Gold World News Flash |

- Merck, SciClone Tapped in Fed Pharma Probe

- Gold Remains Glued To $1200

- Those Interested In Martin Armstrong's Work Should Check Out Ed Moran's Research

- It's the message, not the messenger

- Daily Dispatch: Who Is Buying U.S. Treasuries? - Mar 18, 2010

- The CFTC Says 'NO' to Silver Analyst Ted Butler

- We Have a New Gold Standard: Marc Faber

- In The News Today

- Hourly Action In Gold From Trader Dan

- Jim?s Mailbox

- Afternoon Action In Gold From Trader Dan

- The Root Causes Of Hyperinflation

- China Enters the Gold Market

- Questions and Answers

- Dow/Gold & Summer Doldrums

- Why Jobs Have Gone AWOL

- A Run for the Canadian Border

- An Uncertain Homecoming: BP’s Return To Libya Decades After Gaddafi’s Revolution

- Mortgage Bankers Association: HYPOCRITES

- UK Economy GDP Growth Forecast 2010 to 2015

- China Pushes For Gold: India Follows Suit

- Gold Technicals: Can you "HANDLE" this?

- Gold Extending Weakness

- Grandich Clients Update

- El-Erian: Don't Depend on the Fed

- Fed Rolls Out the Same Rusty Cannon

- Mortgage, Oil, Trade Data on Wednesday's Economic Calendar

- GoldSeek.com Radio Gold Nugget: Kevin Kerr & Chris Waltzek

- Cost of Equity Capital: The Best Indicator of Future Stock Prices

- IPO Analysis: Go Ahead, MakeMyTrip

- An Open Challenge to Paul Krugman: Were America’s Founding Fathers Wrong for Advocating Death for QE Measures?

- Ah, for Those Affordable Fifties!

- If the Jewelry Market is weak, can the Gold Price rise?

- Demanding Demand

- Gold Daily Chart

- Gold Seeker Closing Report: Gold and Silver Fall Slightly Before Fed Announcement; Gain Afterwards

- iPath Rolls Out Eight New Treasury ETNs

- WisdomTree's Latest: Emerging Markets Local Debt, Active Edition

- Tuesday ETF Roundup: VXX Soars, FXI Falls

- Fed Reactions From Around the Web

- Why the Economy Is Addicted to Government Aid

| Merck, SciClone Tapped in Fed Pharma Probe Posted: 10 Aug 2010 07:25 PM PDT The Burrill Report submits: By Michael Fitzhugh Merck (MRK) and SciClone (SCLN) have become the latest targets of ongoing federal investigations intended to curtail direct and indirect payments to foreign officials by companies with a substantial U.S. presence. The investigations, launched by U.S. Justice Department and the Securities and Exchange Commission, are examining potential violations of the Foreign Corrupt Practices Act, a law prohibiting foreign bribery in business and instituting accounting record-keeping requirements intended to detect and prevent such illegal payments. Complete Story » |

| Posted: 10 Aug 2010 07:18 PM PDT |

| Those Interested In Martin Armstrong's Work Should Check Out Ed Moran's Research Posted: 10 Aug 2010 07:17 PM PDT Ed Moran contacted me and as a result we have posted some of his research onto our site. You can access his articles here: Ed Moran - Gold Speculator I'm no expert on cycle theories, but I have been very interested in Martin Armstrong's work for some time now. You can view them here: Martin Armstrong's Economic Pi Cycle - Gold Speculator For those interested in such things, I find it very interesting that Ed Moran and Martin Armstrong come to very similar conclusions and very similar timing cycles. Although their methodologies (from what I can tell) may be slightly different, the point is that they both "see" the cycles in relation to the fabric of time... I know all of this can get a bit esoteric sounding, but cycles are an incredibly complex thing to understand and can only be understood by studying large data sets over very large periods of time, something that has not been possible until the age of computers. As those familiar with the work of William Strauss and Neil Howe, k... |

| It's the message, not the messenger Posted: 10 Aug 2010 07:17 PM PDT By: Theodore Butler [FONT=Arial, Verdana, Helvetica, sans-serif]When I first learned that I would not be invited to the March 25 CFTC public hearing on precious metals position limits, I admit that I was more than a bit surprised and disappointed. After all, this was my signature issue, one on which I had pressed the CFTC and the exchanges for more than 20 years. In fact, until very recently, I was virtually alone in having advanced the issue of establishing legitimate speculative position limits in silver, along with the enforcement of bona fide hedge exemptions to those limits. [/FONT] [FONT=Arial, Verdana, Helvetica, sans-serif]My surprise was heightened because I had previously received an unsolicited telephone call from the CFTC back in January (I didn’t write about it then as I considered it confidential). The call from the agency (the first I can recall in 25 years) was a request to me to help them identify who I thought would make good prospective panelists... |

| Daily Dispatch: Who Is Buying U.S. Treasuries? - Mar 18, 2010 Posted: 10 Aug 2010 07:17 PM PDT March 18, 2010 | www.CaseyResearch.com Who Is Buying U.S. Treasuries? Dear Reader, We’ve aggressively been advising readers to accumulate gold as a portfolio keystone from the very onset of its current secular bull market in 1999. It has been our thesis, looking at a landscape littered with easy money and out-of-control government spending, that the piper had to be paid – in funny money. How things have changed from when we were nearly a lone voice in the woods – with the list of institutional gold buyers growing longer with each passing day. Of those institutions, none is more important than the central banks. That’s because, collectively, they are the world’s single largest institutional holders of above-ground gold, and by a wide margin. During gold’s long bear market hibernation, which lasted from 1980 to June 1999, the central bankers looked upon their gold holdings with something akin... |

| The CFTC Says 'NO' to Silver Analyst Ted Butler Posted: 10 Aug 2010 07:17 PM PDT After not doing much of anything during most of the Far East trading session on Wednesday, gold spiked up to around $1,032 spot at 4:00 p.m. in Hong Kong... just 30 minutes before London opened for their Wednesday trading day. The price pretty much stayed at that level for the next four hours... and then began a gentle decline starting at 12:30 p.m. in London... shortly before New York opened. This decline lasted until 4:00 p.m. Eastern time... which was its absolute low of the day... recorded as $1,117.50 spot. From there, gold recovered almost back to its close on Tuesday. But, all in all, it was basically a nothing sort of day. Silver gained about a percent during Far East and early trading in London. The peak price for silver [around $17.61 spot] was at the London silver fix around noon local time. During the next couple of hours, silver fell to its low of the day in early New York trading... with the low price tick of $17.34 coming shortly after 9:00 a.m.... |

| We Have a New Gold Standard: Marc Faber Posted: 10 Aug 2010 07:17 PM PDT I wouldn't read a thing into yesterdays price action in gold. It spent the entire day range-bound between $1,120 and $1,130. The highs and lows aren't worth mentioning. Nothing to see here, folks! It was the same for silver. There's nothing to talk about in this chart. The dollar has been an interesting case study over the last couple of days. A rally started about 2:00 a.m. Eastern time on Wednesday morning... and, in fits and starts, added about 80 basis points to its price over the next 36 hours... yet the precious metals prices barely reacted at all. In times past, a dollar rally of this magnitude would have resulted in a rather significant sell-off in both gold and silver. It certainly didn't happen this time... and as I mentioned in my column yesterday... we've see a lot more of that kind of action recently, where the gold price is not necessarily tied to the dollar action. As other commentators have pointed out... the precious metals are now bac... |

| Posted: 10 Aug 2010 07:17 PM PDT View the original post at jsmineset.com... August 10, 2010 08:17 AM Jim Sinclair’s Commentary Do you still doubt the Fed will fail to meet all the needs to develop as the economy rolls over to a new low? QE is going to infinity! Fed to Buy Government Debt; Says the Recovery Has ‘Slowed’ August 10, 2010, 2:19 pm Acknowledging that the recovery has slowed, the Federal Reserve announced Tuesday that it would use the proceeds from its huge mortgage-bond portfolio to buy long-term Treasury securities, The New York Times's Sewell Chan reports from Washington. By buying government debt, the Fed is taking an unmistakable step to maintain the large amount of money that it pumped into the economy, starting in 2007, to prop up the financial and housing markets. The Fed bought $1.25 trillion in mortgage-backed securities, and another $200 billion in debts owed by government-sponsored enterprises, primarily Fannie Mae and Freddie Mac, and completed the purchases in Mar... |

| Hourly Action In Gold From Trader Dan Posted: 10 Aug 2010 07:17 PM PDT |

| Posted: 10 Aug 2010 07:17 PM PDT View the original post at jsmineset.com... August 10, 2010 12:17 PM Fed to Buy Government Debt; Says the Recovery Has ‘Slowed’ CIGA Eric Do you still doubt that the Fed will fail to meet all the needs to develop as the economy rolls over to a new low? QE is to Infinity! Jim Acknowledging that "the pace of recovery in output and employment has slowed in recent months," the Federal Reserve on Tuesday announced that it would use the proceeds from its huge mortgage-bond portfolio to buy long-term Treasury securities. Jim, How many investors remember when Fed and its various mouthpieces were worried about timely withdrawal of stimulus in late 2009? Capital unlike the public never forgets. The price of gold, which is closely watched and managed by connected interests, reflects capital's confidence in monetary leadership. Capital does not buy into the BS. The price of gold spiked on the news. Eric Tobacco Smoke Enema: More… When Will Financial Armaged... |

| Afternoon Action In Gold From Trader Dan Posted: 10 Aug 2010 07:17 PM PDT |

| The Root Causes Of Hyperinflation Posted: 10 Aug 2010 07:17 PM PDT View the original post at jsmineset.com... August 10, 2010 12:23 PM Dear CIGAs, In support of the hyperinflation thesis outlined by the three teaching illustrations: Under a situation from the European view in 1931, the only thing to survive was tangible assets. This is not merely gold, but shares in corporations with tangible assets. Velocity is always the key for as it declines due to people then hoarding money, you get deflation. When people are afraid money will become worthless (paper of debased coinage) they spend it faster before it depreciates and that creates hyperinflation. It all depends where confidence stands – with government or within the private sector. We are headed into the later. Martin Armstrong. "Staring into the Abyss" July 31st 2010 Root causes of hyperinflation From [url]http://en.wikipedia.org/wiki/Hyperinflation[/url] The main cause of hyperinflation is a massive and rapid increase in the amount of money, which is not supported by g... |

| Posted: 10 Aug 2010 07:17 PM PDT There was an editorial power struggle at Mogambo News Service over whether it was Big, Big News (BBN) or if it was Big Freaking News (BFN), or even if it was The Biggest Freaking News Of Your Life (TBFNOYL) that China has, officially through the People's Bank of China, said that they have "seen the light" as concerns gold, and they see how gold is the only true money, and how worthless paper monies and computer blip monies are the Wrong Way To Go (WWTO), as evidenced by the Chinese merely looking at us Americans and what happened! Hahaha! The Chinese decision to acquire gold and gold mines, and establish a large, multi-tier market for gold, may have been influenced by many things, including, for example, the stinging criticism of the Fabulous Mogambo Guru (FMG), who said many, many times that if the Chinese did not buy up the world's gold and establish a gold-standard yuan with at least some of that trillion dollars in foreign reserves that they are sitting upon, then they were indeed... |

| Posted: 10 Aug 2010 07:17 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! August 10, 2010 12:22 PM Question: Can you give us your take on the battle between, the*Inflationist's and Deflationists, and tell us where you think were heading. What will either outcome mean to*gold and gold stocks? Thanks Ian W* England. Answer: It's one of the toughest questions in years since both arguments are quite worthy at the moment. The assumption is we eventually have to have inflation because of all the money creation. Too much money chasing fewer products equals inflation – at least in the old days. The one thing I think is fairly certain is deflation is here for at least awhile longer. The housing market is a mess and until there's even stabilization, let alone an uptick in prices, hard to see large inflation any time soon. Question: Would you consider a seminar displaying the "Grandich style" of reading charts, screening a... |

| Dow/Gold & Summer Doldrums Posted: 10 Aug 2010 07:17 PM PDT Richard (Rick) Mills Ahead of the Herd As a general rule, the most successful man in life is the man who has the best information Central banks money printing is out of control. The constant printing of all the world's currencies is just another way for countries to default on their debt – the repayment of a creditor occurs using a currency whose purchasing power has been reduced. Gold's price will continue, has to continue, too rise in value against all depreciating paper currencies For equity investors and speculators alike history shows us, time and again, the greatest leverage to gold's rising price is owning gold exploration/development junior mining stocks. Will mainstream investors eventually catch on to the fact they need to own gold and to own gold shares? The Dow on Gold's terms: • In 2000 gold made its $260 per ounce low • January 2000 the Dow was 10,900 • 10,900 / $260 per ounce = 41.9 ounces to buy the Dow • Today at 10,696 DJII and $1,204 gold it'... |

| Posted: 10 Aug 2010 07:17 PM PDT [COLOR=#000000][FONT=Arial][COLOR=#000000]Michael Pento - Senior Economist and Vice President of Managed Products, Euro Pacific Capital. [/COLOR][/COLOR][/FONT] There are three primary reasons why the US is suffering from structurally high unemployment: a pervasively irresponsible monetary policy, the continued attenuation of our manufacturing base, and an overleveraged consumer who must now reconcile his balance sheet. In reality, the latter two conditions are a direct result of the first. They are the result of a government that seeks to micromanage the cost of money and the rate of economic growth. When the Fed prints money and monetizes debt in order to drag interest rates down, it necessarily encourages excess consumption. The boom in lending and spending results in rising prices, which misallocate what little genuine savings and investment remain. Since inflation is never evenly distributed throughout an economy, it usually gets concentrated into a particular a... |

| Posted: 10 Aug 2010 07:17 PM PDT By Marin Katusa, Chief Energy Strategist, Casey Research The Gulf of Mexico disaster has changed U.S. priorities, costs, and energy supply sources for years to come. But the fact that the U.S. needs energy isn't changing anytime soon, and as mass sources of green energy are still a while away, the most likely alternative might be the most surprising one. With US$15 billion invested annually in offshore drilling in the United States, the disaster in the Gulf of Mexico means that this money is getting ready to migrate elsewhere. And it is the Athabasca oil sands of Alberta, Canada, that are number one on the list. Given the amount of bad press the oil sands get, this could come as a shocker. But technological advances and improvements in recovery methods, as well as reduction of water usage and greenhouse gas emissions, have made oil sands a viable and popular option for the future of U.S. energy. The numbers, too, are looking in their favor. Out of the 1.... |

| An Uncertain Homecoming: BP’s Return To Libya Decades After Gaddafi’s Revolution Posted: 10 Aug 2010 07:17 PM PDT [B][/B]After nearly 40 years, BP is returning to Libya amid widespread controversy about an alleged link to the Lockerbie bomber's release and fears about a potential oil disaster in the Mediterranean Sea. Yet despite the oil giant's enthusiasm, its future in Libya – a country boasting the largest crude oil reserves on the continent -- may end up as murky as competitors that have ventured there. Three years ago, BP signed a $900-million exploration and production deal with Libya, decades after Muammar Gaddafi's government nationalized 100 percent of the oil company's holdings. BP, which has not been involved in the country since 1971, announced in late July that it would begin drilling in the western part of Libya and in the deep waters off the coast in a matter of weeks. Although BP presumably believes the agreement will be good for business, Libya's terms of attracting foreign investment is "so convoluted and corrupt, I don't think anybody gets a real advantage," said Ronald Bruce... |

| Mortgage Bankers Association: HYPOCRITES Posted: 10 Aug 2010 07:17 PM PDT Market Ticker - Karl Denninger View original article August 10, 2010 11:03 AM Now this is hubris: [INDENT]Real estate professionals call it "buy and bail," acquiring a new house before the buyer's credit rating is ruined by walking away from the old one because it's "underwater," or worth less than the mortgage. It's an attempt to escape payments on a home whose value may never recover while securing a new property, often at a lower price with a more affordable loan. ... "Making it possible to pursue people who do this particular kind of default would go a long way to addressing the buy-and-bail problem," said Jay Brinkmann, chief economist for the Mortgage Bankers Association in Washington. [/INDENT]Sounds good, right? Keep up with your obligations, moral (and ethical) standards demand you do what you can to meet the commitments you made, right? There's one problem: The Mortgage Banker's Association appears to have done ITSELF EXACTLY WHAT THEY ARGUE OUGHT TO BE... |

| UK Economy GDP Growth Forecast 2010 to 2015 Posted: 10 Aug 2010 07:17 PM PDT This analysis is a continuation of the UK Debt Forecast article (UK ConLib Government to Use INFLATION Stealth Tax to Erode Value of Public Debt ) on the impact of the new coalition government having effectively hit the reset button on the UK economy to now primarily target a reduction in the £156 billion annual budget deficit which aims to suck £113 billion a year out of the economy by 2015-16 by means of swinging public sector spending cuts and tax rises. The government has now clearly reversed the Labour governments policy of continuous fiscal expansion and set the country on a course for severe fiscal contraction for at least the next 3 years. This analysis seeks to update my existing UK GDP growth forecast for the next 5 years. The analysis of December 2009 concluded in a trend forecast as illustrated below (31 Dec 2009 - UK Economy GDP Growth Forecast 2010 and 2011, The Stealth Election Boom ), with the most recent UK GDP data confirming strong growth... |

| China Pushes For Gold: India Follows Suit Posted: 10 Aug 2010 07:17 PM PDT It was a very quiet and unexciting trading day in gold just about everywhere on Monday. Of course gold came under some selling pressure the moment that New York opened... and the selling pressure didn't disappear until the Comex close at 1:30 p.m. Eastern time. The New York high and low was $1,209.70 spot and $1,198.30 spot. Volume was very light. Silver price action was, as always, more 'volatile'. It was under pretty big pressure right from the Comex open at 8:15 a.m... with the low of the day coming at the close of floor trading. The New York high was $18. 59 spot... and the low was $18.24 spot. Trading volume in silver was also very light. For a change, both platinum and palladium got hit harder than gold and silver. Platinum was down 1.85%... and palladium was down 2.66%. The world's reserve currency didn't do much until about 6:00 a.m. Eastern time, when a bit of a rally commenced... and by the end of trading on Monday... the dolla... |

| Gold Technicals: Can you "HANDLE" this? Posted: 10 Aug 2010 07:17 PM PDT Stewart Thomson email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] Aug 10, 2010 1. Stockcharts.com.au says that if 100 people begin trading the market, after a year only 20 are in the black, and after five years, only 5% are in the black. I view that as likely an optimistic number. Secular bull markets totally distort the reality of the markets, most of which were designed by the banksters as wealth transfer mechanisms, from you to them. I think the numbers are more like 1 out a 1000. 2. The gold community may have been beat on hard by the banksters since 2006 in the junior stocks arena, and a lot of stock was liquidated over the past 4 years, but the gold community is still here, and in many ways is stronger than ever. 3. Here's one reason why: I want you to focus on the relative performance of the various sectors of the market. Since the October 2008 and March 2009 lows for the major stock and commodity markets, my stats show the Dow r... |

| Posted: 10 Aug 2010 07:17 PM PDT courtesy of DailyFX.com August 10, 2010 06:35 AM 240 Minute Bars Prepared by Jamie Saettele Gold has topped. Please see the latest special report for details. Gold is making its way lower in an impulsive fashion. The short term count has changed slightly. It seems as though the first 5 wave decline ended following a terminal thrust from a triangle. The 3 wave correction may be complete just shy of its 100% extension. I am exceptionally bearish gold from here. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Monday evenings), technical analysis of currency crosseson Wednesday and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Posted: 10 Aug 2010 07:17 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! August 10, 2010 06:16 AM I’m being asked a lot (just from my wife) about two Grandich clients this morning: [LIST] [*]Silver Quest Resources – First off, I bought 75,000 more shares yesterday up to $.71 so trust me, I had no prior knowledge of the private placement announced after the close. Normally, one could have some short-term concerns about the share price staying around here until pp closes as the assumption would be some people will sell their current holdings down to the pp price, and buy into the pp and get the half warrant for leverage. [/LIST]I’m not concerned about that in this case for a few reasons: 1 - Bayfront Capital is quickly becoming a force to be reckoned with in the junior resource market. It’s my understanding SQI’s CEO Randy Turner spent three days with them visiting clients of theirs last... |

| El-Erian: Don't Depend on the Fed Posted: 10 Aug 2010 07:15 PM PDT The Pragmatic Capitalist submits: More and more investors are coming around to the opinion that the Fed is largely powerless in times of a balance sheet recession. In an interview this morning Mohamed El-Erian of PIMCO discusses the dangers of deflation and the remaining options for the Fed and the government. Unfortunately, I think El-Erian is even too optimistic about this Federal Reserve. Mr. Bernanke has been wrong about this crisis since before its inception and has misunderstood it at every twist and turn. Why anyone would turn to him for assistance now is simply mind boggling: Complete Story » |

| Fed Rolls Out the Same Rusty Cannon Posted: 10 Aug 2010 07:05 PM PDT Tom Lindmark submits: Well the Fed has spoken and the Cliff Notes version is that the economy is starting to suck again and their plan is to reinvest their maturing MBS portfolio into Treasuries. Note that they aren’t going to expand their balance sheet, just not let it get smaller. Basically saying this is how they’ll do QE2 if it comes to that. In the meantime, any appearance of tightening which might have been imputed to a reduction in their portfolio of mortgage securities is off the table. Complete Story » |

| Mortgage, Oil, Trade Data on Wednesday's Economic Calendar Posted: 10 Aug 2010 07:01 PM PDT optionMONSTER submits: By Bryan McCormick Today we may get to see something quite valuable, which is how traders react to economic reports after yesterday's Fed action. The main question will be whether they discount any bad news on the assumption that the central bank is now on the case. Complete Story » |

| GoldSeek.com Radio Gold Nugget: Kevin Kerr & Chris Waltzek Posted: 10 Aug 2010 07:00 PM PDT |

| Cost of Equity Capital: The Best Indicator of Future Stock Prices Posted: 10 Aug 2010 06:46 PM PDT Kenneth Hackel submits: The metric most closely associated with future stock prices-even more so then cash flow, has been the proper estimate of the cost of equity capital. If you have a fair approximation of cost of equity, it will improve your investment results. In order to arrive at a fair value estimate for an equity security, the analyst, for a going concern, must discount its free cash flow. We stress going concern as analysts use other measures to arrive at fair value, notably, market value of the individual parts, liquidation value, price/sales, price/earnings, or price/book, most of which are tied into GAAP accounting, but are limited in scope and do not provide what an equity investor is really seeking: the maximum amount of cash that could be returned to them without sacrificing the growth or value of the enterprise. Book value has proven to be an unreliable metric if the book consists of assets where buyers at fair market prices are absent. What is the value of an asset for which there are either no buyers or buyers at unreasonably low prices? It is the free cash flows, which must then be discounted. But at what rate? Complete Story » |

| IPO Analysis: Go Ahead, MakeMyTrip Posted: 10 Aug 2010 06:20 PM PDT Renaissance Capital IPO Research submits: Backed by SOFTBANK Asia and Tiger Global, MakeMyTrip launched a US website in 2000 focused on US-to-India airline tickets. In 2005, it launched its Indian website and has rapidly grown into the dominant player in the country's online travel market. The company targets leisure travelers in the fast-growing Indian middle class, offering domestic and international airline tickets, reservations and travel packages for over 4,000 hotels, and other services such as rail and bus ticketing. With a leading brand and a scalable model, MakeMyTrip is poised to take advantage of rapid secular growth in India's online travel industry, fueled by rising discretionary income and Internet penetration. MakeMyTrip is offering 6.2 million shares at a range of $12 to $14 and plans to list on the NASDAQ under the symbol (MMYT). Morgan Stanley (MS) is the lead book runner on the deal, which is slated to price today as one of six deals on the IPO calendar for the week of August 9. Cleared for takeoff Complete Story » |

| Posted: 10 Aug 2010 06:07 PM PDT In light of the US Central Bank’s (I refuse to use their misleading self-anointed US Federal Reserve moniker) most recent grandstanding policy decision that has been referred to as "QE light" that precedes the inevitable QE2 launch sometime in the not so distant future, I present an open challenge to Paul Krugman and all like minded economists, Nobel prize winning or not, that support the monetary policy of dollar debasement. This will be a straightforward challenge issued by our Founding Fathers, in particular the first US Treasury Secretary, Alexander Hamilton, who scripted the US Coinage Act of 1792. The one question I want to see Mr. Krugman and his supporters answer is this:

“If monetary debasement can truly create economic recovery, why did our Founding Fathers establish, in the US Coinage Act of 1792, that any persons discovered to be deliberately debasing US money ‘shall be guilty of felony and shall be punished by death’?”

Note that the punishment was not imprisonment, not even hard labor, but death. Why did our Founding Fathers, who had just gained freedom from the draconian monetary policies of the British monarch King George through the American Revolution and the Treaty of Paris in 1783 deem that monetary stability could not be separated from the conditions of freedom? Why did they deem the act of monetary debasement so insidious that anyone found guilty of deliberately debasing US money would not be imprisoned but should be punished by death? And why is monetary debasement today accepted as the “right thing to do” and “normalized” by prominent economists like Paul Krugman?

So this is all I ask of you Mr. Krugman - to repudiate Alexander Hamilton and explain why he was wrong. I don’t want the employment of deft politician-utilized “block and bridge” techniques that fail to ever address the question, or responses that entail long-winded dissertations on the relationships between monetary base, monetary supply and monetary velocity that fail to answer the question. Please merely be so kind as to answer the one question inspired by Alexander Hamilton and posed to you above and explain your position.

On August 3, 2010, I posted a 3-part video series in regard to the Central Banks’ use of ideological subversion to mislead the masses. Step two of the process of ideological subversion requires the participation of academics to disseminate deceit if the deceit is to not only be widespread but successful in taking root in the consciousness of society. The role of academics in shaping the discourse about the rationality of monetary debasement is critical to the belief system embraced by young impressionable minds for decades into the future as once a false belief takes root it is spread from one generation to the next. In other words, the widespread adoption of the erroneous belief that monetary debasement is beneficial to the economic health of nations would be impossible without you, Mr. Krugman. The Bank of Japan is another Central Bank guilty of executing the act of monetary debasement for decades. And again, academics that reside both within and outside of Japan ensure that the Japanese do not understand how monetary stability is inextricably linked to their most sacrosanct right of freedom.

For those of you reading this that understand why the enforcement of monetary stability is central to your freedom, and I’m sure there are many of you, you must realize that you are among the very small minority of the world’s population that understands this. I have posed this challenge to Paul Krugman because he has the extremely powerful bully pulpit of the New York Times, Princeton University and mass media distribution channels to disseminate his opinion, to hundreds of millions, that monetary debasement is of great benefit to recovering economies.

Today, academics have drawn the focus away from the immorality of the monetary debasement component of quantitative easing by refocusing discussions on the useless debate of whether or not QE assists economic recovery. This type of useless debate only serves as a distraction tactic to draw attention away from the more paramount issue of whether QE destroys the wealth of citizens and therefore is an enemy of freedom. So with this in mind, let us look at the exact language of the US Coinage Act of 1792, scripted by the first US Treasury Secretary and one of the Republic of America’s founding fathers, Alexander Hamilton.

Section 12. And be it further enacted, That the standard for all gold coins of the United States shall be eleven parts fine to one part alloy; and accordingly that eleven parts fine to one part alloy; and accordingly that eleven parts in twelve of the entire weight of each of the said coins shall consist of pure gold, and the remaining one twelfth part of alloy; and the said alloy shall be composed of silver and copper, in such proportions not exceeding one half silver as shall be found convenient; to be regulated by the director of the mint, for the time being, with the approbation of the President of the United States, until further provision shall be made by law. Section 13. And be it further enacted, That the standard for all silver coins of the United States, shall be one thousand four hundred and eighty-five parts fine to one hundred and seventy-nine parts alloy; and accordingly that one thousand four hundred and eighty-five parts in one thousand six hundred and sixty-four parts of the entire weight of each of the said coins shall consist of pure silver, and the remaining one hundred and seventy-nine parts of alloy; which alloy shall be wholly of copper. Section 14. And be it further enacted, that it shall be lawful for any person or persons to bring to the said mint gold and silver bullion in order to their being coined; and that the bullion so brought shall be there assayed and coined as speedily as may be after the receipt thereof, and free of expense to the person or persons by whom the same shall have been brought. Section 19. And be it further enacted, That if any of the gold or silver coins which shall be struck or coined at the said mint shall be debased or made worse as to the proportion of the fine gold or fine silver therein contained, or shall be of less weight or value than the same out to be pursuant to the directions of this act, through the default or with the connivance of any of the officers or persons who shall be employed at the said mint, for the purpose of profit or gain, or otherwise with a fraudulent intent, and if any of the said officers or persons shall embezzle any of the metals which shall at any time be committed to their charge for the purpose of being coined, or any of the coins which shall be struck or coined at the said mint, every such officer or person who shall commit any or either of the said offenses, shall be deemed guilty of felony, and shall suffer death.

On March 20, 2009, in the article “Fiscal Aspects of Quantitative Easing”, Mr. Paul Krugman wrote:

“The big policy news this week has been the Fed’s decision to buy $1 trillion of long-term bonds, going beyond the normal policy of buying only short-term debt. Good move…” “The Fed is, however, creating a new liability: the monetary base it creates to buy these bonds. In effect, it’s printing $1 trillion of money, and using those funds to buy bonds. Is this inflationary? We hope so! The whole reason for quantitative easing is that normal monetary expansion, printing money to buy short-term debt, has no traction thanks to near-zero rates. Gaining some traction — in effect, having some inflationary effect — is what the policy is all about.” “I’m not complaining; I think quantitative easing (it’s really qualitative easing, but I give up on trying to fix the terminology) is the right way to go.”

One thing is clear, Mr. Krugman. Either those men that are universally accepted to be among the greatest American patriots of all time were terrorists for desiring the sentence of death for anyone that destabilized money, OR you are massively wrong. Both of you cannot be right. Your defense of your position needs to repudiate the very founding fathers of the REPUBLIC (not the democracy) of America and needs to explain why you are spreading a diametrically opposing viewpoint to the wishes of America’s founding fathers.

When prominent academics such as yourself, Mr.Krugman, support monetary policies that our Founding Fathers believed to be tyrannical, this supports a misguided and delusional belief system, the mistakes of which are exponentially multiplied by financial journalists that ensure that misinformation becomes not myth but part of a new reality that bankers desire. I cannot recall the hundreds of times have I seen misleading headlines like “Japanese markets fall sharply in the last month on the back of a strengthening Yen” (or replace "Japanese" with another nationality and "Yen" with another nation's currency). Such headlines, by nature, imply that a rising Yen is undesirable when in reality, such policy is enormously beneficial to a nation of savers. Monetary debasement punishes anyone that saves their money instead of spending it right away. Financial journalists, unable to comprehend monetary policy accurately because of academics that spread deceit instead of truth, continuously script headlines that fall victim to the con game of ideological subversion.

Quantitative easing is a banker-created euphemism for monetary debasement. Please explain to Alexander Hamilton, who surely is rolling over in his grave after reading your words Mr. Krugman, why a great American patriot like Alexander Hamilton was so wrong. Billions that have been subjected to and that have suffered a much lower standard of living as a result of monetary debasement policies enforced by Central Banks around the world await your answer. If we are going to emerge from this global monetary crisis with a sustainable solution that benefits all citizens of the world as we all desire, you must not remain silent in responding to this question.

About the author: JS Kim is the Chief Investment Strategist and Managing Director of SmartKnowledgeU, a fiercely independent wealth consultancy company that guides investors in the best ways to invest in gold and silver as well as other strategies to profit from the progression of this global financial crisis. His Crisis Investment Opportunities newsletter has significantly beat all major developed stock market indexes since the first day of its launch, outperforming the Australian ASX 200, the UK FTSE 100 & the US S&P 500 by 308.89%, 304.87%, and 300.85%* during the period of June 15, 2007 to May 12, 2010 (*in a tax-deferred account).

|

| Ah, for Those Affordable Fifties! Posted: 10 Aug 2010 06:00 PM PDT Folded into this week's lively discussion of inflation/deflation was the notion that although Americans seem to live better now than they did fifty or sixty years ago, our parents and grandparents would be appalled to see how deeply in hock we've gone to enjoy the supposed good life. And if the standard of living has risen so impressively, why is it that the single-income, middle-class household of the Fifties could afford things that are barely within the reach of households today that are supported by two incomes? |

| If the Jewelry Market is weak, can the Gold Price rise? Posted: 10 Aug 2010 05:42 PM PDT |

| Posted: 10 Aug 2010 04:10 PM PDT Everything in the financial world just keeps getting stranger and stranger. The sea of credit that floated the world's asset markets for the last twenty years is evaporating and receding. It's leaving some assets high and dry. And it's causing investors to herd themselves into a narrow isthmus of bonds that are perceived as "safe." But let's not be so cryptic. Let's deal with the Federal Reserve's announcement today that it would sort of extend its quantitative easing program; the one begun last year. It wasn't exactly QEII, and for that reason the market didn't quite know what to make of it. Is it time to flee risk assets and pile into bonds? Or is this more free money to change your life? What the Fed said in its statement is this:

What does that mean? Well, that means the Fed is going to "roll over" its existing holdings of Treasury, Agency, and mortgage backed securities, and, for now, keep the asset side of its balance sheet north of US$2 trillion. The anti-deflationists at the Fed (pro-inflationists) believe that not rolling over the debt will lead to a further contraction in credit and the U.S. money supply, which would lead to contracting GDP too. Of course, when households and businesses pay off their debts and borrow less based on their unease about the future, of course it's going to lead to lower growth (and probably higher unemployment). This is what happens on the downside of the business cycle and in a balance sheet Great Correction. You put your financial house in order. But the Fed doesn't want prudence. It subscribes to the blinkered Keynesian worldview that if households and businesses aren't buying, the government must stimulate demand. It presumes that buying Treasury bonds from banks and institutions will force cash into the economy and that cash will go forth and multiply. The cash is being stubborn though, and is desperately clinging to short-term government debt. So here we are treading water stagflationally. There's not much more to add to our core argument that, absent some unexpected surge in US growth, the Fed is going to have to go unconventional on the economy and find a way to monetise debts and/or lend directly to households. But in the meantime, the very sad fact for U.S. savers is that they are getting smashed because of low yields. The even sadder fact is that the giant risk-aversion that's implied by the Fed's negative outlook on the U.S. economy attracts an ever larger number of investors into the death-trap that is the U.S. bond market. Of course if you believe that deflation is inevitable, then short-term bonds and cash are the goer. As we explained in last week's e-mail update to Australian Wealth Gameplan readers, deflation is not politically acceptable. Money will be created by the Fed and spent by politicians, whether it exists or not. A good example of this is the $26 billion emergency blah blah blah package passed by the U.S. House yesterday and signed by the man presiding aloofly over America's fiscal decline, President Obama. The emergency bill forked over $11 billion to U.S. States to pay teachers. Another $16 billion increased Medicaid payments to U.S. States so the States can pay other people, like fireman, police officers, and valuable public workers sitting at desks. The States are the Federal government as Greece is to the European Union. In fact, America's sovereign debt crisis maybe a trickle-up affair, as States and municipalities pass the buck on up the ladder to Uncle Sam. This is why, deep down in our contrarian bones, we know the U.S. dollar is doomed as a store of value. What about here in Australia, though? The amount of money being lent for housing fell by 3.9% in June according to the Australian Bureau of Statistics. It was the lowest amount for housing finance since February of 2001, which was over nine years ago. What does that tell you? It tells you that the largest factor on "underlying demand" for Australian housing is the price of money. When the price of money is cheap, the demand for housing goes up. When the price of money goes up, the demand for housing goes down. This insistence that there is a structural shortage of housing in Australia is the rubbish you get from spruikers at the height of a credit-fuelled bull market. Spruik on! Dan Denning |

| Posted: 10 Aug 2010 04:03 PM PDT |

| Gold Seeker Closing Report: Gold and Silver Fall Slightly Before Fed Announcement; Gain Afterwards Posted: 10 Aug 2010 04:00 PM PDT Gold waffled near unchanged for most of trade in Asia before it fell back off in London to see an almost 1% loss at as low as $1190.25 in early New York trade and then stormed back higher in midday trade to almost unchanged at as high as $1199.65 by early afternoon, but it then fell back off in the last hour of trade and ended with a loss of 0.4%. It has however, more than erased that loss in after hours access trade in reaction to the fed's announcement. |

| iPath Rolls Out Eight New Treasury ETNs Posted: 10 Aug 2010 03:59 PM PDT Michael Johnston submits: iPath, one of the largest issuers of exchange traded notes (ETNs) announced today a significant expansion of its product line. The firm introduced eight new ETNs linked to indexes measuring the performance of various corners of the government bond market. The fixed income ETNs join an existing product line that includes debt instruments offering exposure to commodities, currencies, emerging markets equities, and alternative strategies. The new ETNs, which consist of four pairs of long and short ETNs, are:

The most unique of the new products are the Steepener and Flattener ETNs. STPP offers exposure to the Barclays Capital U.S. Treasury 2 Year/10 Year Yield Curve Index, a benchmark that measures the return of a strategy that seeks to capture returns that are potentially available from a “steepening” or “flattening” of the U.S. Treasury yield curve through a notional rolling investment in U.S. Treasury note futures contracts. The index is designed to increase in response to a “steepening” of the yield curve and decrease in response to a “flattening” of the yield curve. To accomplish this, the index tracks the returns of a long position in 2-Year Treasury futures contracts and a short position in 10-Year Treasury contracts. FLAT offers inverse exposure to the same index; it is designed to increase in value when the gap between 2 Year and 10 Year Treasury yields narrows. Complete Story » |

| WisdomTree's Latest: Emerging Markets Local Debt, Active Edition Posted: 10 Aug 2010 03:56 PM PDT Invest With An Edge submits: By Patrick Watson Yesterday (8/9/10) WisdomTree made a little bit of a splash with the launch of WisdomTree Emerging Markets Local Debt Fund (ELD). We call it a “splash” because the firm apparently lined up some big buyers even before the new ETF hit the tape. Assets are already at $125 million. Complete Story » |

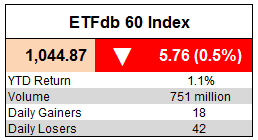

| Tuesday ETF Roundup: VXX Soars, FXI Falls Posted: 10 Aug 2010 03:51 PM PDT ETF Database submits: Equity markets had an extremely rocky Tuesday thanks to the Federal Reserve’s August policy meeting; the bank kept rates on hold but announced that it will use the proceeds from its investments in mortgage bonds to buy government debt on a small scale. This report helped to boost stock markets, which all finished the day significantly off of their lows; the S&P 500 and the Dow both lost roughly half a percent while the Nasdaq slumped further to finish the day down 1.2%. The small level of debt purchases had the effect of increasing the demand for the dollar, as many had assumed that the Fed might announce a more robust program to boost the economy. This helped to push down the prices of commodities across the board, with oil falling by 1.6%, copper by 1.3%, and gold dropping below the $1,200/oz. mark in after-hours trading.

Complete Story » |

| Fed Reactions From Around the Web Posted: 10 Aug 2010 03:00 PM PDT Economic Disconnect submits: I ran across many excellent one liners or short snippets that were insightful and/or funny regarding the Fed decision to buy more treasuries with money they make on MBS assets they bought with treasuries. I know that sounds weird, but this is what passes for monetary policy. My own take on the Fed move today is that they are now deeply enmeshed with Wall Street. As I wrote last night, unable to influence the real economy the Fed will now make sure Wall Street is getting all they need to keep the indices up. Absent that outlier (a higher stock market) there has been no real improvement in the economy in a long time. Everyone on the street knows it, and I think the Fed does as well. There does seem to be a little gamesmanship going on here though; the Fed does not want to keep doing these things and would prefer Congress do something while the Congress is scared to death of the November elections and would prefer the Fed to do all the work. Classic indeed. Complete Story » |

| Why the Economy Is Addicted to Government Aid Posted: 10 Aug 2010 02:54 PM PDT Rick Newman submits: Painful as it is, important parts of the economy are slowly healing. Overleveraged consumers are paying off crushing debt and starting to save more. The financial system has stabilized, thanks to the bazookaful of aid fired by the government in 2008 and 2009. Ruthless layoffs and aggressive cost-cutting have left corporate America "in its best fundamental condition in decades," according to strategist Brian Belski of investing firm Oppenheimer. Some day, those improvements might help our kids or grandkids enjoy a return to prosperity. Today is obviously a different story, though. Unemployment is way too high, hiring is pitiful, the housing bust refuses to end, consumers don't want to spend, and instead of gathering steam, the economy seems to be sputtering toward another breakdown. Democrats, Republicans, Tea Partiers, and No Partiers all have their preferred explanations, but if you put politics aside and look at economics, one big problem is clear: Our supposedly free-market economy is addicted to government spending and federal subsidies. And we're now in the early stage of an ugly detoxification. Complete Story » |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The

The

No comments:

Post a Comment