Gold World News Flash |

- Jim Sinclair - Gold is Poised to Explode

- Collapsing Europe

- Gold Stocks The Focus On GDX

- 5 Gold Stocks Being Targeted by Short Sellers

- The Euro: Après moi le déluge

- Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 3%

- John Hathaway - Start Thinking $100 Intra-Day Moves in Gold

- “Progressive Lenses”

- Hyper inflation (aka currency collapse) risk just ratcheted up A LOT

- Without Much Fanfare, The HSKAX Is Back To August 2007 "Quant Implosion" Levels

- WikiLeaks, Gold and Silver

- Surge In GLD December $145 Call Volume: Zero Hedge

- Monthly Gold Charts From Trader Dan

- Ambrose Evans-Pritchard: Ireland's debt servitude

- Ambrose Evans-Pritchard: Ireland's debt servitude

- Gold/Bonds Ratio Chart From Trader Dan

- Forecast for $100 daily moves in gold as silver shortage is reported

- An I.M.F. Announcement on the Completion of Gold Sales due Soon

- Gold, the EU and the Fed

- Don't Refuse the Gift of Gold

- Hourly Action In Gold From Trader Dan

- The Gold Price Broke Out of It's Triangle Hitting $1,389.76 at Today's High

- Grandich Client Timmins Gold

- TUESDAY Market Excerpts

- 3/3 Keiser/Maloney Buy Silver & Gold! (AND CRASH JP MORGAN!)

- Gold Daily and Silver Weekly Charts

- September home prices fall faster than expected

- The Dual-Mandated Failures of the Federal Reserve

- Graceland Updates 4am-7am

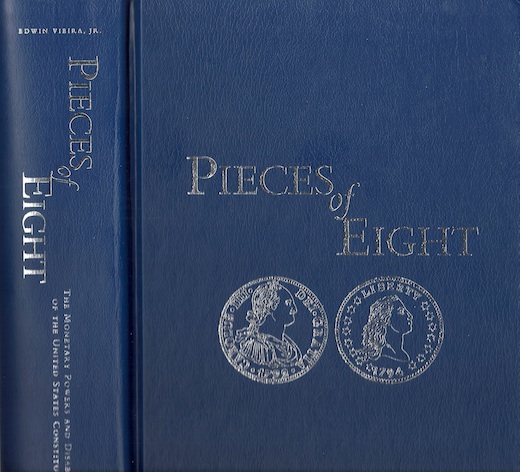

- Pieces Of Eight By Edwin Vieira To Be Reprinted Because Of GoldMoney

- Keiser/Krieger's silver buying campaign showing up in the monthly sales numbers

- Snookered!

- Euro Declines as Europeans Wise Up

- Gold Thoughts

- Debt Bubble Chronicles: And Heeeeere’s the European “Lehman Event”

- US Mint Sells Record 4.2 Million American Eagle Silver Coins In November

- QE2: Beware the Perils of its Success

- America’s Leading Export: Inflation

- America’s Leading Export: Inflation

- Calling All Silver Investors

- China Approves Fund That Will Invest In Foreign Gold ETFs, Opening Avenue For Millions Of Mainland Investors

- Gold Will Head to 1480-1525 Before a Major Correction

- Commodities This Week: Cold Weather, Middle East Tensions Expected to Have an Effect

- U.S. Dollar's Rally From the End of Inverted Parabolic Formation is Bearish for Gold and Silver

- IMF To Soon Announce Completion of Gold Sales

- Gold to $2,000, Silver to $60 Without World's Collapse

- Why I Still Like the Dollar in a Crisis

- Gold rallies as debt woes batter euro, China fund approved

- Four Canaries in the Coal Mine of Risk Trade

- WikiLeaks to Take on Private Sector?.. Hedge Fund Predicts China Disaster

| Jim Sinclair - Gold is Poised to Explode Posted: 01 Dec 2010 01:41 AM PST Listen, there's no stopping. It just can't be stopped because these fools have so screwed it up that whatever kind of camouflage that gets pulled over at any time, whatever plays there are that Goldman is making this week or next week, it's all noise. This stuff cannot be stopped because they have screwed things up that bad. I mean the place is a wreck, and nobody wants to fix anything. Everybody wants just to make it go one step further. They've kicked the can, and kicked the can, and the can has gone nuclear." | ||||||||||||

| Posted: 01 Dec 2010 01:19 AM PST They must be keeping their fingers firmly crossed in Brussels, even praying that the Irish rescue package will do more, much more than buy a little breathing space. Relying on divine intervention will not be good enough, because there are three separate problems that will now make the financial collapse of the euro area a racing certainty. These problems are the large amounts of cross-border lending, misguided economic responses, and creditor-debtor politics. | ||||||||||||

| Posted: 30 Nov 2010 06:06 PM PST $1424 or $1315? Which price does gold touch first? Gold is leaping higher this morning, up $9 to approx. $1375. My unchanged view has been that gold takes out 1424 first, and I bought into the lows at 1315, all the way down in a pyramid formation of buys. The reason I feel gold takes out 1424 first, and have stated it without wavering, is that technically speaking, any consolidation has a 66% chance of continuing (consolidating) the direction price was moving in, when it went into the consolidation. | ||||||||||||

| 5 Gold Stocks Being Targeted by Short Sellers Posted: 30 Nov 2010 05:42 PM PST Kapitall submits: The following is a list of gold stocks that have seen a sharp increase in short interest over the last three months. Complete Story » | ||||||||||||

| Posted: 30 Nov 2010 05:08 PM PST  (This is a continuation of my Part III of my Fiat Evolution Series. Due to my schedule I did not post the final part of that essay, and to be honest, I am still torn as to recent developments and my view of the Euro's ultimate fate. The best I can do is describe the two paths the EU faces) The expression "Après moi le déluge" has been attributed to the King of France, Louis XV. I think it is an appropriate expression to describe the possible breakup of the EU due to a failure of the Euro. The expression, loosely translated, means: "After me, the flood." Louis XV was a fiscal disaster, and he knew it. The Treasury was in a shambles, and it has been said that the expression: "Après moi le déluge" was uttered by him to describe the day of reckoning that awaited France. Fifteen years after his death, the French Revolution broke out, and his successor and grandson, Louis XVI met his fate with the guillotine. I make this analogy because at the beginning of Louis XV's reign, he was very popular. Debt splurges often have that consequence, the times are great. Consumption increases, people work, money flows. But then, there is always a day of reckoning. I have written about this in the past: That the Euro, based on debt, allowed for extreme imbalances in consumption and trade surpluses to develop. Lifestyles in the periphery nations improved, and the economies of nations such as Germany became models for the world to follow. But it was illusory, as all debt based pyramid schemes are. And now we find ourselves with extreme debt levels in violation of the Maastricht treaty - across the board, and extreme trade imbalances that hinder any rebalancing or growth. So what does that mean for the Euro's evolution? In the beginning of this series I mentioned that the EU wants the Euro to "act like gold." That is, they wanted to control its creation through controlling governments' debts, they mark to market their gold holdings quarterly, and they put in place strict deficit guidelines. This is in marked contrast to the US Dollar fiat policy. As we are seeing now, Euro stewarship was a failure. However, I hold the Banks more accountable than the governments. Banks always control money through their decisions to lend. That is what Banks do - it is their business to measure risk and lend accordingly. Well, they failed to measure risk accurately. All of them. And now, due to the Banks' pivotal role in the monetary system, the Banks will not pay the price of rampant irresponsible lending, the people will. And loss of sovereignty will follow. These are not national bailouts. They are Bank bailouts. Let's be clear about that. Just as in the US, QE2 is a masked Bank bailout as well. And so, the Euro faces two paths: Path One - Austerity This is the path that has been taken to date. It is a return to fiscal responsibility, and a return to make the Euro what it was intended to be: a strong reserve currency challenging the dollar and unifying Europe. But will austerity succeed? Will making the Euro act like gold, in a competing for devaluation fiat world, keep the Euro alive? I'm afraid not. Beneath the title of this blog is a quote by Austrian economist Ludwig von Mises: "There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion or later as a final and total catastrophe of the currency system involved." - Ludwig von Mises What von Mises describes are two scenarios that follow a period of extreme credit growth. The EU, with austerity, is following the first approach, the US with QE2, is following the second path. The first leads to immediate depression, the second to ultimate currency collapse. Those are the choices, those are the two corresponding outcomes. Austerity will be a political failure. Why? Because austerity ultimately socializes irresponsible bank and government losses on the people. And not just any people, but the "little" people the most. These are the people that protest and riot. The political repercussions can not be underestimated. And like the aftermath of Louis XV's reign, there will be an uprising when the "little" people feel the pain. I'm not saying it will be as extreme as the French Revolution - and I hope not. But the real concern here is that the anger of the populace will lead to the disintegration of the EU, and thus, the end of the Euro. The economic repercussions of the end of the Euro would be catastrophic. All sovereign debt markets will be suspect. Interest rates would skyrocket, and economies, faced with flat or minimal gdp growth can not handle high interest rates. It's a basic question of mathematics. How can a country successfully manage it's debts if the interest rate on its bonds post Euro is 9-12%, but its GDP is .5-2%? Path Two - The EU follows the US Fiat Model. As I described in Part I, the US has revolutionized (in a bad way) fiat money. With QE and trillion dollar deficits as far as the eye can see, money creation has been taken to a new level - without the limitations of risk measurement that the private banking sector faces. But in order to do this, the EU needs a central Treasury to work with the ECB, and what follows, is an EU wide income tax, just as the US has. See Part I on why the Fed was created at the same time as the Federal Income Tax. Is Europe politically ready for such integration? And how long can such a fictitious monetary system last? A commentator on this blog, Dave Narby posted a quote from Greg Hunter: "If a country could simply buy its own debt with zero downside, I say we should have been doing this all along." Makes sense, right? But what happens when every country on earth, as surely they will, follows suit? The entire global financial system will end in a crack up boom as governments compete to placate the needs of their oligarchs and general populations. You think there is a currency war now, well, Fiat in extremis, done globally, would be the WWIII of currency wars. Gold would be in the six figures in no time! But there is one more final path. Well, not exactly a fiat evolutionary path, as it replaces the Euro and changes the Euro area. It's the disintegration, or possibly splitting up of Europe. Disintegration as a policy is highly unlikely. No one wants to end the EU. But a splitting up of the EU into two currency zones would be something I would not rule out. Conclusion The central thesis of this blog is that fiat money will be replaced by gold, in some form, after a period of chaotic defaults and geopolitical conflict. Currencies and Credit will face so much distrust that the market and governments will be forced to rely on gold, as it is not manipulated, and is not someone else's liability. I wanted to describe the final evolution of fiat before the system ends. These are the days that policymakers globally, are scrambling and implementing policies ad hoc to stop the debt dam from bursting. From what I am seeing. No real solutions have been implemented that address the underlying causes of this global financial crisis, only temporary band-aids that delay the inevitable. Think about it. Since this crisis began in 2008, multiple explanations have been given as to how it came about: First, many said "No one could have predicted this." And then, it was blamed on greedy subprime homeowners, and so it was "contained." Also blamed were consumption motivated credit card users. Well, that didn't last long. So it was the greedy banks and the derivatives market. Which morphed into bad fiscal policies enacted by irresponsible nations like Greece. And now under attack, are the pensions promised to seniors. If we constantly change who to blame, do we really understand what is going on? Has anyone in government or central banking addressed the underlying issue - that all debt based monetary systems, due to the exponential growth of interest, ultimately end? I wrote this yesterday on a message board from Market-Talk, a very good greek financial blog, as part of a debate. I repeat it here, sorry for the poor grammar, as it was written in haste: People do not understand what money is. Money is created through debt. Debt needs to be created for money to be created. It is basic double-entry book keeping. Anyone that has taken an accounting course should understand this concept. In double entry book-keeping, one entity's debt is another's asset. For example, let's look at the relationship between Germany and Greece. German Banks lent money to Greece. Therefore, Greece has a liability, that is, they owe money to German Banks, and German Banks have an asset - they own a Greek debt that pays them interest. If you forgive the debt, you destroy the asset. The two co-exist. Now how healthy are German Banks? French Banks? Can they handle a debt write down of Greece? of Ireland? What about Spain? In the end, who is really getting bailed out in Greece? European banks are a mess. I remember watching Jim Cramer on CNBC in the US. He was explaining how he worked a desk in Wall Street and how they bundled debt. He said when a debt salesperson had trouble selling bonds, they would say: "Sell it to the Germans, those idiots will buy anything." That's what happens to countries that amass a large trade surplus at the expense of everyone else. They accumulate so much money, all they can do with it is buy the risky debts of their trading partners. Look at China, how much US garbage debt do they own? Suckers! But if you look at the big picture, debt accumulates because of interest. Whereas in the example above, say Greece received 100 million Euros from a German Bank. Well, 100 Euros were created. But you know what? That German bank wants 100 Euros plus 5.5% per year interest back. So in a debt based system, the amount of debt in the system always outgrows the amount of money available to service that debt. No monetary system is permanent. The current monetary system began in 1971 when the US went off the gold standard. The post WWII monetary system called Bretton Woods ended when the US effectively defaulted on its gold obligations. Yes, the US has recently defaulted. The current system arose from that default. The current system is 100% debt based. That means money is not convertible and can expand exponentially - far larger than the value of underlying assets in the system. If all monetary systems have an end due to the exponential growth of credit in the system, then I submit that the current 100% debt based monetary system we have today will also end. But its end will be the most catastrophic of all as it relies on credit more than any other monetary system that existed before. It's not a Greek thing. It's not even an EU thing anymore. It's basic mathematics. It's a pyramid scheme that has reached its apex. Game over So long as governments ignore the real causes of the crisis, the unfortunate train wreck will continue. | ||||||||||||

| Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 3% Posted: 30 Nov 2010 04:00 PM PST | ||||||||||||

| John Hathaway - Start Thinking $100 Intra-Day Moves in Gold Posted: 30 Nov 2010 03:43 PM PST With gold up over $20 so far today and silver gaining over $1, King World News interviewed John Hathaway of the Tocqueville Gold Fund. When asked if we were seeing something similar to the London Gold Pool being overrun in the late sixties Hathaway replied, "Yeah, it's kind of like a prison riot or the walls have come down, Bastille Day or whatever. I mean this is basically a free-for-all. I have always said this, we'll all be surprised at what gold can do when the jig is up for paper money which is where I think we are. I think we'll see days when gold is up $100, and then gold is down $100. We should start thinking three digits in terms of intra-day moves on the gold price." | ||||||||||||

| “Progressive Lenses” Posted: 30 Nov 2010 03:37 PM PST Economist Mark Zandi is optimistic about the US's ability to put its economy back on the right track. In a column that appeared in Sunday's Philadelphia Inquirer, Zandi, whose previous claim to fame was being caught totally by surprise by the financial meltdown while he served as John McCain's economic adviser in 2008, takes solace [...] | ||||||||||||

| Hyper inflation (aka currency collapse) risk just ratcheted up A LOT Posted: 30 Nov 2010 03:25 PM PST | ||||||||||||

| Without Much Fanfare, The HSKAX Is Back To August 2007 "Quant Implosion" Levels Posted: 30 Nov 2010 02:50 PM PST While everyone knows that it was two and a half decades of imbecilic monetary policy courtesy of the Monstro [sic] that caused the credit bubble, few things were as much of a direct proximal cause of the market crash as the August 2007 quant collapse. And few indices tracked the obliteration of the M/N quant landscape that followed as well as the HSKAX (below). Well, after two years of painful grinding (for the market neutrals), the HSKAX is back to the same level to which it plunged in that week in early August 2007. What does it mean? Who knows, suffice to say that the market not only stopped working when the quants were all briefly destroyed back in 2007, but it marked the all time high in the S&P. We are now back to those same levels.Only this time instead ot the Market Neutrals providing the traditional market liquidity it is the HFTs, the NYSE DMMs, and the New York Fed. What happens next is anyone's guess.

| ||||||||||||

| Posted: 30 Nov 2010 02:26 PM PST By James West, MidasLetter.com November 30, 2010 I've always occupied the emotional frequencies ranging between disgusted and outraged when it comes to WikiLeaks. Regardless of your stance on governments and sovereign interference, putting the lives of human beings at risk by exposing their participation in intelligence programs is aiding and abetting in murder. The psychotic fundamentalists that perpetuate the bulk of the violent crimes on its own and foreign citizens need not be encouraged by the provision of a list of fresh targets by idealistic or simply amoral grandstanders desperate for attention. Swathed in the self-assigned robes of righteous guardian and revealer of truths, WikiLeaks braves incarceration threats, smear campaigns (Swedish investigation of WikiLeaks founder Julian Assange on sexual abuse charges), and direct attacks on its I.T. infrastructure by intelligence agencies tasked with sabotaging the WikiLeaks site accessibility and functionality. However, now somewhat consumed with the audacity of WikiLeaks, I've embarked on a part time mission to understand and assess whether in fact WikiLeaks is essentially misanthropic or altruistic in nature. My conclusion, after much research, is the latter. In fact, anyone who spends any amount of time going over the information that has been brought to light by WikiLeaks is incapable of objectively concluding that there has been anything released at all the would constitute a direct threat to any individual's security. The only security being compromised is that surrounding various governments' attempts to gain advantage through covert activities against one another. The bottom line is the WikiLeaks web site is ground zero for a re-emergent function of the free press, wherein public pressure is applied to entities like the United States who act unethically and immorally to destabilize governments, instigate revolt and sew discontent in populations where it regards regime change, or other significant political outcomes, to its advantage. By exposing the extent of the unilateral actions of the United States in flagrant disregard for human life or sovereign autonomy, it makes it much more difficult for American covert agencies like the CIA to operate and receive funding, as the exposed information increases public outrage over such tactics. The government of the United States and its allies are now engaged in a broad based campaign to restrict the international travel of Julian Assange and paint him as a traitor. But the question as to who is traitor must be asked in light of the arbitrary murder and assassinations that come to light in the revelations of the WikiLeaked information. Hawks decry the release of classified information insisting that covert operations are crucial to the success of American military efforts to protect freedom and democracy. But if my freedom and democratic process must come at the cost of millions of lives of innocents in other countries, then thanks, but no thanks. To undertake murder on grand scale and shroud it in the mantle of the fight for freedom is the and always has been the essence of fascism. If anything, I've learned that WikiLeaks is a great source of education for just how deeply a fascist imperative dominates U.S. politics these days. Now comes the news that Assange and WikiLeaks plan to reveal 'flagrant violations' at a major U.S. bank. Whether 'flagrant violations" amounts to fraud remains to be seen, according to Assange. "It will give a true and representative insight into how banks behave at the executive level in a way that will stimulate investigations and reforms, I presume," he told Forbes. I can't think of a more welcome development, in the context of the public interest, than the existence of a safe and secure anonymous 'electronic drop box' as WikiLeaks classifies its system, to accommodate whistleblowers who want to expose transgressions by leaders in both government and commerce. Take, for example, the decade-plus long efforts by the Gold Anti-trust Action Committee, whose core premise is that the prices of gold and silver have long been subject to manipulation both to provide an unfair profit advantage to certain financially institutions, but also to influence the perception of citizens at large as to the health of the U.S. Dollar and the American economy. Growing evidence and opinion supports the idea that illegal and unethical manipulation of gold, silver, and who knows what other markets has long existed. Even CFTC Commissioner Bart Chilton has opined that, "There have been fraudulent efforts to persuade and deviously control that price," he said in reference the silver futures market. What has long been absent, is abundant document evidence from within the banks who are allegedly behind the price manipulation schemes. Imagine how much easier the efforts of GATA Chairman William Murphy and CFTC Chairman Gary Gensler would be if such documents were available from a source such as WikiLeaks? One can certainly make arguments that the severity of market bubble implosions like the tech market in 2001 and real estate in 2008 are partially exacerbated by such manipulations, in that they provide an apparent foundation to support the issuance of more currency and lower interest rates to fuel leveraged speculation. If these illegal and unethical practices can be unequivocally exposed, and thus stopped, there is no doubt that a more secure and equitable global financial system would be the result. Gold and silver are important barometers in a financial world dominated by fiat currencies backed by nothing physical. There unfettered ability to trade freely is in the international interest, not just the national interest. Those eventually discovered to be guilty of such manipulation should be charged and tried for treason, with the appropriate sentences fully applied. But, unfortunately for Julian Assange, it is WikiLeaks credibility that is being called into question. As an Australian national, pressure is being applied to the Australian government by the U.S. government to find a way to convict Assange of espionage. U.S. Attorney-General Eric Holder confirmed that an investigation run jointly by the Justice Department and the Pentagon was underway. "This is not sabre-rattling," Mr Holder said. "To the extent that we can find anybody who was involved in the breaking of American law … they will be held responsible. They will be held accountable. To the extent there are gaps in our laws, we will move to close those gaps." If only such indignant scrutiny was directed at the U.S. government and its financial services industry. We might finally, after hundreds of years, end the search for responsible government. James West is the publisher of the highly influential and widely respected Midas Letter at midasletter.com. MidasLetter specializes in identifying emerging companies in gold and silver exploration at the beginning of their share price appreciation curves, and regularly delivers 10 baggers (stocks that increase in value by at least a factor of 10) to his premium subscribers. Until December 31st, Subscribe right now for only $39 per month. After that the price increases to $49 per month: http://www.midasletter.com/subscribe.php | ||||||||||||

| Surge In GLD December $145 Call Volume: Zero Hedge Posted: 30 Nov 2010 01:36 PM PST While it is not surprising that 9 out of the top 10 option classes in GLD are calls, what is odd is that the most actively traded call by a substantial margin are the December $145 strikes. In other words, specs are betting that gold will move $60 higher in the next three weeks. Judging by today's 4% move in silver, the less valuable cousin may have a comparable move. | ||||||||||||

| Monthly Gold Charts From Trader Dan Posted: 30 Nov 2010 01:32 PM PST | ||||||||||||

| Ambrose Evans-Pritchard: Ireland's debt servitude Posted: 30 Nov 2010 01:30 PM PST By Ambrose Evans-Pritchard http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/100008812/ir... Stripped to its essentials, the E85 billion package imposed on Ireland by the Eurogroup and the European Central Bank is a bailout for improvident British, German, Dutch, and Belgian bankers and creditors. The Irish taxpayers carry the full burden, and deplete what remains of their reserve pension fund to cover a quarter of the cost. This arrangement -- I am not going to grace it with the term "deal" -- was announced in Brussels before the elected Taoiseach of Ireland had been able to tell his own people what their fate would be. The Taoiseach said afterwards that Brussels had squelched any idea of haircuts for senior bondholders: a lack of "political and institutional" support in his polite words, or "they hit the roof," according to leaks. One can see why the EU authorities reacted so vehemently. Such a move at this delicate juncture would have set off an even more dramatic chain reaction in the EMU debt markets than the one we are already seeing. ... Dispatch continues below ... ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf It is harder to justify why the Irish should pay the entire price for upholding the European banking system, and why they should accept ruinous terms. I might add that if it is really true that a haircut on the senior debt of Anglo Irish, et al., would bring down the entire financial edifice of Europe, then how did any of these European banks pass their stress tests this summer, and how did the EU authorities ever let the matter reach this point? Brussels cannot have it both ways. Ireland did not run large fiscal deficits or violate the Maastricht Treaty in the boom years. It ran a fiscal surplus (as did Spain) and reduced its public debt to near zero. German finance minister Wolfgang Schauble keeps missing this basic point, but then we don't want to disturb a comfortable -- and convenient -- German prejudice. Patrick Honohan, the World Bank veteran brought in to clean house at the Irish Central Bank, wrote the definitive paper on the causes of this disaster from his perch at Trinity College Dublin in early 2009. Entitled "What Went Wrong In Ireland?," it recounts how the genuine tiger economy lost its way after the launch of the euro, and because of the euro. "Real interest rates from 1998 to 2007 averaged -1 percent [compared with plus 7 percent in the early 1990s]," he wrote. A (positive) interest shock of this magnitude in a vibrant, fast-growing economy was bound to stoke a massive credit and property bubble. "Eurozone membership certainly contributed to the property boom, and to the deteriorating drift in wage competitiveness. To be sure, all of these imbalances and misalignments could have happened outside EMU, but the policy antennae had not been retuned in Ireland. Warning signs were muted. Lacking these prompts, Irish policymakers neglected the basics of public finance." "Lengthy success lulled policy makers into a false sense of security. Captured by hubris, they neglected to ensure the basics, allowing a rogue bank's reckless expansionism," he wrote. Let me add that the ECB ran a monetary policy that was too loose even for the eurozone as a whole, holding rates at 2 percent until well into the credit boom and allowing the M3 money supply to expand at 11pc (against a 4.5 percent target). The ECB breached its own inflation ceiling every month for a decade. It did this to help Germany through its mini-slump, and in doing so poured petrol on the bonfire of the PIGS. So please, no more hypocrisy from Berlin. The truth is that the EMU venture is one of shared culpability. Yes, the Irish should have regulated their banks properly and restricted mortgages to a loan-to-value ratio of 80, 70, or 60 percent, forcing it down as low as needed -- as Hong Kong and Singapore do -- to stop idiotic bubbles. But almost nobody understood the implications of monetary union: in Dublin, in Berlin, in Brussels, and Frankfurt. They were almost all beguiled (though I doubt that the ECB's Axel Weber and Jurgen Stark ever were). Given this, why should the Irish people accept the current terms? As Citigroup said in a note today, the EU part of the package will come at around 7 percent -- higher than the fee paid by Greece. By 2014 interest payments on Ireland's public debt (then 120 percent of GDP) will be E10 billion, while tax revenues will be E36 billion. This ratio is well above the average default trigger of 22 percent, as calculated in a Moody's study. Nominal Irish GNP has contracted by 26 percent since the peak. It is nominal, not real, that matters for debt dynamics. Ireland is in a classic debt-deflation trap, as described by Irving Fisher in his 1933 study. Yes, it has a very vibrant export sector, and can perhaps claw its way out of the trap -- which Greece and Portugal cannot hope to do in time, in my view. In a way that makes the choice even harder. The question is: Should the Dail vote against the austerity budget on December 7, Pearl Harbour Day? And should the next government -- with Sinn Fein in the coalition? -- tell the EU to go to hell, do an Iceland, wash its hands of the banks, and carry out a unilateral default on senior debt by refusing to extend the guarantee? The risks are huge, but then the provocations are also huge. And there is a score to settle. Did the EU not disregard the Irish "no" to Lisbon, just as it disregarded the first Irish "no" to Nice? Did it not trample all over Irish democracy? It is not for a British newspaper to suggest which course to take. Both outcomes are ghastly, but as one Irish reader wrote to me: If Eamon De Valera could defy world opinion in 1945 by sending condolences to Germany for the death of the Fuhrer, today's leaders need not worry too much about scandalizing those who made them swallow Lisbon. Compliance is traumatic. Default is traumatic. What the Irish have before them is a political choice about what they wish to be as a people, and a nation. Let me finish with a few words from Dan O'Brien, the economics editor of the Irish Times, that caught my eye: "Nothing quite symbolised this state's loss of sovereignty than the press conference at which the ECB man spoke along with two IMF men and a European Commission official. It was held in the government press centre beneath the Taoiseach's office. I am a xenophile and cosmopolitan by nature, but to see foreign technocrats take over the very heart of the apparatus of this state to tell the media how the state will be run into the foreseeable future caused a sickening feeling in the pit of my stomach." My sympathies. Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | ||||||||||||

| Ambrose Evans-Pritchard: Ireland's debt servitude Posted: 30 Nov 2010 01:30 PM PST By Ambrose Evans-Pritchard http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/100008812/ir... Stripped to its essentials, the E85 billion package imposed on Ireland by the Eurogroup and the European Central Bank is a bailout for improvident British, German, Dutch, and Belgian bankers and creditors. The Irish taxpayers carry the full burden, and deplete what remains of their reserve pension fund to cover a quarter of the cost. This arrangement -- I am not going to grace it with the term "deal" -- was announced in Brussels before the elected Taoiseach of Ireland had been able to tell his own people what their fate would be. The Taoiseach said afterwards that Brussels had squelched any idea of haircuts for senior bondholders: a lack of "political and institutional" support in his polite words, or "they hit the roof," according to leaks. One can see why the EU authorities reacted so vehemently. Such a move at this delicate juncture would have set off an even more dramatic chain reaction in the EMU debt markets than the one we are already seeing. ... Dispatch continues below ... ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf It is harder to justify why the Irish should pay the entire price for upholding the European banking system, and why they should accept ruinous terms. I might add that if it is really true that a haircut on the senior debt of Anglo Irish, et al., would bring down the entire financial edifice of Europe, then how did any of these European banks pass their stress tests this summer, and how did the EU authorities ever let the matter reach this point? Brussels cannot have it both ways. Ireland did not run large fiscal deficits or violate the Maastricht Treaty in the boom years. It ran a fiscal surplus (as did Spain) and reduced its public debt to near zero. German finance minister Wolfgang Schauble keeps missing this basic point, but then we don't want to disturb a comfortable -- and convenient -- German prejudice. Patrick Honohan, the World Bank veteran brought in to clean house at the Irish Central Bank, wrote the definitive paper on the causes of this disaster from his perch at Trinity College Dublin in early 2009. Entitled "What Went Wrong In Ireland?," it recounts how the genuine tiger economy lost its way after the launch of the euro, and because of the euro. "Real interest rates from 1998 to 2007 averaged -1 percent [compared with plus 7 percent in the early 1990s]," he wrote. A (positive) interest shock of this magnitude in a vibrant, fast-growing economy was bound to stoke a massive credit and property bubble. "Eurozone membership certainly contributed to the property boom, and to the deteriorating drift in wage competitiveness. To be sure, all of these imbalances and misalignments could have happened outside EMU, but the policy antennae had not been retuned in Ireland. Warning signs were muted. Lacking these prompts, Irish policymakers neglected the basics of public finance." "Lengthy success lulled policy makers into a false sense of security. Captured by hubris, they neglected to ensure the basics, allowing a rogue bank's reckless expansionism," he wrote. Let me add that the ECB ran a monetary policy that was too loose even for the eurozone as a whole, holding rates at 2 percent until well into the credit boom and allowing the M3 money supply to expand at 11pc (against a 4.5 percent target). The ECB breached its own inflation ceiling every month for a decade. It did this to help Germany through its mini-slump, and in doing so poured petrol on the bonfire of the PIGS. So please, no more hypocrisy from Berlin. The truth is that the EMU venture is one of shared culpability. Yes, the Irish should have regulated their banks properly and restricted mortgages to a loan-to-value ratio of 80, 70, or 60 percent, forcing it down as low as needed -- as Hong Kong and Singapore do -- to stop idiotic bubbles. But almost nobody understood the implications of monetary union: in Dublin, in Berlin, in Brussels, and Frankfurt. They were almost all beguiled (though I doubt that the ECB's Axel Weber and Jurgen Stark ever were). Given this, why should the Irish people accept the current terms? As Citigroup said in a note today, the EU part of the package will come at around 7 percent -- higher than the fee paid by Greece. By 2014 interest payments on Ireland's public debt (then 120 percent of GDP) will be E10 billion, while tax revenues will be E36 billion. This ratio is well above the average default trigger of 22 percent, as calculated in a Moody's study. Nominal Irish GNP has contracted by 26 percent since the peak. It is nominal, not real, that matters for debt dynamics. Ireland is in a classic debt-deflation trap, as described by Irving Fisher in his 1933 study. Yes, it has a very vibrant export sector, and can perhaps claw its way out of the trap -- which Greece and Portugal cannot hope to do in time, in my view. In a way that makes the choice even harder. The question is: Should the Dail vote against the austerity budget on December 7, Pearl Harbour Day? And should the next government -- with Sinn Fein in the coalition? -- tell the EU to go to hell, do an Iceland, wash its hands of the banks, and carry out a unilateral default on senior debt by refusing to extend the guarantee? The risks are huge, but then the provocations are also huge. And there is a score to settle. Did the EU not disregard the Irish "no" to Lisbon, just as it disregarded the first Irish "no" to Nice? Did it not trample all over Irish democracy? It is not for a British newspaper to suggest which course to take. Both outcomes are ghastly, but as one Irish reader wrote to me: If Eamon De Valera could defy world opinion in 1945 by sending condolences to Germany for the death of the Fuhrer, today's leaders need not worry too much about scandalizing those who made them swallow Lisbon. Compliance is traumatic. Default is traumatic. What the Irish have before them is a political choice about what they wish to be as a people, and a nation. Let me finish with a few words from Dan O'Brien, the economics editor of the Irish Times, that caught my eye: "Nothing quite symbolised this state's loss of sovereignty than the press conference at which the ECB man spoke along with two IMF men and a European Commission official. It was held in the government press centre beneath the Taoiseach's office. I am a xenophile and cosmopolitan by nature, but to see foreign technocrats take over the very heart of the apparatus of this state to tell the media how the state will be run into the foreseeable future caused a sickening feeling in the pit of my stomach." My sympathies. Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | ||||||||||||

| Gold/Bonds Ratio Chart From Trader Dan Posted: 30 Nov 2010 01:07 PM PST | ||||||||||||

| Forecast for $100 daily moves in gold as silver shortage is reported Posted: 30 Nov 2010 01:03 PM PST 9p ET Tuesday, November 30, 2010 Dear Friend of GATA and Gold (and Silver): Over at King World News, Eric King has interviewed Tocqueville Gold Fund manager John Hathaway, who expects $100 daily moves in gold, up and down, as the Western paper money system cracks up. Excerpts from the interview can be found at King World News here: Meanwhile Pan American Silver CEO Geoff Burns tells King that silver users are having trouble locating real metal in size. Excerpts from that interview can be found at King World News here: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php | ||||||||||||

| An I.M.F. Announcement on the Completion of Gold Sales due Soon Posted: 30 Nov 2010 01:00 PM PST At the end of October the I.M.F. had 32.7 tonnes of gold left to be sold. In September they sold 32 tonnes of gold and in October 19.5 tonnes, in the open market. Should they continue selling at the pace of September then we would expect to hear the announcement in December and probably in the first half of December. If they continued the slower pace of selling of October then we will have to wait until January 2011 for the announcement. We believe that this is significant because it will signal the real end of "Official" selling of gold. | ||||||||||||

| Posted: 30 Nov 2010 12:45 PM PST Central bankers hate gold. That’s surprising given that they collectively own the lions share of what’s out there. The record is pretty clear however, most of the majors have sold gold over the past few decades. Today they have even more reason to hate it. It makes them look bad. This chart shows that both the Euro and the dollar are losing the race against gold as a store of wealth. That the Euro is hitting all time lows against gold is an old story. But the move has gone parabolic of late, including a 3% pasting today A very high percentage of Europeans own some gold. Much more than Americans. Younger people who don't own gold have parents that do. They are more aware of gold as an asset class and something to turn to when there is trouble. Therefore the collapse of the Euro against gold is much more relevant then the fall in the EURUSD. EURGOLD is probably the best barometer of how desperate Europeans see their collective financial future. This does not bode well for consumer or business confidence. The US Fed is adding to the misery of the EU Central bankers. They are part of the problem, not part of the solution. They are contributing to the appreciation of gold at a time when the Euro is weak versus the dollar. This creates the exponential price action in EURGOLD. Many things are influencing gold of late. Inflation in China, nuts shooting cannons, a melt down of Europe’s financial picture and of course the biggest of all is the Fed and its effort to create inflation as a policy goal. What does this story from the WSJ do for gold? It’s a good bet that Ben Bernanke and his talking heads will get their way. Actual inflation, and even worse, expectations of inflation will rise. Gold will rise against the dollar as a result. It’s an equally good bet that the Euro is headed lower against the Buck. So the measuring stick that Europeans look at is going to get even more stretched. I wonder if those European central bankers (and a few political leaders) are hating Ben for adding to their woes. | ||||||||||||

| Posted: 30 Nov 2010 12:43 PM PST Stewart Thomson email: [EMAIL="stewart@gracelandupdates.com"]stewart@gracelandupdates.com[/EMAIL] email: [EMAIL="stewart@gracelandjuniors.com"]stewart@gracelandjuniors.com[/EMAIL] Nov 30, 2010 1. $1424 or $1315? Which price does gold touch first? Gold is leaping higher this morning, up $9 to approx. $1375. 2. My unchanged view has been that gold takes out 1424 first, and I bought into the lows at 1315, all the way down in a pyramid formation of buys. 3. The reason I feel gold takes out 1424 first, and have stated it without wavering, is that technically speaking, any consolidation has a 66% chance of continuing (consolidating) the direction price was moving in, when it went into the consolidation. 4. The simple fact is that gold was rising into 1424, so there's a 66% chance it breaks upside. I personally put the odds at 60%. My buying into 1320 has nothing to do with whether gold takes out 1424 or 1320 first. I actually hope 1320 breaks first, ... | ||||||||||||

| Hourly Action In Gold From Trader Dan Posted: 30 Nov 2010 12:12 PM PST View the original post at jsmineset.com... November 30, 2010 10:42 AM Dear CIGAs, Considering the fact that today is the end of the month and that during such times, many markets that have been in uptrends see some price weakness as traders book profits, gold, and silver for that matter, displayed impressive strength as buyers went to work. One can only suspect that December should start off very well for the fans of both metals based on what we saw today as overhead resistance levels were shattered and both markets appear to have broken out of recent consolidation patterns and look poised to move higher. If that wasn't enough, Gold priced in terms of the Japanese Yen made a 27 year high at today. When priced in terms of the British Pound and the Euro, it set new lifetime highs respectively. It also is within a few francs of setting a lifetime high in terms of the Swiss Franc. Clearly unrest regarding the sovereign debt crises of some of the Euro nations is bringing strong demand f... | ||||||||||||

| The Gold Price Broke Out of It's Triangle Hitting $1,389.76 at Today's High Posted: 30 Nov 2010 11:57 AM PST Gold Price Close Today : 1385.00 Change : 19.00 or 1.4% Silver Price Close Today : 28.185 Change : 1.037 cents or 3.8% Gold Silver Ratio Today : 49.14 Change : -1.177 or -2.3% Silver Gold Ratio Today : 0.02035 Change : 0.000476 or 2.4% Platinum Price Close Today : 1658.40 Change : 12.30 or 0.7% Palladium Price Close Today : 697.00 Change : 7.00 or 1.0% S&P 500 : 1,180.55 Change : -7.21 or -0.6% Dow In GOLD$ : $164.27 Change : $ (2.97) or -1.8% Dow in GOLD oz : 7.947 Change : -0.144 or -1.8% Dow in SILVER oz : 390.49 Change : -1.79 or -0.5% Dow Industrial : 11,006.02 Change : -46.47 or -0.4% US Dollar Index : 81.33 Change : 0.491 or 0.6% Today the market answered loudly and unequivocally my worries yesterday. The SILVER PRICE and the GOLD PRICE broke out of those triangles and . . . Well, I'll explain below. Early this morning the GOLD PRICE had already cleared that $1,366 hurdle that was badgering me yesterday. Looking closer at the 5 day chart, gold had formed an up-pointing wedge, when then resolved upside. This is an odd thing about those upward wedges, and I saw it often in the 1990s in stocks. Wedges are supposed to break out in the opposite direction to the direction they point: upward wedges break down, downward wedges break up. However, in strong bull markets that don't always work. Over and over it will form an upward wedge and break out upwards. Of course, every once in a while, just to clean your clock and restore your humility, wedges break in the orthodox fashion. Anyhow, gold hit 1389.76 at today's high. This clears the last intraday high ($1,382.30) and pierces the downtrend line from the 9 November intraday high at $1,424.40. As always, gold must now confirm its intention by closing higher still, I suggest above $1,400. Today it had risen $19.00 by the time Comex settled it at $1,385.00. That pretty well put to death my worries. Whoa! The SILVER PRICE chart today looks even more enthusiastic than gold's. Once it cleared that 2730c resistance, it left a trail of dust clean to 2830c. Comex settled at 2818.5c, higher by a colossal 103.7c. Listen here -- y'all are getting spoiled by this silver performance. This ain't normal, rising a dollar and more in a day. Yes, but it certainly points out silver's greater volatility, and how when money begins running for cover, it makes a much louder noise in the silver market. Something's not right in the world. Silver and gold are simply ignoring the US dollar and climbing right along, thank you very much, right in the face of dollar strength against every other currency alternative. Remember that silver and gold are also alternative monies, offering the only hard alternative to every unbacked fiat money in the world. You are watching the de-coupling now, the world-wide revulsion against central-bank-created money out of thin air. Trouble is brewing, world-wide. GOLD/SILVER RATIO dropped again today, with silver up percentagewise over twice gold's gain. My target for swapping silver into gold remains at 47.5 to one. Folks are getting all antsy about the ratio dropping further, and it certainly might, but once you set a target, assuming the reasons for the target haven't changed, it is a terrible idea to change that target. Then your greed and fear are pushing you, not your brain and reason. Other folks are writing because they have been reading internet articles and interviews that in end-of-the-world fashion predict that all the silver in the world will disappear, probably by next week, and there certainly won't be any when we get ready to swap back into silver from gold 15 or so weeks after the peak. Dearly beloved, let me be candid. The earth and its store of wonders was flung into space long ago, and altho one day 'twill disappear in a fiery flame, it probably won't happen next week, and anyway, that's not an event predictable enough to plan for. What I can plan for, I must, but not for the unknowable. Likewise, I expect silver to rise about three and a half times as much as gold from here, but it ain't all gonna happen next week, or even soon. Nor will all silver disappear from the face of the earth. At some price, we will be able to buy it, until that fiery flame incinerates it all. I know I'm throwing ice-water on somebody's alarmist Chicken Little parade, but I'm 63 and too old and battle-scarred for that mess. Tighten up your belt and be sober. Took Susan up to Nashville to see the doctor today because she thought her incision site was swollen. Nurse said her problem is simply that she's skinny, so the device sticks out more than if she were fleshier. Nice relief. First, look at that US dollar index. Today (I believe) it completed a move up from 79.60 begun last Thursday. That hints tomorrow 'twill move sideways or down. Dollar index cleared through the 80s and gobbled up 49. more basis points (0.63%) to end at 81.326. That solved my riddle about whether the buck would stop at 80 or 81. Right overhead hangs the dollar's 200 day moving average at 81.75, and y'all know that 200 DMA often serves as the upside target for a bear market rally. Lateral resistance lurks as well at 82, and at the last high (83.56 intraday). Dollar has now worked its way clean to oversold on the RSI (72.71), where 70 is oversold, although it shows no sign of stopping yet. Euro is drowning. Lost 0.97 US cents today, down 0.74% to $1.2992. Yen fared little better, closing 83.645 yen, down 0.425 or 0.51%. The scrofulous dollar is cleaning their equally scrofulous plows. Mercy, how glad I am I am not the Nice Government Men tasked with keeping the Dow afloat! That's a job for Sisyphus. Today the Dow plunged early to 10,946, then climbed to 1:30, fiddled, fell, and ended the day 46.47 poorer at 11,006.02. S&P500 gave up 7.21 to close at 1,180.55. When the Dow closes below 11,000, trouble will erupt. Watch. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. | ||||||||||||

| Posted: 30 Nov 2010 11:12 AM PST The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! November 30, 2010 03:04 PM On Korelin Radio After almost tripling in price, TMM has been in a sideways consolidation phase for a few months now. With an improving operational and financial picture, lots of exploration potential and a higher gold price anticipated, TMM appears ready to enter 2011 with all cylinder’s firing. [url]http://www.grandich.com/[/url] grandich.com... | ||||||||||||

| Posted: 30 Nov 2010 11:05 AM PST Gold climbs again on safe-haven demand, ends month up 2.1% The COMEX February gold futures contract closed up $18.60 Tuesday at $1386.10, trading between $1364.00 and $1391.10 November 30, p.m. excerpts: | ||||||||||||

| 3/3 Keiser/Maloney Buy Silver & Gold! (AND CRASH JP MORGAN!) Posted: 30 Nov 2010 10:54 AM PST | ||||||||||||

| Gold Daily and Silver Weekly Charts Posted: 30 Nov 2010 10:29 AM PST | ||||||||||||

| September home prices fall faster than expected Posted: 30 Nov 2010 10:06 AM PST (Reuters) - The decline in U.S. single family homes prices accelerated in September, a closely followed index showed on Tuesday, offering evidence that suggested that a further fall in prices may be in store. "Housing is in big trouble, "That will be Act II in the whole drama of the housing collapse," Shilling said. | ||||||||||||

| The Dual-Mandated Failures of the Federal Reserve Posted: 30 Nov 2010 10:00 AM PST I thought I knew everything about the foul Federal Reserve in that I knew they cause inflation in prices by deliberately creating too much money, which is the One Big Thing (OBT) that you do not want because of the social upheaval of people starving to death and rioting in the streets. And I thought I knew that the Federal Reserve was originally charged with preserving the value of the dollar, but apparently that is not so. Ergo, the Federal Reserve was not prevented, or warned, or even suggested to refrain from actually being evil, in that we have had continuous inflation in prices since the inception of the Federal Reserve in 1913 because of the vast increase in the money supply since 1913, and only a vast and expensive expansion of the welfare state has kept starvation and rioting under control… So far. So I was happy to learn a few things from The Wall Street Journal, like how only since 1978 has the Fed been given a so-called "dual mandate" to achieve both price stability and full employment, where "in the original Federal Reserve Act of 1913 Congress asked the central bank to supervise banks. It did not mention explicit economic goals. Even in the Keynesian heyday of the Employment Act of 1946, Congress did not ask the Fed to manage the economy." Of course, there are those who ask, "Why quibble about whether the Federal Reserve is a failure in both its 'mandates' of maintaining stable prices and high employment now that the horrible Federal Reserve is actually beginning their promised creation of another $600 billion in the next six months, and by extension another $1.2 trillion in the next year, and in fact will be buying a total load of almost $2 trillion in Treasury debt in the next twelve months, when you should be working and not standing around discussing this stupid stuff on company time?" As I was slumping back to my desk, I was muttering under my breath, "The reason is because of inflation in prices from all of this inflation in the money supply and how it is going to destroy us, you moron!" I'll bet that if I was in China, my stupid Chinese boss wouldn't be asking me such a stupid question, as David Stevenson in the Money Morning newsletter notes that "the official figures showed China's cost of living climbing by 4.4% year-on-year." Yikes! And all of this inflation in prices is because, "In the last seven years, China's M2 money supply measure – how much cash is sloshing around the system – has increased more than threefold. In other words, there's been a massive credit bubble" that has not only produced alarming inflation in prices, but "rapid economic growth – China is growing at around 10% a year just now," which means more demand and higher prices still! Yikes! And as bad as that is, Mr. Stevenson goes on that "a member of the Chinese Academy of Social Sciences, one of the government's top think tanks, said that by its own calculations the country's consumer price index had been understated by more than 7% over the past five years," which means that the terrifying 4.4% inflation is grossly understated, and has been estimated by others to be as high as 10%! This probably comes from the fact that "Food prices are already rising at 10% year-on-year. The Xinhua news agency reported that a basket of 18 staple vegetables cost 62% more during the first ten days of November than in the same period last year." They did not mention anything about pepperoni prices, sausage, bacon, cheese or any other ingredients of pizza, so I imagine that's why food riots have not broken out, plus the fact that the Chinese are said to be buyers of gold, protecting themselves against the debasement of their money by their banks and government. And since the same strategy of buying gold, silver and oil when so much money is being created works everywhere, I imagine that in Chinese they say something that sounds like "Ah-so! Oy chow wan go!" while we here in America say, "Whee! This investing stuff is easy!" The Mogambo Guru The Dual-Mandated Failures of the Federal Reserve originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||||||

| Posted: 30 Nov 2010 10:00 AM PST | ||||||||||||

| Pieces Of Eight By Edwin Vieira To Be Reprinted Because Of GoldMoney Posted: 30 Nov 2010 09:41 AM PST Pieces Of Eight By Edwin Vieira To Be Reprinted Because Of GoldMoney Reading time: 4 – 6 minutes I know many of you were greatly disappointed after the Pieces Of Eight reprinting failed to garner enough support last year. The GoldMoney Foundation has stepped in to fund the printing of Dr. Vieira's seminal work and it should be available for deliver in January. I highly recommend getting a copy. My check is already in the mail for multiple copies. We are grateful to Dr. Vieira for his tireless work as a Quixote of the world, GoldMoney for the funding and GoldMoney customer's for directing their capital away from starving vampire squids and towards a freedom centric organization.

While I have my own young padowans I teach and train in economic law and monetary jurisprudence; Dr. Edwin Vieira, Jr. is my intellectual mentor. Dr Edwin Vieira Jr, Pieces of Eight author, is the premier expert in this topic. He holds four degrees from Harvard, has argued several cases before the United States Supreme Court and is a prolific author. Dr. Edwin Vieira, Jr's seminal work is the two volume series Pieces Of Eight. Dr. Edwin Vieira's Pieces of Eight is a two volume, 1,700+ page, meticulously footnoted treatment of the monetary powers and disabilities of the United States Constitution. I have never come across a scholarly work of comparable quality in any topic. This book is a must have for any serious person's library. The demand is evidenced by either being hundreds of dollars per volume at Amazon or being sold out (like it currently is). VIDEO OF OUR NATIONAL TREASURE   CATHERINE AUSTIN FITTS REPORTS OF BOOK RELEASE Thanks to the generous support of James Turk and the GoldMoney Foundation, Pieces of Eight: The Monetary Powers and Disabilities of the United States Constitution is now in the process of being reprinted by R R Donnelley, one of the premier printers in the United States. This is a special run of the 2002 revised edition of the two-volume, 1,700+ page study of American monetary law and history which has been out of print and virtually unavailable (except at scalpers' prices) since 2006. Those who have had an opportunity to peruse this book know that there is nothing equivalent on the market, and likely never will be again. And those who have not seen it will find it to be as comprehensive and complete a study of money and banking in the United States as could be desired by anyone who wants to inform himself as to how sound money and honest banking were subverted and then largely eliminated in this country, where this process of planned degeneration has led us, and what might be done to return America to her constitutional roots. I expect that books will be ready for delivery by mid-January, 2011, and will be available only from me. •The price per two-volume set, delivered by USPS media mail to any address within the continental United States, will be $149.95 plus $10.00 shipping and handling, for a total of $159.95. •For orders shipped by media mail to an address within Virginia, add 5% sales tax ($7.50), for a total (including shipping and handling) of $167.45. •For orders shipped to Alaska or Hawaii, outside of the United States, or within the continental United States by other than USPS media mail, arrangements can be made for delivery by FedEx, UPS, or other means, as the customer desires. Please write "special shipping" on your order, and supply a telephone number and/or e-mail address, so that you can be supplied with the available options and their costs. •To secure your pre-publication order, send a personal check or money order, dated no earlier than 2 January 2011, to: Edwin Vieira, Jr. Copyright © 2008. This article was published on http://www.RunToGold.com by Trace Mayer, J.D. on November 30, 2010. This feed is for personal and non-commercial use only. Applicable legal information and disclosures are available. The use of this feed on other websites may breach copyright. If this content is not in your news reader then it may make the page you are viewing an infringement of the copyright. Please inform us at legal@runtogold.com so we can determine what action, if any, to take. If you are interested in how to buy gold or silver then you may consider GoldMoney.(Digital Fingerprint: 1122aabbLittleBrotherIsWatching3344ccdd) Copyright © 2010 RunToGold.com. This Feed is for personal non-commercial use only. If you are not reading this material in your news aggregator then the site you are looking at may be guilty of copyright infringement. Please contact legal@runtogold.com so we can take legal action immediately. Plugin by TaraganaPieces Of Eight By Edwin Vieira To Be Reprinted Because Of GoldMoney RELATED POSTS:

| ||||||||||||

| Keiser/Krieger's silver buying campaign showing up in the monthly sales numbers Posted: 30 Nov 2010 09:29 AM PST | ||||||||||||

| Posted: 30 Nov 2010 09:00 AM PST The 5 min. Forecast November 30, 2010 12:46 PM by Addison Wiggin - November 30, 2010 [LIST] [*] Say it ain’t so! Ireland not the end of the eurocrisis… gold hits euro record [*] Gold rallies in dollars, too… Alan Knuckman with a cautionary note [*] Housing double dip under way, and the chart that confirms it [*] How the federal wage freeze will make next to no difference to the national debt [*] Uncle Sam determined to improve your life, 2 inches at a time [/LIST] It took a while… but the most clueless European is finally figuring out something the most clueless Americans have known for a year or two: They’ve been snookered. Remember when Ben Bernanke told us that problems in the mortgage market were contained to the subprime sector? Then it became obvious they weren’t contained. But he promised they wouldn’t detonate the credit markets or take down major banks. And so on. Europeans are living this right now, today. Lead... | ||||||||||||

| Euro Declines as Europeans Wise Up Posted: 30 Nov 2010 08:58 AM PST It took a while…but the most clueless European is finally figuring out something the most clueless Americans have known for a year or two: They've been snookered. Remember when Ben Bernanke told us that problems in the mortgage market were contained to the subprime sector? Then it became obvious they weren't contained. But he promised they wouldn't detonate the credit markets or take down major banks. And so on. Europeans are living this right now, today. Leaders of the European Union assured them that problems in Greece would stay in Greece. Then the problems spread to Ireland. So EU leaders said if the Irish would just take a bailout, they'd come up with a plan to make sure nothing like this ever happened again. This week, bond traders are calling their bluff. Yesterday, the yield on Spanish bonds grew from 5.21% to 5.46%. (It's up again today, to 5.55%.) Today, the yield on Italian bonds grew to 4.68%. The spread over similar German bonds – the benchmark of reliability – is its widest since 1997, when the euro was still a gleam in the eyes of central planners. Credit default swaps on Irish debt, Portuguese debt, Spanish debt, Italian debt…they've all surged to record highs. Thus, the euro has slid below $1.30 for the first time in two months. Not surprisingly, gold priced in euros hit a record of €1,059. Priced in dollars, gold is looking pretty impressive too. The dollar index is merely firming up its position above 81…but gold has surged nearly $20, to $1,386. That's within $40 of the record set just three weeks ago. Dave Gonigam Euro Declines as Europeans Wise Up originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||||||

| Posted: 30 Nov 2010 08:40 AM PST | ||||||||||||

| Debt Bubble Chronicles: And Heeeeere’s the European “Lehman Event” Posted: 30 Nov 2010 08:29 AM PST

Earlier this year, I noted that the European debt crisis was mimicking the US’s 2008 banking crisis almost to a T. Greece was the “Bear Stearns” issue: a minor player that was swallowed up in the drive to maintain the appearance of stability.

Then came the $1 trillion bailout, the equivalent of the Fannie/ Freddie “blank check”: a massive sum of money thrown at a problem meant to convey the illusion that the powers that be have everything under control and that systemic risk is non-existent.

During the time of my first article, I stated that all we needed now was a “Lehman event” the event which proves beyond all doubt that contagion is occurring and that the entire system is at risk.

Well, it looks like we’re about to get it.

The ink on the Ireland bailout is not even dry and already Portugal, Italy, and Spain are crumbling. The market is no longer buying the “it’s only this particular country’s problem” jibe. The notion of systemic risk is finally beginning to dawn on investors. And as 2008 proved, once panic hits, it hits in a BIG way.

Indeed, as ZeroHedge recently noted, the yield on the latest Ireland bailout involved interest rates for the country at 6.7%, a full 1.5% higher that the interest demanded of Greek debt. In other words, the IMF and EU view Ireland’s bailout as more risky than that of Greece.

Does Ireland look worse than Greece to you?

So not only is Ireland deficit-to-GDP and debt-to-GDP ratios lower than Greece’s but the country’s actual GDP is smaller, so we’re talking about a lower nominal amount of money here too.

And yet Ireland is considered MORE risky than Greece?

Let’s be blunt here. Ireland is not riskier than Greece; it’s simply getting bailed out later in the game, when the world has begun to realize that all of the bailout funds are basically getting flushed down the toilet and ultimately default is the only real solution. None of this money is going to be paid back… so the higher interest rate is an attempt to recoup as much as possible before the inevitable default hits.

And Spain and Italy are next.

In plain terms, we are literally on the brink of the “Lehman” event in Europe. Everyone, even the dumbest bulltard on the planet, are beginning to wake up and realize that the plain obvious fact that you cannot solve a debt problem by issuing more debt. This has NEVER worked in history. It won’t now either.

I’ve been warning about the return of systemic risk for months now. If you haven’t already taken steps to prepare by now, WHAT ARE YOU WAITING FOR? Do you REALLY think the European debt Crisis will be “contained”? Last time the word “contained” in reference to a debt crisis was in the US in early 2008.

How’d that work out?

Good Investing! Graham Summers PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

| ||||||||||||

| US Mint Sells Record 4.2 Million American Eagle Silver Coins In November Posted: 30 Nov 2010 08:24 AM PST In what is becoming a very sad development, the more money (pardon, monetary base) Bernanke prints, the more silver coins Americans buy. According to the US Mint, November sales of silver just hit 4.16 million ounces or coins, an all time record, since the introduction of the coin in 1986, and that does not even include the last day of the month. The number is roughly a 30% increase to the 3.15 million one-ounce Eagles sold in October, and well above the previous 2010 record of 3.6 million sold in May. So far in 2010, the mint has sold 32.8 million ounces of silver, higher than the previous full year record of 29 million coins set in 2009. More from Reuters:

Oddly, the scramble for precious metals was not mimicked in a surge for gold, which sold "only" 103k ounces, including 99.5 one ounce coins. And to point out an error in the Reuters' article math, the June sales were not 452,000 ounces but coins, while the actual ounce equivalent sold was 151,500 ounces. So far the most active month in US mint gold coin purchases was May when 190k one ounce gold coins were sold. We can merely speculate that the Krieger/Kaiser plan of bankrupting JPMorgan through a popular scramble for physical is if not working, then certainly getting ever more supporters. | ||||||||||||

| QE2: Beware the Perils of its Success Posted: 30 Nov 2010 08:16 AM PST FYI: I’ll be traveling to NYC with my wife next week to support my upcoming Little Book. (I’ll be on CNBC’s Fast Money on Monday). We are going to be in NYC only for a few days, but I wanted to meet my friends and my growing number of readers. So here is my solution – please join me for the NY version of Cheap Talk on Wednesday Dec 8th at the Madison Club Lounge at The Roosevelt Hotel from 2-4pm. We had Cheap Talk get together in Omaha two years in a row, it was a lot of fun. If you want me to sign your copy of the Little Book, I’ll bring a pen. Here is my latest article, it discusses QE2. It took me three weekends to write it. Hope you enjoy it. - Vitaliy