saveyourassetsfirst3 |

- The Breakdown of the Monetary System Will Be Chaotic – Got Gold?

- It's Just a Matter of Time Before Gold Becomes Priceless! Here’s Why

- Direction of Gold, USD and U.S./Chinese Stock Markets – w/e Nov.26

- Gold Stocks Presenting a Break-Out Opportunity for Investors?

- Brigus Gold: A Turnaround Story in the Making

- The Big Picture: Is Gold Going to $4,500?

- Anybody have real money charts?

- David Einhorn Talks Gold, Apple, Pfizer, CareFusion, St. Joe and Moody's

- China approves gold fund of funds

- Gold Advances as Concern European Debt Crisis May Worsen Increases Demand

- Analysts See Silver Profit Taking – Hathor Reports U Resource

- Muni bond crisis looming: Michigan towns set to default on bonds

- China crisis watch: Benchmark stock index plunging...

- Record High Close Gold in Euros 11-29-2010

- GOLD CRAZY: New wave of Chinese money is set to slam the gold market

- Euro-Bankers Demand of Gr...

- Gold to $2,000, Silver to $60 Without World's Collapse

- Pan American Silver CEO - End Users Having Trouble Getting Silver

- Market Update and Commentary

- Super Imperialism: The Ec...

- There is No Head and Shoulders Pattern in Gold

- Is there ANY Evidence That The GLD ETF Has Distorted The Price Of Gold?

- Where are the insider admissions about gold? ...

- 20 Statistics That Prove That Global Wealth Is Being Funneled Into The Hands Of The Elite – Leaving Most Of The Rest Of The World Wretchedly Poor

- Global Sovereign Debt Default Bankruptcy Bailout and Contagion Risk Analysis

- Extremely High Open Interest on Gold and Silver comex on first day notice/bailout for Ireland.

- This Time Is Different

- Cutting Expenses to Borrow More Money

- Time to Sell Bonds

- Latvia’s Neoliberal Madness

- Gold Over €1,056/oz on Fear of European Contagion

- A New Tariff in Town?

- Precious Metals Shrug Off Dollar Rally

- The Road to Fascism

- Jon Hykawy Sees Downstream Value in Rare Earths

- Got Gold Report - Brief COT Update

- Silver Prices Surging on Near-Record Demand

- Gold Rises vs. Falling Euro & Stock-Markets as €85bn Irish Bail-Out Branded "Vicious"

- Breaking News on Comex Futures

- Gold Seeker Closing Report: Gold and Silver Start the Week with Gains

- COT Silver Report - November 29, 2010

| The Breakdown of the Monetary System Will Be Chaotic – Got Gold? Posted: 30 Nov 2010 05:50 AM PST We have entered the endgame for the dollar as the dominant reserve currency and most investors and policy makers are unaware of the implications - but those who are will have positioned themselves in the one asset most likely to be left standing when the dust settles - gold. Here's why. Words: 1003 | ||

| It's Just a Matter of Time Before Gold Becomes Priceless! Here’s Why Posted: 30 Nov 2010 05:50 AM PST If we continue down the same economic path that we have been following for the last four decades (and I seen no indication that we won't even if we wanted to, or could, at this point), it is mathematically inevitable that gold and silver will approach infinity in U.S. dollar terms at some point [in the future]. [Yes, to infinity!] Words: 1242 | ||

| Direction of Gold, USD and U.S./Chinese Stock Markets – w/e Nov.26 Posted: 30 Nov 2010 05:50 AM PST All is not necessarily as it seems according to Nu Yu, Ph.D in his weekly market analyses on the anticipated direction of the U.S. Dollar Index, gold and the U.S. and Chinese stock markets. Words: 891 | ||

| Gold Stocks Presenting a Break-Out Opportunity for Investors? Posted: 30 Nov 2010 04:09 AM PST | ||

| Brigus Gold: A Turnaround Story in the Making Posted: 30 Nov 2010 03:45 AM PST One of the best turnaround stories in 2010-2011 is that of Brigus Gold (BRD). There is a storied history behind this company in which Linear Gold (LGCFF.PK) absorbed Apollo Gold (AGT) through equity financing. This was a win-win for both companies, as Apollo had a less-than-mediocre balance sheet and had an enormous hedge book relative to the size of the company. Linear, on the other hand, was able to acquire some high quality assets relatively cheaply, enhancing its net asset value, immediate production, long term growth and great upside potential. Brigus has been very aggressive in both strengthening its balance sheet and eliminating its hedge book -- which will be completely eliminated by December. Complete Story » | ||

| The Big Picture: Is Gold Going to $4,500? Posted: 30 Nov 2010 02:23 AM PST David Moenning submits: Gold bugs are an interesting bunch. Traditionally known for extremely conservative political views as well as a passion for guns and canned goods, talking to a true gold bug can be a lot of fun if you have an open mind. However, these days, the gold-is-always-good crowd just might have a point or two worth considering. To the average investor, something that has already moved up ~25% this year and has almost doubled over the past two-plus years may not be considered to be a great value. The average technician might even call such an investment “overbought.” But to the gold bugs who have studied history, it looks like gold is still a good buy as there might be some room to run yet – maybe even a LOT of room. Complete Story » | ||

| Anybody have real money charts? Posted: 30 Nov 2010 02:21 AM PST This rally has gone concurrent to a very strong dollar rally. I am just smiling like a mofo, cause I know as soon as that dollar tanks, G&S are getting boosted to infinity. Are we at another high yet in y2000 dollars? | ||

| David Einhorn Talks Gold, Apple, Pfizer, CareFusion, St. Joe and Moody's Posted: 30 Nov 2010 02:00 AM PST Market Folly submits: David Einhorn, manager of hedge fund Greenlight Capital, recently sat down for a rare interview with Consuelo Mack on WealthTrack. The interview encompasses topics ranging from quantitative easing 2, his worries about the financial system, as well as many of his current positions including gold, Pfizer (PFE), Apple (AAPL), CareFusion (CFN) and his shorts of St. Joe (JOE) and Moody's (MCO). Einhorn has returned 22% annualized so it's always worth paying attention to what he has to say. CareFusion Complete Story » | ||

| China approves gold fund of funds Posted: 30 Nov 2010 01:40 AM PST China approves gold fund of funds By Chris Oliver, Nov. 30, 2010 HONG KONG (MarketWatch) — China's securities regulators have given the go ahead for a mutual fund to invest in foreign exchange-traded gold funds, potentially tapping interest among mainland China investors who face negative real interest rates on their bank deposits and want to hedge against inflation. Lion Fund Management Co. said they received approval from the China Securities Regulatory Commission on Monday to proceed with the fund, the first of its kind for mainland China, according to a statement posted on the Beijing-based fund provider's website. The fund has been granted permission to invest outside of China under the Qualified Domestic Institutional Investor (QDII), the fund managers said in the statement. The fund will invest in gold-backed exchange-traded funds operated outside of China, though the fund provider's statement didn't specify which ETFs, or which markets, it was considering. Hong Kong launched its own gold-ETF earlier this month, back by bullion held at a government-run depository at the city's international airport. See report on Hong Kong's first locally backed gold ETF. The QDII scheme enables financial institutions to invest in overseas markets and is widely seen as a vehicle to allow capital outflows from China at a time when the currency is not freely traded, prohibiting China's vast pool of savers from investing abroad. One-year yuan deposits at the Bank of China Ltd., for example, fetch 2.5%, with the People's Bank of China having last hiked its policy rate by a quarter-point in October. However, cash kept in these savings accounts are actually losing purchasing power at a dramatic rate, as with consumer prices in October 4.4% higher than they were a year earlier, and with the inflation rate expected to hit 5% in December, according to estimates by Bank of America- Merrill Lynch. The state-run China Daily said Tuesday that the new gold fund was the first of it its kind to be available to mainland investors. More funds could be on the way soon, as several other fund providers have pending applications for similar products, seeking to tap rising interest among mainland Chinese investors for precious metals, the report said. Chris Oliver is MarketWatch's Asia bureau chief, based in Hong Kong. Source: http://www.marketwatch.com/story/chi...nds-2010-11-30 | ||

| Gold Advances as Concern European Debt Crisis May Worsen Increases Demand Posted: 30 Nov 2010 01:23 AM PST Gold Advances as Concern European Debt Crisis May Worsen Increases Demand By Nicholas Larkin and Sungwoo Park - Nov 30, 2010 7:40 AM CT Gold gained for a second day in New York as speculation Europe's debt woes will worsen boosted demand for the metal as a protection of wealth. The dollar climbed to a 10-week high against the euro on speculation Ireland's banking crisis will spread. Investor concern has shifted to Spain and Portugal since Nov. 28, when European governments sought to bolster the euro by giving Ireland an 85 billion-euro ($111 billion) bailout package. Gold, which typically moves inversely to the dollar, headed for a fourth monthly gain and rose to a record priced in euros. "Safe-haven demand from geopolitical and sovereign-debt concerns may continue in the near term," Tom Pawlicki, an analyst at MF Global Holdings Ltd. in Chicago, said in a report. Gold futures for February delivery added $5.20, or 0.4 percent, to $1,372.70 an ounce at 8 a.m. on the Comex in New York. Prices are up 1.1 percent this month and reached a record $1,424.30 on Nov. 9. The metal for immediate delivery in London was 0.4 percent higher at $1,371.30. Bullion rose to $1,375 an ounce in the morning "fixing" in London, used by some mining companies to sell output, from $1,357 at yesterday's afternoon fixing. Bullion advanced to a record 1,058.733 euros an ounce today, data compiled by Bloomberg show. "Portugal needs to assure strong fiscal consolidation continuing in 2012 and beyond," European Union Economic and Monetary Affairs Commissioner Olli Rehn said yesterday. If growth proved to be "somewhat lower" than expected, "then it's essential still to meet fiscal targets by taking additional measures," he said. Security Concerns There's "speculation Spain and Portugal could be next to ask for aid, prompting increased safe-haven flows into gold," Mark Pervan, head of commodity research at Australia & New Zealand Banking Group Ltd., wrote in a report today. Investors should continue to hold gold as a hedge against currency debasement and long-term inflation, Societe Generale SA said in a report. North Korea confirmed it has a uranium-enrichment facility with thousands of centrifuges, further fueling security concerns after its deadly attack on a South Korean island on Nov. 23. The plant is to provide fuel for a light-water reactor for the "peaceful purpose of meeting electricity demand," the official Korean Central News Agency said today. The International Monetary Fund yesterday said it sold 19.5 metric tons of gold in October. The IMF, which last year said it will sell 403.3 tons as part of a plan to shore up its finances and lend at reduced rates to low-income countries, has sold a combined 222 tons to India, Sri Lanka, Mauritius and Bangladesh. Cumulative "on-market" sales at the end of October were 148.6 tons, it said. Gold Assets Gold assets in exchange-traded products rose 3.69 tons to 2,086.87 tons yesterday, according to data compiled by Bloomberg from 10 providers. Holdings reached a record 2,104.65 tons on Oct. 14. Silver holdings gained 14.3 tons to 14,784.6 tons, data from four providers show. Silver for March delivery in New York fell 0.5 percent to $27.07 an ounce, still heading for a fourth monthly advance. It reached a 30-year high of $29.34 on Nov. 9 and is up 61 percent this year. UBS AG lowered its one-month forecast for the metal to $25.50, from $30, the bank said today in a report. Palladium for March delivery lost 0.3 percent to $693 an ounce. Prices are up 7.4 percent in November, set for a fifth monthly increase. Platinum for January delivery was little changed at $1,646 an ounce, poised for the first monthly decline since August. To contact the reporters on this story: Nicholas Larkin in London at nlarkin1@bloomberg.net; Sungwoo Park in Seoul at spark47@bloomberg.net To contact the editor responsible for this story: Claudia Carpenter at ccarpenter2@bloomberg.net http://www.bloomberg.com/news/2010-1...d-ireland.html | ||

| Analysts See Silver Profit Taking – Hathor Reports U Resource Posted: 30 Nov 2010 12:40 AM PST We tend to look at the COT reports in a different way than most people would. For example, a majority of analysts who cover the positioning of futures traders would likely focus not at the reductions in the commercial net short positioning. Instead, they tend to focus on the positioning of speculators on the long side. They likely see the reductions in large spec positioning over the past two months as "profit taking." | ||

| Muni bond crisis looming: Michigan towns set to default on bonds Posted: 29 Nov 2010 11:55 PM PST From Bloomberg: Cities and towns across Michigan have seen property-tax collections plunge as much as 20 percent in the past year, the steepest drop since a 1994 state tax rewrite, forcing scores of communities to choose by March whether to borrow to pay bills or risk default on bonds. The municipalities rely on property taxes for as much as 60 percent of their revenue, according to the Michigan Municipal League. State support that typically composes another 20 percent to 35 percent of city budgets has been slashed by almost a third in the past year, during the longest recession since the 1930s. The end of a three-year federal stimulus worth $3.1 billion to Michigan – a sum roughly equal to two annual budgets for Detroit – will force "fundamental decisions," according to a memorandum by the Michigan Senate Fiscal Agency. "This gets real bad in about 90 to 150 days," said Robert Daddow, deputy executive of Oakland County, which is adjacent to Detroit's Wayne County and has a per-capita income 146.8 percent of the state average, according to Moody's Investors Service. "The question becomes whether they can secure enough cash from banks and whether banks are willing to lend in a credit-crunch situation." Down, Down, Down The value of taxable housing in Oakland County, which is home to the headquarters of Chrysler Group LLC, fell 11.8 percent this year, Moody's said in a Nov. 23 report. It will drop 10 percent further in 2011 and five percent more in 2012, Moody's said. "Declining housing values and a growing unemployment rate within the county demonstrates the county's exposure to the challenges in this region," Moody's said. State unemployment in October was 12.8 percent; it has been as high as 14.5 percent in December 2009 as the auto industry contracted. The state in October trailed only California and Florida in its number of foreclosure filings, according to RealtyTrac Inc., an Irvine, California-based data firm. A total of 19,288 properties in the state, or one in 235 households, received a default or auction filing or were seized by banks last month, the company said. The rate was up 17 percent from a year earlier. "It'll take us a decade or more for cities to be collecting what they were a decade earlier," Summer Minnick, director of state affairs for the Ann Arbor-based Municipal League, said in a telephone interview. Some municipalities have seen property-tax revenue drop by a fifth, she said. "Right now, we have several communities on the brink of severe problems." At the Edge The recession has pushed many U.S. communities to the edge of Chapter 9 bankruptcy, or, in the case of Vallejo, California, into it. Harrisburg, Pennsylvania, averted a bond default only because the state accelerated an aid payment. Under state law, Michigan has the final say on whether a municipality can enter bankruptcy. Detroit said in March it was considering moving toward a filing. Hamtramck, where General Motors manufactures the Chevrolet Volt, has also pressed state officials for a bankruptcy, saying that Detroit, which largely surrounds it, owes it money. Southfield, an Oakland County city with what Moody's in 2008 called a "satisfactory financial position," anticipates $19.9 million from its general operating tax levy this fiscal year, a 16.7 percent drop from three years ago, when it budgeted for $23.9 million. Its administrator and treasurer asked the state Legislature in September for permission to sell $50 million in bonds to cover operational costs. Emergency Calls Under a 1990 law, a Michigan governor can declare a financial emergency for a city and install a manager to run its business. Of the seven such declarations, four have occurred since December 2008. "Hundreds of jurisdictions" in the state may face financial collapse in the next three to five years, Rick Snyder, Michigan's newly elected Republican governor, said Nov. 19. Nationwide, the value of defaulted municipal securities fell to $2.48 billion through October, compared with $7.28 billion in 2009, and a record $8.15 billion in 2008, according to Richard Lehmann, publisher of Distressed Debt Securities Newsletter. Lehmann told Bloomberg News on Nov. 23 there may be a "new wave" of defaults in 2011 as federal economic-stimulus aid declines and budget pressures mount. Rich Town, Poor Town The number of local governments on Michigan's three-year-old financial watch list, which measures stresses by debt, tax collections, cash flow, and population changes, totaled 68 in 2008, the most recent accounting. Cities on the Michigan Department of Treasury's list include the industrial centers of Detroit, River Rouge, Jackson, and Benton Harbor. Wealthier suburbs are also in danger, Minnick said. "These are upscale suburban bedroom communities that had new homes and tremendous price spikes," Minnick said. "Some are communities you would not have expected." The Michigan Legislature has cut revenue-sharing payments to localities by almost one-third in the past year and by $4 billion in the past 10 years, the Municipal League said. The financial strain on cities is compounded by voter-approved constitutional limits on the growth of property taxes, which restrain annual increases to 5 percent or the rate of inflation, whichever is less. Holding the Bag Falling property-tax collections will create gaps starting next year in the "hundreds of millions of dollars" for cities and townships, said Eric Scorsone, senior economist for the Michigan Senate Fiscal Agency. Michigan counties reimburse local governments for unpaid property taxes and charge fees and interest as the county attempts to collect delinquent amounts for three years, Scorsone said. If the county cannot collect, the city or township can be billed for the uncollectable tax value. Scorsone said the financial liability is "certainly going to be a big number and it's going to hit a lot of places that aren't aware of the problem." "A lot of governments are going to get squeezed pretty hard," Scorsone said. The fall in property-tax collections comes even as Michigan is beginning to emerge from a long economic slump. The University of Michigan on Nov. 19 forecast a net increase in jobs in 2011, the first gain in more than a decade. The state's economic activity in September reached its highest level since June 2008, driven by resurgent manufacturing, according to a Comerica Bank report. Dangerous Mix Meanwhile, the combination of foreclosures, falling tax revenue, and unfunded municipal pension liabilities is becoming unmanageable, said Charles Moore, senior managing director at Conway MacKenzie Inc., which works with municipalities on financial restructuring. "I think there's a very high likelihood we'll see defaults in 2011 and I expect it will only increase in 2012 and 2013," said Moore, who is based in Birmingham, Michigan, a Detroit suburb. Communities are trying to persuade the Legislature to refinance their bond debt that was initially sold on the assumption that property values – and property taxes – would continue to increase at pre-2008 levels, Minnick said. "I hope we can do the refinancing so we can prevent defaults. I don't know if, at the end of the day, that will be enough," she said. To contact the reporters on this story: Tim Jones in Chicago at tjones58@bloomberg.net; Jeff Green in Southfield, Michigan, at jgreen16@bloomberg.net. To contact the editor responsible for this story: Mark Tannenbaum at mtannen@bloomberg.net. More on muni bonds: The run on muni bond funds has begun Muni bonds are getting absolutely hammered A HUGE sign of a top in muni bonds | ||

| China crisis watch: Benchmark stock index plunging... Posted: 29 Nov 2010 11:54 PM PST From Zero Hedge: In a surprising reversal, the Shanghai Composite has dropped 3% in early trading following a statement by the China State Council which on Monday said it will revise penalties to crack down on price violations to tackle inflation, which has been interpreted by traders as an imminent December rate hike. Per Dow Jones: "Shanghai Composite Index down 2.5%3.0% at 2793.95, faces immediate support at 2750 level. "There has been heightened expectations for an interest rate hike soon, which exacerbated earlier weakness in the index from sovereign debt concerns from Europe as well as a stronger U.S. dollar," says Wang Junqing, analyst from Guosen Securities." More importantly key stat arb pairs such as the AUDJPY and the ESZ/NDZ are being dragged below the surface. On an indexed basis, the ES will soon take out the intraday lows per the AUDJPY. For Brian Sack's sake, we hope the Fed has its midnight crew in tow as this could... Read full article... More on China: Marc Faber: "China and the U.S. are on a collision course" This could be a hugely profitable currency play World's biggest supertanker operator is seeing a huge rebound in Chinese oil demand | ||

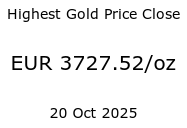

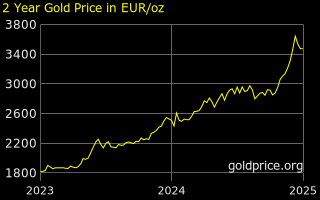

| Record High Close Gold in Euros 11-29-2010 Posted: 29 Nov 2010 11:46 PM PST Yepper... New High, beating previous high set in June 2010.   So... people gonna start talking about a "double top" again? :bandit: . | ||

| GOLD CRAZY: New wave of Chinese money is set to slam the gold market Posted: 29 Nov 2010 11:42 PM PST From Bloomberg: Lion Fund Management Co. will raise up to $500 million in China to invest in overseas exchange-traded funds backed by gold, the first in the country be approved to do so, a company executive said today. The fund manager has received approval from the State Administration of Foreign Exchange and the China Securities Regulatory Commission, Yang Zi, an executive at Lion Fund's marketing deparment said by phone from Beijing. Institutional and retail investors can buy into the fund via banks, she said. "We will be the first fund in China to offer an access to invest in overseas gold-backed ETFs," Yang said. "Given the inflationary environment we are in right now, Chinese investors have great enthusiasm for gold investments." China doesn't have a gold-backed ETF and investors normally buy physical gold jewelry, bars or coins, or invest through gold contracts traded on the Shanghai Gold Exchange, the Shanghai Futures Exchange or through banks. Gold demand in China, the world's largest producer, gained in the first half of this year as government measures to cool the property market and falling equities spurred investment, the Shanghai Gold Exchange said July 7. Gold for immediate delivery climbed to a record $1,424.60 an ounce on Nov. 9 as investors sought to protect their wealth amid concerns about the global economic recovery, and is headed for a 10th consecutive annual increase. Sales of gold products such as bars and coins by China National Gold Group Corp., owner of the country's largest deposit, jumped as much as 40 percent in the first half, Song Quanli, deputy party secretary at the company, said July 7. Exchange-traded funds have become popular worldwide since their creation in 1993 as they widened investors' access to different types of assets. – Feiwen Rong. With reporting by Chua Kongho in Shanghai. Editors: Richard Dobson, Jake Lloyd-Smith. To contact the reporter on this story: Feiwen Rong in Beijing on frong2@bloomberg.net. To contact the editor responsible for this story: James Poole at jpoole4@bloomberg.net. More on gold: Gold demand from this giant Asian nation is surging If you think gold is rising just because the dollar is falling, you're way off The colossal force driving gold higher and higher | ||

| Posted: 29 Nov 2010 10:55 PM PST | ||

| Gold to $2,000, Silver to $60 Without World's Collapse Posted: 29 Nov 2010 09:01 PM PST WikiLeaks... "a melt-down for U.S. foreign policy." Contagion strikes Italy. Hungary to seize private pension plans. IMF sells less gold in October. Richard Russell - Stocks Repeating 1930, Gold Building Base. Renaissance Of The Gold Standard?... and much more. ¤ Yesterday in Gold and SilverAlthough gold got sold off ten bucks shortly after the open in Far East trading during their Monday morning... it had gained all of that back by the London open at 8:00 a.m. GMT yesterday morning. From that point, the gold price declined unevenly until its low of the day [$1,354.20 spot], which came at precisely 3:00 p.m. in London... 10:00 a.m. Eastern... which you now know is the London p.m. gold fix. From that low, gold gained about $12 during the next 90 minutes of trading... and then did little for the rest of the New York trading session... both floor and electronic. All in all, it was a nothing sort of day. I expected little else considering it was the final trading day in the November gold and silver contract... and both months are now in the history books.

The price of silver on Monday was far more 'volatile'... which is, of course, the norm for the most rigged commodity the world has ever known. The price was all over the place in early Far East trading, but reached an interim high at the 8:00 a.m. London open, which is 3:00 a.m. Eastern time. From there [like gold] it got sold off in fits and starts until its New York low of $26.47 spot. Then it rose [once again in fits and starts] to its high of the day [$27.27 spot], which occurred in electronic trading around 3:00 p.m. Eastern time... and that was it for silver on Monday.

Well, the world's reserve currency was pretty easy to analyze. The low came at the London open... and the high of the day came at the London p.m. gold fix... 3:00 a.m. and 10:00 a.m. Eastern respectively... right on the button for both times. Not too many shades of gray here... as it's all pretty much black and white. From the bottom to the top of that 7-hour rally, the dollar gained about 105 basis points... before giving back about 30 points of that going into the close of trading at 5:15 p.m. Eastern time. So, what were the chances that what happened with the world's reserve currency and the precious metals prices between 3:00 a.m. and 10:00 a.m. Eastern time precisely, were random market events? None at all, dear reader.

As an extension of the above managed markets in the dollar and precious metals... it should come as no surprise that the precious metals shares bottomed at precisely 10:00 a.m... the dollar's high right at the London p.m. gold fix. You could have set your watch by what JPMorgan et al were doing yesterday. I don't know why they didn't take out a front-page ad in The Wall Street Journal and have a brass band march down Wall Street... but I digress. Anyway, from that precise low, the stocks managed to climb back into positive territory... almost finishing on their highs... which occurred at 3:45 p.m. in New York yesterday. Anyway, the HUI finished up 0.50%. As both gains and losses were concerned, the gold and silver stocks were a pretty mixed bag yesterday... in both the majors and the juniors.

The last CME Delivery Report for November was issued early on Monday morning... and showed that 16 gold contracts were posted for delivery yesterday, November 29th... the last delivery day for November. Then, at 10:16 p.m. Eastern time last night, the CME posted the First Day Notice numbers for delivery into the December gold and silver contract. There were 5,016 gold contracts posted for delivery on December first... and it should come as no major surprise that the big New York bullion banks... JPMorgan and HSBC were in the thick of it. They were the big issuers. And they were just about the only issuers... with HSBC delivering 3,000 contracts and JPMorgan delivering 1,996 contracts. All of these deliveries were out of the proprietary [house] trading accounts. Goldman Sachs, Deutsche Bank, Bank of Nova Scotia, JPMorgan [client account]... and Barclays were the big stoppers [receivers]. And, with the exception of Goldman Sachs' and JPMorgan's client accounts, the big stoppers were all trading in their 'house' or proprietary trading accounts. And I'm not finished with this report yet. Now onwards to silver. What was in this part of the report was a shocker... and I must admit that I don't know what to make of it... but maybe its nothing. However, only 56 silver contracts were posted for delivery tomorrow... and there should have been many thousands. We'll have to see what tomorrow's CME Delivery Report brings. The CME Delivery Report is well worth spending a few minutes on... and the link is here. Ted Butler was speculating on the phone to me yesterday that maybe the 6 million ounces of silver that were taken out of the SLV in London last week were meant to cover December deliveries on the Comex in New York. If that's the case, then maybe that explains why there we no deliveries worth mentioning for December 1st... as they're sitting twiddling their thumbs waiting for it. Sure, there's lot of silver sitting on the Comex... but it's either not for sale... and if it is, it's not for sale at a price that the issuing banks are prepared to pay without driving the price to the moon and the stars. We'll see. Their was a minor amount added to the GLD ETF yesterday. This time it was 48,822 troy ounces of gold. There was no reported change in SLV. The U.S. Mint had nothing to say for itself yesterday in either gold or silver eagle sales... and we're still hovering just under the 4 million silver eagle sales mark, like we have been for at least a week. Is the mint going to allow that to be broken today... the last day of November? We'll find out soon enough. There was a reasonable amount of activity at the Comex-approved depositories last Friday... and by the time the day was done, the numbers showed a net increase of 28,645 ounces of silver. The link to all the action was here. I was underwhelmed by the Commitment of Traders report that was issued yesterday afternoon. It showed an increase in silver's short position by the Commercial traders [bullion banks] of 1,199 contracts... 6.0 million ounces of silver. The net short position in the Commercial category sits at 234.2 million ounces, with the '8 or less' bullion banks short 306.4 million ounces. In gold, the bullion banks managed to reduce their net short position by a smallish 1,015 contracts... which is basically no change at all. The Commercial net short position sits at 26.4 million ounces, of which the '8 or less' bullion banks are short 28.2 million ounces. Here's Ted Butler's "Days to Cover Short Position" graph updated for positions held at the close of trading on November 23rd... the date of the current COT report.

¤ Critical ReadsSubscribeThe U.S. Economy: Stand by for more worse newsI have a rather embarrassingly large number of stories to post today... and I'm going to post them all, as heaven only knows how many more I may have in my column tomorrow. And, as per usual, you're certainly under no obligation to read them all. Today's first story is from reader Larry Galearis and is posted over at the opinion-maker.org website. The headline reads "The U.S. Economy: Stand by for more worse news". It's only a half-dozen paragraphs, and it's not happy reading... and the link is here.  Smart Money Preparing For Sell Off Like Never BeforeHere's another even uglier story from reader 'David in California'. It's a zerohedge.com offering that's headlined "Smart Money Preparing For Sell Off Like Never Before". The insider selling to buying ratio is now 8,279 to 1. That should tell you all you need to know... and the link to the rest of the story is here.  Senate blocks repeal of tax-filing requirementHere's a story that showed up as a GATA release late last night. Chris Powell stuck on his own headline which reads "Senate fails to repeal $600 tax-filing requirement". Under the new law, nearly 40 million U.S. businesses would start filing tax forms in 2012 for every vendor that sells them more than $600 in goods. Many Democrats who supported the filing requirement now acknowledge that it would create a paperwork nightmare, but whether to make up for the lost revenue has divided senators who agree it should be repealed. It's my opinion that this bill will be repealed long before the 2012 deadline... as everyone now realizes what a bad idea it truly is. The link to the story is here.  US embassy cables leak sparks global diplomatic crisisWell the WikiLeaks documents created a firestorm in the diplomatic world. I have four stories about that... all 'borrowed' from Monday's King Report. The first if from the Sunday edition of The Guardian... and is headlined "US embassy cables leak sparks global diplomatic crisis". The second is from yesterday's edition of The New York Times... and that story is headlined "Leaked Cables Offer Raw Look at U.S. Diplomacy". The last two are posted at the German website spiegel.de. The first one calls it "nothing short of a political meltdown for US foreign policy"... and is headlined "The US Diplomatic Leaks: A Superpower's View of the World". The second story is headlined "Orders from Clinton: US Diplomats Told to Spy on Other Countries at United Nations". They show Pax Americana at its ugliest. No surprises for me here.  WikiLeaks plans to release a U.S. bank's documentsWashington state reader S.A. had another story about WikiLeaks yesterday. It's a Reuters piece from late yesterday evening. The founder of whistle-blower website WikiLeaks plans to release tens of thousands of internal documents from a major U.S. bank early next year. One can only hope that it will be JPMorgan. The headline of this story reads "WikiLeaks plans to release a U.S. bank's documents"... and the link is here.  Hungary Follows Argentina in Pension Fund UltimatumHere's a story that was sent to me by Florida reader Donna Badach. It's a Bloomberg piece from late last week that's headlined "Hungary Follows Argentina in Pension Fund Ultimatum". Hungary is giving its citizens an ultimatum: move your private-pension fund assets to the state or lose your state pension. They want to use the money to reduce the budget deficit and public debt. Workers who opt against returning to the state system stand to lose 70 percent of their pension claim. This is effectively a nationalization of private pension funds. I've heard rumours on the Net to the effect that Obama was thinking out loud about the same thing some time back. The link to the story is here.  The Next Sovereign Crisis - Belgium?While everyone is talking about the PIIGS over in Europe... another European country that's sliding closer to the edge is Belgium. There are serious problems between the Dutch-speaking Flemish and the French-speaking Walloons... and one has to wonder how long it might be before this problem becomes serious. I've run a couple of stories on Belgium before. This one is headlined "The Next Sovereign Crisis - B | ||

| Pan American Silver CEO - End Users Having Trouble Getting Silver Posted: 29 Nov 2010 09:01 PM PST Image:  My last story today is a silver-related blog that was posted late last night over at King World News. The headline reads "Pan American Silver CEO - End Users Having Trouble Getting Silver". The link is here. Of course Geoff Burns didn't mention a word about the silver price manipulation that the CFTC has alluded to... | ||

| Posted: 29 Nov 2010 08:19 PM PST The holiday shopping season might be better than last year but there are lot of problems in the U.S. and Europe and much of the rest of the world. The next few years are not going to be good times. Dow Jones Industrial Average: Closed at 11187.28 +150.91 with prices all this week traveling in a channeled range. Resistance is 11200 and support is 11050. Volume was normal and momentum has peaked and turned down. Expect volume to gradually taper off from now through New Year's Day with two mini rally pops in the middle and end of December. Fundamentally, stocks rose as news of an Irish credit bailout was announced (nothing really decided yet) while iced over with some phony jobless claims. Also prominent fund managers and analysts were doing their usual chortling that things were improving. What world are they in? What the current stock index chart patterns are telling us: they are supported in the bull up-channel trading ranges signaling a set-up for more buying and a potential double top for mid-January selling. Expect more buying and holiday Ha Ha next week. S&P 500 Index: Closed at 1198.35 +17.62 on normal volume and falling momentum. Hard resistance is 1220. Support is 1175 trading above all moving averages like the Dow, which is bullish. We had a higher close today signaling a buy Monday next week, which is common on the calendar. There is plenty of time considering the cycles and holidays for the 500 index to find a newer double top at 1225. Further, the fund managers could drive prices even more toward a final high of 1250 for the middle of January. Seasoned traders and managers know a larger selling event should appear within the next 60-90 days or less. Inflation enters with vigor next year. In the early stages this might rally stocks as long as interest rates do not pivot reverse from a lower low and begin to bite. Eventually they will but we have to get from here to there first and this takes some time. S&P 100 Index: Closed at 537.80 +7.15 on normal volume and falling momentum. This index is weaker than the Dow and the S&P 500 in that the last five days of trading show slippage rather than a sideways or up bias. The close was right on the 20-day average whereas the others above, were decidedly higher than the 20-day. Yet, the pattern remains within the trading channel having room to rise further without slipping on the lower channel line and go negative to sell. Look for more trading sideways until January with price staying in a channel between 530 to 540. Nasdaq 100 Index: Closed at 2160.52 +43.91 on 95% of volume and downward momentum turning toward a flattening pattern. Price is supported by all moving averages and produced a gapping rally breakout. With a close near the top of the range, the Nasdaq will be a buyer next week and should easily rally to touch 2200 to 2250 by the end of next month. While this market is supported for now and should go higher to double or triple top before selling, watch for a peaking top in mid-January followed by a drop from 2250 to 2000 support. 30-Year Treasury Bonds: Closed at 126.50 -2.06 after selling hard on positive Irish news and rising shares. PMO momentum is in the basement and price is now only one point above the 200-day moving average at 125.56. We expect the 125.50 to hold for about 3 days and then continue to sell down to 120.00 major support within 4-5 weeks. We all know what QE2 means for bond prices and the dollar. However, consider the time cycles for this occur. Watch for bonds to stay down in price until the end of the first quarter. Then the price should begin to firm and climb higher. We cannot yet tell exactly when traders force the yields higher and the price continuously lower but, we think sometime in 2011 as credit quality falls lower. Gold: Closed at 1374.70 -2.00 after treading water most of this day in the pre-holiday sessions. It appears a head and shoulders bear top is forming for gold. If correct, we forecast a nearby high of 1385 resistance. If it can hang on and trend higher, the next two resistance points would be 1407, 1424 and 1448 as final potential 2010 higher prices. Price is above all moving averages and remains bullish although in a weaker pattern. Momentum is turning lower as price begins to stall; readying to sell in a normal correction. Should some strongly negative market news appear we could touch $1,448. If the coming trend is similar to November, we can easily block at 1385 and sell lower in a normal head and shoulders pattern. Major lower support is 1248 to 1307 in a trading range. Silver: Closed at 27.59 +0.08 producing a triple top on flattening momentum that refuses to sell and fall down. Price is above moving averages and silver continues to trade in wider ranges each active day. We think silver has a better chance of touching $30 versus gold touching $1,448. You can see it daily in the trading action and rally power. Support is 27.48 and resistance is 27.85. Commodities are softer as a group but energy had a larger rally today. Silver has some advantages over gold in this cycle. It trades faster, and is fast becoming a first choice in physical metals as price is so much cheaper, and it contains commercial components as well as being perceived as real money. Watch for silver to touch $30 in December and then sell off back to $25-$26 lower support by year end. Gold & Silver Index XAU: Closed at 213.51 +1.01 as price continues to rise from a higher right shoulder congested pattern. The metal to shares ratio is stalling as momentum flattens and fades. Last year the XAU lost 150 points in 60 days from December 1 to the end of January. There is stronger support at 200 near the lower channel support line with resistance at 210. Look for a rally into the first week of December helped mostly by silver but also pushed by gold. This then would be followed by two months of selling with one relief rally in January and a following low at the end of that month. Expect the XAU to be over 320 in the last quarter of 2011 and potentially even higher on major system breakdowns. Traders need to be aware all PM's and shares could be having a rough second half in 2011 depending upon what happens in the broader stock and bond markets, which at this juncture appear decidedly negative. This could be a normal but deep selling event. U.S. Dollar Index: Closed at 79.78 +0.10 rallying out of a falling trading channel as Europe and the Euro go in the tank. Major overhead resistance is the price of 80.00 and the 200-day average at 80.51. If the Euro can stay above 120-122.50 the dollar probably cannot break up and through 80.50. Momentum is up and the dollar is now above the 20 and 50 day moving averages. Also on the major annual pattern, if the dollar cannot exceed 80.00 to 82.00, in the larger view the dollar would have formed a major, huge head and shoulders longer than 12 months. This would mean a major decline into next year. For the next 4-5 weeks the dollar should recover to 80.00-82.00 and then flatten into a sideways channel all the way into spring. Major global credit upsets can whipsaw the dollar and USA bonds in both directions. Expect this in 2011. Crude Oil: Closed at 84.16 +2.66 on peaked and falling momentum with a stronger price recovery today on reserves news but primarily a rising stock market. Oil is above all moving averages. Its resistance is 84.50 at the top of the current trading range. Lower ranging support is 78.50 near the 200-day average at 78.54. Three things are pumping oil now (1) new inflation (2) a colder winter and (3) a temporarily rising stock market. We think oil could touch $92.50 by New Year's Day. CRB: Closed at 302.21 +4.52 after basing and doing a pivot reverse on rising oil prices. There is a major price gap between 311 and 315 where price goes next to resist on the higher trading range line right on 315. Price is above all moving averages and can easily rise to 315 first followed by a pullback then reverse long to a 320 double top or proceed even higher. Inflation power and a commodities bull market is something to behold. -Traderrog This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 29 Nov 2010 06:45 PM PST | ||

