Gold World News Flash |

- Irrational Exuberance to Unusually Uncertain

- Hourly Action In Gold From Trader Dan

- In The News Today

- Credit Deflation Lands in Britain

- Ron Struthers: Eat, Pray and Hold Gold

- An Easy Solution to a Major Retirement Worry

- Optimism and Opportunity Abound!

- United Mining Group Poised For Production In Idaho's Silver Valley

- What Was That? Short Covering?

- Crude Oil Approaches Channel Top, Gold Bounces Back Despite Investor Liquidation

- LGMR: Gold Breaks $1200 as Europe's "Secretive" Bank-Stress Tests Fail to Reassure

- If Everything Is So Good, Why Am I Feeling So Bad?

- Gold Seeker Weekly Wrap-Up: Gold About Unchanged While Silver Climbs Almost 2% on the Week

- CFTC's Chilton explains hope for freer, more transparent gold, silver markets

- CFTC's Chilton explains hope for freer, more transparent gold, silver markets

- Comparing CPPIB and PSPIB FY 2010 Results

- More Currency Controls On The Way

- Mining Stock Talk interviews Peter Grandich on gold and silver

- Gold Daily and Weekly Charts; Silver Charts; 1099 Change Does Not 'Target Gold and Silver'

- Some Investors Getting 'Fed Up' with the Fed?

- Addison Wiggin: The golden shell games of ETFs

- Gold Bullion Video

- How Not to Get Your Gold

- China Calls Our Bluff: "The US is Insolvent and Faces Bankruptcy as a Pure Debtor Nation but [U.S.] Rating Agencies Still Give it High Rankings"

- Trader Dan Comments On This Week's CCI Action

- Hungary's Malaise

- Back to the Articles

- The Crisis Is Over

- FRIDAY Market Excerpts

- Bring Out Your Dead

- Higher Taxes are Coming. Head for Your Bunkers.

- European Bank Stress Test Results in, 7 of 91 EU Banks Fail

- Fed Program Acronym Watch: SWATting Down the Market

- Euro sham: European bank "stress tests" revealed

- These states are offering big tax breaks for retirees

- Are Most Things Rigged, Fraudulent And Deceitful?

- BP Bids Likely to Be Short-Term Support for Sterling

- Gold: Another High in Q2 With More to Come

- Gold: Another High in Q2, With More to Come

- The ECRI Weekly Leading Index: Negative Growth for Seventh Straight Week

- Musings on Kids and Asia

- CNBC Squawkbox Europe

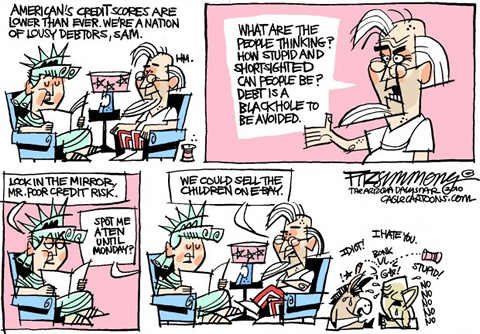

- Typical Family Mired in Debt, Like the US

- COT Gold, Silver and US Dollar Index Report - July 23, 2010

- Dollar's Never-Ending Plunge and Its Golden Consequences

- The State the Welfare State is In

- Gold Miner ETFs: A Better Option Than Spot Gold?

- Europe's Stress Tests Not Very Stressful?

- Gold, Silver, plus #3, for Profit & Protection

- Is the BP Oil Spill a Good Thing?

| Irrational Exuberance to Unusually Uncertain Posted: 23 Jul 2010 06:36 PM PDT View the original post at jsmineset.com... July 23, 2010 09:08 AM Dear CIGAs, The decade of the 1990's is America's modern day equivalent of the Roaring 20's. Back then, we were making great strides in productivity. We had near full employment, the government had a surplus of cash and the stock market was making many people rich. The future looked so bright in December of 1996 that Fed Chief Alan Greenspan warned investors not to get carried away with the good times. Greenspan asked this rhetorical question, "But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?" According to Yale Economics Professor Robert J. Shiller, Greenspan ". . . never actively used the words 'irrational exuberance' again in any public venue." (Click here for more from Shiller who wrote the best selling book titled "Irrational Exuberance... |

| Hourly Action In Gold From Trader Dan Posted: 23 Jul 2010 06:36 PM PDT |

| Posted: 23 Jul 2010 06:35 PM PDT View the original post at jsmineset.com... July 23, 2010 01:57 PM Jim Sinclair’s Commentary What more proof do you want that the cartoon given to you today, commissioned by JSMineset, is ABSOLUTELY correct? Fed Would Act if Needed, Chairman Says By SEWELL CHAN Published: July 22, 2010 WASHINGTON — A day after signaling that he had no immediate plans to take further steps to prop up the economy, the Federal Reserve chairman said Thursday that he was prepared to do so if the outlook worsened. The chairman, Ben S. Bernanke, who had described the nation's economic outlook as "unusually uncertain" in presenting the Fed's semiannual monetary policy report to Congress on Wednesday, was somewhat more explicit about his thinking in the second day of testimony. "We are ready, and we will act if the economy does not continue to improve, if we don't see the kind of improvements in the labor market that we are hoping for and expecting," Mr. Bernanke told Representative Mel... |

| Credit Deflation Lands in Britain Posted: 23 Jul 2010 06:35 PM PDT by Adrian Ash BullionVault Friday, 23 July 2010 Credit deflation just hit the UK for the first time on post-war records... HMMMM...This looks telling. UK banks will soon be able to post raw loans – rather than securitized loans that have been bundled into asset-backed bonds – as collateral against short-term liquidity aid from the Bank of England. This will mean lending central-bank cash against the commercial banks' major assets, as the Old Lady of Threadneedle Street puts it, rather than against that sliver of their balance-sheets held as securitized loans. Which seems prescient, for two reasons. First, securitization of UK consumer, mortgage and business debt has all but collapsed. Net-net, there haven't been any sizeable securitizations of UK bank lending for six months running – the longest period since 1998. The two months before that actually saw securitizations paid back, and at the fastest pace on record, down by £26 billi... |

| Ron Struthers: Eat, Pray and Hold Gold Posted: 23 Jul 2010 06:35 PM PDT Source: Brian Sylvester of The Gold Report 07/23/2010 Newsletter Writer Ron Struthers is an old-school straight talker who doesn't mince words. Ron believes the U.S. economy never came out of the 2008 recession and predicts America is about to face a whole new set of debt problems at the state level. "Any one of the U.S. states is bigger than Greece, and 40 or more of them are in the same bad shape," he warns. Ron recommends investors fortify their portfolios with 15%–20% physical gold and another 40% in cash, ready to jump on any opportunities the moody markets present. In this short but sweet interview with The Gold Report, Ron also offers some of his favorite gold and silver plays, many of which are in Mexico. ¡Ole! The Gold Report: According to Struthers Resource Stock Report early this month, the market rally would continue for as little as two weeks. What fundamentals led you to that conclusion? Ron Struthers: In the first place, the U.S. economy has never b... |

| An Easy Solution to a Major Retirement Worry Posted: 23 Jul 2010 06:35 PM PDT By Dr. David Eifrig, editor, Retirement Millionaire Friday, July 23, 2010 "I'm worried, Doc… I hear so much talk on television about the government printing money and destroying the dollar." Like many retirees, my friend Chris is worried about government spending… about taxes… about Social Security… and about inflation destroying his nest egg. I don't blame him. I've been in the financial markets for over 30 years, and I've never seen such extreme government overreactions to economic problems. I'm sure it's going to cause problems years down the road. But if you're worried like Chris is, here's a chart you have to see… and a solution to your worries. One thing that has folks worried is the threat of inflation. Many analysts point out the Fed has been "pumping money" into the economy to fight the recession. This will lead to inflation, the analysts say. But my chart today shows inflation just isn't a danger right now… Th... |

| Optimism and Opportunity Abound! Posted: 23 Jul 2010 06:35 PM PDT The 5 min. Forecast July 23, 2010 09:58 AM by Addison Wiggin & Ian Mathias [LIST] [*] Could the BP spill be… good? Marcio Mello, Byron King offer rare perspective on the Gulf crisis [*] More optimism hits the Investment Symposium… opportunities from Patrick Cox and Frank Holmes [*] Euros conduct bank “stress tests”… your guide to analyzing the results [*] Plus, the age-old question: Gold or gold miners? [/LIST] “This disaster in the Gulf will bring so much joy, such great future for the U.S.!” Marcio Mello begins today’s 5. If you are unfamiliar, Mello is the geological legend responsible for Brazil’s massive deep-water oil discoveries in the last few years. He shared his thoughts at our Investment Symposium yesterday… But before you read them, have you ever seen Italian television? A Mexican talk show? If you have, then you can picture Mello bounce around the room with wild, infectious, almost cartoonish e... |

| United Mining Group Poised For Production In Idaho's Silver Valley Posted: 23 Jul 2010 06:35 PM PDT By Claire O'Connor James West MidasLetter.com Friday, July 23, 2010 On May 10th 2010, United Mining Group (CNSX:UMG), formerly Scarlet Resources Ltd., began trading on the CNSX under the stock symbol UMG. UMG is an exploration group with a difference; not only does the company own and operate a lucrative mine services company, they've also entered into an earn-in agreement to earn an 80% interest in the Crescent Mine – a past producing silver mine in North Idaho's "Silver Valley". Perched loftily in a position of financial stability that most juniors can only dream of, UMG is aiming for phase one production with Crescent in Q4 2010 - Q1 2011. All permits and financing are already in place. Located in Northern Idaho's historic Coeur d'Alene district - famously referred to as "The Silver Valley" - the Crescent Mine and its neighbors live up... |

| What Was That? Short Covering? Posted: 23 Jul 2010 06:35 PM PDT All was quiet through Far East and London trading on Thursday... but at 9:30 a.m. in New York, gold took off... and, in 30 minutes, was up to its high of the day of $1,202.20 spot. Then, the buyer either disappeared, or massive selling took place that stopped the rally in its tracks at the London p.m. gold fix. Gold certainly wasn't allowed to close over $1,200... and sank back to just below $1,195 spot at the close of electronic trading in New York. Silver's low of the day [around $17.60 spot] was in afternoon Hong Kong trading yesterday... shortly before London opened. From there, the price trended generally higher before going ballistic at precisely 9:30 a.m... right along with gold. Silver's rally ended precisely 30 minutes later at 10:00 a.m. Eastern... which, as I pointed out above, just happens to be the London p.m. gold fix. Silver hit a high of $18.22 before trading sideways for the rest of the day. Ted Butler felt that yesterday's a... |

| Crude Oil Approaches Channel Top, Gold Bounces Back Despite Investor Liquidation Posted: 23 Jul 2010 06:35 PM PDT courtesy of DailyFX.com July 22, 2010 07:39 PM Crude oil continues to move within the now well-established upward trend, as bearish fears slowly fade into the background. Gold's recent positive correlation with risk appetite continued on Thursday. Commodities - Energy Crude Oil Approaches Channel Top Crude Oil (WTI) $79.06 -$0.24 -0.30% Commentary: Crude oil soared $2.74, or 3.58% on Thursday, as strong corporate earnings announcements and better-than-expected existing home sales figures encouraged bullish bets. Since putting in its lows back in May, crude oil has advanced over 23%. The commodity is now less concerned about the potential for more slowing in the global economy, and more concerned with the upside risks to demand from emerging markets and the downside risks to supply from the Gulf of Mexico turmoil. There is a consensus forming among long-term forecasters that oil has a good chance to revisit triple digit levels sometime next year, as surg... |

| LGMR: Gold Breaks $1200 as Europe's "Secretive" Bank-Stress Tests Fail to Reassure Posted: 23 Jul 2010 06:35 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:15 ET, Fri 23 July Gold Breaks $1200 as Europe's "Secretive" Bank-Stress Tests Fail to Reassure Investors THE PRICE OF GOLD rose to a 5-session high above $1200 an ounce early Friday, showing a week-on-week gain for US, Euro and Japanese investors but holding unchanged against Sterling and Swiss Francs. Government bonds edged lower as silver bullion held flat and crude oil slipped back through Thursday's 11-week high of $79 per barrel. Yesterday's 2% gain on Wall Street – plus a strong rise in Asian stocks – failed to spur more than a 0.3% rise in European equities, as investors and traders awaited the "stress test" results on 91 regional banks. "The correlations for gold prices are all over the place at the moment," says Phil Smith at Reuters Technical in Beijing, "and it is actually high-positive with the US Dollar – which is not normal. "Breakdowns in 'normal' correlations generally point to... |

