saveyourassetsfirst3 |

- Investing in Gold and/or Silver Today is a Must Given Tomorrow's Economic Realities! Here's Why

- Silver shortage at COMEX this week (November)

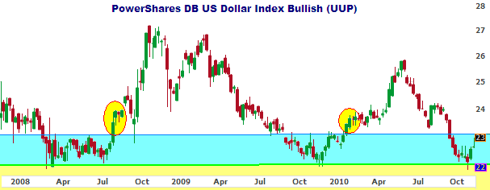

- Dollar Direction Dependent on UUP

- Why the IMF Meetings Fail...

- Silver: Commercial Shorts Continue to Consolidate

- Commodities Inflation

- Ritual dating from 1919 sets price of gold

- Fear & Doubt Are the Weapons of the Gold Stock Short Sellers

- This Past Week in Gold

- Wall Street Moves In for ...

- Schiff interview with GATAs Douglas covers sale of imaginary gold

- Brent Cook: Colombian Gold Rush

- Max Keiser on Alex Jones - Max calling for $500 silver

- Antidote to Globalists’ Threat to U.S. Dollar-Gold Investments

| Investing in Gold and/or Silver Today is a Must Given Tomorrow's Economic Realities! Here's Why Posted: 21 Nov 2010 04:18 AM PST An understanding of the current economic realities and trends suggest that investing in natural resources (i.e. energy, agriculture and minerals - and especially gold and/or silver) is virtually guaranteed to be the most investor-friendly sector. Words: 1466 |

| Silver shortage at COMEX this week (November) Posted: 21 Nov 2010 02:16 AM PST http://www.ronpaulforums.com/showthr...74#post2992874 Widespread Silver Bar Shortages By Patrick A. Heller on November 18th, 2010 Categories: Featured Articles, Gold and Silver Commentary, Precious Metals As of today, there are no longer any regular wholesale supplies of the 1 ounce through 100 ounce silver rounds and bars available for immediate delivery. It may be possible to locate incidental quantities of some product, but most wholesalers are now promising two to four weeks delivery to allow time for the silver to be fabricated. As a result of the shortages, premiums have started to rise. So far, the increases have been modest, on the order of 0.5-2%. However, if the shortage grows, expect to see further and larger premium increases in the coming weeks. We could see a repeat of the late 2008 gold and silver buying frenzy, where product availability got as slow as 1-4 months after payment. At the COMEX close yesterday, registered (dealer) silver inventories fell below 50 million ounces. Even if you include the eligible (investor) silver inventories in the COMEX bonded warehouses, which are not available to fulfill COMEX deliveries unless the investor specifically chooses to do so, there were barely 107 million ounces to fulfill around 725 million ounces of contractual obligations. COMEX silver inventories are now down more than 10% from mid-June even while the amount of silver owed has soared! As the price of silver almost continuously rose from $17.98 on August 23 to $29.36 mid-day on November 9 (a 63% increase), the COMEX had not changed its minimum requirements for leveraged accounts. It would be a normal process to periodically bump us the minimum amounts for margin accounts as prices rise, but this was not done until November 9, when the margin requirement was increased from $5,000 per contract to $6,500. On September 16, the COMEX further raised the silver contract margin requirement to $7,250—even though the price of silver had been dropping since November 9! What is suspicious is that a lot of "insiders" were liquidating their silver positions starting the afternoon of November 15. Is it possible that they may have received advance notice of the coming change in the minimum margin account requirement and sold in anticipation of lower prices the next day? The next round of gold and silver options expiration occurs on Tuesday, November 23. The attempt to suppress gold and silver prices upon the release of the US jobs and unemployment report on November 5 was almost a complete failure. Unless something is done to knock down gold and silver prices before November 23, a lot of call options will be exercised, which would further increase the demand for physical precious metals. I suspect, as do many others, that the two rounds of increasing gold and silver margin requirements were timed for no other reason other than to try to help hold down prices through November 23. Don't be surprised if supplies of other low premium physical silver products, especially US 90% Silver Coin, dry up, with those premiums also starting to rise. If you are looking to acquire some physical silver, I suggest you act sooner rather than later. |

| Dollar Direction Dependent on UUP Posted: 20 Nov 2010 11:53 PM PST Peter Ruud submits: click to enlarge

Complete Story » |

| Posted: 20 Nov 2010 11:40 PM PST |

| Silver: Commercial Shorts Continue to Consolidate Posted: 20 Nov 2010 10:52 PM PST Ananthan Thangavel submits: Between November 9-16 (the date of the latest Commitment of Traders report), silver fell 12.71%. In our last report, we reported that the percentage of open interest held by the four largest short traders of silver had increased from 44.1% to 45.4%. In the latest Commitment of Traders report, we can see that this percentage has again increased to 46.6% for the week of November 9-16. click to enlarge Complete Story » |

| Posted: 20 Nov 2010 09:34 PM PST Energy Heats Up On Inflation. Reserves Are Fine. Supply is good but prices are rising quickly on falling currencies. OPEC Wants $90 On New Normal. Hedge Funds Raise Bullish Bets on Oil to Four-Year High In Energy Markets. "Hedge funds ramped-up bullish bets on oil to the highest level since at least June 2006 as the Federal Reserve enacted stimulus measures, helping drive crude to a two- year high and weakening the dollar." "The funds and other large speculators increased wagers on rising crude prices by +8.6% in the seven days ended November 2, according to the Commodity Futures Trading Commission's weekly Commitments of Traders report. So-called net-long positions climbed to a record for the CFTC data available. The Fed said November 3 it will buy an additional $600 billion of Treasuries to spur job growth in a second round of quantitative easing, known as QE2. U.S. payrolls rose more than forecast in October, the Labor Department said November 5, also helping boost crude futures. The Dollar Index, which tracks the U.S. currency against those of six major trading partners, slipped -0.9% last week; down 13$ since this year's June 7 peak." "It's all about the dollar being debased," said Mike Armbruster, co-founder of Altavest Worldwide Trading in Mission Viejo, California. "You're going to see managed money take its cue from the dollar. If the dollar continues to weaken, you'll see them continue to go long oil." "Net-long positions in oil held by what the CFTC categorizes as managed money, including hedge funds, commodity pools and commodity-trading advisers, rose by 15,304 futures and options combined to 194,128, according to the CFTC report." JPMorgan Chase & Co. and Bank of America Merrill Lynch last week forecast that oil may return to $100 a barrel for the first time since the 2008 financial crisis. Oil surged to a record $147.27 a barrel on July 11, 2008, before plunging -78% to a low of $32.40 on December 19 that year. "Whatever QE2 will or won't do in the economy, it will cause the price of raw materials to rise," said Jennifer Fan, portfolio manager with Arrowhawk Commodity Strategies, a hedge fund in Darien, Connecticut. Petroleum prices were further supported as Saudi Arabia's Oil Minister Ali Al-Naimi said on November 1 that a range between $70 and $90 a barrel is satisfactory for consumers. The kingdom previously indicated a preferred target of $75 a barrel." Asjylyn Loder 11-8-10 Bloomberg.net This posting includes an audio/video/photo media file: Download Now |

| Ritual dating from 1919 sets price of gold Posted: 20 Nov 2010 04:43 PM PST Reuters |

| Fear & Doubt Are the Weapons of the Gold Stock Short Sellers Posted: 20 Nov 2010 03:05 PM PST Fear that the gold shares will never again outperform gold. Doubt that management will ever realize through capital gains or dividend increases the reserves in the ground. Fear and doubt are the weapons of the gold share short sellers. As long as fear and doubt can be raised to the level of action (selling), aggressive naked shorting can slow the advance of many well run and financed gold companies. Correlation analysis of the gold stocks relative to gold reveals how fear and doubt were pushed to extremes in 2009. The historically strong correlation between the gold stocks and gold during secular bull advances, such as 1929-1942 and 1968-1980, had fallen well below 0.80 by the end of 2009. This distortion is better revealed by bisecting the latest secular advance. The correlation between the gold stocks and gold had fallen to -0.14 since 2006. This reading suggest no correlation between the two assets and an extreme 'loosening' of tight correlation, 0.95, displayed from 2000 to 2006. The die of "fear and doubt" had been cast to create a tool for the short sellers to use against the weak hands. Historical Correlation Gold Stocks and Gold Through 2009.12 Once investors were lured in by this contradictory, short-term "lesson", the market has quietly begun (re)teaching its historical relationship. The loosening of historically tight correlation between the gold stocks and gold from 2006 to 2009 has been quietly reversed in 2010. The correlation has gone from -0.14 to 0.42 over the past ten months. While gold stock investors are likely still behaving in terms of the previous short-term lesson characterized by fear and doubt of holding gold shares within a secular gold bull market, the movement of capital has already adapted. Historical Correlation Gold Stocks and Gold Through 2010.10 The correlation between gold stocks and gold has and will always be tight and profitable for investors owning well-run and financed gold companies. Source: Fear & Doubt Are the Weapons of the Gold Stock Short Sellers |

| Posted: 20 Nov 2010 02:55 PM PST 11/20/2010 Summary Disclosure |

| Posted: 20 Nov 2010 11:17 AM PST |

| Schiff interview with GATAs Douglas covers sale of imaginary gold Posted: 20 Nov 2010 09:48 AM PST GATA |

| Brent Cook: Colombian Gold Rush Posted: 20 Nov 2010 09:42 AM PST |

| Max Keiser on Alex Jones - Max calling for $500 silver Posted: 20 Nov 2010 06:15 AM PST This is almost 15 minutes long but worth a listen. |

| Antidote to Globalists’ Threat to U.S. Dollar-Gold Investments Posted: 19 Nov 2010 05:22 PM PST Deepcaster |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment