Gold World News Flash |

- Mike Niehuser: Producers' Upside Potential

- Daily Dispatch: The Path to Perdition

- US Economic Outlook: Bad and Getting Worse

- Oil Crisis to the South, But Oil Opportunity to the North

- Doug Casey: China Won't Save Us - July 21, 2010

- Market Commentary From Monty Guild

- Hourly Action In Gold From Trader Dan

- Two Charts Every Investor Should See

- Fresh Irony for Swiss Central-Bank Gold

- Smoking Guns of US Treasury Monetization

- Gold Technicals for July 21st

- A Safe, Easy 45% Profit Thanks to Bernanke

- Don't Take the Bait

- Russia's Central Bank Adds 200,000 Ounces of Gold to Their Reserves

- The Statist Truth About China... Afghan War Over, as Predicted?

- LGMR: Gold Rallies from "All Important" Trendline as Euro Slips, Silver & Copper Jump

- Crack Smoking Part Deux

- Crude Oil Creeps Higher on Lack of Evidence, Gold Breaks Bounces Back as ETF Holdings

- Greece, Germany, Gold, Oil and the Dollar

- The Future of the World’s Energy Supply

- Apple's Looming Downside

- What's Causing Philip Morris' Volatility?

- Why I'm Not Going to be Long Stocks in the Near Future

- Credit Default Swaps Suggest Recovery in Oil and Gas Sector

- 15 Companies With No Debt

- Fear Not, Bernanke Will Talk the Markets Back to Health

- GoldSeek.com Radio Gold Nugget: Robert Ian, David Morgan, & Chris Waltzek

- The Anxious Index

- Hedge Fund East Coast on Consensus vs. Variant Perception Investing

- Ira Epstein's Weekly Metal Report

- EMX Outlines Significant Copper-In-Soil Anomaly at the Vert de Gris Porphyry Copper Gold Prospect, Haiti

- The Case for Deflation

- Time to Rally: SP-500 and GLD

- GOLD: Summer Consolidatation — Bull Market Alive and Well

- Audiovox: A Lesson in Geographical Corporate Management

- Gold coin sellers angered by new tax law

- When Does the Unusual Become the Usual?

- Asian Metals Market Update

- Credit Ratings Agencies

- Wall Street "Reform" For Neanderthals, Or Donk Goes Full Retard

- New Gold-Backed Currency Could be in Use Next Month

- 2010 Proof Gold Eagle Production Likely?

- Laurel Kamper Appointed Marketing Director of Rare Coin Wholesalers

- Jay Taylor interviews GoldMoney’s James Turk on many gold and silver topics

- China steps up global mining buys

- Ted Butler: Now it’s when, not if, for metals position limits

- Gold Coins Facing IRS Scrutiny?

- Silver Prices Take Tea with 200dma

- Guest Post: Proof Of Gold Price Suppression

- Obama's Next Focus of Reform: Housing Finance

| Mike Niehuser: Producers' Upside Potential Posted: 21 Jul 2010 07:48 PM PDT Source: The Gold Report 07/21/2010 Fascinated to see gold soar in a period of low inflation, Beacon Rock Research Founder Mike Niehuser won't be surprised if it crosses the threshold into 2011 at above the $1,500 price point. Whether it levels off or reaches new heights, Mike explains where to seek investment opportunities in this exclusive interview with The Gold Report. According to him, companies with improving near-term production, pipeline projects to expand reserves and promising exploration prospects present better-than-average potential for returns. Because the market is pricing some pessimism into equities these days, he also sees good opportunities in companies with strong potential to increase fundamental value. The Gold Report: Considering the turns we've seen in the relationship between gold and the U.S. dollar, what is your view on gold prices these days? Mike Niehuser: We are really quite happy with where the prices are now. Our beginning of the yea... | ||||

| Daily Dispatch: The Path to Perdition Posted: 21 Jul 2010 07:48 PM PDT July 21, 2010 | www.CaseyResearch.com The Path to Perdition Dear Reader, The latest edition of our Casey’s Gold & Resource Report has just been published and, in my admittedly biased opinion, it alone is worth the low $39 annual subscription price. In addition to the updated portfolio of our recommended “big gold” producers, it also contains useful advice on the dos and don’ts of buying coins and revisits the question of how high gold might go. On that latter topic, I found one chart particularly interesting and so, with apologies to paid subscribers, am sharing it here. As you can see, it compares gold as a percentage of global financial assets at the apex of gold’s last big bull market in 1980, to today. Based on that, gold would seem to have a long way to go before reaching a top. Of course, things won’t roll out in exactly the ... | ||||

| US Economic Outlook: Bad and Getting Worse Posted: 21 Jul 2010 07:48 PM PDT It was raining outside, and so I was stuck inside the house, listening to my family remind me that I was just a worthless, penny-pinching, hateful old man who loves gold, silver and oil more than I love them, which I hasten to add is not exactly true in all respects, but you gotta admit that gold, silver and oil will treat me very nicely as they soar in price along with inflation in prices because of the insane levels of money creation by the Federal Reserve so that the loathsome Obama administration can deficit-spend us into hyperinflation, whereas spouses and children will be just a heavy millstone around my poor, aching neck, dragging me down, down, down by forcing me to spend money on them for their food and medical care and all the rest of that expensive crap. So I was thinking that my economic situation had gotten a lot worse, and that I am probably the only guy in the whole world whose life Really, Really Sucks (RRS), when I saw a new survey by AlixPartners showing that 71% of ... | ||||

| Oil Crisis to the South, But Oil Opportunity to the North Posted: 21 Jul 2010 07:48 PM PDT In the aftermath of the Deepwater Horizon explosion and the ongoing oil blowout in the Gulf of Mexico (GOM), risk factors have changed for fossil fuel energy developments. We need to consider what it means for our future investment strategy — indeed, there are more lucrative opportunities if you look in the right places. Certainly in the U.S., and doubtless the world over, the GOM disaster will spark tighter restrictions and higher costs for deep-water development. So let's look at what's going on with deep water and then compare it with what's happening far from the sea, in the interior of the North American continent, up in Canada's oil sands country. The bottom line is that the GOM oil disaster will benefit energy development in Canada — and you can profit. But this gets ahead of the discussion Declining Support for Deep-Water Development First, the BP (BP: NYSE) oil well blowout caused a decline in public support for deep-water development. The political forces simply are no ... | ||||

| Doug Casey: China Won't Save Us - July 21, 2010 Posted: 21 Jul 2010 07:48 PM PDT Conversations With Casey July 21, 2010 | Visit Online Version | www.CaseyResearch.com • About Casey • Forward this email • New? Free sign up for Conversations With Casey • CaseyResearch.com (Interviewed by Louis James, Editor, International Speculator) L: Doug, one of the most common replies we hear from the bulls who think the global economy is on the mend - or soon will be - is that China has huge cash reserves and a huge middle class with savings who will keep buying cars and houses and that will save the day. I know you don't buy this line of reasoning - why? Doug: Well, the problems we have can't be solved by having people consume more. The problem is basically overconsumption, which has resulted in huge debt. But that's a different topic. Still, I have to say that those people are ... | ||||

| Market Commentary From Monty Guild Posted: 21 Jul 2010 07:48 PM PDT View the original post at jsmineset.com... July 21, 2010 09:05 AM Dear CIGAs, SO MANY ARE CONVINCED THAT DEFLATION IS AHEAD…WE ARE NOT CONVINCED For years, a few have believed that inflation will be the long-term outcome. We have been among them. We mentioned months ago in our commentary that there would be short term deflationary influences within the U.S. and developed economies in the last half of 2010. Even though the developed economies are struggling to grow, and we predicted that there would be concerns about deflation, we want to reconfirm with our readers that our long-term view that inflation is looming in front of us…and history bears out our thesis. Recently, the wise Jim Sinclair wrote and sent to his many readers an excellent piece on the subject of inflation being a monetary event. To read it, you can access it on [URL]http://JSMineset.com[/URL]. THERE IS HISTORICAL PRECEDENT FOR AN INFLATIONARY OUTCOME TO THE CURRENT WORLD FI... | ||||

| Hourly Action In Gold From Trader Dan Posted: 21 Jul 2010 07:48 PM PDT | ||||

| Two Charts Every Investor Should See Posted: 21 Jul 2010 07:47 PM PDT The 5 min. Forecast July 21, 2010 10:48 AM by Addison Wiggin & Ian Mathias [LIST] [*] One “secular bull market” still very much alive, despite the global recession [*] Two charts for the ages… a trend so powerful we dare not bet against it [*] Barry Ritholtz and Dan Amoss forecast the future of U.S. housing [*] Plus, an off-the-radar commodity set to soar [/LIST] “We are in the midst of a 20-year secular bull market in natural resources,” the inimitable Rick Rule proclaimed yesterday here at our Investment Symposium. That was an easy proclamation to make last decade -- which he certainly did -- but given all that’s happened in the last few years, we note Mr. Rule sounds bullish as ever. “The wind is at our backs still,” he said. “On the supply side, natural resources had a 20-year bear market, which restrained supply. Most major discoveries happened in the ’50s-70s… they a... | ||||

| Fresh Irony for Swiss Central-Bank Gold Posted: 21 Jul 2010 07:47 PM PDT by Adrian Ash BullionVault Wednesday, 21 July 2010 The SNB can neither squash gold, nor (yet) destroy its own currency. But not for lack of trying... GOOD JOB that gold bullion is just an inert lump of metal and holds no grudges. Because twice in the last decade, the value of gold in the Swiss National Bank's vaults has nearly halved as a proportion of its total reserves. Yet still it sits there, helping save the SNB's blushes when policy fails. "The Euro-crisis has torn a deep hole in the calculations of the Swiss central bank (SNB)," reports Tages Anzeiger. "It spent CHF 104.9 billion on Euros [US$104bn] in the first-half of 2010, leading to foreign exchange losses of over CHF14bn [$13.3bn]. "Bottom-line losses were reduced to CHF4bn however [$3.8bn] by gains on other foreign currencies like the Japanese Yen, plus the strong rise of the gold price, which revalued the gold reserves of the central bank." Long before gold hit last month's record above... | ||||

| Smoking Guns of US Treasury Monetization Posted: 21 Jul 2010 07:47 PM PDT by Jim Willie CB July 22, 2010 home: Golden Jackass website subscribe: Hat Trick Letter Jim Willie CB, editor of the "HAT TRICK LETTER" Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A significant feature of fiat money systems is the privilege for the custodian to commit fraud, big fraud, gargantuan fraud, even co... | ||||

| Posted: 21 Jul 2010 07:47 PM PDT courtesy of DailyFX.com July 21, 2010 06:35 AM Gold has topped. Please see the latest special report for details. Near term, gold is making its way lower and in an impulsive fashion. I wrote last week to “look for gold to form a low next week as wave 5 comes to an end. Expectations will then be for a move back to 1220.” A low appears to be in place. Look higher towards the mentioned level. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... | ||||

| A Safe, Easy 45% Profit Thanks to Bernanke Posted: 21 Jul 2010 07:47 PM PDT By Dr. Steve Sjuggerud Wednesday, July 21, 2010 The people who set short-term interest rates in the U.S. just showed their cards last week… Thanks to the minutes to the latest Fed meeting, we now know what Fed Chairman Ben Bernanke's playbook is. Bernanke is making it easy for us to invest… In short, he will keep money as "easy" as possible, for as long as possible – likely beyond 2012. Today, I'll show you the safest, easiest way to make large profits from Bernanke's easy-money deal. Our target gain is 45% in one year. To understand what Bernanke is up to, think of it this way… He's trying to light up the U.S. economy like it's a grill. He's dousing it with rocket fuel and pumping away on the "start" button. We're just waiting on the "WOOSH!"… the big flame. He's trying so hard, we're just standing back and waiting for his eyebrows to get burned off. But chances are, he won't see a "WOOSH." Or more specifically, he won't se... | ||||

| Posted: 21 Jul 2010 07:47 PM PDT Excerpt from the Hussman Funds' Weekly Market Comment (7/19/10): Investors who allow Wall Street to convince them that stocks are generationally cheap at current levels are like trout - biting down on the enticing but illusory bait of operating earnings, unaware of the hook buried inside. I continue to urge investors to have wide skepticism for valuation metrics built on forward operating earnings and other measures that implicitly require U.S. profit margins to sustain levels about 50% above their historical norms indefinitely. Forward operating earnings are Wall Street's estimates of next year's earnings, omitting a whole range of actual charges such as loan losses, bad investments, restructuring charges, and the like. The ratio of forward operating earnings to S&P 500 revenues is now higher than it has ever been. Based on historical data (see August 20, 2007 Long Term Evidence on the Fed Model and Forward Operating P/E Ratios), the profit ... | ||||

| Russia's Central Bank Adds 200,000 Ounces of Gold to Their Reserves Posted: 21 Jul 2010 07:47 PM PDT The gold price didn't do a lot in Far East trading yesterday... and the first noticeable selling pressure showed up at 10:00 a.m. in London when the bullion banks went to work on the price. The absolute low of the day [around $1,174 spot] was about one minute before the Comex open at 8:15 a.m. in New York. From that low, gold rose to its high of the day [$1,194.70 spot] around 11:20 a.m. Eastern time. Volume was pretty chunky... even with all the spread trades and roll-over removed. Silver's price decline began at the London open yesterday morning at 8:00 a.m. local time [3:00 a.m. in New York]... with the absolute low [around $17.37 spot] coming about 12:40 a.m. London time... 7:40 a.m. Eastern. From there, silver rose to its high of the day of $17.79 spot... at 11:20 a.m... the same time as gold's high. Volume was only average. It was nice to see both metals turn around to the upside. But I wish to point out that, once again, gold and si... | ||||

| The Statist Truth About China... Afghan War Over, as Predicted? Posted: 21 Jul 2010 07:47 PM PDT The Statist Truth About China Wednesday, July 21, 2010 – by Staff Report China's Anxiety About Successful Companies ... China is turning independent coal-mines into state-run operations, showing its impatience with private companies that get too big. China's high-profile battle with foreign companies makes it seem as though those businesses keep the nation's economic planners awake at night. It has arrested a Rio Tinto executive on trumped-up charges, blocked Facebook and YouTube, and restricted (in practice if not in name) foreign firms from key industries such as oil, media, and metals. ... While the government has claimed it's putting forth better companies at the expense of weaker ones, the root cause remains that an ever-insecure China wants to rein in independent sources of influence (and wealth) that it feels have become too independent to control. This trend, known in Chinese as "the country advances and the private retreats," allows the gove... | ||||

| LGMR: Gold Rallies from "All Important" Trendline as Euro Slips, Silver & Copper Jump Posted: 21 Jul 2010 07:47 PM PDT London Gold Market Report from Adrian Ash BullionVault 09:00 ET, Weds 21 July Gold Rallies from "All Important" Trendline as Euro Slips, Silver & Copper Jump with Stocks THE PRICE OF wholesale gold bullion bars jumped late-morning in London on Wednesday, reversing the week's 1.5% drop to new two-month lows, as the Euro and Japanese Yen both slipped against the Dollar. Federal Reserve chairman Ben Bernanke was scheduled to speak before US lawmakers, with traders likely to watch closely for intimations of further quantitative easing ahead. World stock markets meantime rose sharply, but government bonds were little changed, leaving 10-year yields at 2.94% and 2.65% respectively on US and German debt. Crude oil crept above $78 per barrel, while copper futures and silver bullion traded in London both jumped 2.5% from yesterday's low. "More of the same on Tuesday with a continued pullback," says Phil Smith's Reuters Technical of the gold market. "Liquidati... | ||||

| Posted: 21 Jul 2010 07:47 PM PDT Market Ticker - Karl Denninger View original article July 21, 2010 03:20 AM I figured I'd give the charlatans running this crap ample rope and they'd hang themselves. They did not disappoint. First, let's dispense with one piece of claptrap right up front: I am not an inflationist - say much less a hyperinflationist. Those who make such a claim haven't bothered to read five Tickers, say much less the last three years of them. Why not? Because we already had the inflation. Where, you ask? How about trying to find places where it did not occur? In house prices? Stock prices that rose by 1,000% or more over 20 years? Price of gasoline? I can keep going, but does it serve a purpose? The fact of the matter is that the so-called "2% target" has been woefully missed if you count actual prices, and not play "hedonics" and similar nonsense games. Second, there's a particularly perverse group of Ponzi bone-smoker... | ||||

| Crude Oil Creeps Higher on Lack of Evidence, Gold Breaks Bounces Back as ETF Holdings Posted: 21 Jul 2010 07:47 PM PDT courtesy of DailyFX.com July 20, 2010 08:33 PM Crude oil is showing little movement ahead of tomorrow's Department of Energy inventory report. Though crude is being pushed and pulled in multiple directions, a bias is clearly evident. Commodities - Energy Crude Oil Creeps Higher on Lack of Evidence Crude Oil (WTI) $77.48 -$0.10 -0.13% Commentary: Crude oil is flat after rising $0.90, or 1.18% on Tuesday. Global economic concerns seem to be fading to the background a bit, with crude now more focused on the upside risks to demand from emerging markets and the downside risks to supply from Gulf of Mexico production. Markets in general and crude oil in particular, will need evidence that the world economy is set to slow sharply before prices respond with another leg lower. Thus far, the evidence has pointed to a modest slow down around the globe. Barring further deterioration in the data, crude oil should gradually move higher. Tomorrow the Department of... | ||||

| Greece, Germany, Gold, Oil and the Dollar Posted: 21 Jul 2010 07:47 PM PDT Basically, Greece is broke. The Greek politicians spent too much money. (Really? Who would've thought?) Aided by the wizards of Goldman Sachs, the monetary magicians managed to mask the Greek problem for 10 years or so. But now the solvency problem in Greece is too big to sweep under the rug. Unlike in the past, the debt markets won't just roll all that Greek debt over to some future time. No more kicking the can down the road for others to deal with. Beware of Greeks bearing gifts, right? In Greece, they're faced with the hard fact that they have too much government and not enough productive economy. Even with their backs to the wall, the Greek politicians won't make painful budget cuts. Greece needs a miracle — if not a bailout — just to keep the lights burning and the civil servants paid. Oh, and just as an aside… Does this seem similar to what's going on in California, or New York, or Michigan, or maybe even the whole United States of America? As that ancient Greek ph... | ||||

| The Future of the World’s Energy Supply Posted: 21 Jul 2010 07:47 PM PDT What is the future of the world's energy supply? Here she is, in all her haze gray glory. Meet the Transocean Discoverer Inspiration. What is this floating giant? Well, in the big scheme of things Inspiration is the future of the world's oil supply. Inspiration, and other ships much like her, is the great, gray hope for anyone who plans to use liquid hydrocarbons any time in the next 50 or 100 years. If you use oil, then you had better want this baby to work as advertised. The Most Powerful Drill Ship Ever Constructed In a practical sense, Inspiration is the newest, most modern, most powerful drilling ship ever constructed. She just put to sea in late 2009, fresh from her builders at the Daewoo Yards in South Korea. She's already had her shakedown cruise. Now Inspiration is at work, under long-term contract with Chevron, drilling holes in the bottom of the sea to test the deepest oil prospects that the geologists can dream up. The New Deep Gold Rush There's a new dee... | ||||

| Posted: 21 Jul 2010 07:46 PM PDT  Andy Wang submits: Andy Wang submits: Let me first start off by saying I love Apple products. Apple 'the company' is second to none. They are true innovators and have certainly created an amazing brand of well-made products that live up to the hype. Complete Story » | ||||

| What's Causing Philip Morris' Volatility? Posted: 21 Jul 2010 07:39 PM PDT Kevin Parker submits: If you follow Philip Morris Int'l (PM) like I do, you'll notice that the stock is now back about $50 per share after being in the low $40's fairly recently. The stock has dipped down into the mid $40 range several times and has frequently bounced back up to $50 (and higher). So is this just normal market activity or is something serving as the catalyst for these movements? The catalyst is of course the euro. As the euro has been in the news much this year with the European sovereign debt issues, you've probably heard something about it. The reality is that after hitting some pretty low lows a few months ago, the euro has bounced nicely. While the general trend in recent years has been dollar down (often means euro up), stocks up, the trend is more specific for a stock like Philip Morris. The reason is because for companies like Philip Morris, currency fluctuations where the dollar becomes stronger is a headwind to earnings. This is because Philip Morris derives all of its revenues from overseas. Complete Story » | ||||

| Why I'm Not Going to be Long Stocks in the Near Future Posted: 21 Jul 2010 07:25 PM PDT Kid Dynamite submits: Oaktree's Howard Marks writes one of the must read quarterly letters (embedded below). This one is a bit lengthy, including many extended quotes from mainstream sources, but there are a few tidbits that resonate soundly with me. First of all, page 5, which describes the basic unsustainable characteristics common in many global economies. More importantly, Marks's conclusion, on page 17, where he notes:

I've used the term "reality" many times to answer the question "why are markets down today?" And Marks's quote perfectly describes why I'm not going to be majorly long stocks any time in the near future: 1) I think reality is much lower, and 2) I don't think I am agile enough to pass the grenade once the pin is pulled. Complete Story » | ||||

| Credit Default Swaps Suggest Recovery in Oil and Gas Sector Posted: 21 Jul 2010 07:17 PM PDT Research Recap submits: Credit default swaps on oil and gas companies tightened nearly 3.7% last week, signaling that perhaps some confidence is gradually returning to the energy markets, according to Fitch Ratings.

Complete Story » | ||||

| Posted: 21 Jul 2010 07:02 PM PDT The Pragmatic Capitalist submits: In these times of high debt and deleveraging it’s unusual to come across companies that aren’t in over their head. CNBC recently ran a piece listing some of the largest firms in the world who have immaculate balance sheets – NO DEBT. The list follows: Complete Story » | ||||

| Fear Not, Bernanke Will Talk the Markets Back to Health Posted: 21 Jul 2010 07:00 PM PDT Kid Dynamite submits: Fear not, Helicopter Ben's soothing prose will act as a policy tool. Courtesy of Clusterstock comes Ben Bernanke explaining that he is not in fact "out of bullets" in terms of monetary policy:

So let's review this real quick: the first method Bernanke describes is changing the wording of the FOMC's policy statements in such a way that, well, I have no friggin' clue what Bernanke is thinking. He's going to make it even MORE clear that rates are not going up soon? As a reminder, the current statement about the interest rate outlook is this:

Complete Story » | ||||

| GoldSeek.com Radio Gold Nugget: Robert Ian, David Morgan, & Chris Waltzek Posted: 21 Jul 2010 07:00 PM PDT | ||||

| Posted: 21 Jul 2010 06:52 PM PDT David I. Templeton submits: The Anxious Index is published by the Federal Reserve Bank of Philadelphia and refers to the probability of a decline in real GDP, as reported in the Survey of Professional Forecasters. The survey asks panelists to estimate the probability that real GDP will decline in the quarter in which the survey is taken and in each of the following four quarters. According to the Philly Fed the Anxious Index is the probability of a decline in real GDP in the quarter after a survey is taken. For example, in the survey taken in the second quarter of 2010, the anxious index is 9.81 percent, which means that forecasters believe there is a 9.81% chance that real GDP will decline in the third quarter of 2010. Click to enlarge: Complete Story » | ||||

| Hedge Fund East Coast on Consensus vs. Variant Perception Investing Posted: 21 Jul 2010 06:30 PM PDT Market Folly submits: We're pleased to present the second quarter 2010 commentary from East Coast Asset Management. The letter, penned by Chief Investment Officer Christopher Begg, touches on a number of intriguing and hotly debated topics, including inflation. Some of you will recall that we featured some past commentary from East Coast where the hedge fund examined the deflation-reflation continuum. Complete Story » | ||||

| Ira Epstein's Weekly Metal Report Posted: 21 Jul 2010 06:07 PM PDT If you're a gold bull I think you realize that gold's in need of an "event of some type" to move it along. While we have a weak economy, it doesn't seem weak enough to create the type of hysteria seen nearly a year and half ago. I think it highly unlikely that the Eurozone Bank Test will come out so poor as to create a rush into gold. | ||||

| Posted: 21 Jul 2010 06:04 PM PDT | ||||

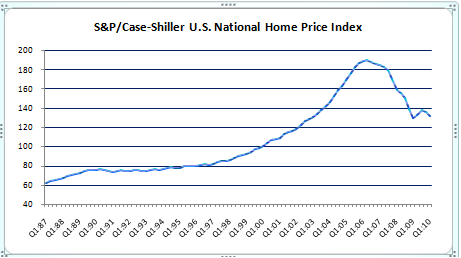

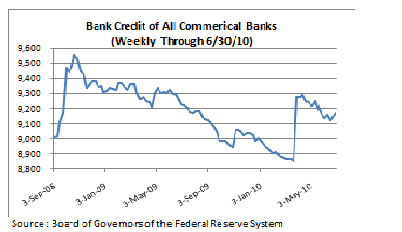

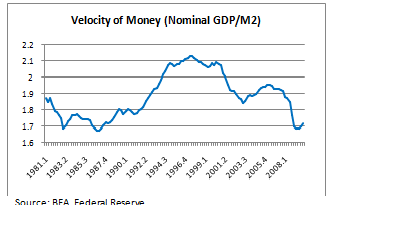

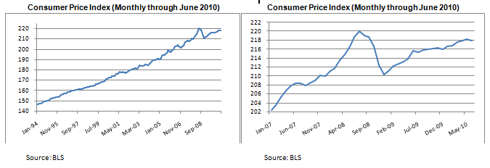

| Posted: 21 Jul 2010 05:51 PM PDT Aigail Doolittle submits: The Deflation Debate There’s been an ongoing dialogue about the effect of the Fed’s extraordinary liquidity activities over the last two years: inflation or deflation? At the core of this disagreement is the real world departure from what monetarists would expect to occur as a result of a near-zero federal funds rate and a massive increase in the money supply. While in ordinary economic times the Fed would need to raise rates in order to tame a deliberate rise in pricing, or inflation, these are not ordinary times. These are times of the worst financial crisis in 80 years. These are times of surplus capacity crashing with a spiked demand for cash. These are times of uncertainty. As a result, there has remained significant slack in the economy while there has also been significant hoarding of cash by banks, companies, and consumers. The toxic stew born of such a situation is a system awash with stagnant money as I first pointed out in Where’s the Velocity? Why the Fed Is Fighting Slow-Moving Money and Not Inflation on March 1 of this year. And the slower money moves, the slower money changes hands, the greater the risk deflation becomes as economic activity and demand for the products of that activity invariably slow. In turn, this slowing causes a decline in general prices as consumers wait for discounting and this dynamic is deflation by definition. I’ve been in the deflation camp for at least two years for one very simple reason: U.S. home prices have been on the decline since the third quarter of 2006. Put otherwise, the asset class at the eye of the financial crisis has been deflating for four years now. And while it takes years for such a shift to drift into the everyday economy, I believe those signs are apparent today as slow-motion deflation is turning into real-time deflation. In fact, I strongly believe that a closer look at much of the evidence clearly makes the case for deflation. Consumer Price Index The long-term trend in consumer prices is up. However, the near-term trend is mixed with the Consumer Price Index down today from where it was in the summer of 2008 as shown below (click to enlarge). While the primary and upward trend of consumer pricing should remain in effect, the possibility of an intervening near-term trend needs to be considered as it seems that businesses are continuing to discount goods to entice consumers to spend. For interestingly, and despite an overall decline in consumer confidence over the same time period, consumer spending has mainly recovered from the “abyss” of late 2008 and early 2009. However, if much of that recovery is a result of discounting and the trend of discounting continues, it is likely to cause the CPI to remain flat or move down slightly in the best-case scenario. Also possible is that this current discounting turns into deep discounting, or worse yet, consumer spending slows in the face of deep discounting causing it to turn into distressed discounting. While not certain to occur, deep discounting or distressed discounting will result in a decline in the Consumer Price Index and this will be very clear proof of deflation. Commodity Pricing The prices for copper, steel, lumber, and some other hard commodities have been off between 10% and 35% since April depending on the commodity. While it is impossible to know whether this near-term trend in commodity pricing will remain in place, there are two charts that may suggest a continued decline:  First, the 5-year chart of copper shows a trough of sorts that is significantly below current pricing per pound and suggests a downward pull. If the fundamentals move to meet this suggested support level, such a decline would reinforce the fears of a slowdown in global growth and feed a continued decline in commodity pricing. Second, those fears are further supported by a sharp decline in the Baltic Dry Index which tracks global shipping rates of dry bulk cargoes. While this drop is dwarfed by the one made between 2008 and 2009, it may suggest a global slowdown in demand and gives us reason to believe that commodity prices could continue to decline. In an “unusually uncertain” environment, it would only be a matter of time before a continued decline in commodity prices would trickle into the Consumer Price Index and cause it to decline too. Housing and Bank Lending According to the highly esteemed S&P/Case-Shiller National Home Price Index, home prices are down 31% from peak prices in Q2:06. This is a rather dramatic decline and it cannot be overlooked in considering the overall case for deflation. First, it seems likely that a continued decline in value in the largest investment for most Americans, or their homes, will cause consumers to continue to wait for discounts at the very least but perhaps slow their spending all together. Either will show up as a decline in the Consumer Price Index. Second, and more importantly, the deflation that has occurred in housing has had the unfortunate effect of causing bank lending to slow. This has happened because the physical assets of houses exist simultaneously in the paper assets of mortgages. In turn, many of these mortgages are pooled together in mortgage-backed securities (“MBS”) which are then sold to investors.  Source: S&P/FiServ When home prices started to decline in mid-2006, this decline brought the paper world down with it as mortgages started to go bad and especially those of the sub-prime or riskier variety. As a result, banks were left with the decaying mess made of the bad mortgages that were not pooled plus the rot of those pooled into the “toxic assets”. The only response available to most banks in this situation was to write down or write off both the bad mortgages and the “toxic assets”. The initial net result of this response was constrained capital and a shift toward safety. In the real world, this shift has manifested itself with banks choosing to lend to the U.S. government in the form of buying Treasurys with the low-cost of capital supplied by the Fed rather than lending to businesses and consumers.  Unfortunately, a decline in bank lending will lead to deflation as dried-up credit puts downward pressure on growth, demand, and, ultimately, pricing. Slow-Moving Money Back in March, I wrote about how the Fed was caught between slack and M2. In other words, the Fed’s monetary hands were bound between the economic slack born of the recession and the money it had pumped into the system in 2008 and 2009 to keep it operable. While monetarists were expecting the Fed to raise rates in order to prevent the increased liquidity from blossoming into inflation, this was not an option in the face of a fragile economy that needed the continued accommodation of ultra-low rates to keep the system functioning. Simultaneously, the demand for cash by banks, companies, and individuals increased due to the uncertainty created by the crisis. The result was a steep decline in the velocity of money due largely to the aforementioned decline in bank lending.  In other words, money is moving through the system slowly despite an ample supply of it because the bulk of it is being held by banks. Until this money starts to move into the real economy, it will not and cannot cause inflation. However, as has been mentioned, it will lead to deflation as demand drops from credit-deprived companies and consumers, causing prices across the supply chain to decline. At the risk of being repetitive: if banks do not start lending, deflation is a certain result. Putting It All Together There is one gauge of economic activity that does not support deflation at this moment: consumer spending. Despite the black hole of late 2008 and early 2009 in consumer spending, recent figures, while tepid are mainly improved from that time period. If consumers continue to spend as they have been spending over the last 12 months, it seems likely that level consumer pricing will remain in effect unless, of course, it is maintained by the discounting previously discussed. However, if the financial markets continue to gyrate, the housing market weakens, and the employment situation stays the same or worsens, there is reason to believe consumers may react as they did in the fall of 2008 when spending fell off a cliff. In other words, if the economic recovery falters, the risk of deflation increases dramatically. In addition, and perhaps ironically, the world’s 30-year borrowing binge may, itself, promote deflation. As consumers and companies continue to pay down their debts, consumer prices could fall on potentially curbed spending. In turn, falling prices would cause economic growth to spiral down too. Unfortunately, this is similar to what happened here in the United States in the 1930s. The ultimate sign of deflation, however, will be when it hits incomes. When people literally have less money in their pockets to spend, consumer prices will falter. Declining incomes will also make it harder for consumers to pay down their debts and will put further pressure on the housing and credit markets. And for those monetarists who measure deflation, or inflation, by the federal funds rate, not only did the Fed recently comment for the first time that “underlying inflation has trended lower” but with the key rate near zero in reality and well below zero in theory, there is no arguing that inflation – hyperinflation – is tomorrow’s problem while deflation is today’s worrisome reality. Complete Story » | ||||

| Posted: 21 Jul 2010 05:50 PM PDT | ||||

| GOLD: Summer Consolidatation — Bull Market Alive and Well Posted: 21 Jul 2010 05:46 PM PDT | ||||

| Audiovox: A Lesson in Geographical Corporate Management Posted: 21 Jul 2010 05:26 PM PDT Saj Karsan submits: As the financial news media has expounded Europe's emerging debt crisis, investors have shied away from companies with significant operations in Europe. Austerity measures are expected to hurt the economy, and so investors have looked elsewhere for opportunities. But is the European situation really that bad? Companies operating in Europe are still free to only allocate capital to projects they expect will generate returns, which may seem obvious but appears to be something we take for granted. While the focus has been on Europe, severe economic problems in a country much closer to home (for North Americans, that is) have gone largely unnoticed. Venezuela has seen its economy contract 5.8% in just the first quarter of the year! While its economy is quite small compared to some of the European nations undergoing austerity measures, the effect can be much stronger for companies with interests in the small, Latin-American country due to the policy impositions of the government. Complete Story » | ||||

| Gold coin sellers angered by new tax law Posted: 21 Jul 2010 05:18 PM PDT Amendment Slipped Into Health Care Legislation Would Track, Tax Coin and Bullion Transactions By Rich Blake http://abcnews.go.com/Business/gold-coin-dealers-decry-tax-law/story?id=... Those already outraged by the president's health care legislation now have a new bone of contention -- a scarcely noticed tack-on provision to the law that puts gold coin buyers and sellers under closer government scrutiny. The issue is rising to the fore just as gold coin dealers are attracting attention over sales tactics. Section 9006 of the Patient Protection and Affordable Care Act will amend the Internal Revenue Code to expand the scope of Form 1099. Currently, 1099 forms are used to track and report the miscellaneous income associated with services rendered by independent contractors or self-employed individuals. ... Dispatch continues below ... ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Starting Jan. 1, 2012, Form 1099s will become a means of reporting to the Internal Revenue Service the purchases of all goods and services by small businesses and self-employed people that exceed $600 during a calendar year. Precious metals such as coins and bullion fall into this category and coin dealers have been among those most rankled by the change. This provision, intended to mine what the IRS deems a vast reservoir of uncollected income tax, was included in the health care legislation ostensibly as a way to pay for it. The tax code tweak is expected to raise $17 billion over the next 10 years, according to the Joint Committee on Taxation. Taking an early and vociferous role in opposing the measure is the precious metal and coin industry, according to Diane Piret, industry affairs director for the Industry Council for Tangible Assets. The ICTA, based in Severna Park, Maryland, is a trade association representing an estimated 5,000 coin and bullion dealers in the United States. "Coin dealers not only buy for their inventory from other dealers, but also with great frequency from the public," Piret said. "Most other types of businesses will have a limited number of suppliers from which they buy their goods and products for resale." So every time a member of the public sells more than $600 worth of gold to a dealer, Piret said, the transaction will have to be reported to the government by the buyer. Pat Heller, who owns Liberty Coin Service in Lansing, Michigan, deals with around a thousand customers every week. Many are individuals looking to protect wealth in an uncertain economy, he said, while others are dealers like him. With spot market prices for gold at nearly $1,200 an ounce, