Gold World News Flash |

- In the midst of Currency Confrontation, why are Gold and Silver falling?

- International Forecaster November 2010 (#6) - Gold, Silver, Economy + More

- The Fed Is Saying One Thing But Doing Something Very Different

- JPMorgan Private Bank On The "Quixotic" End To Europe's Latest (Failed) Grand Experiment

- The quiet fortitude of Silver

- In The News Today

- Max Pain For Options Trading On Dec 2010 Silver Futures

- US Mint Reports Soaring November Month-To-Date Silver Coin Sales

- If you're new to this whole ‘Crash JP Morgan Buy Silver' thing – watch this video (twice)

- RAT A TAT TAT TAT TAKE THAT JPM YOU FUCKER BANG BANG BANK CRASH CRASH CRASH – OMG YOU GOTTA WATCH THIS ONE!

- Bob Chapman – great radio interview on Silver margin rate increases, vulnerability of the banks with huge short-Silver postions and a whole lot more.

- December 7th (day of infamy?) bank run question

- Currency War heats up: “Let Scotiabank Help You Crash JP Morgan”

- I Try To Buy Lunch Using SILVER

- No words, no music, no graphics, no effects . . . PURE SILVER SPEAKS FOR ITSELF

- 2010 Proof Silver Eagle Coins Launch

- Gold’s Holding Pattern is a Golden Opportunity

- Price suppression coming undone, Turk tells King World News

- Weekly precious metals review at KWN has Haynes, Norcini, Arensberg

- Schiff interview with GATA's Douglas covers sale of imaginary gold

- Analysts Who Put the Bull in Bullish: Gold Outlook

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week

- COT Silver Report – November 19, 2010

- Why have gold and silver been falling in this time of monetary turmoil?

- Russia's Central Bank Buys 600,000 Ounces of Gold In October

- Congress Takes Vigorous Steps to Look Like it’s Planning to Reduce Deficit

- Is Ferdinand Pecora Rolling Over in His Grave?

- JPMorgan: Dollar to become the world's weakest currency

- Councilman Takes the Cake

- Global Financial System Crisis, Collapse in Consumer Spending, Unemployment, Rising Prices

- KWN Weekly Metals Wrap – Friendly Trends

- Growth vs. Value - The New Buggy Whip

- Schiff interview with GATA's Douglas covers sale of imaginary gold

- Are Expert Networks About To Be Exposed As The Ringleader In The Biggest Insider Trading Bust In History?

- Band-Aid Solutions

- While The U.S. Prints And Spends, Russia Loads The Boat With Gold...

- Guest Post: Currency Wars And The Fed’s Demise

- Target Zones for Buying Silver

- S&P 500, Treasuries, Gold, & Dollar are At Key Price Levels

- Higher Interest Rate Yields Impact on Gold, Metals and Other Commodities

- Gold Analyst Who Puts the Bull in Bullish

- Beginning of The Gold Plunge, or Just a Golden Breather?

- Buy Physical Silver And Gold Instead Of Suing Manipulators

| In the midst of Currency Confrontation, why are Gold and Silver falling? Posted: 21 Nov 2010 01:00 PM PST In the last week, gold and silver prices fell even as George Soros himself commented that conditions for gold looked perfect. Why? A look around at virtually all markets from Shanghai through Europe and back to the States fell. The media pointed to the potential for interest rates to rise, but that is an insufficient explanation when one considers that the declines were in the region of 5% across all the board. An event that touched the very structure of the global financial system occurred and is still happening right now was, we believe, the cause of the falls. |

| International Forecaster November 2010 (#6) - Gold, Silver, Economy + More Posted: 21 Nov 2010 03:12 AM PST Something is going on that your government does not want you to know about. Very few journalists have written about it and little or nothing has appeared in the mainstream media. The story could be one of major stories of our time. Western powers have tried to destroy gold as a backing for currencies for many years. Presently the major media won't touch the story and that is understandable. Something we have been writing about for years is the Shanghai co-operation organization known as SCO. Few have been listening and few have been interested in what their mission is and what they have been up to. |

| The Fed Is Saying One Thing But Doing Something Very Different Posted: 20 Nov 2010 06:25 PM PST Ben Bernanke has said that the Fed is trying to promote inflation, increase lending, reduce unemployment, and stimulate the economy. However, the Fed has arguably - to some extent - been working against all of these goals. For example, as I reported in March, the Fed has been paying the big banks high enough interest on the funds which they deposit at the Fed to discourage banks from making loans. Indeed, the Fed has explicitly stated that - in order to prevent inflation - it wants to ensure that the banks don't loan out money into the economy, but instead deposit it at the Fed:

Robert D. Auerbach - an economist with the U.S. House of Representatives Financial Services Committee for eleven years, assisting with oversight of the Federal Reserve, and subsequently Professor of Public Affairs at the Lyndon B. Johnson School of Public Affairs at the University of Texas at Austin - argues that the Fed should slowly reduce the interest paid on reserves so as to stimulate the economy.

In September, Auerbach explained:

The fact that the Fed is suppressing lending and inflation at a time when it says it is trying to encourage both shows that the Fed is saying one thing and doing something else entirely. |

| JPMorgan Private Bank On The "Quixotic" End To Europe's Latest (Failed) Grand Experiment Posted: 20 Nov 2010 03:04 PM PST One of the more persuasive analyses on the fate of the EMU that we have read recently, comes, oddly enough, from JP Morgan, although not from the firm "proper" but from its somewhat more iconoclastic Private Bank division (which manages portfolios for the ultrawealthy). At the core of the argument, which is far more subtle and nuanced than any report by Ambrose-Evans Pritchard, yet which reaches the same conclusion on the viability of the Eurozone, is the now accepted schism between the core and the periphery, in virtually every aspect of their economies: "how can the European Central Bank simultaneously maintain the “right” monetary policy for inflation-phobic Germany and the weak periphery at the same time?" What many don't know, however, is that this very dichotomy was the reason for the collapse of the first attempt at a monetary union in Europe, the European Exchange Rate Mechanism, which ended with a loud thug back in 1992, "when the UK needed a much weaker monetary policy than Germany, which was overheating in the wake of Unification stimulus." Of course, instead of taking no for an answer, Europe merely upped the ante and layered monetary unification on top of an artificial political and customs union. The current state of affairs is all Europe has to show for it. So what happens next? Just as Dylan Grice suggested on Friday that China may have realized that its inflationary endgame has now entered its "out of control" phase, so too perhaps Europe, now accepts the realization that the same unsuccessful outcome as 1992 is inevitable and the premise of a European Union can finally be shelved. Yet in a world in which, as JPM claims, the need for an artificial European union to preserve the peace ended in 1954, and the far more critical peace-perpetuation mechanism - global corporatocracy - is far more important, perhaps Europe should instead focus on doing all it can to promote the interests of various multinational corporations, whose viability may be far more important to Europe's continued non-wartime status. Or perhaps that is the idea all along - with corporate viability more reliant on a healthy banking sector than anything else, are Europe's taxpayers now expected to pay for the 50+ years of peace and social welfare they have received by rescuing the various banks whose bad investments would not sustain one day without an explicit and implicit sovereign backstop. Is Europe essentially saying that should Europe's banks be impaired, that war will certainly follow? Or if the message is not too clear yet, perhaps it will be made soon enough... From JPM Private Bank: A Don Quixote Thanksgiving The diverging economic conditions between Europe’s core and periphery are severe, but not insurmountable1. However, a flaw in Europe’s creation myth may lay at the heart of the inability of the European Monetary Union to survive over the long run. As Europe deals with its latest weak link (Ireland), I am reminded of Don Quixote, who among other things, went on a difficult journey for all the wrong reasons. For Europe, the EMU may turn out to be the same. First, the economics. The Periphery and Pompeii Peripheral Europe (Greece, Portugal, Ireland and Spain) is dealing with the aftermath of a consumption boom gone wrong. As we discussed in our “Sick Men of Europe” paper last February, a pattern of faster consumption, growing current account deficits and a loss of competitiveness began in the Periphery almost immediately following the adoption of the Euro. In the wake of the global recession, like Pompeii, growth in the Periphery is frozen in time while Core Europe has revived. One reason: home prices actually rose more relative to income in Spain and Ireland than they did in the US (see below). Recall as well that while banks grew to be 100% of GDP in the US, in Spain they grew to 200% of GDP, and in Ireland, 400% of GDP (that’s why GDP measures may not be the best barometer of event risk). Irish banks essentially became European banks in the broadest sense of the word. But who pays the freight if something goes wrong? More on that later. Another sign of Core Europe’s revival: Germany (15x the size of Ireland) is doing quite well, and represents a large part of the European equity holdings that we do have in portfolios (see post-script for more on European equities). As shown below, German unemployment is at a 20-year low, and there are increasing signs of labor shortages reported by German manufacturers. These are “good” problems to have at a time of low global growth, particularly across the developed world. But this is part of the problem: how can the European Central Bank simultaneously maintain the “right” monetary policy for inflation-phobic Germany and the weak periphery at the same time? This conundrum lay behind the collapse of the prior monetary union in Europe, the European Exchange Rate Mechanism. This effort collapsed in 1992, when the UK needed a much weaker monetary policy than Germany, which was overheating in the wake of Unification stimulus. As Maastricht orthodoxy is imposed on Greece and Ireland, we are reminded again of how infrequently belt-tightening has been attempted without an exchange rate devaluation to help cushion the blow. The chart above plots current fiscal adjustments in Europe (orange) compared to prior ones in Europe and Latin America (yellow). No one (other than Latvia) has tried this before: large fiscal adjustments in a low-growth, no-devaluation environment. In Ireland, austerity measures have simply led to lower growth, lower tax revenue and more austerity. Pursuing this course of action to repay foreign bondholders is causing political and social pressure (as well as 8% real interest rates) which we do not believe can be withstood in the long run. As things stand now, the Irish bank bailout may cost 8-10x more than its US equivalent (TARP). The “Irish Bailout” is more a bailout for Ireland’s lenders (European banks and the ECB) than for Ireland itself, as Irish taxpayers are stuck with the bill. Optimists concede problems in Ireland but point instead to improvements in Spain, which is 6x the size of Ireland. As shown, while Ireland has become more reliant on the ECB, market conditions for Spain improved after bank stress tests this summer, which allowed Spain to reduce its borrowing from the ECB. Improvements in Spanish credit markets unleashed an array of “Mission Accomplished” banners, mostly from strategist and economists that work at European banks. However, let’s not get too excited about Spain just yet. In a world of US Fed bond purchases and Asian currency intervention driving down rates, the desperate thirst for yield is helping Spain sell its debt, and is a natural market stabilizer of sorts. But…Spain’s Q3 GDP growth was zero; the service sector (60%-70% of the economy) has rolled over; car sales are down 40% to their lowest level in 20 years after the expiration of an incentive program which ran out in June; the improvement in Spain’s trade deficit reflects a massive, unhealthy collapse in imports (see EoTM 6-7-2010); and unemployment remains over 20%, possibly a reflection of Spain’s limited labor mobility, one of the lowest in Europe. One key thing to watch in Spain: the Achilles heel of the EMU, competitiveness gaps between countries. There are a lot of ways to measure this; below (left) we look at unit labor costs. While the difference between Spain and Germany is not rising anymore, the gap is still large. How big is this gap? For comparison’s sake, we show as well the widest labor cost differentials across US regions over the same time frame. While the Fed’s challenge is a large one, at least it is dealing with a more homogenous set of economic conditions. This is not “new news”: such problems were highlighted within Europe well before the recession hit. The German Institute of Economic Research2 looked at labor cost divergence in 2007, and was concerned about what they found: permanently higher rates of labor cost increases in Portugal, Greece and to a lesser extent, Italy; labor-cost differences that were much greater in Europe than across US states or German Lander; and a loss of competitiveness, such that countries might experience excessive investment in housing, lower productivity and higher structural unemployment. Their conclusion:

As we noted in our Sick Man of Europe article, UK stocks rallied sharply in 1992 after they left the ERM and were able to engineer their own monetary policy. Flaws in the Creation Myth of Europe3 In the wake of the 1992 ERM collapse, why did Europe attempt another monetary union given large differences in language, labor mobility and productivity? It makes sense if seen as part of a broader effort to create a United Europe, both politically and economically. A few years ago, Swedish and Dutch politicians responsible for mobilizing support for the EU Constitution referred to “Yes” votes as necessary tribute to honor the dead from the Second World War, and more urgently, to avoid the pre-war divisions which led to it. Conflict between European empires existed for hundreds of years (1871-1914 was the only period of peace in European history until 1945), so the idea of a united Europe would have seemed appealing in 1945. However, conditions for securing a lasting peace within Western Europe were arguably already in place by 19544:

To summarize, Europe seems to be on a Quixotic quest for mechanisms to support a peace that had already been obtained by The author of the 1992 German Constitutional Court opinion on Maastricht described this issue in plain terms. The treaty…

Support amongst EU countries for EU membership is close to its lowest levels since the surveys began in 1973 (see chart). To be clear, this paper is about the durability of the current European Monetary Union and the risk of bondholder losses, not the viability of the EU as a political entity. But as support for the latter wanes, steps that need to be taken to support the former may be more difficult to achieve. The European Financial Stability Facility does suggest that Europe understands the need for fiscal transfers to get through this crisis. Ireland may now draw upon it, and its creators see it as a bridge to a more secure monetary union. It is designed to allow member countries to straighten out their finances, refrain from having to issue in the debt markets for 3 years, and then come back to the debt markets once they run Germanic fiscal policy, but with debt/GDP ratios well over 100% and stuck in a rut of low growth. It’s a great vision and makes total sense on paper. I think I see a windmill in the distance… Michael Cembalest Chief Investment Officer Postscript: on investments in Europe Ten-year Irish debt is currently pricing in an 80% probability of a default (55% for Spain). Some hedge funds and high yield funds we invest with may find value here, as a lot of bad news is priced in. However, our managed fixed income funds aim for steady income and capital preservation, so they generally do not hold much Ireland, Portugal, Spain or Greece debt. We have been investing in bank non-performing loans and distressed corporate debt in Europe, opportunities we expect to continue as the European banking system continues to shrink. Given the current reliance on the ECB, this process has a long way to go. On European equities, we have highlighted before the large degree of non-European revenue earned by European companies. That explains why European equities have over long periods of time kept pace with other markets despite low nominal growth. This year and since January 2008, however, European equities have trailed the S&P 500 in local currency terms (“European equities” include countries like the UK, Denmark and Sweden; EMU equities trailed the S&P by even more). Our European equity holdings have been tilted towards German mid-cap exporters, which have outperformed the rest of Europe and the US as well. In terms of valuation, European equities trade somewhere around 10-12x earnings, so like the peripheral European bond markets, there’s a lot of pessimism priced in. We have a regional equity preference for the U.S. and Asia in our portfolios at the current time, but it cannot be said that European equity markets are unaware of the challenges facing the EMU.

1 The regions of the United States, for example, experienced tremendously divergent economic conditions during the depressions of the 19th century and the Great Depression of the 20th. Throughout these periods, monetary and labor conditions converged and a system of fiscal transfers was put in place to endure them. In prior “Eye on the Market” notes, we covered the convergence of labor costs in the Northeast and Midwest from 1820 to 1900, and the fiscal transfers which took place from the Northeast to the Midwest during the Great Depression, when farm prices fell by 40%. 2 “Does the Dispersion of Unit Labor Cost Dynamics in the EMU Imply Long-run Divergence?”, Dullien and Fritsche, Deutsches Institut für

|

| Posted: 20 Nov 2010 02:00 PM PST |

| Posted: 20 Nov 2010 01:37 PM PST Jim Sinclair's Commentary Three so far this week. Bank Closing Information – November 19, 2010 First Banking Center, Burlington, WI

Jim Sinclair's Commentary Incapacity due to gridlock is now the definition of Washington's ability to handle a second banking crisis that is certain to come. This is the "why" of QE even though it is itself a guarantee of hyperinflation. The entire pressure will be on the Fed who possesses no other alternative. At this time the application of austerity is more dangerous. The entire Western world will go with QE to infinity no matter what the call is or how they camouflage it. Gold will trade at $1650 and beyond. Washington's efforts can been seen in the red circle.

Jim Sinclair's Commentary No matter how difficult things are be sure to keep your feet on the ground. |

| Max Pain For Options Trading On Dec 2010 Silver Futures Posted: 20 Nov 2010 12:59 PM PST December 2010 options expiration day for gold and silver futures is on Tuesday, Nov 23rd 2010 (2 business day away). How things are looking after Friday, Nov 19th 2010 business day ended, you can see on the following image. Max pain for option trading with Dec 2010 Silver Futures is at $25 and last settled [...] |

| US Mint Reports Soaring November Month-To-Date Silver Coin Sales Posted: 20 Nov 2010 10:25 AM PST Is Max Keiser's attempt to put JP Morgan out of business working following the mother of all silver physical squeezes? The price of silver has been stable in the past few days, but if the US official precious metal seller is to be trusted, this will not last long. According to the US Mint, sales of 1-ounce American Eagle silver coins are headed for the strongest month since at least May, Bloomberg reports. More details: about 3,175,000 of the coins have been sold this month, compared with 3,633,500 in May, according to data on the Mint website. Silver futures in New York touched a 30-year high of $29.34 an ounce on Nov. 9. American Eagle coins also are available in gold and platinum. The Mint said 62,500 ounces of gold Eagles have been sold in November. What is interesting is that sales of the coins continue at an astronomic pace despite the nearly 10% premium one has to pay over spot. What is more interesting, is that the Mint has not run out yet. Yet the refreshing thing, is that instead of buying paper certficates promising that one's presumed purchases of gold is held by the DTCC, Americans are once again going straight into physical. Here is hoping Keiser's plan ultimately unravels whatever the RICO suit against JPM and HSBC leaves untouched. Total US Mint Sales HERE.. |

| Posted: 20 Nov 2010 10:15 AM PST |

| Posted: 20 Nov 2010 09:59 AM PST |

| Posted: 20 Nov 2010 09:33 AM PST Bob Chapman talks Comex/CME, short selling, margin calls and everything you need to know to understand current market conditions relating to JPM's short-silver (3.3 bn. ounces) positions. MK – Note: Bob Chapman mentions that I've been a fan of his for twenty years. In fact, I've been reading Bob since the early 1980′s. He was [...] This posting includes an audio/video/photo media file: Download Now |

| December 7th (day of infamy?) bank run question Posted: 20 Nov 2010 09:17 AM PST Dear Mr. Keiser, Thanks for the show. Have found it informative and entertaining in equal measure – an excellent and rare combination. Are you aware there are people trying to get a bank run organised for the 7th December: http://www.facebook.com/event.php?eid=137793666269183 ? Do you think it would be a good idea to bring your silver bomb [...] |

| Currency War heats up: “Let Scotiabank Help You Crash JP Morgan” Posted: 20 Nov 2010 08:21 AM PST MK: This is a dream scenario. State banks attack JP Morgan by encouraging their customers to buy Silver. This is what Canada is doing. This is what the Irish, Greek, Latvian, and Icelandic banks should have been doing throughout the entire '00′s instead of being used by JP Morgan and Goldman to perpetuate global ponzi [...] |

| I Try To Buy Lunch Using SILVER Posted: 20 Nov 2010 07:40 AM PST |

| No words, no music, no graphics, no effects . . . PURE SILVER SPEAKS FOR ITSELF Posted: 20 Nov 2010 07:35 AM PST |

| 2010 Proof Silver Eagle Coins Launch Posted: 20 Nov 2010 07:17 AM PST The US Mint today began selling the long-awaited 2010 Proof Silver Eagle coin, filling a void that has been felt by many collectors for over two years now. |

| Gold’s Holding Pattern is a Golden Opportunity Posted: 20 Nov 2010 07:16 AM PST Billionaire George Soros declares: "Conditions for gold are pretty perfect"Gold's holding pattern is a gift to bargain hunters

The trend is "back up again"Gold prices surged back Thursday as the euro rose against the dollar on optimism of a bailout for Ireland. "Having held $1,330, and with the dollar a bit weaker … we are just following the trend back up again," the Bank of Nova Scotia's Simon Weeks said. VTB Capital's Andrey Kryuchenkov noted: "Should fear in the eurozone escalate, gold would draw fresh support from risk-averse buyers similar to what happened earlier this summer when investors scrambled for the safe-haven asset on fears of sovereign default." Investors also are watching China for potential news of an interest-rate rise, which would only create a buying opportunity for bargain hunters. Billionaire George Soros tips his hat to goldWith quantitative easing going full-steam ahead and U.S. interest rates low for the foreseeable future, billionaire investor George Soros said the precious metal still has plenty of kick to it. "The conditions for gold are pretty perfect," he said Monday. Soros also said the present world order is on the brink of breaking down. "There is now a rapid decline of the United States and a rapid rise of China," he said. "It is happening very quickly. … If they persist in their present course, it will lead to conflict," he said, adding that China's neighbors are already getting nervous about its rising global influence. Read more Inflation surfaces at Walmart, not in feds' data

The Fed sticks to its quantitative-easing gunsBen Bernanke had to defend the Fed's actions on Capitol Hill, where he briefed skeptical lawmakers on the QE plan's merits on Wednesday, and some of his colleagues said the bank is likely to follow through on its entire $600 billion bond-buying program, citing weak economic data. "It looks like we'll be purchasing at this pace through the end of the second quarter to add up to $600 billion," St. Louis Federal Reserve Bank President James Bullard said. The Fed's QE plan came under fire this week from a group of prominent Republican-leaning economists and other experts. "The planned asset purchases risk currency debasement and inflation, and we do not think they will achieve the Fed's objective of promoting employment," they said in an open letter published in The Wall Street Journal and The New York Times. Top Republican lawmakers also sent Bernanke a letter warning that QE "introduces significant uncertainty regarding the future strength of the dollar and could result both in hard-to-control, long-term inflation and potentially generate artificial asset bubbles that could cause further economic disruptions." Read more Chinese march toward gold continues"China is considering raising its gold reserves, a move which would push up gold prices in the future, a person providing consulting services to the Chinese government said" in a Chinese daily-newspaper article. "The source told the 21st Century Business Herald [that] China may gradually increase gold holdings as it is not possible for the country to buy large amounts of the metal within a short time." Two Chinese precious-metals experts also weighed in on gold's prospects for the article: "Chen Beilei, director of metals and mining at BOC International Holdings, said China may increase its gold reserves to diversify its foreign exchange reserves. … Demand for gold may continue to rise due to inflationary risks brought by Washington's recently announced quantitative easing program, high public debts and low economic growth in Europe, Chen said. … Feng Rui, president of Silvercorp Metals, said the decline [in gold prices] is an adjustment in the upward trend … and the metal may rise by as much as 20 percent in the future. Feng predicted the price of gold would peak at $1,600 per ounce in 2011." Read more "Bullish" Barclays Capital sees $1,485 gold this yearGold could hit a record $1,485 by year's end, Barclays Capital analysts say. "Strategically, we are bullish," the bank said. "Medium-term trend followers are unlikely to have been panicked out of their positions given that important support between $1,314 and $1,331 is still holding. A bearish divergence signal on weekly charts, though, warns of downside risk throughout the month, and we still fear an important clearout below $1,314 to $1,250 before gold recovers. We would be bargain-hunting as the price approaches $1,250." Read more French banking giant raises its precious-metals forecastsBNP Paribas said Wednesday it has raised its 2011 forecasts for gold and silver (as well as palladium and platinum). Gold: The bank increased its gold forecast for the first quarter of next year to an average $1,415 from its previous estimate of $1,280, with the price expected to rise to an average $1,565 by the end of next year, compared with a previous $1,310 forecast. "Gold is considered one of the best hedges against either of these risks," BNP Paribas analysts wrote, referring to dollar weakness and rising inflation fueled by QE. "Add to inflation expectations a low nominal interest rate environment, and the decline in expectations for real returns makes alternative asset classes, such as commodities, appealing for investors." Silver: The bank expects silver to average $25.30 in the first three months of next year, up from its previous forecast of $19.75, rising to an average $27.45 by year's end. The spot silver price has risen by more than 50 percent this year to 30-year highs well above $25. Read more

|

| Price suppression coming undone, Turk tells King World News Posted: 20 Nov 2010 07:16 AM PST 11:35a ET Saturday, November 19, 2010 Dear Friend of GATA and Gold (and Silver): GoldMoney founder and GATA consultant James Turk tells Eric King of King World News that more short covering in the precious metals seems likely next week as today's precious metals markets look increasingly like those of the late 1970s, as price suppression came undone. You can listen to the interview here: http://kingworldnews.com/kingworldnews/Broadcast/Entries/2010/11/20_Jame… CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:http://www.gata.org/node/16 |

| Weekly precious metals review at KWN has Haynes, Norcini, Arensberg Posted: 20 Nov 2010 07:16 AM PST 11:10a ET Saturday, November 19, 2010 Dear Friend of GATA and Gold (and Silver): The weekly precious metals market wrapup at King World News features Bill Haynes of CMI Gold & Silver, Dan Norcini of JSMineSet.com, and the Got Gold Report's Gene Arensberg. You can listen to it at the King World News Internet site here: http://kingworldnews.com/kingworldnews/Broadcast/Entries/2010/11/20_KWN_… Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Schiff interview with GATA's Douglas covers sale of imaginary gold Posted: 20 Nov 2010 07:16 AM PST 11a ET Saturday, November 20, 2010 Dear Friend of GATA and Gold (and Silver): GATA board member Adrian Douglas' interview on investment fund manager Peter Schiff's Internet radio show yesterday covered the massive sale of imaginary gold — the fractional-reserve gold banking system — and ran about 16 minutes, and you can listen to it at the Schiff Radio Internet site here: http://schiffradio.com/pg/jsp/charts/audioMaster.jsp?dispid=301&id=5116… CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia — Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: – Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. – Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. – Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:http://www.gata.org/node/16 ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia — Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan powerplants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php |

| Analysts Who Put the Bull in Bullish: Gold Outlook Posted: 20 Nov 2010 07:16 AM PST The Gold Report submits: By Brian Sylvester Dundee Wealth Inc. Chief Economist Martin Murenbeeld is long on opinion and the gold market. "Gold bullion is in a long-term bull market. And that's going to go on for a number of years," he predicted during the recent Forbes & Manhattan Resource Summit in West Palm Beach, Fla. Analysts David Keating, Mackie Research Capital Corp., and Paolo Lostritto, Wellington West Capital Markets, also participated in this Gold Report exclusive, giving candid views of the global gold markets and plenty of reasons to be a gold bull. "Gold bullion is in a long-term bull market. And that's going to go on for a number of years," Martin predicted during a recent presentation at the first annual Forbes & Manhattan Resource Summit in West Palm Beach, Florida. His remark was included as one of a handful of reasons to be bullish about gold and commodities. |

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week Posted: 20 Nov 2010 07:14 AM PST Gold saw modest gains in Asia before it fell back to see an $11.32 loss at $1341.58 at about 10AM EST, but it then rallied back higher into the close and ended with a gain of 0.01%. Silver fell as much as 53 cents to $26.36 by about 10AM EST before it also rallied back higher in late trade and ended with a gain of 1%. |

| COT Silver Report – November 19, 2010 Posted: 20 Nov 2010 07:13 AM PST |

| Why have gold and silver been falling in this time of monetary turmoil? Posted: 20 Nov 2010 07:12 AM PST Reasons behind the recent weakness in the gold and silver price despite, as George Soros commented, conditions for gold looking "perfect". |

| Russia's Central Bank Buys 600,000 Ounces of Gold In October Posted: 20 Nov 2010 06:21 AM PST "U.S. Mint sells 32,405,500 silver eagles so far this year... and 3,775,000 so far in November. SLV ETF adds 1,319,879 ounces of silver. JPMorgan/HSBC now have 25 silver price manipulation lawsuits filed against them... and much, much more. " Yesterday in Gold and Silver Well, with 20/20 hindsight, it's obvious that I filed my Friday commentary right at gold and silver's high of the day... which was shortly before 5:00 a.m. Eastern time yesterday... as it was mostly down hill from there. Gold's high price print was around $1,363 spot in early London trading... but then quickly ran into not-for-profit sellers that sold the price down to its low of the day [$1,340.90 spot]... which occurred at the London p.m. gold fix at 10:00 a.m. Eastern time. The price bounced back quickly during the next hour of trading... and then went sideways for the rest of the New York trading session, finishing up a magnificent 60 cents. Silver's high tick of the day [around $2... |

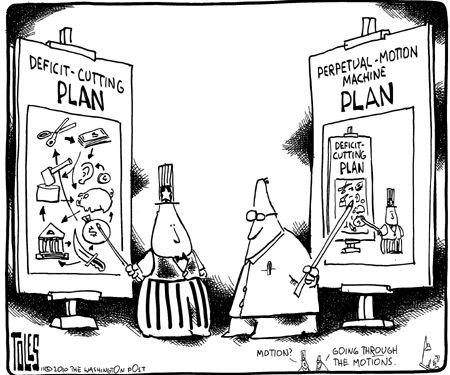

| Congress Takes Vigorous Steps to Look Like it’s Planning to Reduce Deficit Posted: 20 Nov 2010 06:00 AM PST Erskine Bowles, President of UNC, and former Wyoming Senator, Alan Simpson, the co-chairmen of President Obama's National Commission on Fiscal Responsibility and Reform, are getting political leaders caught up with the obvious reality of the US' precarious financial state… that the budget deficit is quickly hurtling the nation toward a debt crisis not unlike Greece, but on a much larger scale. Yet, even with annual interest payments alone already totaling roughly $200 billion, there is little political will to make the kind of cuts necessary to have an impact on the deficit. Policy makers and citizens alike want action to be taken, but the required sense of taking personal responsibility — with fewer public services, higher taxes, or reduced welfare — is still lacking. This cartoon came to our attention via The Mess That Greenspan Made's post on the appearance of getting something done.

Congress Takes Vigorous Steps to Look Like it's Planning to Reduce Deficit originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Is Ferdinand Pecora Rolling Over in His Grave? Posted: 20 Nov 2010 05:58 AM PST Can the state of affairs Larry Doyle complains about be changed when we have a corrupted system to work within to change its own nature? - Ilene Is Ferdinand Pecora Rolling Over in His Grave?Courtesy of Larry Doyle at Sense on Cents

Where are the individuals who would choose to sacrifice personal gain for our national welfare? I am not talking about mere public policy implementation. I am talking about those who would choose to pursue and embrace the truth while exposing the incestuous Wall Street-Washington relationship that has brought our nation to its knees. Where is today’s Ferdinand Pecora when we need him? I shudder to think that the great Pecora, who led the investigation of Wall Street practices which brought on the Great Depression, might be rolling over in his grave right now. Why’s that? Reports released yesterday indicate that the Financial Crisis Inquiry Commission (FCIC), this generation’s Pecora Commission, is not exactly embracing Ferdinand’s ‘take no prisoners’ approach, but likely playing politics. Are you kidding me? The commission charged with exposing the people and practices behind this devastation is locked in a political dogfight? While I am not surprised, I am enormously disappointed. Perhaps the FCIC will surprise me and all of us, but for now my confidence level in the FCIC has dropped precipitously. While little attention is brought to this story in our domestic media, the Financial Times yesterday highlighted, Crisis Panel Delays Report Amid Rancor:

WOW. Is this the best America gets? The commission charged with pursuing the truth after eleven months “is yet to get into substantive discussion on the cause of the crisis.” And people are surprised as to why The Tea Party is thriving? Boy, what would our friend Ferdinand have to say about this state of affairs? If only we could bring him back. Well, let’s do the next best thing. Let’s go back and take a peek at the preface to Ferdinand Pecora’s book Wall Street Under Oath. As you read Pecora’s words, reflect upon today’s money-changers on Wall Street and also today’s financial policemen in Washington. Pecora wrote:

(LD’s comment…please do not tell me that the Dodd-Frank financial regulatory reform will truly make an impact. Wall Street is already hard at work gutting the Volcker Rule to limit proprietary trading!!)

The FCIC NEVER responded to any of the details I shared with them on a wide array of topics regarding FINRA's relationship with the investment banks, its timely liquidation of ARS (auction rate securities), the allegation of a FINRA investment in Madoff, and the allegation that FINRA lied in the proxy statement utilized for the formation of the organization. Do we know if the FCIC ever used its subpoena power? Originally published on Larry Doyle's Sense on Cents, Is Ferdinand Pecora Rolling Over in His Grave? |

| JPMorgan: Dollar to become the world's weakest currency Posted: 20 Nov 2010 05:37 AM PST INTERNATIONAL. The dollar may fall below ¥75 next year as it becomes the world's "weakest currency" due to the Federal Reserve's monetary-easing program, according to JPMorgan & Chase Co. The U.S. central bank, along with those in Japan and Europe, will keep interest rates at record lows in 2011 as they seek to boost economic growth, said Tohru Sasaki, head of Japanese rates and foreign-exchange research at the second-largest U.S. bank by assets. U.S. policy makers may take additional easing steps following the US$600 billion bond-purchase program announced this month depending on inflation and the labor market, he said. "The U.S. has the world's largest current-account deficit but keeps interest rates at virtually zero," Sasaki said at a forum in Tokyo yesterday. "The dollar can't avoid the status as the weakest currency." The Fed said on Novenebr 3 it will buy US$75 billion of Treasuries a month through June to cap borrowing costs. The central bank has kept its benchmark rate in a range of zero to 0.25% since December 2008. The Bank of Japan on October 5 cut its key rate to a range of zero to 0.1% and set up a ¥5 trillion (US$59.9 billion) asset-purchase fund. |

| Posted: 20 Nov 2010 05:00 AM PST Earlier this week, we came across the story of young Andrew DeMarchis and Kevin Graff, a couple of 13-year old students who were caught selling cupcakes and baked goods at their local market. The two hoodlums were discovered peddling a range of treats, from cookies to brownies…even Rice Krispies. As is often the case with aspiring criminals, this was not the first time the boys had flouted the law. Readers may be shocked to learn that this was actually the second time these would-be ruffians had conducted their illicit activities in public. On the first occasion, another bake sale, the boys managed to net a cool $120 in profit. And, like greedy capitalists the world over, the team invested half the loot to buy a cart from Target and even expanded their operations to include the sale of water and Gatorade. Who knows how many treats the boys might have sold or how large their empire of dough-sponsored delinquency might have grown if left unchecked by the authorities. They had, according to one report, told a few members of their trusted inner circle (their Moms and Dads) of their intentions to one day open their own restaurant. Clearly, something had to be done. Enter our hero, local Councilman Michael Wolfensohn. Upon hearing of the boys vast and expanding operation down at the local market, Cr. Wolfensohn, his superhero cape sewn with the very threads of truth and justice, decided to act. Doing what any unquestioning citizen living in a police state would do after learning that two boys had decided to sell cupcakes, Wolfensohn called the cops. On Saturday, October 19, after about an hour of business – during which the perpetrators had raised around $30 (in cash) – police arrived on the scene. The store – and the seed of a crime syndicate that may one day have rivaled all the government agencies of the world combined – was shut down. Justice: 1; Kids trying to sell brownies: 0. "All vendors selling on town property have to have a license, whether it's boys selling baked goods or a hot dog vendor," explained Wolfensohn. When asked by the boys' parents whether he might have just informed them that they needed a license rather than calling the police, Wolfensohn laid out his watertight case. "In hindsight, maybe I should have done that, but I wasn't sure if I was allowed to do that," he said, demonstrating an admirable incapacity to think for himself. "The police are trained to deal with these sorts of issues," he added. We can only hope their brush with the law sets these two lads back on the right path, one that excludes entrepreneurial ambition and fosters a healthy fear of the state. As for Wolfensohn, this editor would like to formally recommend him for a senior position with the TSA, where no incident is too small to completely blow out of proportion and no threat, imagined or actual, is too big to miss altogether. Enjoy your weekend. Cheers, Joel Bowman Councilman Takes the Cake originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Global Financial System Crisis, Collapse in Consumer Spending, Unemployment, Rising Prices Posted: 20 Nov 2010 04:52 AM PST We hear stories about oil and about how it will probably move higher, perhaps to $150.00 a barrel and perhaps higher. This is the first time in more than three years that it has moved to lofty levels. The net speculative long position is more than 200,000 contracts, or about 35% higher than in 2007. Some economies are doing well, particularly in Asia and in Latin America, but not enough to create such higher prices. $60.00 a barrel would more nearly meet demand. |

| KWN Weekly Metals Wrap – Friendly Trends Posted: 20 Nov 2010 03:36 AM PST HOUSTON – Yesterday's CFTC commitments of traders (COT) report for gold and silver futures did not disappoint us COT mavens and pro traders camped on the long side. To learn why, Vultures (Got Gold Report subscribers) will want to tune in and listen to Eric King's interview with 37-year veteran bullion dealer Bill Haynes of CMI Gold and Silver, savvy commodities trader Dan Norcini of Jim Sinclair's J.S. MineSet and our own Gene Arensberg of Got Gold Report, in this week's important King World News Weekly Metals Wrap audio program for November 20. ... |

| Growth vs. Value - The New Buggy Whip Posted: 20 Nov 2010 03:22 AM PST There once was a time when the "learned" believed the sun revolved around the earth, the world was flat, and government spending led to sustainable economic growth. This week's Investment Advisor Ideas focuses on another such misconceived idea, classifying stocks with growth and value designations. While the investment consultant community has firmly adopted the growth vs. value concept, at some point, hopefully in the near future, this classification will go the way of the buggy whip, leaching, and the above silly misconceptions. After all, the classification tends to imply a choice between owning a stock that can grow but doesn't offer much value, versus one that offers a compelling value but doesn't offer much growth. Such a choice is silly - every stock valuation implies a future stream of cash flows to justify its price. If today's price implies a smaller cash stream than a company is capable of generating, it is a value stock. If a stock's price implies greater cash stream than a company is capable of generating, it is a value trap, regardless of how sexy its products are or how strong its future revenue growth appears. It does not get much simpler than that.

Years ago, in 2005, I traded emails with a popular financial writer that had just criticized AutoZone for failing to deliver sufficient comparable store sales growth, though the company continued on its stated path of improving margins. He appeared smart as AutoZone shares were underperforming, and carried on with his typical snarky tone in his email. I more or less let him know he was clueless and silly for not understanding wealth creation and how that translates to intrinsic value. Needless to say, he did not reference my analysis in his later article on the company and AFG failed to obtain a PR win. Our analysis was vindicated, however, as over the past 5 years AZO has moved from approximately $80 at the time to $250 today, while the S&P 500 remained flat. Worth noting, for most of the years, AutoZone's comparable store sales growth was still negative to mediocre. His (and other investors) obsession on "growth" versus "value", rather than understanding that AZO was taking the right steps to create shareholder value and the cash flow expectations embedded in its price were very reasonable caused him to miss a great trade of our day. He was fixated on AZO as a growth stock that failed to deliver "growth", rather than understanding AZO's valuation. It is often said that history repeats itself, and today's lesson may apply to many technology giants. For example, CSCO was recently crushed on weak growth numbers, but justifying its stock price requires virtually no top line growth if it can maintain its existing margin levels. As today's kiddy set often whines - Just saying....

Much like Beta as a risk proxy survived long after its "use by" date, due to its simplicity so I suspect has been and is the case for the growth vs. value classification. Instead we would like to see stocks classified in duration terms, as companies will pursue different strategies which lead to different cash flow durations. This provides a much better framework to structure a portfolio for different phases of the economic cycle. Further, it better allows analysts to discuss stocks in terms of the operational expectations (sales growth, margins, and turns), and how they translate into future cash flows to evaluate how attractive a stock looks as an investment. At the same time, we are also mindful of reality - some investors still want traditionally defined growth and value stocks. Like golfers with stubborn hitches in our swing, we understand the need to "play through our slice" and thus prepared this list to help identify attractive "growth" and "value" stocks. The article below is a sample of our free Investment Advisor Ideas Newsletter. Click here, to view the most current issue.

Sincerely, Value Expectations

Growth vs. Value - The New Buggy Whip Traditionally most investors tend to identify themselves as either growth or value oriented when they approach constructing their portfolios. There are many varying approaches of how to classify stocks in either category, but growth investors typically focus on earnings and sales growth regardless of the company's ability to add value to its shareholders, whereas value investors search for stocks trading at relatively low price multiples. We believe that both approaches for picking stocks have their pitfalls if the investor fails to understand the cash flows that are driving the company's value and how they relate to its stock price. If a growth company is capable of generating larger cash stream than is implied by its current stock price, we consider it attractive. Likewise, if a low P/E company's stock price implies greater cash stream than a company is capable of generating, it is a value trap. Below we have provided a list of stocks which we consider attractive right now in both the "value" and "growth" universes, to help investors from both groups identify investment opportunities.

This is a sample of our free Investment Advisor Ideas Newsletter. Click here, to view the rest of this issue.

As mentioned before, there are many different methods investors use to separate growth and value universes - here are some of the most common characteristics for the two groups: Growth companies tend to have...

Value Companies tend to have...

At AFG we have developed our own methodology of classifying the companies within a certain universe as value and growth - we use their relative Market Value/Net Invested Capital ratio. Companies with MV/IC greater than the median for the group are considered "growth", and those lower than the median are considered "value" stocks. The following chart provides some insight into how growth has fared relative to value stocks in the past based on AFG's classification. As you can see, in line with what we have already found out, AFG defined value stocks have outpaced growth stocks over the past 12 years.

In addition, we wanted to shine some light on how our buy and sell recommendations have done within each group. The chart below demonstrates that there is a significant positive spread between the returns of the companies we find attractive and those we recommend to stay away from in each style category.

Now that we have viewed the past performance, let's look at our outlook of the attractiveness of each investment style going forward using our EM framework and valuation metrics. Based on current valuation attractiveness within our default valuation model, value looks more attractive as an investment opportunity than growth in any size category (small, mid, large), with the large cap value bucket looking the most attractive of the bunch.

In an ideal world our portfolios would be filled with stocks with booming earnings growth and discounted price tags, however in reality any solid growth stories will attract investors, which inflate the price. We recommend not to automatically ignore companies based on style as there are plenty of attractive opportunities in both the growth and value universes, especially when utilizing AFG's research and valuation techniques to identify attractive long and short prospects. By not overlooking companies based on style you will increase the size of your fishing pond and your portfolio will benefit from the diversification. In the table below you will find a list of companies in both styles (based on MV/IC) that look attractive going forward. When creating our list of Attractive Growth/Value stocks we looked for companies that fit the following criteria. &iddot; Attractive valuations &iddot; Profitable from an economic standpoint &iddot; Expected to improve economic profitability &iddot; Poised to outperform

|

| Schiff interview with GATA's Douglas covers sale of imaginary gold Posted: 20 Nov 2010 03:04 AM PST 11a ET Saturday, November 20, 2010 Dear Friend of GATA and Gold (and Silver): GATA board member Adrian Douglas' interview on investment fund manager Peter Schiff's Internet radio show yesterday covered the massive sale of imaginary gold -- the fractional-reserve gold banking system -- and ran about 16 minutes, and you can listen to it at the Schiff Radio Internet site here: http://schiffradio.com/pg/jsp/charts/audioMaster.jsp?dispid=301&id=5116... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:http://www.gata.org/node/16 ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan powerplants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php |

| Posted: 20 Nov 2010 03:04 AM PST Over a year ago, Zero Hedge published an expose in three parts (two of them in the form of direct letters to Andrew Cuomo) discussing the possibility that so-called "expert networks" are nothing less than legalized insider trading rings for the uber-wealthy, operating largely unsupervised, and leaking selective information to preferred clients. For those who may be new to this topic, we suggest catching up on Part 1, Part 2 and Part 3. Subsequently, we also suggested that expert networks would be implicated in the bust of Galleon Partners, the Goldman "Huddle", the collapse of FrontPoint Partners and, most recently, that expert networks may have been directly or indirectly involved in facilitating the record historical P&L of such hedge fund "titans" as SAC Capital. Today, via the Wall Street Journal, we realize that not only have the good folks at the SEC been diligently reading us for the past 13 months, but that we may have been right all along (once again). To wit: "Federal authorities, capping a three-year investigation, are preparing insider-trading charges that could ensnare consultants, investment bankers, hedge-fund and mutual-fund traders and analysts across the nation, according to people familiar with the matter. The criminal and civil probes, which authorities say could eclipse the impact on the financial industry of any previous such investigation, are examining whether multiple insider-trading rings reaped illegal profits totaling tens of millions of dollars, the people say. Some charges could be brought before year-end, they say." Good bye expert networks (and many, many hedge funds) - we hardly knew you. More from the WSJ:

Some more on expert networks:

And it is not only the SEC who reads us:

|

Offering up its statistics Wednesday, the Labor Department said the core consumer price index, an inflation indicator that excludes food and energy prices, was unchanged in October. However, a new pricing survey of 86 products sold there – mostly everyday items like food and detergent – showed a "meaningful" 0.6 percent price increase in just the past two months, according to MKM Partners. At that rate, prices would be close to 4 percent higher a year from now, double the Federal Reserve's mandate. "I suspect that when [Fed Chairman Ben Bernanke] thinks about reflation, he has a difficult time seeing any other asset besides real estate," said Jim Iuorio of TJM Institutional Services. "Somehow the Fed thinks that if it's not 'wage-driven' inflation then it is somehow unimportant. It's not unimportant to people who see everything they own (homes) going down in value and everything they need (food and energy) going up in price."

Offering up its statistics Wednesday, the Labor Department said the core consumer price index, an inflation indicator that excludes food and energy prices, was unchanged in October. However, a new pricing survey of 86 products sold there – mostly everyday items like food and detergent – showed a "meaningful" 0.6 percent price increase in just the past two months, according to MKM Partners. At that rate, prices would be close to 4 percent higher a year from now, double the Federal Reserve's mandate. "I suspect that when [Fed Chairman Ben Bernanke] thinks about reflation, he has a difficult time seeing any other asset besides real estate," said Jim Iuorio of TJM Institutional Services. "Somehow the Fed thinks that if it's not 'wage-driven' inflation then it is somehow unimportant. It's not unimportant to people who see everything they own (homes) going down in value and everything they need (food and energy) going up in price." Any dip is a buying opportunity, experts concur

Any dip is a buying opportunity, experts concur

Where are our statesmen?

Where are our statesmen?