Gold World News Flash |

- The Cycle of Violence in Afghanistan

- Jim?s Mailbox

- The Real Reason for Bank of England's Worthless CPI Inflation Forecasts

- Crude Oil Prices Fall Below $80 Again as Officials Anticipate Slower Growth

- Daily Dispatch: he Best Gold Interview of 2010

- Fooled By Stimulus

- New Report Trashes Precious Metal ETFs

- Metals ‘KISS’ Analysis – (Keep It Simple... Umm Silly)

- No Exit - Stage Left or Right

- Several Opportunites for Gold Investors

- Gold Reaches Nearing Resistance

- We Got A Little Problem Here (Europe)

- Crude Oil Falls on Growth Concerns, Gold Regains Safe Haven Status

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week

- Guest Post: Florida – Much Worse Problems Than the Oil Spill

- Are Gold Bugs = Apple Borg Collective?

- So Much for the Exit Strategy

- Gold in a Bull Market, Stocks in a Bear Market

- Death Cross Confirmed, Gold and Silver a Sure Bet During Crisis

- The Trade Deficit Nightmare

- Longer Term Gold Remains on Track for Higher Prices

- Can We Avoid Another Lost Decade?

- Santelli Goes Off, And Luxury Condos Now Get FHA Backing

- RadioShack: Earnings Scorecard

- Charting Next Week's Bearish Action: Goldman Warns Of A "Meaningful Decline" In Stocks

- FRIDAY Market Excerpts

- Jim's Mailbox

- Implied Correlation Closes At All Time Record High

- Inflation Remains in Check

- Monopoly Money and the International Banking Cartel

- Geithner’s Delusional Recovery

- Is Vanguard Blogger John Ameriks Right That 'It's Too Late for Gold'?

- Inflation Scorecard: Gold Widens Its Edge Over European Currencies

- Is the Ireland ETF in Trouble?

- US Bureau of Economic Analysis: Gov’t Pay is About Twice Private Sector

- SP 500 and Nasdaq 100 September Futures; Gold Daily Chart at Week's End

- Dead Fish Are Washing Up Everywhere . . . Is It Due to BP Oil Spill and Dispersants?

| The Cycle of Violence in Afghanistan Posted: 13 Aug 2010 07:06 PM PDT Last week the National Bureau of Economic Research published a report on the effect of civilian casualties in Afghanistan and Iraq that confirmed what critics of our foreign policy have been saying for years: the killing of civilians, although unintentional, angers other civilians and prompts them to seek revenge. This should be self-evident. The Central Intelligence Agency has long acknowledged and analyzed the concept of blowback in our foreign policy. It still amazes me that so many think that attacks against our soldiers occupying hostile foreign lands are motivated by hatred toward our system of government at home or by the religion of the attackers. In fact, most of the anger towards us is rooted in reactions towards seeing their mothers, fathers, sisters, brothers and other loved ones being killed by a foreign army. No matter our intentions, the violence of our militarism in foreign lands causes those residents to seek revenge if innocents are kill... | ||||

| Posted: 13 Aug 2010 07:06 PM PDT View the original post at jsmineset.com... August 13, 2010 01:41 PM Jim Sinclair's Commentary A for payment subscription service that is, in my opinion, a must have. JOHN WILLIAMS’ SHADOW GOVERNMENT STATISTICS SPECIAL NOTICE — August 13, 2010 Retail Sales Hint at Third-Quarter GDP Contraction BRIEF OBSERVATIONS ON TODAY’S DATA. As noted below, posting of the full Commentary planned for today has been pushed into this weekend. Nonetheless, here are a couple of observations on this morning’s CPI and retail sales reporting, which respectively were slightly stronger and weaker than consensus estimates. July’s rebounding seasonally-adjusted month-to-month 0.31% CPI-U inflation (versus down 0.14% in June) and July’s unadjusted year-to-year 1.24% gain (versus 1.05% in June), partially reflected a swing in seasonal factors that now will be boosting adjusted gasoline prices for several months. The SGS alternative estimates f... | ||||

| The Real Reason for Bank of England's Worthless CPI Inflation Forecasts Posted: 13 Aug 2010 07:06 PM PDT The Bank of England released their latest quarterly inflation report this week that again sought to revise the forecast for UK inflation to converge towards 2% in 2 years time. However one major change accompanying the forecast was that the mantra of UK inflation being above the 2% target and the 3% upper limit as only temporary has now been dropped, this after repeatedly claiming month in month out for the past 7 months that Inflation would magically fall that the academic economists and mainstream press had swallowed up until quite recently. Bank of England's August Inflation Report Highlights The most recent August 2010 Bank of England Inflation report concluded in the following trend forecasts for UK inflation and economy. Chart 1 shows the Committee’s best collective judgement for four-quarter GDP growth, assuming that Bank Rate follows a path implied by market interest rates and the stock of purchased assets financed by the issuance... | ||||

