saveyourassetsfirst3 |

- We Will Have an Upside Explosion in Gold: Richard Russell

- Richard Russell - We Will Have an Upside Explosion in Gold

- The EurozoneInNeed An Undertaker

- BioSante Attracts Institutional Investors Ahead of Key FDA Catalysts in 2011

- Monday Bond Market Recap

- 2010 Dogs of the Dow Update

- Almost Everything Is A Crime In America Now: 14 Of The Most Ridiculous Things That Americans Are Being Arrested For

- Timberline Resources Our Top Pick for 2011

- Gold Has Been A Terrible Investment?

- If You Haven’t Bought Silver Yet, Read This

- 3 Things that Could Halt Gold’s Run

- Dec 27.2010 commentary. Limited data at the comex..Gold and silver open interest remain high.

- US Tax Policy Will Push Gold & Silver Much Higher

- Snowmageddon

- “YOU AIN’T SEEN NOTHING, YET”

- Gold Seeker Closing Report: Gold and Silver End Mixed In Quiet Trade

- COT Silver Report - December 27, 2010

- Gold To Outperform Silver

| We Will Have an Upside Explosion in Gold: Richard Russell Posted: 27 Dec 2010 08:31 PM PST Ted Butler tells CFTC Commissioner Bart Chilton not to bring a knife to a gunfight. GLD ETF has a 117,000 ounce withdrawal. Demanding the Mark Back: Opposition to the Euro Grows in Germany. GATA's lawsuit for Fed's gold documents slogs on. ¤ GOLD AND SILVER: A 2-Day ReportNot much happened on December 24th... which should be no surprise to anyone. But that can't be said of the 23rd. What happened on that day was right out of JPMorgan's playbook. Engineer a sell-off in both gold and silver... then cover/go long like mad themselves... even though volume was very skinny in both metals.

It's obvious that they're leaving no stone [no matter how small] unturned in their quest to cover their short position in silver. Gold appears to be just a sideshow for them. It's already obvious that they're heading for the exits in silver... but they don't want to appear even more conspicuous about it than they already are, by just going after silver all by itself. You will note that the lows of the day in both metals came at 10:00 a.m. Eastern time... which is the London p.m. gold fix. We've seen this sort of price action many times before... have we not?

Although gold finished down on Thursday... the shares managed a small gain. I'm always encouraged to see that sort of activity... as those are strong hands buying.

The dollar had quite a trading range on Thursday... but was never a factor in the gold and silver price action.

And now for Monday's action. You'll note that both gold and silver got smacked pretty good right at the beginning of Far East trading on Monday morning. True, there was a minor gap up in the world's reserve currency at the same moment... but the down moves in both metals were out of all proportion to the dollar move. Anyway, it wasn't long before both metals had recouped their losses... and gold basically traded unchanged on the day. Volume was very light... and there was nothing in the trading pattern in New York to suggest that the bullion banks were lurking about.

The silver chart looks almost identical to its golden cousin... except the price was more 'volatile'.

Here's the dollar chart for Monday. You can see the 20 basis point price spike at 5:00 p.m. Sunday night in New York that caused the big instantaneous drops in both gold and silver prices right at the opening of trading in the Far East . If I had to bet ten bucks, I'd say that Monday morning's opening scenario in the dollar and the precious metals was deliberate. The reason I say that is very simple. The dollar fell off a 35 basis point cliff shortly after Far East trading began early this [Tuesday] morning... and I see little in the gold and silver charts [posted just above this paragraph] that indicates that this event ever happened. Why wouldn't there be an instantaneous and corresponding rise in both gold and silver prices at the same moment? Just asking.

The nadir for gold stocks came at gold's low at 12:45 p.m. Eastern time yesterday... and then cut their losses by the end of the trading session... with the HUI only down 0.72%. I wouldn't read a thing into yesterday's share price action.

I'm combining Thursday's and Monday's CME Delivery Report into one. In gold... 189 gold contracts were issued/delivered [all on Monday... and 184 were delivered by JPMorgan from their customer account]. The big stopper [receiver] was Deutsche Bank in their proprietary [house] trading account. In silver... 164 contracts were posted for delivery on Wednesday. 157 contracts were issued by JPMorgan... and all were from their customer account. Of those 157 contracts... 133 were stopped/received by the Bank of Nova Scotia in their proprietary [house] account. The link to Monday's action is here. On Monday, the GLD ETF reported a small withdrawal of 117,202 ounces... and there were no reported changes in SLV... and there haven't been any since December 17th. The U.S. Mint has had nothing to say since December 23rd... but I'm expecting one more big sales report from them between now and the end of this week. There was a small silver withdrawal from the Comex-approved depositories on December 23rd... but it was only a few thousand ounces... and there was no report from them on Monday because of the weather conditions in the New York area. The CME advised "that these reports will resume [today] at their normally scheduled time." Because of the holiday-shortened trading week last week, the CFTC's Commitment of Traders report [for positions held at the close of trading on Tuesday, December 21st] didn't get published until Monday afternoon. Both Ted and I were pleasantly surprised with what the numbers showed. The Commercial net short position in silver was down 1,079 contracts... and is now sitting at 235.3 million ounces. The '4 or less' bullion banks are short 198.4 million ounces of silver... and the '8 or less' bullion banks are short 273.6 million ounces of the stuff. Historically speaking, these are really low numbers... especially considering the high total open interest... and powerful rallies have been know to start when the COT is in the bullish configuration that it is now. The same can be said for gold. The bullion banks reduced their net short position by 2,381 contracts during the prior reporting week... and the Commercial net short position is now down to 25.2 million ounces. The '4 or less' bullion banks are net short 10.9 million ounces... and the '8 or less' bullion banks are short 27.1 million ounces of gold. One has to wonder how high the silver and gold prices will go when JPMorgan et al begin to cover their short positions in earnest. I would say that we'll find out the answer to that in the next 30 days. Silver analyst Ted Butler had another commentary for his clients over the weekend... and I'll steal a paragraph from it. "While I understand Commissioner Chilton's reluctance to be openly adversarial to the CME over the issue of [silver] position limits, the CFTC's attempts to work co-operatively with the CME have yielded nothing to date. The CME has been working overtime to undermine position limits. That must be stopped. My advice to Chilton is not to bring a knife to a gunfight. It is time to lower the hammer on these SOB's. And this continuing worry... that trading will migrate to other exchanges if legitimate silver position limits are established... is pure nonsense. Let the short silver crooks go wherever they want to go; no one will follow them. Legitimate traders want to operate on legitimate exchanges and in legitimate markets. The only thing the regulators must do is to insure that the crooks dealing on foreign markets can't link their crooked trades back to our markets. If JPMorgan wants to hold crooked silver OTC positions with the Chinese or anyone else, let them. Just don't let them transfer or link anything back to the Comex."

¤ Critical ReadsSubscribeAlabama Town's Failed Pension Is a WarningI have a lot of stories accumulated over the last five days. I hope you can find the time to go through them all. The first is courtesy of reader Phil Barlett... and is out of the December 22nd edition of The New York Times. The headline reads "Alabama Town's Failed Pension Is a Warning". This is a longish story, but well worth your time, as I see most pension plans ending exactly as this one did. The link is here.  The Mexican Drug War: A Nation Descends into ViolenceThe next essay [courtesy of Roy Stephens] is on the longish side... and is posted over at the German website spiegel.de. The headline reads "The Mexican Drug War: A Nation Descends into Violence". It's an ugly, brutal story... and a very depressing read, as seen through European eyes. The link is here.  Rosenberg's Top Ten Reasons For Caution in 2011The next item is a zerohedge.com offering courtesy of Australian reader Wesley Legrand. I have a lot of time for anything that David Rosenberg over at Gluskin Sheff in Toronto has to say. It's headlined "Rosenberg's Top Ten Reasons For Caution in 2011"... and the link is here.  China Trade Minister Sees 'Chronic' Euro Debt ProblemHere's a story posted Christmas eve over at cnbc.com... and I thank Russian reader Alex Lvov for sharing it with us. The headline reads "China Trade Minister Sees 'Chronic' Euro Debt Problem". It's a short read... and the link is here.  Fitch downgrades Portugal's Credit RatingYour next story was posted on the france24.com website back on December 23rd. It's another offering from reader Roy Stephens... and the headline reads "Fitch downgrades Portugal's Credit Rating"... citing a "much more difficult financing environment for the Portuguese government," ratings agency Fitch downgraded Portugal's credit rating by one notch Thursday and warned of further downgrades. Without doubt, both Spain and Italy will be next. How much longer will the euro... and the European Union... last under these circumstances? The link to this very worthwhile read, is here.  Demanding the Mark Back: Opposition to the Euro Grows in GermanyRoy Stephens has another story that fits like a hand in a glove with the last one. This was posted yesterday over at the German website spiegel.de. The headline reads "Demanding the Mark Back: Opposition to the Euro Grows in Germany". This is your first must read story of the day... and the link is here. Richard Russell - We Will Have an Upside Explosion in Gold Posted: 27 Dec 2010 08:31 PM PST Image:  Lastly today, is this blog that was posted over at King World News late yesterday. The headline reads... "Richard Russell - We Will Have an Upside Explosion in Gold". It's a short piece... and well worth your time. The link is here. | ||||

| The EurozoneInNeed An Undertaker Posted: 27 Dec 2010 08:14 PM PST "The EU's Franco-German "Directoire" and the European Central Bank have between them ruled out all plausible solutions to the Eurozone's debt crisis." "There will be no Eurobond, no increases in the EU's €440bn (£368bn) rescue fund, and no mass purchases of Spanish and Italian bonds by the ECB. Nothing. The system is politically and constitutionally paralyzed. Spain and Portugal will be left nakedly exposed before their funding crunch.." Trader Tracks says the Germans will move swiftly to cut the Euroland attachment. "It is entirely predictable that Angela Merkel and Nicolas Sarkozy would move so quickly to shoot down last week's Eurobond proposal, issuing pre-emptive warning before this week's EU summit that they will not accept "a bundling together of all Europe's debts". "How can Germany or France agree lightly to plans that amount to an EU debt union, with a common treasury, tax system, and budget policy, the stuff of civil wars and revolutions over the ages? To do so is to dismantle the ancient nation states of Europe in all but name. Even if Chancellor Merkel wished to take this course – and even if the Bundestag approved it – the scheme would still be torn to pieces by the German constitutional court unless legitimized by radical EU treaty changes, which would in turn take years, require referenda, and face populist revolt in half Europe." "What the German people are being asked to do is to surrender fiscal sovereignty and pay open-ended transfers to Southern Europe, taking on a burden up to six times reunification (costs) with East Germany. "If we pool the debts of the countries in the south-west periphery of Europe, we are blighting our children's future: the debt levels are astronomic," said Hans-Werner Sinn, head of Germany IFO institute." "Any attempt to prop-up the status quo will cement the current account imbalances of EMU's North and South, to the detriment of both sides. 'I doubt that the current leaders of Europe fully understand the economic implications of their decisions. They are repeating the mistakes that Germany made over reunification," he told the Handelsblatt." "Transfers to the East are still running at €60bn a year two decades after the fall of the Berlin Wall. There has been no meaningful East-West convergence for the last 15 years." "To those who blithely argue that EMU is a good racket for German exporters because it locks in Germany's competitive advantage, he retorts that a trade surplus is the flip side of a capital deficit. Germany has seen €1 trillion – or two thirds of its entire savings since 2002 – leak out to fund the EMU party, gutting investment at home. This is toxic for Germany too." "It is no surprise to Euroskeptics that Europe should have reached this fateful point where leaders must choose between the twin traumas of EMU break-up or giving up their countries. Nor is it a surprise to an inner-core of schemers within the EU system, who have always calculated that they could exploit such a crisis to catalyze political union. "However, it is a big surprise to Europe's leaders, and they do not know what to do about it." "Chancellor Merkel and President Sarkozy seem unwilling even to boost the firepower of the European Financial Stability Facility, though in this they may be right. 'The drama has moved beyond the point where headline "shock and awe" pledges can achieve anything. Markets are already looking beyond the debt-stricken periphery to the creditor core, fearing that bail-out costs will themselves create a chain of contamination. Credit default swaps on France have risen above 100 basis points, where they linger stubbornly." "A Fitch report on the European Stability Mechanism (ESM) said the new rescue fund 'could result in lower ratings' on the risky sovereigns because the EU would have instant debt seniority, leaving private bondholders exposed to the risk of bigger haircuts. To make matters worse, debt restructuring would depend on the whim of politicians. The incoherence of the rescue machinery itself is feeding the debt crisis." "So as EU leaders flounder, the task of saving monetary union falls to the ECB. Yet it too has declined the burden, refusing to go nuclear with bond purchases. 'Each country needs to be held responsible for its own debt," said Germany's monetary avenger at the ECB, Jurgen Stark. He was joined last week by Mario Draghi, Italy's governor and candidate for ECB chief, who said it was not the job of a central bank to carry out fiscal rescues. 'We could easily cross the line and lose everything we have, lose independence, and basically violate the Treaty,' he said." "Indeed. Maastricht forbids the ECB from buying the debt of Eurozone states except for specific purposes of liquidity management. But this saga no longer has anything to do with liquidity. Southern Europe faces a solvency crisis. 'The ECB has postponed its threat to pull away the lending props beneath the banking systems of the PIIGS. Beyond that it has limited itself to tactical strikes in the small illiquid debt markets of Ireland and Portugal, buying enough bonds to ram down yields and burn a few hedge funds." "The effect has faded within days. It had little impact on Spanish and Italian bonds in any case. Spanish 10-year yields reached 5.45% last week, far above 5% level where compound arithmetic comes into play." "At the end of the day, debtor governments still have to persuade Japanese life insurers, Mideast wealth funds, or French and German banks, to put-up real money to buy their bonds at a bearable interest rate. 'Crédit Agricole's research team has expressed caution about participating in the auctions of Spanish debt until the ECB steps up to the plate. 'The risk is simply too large,' it said. However the bank itself does intend to take part in the auction." "So we drift on with rising yields into 2011, when Portugal must raise €38bn, Belgium €85bn, Spain €210bn, and Italy €374bn – according to Goldman Sachs. "Europe's leaders still seem to hope that brisk global growth will lift everybody off the reefs. That too is wishful thinking. Recovery brings its own set of problems, and will make intra-EMU tensions even worse. 'Germany will hit the inflation buffers and force the ECB to raise interest rates before the trickle down benefits of trade have begun to make any difference in the closed economies of the South. Floating Euribor rates that determine 98% of mortgages in Spain have been shooting up already, even as wages fall. The vice is still tightening on Spain. The reflex of the EU elites is to blame this structural mess on lack of statesmanship." "There is something surreal about the unfolding financial crisis,' said Stefano Micossi from the College of Europe, the sanctum sanctorum of the European Project. 'Leaders grudgingly do what is needed to prevent disaster at the last minute before it is too late, and the next minute they go back to the behaviour that brought them against the wall in the first place. The Eurozone is in bad need of a psychiatrist,' he wrote at VoxEU." "If the Eurozone follows this path, either all of the sovereign debts become German public debt, or the Euro will collapse,' he said. This is admirably candid in one sense, but is today's crisis really just a failure of leadership? 'Was EMU not dysfunctional from the first day? Did it not inflict negative real interest rates on Club Med and Ireland in the boom years, driving them into distastrously pro-cyclical policies?" "Did it not lock in chronic imbalances between North and South? Has it not left victim states trapped in debt deflation or slumps which have gone too far to respond an austerity cure, and from which there seems to be no escape on terms acceptable to Germany? 'Should we blame the current hapless leaders, or the guilty men of Maastricht who created this doomsday machine? If the project itself is rotten, surely what the eurozone needs most is an undertaker." Ambrose Evans-Pricchard, International Business Editor The Telegraph 12-13-10 As we wrote in 2003, The Euro currency and grand plan for the United States of Europe was ill-conceived from day one. Wide differences in cultures, economics, populations, and politics determined the failing end from the very beginning. Watch for Germany to begin trading Marks alongside the Euro. That is the beginning of the end for the Euro and the ECU experiment. This posting includes an audio/video/photo media file: Download Now | ||||

