Gold World News Flash |

- If Deflation Wins, What Will Gold Stocks Do?

- Gold Reaches 50% Retracement of Decline

- Jim?s Mailbox

- In The News Today

- Hourly And Daily Action In Gold From Trader Dan

- Corporate-Muni Bond Yield Gap: The Sign of Another Crisis?

- Crude Oil to Rebound with Risky Assets, Gold Consolidation to Continue

- Goldman Sachs Turns Bullish on Gold

- How to Take Advantage of Panic Selling for SP500 and Gold

- The End of the Expense Cutting Rope

- Ghana and Edgewater Exploration

- Cut The Cord to PIMPco

- Quick Update

- Real GDP Growth in Q2 Now Projected at 0.2%

- The Eurozone Crisis Returns

- Has the ECB Succeeded?

- Liquidity Trap: Basile, Landon-Lane and Rockoff Are Either Confused or Confusing

- What to Make of Debt, Deficits, and Interest Rates

- Is China in Trouble?

- Six Ways to Cash In on Wheat

- Why U.S. Bankruptcy and Currency Reform Are Inevitable

- Inflation and the Cyclical P/E10

- Trends Shaping the Outsourcing Industry

- Compugen Goes the Extra Mile in Drug Discovery

- Morgan Stanley Emerging Market Debt Fund Currently Trading at a Discount

- The Fed Didn't Announce QE2

- Metals ‘KISS’ Analysis – (Keep It Simple... Umm… Silly)

- Gold outperforms as more bad news from EU emerges

- Gold Trust Adds a Little Gold

- The Dodd-Frank Wall Street Reform and Consumer Protection Act: The Triumph of Crony Capitalism (Part 2)

- Debunking Deflation

- Bridging the Fiscal Gap of Unfunded Liabilities

- A Moment in the Sun

- Gold Seeker Closing Report: Gold and Silver Gain Roughly 1%

- The Only Things That Matter… And No One Talks About

| If Deflation Wins, What Will Gold Stocks Do? Posted: 12 Aug 2010 07:55 PM PDT |

| Gold Reaches 50% Retracement of Decline Posted: 12 Aug 2010 07:50 PM PDT courtesy of DailyFX.com August 12, 2010 09:14 AM 240 Minute Bars Prepared by Jamie Saettele Gold has topped. Please see the latest special report for details. Gold is making its way lower in an impulsive fashion. The short term count has changed slightly. It seems as though the first 5 wave decline ended following a terminal thrust from a triangle. I do expect this rally from the low to prove corrective. 1220/30 is resistance. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Monday evenings), technical analysis of currency crosseson Wednesday and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Posted: 12 Aug 2010 07:50 PM PDT View the original post at jsmineset.com... August 12, 2010 08:33 AM U.S. Jobless Claims Unexpectedly Climb to Five-Month High CIGA Eric Who are the official "EXPECT-ORS" that are always shocked by a bad economic report clearly indicating the report is an aberration of some sort? Good reports are usually expected indicating that is the the norm..This is as form MOPE. Jim "Unexpected" suggests a lack of understanding of ebb and flow within larger secular patterns/cycles. Do not assume mass ignorance of the secular trends, though. As Jim suggests, perception management is a powerful short-term tool. If you cannot win a battle, you don’t rush to fight it. You talk it to death. Eric Average Weekly Initial Claims State Unemployment (AWIC) And YOY Change: Source: bloomberg.com More… Gold Shares and Newmont Mining CIGA Eric Hi Eric: Am I crazy or is NEM tracing out this huge reverse head and shoulders pattern over the past 4 years.I know you've b... |

| Posted: 12 Aug 2010 07:50 PM PDT View the original post at jsmineset.com... August 12, 2010 08:36 AM Jim Sinclair's Commentary Bloomberg announced the Fed is buying Treasuries on the open market today. The process of a central bank buying the debt of the nation it represents is called "Debt Monetization." The following is a reasonable review of what the process is and the results thereof. This time the form of the result will be "Currency Induced Cost Push Inflation." Gold will trade at $1650 and above. Monetizing debt In many countries the government has assigned exclusive power to issue or print its national currency to independently operated central banks. For example, in the USA the independently owned and operated Federal Reserve banks do this.[1] Such governments thereby disavow the overly convenient ’slippery slope’ option of paying their bills by printing new currency. They must instead pay with currency already in circulation, else finance deficits by issuing new bonds, and selling them to ... |

| Hourly And Daily Action In Gold From Trader Dan Posted: 12 Aug 2010 07:50 PM PDT |

| Corporate-Muni Bond Yield Gap: The Sign of Another Crisis? Posted: 12 Aug 2010 07:50 PM PDT The jillions of dollars in municipal bonds issued by cities and states over the last half century are getting a lot of attention lately, mostly because a lot of people own municipal bonds, either directly or indirectly, and now cities and states seem to be sliding, sliding, sliding towards an obvious and unavoidable default, like everyone else, sort of like how my wife noticed my decades-long slide into lazy worthlessness and irritability, reducing my value as a husband and father to zero, thus wiping out all her stupid "investment" in me. She was, and still is, angry about it, which is instructive in that muni bonds falling in price normally means that the bondholders suffer, who would likewise make a big, angry stink about it, resulting in the wholesale ouster of such incompetent politicians as bondholders put some of their remaining money to work accomplishing just that. Ah, but those are the "good old days" of fiscal prudence and intelligent management, and now all long-term de... |

| Crude Oil to Rebound with Risky Assets, Gold Consolidation to Continue Posted: 12 Aug 2010 07:50 PM PDT courtesy of DailyFX.com August 12, 2010 01:51 AM Crude oil is likely to rebound as stocks lead spectrum of risky assets on a correction higher after yesterday’s selloff while gold consolidation is set to continue as traders weigh which side of the risk/safety split to place the yellow metal. Commodities – Energy Crude Oil to Bounce as Risky Assets Pare Losses Crude Oil (WTI) - $77.28 // -$0.74 // -0.95% Commentary:Crude is increasingly tracking overall risk sentiment with the correlation between prices for the WTI contract and the MSCI World Stock Index now at 0.74, the highest in nearly three weeks, on 20-day percent change studies. This hints that a rebound may be ahead in the near term with US equity index futures now in essentially flat having recovered from deep losses (0.8 and 1.1 percent on the Dow Jones and S&P 500, respectively) in early Asian trade. The economic calendar offers little that stands in the way of the correction, with weekly US jobless ... |

| Goldman Sachs Turns Bullish on Gold Posted: 12 Aug 2010 07:50 PM PDT Despite the fact that the U.S. dollar gained about 150 basis points during Wednesday's trading day... there was little sign of it in the gold price activity yesterday. Yes, gold came under a bit of selling pressure at 2:00 a.m. Eastern time... just like Tuesday... but that all ended at exactly 11:00 a.m. in London trading [6:00 a.m. in New York]. From that point, a rally began that really gathered some legs once the Comex opened... and if a not-for-profit seller hadn't shown up around 8:50 a.m. Eastern, there's no telling how high gold would have gone. Then, around 11:15 a.m. in New York, the bullion dealers collusively pulled their bids... and gold was down $13 in minutes. Every attempt after that to break above $1,200 was rebuffed. Gold's high and low for Wednesday both occurred during New York trading. The high [$1,209.10 spot] was at the 08:50 a.m. price spike... and the low was $1,191.40 spot, shortly after the bullion banks pulled their bids at 1... |

| How to Take Advantage of Panic Selling for SP500 and Gold Posted: 12 Aug 2010 07:50 PM PDT Did you close out any long positions today? Well if not then you are one of a few! Today (Wednesday) the market gapped down 1.5% at the opening bell which set a very negative tone for the session. Volume was screaming as protective stops triggered and traders close out positions before prices fell much further. This gap seemed to have caught several traders off guard but those of you who follow my newsletter knew something big was brewing and to keep positions very small. Just before the close on Tuesday I had a buy signal for the SP500 which was generated from the extreme readings on the market internals. After watching the market chop around and get squeezed into the apex of the rising wedge the past 3 weeks I knew something big was about to happen and I did not want to get everyone involved because I felt a large gap was about to happen and the odds were 50/50. Instead we passed on the technical buy signal and waited to see what would happen Wednesday. Below are a ... |

| The End of the Expense Cutting Rope Posted: 12 Aug 2010 07:50 PM PDT Three graphs today at the 5-Min. Forecast go a long way toward telling the story of where we are in this economic recovery. Productivity has Rolled Over The first graph shows how productivity growth has been declining for over a year and turned negative in the second quarter. U.S. corporations have cut expenses to the point where more cuts reduce output. The end of this rope is when it is discovered that cutting expenses can improve the bottom line only up to a point. After that point further cuts will reduce income more than expenses. For any other reality, it would be possible to approach infinite income by cutting expenses close to zero. Capital Improvement is not Offsetting Lower Employment The first question that can be raised is that there could be hope for future productivity gains to return based on capital investment in new facilities, tools and technology. The second graph shows that will not happen. The annual change in capital stock has gone neg... |

| Ghana and Edgewater Exploration Posted: 12 Aug 2010 07:50 PM PDT Richard (Rick) Mills Ahead of the Herd As a general rule, the most successful man in life is the man who has the best information Over the last few years some of the biggest wins in the market have come from gold plays in Africa. The one-time forgotten continent is now one of the hottest places in the junior mining world. Recent success stories such as: -Red Back Mining (TSX -RBI) $3.50 - $30.00 800% Gain -Semafo (TSX - SMF) $2.00 - $9.00 450% Gain -Keegan Resources (TSX - KGN) $1.00 - $5.00 500% Gain -Canaco Resources (TSX.V - CAN) $0.10 - $2.00 2000% Gain have the investment community ripe with confidence and excitement. The Kinross acquisition ($7.1Bn deal) of Red Back Mining has cemented Western Africa in investor's minds as a good place to be invested. Now Edgewater Exploration TSX.V - EDW is positioned to benefit from the excitement and they have the most important things I look for in a potentially successful company: Management President &... |

| Posted: 12 Aug 2010 07:50 PM PDT Market Ticker - Karl Denninger View original article August 12, 2010 06:14 AM Now comes Bill Gross with yet another threat: [INDENT]Bill Gross, who manages the world's largest bond fund, said on Wednesday that he would not buy bonds backed by mortgages unless the US government continued to guarantee the debt. [/INDENT]So what? Gross has, over the last couple of years, successfully goaded the government into giving him guaranteed profits by essentially demanding - and getting - policy moves which he unabashedly and publicly front-ran! Remember "shaking the hand of government" folks? [INDENT]"Without a government guarantee, as a private investor, I'd require borrowers to put at least 30 per cent down, and most first-time homebuyers can't afford that," said Mr Gross, who will be one of the most prominent private sector participants at the August 17 conference. [/INDENT]They sure will be able to afford to do that if house prices shrink to affordable levels! Yeah, I know, I... |

| Posted: 12 Aug 2010 07:50 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! August 12, 2010 05:07 AM U.S. Stock Market - Starting to see some serious long-term technical damage. Not surprised since my cyclical high for June/July has now passed. While I continue to not look for a melt-down, we finally have conditions set that can allow a very significant retreat. The economy is tanking again and with fall elections now becoming a daily topic, the “Don’t Worry, Be Happy” crowd appear out of bullets. U.S. Bonds - While I wouldn’t touch any maturity over two years, I also wouldn’t go short any time soon. Gold – What can I say that I haven’t said already? The belief we’re in the “mother” of all bull markets should be enough to know where I stand. The fact that I beg listeners when it comes to gold not to listen to people like “Tokyo Rose”. always wrong... |

| Real GDP Growth in Q2 Now Projected at 0.2% Posted: 12 Aug 2010 07:41 PM PDT Erik McCurdy submits: On Wednesday, the Census Bureau reported that the trade deficit increased to $49.9 billion in June from $42.0 billion in May. Consensus expectations were for a decrease, so this economic data release was yet another disappointment, especially when you consider its impact on the next revision to second quarter GDP. In late July, the Bureau of Economic Analysis reported that their initial estimate of second quarter GDP was 2.4%. However, if you exclude the waning impact of the inventory adjustment cycle, real growth was only 1.3%. If you then factor in this substantial increase in the trade deficit, that real growth number drops all the way down to about 0.2%, which is virtually no growth at all. If the economic recovery, as defined by GDP, had already decelerated to the point of negligible expansion during the first half of the year, the likelihood of experiencing negative growth in the third or fourth quarter has increased substantially, especially given the pronounced decline in consumption indicated by the real-time Growth Index tracked by the Consumer Metric Institute. Complete Story » |

| Posted: 12 Aug 2010 07:39 PM PDT The Business Insider submits: Europe's PIIGS economies, the soft underbelly of the Eurozone, are back in the spotlight. Fresh concerns have emerged in the news regarding Spain, Greece, and Ireland's finances. Yet if the wave of news stories isn't enough to convince you that something is up, then check out the latest move for credit default swaps. Complete Story » |

| Posted: 12 Aug 2010 07:38 PM PDT The Pragmatic Capitalist submits: Fears in Europe were quickly calmed in recent months after unprecedented moves by the European Central Bank. But since that time there have been some further signs of weakness in the regions that were supposed to benefit most from the bailout – specifically Ireland and Greece. As we noted yesterday, there were rumors that the ECB was buying Irish bonds as yields began to spike and budget woes continue to weigh on Ireland. On Thursday Greece announced lower than expected GDP at -1.5% and a 12% unemployment rate. The worsening of both was attributed in large part to government austerity measures. Deutsche Bank analysts are now referring to Greece as a “a death spiral of government insolvency.” The IMF also commented briefly on the action in Greece: “Speculation that Greek debt restructuring may have only been postponed, rather than decisively put to rest, clearly weighs on sentiment.” Bond spreads have steadied back near their highs (after briefly declining) while CDS spreads have begun to move higher. The cumulative probability of default now sits at 49.72% – roughly a coin flip and not exactly a sign of faith in the ECB’s actions (click to enlarge images): Complete Story » |

| Liquidity Trap: Basile, Landon-Lane and Rockoff Are Either Confused or Confusing Posted: 12 Aug 2010 07:35 PM PDT Brad DeLong submits: From Peter F. Basile, John Landon-Lane, and Hugh Rockoff's "Money and Interest Rates in the United States during the Great Depression" (2010):

Complete Story » |

| What to Make of Debt, Deficits, and Interest Rates Posted: 12 Aug 2010 07:29 PM PDT IPE at UNC submits: by Kindred Winecoff There has been a lot of talk recently about the capacity of states to accumulate debt during recessions. This usually is merely background for an argument over whether states should use more deficit fiscal spending to try to stimulate their economies out of recession, or a sluggish "jobless" recovery. One side of that debate typically argues that if debt grows too large, bond investors will demand a high interest rate premium for continuing to extend credit. If this premium gets too large, the debt burden can become crippling, triggering either a currency crisis or a debt default, each of which has adverse long-run consequences for growth. Even if interest rates on bonds are at acceptable levels right now, things can turn irreversibly on a dime. Therefore, debt should be kept at moderate levels even if that requires short-run "austerity", so that the long-run solvency of states is maintained. Proponents of this view include most European governments, almost the entire Republican party and right-wing punditocracy, and significant chunks of the center-left technocracy (e.g. Robert Rubin). Complete Story » |

| Posted: 12 Aug 2010 06:49 PM PDT New Finance submits: A few months ago, the buzz about China centered on the debate over revaluing the yuan. Now, the focus has shifted to whether or not the growth sustained in the mainland has created a bubble of epic proportions. The focus has been on a few things: the housing market, banks and the massive engine that is the Chinese economy. In the United States it is a well-known fact that the housing market has gone through a massive correction. There may be more downward pressure ahead, despite or as a result of a tax credit extended by the US government that expired in April. The housing bubble in China is the result of loose lending practices and overextension of credit, much like what preceded the collapse in the US. The probability of the housing bubble bursting is low, according to industry experts, if Beijing can successfully implement policy. However, even if Beijing succeeds, a 20-30% correction is expected. Excuse me, but isn’t that a bit steep for something that is not regarded as a burst bubble? Complete Story » |

| Posted: 12 Aug 2010 06:41 PM PDT Investment U submits: By Tony D'Altorio The price of wheat recently made its largest one-month jump in more than three decades. With global demand soaring and production tanking, wheat really has become the “golden” grain. And at the heart of the crisis is the weather in Russia, Ukraine and Kazakhstan. Complete Story » |

| Why U.S. Bankruptcy and Currency Reform Are Inevitable Posted: 12 Aug 2010 06:33 PM PDT Wall Street Cheat Sheet submits: By Jordan Roy-Byrne, CMT The US Treasury reported that the budget deficit hit $165 billion in July which is actually less than the near $180 Billion in July of 2009. Month to month activity is volatile so it is best to compare single months to previous years and compare several months of data. I looked at the deficit for the first seven months of 2009 and compared it to the deficit through July of 2010. We are supposed to be in a recovery yet the budget deficit (for the first seven months of 2010) is up 2.36% compared to last year. Complete Story » |

| Inflation and the Cyclical P/E10 Posted: 12 Aug 2010 06:19 PM PDT Doug Short submits: Here is a more detailed look at the pattern of cyclical P/E10 ratios which form the basis of my monthly valuation update Is the Stock Market Cheap? The scatter diagram below plots 129 years of monthly P/E10 ratios on the vertical axis according to the annualized inflation rate on the horizontal axis. I've set vertical gridlines at 4% intervals and illustrated the average (arithmetic mean) P/E10 for each 4% vertical band. Complete Story » |

| Trends Shaping the Outsourcing Industry Posted: 12 Aug 2010 06:19 PM PDT

Complete Story » |

| Compugen Goes the Extra Mile in Drug Discovery Posted: 12 Aug 2010 06:13 PM PDT Prohost Biotech submits:

Complete Story » |

| Morgan Stanley Emerging Market Debt Fund Currently Trading at a Discount Posted: 12 Aug 2010 06:12 PM PDT George Spritzer submits: Morgan Stanley Emerging Markets Debt Fund (MSD) is a closed-end fund that could appeal to income-oriented investors who want to diversify their US fixed income holdings. The fund invests in debt securities of government and other issuers located in emerging market countries. About 90% of the portfolio has a credit rating from BB- through BBB, although there are also some higher rated and lower rated issues. MSD is currently trading at a 9.5% discount to NAV. It has appreciated quite a bit from the lows in 2009. But there is long term secular trend in place where emerging market debt securities are being viewed as safe havens. Unlike Japan or the US, emerging market nations generally have lower debt to GDP ratios. More emerging market nations have been getting reclassified as investment grade which means a greater percentage allocation from large institutions. Complete Story » |

| Posted: 12 Aug 2010 06:09 PM PDT Rebecca Wilder submits: Fortune published an op-ed piece by Keith R. McCullough at Hedgeye (h/t to my Mom). He argues (not very well, I might add) that QE2 is the doomsday scenario for "markets". Complete Story » |

| Metals ‘KISS’ Analysis – (Keep It Simple... Umm… Silly) Posted: 12 Aug 2010 06:07 PM PDT |

| Gold outperforms as more bad news from EU emerges Posted: 12 Aug 2010 05:58 PM PDT I will be updating this blog on about a weekly basis with market commentary, as well as articles on specific topics. I will instead also be providing daily market commentary in newsletter .pdf format. If you would like to subscribe (for free) to the Shadow Capitalism market commentary newsletter, please email me at naufalsanaullah@gmail.com so I can put you on the mail list. Thank you. |

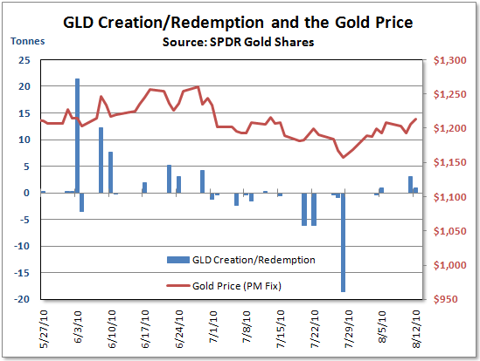

| Posted: 12 Aug 2010 05:38 PM PDT  Tim Iacono submits: Tim Iacono submits: It’s not much, but it’s a start. After net redemptions of almost 40 tonnes from July 1st up until about two weeks ago, the popular SPDR Gold Shares ETF (NYSE:GLD) has been adding gold bars to the trust in recent days, a total of five tonnes since last Wednesday. Complete Story » |

| Posted: 12 Aug 2010 05:19 PM PDT From The Daily Capitalist Part 2 Assumptions Guiding the Act The Act is guided by several broad concepts:

Specific blame for the financial collapse is assigned as follows:

Description of the Act What is obvious from a review of the Act is that the powers granted are very broad, almost unlimited, ill-defined, and yet to be written. The following descriptions of the Act are intended to give you an idea as to the vast scope of the Act and the powers granted. I have picked out some of the more important powers, but the Act is much more invasive and controlling than what I am describing here. I have gone into some detail because I believe that most people don't understand how pervasive the Act is. Please bear with me here; it will be eye-opening. Here is a major law firm’s (Gibson Dunn) overview of the Act:

As you will see, the Act, while it comprises 2,300 pages, speaks mostly of legislative goals, with specific requirements that require fleshing out by rules and regulations that will follow. For the most part, the actual law will be developed by the mandarins. The Concept of Financial Risk The entire Act is built around the concept of protecting the “financial stability” of the economy. The term “financial stability” is mentioned about 80 times in the Act but there is no definition of what it is. The Act assumes that the Council will know it when it sees it. Instead of defining the term, the Act assigns the new Financial Stability Oversight Council the duty of regulating companies whose activities threaten “financial stability.” The Council is obligated to conduct studies and make findings on which to base new rules and regulations which establish “prudential standards” for regulated companies. It is assumed that out of that process “financial stability” will be defined, but it seems no one really knows what “financial stability” is or what consists of a threat to it. Which is a problem is when you give vast powers to a new agency: it makes their powers almost unlimited. The likelihood of finding this Act unconstitutional because of vagueness is low. Consider the fact that a Council takeover of a company because it is a “threat to financial stability” will probably only be challenged in the courts during a financial crisis. This puts pressure on judges who have little knowledge of economics. They would be afraid to assume responsibility for the economy. Since the experts testifying in court will most likely be mainstream economists and financiers who believe in current economic thinking that such powers are necessary to save the economy, it is unlikely that courts will believe the testimony of “outliers” such as Austrian theory economists. The Act thus creates a board of economics czars who will have almost unlimited powers to regulate the financial sector of the economy. Financial Stability Oversight Council The Act creates a council of regulators, the Financial Stability Oversight Council, to monitor and regulate companies it believes have the ability to jeopardize financial stability. It is to be chaired by the Secretary of the Treasury. The Fed ends up as the primary regulator of financial firms and oversees the Council. The idea is to prevent big “interconnected” banks and other large financial institutions such as hedge funds, investment banks, and insurance companies, from blowing up again. The extension of federal power to regulate nonbank financial institutions is a major expansion of federal authority. The Council has the power to seize and break up financial firms whose collapse would put the economy in danger (“threaten the financial stability of the economy”). The Fed has the responsibility to decide whether the Council should vote on breaking up big companies. A position of a second Fed vice-chair is established to supervise financial firms; the White House appoints him or her (they have nominated Janet Yellen). How the Rules Will Be Determined The Council is given the following duties:

Within 9 months they must adopt new regulations which must include:

Financial Institution Rules Some of the key rules that apply to large ($50+ billion) interconnected financial companies include:

The Financial Stability Oversight Council has the power to do almost anything and there is very limited judicial review of their decisions. They justify these vast powers on their belief that they are necessary to protect the economy. Tomorrow Part 3 of 4: a further look at the Act's provisions revealing the vast scope of this new law. |

| Posted: 12 Aug 2010 04:48 PM PDT Now that almost every Wall Street economist is looking for the arrival of a Great Deflation, we think investors should begin looking the other way. Keep an eye out for inflation, we say. You will recall that during the bottom of the previous bear-market, most of the pundits were shunning 'risky assets' (stocks and commodities) and they were advocating a heavy exposure to cash and fixed income assets. Back then, the vast majority of strategists and their devotees were erroneously fretting about deflation. According to these folks, deflation was a done deal due to the following reasons: a. Contraction in private-sector debt - When the credit crisis arrived in the summer of 2008 and asset prices collapsed later that year, over- leveraged consumers and businesses started paying off their debt. After all, this act of deleveraging was a logical reaction to the devastation caused by the most vicious bear-market since the 1930s. So, when private-sector debt began to shrink, the proponents of deflation (deflationists) announced the death of inflation. "How could the global economy inflate when the private-sector was tightening its belt?" was their battle cry.  Although the deflationists had a point, their assessment was flawed because they totally ignored the borrowing capabilities of the governments. While it is true that from peak to trough, private-sector debt in the US contracted by roughly US$800 billion, this debt reduction was overwhelmed by the US government's debt accumulation efforts. As the chart below shows, over the past two years US federal debt has surged by a whopping US$3 trillion, thereby more than offsetting the deflationary impact of private-sector deleveraging. If you have any doubts whatsoever, you will want to note that total debt in the US is now at a record high!  b. Excess capacity - The lack of aggregate demand and the excess capacity prevalent within the economy is another factor often cited by the deflationists. Let us explain: You will recall that in the aftermath of the Lehman Brothers bust, the credit markets froze and the global economy came to a screeching halt. Suddenly, worldwide consumption contracted and the world was left with idle factories, empty buildings and unwanted inventories. Thus, the deflationists argued that with such a lack of aggregate demand and so much spare capacity, we could never experience inflation. Once again, the deflationists failed to understand that over-capacity has been a constant feature in our economic landscape and price increases (which they erroneously describe as inflation) have very little to do with capacity utilization. It is interesting to observe that over the past 42 years, the US economy has never operated at full capacity. Moreover, it is notable that even during the highly inflationary 1970s and the most recent inflationary boom (2003-2007), the US economy operated well below maximum capacity. In case you are wondering, the same holds true for the global economy. Therefore, the idea that inflation cannot occur in the face of excess capacity is ill-conceived and absurd. All the popular deflation myths aside, the reality is that inflation is an increase in the supply of money and debt within an economy. Furthermore, the price increases often described as inflation are simply consequences of monetary inflation - a euphemism for the dilution of the money stock. Look. Whenever any central bank creates new money and whenever any entity (individual, business or government) takes on more debt, the outcome is inflation. As Milton Friedman once said, "Inflation is always and everywhere a monetary phenomenon." Today, under our fiat-money system, governments are willing borrowers and central banks are more than eager lenders (money creators). Under these circumstances, a contraction in the supply of money and debt (deflation) is out of the question. Conversely, given the short- sightedness of the politicians and their perpetual urge to "kick the can down the road," the real risk facing the economy is extreme inflation or even hyperinflation. Given our grim outlook on inflation, we continue to favor hard assets and the fast-growing developing economies in Asia. If our assessment is correct, our preferred sectors (energy, precious metals and industrials) and our favorite stock markets (China, India and Vietnam) are likely to generate superior long-term returns. Regards, Puru Saxena, |

| Bridging the Fiscal Gap of Unfunded Liabilities Posted: 12 Aug 2010 04:41 PM PDT The stock market took a tumble yesterday. The Dow fell 265 points after investors had a chance to ruminate about the Fed's latest action. It wasn't what the Fed did or said that discouraged investors. It was what it didn't say and what it didn't do. It didn't say, for example, that it was going to "crank up the printing presses" and deliver trillions of new dollars to the economy. We didn't think it would. But it also didn't say that the economy was doing well. Au contraire, it gave investors reason to believe that it was worried about the "recovery." (We continue to put the word in quotation marks so dear readers will know there's something fishy about it...) Eventually, the Fed probably will get the printing presses going. But not just because it is desperate to re-start the economy. We are getting used to big numbers. US trade deficits are more than $500 billion per year. US federal budget deficits are more than $1 trillion. And the US official debt is now more than $13 trillion. Then, you add in all the off-budget items and the numbers get bigger and bigger. If the government promises to buy drugs for someone five years from now, for example, that's a financial commitment that it has to own up to. If it were a private company, the expenses would be put on its balance sheet as a liability...a bill that will have to be paid in the future. Typically, a company would put aside money to pay the bill, so it would be "funded" - covered by savings or a special-purpose fund. The US government, however, hasn't saved any money since the Carter Administration. But it's added a heckuva lot of financial commitments since then. Democrats, Republicans - it didn't matter who was in office; the zombies got more money and the financial picture worsened. The last number we saw for the whole enchilada of unfunded federal financial obligations was $115 trillion or thereabouts. So we were shocked when Laurence Kotlikoff, a well-known professor of economics at Boston University, updated the figure to...are you sitting down, dear reader?...$202 trillion. How much is $202 trillion? Well, if you laid out $100 bills, end to end, day after day...you'd be an idiot. Because you'd die long before you got to even a trillion worth. The $202 trillion is the current "fiscal gap" of the federal government. It is the present value of future unfunded obligations. To fund that gap, Kotlikoff refers to an IMF study showing we'd have to double taxes...raising an amount equal to 14% of GDP every year from now on. Every year that the gap is not closed, the additional amount is added to the "principal," making that much more to be paid in the future. "How can the fiscal gap be so enormous?" asks Kotlikoff. "Simple. We have 78 million baby boomers who, when fully retired, will collect benefits from Social Security, Medicare, and Medicaid that, on average, exceed per-capita GDP. The annual costs of these entitlements will total about $4 trillion in today's dollars. Yes, our economy will be bigger in 20 years, but not big enough to handle this size load year after year. "This is what happens when you run a massive Ponzi scheme for six decades straight, taking ever larger resources from the young and giving them to the old while promising the young their eventual turn at passing the generational buck." What to do about it? There are no win-win solutions. "Recovery"..."stimulus"..."grow our way out"...and all the other painless remedies are just claptrap. Nor is the US government going to double all taxes. Congress doesn't have the stomach for it. And it wouldn't help anyway. The economy would collapse even further - leaving possibly less revenue for the feds. No, there is only one real solution. The feds will have to renege on their promises. But how? Will they step up to a microphone and just admit that they have been fools and knaves...and that they are cutting federal spending in half? Will they look the voters in the eye and tell the truth: "I can't give you anything that I haven't taken from you in the first place"? Whatever your party affiliation, we wouldn't advise you to hold your breath waiting for politicians to be straight with voters. No, dear reader, they will use the only tools they have - lies, bombast and subterfuge. One way or another, sooner or later, they will call upon the Fed and the Treasury to bail them out. How? By using quantitative easing - money printing, in other words. The Treasury will borrow the money from the Fed. The bills will be paid. And the dollar will become almost worthless...or perhaps completely worthless. At least, that's what it looks like this morning... And more thoughts... "Things are heating up around here," said Elizabeth last night. She was not talking about the weather. "I guess it is inevitable. The balmy weather. The moonlight. The little boat on the lake. So many young people together. "People were up until 5am last night. I couldn't sleep. I kept hearing them singing. Laughing. Or I heard the crunch of the gravel when someone was walking around. "Of course, I'm glad they're having a good time. But I'm worried too. I don't know what's going on. Some of them are probably having a great time. And some of them are miserable. I suppose that's inevitable too. The two boys got into an argument at the table last night. We couldn't hear it because they were at the other end. But I know they're upset. "You don't see it so much. You keep working. Which is probably a good thing. It gives you a kind of stability. But I think this extended vacation has a de-stabilizing effect on people. They spend a lot of time talking to one another. They get to know each other better...and know things about themselves probably that they didn't know before. They're just teenagers and young adults. The boys are more than a little impressed by Maria's beautiful friends. And the girls seem to be at ease and relaxed in the large family setting. They're treating the boys like little brothers...but the boys would probably like to imagine different roles. "And then, the cook is acting very strange... I don't know what to make of it... "But sometimes when we're here, I feel like we are dancing on top of a huge gasoline tank...and everyone is smoking a cigarette." Regards, Bill Bonner |

| Posted: 12 Aug 2010 04:22 PM PDT If Goldman Sachs is publicly bullish on gold, is that a good thing or bad thing for gold bulls? Wall Street's notorious trading house published a report on gold earlier this week setting a price target of US$1,300 in the next six months. The report cited several factors. But before we get into them, we'll confess it made us a bit nervous. Whenever any broker is saying one thing, you have to wonder if they're actually doing the opposite. That said, Goldman did make a point that is true of an asset in a bull market: it requires corrections to shake out the speculators and weak hands from time to time. Following the June high north of $1,250 the net speculative long positions declined. Traders took profits. And so did momentum players in the exchange traded funds market. But then something happened that Michael Pascoe and Rory Robertson did not expect. The gold bubble did not pop. Because it's not a bubble. The momentum players departed and the price found plenty of support. It's now around US$1,220. Goldman says the big catalyst for move higher (other than its announcement leading to a stampede of money into gold short-term) is a repricing of U.S. growth expectations for the rest of this year and all of next. Maybe it's a fear trade, or just bearishness on U.S. corporate profits when unemployment keeps rising. Either way, about the only dubious chart we saw in the whole report is the one showing lower U.S. real interest rates and the gold price (exhibit five). As those cool cats in statistics say, correlation is not causation. Its possible low rates give speculators fuel to play in the gold market. But it's more likely, we reckon, that U.S. rates are low because the bond market is pricing in a deflationary scenario. So why would gold rise in a deflationary scenario? Good question! It brings us full circle to the argument fund - manager David Einhorn made when we announced his gold position: you buy gold when you think monetary and fiscal policy are bad (we're paraphrasing). Whether it's inflation or deflation matters less than something unconventional and bad is going down. Gold does well in that environment, what with it being real money and all. Take a look at the Aussie gold price chart below. It shows you that gold is much closer to making a new high in U.S. dollar terms than it is in Aussie dollar terms. For Aussie gold to match the greenback gain, you'd need a much stronger greenback or a much weaker Aussie. It's worth noting that following the Fed's announcement that it would sort of begin quantitative easing part two, the Aussie made the second-largest declines against the greenback, trailing only the dreaded Esperanto currency (the euro).

As we have banged on about gold for years now - and have a long position in the list of recommendations to Australian Wealth Gameplan readers - we won't test your patience much longer. But yesterday's news that the Aussie unemployment went rate up in July wouldn't be Aussie dollar bullish, would it? Maybe the Aussie will get a boost when this miserable Federal election nonsense is over. When thinking about the election we recall the phrase, "Don't vote! It only encourages them." Of course voting in Australia is compulsory. But it might be a fine worth copping if you can say you weren't an accessory to, "the advanced auction of stolen goods," as Mark Twain once put it. Seriously. If anything is clear so far about the difference between the two major parties, it's that both treat Australians as chattel. We are but tax slaves who exist to fund the government's spending pleasures. And the Greens? More like the Reds! But that's all politics. Financial independence is the only real defence against this kind of relentless State encroachment from all sides. Get it. Keep it. Defend it. Whether you like it or not, more and more governments across the world are spending out of an empty pocket. They're spending to give people money that've lost jobs as a result of the structural shift in the labour markets. That shift came from globalisation. The money might keep people above water for awhile, but it's no replacement for a real job making real things. More and more spending is going to simply pay the interest on previously borrowed money. This is probably the most dangerous aspect of a credit bubble. You borrow and spend all that money and, and the end of the day, you have nothing to show for it...no bridges...no roads...no factories...no real increase in the capital stock. Just a lot of over-priced residential housing that suddenly isn't in such short supply as you thought. And now Australia finds itself at an interesting crossroads. Just a little debt didn't seem like such a bad idea at the height of the GFC. Both parties now promise to pay it off quickly, with all the bounty from mineral and energy royalties. Both will increase spending too, but in different places, cutting other spending priorities. But should the housing bubble pop sooner rather than later, and should Aussie banks find themselves last in the queue for global capital in another phase of the Great Correction, the temptation for more government borrowing will be nigh irresistible. Why? Well, our stance against government debt may seem dogmatic. But if it is, it's because the modern State always abuses the power to borrow. Always. Whether it's to fund politically popular but economically unproductive projects, or whether it' just a way of putting off tough choices about actually reducing government spending and, thus, the reach of the State into private life, it's always easier to borrow and kick the can down the road. Debt is the health of the State in the same way that liquor is the health of the alcoholic. The relationship is inherently destructive. But we reckon that in the face of so much unproductive debt (household and sovereign) the only politically palatable policy response will be to monetise that debt: pay it off or buy it from bank with new money. The deflationists can enjoy their moment in the sun while it lasts. But it won't last for long at this rate. Dan Denning

|

| Gold Seeker Closing Report: Gold and Silver Gain Roughly 1% Posted: 12 Aug 2010 04:00 PM PDT Gold traded mostly slightly higher in Asia, rose almost $10 in London, and popped to as high as $1215.13 at the open of trade in New York before it dropped back off a bit by late morning, but it then climbed back near its earlier high in the last minutes of trade and ended with a gain of 1.44%. Silver climbed to as high as $18.095 by late morning in New York before it moderated its gains a bit in the last couple of hours of trade, but it still ended with a gain of 0.73%. |

| The Only Things That Matter… And No One Talks About Posted: 12 Aug 2010 03:53 PM PDT

Today, most pundits are growing increasingly concerned that we are headed for a “double dip” recession. I think this view is idiotic as the US “recovery” was in fact nothing more than a small bounce in economy activity within the context of a DEPRESSION.

Regardless, the stooges are out again in full force proclaiming that the US economy is in trouble again (duh), that the Stimulus high is wearing off (duh again) and that the only solution is to issue more Stimulus and money printing to stop another economic contraction (WHAT!?!).

Let’s be honest here. The money printing and Stimulus DIDN’T work last time. All it did was buy time. Indeed, from an economic perspective, the only thing the Feds can claim with any certainty is that the Stimulus produced a bunch of economic data points that were questionable in authenticity (GDP, inflation, employment, etc) many of which have since been revised lower (GDP again).

If the best evidence you can come up with for justifying Stimulus spending is a bunch of accounting gimmicks, why even bother spending the money at all? I mean, if you want to measure success by just fudging a bunch of numbers, why not SAVE the money and just crank out a bunch of nonsensical data from thin air?

Indeed, why not say that we’ve got 17% GDP growth and employment of 500%? Sure our economic researchers would lose all credibility, but they’re already doing that anyway, and at least by simply making stuff up we wouldn’t be ruining the US’s balance sheet and wasting money in the process.

This real issue with US economic policy today is that no one in a position of power actually has a clue how to address the structural issues in the US economy. Either that, or they willingly ignore the obvious for the sake of career risk, choosing instead to take a “wack a mole” approach to handling economic issues: applying the same solution (spend money) to every problem that raises its head.

The fact of the matter is that the US economy, on a structural basis, is BROKEN. Starting in the early ‘70s, we outsourced our manufacturing and began shifting to a services economy (particularly financial services). We also outsourced our wealth to Asia, OPEC, and Wall Street.

Because of this, the average American has seen his income dramatically in the last 30 years. This is obvious to anyone with a functioning brain. Forty years ago one parent worked and people got by. Today both parents work (if they can find jobs) and still can’t have a decent quality life.

THESE are the items that matter for economic growth: jobs and income. If you want people to have money for them to spend and consequently boost economic growth, they need to have decent jobs that pay them well.

However, instead of focusing on these factors, the pundits and powers that be focus on peripheral issues like stock market levels and housing prices. Don’t get me wrong, these two markets matter in terms of retirement and savings (they’re the two largest stores of wealth for most approaching retirement). But people don’t pay for goods and services using stock gains or home equity (at least not since the Housing bust).

No, people pay for things using money they make from their jobs.

Tax credits, stock market manipulation, QE… all of these solutions address asset prices, but NONE of them address income growth: the primary source of funding people need to BUY assets. Put another way, all of the Feds’ efforts have been directed towards financial speculation NOT economic fundamentals.

Until this changes, the US economy is doomed. The consumer drives the US economy and the consumer’s income is the fuel. And we’re fast running out of gas.

Good Investing!

Graham Summers

PS. Come join me for in-depth market analysis and exposes of the various frauds, cheats and corruption taking place in the financial markets at www.gainspainscapital.com

|

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

With the evolution of the genomic and proteomic technologies, we highly regard and appreciate the firms that have invested in these technology towards breakthrough discoveries that are used in a therapeutic progress towards healing chronic and deadly diseases. One of these firms has offered us more than hints about what it can accomplish through its thoroughly developed technologies. The firm in question is Compugen (

With the evolution of the genomic and proteomic technologies, we highly regard and appreciate the firms that have invested in these technology towards breakthrough discoveries that are used in a therapeutic progress towards healing chronic and deadly diseases. One of these firms has offered us more than hints about what it can accomplish through its thoroughly developed technologies. The firm in question is Compugen (

No comments:

Post a Comment