saveyourassetsfirst3 |

- Why Owning Cash Is More Speculative Than Owning Gold

- Everybody Loves Silver!

- Whats up with Platinum?

- ‘Shock and Awe’ in Precious Metals

- November Sees Gold Up 3% in USD and 9% in EUR and Silver Surges 14% and 22%

- Strange Silver Action in Futures

- Silver coin sales soar to all-time record

- "Dr. Doom" Roubini: Euro crisis cannot be contained

- Gold and Silvers Daily Review for 1st December 2010

- Gold Rises vs. US Dollar, Eases from Euro Record, as "Complications" Threaten Both Currencies

- Record High Close in Silver in Euros 11-30-10

- Lack of Good Leadership

- Tocqueville Gold Fund manager John Hathaway

- China Approves Fund That Will Invest In Foreign Gold ETFs, Opening Avenue For Millions Of Mainland Investors

- Does the COMEX Have a December Silver Delivery Problem?

- Death Comes For Us All

- Jim Sinclair - Gold is Poised to Explode

- It is Just a Matter of Time Before Gold Becomes Priceless! Here’s Why

- Gold Stocks: The Focus On GDX

- Cups That Runneth Over

- Here we go again...

- Quantitative Easing - Office Discussion

- The naked emperor

- Gold will head to 1480-1525 before a major correction

- Euro Gold Hits New Record High as "Too Big to Bail" Risks Infecting German Bunds

- I canceled my Ron Paul 2012 silver order today....

- Less Money, More Problems

- China Goes To Gold

- America's Leading Export: Inflation

- Precious Metals Tally Strong Increases for November

- Gold/Platinum Ratio & Economic Weakness

- Talking Gold & Silver with Archipelago Resources

- Silver and gold have high amounts standing/record silver eagle sales at the Mint

- The Dual-Mandated Failures of the Federal Reserve

- Wikileaks, Gold and Silver

- Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 3%

- An I.M.F. Announcement on the Completion of Gold Sales due Soon

| Why Owning Cash Is More Speculative Than Owning Gold Posted: 01 Dec 2010 05:52 AM PST The question most often asked of gold bulls is, "At what price will you take your profits?" It is a question that betrays a lack of understanding about why anyone should own gold. Nevertheless, the simple answer must be, "When paper money stops losing its value". This response should alert anyone who asks this question to the idea that owning fiat cash is the speculative position, not ownership of precious metals. Words: 1403 | ||

| Posted: 01 Dec 2010 05:48 AM PST There has been a lot of negative press about the big banks rigging the silver market, fake silver inventories in large ETFs and regulators at the CFTC not doing their job by enforcing commodity laws in the COMEX Silver markets. Well, I'm here to tell you to BLOCK OUT all that negativity and sink your teeth into everything GOOD and HONEST about silver! And there is a lot to sink your teeth into because... | ||

| Posted: 01 Dec 2010 03:52 AM PST All of the metals have had a nice run up in price but the least of these is Platinum, especially compared to Palladium. February of this year had Pd at $450 with Plat @ $1540. Today Pd is at $734 while Plat has only gone to $1687. Plat at $1600 isn't all that unusual. We've seen it at over $2K at times. I'm wondering if Plat will pop at some point. Perhaps its worth picking up a bit more but its a very expensive habit to maintain. | ||

| ‘Shock and Awe’ in Precious Metals Posted: 01 Dec 2010 02:24 AM PST Earlier this month, precious metals investors witnessed arguably the most concerted take-down of the precious metals sector since the Crash of '08. First, investors were lathered-up into a mania, after World Bank head Robert Zoellick planted a piece in the Financial Times where he feigned interest in having a gold standard re-instituted. Then the ambush took place. This time, China was clearly participating as the 'tag-team' partner of the U.S. government. It began by raising reserve requirements for its banks – a move always seen as restraining the growth of an economy (and reducing commodities demand). Then the Chinese government leaked word that it was "planning interest rate increases" (even more bearish for commodities), all within the span of a couple of days. What launched the "ambush", however, was the utterly unprecedented move by the CME Group (owner of the Comex exchange) to radically increase margin requirements for silver halfway through a trading session. Clearly, the intent was to get precious metals investors as over-extended as possible – and then to "drop the hammer" on them at literally the best (i.e. most-damaging) moment. This was immediately followed by yet another increase in bank reserves by China's government, mere days after the previous reserve-increase was announced. With the U.S. having already taken radical action to curb commodities markets, it is simply not plausible that the Chinese government suddenly decided that further tightening was necessary. Instead, this was a move purely intended to generate more downside momentum in commodities by China, the world's largest consumer of those commodities (including precious metals). And when those moves still did not generate the downward momentum desired by these market-manipulators, the CME Group announced yet another reduction of "margin" – this time for both gold and silver. In previous years, a premeditated, orchestrated take-down of precious metals of this magnitude would derail the market for many weeks, if not months. However, that era is over. Following the inevitable plunge of these commodities markets (as margin players were driven out), gold and silver quickly bottomed and firmed. This epitomizes the entirely different attitude of precious metals buyers. Whereas before such ambushes would create fear among investors that a "top" had occurred in the market, today all that goes through the minds of investors when precious metals go lower is "gold and silver are on sale!" Buyers gleefully soaked-up every ounce of cheap bullion which the bullion banks chose to bestow upon them (as an early Christmas present). And now, with the month over, and "delivery" due in the Comex, those buyers are saying "give us our gold and silver." While the numbers bounce around day-to-day, at present these buyers are wanting to take delivery on a large portion of total, available gold inventories and nearly ¾ of all available silver in Comex inventories. Though it was the bankster cabal which launched this 'shock' on the precious metals market (and precious metals investors), the only 'awe' that was experienced was that of the banksters, themselves, as buyers are now holding out their hands and demanding that the bullion banks deliver most of their dwindling supplies of real bullion. Much like pointing a bazooka at someone – and not noticing that you were holding it backwards – this ambush has now blown up in the faces of these bankers. If these manipulative buffoons had the slightest understanding of these markets, the spectacular failure of their attempt to (once again) "cap" precious metals would have come as no surprise. As I write regularly, anything under-priced (like precious metals) will be over-consumed. Push the price even lower, and inventories will disappear that much quicker. | ||

| November Sees Gold Up 3% in USD and 9% in EUR and Silver Surges 14% and 22% Posted: 01 Dec 2010 01:34 AM PST gold.ie | ||

| Strange Silver Action in Futures Posted: 01 Dec 2010 12:38 AM PST If there was an effort to "cap" silver at $28 going back into last week, we can say that effort has failed. As we write this Wednesday morning at 07:00 CT silver has maintained its thrust above the $28 mark, currently edging back down through the $28.50s having run to as high as the $28.70s overnight. New record highs for gold in euro terms (in the €1,070s) and fears of a full-blown currency crisis underpin the precious metals. What we find unusual is that as silver advanced from $27.50 on COT reporting Tuesday, November 23 to $28.09 yesterday (COT Tuesday for this week) the COMEX open interest has fallen by a very large 14,895 contracts, from 147,685 to 132,790 lots open. | ||

| Silver coin sales soar to all-time record Posted: 01 Dec 2010 12:19 AM PST From Zero Hedge: In what is becoming a very sad development, the more money (pardon, monetary base) Bernanke prints, the more silver coins Americans buy. According to the U.S. Mint, November sales of silver just hit 4.16 million ounces or coins, an all time record, since the introduction of the coin in 1986, and that does not even include the last day of the month. The number is roughly a 30% increase to... Read full article... More on silver: What you need to know about buying silver today Coin dealers are seeing unbelievable demand for silver bullion Three new reasons to buy silver that many investors aren't aware of | ||

| "Dr. Doom" Roubini: Euro crisis cannot be contained Posted: 01 Dec 2010 12:14 AM PST From Bloomberg: Europe's debt woes are at risk of spreading to Portugal and Spain, and rising budget deficits in the euro area are a concern, said Nouriel Roubini, the New York University professor who predicted the global financial crisis. "There's now financial contagion in Portugal, Spain, and to a smaller degree even in countries like Italy, Belgium, and others in the euro zone," Roubini said in a speech to a conference in Taipei today. Concern that Europe's debt crisis will worsen has shifted to Portugal and Spain since Nov. 28, when the region's governments gave Ireland an 85 billion-euro ($111 billion) rescue package. The average yield for 10-year debt from Greece, Ireland, Portugal, Spain, and Italy reached a euro-era record as speculation intensified that other nations will require support. The shock from the Ireland rescue was more limited than from the bailout of Greece, Roubini said today. The European Union decided in May to set up a 750 billion-euro fund to help rescue Greece. Europe's currency rose 0.7 percent to $1.3075 at 8:43 a.m. in London, from $1.2983 yesterday, on speculation European Central Bank policy makers will signal willingness to act to prevent the spread of the debt crisis when they meet tomorrow. The risk of a "double-dip" recession in the U.S. has declined compared with four to five months ago, Roubini said, helped by the U.S. Federal Reserve's plan to buy $600 billion of assets to spur economic growth. 'Party Over' "The world can't rely any more on the U.S. to keep spending more than its means, more than its income," Roubini said. "That party, unfortunately, is over." Roubini in 2006 predicted the U.S. economy was "headed toward a serious slowdown" because of the slump in the housing market, high oil prices, and the delayed impact of interest-rate increases. Emerging markets need to develop domestic demand and let their currencies rise to help rebalance the global economy, a process that may take many years, Roubini said today. "There's quite a significant difference between what's going on in most of the advanced economies and what's going on in most of the emerging market economies," he said. Most advanced economies, including the U.S., Japan, and much of Europe, are going to have "U-shaped," or more "anemic" recoveries, the professor said, while most emerging nations will have a "V-shaped" recovery. Capital Flows Officials from emerging nations have complained that near-zero borrowing costs and monetary easing in advanced nations is propelling capital to their higher-yielding markets, threatening asset bubbles. Nations have adopted disparate steps to manage the risk, with South Korea embracing a tax on foreigners' investments in its bonds and Indonesia favoring a lock-up period for overseas purchases of bills Emerging nations face a challenge in trying to manage long-term capital flows as a "wall of liquidity" flows to their economies, Roubini said. They are restraining their currencies as China's won't let the yuan appreciate more, he said. China can't be the only "locomotive" of global growth and "you still need robust growth in other advanced economies," Roubini said. A real-estate bubble has started in China and some Asian property markets also show signs of the same development, he said. To contact the reporter on this story: Tim Culpan in Taipei at tculpan1@bloomberg.net. More from Roubini: "Dr. Doom" Roubini: The U.S. dollar will beat gold now "Dr. Doom" Roubini: Euro debt crisis will spread to the U.S. Nouriel "Dr. Doom" Roubini: Nightmare scenario ahead for Europe | ||

| Gold and Silvers Daily Review for 1st December 2010 Posted: 01 Dec 2010 12:07 AM PST Gold Forecaster | ||

| Gold Rises vs. US Dollar, Eases from Euro Record, as "Complications" Threaten Both Currencies Posted: 30 Nov 2010 11:50 PM PST Bullion Vault | ||

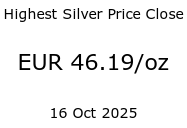

| Record High Close in Silver in Euros 11-30-10 Posted: 30 Nov 2010 09:46 PM PST  There it is...  | ||

| Posted: 30 Nov 2010 08:55 PM PST Ain't No Leadership In The USA. We Are Floundering. Most of the news is just a reaction to useless floundering by so-called leadership. Stick with the fundamentals, have patience and go the course. Control your risk first. Small losses are okay. Big losses are a disaster. Global central bankers and the leaders of their nations all have personal agendas as do the countries they represent. None of this stuff makes sense for the long term economic well-being of the world. We are solidly moving into Greater Depression II, which will be much worse than the "Dirty 30's." It's not the end of the world but a world much different demanding daily adjustments. Watch the big picture for a falling dollar, with inflation next and then hyperinflation to follow. Read the books "When Money Dies" by Adam Fergusson and "Reinventing Collapse" by Dmitry Orlov. Sean Broderick of the Weiss Group in Florida has a good common sense survival book with lots of great ideas for everyday living while keeping friends and family safe, together, and maybe even prosperous. We've read this books; some of them more than once. They depict real life issues we all must face and help to prepare us and eliminate potential pain and problems in just getting through the day. This posting includes an audio/video/photo media file: Download Now | ||

| Tocqueville Gold Fund manager John Hathaway Posted: 30 Nov 2010 08:37 PM PST Image:  The following story was posted as a GATA release yesterday... but I'm just going to steal Chris Powell's preamble and provide the link. Over at King World News, Eric King has interviewed Tocqueville Gold Fund manager John Hathaway, who expects $100 daily moves in gold, up and down, as the Western paper money system cracks up. Any time that John Hathaway has got something to say, I'm listening. Excerpts from the interview can be found linked here. | ||

| Posted: 30 Nov 2010 08:37 PM PST Image:  Today's first gold-related story is from 'David in California'. It's a zerohedge.composting that bears the longish headline "China Approves Fund That Will Invest In Foreign Gold ETFs, Opening Avenue For Millions Of Mainland Investors". David's comment to me was whether or not this was going to be "more paper gold b.s." I'm somewhat more optimistic than that... | ||

| Does the COMEX Have a December Silver Delivery Problem? Posted: 30 Nov 2010 08:37 PM PST CFTC to unveil position limit plan Dec 16th... Reuters story in 'The Wrap'. 4,260,000 Silver eagles sell in November... 32,890,500 year-to-date. Mounting calls for 'nuclear response' to save European monetary union. John Hathaway speaks... and much, much more. ¤ Yesterday in Gold and SilverExcept for a brief dip to its low of the day [around $1,363 spot] during the Hong Kong lunch hour, gold moved mostly higher in early Tuesday morning trading... with an interim top at the London a.m. gold fix at 10:30 a.m. local time... 5:30 a.m. Eastern. From that point, the gold price slid a little into the Comex open. The moment that trading began in New York, the gold price rocketed $14 higher to $1,386 spot during the following fifteen minutes. And, except for a brief excursion to its high of the day [$1,391.00 spot] around 12:15 a.m. Eastern, gold basically traded sideways for the rest of the New York session.

Silver traded mostly between $27.00 and $27.25 spot right up until the Comex open at 8:20 a.m. yesterday morning. Then away went the silver price to the upside with the top [$28.36 spot] coming around 12:20 p.m. in New York. Silver then gave back about 15 cents of those gains going into the close of electronic trading at 5:15 p.m. Eastern.

It was a terrific day all around. But, having said that, I wonder how high the prices of both metals would have gone if there hadn't been a not-for-profit seller show up shortly after the lunch hour began in New York. Not that I wish to sound ungrateful... nor do I want to look a gift horse in the mouth... but this is still not a free market in either commodity. However, we are headed in the right direction. The almighty U.S. dollar began a rally at precisely 3:00 a.m. New York time [8:00 a.m. in London] for the second day running. What are the chances that that was a market coincidence, you may ask? None at all, is the answer. Two hours later, the dollar was up to 81.35 cents... and it basically didn't move much from that for the rest of Tuesday's trading session. As for any co-relation to the gold price... most of gold's $20 move and $1 plus move in silver happened during a drop of about 35 basis points in the dollar between 8:30 a.m. and 11:30 a.m. Eastern time. Not a lot of movement to hang one's hat on. I'd say there was no co-relation at all.

The gold stocks topped out about an hour after both gold and silver hit their zenith on Tuesday... then gave back some of those gains going into the New York close. The HUI finished up 1.36% on the day. But, once again, it was the silver stocks that were on fire. And the gains were across the board, in both majors and the juniors... but the junior silver producers were the big stars of the day. My own personal portfolio [60/40 silver/gold] was up more than double the HUI yesterday.

Well, the CME Delivery Report showed a lot of activity once again. In gold, there were 1,098 contracts posted for delivery on December 2nd. All the big issuers on First Day Notice were stoppers this time... and everyone else was an issuer. Goldman Sachs and Deutsche Bank [both trading for their proprietary {house} accounts] were the big issuers and stoppers of note. But, after yesterday's big surprise in silver, I didn't know what to expect when I opened the CME Delivery Report a few minutes ago. Well, it was another big surprise, as only 34 silver contracts were posted for delivery tomorrow. That's 90 contracts month-to-date in total... and December is one of the biggest delivery months of the year. This is unprecedented! I don't think its too much of a stretch to speculate that the reason that there have been no big deliveries so far in December, is that there is no silver available to deliver. But is the Comex in default? Was the big withdrawal from SLV about ten days ago, Comex bound for the December delivery schedule? These are very important questions that scream for answers. So far neither the Comex nor the CME have said a word about it... so we must await developments. Needless to say, this CME report is also well worth spending time on... and the link is here. There were no reported changes over at the GLD ETF for the last day of November. But a smallish amount of silver was taken in by the SLV ETF on Tuesday. That amount totaled 537,647 troy ounces. Over at that the Zürcher Kantonalbank in Switzerland last week, their ETFs reported a small drop of 1,218 ounces of gold... and a decline of 45,090 ounces of silver. As always, I thank Carl Loeb for these numbers. Well, the last sales report from the U.S. Mint in November pushed silver eagles sales over the 4 million mark for the first time in history. The exact total for November was 4,260,000 silver eagles. And that, dear reader, is a phenomenal amount. There were some whole years of silver eagle production in the past that barely exceeded that number... and a few years that didn't. Year-to-date silver eagle production is 32,890,500. Wow... and we still have one month to go! One has to wonder how long the U.S. Mint can [or will] keep this up. I hope that you are getting your share. Gold eagle sales added another 11,500 ounces for the month... bringing the month-end total for November up 112,000 ounces of gold minted into gold eagles. That is not a record month for 2010 by any stretch of the imagination. For the month of November, silver eagles outsold gold eagles by 38 ounces to 1. Year-to-date that number is 28 ounces to 1. What that means is that silver bullion sales are increasing at the expense of gold bullion sales. My bullion dealer here in town is selling about 200 ounces of silver for every ounce of gold. The short squeeze in silver is definitely on at the retail level. It appears that the plan to bury JPMorgan et al by buying up as much physical silver as possible is already well under way. I plan to add to their litany of woes on Thursday. It was a busy day over at the Comex-approved depositories on Monday. All four depositories were very active... and by the time the smoke cleared, they had added a net 743,072 ounces of silver to their inventories. The link to that action is here.

¤ Critical ReadsSubscribeBofA Mortgage Morass Deepens After Employee Says Notes Not SentMy first story today is from 'David in California'. It's a Bloomberg piece from yesterday that's headlined "BofA Mortgage Morass Deepens After Employee Says Notes Not Sent". This is not good news for Bank of America... or any other lender who followed this practice. It appears that it was routine for the lender to keep mortgage promissory notes even after loans were bundled by the thousands into bonds and sold to investors. No promissory note... no foreclosure rights! It's a long read... and for some, it may be worth it... and the link is here.  Death Comes For Us AllReader Roy Stephens is responsible for today's next longish article... which is a Bill Bonner offering from over at dailyreckoning.com.au. The headline reads "Death Comes For Us All"... "Eventually, death gets us all. And not just us... Banks. Corporations. Trends. Bull markets. Paper currencies. Monetary systems. Empires... For example, death seems to be stalking the euro as well as the dollar." Bill is one of the great writers on the Internet... and this piece is another gem. It's definitely worth the time... if you have it... and the link is here.  Ireland's Debt ServitudeNot to be outdone by the likes of Bill Bonner,The Telegraph's Ambrose Evans-Pritchard gets up on his soap box and pontificates on the 'deal' struck by the ECB and Euroland to 'save' Ireland... and, by extension, themselves. The headline reads "Ireland's Debt Servitude"... and the link to this very worthwhile read, is here.  Fears of a Euro Demise: The Disastrous Consequences of a Return to the Deutsche MarkThe next piece was sent to me by Texas reader Norbert Wangnick... and it's a Monday posting over at the German website, spiegel.de. The headline reads "Fears of a Euro Demise: The Disastrous Consequences of a Return to the Deutsche Mark". I'm not sure whether this a propaganda piece to strike fear into the hearts of the German people, or not. I'm sure that a Deutsche Mark backed by some sort of precious metal standard might work just fine. The problem would be that virtually all of Germany's gold is stored at WestPoint in the United States... or in London. They would obviously have to get it back first. The issue after that could be this... would their former conquerors be prepared to do that? Don't forget that possession is 9/10th of the law. This essay is in five parts, so it's a bit of a read... and the link is here.  Following Hungary and Ireland, France Is Next To Seize Pension FundsYesterday I posted a story about Hungary basically nationalizing all private pension plans to pay down their debt. Today, courtesy of Australian reader Wesley Legrand, comes this zerohedge.compiece that's headlined "Following Hungary and Ireland, France Is Next To Seize Pension Funds". This disease is spreading rapidly. It's not an overly long piece... but I suggest you find the time to read it... and the link is here.  Mounting calls for 'nuclear response' to save monetary unionJust as I finished up on my column this morning, I received the following Ambrose Evans-Pritchard offering from Australian reader Nick Laird... of sharelynx.com fame. It was posted at The Telegraph in London this morning at 6:00 a.m. GMT... which is 1:00 a.m. in New York. The headline reads "Mounting calls for 'nuclear response' to save monetary union". As Europe's debt crisis spreads ever wider, the EU authorities are coming under intense pressure to move beyond piecemeal rescues and resort to radical action on a nuclear scale. The only way to save this worthless currency is to back it by gold. I suspect that any other solution will result in the immediate and catastrophic failure not only of the euro, but the European Union itself will disintegrate immediately thereafter. The link is here.  Safe Storage FacilityBefore I get started on my precious metals-related stories today, I'd like to share this photo of reader Charley Orr's Safe Storage Facility. Don't try this at your house!

China Approves Fund That Will Invest In Foreign Gold ETFs, Opening Avenue For Millions Of Mainland InvestorsToday's first gold-related story is from 'David in California'. I | ||

| Posted: 30 Nov 2010 08:37 PM PST Link: Image:  Reader Roy Stephens is responsible for today's next longish article... which is a Bill Bonner offering from over at dailyreckoning.com.au. The headline reads "Death Comes For Us All"... "Eventually, death gets us all. And not just us... Banks. Corporations. Trends. Bull markets. Paper currencies. Monetary systems. Empires... For example, death seems to be stalking the euro as well as the dollar." Bill is one of the great writers on the Internet... and this piece is another gem. It's definitely worth the time... if you have it... | ||

| Jim Sinclair - Gold is Poised to Explode Posted: 30 Nov 2010 08:37 PM PST Image:  Eric King sent me another blog that he posted late last night. This is from Jim Sinclair. It's not overly long... and the headline of the blog reads "Jim Sinclair - Gold is Poised to Explode". It's worth the read... and the link is here. | ||

| It is Just a Matter of Time Before Gold Becomes Priceless! Here’s Why Posted: 30 Nov 2010 06:37 PM PST

By Jerry Western with Lorimer Wilson www.FinancialArticleSummariesToday.com If we continue down the same economic path that we have been following for the last four decades – and there is no indication that we won't even if we wanted to, or could, at this point – it is mathematically inevitable that gold and silver will approach infinity in U.S. dollar terms at some point in the future. Yes, approach infinity! John H. (Jack) Weber made reference to our most recent article (see here) in his entitled "Considering All the Guesses Out There, What Will The Price Of Gold Ultimately Go To – And WHY" in which he stated "If you divide any number, i.e. the value of the dollar, by zero you get infinity which is a meaningless number, but that is the ultimate price to which gold and silver are headed." In reality, there can be no end to this bull market in gold if there is no end to profligate dollar creation. The mathematical function 'X Squared' or 'X to the second power', when solved for all numbers and plotted on a graph is a parabola. A parabola looks like a jet fighter taking off. It starts as a near horizontal line and rises gradually at first, but then steeper and quicker, until the line approaches vertical. The line rises at an ever steeper rate – and this is what has been happening to the number of dollars in existence. There are more and more of them every day and the rate at which they are being created is increasing at a faster pace as time goes by. U.S. dollars need to be created in parabola fashion to keep the economy afloat. The number of dollars in existence is not only increasing but increasing at an accelerating rate. One way to think about this is to watch how fast the supply of dollars doubles. If one plots a point on a timeline each time the number of dollars doubles, one will see that it is taking less and less time for the number of dollars to double. At first it takes decades for the number to double and then years. Eventually the numbers will be doubling in six months, then three, then six weeks, then three. You see where this is going. An economy cannot function in such an environment. This is where we are headed. We get closer to the abyss and sudden catastrophic collapse by the day as we climb the vertical line. We really dislike speaking in these terms or sounding alarmist but it's in the nature of markets and of life to surprise from time to time. How many people predicted the market crash of 1929, the attack on Pearl Harbor or the confiscation of gold in 1933? Very few, if any, and we believe that will be the case with the coming moves in the U.S. dollar, gold, and silver. The amount of money needs to be continually increasing because in a fiat, credit-based monetary system such as ours, all money comes into being by way of loans or credit. There needs to be an ever-increasing number of dollars created to pay off existing loans. If a loan is made at 10% interest then there needs to be 10% more currency injected into the system to pay off that loan. Then more loans are issued on the repaid money and the system continues on. Let's look at a simplistic example for clarity. A loan is provided for $100 @ 10% interest. The amount of money paid back is $110. That $110 is then lent @ 10%. The amount paid back is $121. That $121 is lent out @ 10%. The amount paid back is $133.10 – and so it goes. Do you see how the money supply is increased? Not only is it increased but the amount of money in circulation is increasing by a larger amount with each iteration. If we charted this growth we would see that the line is not linear but is rising and rising at a faster angle over time. After a number of iterations the line approaches vertical and a vertical line is unsustainable. Because the amount of gold in the world is relatively stable, and its price is denominated in U.S. dollars, and the number of those dollars is increasing, it is inevitable that the price of gold will also rise. As the number of dollars in existence approaches infinity, so too will the price of gold (and silver and all other commodities). Actually, we believe that 'changes' are likely to be made before we get to the point of incipient hyperinflation but we'll leave what those changes might look like for another article. We do believe, however, that those changes will be sudden and catch most everyone off guard. We may see a surprise overnight devaluation or revaluation of both the dollar and of gold. That may be when this bull market in precious metals comes to an end – but you will have won because you have physical metal in your possession. You do, don't you? The current dollar/bond paradigm we live under is by far the largest Ponzi scheme ever unleashed. It is literally impossible to pay off all claims at current (par) dollar value. If nothing is done and we do go through a hyperinflation of the dollar, all of these fantastic dollar gains in equities will be an illusion. It is those who hold the real tangible items or claims on those items who will win. If you have a bond or equity that is denominated in dollars and only pays out in dollars, have you really won anything in a hyperinflation that culminates in the destruction of the currency? No,of course not. So your investment in bonds went from a million to a billion and then to a trillion dollars. Big deal when that trillion buys you a dozen eggs. Don't scoff. It happened in Zimbabwe recently and many times throughout history, including twice in the United States. You only win if you possess an asset. The most liquid, tangible, fungible, recognizable, coveted, time-tested, and easily-converted-to-something-else assets are precious metals. Got gold yet? If not, what are you waiting for! Don't forget to sign up for the FREE weekly "Top 100 Stock Market, Asset Ratio & Economic Indicators in Review." Jerry Western is the author of a new book entitled "Got Gold? Get Gold!: The Everything Gold Book" on how to protect one's wealth in the 21st century gold rush and a frequent guest contributor to www.FinancialArticleSummariesToday of which Lorimer Wilson is editor (editor@munKNEE.com) | ||