| If Everything Is So Good, Why Am I Feeling So Bad? Posted: 23 Jul 2010 04:06 PM PDT From The Daily Capitalist The markets behave as if everything is just fine. This week the S&P 500 was up 7.3% for the month (from 1027 to 1102), corporate earnings have been looking good, retail sales inched up last week, the CPI is low, interest rates are low, Dr. Bernanke is ready to pump money into the economy if things go awry, most European banks passed their stress test, and we've got a new financial markets regulation bill which will save us from economic collapse. Yet most folks don't believe things are getting any better. What's wrong? Here's some data I gathered for the week of economic reports that might shed some light on the topic: The U of Michigan's consumer sentiment index crashed: it dropped from the June high of 76 to a mid-July reading of 66.5. About 10 points. This could mean that consumers are pulling back, according to the data. The latest Conference Board's Index of Leading Indicators turned negative, down 0.2% in June. In May it was up 0.6%. According to my report, if you take the interest rate spread out of their index, it would have fallen 0.6%. (See Leading Indicators Have Turned South.) New jobless claims for the week of July 17 jumped 37,000 to 464,000 from 427,000 in the prior week. The four week moving average also declined by11,750 to 455,250, the lowest level since mid May. Corporate earnings have been good; so far three-quarters of companies have beat estimates. For example Ford reported a 13% gain in earnings for Q2. Up-selling and cost cutting seemed to do the trick. Which lies at the heart of the problem: revenues tend to be tame and gains are coming from efficiencies. It's a mixed bag, so it's difficult to generalize here. Oil, autos, technology, and exporters did well. The key to any sustained recovery will be consumer spending. Which gets me to payrolls. The state-by-state report from the Labor Department showed that payrolls decreased in 27 states, including the biggest, California and New York. Some 16 states had unemployment in excess of 10%. We'll have to wait for the next unemployment reports to sort this out, but it seems that we aren't adding net jobs. What consumers are doing is paying down debt. According to an American Banker report, a "handful" of mid-size banks (KeyCorp, Huntington Bancshares Inc. and M&T Bank Corp.) are experiencing a surge in loan paydowns without experiencing an increase in lending. While this improves credit quality it doesn't help their longer-term loan book. I see this as a good thing, part of a necessary deleveraging process, it shows us where consumers are putting their money. It's the biggest raise they can give themselves: with negligible earnings on money market accounts, a debt paydown on a 6% loan is a positive for them. The housing market is still bad. While prices have been going up (0.5% per Federal Housing Financing Agency--FHFA), sales of existing home sales are down 5.1% in June.

Home inventory which had been declining as the result of the housing tax credit went up in June by 2.5%. The supply vs. sales index went from 8.3 months to sell a home to 8.9%. My last point is the Baltic Dry Index. I follow this report on shipping traffic around the world as an indicator of worldwide economic health. If China is shipping a lot of goods to the U.S. and Europe it is because there is consumer demand for such goods, which shows a healthy economy. In the past two months it has dropped almost 60%: P.S. Coming soon: a major article analyzing the financial markets overhaul bill. |

| Gold Seeker Weekly Wrap-Up: Gold About Unchanged While Silver Climbs Almost 2% on the Week Posted: 23 Jul 2010 04:00 PM PDT Gold reversed slight losses in Asia and rose as much as $7.77 to $1203.97 at around 8:15AM EST, but it then chopped back lower for most of trade in New York and ended near its early afternoon low of $1185.75 with a loss of 0.65%. Silver climbed to $18.265 and dropped to $18.03 before it bounced back higher in late morning New York trade and ended unchanged on the day. |

| CFTC's Chilton explains hope for freer, more transparent gold, silver markets Posted: 23 Jul 2010 03:39 PM PDT 11:38p ET Friday, July 24, 2010 Dear Friend of GATA and Gold (and Silver): The member of the U.S. Commodity Futures Trading Commission who has been advocating imposing position limits on traders in the precious metals markets, Bart Chilton, has made a video explaining why he thinks the financial regulation law just enacted by Congress and President Obama promises great progress, particularly in making the commodity markets freer and more transparent. The law, Chilton explains, requires the CFTC to establish position limits and authorizes the commission to prosecute "disruptive trading practices." Chilton says he is especially pleased with that, because the commission's market manipulation standards have failed almost completely for many years. Chilton has been amazingly conscientious on the precious metals manipulation issue and has been amazingly responsive to gold and silver investors who have complained to the CFTC about market manipulation. He'll need their support as the CFTC writes the position limits regulations required by the new law. The big commercial shorts are sure to be heard as the commission continues to take public comment, so gold and silver investors can't let up yet. You can watch Chilton's presentation at YouTube here: http://www.youtube.com/watch?v=K1_q88rlUkw&feature=player_embedded CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| CFTC's Chilton explains hope for freer, more transparent gold, silver markets Posted: 23 Jul 2010 03:39 PM PDT 11:38p ET Friday, July 24, 2010 Dear Friend of GATA and Gold (and Silver): The member of the U.S. Commodity Futures Trading Commission who has been advocating imposing position limits on traders in the precious metals markets, Bart Chilton, has made a video explaining why he thinks the financial regulation law just enacted by Congress and President Obama promises great progress, particularly in making the commodity markets freer and more transparent. The law, Chilton explains, requires the CFTC to establish position limits and authorizes the commission to prosecute "disruptive trading practices." Chilton says he is especially pleased with that, because the commission's market manipulation standards have failed almost completely for many years. Chilton has been amazingly conscientious on the precious metals manipulation issue and has been amazingly responsive to gold and silver investors who have complained to the CFTC about market manipulation. He'll need their support as the CFTC writes the position limits regulations required by the new law. The big commercial shorts are sure to be heard as the commission continues to take public comment, so gold and silver investors can't let up yet. You can watch Chilton's presentation at YouTube here: http://www.youtube.com/watch?v=K1_q88rlUkw&feature=player_embedded CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| Comparing CPPIB and PSPIB FY 2010 Results Posted: 23 Jul 2010 03:13 PM PDT Given that PSP Investments reported its FY 2010 results, I think it would be useful to compare their results to those of CPPIB who reported back in May.

You can download CPPIB's FY 2010 Annual Report by clicking here. On page 7, CPPIB's President & CEO, David Denison, discussed the key factor influencing the Fund's performance:

You can click on the image above to see a breakdown of the performance by asset class. As mentioned above, Private real estate (-11.8%), Private foreign developed market equities (-9.4%), Private emerging market equities (-4.3%), and Infrastructure (-6.4%) all had a negative impact on the CPP Fund's portfolio in FY 2010.

This business of compensation gets very messy. I will be the first to admit that it's not easy to find a proper framework of compensating senior officers who deal in private markets. Public markets is another story, either you outperform your index or you don't. |

| More Currency Controls On The Way Posted: 23 Jul 2010 03:07 PM PDT (snippet) This house bill that is being proposed by democratic congressman Pete Stark. The currency exchange tax will help with everything from global warming to HIV and child care. This should make the U.S. dollar even more competitive. Sign me up! Read the whole lame mess here.The name: Investing in Our Future Act of 2010 Why we need it; Findings- Congress finds the following: (1) While Wall Street continues to reap massive profits, the 2008 global economic crisis they helped cause has destabilized economies and impacted the budgets of the United States and impoverished nations, compromising the ability of governments to address pressing needs. (2) Currency speculation has destabilizing impacts on the real economy and can contribute to financial crises. (3) Millions of people around the world have been pushed into poverty because of the global financial crisis, through no fault of their own. (4) The impacts of climate change, disease, and ill health undermine the economies of developing nations and their ability to contribute to a secure, stable world. (5) Predictable, adequate, sustainable, long-term funding to address global health and climate change in developing countries at the scale needed does not currently exist. (6) The United States has been a world leader in fighting against HIV/AIDS, Tuberculosis and Malaria and new science has shown that success against these major killers is possible within a generation, yet a greater commitment of resources is needed to save more lives. More Here.. |

| Mining Stock Talk interviews Peter Grandich on gold and silver Posted: 23 Jul 2010 02:59 PM PDT 11p ET Friday, July 24, 2010 Dear Friend of GATA and Gold (and Silver): Mining sector analyst Peter Grandich was interviewed for an hour this week by Mining Stock Talk. The interview covered not just the prospects for gold and silver but the always-negative gold and silver analysts who monopolize publicity given to the sector by mainstream financial news organizations; Grandich's belief in gold and silver market manipulation and his support for GATA; and some of his mining stock recommendations. You can listen to the interview at Mining Stock Talk here: http://miningstocktalk.com/mining-stock-talk-interviews-peter-grandich/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Gold Daily and Weekly Charts; Silver Charts; 1099 Change Does Not 'Target Gold and Silver' Posted: 23 Jul 2010 02:45 PM PDT |

| Some Investors Getting 'Fed Up' with the Fed? Posted: 23 Jul 2010 02:14 PM PDT |

| Addison Wiggin: The golden shell games of ETFs Posted: 23 Jul 2010 01:31 PM PDT 9:30p ET Friday, July 23, 2010 Dear Friend of GATA and Gold: Addison Wiggin of The Daily Reckoning this week warned investors against exchange-traded funds trading in gold because they may not really control the metal they claim to have. He mentions GATA along the way. Wiggin's commentary is headlined "Golden Shell Games" and you can find it at The Daily Reckoning here: http://dailyreckoning.com/golden-shell-games/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| Posted: 23 Jul 2010 01:02 PM PDT |

| Posted: 23 Jul 2010 12:52 PM PDT Just saw this article over on Tampa Bay Online (the online version of the Tampa Tribune – right in my backyard no less!) about a son that stole his father's Krugerrand:

He has the right idea, but certainly the wrong method. |

| Posted: 23 Jul 2010 12:13 PM PDT America's biggest creditor - China - has called our bluff. As the Financial Times notes, the head of China's biggest credit rating agency has said America is insolvent and that U.S. credit ratings are a joke:

China is right. U.S. credit ratings have been less than worthless. And - in the real world - America should have been downgraded to junk. See this, this, this, this, this, this, this, this and this. China is not shy about reminding the U.S. who's got the biggest pockets. As the Financial Times quotes Mr. Guan:

Might Makes Right Economic Collapse

As I've repeatedly shown, borrowing money to fund our huge military expenditures are - paradoxically - weakening our national security:

Indeed, as I pointed out in 2008:

The fact that America spends more than the rest of the world combined on our military means that we can keep an artificially high credit rating. But ironically, all the money we're spending on our military means that we become less and less credit-worthy ... and that we'll no longer be able to fund our military. To my surprise, he simply responded:

In other words, everyone who pays any attention knows that we're broke. What's scary is that our biggest creditor knows it. |

| Trader Dan Comments On This Week's CCI Action Posted: 23 Jul 2010 12:05 PM PDT Dear Friends, I have already put up a chart of the CCI this week in which I noted that it was approaching the top of its trading range that has held for the entirety of this year. The reason I seem somewhat obsessed with this is the fact that this chart, in my opinion, is the clearest indicator of how the war between the deflationists and the inflationists is faring. Until we get a decisive breakout of this trading range in one direction or the other, the uncertainty that has gripped the markets for what now seems an eternity will continue with the subsequent wild price swings up one week and then down the next. My analysis of this chart suggests that until we get a clean break of the 500 level, it is hard for me to get too excited about the prospects for a shift in investor sentiment decidedly in the favor of inflation. When we do however, I suspect that prices will move rather quickly as the rush into tangibles will commence in earnest. As noted in the cartoon that Jim had commissioned, it is inevitable that the madness involved in Quantitative Easing has set the stage for "something terrible our way cometh". We will be alerted to its arrival by means of this simple little price chart. Stay tuned for we are in uncharted waters much like the Black Pearl arrived at when it sailed to the end of the world and was caught up in the maelstrom therein housed. Click chart to enlarge in PDF format |

| Posted: 23 Jul 2010 12:00 PM PDT Prime Minister Ference Gyurcsany, identified by some as "the golden boy" of Hungary's Socialist Party, got himself into serious trouble with many Hungarians for having admitted, in a leaked closed-door party conference speech, that during his two years term as Prime Minister and the Socialist (post-communist) Party leader for the 2006 election which he and his party won, he was lying about the country's economy "morning, evening and night." Given that this was said in a recording that captured |

| Posted: 23 Jul 2010 12:00 PM PDT How would you like to begin a peaceful, legitimate political action which could roll back the last 100 years of government growth and national debt along with the hated federal income tax and the Fed? What if you could force Washington to return to a strong dollar policy and allow real currency competition to escape the near total destruction of the dollar now worth only 5 cents of the 1913 dollar? Imagine a future when the President would be forced to seek a Declaration of War and get the state |

| Posted: 23 Jul 2010 11:00 AM PDT Remember Hank Paulson's US$ 700,000,000,000 boondoggle way back when the financial crisis was at its height? Well just guess how much money the US has committed in the past year to supporting the financial system? US$ 700 billion... The more impressive figure follows in the Reuters article:

This is exactly why the first bailout shouldn't have happened. Now the economy relies on government backing. Unusually Unusual Ben Bernanke described the economic outlook as "unusually uncertain" at a Senate Banking Committee meeting this week. Considering he missed the biggest financial crisis since the Great Depression (which he is supposed to be an expert on), it is not a revelation that Ben can't see what's coming. Sarah Hunt, research analyst at Alpine Mutual Funds in Purchase, pointed out that "People were waiting for some, 'By the way, we're going to make some announcement that we're going to fix the world.'" Instead, they got a bunch of mumbo jumbo, causing media outlets to report on what Bernanke didn't say instead of what he said. Even The Age is substantially confused about what the future might hold. This homepage headline didn't seem to match the article well:

But back to Bernanke and his inflation crusade. Reuters outlines what "ammo" the Fed has left in the face of a slowdown, as well as the "exit strategy toolkit" in case things improve rapidly. Regarding "ammo", Ben came up with this:

But the market didn't like Bernanke's comments. Markets fell. Some traders had expected the federal funds rate to fall lower after the Committee hearing. That's lower than the 0% to 0.25% which is the current target. We would say this is unlikely, but then there was Japan's stint below 0 and underestimating Ben Bernanke doesn't seem wise. The Election Begins in Earnest Glenn Stevens has been unusually busy lately. He is making a nuisance of himself all round. Tony Abbott's announcement of budget cutting measures due to excessive public sector debt was met with a defiant "[Australia has] virtually no net public debt" from Stevens. Someone has it wrong because Abbott mentioned the following:

And Stevens retorts:

Well, isn't this fun? Gillard isn't exactly enjoying the spectacle either. It seems her stimulus program, which got some analytical mention last week, has bitten her on the backside in more ways than one.

But Nobel Laureate Joe Stiglitz reckons Rudd and Julia were spot on with the stimulus. Even if Stevens goes on a rate rampage to deal with the consequences. Supposedly the stimulus was "one of the most impressive economic policies [Stiglitz has] seen, ever". And Stiglitz was equally enlightened on the mining tax: "I have to say that I'm completely puzzled at the ability of the iron ore companies to seemingly win or at least partially [win] on that issue." Needless to say, Stiglitz spent his time at institutions including the World Bank. He also wrote the worst book your editor has ever read part of. We won't even name it. Jessica Irvine, economics editor at The Age adds her own analysis to the article on Stiglitz:

But if anyone examines what the money went into, it was unarguably wasteful. As Dan often mentions, Rudd's stimulus program even managed to kill people. Bipolar Euro Depressing The Euro fell and markets fretted. Now, the Euro rises and markets fret... Ken Wattret, chief euro-area economist at BNP Paribas SA in London:

Whether its solvency issues or export profitability, there is always something to whinge about. But who would have guessed that the Euro staged a 9.5% gain against the US$ since June 7th? Regardless of how informed you are about currency futures, there are more fundamental things to worry about. Currencies change in value relative to each other. That's the market at work. But the market isn't the only thing at work these days. The European bank stress tests are due this week. The regulators have been deciding who has been naughty and nice. And they've supposedly caught one of the naughty ones.

Of course, unlike with Santa, the naughty will be receiving the presents. Cash, cash lines, swaps (for cash) and cheap cash are said to be on the wish list this year. Photoshopping a Santa hat onto Trichet seemed like a lot of effort. Maybe we should get the guys at BP to do it for us. Deja Vu? Another week, [insert] more bank failures in the US. This brings the total to [insert]. Another week, another downgrade from our steadfast bastions of financial wisdom - ratings agencies. [insert] falls victim this time. But what is new this time around is the latest be-ratings agency kerfuffle. Daily Reckoning guest editor Dr. Alex Cowie discussed Obama's latest move to stir the proverbial in the world of credit here. It's a comical one. The United Shambles of America (2) What does an insolvent government look like?

But don't worry, the municipals wont default on their debt any time soon. "Even in a Draconian scenario such as the Great Depression, we believe that there is no out-sized risk in the municipal bond market," said Bijan Moazami from FBR Capital Markets (holders of US$369 billion municipal debt).

Sounds like they are missing the point and the news. Extreme circumstances began months ago when banks foreclosed on loans for police cars and repossessed them. And dependence on funding does not determine whether you can meet your payments. Having cash does. All these public sector funding issues put a whole new angle on Karl Marx's prediction of how capitalism would destroy itself:

So it seems there was something to Marx's prediction. At least the amended version. He just got his definition of capitalism wrong. And he, like Keynes, forgot to mention where the funding for all this socialism/stimulus would come from. Ironically, it's the US that leads the charge in proving Marx partially right. Municipal governments and cities will have to outsource their increasingly collectivist services to cheaper and more efficient private companies, as described in the articles above. Because they can't pay for them. Oops. The UK, the world's next biggest touter of capitalism, follows the US with the same development on a national level:

This is what austerity looks like. It's not communism that comes after crony capitalism. Communism is too expensive. What does come after crony capitalism is something we can only guess at. History says hyperinflation. For now, the Road to Serfdom continues under the guise of a "citizen's assembly". Governments can Multitask The best way to simplify the tax code is, apparently, to appoint a tax lawyer to do it. In other words, ask the guy who made a living out of the complexity of tax law to simplify it. That's what the Brits are planning. Just like asking the fox to guard the chicken coup, it's going to work. Meanwhile, Cameron and his cronies are raiding dormant UK bank accounts. Yes, if you have an account in the UK, it might pay to send your banker a postcard that you are still alive. Otherwise you will be funding the British Empire's exploits. Even Bogus Profit is Gone Shocking news from the US: "Goldman Sachs Profit Drops 82%". Oh, sorry, we forgot the more important bit: "Goldman Sachs Profit Drops 82%, Missing Analysts' Estimates". It turns out that Goldman's traders couldn't keep their winning streak. But this is seriously concerning news. If Goldman can't make money in this market, what kind of self respecting decent businessman can? Ben Bernanke of course! He can always make more money. He is Time's man of the year after all. And money really is funny in his world. Who Has the Power? China surpassed the US as the world's largest power consumer recently. Dan discussed where all this power came from here. Closer to home, power companies are the latest to whinge over uncertainty on Australia's policy future. What will carbon be under the new government? An externality or source of tax revenue? For now, those questions have cost the country $10 billion in spending plans being slashed. And both political parties have it wrong anyway. Everyone knows about carbon emissions by now. And if power consumers are aware, but don't change their polluting habits, then it's because they don't care enough. Thus, implementing a bureaucratic and legal nightmare to do what consumers will do when they want to is not a winning policy move. Ah, perhaps the political mind works differently, as Dan points out. It's not about decreasing pollution anyway, it's about being elected. So if you can create a fear in people's minds, and claim to be the only one to provide a way out, then people will vote for you. Germans Commit to Europe Again The German Finance Minister seems like quite a guy. And with Germany leading by example in Europe, this is quite important. Supposedly, Schaeuble cannot become Chancellor because he stepped down as his party's chairman over a donations scandal. This is what made way for the current chancellor. More importantly though is the fact that Schaeuble considers his own health second to Europe's. The wheelchair bound Euro visionary did the "heavy lifting" in getting the Euro off the ground in the 1990s, according to his biographer. He was even the one who negotiated Germany's reunification. Then recently he defied doctors and attended the Greek bailout meeting shortly after an operation. So it seems the Germans have a commitment to the Euro from one of their key politicians. Until next week, Nickolai Hubble. |

| Posted: 23 Jul 2010 10:32 AM PDT Gold softens after EU bank tests fail to suprise The COMEX August gold futures contract closed down $7.80 Friday at $1187.80, trading between $1185.80 and $1203.90 July 23, p.m. excerpts: see full news, 24-hr newswire… July 23rd's audio MarketMinute |

| Posted: 23 Jul 2010 10:15 AM PDT |

| Higher Taxes are Coming. Head for Your Bunkers. Posted: 23 Jul 2010 10:00 AM PDT In the calming environment of the Big Mogambo Big Is Better Bunker (BMBIBB), I can finally relax by sitting, armed to the teeth, amongst my puny trove of gold, silver and oil, idly trying to say, "Big Mogambo Big Is Better Bunker" five times quickly until my seething, vaguely homicidal rage at the Federal Reserve and the socialist/fascist/ communists in the White House and Congress that have destroyed us all. Still, I can find no respite from the paralyzing fear of economic catastrophe as I wait for a huge avalanche of people, who are sitting on unrealized profits of any kind, to sell the profitable asset, realize the profit, and willingly pay the tax on the gains. I see the quizzical look on your face, as you wonder, "What in the hell are you talking about, Lunatic Mogambo Weirdo (LMW)? Does this have anything to do with tacos, pizza, Chinese food or making money without working, or does it really have something to do with taxes, which you are far too stupid to understand, so who's fooling who here?" Well, if there is such a thing as the hypothetical "rational economic man," then this "sell everything!" scenario is exactly what will happen because taxes of all kinds, including the all-important income taxes and capital gains taxes, are going to all go up by – hold onto your hats! – almost a third or more next year! Right now, the marginal income tax rates are 10%, 15%, 25%, 28%, 33% and 35%, which is the range of six different tax rates for the few people that make enough money to actually pay any federal income taxes, which seems like such a quaint anachronism these days because more people receive money from the government than people who pay the government, which explains why the budget deficit this year – alone! – is $1.4 trillion or so, and when including the inevitable supplemental appropriations throughout the year, will surely be near staggering $2 trillion, bringing total federal government spending to almost $5 trillion, whereas all the business and personal income taxes collected for the whole year is less than $1.5 trillion! And yet, with that kind of staggering imbalance, there are 6 income tax brackets! Hahaha! 6 brackets! Hahahaha! Income taxes are now just chump change for the government, for one thing, and yet it has to be complicated, too? Thanks, Congress, you corrupt morons! Hahaha! According to the Tax Foundation, "All taxpayers" paid a total of just over a $1.1 trillion in 2009, and thanks to the taxpolicycenter.com, I see that corporate taxes were a mere $250 billion pittance in comparison. The surprising and alarming thing is the amazing, cancerous growth of payroll taxes over the years, which now collects almost as much tax as individual income taxes! Hahahaha! Pardon my laughing at the sheer stupidity that creeps into government, and the sheer stupidity of the people who elect the stupid representatives in the stupid government that stupidly create such sheer tax stupidity, but this is not real laughing, like when you are laughing at a funny joke. For example, notice how you can't help but laugh at this joke: "How many mainstream economists who agree with the neo-Keynesian econometric theoretical underpinnings of the Federal Reserve does it take to change a light bulb?" Answer: "None, because they are too stupid to realize that the light has actually burned out, and they think that by merely lowering interest rates and creating more money, they can raise the 'animal spirits' of the light bulb to light again, and again and again, as many times as needed, and everything will then be fine from then on, as many times as needed, but in the meantime they are all stumbling around in the dark trying to make the light bulb incandesce again trying various magic tricks, like just throwing money out into the darkness." Hahaha! See? It's funny! Now that is real laughter! On the other hand, my laugh is a kind of nervous titter, accompanied by shifty eyes narrowing to slits and by my shaking hands furtively inching towards bulging shoulder holsters, all of these behaviors being indicators that I am So Freaking Scared (SFS) that I want to start blasting a path to the safety of the Mogambo Bunker For Scaredy Cats (MBFSC) so that I could lock myself in, safely away in a panicked shoot-first-and-ask-questions-later defense from the calamitous destruction that always ultimately befalls an economy that is so stupid, so unbelievably stupid, so tragically stupid, as to construct an entire economy around the belief that there is such a thing as a "free lunch for everyone" through government deficit-spending, despite racking up a national debt ($13.3 trillion) that is almost 95% of GDP ($14 trillion) to pay for the "free lunch" so far! Gaaahhh! Fortunately, this is not about how I am such a sniveling coward, but about how the current tax regime is scheduled to expire at the end of this year, and then the tax rates automatically go back to five brackets of 15%, 28%, 31%, 36% and 39.6%, unless Congress "does something." And unless the government "does something", then selling assets to realize a profit before the end of the year means paying a third less taxes than if you sold next year! Big savings! Alas, most of us realize at this point that the government will "do something," by which I mean "borrow and spend money," and things will get worse, and inflation will surge as the filthy Federal Reserve "does something" by creating staggering amounts of money to accomplish it. And if you want something to do, too, then buy gold, silver and oil, because such fiscal and monetary stupidity makes the decision to buy them so easy that you positively giggle with childish delight, "Whee! This investing stuff is easy!" The Mogambo Guru Higher Taxes are Coming. Head for Your Bunkers. originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| European Bank Stress Test Results in, 7 of 91 EU Banks Fail Posted: 23 Jul 2010 10:00 AM PDT The European Union bank stress test, which included 91 banks or about 65 percent of the EU banking sector, has resulted in seven failures: five Spanish, one Greek, and one German institution were unable to earn a passing mark… with a combined $4.5 billion shortfall. They are as follows: * CajaSur (Spainish) * A Caixa Catalunya group (Spainish) * A Caixa Sabadell group (Spainish) * Caja Duero-Caja Espana (Spainish) * Banca Civica (Spainish) * Agricultural Bank of Greece SA (Greek) * Hypo Real Estate Holding AG (German) As expected, right out of the gate the credibility of the stress test is being called into question. According to Bloomberg: "Hypo Real Estate Holding AG, Agricultural Bank of Greece SA and five Spanish savings banks have insufficient reserves to maintain a Tier 1 capital ratio of at least 6 percent in the event of a recession and sovereign-debt crisis, lenders and regulators said today… "…'The amount of capital needed is much lower than the market expected,' said Mike Lenhoff, London-based chief strategist at Brewin Dolphin Securities Ltd., whose parent company oversees $33 billion. 'The amount does seem quite trivial considering the concerns about losses from the sovereign crisis.' [...] estimates for the amount banks would need to raise ranged from 30 billion euros at Nomura Holdings Inc. to as much as 85 billion euros at Barclays Capital. Tests carried out in the U.S. last year found 10 lenders including Bank of America Corp. and Citigroup Inc. needed to raise $74.6 billion of capital. "…'The long awaited stress tests do not seem to have been that stressful after all," said Gary Jenkins, an analyst at Evolution Securities Ltd., in a note. "The most controversial area surrounds the treatment of the banks' sovereign debt holdings." As the article also points out, one of the main reasons the banks looked better than expected is the test focused on government bonds the banks actively trade, as opposed what's actually a greater share of bank holdings, the sovereign debt held to maturity. We'll be sure to keep you posted on additional weaknesses in the bank test as they emerge. You can read more of the details in Bloomberg coverage of how seven EU banks failed the stress tests with a $4.5 billion shortfall. Best, Rocky Vega, European Bank Stress Test Results in, 7 of 91 EU Banks Fail originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Fed Program Acronym Watch: SWATting Down the Market Posted: 23 Jul 2010 09:36 AM PDT Wall Street Strategies submits: Admittedly, while I wanted more honesty from Ben Bernanke, there is always a price to pay for the things we ask for. Although the Federal Reserve Chairman made what are obvious comments, the fact he had to take the shine off his previously glossy assessments of the economy was unnerving. In other words, we like it when Big Ben lies to us; we are human, after all. There seems to be a suggestion the economic rally baton can be handed off to household and business spending as fiscal policy and inventory restocking will not provide the same oomph. The big problem, or "drag" as the Fed chief put it in his opening statement, emanates from a lack of jobs. Judging the average of 100,000 jobs gained per month in private payroll (no word on those saved and created jobs) as "insufficient" to reduce the unemployment rate materially only told us what we knew. But we were able to suspend the thought from time to time even as our unemployed brother-in-law keeps blowing up our cell phone. Hey, he was bumming money even when he had a job. In a week with heavy debate over extending unemployment benefits with paying for them, Bernanke underscored the harsh reality that those chronically unemployed (about half of total unemployed) face erosion of skills which makes future employment opportunities more difficult. That stuff didn't send the market lower; however, it was the tone of the testimony which makes it seem as if the Fed is confused, and maybe even frustrated. There were comments on Europe and its economic crisis being something of a wildcard, but it's clear those early victory laps were premature. Complete Story » |

| Euro sham: European bank "stress tests" revealed Posted: 23 Jul 2010 09:32 AM PDT From Bloomberg: Seven of 91 European Union banks subject to stress tests failed with a combined capital shortfall of 3.5 billion euros ($4.5 billion), stirring concern the evaluations weren’t strict enough. Hypo Real Estate Holding AG, Agricultural Bank of Greece SA, and five Spanish savings banks have insufficient reserves to maintain a Tier 1 capital ratio of at least 6 percent in the event of a recession and sovereign-debt crisis, lenders and regulators said today. The banks are in “close contact” with national authorities over the results and the need for more capital, said the Committee of European Banking Supervisors, which coordinated the tests. Governments are seeking to reassure investors about the health of financial institutions after the debt crisis pummeled the bonds of Greece, Spain, and Portugal. “It would have aided credibility if there had been a higher number of fails and a higher amount of capital raised,” said Jon Peace, a London-based analyst at Nomura International Plc. “People will be surprised that it is as small as that.” The evaluations took into account potential losses only on government bonds the banks trade, rather than those they are holding to maturity, according to CEBS. That means the tests ignored the majority of banks’ holdings of sovereign debt, analysts said. Test Criteria “The long awaited stress tests do not seem to have been that stressful after all,” said Gary Jenkins, an analyst at Evolution Securities Ltd., in a note. “The most controversial area surrounds the treatment of the banks’ sovereign debt holdings.” Regulators tested portfolios of sovereign five-year bonds, assuming a loss of 23.1 percent on Greek debt, 12.3 percent on Spanish bonds, 14 percent on Portuguese bonds, and 4.7 percent on German state debt, according to CEBS. The tests also assessed the impact of a four-step credit rating downgrade on securitized debt products, a 20 percent slump in European equities in both 2010 and 2011, and 50 other macroeconomic parameters, including a drop in the EU’s gross domestic product over two years, CEBS said. In Germany, Hypo Real Estate, a property lender that was taken over by the state, was the only bank to fail among the 14 that were tested, the Bundesbank and the nation’s financial regulator, BaFin, said in a joint statement today. Spanish Banks Agricultural Bank of Greece, which is 77 percent owned by the Greek state, reported a shortfall of 242.6 million euros and said it would proceed with a share capital increase to strengthen capital. Spain, with 27 tested banks, makes up the biggest portion of the exams. The savings banks that failed were: CajaSur; a merger group led by Caixa Catalunya; a group led by Caixa Sabadell; Caja Duero-Caja Espana, and Banca Civica. Spain’s largest bank, Banco Santander SA, passed with a Tier 1 capital ratio of 10 percent under the most stringent scenario. BNP Paribas, Societe Generale SA, Credit Agricole SA, and BPCE SA, France’s four largest banks, each have enough capital to outlast an economic slump and a sovereign debt crisis, the Bank of France said. In Britain, HSBC Holdings Plc, Barclays Plc, Lloyds Banking Group Plc, and Royal Bank of Scotland Group Plc passed the tests, the Financial Services Authority said today. The evaluations, which came two years after the U.S. subprime mortgage crisis roiled global financial markets, covers 65 percent of the EU banking industry. Tests carried out in the U.S. last year found 10 lenders, including Bank of America Corp. and Citigroup Inc., needed to raise $74.6 billion of capital. The results helped lift the Standard & Poor’s Financials Index 36 percent from the start of May through the end of last year. The 54-member Bloomberg Europe Banks and Financial Services Index has risen 9.4 percent in July, boosted by optimism that most lenders would pass the tests. To contact the reporters on this story: Jann Bettinga in Frankfurt at jbettinga@bloomberg.net; Charles Penty in Madrid at cpenty@bloomberg.net. More on the euro crisis: Unbelievable chart shows the euro is doomed Top analyst Shilling: Euro will fall to parity with dollar Unbelievable: Moody's downgrades Greece to junk status... yesterday |

| These states are offering big tax breaks for retirees Posted: 23 Jul 2010 09:26 AM PDT From Forbes: Last month, even as they slapped a new tax on hospitals, raised dozens of user fees, and eliminated a low-income tax credit, Georgia legislators passed income tax relief for one group: well-off retirees. For residents 62 or older, Georgia already exempts from its 6% tax all Social Security and $70,000 per couple of income from pensions, retirement accounts, annuities, interest, dividends, capital gains and rents. But in 2012... Read full article... More on taxes: The best thing you'll read about taxes this week What you need to know about gold and your taxes Wealthy Americans are fleeing south in record numbers |

| Are Most Things Rigged, Fraudulent And Deceitful? Posted: 23 Jul 2010 09:18 AM PDT How many times have you, your loved one, friend or relative been defrauded over your lifetime? I bet not one reader of this, or any blog, has gone through a time when they have not lost money on a "deal". Perhaps you have lent out money or bought a lemon vehicle that you couldn't get your money back. You may have lent a few bucks to your own sweet trusting relative or friend and he/she ensured you, that it will be paid back. Have you ever been promised a lunch and they didn't pay? Maybe you applied for a job and your credentials were much more adequate, your better looking, better educated and trusting, with an app to prove it, but the twirp got the gig instead. You know you should have got the job. But why didn't you? This brings us to the Government. How many times have you heard a politician claim he won't raise the taxes or cut a service, then does exactly that? You voted for this creep and he stepped on you. He lied, cheated and deceived you as a voter. Many, perhaps, have seen this video, showing how voting is rigged. Why keep voting? Does it make you feel good? Do you enjoy watching the media ads telling you to get out and vote? For what? A criminal? You know what's going to happen! Its a given, he will lie, cheat and steal from you, me and your kids! Then you have banks extorting billions of dollars off the public in the form of overdraft fees. They've been doing it for years and you keep paying them, why? You keep your money in the banks and get .01% interest as they lend it out and get 4%, 5% and up. Are you sick and tired of being scammed, slammed, railroaded and cheated? Probably, but you do nothing about it. You don't boycott, you don't stop buying, you don't stop going into debt, obtaining credit or buying junk you don't need. Instead, we sit, read the papers, watch CNN, then complain.. at parties, starbucks and hair salons. So tell us your beef.... to be continued..By Simon Castilla |

| BP Bids Likely to Be Short-Term Support for Sterling Posted: 23 Jul 2010 09:00 AM PDT The British pound has continued to strengthen in the past week, especially against the US dollar. Up till now, with the country's economic turmoil and rising public concern over divided central bank officials, currency market sentiment sold the sterling short. However, some new speculation regarding one of Britain's largest companies has helped to at least support the underlying currency in the short term. On the heels of creating one of the worst oil spills in American history, BP may be accepting funds from one of the world's largest sovereign wealth funds – Abu Dhabi. On July 13, crown prince and fund board member Sheikh Mohammed bin Zayed Al Nahyan said the fund was "looking across the board" when it came to a potential investment in BP. No confirmation has been given, of course, and authorities stress that the investment is currently one of many opportunities. Of course, "opportunity" isn't a word many people associate with BP these days. The beleaguered oil companies now looking to fund a $20 billion promise to help alleviate public distress over its oil spill. But exceptionally large investments in troubled companies are definitely not all that foreign to Abu Dhabi and its wealthy investors. Back in October 2008, amid the collapse of the global financial system, investors from the region came to the rescue of Barclays PLC. Abu Dhabi's royal family chipped in 3.5 billion pounds – giving them an outstanding 16% ownership in the UK-based bank. And the bet paid off. Just nine months later, the royal family sold the shares, ultimately reaping a 2.2 billion-pound gain – a 42% increase in wealth. With BP in such distress – and a double-digit potential for returns – it would be difficult to ignore this new opportunity.. Officials in China recognize the potential opportunity, too. A country that has already spent upwards of about $20 billion in investments in raw commodity producers over the last two years, Beijing is always on the lookout for bargains. (In fact, it also saw a decent return by investing in Barclays shortly before Abu Dhabi jumped in.) In the second quarter of 2008, Chinese officials made a $2 billion investment in BP. This equated to a small 1% portion of the company, but it kept China's interests solidified in a key global oil producer. The two-year relationship is now likely to lead to other deals in the short term. Recently both sides have begun talks for a $9 billion purchase of BP's stakes in South America – specifically, Argentina. The transaction would involve the state-owned China National Offshore Oil Company, or CNOOC, increasing its already 20% stake in the area. A win-win, the deal would further solidify China's hold on global commodities while boosting BP's need for funding. The enormity of both the Abu Dhabi investment and the CNOOC deal is set to boost British pound prospects in the short term. This is because the pound sterling will be used as a base currency for the transactions – an exchange currency to both the Abu Dhabi dirham and the Chinese yuan. The price of the investments will be quoted in pounds, and therefore will be settled in pounds. As with anything, an increase in the demand for a currency will help strengthen it against its counter currency. Against the greenback, the sterling will remain supported. But the effects could be even more powerful against the Swiss franc. A 25-basis point investment yield advantage will also help to boost a preference for the British currency against a lower yielding currency like the Swiss franc. Now throw in the fact that the British pound/Swiss franc currency pair has precipitously fallen by about 36% over the last three years. The currency was able to gain some strength in the first half of 2009. But, the move wasn't sustainable – kicking the currency pair back down to retest decade lows. Although the current economic condition of the UK warrants a continually bearish outlook for the pound sterling, there may be a silver lining for its currency in the short term. With speculation of cash injections and investments into BP – and smaller interests – likely to surface in coming months, simple demand may be enough to support a short-term rise in the currency against a low yielding Swiss franc. Richard Lee BP Bids Likely to Be Short-Term Support for Sterling originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Gold: Another High in Q2 With More to Come Posted: 23 Jul 2010 09:00 AM PDT Daniel Zurbrügg submits: Our fundamental view on gold hasn’t changed in the last couple of weeks, we continue to be positive and expect further price increases in 2010 and 2011. The last quarter brought yet another new high with gold reaching USD 1’264. The gold price has fallen back to USD 1’200 recently because of negative sentiment caused by the news about the annual report of the Bank of International Settlement (BIS) that revealed that an amount of 346 tons of gold have been swapped for liquidity from the BIS. This is a very significant trade and there is a lot of speculation about possible counterparties for such trade. The most likely candidates seem to be troubled countries such as Italy, Spain or Portugal but no additional information was disclosed. Complete Story » |

| Gold: Another High in Q2, With More to Come Posted: 23 Jul 2010 09:00 AM PDT Daniel Zurbrügg submits: Our fundamental view on gold hasn’t changed in the last couple of weeks; we continue to be positive and expect further price increases in 2010 and 2011. The last quarter brought yet another new high with gold reaching USD 1,264. The gold price has fallen back to USD 1,200 recently because of negative sentiment caused by the news about the annual report of the Bank of International Settlement (BIS) that revealed that an amount of 346 tons of gold have been swapped for liquidity from the BIS. This is a very significant trade and there is a lot of speculation about possible counterparties for such a trade. The most likely candidates seem to be troubled countries such as Italy, Spain or Portugal, but no additional information was disclosed. Complete Story » |

| The ECRI Weekly Leading Index: Negative Growth for Seventh Straight Week Posted: 23 Jul 2010 08:50 AM PDT Doug Short submits: Today the Weekly Leading Index (WLI) of the Economic Cycle Research Institute (ECRI) registered negative growth for the seventh consecutive week, coming in at -10.5. This number is based on data through July 16th. The rate of decline from the peak in October 2009 is unprecedented since the metric was first devised in 1967. Before we examine the WLI, let's first review the relationship between the Gross Domestic Product (GDP) and recessions since 1965. The conventional definition of a recession is two or more consecutive quarters of negative growth. The National Bureau of Economic Research (NBER), charged with establishing official recession start and end dates, doesn't follow convention in making its recession calls — often a year or more after the fact. Complete Story » |

| Posted: 23 Jul 2010 08:35 AM PDT