Gold World News Flash |

- Bumpy Road Ahead - Go for Blue Chips and Gold

- The Year of Living Quantitatively

- Class action against Morgan, HSBC specifies silver manipulation mechanism

- Gold Seeker Closing Report: Gold and Silver End Mixed In Quiet Trade

- Timberline Resources Our Top Pick for 2011

- Stewart Thompson: Central banks use gold to control markets

- Porter Stansberry: Bumpy Road Ahead; Go for Blue Chips and Gold

- Outlook 2011: China Says No More Cars, Down Goes the Auto Industry

- Strong foreign banks splurged on, profited from Fed's emergency credit

- Strong foreign banks splurged on, profited from Fed's emergency credit

- Greed And Fear's Chris Wood On The Timing Of The Euro Endgame

- The 'Gold Covered Call Writing' Managed Futures Program

- Daily Market Recap: 12.27.2010

- MONDAY Market Excerpts

- Richard Russell - We Will Have an Upside Explosion in Gold

- Gold Daily and Silver Weekly Charts

- GATA's lawsuit for Fed's gold documents slogs on

- GATA's lawsuit for Fed's gold documents slogs on

- COT Gold, Silver and US Dollar Index Report - December 27, 2010

- The Why of White Metals: Silver, Platinum and Palladium in 2010

- No signs of a gold bubble despite record advances in 2010

- Mandarin Monday – China Tightens, Snow Chills Markets

- Jim's Mailbox

- Reader Threatens To Sue Fed After Losses Incurred By Going Long Inverse Leveraged ETFs

- If You Haven't Bought Silver Yet, Read This

- The China Syndrome: A Building Bubble This Way Bloweth

- Is China The Big Silver Short?

- +74% later, Wall St. Journal notices silver only to try to talk it down

- Demanding the Mark Back: Opposition to the Euro Grows in Germany

- The Past: Abandoned Principles and Misguided Policies

- Deficit Hawk Coburn Should Save His Breath

- Government Spending, GDP and Nonsense In Between Them

- The Impossibility of a Gold Bubble

- Real Estate Spin Continues by Mainstream Media

- China Raises Interest Rates to Combat Inflation

- Rick Rule Very Bullish On Silver For 2011

- Bailed-out banks slip toward failure

- Indian gold appetite remains strong

- A Chinese New Year in Currency Wars

- Either America Or China Will Crash In 2011

- The Case For Gold Today

- Gold up Rs 20 on global cues, silver falls on reduced offtake

- The Case For Buying Gold Today

- Gold prices shrug off rate hikes

- No Signs of a Gold and Silver Bubble Despite Record Advances in 2010

- The Morning Gold Report

- If You Haven't Bought Silver Yet, Read This

- Gold and the Economy : Don’t be fooled

- Dallas Fed's Texas Manufacturing Index Misses Expectations Of 17, Comes At 12.8, Inventories Surge

- Dollar Pays Bill for US Military

| Bumpy Road Ahead - Go for Blue Chips and Gold Posted: 27 Dec 2010 06:03 PM PST Steady tailwinds benefited the stock market for most of 2010, but Stansberry & Associates Investment Research Founder Porter Stansberry is bracing himself and his clients for a bumpy ride for equities in the new year, as well as unprecedented instability in muni bonds and Treasuries. In this exclusive interview with The Gold Report, Porter, who's been predicting the dire consequences of unbridled borrowing and continued quantitative easing for some time, recommends utmost caution and conservatism for investors in 2011. | ||||

| The Year of Living Quantitatively Posted: 27 Dec 2010 06:02 PM PST There are increasingly those who predict hyperinflation, which is popularly defined as rapidly-rising prices that soon reach un-payable levels, and which is always caused by the true definition of inflation, which is (according to the Mogambo Big Book Of Economic Stuff (MBBOES), "A gigantic growth in the money supply, which is caused by banks deliberately acting like greedy, lying, filthy pigs who deserve to be thrown in jail." | ||||

| Class action against Morgan, HSBC specifies silver manipulation mechanism Posted: 27 Dec 2010 05:31 PM PST 1:30a Tuesday, December 28, 2010 Dear Friend of GATA and Gold (and Silver): A Chicago law firm yesterday announced another class-action lawsuit against J.P. Morgan Chase & Co. and HSBC Holdings PLC complaining of silver market manipulation. Interestingly, the lawsuit cites GATA's silver market manipulation whistleblower Andrew Maguire and U.S. Commodity Futures Trading Commission member Bart Chilton, and specifies mechanisms by which Morgan and HSBC could manipulate the silver market through the use of silver exchange-traded funds. The lawsuit complains: "Before the Class Period began, JPMorgan had become the custodian and an authorized participant of the largest known concentration of silver bars, the iShares Silver ETF, which holds in excess of 340 million troy ounces of silver, a sum that equals an estimated 1/3 of the total present global supply of silver bullion. As a result, it had actual knowledge of the precise whereabouts of much of the world's known silver bar supply. ... Dispatch continues below ... ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf "In approximately March 2008, JP Morgan acquired Bear Stearns, which held a very large short position in silver. With more of the total short position in silver concentrated in the hands of JP Morgan, it had a further motive to suppress prices. "Upon information and belief, JP Morgan works together with HSBC, the other dominant player in the silver and precious metals markets. In July 2009, HSBC became the custodian of the SIVR ETF, which meant that it had physical access to and knowledge of the silver held by that trust. Notably, it named JP Morgan as one of the sub-custodians of the SIVR ETF. "As a result of their participation in the silver ETFs, JP Morgan and HSBC had a direct opportunity to confer and discuss with each other the prices of silver held by each of them. "In addition, Defendants had a strong incentive to suppress downward the price of silver as measured by the NYSE-Arca and CME/COMEX instruments. For example, Defendants could pledge their silver to the ETFs in exchange for ETF shares, sell their shares to other market participants, drive down the prices of silver through trades on NYSE-Arca and CME/COMEX, buy back their ETF shares from investors at lower prices, and return their (now lower-priced) silver ETF shares in exchange for the silver bars initially pledged against those shares, the real value of which remained the same, and only notionally appears lower because of Defendants' suppression. "With respect to Defendants' conduct on the CME/COMEX platforms, JPMorgan and HSBC's scheme has been corroborated by Andrew Maguire, a 40-year precious metals trading veteran. Mr. Maguire reported his findings to the Commodity Futures Trading Commission (CFTC), which commenced an investigation in 2008. "On October 26, 2010, CFTC Commissioner Bart Chilton stated that there had been 'violations of the Commodity Exchange Act in the silver market' and 'fraudulent efforts to persuade and deviously control' silver prices, and that these efforts 'should be prosecuted.'" The full complaint of the lawsuit has been posted at GATA's Internet site here: http://www.gata.org/files/SilverManipulationLawsuit-NIllinois-12-07-2010... The law firm's press release is appended. CHRIS POWELL, Secretary/Treasurer * * * Cafferty Faucher LLP Files Class Action Lawsuit Law Firm Press Release http://www.businesswire.com/news/home/20101227005224/en/Cafferty-Faucher... CHICAGO -- Cafferty Faucher LLP (www.caffertyfaucher.com) filed a lawsuit on behalf of a class that includes purchasers and sellers of the iShares Silver Trust (NYSE-Arca SLV) and the ETF Securities Ltd. Silver Trust (NYSE-Arca SIVR) during the period March 1, 2008, through the present. The lawsuit alleges that JPMorgan, the custodian of silver backing SLV securities and the sub-custodian of silver backing SIVR securities, and HSBC, the custodian of silver backing the SIVR securities, manipulated and suppressed the price of silver bar financial products, including SLV and SIVR, in violation of Section 9 of the Securities Exchange Act. If you purchased or sold the iShares Silver Trust ETF or the ETF Securities Silver Trust securities during the period March 1, 2008, through the present, you may move the Court to serve as lead plaintiff within 60 days. The lawsuit, Case No. 1:10-cv-07768, was filed in the Northern District of Illinois on December 7, 2010 and is assigned to the Honorable Charles R. Norgle Sr. The case is also brought on behalf of investors who purchased or sold CME Group Inc.'s Comex silver futures or options contracts, which are traded electronically through the Chicago-based Globex platform and through Comex. On behalf of these investors, the lawsuit alleges violations of the anti-manipulation provisions of the Commodity Exchange Act. In addition to the claims under the anti-manipulation provisions of the Securities Exchange Act and the Commodity Exchange Act, the lawsuit also alleges that defendants violated federal antitrust law. Cafferty Faucher LLP, with offices in Chicago, Philadelphia, and Ann Arbor, Michigan, is a national litigation firm that represents investors, businesses, and consumers who have been injured by illegal marketplace practices. Firm contact information is available at the above website. The firm has recovered tens of billions of dollars for its clients in cases targeting illegal acts and practices in a variety of industries including securities, commodities, insurance, pharmaceuticals, banking services, medical, high-tech, food and beverage, construction materials, and many others. Combined, the firm's attorneys have hundreds of years of experience working to recover losses on behalf of clients. Contacts for Cafferty Faucher LLP: Anthony Fata (Chicago), 312-782-4880, or Bryan Clobes (Philadelphia), 215-864-2800. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php

This posting includes an audio/video/photo media file: Download Now | ||||

| Gold Seeker Closing Report: Gold and Silver End Mixed In Quiet Trade Posted: 27 Dec 2010 04:00 PM PST Gold fell $10 to $1371.20 in early Asian trade before it rebounded to see a $5.18 gain at $1386.38 and next fell back to $1377.69 by a little after noon EST, but it then rallied back higher in the last hour of trade and ended with a gain of 0.08%. Silver fell to $28.74 and climbed to $29.31 before it dropped back to $29.03 by a little after 8AM EST, but it also rallied back higher in New York and ended with a loss of just 0.34%. | ||||

| Timberline Resources Our Top Pick for 2011 Posted: 27 Dec 2010 03:04 PM PST | ||||

| Stewart Thompson: Central banks use gold to control markets Posted: 27 Dec 2010 02:00 PM PST 10:54p ET Tuesday, December 21, 2010 Dear Friend of GATA and Gold: In commentary published today at GoldSeek, Stewart Thompson of the Graceland Updates letter emphasizes again that central banks buy and sell gold not to "make money" but rather to control the value of their currencies, moving their currencies up and down as politics seems to require -- that is, to rig currency markets. This point was made four years ago by the British economist Peter Millar in his excellent study, ""The Relevance and Importance of Gold in the World Monetary System," which you can find at GATA's Internet site here: Of course the same point has been made quite often lately by market analyst James G. Rickards of Omnis Inc., who has suggested that the Federal Reserve peg the dollar to a higher gold price through "open market" purchases and sales of gold, rather than through the traditional surrpetitious maneuvering of intermediaries: Thompson writes today: "With quantitative easing effectively dead now as a tool to handle any further worsening of the crisis, the central banks will look to accelerate their gold buy programs to revalue gold higher, and keep it higher. The point of revaluation is to devalue the debt that is owed by the government to its citizen creditors. "There is no possible way on this earth that I am going to stand before you four days before Christmas as gold revaluation gets under way and top-call myself or you out of your gold items. "The central bank buy programs are not about accumulating gold as an asset, as you accumulate it as an asset, an investment. They use gold as a control mechanism, and it takes very little gold to control the entire paper money system. "The central banks have no interest in buying gold cheaply or selling it 'high.' During gold revaluation (now) they want to pay higher and higher prices for gold, to ease their ability to pay their creditors in paper money." Compare the thoughtfulness of Thompson, Millar, and Rickards with the cavalier remarks of supposed analysts like Jon Nadler of Kitco, who insists that central banks have absolutely no interest in the price of gold, and Jeff Christian of CPM Group, who says he has consulted for most central banks and has found that they hardly ever think about gold at all even as they claim to sit on huge gold reserves. Of course the Fed somehow thinks about gold enough to refuse to give GATA access to its records about gold and particularly the records of the Fed's gold swap agreements with foreign banks: Thompson's commentary is headlined "Gold and Dow: Liquidity Flows For 2011" and you can find it at GoldSeek here: | ||||

| Porter Stansberry: Bumpy Road Ahead; Go for Blue Chips and Gold Posted: 27 Dec 2010 01:32 PM PST Source: Karen Roche of The Gold Report 12/27/2010 Steady tailwinds benefited the stock market for most of 2010, but Stansberry & Associates Investment Research Founder Porter Stansberry is bracing himself and his clients for a bumpy ride for equities in the new year, as well as unprecedented instability in muni bonds and Treasuries. In this exclusive interview with The Gold Report, Porter, who's been predicting the dire consequences of unbridled borrowing and continued quantitative easing for some time, recommends utmost caution and conservatism for investors in 2011. The Gold Report: Much has happened since our last discussion in September. The election, with the Republicans taking the House and the super majority in the Senate. QE2 (quantitative easing) not only discussed but actually released. The U.S. assisting in the financing in Europe. The benefactors of the 2008 bailout money finally published. And then the hottest topic in Washington for a while, extending the B... | ||||

| Outlook 2011: China Says No More Cars, Down Goes the Auto Industry Posted: 27 Dec 2010 11:57 AM PST By Dian L. Chu, EconForecast Although China auto market is expected to slow down in the coming years (see Predicted Sales Chart) partly because the tax incentives that help drive the auto sales are set to expire on Dec. 31, 2010, the world’s top auto companies still have high hopes for China.

| ||||

| Strong foreign banks splurged on, profited from Fed's emergency credit Posted: 27 Dec 2010 11:29 AM PST Non-US Banks Gain from Fed Crisis Fund By Robin Harding, Bernard Simon, and Christian Oliver http://www.ft.com/cms/s/0/69728262-11ec-11e0-92d0-00144feabdc0.html#axzz... Some of the world's strongest banks have profited from an emergency credit facility set up by the US Federal Reserve to shore up confidence in the global financial system, according to a Financial Times analysis of data released by the Fed. More than half of lending under the Fed's term auction facility -- the largest of its crisis programmes -- went to foreign banks. Details of the varied uses to which they put it may add to political criticism of the Fed. The Taf was set up in December 2007 to provide one-month loans to credit-worthy banks as markets dried up for lending longer than overnight. In August 2008 it began offering three-month loans as well. Rabobank of the Netherlands and Toronto-Dominion of Canada, two of the only banks in the world with triple-A credit ratings, used more than $20 billion in cumulative Taf loans. ... Dispatch continues below ... ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php Ed Clark, TD chief executive, said that using Taf was logical even though his bank never had a liquidity problem. "That wasn't how we made a lot of money. But you make a dollar here, you make a dollar there. What's the spread you make on a billion dollars?" he said. In the summer of 2008, TD was borrowing $1 billion from TAF at rates of between 2 and 2.5 per cent. For that borrowing it used the lowest quality -- and hence highest yielding -- collateral acceptable to the Fed. More than 80 per cent of its collateral had a triple-B credit rating at a time when such bonds yielded about 7 per cent. TD could therefore have made a notional gross spread of about $4 million a month during 2008. Mr Clark said the authorities were encouraging healthy banks to use schemes such as the Taf so as not to stigmatise their weaker counterparts. In January 2008, Ben Bernanke, the Fed chairman, said the Taf appeared to be succeeding because "there appears to have been little if any stigma." "You go through the whole crisis and there were lots of things we did that weren't necessarily economic but were the right thing to do for the system," said Mr Clark. "So I'm not embarrassed by this at all." Rabobank said it used the Taf only "in case the situation on the financial markets would further deteriorate" but it still had $5 billion in outstanding loans as late as January 2010. The Fed declined to comment, but has pointed out that all of its emergency credit was repaid in full with interest, and that its goal was to provide liquidity. Korean banks, including Hana Bank, Korea Development Bank, Industrial Bank of Korea, and Shinhan Bank, were also among the most enthusiastic posters of triple-B collateral to the Taf. One Korean bank official said: "It was the best option we had for raising foreign capital during the financial crisis." Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: | ||||

| Strong foreign banks splurged on, profited from Fed's emergency credit Posted: 27 Dec 2010 11:29 AM PST Non-US Banks Gain from Fed Crisis Fund By Robin Harding, Bernard Simon, and Christian Oliver http://www.ft.com/cms/s/0/69728262-11ec-11e0-92d0-00144feabdc0.html#axzz... Some of the world's strongest banks have profited from an emergency credit facility set up by the US Federal Reserve to shore up confidence in the global financial system, according to a Financial Times analysis of data released by the Fed. More than half of lending under the Fed's term auction facility -- the largest of its crisis programmes -- went to foreign banks. Details of the varied uses to which they put it may add to political criticism of the Fed. The Taf was set up in December 2007 to provide one-month loans to credit-worthy banks as markets dried up for lending longer than overnight. In August 2008 it began offering three-month loans as well. Rabobank of the Netherlands and Toronto-Dominion of Canada, two of the only banks in the world with triple-A credit ratings, used more than $20 billion in cumulative Taf loans. ... Dispatch continues below ... ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php Ed Clark, TD chief executive, said that using Taf was logical even though his bank never had a liquidity problem. "That wasn't how we made a lot of money. But you make a dollar here, you make a dollar there. What's the spread you make on a billion dollars?" he said. In the summer of 2008, TD was borrowing $1 billion from TAF at rates of between 2 and 2.5 per cent. For that borrowing it used the lowest quality -- and hence highest yielding -- collateral acceptable to the Fed. More than 80 per cent of its collateral had a triple-B credit rating at a time when such bonds yielded about 7 per cent. TD could therefore have made a notional gross spread of about $4 million a month during 2008. Mr Clark said the authorities were encouraging healthy banks to use schemes such as the Taf so as not to stigmatise their weaker counterparts. In January 2008, Ben Bernanke, the Fed chairman, said the Taf appeared to be succeeding because "there appears to have been little if any stigma." "You go through the whole crisis and there were lots of things we did that weren't necessarily economic but were the right thing to do for the system," said Mr Clark. "So I'm not embarrassed by this at all." Rabobank said it used the Taf only "in case the situation on the financial markets would further deteriorate" but it still had $5 billion in outstanding loans as late as January 2010. The Fed declined to comment, but has pointed out that all of its emergency credit was repaid in full with interest, and that its goal was to provide liquidity. Korean banks, including Hana Bank, Korea Development Bank, Industrial Bank of Korea, and Shinhan Bank, were also among the most enthusiastic posters of triple-B collateral to the Taf. One Korean bank official said: "It was the best option we had for raising foreign capital during the financial crisis." Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: | ||||

| Greed And Fear's Chris Wood On The Timing Of The Euro Endgame Posted: 27 Dec 2010 10:02 AM PST From CLSA's Greed and Fear, by Chris Wood, December 23 edition. The S&P500 remains at post-Lehman highs and GREED & fear remains nervous about a correction. But GREED & fear will also have to admit that the short-term technical indicators long followed here are not sending warning signals. Rather the message is bullish which is one reason why GREED & fear is not reducing the beta of the long-only portfolios. It is also the case that the US continues to be cut relative slack because of the problems in Euroland. Here the ongoing noise from Brussels makes it clear that the final crescendo of this particular drama lies in the future. With Frau Merkel continuing to talk tough about the need for fiscal discipline, and rejecting euro bonds, it appears that there will have to be more market turmoil before the inevitable decisions are taken. GREED & fear says inevitable because it still seems likely that the end game will involve some form of German acceptance of collective fiscal responsibility and debt restructuring. This is partly because the German establishment is so committed to the euro and partly because of the practical fact that German banks have such big exposure to the debt of the European periphery countries. The past week have seen further signals that the above will be the end game. Thus, an article in the pinko paper by Peer Steinbru?ck and Frank-Walter Steinmeier, the former minister of finance and former foreign minister in the last SPD government, proposed debt haircuts as well as the limited introduction of European-wide bonds (see Financial Times: “Germany must lead fightback”, 15 December 2010). Second, the ECB announced on 16 December that it decided to almost double its subscribed capital base from €5.76bn to €10.76bn, with effect from 29 December. This suggests that there is an understanding, despite the official rhetoric, that there are losses that will need to be taken. Still it also seems clear that there needs to be more market panic for such decisions to be forced on the relevant authorities, most particularly Frau Merkel. All this suggests an opportunity for macro investors since it seems increasingly likely to GREED & fear that this drama is going to come to a head in the first half of 2011 and not in 2013 or later. Moreover the moment some form of credible debt restructuring is agreed, in the form of a European version of the Brady Plan, a bid should come in for the euro against the US dollar and indeed against the Swiss franc which has been the major beneficiary of the systemic surrounding the euro to the chagrin of the Swiss National Bank. But all this lies in the future. For the moment the issue for investors is what will be the catalyst to precipitate the next wave of market turmoil. Will it be Portugal, will it be Spanish banks’ property exposure or will it be a new Irish Government’s desire to walk away from the massively costly bank guarantees committed to by its predecessor? GREED & fear has no idea which will be the precise catalyst. Indeed it could be all of them. But more turmoil is coming which is why the best hedge for those owning Asian equities remains shorting European bank stocks Meanwhile, the risk to the above view remains that Frau Merkel remains hard line to the end and that German public opinion revolts against taking on any of the periphery’s debts. Clearly, this is possible. But it seems unlikely to GREED & fear given that all the empirical evidence thus far is that when push comes to shove, the Germans capitulate to the political mantra of maintaining the euro. What about the Chinese inflation story? GREED & fear will not repeat the relatively sanguine view already articulated here. But what is worth re-iterating here is that mainland policymakers are not concerned. The past week has seen more evidence of this. Thus, the Chinese government announced on Tuesday another increase in gasoline and diesel prices. As noted by CLSA China macro strategist Andy Rothman, this is not a signal that the PRC is particularly worried about inflation. Second, the chairman of the China Banking Regulatory Commission (CBRC), Liu Mingkang, made a speech at a financial forum in Beijing last Friday stating specifically that inflation was not a problem because of China’s continuing excess capacity. Thus, Liu said that there remains overcapacity for most industrial goods in China and that it is difficult for upstream inflation to be transmitted downstream. Clearly, the PRC policymakers could always be wrong. But in GREED & fear’s view the empirical evidence of the past ten years and more suggests they deserve to be given the benefit of the doubt. Still it is also the case that markets are likely to spend the first quarter of 2011 continuing to worry about inflation in China. This is because the mainland authorities are themselves now expecting inflation to peak at about 6% in the second quarter, primarily because of weather related seasonal pattern. Thus, January and February traditionally show strong month-on-month inflation pressures. Still the longer investors want to look into 2011, the less likely they are to be worrying about inflation in China or the rest of Asia and the more likely they are again to be worrying about renewed deflationary pressures in the West. As for developed market equities, the best place to be remains in those companies whose revenue streams are geared to the emerging markets. This is certainly how GREED & fear’s Japan long-only portfolio is positioned. On that point, the Nikkei published last week an interesting survey of 420 nonfinancial companies that found that 36% of Japanese listed companies’ earning last fiscal year (ended 31 March) came from emerging markets, up from just 9% a decade earlier. The same story applies in the US and European stock markets. But the only domestic story GREED & fear really likes in the West remains Germany and even there the final drama of Euroland’s crisis has the potential to hit resurgent consumer confidence, at least for a while. There have been interesting developments in the Korean peninsula in recent days. GREED & fear refers to South Korea’s so-called “live-fire drill” on Monday on Yeonpyeong Island and North Korea’s subsequent statement that the exercise was not worth reacting to. This suggests the North is hoping for a resumption of the six-party pantomime, or some variation of it, after the recent flurry of diplomatic activity. Thus, China’s leading diplomat, State Bingguo, has visited Pyongyang and Seoul in recent weeks while an unofficial US envoy, Governor Bill Richardson of New Mexico, also visited Pyongyang last week. Still if Washington and Seoul decline to be pressured into more talks, the risk to GREED & fear remains of further escalation from the North. For the failure of the South to do anything to stop the death of four South Koreans on South Korean soil, as a result of the violent attack in November, has led to a long overdue wake-up call in terms of South Korean public opinion. The support for the so-called “sunshine policy” has now all but evaporated. Instead there has been rising popular demand, in response to the South’s evident lack of military preparation for the North’s November attack, that Seoul makes it clear to Pyongyang that the next time such an incident occurs there will be a more aggressive retaliation. Hence this week’s military drills. This is why investors should understand that the risk of military escalation in the Korean peninsula has increased since the government of President Lee Myung-bak has now made it clear to the North Korean regime, via communications with the North’s main ally, namely China, that it has changed the rules of engagement. The message is that if the North launches another attack the response will be to retaliate by launching an attack on pre-targeted strategic assets such as missile sites in the North. The question then becomes the risk of escalation if the North responds in turn to such an attack. In this respect the ability of China, or the lack of it, will become a critical variable given the fact that Beijing was clearly not pleased with the North’s November provocation which put it in a difficult position diplomatically. Still so long as China is willing to shore up the North, and it is estimated to supply about three quarters of North Korea’s food and oil, it is not clear to GREED & fear if Beijing really has any control over the North’s behaviour. For the Kim Jong il regime presumably calculates that China will continue to prop it up because the alternative is a collapse of the Pyongyang regime which would likely mean a united Korean peninsula coming under the control of a pro-American alliance. Meanwhile the North Korean interest in launching the November attack was clearly to gain America’s attention. The ultimate goal is US acceptance of the North’s nuclear weapons programme. Hence the not coincidentally close timing in November of the shelling of the island and the decision to show the world the uranium enrichment facility. As for the investment implications, North Korea remains an impossible issue for markets to discount. It either does not matter at all or it is the only issue that counts. | ||||

| The 'Gold Covered Call Writing' Managed Futures Program Posted: 27 Dec 2010 10:00 AM PST | ||||

| Daily Market Recap: 12.27.2010 Posted: 27 Dec 2010 09:41 AM PST The S+P traded in a 7 point range, closing small up on the day. Financials did the best, up almost 1%, on the back of the news that AIG received $4.3bn in bank credit lines. Not surprisingly, today was the lightest day of the year in terms of volumes. | ||||

| Posted: 27 Dec 2010 09:36 AM PST Gold edges higher despite rate hikes The COMEX February gold futures contract closed up $2.40 Monday at $1382.90, trading between $1372.70 and $1387.00 December 27, p.m. excerpts: | ||||

| Richard Russell - We Will Have an Upside Explosion in Gold Posted: 27 Dec 2010 09:30 AM PST  With gold still consolidating gains, the Godfather of newsletter writers Richard Russell in his latest commentary stated, "I have posted (above) the year-end price of gold starting with the year 2000, the first up-year of one of the greatest and least appreciated bull markets in history. Take in this series, you may never see its like again." With gold still consolidating gains, the Godfather of newsletter writers Richard Russell in his latest commentary stated, "I have posted (above) the year-end price of gold starting with the year 2000, the first up-year of one of the greatest and least appreciated bull markets in history. Take in this series, you may never see its like again." This posting includes an audio/video/photo media file: Download Now | ||||

| Gold Daily and Silver Weekly Charts Posted: 27 Dec 2010 08:21 AM PST | ||||

| GATA's lawsuit for Fed's gold documents slogs on Posted: 27 Dec 2010 08:07 AM PST GATA's lawsuit against the Federal Reserve in U.S. District Court for the District of Columbia slogs on amid the Fed's desperate obstructionism. Last week, through its lawyers, William J. Olson and Jon S. Miles of the Vienna, Virginia, firm of William J. Olson P.C. (http://www.lawandfreedom.com/), GATA filed a long brief replying to the Fed's objection to a couple of GATA's requests. We have asked the court to review privately the gold-related documents the Fed doesn't want to disclose and to permit GATA to pose a limited number of questions to the Fed. | ||||

| GATA's lawsuit for Fed's gold documents slogs on Posted: 27 Dec 2010 07:36 AM PST 3:37p ET Monday, December 27, 2010 Dear Friend of GATA and Gold: GATA's lawsuit against the Federal Reserve in U.S. District Court for the District of Columbia slogs on amid the Fed's desperate obstructionism. Last week, through its lawyers, William J. Olson and Jon S. Miles of the Vienna, Virginia, firm of William J. Olson P.C. (http://www.lawandfreedom.com/), GATA filed a long brief replying to the Fed's objection to a couple of GATA's requests. We have asked the court to review privately the gold-related documents the Fed doesn't want to disclose and to permit GATA to pose a limited number of questions to the Fed. Our lawyers' mastery of freedom-of-information law and precedent is amazing even as their reply brief may make any layman's eyes glaze over after reading just a few of its 25 pages. The brief has been posted at GATA's Internet site so our supporters and gold's friends can see just how much effort is going into the lawsuit: http://www.gata.org/files/GATAReplyVsFed-12-22-2010.pdf If you're inclined to help us carry on the struggle, please visit: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php

This posting includes an audio/video/photo media file: Download Now | ||||

| COT Gold, Silver and US Dollar Index Report - December 27, 2010 Posted: 27 Dec 2010 07:33 AM PST | ||||

| The Why of White Metals: Silver, Platinum and Palladium in 2010 Posted: 27 Dec 2010 07:32 AM PST Hard Assets Investor submits: By Julian Murdoch Precious metals have had a heck of a year, even the non-gold metals. Especially those, in fact: As of December 23rd, silverprices had risen 73% for the year and platinumup 17%; palladium, the surprise winner, had increased a shocking 84%. Complete Story » | ||||

| No signs of a gold bubble despite record advances in 2010 Posted: 27 Dec 2010 07:11 AM PST December 27, 2010 (SeekingAlpha) — … So far it's been the amazing, runaway investment of the past decade. If you'd put your money into gold at the lows of about 10 years ago, you'd have made approximately a 400% return. That's left pretty much everything else — stocks, China, housing — in the dust (and we don't mean gold dust). We would be willing to bet that if you asked for a show of hands of how many people own gold in an audience of 100 seasoned investors, probably less than 10 might raise their hands. If you asked the same question in a room of average, random people, probably one or two hands at the most might go up. Gold is clearly not in the bubble stage yet. …Niall Ferguson in his book The Ascent of Money distills the formation of bubbles into five stages:

– 1) Some change in economic circumstances creates new and profitable opportunities. Following this analysis, gold is probably only in stage one, where changes in economic circumstances create profitable opportunities to buy the yellow metal. We are still far from euphoria. … We think that the bubble is not in gold, but rather in what is driving the price of gold: Fiat money creation. [source] | ||||

| Mandarin Monday – China Tightens, Snow Chills Markets Posted: 27 Dec 2010 06:41 AM PST Here’s the latest Stock World Weekly (archives here) We hope all of you had a great holiday weekend! –Ilene Mandarin Monday – China Tightens, Snow Chills MarketsIt's going to be another light trading week. Europe is off 1.25% this morning (8am) as the Shanghai fell 2% and the Hang Seng dropped 0.3% on news that China was raising rates 0.25% for the second time in 2 months - weeks ahead of what most considered a fairly aggressive tightening schedule. Chinese Premier Wen Jiabao voiced confidence Sunday that his government can contain rising prices. Speaking to listeners during a visit to state radio headquarters, Mr. Wen acknowledged that recent price increases have "made life more difficult" for middle and lower-income Chinese. But, pointing to measures the leadership has taken in recent months, he said: "As it looks now, we are completely able to control the overall level of prices." The remarks, in a session where Mr. Wen was asked repeatedly about prices, reflect the issue's political sensitivity for Beijing. Our futures would certainly be taking a much bigger hit if the dollar wasn't down half a point since Friday, inflating the prices of stocks and commodities and giving us the illusion of stability in what can easily become a rough morning. Of course we felt that last week's zero-volume move higher was fake, Fake, FAKE but, when the acting is that good, there's nothing else you can do but sit back and enjoy the ride. One long we did take on Thursday was a long on the VIX as we expect volatility to perk up in January. We took a short position on FCX at 2pm ($119) as a proxy for shorting gold and copper and we have an obvious exit point if they hit $120.

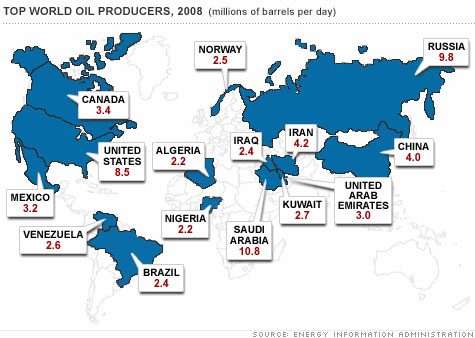

Let's not kid ourselves folks, oil is up $20 a barrel since September and that gives Ahmadinejad $84M PER DAY extra cash which he can use to help defeat the Great Satan. They are pumping the same oil as they were before - simply for a lot more money thanks (as usual) to Goldman Sachs, JP Morgan and the other patriotic speculators who are willing to bankrupt the people of their own countries in order to scrape a few extra dollars of commissions and profits off their energy trading. At $90 and 4.2M barrels a day, Iran gets 138Bn American Dollars a year to spend however they think is best and, if they thing that money is best spent buying roadside bombs for their militant friends in Iraq - well that's just good old fashioned Capitalism at work, right?

Wen, is the question everyone needs to be asking as China's last round of rate tightening, also spurred on by ridiculous rises in energy prices that the government was determined to put a lid on, was a trigger that collapsed the global economy in 2008. As you can see from the chart on the right, the last series of rate hikes took them from 6% to 7.5% in just over a year but, from their perspective, were not aggressive enough as oil soared to $140 a barrel in 2008 because Bush was giving away stimulus money as fast as China could remove it from the system. Obama and the Bernanke have already teamed up for a $2Tn money drop in 2011 and that $20 that oil has risen since The Bernanke announce QE2 in September is $20 per barrel that China has to subsidize for their people, who pay a fixed rate. So take the $30Bn bonus that we're shipping over to Iran and multiply that by about 4 and that's what it costs the Chinese government to cover that extra $20 per barrel. Believe me, they DO NOT want to see $100, let alone $140 again, no matter how much CNBC, GS et al salivate over the possibility... Somehow, the MSM seems to think American Consumers have an extra $400M a day to spend on oil and that, of course, is just 20M barrels times $20 extra or "just" $146Bn a year that will be spent on oil instead of ITunes. Of course, then you have refining mark-ups (great for our VLO, who are up 20% since Sept) and ancillary inflation in food, heat, electricity etc and you can easily double that to $300Bn. Figure each $10 rise in oil costs US Consumers $150Bn more to consume the same food and fuel that they did before and then contemplate that the bottom 90% of wage-earners in this country are making 5% LESS than they did in 2005 AND that 10% of them have no jobs at all.

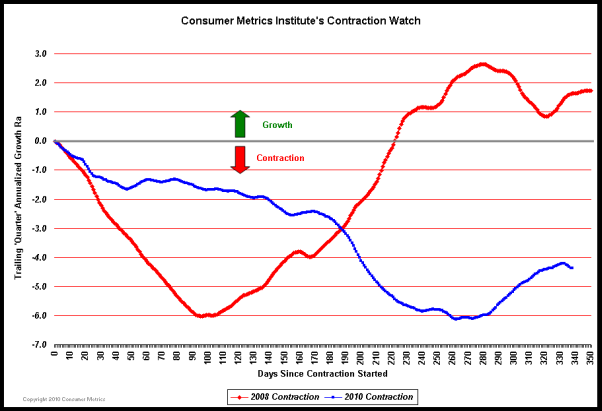

What we are seeing this holiday season is consumers RE-leveraging for the holidays. Now, I'm a little early with this, you won't hear about it until the data comes in later in the month - just like I told you about the Muni Debt months before it became a popular theme so let's just consider this something we'll need to watch out for in 2011. As you can see from the chart on the left, we are in a contraction on CMI (Consumer Metrics Institute's) data, which takes into account broad consumer spending trends and clearly indicates we are in no way out of the woods yet. As Housing Time Bomb points out: "The CMI goes on to explain how the majority of our growth in 2010 was as a result of massive government stimulus combined with improved exports thanks to a falling currency." Or, as I said last week - we have fooled almost all of the people some of the time in 2010 - whether that will last into 2011 or not is the question we must ponder for the new year. Meanwhile, baby it is cold outside in the Northeast and that, of course is bad news for retailers, who want consumers to come out and cash in those gift cards. It also stops air travel and keeps people at home and not driving - all bad for oil prices but we're not expecting them to fail $90 as long as we keep getting short-shipped over 10M barrels a week from our good friends at OPEC - a trick they've been using all of December to create artificial draws in US crude supplied. Last week, 8.7Mb of oil were imported per day and at least that was some improvement over the prior week's 7.7Mbd of imports, quite a bit below our 5-year average of 10Mbd. This effectively shorts our inventories by 10-15Mb PER WEEK so it doesn't matter whether you try to conserve oil or not, they will just short-ship us and call the draw-down in energy "consumption" because that is the totally BS way they measure it. As I said, we are short oil and short the markets at the moment as we still aren't quite seeing how they can keep all these balls in the air - no matter what, it's going to be an interesting New Year - but let's try to get through the week first! Be careful out there! | ||||

| Posted: 27 Dec 2010 06:38 AM PST Hi Jim and Dan, I hope you both had a great Christmas. I keep mentioning to my readers that we may be in the early stages of a significant drought in the plains area. The first impact will be the winter wheat crop, followed by beans and corn if the pattern continues into the spring. Cost-push inflation is going to be horrible as is. Imagine the impact of crop failure too. Yikes! Have a great week! Hi Craig, Thanks for the map. I have also been following that situation very closely. Not only are we dealing with some potential here in the US for dryness issues, but Argentina is running very hot and dry right now as corn enters its critical pollination phase. Soybeans also are at a stage where they too are affected in terms of both size and pod filling. It looks like the grain and bean situation has the potential to put more pressure to the upside on food prices. As you say, a combination of monetary issues and fundamentals could get ugly very quickly. Happy New Year,

Jim, China is a heavy investor in Brazil, mostly in strategic sectors like oil or land. Lately they have bought stakes in Brazilian electricity distribution businesses for close to $1 billion. Why would China do this except for diversifying from its dollar holdings? Best regards, China Spends Close to US$ 1 Billion Buying Power Plants in Brazil Electric power in Brazil Beijing-based State Grid Corp. of China completed the purchase of seven electricity distribution businesses in Brazil for US$ 989 million, announced the Chinese government this past week. Beijing-based State Grid will run electricity transmission services in the southeast of Brazil and supply power to Brazilian capital Brasília, São Paulo and Rio de Janeiro, according to a statement at the website of the Chinese government's state-owned Assets Supervision and Administration Commission. China's biggest electricity network operator agreed in May to buy controlling stakes in seven power transmission units in Brazil from Elecnor SA, Abengoa SA, Isolux Ingenieria SA and Cobra Instalações e Serviços SA. Latin America's biggest economy is attracting local and overseas investors to develop its energy infrastructure to meet power demand as its GDP expands more than 7%. State Grid has obtained a 30-year right to transmit power to the southeastern region of Brazil, the statement said. The electricity distribution businesses will generate annual profit of about US$ 110 million, according to the statement. | ||||

| Reader Threatens To Sue Fed After Losses Incurred By Going Long Inverse Leveraged ETFs Posted: 27 Dec 2010 06:22 AM PST Remember when double and even triple inverse leveraged ETFs were all the rage? That all occurred in the brief period of time before it became clear that Bernanke would first take down the global financial system before he let Citi get back to $1/share again. Apparently one reader recalls it all too well: "In 2008 at the bottom of the market I sold positions I owned in physical gold and banks stocks such as Bank of America (BAC), Citigroup (C) and also non financial companies such as Ford (F). I used these proceeds to purchased inverse ETF’s such as NYSE: FAZ (Direxion Financial 3x Short) and NYSE:SRS (Proshares Real Estate 2x Short). Since making these purchases, these ETF’s have suffered significant drops in value as reflected in their price. In fact NYSE: FAZ has plummeted from $1100 per share to $11 per share and SRS has reduced in price from $1000 per share to $19.50 per share. It is now apparent that the Fed spent trillions of dollars to raise the price of bank stocks and to inversely suppress the price of these inverse ETFs." Yet is this nothing but a case of fippers' remorse? Is there legal precedent for an actual claim? Was the Fed in breach of duty "by allowing investors to make investments into funds such as FAZ and SRS and other inverse ETF’s, while the Fed was performing transactions that the Fed knew or should have known would severely harm the investors in these publicly traded fund." Will Bernanke cave and make whole everyone who dared to put money into the market, even if it meant betting on a broad market decline? After all the whole purposes of the latest propaganda campaign is to get people to put money in the market with no fear of loss whatsoever: whether one is bullish or bearish (and as the lack of participation shows, most are certainly still bearish). Which is where it gets interesting: "Therefore, I appeal to your office to make due and just compensation in treble damages amounting to $__ million dollars for a full and good faith settlement of this matter. If this is agreeable, I am prepared to enter into a confidential good faith settlement." In our ridiculous bizarro world, in which nothing makes sense following each recurring Fed intervention, perhaps the Fed making whole those who lose money regardless of their bias, is just what is needed to break the 33 weeks of outflows... Full letter submitted by Bill Pitts: December 7, 2010 On or about March of 2009, the Federal Reserve Bank (The “Fed”) commenced in actions that involved making loans to banks, financial institutions, wholly owned Fed companies (i.e. Maiden Lane), lenders and publicly traded companies. Additionally evidence suggest that the Fed through these firms and at the direction of the Fed made direct purchases of equities in publicly traded companies for the purpose of raising stock prices. These transactions were undisclosed to the public and investors. Neither the Fed nor the recipient companies disclosed these material transactions to the investing public. Ostensibly, this assistance from the Fed was conducted with the objective of increasing the stock value of many troubled companies and banks. Additionally, under the plan by the Fed and U.S. Treasury, these banks and financial institutions used the Fed supplied funds to purchase each other’s stock. This was conducted to allow each bank to raise each other’s stock values to improve the assets values on one another’s balance sheets. These actions were supported encouraged, known about and assisted through actions of the Fed and the United States Treasury. While these actions may have been helpful to those firms to abate the systemic problems within the market, assisted in working to make recipient banks more solvent and may have prevented additional bank failure, these actions resulted in severe detrimental damage to many individual investors. As you are keenly aware, most every market transaction has two sides to a trade. As a stock or asset class increases in value, some investors realize gain while simultaneously others who concluded that the stocks would NOT improve in price and made investments accordingly known as taking a “short” position would loose money. The inverse of this scenario is also true. As I understand it, between the Fed and the SEC you all are charged with ensuring fairness, honesty and integrity in our markets and monetary system. It is also my understanding that the Fed professes to never intervene in the markets unless it is to prevent crisis. In 2008 at the bottom of the market I sold positions I owned in physical gold and banks stocks such as Bank of America (BAC), Citigroup (C) and also non financial companies such as Ford (F). I used these proceeds to purchased inverse ETF’s such as NYSE: FAZ (Direxion Financial 3x Short) and NYSE:SRS (Proshares Real Estate 2x Short). Should your office desire to discuss this, I can be reached at my office at XXX-XXX-XXXX or my mobile at XXX-XXX-XXXX "Secret bailouts do not merely benefit recipients; they also deceive investors into mistaking fantasy for fact. Such deceptions often punish honest investors, like the honest investors who sold short the shares of insolvent financial institutions early in 2009.Based on all available public disclosures, the story remained fairly grim into the spring of 2009. Accordingly, the short interest – i.e., number of shares sold short – on Goldman Sachs common stock hit a record 16.3 million shares on May... 15, 2009 – about 3.3% of the public float. But over the ensuing six months, Goldman’s stock soared more than 30% – producing roughly $500 million in losses for those investors who had sold short its stock. Not surprisingly, the total short interest during that timeframe plummeted to less than 6 million shares, as short-sellers closed out their losing positions." http://www.economicpolicyjournal.com/2010/12/totally-busted-truth-about-goldmans.html http://www.washingtonpost.com/wp-dyn/content/article/2010/12/01/AR2010120106870.html http://www.youtube.com/watch?v=rTPa1hGtpJs http://money.cnn.com/2010/12/01/news/economy/fed_reserve_data_release/index.htm?hpt=T1 http://www.zerohedge.com/article/meet-35-foreign-banks-got-bailed-out-fed-and-just-cpff-banks http://www.bloomberg.com/news/2010-12-02/federal-reserve-may-be-central-bank-of-the-world-after-ubs-barclays-aid.html http://www.bloomberg.com/apps/news?pid=20601087&sid=aymTlczlMmpA&os=1 http://www.csmonitor.com/Money/Robert-Reich-s-Blog/2010/0401/Fed-in-hot-water-over-secret-bailouts http://networkedblogs.com/21Xqv http://www.huffingtonpost.com/2010/12/01/fed-opens-books-revealing_n_790529.html http://www.youtube.com/watch?v=E10bHAI7U68&feature=player_embedded http://www.thefoxnation.com/business/2010/04/22/goldman-ceo-visited-wh-4-times-during-sec-investigation http://www.mcclatchydc.com/2010/04/21/92637/goldmans-connections-to-white.html http://www.youtube.com/watch?v=ssl5yb7FewA http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a.G6KFfaDdSc http://www.youtube.com/watch?v=HaG9d_4zij8 http://www.youtube.com/watch?v=n0NYBTkE1yQ&feature=player_embedded http://www.cnbc.com/id/34126826 http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/6646923/Bank-of-England-tells-of-secret-62bn-loan-to-save-RBS-and-HBOS.html http://www.guardian.co.uk/business/2009/dec/03/bank-england-secret-loan-hbos http://www.youtube.com/watch?v=2EQDrVKYWmc Bailouts could cost U.S. $23 trillion http://www.politico.com/news/stories/0709/25164.html http://abcnews.go.com/Business/Politics/story?id=814 http://blog.newsweek.com/blogs/wealthofnations/archive/2009/09/22/tracking-the-19-trillion-bailout-funds.aspx http://www.youtube.com/watch?v=oxuqmPyKqcs&feature=player_embedded http://www.zerohedge.com/article/how-lehman-feds-complicity-created-another-illegal-precedent-abusing-primary-dealer-credit-f http://www.youtube.com/watch?v=Q48eSoTNByQ&feature=related http://www.washingtonsblog.com/2010/04/geithner-looting-country-for-trillions.html http://www.zerohedge.com/article/why-fed-actively-managing-25-billion-maiden-lane-mbs-portfolio-when-its-24-trillion-soma-hol http://www.themarketguardian.com/2010/04/did-the-fed-just-surreptitiously-bail-out-europe/ http://www.dailymail.co.uk/news/article-1339220/Goldman-Sachs-pay-111million-bonuses-despite-taking-billions-bailout-money.html#ixzz18NTzHyqF http://www.mcclatchydc.com/2010/04/21/92637/goldmans-connections-to-white.html http://www.ynetnews.com/articles/0,7340,L-3320118,00.html http://articles.cnn.com/2010-04-20/politics/obama.goldman.donations_1_obama-campaign-presidential-campaign-federal-election-commission-figures?_s=PM%3APOLITICS http://news.antiwar.com/2010/09/16/following-fierce-debate-israel-decides-to-buy-f-35-warplanes/ h/t Will | ||||

| If You Haven't Bought Silver Yet, Read This Posted: 27 Dec 2010 06:18 AM PST By Chris Weber, editor, The Weber Global Opportunities Report Monday, December 27, 2010 The last time I was able to identify a period when a precious metals correction was about over happened two years ago… At that time, gold hit a low of $693 and silver $9.63. Since then, gold has risen about 100%, but silver has soared 206%. This is an extraordinary occurrence in just two years. Back in October, I thought both metals, and especially silver, were due for a rest, and perhaps a correction. Silver reached $24.75 on October 14. I expected a back-off to begin. Silver briefly touched as low as $23. That is a 7% fall. In the universe of silver, this is nothing. And then the rise resumed. In December, silver reached a new high of $30.50. This all feels unprecedented to me. Gold has not been giving people an advantageous entry point for a long time now. But silver is supposed to crash at certain times… It can almost be relied upon to do this. Not this time. A... | ||||

| The China Syndrome: A Building Bubble This Way Bloweth Posted: 27 Dec 2010 06:17 AM PST By James West MidasLetter.com December 27, 2010 The investment world has become obsessed with phenomena that cause catastrophic loss – so much so that a new language has evolved, subjugating old words to new meanings. Melt-downs, for example. Collapse. Bubbles. Bubble, in fact, is now the word that classifies any asset class believed to be overpriced as a result of investment hysteria. Right now, we have the gold bubble, the silver bubble, more generally, the commodities bubble. The real estate bubble, now burst, precipitated the world financial crisis of 2008, which, according to most financial press, is now over. Strange, that, since unemployment remains rampant, home prices are still at rock bottom, and earnings for any corporation who didn't get stimulus cash to superficially improve their balance sheet optics, are non-existent. But, as usual, the mainstream financial press misses the point. Gold and silver are not bubbles. Their demand as monetary metals grows in di... | ||||

| Is China The Big Silver Short? Posted: 27 Dec 2010 06:15 AM PST It is well known that the Chinese have been accumulating gold for at least a decade, and presumably silver as well, gold primarily for its monetary value, and silver for both its monetary and industrial value. In April of 2009, the Chinese Central Bank announced that it had secretly acquired 454 tons of gold bullion over the previous six years, supposedly all from Chinese domestic production, increasing their total stock from 600 metric tons to 1054 metric tons, and making them the fifth largest holder of gold bullion in the world. Quoting Dow Jones Newswire, April 24, 2009: “The new figure leaves China as the fifth biggest holder of gold after the U.S, Germany, France and Italy. Including Switzerland's 1,040 tons, six countries and the IMF now have gold holdings of more than 1,000 tons.” I find these numbers most curious and suspicious. The reputed 454 tons that the Chinese central bank claims to have acquired between 2003 and mid 2009 is just enough to put t... | ||||

| +74% later, Wall St. Journal notices silver only to try to talk it down Posted: 27 Dec 2010 06:10 AM PST Big advertiser J.P. Morgan Chase & Co. will be pleased. * * * Price of Silver Soaring Investor-Fueled 74% Gains Dwarf Gold; Race to Open Mines By Carolyn Cui and Robert Guy Matthews http://online.wsj.com/article/SB1000142405297020356800457604382039806794... BIG CREEK, Idaho -- An unexpected surge in investor demand is sending silver prices soaring—and speculators and mining companies are digging in. In the past four months, the metal has upended forecasts, rising 51% to a series of 30-year highs, before inflation. Silver closed Thursday at $29.31 a troy ounce, up from $16.822 at the beginning of 2010. Among the four major precious metals—the others being gold, platinum and palladium -- silver is up 74% this year, on track to be the second-best performing commodity after palladium, which is up 86%. Gold, by contrast, is up 26% and copper just under 28%. ... Dispatch continues below ... ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Prices are rising despite oversupply and a lackluster recovery in industrial demand. Many analysts expected those factors would keep a lid on prices in 2010. What they didn't expect was an overwhelming flow of money into the market from investors eager to ride a commodities rally. "This is a story almost entirely about investment," says Stephen Briggs, senior metals strategist at BNP Paribas. The global silver appetite partly reflects world economic improvements. Investors from the U.S. to China turned to "hard" assets such as copper and other commodities in part as a hedge against inflation worries. Silver benefits from a dual role as industrial commodity and precious metal. Here in the mountain-ringed Silver Valley, historically one of the world's largest silver production regions, workers are busy punching through rocks to open passages in the Crescent Silver Mine, which closed more than a dozen years ago when prices of silver dipped to $5 to $6 an ounce. Even if prices retreat to $15 an ounce -- a level seen as recently as early this year -- some prospectors say they can break even, which means development will continue. "I think we are starting a new era in mining here," says Greg Stewart, president of United Mining Group, which has an 80% interest in the Crescent Silver Mine. Exchange-traded funds backed with silver have enabled investors to invest in a market that traditionally was harder to participate in. The largest silver ETF, the $10.2 billion iShares Silver Trust, has seen a $1.1 billion net inflow for the first 11 months of this year. In recent months, concerns about inflation, the European debt crisis and the U.S. Federal Reserve's recent moves to boost the economy have driven investors to hard assets, also benefitting silver prices. The craze has reached the coin market. In November, silver American Eagle coins sold by the U.S. Mint amounted to 4.26 million ounces, a monthly record in the agency's history. Silver's reliance on investors to prop up the price could cause it to tumble suddenly. "When investor support for the metal fades, the downside is going to be pretty substantial," says Credit Suisse analyst Tom Kendall. He forecasts an average price of $30.10 per troy ounce next year as "a lot of factors that have led people to buy silver would still be there in 2011." But he cautions, "The number is only going to be achievable as long as fresh money keeps moving in." Silver's all-time high was set in January 1980 at $48.70 an ounce, or $129.32 when adjusted for inflation. This year investors are expected to pile a record $4.5 billion into the silver market, accounting for 24% of the world's total demand, says GFMS Ltd., a metals consulting firm in London. That's the highest level, in dollar terms, in decades. Silver's relatively small market size—$19 billion compared with $170 billion for gold—has also played a role in amplifying the impact of investors, according to GFMS. The strength in silver prices has prompted a flurry of development around the globe and pushed anticipated production in 2010 to 733.2 million ounces, up 3.3% from 2009 levels, and up 14% since 2006. Silver has some inherent appeal due to its industrial use in electronics, silverware and coins. And reserves are limited. According to the U.S. Geological Survey, there are fewer years of U.S. silver production left in the ground than any other precious metal including gold. The recent price increase has been fueled by other factors in addition to investor interest. For instance, China recently abolished an exports tax rebate on metals. That has resulted in a 59% decline in silver exports. China is a major silver producer and was a big exporter until 14 months ago. Strong demand there, coupled with the elimination of the tax break to protect domestic natural resources, have led Chinese producers to slash exports. Concerns are lingering over excess supply. The market is set to see a surplus of 64.4 million ounces in 2010, says Barclays Capital, which could curb prices. This year's surplus will be 16% smaller than 2009's but much higher than previous years. Overall, silver production has been rising steadily in the past five years, with most of the growth coming from mines in Mexico, Latin America, and Australia. Gold Corp., a Vancouver-based mining company, expects to more than triple output at its mine in Mexico, Penasquito, which is expected to produce 10 million ounces of silver in 2011, up from about 3 million ounces in 2009, according to GFMS. Another new mine, Coeur d'Alene Mines Corp.'s Palmarejo silver and gold mine in Mexico, is also ramping up to produce 9 million ounces annually. And BHP Billiton, which owns one of the largest silver mines in the world, Cannington, is looking to increase production and extend the life of the mine, located in Australia. So-called junior miners like United Mining Group, which has an interest in the Crescent Silver Mine, are much smaller than mining giants like BHP and Rio Tinto. They often lack the capital or expertise to run a mine, which requires costly equipment and infrastructure. Instead, their geologists often scout projects and then sell an interest in them to larger companies. United Mining Group is issuing shares on the Toronto Stock Exchange to raise up to $8 million to develop the Crescent Silver Mine, which is more than 90 years old. Located in Idaho's Silver Valley—an area peppered with colorfully named mines like Lucky Friday, Sunshine and Bunker Hill—it is expected to begin production in early 2012, with output just over 1 million ounces. "The whole industry is like feast or famine," says Mr. Stewart of United Mining. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | ||||