Gold World News Flash |

- Crude Ends the Week with a Bullish Break, Gold a Potential Trend Reversal

- Jim?s Mailbox

- Hourly Action In Gold From Trader Dan

- China’s $220 Oil Catalyst

- Big Autumn Gold Rally

- Wes Roberts: Experience Matters

- Gold Breaks Below Channel Intraday

- Graveyard of Fiat Money: Richard Russell

- Happy Anniversary to the Wreck of the Rock

- LGMR: Gold & Silver Rally to Unchanged for the Week as Bangladesh Buys IMF Gold

- Market Commentary From Monty Guild

- Long Term Silver Chart From Trader Dan

- Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Slightly on the Week

- 9/11 – A FOURTH TURNING PERSPECTIVE

- Bubble Thesis Update

- Just Another Hyperinflation Post - Part 2

- The Green Police

- A Global Yuan is a Threat to the Dollar but good for Gold!

- Guest Post: Thinking Outside the Bubble: A Pairs Trade On The EU Experiment

- The Power of Freedom

- COT And Silver Charts From Trader Dan Norcini

- Labor-ious to Watch

- A Free Market Is Not Possible Without Strong Laws Against Fraud

- FRIDAY Market Excerpts

- ECRI's WLI Growth Rate Ticks Up

- This Week in ETFs

- Alternatives and Strategies to Handle the Bond Bubble

- Credit Suisse: Five reasons there won't be another recession

- Are Gold ETFs Economic Teflon?

- Nine Bullish Arguments for Gold

- Gold and Silver Charts

- Greek Default Near? Finance Minister Tries Some Spin

- Jobless Claims Still Not Pointing to Imminent Double Dip

- Guest Post: "As Implied Correlations Approach 100%, Energy = Healthcare = Technology = A Rat’s Ass, Etc. "

- How Stressed is Your County?

| Crude Ends the Week with a Bullish Break, Gold a Potential Trend Reversal Posted: 10 Sep 2010 07:10 PM PDT courtesy of DailyFX.com September 10, 2010 03:01 PM There were high hopes that the return of speculative liquidity this week (after the extended US holiday and the general return from summer vacation) would encourage a meaningful trend development. Yet, nothing has developed; and lethargy is setting back in. North American Commodity Update Commodities - Energy Can US Oil Maintain a Breakout Base on a Supply Shock when Risk Appetite Trends are Still Stalled? Crude Oil (LS Nymex) - $76.45 // $2.20 // 2.96% While the capital markets were simply winding down into the weekend liquidity drain and fortifying their well-weathered ranges, US oil would stand out among the crowd for its meaningful, bulling breakout. The Nymex-based energy futures contract enjoyed its biggest single-day rally since August 2nd and easily cleared the frequented $75.75 ceiling that had capped price action for nearly a month. This level of activity and significant progress are especially remarkable giv... | ||||

| Posted: 10 Sep 2010 07:10 PM PDT View the original post at jsmineset.com... September 10, 2010 07:56 AM Technical Look at Silver CIGA Eric Silver has surged above the 2008 and cup & handle resistance. The longer price hangs above this zone, the greater motivation for technical orientated trading funds to 'chase' the breakout. While trend energy is growing, it has yet to exceed the 2009 highs. It is important to note that while trend energy has breached the 2008 highs into 2009, price has remained below the all-time highs. This positive divergence of trend energy has implied a pending breakout for months. Paper Silver ETF (SLV): More…... | ||||

| Hourly Action In Gold From Trader Dan Posted: 10 Sep 2010 07:10 PM PDT | ||||

| Posted: 10 Sep 2010 07:10 PM PDT The 5 min. Forecast September 10, 2010 10:57 AM by Addison Wiggin [LIST] [*] How China could set oil rising to record highs, starting this Sunday [*] China executes next step in incremental dollar-dumping plan [*] What’s this? Rising mortgage rates? How to play the latest housing news [*] “Like a futuristic police state”… Vancouver housing bubble’s ridiculous heights [*] Little-known nuggets in the health care bill: The 5 helps readers sort fact from fiction [/LIST] China is on the verge of signing a metaphorical death warrant for the Western economies. Maybe its own, too. On Sunday, the Chinese railways minister is due to visit Iran to sign a $2 billion-dollar deal. China will build a 360-mile rail line stretching from Tehran westward to the Iraq border. But that could be just the beginning, reports the London Telegraph: “Eventually, the Iranian government said, the route could link Iran wi... | ||||

| Posted: 10 Sep 2010 07:09 PM PDT Adam Hamilton September 10, 2010 2456 Words Gold enjoyed a strong August after emerging out of its late-July seasonal lows. But interestingly last month's bullish action was probably just the beginning of gold's newest rally. A whole host of bullish seasonal, sentimental, and technical factors are converging that ought to catapult gold much higher in the coming months. In seasonal terms, autumn is the strongest time of the year for the ancient metal of kings. Big surges in gold investment demand emerge out of Asia. The initial one is post-harvest buying once Asian farmers learn how much surplus income their hard work generated in the latest growing season. They invest some of these savings in physical gold. Harvest time for them is like year-end for Westerners, when we figure out how much money we've earned beyond our living expenses. After that, Indian festival seaso... | ||||

| Wes Roberts: Experience Matters Posted: 10 Sep 2010 07:09 PM PDT Source: Brian Sylvester of The Gold Report 09/10/2010 Wes Roberts, vice president of Toronto-based HB Global Advisors, has seen just about every type of mineral deposit on the planet. There is no substitute for that kind of experience. In this exclusive interview with The Gold Report, Wes shares some of that knowledge with you to help guide your investment decisions. He even talks about a couple of gold explorers that have interesting prospects. The Gold Report: Wes, you work with Heenan Blaikie LLP, one of Toronto's most respected law firms, especially in the mining space. But you're not a lawyer. Please tell our readers a little bit about yourself and what you do. Wes Roberts: I am vice president of HB Global Advisors Corp.'s mining group. HB Global Advisors is a consulting group and an affiliate company of Heenan Blaikie LLP. HB Global consists of a team of business professionals, industry specialists and government leaders that the firm can draw on for support ... | ||||

| Gold Breaks Below Channel Intraday Posted: 10 Sep 2010 07:09 PM PDT courtesy of DailyFX.com September 10, 2010 06:35 AM Daily Bars Prepared by Jamie Saettele Gold is closing in on its all-time high. A move to a new high would negate the bearish implications from the impulsive decline and set sights on round figures such as 1300, 1400, 1500, etc. Daily RSI has rolled over from overbought territory and gold did break below its channel (albeit just intraday at this point), so this might be the top.... | ||||

| Graveyard of Fiat Money: Richard Russell Posted: 10 Sep 2010 07:09 PM PDT The gold price sold off a couple of bucks until trading in Hong Kong was through for the day. Gold's high on Thursday [around $1,258 spot] was in London just after twelve noon local time... and once the London p.m. gold fix was in less than three hours later [9:45 a.m. Eastern time], the selling really got serious... with the low of the day [$1,242.50 spot] coming around lunch time in New York. From that low, the gold price recovered a bit, but once floor trading ended and electronic trading began, the selling pressure began anew. Silver was under some selling pressure early on Thursday morning in Far East trading, but headed upwards once London opened. The silver price broke through $20 a few times during afternoon London and early morning trading in New York. The last trip above $20 was close to the London p.m. gold fix... and from there, silver got sold off and closed virtually on its low of the day at the close of electronic trading at 5:15 p.m.... | ||||

| Happy Anniversary to the Wreck of the Rock Posted: 10 Sep 2010 07:09 PM PDT by Adrian Ash BullionVault Friday, 10 September 2010 How saving the savers is costing the savers so dear... On the MORNING of Weds 12 Sept. 2007, Northern Rock – the UK's fifth-largest mortgage bank – ran a banner advertisement across the lower front-page of Britain's best-selling broadsheet, The Daily Telegraph. The ad promised 6.30% interest on new deposits, a return-to-cash not offered by High Street accounts in nearly a decade. To keep cash in the bank, the Rock was paying more than 220 basis points over its peers. Anyone tempted soon found out why... Thurs 13 Sept. '07: Northern Rock asks for, and gets, an emergency credit line at the Bank of England; the BBC's Robert Peston breaks the scoop, stressing the wrong causes (and syllables) by blaming the US subprime collapse on his blog; Fri 14 Sept: The bank's website and phonelines melt down; savers queue outside its handful of branches, waiting to empty its cashdesks and at last putting flesh on the T... | ||||

| LGMR: Gold & Silver Rally to Unchanged for the Week as Bangladesh Buys IMF Gold Posted: 10 Sep 2010 07:09 PM PDT London Gold Market Report from Adrian Ash BullionVault 05:45 ET, Fri 10 Sept. Gold & Silver Rally to Unchanged for the Week as Bangladesh Buys IMF Gold THE PRICE OF GOLD rallied on Friday after falling 1.5% from Wednesday's near-record levels on news that the Bangladesh central bank bought 10 tonnes of bullion from the International Monetary Fund. Some 222 of the 403 tonnes the IMF has been looking to sell since Sept. '09 have now gone to central banks, according to Bloomberg, led by India's 200-tonne purchase last Oct. Tuesday's gold sale to Bangladesh was done "on the basis of market prices" the IMF says. By the AM Gold Fix in London, gold was trading at $1248.75 per ounce. Silver was also unchanged for the week, trading at $19.89. "Whenever these [central-bank] things come out, they tend to be relatively supportive of the gold price," says Darren Heathcote at Investec Bank in Sydney, Australia. "It will add more support to what is already a well-su... | ||||

| Market Commentary From Monty Guild Posted: 10 Sep 2010 07:09 PM PDT View the original post at jsmineset.com... September 09, 2010 05:51 PM Jim Sinclair's Commentary Eric specializes in following the money and agrees, as I see it, with Monty. The rally I see in shares, when it comes in a big way, will be a product of Currency Induced Cost Push Inflation. Gold is going into a major move upwards. Do not try and understand what seems contradictory, but is not. Consider all markets as locomotives and never stand in front of it. What I garner from Monty’s writings here is that with technical analysis as your guide on each issue, you should consider taking on calls against your short of general equity positions. As far as the long bond is concerned, I am feeling for a top here for different reasons than Monty’s position, but that is all semantics. Feeling for a top in long bonds means shorting and seeking to get a lead. A lead is a profit so that the position can in time be on OPM (other people's money). With OPM you can spec all you like.... | ||||

| Long Term Silver Chart From Trader Dan Posted: 10 Sep 2010 05:16 PM PDT | ||||

| Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Slightly on the Week Posted: 10 Sep 2010 04:30 PM PDT Gold waffled on either side of unchanged in Asia and London before it fell almost 1% in early New York trade to as low as $1236.80 by a little before 9AM EST and then rebounded to see a slight gain at as high as $1250.45 by late morning, but it ultimately fell back off into the close and ended with a loss of 0.34%. Silver fell to as low as $19.68 and climbed to as high as $20.026 before it also fell back off in afternoon trade and ended with a loss of 0.15%. | ||||

| 9/11 – A FOURTH TURNING PERSPECTIVE Posted: 10 Sep 2010 04:06 PM PDT (snippet) The anger building against the ruling elite on Wall Street and in Washington DC is real. Average Americans feel betrayed by politicians, bankers and corporate America. The Tea party movement is a reflection of that anger. The country certainly hasn't reached a consensus about which direction the country needs to move, but we are still in the early stages of the Fourth Turning. A threat to our very existence will reveal itself in the near future and generate the consensus necessary to meet the threat. What is beyond a doubt is that the country is facing extreme peril as it tries to maneuver its way through an economic Depression, a looming peak oil crisis, unresolved long-term fiscal obligations, and antagonism from countries throughout the world. The cycles of history do not reveal the exact nature of the Crisis ahead, but previous Crisis periods give us a flavor of what to expect. Based on our previous Crises periods and knowing which national issues have been ignored for decades, the likely threats to confront the nation over the next decade include:

Fourth Turnings always sweep away the old order and replace it with a new order. There is no guarantee that the new order will be better. It could be far worse. More Here.. | ||||

| Posted: 10 Sep 2010 03:43 PM PDT | ||||

| Just Another Hyperinflation Post - Part 2 Posted: 10 Sep 2010 03:28 PM PDT The question was asked: Is this inevitable with any debt-based system?Short answer for now. ;) Systemic collapse is inevitable as long as the item used for lending is the same item used for saving. In a gold money system with gold lending (which is always demanded by the collective will) fractional reserve banking is the inevitable result. And from there, bank failures are the inevitable result | ||||

| Posted: 10 Sep 2010 01:57 PM PDT

Not that there is anything wrong with recycling. I personally recycle large amounts of trash each week. But there is a huge difference between recycling as a free individual and being coerced by law to adhere to the sustainable development policies of the United Nations. The truth is that "Agenda 21" is being pushed down all of our throats whether we like it or not. It is all part of the Big Brother police state control grid which is being implemented in the name of "saving the environment" and which is being paid for by "economic stimulus" money in many areas. That's right. Government snooping on your trash apparently meets the definition of "economic stimulus" in 2010. Perhaps this is what Barack Obama meant when he talked about creating "green jobs". Local governments are going to need a lot of "trash snoopers" to make certain that we are all recycling acceptably. In fact, John McCain almost flipped his lid when he found out that Dayton, Ohio was given a half million dollars in "stimulus funds" to put RFID tracking chips in recycle bins. Not that McCain is a friend of liberty and freedom either. The truth is that the vast majority of the politicians in Washington D.C. have been helping to advance the "sustainable development" agenda in one way or another. But can you imagine spending "economic stimulus" money to spy on the trash of the American people? No wonder all of the "stimulus packages" didn't do that much good for the economy. In fact, the amount of waste in the stimulus packages was absolutely mind blowing. But those "green jobs" must be created one way or another, eh? Even if it means spying on Americans. So now even though we are in the midst of a horrific economic downturn, lots of communities from coast to coast have plenty of money to track our trash with RFID microchips. Cities that are now using these chips to spy on our trash include.... *Cleveland, Ohio *Charlotte, North Carolina *Alexandria, Virginia *Boise, Idaho *Dayton, Ohio *Flint, Michigan Now how in the world does Flint, Michigan have money for anything? Flint, Michigan is one of the poster children for the deindustrialization of the United States. It is a crime-infested war zone where thousands upon thousands of Americans live in desperate poverty. And yet somehow they have money to monitor trash with RFID tracking chips? It is almost as if we have stepped into "Bizarro America" where everything is the opposite of what it should be. Unless the American people speak up and renounce this militant green agenda it is going to continue to be forced down our throats. The scenes in Audi's "Green Police" commercial are not going to be so "funny" when they start becoming real.... So far, the worst city of all for snooping on the trash of citizens is Cleveland, Ohio. The truth is that Cleveland should be worried about how to put hundreds of thousands of people without jobs in the region back to work, but instead city officials seem obsessed with enforcing the radical green agenda of the United Nations. The new RFID chips being installed will allow Cleveland officials to monitor exactly how often residents roll their carts out to the curb for collection. According to news reports, if an RFID tracking chip signals that a recycle bin has not been brought out to the curb within a certain period of time, a "trash supervisor" will actually sort through the trash produced by that home for recyclables. Yes, this is now going on in America. So what will the penalties be? Well, according to Waste Collection Commissioner Ronnie Owens, trash bins that contain over 10 percent recyclable material will be subject to a $100 fine. How ridiculous is that? I recycle constantly, but I am sure that if I lived in Cleveland they could get me for being over the "10 percent limit" at least half the time. Is there anyone who could honestly say that they will be able to stay under the 10 percent limit each and every time? But that isn't the only fine in the new system. If you set out an "excessive" amount of trash you will be fined between $250 and $500. In addition, residents of Cleveland are also fined for putting out their trash too early and for failing to bring in their garbage cans from the curb in a timely manner. Meanwhile, the city of Cleveland has hordes of unemployed workers and it is literally falling apart. How completely and utterly ridiculous can one city possibly be? But a city that is broke has to raise money some how. In 2009, the city of Cleveland has issued 2,900 tickets for trash violations, which was almost five times more tickets than in 2008. In 2010, the city of Cleveland is on track to issue over 4,000 tickets for trash violations. One of the bizarre aspects of Cleveland's trash regulations is that it is always the property owner that receives the ticket. That means that landlords in Cleveland are now forced to become spies in order to ensure that their tenants follow the law. It is almost as if we are back in East Germany once again. Has everyone simply forgotten that we have something called the Fourth Amendment to the U.S. Constitution? According to the Fourth Amendment, the American people are guaranteed the right to be free from unreasonable searches and seizures. But these RFID tracking chips spy on us and our trash 24 hours a day. What has happened to America? As more insane measures like this are implemented across the United States, more factories, more jobs and more economic activity will continue to be chased overseas. Meanwhile, the "smart growth" agenda is about to get a big boost by the U.S. Congress. Retiring Senator Christopher Dodd's last major piece of legislation, the Livable Communities Act, will create a new federal bureaucracy to make sure that "sustainable development" principles are being followed on every inch of land in the United States. This new bureaucracy, the Office of Sustainable Housing and Communities, would be given approximately $4 billion in federal money to pressure local governments to implement a more "green" agenda. Not that the federal government has an extra $4 billion to throw around and waste, but that has never stopped them before. The truth is that the U.S. is absolutely drowning in debt and the economy is coming apart at the seams. That is what the Congress and the White House should be worried about. Instead, most of our "representatives" in Washington D.C. seem to have no trouble using "Big Brother tactics" to enforce the green agenda that so many of them are so obsessed with. Sadly, most Americans actually still believe that we are "free". But we are not free. The government controls and regulates us in tens of thousands of different ways, and each year the controls and the regulations just get tighter and tighter. It's just that we have lost our freedoms so slowly that most Americans have not become alarmed. It is like the old story of the frog in the kettle. If you put a frog right into boiling water it will hop right out. However, if you put a frog into water that is cool and then turn up the heat little by little it will sit there until it has boiled to death. America, you are that frog. It is time to hop out of the water. | ||||

| A Global Yuan is a Threat to the Dollar but good for Gold! Posted: 10 Sep 2010 01:00 PM PDT We have written many times about the need for the Yuan to be a global currency and eventually a global reserve currency [one of several]. We have talked of how it had to develop its banking system before it could take such a journey. We highlighted the experiments that the Chinese were making first in Hong Kong then in Guanchow in using the Yuan in international dealings. | ||||

| Guest Post: Thinking Outside the Bubble: A Pairs Trade On The EU Experiment Posted: 10 Sep 2010 12:44 PM PDT Submitted by JM Thinking Outside the Bubble: A Pairs Trade on the EU Experiment (pdf)

This posting includes an audio/video/photo media file: Download Now | ||||

| Posted: 10 Sep 2010 12:00 PM PDT At this time when most people are clamoring, or at least hoping for, economic revival, the major debate centers around how it could be achieved. One side, mainly the current administration and its supporters in the academy, believe in some variety of stimulus initiated by the federal government - funneling funds (taken from taxes and borrowed from future generations and foreign governments) to the various state governments that are to use them to pay for public work projects, improving | ||||

| COT And Silver Charts From Trader Dan Norcini Posted: 10 Sep 2010 11:56 AM PDT Dear Friends, The Commitment of Traders report for this week reveals pretty much the norm for both the gold and silver markets that we have seen over the past 9 years or so. Speculators consisting mainly of the big funds and the smaller public were buying while the commercial category was selling. First for gold – managed money flows remain in gold through Tuesday of last week which was countered by bullion bank and swap dealer selling (those two categories can sometimes include the same entity). While the commercial position is not the largest on record, the swap dealer is just shy of a record by some 3,000 contracts. That sets up a situation where we have a large number of speculative longs sitting in the gold market with prices stalling out near $1,260. The potential for some stale long liquidation is definitely there as a result of the loss of upside momentum so we will want to see how price acts should any downside technical levels be taken out. Quite frankly I would like to see some downside movement in gold just to test the market action to see how aggressive dip buyers will be. Today they were obvious with the decent sized push up off the worst levels of the session. If they continue this sort of stand, bears are going to be quite frustrated and some of the weaker hands will be forced to cover. One way or the other we are going to see rather quickly what kind of strength is in this market. In a market in a truly strong bullish phase, dips are rather short-lived as buyers are always EAGER to get into the market or to add to existing positions. Thus setbacks in price uncover more buying than they do selling and price quickly reverses and resumes the original trend, which in the case of gold is higher. Since this market is a managed market by the feds, the price action is always a bit inconsistent with a freely traded market but the pattern should hold true – dips will be shallow and not long-lived in spite of the never ending capping action by the bullion bank crowd. September does tend to be a very strong seasonal month for gold so that is in favor of the bulls. The key will be whether the longs hold their ground and attempt to defend their positions. If they do, a new high is shortly in the cards. If they run, we will have to see how long stronger-handed bulls wait to wade back in and snatch up more of the yellow metal. Let's see what next week brings. The key as in last week is a closing push through the $1,260 level. If the bulls can get price back up and through that level, the bears are going to be forced to retreat to $1,285 or so. Now for silver – very similar situation as compared to gold with the exception that managed money is sitting at an extremely high level on the long side, the largest since last September. As was the case last week, the "Other reportables" category (large floor and off the floor traders and some CTA's) were apparently liquidating longs into buying provided by the managed money crowd. That category is still net long but has come down roughly 4700 net longs in the last two weeks. Perhaps they had a target in their initial trade at $20 and lifted out near that level. Commercials continue to sell and add shorts (hello Morgan) while the Swap Dealers have moved to a flat position which is interesting. Flat means that they are neither net long nor net shorts but are basically neutral. I find that quite remarkable given their history and given the fact that when the managed money position is at this large of a net long position, they are generally siding with the short side of the market. Let's continue to keep an eye on this category for I think it might well turn out to be the key to what is going to happen with silver. As with gold, silver has such a large build of managed money that it will need to keep moving higher through chart resistance levels to prevent some tired longs from deciding to book profits in that category and result in some liquidation pressure. Again, the key will be $20 and whether or not it can punch through that level and HOLD ABOVE it. If not, it will slide lower where we will have to await to see what level the buyers step back in. As strong as it has been of late, one would normally expect to see shallow dips but with silver, the play toy of the funds, one can never quite be sure. What might happen in there is a wave of liquidation but then a sharp spike higher indicating a recovery and the end of the selling pressure. Such a day of price action would signal the next leg higher. Click either chart to enlarge this week's COT and Silver action in PDF format with commentary from Trader Dan Norcini | ||||

| Posted: 10 Sep 2010 11:00 AM PDT Did anyone watch the live coverage of the independent's decision to back Labor? We caught the last few minutes. They were remarkable enough. It went something like this: "Why do you think that the coalition would be more likely to go to [back to] the polls?" a reported asked. "Because they are more likely to win!" replied Tony Windsor. So you'd think they are going to back the Coalition then... The party who would most likely win the democratic election... Nope. "Aren't you defying the will of the Australian people?" another reporter accuses the independents. They reply, "We asked them: Do you want to go back to the polls? And they said no." The independents continue with, "We want to keep the minority government alive, not find out who has the support of the people. Two completely different questions." One of the independents mentioned they want to back the party, "Who's got more to lose from [us] not supporting them." And to sum it all up, Rob Oakeshott comes up with this gem: "It's going to be a cracking parliament. Beautiful in its ugliness". Oh well, more to write about, I guess. The situation reminds us of this story involving nudity being used as a weapon to thwart a car thief. The major parties have been so desperate to get away with minority government, they now find themselves with company they don't particularly like the look of. The hammer and Fidel As one bunch of commies declare defeat and give up, another bunch are ramping up their efforts. A journalist from the Atlantic Monthly magazine asked Fidel Castro, "If Cuba's model -- Soviet-style communism -- was still worth exporting to other countries." The admission in reply: "The Cuban model doesn't even work for us anymore." Oops. But Hugo Chavez is undeterred by his comrade's demise. He has decided to introduce a food card, similar to the ones used in Cuba (apparently). The idea is that you conveniently pay for food with your card. Problem is the aptly named "Good Life Card" lends itself rather well to rationing. That's what the Cubans learned the hard way. In this environment, even central bankers seem sensible:

Ooo. A central banker admitting central planning can't get complex tasks done. It's unlikely the Cubans will be able to go into debt on their cards, which puts them head and shoulders ahead of us in the developed world. For the record, your editor uses a debit card and rents. As misled first homebuyers will tell you, a debt free life was a "Good Life". Card or no. Speaking of central bankers, they are probably the closest thing we have to communists here in the land of Oz. (Yes, the Greenies were given due consideration.) The idea that a government entity should control the quantity and price of money (interest rate) sounds rather like the Good Life Card, doesn't it? Banks dropping like flies What is the meaning of dropping like flies anyway? Flies fly, don't they? Maybe someone was being witty. Banks certainly aren't lifting off in America. Economics guru Dr Doom Jr. (Nouriel Roubini, not Marc Faber) reckons more than 400 American Banks will fall. Sorry, "fail". That's more than half of the 800 on the government's "critical list". Roubini has been making some other valuable points. Firstly, the stimulus is going to begin depressing the economy. Sounds stupid, right? Well, the point is that stimulus may have stimulated economic activity into action. But as stimulus ends, the economic activity that was created will end too. The multiplier effect works both ways. Just like lots of other things. (If you bothered clicking on the link, you can imagine whoever was in charge of the German central bank during the Weimar years holding the watermelon. Or Gideon Gono of the Reserve Bank of Zimbabwe. Ben Bernanke (Federal Reserve), Trichet (ECB) and Merv King (Bank of England) will be getting a mouthful at some point.) Back to the failure of stimulus. As Nouriel put it, "tailwinds become headwinds". Where stimulus was, a void now appears. It's kind of like watering the desert with a watering can. Stuff dies when you stop pouring. The problem is that this leaves President Obama with a situation where more stimulus won't help. Obviously, the first thing he does on this news is to announce a new stimulus package. His defiance won't work. "We have to expect the new normal," Roubini claims. "We do not need a double dip for it to feel like recession." Our analysis of all this is that stimulus got the US nowhere, except into debt. There was no real water in the watering can to begin with. The correction wasn't avoided. It was delayed. And made much worse, as the entire financial backing of the US has been gambled on a recovery that won't eventuate. And the financial backing of the US is the financial backing of the world. But still the stimulists continue their campaign. Not content with the excesses of the past, they advocate the excesses of the future – as a solution to the excesses of the past, no less:

Please read that quote again. And again, until you feel your blood boil. If it doesn't read this. Only a Nobel laureate like Paul Krugman would write that. (Only the New York Times would print it.) It should be the Keynesian intellectual family motto. "It is necessary for the nation to spend its way out of debt" and "excess can cure problems brought on by past excess". If you could translate the above into Latin, please send it to dr@dailyreckoning.com.au. Perhaps check out Emperor Nero's family motto for a guide. But even the Roman Emperor did better than Obama with his spending. Rebuilding Rome outclasses this performance by miles:

Oh well, at least our Aussie politicians aren't that stupid. To quote a former minister, "how do we sleep while our [roofs] are burning?" What happens when a bank stubs its toe? It took the intelligent part of the financial world seconds to spot the flaws in the European bank stress tests. The result itself was a giveaway. Heck, it was predictable that the analysis would be a joke. Several weeks after the result, the rest of the world has come to the same conclusion. (This performance is better than usual and our comments are intended as a compliment.) The underpinning problem of the EU banking system is the sovereign debt that is at risk of default. And this default scenario is one of the things that was excluded from the banking stress test. I mean how dumb can you get? Even dumber, according to the Wall Street Journal. The exposed flaws are too long to list. Cardinal sin This one should be included in the Guinness book of world records for hypocrisy. It refers to the fact that the Greeks still haven't disclosed their true debt figures to the EU. "What the Greeks did was an absolute cardinal sin. They deserve to be punished for it. I think they have been severely punished for it." said Ruairi Quinn, former finance minister of ... guess where? Ireland! One of the Is in PIIGS. Better still, this is the guy, "who presided over the 1996 meeting where debt and deficit limits for countries joining the euro were set." In other words, he didn't do his job properly at the time, which led to excessive debts building up throughout Europe. Shady dealings don't make the bond market happy, which is leading to high yields that the Greeks have to pay on their government's debt. That's the punishment Ruairi is referring to. But keep in mind that it's the politicians and head honchos of the public sector that did the shady deals, while it's the Greek taxpayer that is being punished. State of the European Union To find out how sentiment sits amongst Europeans for their Union, check this out. It's good entertainment value too. Isn't it nice to be sitting on the opposite site of the globe, atop a pile of iron ore, while Europe squabbles? Each time sovereign debt troubles flare up, the global financial market wobbles. We are all in this together isn't always such a good policy. The pen vs the sword vs humour Hey, who hijacked the meaning of speculation? Speculation means thinking, pondering and wondering about things, doesn't it? And now it's synonymous with evil betting. Here are some more analogies of how the world has changed due to the financial crisis:

Thanks to the reader who emailed them in. We can't figure out the original source. Yours, Nickolai Hubble. P.S. Just to keep the controversy rumbling, check out climate science's latest stumble. And China's solution to energy targets: turn off the power. Similar Posts: | ||||

| A Free Market Is Not Possible Without Strong Laws Against Fraud Posted: 10 Sep 2010 10:41 AM PDT Many economists are now starting to question long-held assumptions that bubbles don't matter, that huge amounts of leverage are good, and that the Federal Reserve has mastered monetary policy. They are starting to read Minsky and other forgotten economic theorists. And Austrian economists such as Steve Keen are gaining a wider audience. As I wrote in March 2009:

So what can we do to help people and to improve the economy? Well, as I've repeatedly pointed out, the economy cannot recover until trust and the rule of law are restored (and see this). Imposing accurate accounting standards, stopping high-frequency trading, quote-stuffing and front-running, and prosecuting fraud to the fullest extent of the law are prerequisites to restoring trust in our economy. Indeed, America has a long tradition of using fraud, antitrust, conspiracy and racketeering laws to rein in the worst economic abuses. These laws are an important part of American history, and our recent abandonment of them must be reversed. Austrian Economics Does Not Require Abandoning the Law ... In Fact, Laws Are Necessary for a Functioning Free Market Just as neo-conservatives are not really conservative and neo-liberals are not really liberal, a fake, neo-Austrian legal argument has sprung up trying to excuse the criminal fraud and manipulation of the big banks. As William K. Black - professor of economics and law, and the senior regulator during the S&L crisis - pointed out last week, Austrian economics has been twisted by the powers-that-be and bastardized into a basis for arguing that there should be no prosecutions for fraud or criminal conduct:

| ||||

| Posted: 10 Sep 2010 10:05 AM PDT Growing risk appetite weighs on gold price The COMEX December gold futures contract closed down $4.40 Friday at $1246.50, trading between $1237.90 and $1253.00 September 10, p.m. excerpts: see full news, 24-hr newswire… September 10th's audio MarketMinute | ||||

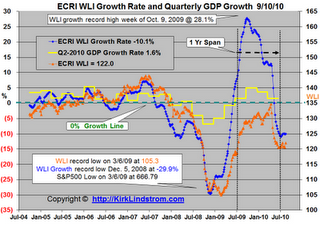

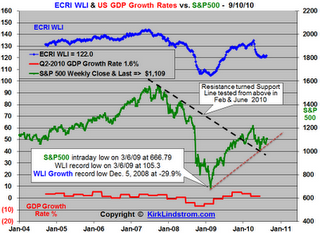

| ECRI's WLI Growth Rate Ticks Up Posted: 10 Sep 2010 09:54 AM PDT Kirk Lindstrom submits: The Economic Cycle Research Institute, ECRI - a New York-based independent forecasting group - released their latest readings for their proprietary Weekly Leading Index (WLI) this morning. For the week ending September 3, 2010:

Chart of WLI and WLI growth vs GDP Growth Since ECRI releases their WLI numbers for the prior week and the stock market is known in real time, you can often get a clue for next week's WLI from the weekly change in the stock market. Chart of S&P500 vs ECRI's WLI Notes: Complete Story » | ||||

| Posted: 10 Sep 2010 09:52 AM PDT Jarred Cummans submits: This week may have been shortened by the Labor Day holiday, but that did not leave a dearth of significant economic developments–even if trading volumes were persistently light. The Obama administration created quite a buzz early this week when it announced a $50 billion infrastructure plan along with some tweaks to our current tax system. This week also saw change of leadership in two major firms; Nokia (NOK) named a former Microsoft (MSFT) executive as its new CEO and Oracle (ORCL) hired former Hewlett-Packard (HPQ) head Mark Hurd in a move that drew a lawsuit from the competitor. Outside of the U.S., many central banks released their interest rate decisions, commenting on prospects for inflation and the governments’ economic outlook. Complete Story » | ||||

| Alternatives and Strategies to Handle the Bond Bubble Posted: 10 Sep 2010 09:50 AM PDT Gregory Skidmore submits: In response to concerns that the fixed income markets are becoming increasingly risky, CalPERS, the largest public pension fund in the US, is reducing some of the risks in its fixed income portfolio. In addition, reports that institutions have shifted their allocations to stocks have begun to surface. I am recommending that clients to keep duration short and quality high. These are the areas least likely to be impacted by a change in interest rates or a deterioration in credit quality should the global economy double dip. Complete Story » | ||||

| Credit Suisse: Five reasons there won't be another recession Posted: 10 Sep 2010 09:25 AM PDT From Pragmatic Capitalism: Credit Suisse is still bullish on the economy and the equity markets. They believe we are experiencing a typical mid-cycle slow-down and NOT a double dip. The following five reasons outline their thinking: Global PMIs are consistent with 3.5% GDP and European PMIs with 2.5% GDP (against our economists’ forecasts of 4.3% and 2.5% in 2011, while consumer confidence is rising in Europe). We acknowledge that the US is experiencing a mid-cycle slowdown, but this is normal – and our high-frequency economic indicator is now... Read full article... More on the economy: Why stocks are going higher as the economy tanks New data suggest the economy is contracting at a startling rate Banishing this rule could be the No. 1 way to fix unemployment | ||||

| Are Gold ETFs Economic Teflon? Posted: 10 Sep 2010 09:20 AM PDT Tom Lydon submits: When it comes to gold exchange traded funds, the direction of the economy is apparently no issue. Analysts say that regardless of what happens in the markets, gold is on track to see a full decade of price gains – its most sustained rally in at least 90 years. Analysts and investors are upping their stake in gold because the metal is now seen as impervious to economic developments – good or bad. Don Miller for NuWire Investor reports that new investors and buyers are in the market for gold because it’s seen as the ultimate safe haven. Complete Story » | ||||

| Nine Bullish Arguments for Gold Posted: 10 Sep 2010 09:15 AM PDT Frank Holmes submits: Dr. Martin Murenbeeld, chief economist for Dundee Wealth Economics and one of the smartest gold minds around, recently released his latest chart book – hundreds of useful visuals to help him tell the gold and commodity stories. Dr. Murenbeeld also outlines his nine bullish arguments for gold. Complete Story » | ||||

| Posted: 10 Sep 2010 09:14 AM PDT | ||||

| Greek Default Near? Finance Minister Tries Some Spin Posted: 10 Sep 2010 09:12 AM PDT Brett Owens submits: Hat tip to our buddy and fellow debt deflationist Carson for passing along this mind-blowing number on Greek debt:

Complete Story » | ||||

| Jobless Claims Still Not Pointing to Imminent Double Dip Posted: 10 Sep 2010 08:21 AM PDT Edward Harrison submits: I tend to put a lot of stock in jobless claims as a coincident (real-time) indicator of the economic scene. My reasoning here is fairly simple. Household spending makes up 70% of the economy. Households are dependent on labour wages for the lion’s share of their disposable income. Absent changes in debt levels, one should expect changes in output (which is what the GDP measure we care about is) to mirror changes in consumer spending derived largely from labour income. So, naturally, if fewer people are losing their jobs and filing for unemployment compensation, labour income is likely to increase. If more people are filing jobless claims, disposable income is likely to move lower. The key here is that we are looking at a first derivative statistic i.e the change in GDP as determined largely by the change in disposable income. Complete Story » | ||||

| Posted: 10 Sep 2010 08:03 AM PDT From John Lohman A hedge fund manager/friend of mine recently described forces driving the market as “barely manned scrip cannons.” Unfortunately, I believe it’s a fairly accurate description of the HFT-ETF-Algo driven cluster that used to be a market for financial assets. Individual investors have lost confidence, voted with their feet, and left us with a single asset. It comes with a put option underwritten by the federal government and its value fluctuates in response to barely manned scrip cannons. This phenomenon can also be seen within the equity market. Zero Hedge has pointed out the absurdity of the level of implied correlations several times. This chart from Barclays provides some context. As shown, the trailing one month cross-sectional correlation for the largest 1,000 stocks averaged roughly 20% for the last half of the 20th century. The remaining variance in prices would be explained by the fundamental factors within each sector, industry, and firm. But in today’s environment, idiosyncratic risk doesn’t exist. As implied correlations asymptotically approach 100%, energy = healthcare = technology = a rat’s ass, etc. This is the unfortunate result of markets where governments and central banks try to truncate risk and algos determine marginal prices based on short-term patterns. In the real economy, price signals have become distorted, thus causing capital to be inefficiently allocated. In the financial economy, the environment has become riskier than ever. The farther prices are pushed away from their true underlying value, the greater the adjustment will be. And one thing the algos don’t do - adjust slowly. | ||||

| Posted: 10 Sep 2010 08:00 AM PDT There's a pretty neat interactive graphic over at the Associated Press where they've got the rates for unemployment, foreclosures, and bankruptcies by county across the entire U.S. going back to late-2007, just before the start of the Great Recession. Not surprisingly, the housing bubble states of California, Nevada, Arizona, and Florida continue to fare the worst, though the results vary widely by county, those in such tony locales as Santa Barbara and Marin Counties in California now about as stressed as Wichita Kansas. You get a much different picture when you select Foreclosure at the top, bank repossessions being very much a coastal and rust belt development. |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Analysts said that interest in bullion from Asian central banks is another factor that could support prices in the long-term. The IMF said it sold 10 tonnes of gold to the central bank of Bangladesh this week and industry experts expect more central banks to follow. "Gold is one of the few asset classes that is almost universally permissible by the investment guidelines of emerging countries' central banks," remarked Natalie Dempster, director, government affairs at the World Gold Council…

Analysts said that interest in bullion from Asian central banks is another factor that could support prices in the long-term. The IMF said it sold 10 tonnes of gold to the central bank of Bangladesh this week and industry experts expect more central banks to follow. "Gold is one of the few asset classes that is almost universally permissible by the investment guidelines of emerging countries' central banks," remarked Natalie Dempster, director, government affairs at the World Gold Council…

No comments:

Post a Comment