| Posted: 30 Nov 2010 06:35 PM PST 1. $1424 or $1315? Which price does gold touch first? Gold is leaping higher this morning, up $9 to approx. $1375. 2. My unchanged view has been that gold takes out 1424 first, and I bought into the lows at 1315, all the way down in a pyramid formation of buys. 3. The reason I feel gold takes out 1424 first, and have stated it without wavering, is that technically speaking, any consolidation has a 66% chance of continuing (consolidating) the direction price was moving in, when it went into the consolidation. 4. The simple fact is that gold was rising into 1424, so there's a 66% chance it breaks upside. I personally put the odds at 60%. My buying into 1320 has nothing to do with whether gold takes out 1424 or 1320 first. I actually hope 1320 breaks first, so I buy more gold. More wealth. 5. In one way, I'm the only perma big picture bear in the gold community. Because I view gold as the only wealth, as the only money. The lower the price wealth and money is, in terms of paper credit, the more I buy. If you could get a Rolls Royce for less money, is that a good thing or a bad thing. Know what gold is. Know what the opponents of gold are. Know their heart. It is black. 6. The question the gold community needs to ask yourself is, do you want more wealth, or more credit? The mechanism of wealth building is not to guess when you might get to use credit paper to buy more wealth, but to make one hundred percent sure that when the opportunity does present itself, you are there, on the buy. Buy professionally without fail as each opportunity presents itself, as you just did into 1320. Or should have "just did". 7. A move down to $1225, if it happens, which I doubt, is not a problem. It's a gift. Take it. Take your wealth. 8. If you have bought gold in the bottom $250-400 area, you need to think very carefully before ever selling that gold, before trading that wealth for credit. 9. Some fans of photocopied credit tell you that wealth (gold) "doesn't pay any interest". Look, I told you that 2010 was the year gold takes of its mask and goes on the aggressive, and told you that emphatically. Price rise in Gold based on photocopied paper credit measurement is only 1% of what I was talking about. 10. My response to those who say gold doesn't pay interest is: "You're a pathetic market loser, a failure who can't buy weakness in the ultimate wealth, and the popsicle stick foundation of your credit-issuing clown act is: usury. What a joke. Go back to your photocopiers, toilet paper rolls, and your freedom-destruction fan club. You're a price-chasing bustout. Scram." Don't let price-chasing cowards and freedom-robbers push you around. Those who push on Gold find Gold can push back "only" a billion times harder than all the paper credit issued in the world combined. Never forget that reality. Do not disrespect Gold or you will pay a major financial penalty. 11. Likewise, if you are buying Uranium now at "Gold $400" pricing levels, you want to think carefully before donning the hamburger flipping uniform the banksters are offering you. 12. Never trade out a core position in a major asset to "get it back cheaper" in terms of paper credit. Attention wealth builders: Here's the Uranium chart, click here now to view: Uranium Daily Chart Technicals 13. You can't really understand what is going on here (or in any market) unless you look at the daily chart within the confines of the weekly chart. Here it is: Uranium Weekly Chart. What you are looking at is a massive basing formation that is over two years in size/time. As a bull market moves forwards, technical indicators like RSI (Relative Strength Index) are going to become overbought from time to time. The great error made by investors is to liquidate core positions because price might sell off. That's what is better termed "top calling". 14. Top calling is arguably the single greatest core position wealth destroyer that exists in markets. Yes, Uranium is overbought on the weekly chart now, just as GOLD was overbought at $330 after it rallied from $250. Looking back, how have the Fools Gold Top Callers done against the Golden Wealth Builders from $330? Glad you sold out at 330? Many never got back in. Make technicals answer to you. Not the other way round. Be very judicial in the amounts of a major asset that you liquidate in anticipation of (or during) perceived market corrections. 15. If you bought Uranium core positions at these prices or lower, you do not liquidate them now, even if you know for 100% sure price is going lower, which you don't. Yesterday was a perfect example of price continuing higher in an overbought condition when it was "supposed" to fall. It has occurred in Gold a zillion times since the bull began. It will be the same for Uranium. Notice that the key $8.48 high has already been taken out with the move to $8.52 on this run. Many of you have enormous wealth; dumping core positions also has tax ramifications that the teckie crowd can't relate to. The lowest prices with a major asset are the safest prices. That base formation on Uranium targets the $12 area, just based on price alone. Factoring in the time of the base formation, and the $15-20 zone becomes very realistic. 16. Do not chase price with a demonic mindset that it is "getting away". While core positions must be held, even when the top callers tell you to sell what you have to the banksters "before you lose all your credit with the Gman", you must also exhibit a similar iron hand of patience, in regards to entering into new trading or core positions. My instruction to you is: Let price get away, as it was supposedly doing at $1387, the point where I identified a "loss of market sanity" in the gold community. 17. Natural Gas is another "untradeable at higher prices" asset. As price turns and begins a major bull market I will decrease my trading of natgas drastically. Natural Gas is arguably the world's most volatile commodity, and professional investors, never mind amateurs, stand to meet the ultimate whipsaw as price goes higher. Your only protection in NatGas is to ensure your buys are at the lowest possible prices. Guessing at market bottoms or turns is insane. Get the wealth now. As price goes higher, leave it alone. Don't pick your NatGas nose with trading, or you will find the nosebleed you get looks like a red Niagara Falls. 18. It's possible that even if the supposed head and shoulders top formation on gold activated, the gold stocks indexes could blast higher anyways! Here's a look at the supposed head and shoulders on bullion: Gold Bullion Daily Chart. Price has already taken out the downtrend supply line this morning, and a move to 1390, and arguably just 1385, could be viewed as negating the whole supposed top pattern! Why? Because that is the right shoulder high area, a violation of the right shoulder high on the upside negates the pattern. Some technicians view such an action as a buy signal! The red "neckline" is not to be feared. A violation of that line on the downside is a gold wealth accumulation signal, not a "hand your gold to the banksters now" signal. There is nothing to fear, not even fear itself, when it comes to gold! 19. Does anyone know how significant the price of gold bullion now is, for gold stocks? Even if the indexes (GDX, GDXJ, ZJG.to) fell, many individual stocks will pop higher anyways. The next golden popcorn to pop…could be yours! 20. There is NO strategy to employ now, other than buying gold stock, both indexes and individuals, if they move lower. Blowing out core gold stock positions now, in my professional opinion, in all seriousness, is at least one thousand times stupider, from a possible reward perspective, than blowing out bullion as it pulled back from 1045, after launching from what I termed "Michaelangelo's head and shoulders pattern". Here's why: We are at a totally different point in the crisis now, yet Elmer Fudd Public Investor and the Institutional Fundsters are not getting the picture. Gold stock is a leveraged play on gold and gold $1400 is rocket fuel. We are vastly closer to a currency crisis now, and potentially a partial hyperinflation, so gold stock is a near-infinitely better buy now than it was then, from a fundamental macro perspective, although not from an absolute price point perspective. 21. Meantime, Elmer Fudd Public Investor crawls on his knees to the banksters, grovelling for his 4% a year payout on a $100,000 roll of the Gman's T-bond toilet paper, buying after it's marked up to $130,000 by Dr. Pinocchio. Think carefully about what I'm saying, it is not a joke. I wouldn't pay more than about 80 grand for my first roll of the Gman's t-bond crap paper, and odds are about 90% that I will pay that 80k, as the public busts out of their toilet paper bonds and onto the bread line in total failure. Again. 22. You are told by Fudd that Gold doesn't pay you any interest. Hey Fudd, take a look at the Gold Community's "interest" on bullion: It's called GOLD STOCK, and the "if you are interested!" rate could be about 1000% over the next 12 months, while you hit the breadline! The Gman plans to pay you your interest on his toilet paper bonds in bread crusts. You wished for usury. You got it. Enjoy the fruits of your pathetic price chase. Do any of you understand what each $50 move higher in bullion above 1424 means for the bottom line profits of gold mining companies? Do any of you understand that the bond market is on the verge of implosion and how major that is for gold on the upside? Do any of you know how close we are to a US dollar currency crisis in response to the bond market crisis? Forget the microscopic top calls on the ultimate asset, or you are going to get buried by the Gold Punisher, alongside the rest of the cowards and price chasers. 23. Here's the Supermonster Cup & Handling action on the GDX weekly chart. Click here now to view the gold stocks rocket sitting on the launch pad. GDX Weekly Chart Pullback to Launch Pad. 24. Target: GDX 100. That pullback is the buying opportunity of a lifetime. You've been told by Golden Rap Star Eminem: Do not blow this opportunity! You've seen the effects of Bullion $1400 on a large group of individual gold-related stocks. As we move towards bullion $1500 the whole show is going to experience liftoff. Are You Prepared? Well, put your space helmet on and get prepared, and remember, Gold $1225 is unlikely to happen before Gold $1500. But if it does, you better understand that it's a gift. In China, you lose face if you refuse a gift. Don't refuse the gift of gold, or you won't like the face slap that follows! Special Offer For Website Readers: Send me an Email to freereports4@gracelandupdates.com and I'll rush you my "Gold Does Pay Interest!" report! I'll be covering a mindboggling 100 gold juniors that you have sent me over the past year with specific buy and sell points for every single one. How's that for an interest payout?! Thanks! st Thank-you | ||

| Posted: 30 Nov 2010 06:33 PM PST As much as I do enjoy some time off there's nothing like getting back to work either, since it's something I love to do. So over the weekend I got into one of my favourite books, and ran over some historical charts which highlighted one of my favourite patterns. I figured I should share a few examples with you. The pattern is termed the cup and handle. My, and likely your day, is filled with cups and handles. From morning coffee to a lunchtime Chia to an afternoon green tea to an after dinner tasty Guinness, or some other tasty treat. To begin with, Ivestopedia has a good definition; A pattern on bar charts resembling a cup with a handle. The cup is in the shape of a "U" and the handle has a slight downward drift. The right-hand side of the pattern has low trading volume. It can be as short as seven weeks and as long as 65 weeks. As the stock comes up to test the old highs, the stock will incur selling pressure by the people who bought at or near the old high. This selling pressure will make the stock price trade sideways with a tendency towards a downtrend for four days to four weeks… then it takes off. Technical analysis is definitely a science, but also I view it as very subjective and almost a form of art since nothing is ever exactly the same or written in stone. Chart patterns only have to fit the definition in a loose sense in general, although volume is a very important and key breakouts must always occur with strong volume or they will have a high probability of failure. There is no volume on this chart so I took a look at the GLD chart volume and it was good. Volume was low on the left cup coming into the low of the cup and higher moving back up where the right side of the cup was formed. It was below average in the handle also. So far the only issue with this one on a technical basis is that the right side is higher than the left. This isn't the end of the world but it's something to at least be aware of. Now let's see the chart post cup and handle as it moved out of the pattern. Now let's look at potential targets. In theory you measure the distance from the right peak to the cup low. In this case it's roughly $200. So in theory we could have seen the end of this continuation pattern for Gold and now need to rest and consolidate and build another pattern, perhaps even another cup and handle. We all know how easy it is to look at hindsight and say, see I told you so, or I should have done such and such. The S&P has a superb looking cup and handle which is textbook except that the right rim is slightly higher than the left. But in reality target are only targets. Their something you shoot at, but sometimes miss. Often a stock will have powerful underlying fundamentals such as earnings growth, increasing margins or even a breakthrough product which pushes the stock past targets and higher for an undetermined amount of time. This next chart is a textbook example of a bullish cup and handle pattern followed by a chart that just kept going and going even to today. It's from William J. O'neil's must have book, "How To Make Money In Stocks" As you can easily see, targets were thrown out of the window with this stock as it moved from the $35 area to $140 before everything it crashed in 2008. (chart in log-scale…google it) Let's take a look at this stocks chart including all of 2008 and up to today. It's also prudent to note the power of a simple uptrend or downtrend. You just need a ruler and you can easily identify major trends and generally steer clear of any major trouble coming. I've talked many times in the past about the high probability of a rising stock market even as the economy crumbled around it simply due to the fact that the US dollar is being devalued. Although the US dollar chart doesn't look half bad at the moment. Just because the market continues higher does not mean the purchasing power is increasing. That's why Gold and Silver account for such a large portion of my portfolio at this time. Our investment philosophy remains the same. Hold large percentages of physical Gold and Silver mainly, while actively managing and trading another portion in anything from mining stocks to mining indexes, to general equities and their indexes or even ETF's. Were are not limited from making money on the downside either as we enjoy the leverage options afford us at times as well. Until next time take care and thank you for reading. Warren Bevan In my free, nearly weekly newsletter I include many links and charts which cannot always be viewed through sites which publish my work. If you are having difficulties viewing them please sign up in the left margin for free at http://www.preciousmetalstockreview.com/ or send an email to warren@preciousmetalstockreview.com with "subscribe" as the subject and receive the newsletter directly in your inbox, links and all. If you would like to subscribe and see what my portfolio consists of please see here. If you found this information useful, or informative please pass it on to your friends or family. Free Service The free weekly newsletter "Precious Metal Stock Review" does not purport to be a financial recommendation service, nor do we profess to be a professional advisement service. Any action taken as a result of reading "Precious Metal Stock Review" is solely the responsibility of the reader. We recommend seeking professional financial advice and performing your own due diligence before acting on any information received through "Precious Metal Stock Review". *To unsubscribe send an email to newsletter@preciousmetalstockreview.com with "unsubscribe" in the subject line. www.preciousmetalstockreview.com | ||

| Posted: 30 Nov 2010 05:51 PM PST Fish on! Fish on! We've got action! I heard the the reel scream as the line started to "zizzz" off it again. Big Silver and Gold fish runnin' deep and long. This is not your typical Christmas PM doldrums. | ||

| Quantitative Easing - Office Discussion Posted: 30 Nov 2010 05:30 PM PST Dollar Daze | ||

| Posted: 30 Nov 2010 05:19 PM PST Whatever the spin, the fact is that 1.6 gigabytes of text files on a memory stick spanning 251,287 leaked United States State Department cables from more than 250 embassies and consulates are not exactly bound to provoke "a political meltdown" - as German magazine Der Spiegel has put it - concerning the foreign policy of the world's declining hyperpower... Read | ||

| Gold will head to 1480-1525 before a major correction Posted: 30 Nov 2010 04:40 PM PST | ||

| Euro Gold Hits New Record High as "Too Big to Bail" Risks Infecting German Bunds Posted: 30 Nov 2010 04:33 PM PST | ||

| I canceled my Ron Paul 2012 silver order today.... Posted: 30 Nov 2010 01:59 PM PST Because I don't want to wait 12 weeks for 1/2 oz. blanks. I was hoping to have 200 produced, but given the wholesale backlogs, and current events, I will exchange FRNs for something that has already been manufactured. I vividly recall the same blank backlogs in early 2008. Ah, history! | ||

| Posted: 30 Nov 2010 11:55 AM PST

Millions of unemployed American workers are heading for a very bleak 2011. Unless Congress acts, and there is no indication that is going to happen, approximately 2 million Americans will stop receiving unemployment checks over the next couple months. The government is really between a rock and a hard place on this one. After all, who is so heartless that they actually want to cut off the little financial support that millions of deeply struggling American families are depending on? Not extending the long-term unemployment benefits is going to mean more Americans are going to lose their homes, more Americans are going to go bankrupt and more Americans will end up in tent cities. But as CNN recently reported, extending the long-term unemployment benefits through next year would cost the federal government $56.4 billion that we simply do not have. The U.S. government is absolutely drowning in red ink and cannot afford to just chuck another 56 billion dollars more debt on to the pile. At this point even Barack Obama is taking some small steps to get federal spending under control. He has just announced a plan to freeze the pay of federal government workers for the next two years. So how are federal government workers handling the news that they will not be seeing any raises for the next coupe of years? Not well. In fact, many of them are absolutely furious. But can you blame them? How would you feel if your wages were just frozen for two years and yet the price of everything just continues to keep going up? Meanwhile, the Social Security Administration announced last month that there will be no cost of living adjustments for Social Security benefits once again next year. According to the government, the cost of living is not going up. So now our seniors will just have to stretch those meager checks even more. As if all that wasn't bad enough, now a whole slew of tax increases is coming. The U.S. Congress is busy debating which (if any) of the Bush tax cuts that they are going to allow to expire, but the truth is that the Bush tax cuts are only a small part of the story. There are so many tax increases scheduled to go into effect in 2011 that it is hard to keep track of them all. In fact, there are many (myself included) that are calling 2011 "the year of the tax increase". But it is not just the federal government that is raising taxes. In the past two years, 36 of the 50 U.S. states have jacked up taxes or fees. In addition, many local governments are so strapped for cash that they are going to absolutely ridiculous lengths to raise cash. For example, from now on if you are caught jaywalking in Los Angeles you will be slapped with a $191 fine. This kind of thing is happening all over America. Police departments are being turned into revenue raising operations. Police are so busy writing tickets that they barely have any time to investigate actual crimes anymore. Unfortunately, all of this latest news comes at a time when incomes are already down from coast to coast. Median household income in the U.S. declined from $51,726 in 2008 to $50,221 in 2009. Some areas are declining faster than others, but the truth is that almost all areas of the United States have been seeing incomes go down. In fact, of the 52 largest metro areas in the United States, only the city of San Antonio did not see a decline in median household income during 2009. Times are getting really tough. Employers all over America are forcing their employees to take pay cuts. Even some of the most prominent unions are agreeing to unprecedented concessions. For example, just check out what The New York Times says is going on over at General Motors....

Unfortunately, American families are going to have to try to do more with less during a time when prices are going to be going up. Most economists agree that all of the quantitative easing that the Federal Reserve is doing is going to cause inflation to start increasing significantly at some point. In fact, some of the top Federal Reserve officials have publicly stated that they want to purposely raise the rate of inflation as a way to stimulate the economy. One of the great things about Americans is our relentless sense of optimism, but it is time for a major reality check. Our economic system is in an advanced state of decay. Our nation is a sea of red ink from coast to coast, we continue to consume tens of billions more than we produce every single month and we are rapidly being transformed into a post-industrial wasteland. The economy is not going to be "getting better" in the long-term. Unless fundamental changes are made to our economic system, we are going to continue to speed toward a horrific economic collapse. The storm clouds are gathering on the horizon and time is running out. It is imperative that we all make the most out of every single day because night is coming soon. | ||

| Posted: 30 Nov 2010 10:28 AM PST -- Probably keep your mouth shut and lay low and try not to get yourself killed. That's what you should do if you find yourself confronted with a belligerent and powerful enemy who's bent on destroying you but is currently engaged in internal quarrelling and self destruction. See, we told you gold was smart. --Gold futures closed up 1.10% in Tuesday New York trading to $1,382.30. The big driver is still the uncertainty about what will happen with Europe's ongoing, never ending, this-can-only-end-badly Sovereign debt crisis. But don't forget another important driver for gold and precious metals in general: demand! -- "China's securities regulators have given the go ahead for a mutual fund to invest in foreign exchange-traded gold funds, potentially tapping interest among mainland China investors who face negative real interest rates on their bank deposits and want to hedge against inflation," reports Marketwatch. With one-year bank deposits yielding 2.5% and the official inflation rate at 4.4%, you can see why a saver in China would want to get out of cash and into something like gold, stocks, or property. --The trouble is that two of those three options listed above are currently getting smashed in China. China's Shanghai Composite Index fell 1.6% yesterday. You can see from the chart below that the index is back where it was in early October after a powerful move up. A hike in interest rates to (hopefully) contain inflation was expected over the weekend but didn't arrive. --We've been catching up the last few days on the Shanghai and Hong Kong property markets. Of course there's a lot we don't know about the real estate market in China. For example, it might be normal to speculate on house prices in China, as it is here in Australia. There are cultural attitudes to certain asset classes that foreigners sometimes just don't understand (or see more clearly than locals). --On the other hand, if you're a loud-mouthed American or just believe there's plenty of evidence that China is in the grip of a credit bubble, AND you have a $1.6 million Aussie dollars to put your money where your mouth is, you can sign up for Mark Hart's hedge fund betting on the imminent implosion of China. --Hart reckons China has consumed only 65% of the cement it's produced in the last five years. And more worrying for Australia, he says China has 200 million tonnes of excess steel capacity (more than the total production of the EU and Japan combined). He also reckons there's 3.3 billion square metres of excess floor space and that there's an enormous property bubble in China, with the average price-to-rent ratio in China's eight key cities just under 40. --This would correspond to the idea that there's a fixed asset boom in China being driven by reckless lending, an obsession with GDP growth figures by local governments (with dubious financing schemes), and a good old fashioned speculative frenzy in property. It would also mean those glowing terms of trade Greg mentioned yesterday are, in fact, one-offs and not a permanent feature of the Australian economic landscape. --By the way, if you don't have $1.6 million dollars, or don't feel like making a punt that large on China's fall, we'll keep you posted on what Murray's up to lately at Slipstream Trader. If China's going down, it's going to take a heaping helping of iron ore companies with it. But that in itself might cause a re-allocation of institutional assets in Australia that would benefit other sectors, even if it was grim news for the miners. --Of course maybe Hart is wrong and your editor is an idiot. Time will tell. --China certainly has one big thing going for it: it's not Spain. Spain is a very nice place, mind you, with beautiful churches and bullfights and afternoon naps. But right now it finds itself at the centre of Europe's sovereign debt crisis. Bloomberg reports that yields on ten-year Spanish debt no yield nearly 3% more than ten-year German bonds. "Ireland's bailout did nothing to ease the euro-zone debt crisis: it might have even made it worse," says Standard Bank strategist Steven Barrow. --The last think you probably want to read about on a Wednesday is rising bond spreads in Europe. We know because we just finished writing about them in yesterday in the monthly issue of the Australian Wealth Gameplan. The takeaway: Europe's bond crisis is an existential crisis for European Federalism. --That may or may not be an interesting idea (depending on how much you like history and geopolitics). If you believe there's a connection between modern State finance and the reach and scope of government in public and private life, then Europe's crisis (and America's and Japan's) is really a crisis for the Nation State and its ability to deal with globalisation and trans-national bankers. --But what, if anything, does it have to do with Australia? And should it interrupt our enjoyment of the cricket, the spring, and beer? Two words dear reader: capital flows. Stay tuned. Regards, Dan Denning | ||

| America's Leading Export: Inflation Posted: 30 Nov 2010 10:26 AM PST "Depending on how bad a crisis gets, gold ranges from being between the best answer and the only answer." Inflation is on everyone's lips these days...everyone in Asia, that is. Because Fed Chairman, Ben Bernanke is so busy pumping up the US money supply to battle a perceived deflationary threat here at home, he is putting pressure on overseas economies to print money at the same pace, in order to prevent their currencies from appreciating against the dollar and, thereby, become less "competitive." The mechanics of all this are a bit complicated, but suffice it to say that the US is "exporting inflation." This important topic hit the front page of yesterday's The Wall Street Journal's Money & Investing section. The paper posted official inflation rates for the biggest emerging market economies in Asia. India leads the pack with an 8.6% official inflation rate. At that pace, prices would double in India in less than nine years. Indonesia is at 5.8%, China at 4.4% and South Korea at 4.1%. These are on the high side and increasing. Folks worry that central banks in these countries will tighten up their loose monetary policies to try to rein in inflation. In so doing, these people worry economic growth will slow or even reverse. And that would have a wide impact on the world's stock markets, as most of the growth that companies enjoyed in the last year came from Asian markets. After all, those rising commodity prices that delight commodity investors are due in good part to the demand from places like Asia. China is already at work trying to contain price increases. It has implemented price controls, which never work. It has also tried to boost the reserve requirements of its banks, essentially forcing them to hold more in reserve and lend less. This kind of tinkering and meddling creates its own problems and almost always ends badly. I should send a copy of Henry Hazlitt's Economics in One Lesson to the world's central bankers and policymakers - if only they'd read it. I was in Baltimore last week recording an interview with my publisher, Addison Wiggin. We talked about this book, because Agora Financial has acquired the rights to it. We think it is an important book, so we are reprinting it. (You'll hear more soon.) Anyway, Hazlitt's book is full of good principles and prescient predictions. The one key lesson he hammers home is to think not only of the immediate impact of any act or policy on one group, but to reason out the longer-term consequences for all groups. For instance, the policy of encouraging homeownership seems a good one. But Hazlitt points out the problems of government-guaranteed mortgages. He wrote this passage in 1946, which is startling for its prescience. This describes exactly what happened in the big housing bubble that popped in the financial crisis: "Government-guaranteed home mortgages, especially when a negligible down payment or no down payment whatever is required, inevitably mean more bad loans than otherwise. They force the general taxpayer to subsidize bad risks and to defray the losses. They encourage people to 'buy' houses that they cannot really afford. They tend eventually to bring about an oversupply of houses as compared with other things. They temporarily over-stimulate building, raise the cost of building for everybody (including the buyers of the homes with the guaranteed mortgages) and may mislead the building industry into an eventually costly overexpansion." Remember, this was written in 1946! If only more policymakers and central bankers had read and understood this passage, we could have avoided a lot of pain and losses. This is also a pretty good way to think as an investor. For example, Hazlitt writes about inflation. He makes some good points that most people overlook. Inflation, he tells us, doesn't mean that all prices rise at the same time. Inflation is really a process, as the newly printed money courses its way through the economy. "The process of inflation is certain to affect the fortunes of one group differently from those of another... It may indeed bring benefits for a short time to favored groups, but only at the expense of others. And in the long run, it brings ruinous consequences to the whole community. Even a relatively mild inflation distorts the structure of production. It leads to the overexpansion of some industries at the expense of others... When the inflation collapses, or is brought to a halt, the misdirected capital investment - whether in the form of machines, factories or office buildings - cannot yield an adequate return and loses the greater part of its value." This brings us to the inflation worries in Asia. Most of the time, you'll hear commentators talking about economies "overheating" as if it is the duty of central banks to cool things down. But really, the damage is already done. Inflation distorts markets. It leads to people making investments they might not otherwise have made. So the only choice is continuing the inflation to its ultimate flameout, or stopping it earlier. Either way, the "misdirected capital" - as Hazlitt dubs it - loses the greater part of its value. Anyone who owned, say, a homebuilder stock over the last five years knows this all too well. Where is the misdirected capital in Asia? That's what you want to avoid. It's hard to say, or investing would be easy. But it seems fair to say that real estate is one to be careful about. The building spree in Chinese cities has surely been abetted by lose money and an approving nod from the powers in Beijing. The whole region, but China in particular, has had a great boom in heavy industry. Producers of cement and steel are concerns, in my view. But the process of inflation also creates areas of neglect. The great commodity boom we've enjoyed in the last decade came about in part because the industry has been starved for capital for a long time. Investors were drawn first to the telecom, media and Internet darlings of the 1990s...then to the miracles of subprime loans and financing in the 2000s. As a result, the resource sector received very little new investment. The last financial crisis also tightened the spigot on investing in resources. A whole raft of projects suffered delay, or even cancellation. This, too, doesn't fall evenly on all commodities. Some have been harder hit than others. Just this past weekend, I read a good piece in Barron's on the titanium miners. From the piece: "Titanium miners have painted themselves into a corner, as a lack of investment during the downturn has made it difficult to keep pace with booming emerging-market demand now. Higher prices are likely to result." It goes on to cite some titanium plays. Iluka Resources - trading under the ticker ILU in Australia - is the second largest miner, after Rio Tinto. Its stock is up 112% this year. South Africa's Exxaro Resources is up 25% and Kenmare Resources is up 21%. The latter has a mine ramping up in Mozambique. We've seen other commodities enjoy tight supply: uranium, iron ore, hard coking coal and rare earths. Each of these has gone up in price in the last year. No doubt there are some distortions in these markets, too. But new supply is not so easily forthcoming, leaving a window for investors to make some good money. Another commodity that should be good no matter how Asia's inflation story plays out is gold. The strength of gold reflects concerns of the creditworthiness of the issuers of paper money. As a result, gold is near 52-week highs. Yet the stocks of gold miners have lagged the metal. Gold miners should put up some great numbers in the next few quarters, though, sending their shares higher. Hang onto your gold stocks. Finally, if you read only one economics book in your life, Hazlitt's is the one I recommend. I tell people that this book changed my life because it changed many of my ideas on economic questions and set me on a path that I still follow today. You'll find Hazlitt's book is also a doorway to other thinkers, should you decide to go deeper. His final section, "Notes on Books," contains many excellent recommendations. I found Hazlitt back in 1996 while browsing bookstore shelves. I had been studying finance and the great investors - Ben Graham, Warren Buffett, Peter Lynch, Phil Fisher and others - for several years. But I felt I wanted to get a better grounding in broader economic principles. I was looking for one readable book that had a good summary. Hazlitt's book is the one I found. Regards, Chris Mayer, | ||

| Precious Metals Tally Strong Increases for November Posted: 30 Nov 2010 10:00 AM PST Concerns of contagion in eurozone debt markets and increasing existential concerns about the actual single currency itself saw gold rise 1% and silver by 3% yesterday (in USD). Gold in euro terms rose by even more. | ||

| Gold/Platinum Ratio & Economic Weakness Posted: 30 Nov 2010 10:00 AM PST Since about the turn of the century, platinum has become the prestige metal. Even credit card companies got into the act by replacing gold cards with platinum cards as their premier credit cards. This ensured the world became almost platinum crazy. | ||

| Talking Gold & Silver with Archipelago Resources Posted: 30 Nov 2010 10:00 AM PST The flagship Toka Tindung gold project in Indonesia is set to move into first production in March 2011. It has been a long road for Archipelago since their flotation back in 2003. | ||

| Silver and gold have high amounts standing/record silver eagle sales at the Mint Posted: 30 Nov 2010 09:40 AM PST | ||

| The Dual-Mandated Failures of the Federal Reserve Posted: 30 Nov 2010 09:00 AM PST I thought I knew everything about the foul Federal Reserve in that I knew they cause inflation in prices by deliberately creating too much money, which is the One Big Thing (OBT) that you do not want because of the social upheaval of people starving to death and rioting in the streets. And I thought I knew that the Federal Reserve was originally charged with preserving the value of the dollar, but apparently that is not so. Ergo, the Federal Reserve was not prevented, or warned, or even suggested to refrain from actually being evil, in that we have had continuous inflation in prices since the inception of the Federal Reserve in 1913 because of the vast increase in the money supply since 1913, and only a vast and expensive expansion of the welfare state has kept starvation and rioting under control… So far. So I was happy to learn a few things from The Wall Street Journal, like how only since 1978 has the Fed been given a so-called "dual mandate" to achieve both price stability and full employment, where "in the original Federal Reserve Act of 1913 Congress asked the central bank to supervise banks. It did not mention explicit economic goals. Even in the Keynesian heyday of the Employment Act of 1946, Congress did not ask the Fed to manage the economy." Of course, there are those who ask, "Why quibble about whether the Federal Reserve is a failure in both its 'mandates' of maintaining stable prices and high employment now that the horrible Federal Reserve is actually beginning their promised creation of another $600 billion in the next six months, and by extension another $1.2 trillion in the next year, and in fact will be buying a total load of almost $2 trillion in Treasury debt in the next twelve months, when you should be working and not standing around discussing this stupid stuff on company time?" As I was slumping back to my desk, I was muttering under my breath, "The reason is because of inflation in prices from all of this inflation in the money supply and how it is going to destroy us, you moron!" I'll bet that if I was in China, my stupid Chinese boss wouldn't be asking me such a stupid question, as David Stevenson in the Money Morning newsletter notes that "the official figures showed China's cost of living climbing by 4.4% year-on-year." Yikes! And all of this inflation in prices is because, "In the last seven years, China's M2 money supply measure – how much cash is sloshing around the system – has increased more than threefold. In other words, there's been a massive credit bubble" that has not only produced alarming inflation in prices, but "rapid economic growth – China is growing at around 10% a year just now," which means more demand and higher prices still! Yikes! And as bad as that is, Mr. Stevenson goes on that "a member of the Chinese Academy of Social Sciences, one of the government's top think tanks, said that by its own calculations the country's consumer price index had been understated by more than 7% over the past five years," which means that the terrifying 4.4% inflation is grossly understated, and has been estimated by others to be as high as 10%! This probably comes from the fact that "Food prices are already rising at 10% year-on-year. The Xinhua news agency reported that a basket of 18 staple vegetables cost 62% more during the first ten days of November than in the same period last year." They did not mention anything about pepperoni prices, sausage, bacon, cheese or any other ingredients of pizza, so I imagine that's why food riots have not broken out, plus the fact that the Chinese are said to be buyers of gold, protecting themselves against the debasement of their money by their banks and government. And since the same strategy of buying gold, silver and oil when so much money is being created works everywhere, I imagine that in Chinese they say something that sounds like "Ah-so! Oy chow wan go!" while we here in America say, "Whee! This investing stuff is easy!" The Mogambo Guru The Dual-Mandated Failures of the Federal Reserve originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||

| Posted: 30 Nov 2010 07:39 AM PST | ||

| Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 3% Posted: 30 Nov 2010 07:16 AM PST Gold held near unchanged in Asia and saw decent gains in London before it jumped even higher in New York and ended near its early afternoon high of $1389.75 with a gain of 1.38%. Silver soared to as high as $28.33 and ended with a gain of 3.65%. | ||

| An I.M.F. Announcement on the Completion of Gold Sales due Soon Posted: 30 Nov 2010 07:14 AM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment