Gold World News Flash |

- GoldSeek.com Radio Gold Nugget: Gerald Celente & Chris Waltzek

- Rogoff and Reinhart Analysis Has Major Flaw

- Teva Acquires Ratiopharm

- Wednesday ETF Wrap-Up: VXX Surges, VGK Tumbles

- Yen ETFs: On a Hot Streak

- Gold Miner ETFs Fail to Shine Despite Spectacular Earnings

- Digesting the Importance of Chinese Gold Investing

- Savers Will Rise Again Someday

- Goldman Goes Goo-Goo For Gold: "Gold Market Poised For A Rally As US Real Rates Head

- The Flip Flop Fed

- How Soon Will We Face Deflation?

- Tyler Cowen Calls, I Think Wrongly, for Deflation

- Irish debt under fire on fresh bank jitters

- Why You Should Buy What Brazil Needs

- Jim?s Mailbox

- Review: Evaluation of Precious Metal Shares in Today Marketplace

- Hourly Action In Gold From Trader Dan

- In The News Today

- The Global Speculator #36

- Daily Dispatch: The Fed Continues the Stimulus

- Why 40% Silver is Usually Best Left to Refiners

- Money, Inflation, Fear, and Industry: The Basis for Capital Gains in Precious Metals

- Naked Shorts as Liquidity Machine

- Credit Easing Goodbye - Quantitative Easing Ahoy!

- Stan Bharti: Hard Assets Heyday

- Bloody Well Right...

- The Great Intervention, Part II

- Gold Treading Water

- The Golden Mean

- Daily Dispatch: Invest in a New Education Trend

- UK Central Bank Loses Credibility... US Prosperity Meme Comes Undone

- The Safest, Best Place to Park Money for the Next Seven Years

- Great Basin Gold – Ready to Break Out From Solid Base

- Things

- Today is a Sad Day For America

- The Fear

- The Dodd-Frank Wall Street Reform and Consumer Protection Act: The Triumph of Crony Capitalism (Part 1)

- Gold Seeker Closing Report: Gold and Silver End Mixed While Stocks and Oil Drop

- Get Ready for the Sack of Rome

- And The Obligatory “Selloff Day” Gold Plunge Is Here

- Gold Breaking Out Verse Euro, Relative Strength Chart Shows Trend Change

| GoldSeek.com Radio Gold Nugget: Gerald Celente & Chris Waltzek Posted: 11 Aug 2010 07:00 PM PDT |

| Rogoff and Reinhart Analysis Has Major Flaw Posted: 11 Aug 2010 06:39 PM PDT Paul Hanly submits: The debt vs GDP analysis by Ken Rogoff and Carmen Reinhart as summarised by Business Insider (here) has a major flaw. What were the growth rates enjoyed as countries increased their debt through each zone and what happens to growth as debt was decreased through each zone? Complete Story » |

| Posted: 11 Aug 2010 06:26 PM PDT Renaissance Capital IPO Research submits: Teva Pharmaceutical Industries Ltd. (TEVA) recently announced the completion of its second major acquisition in a period of two years. The company announced that it has acquired Germany’s second largest generics producer, Ratiopharm, for an enterprise value of €3.625 billion plus accrued interest of €186 million (a total value of approximately $4.95 billion). Complete Story » |

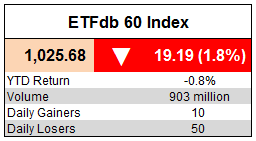

| Wednesday ETF Wrap-Up: VXX Surges, VGK Tumbles Posted: 11 Aug 2010 06:06 PM PDT ETF Database submits: Equity markets fell around the world in Wednesday trading as gloom and doom over the outlook of the global economy resurfaced thanks to the Fed’s new quantitative easing program and weaker than expected trade deficit numbers. While the Fed announced that it was going to reinvest the proceeds from its maturing mortgage-bond portfolios into Treasury Bonds yesterday, news broke this morning that the U.S. trade deficit widened to nearly $50 billion in June thanks to surging imports and slumping exports (which fell by 1.3% on the month). These disappointing reports helped to send equity markets tumbling with the Dow losing close to 2.5%, the S&P 500 falling by 2.8%, and the Nasdaq slumping by over 3%. This also pushed traders into the relative safety of gold and T-bills, which both saw their prices rise. The 10 year T-bill yield fell to below 2.7%.

Complete Story » |

| Posted: 11 Aug 2010 06:04 PM PDT Michael Johnston submits: As investors have grown uneasy over the prospects for global growth and the odds of a double dip recession have seemingly shortened, many safe haven investments have seen sudden uptick in interest. Investors have been snapping up Treasuries and other investment grade bonds as risk appetite has waned, looking to protect themselves against future volatility [see Five Safe Haven ETFs]. This increased demand has also boosted the U.S. dollar since all T-Bonds are denominated in greenbacks, leaving investors to buy dollars if they want to buy the traditional safe-haven. The PowerShares DB USD Index Bullish (UUP), which measures the performance of the dollar against a basket of developed market currencies, gained nearly 2% in Wednesday afternoon trading and is up nearly 4% on the year. The dollar’s gains against the embattled euro have been well documented, and the advances against Britain’s currency have been nearly as significant [also read Forget About Euro ETFs British Pound ETFs Are The Real Danger]. Complete Story » |