| Crude Oil Prices Fall Below $80 Again as Officials Anticipate Slower Growth Posted: 13 Aug 2010 07:06 PM PDT Oil Market Summary for 08/09/2010 to 08/13/2010 Crude oil prices slumped below $80 a barrel again this week as the Federal Reserve and other official forecasters took a dimmer view of the economic recovery. Friday's closing price for the benchmark West Texas Intermediate futures contract of $75.39 a barrel marked a retreat from the contract's short-lived foray outside the $70 to $80 a barrel range it has been trapped in for months. Prices fell nearly 7% from last Friday's close of $80.70 a barrel. The Federal Open Market Committee, the policy-making body for the Fed, said Tuesday it will keep interest rates low for "an extended period" amid signs that the recovery is slowing. Citing recent economic data as evidence, the FOMC concluded that "the pace of economic recovery is likely to be more modest in the near term than had been anticipated." Worries about the recovery and the possibility of a double-dip recession hit equities and commodities markets a... | ||||

| Daily Dispatch: he Best Gold Interview of 2010 Posted: 13 Aug 2010 07:06 PM PDT August 13, 2010 | www.CaseyResearch.com The Best Gold Interview of 2010 Dear Reader, We have something a little different but very special for you today. Jeff Clark, senior editor of our Casey’s Gold & Resource Report, recently sat down with an industry insider to talk about the gold and silver supply. The insight gleaned is something every investor should know – even if you’re not currently positioned in precious metals. Here’s the interview in its entirety. The Best Gold Interview of 2010 Jeff Clark, Casey's Gold & Resource Report Much of what passes for “insider” information these days is often conspiracy-edged or largely conjecture. True inside information is actually hard to come by. So what follows is the refreshingly candid and uncut version of my talk with a first-hand participant in the murky and little-understood world of g... | ||||

| Posted: 13 Aug 2010 07:06 PM PDT By Eric Sprott & David Franklin Despite our firm’s history of investing primarily in equities, we’ve spent much of this past year writing about the government debt market. We’ve chosen to focus on government debt because we fear its impact on the equity markets as a whole. Government debt is an intrinsically important part of the financial landscape. It is the bellwether by which we measure risk, and we believe we have entered a new era where traditional "risk-free" assets are undergoing a tremendous shift in quality. In studying the government debt market, we have inadvertently been led to question the economic theory that most fervently justified recent government spending programs: that of Keynesian economics. The so called "beautiful theory" of Keynesian economics is arguably the most influential economic theory of the 20th Centur... | ||||

| New Report Trashes Precious Metal ETFs Posted: 13 Aug 2010 07:06 PM PDT The gold price did nothing in Far East trading on Thursday... and not much happened at the London open or the London a.m. gold fix, either. But, for the second day in a row, the gold price began moving higher at precisely 11:00 a.m. in London... which is 6:00 a.m. in New York. Then, just like Wednesday, the gold price took off to the upside moments after the Comex opened for business and... just like Wednesday, the gold price spiked higher until 8:40 a.m. Eastern time. From there, it basically flat-lined for the rest of the Thursday trading session. Gold's low was moments after trading began in the Far East on Thursday morning... around $1,197 spot... and the high was in New York $1,216.70 spot. Volume was huge. Silver's path was slightly different, as its price bounced off its low [around $17.85 spot] several times during late Hong Kong and early London trading. Then, at 10:00 a.m. in London [5:00 a.m. in New York] silver began a slow-but-steady... | ||||

| Metals ‘KISS’ Analysis – (Keep It Simple... Umm Silly) Posted: 13 Aug 2010 07:06 PM PDT August 13, 2010 It is interesting to note just how complex investment advisors and investors can make their market analysis. When it comes to analyzing the markets we do enjoy “chewing” on a lot of data, but often good old fashioned simplicity and common sense are the most effective strategy. We don’t believe in an indefinite ‘buy and hold’ strategy nor do we concern ourselves with daily short term movements. We are interested in two main objectives: [*]Catching Macro Bull Market moves such as the 1970’s commodities bull, the stocks bull move from 1980 to 2000 and also the current 2000’s commodities bull. [*]We also strive to identify “intermediate term trends” in order to help us determine when to add to new positions or lighten up on existing holdings within the bull market. When we look back at the Silver bull market, since 2001 we can see very distinct periods of price consolidation followed by trend... | ||||

| Posted: 13 Aug 2010 07:06 PM PDT [FONT=Arial,Helvetica,sans-serif][COLOR=#000000][FONT=Arial]Peter Schiff, president of Euro Pacific Capital and author of the new best-selling economic fable, How an Economy Grows and Why It Crashes. [/COLOR][/FONT] This week, national attention was fixated on JetBlue flight attendant Steven Slater, whose bold, creative, and controversial exit strategy could revitalize his future prospects. Not nearly as noticed was the Federal Reserve's decision on Tuesday to avoid finding an exit strategy for its own never-ending career trap. Unfortunately, the Fed's choices affect our lives much more than Slater's. Just a few weeks ago, pundits were asking how Ben Bernanke would shrink the Fed's bloated post-crisis balance sheet. But in its August 10th decision, the Fed signaled that it would "recycle" its debt holdings; in other words, there would be no exit strategy for the foreseeable future. Given the fact that monetary stimulus will not only fail to spark a genuine recov... | ||||

| Several Opportunites for Gold Investors Posted: 13 Aug 2010 07:06 PM PDT The 5 min. Forecast August 13, 2010 09:48 AM by Addison Wiggin & Ian Mathias [LIST] [*] ’Tis the season, Part 1: Frank Holmes on why gold is poised to take off any day now [*] ’Tis the season, Part 2: Why stocks are due for a pummeling after Labor Day [*] The commercial real estate shakedown of 2010… Jim Nelson on a scheme stinking up Capitol Hill [*] “Way off the realities”…. Reader in China takes issue with Chris Mayer’s China thesis [/LIST] Steady as she goes. Gold is sitting tight at $1,212 this morning. It popped up from $1,200 yesterday the moment that first-time jobless claims numbers came out… and hot money fled for safety. So what’s the outlook from here? “If history is any guide,” says U.S. Global Investors chief and Vancouver favorite Frank Holmes, “gold is about to get even more attractive because we are heading into the fall and winter g... | ||||

| Gold Reaches Nearing Resistance Posted: 13 Aug 2010 07:06 PM PDT courtesy of DailyFX.com August 13, 2010 06:13 AM 240 Minute Bars Prepared by Jamie Saettele Gold has topped. Please see the latest special report for details. Gold is making its way lower in an impulsive fashion. The short term count has changed slightly. It seems as though the first 5 wave decline ended following a terminal thrust from a triangle. I do expect this rally from the low to prove corrective. 1220/30 is resistance.... | ||||

| We Got A Little Problem Here (Europe) Posted: 13 Aug 2010 07:06 PM PDT Market Ticker - Karl Denninger View original article August 13, 2010 06:37 AM Not quite sure what it is, but this is not good. There's no news on the wire that I can find that accounts for that move, but it is coming toward the end of the European session into a weekend. One has to wonder if the "euphoric" response to the so-called (bogus) "stress tests" is wearing off, whether the creeping-higher CDS spreads on European nations have finally woken people up, or whether, just perhaps, there's a nasty little - or not-so-little - surprise that is going to be served up on someone over the weekend. Right now, as I write this, our markets look reasonably stable. But FX moves like this, when there is no news story on the wire, are rarely "no big deal" - instead, they typically indicate that something is going on and you're just not privvy to what it is - yet. Extreme caution advised.... | ||||

| Crude Oil Falls on Growth Concerns, Gold Regains Safe Haven Status Posted: 13 Aug 2010 07:05 PM PDT courtesy of DailyFX.com August 12, 2010 11:00 PM Crude oil has lost 7% over the last three days as concerns regarding the U.S. economy reemerge. Gold has broken free of its downtrend and regained its safe haven status in the process. Commodities – Energy Crude Oil Falls on Growth Concerns Crude Oil (WTI) $76.31 // +$0.57 // +0.75% Commentary: Crude oil fell notably for the third day in a row, shedding $2.29, or 2.92%. Over the last three sessions, the commodity has lost $5.74, or 7%. Weak economic data, especially out of the U.S., has challenged the optimism that was developing in financial markets. Whether the recent sell-off is merely a correction of the significant rally off the May and June bottoms or the start of a new down leg remains to be seen, and will be dependent on the course of the economic data going forward. Without a doubt, financial markets have priced in a lot of bad news, but a double dip recession would likely send equities and cr... | ||||

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week Posted: 13 Aug 2010 04:00 PM PDT Gold saw a slight gain in Asia at $1217.40 before it fell back off in London to as low as $1210.97 by about 11AM EST in New York, but it then rallied back higher in the last couple of hours of trade and ended with a loss of just 0.02%. Silver climbed almost 1% to $18.18 before it fell to $17.947 at about 9AM EST, but it then bounced back higher and ended with a gain of 0.28%. | ||||

| Guest Post: Florida – Much Worse Problems Than the Oil Spill Posted: 13 Aug 2010 02:11 PM PDT Submitted by Doug Hornig of The Casey Report Florida – Much Worse Problems Than the Oil Spill Media coverage of the oil spill’s effect on the Gulf focusing on tourist income lost by the waterfront towns – with footage of empty beaches, restaurants and T-shirt shops – dominates the news. Interviews with devastated business owners are heart rending. But they always end with references to somehow hanging on until “things get back to normal.”

| ||||

| Are Gold Bugs = Apple Borg Collective? Posted: 13 Aug 2010 02:03 PM PDT Several weeks ago, a spoof xtranormal cartoon went viral, in which the purchasing sequence of an iPhone (as compared to an HTC Evo) was hyperbolized, and which ruthlessly mocked the brainwashing practices of the Apple Borg collective. It was only a matter of time, before the brain trust behind the lampoon decided to focus its attention on the next group that has been ridiculed since time immemorial: the long-suffering gold bugs. Sure enough, the sequel is now out, and the process of purchasing an iPhone is now downright boring compared to the purported thought process behind buying gold. Of course, the cartoon is quite hilarious, but for all the wrong reasons, as in trying to mock those who believe that on a short/medium enough timeline, the survival rate for paper drops to zero, the video, which is sure to go just as viral, in fact proves all the concerns not just of the faceless "goldbug" collective, but of all those others who believe gold is headed much, much higher, which also includes the richest and most prominent money managers, financiers, and politicians in the world. And so, for your viewing pleasure, we present the cartoon and pose the question; is gold nothing more or less than the functional equivalent of the next Steve Jobs inspired fad...(luckily, the hybridization of the two concepts in the form of the iGold seems sufficiently remote to not have to consider the horrific prospects of aurum-aural fusion).

h/t John

| ||||

| Posted: 13 Aug 2010 02:02 PM PDT | ||||

| Gold in a Bull Market, Stocks in a Bear Market Posted: 13 Aug 2010 01:30 PM PDT | ||||

| Death Cross Confirmed, Gold and Silver a Sure Bet During Crisis Posted: 13 Aug 2010 01:27 PM PDT | ||||

| Posted: 13 Aug 2010 12:31 PM PDT

The U.S. Commerce Department recently announced that the U.S. trade deficit increased by 18.8 percent in June to $49.9 billion. Most analysts had expected the figure to be somewhere around 41 to 43 billion dollars. In the month of June, imports rose to approximately $200 billion while exports fell to about $150 billion. So can we afford to have a net outflow of 50 billion dollars each and every month? Of course not. We had so much wealth as a nation that we could afford to do this for a while, but the reality is that if this keeps up the rest of the world will eventually drain us dry. So just how dangerous is the trade deficit? Well, world famous investor Warren Buffett once put it this way.... "The U.S trade deficit is a bigger threat to the domestic economy than either the federal budget deficit or consumer debt and could lead to political turmoil... Right now, the rest of the world owns $3 trillion more of us than we own of them." But very few Americans talk about the trade deficit. Why? Number one, it is because our education system has become so dumbed down that most Americans (especially among the younger generations) do not even know what the trade deficit is. Number two, most Americans are so obsessed with frivolous things such as American Idol, Dancing With The Stars, Lady Gaga and their favorite sports teams that they could care less about thinking about real issues. But they should be thinking about foreign trade, because it is literally destroying the nation. What we have done is we have allowed the monolithic predator corporations that dominate our economy to slowly but surely move their operations to countries such as China and India where labor costs less than a tenth of what it does here. In the process, executives at those predator corporations are earning huge "performance bonuses" while millions of hard working middle class Americans are losing their jobs. It is time to wake up. Have you ever wondered why it is so hard to find a decent job out there right now? Well, there is a good reason. The giant predator corporations have decided that they don't really need us anymore. Once upon a time, great American companies provided great American jobs for great American workers. We created the biggest middle class in the history of the world and great industrial cities like Detroit, Michigan were the envy of the world. But have you been to Detroit lately? One of the greatest cities in the United States has become a hellhole. The mayor says that nearly half the people there are out of work. So what happened? Did the giant corporations who used to make stuff in Detroit stop making stuff? No, they are still making lots of stuff. They just aren't making their stuff in Detroit anymore. Now, the truth is that it is really easy to jump on Detroit. It is a city that has been mismanaged for decades. But Detroit is far from alone. All throughout the "rust belt" you can find other Detroits. At this point many of you may be thinking that people living in places like that should just move. That may be good advice, but the truth is that what has happened to Detroit is going to be happening everywhere. It is going to come to your own neighborhood soon enough. The giant predator corporations are going to continue to try to outsource and offshore every job they can. Your job may be next. Perhaps you should start learning about the trade deficit. Perhaps you should start asking your representatives about it. Just look at what all of this "free trade" and "globalism" did to our trade deficit between 1991 and 2005..... Are you troubled by that chart? You should be. The U.S. economy is bleeding and the top politicians from both political parties act as if they could really care less. What do you think is going to happen if tens of billions of dollars continue to pour out of the United States month after month after month? The economic prosperity that we have all been enjoying is not guaranteed to last forever. The system of world trade that has developed over the past few decades has provided us with gigantic mountains of cheap plastic crap, but it is not a good system for America or for middle class American workers. Someday we will look back in horror at how incredibly stupid it was to ship our manufacturing base, our jobs and our prosperity to China. But the American people have made their choices. They allowed the politicians to convince them that NAFTA, GATT and the WTO would be wonderful things for Americans. They didn't listen to the warnings about what would ultimately happen to our jobs and our economy. They didn't take the time to get educated about foreign trade and the exploding trade deficit. So now we all get to pay the price. | ||||

| Longer Term Gold Remains on Track for Higher Prices Posted: 13 Aug 2010 11:58 AM PDT Gold Price Close Today : 1,213.50Gold Price Close 6-Aug : 1,203.30Change : 10.20 or 0.8%Silver Price Close Today : 1810 Silver Price Close 6-Aug : 1845.9Change : -35.90 or -1.9%Platinum Price Close... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! | ||||

| Can We Avoid Another Lost Decade? Posted: 13 Aug 2010 11:01 AM PDT Michael Darda, chief economist, chief market strategist and director of MKM Partners, wrote an op-ed in the WSJ asking, Are We Headed for a Lost Economic Decade?:

Stéfane Marion, chief economist at the National Bank of Canada, discusses another factor which people should bear in mind before drawing too many parallels with Japan's lost decade:

But while the US is not Japan, some see major problems ahead as interest rates are kept at historic lows. The Associated Press reports, Fed official sees bigger risks in future, not now:

I happen to agree with Hoenig that the US economic recovery is well underway, and that things aren't half as bad as doomsayers will have you believe. But I disagree with him is that the Fed should raise rates anytime soon.

So there you have it, even the experts are divided as to where we're heading. One thing is for sure, markets will remain choppy until we get some clear signs that the threat of deflation has been averted. Until then, expect more volatility, and watch for a few potential bubbles which are forming as all this sorts itself out. | ||||

| Santelli Goes Off, And Luxury Condos Now Get FHA Backing Posted: 13 Aug 2010 10:30 AM PDT Trader Mark submits: It's been a long while since we've done a Rick Santelli video. While some of his other blowups have been larger [Feb 19, 2009: Rick Santelli Speaks for the Silent Majority] [Feb 28, 2008: Rick Santelli is Quickly Becoming my Hero], today's was more of a slow boil which grew over time. Basically he speaks for all of us sick of interference by the Fed and government in every form of life, and distorting markets to level that are barely recognizable. As I've been saying for years, we are dependent on big brother's drugs, and as we become more dependent the drug hits necessary are getting bigger and bigger. Which in turn makes it more "impossible" for Big Brother to remove himself. Which requires even more drugs (as these economists demand). And so on and so forth. Complete Story » | ||||

| RadioShack: Earnings Scorecard Posted: 13 Aug 2010 10:08 AM PDT Zacks.com submits: The future outlook for RadioShack Corp. (RSH) is flat. Second quarter 2010 financial results were mostly in line with Zacks Consensus Estimates. Recent earnings estimate revisions are showing an almost 50-50 swing in both directions. RadioShack continues its solid performance supported by significant growth of wireless businesses. However, the company’s non-wireless product segment is facing a gradual decline in sales. Moreover, the company is facing intensifying competition from more diversified retail stores. Complete Story » | ||||

| Charting Next Week's Bearish Action: Goldman Warns Of A "Meaningful Decline" In Stocks Posted: 13 Aug 2010 10:07 AM PDT Goldman's John Noyce (part of the firm's trading desk) has released his most recent barrage of technical analysis and charts, confirming our running expectation that a drop in stocks is now widely anticipated by the charts. In addition to extended commentary on FX, Bonds, Curves, and the VIX, Noyce notes the following on the S&P: "as discussed in recent client meetings, while the timing is difficult, we remain concerned that a larger topping structure is still being formed on the S&P – which will eventually lead to another meaningful decline." Has everyone, Goldman included, now gone from bullish to bearish in the span of two weeks? In the S&P: Arguably the market could still be forming a larger H&S top; This would fit well with some further downside correction in risk correlated FX currency pairs. If Friday’s close is below 1,101 the market will post a bearish weekly reversal from the high of the recent recovery In conclusion, as discussed in recent client meetings, while the timing is difficult, we remain concerned that a larger topping structure is still being formed on the S&P – which will eventually lead to another meaningful decline. In FX: There are certainly a number of warning signs that the last stage of the USD-weakness trend we have been looking for (EURUSD to 1.35-1.37) is unlikely on a tradeable horizon; Overall, as an overview chart this warns of a material turn in the broader trend of the G10 currencies versus that USD. Once the market eventually broke lower in late-July (a similar time of year to now) the market [in AUDUSD] began the sharp drop into the October ‘08 lows In VIX: If Friday’s close is above 23.89 the market will post a bullish weekly reversal from the base of the recent down move Beyond the significance of VIX patterns for the S&P they’re also important for broader markets as in the vast majority of cases a broader swing in risk appetite will take place across asset classes. (not today's implied correlation) In Treasurys: Following last Friday’s poor data yields broke from their July range The multi-week chart still looks like a big double top targeting 2.2% On the Curve Shape: The 10-year/2-year curve is continuing to flatten: The ultimate target of the 200-week moving average now stands approximately 66bps below current levels

This posting includes an audio/video/photo media file: Download Now | ||||

| Posted: 13 Aug 2010 09:58 AM PDT Gold pauses after rally, ends week up 0.9% The COMEX December gold futures contract closed down $0.10 Friday at $1216.60, trading between $1212.30 and $1219.80 August 13, p.m. excerpts: | ||||

| Posted: 13 Aug 2010 09:41 AM PDT Jim Sinclair's Commentary A for payment subscription service that is, in my opinion, a must have. JOHN WILLIAMS' SHADOW GOVERNMENT STATISTICS Retail Sales Hint at Third-Quarter GDP Contraction BRIEF OBSERVATIONS ON TODAY'S DATA. As noted below, posting of the full Commentary planned for today has been pushed into this weekend. Nonetheless, here are a couple of observations on this morning's CPI and retail sales reporting, which respectively were slightly stronger and weaker than consensus estimates. July's rebounding seasonally-adjusted month-to-month 0.31% CPI-U inflation (versus down 0.14% in June) and July's unadjusted year-to-year 1.24% gain (versus 1.05% in June), partially reflected a swing in seasonal factors that now will be boosting adjusted gasoline prices for several months. The SGS alternative estimates for July annual inflation are 5.4% (1990-base, Pre-Clinton), 8.6% — 8.57% to the second digit — (1980-base). The 0.41% seasonally-adjusted monthly gain reported for July Retail Sales was statistically indistinguishable from zero growth. After inflation adjustment, the real monthly gain was 0.10% percent. Even with some upside revision to prior periods, the inflation-adjusted July number was below the average for second-quarter 2010. That opens up a fair chance of real third-quarter retail sales contracting versus the second-quarter, with a suggestion that third-quarter GDP could show an outright quarterly contraction, even as reported by the government. Full details will follow in the Commentary. Best wishes to all,

Debts Rise, and Go Unpaid, as Bust Erodes Home Equity During the great housing boom, homeowners nationwide borrowed a trillion dollars from banks, using the soaring value of their houses as security. Now the money has been spent and struggling borrowers are unable or unwilling to pay it back. The delinquency rate on home equity loans is higher than all other types of consumer loans, including auto loans, boat loans, personal loans and even bank cards like Visa and MasterCard, according to the American Bankers Association. Deep within the finger point phase (either borrower's or lender's fault) of the debt crisis, it is clear that an increasing number of borrowers cannot or will not pay. Also, the inability to define direct ownership loans as a result of securitization only perpetuates the cycle of inaction described below. "I am not going to be a slave to the bank," said Shawn Schlegel, a real estate agent who is in default on a $94,873 home equity loan. His lender obtained a court order garnishing his wages, but that was 18 months ago. Mr. Schlegel, 38, has not heard from the lender since. "The case is sitting stagnant," he said. "Maybe it will just go away." Who is a greater fool? The person (and institution) that borrowed and loaned recklessly based on an illusion, or the individual that lived within their means but continues to pay their debts while others do not? Society's answer will influence confidence in a monetary system formed this question. Source: nytimes.com | ||||

| Implied Correlation Closes At All Time Record High Posted: 13 Aug 2010 09:27 AM PDT Or another possible title: Stock Dispersion Hits All Time Record Low... It was only Wednesday when we were lamenting the collapse of alpha after implied correlation hit an all time intraday high of just under 80. Well, today should be the day when all long/short funds are shutting down: implied corr just closed at an all time record high of 79.57, after also posting an absolute intraday record of 80.08. It is getting ever more obvious that stocks continue to trade more and more as just one asset class, as seen by the constant increase in JCJ below, which has risen almost 15% in this week alone. At this rate, every stock will trade just like every other stock in under 3 weeks when alpha is officially put to rest and stock dispersion has undergone an extinction level event (better known as HFT and ETF encroachment, in which it is the price that determines value and not the other way around). And here is some food for thought: if stocks trade increasingly as one, and if the Hindenburg Omen (as we pointed out first yesterday before the term the internet on fire) is confirmed in the next 5 weeks, just what will happen when everything sells off as one? | ||||

| Posted: 13 Aug 2010 09:25 AM PDT Zacks.com submits: By Dirk van Dijk The Consumer Price Index (CPI) rose by 0.3% in July after declining in each of the previous three months. While this was slightly higher than the 0.2% that was expected, it is still a very tame reading. On a year-over-year basis, consumer prices are up just 1.2%. Most of the increase in July was due to higher energy prices; most importantly, higher gasoline prices. Overall energy prices rose by 2.6% in the month, reversing sharp declines in June, May and April. Energy commodities had the sharpest increase (and previously had suffered the biggest declines) with a 4.0% rise. Gasoline was up 4.6%. The price of energy services, such as electricity, also rose, but by a tamer 0.8%. They had suffered more modest declines in the previous three months. Complete Story » | ||||

| Monopoly Money and the International Banking Cartel Posted: 13 Aug 2010 09:11 AM PDT Some people have asked what I mean by "international banking cartel" and if it really exists. indeed it is very real and it has profound power over our lives. here are the details... The Federal Reserve has been at the top of the news for a long time and it's getting a lot of attention now as it appears the next down cycle in the depression may be upon us. So what's the real reason the world listens so intently to an Ivy League bureaucrat like Bernanke? Of course, it has nothing to do with him. These institutions are the current primary dealers of the Federal Reserve System. They have power over the entire economy, everything in "the market," very much a non-free market. They sit at the top of the world's monetary system, currently the Fed's debt-dollar pyramid, with a governmental license to what has been the most secure capital in the world - US Treasury debt - for a monopoly price that nobody else can get. And when it comes to global finance, the difference between the strongest banks vs. dying banks is just a few basis points in price (cost of capital). These banks get first dibs on buying the servitude of the US population through the Fed/Treasury auction process. See who is the top Federal Reserve Banking partners: This posting includes an audio/video/photo media file: Download Now | ||||

| Geithner’s Delusional Recovery Posted: 13 Aug 2010 09:00 AM PDT Bill Bonner here at The Daily Reckoning writes that Tim Geithner, Secretary of the Treasury of the United States of America, is the author of the now-infamous "Welcome to the Recovery" piece he wrote for The New York Times, which I meant to read, and tried to read, but I could only get part way through it before getting visibly upset with such self-serving, lying, sophomoric qualitative excuse-mongering. I also think I remember quickly scanning the article, but it was just, "Bah! More of the Same Old Crap (SOC)" about how the brave, handsome and beautiful brilliant Obama people (like Mr. Geithner himself) and the brave, handsome and beautiful geniuses in Congress courageously worked together in a glorious heroic effort to "save us" from the terrible fate of booms caused by inflationary increases in the money supply and the cancer of deficit-spending governments grown to grotesque proportions, by (oddly enough) providing more government grotesqueries by dint of outrageously more deficit-spending and even outrageously more money created by the outrageous Federal Reserve! Outrageous! How could I continue reading such crap? Anyway, Mr. Bonner thankfully does not mention how I seem to be working myself into a Raging Mogambo Snit (RMS) about this stuff right in front of his eyes, like some kind of weird Jekyll and Hyde monster, or how I am so angry that little specks of spittle are flying out of my mouth at high rates of speed as I speak, which I do, loudly, so that even the furthermost disinterested passerby will hear me and think to him or herself, "Gee! The Federal Reserve is a monster that has destroyed us with their stupid neo-Keynesian econometric inanities, which apparently translates as 'Mathematical reasons why the money supply should be increased all the time, only varying between more and a lot more, depending upon, you know, the current whim as to arrangements of formulae and computer models!'" Instead, he apparently intuits that it would calm me down to note that Geithner mentions "that households were paying down their debts," which he somehow sees as "a sign of recovery." And you know what? He was right! Whereas I was angry, now I am laughing! Hahaha! I am laughing the Bitter Laugh Of Scorn (BLOS) at Tim Geithner and that anyone else would see good news in massive leveraging of a depreciating fiat currency to amass suffocating, bankrupting, un-payable debt levels in every part of the economy, leading to less consumption, leading to losses, declining sales revenues to retailers, credit card companies, and taxing authorities. Hahaha! Bitter Laugh Of Scorn (BLOS)! BLOS! Hahaha! Apparently, I was too detailed in my explanation of how Tim Geithner is an idiot, and I was immediately bombarded with questions like "Did you say something that was not stupid?" and, "Could you explain that, please, or are you too stupid?" and, "What is wrong with you that you sound so stupid?" So I was soon busy with explaining to the media nerds how a consumer-driven society, especially one where total government spending is half of GDP, is the Shining Path To Doom (SPTD), and Mr. Bonner shows not only real insight into the problem, but with the brevity that is, so they say, the soul of wit, which explains with crystal clarity that debt repayment is not, as Mr. Geithner believes, a sign of recovery, as, in a consumerist, debt-driven currency and economy, "it is actually the source of the slump." Paradoxically, it is also the sign of a boom in gold, silver and oil which, because they are so cheap right now, makes you gloat, "Whee! This investing stuff is easy!" The Mogambo Guru Geithner's Delusional Recovery originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||

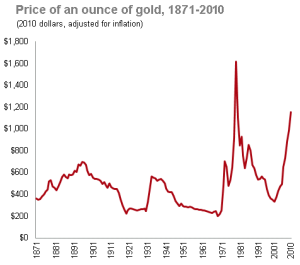

| Is Vanguard Blogger John Ameriks Right That 'It's Too Late for Gold'? Posted: 13 Aug 2010 08:51 AM PDT  Tim Iacono submits: Tim Iacono submits: Writing for the Vanguard Blog, John Ameriks offers these thoughts about how the world’s smartest investors are foolishly piling into gold and how some of the richest people in the world are deluding themselves if they think the metal will help preserve their wealth.

Complete Story » | ||||

| Inflation Scorecard: Gold Widens Its Edge Over European Currencies Posted: 13 Aug 2010 08:37 AM PDT Hard Assets Investor submits: By Brad Zigler Real-time Monetary Inflation (last 12 months): -1.3% Gold continued to rally against Continental currencies this week but lost 0.3% against the Japanese yen. Bullion rose 2.0% in euros, 1.7% in sterling and 1.3% in Swiss francs. Complete Story » | ||||

| Is the Ireland ETF in Trouble? Posted: 13 Aug 2010 08:34 AM PDT Jarred Cummans submits: For much of 2010 the euro zone has taken center stage, giving directions to equity markets around the world as the debt-laden continent did its best to stave off a potentially devastating fiscal crisis. In recent weeks, a number of positive indications have emerged, giving investors hope of a rally not only in Europe but around the globe. Recent stress tests of 91 of the major European banks showed that only 7 would need additional capital in a “worst case” scenario; these figures helped to ease investors’ minds, flashing signs that Europe’s downtrodden financials may be on their way to a recovery. Following these positive stress tests, the euro-zone reported better-than-expected GDP growth of 1% for the second quarter today. The impressive showing was led by Germany, which posted gains of 2.2% on a quarter-over-quarter basis. But amidst all of the seemingly positive indications, some troubling developments are brewing in one of the promising figures to come out of this 16 country union, problems are beginning to surface in Ireland. Complete Story » | ||||

| US Bureau of Economic Analysis: Gov’t Pay is About Twice Private Sector Posted: 13 Aug 2010 08:30 AM PDT Recent research out of the US Bureau of Economic Analysis confirms what other analyses have shown… and we've come to expect. Government workers are now compensated an average of more than $120,000, or about twice as much as the average private sector worker, who receives about $60,000. According to Newsmax: "For the past nine consecutive years, federal employees have received higher increases in salary and benefits on the average compared to nongovernment workers, according to a USA Today analysis. "Chris Edwards, a budget analyst at the libertarian Cato Institute, said changes need to be made when other employees have seen their salaries in a holding pattern or slashed. "Can't we now all agree that federal workers are overpaid and do something about it?" he said. "Civil servants received salaries with benefits of $123,049 in 2009 on average compared to employees at private companies making $61,051 in total compensation, according to the Bureau of Economic Analysis." Over nearly a decade, the incentive for job seekers to choose productive work in the private sector over the often better rewarded, and potentially less demanding, public sector has been dwindling. Likewise, as government jobs have become more popular its ranks have swollen and put further strain on the remaining productive taxpayers… not exactly a virtuous cycle. You can read more details in Newsmax coverage of government workers earning twice as much as their private counterparts. Best, Rocky Vega, US Bureau of Economic Analysis: Gov't Pay is About Twice Private Sector originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||

| SP 500 and Nasdaq 100 September Futures; Gold Daily Chart at Week's End Posted: 13 Aug 2010 08:19 AM PDT | ||||

| Dead Fish Are Washing Up Everywhere . . . Is It Due to BP Oil Spill and Dispersants? Posted: 13 Aug 2010 08:14 AM PDT Dead fish are washing up everywhere. For example, numerous dead fish washed ashore in Massachusetts a couple of days ago: Dead fish had washed up in New Jersey yesterday. Hundreds of thousands of dead fish washed up today in New Jersey, and even the birds wouldn't eat them: (The second report in this video compilation - referring to a ripped fishing net - is actually from Virginia, some 210 miles from the scene of the first report in New Jersey. The size of the Virginia fish incident was much smaller than the one in New Jersey.) And they have washed up in Mississippi as well. Scientists attribute the dead fish to low oxygen levels in the Gulf of Mexico. Indeed, scientists have been warning about this for months. For example, on May 16th, the New York Times wrote:

As I pointed out in June, the high methane content in the BP crude also depletes oxygen:

In addition, millions of gallons of Corexit have been sprayed in the Gulf. Corexit contains oil, propylene glycol and a host of other chemicals. Propylene glycol depletes oxygen from water. See this and this. Even if there are other causes for the fish deaths - such as unusually warm water in the Gulf - the oil, methane and Corexit could very well be contributing to the oxygen depletion or weakening the fish's ability to deal with such factors. |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment