Gold World News Flash |

- GoldSeek.com Radio: David Morgan, Robert Ian, The International Forecaster, and your host Chris Waltzek

- CFTC's Chilton explains hope for freer, more transparent gold, silver markets

- Some Thoughts on Deflation

- International Forecaster July 2010 (#7) - Gold, Silver, Economy + More

- Bring Out Your Dead

- With Silver Soaring, Beware of Who You Buy From

- JPMorgan et al Reduce Their Gold Short Position Substantially

- In The News Today

- How to Pull Cash Out of Your Silver Holdings Without Losing Ounces

- The Future of America

- Trader Dan Comments On This Week?s CCI Action

- Higher Taxes are Coming. Head for Your Bunkers.

- The Goldsmiths—Part CLI

- 17 Reasons to be Bullish About the Markets

- The Bondsman's "Fear of Death"?

- Gold Bullion, Sales Exploding

- School Stocks Soar, Remain Unattractive; Any Exceptions?

- 3 Undervalued Foreign High Dividend Stocks

- Commodities Week: Oil and Copper Focus on Upside Risks, Gold Unchanged Despite Investor Liquidation

- Franklin Sanders on the Coming Avalanche of 1099 Forms

- Leading Economic Indicators Offer More Warning Signs

- 10 Charts, 10 Stories of the 'Real' Gold Price

- US Equities Outperformed On Sad Day For Integrity

- The Sagging Sector Component Making Gold More Volatile

- Goldman, Blackrock In Cross Hairs Again As Senator Grassley Digs Up Old Corpses

- Options Game Thrives on Plentiful Suckers

- When Will the AA Batteries Run Out?

- Junior Gold Miners Versus The Big Producers

- US Coin Composition Debate Returns with High Penny and Nickel Costs

- Metals now strongly bullish, Ted Butler tells King World News

- CFTC’s Chilton explains hope for freer, more transparent gold, silver markets

- Mining Stock Talk interviews Peter Grandich on gold and silver

- Gold: Another High in Q2, With More to Come

- Gold Miner ETFs: A Better Option Than Spot Gold?

- Rocky Mountain Chocolate Factory Update

- Guest Post: The Strategic Ramifications Of A US-Led Withdrawal from Afghanistan

- The Health Care Bill Change in 1099 Reporting Requirements Does NOT Target Gold and Silver

- Doubling Down on Housing?

- OMB's Latest Projections Estimate 250K Jobs Created Each Month Through End Of 2015

- Dollars Never-Ending Plunge and Its Golden Consequences

| Posted: 25 Jul 2010 04:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||

| CFTC's Chilton explains hope for freer, more transparent gold, silver markets Posted: 25 Jul 2010 06:00 AM PDT The member of the U.S. Commodity Futures Trading Commission who has been advocating imposing position limits on traders in the precious metals markets, Bart Chilton, has made a video explaining why he thinks the financial regulation law just enacted by Congress and President Obama promises great progress, particularly in making the commodity markets freer and more transparent. | ||||||||||||||||||||||||||||||||||||||||||

| Posted: 25 Jul 2010 05:02 AM PDT The debate over whether we are in for inflation or deflation was alive and well at the Agora Symposium in Vancouver this this week. It seems that not everyone is ready to join the deflation-first, then-inflation camp I am currently resident in. So in this week's letter we look at some of the causes of deflation, the elements of deflation, if you will, and see if they are in ascendancy. | ||||||||||||||||||||||||||||||||||||||||||

| International Forecaster July 2010 (#7) - Gold, Silver, Economy + More Posted: 25 Jul 2010 04:00 AM PDT The talk of recovery pervades insider thinking. The major media worldwide plays the same refrain. This is a desperate attempt to befuddle the public with misdirected propaganda to preserve confidence in a system that is in a state of collapse. As CNBC leads the charge, loss of faith in the system grows with each passing day. | ||||||||||||||||||||||||||||||||||||||||||

| Posted: 25 Jul 2010 03:00 AM PDT Last week, the price of gold again broke below its new base at $1,200, and the U.S. stock market was again under strong pressure, due to a confluence of fears, most of which point to a deflationary double-dip. The fears were fanned by disappointment in the just-released early quarterly results, by the latest CPI reports that show inflation continuing to moderate, and by yet another poll revealing faltering consumer confidence. | ||||||||||||||||||||||||||||||||||||||||||

| With Silver Soaring, Beware of Who You Buy From Posted: 24 Jul 2010 09:00 PM PDT With silver attracting headlines, cult-like following, and higher prices, silver investors should be on high alert for a scam being perpetrated on the internet. Newly minted fake coins are finding their way from Chinese counterfeiters to Ebay and then to investors who unknowingly purchase $20 rounds that are in reality only a few dollars worth of metals. | ||||||||||||||||||||||||||||||||||||||||||

| JPMorgan et al Reduce Their Gold Short Position Substantially Posted: 24 Jul 2010 07:10 PM PDT The tiny rally in gold that began at 3:00 p.m. Friday in Hong Kong [2:00 a.m. in New York] lasted for only a couple of hours, as once it broke through $1,200 spot... a not-for-profit seller was only too happy to sell it down to below that number... and by lunchtime in London, the rally had pretty much petered out. However, just before New York opened, gold caught another bid and was back over $1,200 in a jiffy... only to be hammered back below $1,200 spot the moment that the bullion banks in New York swung around to their trading desks at the Comex open. Then, once the London p.m. gold fix was in shortly before 10:00 a.m. Eastern time, the dealers pulled their bids... and that was basically that for the rest of the New York trading day. The high and low prices for gold on Friday were both set in New York... with the high posted at $1,203.90 spot... and the low at $1,183.90 spot. Silver's chart was a sort of mini-version of the gold chart... and, for ... | ||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2010 07:10 PM PDT View the original post at jsmineset.com... July 24, 2010 01:40 PM Dear CIGAs, Where the FDIC has vended banks to the good ole boys with stated value guarantees on the junk paper, the bank is whole, not broke, if you think about it. The junk paper that killed the bank is as good as a US treasury bill as it has a government agency guarantee without any doubt. There is always cash and the junk paper now is excellent collateral. What gifts are being wrapped, tied with green ribbons, and given to the insiders? If karma exists these horrid beings are in for a terrible future. Jim Sinclair’s Commentary We are now up to seven so far this weekend. Bank Closing Information – July 23, 2010 These links contain useful information for the customers and vendors of these closed banks. Home Valley Bank, Grants Pass, OR SouthwestUSA Bank, Las Vegas, NV Community Security Bank, New Prague, MN Thunder Bank, Sylvan Grove, KS Williamsburg First Natio... | ||||||||||||||||||||||||||||||||||||||||||

| How to Pull Cash Out of Your Silver Holdings Without Losing Ounces Posted: 24 Jul 2010 07:10 PM PDT With silver on a bull run, you might be tempted to take some cash out of your silver holdings. However, if you're like most silver investors, who have an array of different silver coins, rounds, and other metal pieces, you might just be able to cash in without reducing your total holdings. Silver Grab Bag You bought a bag of junk silver, it weighs the right amount, and all of it looks quite dated. The mesh bag is interesting, and it may even have some bank ink on it showing the silver's origins. However, other than the price, weight or type of coins, do you really know what you own? You will need to think like a collector to do this, but for people who have a variety of silver, this can be both fun and rewarding, and maybe it can help better connect you with other silver collectors or investors. All About Collecting Coin collectors are interested in picking up coins to complete their sets. A collection that spans dimes from 1900-2000 is worthless if i... | ||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2010 07:10 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 24, 2010 05:19 AM China to switch away from U.S. Dollars? Inflation to come roaring back? Rollover Is there anything we can do about it? [url]http://www.grandich.com/[/url] grandich.com... | ||||||||||||||||||||||||||||||||||||||||||

| Trader Dan Comments On This Week?s CCI Action Posted: 24 Jul 2010 07:10 PM PDT View the original post at jsmineset.com... July 23, 2010 04:05 PM Dear Friends, I have already put up a chart of the CCI this week in which I noted that it was approaching the top of its trading range that has held for the entirety of this year. The reason I seem somewhat obsessed with this is the fact that this chart, in my opinion, is the clearest indicator of how the war between the deflationists and the inflationists is faring. Until we get a decisive breakout of this trading range in one direction or the other, the uncertainty that has gripped the markets for what now seems an eternity will continue with the subsequent wild price swings up one week and then down the next. My analysis of this chart suggests that until we get a clean break of the 500 level, it is hard for me to get too excited about the prospects for a shift in investor sentiment decidedly in the favor of inflation. When we do however, I suspect that prices will move rather quickly as the rush into tangibles wil... | ||||||||||||||||||||||||||||||||||||||||||

| Higher Taxes are Coming. Head for Your Bunkers. Posted: 24 Jul 2010 07:00 PM PDT In the calming environment of the Big Mogambo Big Is Better Bunker (BMBIBB), I can finally relax by sitting, armed to the teeth, amongst my puny trove of gold, silver and oil, idly trying to say, "Big Mogambo Big Is Better Bunker" five times quickly until my seething, vaguely homicidal rage at the Federal Reserve and the socialist/fascist/ communists in the White House and Congress that have destroyed us all. | ||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2010 06:08 PM PDT Gold and silver advocates and aficionados have had a strong supporter and promoter for years in North Idaho named Edgar J. Steele. Steele has been important to the pro precious metals people and markets because he was a prominent lawyer who had defended several legal cases which received wide press across America. | ||||||||||||||||||||||||||||||||||||||||||

| 17 Reasons to be Bullish About the Markets Posted: 24 Jul 2010 05:43 PM PDT The Pragmatic Capitalist submits: Regular readers know I tend to focus on the negative aspects of the markets as opposed to the positives – anyone could put on a smile and skip through oncoming traffic, but the truth is, the investment world can be a very dangerous place so skipping along as if there are no risks involved is beyond foolish. But ignoring the positives is equally foolish. In this world of heightened market risks and particularly clear uncertainty here are 17 reasons to consider the bullish case (via David Rosenberg at Gluskin Sheff):

Source: Gluskin Sheff Complete Story » | ||||||||||||||||||||||||||||||||||||||||||

| The Bondsman's "Fear of Death"? Posted: 24 Jul 2010 01:59 PM PDT I spent the afternoon reading a fascinating paper by Shimshon Bichler and Jonathan Nitzan, Systemic Fear, Modern Finance and the Future of Capitalism (PDF file is available here). The introduction sets out the intent of their research:

While I recommend you carefully read the entire article, I want to focus on a few passages that are particularly interesting to financial market observers and pertinent to my post. First, let's begin with the takeoff:

Bichler and Nitzan then discuss why this debate is fundamentally wrong:

The authors then explore why investors depart from this conventional forward-looking practice:

Looking at the current crisis, Bichler and Nitzan write:

Finally, Bichler and Nitzan ask whether capitalism is heading for systemic collapse:

They conclude with these thoughts:

Tomorrow, I will go over some leading indicators that are being misread and show you why I'm more optimistic that the economic recovery will continue. As for the stock market, it is in the best interest of the financial oligarchy to reflate risk assets, and inflate our way out this mounting debt problem. Debt deflation will ultimately lead to systemic collapse and "collective ruin". | ||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2010 01:02 PM PDT According to a recent article over on MarketWatch, the purchase of bullion gold coins is absolutely exploding. Even businesses that do little to no advertising, but supply the glittery commodity are doing very well. For example the article highlights one such business – called MTB – that is located in a dark Manhattan basement, that only features a yellow pages listing that is busier than ever:

With the economy at a plateau at best – and another potentially feared free fall ahead, it's no wonder investors are seeking gold as a safe harbor. But, is it the best option? Questionable Sales Tactics The gold coin brokering business has come under scrutiny lately with major dealers like GoldLine receiving negative press and ongoing investigations. But, this is potentially good, this world is fraught with fraudulent dealers and those that fraud their customers in an attempt to earn a quick buck by incorrectly steering you into coins or packages that are more profitable for them. Yet, another potential example of companies taking advantage of consumers. | ||||||||||||||||||||||||||||||||||||||||||

| School Stocks Soar, Remain Unattractive; Any Exceptions? Posted: 24 Jul 2010 09:36 AM PDT Kevin Kennedy submits: Beleaguered school stocks got some relief Friday after new regulations proposed by the U.S. Dept. of Education weren’t as tough as expected. It's not really enough to make them attractive yet, but it's a start. Publicly-traded stocks in the U.S.-based education and training services industry jumped an average of more than 3.8% Friday. The group, attacked by short sellers and battered by tales of bad student loans and mixed results in training students for the work force, had suffered losses of more than 10% year-to-date that included a 22% drubbing in the past three months. The government released a preliminary version of the regulations in January, and uncertainty has hung over the group ever since. The proposed rules aren’t a panacea for the industry, analysts say, and could still hurt schools with high debt-to-income ratios as a result of school loans, according to a report by Melissa Korn and Caitlin Nish for The Wall Street Journal. Schools also face greater scrutiny to ensure that their programs are actually preparing students for real jobs. Leading the way higher Friday was DeVry (NYSE: DV), up 15.1% to 15.29. Other top gainers in the group included Nobel Learning Communities (Nasdaq: NLCI), up 9.0%; Strayer Education (Nasdaq: STRA), up 7.9% to 236.49; Education Management (Nasdaq: EDMC), up 7.5% to 16.31; Capella Education (Nasdaq: CPLA), +7.3% to 89.69; Grand Canyon Education (Nasdaq: LOPE), +6.6% to 23.12; Bridgepoint Education (NYSE: BPI), up 6.4% to 18.32; and Apollo Group (Nasdaq: APOL), which advanced 6.4% to 49.27. The stocks of three companies that the rules are expected to impact more negatively struggled in Friday’s trading. ITT Educational Services (NYSE: ESI) edged ahead 0.3% to 85.44, while Corinthian Colleges (Nasdaq: COCO) slipped 0.5% to 10.20 and Universal Technical Institute (NYSE: UTI) gave back 0.7% and closed at 21.79. The final regulations are expected to be adopted in November following a public comment period and take effect next year. Any penalties would not kick in until the 2010-13 school year. The proposal would create three levels of schools and would likely impact about 5% of all schools serving about 8% of the roughly 1.8 million students enrolled in for-profit schools, reported John Lauerman for Bloomberg. Schools with high student debt-to-income ratios whose students are not repaying government loans fast enough would be restricted to growth limits and be forced to warn students in promotional materials. The for-profit school industry received $26.5 billion in federal aid last year, a dramatic increase from $4.6 billion in 2000. Despite today’s gains, none of the stocks in the group is close to being a market leader, and it will take a significant show of strength in the next several months to make the stocks attractive as new buys. Most of the stocks are closer to their 52-week lows than highs. If I had to take a stab at one education stock that might emerge, it would be Minneapolis-based Capella Education. Today’s move brought it back to within 9% of its April 29 all-time high of 98.01. It’s a little pricy with a market cap of $1.5 billion and trading at 3.9 times sales, but its PE is reasonable at 31. Capella operates Capella University, an online school with 42 graduate and undergraduate degree programs and more than 37,000 students. The company reported first-quarter earnings growth of 82% and revenue gains of 32% in April. The company is scheduled to report again next Tuesday, with analysts expecting second-quarter earnings to rise 41% to 79 cents per share and revenues to increase 29% to more than $103 million. Disclosure: No positions Complete Story » | ||||||||||||||||||||||||||||||||||||||||||

| 3 Undervalued Foreign High Dividend Stocks Posted: 24 Jul 2010 09:32 AM PDT Double Dividend Stocks submits: If you're looking for undervalued foreign dividend stocks with good growth prospects, our latest screen might interest you. We screened for attractive valuation metrics, such as, low Price/Free Cash Flow and PEG ratios, and high future EPS. We also screened for attractive ROE, ROI, ROA ratios, dividend stocks with a dividend yield above 5%, and low debt. This screen returned 2 Asian dividend paying stocks and 1 Latin American Telecom dividend stock, all of which are now in our High Dividend Stocks by Sector tables: &iddot; City Telecom HK (CTEL): Provides integrated telecommunications services in Hong Kong via its own self-built fiber network. CTEL has a subsidiary, Hong Kong Broadband Network Limited (HKBN), that’s the fastest growing broadband service provider in Hong Kong. HKBN offers a diversified portfolio of innovative products that service over 1,027,000 subscriptions for broadband, local telephony and IP-TV services. CTEL also has branch offices in Canada and Guangzhou. (Source: CTEL website) Complete Story » | ||||||||||||||||||||||||||||||||||||||||||

| Commodities Week: Oil and Copper Focus on Upside Risks, Gold Unchanged Despite Investor Liquidation Posted: 24 Jul 2010 09:10 AM PDT Sumit Roy submits: Energy After a pause in the prior week, crude oil resumed rallying this week, gaining 3.9% in the period. While encouraging corporate earnings announcements and a better-than-expected existing home sales figure were supportive of prices, the primary catalyst for crude’s advance is not what has happened, but rather what has not happened. The 26.3% decline in oil prices during May was due in large part to fear. As those worst-case economic fears have so far failed to materialize, the commodity has snapped back to more normalized levels. In the bigger picture, crude oil has been largely rangebound, fluctuating between the upper-$60’s and the lower-$80’s since September of 2009. The latest economic scare was enough for crude oil to test the bottom of the range, but obviously not enough to cause any sort of breakdown. At $79, Friday’s close puts crude oil prices above the 50% retracement level of the May correction, or $75.70, indicating that risks are tilted modestly to the upside. The most obvious of those upside risks is the fate of Gulf of Mexico production, but there are also upside risks with regard to demand from emerging markets. Unavoidable is that fact that going forward, higher OPEC production will be necessary to close the gap between ‘free market supply’ (non-OPEC) and demand growth (the vast majority of which is from emerging markets). Complete Story » | ||||||||||||||||||||||||||||||||||||||||||

| Franklin Sanders on the Coming Avalanche of 1099 Forms Posted: 24 Jul 2010 09:07 AM PDT | ||||||||||||||||||||||||||||||||||||||||||

| Leading Economic Indicators Offer More Warning Signs Posted: 24 Jul 2010 09:01 AM PDT  Markos Kaminis (Wall St. Greek) submits: Markos Kaminis (Wall St. Greek) submits: The Conference Board's Leading Economic Indicators Index slipped 0.2% in June, offering yet another critical sign that the economy faces real risk of double-dip recession. The 0.2% drop compared against a revised 0.5% increase in May's measure. Economists were on target with their estimations, and so the news did not shake the market on Thursday. Rather, more positive testimony from Chairman Bernanke helped restore shares that were drained on Wednesday's commentary from the same. Complete Story » | ||||||||||||||||||||||||||||||||||||||||||

| 10 Charts, 10 Stories of the 'Real' Gold Price Posted: 24 Jul 2010 08:09 AM PDT Gold in Mind submits: The charts never lie. But – half a truth is ever the blackest of lies. Complete Story » | ||||||||||||||||||||||||||||||||||||||||||

| US Equities Outperformed On Sad Day For Integrity Posted: 24 Jul 2010 07:11 AM PDT From Nic Lenoir of ICAP The S&P looks like it has validated an inverted H&S pattern. While H&S pattern bearish patterns triggered on poor economic news and high volume are usually head fakes and a deadly bear trap, inverted bullish H&S with no participation on no news tend to see quite a bit of follow through. More broadly we have pointed out that we would need a bit of confirmation from the Bovespa to fully confirm that the markets are breaking out, currently as seen on the daily chart we are right on the resistance still. Similarly AUDUSD closed right on the 200-dma. We once again point out the global liquidity index which isgetting close to making new highs, and given the huge correlation between liquidity and equity markets over the last year, stocks are in fact under-priced in that respect, no matter all the reasons I see out there for a bear move. Governments and central banks have done their job well at propping up a piece of crap.

| ||||||||||||||||||||||||||||||||||||||||||

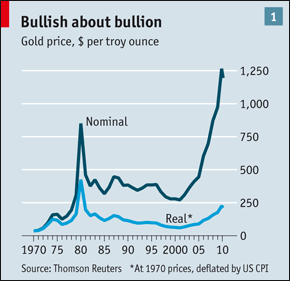

| The Sagging Sector Component Making Gold More Volatile Posted: 24 Jul 2010 06:56 AM PDT Denis Ouellet submits: It has been a while since I took a good look at gold’s “fundamentals”, i.e. real world supply and demand. The Economist ran a good article on gold on July 8 which triggered more research. I am even more prudent with gold than before. Demand for gold essentially comes from two different sources: jewellery and investment. Jewellery demand has declined spectacularly in the last decade, most likely in reaction to the rising price of gold. Pretty typical and rational behavior given gold’s five-fold price jump. Complete Story » | ||||||||||||||||||||||||||||||||||||||||||

| Goldman, Blackrock In Cross Hairs Again As Senator Grassley Digs Up Old Corpses Posted: 24 Jul 2010 06:53 AM PDT Just as Goldman's hope that the BP gusher's taking front page priority, especially in the aftermath of the rather amusing settlement between the firm and the SEC, was finally appearing to bear fruit as for the first time in over a year there was nothing relevant on the news front regarding the 200 West company, here comes Senator Chuck Grassley lobbing a grenade full of provocative and very much unanswered questions directed at the GAO, at Elizabeth Warren, and at Neil Barofsky that demand clear and prompt answers. We are also quite content that Blackrock and AIG once again manage to get themselves dirty. Grassley submits questions for committee record about taxpayer dollars for AIG, Goldman Sachs counterparties Question for the Record Hearing before the Senate Finance Committee July 21, 2010 Questions for Richard Hillman – Government Accountability Office 1. What does Treasury need to do to successfully exit from TARP? 2. Will Treasury reach its goal for HAMP of helping 3 to 4 million borrowers? If not, how many borrowers do you think will get help from the program? 3. To what extent were CPP investment decisions influenced by political considerations or other external factors? 4. Does the increasing number of firms missing their CPP dividend payments indicate that more CPP firms are at risk of failure? And does the number of missed dividend payments show that Treasury made mistakes investing in these institutions? 5. Will the government’s equity stakes in Chrysler and GM be worth enough for the government to make back its entire investment? How long might it take for the government to recoup this money? 6. GM has announced that it plans to launch an initial public offering (IPO) by the end of this year. Is an IPO the only, or the best, alternative for recovering the taxpayer investment in GM, is an IPO on this timetable feasible, how will an IPO impact the government’s equity stakes in GM, and what role is Treasury playing in the IPO? 7. What work are you currently doing on Treasury’s aid to the auto industry? 8. GAO recommended last year that Treasury ensure it has adequate staffing to manage its investments in Chrysler and GM. Where does Treasury stand on this? 9. What is the likelihood of AIG repaying the government? 10. How is Treasury helping small businesses? Is Treasury meeting its goals for small businesses? Questions for Elizabeth Warren, Congressional Oversight Panel Several times in your Panel’s June report on the AIG bailout, you indicated that Goldman Sachs failed to provide information requested by the Panel. In particular, you indicated that Goldman did not provide information sufficient to identify entities you called the “indirect beneficiaries” of the AIG bailout — financial institutions with whom Goldman had hedged the risk of its exposure to an AIG default. You said, “And we want to know the identity of those parties partly just to know where American taxpayer dollars went, but partly to assess Goldman’s claim … that they had nothing at stake one way or the other in the AIG bailout.” Following my suggestion to the Chairman that the Committee issue as subpoena if necessary, after the hearing, Goldman Sachs provided the Committee with the following spreadsheets and a briefing (see Attachments 1 and 2). My understanding is that Attachment 1 lists companies that wrote credit default swap protection on AIG for Goldman, meaning that in the event of an AIG default in September 2008, these entities would have been responsible for paying Goldman the amount in the “Net” column. Thus, these entities avoided losses in the amounts listed on Attachment 1 as a direct result of the taxpayers’ bailout of AIG in September 2008. 1. The fifth largest amount listed is about $175 million that Lehman Brothers would have owed Goldman Sachs on CDS protection. However, given Lehman’s financial position at the time (September 15, 2008), isn’t it true that the real value of this hedge to Goldman would have been much less than $175 million? Wouldn’t it have only been worth the approximate value of any collateral that Lehman had already posted to Goldman up to that date? 2. Similarly, is it possible that financial health of the other institutions on the list may have prevented them from being able to pay Goldman in the event of an AIG default? Does this undermine Goldman’s claim that it was “fully collateralized and hedged” with regard to the risk of an AIG default, and thus demonstrate that Goldman did, in fact, receive a direct benefit from the government’s assistance to AIG? 3. Will the Panel be seeking additional details about these transactions in order evaluate Goldman’s claim to have been indifferent to whether AIG went bankrupt? If so, please describe the scope of your additional requests and inform the Committee if you do not receive complete cooperation. As I understand Attachment 2, it lists a series of entities that directly benefited from government assistance through the Federal Reserve’s Maiden Lane III facility, in that they received cash provided to AIG, which it owed to Goldman and which, in turn, Goldman owed them. The majority of these beneficiaries appear to be foreign entities. 4. Can you please explain how ensuring that these institutions were paid in full, rather than required to suffer the consequences of the risks that they took, benefited the U.S. taxpayer? 5. Will the Panel be seeking additional details about these transactions? If so, please describe the scope of your additional requests and inform the Committee if you do not receive complete cooperation.

Questions for Neil Barofsky, Special Inspector General, TARP

Last year it was estimated that although the TARP program itself amounted to about $700 billion, the total government risk from other programs at the Freddie Mac, Fannie Mae, HUD, and the Federal Reserve amounted to about $3 trillion. In the last year, this estimate has increased to $3.7 trillion. So, we’ve added a whole new TARP program worth of risk in the last twelve months in the amount of $700 billion. 1. How likely is it that taxpayers could start suffering actual losses from this $3.7 trillion in risk? 2. What are the potential pitfalls that could cause these risks to start causing losses to taxpayers? 3. The last time you testified before the Committee, I asked you about a Wall Street investment firm named Blackrock. I understand your office is auditing or investigated potential conflicts of interest involving this company and the Public-Private Investment Program, the $40 billion TARP program designed to buy toxic assets. As I understand it, BlackRock has a deal to work on Maiden Lane for the Federal Reserve Bank of New York as a toxic asset analyst, while a separate BlackRock company has a deal with Treasury to participate in the Public-Private Investment Program to buy toxic assets. What can you tell this Committee about the results of your investigation/review to date? 4. Your office has been investigating excessive executive severance payments to AIG executives that occurred earlier this year. I have asked you to conduct this investigation because the Treasury Special Master for Executive Compensation has been unwilling to get to the bottom of what happened. You also are investigating potential conflicts of interest within the Special Master’s office. Could you please update the Committee on your progress? | ||||||||||||||||||||||||||||||||||||||||||

| Options Game Thrives on Plentiful Suckers Posted: 24 Jul 2010 06:39 AM PDT By Rick Ackerman, Rick's Picks (Rich Cash, a wise and prolific contributor to the Rick's Picks forum, as well as a blogger of note, has written insightfully and with good humor on a subject near and dear to our heart – i.e., the put-and-call game. Fortunately, we retired our powder-blue market-maker smock and badge (#K30) just before the Feds started using RICO laws to prosecute white-collar criminals. We were a scurvy lot, for sure, and Rich has captured the flavor of the game in a way that explains what drew so many of us sleazeballs to the options trading floor. RA) On Monday, some of the Fast Money Crowd were ready to jump off the bridge after INTC, JPM and GOOG flamed out on brilliant earnings. Tuesday, they were extolling weekly call options on AAPL with 70% volatility premiums. That's right — if a security that expires in a month is not a risky enough disappearing asset, now we can buy weekly options at a price almost guaranteed to absorb all price fluctuations and expire worthless. Options have a long and checkered history that dates from the seven years Isaac worked to marry Rebekah, only to wake up in the marriage bed with her older sister Leah, and work another seven years for the woman he loved. In the early 1900s, Jesse Livermore frequented options parlors known as bucket shops. For a small amount of money down, you had the brief right to buy or sell a security at a fixed price. If it went higher in that short amount of time, you made money. If not, you were out of luck. The bucket shops were so good at pricing option premiums they usually bucketed the orders rather than enter them. Livermore was one of the few that did well enough in the bucket shops that he was banned. In the Roaring Twenties, Over-the-counter option writers sold puts and calls to anyone on anything that moved in the markets. Since most of the options expired worthless, they just pocketed the money. When put buyers came around to collect after 1929, most writers were long gone. A variation of this mindset may account for what and why Banks did with OTC derivatives, off-balance sheets, and out-of-the-country subsidiaries up until the 2008 crash and taxpayer bailout. It took a bridge player named Bill Sullivan to formalize option rules to create the Chicago Board of Options Exchange in 1973. They used a normalized gaseous diffusion equation adopted by Fisher Black and Merton Scholes to price option premiums rationally. Bill created not only standardized, transparent, market-price cleared contracts, but a private third-party AAA credit guarantor in case either side defaulted. This model falls apart during Black Swan market distributions with long tails over long times, something the man who called derivatives "weapons of mass financial destruction" cited to shareholders to rationalize writing a lot of long-term options without collateral. Now, after his firm's credit rating was reduced, FinReg may require him to post margin, a giant margin call that may also impact earnings, since he had the integrity to mark his naked option shorts to market. Taking It Public Too bad Banks, Congress and Regulators did not enforce the CBOE derivative lesson before defaulting and leaning on taxpayers. The CBOE waited 37 years to go public, just before Summer 2010, and traded from 34.18 to 26.10, the fate of many hot IPOs and options. Of interest, options may have value as a leading market sentiment indicator. The International Securities Exchange, now the leading option exchange, developed the 20 minute daily ISEE Sentiment Indicator index that excludes market maker and firm transactions to focus exclusively on the ratio of opening Call to opening Put customer transactions. ISEE has a pretty good history of calling market turns, including the March 2009 bottom and April 2010 top. The last few days, the ISEE set annual records with up to 224 Calls bought for every 100 puts bought, suggesting market sentiment is pretty complacent, if not ebullient. We may see in the short fullness of time if the complaint of the man who claimed he could make love to 100 women in a night was valid — that he had practiced too much that afternoon. We observe AAPL at 252 had a Point & Figure downside target of 216. We leave it to former P-Coast market maker, Blue Fin fund manager and financial journalist Rick Ackerman to make profitable picks and sense of all this… (If you'd like to have Rick's Picks commentary delivered free each day to your e-mail box, click here.) Rick's Picks is a trading newsletter for stock, gold, silver and mini-indexes. All trades are based on the proprietary Hidden Pivot technical analysis method. © Rick Ackerman and www.rickackerman.com, 2010. | ||||||||||||||||||||||||||||||||||||||||||