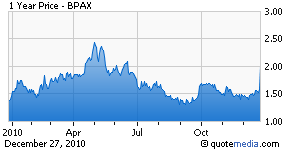

| BioSante Attracts Institutional Investors Ahead of Key FDA Catalysts in 2011 Posted: 27 Dec 2010 06:50 PM PST TheMarketFinancial submits: Following the Christmas break, shares of BioSante (NASDAQ:BPAX) soared more than 27% during Monday’s session on volume of 10.57M shares versus an average of 251,478, leaving investors hungry for the company’s potential that should be enhanced thanks to upcoming FDA catalysts in early 2011, as highlighted by our previous article. All seemed well going into the next trading session, until the after-hours session when news of a registered direct offering sparked newly found worries striking fear in the hearts of current and potential shareholders. To those who follow the biotech industry religiously, this occurrence shouldn’t catch anyone off guard, and in most cases does not pose a major roadblock for an undervalued company whose investment purposes should be for the long-haul rather than flipping a few pennies on the dollar. As an immediate example, during the month of December, no less than three highly profiled biotech companies with upcoming catalysts decided to raise cash ahead of these events. Complete Story » | ||||

| Posted: 27 Dec 2010 06:26 PM PST Bondsquawk submits: By Maulik Mody Stocks ended mostly flat Monday and Treasuries advanced as the 2-yr notes met with good demands. The dollar fell slightly, crude prices declined and metals rose in price. Volumes were lower across the American markets as the blizzard that arrived post Christmas made travelling difficult for many. Complete Story » | ||||

| Posted: 27 Dec 2010 04:52 PM PST David I. Templeton submits: One investment strategy that seems to get quite a bit of press is the "Dogs of the Dow" strategy. This strategy consists of selecting, after the close of business on the last trading day of the year, the ten stocks which have the highest dividend yield from the stocks in the Dow Jones Industrial Index. Once the ten stocks are determined, an investor would invest an equal dollar amount in each of the ten stocks. The strategy has had mixed results over the years. With the year coming to an end, it does appear the 2010 Dow Dogs will outperform the Dow Jones Industrial Index. Additionally, the Dow Dogs are maintaining a narrow performance edge over the S&P 500 Index. On a price only basis, the YTD return for the S&P 500 Index is 12.77% and the S&P's total return equals 15.03%. Complete Story » | ||||

| Posted: 27 Dec 2010 04:35 PM PST

We are throwing anyone and everyone in prison these days. It is getting absolutely ridiculous. Today, the United States leads the world in the number of prisoners and in the percentage of the population in prison. The United States has 5% of the world's population, but approximately 25% of the world's incarcerated population. According to the U.S. Bureau of Justice Statistics, as of the end of 2009 a total of 7,225,800 people were either on probation, in prison or on parole in America. That is a sign of a very, very sick society. Either we have a massive crime problem or the "control grid" that our leaders have erected for us is wildly out of control. Or both. But how in the world are we supposed to have a healthy economy if our entire nation is being turned into one gigantic prison? Sadly, it is not just hardcore criminals that are being rounded up and abused by authorities these days. The following are 14 of the most ridiculous things that Americans are being arrested for.... #1 A Michigan man has been charged with a felony and could face up to 5 years in prison for reading his wife's email.

#2 A 49-year-old Queens woman had bruises all over her body after she was handcuffed, arrested and brutally beaten by NYPD officers. So what was her offense? The officers thought that her little dog had left some poop that she didn't clean up. #3 A 56-year-old woman who was once a rape victim refused to let airport security officials feel her breasts so she was thrown to the floor, put in handcuffs and arrested. #4 In Milwaukee, one man was recently fined $500 for swearing on a public bus. #5 Several years ago a 12-year-old boy in South Carolina was actually arrested by police for opening up a Christmas present early against his family's wishes. #6 In some areas of the country, it is now a crime to not recycle properly. For example, the city of Cleveland has announced plans to sort through trash cans to ensure that people are actually recycling according to city guidelines. #7 A 12-year-old girl from Queens was arrested earlier this year and taken out of her school in handcuffs for writing "Lex was here. 2/1/10" and "I love my friends Abby and Faith" on her desk. #8 Back in 2008, a 13-year-old boy in Florida was actually arrested by police for farting in class. #9 The feds recently raided an Amish farmer at 5 AM in the morning because they claimed that he was was engaged in the interstate sale of raw milk in violation of federal law. #10 A few years ago a 10-year-old girl was arrested and charged with a felony for bringing a small steak knife to school. It turns out that all she wanted to do was to cut up her lunch so that she could eat it. #11 On June 18th, two Christians decided that they would peacefully pass out copies of the gospel of John on a public sidewalk outside a public Islamic festival in Dearborn, Michigan and within three minutes 8 policemen surrounded them and placed them under arrest. #12 A U.S. District Court judge slapped a 5oo dollar fine on Massachusetts fisherman Robert J. Eldridge for untangling a giant whale from his nets and setting it free. So what was his crime? Well, according to the court, Eldridge was supposed to call state authorities and wait for them do it. #13 Once upon a time, a food fight in the cafeteria may have gotten you a detention. Now it may get you locked up. About a year ago, 25 students between the ages of 11 and 15 at a school in Chicago were taken into custody by police for being involved in a huge food fight in the school cafeteria. #14 A few years ago a 70 year old grandmother was actually put in handcuffs and hauled off to jail for having a brown lawn. Why in the world would anyone approve of the police arresting ordinary Americans for such things? It seems like ever since 9/11 the whole country has gotten "security fever". Suddenly we need to "get tough" on everyone. Yes, crime is making a comeback, but once upon a time the police in this country were able to handle crime quite well and be courteous and helpful to ordinary citizens at the same time. But today it seems like nearly every single encounter with police ends up being negative. It does not have to be that way. The rest of the world sees what is going on in this country and many of them are deciding that they simply do not want to spend their tourist dollars here anymore. That is not a good thing for our economy. As the government continues to get even bigger and exerts even more control over our lives, many of our own people are getting sick of it and are moving abroad. America used to be the land of the free and the home of the brave. That is no longer true. Now we get thrown to the floor, handcuffed, beaten and arrested for things that we did not even know were crimes. If America continues to move in this direction it is going to ruin our economy, our reputation in the world and our national spirit. Unfortunately, history has shown us that once a free nation starts to lose that freedom it is hard to reverse that slide. Perhaps we will be different. Perhaps the American people will stand up and demand that we restore the principles of liberty and freedom that this country was founded on. Do you think that will happen? Feel free to leave a comment with your opinion.... | ||||

| Timberline Resources Our Top Pick for 2011 Posted: 27 Dec 2010 02:04 PM PST Steven Halpern's The StockAdvisors.com Top Pick Challenge for 2011 is up and posted on AOL at the following link: http://www.bloggingstocks.com/2010/12/27/top-picks-2011-favorite-stocks-from-60-advisors/ Our Top Pick for 2011 is our Vulture Bargain #4, Timberline Resources.... | ||||

| Gold Has Been A Terrible Investment? Posted: 27 Dec 2010 11:59 AM PST How many of you hear these financial advisor morons get on CNBC and discuss what a lousy investment has been over the years? What? Oh, it doesn't pay interest? Junk bonds paid tremendous interest all thru the 1980′s and then the market crashed hard. 99% of the world lost substantially more in capital loss than they earned from the coupon payments. If you chart U.S. Treasury Bills since 1991, adjusted for inflation, that interest-bearing investment is actually negative. How many your genius registered reps have you sitting in T-Bills? Well, here's how this "lousy" investment has done since 1970 – I borrowed this chart from Casey's Reasearch, the edit in red is mine: The next time your ignorant, idiotic "financial advisor" calls you up to tell you what a lousy investment gold is and what a great opportunity is being presented in the muni bond and mortgage-backed bond market, YOU are the idiot if you don't hang up the phone and find an advisor who knows the facts/truth. If I find more inspiring material to post I will do so, otherwise I'm off to do some back-country sno-cat skiing tomorrow. Have a great Christmas/Boxing Day/Holiday weekend! BUON NATALE A TUTTI! | ||||

| If You Haven’t Bought Silver Yet, Read This Posted: 27 Dec 2010 11:50 AM PST By Chris Weber, editor, The Weber Global Opportunities Report The last time I was able to identify a period when a precious metals correction was about over happened two years ago… At that time, gold hit a low of $693 and silver $9.63. Since then, gold has risen about 100%, but silver has soared 206%. This is an extraordinary occurrence in just two years. Back in October, I thought both metals, and especially silver, were due for a rest, and perhaps a correction. Silver reached $24.75 on October 14. I expected a back-off to begin. Silver briefly touched as low as $23. That is a 7% fall. In the universe of silver, this is nothing. And then the rise resumed. In December, silver reached a new high of $30.50. This all feels unprecedented to me. Gold has not been giving people an advantageous entry point for a long time now. But silver is supposed to crash at certain times… It can almost be relied upon to do this. Not this time. At least, not so far. Given an opportunity to correct or even consolidate its prior gains, silver barely takes a breath and then reaches new highs. Why? Some say silver shorts are covering. But why now? Why this time? Silver prices refused to fall, and then rose… Of course under these circumstances shorts will cover. No answer I've heard is satisfying. I just take the price action as the news. And the news is that this is bullish behavior the likes of which I don't think I even saw back in the last bull market of the 1970s. Of course, over the life of that bull market, silver soared from $1.29 to $48: a rise of 3,600%. So far this time, silver has only risen from $4.03 to about $29.50 today. That's "just" 632% during a similar time period. But the feeling this time is different. Silver has only had one typical correction: from $23 to just under $10. But while the percentage correction was typical (over 50%), it was all over in just seven months. A huge and powerful bull then quickly returned silver to new highs. And so far, this time, when I expected a real rest, silver isn't having it at all. It is possible that average investors now think gold is too expensive for them and see silver as something they should have. For a few hundred dollars or the equivalent in other currencies, silver is regarded as within the budgets of all investors, be they from India or Indiana, from China or Chinon. Can you imagine what would happen if every investor on earth became convinced they needed to own some silver? My old forecast of $187 per ounce may start to not look so wild. One other thing has happened recently that I haven't seen mentioned. Silver has now clearly overtaken gold as the best-performing asset class since 2000. Gold has risen from $256 to $1,390. That is a rise of 443%. Silver has risen from $4.02 to $29.50. That is a rise of 632%. As important, those advising silver accumulation have been few in number, and remain so. For those who have been waiting to buy or add to their silver holdings, there is no guarantee we'll have any big correction, or even a consolidation. I'm forced to advise people to simply buy or add without trying to time their purchases. In general, this is what you should do in a bull market, but I had until now thought I was clever enough to attempt to time purchases a little. I no longer consider myself so clever. So my advice is to bite the bullet and accumulate at least some physical silver. Good investing, Chris Weber Editor's note: Chris Weber is one of the best investors we know – and definitely someone you should listen to. We've never seen him be wrong about a major market call, ever. Right now, Chris is recommending a simple way to hold gold (this was the investment that started his multimillion-dollar fortune)… and a currency savings account that's made him 1,700% over the years. For more on what Chris is doing with his own money, click here. | ||||

| 3 Things that Could Halt Gold’s Run Posted: 27 Dec 2010 11:42 AM PST Normally we write about the things and conditions that cause precious metals to rise. While these things may be obvious, the corresponding rise in the bull market will not always be consistent and linear. Small and large corrections will occur along the way. Some will be purely technical while some have real drivers. There are three things which can precede a deep correction or consolidation in the precious metals complex. Other Markets Strengthen Precious metals perform best when strongly outperforming most other markets. They are at times an "anti-investment." In other words, when stocks and/or commodities are healthy, there is going to be less demand for precious metals. This doesn't mean precious metals will decline, it just means they won't rise or rise as much. Remember, stocks performed especially well from 2003 to 2006. Precious metals still performed well but not as well as in 2001 to 2003 or in 2007. In early 2009, Gold neared $1000 but stocks were set to begin a huge bounce, which evolved into a cyclical bull market. The first six months of said bounce caused Gold to consolidate before it would eventually break $1000. Currently, stocks are performing well as are commodities led by energy. As a result, some investors feel they won't need to invest in Gold if the "conventional" options are performing well. I expect this to continue in the early part of Q1 in 2011. This is partly why the precious metals complex is consolidating or correcting. The Economy Recovers The biggest issue and driving force for the bull market in precious metals is the sovereign debt situation. Inflation results from excess money and credit growth while hyperinflation or severe inflation results from the inability to grow out of the debt burden. The latter is more tied to the economy. It happens very quickly in small countries with small borrowing power. They accumulate too much debt, their economy weakens and as the economy fails to grow quickly, the market demands higher interest rates which eventually leads to default or printing money. Monetizing the debt (also known as printing money or quantitative easing) is one way to forestall the rising rates. This is what we are doing and what Europe and Japan have done. We can do it because we have a massively huge bond market compared to Greece, Argentina, Iceland, etc. For those who can't figure out why Gold is rising or why this is a bull market, there is your hint. If the economy would grow fast enough then debt to gdp would start to come down and the budget would come under control. This would lead to lower interest rates. Problem is, the US economy is growing well below trend in this "recovery." Debt and interest service costs continue to grow faster. We would need to see above trend growth sustained for several years. If you believe this is reasonably possible or likely anytime soon, then I guess you believe pigs can fly. Technical Selloff Silver in 2004, 2006 and recently, provides the best examples. The market reached a level where it was well above the moving averages. There was little chance of the market avoiding a correction or consolidation. The same could be said of Gold in 2006 and Q2 of 2008. Since late 2008, Gold has followed a different pattern. It has gained for three to four months then corrected for one or two. This action is far more sustainable then a vertical move for several quarters. However, silver has reached a technically overbought condition, so it will need to consolidate for at least several months. Gold is less vulnerable at present. Conclusion Presently, other markets are performing better and that is providing resistance against a continued rise in precious metals. Meanwhile, Silver is also technically overbought. A consolidation is needed to digest the huge gains and bring the market back to more of an equilibrium. These are some of the conditions we always look for and are thinking about as 2011 dawns. We are gold bulls but realize corrections and consolidations are inevitable. Our goal is to make subscribers money but help them make money in a timely fashion. If this interests you, we invite you to consider a free 14-day trial to our service. Good Luck! Jordan Roy-Byrne, CMT | ||||

| Dec 27.2010 commentary. Limited data at the comex..Gold and silver open interest remain high. Posted: 27 Dec 2010 09:34 AM PST | ||||

| US Tax Policy Will Push Gold & Silver Much Higher Posted: 27 Dec 2010 09:29 AM PST US Tax Policy Will Push Gold & Silver Much Higher The Obama administration's inability to obtain an improved tax revenue for federal coffers is the latest farce in the comic American tragedy unfolding before our very eyes. This government appears incapable of understanding that printing increasing amounts of currency while realizing deteriorating tax revenues and generally lethargic economic conditions is the direct path toward default.James West It would be excellent entertainment for the rest of us were it not for the fact that this bumbling government is likely to precipitate an even broader economic meltdown than that of 2008 with its arrogant insistence on unilateral financial dis-incentives. Future generations are now further encumbered by a debt and deficit load that is growing exponentially. Forget the feel-good reports coming out the main stream media. They are nothing more than post-meal flatulence from a body fed on the gassy and rosy statistics generated by payroll economists. Ridiculous new configurations in the English language are evidence of the totality with which financial journalism has been compromised. Who ever heard of something so utterly vapid and oxymoronic as a "jobless recovery"? Bankruptcies loom at the state, county and municipal level throughout the U.S. Even wealthy jurisdictions, like New York's Nassau County, home to some of the most expensive schools in the United States, faces a fiscal crisis. California is battling insolvency on an almost daily basis, and the U.S. Federal Reserve is forced to buy T-bills from the Treasury department just so the government can continue kiting checks to itself to stay operational. While America heads blindly towards third world status, there is immense opportunity for investors in gold and silver in such pig-headed policy. For the more money the government prints, the more the jobs market limps, the more homes half-built linger on disinterested markets, the more gold and silver will rise in price relative the U.S. dollar, which is increasingly representative of nothing, and now, less than nothing. Larry Summers, whose stint as Barack Obama's National Economic Council director thankfully comes to an end this year, is largely responsible for ensuring the enshrinement of unregulated derivatives and financial services industries from administration to administration as the number one hatchet man for Wall Street. That such a hugely ignorant human being can come to preside over the lofty highest offices of finance and education (as Harvard University president) is testimony to the existence a self-destructive genetic predisposition of the American people. Obama has essentially been castrated by the Republican and his own party in a presidency that was designed to fail, as Republican economists rightly identified the opportunity presented by the financial contraction precipitated by the absence of transparency in unregulated derivatives and swaps markets. He is forced to make deals and concessions to his ambitious plans that amount to status quo in most cases. He is facing defeat of key provisions in health care, his foreign policy on the middle east is continuously stymied, and now he is forced to extend tax cuts for the wealthy to preserve aspects of his initiatives. And so here we sit on the cusp of another year, where the bull market in gold and silver is now legislated into continuing thanks to the sterilized tax base of the American government. There is now absolutely no doubt that gold and silver with both continue to power higher throughout 2011, as the crumbling U.S. Dollar, expanding sovereign debt crises, general economic deterioration in the G7 nations induces even more demand for the safe haven monetary metals. Gold will likely break through $1,700 an ounce by the end of 2011, and silver will likely see $35, and may even go through $40 an ounce. Ben Bernanke recently commented that the $600 billion 'QE2" stimulus package might yet be expanded on if deemed necessary. That comment in and of itself is almost guaranteed to push gold through $1500 an ounce within the next two weeks.  James West is the publisher of the highly influential and widely respected Midas Letter at midasletter.com. MidasLetter specializes in identifying emerging companies in gold and silver exploration at the beginning of their share price appreciation curves, and regularly delivers 10 baggers (stocks that increase in value by at least a factor of 10) to his premium subscribers. Subscribe at www.midasletter.com/subscribe.php | ||||

| Posted: 27 Dec 2010 07:36 AM PST

Mercenary Links Roundup for Monday, Dec 27th (below the jump).

12-27 Monday

| ||||

| Posted: 27 Dec 2010 07:27 AM PST "YOU AIN'T SEEN NOTHING, YET" THE HUI INDEX~ HOLIDAY FRACTAL SEASONALS By: Goldrunner www.FinancialArticleSummariesToday.com The Holiday Season often tends to usher in strength for the Precious Metals Sector and this is especially true for those Holiday Seasons which are related in a fractal pattern. | ||||

| Gold Seeker Closing Report: Gold and Silver End Mixed In Quiet Trade Posted: 27 Dec 2010 07:14 AM PST Gold fell $10 to $1371.20 in early Asian trade before it rebounded to see a $5.18 gain at $1386.38 and next fell back to $1377.69 by a little after noon EST, but it then rallied back higher in the last hour of trade and ended with a gain of 0.08%. Silver fell to $28.74 and climbed to $29.31 before it dropped back to $29.03 by a little after 8AM EST, but it also rallied back higher in New York and ended with a loss of just 0.34%. | ||||

| COT Silver Report - December 27, 2010 Posted: 27 Dec 2010 06:33 AM PST COT Silver Report - December 27, 2010 | ||||

| Posted: 26 Dec 2010 03:48 AM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment