Gold World News Flash |

- A Precious Metals Bubble?

- Silver Investing Chapter 5 : Alternative Silver Investing

- Update: NewBridge Bancorp

- Economic Data Down, Stocks Up: Why the Disparity?

- In The News Today

- Hourly Action In Gold From Trader Dan

- Frightfully Foolish People

- Back 2 Back Reversals for the Stock Market

- Gold Coin Sellers Angered by New Tax Law

- Central Bankers to Prick Bubbles... Internet Forces Honest Reporting?

- LGMR: Gold Slips, Silver Gains with Stocks, Euro & Oil as Fed's "Deflation Warning"

- Extremely Worthy Article

- Crude Oil Falls on Bearish Inventory Data, Gold Seesaws Lower

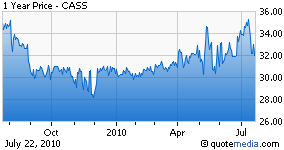

- Strong Performance From Cass Information Systems

- Unusually Fed Up

- 6 Dividend Aristocrats Worth Considering

- 3 Simple Reasons for ETF Investors to Believe in the Bull

- MOVE Index Suggests 10-Year Treasury Is Not Moving Lower...For Now

- 2011: The Year Of The Tax Increase

- Gold Seeker Closing Report: Gold and Silver Gain With Stocks and Oil

- Is College Education The Next Bubble Set To Burst?

- PSP Investments Up 21.5% in FY 2010

- Gold Daily Chart

- Golden Shell Games

- Public Debt Replaces Private Debt in the Name of Progress

- Gold Price is Trying to Turn Up

- THURSDAY Market Excerpts

- City Manager of Bell, CA, Earns $800,000 — Twice President Obama’s Salary

- Green Jobs from the Government Not Gonna Happen

- Risk Break Out?

- Why unemployment could remain high for decades

- FHA – “We are Officially Broke”

- Barclays: The 3 biggest risks to stocks now

- physical gold vs gold equities correlation

- Richard Russell: Inflation will dominate deflation

- [KR62] Keiser Report – Markets! Finance! Hollow Men!

- Big Storm to Hit Gulf of Mexico ... All Oil Relief Operations Will Be Suspended ... Cap Will Stay On, Unattended

- Izabella Kaminska: Looks like BIS swaps relieved gold market squeeze

- Kindling Finally Micturated On - Amazon Grace Expires As Stock Plummets

- China Throwing World’s “Biggest Creditor Nation” Weight Around

- The Long and Short of Informed Investment Decisions

- Gold Mining Stocks Trendpower

- Time to Buy Gold?

- U.S. Credit Firms Tell Clients Not To Use Their Ratings?

- The coming Silver Supernova

- Gold Producers' Upside Potential

- 5 Ways to the US Government Can Fix the Economy

- Clues to GLD's Price Trajectory

| Posted: 22 Jul 2010 06:11 PM PDT In the first few days of July, the prices of gold and silver appeared to break a five-month upward trend by drawing back about five per cent from the record June peaks. Despite many similar corrections that have occurred frequently during the long bull market in precious metals, pundits nevertheless looked to draw bold and significant conclusions from the drop. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Investing Chapter 5 : Alternative Silver Investing Posted: 22 Jul 2010 06:00 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 05:54 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Data Down, Stocks Up: Why the Disparity? Posted: 22 Jul 2010 05:52 PM PDT Kevin Parker submits: The economic data continues to be bleak these days with housing numbers continuing to worsen showing more and more that housing is far from a bottom. Additionally, Bernanke flinched for the first time yesterday in his testimony mentioning that the economic future is unusually uncertain despite expressing confidence in the recovery for most of the past year. Despite these developments, stocks were up big yesterday! The Dow was up over 200 points. Why? Well, earnings have been great. Corporations are continuing to produce impressive profits and are earning cash. The problem is this is not having even close to the same effect on the real economy as it used to where corporate profits typically would translate into investments and job growth. Unfortunately, corporations continue to hoard cash rather than invest it toward future growth. Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 05:43 PM PDT View the original post at jsmineset.com... July 22, 2010 08:11 AM Jim Sinclair’s Commentary How can you doubt QE to infinity in the entire Western world? Bernanke Vows Fed Will Act If Uncertain Recovery Falters Wednesday, 21 Jul 2010 02:03 PM Federal Reserve Chairman Ben Bernanke said on Wednesday the U.S. economy faces "unusually uncertain" prospects, and that the central bank was ready to take further steps to bolster growth if needed. "Even as the Federal Reserve continues prudent planning for the ultimate withdrawal of monetary policy accommodation, we also recognize that the economic outlook remains unusually uncertain," Bernanke told the Senate Banking Committee. "We remain prepared to take further policy actions as needed to foster a return to full utilization of our nation’s productive potential in a context of price stability." Bernanke, delivering the central bank’s semiannual report to Congress on monetary policy, said Fed officials believ... | |||||||||||||||||||||||||||||||||||||||||||||||||

| Hourly Action In Gold From Trader Dan Posted: 22 Jul 2010 05:43 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 05:43 PM PDT (They live, breathe, and walk among us!) Silver Stock Report by Jason Hommel, July 21, 2010 Frightful Stupidity: Jo from Florida demonstrates how stupid she is on radio [ame]http://www.youtube.com/watch?v=RMK9zxb5HyE[/ame] She can't answer any basic questions. She thinks the population of the USA is 600 million, which is not even close: (USA population is nearing 310 million): http://en.wikipedia.org/wiki/Demographics_of_the_United_States She wants to put "limits on people's incomes," but she is on welfare. She is on welfare, and has no idea where welfare money comes from -- or thinks it all comes from "illegal aliens". Of course, I don't know where the government gets all its money either, since they don't get it all from taxpayers, as Michael Savage seems to indicate. The more complete answer is, "they print it", but that's not even technically correct, since so much of new money today is all e... | |||||||||||||||||||||||||||||||||||||||||||||||||

| Back 2 Back Reversals for the Stock Market Posted: 22 Jul 2010 05:43 PM PDT The market continues to become quicker and fiercer as it move up and down 2+% on a regular basis This week we have seen some wild price swings due to earnings, events and the Fed’s which just makes trading that much more intense. I have pointed out yesterday that this market only gives you a brief moment to take profits before it starts going wild shaking traders out of positions. This increased volatility is caused from a couple of things: 1. Traders/Investors know the financial system is still riddled with unethical practices/manipulation. This causes everyone to be extra jumpy/emotional and causes volume surges in the market as the herd starts to get greedy or fearful. 2. Volume overall on the buying side of things just isn’t there… I see some nice waves of buying but it doesn’t move the market up much… then it only takes a small wave of sellers for the market to drop… Investors are just scared to buy stocks and that is not ... | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Coin Sellers Angered by New Tax Law Posted: 22 Jul 2010 05:43 PM PDT It was very quiet in Far East and early London trading on Wednesday... but at 10:00 a.m. local time [5:00 a.m. Eastern in New York]... gold began to rise briskly. But, at noon local time, with gold about to break the $1,200 price level to the up-side... a not-for-profit seller showed up. Every subsequent rally attempt after that [no matter how tiny... and there were five in all] ran into a seller. The last sell-off occurred when Weimar Ben opened his mouth at 2:00 p.m. in New York. The high for the day was at noon in London and... eyeballing the chart... I'd say that gold came within an eyelash of $1,200 spot at that point. The low occurred after Weimar Ben closed his mouth... and was reported as $1,182.70 spot. Volume was on the lighter side. Silver followed almost the same pattern as gold on Wednesday... complete with the not-for-profit bullion banks capping every little rally attempt. However, silver's high of the day [$17.92 spot] was at 9... | |||||||||||||||||||||||||||||||||||||||||||||||||

| Central Bankers to Prick Bubbles... Internet Forces Honest Reporting? Posted: 22 Jul 2010 05:43 PM PDT Central Bankers to Prick Bubbles Thursday, July 22, 2010 – by Staff Report Ben Bernanke IMF Shifts Advice to Banks on Asset Bubbles ...The International Monetary Fund's executive board said central banks may want to use interest rates in a "limited" way the next time they encounter an asset bubble that needs to be pricked, weighing in as the Federal Reserve and other major central banks reevaluate their bubble-fighting strategies. Before the global financial crisis, the Fed's main strategy for addressing bubbles was to mop up after they burst, lowering interest rates to cushion the blow to the economy and restart growth. That was a central conclusion of the academic work of Ben Bernanke (left) before he became Fed chairman and was an approach embraced by his predecessor Alan Greenspan. – Wall Street Journal Dominant Social Theme: It is time to rethink and then recalibrate the wisdom of monetary management. Free-Market Analysis: We have repor... | |||||||||||||||||||||||||||||||||||||||||||||||||

| LGMR: Gold Slips, Silver Gains with Stocks, Euro & Oil as Fed's "Deflation Warning" Posted: 22 Jul 2010 05:43 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:35 ET, Thurs 22 July Gold Slips, Silver Gains with Stocks, Euro & Oil as Fed's "Deflation Warning" Splits Analysts THE PRICE OF GOLD slipped in early London trade on Thursday, while silver prices rose and Chinese stocks led world equities higher. Long-dated government bonds ticked down following a raft of better-than-expected European data that also saw the Euro and Sterling both reverse Wednesday's drops vs. the Dollar. US equity futures pointed to a sharp bounce from yesterday's 1% loss. "In the near term, silver is likely to lag gold's price performance," says analyst Anne-Laure Tremblay at BNP Paribas, but "if the economic recovery does indeed see a more solid footing in 2011, then we can expect silver to catch up and eventually outperform gold." Silver prices today recovered to touch last week's finish at $17.90 an ounce, but gold held below $1190 – down more than 4% for July so far – as c... | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 05:43 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 22, 2010 07:03 AM Unlike Tokyo Rose, always wrong Kaplan and always whipsaw Gartman, Clive Maund has not only been on both sides of the market, but has earned my respect over many years of publishing his work. Like the author of this article, I also take issue with Clive’s commentary. In regards to the stock market, I believe it ends up going no where’s fast over several years but don’t believe it’s about to fall off a cliff. In regards to precious metals and especially gold, I believe we’re in the “mother” of all secular bull markets. The seasonally weak period of July and August has created an avalanche of bearishness with predictions of gold’s top now a dime a dozen. This comes despite gold not breaking any key support or major up-trends. Like the author of the article declares, this is A-... | |||||||||||||||||||||||||||||||||||||||||||||||||

| Crude Oil Falls on Bearish Inventory Data, Gold Seesaws Lower Posted: 22 Jul 2010 05:43 PM PDT courtesy of DailyFX.com July 21, 2010 08:42 PM Crude oil took its cues from the DOE inventory report in Wednesday's session, but volatility remains extremely low. Gold is exhibiting an interesting correlation. Commodities - Energy Crude Oil Falls on Bearish Inventory Data Crude Oil (WTI) $76.53 -$0.03 -0.04% Commentary: Crude oil is flat after shedding $0.88, or 1.14% on Wednesday. The primary catalyst for the move was the DOE inventory report, which was decidedly bearish. Gasoline and distillate inventories are now sitting at or near record seasonal levels. In the event refiners start cutting back utilization rates, and they have to if they are to get the current oversupply under control, crude oil demand will take a near-term hit. Equity markets sold off steeply late in the afternoon on Wednesday after Fed Chairman Bernanke presented a cautious outlook of the economy to Congress in the semiannual report. While stock markets have not been making new l... | |||||||||||||||||||||||||||||||||||||||||||||||||

| Strong Performance From Cass Information Systems Posted: 22 Jul 2010 05:21 PM PDT Edward J. Roche submits: Cass Information Systems (CASS) is a largely undiscovered small cap (just north of $300 MM) provider of payment and information processing services. The company’s clients include many much larger companies in the manufacturing, transportation and utility industries. CASS has been a holding in accounts managed by my firm Freedom Mountain Investments for a number of years as well as a holding in my individual accounts. It is the type of undiscovered small cap that I search for having a strong history of real and rising financials. CASS has performed well over the last 5 years, increasing earnings by an average of 17.5%. The company has done well in increasing transaction volume with existing customers as well as in adding new customers. The stock has roughly doubled in value over that time period far surpassing the S&P 500.  The balance sheet is solid with no long term debt. The company has a long history, starting business in 1906 as a commercial bank. The company still includes a bank division today which it counts as a strategic advantage in providing a range of services to customers. CASS pays a dividend of roughly 1.7%. CASS reported earnings on 7/22/10 with very strong results across its business groups. Revenues increased by 9% vs. the same quarter in 2009 and earnings increased by 33%. CASS is a great way to play an economic recovery. Its revenues increase with the number of economic transactions. It also has the unusual feature of profiting from higher interest rates. Low rates have hurt CASS over the last couple of years, but as rates rise this will be another significant factor driving performance. CASS is a thinly traded stock. I would strongly advise using limit and all or none orders for purchases. Disclosure: I own CASS in my individual accounts as well as in accounts managed for my firm, Freedom Mountain Investments. Long CASS in individual and accounts managed for Freedom Mountain Investments Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 05:18 PM PDT --Feeling besieged by the Welfare State? Tired of rising taxes, endless browbeating by unelected bureaucrats and insipid drivel in the news papers that passes for economic thinking? You're not alone friend. You're not alone. --A big welcome to www.economics.org.au. We learned of the project when we were up in Sydney recently. If you're interested in economics and more discussion on some of the ideas you find here in the Daily Reckoning, give the site a look. It is always encouraging to find fellow travellers on the road to financial freedom and liberty. They usually make good drinking buddies too. So have a look. --When we have a look at markets today, well...it's depressing. Day after day we all have to put up with the fraud of serious looking men and women in suits making a complete mockery of common sense, reason, and good judgement. As exhibit A in the case against the absurdists running our money and our economy into the ground, we offer the remarks this week of Federal Reserve Chairman Ben Bernanke. -- Bernanke spooked investors in New York when he fronted a group of empty headed Senators in Washington and told them that the future of the U.S. economy was "unusually uncertain." But in a real boon to those of us looking forward to the inflationary effects of trillions of dollars more in quantitative easing, Bernanke assured the Senators that, "We remain prepared to take further policy actions as needed to foster a return to full utilization of our nation's productive potential in a context of price stability." --Can this sort of nonsense really be taken seriously? Unfortunately, we have to take it seriously because it has serious investment consequences. --But how long will it be before most people understand that the Fed, the regulators, and the monetary authorities have no credibility when it comes to: a) understanding what is going on, b) fixing it, c) confessing to their culpability in causing the misallocation of capital and the zombification of large chunks of the global banking sector and generally forcing all of us contemplate their moronic and opaque pablum? --These people really are vandals and thieves. We are encouraged to take them seriously and cede micromanagement of the economy and public life to people who don't have an entrepreneurial bone in their body. What a big con. --In any event, don't be fooled about the stress tests coming up. When those so-called stress tests for European banks come out late this week they are likely be just as much a whitewash of the real capital inadequacy issues as were the American stress tests. In fact, the whole exercise is perfect pretext for another round of central bank quantitative easing/outright support of asset prices. --After all, American and European banks are stuffed full of housing-backed securities and sovereign debt. The credit boom manifested itself in many assets. Much of the fiscal and monetary policy since 2000 has been designed to keep those assets from deflating. It can't work. --We reckon-as we wrote in the July issue of Australian Wealth Gameplan published last night-this latest and largest round of quantitative easing will come sooner than most people are expecting and be a lot less effective than some people are hoping. It's time to get ready for it now. Crank up the fan...here comes the merde. --Meanwhile, a minor merde storm is brewing between Australian banks. Nothing sexier than watching the banks go at it over lending practices. Commonwealth Bank of Australia hard man Ralph Norris delivered a rhetorical smash to the nose of NAB's Mark Joiner. According to the Australian, Joiner said last month that some banks in Australia were making "super profits" by expanding their mortgage lending to the detriment of small business lending. --"Kapow!" says Mr. Norris. Well, not literally. Rather, he said, "I think the real issue is that we have a bank (NAB) that has performed poorly for many years and missed out on an opportunity when the mortgage market opened up... The market [for small business lending] grew by 0.5 per cent and we grew by 9 per cent...I don't know where that rubbish is coming from, because the facts certainly don't support it." --Never having been a banker, we are inclined to sit back and watch the slap fight. But the stakes are high. CBA's loan book is 60% in residential mortgages. Under Basel II, the bank has to hold less capital against a home loan than it does against a 'riskier' business loan. So, you could argue that expansion of the mortgage lending book, even at the expense of business lending, is a safer move for the bank and delivers bigger profits to shareholders. It also keeps the rivers of credit flowing into Australian property. --You could argue that. But it's not the argument we would make. We would instead make a high-handed, ivory tower, abstract kind of comment that the people of a nation can't all get rich by buying and selling houses from one another. For one, it's a singularly unambitious national goal. But that's not the biggest argument against it. --Creating a profit is hard. In some ways, it's unnatural. Profit is surplus value. Human beings improve their living standards by increasing productivity and efficiency through innovation and constant adaptation. The free market is a great mechanism for producing surplus, as long as risk taker and small businesspeople and crack pot inventors and dreamers and builders have access to capital. --Of course the banks are under no obligation to take bad risks (unless you're talking about U.S. banks compelled to make loans to bad credit risks during the American housing boom.) But perhaps this is just one of the inevitable costs of being an island economy. Were there more competition in the financial sector, there would be big profits on offer for banks able to make good lending decisions to small business. --In fact, we're sure the Big Four probably do quite nicely on their business loan books. But there's no doubt in our doubting mind that the banks are over-exposed to property because Australia has a collective national obsession with getting rich on property. Why NAB is choosing to stick it to CBA isn't quite clear to us. But we do agree with NAB's general point. --As for the aforementioned impending (we believe) quantitative easing round two, how should you prepare? Well, in the fashion that you find most fit naturally. But we'd suggest that asset markets are going to cop it good and hard in the second half of this year. We're expecting a one-two combination of big falls in stock markets and then wild, irresponsible, unprecedented and unconventional attempts to reflate by central banks. --But it's Friday. So let's all go away and think about it over the weekend and come back Monday and discuss. And by the way, thanks very much for the many, many emails we received about climate change and carbon pricing. Most were thoughtful and articulate. A few were rubbish but amusing. We'll print some of the responses next week. --In the meantime don't forget: the people backing an emissions trading scheme the most usually have a vested interest in the exchanges that will be set up to trade said emissions. It's like a potential casino owner telling you we should all be compelled to gamble. The government's interest in the matter is self-evident: mo' money. And the bureaucrats who are backing it presumably thrive, in some small-minded and mean-spirited but satisfying way, on simply telling people what to do. --Resist them all! And as the great thinker, champion of liberty, and emancipated American slave Frederick Douglass advised, "Agitate! Agitate! Agitate!" Dan Denning, | |||||||||||||||||||||||||||||||||||||||||||||||||

| 6 Dividend Aristocrats Worth Considering Posted: 22 Jul 2010 05:11 PM PDT Scott's Investments submits: In a continued effort to expand the focus of my site's screens and hypothetical portfolios, this article is a third follow-up to an article written in early April focusing on the S&P 500 Dividend Aristocrats. The S&P 500 Dividend Aristocrats index measures the performance of large cap, blue chip companies within the S&P 500 that have followed a policy of increasing dividends every year for at least 25 consecutive years. The current list has 43 constituents and the entire list is available from S&P or on my site. If an investor's portfolio was large enough he or she could consider purchasing the entire list. Alternatively, an investor could invest in the SDY, the SPDR Dividend ETF, which is a variation of the Aristocrats - it seeks to replicate the “High Yield” Dividend Aristocrats Index. A third alternative is to start with the Aristocrat list and then reduce the list of candidates through screens and/or fundamental analysis. I screened for Aristocrats which had a sustainable payout ratio, a high dividend yield, reasonable debt/equity ratio, and moderately positive return on assets and equity.

Below is a list of 6 Aristocrats which are worthy of further consideration, especially if one is seeking yield or seeking to reduce exposure to non-dividend paying companies. All of the companies on the list are familiar names and they were also all on last month's list which tells me this could be a relatively low turnover strategy. Another thought is to hedge the list with a short position in the S&P 500 is below its 200 day moving average. One such vehicle for doing so is SH. Obviously, hedging could reduce returns but also reduce drawdowns and volatility. Or, an investor could only purchase stocks which are above its 200 day moving average.

Disclosure: No positions Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||

| 3 Simple Reasons for ETF Investors to Believe in the Bull Posted: 22 Jul 2010 05:02 PM PDT  Gary Gordon submits: Gary Gordon submits: Why are so many financial articles attributing the 2.25% jump in equities to upbeat earnings reports? Honestly… it’s not like upside surprises haven’t been running at 3 out of 4 from the get-go. It’s not like 3M (MMM), AT&T (T) or UPS (UPS) presented game-changing insight into corporate America’s stellar profitability and respectable sales. Sure, some of the market gains are attributable to earnings “beats” and top-line revenue “beats.” Some of it is a recognition of the prior day’s over-reaction to Fed Chairman Bernanke’s testimony. Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||

| MOVE Index Suggests 10-Year Treasury Is Not Moving Lower...For Now Posted: 22 Jul 2010 04:36 PM PDT Bondsquawk submits: by Rom Badilla The 10-Year Treasury yield has declined from a recent high of 3.04 percent set on July 15, fueled by signs of further economic weakness. Currently, the benchmark note is trading at 2.88 percent, at or near recent lows. Given the current headwinds which suggest a slowing economy and easing price pressures, the yield on the 10-Year should maintain its longer-term downward trend. However, it may be running out of steam for now. By looking beyond just the charts, there is some evidence that supports this thesis. Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2011: The Year Of The Tax Increase Posted: 22 Jul 2010 04:19 PM PDT

The following are some of the tax increases that are scheduled to go into effect in 2011.... 1 - The lowest bracket for the personal income tax is going to increase from 10 percent to 15 percent. 2 - The next lowest bracket for the personal income tax is going to increase from 25 percent to 28 percent. 3 - The 28 percent tax bracket is going to increase to 31 percent. 4 - The 33 percent tax bracket is going to increase to 36 percent. 5 - The 35 percent tax bracket is going to increase to 39.6 percent. 6 - In 2011, the death tax is scheduled to return. So instead of paying zero percent, estates of $1 million or more are going to be taxed at a rate of 55 percent. 7 - The capital gains tax is going to increase from 15 percent to 20 percent. 8 - The tax on dividends is going to increase from 15 percent to 39.6 percent. 9 - The "marriage penalty" is also scheduled to be reinstated in 2011. It is being estimated that the total cost of these tax increases to U.S. taxpayers will be $2.6 trillion through the year 2020. Ouch! But wait, there are even more tax increases coming. The "health care reform law" contains over a dozen new taxes that will be implemented in stages over the next decade. When you add all of these taxes to the taxes that were mentioned earlier, the result is going to be absolutely devastating. According to an analysis by the Congressional Joint Committee on Taxation the health care reform law will generate $409.2 billion in additional taxes by the year 2019. Double ouch! So is it any wonder why the public has such a low opinion of the U.S. Congress? Every single major poll done on the topic shows that approval ratings for Congress are at record lows. For example, Gallup's 2010 Confidence in Institutions poll found Congress ranking dead last out of the 16 institutions rated this year. Of course there are a whole host of reasons why the American people are upset with Congress, but one of the big ones is the fact that we are literally being taxed to death. However, it is not just federal income taxes that are killing us. In a previous article entitled "Taxed Enough Already!", we listed just a few of the taxes that Americans have to pay each year.... Accounts Receivable Tax Building Permit Tax Capital Gains Tax CDL license Tax Cigarette Tax Corporate Income Tax Court Fines (indirect taxes) Dog License Tax Federal Income Tax Federal Unemployment Tax (FUTA) Fishing License Tax Food License Tax Fuel permit tax Gasoline Tax Gift Tax Hunting License Tax Inheritance Tax Inventory tax IRS Interest Charges (tax on top of tax) IRS Penalties (tax on top of tax) Liquor Tax Local Income Tax Luxury Taxes Marriage License Tax Medicare Tax Payroll Taxes Property Tax Real Estate Tax Recreational Vehicle Tax Road Toll Booth Taxes Road Usage Taxes (Truckers) Sales Taxes School Tax Septic Permit Tax Service Charge Taxes Social Security Tax State Income Tax State Unemployment Tax (SUTA) Telephone federal excise tax Telephone federal universal service fee tax Telephone federal, state and local surcharge taxes Telephone minimum usage surcharge tax Telephone recurring and non-recurring charges tax Telephone state and local tax Telephone usage charge tax Toll Bridge Taxes Toll Tunnel Taxes Traffic Fines (indirect taxation) Trailer registration tax Utility Taxes Vehicle License Registration Tax Vehicle Sales Tax Watercraft registration Tax Well Permit Tax Workers Compensation Tax Are you dizzy yet? The reality is that the American people are being drained in dozens and dozens of different ways. But what did you expect? Did you think that our politicians would pile up the biggest debt in the history of the world and never ask you to pay for it? Did you think that we could run deficits equivalent to about 10 percent of GDP without ever seeing tax increases? The truth is that the U.S. government needs a whole lot more money than even these new tax increases will bring in. After all, it is being projected that the U.S. government will be spending $2 trillion on the interest on the national debt alone by the year 2020. To put that in perspective, the entire budget for the U.S. government is less than $4 trillion for 2010. Are you starting to get the picture? In the years ahead the IRS is going to be digging deeper and deeper into our pockets and a gigantic chunk of that money is going to go directly into the pockets of those who own our debt. But very few Americans wanted to listen when this problem was actually somewhat fixable 20 or 30 years ago. So now we are all going to pay the price - literally. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Gain With Stocks and Oil Posted: 22 Jul 2010 04:00 PM PDT Gold extended yesterday's after hours losses and dropped almost 1% to as low as $1180.70 in Asia before it rebounded a bit in London and then shot higher between 9:30 and 10AM EST to see an $8.25 gain at $1200.30 by midmorning in New York, but it then fell back off into the close and ended with a gain of just 0.35%. Silver jumped to as high as $18.173 before it also fell back off a bit in the last few hours of trade, but it still ended with a gain of 1.74%. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Is College Education The Next Bubble Set To Burst? Posted: 22 Jul 2010 03:53 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||

| PSP Investments Up 21.5% in FY 2010 Posted: 22 Jul 2010 02:58 PM PDT The 2010 Annual Report of the Public Sector Pension Investment Board (PSP Investments or PSPIB) was tabled with the Parliament of Canada on July 21st, 2010. On Thursday, PSP Investments posted this press release on its FY2010 results:

The full 2010 Annual Report is available on-line (click here for PDF file). Obviously, PSP did a 180 degree turn from FY2009 where they lost 23% and severely underperformed their policy portfolio.

It worries me that after all these years, and after experiencing the 2008 financial crisis, PSP Investments is still trying to figure out the notion of undue risk with their stakeholders. The latter are mostly to blame for this lack of proper oversight.

Gordon is right, many investors did miss the sharp rebound in asset prices starting in March 2009, and were forced to sell high-quality assets at the most distressed time. It was a matter of liquidity - those pension funds that needed it the most during the crisis were the ones who suffered the most. Other funds like PSPIB and CPPIB, were able to sit back and wait out the crisis without having to sell any of their public market holdings (at the market bottom).

Taking an even closer look at private Equity's performance (page 19):

We still don't know the details about Telesat's performance, but as I suspected, the $1.5B plus secondary market sale PSP is reportedly engaged in, has more to do with a shift towards co-investments and direct investments which allows them to realize gains on their private equity investments more quickly.

Real Estate, led by Neil Cunningham, which is fully ramped up, is still struggling, but doing comparatively better than large US and Canadian funds:

Let me wind down here by commenting on overall results. While PSP Investments did bounce back solidly from last year's disaster, not missing the rally in stocks since March, the results are not as spectacular as the headline figure implies. In fact, the table below was taken from Brockhouse Cooper's Q1 Universes (click on image to enlarge):

True, but over the last five years, PSP's returns are 4.4% while the Benchmark portfolio returned 5.3% (click on first chart above). Despite this long-term underperformance, PSP's senior officers enjoyed another stellar year in terms of compensation. The summary compensation table below was taken from page 46 of the 2010 Annual Report (click on image to enlarge):

But union leaders representing federal civil servants aren't happy with compensation and other governance issues at PSP. In fact, the Public Service Alliance of Canada (PSAC) shared these concerns with me: | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 01:43 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 12:19 PM PDT That's right, gold. You know, the ultimate money. Or Gold: The Once and Future Money, as our friend Nathan Lewis titled his 2007 book, for which we were privileged to write the foreword. Hey, Wall Street can take a $250 million sewer project in Alabama and turn it into an insurmountable debt 20 times as big. So it can find a way to pervert the Midas metal, too. And the evidence is piling up: You don't have to be partial to conspiracy theories about the "manipulation" of gold to conclude something just doesn't look right. That means you need to be very careful about how you hold any gold outside your physical possession - especially in a retirement account. Of course, it's always important to ask oneself, how much is there to these conspiracy theories, really? Well, ever since the publication of his book, Lewis has been scrutinizing them. And this year, they've reached a fever pitch.

You could go very far down the rabbit hole trying to separate fact from fiction with these kind of stories. And you'd be wasting your time. Marc Faber, editor of The Gloom Boom & Doom Report stated it well in April, so well we quoted it in The 5 Min. Forecast: "If you have manipulation to keep the price down, it eventually goes ballistic. So all the people that are bitching about the manipulation of silver and gold should be happy that it is manipulated, because it still gives them an opportunity to buy it at a depressed price." Exactly. Manipulation stories are a source of entertainment, outrage or both. They underscore the perils of the Wall Street Fandango. But their truth or falsehood makes little difference if you hold gold in your physical possession. Or in an allocated account (the gold has your name on it) in an independent, insured depository. Or if you use a reputable electronic gold purveyor. (We like GoldMoney.com and BullionVault.com.) But it makes a lot of difference if you hold "paper gold" in the form of an exchange-traded fund. Many people buy vehicles like GLD and IAU with the comforting illusion that what they're buying is "good as gold." And it's an incredibly convenient way to get metals exposure in a retirement account. Which brings us to the revelations of Janet Tavakoli. Tavakoli is not a gold bug. She's an expert in structured finance and credit derivatives who runs her own consulting firm in Chicago. Recently, she published a client report that took the format of "advice" she would give to Wall Street sharpies trying to corner the gold market. Not that they'd ever try that, of course. Pump up the gold story. Get your friends to tell retail investors to buy some gold every month. Get your buddies in the financial business to offer exchange-traded gold funds (ETFs) that claim to buy physical gold. This will sound safe to retail investors, but in fact, the ETFs are very risky. This will serve your purpose when you are ready to start a panic. These particular ETFs will allow the "gold" to be commingled with the custodian's gold, and the custodian can lease out the gold. Moreover, the "gold" custodian can give it to a subcustodian that the manager doesn't know. The subcustodian can give it to yet another subcustodian unknown to the original custodian. The manager will never audit the gold, and the gold is not "allocated" to a particular investor. Since this is an "exchange traded" gold fund, investors will probably assume the gold is regulated by the Commodities Futures Trading Commission (CFTC), but it isn't. By the time investors wake up to the probability that there is very little actual gold backing their investment, your plan will be ready to execute. The "plan" involves buying huge futures contracts and expecting physical delivery. If this sounds familiar, it's pretty much what the Hunt brothers did when they tried to corner the silver market in 1980. Silver shot up to $50, however briefly. It's never seen that territory again. But the consequences this time around would be far more serious. It could collapse banks holding huge short positions in the futures market, accustomed to settling contracts cash only. More to our point, it would crater the ETFs: Their complex network of custodians and subcustodians would be laid bare. ETF investors would realize they have a claim on the same chunk of gold as, say, Goldman Sachs. But Goldman would have the actual metal. The ETF investor would have to settle for pennies on the dollar. Far-fetched? Maybe. Just remember that ETFs are ultimately, like a complicated mortgage derivative, subject to counterparty risk. If the day comes when trust evaporates from the system, value will evaporate from the ETFs. If you want to play gold's short-term ups and downs, the ETFs are an ideal instrument. Otherwise, stay away. Addison Wiggin | |||||||||||||||||||||||||||||||||||||||||||||||||

| Public Debt Replaces Private Debt in the Name of Progress Posted: 22 Jul 2010 11:59 AM PDT The Dow fell 109 points yesterday. Gold was flat. Otherwise, all quiet on the financial front. We're keeping these reckonings short this week. Your editor is attending a financial conference in Vancouver. He doesn't want to miss anything. What have we learned so far? Both Rob Parenteau and John Mauldin mentioned the danger of fiscal retrenchment. Tightening seems like the right thing to do. It IS the right thing to do. But it results in bigger deficits. How could that be? "It sets in motion a vicious cycle," said Rob. The private sector is already correcting. If the public sector tries to correct its debt at the same time it puts even more pressure on households and companies. Their income goes down (less government spending). And their taxes go up. So they cut back. Jobs are lost. So tax revenues fall. So the government's deficit increases and it must cut even more. "That's what is happening in Ireland. Ireland has done everything right. It cut spending just as it said it would. But the picture has deteriorated, not improved." What's the solution? There is no solution. But both Rob and John implied that perhaps the government should wait for an upturn in the private sector before it begins cutting in earnest. Here at The Daily Reckoning, we wouldn't worry about it. First, we don't think governments really are cutting in earnest. We think they're just flirting with the idea. When the time comes to go upstairs, our guess is they'll have to leave the party rather than get serious. Already, Hungary announced that it was fed up with austerity. When push comes to shove, will other nations stick it out? Probably not many. Second, the real problem is still too much debt. It needs to be destroyed. The sooner, the better. Nobody ever said it would fun. But it's better to get it over with. That's why a hands-off approach would have been much better in the beginning. After Lehman went down, the whole street was ready to fall. Households, businesses, banks - trillions in debt might have been wiped out overnight; we'll never know. Instead, we're headed for Tokyo where they've had bailouts, boondoggles and counter-cyclical fiscal stimulus for 20 years. And for what? "It would have been worse had the Japanese authorities not acted," say the neo-Keynesians. How they know that is a mystery to us. As it turned out, Japanese investors lost nominal wealth equal to three entire years' GDP. And the economy today hasn't grown in 17 years or created a single new job. Nor has the debt been reduced. Instead of permitting the private sector to destroy and pay off its debt, the public sector fought against it...borrowing heavily to try to bring about a recovery. Result: no recovery...and almost exactly the same amount of debt. But while the private sector paid off its debt, the public sector picked up the borrowing. Now it's the government that owes money all over town. Is that progress, or what? Meanwhile, 'double dip' sightings are becoming more frequent. Here, The New York Times brings joyless tidings from the housing industry:

And this report from Charles Hugh Smith: Evidence for falling demand is plentiful: Pending home sales have tumbled 30%, hitting two records. Mike Larson of Weiss Research recently said: "Demand has fallen off a cliff in the wake of the tax credit expiration, with pending sales falling by the biggest margin ever to the lowest level ever." The consensus is the sharp decline in home sales is the result of the federal tax credit ending, but few analysts have hazarded guessing where new demand will come from, absent the tax credit. Meanwhile, the supply of homes for sale or in default marches ever higher in all price segments. To the surprise of those who reckoned that higher-end homes were holding up better than the rest of the market, the delinquency rate on investment homes with an original mortgage of more than $1 million is now 23%. And a staggering one in seven homes over $1 million is in default. Even the posh Beverly Hills zip codes have seen prices shrivel by 31%. An Ever-Larger Shadow Lenders are thus rightly worried that many of the 11 million homeowners who owe more than their house is worth - the 24% of homeowners who are "underwater" - will walk away from their mortgages, especially if the real estate market rolls over again. Such an increase in so-called strategic defaults would burden lenders with even more unsold homes - a category known as "shadow inventory" because lenders don't always list a newly foreclosed home for sale immediately. This shadow inventory could reach as high as 7 million homes by some estimates. Other analysts have calculated that it will take 103 months (about 8.5 years) to clear this gigantic inventory of foreclosed, distressed and defaulted homes. To put these numbers in context: according to the US Census Bureau, 51 million households have a mortgage and 24 million own homes free and clear (no mortgage), and about 37 million households rent. Even more sobering, the total number of vacant dwellings in the US increased to a record 19 million in the first quarter of the year, up from 18.9 million in the fourth quarter of 2009. As new homes continued to be constructed, inventory rose last year by 1.14 million to 130.9 million, while occupied homes increased by 1.07 million to 111.9 million. And more thoughts... "This is the Greater Depression...and it's going to be worse...far worse...than the Depression of the '30s," said Doug Casey. "We're just in the eye of the hurricane now. It seems calm. But the other side of the storm is going to hit soon. And it's going to be much worse..." Doug proceeded to list all the reasons this storm will cause more devastation than the '30s tempest. For one thing, people have much more debt. There was relatively little consumer debt in the '20s. Credit cards hadn't been invented yet. And if you wanted to buy something from a store you had to pay for it in advance. They had 'lay-away' plans. You could pay a little each month. Then, when you'd finished paying for it, they'd give you the merchandise. Generally, people still believed in saving money. Other reasons: There was no expensive social-welfare establishment. There were few bailouts and few boondoggles. The US government had little debt and was relatively little-involved in the economy. The US had a positive trade balance. The US was still a growing, dynamic economy...and the world's leading exporter. And the US wasn't involved in any foreign wars. Its military expenses were trivial compared to those of today. People wanted to invest in the US. The US dollar was backed by gold. "Now, smart Americans are getting their money out of the US," said Doug. "This time it's going to be much worse." Bill Bonner | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price is Trying to Turn Up Posted: 22 Jul 2010 10:44 AM PDT Gold Price Close Today : 1191.60Change : 0.10 or 0.0%Silver Price Close Today : 17.798Change : 0.113 cents or 0.6%Platinum Price Close Today : 1525.80Change : 8.50 or 0.6%Palladium... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 10:20 AM PDT Rising risk appetite, softer dollar lift gold price The COMEX August gold futures contract closed up $3.80 Thursday at $1195.60, trading between $1180.70 and $1201.20 July 22, p.m. excerpts: see full news, 24-hr newswire… July 22nd's audio MarketMinute | |||||||||||||||||||||||||||||||||||||||||||||||||

| City Manager of Bell, CA, Earns $800,000 — Twice President Obama’s Salary Posted: 22 Jul 2010 10:00 AM PDT This week, Bloomberg reports one of the poorest areas in Los Angeles County, the City of Bell (population of 38,000), erupted in protest after word spread its city manager earns about $800,000 per year, or nearly twice the salary of the US president. Exorbitant pay is a rampant problem in the pint-sized city, where the police chief earns almost $460,000 — more than the police chief of the City of Los Angeles (population of 3.8 million) — and council members make roughly $100,000 for the part-time work of meeting twice a month. This all takes place in a California city with a per-capita income of $24,800 in 2008. It's yet another example of the wise and efficient allocation of taxpayer dollars… right. You can view a clip of the story below, read more details at Bloomberg, or visit The Daily Bail, where this post came to our attention.

City Manager of Bell, CA, Earns $800,000 — Twice President Obama's Salary originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||||||||||||||||||||||||||||||||||||||||||||||||

| Green Jobs from the Government Not Gonna Happen Posted: 22 Jul 2010 10:00 AM PDT "Green Jobs Don't Exist in a Free Market" was the headline for Tom DeWeese, writing at NewsWithViews.com, which is exactly right; the only jobs that exist in a free market are those supplying real demand for, as an example, hamburgers, pizza, fried chicken and tacos, which has resulted in fast-food restaurants supplying them to be located on, seemingly, every other block in the Whole Freaking Country (WFC). The reason he brings this up is that he says, "Obama and his environmentalist hordes convinced Congress that the money would be used to create an army of home weatherizers, wind-turbine factory jobs and other employment opportunities that would help put to work the nearly 8 million people who have lost their jobs during the recession." That sounds just like Obama, as that particular doofus said, apparently before reading Mr. DeWeese's article and getting a little smarts, "We know the jobs of the 21st century will be created in developing alternative energy," which is so laughably preposterous that I am sure it made Mr. DeWeese laugh with a cruelly mocking tone as did the Cruelly Mocking Mogambo (CMM)! Hahaha! Actually, I figure that the most jobs will be created in making 3-D pornography, importing high-definition video equipment on which to view it, smuggling stuff, and rampant prostitution as Americans find out the true market value of their terrible educations and ridiculous sense of entitlement versus the value of software and industrial robots, particularly if software starts making a robot that can shoot flames out of its mouth and bullets out of its fingers. As to where Mr. DeWeese got this timeless fact that "green jobs" don't exist in the private economy, it apparently comes from "Economic lesson number one: Government regulations do not create jobs. Private industry serving the wants and needs of the consumers create jobs. Period." I figure that the word "period" followed by a real period was somewhat premature, as I would have added, "In fact, government and government regulations are a net economic drain and a real loser, you morons, and the more government and the more government regulations you have, the sicker and sicker the economy becomes until you wind up like we are today, where government spending is half the economy, the total tax take is almost 60% of Every Freaking Thing (EFT), national debt is 95% of GDP and going up 10% a year, and everybody is broke, and if you are not buying gold, silver and oil, then something is wrong, seriously wrong, with you!" And I am sure that it will get worse and worse as the ridiculous Obama and his Congressional lapdogs will spend gigantic amounts of money forcing people into "green jobs," with the Federal Reserve creating the money that the government will borrow and spend, creating ruinous inflation in consumer prices. Maybe even to the point of hyperinflation! Hyperinflation and beyond! As to that, Jim Sinclair, in his Mineset newsletter, notes that "Hyperinflation is always the product of a loss of confidence in currency resulting in a 'Currency Produced Cost-Push Hyperinflation,'" which is very classy of him, since he does not mention that I am screaming that "loss of confidence in a currency" is the result of the stupid government creating, or allowing to be created (as in the case of the foul Federal Reserve here in America), excess amounts of money so that the money goes into prices, and price inflation is because the money is more and more valueless because so much of it is being created, and soon nobody in their right mind wants the stuff. Again without mentioning my Screaming Mogambo Interruption (SMI) about the odious Federal Reserve and how they should all rot in hell, he goes on, "All hyperinflation in modern history has occurred for one reason, and one reason only. That is loss of confidence in currency." Worse, "When hyperinflation has occurred in modern history, EVERY economy involved was decimated as, and when, it occurred." I notice that again he does not mention price inflation, the scary boogieman that haunts my nightmares and the thing that will destroy us all. I figure that this is my chance to interrupt with something more than denouncing the horrid Federal Reserve for creating so much money that inflation is boiling along at more than 6%, which he probably cleverly deduces from the expectant look on my face. Anticipating me, or perhaps trying to make me just sit down and shut up, he says essentially the same thing! He notes how hyperinflation, "has never been caused by 'Demand-Pull,' but always and without exception caused by 'Currency Induced Cost-Push Hyperinflation" which makes me scream even louder because this is the same thing as saying prices are higher, which is what I have been screaming about for about ten minutes now and my throat is getting sore! Gaaahhh! The awful news is that Fed will create trillions and trillions more dollars over the years to slake the ravenous appetite of Congress for deficit-spending, a fact characterized by Mr. Sinclair as "the Fed can and will do QE to infinity." Setting your Mogambo Secret Decoder Rings (MSDR) you can translate "quantitative easing to infinity" to mean, "Buy gold, silver and oil!" which makes it all so easy that I finally stop screaming, and merely shout in glee, "Whee! This investing stuff is easy!" The Mogambo Guru Green Jobs from the Government Not Gonna Happen originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 09:50 AM PDT From Nic Lenoir of ICAP The market continues to chop around aggressively in the 1,055/1,100 for the S&P future. However more broadly the Bovespa which has been a key indicator representing the commodity/Emerging Market trade has not yet validated a market wide break out for risky assets, and we currently are right on the resistance formed by the 100- and 200-dma as well as the neckline of an inverted H&S. We would need confirmation of a break there to really feel strongly about the possibility of a prolonged move towards more risk appetite. Similarly AUDUSD has almost come back to test the 200-dma and the 0.8980/0.9060 zone should be relatively strong resistance. If bypassed then clearly expect quite a few more days like today. With Fixed Income already pricing a double dip watch for weaknes there if the breakout occurs. The Bund almost saw the key resistance at 129.50 overnight and rejected it strongly, now we focus on a break of 128.10 which would mean further acceleration lower. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Why unemployment could remain high for decades Posted: 22 Jul 2010 09:43 AM PDT From Zero Hedge: Even as Bernanke is receiving his last-minute briefing on what to say (everything, EVERYTHING, is good) and what to play dumb on (explaining the price of gold for example), a new report by the Center for Economic and Policy Research concludes that digging ourselves out of the current unemployment hole (7.5 million more unemployed since December 2007) will take at least... Read full article... More on unemployment: MUST read bit from Doug Casey on unemployment The headlines are misleading you about unemployment How to make the unemployment rate collapse immediately | |||||||||||||||||||||||||||||||||||||||||||||||||

| FHA – “We are Officially Broke” Posted: 22 Jul 2010 09:33 AM PDT An interesting item in the Federal Register. This notice: (Link to FHA/FR)

SUMMARY: A recently issued independent actuarial study shows that the Mutual Mortgage Insurance Fund (MMIF) capital ratio has fallen below its statutorily mandated threshold.

Given FHA’s mission, allowing the continuation of practices that result in such a high proportion of families losing their homes represents a disservice to American families and communities. It is FHA’s intent to eliminate this portion of its business, and utilize other established methods to reach and support these families.

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Barclays: The 3 biggest risks to stocks now Posted: 22 Jul 2010 09:31 AM PDT From Pragmatic Capitalism: Barclays Wealth opines on the three biggest risks to the market (Via FT Alphaville): “The first big issue facing the global economy is the reluctance of the US consumer to spend, with real household disposable income well below what it normally is at this stage of the economic cycle. The outlook here is worrying... Read full article... More on stocks: Dow 5,000 could be coming This hated stock is one of the best buys in the world right now Richard Russell: This is one of the biggest tops in stock market history | |||||||||||||||||||||||||||||||||||||||||||||||||

| physical gold vs gold equities correlation Posted: 22 Jul 2010 09:23 AM PDT Interesting story today about the relationship between physical and the stock prices for miners http://www.businessspectator.com.au/...cument&src=sph some interesting bits: In fact there appear to be two quite distinct breaks in the relationship – the big one after Lehman Brothers collapsed and another widening earlier this year as the European sovereign debt crisis erupted. The obvious explanation for the breaks in the correlation since the crisis developed is gold's peculiar status as a secure and portable financial asset. In times of crisis physical gold provides greater reassurance than shares in corporate entities. peculiar??? yeah, right. The story goes on to suggest that broader sharemarket uncertainly and issues like tax changes are effecting equity prices differently now (don't know why this should be any different than the past, though). In all seriousness, the story also suggests that sharebuyers are discounting gold equities because of a lack of confidence that the gold price will remain strong!! Oddly, omitted from the story is the possibility that investors may see the management of miners and their cohorts in the financial industry as standing between the deposit and share buyers getting any actual real return from the enterprise, and discounting the shares accordingly | |||||||||||||||||||||||||||||||||||||||||||||||||

| Richard Russell: Inflation will dominate deflation Posted: 22 Jul 2010 09:18 AM PDT From Richard Russell in Dow Theory Letters: The too-low inflation numbers (call it what it is -- multiple indications of deflation) are appearing. The Bernanke Fed crowd must be sitting on the edge of their seats with accompanying white knuckles. As the hints of deflation break out into the open, I expect the Administration to freak out and come up with new stimulus and make-work plans, and I would expect the Fed's balance sheet to expand - meaning to look worse. All this is not lost on gold, which has been holding up rather well -- this, despite the slowly-strengthening dollar. Do you remember Bernanke's words, "You cannot have deflation in a fiat currency system." Why not? Because the Fed can create so much money that inflation will dominate deflation. Crux Note: Learn more about the excellent Dow Theory Letters here. More from Richard Russell: Richard Russell: Don't be fooled by bear market rallies Richard Russell: "This market has nowhere to go but down" Richard Russell: Everything you need to know about gold in three sentences | |||||||||||||||||||||||||||||||||||||||||||||||||

| [KR62] Keiser Report – Markets! Finance! Hollow Men! Posted: 22 Jul 2010 08:57 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 08:28 AM PDT As oil industry expert Bob Cavnar writes:

In other words, BP is shutting down its drilling of the relief wells until the storm passes. Cavnar points out that this could be awhile:

I agree with what Cavnar as written previously: instead of doing the "well integrity test", BP might have been able to kill the well by now if it hadn't suspended drilling of the relief wells so that it could run that test. It is not yet clear whether the storm will turn into a hurricane. As I warned on May 14th, there is a possibility that a hurricane could spread the oil inland. The Weather Channel notes today:

I don't believe anyone has studied the potential effect of a hurricane on the large amounts of methane released by the oil gusher, and the millions of gallons of Corexit sprayed into the Gulf. While some blithely dismiss any danger and others are giving apocalyptic visions, I don't think anyone really knows how bad it could be. The government has just announced that the cap will stay on - unattended - throughout the storm. Specifically, National Incident Commander Thad Allen just announced that:

I hope and pray that the well does not blow out while no one is looking. Hurricanes can also tear up the seafloor, but probably only in shallow waters. As pointed out in a study conducted by the U.S. Naval Research Laboratory at Stennis Space Center, Mississippi (via Science Daily):

But even thought the ill-fated well is too deep to suffer a direct hit by a hurricane, there are many things which could still go wrong. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Izabella Kaminska: Looks like BIS swaps relieved gold market squeeze Posted: 22 Jul 2010 08:22 AM PDT 4:22p ET Thursday, July 22, 2010 Dear Friend of GATA and Gold: Gold market blogger Izabella Kaminska has examined data for the New York Commodities Exchange's gold inventory and finds that while inventory is nominally high, the metal actually available for sale is relatively low on a historical basis. Recent negative gold lease rates, she writes, have signified tightness in the physical market. "That is to say," Kaminska explains, "we used to pay for borrowing money from the bank -- pledging gold as collateral. Now we get paid for borrowing money from the bank -- pledging gold as collateral. We wonder why. In which case, the Bank of International Settlements getting involved in the 'cash for gold' market might make perfect sense -- especially if its real aim was to reset the stakes. We note that three-month lease rates, for example, did coincidentally go positive over the supposed gold swap action." Kaminska's commentary is headlined "The Story of the Gold Curve So Far" and you can find it at FT Alphaville here: http://ftalphaville.ft.com/blog/2010/07/21/287566/the-story-of-the-gold-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth | |||||||||||||||||||||||||||||||||||||||||||||||||

| Kindling Finally Micturated On - Amazon Grace Expires As Stock Plummets Posted: 22 Jul 2010 08:20 AM PDT It appears the Derek Zoolander Center For Children Who Can't Read Kindle Good And Want To Learn To Go Long AMZN Stock good too (and must be at least this big), is just not gonna get built after all. And so America's brief infatuation with yet another fad draws to a close. All AAPL fans: keep an eye on this one. Don't worry though, both Amazon and Apple will pass the ECB's stress test with flying colors. Here is some perspective on Amazon from Jim Cramer circa April 26, (courtesy of Benzinga):

| |||||||||||||||||||||||||||||||||||||||||||||||||

| China Throwing World’s “Biggest Creditor Nation” Weight Around Posted: 22 Jul 2010 08:00 AM PDT In a recent Financial Times interview, Guan Jianzhong, chairman of Dagong Global Credit Rating Co., lashes out with harsh words against "politicised and highly ideological" Western rating agencies. Guan insists Dagong Global ratings are superior to those of his competitors. He defends his agency's assessment, of rating China's debt higher than the US, as being due to its status as "the biggest creditor nation in the world." According to the Financial Times: "'The western rating agencies are politicised and highly ideological and they do not adhere to objective standards,' Guan Jianzhong, chairman of Dagong Global Credit Rating, told the Financial Times in an interview. 'China is the biggest creditor nation in the world and with the rise and national rejuvenation of China we should have our say in how the credit risks of states are judged.' "On the corporate side, Mr Guan [...] specifically criticised the practice of 'rating shopping' by companies who offer their business to the agency that provides the most favourable rating. "In the aftermath of the financial crisis 'rating shopping' has been one of the key complaints from western regulators, who have heavily criticised the big three agencies for handing top ratings to mortgage-linked securities that turned toxic when the US housing market collapsed in 2007." The big three ratings agencies — Moody's, Standard & Poor's, and Fitch — have encountered plenty of well-deserved criticism. First, for failing to accurately assess mortgage-backed debt before the housing market's collapse. Then, once again, for being slow on the trigger in downgrading countries with overwhelming sovereign debt, a problem whose full scope is still coming to light. However, Guan saved his most stinging critique for the US as whole for later in the interview, stating… "'The US is insolvent and faces bankruptcy as a pure debtor nation but the rating agencies still give it high rankings,' Mr Guan said. 'Actually, the huge military expenditure of the US is not created by themselves but comes from borrowed money, which is not sustainable.'" Guan looks to be itching for a showdown with the Western rating agencies he so firmly dismisses. The US is fiscally troubled, and the federal deficit is not unsustainable on its present course. However, broaching the topic of the "huge military expenditure of the US" — which is, of course, funded partly by debt — as unsupportable must be a brand new credibility-building tactic in the ratings business. Well, it's new to us. It's probably safe to say that from Guan Jianzhong we haven't heard the last of this yet. You can check out more of the interview in Financial Times coverage of the China rating agency condemning its rivals. Best, Rocky Vega, China Throwing World's "Biggest Creditor Nation" Weight Around originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||||||||||||||||||||||||||||||||||||||||||||||||

| The Long and Short of Informed Investment Decisions Posted: 22 Jul 2010 08:00 AM PDT "What is your favorite government agency, and why?" "What are the two largest holdings in your own personal wealth?" "What is your trade of the new decade [best long and short idea for the next ten years]?" "Where will the Dow and gold be a year from now…and what is your favorite chilled beverage?" The questions came on thick and fast at last night's "rough and tumble" Whiskey Bar Debate here in Vancouver. If you've attended our little shindig before, you'll know what it's all about. If you haven't yet partaken in the feistiest chapter of our annual symposium, we basically get our most outspoken, controversial contrarians liquored-up and hit them with a slew of attendee-penned questions. Here's a taste of what went down when the Trade of the (New) Decade question popped up, as relayed by our mates over at The 5-Minute Forecast:

The gold/Dow/chilled beverage question also yielded some colorful responses from the panel: Gold at $1,800 per ounce…Dow down 20%…Mojitos… Not a member of the distinguished panel, your humble editor didn't throw in his 2 cents last night, so we'll do so now. But instead of measuring the index in points and the metal in dollars, we'll do away with floating abstractions and simply measure the index in metal. Historically, the peak of a gold bull market/stock bear market occurs when you can pick up the 30 bluest stocks for about one, maybe two, ounces of gold. The Dow/Gold ratio, at that point in time, is said to be around 1:1 to 2:1. During the furor of tech. mania in the late '90s, early '00s, when the Midas metal was scoffed at in polite company, that ratio reached 45:1. In other words, it would take you 2.8 POUNDS of Mother Nature's money to buy the Dow. During the past decade, as stocks stagnated and gold rallied fourfold, that ratio has slipped dramatically. Today, it takes about 8.6 ounces of gold to buy the Dow. Our bet, for what it's worth, is that this trend continues for a while yet. Next year, we're probably looking at a Dow/Gold ratio of about 6:1…and not because the Dow goes to 60,000. Oh yes, and we'll take a caipirinha. Joel Bowman The Long and Short of Informed Investment Decisions originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 08:00 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 07:50 AM PDT Market Folly submits: MarketClub recently took a technical look at gold and given that everyone is talking about the metal, we wanted to highlight their analysis. Pulling up a chart of the precious metal, Adam points out a potential double top at around 1,264 that took place in June. Since then, gold has sold off in a substantial manner, down to 1,179. He then pulls up the fibonacci retracement tool to identify very important levels in gold. Both the 50% retracement and the 61.8% retracement levels are important in the metal and here's why: Both reside around previous support levels of 1,157 and 1,132. While gold could still possibly fall below these levels, he looks for those two areas to provide price support. Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Credit Firms Tell Clients Not To Use Their Ratings? Posted: 22 Jul 2010 07:47 AM PDT By Dian L. Chu, Economic Forecasts & Opinions

China, the largest sovereign debt holders of the world, with a record 2.454 trillion dollars at the end of June, undoubtedly would like to have a bigger say as to the risk and reward Beijing deems appropriate for its investment. In that regard, we pretty much know Beijing's thoughts judging from the sovereign credit ranking issued by Dagong, which in many ways contradict the big three. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2010 07:27 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Producers' Upside Potential Posted: 22 Jul 2010 07:22 AM PDT The Gold Report submits: Fascinated to see gold soar in a period of low inflation, Beacon Rock Research Founder Mike Niehuser won't be surprised if it crosses the threshold into 2011 at above the $1,500 price point. Whether it levels off or reaches new heights, Mike explains where to seek investment opportunities in this exclusive interview with The Gold Report. According to him, companies with improving near-term production, pipeline projects to expand reserves and promising exploration prospects present better-than-average potential for returns. Because the market is pricing some pessimism into equities these days, he also sees good opportunities in companies with strong potential to increase fundamental value. Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||

| 5 Ways to the US Government Can Fix the Economy Posted: 22 Jul 2010 07:15 AM PDT A pop quiz: How much money did the US government inject into the American "financial system" from June 30, 2009, to June 30, 2010? Drumroll… $700 billion. That's right…the same amount promised to the financial system in TARP, back in 2008, when they were literally on the brink of destruction. Over the last 12 months, as the S&P 500 rose as much as 30% (up about 15% now, after the summer correction), evidently banks, brokers and lenders needed another $700 billion… just trust 'em…really. "The current outstanding balance of overall federal support for the nation's financial system…has actually increased more than 23% over the past year," wrote TARP inspector general Neil Barofsky this week, "from approximately $3.0 trillion to $3.7 trillion – the equivalent of a fully deployed TARP program – largely without congressional action, even as the banking crisis has, by most measures, abated from its most acute phases." You're supposed to feel better, we're told, that most of the money went to Fannie, Freddie and the FHA. Hence we arrive at one of the underlying themes of this year's Investment Symposium: Government out of control. At the sharpened edge of this sword is Doug Casey. Here's how he suggested the government fix itself in yesterday's general assembly…not exactly "News at 10" material: "What should they do? Well, I have a nice list of pointers," Doug mulled onstage: "1. Central banks, starting with the Fed, should be abolished. They serve no useful purpose. The US has 260 million ounces of gold. That can be used to back what's left of the currency. What price, I don't know – $10,000 an ounce? "2. Urgently disband 95% of the government. I would go all the way, but I'm a gradualist. It's not radical – it just means going back to the original ideas of the Constitution "3. Withdraw troops from all countries around the world. End the insane wars in Iraq and Afghanistan. Cut the military back about 95% too. All these V-2 rockets and carriers are just junk, expensive junk. Their main purpose is going to be excellent dive sites for people of the next century. "4. Abolish, totally, absolutely, the whole income tax and whole IRS. "5. US government should default on the debt. That's the honest way to handle it. They will likely do it subvertly with inflation over time, but I would prefer overtly. "What are the chances this is going to happen? Slim to none, and slim's out of town. It ain't going to happen. Thus, they chose an uncontrolled collapse, not a controlled one." We suspect this is what Barry Ritholtz meant when he said he felt fatigued by all the "recession/depression porn" featured at this year's Symposium. But hey… there's plenty to be gloomy about. Ian Mathias 5 Ways to the US Government Can Fix the Economy originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||||||||||||||||||||||||||||||||||||||||||||||||

| Clues to GLD's Price Trajectory Posted: 22 Jul 2010 07:05 AM PDT Hard Assets Investor submits: By Brad Zigler Real-time Monetary Inflation (last 12 months): -1.6% Over the past month, the price of gold sank, taking the SPDR Gold Shares Trust (GLD) with it. Many gold aficionados were perplexed by the seemingly disparate buildup in GLD's bullion stores and the softness in the trust's share price. After all, GLD's bullion hoard reached a record 1,320 tonnes on June 30, but its share price had peaked five days before at the double-top level near $123. Complete Story » |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment