tuesday at $1404.30, trading between $1393.80 and $1405.60 December 14, p.m. excerpts: |

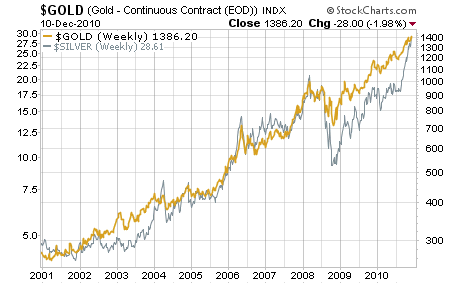

| Posted: 14 Dec 2010 10:06 AM PST Dec 14, 2010 (ArabNews) — On Dec. 7, gold hit an all-time high above $1,425 per ounce (London morning fix), after having risen from under $300 per ounce at the beginning of the millennium…. The price of gold is up 27 percent this year in dollar terms, as worry spreads over the debasement of currency values worldwide following the US government's decision to pump trillions of dollars into the global economy. … The fundamentals, however, are clear. Increasing consumer demand at the retail level in new markets is not the only fundamental factor that may drive gold prices higher over the long term. Central banks have begun to ramp up gold purchases, and relatively new investment vehicles such as exchange-traded funds (ETFs) are helping to drive prices. Central banks outside Europe and North America have been on a gold-buying binge since mid-summer. Russia has bought 65 metric tons (all tons in this Intelligence Note are metric tons) of gold since July so as to diversify its foreign exchange reserve holdings. It now holds 775 tons, the eighth largest state holding in the world. … The trend has increased since then, with central banks' purchases totaling 91.5 tons in the five months from July through November this year. India has become an important net gold buyer, and China's gold imports for the first 10 months of 2010 amounted to 209 metric tons, compared with only 45 tons for the whole of 2009. This is all the more striking in view of the fact that China is the world's largest gold producer. [source] RS View: It simply boils down to having a reliable economic scorekeeper. Whereas nobody can have steady confidence in the quantities of debt and associated bonds being racked up and issued forth by any given country, such bonds are unsuitable economic scorekeepers and therefore present themselves only as shabby reserve assets. On the other hand, everybody can have confidence in the reliable tight grip of our ancient earth releasing only marginal new quantities of physical gold, and consequently the amount of physical gold which can be accumulated and held by any given entity in reserves or savings provides them each with economic scorekeeping of the very highest quality. Lessons learned the hard way from the last few years of international financial crisis assure that the reserve structure of the international monetary and financial system will evolve toward a gold-reserve structure to replace the failed dollar-debt reserve structure. |

| Nevada Sunrise Closes First Tranche of Warrants from Its December 2009 Private Placement Posted: 14 Dec 2010 09:56 AM PST NEVADA SUNRISE GOLD CORPORATION (the "Company") (TSX-V:NEV - News)(PINK SHEETS:NVSGF - News) is pleased to announce that it has issued an aggregate of 2,000,000 common shares in the capital of the Company pursuant to the exercise of share purchase warrants of the Company previously issued to subscribers during the Company's non-brokered private placement closed on December 29, 2009 (the "Warrant Exercise"). A total of 2,000,000 warrants were exercised at a price of $0.15 per warrant, yielding the Company gross proceeds of $300,000. |

| Posted: 14 Dec 2010 09:50 AM PST The 5 min. Forecast December 14, 2010 01:49 PM by Addison Wiggin - December 14, 2010 [LIST] [*] “I get knocked down and get up again... nothing’s going to keep me down” ... Gold goes pop! [*] The Midas metal’s next catalyst, coming as early as this afternoon [*] J.P. Morgan adjusts its “controversial” silver position as prices sit just below $30 [*] WikiLeaks is really just a CIA conspiracy... oh, didn’t you know? [*] Readers question the value (or lack thereof) of a college education… and collecting government goodies as compensation for the great “shakedown”... (and suggest you write your congressman... Ha!) [/LIST] Gold pushed above $1,400 overnight, sending holiday cheer around the world... for some. For others, ‘twas the nightmare before Christmas. But as the sun began to warm the East Coast of the U.S., sort of, “rosy” economic data rolled in and put the Midas metal back in its place.... |

| Posted: 14 Dec 2010 09:37 AM PST United Mining Group, Inc. (TSX:UMG; Frankfurt:UM8; OTCQX:UMGZF, the "Company") is pleased to announce that it has completed its claims purchase agreement that increases its contiguous exploration land holdings by approximately 265%, from approximately 143 hectares (353 acres) to a new total of 379 hectares (973 acres) at the Company's Crescent Mine project in Idaho's prolific Silver Belt. |

| Gold's Reaction To Central Banks And Rising Rates Urges Caution Posted: 14 Dec 2010 09:15 AM PST |

| Posted: 14 Dec 2010 09:01 AM PST From Nic Lenoir of ICAP We had highlighted last week that a lot of reversal patterns were in the works for beta assets. A lot of them were not validated by a follow through the next day, with the exception of precious metals. Still, the picture remains the same: if you buy equities here you buy a market that rallied 25% since July 1, with bullish sentiment at its highest since the Nasdaq bubble, trading anemic volume on the uptick, with the 10-day NYSE TRIN at its lowest since before the 1987 crash, and a put-call ratio telling you no long is hedged. With that in mind some will tell me that I am going to miss an 8% move or something like that. When you start getting worried about missing out on some upside that's exactly when you start thinking like the guy who is going to be left holding the bag. Personally I would gladly miss even 20% to make sure I am not left long when this one bursts. I won't extend too much again into why I think we missed a great opportunity to clean up the system in 2008 and instead set ourselves up for a harsher fall as I fear I might lose my most bullish readers to their brickgame.

ERU2 almost tested to the tick the resistance at 98.00 this morning and turned south sharply. I still believe fixed income volatility for red Euribor contracts is far too cheap here.

|

| Posted: 14 Dec 2010 08:49 AM PST by Addison Wiggin - December 14, 2010

Gold pushed above $1,400 overnight, sending holiday cheer around the world... for some. For others, ‘twas the nightmare before Christmas. Gold pushed above $1,400 overnight, sending holiday cheer around the world... for some. For others, ‘twas the nightmare before Christmas.But as the sun began to warm the East Coast of the U.S., sort of, “rosy” economic data rolled in and put the Midas metal back in its place. At least the place monetary policy wonks would like to see it in. Still, for all the beatings gold has taken lately -- getting whacked for $20, $30, even $40 in a day -- it just keeps bouncing back. At $1,394 this morning, the molten lump is still higher than it was a month ago… or two months ago. It’s 22% higher than it was a year ago.  Near-record prices have done nothing to deter gold demand in the Middle East. Retail investors in the United Arab Emirates snapped up 1.6 metric tons of gold bars and coins in the third quarter, according to the World Gold Council. Near-record prices have done nothing to deter gold demand in the Middle East. Retail investors in the United Arab Emirates snapped up 1.6 metric tons of gold bars and coins in the third quarter, according to the World Gold Council.That’s a 23% increase from a year earlier. “Buying gold coins and bars as investment has turned out to be every family’s first priority in the Middle East,” says Kiran Desai, a Dubai-based bullion dealer. “Sales are shooting up across the UAE as people are buying these precious metals products, despite the high prices of the yellow metal.”  Further, many of gold’s ups and downs lately can be traced to China. “China is the focal point of the commodities play these days,” analyst David Wilson tells Commodity Online. “Gold and silver prices and other commodities are going bullish or bearish thanks to events that are taking place in China.” Further, many of gold’s ups and downs lately can be traced to China. “China is the focal point of the commodities play these days,” analyst David Wilson tells Commodity Online. “Gold and silver prices and other commodities are going bullish or bearish thanks to events that are taking place in China.”So when China upped its banks’ reserve requirements last week, that knocked gold down a peg. But when China passed on a chance to raise interest rates over the weekend, gold rallied on the open yesterday morning. With Chinese inflation at a 28-month high, the broad trend is still up. “We believe markets might be reacting too bearishly to the threat of Chinese monetary tightening,” says a research report from Standard Bank, because the tightening cycle “may already be at or near its peak.”  Gold’s next near-term catalyst may come this afternoon -- when the Federal Reserve issues a statement at the end of its latest meeting. We don’t have to go too far out on a limb to say our monetary mandarins still see a weak recovery that merits full speed ahead on its purchases of $875 billion in U.S. Treasuries through next June. Gold’s next near-term catalyst may come this afternoon -- when the Federal Reserve issues a statement at the end of its latest meeting. We don’t have to go too far out on a limb to say our monetary mandarins still see a weak recovery that merits full speed ahead on its purchases of $875 billion in U.S. Treasuries through next June.“This new round of money printing is not going to help the economy,” says our friend James Turk of GoldMoney, “which has been hollowed out by years of debt-financed consumption along with too little savings and production.” “This money printing is serving only one purpose. This central bank trickery is providing the federal government with all the dollars it wants to spend.” Yet for all the Fed’s efforts to goose the economy, and thus tax revenue, there’s still a yawning chasm between Uncle Sam’s income and outflow. James took the deficit numbers we brought you yesterday, extended them back 10 years and came up with this: “The rise in commodity prices and bond yields means that the dollar is picking up speed as it heads toward the fiat currency graveyard,” James concludes. That can only be bullish for gold. [Ed Note: “Yes you can still get rich with gold,” our own Byron King asserts. Even at these whipsawing prices. O, let us count the ways! Right here: 9 Ways You Can Still Get Rich With Gold.]  Silver is holding firm as we write at $29.57, as the metals markets buzz over news that J.P. Morgan Chase has “quietly reduced a large position in the U.S. silver futures market,” to quote the Financial Times. Silver is holding firm as we write at $29.57, as the metals markets buzz over news that J.P. Morgan Chase has “quietly reduced a large position in the U.S. silver futures market,” to quote the Financial Times.Our investment director Eric Fry wrote an expose on this Thursday in The Daily Reckoning: In short, the scuttlebutt is that JPM tries to suppress the silver price by holding a massive short position equal to four times the world’s annual mine supply. “The decision by JPMorgan,” says the FT, “was an attempt to deflect public criticism of the bank’s dealings in silver, a person familiar with the matter said.” But with no firm numbers backing up the story, the situation remains murky, to say the least. This much we do know: The CFTC is investigating claims that JPM manipulates the silver market. And investors are keen to get their hands on real metal, and not paper substitutes.  Thus, sales of U.S. Silver Eagles so far in December are on a pace to equal last month’s record. With sales of 4.26 million, November 2010 was the month that finally broke the record set in December 1986 -- the first full month the U.S. Mint sold Silver Eagles. Thus, sales of U.S. Silver Eagles so far in December are on a pace to equal last month’s record. With sales of 4.26 million, November 2010 was the month that finally broke the record set in December 1986 -- the first full month the U.S. Mint sold Silver Eagles.Through the first 10 days of December, sales are on the same torrid pace -- 1.42 million. Meanwhile, the collector world is buzzing about the first proof-grade Silver Eagles the Mint has made available since 2008.The Mint is working within a very small window -- just 42 days -- to get the 2010 issues out the door. Our friends at First Federal have secured a small batch just for you. Check it out here. As always, we may be compensated if you buy; it’s our business relationship with First Federal that makes it possible to bring you offers like these.  Stocks are generally up again today, the Dow up more than 60 points as we write, as traders digest these data points: Stocks are generally up again today, the Dow up more than 60 points as we write, as traders digest these data points:

We see a judge in London has set bail at $315,000 for WikiLeaks founder Julian Assange -- which surely will set the conspiracy crowd buzzing. We see a judge in London has set bail at $315,000 for WikiLeaks founder Julian Assange -- which surely will set the conspiracy crowd buzzing.“WikiLeaks is a big and dangerous U.S. intelligence con job,” writes F. William Engdahl at the Center for Research on Globalization, “which will likely be used to police the Internet.” The theory’s been going around much of this year, and it goes like this: WikiLeaks is really a counterintelligence operation by the CIA (and maybe Mossad).After all, many of the cables leaked so far attempt to justify war with Iran, and even retroactively justify the war in Iraq. Furthermore, the thinking goes, the resulting controversy has been manufactured to create a convenient excuse for new laws to shut down dissent online… and maybe even round up people who’ve spoken up on behalf of WikiLeaks. Heh… We’ll know they’re serious if you hop onto our home page one day and see this:  “WikiLeaks, TSA... FDA...” writes the inimitable Dave Gonigam by IM this morning, commenting on some of our more overt themes of late. “It’s all happening very fast now.” “WikiLeaks, TSA... FDA...” writes the inimitable Dave Gonigam by IM this morning, commenting on some of our more overt themes of late. “It’s all happening very fast now.” “Thank you for pointing out what is increasingly becoming the ‘the world is flat’ belief of our century,” writes a reader taking us in another direction. “For too long, our young people have been subjected to this philosophy that higher education will cure all ills, only to find out that at the end of the day they still have to go to work. “Thank you for pointing out what is increasingly becoming the ‘the world is flat’ belief of our century,” writes a reader taking us in another direction. “For too long, our young people have been subjected to this philosophy that higher education will cure all ills, only to find out that at the end of the day they still have to go to work.“Basic economics teaches us that when the market gets saturated with any product, then said product loses its value over time. Think televisions and desktop computers. In addition, there are many trades that compensate better than degreed occupations. “Of course, you actually have to earn your money then. “Too bad young people today, as well as their parents, were subjected to our obvious substandard public education system. Without it, they could figure this out on their own.”  “I wonder,” chimes in another, “if professor Vedder correlated the area of study versus job level. My bet is the data reflect the silly stuff higher education now calls a discipline as much as the plight of business. After all, why would I hire an anthropologist or an ethnic study-ist (I can’t even conjure up the noun to describe that ‘skill’) when I need results? “I wonder,” chimes in another, “if professor Vedder correlated the area of study versus job level. My bet is the data reflect the silly stuff higher education now calls a discipline as much as the plight of business. After all, why would I hire an anthropologist or an ethnic study-ist (I can’t even conjure up the noun to describe that ‘skill’) when I need results?“The key is ‘new grads are saddled with an average $24,000 in debt.’ Just like with the housing market, unqualified students spent other’s money to get something they didn’t deserve. Oh well, I’m sure they will work it off somewhere in government. “Just what we need...more lemmings.”  “To the $600,000 income earner” whose common law wife collects food stamps, “I say cheers! Don’t listen to all this poppycock from the righteous. “To the $600,000 income earner” whose common law wife collects food stamps, “I say cheers! Don’t listen to all this poppycock from the righteous.“You’ve figured out you’re not going to get a nickle of the thousands you’ve put into Social Security, so why not stick a fork in it now?”  “The issue for many people with high incomes,” agrees another, “is simply that they feel -- in many cases, rightly -- that they are being screwed by tax policies set by the booboisie majority: people who think they have a right to the fruits of other people’s labor. “The issue for many people with high incomes,” agrees another, “is simply that they feel -- in many cases, rightly -- that they are being screwed by tax policies set by the booboisie majority: people who think they have a right to the fruits of other people’s labor.“I suspect that in the vast majority of cases, the assistance these people are getting back is but a small fraction of the gap between what they the government shakes them down for at the point of a gun and the value of what the government does for them. “Now the follow-up question is how does that guy make his $600,000? The real underlying scam is widely held notion that government is something other than a huge transfer of wealth from everyone else, rich and poor, to the politically well-connected. “People need to wake up and realize that the combination of governments and incumbent corporations are together nothing more than a parasite on actual wealth creation.” The 5: Not quite sure what an ‘incumbent corporation’ is... but sure. If you’re referring to the unholy alliance between “too big to fail” corporations, even moribund industries as a whole, and the elected officials who prey on them for votes, we like the cut of your jib.  “It’s not just the people who are out to rip the system off,” writes another reader with a slightly different tack. “It’s the people in the system, too. “It’s not just the people who are out to rip the system off,” writes another reader with a slightly different tack. “It’s the people in the system, too.“My wife is uninsurable. We’ve asked for aid and filed for disability for her. Interestingly (tragically), we were advised by social services agents to divorce so she would qualify. They said we didn’t have to live apart, just file for divorce. “A doctor told us the same thing. A social worker advised she get pregnant as well, because then she’d be a shoo- in. “Since divorce wasn’t an option, and neither is pregnancy, we simply kept applying and she eventually got the disability, which is all we really needed.Of course, the system is designed to keep one in the poor house. If I make just enough (not much), then they cut insurance and our medical expenses are unaffordable. “It’s a miserable trap that is, for some of us, impossible to see a way out of. We’ll keep trying, though.”  “Day after day, I read the feedback from your readers. Bitch, bitch, bitch -- but generally on the mark. How about a generic solution: It’s called email. One to your congressperson, one to each of your senators, one to the White House. “Day after day, I read the feedback from your readers. Bitch, bitch, bitch -- but generally on the mark. How about a generic solution: It’s called email. One to your congressperson, one to each of your senators, one to the White House.“It simply needs to say, ‘I’ve had enough of this crap. Either move to stop [the insane and totally unnecessary indignities in the airports, for example] right now or you are serving your last term.’ “Target your state officials when appropriate. Ride others, hard, to do the same. Then remember and actually vote your threat. Simple, certainly, but apparently beyond the grasp of the sheeple.” The 5: Yes, of course! Let’s all write strongly worded e-mails. That’ll solve everything. Frankly, we’d all do better to drop out, turn on and tune in. At least, we’d have a lot more fun that way. Cheers, Addison Wiggin The 5 Min. Forecast P.S.: Shares of Alaska Communication Systems Group moved up on the open today, giving readers of our newest service a handsome gain in less than a month -- 9.3% on the stock… and 100% on call options. This is a terrific early win for a service that allows you to sidestep Wall Street’s high-frequency trading games… handing you big gains in a market where the investment banks’ supercomputers don’t have access. Act today and you can still get membership to this service at the charter-member rate. As is our wont, once we take this offer off the table, the fee will double. So check it out now. P.P.S.: Forecast Fruit! For new readers of Chris Mayer’s premium service Mayer’s Special Situations: The tiny rare earth producer he wrote about a few weeks ago just got its permit, just as he forecast. Shares have jumped 22% today alone… with the best yet to come. “MSS” readers will get the full scoop directly from Chris...if you’d like to join their ranks, he’s working on a brand-new presentation with an opportunity just as lucrative. Stay tuned. |

| Private Sector Obliged to Work Off the Public Debt Posted: 14 Dec 2010 08:44 AM PST I was idly reading The Economist magazine instead of working, or instead of taking a nap, when I saw their headline "The Mortgage Parallel," which was kind of intriguing to me, and I was curious to see what they thought was, you know, a good parallel to a mortgage. The subhead was not much of a clue, as it started off "Nerves jangle," which sounds more like an eerie parallel to parenthood, if you ask me! Hahaha! Parenthood as a parallel to the hell of mortgages, month after month of someone gobbling up your income! Hahaha! They're right! I can see the parallel! Alas, I see that my little joke is not appreciated, and so, chastised, I will dryly note that the article starts out, "Habitually seen as safe, America's $2.8 trillion municipal-bond market was rocked in the crisis of 2008," which is, of course, old news, being from 2 years ago. At this point I was yawning to indicate my disinterest, until idly dividing $2.8 trillion by the 100 billion non-taxpayer-paid, private-sector, for-profit workers in America, only to discover that municipal debt alone comes to $28,000 for each of the disappearing paying-taxes-out-of-profits workers! Yikes! And this does not count the $14 trillion in national debt, which is another $140,000 for each of the 100 million non-taxpayer, private-sector, for-profit workers, which does not include all the trillions in mortgage debt, or that nagging, yet seemingly piddly in comparison, $2.4 trillion in consumer debt, which by itself is another $24,000 for each worker, or cars, or boats, or any of that crap, and which went up a couple of billion dollars last month! Suddenly, and I gag in awe, we are talking more than $200,000 in obligations for every private-sector worker! You can understand my terrified confusion and fear when I wonder aloud, "How in the hell can these 100 million non-taxpayer, private-sector, for-profit workers, making an average of $45,000 a year, pay enough in taxes to pay such a colossal debt, which doesn't even count the accrued federal government entitlement liabilities of another $100 trillion or so?" Being a naturally irresponsible and lazy kind of guy, the thought of my being responsible for paying the interest on, and somehow paying off over the long-term, such unfathomable debt makes me feverish with fear at the sheer impossibility of it, until overcoming me with a feeling of dread from the certain knowledge that things are only going to get worse and worse until that last, fateful day when angry mobs of starving, desperate people are banging at the door of the Mogambo Bunker Of Last Retreat (MBOLR), all weapons, their barrels red-hot, finally depleted of ammunition, the floor littered ankle-deep with spent shell casings still warm, the acrid smell of cordite hanging in the air, mingling with the sound of my attackers shouting, "Let us wounded survivors in! We want your gold and silver because we did not listen to you when you told us to buy them because the evil Federal Reserve was creating so much money which will create inflation in prices, and now you are rich and we are poor because of it!" And I will answer, "No, you don't! You want to kill me and eat my brain!" They will naturally reply, "No, we don't! In fact, we are tired of killing each other and eating each other's brains just because we can't afford to buy real food! We only want your gold and silver because they are the only things of value left for miles around, now that all your valuable ammo is gone, which is because the Federal Reserve created too much money for too long that all our dollars are worthless in terms of buying power against inflation in prices that is eating us alive, which explains why we are eating each other's brains to stay alive, you moron!" To this I will cleverly reply, "Nobody home! At the beep, leave a message! Beep!" If you have read this far, you must admit that it takes a lot of anger and fear about the inflation caused by the Federal Reserve creating so much new money, to induce me to write such far-fetched and utter stupidity as positing that people could subsist on human brains without benefit of a daily intake of vegetables, fruits and grains. But the nutritional errors aside, and disregarding how you should be buying gold, silver and oil because the foul Federal Reserve is creating so much money, the part that froze my brain was when The Economist article went on, "A sudden jump in yields has renewed fears that the main source of finance for America's 50 states and thousands of towns and cities is ripe for a crisis all its own." My brain is staggered at how issuing debt could be the "main source of finance for America's 50 states and thousands of towns," and yet be so big! Doesn't anything ever get paid off? And now, to even think for a moment that this enormous load of un-payable, unfathomable, unbelievable debt, all thanks to the evil Federal Reserve, could NOT end Very, Very Badly (VVB) is to embarrass oneself, like the embarrassment many will feel one day soon when their starving kids ask them, "How come you, as responsible parents, didn't buy gold, silver and oil when the Federal Reserve was creating so much money? What are you, stupid?" To this I will cheerfully say, "No, kids, they WERE stupid, but they are a lot smarter now!" The Mogambo Guru Private Sector Obliged to Work Off the Public Debt originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Economic Recovery Nonsense Continues Posted: 14 Dec 2010 08:00 AM PST For the duration of what I estimate to be a 10 year economic slowdown (we are entering year 4), you will hear countless experts proclaim that the economy has recovered. Economic recovery evangelists were temporarily silenced earlier in the year, but they have now come out in force.In today's FOMC statement, the Fed actually had the chutzpah to say: "The economic recovery is continuing, though at a rate that has been insufficient to bring down unemployment". That the Fed can continually get away with saying such asinine comments this far into the recession is very surprising. The economic recovery crowd will no doubt point you to the rise in retail sales. However, they will probably leave out a couple of key points. They probably won't tell you that wholesale prices rose 0.8% in November, the most in 8 months. They also won't tell you that the rise in retail sales was driven largely by the rise in food and energy costs. I keep hearing that oil prices are rising show that the economy is recovering. In that case, would $10 gasoline evidence an economic recovery for the ages? Is the weak dollar, not demand, not driving wholesale prices higher? Retail sales are denominated in dollars, so you would expect a rise in sales year after year on a nominal basis. Also, core inflation has been relatively stable compared to headline inflation, which includes the price of the goods that retailers are selling. Given the relatively muted inflation figures of our government, this implies some core prices are falling. Retailers announced a "surprising " jump in apparel sales. Well let me tell you that this shouldn't be so surprising since apparel was one of the few items in the CPI that went down year-over-year. Revenues (sales) may be up, but margins are down. Discounts started earlier this holiday season and lasted longer. Please see Best Buy, which was down 15% this morning on weak earnings figures. So all in all, let's not get too bent out of shape about buoyant retail sales.

The government will never tell you that it is inflation that is driving economic statistics higher. The strong rise in commodities reflect an undercurrent of inflation that is eased away via government statistics. People will consistently be puzzled by the phenomenon of high unemployment and supposedly rosy economic statistics because the data has becomes so skewed at this point. This is why I always say to focus on the gold, dollar. and bond markets. Focus on gold first and foremost, since it is a globally traded asset that is not easily manipulated by central banks, especially since they have drained there reserves over the years. Government statistics are just noise in this ongoing economic drama.

Expected Returns is a blog focused primarily on gold investing. |

| France’s Sarkozy Joins Chorus to End Dollar Dominance Posted: 14 Dec 2010 07:30 AM PST Speaking at the 50th anniversary of the Organization for Economic Co-operation and Development (OECD), France's President Nicolas Sarkozy laid out his position against the current world monetary system dominated by the "accumulation of dollar reserves." Further, he suggested the expanded use of the International Monetary Fund's Special Drawing Rights (SDR), and — as China and several other nations have already recommended — insisted the renminbi be included in the SDR's basket of currencies. According to Reuters: "French officials have said they hope to encourage greater use of the Chinese yuan as a reserve currency during their G20 presidency, including talks on a possible timetable for its inclusion in the basket of currencies which underpin the International Monetary Fund's Special Drawing Rights. "Other ideas include encouraging a greater role for the SDR itself as a reserve currency, in an effort to move away from dollar hegemony. China is keen for the IMF to broaden the currencies that make up its SDR international reserve assets from the current basket of dollars, euros, yen and sterling. "China wants to promote the use of SDRs for pricing commodities and in global trade. Russia has championed SDRs and recruited fellow emerging heavyweights China, Brazil and India to promote it as a reserve currency." As long as the Fed keeps up quantitative easing, the White House folds to tax cuts, and Congress fails to curb spending, faith in the dollar is likely to continue diminishing. The feds may want to believe there's no alternative to the dollar's world reserve currency status, but the hunt is on for one… and, a global shift in currency roles could result in US interests getting left behind. You can read more details in Reuters coverage of how France's Sarkozy says it's time to consider the SDR's role. Best, Rocky Vega, France's Sarkozy Joins Chorus to End Dollar Dominance originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| KWN Source - “When That Happens, The Game is Over” Posted: 14 Dec 2010 07:30 AM PST  The contact out of London has updated King World News on the massive Asian buyers which have been accumulating both gold and silver. The London source stated, "Last week Asian buyers let the price come in to them. They were buying all day long, hitting all of the offers and they were not sending the price higher. As much as the orchestrators were hitting the bids, there were some smart buyers hitting the offers. The thinking was, I can pick up tonnage here, literally I can pick up tonnage here." The contact out of London has updated King World News on the massive Asian buyers which have been accumulating both gold and silver. The London source stated, "Last week Asian buyers let the price come in to them. They were buying all day long, hitting all of the offers and they were not sending the price higher. As much as the orchestrators were hitting the bids, there were some smart buyers hitting the offers. The thinking was, I can pick up tonnage here, literally I can pick up tonnage here." This posting includes an audio/video/photo media file: Download Now |

| The IMF and the ECB on Perfecting Stupidity Posted: 14 Dec 2010 07:17 AM PST |

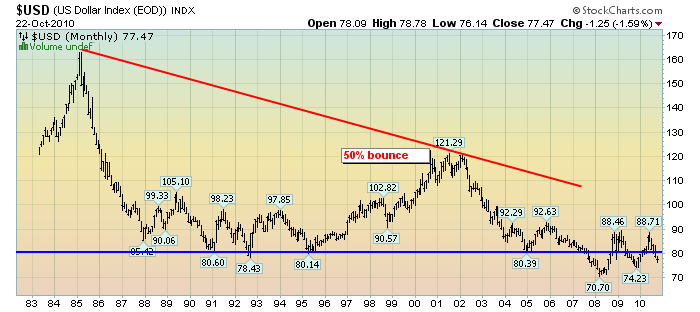

| Toppy Tuesday - Can the Dollar Fall Faster than our Indexes? Posted: 14 Dec 2010 07:15 AM PST Toppy Tuesday - Can the Dollar Fall Faster than our Indexes?It's a race to the bottom! While we may have thought we were flat-lining yesterday near our breakout, Europe and Asia had a different view of our markets as we pulled back -0.5% to -1.73% when priced in other currencies. While you may not care what happens in other countries, there are 6.5Bn people who would disagree with you there and the US is not the World leader anymore (despite what the citizens of the US may think) - we can no longer afford to ignore things like how exchange rates affect us. Here's the chart for the Dow, S&P and Nasdaq priced in Dollars, Euros and Yen for the past two months:

Fortunately for the bulls (especially the commodity ones), the dollar has resumed it's pathetic decline as Obama and The Bernank have combined to dilute our currency by another $2Tn over the next 48 months, from about $14Tn to $16Tn (+14%) plus, possibly, the $110Bn of new $100Bills the Treasury is trying to run off. This has sent the dollar back down from it's Thanksgiving high and now it's going to be all about whether or not we can hold that 78.5 line as our Congress finalizes their vote on the Obama Tax Cuts and another $1,000Bn of US debt taken by our citizens in order to hand another $650Bn to the top 1%.

On top of the relentless devaluation of our dollar-denominated assets, we also have wild rumors driving up demand for commodities by speculators, who are generally those same top 1% who are being handed money by our Government at a rate of $2Bn per day. If you had to put away $2Bn a day, where would you put it? Well they've made Treasuries very unattractive with historically low yields and low deposit rates and a declining dollar have made saving the money look like suicide. Bonds are getting crazy too so that leaves stocks and commodities and, since the top 1% are every bit as stupid as the bottom 99% - the best game in town is to start rumors to drive their money in and out of "the next big thing" like dot coms, oil, natural gas, housing, mortgage-backed securities and now oil (again), gold (again), copper (again) and silver. At least sliver hasn't been used since the Hunt Brothers crashed the market back in 1979 but that was long enough ago that we have an entirely new generation of suckers who are willing to believe that JPM has been foolish enough to be short 3.3Bn ounces worth of silver ($99Bn) to the point where if everyone in America bought an ounce (300M ounces for $10Bn) it would bankrupt them. Aside from the fact that the math doesn't work in the first place (10% isn't going to blow out JPM), what are the odds you could get more than 2% of the people in this country to do something so stupid as to buy silver for about 100% above it's 5-year average based on some idiotic rumor.

Rather than listen to the blather of the MSM to tell us how great the economy is, we tend to rely on actual reports - like the very depressing December "Rail Time Indicators" report, which shows a very steep drop-off in the actual delivery of commodities (pg 2), indicating demand has NOTHING to do with prices right now. Average Weekly Carloads excluding coal and grain (pg 11) are closer to 2008 lows (+20K) than 2007,8 highs (-30K) with petroleum shipments (pg 12) similarly depressed while auto shipments (also on 12) have actually crossed below the lowest trends.

That has led us to stick to our guns on the above short plays as well as our repeated success on oil shorts. Just yesterday, in the morning post, I mentioned we'd be shorting oil at $89 (we did in the futures for a very nice .75 gain) as well as picking a USO put. It took only as long as 9:32 for my Morning Alert to go out to Members with a trade idea for the USO Dec $38 puts at .41. We took .60 and ran at 1:23 (up 46%) as well as a too early exit on those NFLX Jan $155 puts at $2.25 (up 40%) that I had mentioned we'd be getting back into in Friday morning's post, when they opened at $1.50. Well, as my Dad always said: "You can lead a horse to water but you can't make him think." We choose every day to listen to one media source or another and I simply try to introduce a healthy level of skepticism that, on occasion, enables us to find nice investing opportunities - often as we play on the opposite side of "The Beautiful Sheeple." What's scary is I can tell 250,000 people that a trade's going to work in the morning and it still does - that is one MoFo of a rigged market when we can pile in the opposite side of a trade and it fails to affect the outcome! Speaking of data - BBY missed by .07 with just .54 of Q3 EPS and that is in-line with our observations as we were simply not seeing a lot of big-ticket items going out the doors at the stores (watch out WHR!). ICSC Retail Sales were up 0.8% this week so that's trending up and November Retail Sales were also up a strong 0.8% but this one has a breakdown and, as you can see from the tables, it's pretty much all Gasoline sales, which are up 16.6% due to inflation and on-line sales, which are up 13.3%. Meanwhile, we have a PPI report that, coincidentally, also shows a 0.8% increase, which is DOUBLE the last reading of 0.4% and, ex-autos (which are being heavily discounted to move inventory), the November PPI is up 1.2% vs 0.4% in October. We'll have to wait for tomorrow's CPI report but raise you hand if you think that the Producers will have trouble passing that 1.2% increase along to the unemployed masses (Best Buy sure did!). You should be rooting for runaway inflation if you are a bull as we need that Dollar to die so we can keep pretending how great things are in the economy. UK inflation shot up to 3.3% in November, 65% over the BOE's 2% target rate and the EU, not wanting to be out-inflated by their island neighbor, is looking to increase their own bailout fund beyond it's current $1Tn level even while trying to tell bond investors that they will have no need of the first Trillion. As I said over the weekend, when you are peddling a fiat currency, trust is about the only thing you have going for you. Small businesses trust our government with a 1.5% increase in the NFIB Optimism Index since October but that's slowed considerably into the holiday's from October's 2.7-point increase and, let's not kid ourselves, we're still deeply into recessionary numbers. This is like when we get excited about home building going from 400,000 to 410,000 when the high was 2M. As usual, you don't want to look too deeply into the data or you'll notice that Earning Trends had a -24% impact on the survey and Current Inventories also knocked 24% off the gains. So how could the index be going up? Well EXPECTATIONS are up 47% on the overall economy and up 29% on sales expectations with 24% of small business owners planning to increase inventories. That means the summary is, inventories are building out of control and the margins on things that are selling are contracting but The Bernank says things are getting better so I'm going to put on my 3D glasses and watch the cool charts on Fox news while I wait for customers to come through the door. OK America - good luck with that plan. Meanwhile, we will wait to see if they can finally break 11,500 on the Dow and force us to get more bullish but, until then, it's a different kind of BS I'm worried about.

Try PSW with a 20% discount, here. |

| Gold and You: Topping Out or Topping Up? Posted: 14 Dec 2010 07:13 AM PST Stewart Thomson email: [EMAIL="stewart@gracelandupdates.com"]stewart@gracelandupdates.com[/EMAIL] email: [EMAIL="stewart@gracelandjuniors.com"]stewart@gracelandjuniors.com[/EMAIL] Dec 14, 2010 1. Gold war update from the front lines: The Gold Community retook $1400 last night. Silver is close to retaking $30. I won the battle as to whether gold would take out $1424 on the upside or $1315 on the downside. Most thought $1315 would fall. It didn't. Gold soared to $1430 basis dec futures and many gold stocks continue to exhibit violent upsurges. 2. I don't like losing. So I don't. Don't you throw your gold away either because of all the correction talk going around. Click here now to view this morning's Gold Chart with the new range highlighted: Gold's New Range Chart. 3. Gold is now trading between 1370 and 1430, and doing so after breaking out, upside, from the 1315-1424 range. The fact is… gold is marching higher. An army of gold top calle... |

| Implications Of The Long Bond Price Collapse Posted: 14 Dec 2010 07:11 AM PST View the original post at jsmineset.com... December 14, 2010 09:25 AM Dear Friends, We have been alerting you to the breakdown in the US long bond over the last several weeks and have noted that its collapse in price has serious implications for all of us. Judging solely by the price action in both the Ten year and the long bond, the Fed's QE program, which was designed to hold down long term interest rates and thus spur lending particularly in an attempt to generate activity in the real estate sector, has proven to be an abject failure. Rates have gone up, not down. Combine that with a surfeit of houses due to the wave of foreclosures and it is difficult to see this distressed sector turning around any time soon. What appears to have taken place is that the focus on the long end of the curve has shifted firmly towards the inflationary aspects of all this Quantitative Easing. In effect, the market has thumbed its nose at the policy boys of the FOMC and completely short-circuite... |

| Posted: 14 Dec 2010 07:02 AM PST |