| Gold Miner ETFs Fail to Shine Despite Spectacular Earnings Posted: 11 Aug 2010 06:03 PM PDT  Gary Gordon submits: Gary Gordon submits: A wide variety of gold miners served up sparkling Q2 reports during the recent earnings season. Newmont Mining posted a 34% year-over-year sales increase, and promptly raised its dividend. TheStreet.com noted that precious metal miner Goldcorp (GG) increased its net income over 2009’s 2nd quarter by 457%. Meanwhile, Canadian miner Kinross Gold (KGC) posted 25% earnings per share growth. In spite of what many regard as a banner season for precious metals mining, Market Vectors Gold Miners ETF (GDX) has been relatively weak. GDX is down-2.6% whereas non-precious metal commodity companies have offered actual percentage gains to investors. Complete Story » |

| Digesting the Importance of Chinese Gold Investing Posted: 11 Aug 2010 06:02 PM PDT Naturally, I started having pleasant daydreams about being rich, rich, rich after the Chinese government surprised me by announcing that it would finance the buying of foreign gold mines, and ordered their banks to set up big distributed systems for buying and selling gold at the retail and whole levels and all kinds of stuff like that. Wow! |

| Savers Will Rise Again Someday Posted: 11 Aug 2010 06:00 PM PDT We suspected years ago that the day would come when the Fed would have no more room to move. Administered interest rates were bound for zero, and once they got there easing would cease to be an option. Except that we were wrong. Now it turns out the Fed can, and will, ratchet up the desperation meter, already well into the red zone, to new and untold heights... |

| Goldman Goes Goo-Goo For Gold: "Gold Market Poised For A Rally As US Real Rates Head Posted: 11 Aug 2010 05:56 PM PDT |

| Posted: 11 Aug 2010 05:56 PM PDT The Pragmatic Capitalist submits: In a note yesterday David Rosenberg notes the recent flip flop from the Federal Reserve. Just last week things were moving along swimmingly, but yesterday’s FOMC statement implied an economy that was in turmoil and necessary of intervention:

Complete Story » |

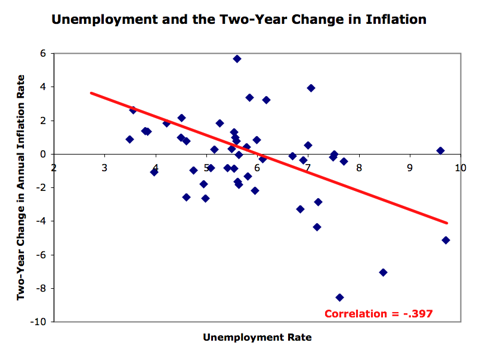

| How Soon Will We Face Deflation? Posted: 11 Aug 2010 05:51 PM PDT Brad DeLong submits: In the post-WWII United States, the rate of inflation has a very clear tendency to fall whenever the unemployment rate rises above 7%: Complete Story » |

| Tyler Cowen Calls, I Think Wrongly, for Deflation Posted: 11 Aug 2010 05:49 PM PDT Brad DeLong submits: Tyler Cowen (Marginal Revolution: What's the actual problem in the labor market?):

Complete Story » |

| Irish debt under fire on fresh bank jitters Posted: 11 Aug 2010 05:36 PM PDT |

| Why You Should Buy What Brazil Needs Posted: 11 Aug 2010 05:36 PM PDT Stefan Zweig pegged it right after all. In the late 1930s, the Austrian playwright and writer sought relief from war-torn Europe and settled in Brazil. He loved it. In 1941, he moved there and wrote his book Brazil: Land of the Future. Brazil, he thought, "was destined to become one of the most important factors in the development of our world." Brazil impressed Zweig with its enormous size — it is bigger than the continental U.S. — and impressive landscapes. He also saw what many saw before him. "Here lies immeasurable wealth of soil that has never been plowed or cultivated," he wrote, "and beneath it are ores, minerals and natural resources that have not in the least been used up nor even extensively explored." And so it remains today. As I say, Zweig was not the first to find charm in these sunny lands. A long line of travelers and adventurers have said much the same thing. But it took a long time to get going, so much so that it became a joke: "Brazil, the land of the future an... |

| Posted: 11 Aug 2010 05:36 PM PDT View the original post at jsmineset.com... August 11, 2010 07:43 AM Follow the Secular Trends While The Headline Dog Chases Its Own Tail CIGA Eric Like a dog chasing its own tail headline commentary tries associate short-term market movements with explanation, connected money repositions into weakness for the September-October advance. The inconsistency of day-to-day explanations creates only confusion. August 10th, Headline: Gold Rises on Speculation Federal Reserve Debt Purchase to Spur Inflation The dollar climbed for a third day against the euro on concern the economic recovery is waning. Bullion typically moves inversely to the greenback. The Federal Reserve yesterday said "the pace of economic recovery is likely to be more modest in the near term than had been anticipated," and reversed plans to exit from aggressive monetary stimulus. August 11th Headline: Gold Falls in London as Stronger Dollar Cuts Investment Demand Gold declined in London as a strengthening dol... |

| Review: Evaluation of Precious Metal Shares in Today Marketplace Posted: 11 Aug 2010 05:36 PM PDT View the original post at jsmineset.com... August 11, 2010 08:45 AM Dear Fellow CIGAs, Perhaps today might be a good time to review Jim’s words of wisdom about precious metals shares while "sitting tight!"as winter arrives for the U.S dollar and the Gold season heats up. CIGA "The Gordon" Evaluation of Precious Metal Shares in Today Marketplace Posted: Oct 21 2009 By: Jim Sinclair Dear CIGAs, I shared the matrix of categories of gold shares with you because if you understand this concept you will understand the thinking strategies of company management that wish to grow as well as the mind of the short that wishes to profit. At lunch today with a professional investor we discussed the use of the gold share matrix. It is the mission of the short seller to push a situation down the six categories of companies to profit. It is the mission of the company intent on significant success to move up the line of six categories to the top most posit... |

| Hourly Action In Gold From Trader Dan Posted: 11 Aug 2010 05:36 PM PDT |

| Posted: 11 Aug 2010 05:36 PM PDT View the original post at jsmineset.com... August 11, 2010 04:20 PM Jim Sinclair’s Commentary When a government plan fails, further government and agency programs will be initiated based on the same game plan. Here we go down that slippery slope of bailing out homeowners without jobs and yesterday’s states without necessary income. This period will consume as much and more than the first bailout of Wall Street – one trillion or more. Gold will trade $1650 and beyond. New Treasury/HUD Program Targets Help For Unemployed Homeowners By: David Dayen Wednesday August 11, 2010 10:15 am The Treasury Department and the Department of Housing and Urban Development have announced a new foreclosure-prevention program, aimed to provide up to $3 billion dollars between the two agencies for targeted aid to unemployed borrowers. The Treasury Department will add $2 billion dollars to their "Hardest Hit" fund, specifically providing assistance to jobless Americans str... |

| Posted: 11 Aug 2010 05:36 PM PDT [COLOR=#FFFFFF][FONT=Arial] Introduction Segment [/COLOR][/FONT] [COLOR=#666666][FONT=Arial] Gold Consolidation in Progress [/COLOR][/FONT] [COLOR=#666666][FONT=Arial] With the gold price consolidation in progress, I hope you are all taking advantage of this lull in the sector to take a break! If we revisit our Gold Wave Analysis chart below, we can see not a lot has happened since the last issue more than 2 months ago. [RIGHT] Please Click Here ... |

| Daily Dispatch: The Fed Continues the Stimulus Posted: 11 Aug 2010 05:36 PM PDT August 11, 2010 | www.CaseyResearch.com The Fed Continues the Stimulus Dear Reader, We’ve got some great stuff from other members of the team, so I’ll be playing more the role of moderator today. Now, without further ado, I’ll turn it over to Casey Research Chief Economist Bud Conrad for his comments on the latest round of stimulus. The Fed Continues the Stimulus By Bud Conrad, Chief Economist The Fed’s announcement yesterday to maintain the target range for the federal funds rate at 0 to ¼ percent was pretty much expected. But buried in the words was a point that affected the markets. Here’s the text. And this is the market-moving point: [LIST] [*]… the Committee will keep constant the Federal Reserve's holdings of securities at their current level by reinvesting principal payments from agency debt and agency mortgage-backed securities in longer-term Treasury securities. The C... |

| Why 40% Silver is Usually Best Left to Refiners Posted: 11 Aug 2010 05:36 PM PDT There are a myriad of investing options for those looking for physical allocations of silver. Among them are silver bars, silver coins, and junk coins. Junk coins, most well known for having 90% silver (pre-1964 dimes, for example), can also have 40% silver content (think old Kennedy Halves and Eisenhower dollars). Purity First Investors should most certainly allocate part of their physical holdings to junk coins because of the miniscule premium dealers usually put on junk coins. 90% silver coins typically sell at a discount to the same amount of silver content in coins. This discount grows even bigger as the percentage of silver by weight drops. 40% silver coins are among the least expensive ways to buy silver, but they are also highly illiquid. They are harder to sell than similar silver content in pure .999 coins or bars or even 90% junk coins. 40% Silver Discount Of the junk silver available on the market, 40% silver is the most discounted, and it is... |

| Money, Inflation, Fear, and Industry: The Basis for Capital Gains in Precious Metals Posted: 11 Aug 2010 05:36 PM PDT There are four major pieces to the ebb and flow of precious metals prices. All of them are as interrelated as much as they aren't, and all of them are equally important in the current prices of any precious metal. Let’s dissect the four pieces and explain the role each plays in today's market price. Money Money can be broken into two subsections. First is the use of silver and gold as money or currency, but since the Swiss Franc broke away from a very small metals standard, you're unlikely to find any major currency around the world that is backed by precious metals. Instead of just plain currency, we'll focus on fiscal policy. Silver and gold enjoy their biggest gains when governments are on a spending binge, whether it is from bailouts, stimulus efforts, or old fashioned deficit spending. When governments opt for austerity, or turning deficits into surpluses, gold and silver fall due to a reduction in inflation (generally) and renewed confidence ... |

| Naked Shorts as Liquidity Machine Posted: 11 Aug 2010 05:36 PM PDT by Jim Willie CB August 11, 2010 home: Golden Jackass website subscribe: Hat Trick Letter Jim Willie CB, editor of the “HAT TRICK LETTER” Use the above link to subscribe to the paid research reports, which include coverage of critically important factors at work during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. The article of July 22nd on "Smoking Guns of USTreasury Monetization" hit more desks, raised more dust, and brought more attention... |

| Credit Easing Goodbye - Quantitative Easing Ahoy! Posted: 11 Aug 2010 05:36 PM PDT Axel Merk, Portfolio Manager, Merk Mutual Funds The Federal Open Market Committee (FOMC) has decided to reinvest the proceeds from maturing securities acquired through its $1.25 trillion mortgage-backed security (MBS) purchase program. The proceeds won't be invested in short-term, but in long-term Treasuries. Federal Reserve (Fed) Chairman Bernanke has long argued that the MBS program constituted credit easing, not quantitative easing. Credit easing, the argument goes, ought to support the functioning and liquidity in the housing market. In various speeches, Bernanke has called the chapter on credit easing closed, a sign that the Fed is engaged on an "exit strategy". We have repeatedly cautioned that merely not buying additional securities is no exit at all, but rather a pause. To be consistent with its public communication, we argued quantitative easing would follow credit easing. Quantitative easing is the purchase of government debt w... |

| Stan Bharti: Hard Assets Heyday Posted: 11 Aug 2010 05:36 PM PDT Source: Karen Roche of The Gold Report 08/11/2010 Is there magic in all those hats that Forbes & Manhattan Founder and CEO Stan Bharti wears? The financier who has seeded, nurtured, supported and guided dozens of junior resource companies to the pinnacle discusses his formula—and a few of his favorites—in this exclusive interview with The Gold Report. With hard assets in favor these days, Stan believes the best you can buy are commodities—they're "real, fundamental. . .something you can touch and feel." The Gold Report: What led you to start Forbes & Manhattan, Stan? Where did you begin? Stan Bharti: I graduated in engineering and had my Master's in Engineering from the University of London. I started my career in Africa, working in Zambia for two years as a young engineer. I came to Canada and worked for Falconbridge for about 15 years. After that I went on my own, setting up an engineering and contracting firm—BLM Inc.—that grew into ... |

| Posted: 11 Aug 2010 05:36 PM PDT Clive Maund I took some stick over the past week for my predictions that the market was about to "come a cropper", in the Message to Wall St and Friday`s Candlestick Warnings articles. So it is gratifying to see markets plunging today, and US markets breaking down from their weakening uptrends to enter what is expected to a be phase of protracted and severe decline. The classic atmosphere of panic is nicely captured in the photos in this Bloomberg article. Fundamentally it was almost inevitable that the markets would turn lower after the latest Fed meeting. They had been rising for a month or so in the hope that the Fed would "pull the rabbit out of the hat" by announcing QE2, not to be confused with the old ocean liner QE2 which stood for Queen Elizabeth 2. QE2 in the financial world stands of course for Quantitative Easing 2. Even if they did announce a full fledged QE2, what would it mean? - it would mean that their bankrupt and desperate policies up to now have not b... |

| The Great Intervention, Part II Posted: 11 Aug 2010 05:36 PM PDT The 5 min. Forecast August 11, 2010 09:11 AM by Addison Wiggin & Ian Mathias [LIST] [*] American workers tap out… U.S. productivity falls for the first time in years [*] Panic at the Fed: FOMC reinstates quantitative easing… what it means for markets, your finances [*] Byron King on the world’s best-known source of energy [*] Government boondoggle No. 1,295,672: Free shipping of free money [*] Plus, readers outraged… what’s our beef with Glenn Beck? [/LIST] Two charts for the history books to start today’s 5… let’s get right to ’em: Worker productivity fell at a 0.9% annual clip from the first quarter this year to the second, the government announced yesterday. That's the first quarterly contraction since the crisis of 2008. Thus, we’ve found an end of an incredible boom for this D-list data point. Companies have been asking more and more out of fewer employees for the last three years, and the t... |

| Posted: 11 Aug 2010 05:36 PM PDT courtesy of DailyFX.com August 11, 2010 06:19 AM 240 Minute Bars Prepared by Jamie Saettele Gold has topped. Please see the latest special report for details. Gold is making its way lower in an impulsive fashion. The short term count has changed slightly. It seems as though the first 5 wave decline ended following a terminal thrust from a triangle. The 3 wave correction may be complete just shy of its 100% extension. I remain bearish gold from here. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Monday evenings), technical analysis of currency crosseson Wednesday and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Posted: 11 Aug 2010 05:36 PM PDT Gold traded basically unchanged in Far East action on Tuesday... despite the fact that the dollar was rising steadily. This lasted until 3:00 p.m. in Hong Kong... and then the selling pressure began. The gold price hit bottom [around $1,190 spot] starting just before 8:00 a.m. in New York... and moments before the Comex opened. The price bounced along between $1,190 and $1,194 spot for over an hour and a half, before rising back towards unchanged. But, once the FOMC made their announcement, gold spiked up $10... and managed to finish in positive territory. My guess is that spike was short covering. Gold's high of the day was reported at $1,208.80 spot. Silver, as usual, got hit harder than gold. Silver's sell-off also began at 3:00 a.m. Eastern time... with the low [$17.96 spot] coming at 8:40 a.m. in New York. This price was well below its 50-day moving average... and a lot of the technical funds [plus others] that had recently put on levera... |

| Daily Dispatch: Invest in a New Education Trend Posted: 11 Aug 2010 05:36 PM PDT August 10, 2010 | www.CaseyResearch.com Invest in a New Education Trend Dear Reader, Today’s dispatch will probably be shorter than usual, since I spent most of the morning doing the research and calculations for the table below. The subject of today’s issue is education and an important trend in education that’s been taking root over the past few years. Traditional university degrees have become prohibitively expensive today. Even if students get a loan to pay for school, they find themselves up to their eyeballs in debt when they graduate – with no chance of paying off the loan for decades, in some cases (if at all). So students yearning to learn valuable skills for the marketplace have turned to the for-profit private sector in droves to help solve their problem. Recognizing that this trend toward online and for-profit education will likely accelerate in years to come, I decided to take a look ... |

| UK Central Bank Loses Credibility... US Prosperity Meme Comes Undone Posted: 11 Aug 2010 05:36 PM PDT UK Central Bank Loses Credibility Wednesday, August 11, 2010 – by Staff Report Mervyn King Bank of England's inflation excuses begin to wear thin ... Mervyn King (left), Governor of the Bank of England, will on Wednesday morning hold up his hand and admit he got the UK economy wrong. Britain's central banker-in-chief may not put it quite like that, but the message from Wednesday's August inflation report will be loud and clear. Inflation next year will be substantially higher than forecast just three months ago, and growth will be notably slower. The Bank will have an excuse: George Osborne's decision in the June emergency Budget to increase VAT from 17.5% to 20%will push inflation higher in 2011. But the Bank's excuses are beginning to wear as thin as the "dog ate my homework" has in the classroom. – UK Telegraph Dominant Social Theme: What's wrong with Mervyn? Time for a different King? Free-Market Analysis: The power elite insists on its ... |

| The Safest, Best Place to Park Money for the Next Seven Years Posted: 11 Aug 2010 05:36 PM PDT By Dr. Steve Sjuggerud Wednesday, August 11, 2010 Jeremy Grantham predicted the peak in stocks in 2000 and the bottom in March 2009. Nobody on the planet called it better. Today, Jeremy Grantham's prediction is for DEFLATION. He's "throwing in the towel" on inflation. And he recently explained what will make you the most money over the next seven years. Grantham comes across as grumpy. And his writing is cumbersome to trudge through. But he's an original thinker… Original thinkers are hard to come by (particularly on Wall Street!). And the guy was RIGHT… He called the biggest top and the biggest bottom in stocks in recent memory. In the latest letter to customers of his Boston-based investment management business, Grantham described the deflation situation and how you should invest: I, like many, was mesmerized by the potential [for inflation,] for money supply to increase dramatically, given the floods of government debt used in the bailout… ... |

| Great Basin Gold – Ready to Break Out From Solid Base Posted: 11 Aug 2010 05:36 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! August 11, 2010 05:13 AM GBG-NYSE $1.81 has been in a multi-year base-building period that appears ready to be broken to the upside. Corporate news continues to improve. A close above the 200-Day M.A. around $2.10 would be very bullish. [url]http://www.grandich.com/[/url] grandich.com... |

| Posted: 11 Aug 2010 05:36 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! August 11, 2010 05:25 AM [LIST] [*]Worthy technical comments [*]The jobless in the jobs news [*]Gold – the best months are just ahead [*]Oh my God Charlie – just go already [/LIST] [url]http://www.grandich.com/[/url] grandich.com... |

| Today is a Sad Day For America Posted: 11 Aug 2010 04:45 PM PDT Today is a sad day for America. Last night, Peter Schiff lost the Republican primary for U.S. Senate in the State of Connecticut. Linda McMahon was the winner of the primary with 49% of the vote compared to Rob Simmons at 28% and Peter Schiff at 23%. Peter Schiff received 53% more votes than what the latest Quinnipiac poll had indicated, which showed his support at only 15%. NIA believes that Peter Schiff understands the upcoming hyperinflationary crisis better than any other candidate who was running for office this year nationwide. He was perhaps our nation's last and only hope to prevent U.S. hyperinflation. It won't take long for the true nature of our country's dollar bubble to become apparent to all and when this time comes, Americans will sadly regret not electing Peter Schiff to the U.S. Senate. America's tea party movement started out as a libertarian movement but it has recently been hijacked by FOX News and others in the mainstream media. On June 21st, thousands of NIA members wrote to FOX News asking for Glenn Beck, Sean Hannity, and Bill O'Reilly to feature Peter Schiff on their respective shows. All three of them decided to completely ignore Peter Schiff's senate campaign, despite the fact that Peter Schiff's credentials are stronger than any of the tea party candidates they are supporting. Glenn Beck previously had Peter Schiff as a guest on his show on several occasions and obviously knew he was running for senate. It appears as though Glenn Beck wants to have Peter Schiff on only when it is supporting his agenda. Glenn Beck doesn't care about helping the public become educated about a true libertarian candidate who would actually make a difference in Washington. Glenn Beck is not our friend. This is not the first time he has showed his true colors. Back when Ron Paul was running for President, Ron Paul raised a record $4.3 million in a single day "money bomb" all from grassroots supporters. Rather than praising Ron Paul and his supporters for their tremendous accomplishment, Glenn Beck questioned the use of the word "bomb" in "money bomb" and said that Americans who were supporting the "Ron Paul Revolution" were taking the word "revolution" way too seriously. Glenn Beck even said that he feared the U.S. military would one day need to be used domestically against Ron Paul donors. More Here.. |

| Posted: 11 Aug 2010 04:37 PM PDT And just like that "the fear" is back. "The fear" is that the lazy month of August in the Northern Hemisphere might be good for your tan, but it's not going to do anything for you have a lot of money to repay and no way to repay. That goes for sovereign debtors in Europe and homeowners in America alike. Dawes called it. Dawes, as some of his readers refer to Slipstream Trader Murray Dawes(in the way that rock aficionados refer to "Prince" as "Prince" and pop aficionados refer to "Gaga" as "Gaga") sent out two alerts yesterday that amounted to single-stock plays on a falling market. He did the same thing, amazingly, on April 15th - the very day the ASX made its intra-day and closing high for the year. Dawes, like all traders, is a bit weird. We have to confess the traders are a different breed. It's like they speak the same language but use an entirely different vocabulary. Part of that vocabulary is technical. In the case of Dawes, it's understanding the concept of the widening distribution and the point of control - the formations which explained and, to a less clear extend, predict future price action. But as for present price action, it isn't good. The S&P 500 lost nearly three percent overnight. The Dow Jones Industrials shed 2.5%. Even oil was down 2.8% to $78.02 on the futures market. The yield on two-year U.S. notes fell to a new record low of 0.4892 (safety?!), and good old gold held the line at $1,200. What about the dollar index? Earlier in the week we had a technical look at it and wondered where it was headed and what impact that would have on commodity prices. Dawes chimed in and wrote, "It is far too dangerous to try and short the US Dollar index here while it is so oversold and so close to very major support. The smarter play is to be patient and wait for a reversal signal in this 78-81 area and then ride the short squeeze." Squeeze, anyone? The Euro fell 2.3% against the U.S. dollar overnight. Dawes wrote in again this morning with this: "The US Dollar index had a massive rally last night and looks like it has put in the intermediate low I was calling for between 78-81. It also closed above the 200 day moving average. The equity market also fell over as expected and looks to have made an intermediate top. The squeeze is on in the US Dollar." Dollar higher and stocks lower is roughly the trade you'd expect as investors crowd into-short term bonds and get out of stocks. But why are investors just know deciding that earnings prospects for stocks are not good? It could have a lot to do with Federal Reserve's bearish announcement and its intention to start buying Treasuries again to "support growth." We suspect that many investors are starting to realise what we've been saying all along: these guys at the Fed have no freakin' clue what they're doing. And they're only making it worse. Mind you they have plenty of help from the U.S. government. It ran a $165 billion deficit in the month of July. Despite that, the Obama administration managed to find $3 billion lying around to distribute to people who can't pay their mortgage. America. Is it going to be a failed State sooner than most imagine? Disappointing profits from Telstra and Qantas probably didn't help Aussie stocks at the open. Nor did the news that China's industrial production expanded at the weakest pace 11 months last month. Chinese retail sales grew 17.9% in July, which was slightly lower than the previous month's rate. All in all it was quite a bit of synchronised wretchedness in an interconnected financial world. But what would you expect? The global reflation beginning in 2003 was transnational and crossed all asset classes. With slower credit growth, and with people on the front lines of the economy dialling back debt and spending, the tide is going out. This creates a highly volatile political situation. Politicians insist on growth at all costs, whether they are broke or not. Unemployed voters are not happy voters. But this political element to monetary and fiscal policy - indeed to social cohesiveness - is dangerous. More on this tomorrow. Dan Denning |

| Posted: 11 Aug 2010 04:13 PM PDT From The Daily Capitalist Part 1 The new financial overhaul bill is the greatest government takeover of the financial sector of the economy since the National Recovery Act of 1933 when Franklin Roosevelt attempted to introduce central planning in America. More than just a new law, the Dodd-Frank “Wall Street Reform and Consumer Protection Act” (the "Act") gives government a relatively free hand to set prices and wages, to make business decisions, to promote or eliminate businesses, and to break up businesses. It establishes a large new bureaucracy to enable the government to dictate its wishes to the industry. A major law firm described the Act as follows:

The Act isn’t directed just at the financial sector; because of its vast scope, it is directed against everyone. Startling as it may seem, the Act does nothing significant to prevent the real causes of this or any future boom-bust cycle. At best one may analogize this as the doctor breaking the thermometer to cure a fevered patient. At worst it is a massive federal power grab which will inhibit financial innovation, increase the cost of money, and open wide the gates to a favored few where politicians, politics, and lobbyists, rather than markets, determine the direction of the financial sector of America’s economy. While the new law has been signed by the President, it has not yet been written. That task will be the job of federal mandarins, the career lawyers and economists inside and outside of government who live off of government regulation. As such the ultimate consequences of this Act are unknown and will not be fully known until years later after the regulations have been written, agencies are established, and power is distributed among the bureaucrats. In other words, the Act’s advocates have no idea how the new law will impact the economy. The ‘Failure of Capitalism’ The Act assumes that the economic bust was caused by a failure of capitalism and a failure of government to properly regulate the economy. Upon signing the Act, President Obama said:

The President and most politicians, Republicans and Democrats, blame the crisis on capitalism itself, and, rather incredibly, on what they view as unregulated “laissez-faire” capitalism. They ignore the fact that the financial industry is one of the most regulated sectors of our economy. When they say “laissez-faire” what they really mean is that they want to completely control the financial sector. The President views Wall Street and free enterprise with disdain, repulsed by what he sees as just the latest failure of capitalism and the “old ways and failed policies of yesterday.” He believes, as the benevolent legislator-in-chief, he must step in and protect us from evil predations of Wall Street like a shepherd guarding his flock: only the guiding hand of government can make capitalism safe for society. The President, like most politicians, lawyers, and economists, believes that the economic bust was caused by greed, excessive compensation, fraud, speculation, complex securities that no one understood, predatory Wall Street practices, and a lack of sufficient regulatory powers. These factors, they say, allowed financial institutions to take unnecessary risks which jeopardized the world’s financial system and almost brought it down. The problem is that their beliefs are wrong and they make up data to fit their beliefs. Their conventional wisdom fails to satisfactorily explain the actual underlying causes of this boom-bust cycle and the new law will do nothing to prevent another cycle. The factors they blame for the crash always exist in financial markets, and yet, for reasons they do not explain, actors on the financial stage suddenly explode into an orgy of greed directed at the housing market. There are two questions you should consider while evaluating the Act’s impact and scope that help explain this boom-bust cycle:

I would answer these questions by saying:

Everything stems from these two factors yet there is nothing in the Act that prevents the Fed from starting a new cycle or that prevents Fannie or Freddie from again distorting the economics of the housing market. The purpose of this article is not to go into the ultimate causes of the bust as I have discussed them at length in other articles, but these factors highlight the foundational fallacies of the Act. The Act’s Timing This chart gives a good picture of the timing for implementing the Act: This process is described as follows:

Law firm Davis Polk Wardwell calculated the number of agencies involved in the rule making process. In the below chart, the “Bureau” is the Bureau of Consumer Financial Protection, the “Council” is the Financial Stability Oversight Council, and the “OFR” is the Office of Financial Research: Here is the reality: it will take many more years to write and implement the regulations which really define the Act. It may be that some of these regulations will never be written, something that is not unheard of in Washington. The Act will be a siren call to lobbyists, lawyers, accountants, and economists. Regime Uncertainty and Perfect Wisdom The initial impact of any new and unwritten law is uncertainty, and uncertainty is what business abhors. “Regime uncertainty,” a concept developed by economist Robert Higgs, says that such legislation causes businesses to pause expansion until they know how the law will affect them. This is apparently already happening:

Yet Treasury Secretary Timothy Geithner believes they can regulate us with perfect wisdom:

Mr. Geithner believes in the “just right” Goldilocks philosophy of regulation. I question that any central planner would have the wisdom to supplant the decisions of millions of economic actors without negative consequences. One might say this is a form of arrogance associated with (almost) absolute power.???? ‘Some Provisions of the Act Are Good’ When we evaluate the Act it would be a mistake to look at its individual parts rather than its whole. To look at one provision and say, “well that sounds reasonable” is a form of political diversion that only serves to obscure the fact that the thousands of provisions in this Act taken together vastly enlarge the power of the federal government and reduce individual freedom. That cannot be good. I will say that some of the provisions, in light of the Wall Street-Washington Financial Complex’s system of crony capitalism, may actually reduce some risk that we taxpayers will eventually have to pay for. But that ignores the power and influence of Wall Street and its friends within government to influence rule-making to suit their needs (“regulatory capture”). This revolving door between Washington and Wall Street allows people attracted to power and who are skeptical of the ideals of a free market, to dominate economic policy for their benefit. One way to say this is that it creates a partnership between the financial sector of the economy and the government (which is the controlling partner in this relationship). In the 1930s this type of political system was greatly admired in Washington. Today this system has evolved into “crony capitalism,” an oligarchic structure maintained by the Wall Street-Washington Financial Complex to perpetuate itself. Tomorrow Part 2 of 4: descriptions of the Act's provisions revealing the vast scope of this new law. |

| Gold Seeker Closing Report: Gold and Silver End Mixed While Stocks and Oil Drop Posted: 11 Aug 2010 04:00 PM PDT Gold erased all of yesterday's post-fed after hours gains and fell to just below yesterday's close at as low as $1195.40 in London before it rose over 1% to as high as $1207.75 by about 9AM EST in New York and then fell back off for most of the rest of trade to as low as $1192.40 by late morning, but it then bounced back higher in afternoon trade and ended with a gain of 0.16%. Silver fell throughout most of trade in Asia, London, and New York and ended near its late morning low of $17.79 with a loss of 1.32%. |

| Get Ready for the Sack of Rome Posted: 11 Aug 2010 03:24 PM PDT I traded the great Japanese bull market during the eighties at Morgan Stanley, from the very bottom all the way up to the peak. The firm’s fundamental analysts railed against the tide for years, claiming that stocks were liquidity driven, overvalued, and headed for a huge fall. Every time they made that call, their offices got moved ever closer to the elevator, and eventually, the men’s bathroom. When the turn finally came, I had already taken off on an extended vacation, and the ignored analysts had moved on to hedge funds, where they proceeded to make vast fortunes. When someone at last threw the switch on Japan, it got dark amazingly fast. Tokyo went out at an all time high of ¥39,000 on the last day of 1989, and then dropped a staggering 45% in January. Yesterday’s close, 21 years later, was ¥9,489. These days, I feel like those Japanese analysts, except the market that is driving me nuts is the one for US Treasury bonds (TBT), (TMV) . The more arguments I find that they should fall, the faster they go up (see charts below). I probably would have fired myself my now, if I weren’t my own boss, as nepotism is always a powerful force. Now I hear that PIMCO’s Mohamed E-Erian says that there is a 25% chance of real deflation hitting the US, after telling us it won’t for so long. Again, this reminds me of Japan, where the higher it went, the more imaginative the explanations became as to why it should continue. Ignore those 100 PE multiples, just focus on the damn Q-Ratios! I believe that we are witnessing the final blow off top in the great 30 bull market in bonds. A decade from now, it will not be stock investors complaining about a lost decade, but owners of bonds. Could it go on for another six months or a year? Sure. Like gold in 1979, technology stocks in 2000, the absolute tops of these parabolic moves are impossible to predict, both on a time and price basis. But when the turn comes, it will resemble the Sack of Rome. To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last two years of research reports available for free. You can also listen to me on Hedge Fund Radio by going to the "Hedge Fund Radio Archives". |

| And The Obligatory “Selloff Day” Gold Plunge Is Here Posted: 11 Aug 2010 03:10 PM PDT by Tyler Durden Just when you thought gold could go through at least one major selloff day without some remarkable fireworks, here comes a perfectly natural $10 selloff in the span of under a minute, because that is precisely how a quantized and "deep" order book looks like. Just how related this [...] |

| Gold Breaking Out Verse Euro, Relative Strength Chart Shows Trend Change Posted: 11 Aug 2010 03:04 PM PDT The trade deficit widened unexpectedly this month after the dollar reached extremely oversold levels, which was quite surprising to Wall Street. Usually, a weaker dollar should lead to an increase of exports of U.S. goods; however, the exact opposite occurred. This further signifies the global economic slow down despite record government stimulus, a devalued dollar and artificially induced low interest rates. The market and the employment situation are no better off now than they were previously. Despite Washington's attempts to prevent a depression through spending, investors are beginning to lose hope in what the Fed and Congress are doing to prevent a collapse of the markets into new lows. Yesterday, as predicted, the House created a $26 billion job bill that will supposedly prevent government layoffs and expand the job market for government workers. Washington is trying to alleviate high unemployment by creating more government jobs. That is not real job creation. Incidentally, the previous employment numbers were mildly inflated due to the recent influx of temporary Census workers and did not accurately reflect the true numbers of unemployed Americans. Investors believe that sustainable job creation is through small business growth. The markets, as well as the American people are looking for leaders who will cut government spending and institute tax cuts for small business owners. Entrepreneurs who are trying to innovate and meet consumers' demands in a struggling economy should be supported with meaningful tax breaks. This spurs authentic growth and innovation. I expect the market and the American People to vote in candidates who are committed to these principles. The people are losing their faith in the current leadership, as evidenced by President Obama's approval ratings dropping to their lowest point in his entire tenure. The Fed has committed to buying long term treasuries, which would artificially keep interest rates low. They are desperate to get capital flowing again, but it comes at a cost. Eventually, markets move back to their former equilibrium and long term trends. If you push down a spring as far as it goes, it eventually snaps back harder than before and reverberates. We may not see it for a while, but eventually long term treasuries will crash. Right now investors are flocking to treasuries for security and safety. However, just as the market is losing faith in the Fed's handle on the economic situation, bond holders will ultimately lose faith in government bonds. We may see a drop in treasury prices along with continued high interest rates over the next several years and possibly even decades as our children and grandchildren face the burden of credit downgrades. My fear of a devalued currency and lack of confidence in Obama's handling of the economic situation are the reasons I am bullish on specific mining exploration stocks that are converting their strong cash positions into high grade copper, silver and gold resources. I have been following this sector for over nine years. I gather that during the next five to ten years, precious metals will see a lot of growth as investors seek hard money and hard assets. Today's major collapse in the equity market was significant. Last week, I mentioned that the dollar was extremely oversold and that the Euro and U.S. equities were about to correct considerably. Today we are seeing the beginning of a new downwards trend in global equities and a flight to safety. Investors are worried that efforts from Washington will do nothing to prevent a slowing economy and a huge trade deficit. Yesterday's weakness in gold was only relative to the dollar and U.S. treasuries. Compared with the Euro, there are technical signs of a major move upward in the price of gold. We could see a resumption of the market patterns that we saw in April and May when gold and the dollar rallied together as investors were seeking shelter from government defaults and sovereign debt crises. The relative strength trend of gold versus the Euro is an important indicator of the true price action of gold. Right now, it is showing signs of a bullish move higher after finding long-term support. Although Gold was down slightly to the dollar it gapped up today versus the Euro after reaching an important 38.2% Fibbonaci Retracement and Long Term Trend Support. MACD supports that Momentum has shifted. RSI Crossed 50 today also a bullish sign. Disclosure: Long Gold and Silver Mining Stocks |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The

The

No comments:

Post a Comment