| When Will the AA Batteries Run Out? Posted: 24 Jul 2010 06:24 AM PDT Dagong International Credit Rating, a new Chinese credit rating agency, purports to adhere to "fundamental principles of truthfulness, timeliness, and consistency." It warns that "over-reliance on financing income and debt roll-over will ultimately lead to a strong reaction of bond market, thus when the borrowing costs and difficulties increase, the credit risks will burst dramatically." Although it rates the United States AA and says "the advantages of a comprehensive institutional system will help them gain the rooms for adjusting finance and debt," it culls out 18 countries for which it assigns ratings lower than those assigned by Moody's, S&P, and Fitch (and the United States is among them). Thirteen of these are developed nations that have become, in Dagong's words: "the biggest source of systemic risk.. (and a) double dip for the world economy… Once the fiscal risk in this sort of countries get out of control, they will have to face even more financing difficulty. Up to then the interest rate attached to the debt instruments will be running up rapidly, and the default risk in these countries will grow even larger; the fiscal fragility may badly threaten the successful recovery of their economic and financial conditions, and may even plague these countries in a relatively long run." These are interesting observations, because they indeed are truthful and timely as well as the product of consistently applied financial statistical analysis that provides Dagong a superior way to compare sovereign credit risk among nations. But they are also devoid of understanding of the systemic monetary flaws that led to the creation of excessive debt in recent decades, which are articulated in my book, Endless Money (John Wiley & Sons 2010), and the writings of other Austrian economists. This may explain why China may have not sold much U.S. debt, and why it may feel that it can safely invest in other nations' credit rather than avoid systemic credit risk generally through allocating more than a trivial share of its currency reserves to gold. Laced through the analysis is recognition that some countries may apply Keynsian solutions because their sovereign and private credit capacity is ample, and their outlook for economic growth may be more intrinsically secure. In this way, China's policy actions are rationalized by its policy makers (as well as by western pundits). So in addition to having consumed the monetary Kool-Aid of the west, China has embraced the fiscal orthodoxy as well. This point of view echoes Bernanke's and Greenspan's view that the global debt crisis was fostered by a "savings glut" in China. Murray Rothbard warns of businessmen clustering together in error. It would be a shame if the Chinese, despite this trenchant analysis of how the world's credit markets could unravel once again, steadfastly cast their lot with the Bernankes and Krugmans in the economics community. As for the United States, we have already crossed the Rubicon, hopelessly defending a fiat based reserve currency and admonishing all others in the G-20 to spend recklessly and prop up impaired credit instruments at any cost. The Chinese may be rating the U.S. "AA" for now, but if the process of instability of which Dagong hints takes over, we should expect the juice in this AA battery to run out, unable to be recharged by "a comprehensive institutional system (that) will help them gain the rooms for adjusting finance and debt." Regards, Bill Baker, [Editor's note: William Baker is the author of "Endless Money: The Moral Hazards of Socialism. You can get your own copy of his book here. You can also follow his commentaries on The Conservative Economist.] When Will the AA Batteries Run Out? originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. | ||||||||||||||||||||||||||||||||||||||||||

| Junior Gold Miners Versus The Big Producers Posted: 24 Jul 2010 06:24 AM PDT By Jeff Nielson, Bullion Bulls Canada As we see the in-flux of "born again" gold-bugs among mainstream market commentators, there has also been a commensurate increase in articles about the gold miners. Many "experts" who only a couple of years ago were shunning gold as a "barbarous relic" now feel qualified to "recommend" individual gold miners to their readers. To the credit of a few of these individuals, they have done their "homework", and offer credible analysis and insight on the companies they cover. However, the majority of such pundits haven't learned the various quirks of this sector which make it different from all other commodity-producers. They engage in simplistic balance-sheet analysis which leaves investors dangerously uninformed about factors which have tremendous significance in the current and future performance of these companies. In particular, we have numerous analysts touting the large gold-producers to their readers and clients, despite the consistent failure by most of these companies to deliver good "returns" to shareholders. Meanwhile, the smaller producers – the "junior miners" – have provided investors with many spectacular success-stories, with the best clearly still to come. The leading "voice" when it comes to warning investors of the potential pit-falls of the larger mining companies is Jim Sinclair. He has told investors on countless occasions that many of these companies were carrying dangerous/destructive "gold derivatives" on their balance sheets – courtesy of the big-banks. These derivatives were either incorporated into their operations as merely "hedges" against the gold-price or were a necessary condition in order to obtain financing for large, capital projects – such as the construction of a new mine. We've seen the results of these "deals with the devil" show up on the bottom-line of these mining giants: the complete inability to "leverage" the price of gold – either in terms of their own profitably or in returns to shareholders.

The table above shows five of the "brand names" among the small group of "senior" gold producers (all listed on the New York Stock Exchange). Their stock performance over the past three years has been nothing short of dismal. While the price of gold has increased from $700/oz to $1200/oz over that period of time (roughly a 70% increase), these chronic under-achievers have (on average) only produced half that rate of return for shareholders – rather than "leveraging" the gold price, as all commodity-producers (should) do naturally. Critics will argue that it's misleading (and unfair) to include Yamana Gold (NYSE: AUY) in this three-year comparison, as they had completed a major take-over in 2007 – which led to a massive dilution of the share structure. Certainly, I could have come up with a better-performing choice than Yamana Gold. However, I wanted to include it in this analysis, as it illustrates two of the major problems facing the large gold-producers: the difficulty in trying to generate production growth and the need for these "gold miners" to add more and more base metals mining to their operations. More articles from Bullion Bulls Canada…. | ||||||||||||||||||||||||||||||||||||||||||

| US Coin Composition Debate Returns with High Penny and Nickel Costs Posted: 24 Jul 2010 06:23 AM PDT

In fact, this topic proved to be a bit more contentious than the eagles as it invoked a miniature power struggle between the executive branch of the United States and Congress. At the heart of the matter is the makeup of American circulating coinage — its composition…. Read the rest of US Coin Composition Debate Returns with High Penny and Nickel Costs (855 words) © 2010 CoinNews Media Group LLC | ||||||||||||||||||||||||||||||||||||||||||

| Metals now strongly bullish, Ted Butler tells King World News Posted: 24 Jul 2010 06:23 AM PDT 12 noon ET, Saturday, July 24, 2010 Dear Friend of GATA and Gold (and Silver): Silver market analyst Ted Butler tells Eric King of King World News that the big commercial shorts have massively closed positions on the New York Commodity Exchange and he sees gold's bullish prospects as 85 percent and silver's nearly 100 percent. Butler adds that he's encouraged about persuading the U.S. Commodity Futures Trading Commission to adopt effective position limits in precious metals futures trading now that new law requires the commission to set limits. Butler compliments CFTC Commissioner Bart Chilton for his work on the issue and his responsiveness to the public. You can listen to the interview at King World News here: http://kingworldnews.com/kingworldnews/Broadcast_Gold+/Entries/2010/7/24… CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||

| CFTC’s Chilton explains hope for freer, more transparent gold, silver markets Posted: 24 Jul 2010 06:23 AM PDT 11:38p ET Friday, July 24, 2010 Dear Friend of GATA and Gold (and Silver): The member of the U.S. Commodity Futures Trading Commission who has been advocating imposing position limits on traders in the precious metals markets, Bart Chilton, has made a video explaining why he thinks the financial regulation law just enacted by Congress and President Obama promises great progress, particularly in making the commodity markets freer and more transparent. The law, Chilton explains, requires the CFTC to establish position limits and authorizes the commission to prosecute "disruptive trading practices." Chilton says he is especially pleased with that, because the commission's market manipulation standards have failed almost completely for many years. Chilton has been amazingly conscientious on the precious metals manipulation issue and has been amazingly responsive to gold and silver investors who have complained to the CFTC about market manipulation. He'll need their support as the CFTC writes the position limits regulations required by the new law. The big commercial shorts are sure to be heard as the commission continues to take public comment, so gold and silver investors can't let up yet. You can watch Chilton's presentation at YouTube here: http://www.youtube.com/watch?v=K1_q88rlUkw&feature=player_embedded CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||

| Mining Stock Talk interviews Peter Grandich on gold and silver Posted: 24 Jul 2010 06:23 AM PDT 11p ET Friday, July 24, 2010 Dear Friend of GATA and Gold (and Silver): Mining sector analyst Peter Grandich was interviewed for an hour this week by Mining Stock Talk. The interview covered not just the prospects for gold and silver but the always-negative gold and silver analysts who monopolize publicity given to the sector by mainstream financial news organizations; Grandich's belief in gold and silver market manipulation and his support for GATA; and some of his mining stock recommendations. You can listen to the interview at Mining Stock Talk here: http://miningstocktalk.com/mining-stock-talk-interviews-peter-grandich/ CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||

| Gold: Another High in Q2, With More to Come Posted: 24 Jul 2010 06:23 AM PDT Daniel Zurbrügg submits: Our fundamental view on gold hasn’t changed in the last couple of weeks; we continue to be positive and expect further price increases in 2010 and 2011. The last quarter brought yet another new high with gold reaching USD 1,264. The gold price has fallen back to USD 1,200 recently because of negative sentiment caused by the news about the annual report of the Bank of International Settlement (BIS) that revealed that an amount of 346 tons of gold have been swapped for liquidity from the BIS. This is a very significant trade and there is a lot of speculation about possible counterparties for such a trade. The most likely candidates seem to be troubled countries such as Italy, Spain or Portugal, but no additional information was disclosed. | ||||||||||||||||||||||||||||||||||||||||||

| Gold Miner ETFs: A Better Option Than Spot Gold? Posted: 24 Jul 2010 06:22 AM PDT Tom Lydon submits: For investors who don’t want to deal with the tax implications of futures-backed gold ETFs or those that hold the physical metal, gold miner funds may be an appealing option. Almost 70 respected economists, academics, gold analysts and market commentators are of the opinion that gold is going to go to at least $2,500 per ounce before the top is reached, says ETF Daily News on iStock Analyst. Whether that’s true or not, gold miners still have a strong case. | ||||||||||||||||||||||||||||||||||||||||||

| Rocky Mountain Chocolate Factory Update Posted: 24 Jul 2010 05:52 AM PDT ValueHuntr submits: Rocky Mountain Chocolate Factory (RMCF), one of the stocks still part of the ValueHuntr Portfolio and also one of our favorite investments, recently held an earnings call where management updated shareholders on the company’s future plans and strategy. Some of the updates, along with an updated valuation, are posted below. Revenues and Earnings Complete Story » | ||||||||||||||||||||||||||||||||||||||||||

| Guest Post: The Strategic Ramifications Of A US-Led Withdrawal from Afghanistan Posted: 24 Jul 2010 05:41 AM PDT Submitted by Yossef Bodansky of www.oilprice.com The Strategic Ramifications of a US-Led Withdrawal from Afghanistan | ||||||||||||||||||||||||||||||||||||||||||

| The Health Care Bill Change in 1099 Reporting Requirements Does NOT Target Gold and Silver Posted: 24 Jul 2010 04:42 AM PDT | ||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Jul 2010 04:11 AM PDT While I sometimes lament the troubles we're having in getting our short sale offer moving toward a signed sales agreement, it's easy to lose sight of the fact that the housing market is dramatically different than it was just a few years ago for long-time homeowners who may have been non-participants in the housing bubble back around 2005 or 2006. This WSJ story provides more reasons why being long-time renters isn't all that bad…

Uh… yes? No, apparently the correct answer is no – they're not crazy. At least according to economists.

Oh puhlease. Chris Mayer? Housing bubble denier extraordinaire? Why do these people who gave such bad advice about five years ago still get called on by reporters to give even more advice? Search on "Mayer" here or here to see what Chris was thinking back in 2005 and 2006 – something about "Superstar Cities" where prices have fallen up to 40 percent since that wisdom was offered up. Now here's something that seems to make sense in our new de-leveraged world…

Man, that's gonna kill an economy like ours that is largely based on asset prices forever rising faster than debt. I guess people are starting to catch on – aspiring to live a debt free and more stress free life. There's a bit more in this report including a few examples of growing families trading up to a bigger house that seem to make good sense – just be sure to sell the old one before you commit to the new one! | ||||||||||||||||||||||||||||||||||||||||||

| OMB's Latest Projections Estimate 250K Jobs Created Each Month Through End Of 2015 Posted: 24 Jul 2010 02:30 AM PDT Yesterday the OMB released its Mid-Season Review of the US Budget. In keeping with the encroaching Beijingization of all data releases, the administration now sees yet another decline in the 2010 budget deficit, this time a reduction of $84 billion compared to the February forecast. According to the budget office, despite a $33 billion projected drop in revenues, outlays will see an even greater haircut courtesy of "lower unemployment and government program" spending. Yet even so, the 2010 budget deficit is expected to hit $1.47 trillion and $1.42 trillion in 2011. Of course, all these numbers are flawed and irrelevant: the confirmation - the OMB's assumption about jobs projections. To wit: "With continued healthy growth in 2011 and beyond, the unemployment rate is projected to fall, but it is not projected to fall below 6.0 percent until 2015." One problem with this "assumption": for this projection to actually happen, it means the US government needs to start creating 245 thousand jobs every month beginning in July through the end of 2005 (and we give the OMB the benefit of the doubt: if their assumption means 6% by the beginning of 2015, it implies a ridiculous job creation rate of 300,000 per month for 54 months straight). Alas, in attempting to present the rosiest picture possible, the budget office is now completely ignoring such useless things as logic and merely discrediting itself with increasingly more ridiculous "analyses." Readers will recall that a few days ago we presented the summary findings of a CEPR paper which demonstrated that 2007 peak employment levels will not be met until 2021, even after assuming a job creation rate of 166,000 a month for eleven straight years. The reason for this is that all the very smart economists consistently miss the most glaringly obvious thing: demographics, or specifically population growth. As the CEPR indicated, "Based on CBO projections, we assume a monthly growth in the labor force of just over 90,000 workers per month from January 2008 forward." In other words, just the natural growth of America will have added 8.6 million vacancies to the labor force from December 2007 through the end of 2015. And since the economy is already in the hole to the tune of 7.5 million jobs from the 2007 peak (see chart below), the OMB is effectively stating that it can bridge the shortfall of 16 million jobs in the next 5 years. Why, sure they can - if they can somehow create 245k jobs each month for the next 66 months. Alas, as the data demonstrates, the only time during the tenure of the Obama administration where there was a positive NFP number, is when the census fudge factor added hundreds of thousand of (potentially double-counted) positions, which have now been unwound. And obviously each month that does not create a net positive add to the economy, means more and more jobs have to be back-end loaded. In a few months, the economy will need to be adding 300k amonth to get to the OMB projection, then 400k... then 500k... Soon after that even China will have to tip its hat to the US propaganda machine. Alas, this utter lack of logical thinking is precisely what occurred in the European stress tests: we will have quite a few more things to say shortly about Germany's Street Test Urban Achievers, the Landesbanks shortly, and how using a little comparable logic and data mining also quite easily refutes yesterday's "stupendous news." | ||||||||||||||||||||||||||||||||||||||||||

| Dollars Never-Ending Plunge and Its Golden Consequences Posted: 24 Jul 2010 02:00 AM PDT |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Indians and Chinese consumers have, so far, kept buying gold while consumers elsewhere have cut their appetite by more than half. In a May 10, 2010 write-up on the India gold market, the

Indians and Chinese consumers have, so far, kept buying gold while consumers elsewhere have cut their appetite by more than half. In a May 10, 2010 write-up on the India gold market, the

The recent hearing on "The State of U.S. Coins and Currency" by the House Subcommittee on Domestic Monetary Policy and Technology yielded another interesting sub-topic aside from the increased

The recent hearing on "The State of U.S. Coins and Currency" by the House Subcommittee on Domestic Monetary Policy and Technology yielded another interesting sub-topic aside from the increased  Record-low mortgage rates and a new slump in home prices are presenting unusual opportunities in the housing market these days—even for so-called underwater borrowers.

Record-low mortgage rates and a new slump in home prices are presenting unusual opportunities in the housing market these days—even for so-called underwater borrowers.

No comments:

Post a Comment