| There is No Head and Shoulders Pattern in Gold Posted: 29 Nov 2010 04:47 PM PST trendsman | ||

| Is there ANY Evidence That The GLD ETF Has Distorted The Price Of Gold? Posted: 29 Nov 2010 04:31 PM PST Business Insider | ||

| Where are the insider admissions about gold? ... Posted: 29 Nov 2010 04:30 PM PST | ||

| Posted: 29 Nov 2010 01:33 PM PST

There are very few nations around the world that have not been almost entirely plundered by the global elite. When the elite speak of "investing" in poor countries, what they really mean is taking control of the land, water, oil and other natural resources. In dozens of nations around the world today, big global corporations are stripping fabulous amounts of wealth out of the ground even as the vast majority of the citizens of those nations continue to live in abject poverty. Meanwhile, the top politicians in those nations are given huge bribes to go along with the plundering. So what we have in 2010 is a world that is dominated by a very small handful of ultra-wealthy elitists that own an almost unbelievable amount of real assets, a larger group of "middle managers" that run the system for the global elite (and are rewarded very handsomely for doing so), hundreds of millions of people who actually do the work required by the system, and several billion "useless eaters" that the global elite don't really need and that they don't really have much use for. The system was not ever designed to lift up the poor. Nor was it ever designed to promote "free enterprise" and "competition". Rather, the elite intend to funnel all wealth to themselves and to have the rest of us enslaved either to debt or to poverty. The following are 20 statistics that prove that the wealth of the world is increasingly being funneled into the hands of the global elite, leaving most of the rest of the world wretchedly poor and miserable.... #1 According to the UN Conference on Trade and Development, the number of "least developed countries" has doubled over the past 40 years. #2 "Least developed countries" spent 9 billion dollars on food imports in 2002. By 2008, that number had risen to 23 billion dollars. #3 Average income per person in the poorest countries on the continent of Africa has fallen by one-fourth over the past twenty years. #4 Bill Gates has a net worth of somewhere in the neighborhood of 50 billion dollars. That means that there are approximately 140 different nations that have a yearly GDP which is smaller than the amount of money Bill Gates has. #5 A study by the World Institute for Development Economics Research discovered that the bottom half of the world population owns approximately 1 percent of all global wealth. #6 Approximately 1 billion people throughout the world go to bed hungry each night. #7 The wealthiest 2 percent own more than half of all global household assets. #8 It is estimated that over 80 percent of the world's population lives in countries where the income gap between the rich and the poor is widening. #9 Every 3.6 seconds someone starves to death and three-quarters of them are children under the age of 5. #10 According to Gallup, 33 percent of the people on the globe say that they do not have enough money for food. #11 As you read this, there are 2.6 billion people around the world that lack basic sanitation. #12 According to the most recent "Global Wealth Report" by Credit Suisse, the wealthiest 0.5% control over 35% of the wealth of the world. #13 More than 3 billion people, close to half the world's population, live on less than 2 dollar a day. #14 CNN founder Ted Turner is the largest private landowner in the United States. Today, Turner owns approximately two million acres. That is an amount greater than the land masses of the states of Delaware and Rhode Island combined. Turner also advocates restricting U.S. couples to 2 or fewer children to control population growth. #15 There are 400 million children in the world today that have no access to safe water. #16 Approximately 28 percent of all children in developing countries are considered to be underweight or have had their growth stunted as a result of malnutrition. #17 It is estimated that the United States owns approximately 25 percent of the total wealth of the world. #18 It is estimated that the entire continent of Africa owns approximately 1 percent of the total wealth of the world. #19 In 2008, approximately 9 million children died before they reached their fifth birthdays. Approximately a third of all of these deaths was due either directly or indirectly to lack of food. #20 The most famous banking family in the world, the Rothschilds, has accumulated mountains of wealth while much of the rest of the world has been trapped in poverty. The following is what Wikipedia has to say about Rothschild family wealth....

Nobody seems to know exactly how much the Rothschilds are worth today. They dominate the banking establishments of England, France, Germany, Austria, Switzerland and many other nations. It was estimated that they were worth billions back in the mid-1800s. What the total wealth of the family is today is surely an amount that is almost unimaginable, but nobody knows for sure. Meanwhile, billions of people around the globe are wondering where their next meal is going to come from. At this point, many readers will want to start arguing about how horrible capitalism is and about how wonderful socialism and communism are. But capitalism is not the problem and as we have seen countless times over the past several decades, government ownership of business is not the solution to anything. What we have in the world today is not capitalism. Rather, it more closely resembles "feudalism" than anything else. The elite are "monopoly men" who use their unbelievable wealth and power to dominate the rest of us. In fact, it was John D. Rockefeller who once said that "competition is sin". It would be great if we lived in a world where those living in poverty were encouraged to start owning land, to create businesses and to build better lives for themselves. But instead, things are going the other way. Wealth is becoming more concentrated in the hands of the elite, and the middle class is starting to be wiped out even in prosperous nations such as the United States. It turns out that the global elite have decided that they don't really need so many expensive American "worker bees" after all and they have been moving thousands of factories and millions of jobs overseas. Meanwhile the American people are so distracted watching Dancing with the Stars, Lady Gaga and their favorite sports teams that they don't even realize what is going on. There is no guarantee that America will be prosperous forever. Today, a record number of Americans are already living in poverty. Today, a record number of Americans are on food stamps. The median household income went down last year and it went down the year before that too. So wake up. America is being integrated into a world economic system that is dominated and controlled by the insanely wealthy elite. They don't care that you have to pay the mortgage or that you intend to send your kids to college. Mostly what they care about is making as much money for themselves as they can. Greed is running rampant around the globe, and the world is becoming a very cold place. Unfortunately, unless something really dramatic happens, the rich are just going to continue to get richer and the poor are just going to continue to get poorer. | ||

| Global Sovereign Debt Default Bankruptcy Bailout and Contagion Risk Analysis Posted: 29 Nov 2010 12:07 PM PST This analysis seeks to update the global sovereign risk of bankruptcy following the developments of the past 9 months that have seen governments and economic policies change, economic austerity plans implemented or failure to implement, as well as the bailout of two Eurozone member countries with first Greece in May and now Ireland's Euro 85 billion bailout. My original analysis of March (30 Mar 2010 – Global Sovereign Debt Crisis, Country Bankruptcy Relative Risk of Default ) concluded in the high debt default risks presented by Ireland and Greece, with Belgium, Portugal, UK and Spain not far behind as illustrated by the below graph.

Risk of Bankruptcy / Bailout The country risk of bankruptcy / bailout represents the current risk of a country going bankrupt and therefore triggering a pre-default bailout (if affordable). This takes into account each countries current GDP growth rate, total public debt, public and banking sector liabilities, budget deficit, total external debt and sovereign bond market interest rates, other determinants include the ability to devalue and part inflate ones way out of debt which is not possible for most eurozone members. The bailout mechanisms that the euro-zone has implemented to date only act to delay ultimate bankruptcy where in Greece and Irelands case involves financing the next 3 years or so of deficits and debt rescheduling which has the effect of adding to a bailed out countries total debt burden and therefore increases the debt pressures on the economy as debt interest as a percentage of GDP rises each year until the country is forced to restructure its debts. The Contagion Factor The risk of debt default contagion measures the global impact of each country going bankrupt as a percentage of between 0% and 100%, where the US equals a 100% risk in terms of what the fallout would be on the global financial system if the United States went bankrupt, which at 100% implies that the whole worlds financial system and probably economy would collapse. For instance Iceland going bust during October 2008 had little contagion effect because of its relatively small economic size and external debt foot print, whereas countries such as Ireland have a far greater contagion effect, hence the E.U. / IMF bailout of Ireland which at Euro 85 billion is far less than the impact of contagion spreading and increasing the risks of default in other larger countries as counter parties to Irish banks and holders of Irish debts would come under pressure. However, a bailout does not wholly negate the contagion risk factor as bond holders and counter parties would still be subject to the likelihood of a debt restructuring at some point in the future which therefore would still to some extent elevate the risks of default for all other exposed countries. The key data used to determine the contagion effect is the size of the economy and total debt and liabilities including external. Debt Default is Inevitable for All Countries All countries are trending towards debt default / restructuring. However most countries are defaulting on their debt by means of high real inflation, therefore outright debt default risk is lower for most countries as they are able to avoid a debt default / IMF bailout by eroding the value of public debt by stealing the wealth of savers and purchasing power of workers earnings through inflation. For instance the UK government prints money that it loans to the bankrupt banks at 0.5% to buy UK government bonds at 3.3%, hence why the yields are lower than the likes of Spain and Italy, which acts as a safety valve preventing outright default, but the price paid is in high inflation, with the doctored official inflation measure of CPI is at 3.2%, the more recognised RPI at 4.5% and real inflation at 6% as the following graph illustrates.

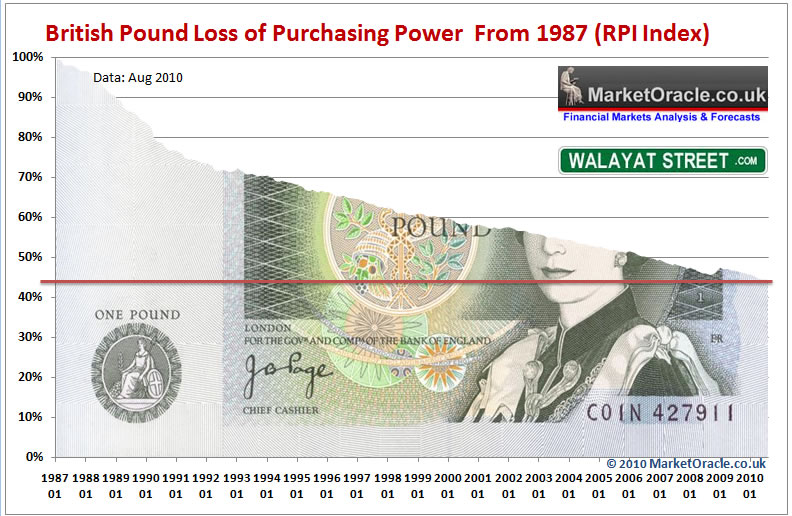

The CPI inflation trend is inline with forecast expectations as of December 2009 (27th December 2009 (UK CPI Inflation Forecast 2010, Imminent and Sustained Spike Above 3%). The inflation stealth debt default is reflected in this analysis as a lower risk of outright debt default / bailout, as the higher the real inflation rate is (upto a limit) then the lower will be the relative risk of outright default as governments use inflation to steal the value of earnings and savings to reduce the value of debt. Also considering that all currencies are in perpetual free fall against one another to achieve the same default through inflation outcome then usually the debt denominated in foreign currencies should pose less of a problem than that denominated in the domestic currency than many commentators perceive it to be. For instance Britain's stealth inflation debt default is reflected by the British Pound in exchange rate terms being roughly where it was against the U.S. Dollar 20 years ago, however the following graph shows that sterling has lost over 40% of its purchasing power on the RPI inflation measure over the past 20 years.

Also having more of ones debt in the domestic currency does reduce the risk of default, which is why the United States risk of default remains very low. At the other end of the currency devaluing high real inflation debt spectrum are the Euro-zone PIGIBS that are locked in the Euro and thus cannot default by high real inflation and even if they left the Euro would not address the fact that their debt is denominated in Euro's unless all of their debt at the same time was also converted into the new currency resulting in an instant huge devaluation (probably an hyper inflation panic event). Therefore whilst the PIGIBS remain in the Euro-zone then they can only devalue internally by cutting wages and spending so as to make their economies more competitive against other Eurozone members. Though the flaw here as opposed to using inflation to default on debt denominated in local currencies is that as the economy contracts the debt increases as a % of GDP and hence over time the risk of default increases which is why the Euro-zone members will probability require continuous bailouts until they default on their debts which is inevitable. Sovereign Debt Default / Bailout and Contagion Risk Graph – November 2010 The updated analysis is presented as a graph with the two axis as the Sovereign Risk of Bankruptcy / Bailout and the Contagion Factor.

Ireland - Has now been bailed out at a cost of Euro 85 billion. In terms of debt contagion Ireland at 15% posed a far greater risk than Greece, which means that if Ireland had outright defaulted on its public and banking sector debts then it probably would have crashed the global economy, hence the bailout. Portugal - Is at a current default risk of 43%, the graph confirms the current consensus view that Portugal is next inline for a bailout. However the risks that Portugal poses to the global financial system in terms of contagion factor at 4% is far less than that of Ireland. Estimate Bailout cost Euro 80 billion Belgium – At 29%, continues to pose a high default risk and stands next after Portugal for a bailout, especially as the contagion risk at 10% is more than double Portugal's . Estimated bailout cost rises to Euro 175 billion. Spain – At 26% risk of default carries a 16% Contagion factor. Spain is a much larger economy, hence the estimated bailout costs now start to jump substantially by rising to Euro 550 billion. Italy – At a current default risk of 17%, suggests that Italy could survive for several more years, however if Portugal, Belgium and Spain are bailed out then Italy would come under far more pressure. The contagion factor for Italy is similar to that of Spain of 16%. A bailout would cost an estimated Euro 800 billion. UK – Has an improved risk of default of 14% since the March update as a consequence of coalition government measures and due the UK's ability to stealth default by means of high real inflation. However should all of the above have defaulted / been bailed out then the pressure on UK would become very high which would manifest itself in a severe plunge in sterling. The UK has a contagion factor of 61%, second only to that of the United states which means that should the UK default then it definitely would being down the worlds financial system and global economy with it. A bailout to prevent bankruptcy would cost an estimated Euro 850 billion. France – At 12% risk of default, has a high contagion factor of 34%, which means that if France should ever default then it would probably take the global financial system down with it. A bailout would cost an estimated Euro 1 trillion. Bailouts - Again bailouts just delay the inevitable debt restructuring. Contagion factor - The most important factor is the contagion factor, where countries approaching default, even if they are subsequently bailed out could still crash the global financial system if their contagion factor is high such as that for the UK, France and Germany. Luckily there is no sign that any of these three is likely to reach a critical state that risks debt default / bailout during the next 6 to 12 months, so have time on their sides to address budget deficit and bank debt issues. Also despite widespread speculation surrounding US debt and liabilities, the United States remains at a low overall risk of default at 5%, though up on March's 3%. Another an important factor to note is that countries such as Pakistan, Mexico and India are at a far lower risk of default because their external liabilities are smaller and debt metrics less critical compared to that of Euro-zone members, which is why the likes of Greece, Ireland and Portugal have required bail outs whilst the former have not, as the original analysis of March 2010 implied that the debt risk world has been turned upside down where those that were deemed to be high risk countries a couple of years ago are now low risk and those that were low risk are now high risk countries. Conclusion Whilst Portugal is next with Belgium and Spain to also trigger a probable bailout of sorts during the next 12 months. However it is possible that a line could be drawn under the bankrupting PIGIBS with Spain, especially if new mechanisms are introduced by the Eurozone for a more orderly partial debt restructuring that is able to release pressures on the likes of Italy and France and therefore have far less of a contagion effect. In the meantime all savers and depositors should seek to protect their wealth and savings against the risk of PIGIBS contagion by ensuring that they limit their exposure to PIGIBS banks and that their savings are within the compensation limits as discussed at length in the recent article (26 Nov 2010 – Euro Debt Crisis Bankruptcy Bailout Queue, Protect Savings & Deposits From Banks Going Bankrupt! ). Debt Crisis Solutions – Mechanism's for an Orderly Partial Debt Default / Restructuring As mentioned in the recent analysis (14 Nov 2010 – Bankrupting Ireland in Economic Depression Announces Policy of Quantitative Cheesing), the Eurozone needs to develop orderly mechanisms for partial debt restructuring to take place so as to prevent outright default, triggering a costly full bailout. The current system of the ECB funding the bankrupt European banks at 1% is not working, as it is the primary reason for the current sovereign debt crisis as after the 2008 credit crisis the European banks took ECB cash and bought high yielding PIGIBS debt with it, hence the current crisis. One mechanism to address this is if future PIGIBS bond issuance was sold on the basis that a certain percentage of the debt could be defaulted on if the issuing government at the time of maturity had a high budget deficit. This would result in higher interest rates for PIGIBS debt to reflect the risks of partial default as well as produce an orderly market for slow serial debt default rather than crisis events that hits the sovereigns whole bond market i.e. it could be on the basis that an issue of 10 year Portuguese debt at a 8% interest rate would lose 3% of its capital on maturity for every 1% that Portugal's budget deficit was above the 3% deficit target, or utilise some other similar measure. However the above mechanism would only apply to future debt and it would take many years for new default prone debt to replace existing debt, therefore there needs a mechanism to restructure existing PIGIBS debt, especially for Greece, Ireland and Portugal as their debt remains unsustainable. The difficulty here is in partially defaulting on Greece Ireland and Portuguese debt without triggering a Euro-zone wide bond market panic, where the only country that could attract bond market investors would be Germany. Clearly the mechanism for restructuring PIGIBS debt would be for the ECB to restructure the Eurozone banks so as to separate public debt from bank debt. Much as Ireland is being forced to do with regards its banks, which should instead fall under the responsibility of the ECB which would reduce the burden on PIGIBS from banking sector liabilities. During the past week there have been some signs that the Eurozone does intend on enacting some sort of ultimate haircut for bond market investors so as to reflect the risks. However there is no sign that any member country wants to leave the Euro-zone, which for especially Greece and Portugal would probably be in their long-term best interests as their economies will never be able to compete against the likes of Germany on a level playing field and therefore look set for a decade of low growth compared with the industrialised Euro-zone. Similarly neither will Germany leave the Euro-zone as it relies on the Bankrupt PIGIBS to keep the Euro weak whilst also exporting to a captured internal market. At the end of the day, bond markets need a reason to buy sovereign debt, if there is a great deal of uncertainty as to what they will get back on maturity then they won't buy it. Therefore the Eurozone needs to introduce certainty for the bond markets for especially the PIGIBS debt market to function, otherwise the only buyer of the their debt will be the ECB. U.S. Dollar Trend Quick Update

However the trend whilst coming as a surprise to the dollar collapse merchants and triggering the emergence of a new bullish consensus, is inline with the last in depth analysis and trend forecast into Mid 2011 (12 Oct 2010 – USD Index Trend Forecast Into Mid 2011, U.S. Dollar Collapse (Again)?) that forecast a bullish trend for the USD from 76 to target USD 80 by early December. The forecast path for the dollar should now be for the primary downtrend to resume towards a Mid 2011 target of between 69-70.

Similarly Sterling should resume its uptrend against the US Dollar which targets a trend to £/$1.85 by mid 2011 (04 Oct 2010 – British Pound Sterling GBP Currency Trend Forecast into Mid 2011). Therefore the current price of £/$ 1.5580 should should represent the approx low point for the whole move from 163.

Ensure you are subscribed to my always FREE NEWSLETTER to receive in depth analysis and forecasts in your email in box. Comments and Source: http://www.marketoracle.co.uk/Article24619.html By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

| ||

| Extremely High Open Interest on Gold and Silver comex on first day notice/bailout for Ireland. Posted: 29 Nov 2010 11:18 AM PST | ||

| Posted: 29 Nov 2010 11:16 AM PST Well, so much for the supposed confidence-building announcements from the EU over the weekend. European equity markets fell heavily when trading resumed on Monday. Bond yields in Portugal, Spain, Belgium and even Italy continued to rise to new highs. The bureaucrats in the EU are losing their already tenuous grip on the situation. Despite assurances that senior bondholders will not take 'haircuts' on their investments (not on lending before 2013 anyway) markets are imposing their own form of ruthless discipline. For years the concept of risk was ignored. For years countries like Greece, Ireland and Portugal could borrow on terms almost identical to Germany, despite massive differences in economic structures. Now, at a time when EU officials are desperately trying to convince markets that risk still doesn't matter - that you can still have reward without risk - the markets are not buying it. This puts mounting pressure on the European Central Bank (ECB) to 'do something'. It meets on Thursday European time to discuss monetary policy. Bond investors will be sweating on the bank to open the liquidity floodgates and buy up peripheral European debt big time. Whether it will do this is questionable. But even if it does, such action would only push the problem a few months down the track. We're dealing with a problem of solvency here, not a liquidity problem. Such problems cannot be dealt with by temporarily monetising debt. We wonder how Ben Bernanke is feeling about all this. On the one hand, he's probably relived that some other central banker is the centre of attention for a change. On the other, he's probably gutted that his QEII plans seem to have backfired. Check out the chart of the US dollar index below

The dollar has rallied strongly since Bernanke announced his money printing scheme in early November. Things haven't exactly gone according to plan for Ben. He's trying to lower the value of the dollar to generate inflation and boost export competitiveness. But he's forgetting the minor point about the US dollar being the world's reserve currency. In times of economic stability, the US dollar will generally trade according to domestic fundamentals. In times of turmoil though, it retains its safe haven status. Because the euro is under all sorts of pressure, capital is now flowing back to the US dollar. It's all relative in the world of currencies and as bad as the US dollar looks, it's not as bad as all the other major currencies. If there's one lesson to be learned from the euro crisis it's that problems begin at the core. The US dollar is at the epicentre of the global economy. The peripheral currencies (euro, yen) will likely come under major pressure before the greenback faces its day of reckoning. But one thing is for sure, the dollar is not as good as gold. Gold is in a consolidation phase at the moment and just doesn't seem to want to put in a decent correction. Dips are bought with gusto. It's a sign of a powerful bull market when everyone seems to be waiting for a correction and it doesn't happen. The bull market in gold is the mirror image of the bear market in government policymaking and fiat currencies. The trend has a long way to run yet. Closer to home, RBA governor Glenn Stevens was out last night talking about the terms of trade again. Unusually for a central banker, this was a thoughtful speech about how Australia should think about managing the recent jump in the terms of trade. As you can see from the graph Stevens presented in his speech, the recent spike in the terms of trade is up there with past historical increases. The question he raises is whether it's a permanent or temporary shift in our fortunes.

The terms of trade, by the way, measures the value of our exports in terms of imports. As Stevens puts it, 'when the terms of trade are high, the international purchasing power of our exports is high.' Stevens correctly points out that history suggests the huge increase in the terms of trade will be temporary. He just doesn't know when the temporary bit will kick in. If it is, he says that 'it would probably not make sense for there to be a big increase in investment in resource extraction if that investment could be profitable only at temporarily very high prices'In other words, Australia's resource sector could 'probably'suffer from overinvestment if it turns out that China's insatiable appetite for iron ore and coal is more a product of its massive credit boom than anything else. Has Glenn Stevens been reading a bit of Ludwig von Mises lately? Of course you don't have to have studied Austrian economics to come to that conclusion, you just need common sense. Surprisingly for a central banker, Stevens seems to have plenty of it. But let's not get too excited. There is always 'the other hand'. 'On the other hand, experienced people seem to be saying that something very important - unprecedented even - is occurring in the emergence of very large countries like China and India. If the steel intensity of China's GDP stays where it is already, and China's growth rate remains at 7 or 8 per cent for some years to come, which appears to be the intention of Chinese policy-makers, then the demand for iron ore and metallurgical coal will rise a long way over the next couple of decades.' Translation: 'This time is different.' Lookout. Similar Posts: | ||