Gold World News Flash |

- A Global Yuan is a Threat to the Dollar but good for Gold!

- Nine Bullish Arguments for Gold

- International Forecaster September 2010 (#4) - Gold, Silver, Economy + More

- Railroads: Where Buffett Went Right

- Home Equity Lines of Credit: The Next Looming Disaster?

- Trading Week Outlook: September 13 - 17, 2010

- Gold's Telling Us Something - As Usual

- Aluminum Content of Infant Formula Remains a Challenge for Pfizer

- Synovus Financial: Regional Bank Stock on Steroids

- What's the Duration of Gold?

- JPMorgan Adds to Their Silver Short Position

- China Real Estate Glut Widens... Afghanistan End Game

- COT And Silver Charts From Trader Dan Norcini

- Long Term Silver Chart From Trader Dan

- On Safari for Trades in South Africa

- United States Joint Forces Command Warns that Huge U.S. Debt Might Lead to Military Impotence, Default or Revolution

- Gold Thoughts

- Is Gold Getting Too Much Media Attention?

- Pretty good interview, talks about gold and silver.

- The Deflation vs Hyperinflation Debate On Steroids, Or Mish vs Gonzalo Lira In The Octagon

- Silver Is The Perfect Bartering Currency For Food

- Obama Is Clueless on the Economy

- Video: Is Greenspan actually going back to his gold-en roots?

- Gold falters just under all time high

- Why The Real, Not Nominal, Consumer Debt Burden Will Push The US Economy Lower And Force The Fed To Accelerate Its Monetary Intervention

- Big Autumn Gold Rally

- what do you use to keep track of your PM's?

- Book Review: 'Fault Lines: How Hidden Fractures Still Threaten the World Economy,' by Raghuram G. Rajan

- Michael Pento Explains The CNBC Incident, Shares His Other Concerns (Uninterrupted And GE-Commercial Free)

- Working for a Living: A Report on Emerging Market Productivity

- Fake gold bars vid

- What Is The Duration Of Gold?

- Goldman Does It Again: Firm Top Ticks Record Gold Price To The Penny

- Claim Jumper Restaurants Files for Bankruptcy With Plan to Sell Business

- Time to Add some Corn to Your Diet.

- Jimmie Dines: "GOLD IS MONEY. GOLD IS ESSENTIAL MONEY!", Rare Earth Stocks

- Haynes and Arensberg review metals' week at King World News

- Haynes and Arensberg review metals' week at King World News

| A Global Yuan is a Threat to the Dollar but good for Gold! Posted: 12 Sep 2010 01:00 PM PDT We have written many times about the need for the Yuan to be a global currency and eventually a global reserve currency [one of several]. We have talked of how it had to develop its banking system before it could take such a journey. We highlighted the experiments that the Chinese were making first in Hong Kong then in Guanchow in using the Yuan in international dealings. |

| Nine Bullish Arguments for Gold Posted: 12 Sep 2010 04:00 AM PDT |

| International Forecaster September 2010 (#4) - Gold, Silver, Economy + More Posted: 12 Sep 2010 03:30 AM PDT There is no question the US monetary system is in serious trouble and the situation continues to deteriorate. The smug elitist owners of the system are not getting the desired results and there is great consternation among the players. Since 1913 in running US monetary policy the Fed has had one recession after another and two depressions. The second one is the one we are now in. |

| Railroads: Where Buffett Went Right Posted: 11 Sep 2010 06:42 PM PDT Wall Street Post Game submits: Warren Buffett, famous for his value investing approach to the global equity markets, hit the jackpot after his bullish take on railroads. Buffett has always been a fan of the industry, but last year he decided to go all in and increase his position size. In early November 2009, when the market was rallying off the March lows, the value investor agreed to make a $34 billion investment into Burlington Northern Sante Fe Corp (BNI). What was Buffett thinking? BNSF, the world’s second largest railroad, is engaged in the freight rail transportation business, vital to the transport of consumer goods, food products, and coal. Investing in railroads is essentially the equivalent to placing a bullish bet on the economy. After the announcement, Buffett stated, “it’s an all-in wager on the economic future of the United States.” This acquisition was the biggest ever for Berkshire Hathaway (BRK.A), just to show you how serious Buffett was. Prior to the acquisition, Berkshire Hathaway owned 22% of the company, and paid $100 a share, a healthy 31.5% premium. Complete Story » |

| Home Equity Lines of Credit: The Next Looming Disaster? Posted: 11 Sep 2010 06:25 PM PDT Keith Jurow submits: A previous article of mine briefly discussed the madness of borrowing through home equity lines of credit (HELOC) during the bubble years. Now is a good time to take an in-depth look at these second liens and the dangers they pose for the housing market and the large banks.

Complete Story » |

| Trading Week Outlook: September 13 - 17, 2010 Posted: 11 Sep 2010 06:23 PM PDT All Things Forex submits: The consumer spending, industrial activity and inflation data from the world’s largest economy will guide the direction for equities, commodities and currencies in the week ahead. Complete Story » |

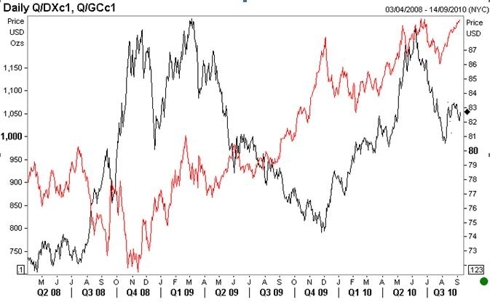

| Gold's Telling Us Something - As Usual Posted: 11 Sep 2010 06:13 PM PDT Black Swan Capital submits: In our webinar last week, we showed a chart comparing gold and the US dollar index, as you can see below (click to enlarge images): Complete Story » |

| Aluminum Content of Infant Formula Remains a Challenge for Pfizer Posted: 11 Sep 2010 06:07 PM PDT Pharmalot submits:

The study (pdf), which was published in BMC Pediatrics, examined 15 infant formulas, including powered and ready-made liquid formulas based on cow’s milk and a soy-based product, for babies at various ages. The researchers found that concentrations of aluminum in the milk formulas varied from 200 to 700 micrograms per liter and would cause up to 600 ug of aluminum to be ingested per day. Put another way, the aluminum content was between 10 and 40 times higher than the aluminum content of breast milk, which is usually 15 to 30 microgram per liter. Complete Story » |

| Synovus Financial: Regional Bank Stock on Steroids Posted: 11 Sep 2010 06:05 PM PDT  Tom Brown submits: Tom Brown submits: We’re back from a visit to Columbus, Georgia last week, where we spent time with the management of Synovus Financial (SNV). We are very bullish on Synovus, you may recall; the stock is one of the largest positions in the fund we manage. Our bottom line after our meetings: the Synovus story is still very much on track. Credit is improving on schedule, and the company is set to return to profitability in the first quarter of next year, and can generate “normalized” earnings within 18 months after that. If everything goes according to plan, we expect the stock to double over the next twelve months. I’ve said in the past that I believe that in March of last year the bank stocks began what will turn out to be an extended, three-stage bull market. Phase 1 happened in 2009 as the stocks jumped on investor recognition of the fact that, no, the largest banks weren’t going to fail, after all, and would live to see another cycle. Complete Story » |

| Posted: 11 Sep 2010 05:59 PM PDT On Friday, the U.S. inflation market rallied further. Inflation-linked bonds were well-bid as zero-coupon inflation swaps rose 5-7bps across the board. Considering that nominal yields rose only 1-3bps, this is a noticeable outperformance: TIPS went up; nominal bonds went down. Equities did their by-now-usual afternoon squirt higher. All of this occurred in a veritable news vacuum. Next week sees Retail Sales, Empire Manufacturing, Industrial Production, PPI, an updated Initial Claims number, and CPI. We will see how strong these hands are then. Complete Story » |

| JPMorgan Adds to Their Silver Short Position Posted: 11 Sep 2010 04:29 PM PDT The gold price gained about five bucks in Far East trading on Friday... and then basically flat-lined for four and a half hours between the London open and the New York open. The moment that trading began on the Comex, a big not-for-profit seller showed up... and gold was sold down to its low of the day of $1,235.70 within the next thirty minutes. Then the selling stopped... the gold price turned on a dime... and around 11:15 a.m. gold hit its high of the day at $1,252.30 spot. From there it got sold off once again and closed the Friday session up $2.70 from Thursday's spot close. The silver price, as they say, was more 'volatile' yesterday. Starting around lunchtime in Hong Kong, silver rallied to its London high around 11:30 a.m. their time. From that point, silver got sold off into the New York open where the not-for-profit seller took it even lower, with silver's low price [$19.71 spot] coming at precisely the same instant as gold's low price... |

| China Real Estate Glut Widens... Afghanistan End Game Posted: 11 Sep 2010 04:29 PM PDT China Real Estate Glut Widens Friday, September 10, 2010 – by Staff Report US & China China `Sweet Spot' Is Returning for Investors: To understand what is going on with China's economy, just look at wheel loaders. They are tractors with a big shovel on the front to pick up and move earth or coal. Such machines are used to build roads and railways or to dig black stuff out of shallow mines. China is, as we all know, an investment-heavy economy, so wheel-loader sales are a pretty good leading indicator: Companies only buy them if they plan to use one over the next 24 months. In July, 15,823 new loaders rolled out of the showrooms. That represented a 50 percent increase in seasonally adjusted sales compared with a year earlier. This is hardly the kind of number that one would expect from an economy on the verge of collapse. Instead it is just one of many signs that Chinese gross domestic product is steadily expanding while inflationary pressures have ... |

| COT And Silver Charts From Trader Dan Norcini Posted: 11 Sep 2010 04:29 PM PDT View the original post at jsmineset.com... September 10, 2010 03:56 PM Dear Friends, The Commitment of Traders report for this week reveals pretty much the norm for both the gold and silver markets that we have seen over the past 9 years or so. Speculators consisting mainly of the big funds and the smaller public were buying while the commercial category was selling. First for gold – managed money flows remain in gold through Tuesday of last week which was countered by bullion bank and swap dealer selling (those two categories can sometimes include the same entity). While the commercial position is not the largest on record, the swap dealer is just shy of a record by some 3,000 contracts. That sets up a situation where we have a large number of speculative longs sitting in the gold market with prices stalling out near $1,260. The potential for some stale long liquidation is definitely there as a result of the loss of upside momentum so we will want to see how price acts shou... |

| Long Term Silver Chart From Trader Dan Posted: 11 Sep 2010 04:29 PM PDT |

| On Safari for Trades in South Africa Posted: 11 Sep 2010 04:25 PM PDT When I first visited South Africa (EZW) as a journalist in 1979, I was stuffed into the trunk of a car and smuggled into Soweto, a fenced off “township”, so I could write about the appalling living conditions there. Six ANC bodyguards accompanied my every move, as to venture out alone amidst 100,000 oppressed blacks would have been suicidal. The preferred means of execution then was to jam a sharpened bicycle spoke into your lower back and sever your spinal cord. Bringing along my non-white Japanese wife to the land of apartheid didn’t exactly go down well with the white locals either. There was only one hotel in the country that would accommodate us, the elegant Carlton in Johannesburg, the same one that put up John and Yoko Lennon. The bottom line: everyone hated us. We were lucky to get out alive. Is those days, when long lines of Afrikaners snaked out of coin dealers selling their krugerrands for $900/ounce, everyone was convinced the country would soon blow up in a gigantic, bloody racial war. You could buy a beautiful four bedroom house there on an acre of land for $25,000, servants included. It never happened. Everyone collectively looked into the abyss and decided to pull back. The Afrikaners made peace with the ANC, an incredible reconciliation process ensued, and by 2010 the country had healed enough to host the World Cup. It’s all proof that if you live long enough, you see everything. Now South Africa is popping up on the radars of several big hedge funds as one of a handful of frontier emerging markets ready to make the move to prime time. Of course we already know about world class companies like De Beers, Standard Bank, and Sasol, which give it enough muscle to stand out from the rest of the Dark Continent. But did you know about alternative energy and venture capital? Local entrepreneurs report that South Africa is among the best countries to start a new company these days, with top rate universities, a plentiful, well educated professional class, a trained work force, generous government subsidies for key industries, and a healthy local market. Despite its well earned reputation as the premier source for the world’s gold and diamonds, 50% of the country’s exports were manufactured goods. This dynamic mix enabled South Africa’s GDP to hold up well during the financial crisis. Analysts are expecting a 3.3% growth rate this year and acceleration to 5% or more next year. But this all misses the really big play in EWZ, whose ticket to prosperity will get punched by selling into fast growing markets and a rapidly rising standards of living in the rest of Africa. The entire region has enjoyed accelerating GDP growth rates since 2002. This has been partly fueled by soaring commodity prices where Africa has a lock on the market, such as for cobalt and iridium, crucial elements for advanced electronics and cell phones. There have been a number of new oil discoveries in Nigeria and Sudan. The Chinese are pouring tens of billions of dollars there into gigantic farms in Africa to feed its own hungry masses. Mass distribution of free anti retrovirals and malaria drugs by the likes of billionaire Bill Gates and the US government has also stopped the AIDS epidemic in its tracks. The more work I do on Africa generally (AFK), (GAF), the more I like (click here for “Feel Like Investing in a State Sponsor of Terrorism” at http://www.madhedgefundtrader.com/july-30-2010-3.html ). Africa has a population that approaches India and China’s, possibly making it the next cheap labor market. Some 60% of the planet’s remaining uncultivated land is there, which is why China, Libya, and Saudi Arabia have been pouring billions into agriculture there. Africa has 40% of the world’s gold reserves and 10% of its oil reserves, with massive deposits of coal and other key resources. If you have any doubts, take a look at the direct investment that has been pouring into the banking sector in South Africa in recent years, the most stable and best capitalized industry on the continent. HSBC has gobbled up Ned Bank, Barclays has swallowed ABSA Bank, and China has taken a 20% stake in Standard Bank, probably the best run institution on the continent. Having been a four decade observer of the global financial system, I can tell you from experience that the changing of the guard in the banking system often presages major long term bull markets. You want to follow the smart money here. Despite all this, only 3% of global direct investment finds there way to Africa. Prices are so low and earnings leverage so great that any dire political risks you can come up with, and there are definitely some out there, have got to already be priced in. It’s just a matter of time before the markets address this imbalance. Mind you, this is not a country without challenges. The unemployment rate is stuck at a daunting 24.5%, crime is rampant, income disparities are vast, and inter racial strife still percolates under the surface. Pessimists say Armageddon hasn’t been avoided, only postponed. However, when the world’s investors flip back to risk accumulation mode, this is a new country you should consider. High risk can bring in high returns. To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last two years of research reports available for free. You can also listen to me on Hedge Fund Radio by clicking on “This Week on Hedge Fund Radio” in the upper right corner of my home page. |

| Posted: 11 Sep 2010 02:58 PM PDT As I have repeatedly pointed out, the American military and intelligence leaders say that debt is the main national security threat to the U.S. As I noted in February 2009 and again last December, a number of high-level officials and experts are warning of financial crisis-induced violence ... even in developed countries such as the U.S. And as I pointed out in February of this year, the U.S. runs the risk of going the way of the Habsburg, British or French empires:

The United States Joint Forces Command - which oversees military operations in the North Atlantic geographic area and supports the other commanders-in-chief in their geographic regions around the world - is now echoing all of these themes. As World Net Daily reported Thursday:

Of course, debt is not the only threat to empire ... or the only indicator of a nation's economic malaise. In that regard, the crash in Italy in the 1340s and the hyperinflation in Hungary in 1946 are instructive. |

| Posted: 11 Sep 2010 01:18 PM PDT |

| Is Gold Getting Too Much Media Attention? Posted: 11 Sep 2010 01:16 PM PDT |

| Pretty good interview, talks about gold and silver. Posted: 11 Sep 2010 11:20 AM PDT |

| The Deflation vs Hyperinflation Debate On Steroids, Or Mish vs Gonzalo Lira In The Octagon Posted: 11 Sep 2010 11:01 AM PDT A recent guest post by Gonzalo Lira on Zero Hedge, providing a theoretical framework for the arrival of hyperinflation, went viral, generating over 75k views and over 1,000 comments, further confirming that the biggest and most confounding debate in all of finance is what will the final outcome of the Fed's market manipulative actions be: deflation, inflation or, and not really comparable, hyperinflation (which is a distinctly different phenomenon from either of the above). The post infuriated some hard core deflationists who continue to refuse to acknowledge the possibility that in its attempt to inspire inflation at all costs, the Fed may just push beyond the tipping point of monetary imprudence away from mere target 2-3% inflation, and create an outright debasement of the world's reserve currency. One among these was none other than Mish himself, who a week ago recorded a podcast on Global Edge with Eric Townsend and Michael Hampton (link here), in which his conclusion was that Hyperinflation is the endgame, "so it is unlikely." Of course, the very premise of this statement argues that even in a monetary collapse the Fed will retain control over the flow of money, which of course is unlikely, and thus makes us very skeptical that such a simplistic and solipsistic argument is enough to resolve the debate. Since one of the items covered in the Mish podcast was Lira's argument, it was only fair that Gonzalo himself should be heard. So a few days ago Global Edge ran a follow up podcast with just Gonzalo Lira, in which the Chilean was given the opportunity to defend himself and to further validate his argument. In a very lively and heated discussion, which teaches the amateurs at CNBC just how one should run a financial debate, Lira and host Hamtpon agree that hyperinflation may play out differently than many expect. Among the questions probed are whether property will be a good investment in a hyperinflation scenario, and what may happen to all other key asset classes once the Fed finally loses control of everything. Still, the best outcome would be to give Lira and Mish a one to one venue in which the two can battle it out: surely it would have no actual impact as the deflationists and hyperinflationists of the world tend to be among some of the most dogmatic individuals in the world, but it sure makes for much more entertaining theater than watching those idiots in Congress pretend they are in control of the financial destruction currently going on in America. 45 minutes of excellent financial debate follow after the jump (and the original Mish interview can be found here). |

| Silver Is The Perfect Bartering Currency For Food Posted: 11 Sep 2010 10:39 AM PDT The big news in the financial mainstream media during the past week has been JP Morgan's announcement that they will be closing their proprietary trading desks. JP Morgan is in the process of winding down their proprietary trading operations and will be laying off their 20 proprietary commodities traders, who NIA believes could be responsible for the current concentrated short position in silver. NIA has been receiving countless emails from members asking us if this means the silver manipulation is coming to an end and what this means for the price of silver. One thing is for sure, this news from JP Morgan can't be a bad thing. NIA has long held the belief that JP Morgan's manipulation of the silver market is the sole reason for the artificially high gold/silver ratio of recent years, which currently stands at 63. Silver possesses all of the same monetary qualities as gold. There is no rational reason for gold to be 63 times more expensive than silver when only 10 times more silver has been produced in world history than gold. The main thing Americans will need to barter for during hyperinflation is food, but gold is too expensive to be good for bartering for food. Silver is the perfect bartering currency for food. Assuming the gold/silver ratio returns to 16 during hyperinflation and food prices increase at the same rate as gold, it will be possible to feed a family of four with only 2 to 3 ounces of silver per week. However, just 1 ounce of gold will buy 6 to 7 weeks worth of food for a family of four, and most perishable food items go bad in just a week or two. The only advantage of owning gold over silver during hyperinflation will be having the ability to pick up and leave with your entire net worth in hand. The average American currently has their entire net worth tied up in their house. There is already a 12.5 month supply of Real Estate on the market. During U.S. hyperinflation, the U.S. mortgage market will come to a complete halt and it will become nearly impossible to sell your house unless you are willing to lower the price to a level where buyers can afford it without a mortgage. With the U.S. unemployment rate likely to rise above Great Depression levels, the last thing you will want during the upcoming currency crisis and societal collapse is to have your wealth stuck in Real Estate. Americans will desire the freedom and flexibility that comes with owning precious metals. More Here.. Buy Silver And Gold Safely Online: Scottsdale Silver |

| Obama Is Clueless on the Economy Posted: 11 Sep 2010 09:16 AM PDT By Dian L. Chu, Economic Forecasts & Opinions

|

| Video: Is Greenspan actually going back to his gold-en roots? Posted: 11 Sep 2010 09:07 AM PDT |

| Gold falters just under all time high Posted: 11 Sep 2010 09:00 AM PDT |

| Posted: 11 Sep 2010 08:46 AM PDT It is no secret that both the household debt/income ratio, as well as the debt service ratio (interest expense as a % of disposable income) continue to be near all time high levels, albeit slightly lower than recent all time records. In fact, the debt service ratio has declined more in real terms than in nominal terms, making the argument that the consumer deleveraging process might not be as dramatic as some expect. Yet it is precisely when looking at the real, and not nominal, value of a projected debt service burden, that explains why consumers will continue to be faced with a crippling debt regime, why deleveraging will continue, and why the economy will be far weaker than the Fed expects for years to come. Goldman's Jan Hatzius, who continues to be more bearish on the future prospects for the economy than ever before, explains.

Once again, the Fed is caught with its pants down as it is faced with no options of how to extract an economy continuing to plunge into a deflationary abyss. And it is not so much the overleveraged mega-corporations that are hurting as a result of massive debt load, as at least they can refinance into lower interest rates: it is mostly consumers - that driving force behing the US economy - who are unable to take advantage of refinanci g opportunities on their underwater assets, that will further retrench, causing further economic stress and increasing declines in GDP. Tangentially, and a topic that needs to be investigated in depth here and elsewhere as it has gotten virtually no coverage in the media, is what will happen to the tax shield that interest payments provide. Assume a scenario where a company with $X in debt manages to refiance all of it at near-zero interest rates. This will simply make pretax net income jump substantially, and provide for a much greater tax provision owed to the government. As everyone is aware, the number one prerogative before CFOs and corporate strategists, is how to minimize tax payments, which, in our opinion, means that soon companies, even Investment Grade, will lever over and above the level of debt suitable for their business model, with dividend recap deals coming down the line, all in the pursuit of recapturing an debt interest-based tax shield. After all, a company (and most definitely its Board of Directors) would certainly prefer to pay a dividend to its shareholders, than to give away 40% of its profits to the government, even if this means a sudden and abrupt deterioration of debt ratios across levered corporate America. And once interest rates do pick up, and the next refi/maturity wave hits in 5-7 years, then it will be really game over. But that is a topic for another day. (We are also confident that the tax code's Section 382 NOL Limitations will also soon have to be adjusted to facilitate the M&A boom which everyone expects yet never happen, as there are thousands of companies with huge NOL "assets" that could be acquired if Sec. 382 were to be changed... and it will be). But back to the consumer, and why the expectation (and reality) of deflation will keep US buyers subdued, and continue to make the US economy ever more reliant on the government's transfer payment, aka welfare, program.

And here is the kicker, explaining why once again the Fed has misunderestimated American consumers:

Hatzius is kind enough to provide a simplistic example of the impossible task facing the US consumer of deleveraging into a deflationary environment, especially when the primary debt burden is in a 100%+ LTV position, and therefore unrefinanceable.

And this is precisely the issue: while companies would in theory refinance all the way to a cost of capital just about the Fed Funds rate, US consumers don't have that luxury. Which means that the government will be forced to extract increasingly more "capital" out of the US corporate system, whether via tax code changes or some other yet unthought of way. Yet the far greater implication is that the Fed continues to be stuck with no recourse of how to fix the system in the long-run, once the toxic spiral of deflationary deleveraging accelerates. And yes, the only option will soon be the nuclear one, which is QE on top of QE on top of QE, all with the hope of spurring inflation, yet leading to the unfortunate outcome of loss in the US reserve currency. Hatzius' conclusion, which pretty much the same, is somewhat more diplomatic:

As more and more pundits realize that looking at debt burdens in nominal terms is erroneous, and that one has to apply deflation expectations to projections of real debt burdens, look for the feedback loop of lack of confidence in the economy to become ever more acute, as consumers further retrench in the saving mode so very abhorred by the Fed. And as more and more money finds its way to the mattress and precious metals, look for some incendiary decisions out of the government that seek nothing less than to devalue the dollar directly. |

| Posted: 11 Sep 2010 08:38 AM PDT |

| what do you use to keep track of your PM's? Posted: 11 Sep 2010 07:58 AM PDT ive been looking for some kind of free spreadsheet or database to keep track of my metals and stumbled on this http://bullion.nwtmint.com/mybulliontracker.php it doesnt have all the bells and wistles but i cant complain for the price. is there anything else out there that i can get for free? |

| Posted: 11 Sep 2010 07:15 AM PDT John M. Mason submits:

Complete Story » |

| Posted: 11 Sep 2010 06:23 AM PDT For some, this week's incident on CNBC where Michael Pento was kicked off CNBC for daring to question the basic assumption that his host Erin Burnett presented as fact, was perplexing (to others, who are well aware of the modus operandi of the TV station is, not so much). In a follow up interview that was uninterrupted by commercial breaks and octoboxes, with King World News, Michael Pento gives a post-mortem of just what transpired: "I looked at it 4 times and I don't when I went off the rails, I thoughty it was a bit unwarranted. All I was doing was being very passionate about an issue I feel very strongly about." The core of the disagreement of course, is the underlying assumption which CNBC takes as gospel, which is that no matter what, interest rates will not, are not allowed to rise (which together with a failed treasury auction, will be the key indicators of the "beginning of the end"). And Pento is completely right to question this as the underlying "factual basis" of any rhetorical question: "We as Americans have no right to believe that interest rates on the 10 year, which are far below their historic 49 year average, 7.31%, are now on 2.7%, so the onus is not on me that interest rates will rise. The onus is on other people to convince me and the investing public that the US bond market will always be in a perpetual bubble that will never burst. And if you look at the data, it shows that this can not be a sustainable situation." Pento then goes on to highlight all the facts that certainly make his case, but that ultimately all collapse into one thing: that the Fed will be able to continue to control, and frankly, manipulate the rate market for perpetuity. This is a flawed assumption and sooner or later Ben Bernanke will lose control as with every system which is in disequilibrium, the snapback to a sustainable balance will occur, and the longer it is kept away from its natural state, the more violent the snapback will be. One point that Pento discusses that bears further attention, is his argument that governmental investment in the economy should decline and the private sector should be encouraged to pick up the slack. Of course, with the Balance of Payments equation which is now on the forefront of public attention, this means that unless the Current Account goes positive, the private sector is unlikely to be able to pick up the slack from a collapse in endless governmental stimulus (and thus constant debt creation). Which goes to the crux of the Keynesian-Austrian debate. Many would say here that instead of having funded the government apparatus, which as even Mort Zuckerman points out is beyond unwieldy and has grown excessively, the government should have instead have focused on making the US competitive from an international trade standpoint, a topic even Warren Buffett lamented in his non-corrupt days, when he was actually a voice of reason, and not just unbridled, government captured greed. Alas, that would mean a total break from the current Chinese trade surplus hegemony and realigning the US economy in a way that would result in a dramatic shock to millions of people who realize they are simply uncompetitive in the global picture (and thus redundant in the job market) but which would serve as another much needed reset to get America off on a way to long-lost prosperity with an attempt to reincarnate the American manufacturing sector while gradually phasing out the service sector (and especially its "financial innovation" component) . Yet as Gorgon T. Long also pointed out a few days ago, America is now dead set on repeating the destructive Keynesian mistakes of the past, and will continue to fund a broken model until one day, as Michael Pento all too correctly points out, it all snaps, and the "shocking" death of Keynesianism, as described a month ago by Eric Sprott, catches all so many completely unaware. Of course to explain all this to Erin Burnett, who still believes that the government has done a great job with the "fastest" recovery in the past 20 years, which would be correct if one could eliminate those little pesky things known as "facts", is beyond folly. All those who are invited to CNBC, and dare to explain the truth: you have been warned. Llink to Pento post-mortem on King World News.

|

| Working for a Living: A Report on Emerging Market Productivity Posted: 11 Sep 2010 06:22 AM PDT "If I have a handful of silver it is because I work and my wife works, and we do not, as some do, sit idling over a gambling table or gossiping on doorsteps never swept, letting the fields grow to weeds and our children go half fed!" – Pearl S. Buck (from the character Wang Lung in Buck's novel The Good Earth) Arriving in Argentina's capital city after a month-long journey across the United States, we are once again reminded of perhaps the most thrilling aspect of a developing market: that it is, indeed, developing. This, for value-seeking investors and gypsy newsletter writers alike, is a source of excitement one simply wouldn't be without. Much has been written on the subject of emerging vs. submerging markets, and with increasingly good reason. According to Goldman Sachs strategist, Timothy Moe, the market value of emerging market stocks is set to quintuple over the coming two decades, reaching some $80 trillion (with a "T") by 2030. China, by this time, will have eclipsed the United States as the world's largest market. "The primary drivers are rapid economic growth and the maturing of equity markets that are at earlier stages of development," Moe, as quoted in The Financial Times, wrote in a report Friday. "Developed-market institutional asset management pools will need to increase their holdings of emerging-market equities." Investors with an eye to the future, therefore, will want to be in the pool when the big money pours in. The ride will be rough, no doubt, but the waterline is most definitely rising. According to figures released by research firm EPFR Global, investors added money to emerging-market equity funds for a 14th straight week last week, even as they pulled $6.87 billion from global stock funds. The driver, it is clear, is the upward and ongoing growth, both registered and forecast, in emerging markets. The IMF expects the emerging economies to grow by 6.4% collectively next year, almost three times faster than developed nations which, reckons the fund, will likely dawdle along at a paltry 2.4%. How do these nations achieve such veracious growth rates, puzzled politicians in the west want to know. Pearl Buck's character, Wang Lung, answered the question in the quote above, but for the slow-minded policy wonk, we'll simplify: They work. Moreover, their toils are of the productive kind – making cars, toothbrushes and belt sanders – as opposed to what the west counts as productivity – counting people, writing laws and tasering grandma at the airport. Put another way, producers outnumber parasites and factory floor hands outnumber Congress floor copouts. Such a divergence in productivity is, of course, not lost on Mr. Market. Over the past decade the MSCI Emerging Markets Index has more than doubled. During the same period, the MSCI World Index of advanced nations has slumped nearly 21%. This worrying (for developed nations) trend expresses itself in entirely unsurprising forms:

For economists fretting about "unfair trade imbalances" who have their knickers in a knot now, just wait until they see what's coming down the pipes. When we attended the screening of Addison and Kate's movie, I.O.U.S.A., in our then home country of Taiwan, we took the opportunity to quiz a few of the local audience members after the screening. One woman, clearly shaken by the movie's warning against (ironically, unsustainable levels of American debt), winced: "I am scared. I don't even save 50% of my income!" Eventually, however, savers turn into spenders. Keeping up with the Changs or the Patels is just as much a part of human nature as is keeping up with the Joneses. At first it's just a night out at the movies or a new handbag, then, before you know it, Mr. and Mrs. Chang are splashing out on a new ride.

Clearly, the winds of economic change are at the emerging markets' backs. Yet, despite their uncompromising capacity for – and incredible track record of – growth, many stocks in developing economies trade at very competitive valuations. The MSCI Emerging Market Index is valued at 14.2 times reported profits, according to data compiled by Bloomberg. The MSCI World Index, meanwhile, trades for 15.1 times earnings. That may not seem like much of a difference, but remember that those are very broad measures. Drill down into individual markets and you'll find that Russia, for example, trades for just 6 times earnings, as does the Middle East's abandoned wonder, Dubai. Dig further and find individual Chinese, Indian and other emerging market companies, with impressive, double-digit growth rates, solid cash holdings and little debt, trading at even steeper discounts. The rough and tumble, dog-eat-dog capitalistic initiatives coloring the emerging nations' economic landscape harkens back to the "good old days" of the world's developed economies; when entrepreneurial endeavourers were rewarded by the market, rather than punished by the state, when profit was a goal for which to strive in earnest, not a dirty word emblazoning the protest sign of a state-dependant layabout looking to borrow somebody else's axe to grind. So buy the Cash for Clunker economies if it helps you sleep at night…but don't expect the hard workers in developing economies to share their handful of silver with you if you do. Joel Bowman Working for a Living: A Report on Emerging Market Productivity originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Posted: 11 Sep 2010 05:56 AM PDT http://www.youtube.com/watch?v=ZKczs-7BFRI Also see... http://www.marketoracle.co.uk/Article14996.html Says tungsten is exact weight of gold. If that is true, fake gold plated coins may measure and weigh like real ones? Although tungsten may be hard to stamp out like gold. What do you think? |

| Posted: 11 Sep 2010 04:19 AM PDT |

| Goldman Does It Again: Firm Top Ticks Record Gold Price To The Penny Posted: 11 Sep 2010 02:58 AM PDT See graph: http://www.zerohedge.com/article/gol...ld-price-penny If only Goldman clients could receive a penny for every time the firm's sellside advice top ticked the market (to the dot), they would actually be in the green despite following said advice... The most recent blatant example of a concerted sell off following a Goldman "buy" note, occurred at the very peak of the gold move, when the yellow metal had just hit a new all time record high. Sure enough, Goldman, which now apparently caters only to the momentum crowd, decided to use that catalyst as a reason for a note (dated 8:18 am on September 8, note the time relative to the gold price below) to send the signal it was once again in the outright dumping mode. -------------------------A little silver action: Silver 1m 26.75/28.25 2m 28.25/29.75 3m 30.50/31.50 6m 32.50/33.50 1yr 35.00/36.00 |

| Claim Jumper Restaurants Files for Bankruptcy With Plan to Sell Business Posted: 11 Sep 2010 02:57 AM PDT Claim Jumper Restaurants LLC, the operator of a restaurant chain in California and seven other states, sought bankruptcy protection with a plan to sell the business to one of its investors. The Irvine, California-based company listed assets of as much as $100 million and debt of as much as $500 million in Chapter 11 documents filed today in U.S. Bankruptcy Court in Wilmington, Delaware. Private Capital Partners, an affiliate of Los Angeles-based Canyon Capital Advisors LLC, agreed to buy virtually all of the assets, Claim Jumper said today in a statement. Claim Jumper expects to leave bankruptcy in 60 to 75 days with no debt. The company said it filed a motion to set up an asset auction. More Here.. Up To 40,000 Front-line Police Jobs 'At Risk' (UK) |

| Time to Add some Corn to Your Diet. Posted: 11 Sep 2010 02:53 AM PDT I have been waiting for a substantial dip in the grains to add to a position in corn, and it is clear from the chart below that we are just not getting it. While the US crop seems to be in good condition, with 70% rated “good/excellent”, the global picture continues to move from bad to worse. In just a few days, torrential rains wiped out Pakistan’s entire crop for the year, which historically has been a regional net supplier, and they have destroyed much of the storage as well. Russia and the Ukraine have completely withdrawn from the export market, husbanding what meager harvests they can now expect to feed their own people, forcing several international suppliers to declare a force majeur on their contracts. It’s looking like Canada can expect an early winter, as frosts have already appeared in some of the northernmost fields. Cold, dry weather is also forcing major supplier, Argentina, to pare back forecasts. I caught a double in wheat a few months ago (click here for “Going Back into the Ags” at http://www.madhedgefundtrader.com/june-24-2010.html ) during its parabolic move from $4/bushel to $8 and quickly cashed out at the top (click here for “My Best Trade of the Year” at http://www.madhedgefundtrader.com/august-10-2010.html ). It is still rich at $7.40. Corn has been a laggard, up only 25% from its May low, and clearly looks like it has broken out to the upside. It also offers individuals a new, easily tradable, liquid ETF (CORN). Mother Nature is not the only factor boosting grain prices. There is a ton of cash sitting on the sidelines because so many investors are afraid of an Autumn stock market crash, and are loathe to buy the top of the greatest bond bubble in history. Given the strong fundamentals (click here for “The Bull Market in Food is Only Just Starting” at http://www.madhedgefundtrader.com/august-10-2010-2.html ) and the historically low prices, the grains look pretty good right now on a risk/reward basis in the global scheme of things. And if the trade doesn’t work out, you can always take delivery and eat your long. It’s great for the digestion. Believe me, I know! To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last two years of research reports available for free. You can also listen to me on Hedge Fund Radio by clicking on “This Week on Hedge Fund Radio” in the upper right corner of my home page. |

| Jimmie Dines: "GOLD IS MONEY. GOLD IS ESSENTIAL MONEY!", Rare Earth Stocks Posted: 11 Sep 2010 02:34 AM PDT Excellent interview. with Eric King. http://www.kingworldnews.com/kingwor...mes_Dines.html Dines is still super-bulish on Rare Earth, Gold, Silver.and Uranium. The Rare Earth stocks are just starting to heat up. I've got a 11-bagger in REE, and I'm still holding. Much much more to go. I ain't selling until Jimmie Cramer recommends the stock or until the Rare Earth story is on the cover of Newsweek. JMHO DYODD |

| Haynes and Arensberg review metals' week at King World News Posted: 11 Sep 2010 02:29 AM PDT 10:30a ET Saturday, September 11, 2010 Dear Friend of GATA and Gold (and Silver): Reviewing the week in precious metals at King World News, CMI Gold and Silver's Bill Haynes says the public is "nowhere near" the market yet, while Gene Arensberg of the Got Gold Report says the large commercial traders in the New York futures market are not yet aggressively shorting the precious metals. You can listen to the interviews at the King World News Internet site here: http://www.kingworldnews.com/kingworldnews/Broadcast_Gold+/Entries/2010/... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Haynes and Arensberg review metals' week at King World News Posted: 11 Sep 2010 02:29 AM PDT 10:30a ET Saturday, September 11, 2010 Dear Friend of GATA and Gold (and Silver): Reviewing the week in precious metals at King World News, CMI Gold and Silver's Bill Haynes says the public is "nowhere near" the market yet, while Gene Arensberg of the Got Gold Report says the large commercial traders in the New York futures market are not yet aggressively shorting the precious metals. You can listen to the interviews at the King World News Internet site here: http://www.kingworldnews.com/kingworldnews/Broadcast_Gold+/Entries/2010/... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: Toronto Resource Investment Conference The Silver Summit New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

A new study finds that the aluminum content of infant formula remains unacceptably high and one of the manufacturers cited is

A new study finds that the aluminum content of infant formula remains unacceptably high and one of the manufacturers cited is

Raghuram Rajan, in his book

Raghuram Rajan, in his book

No comments:

Post a Comment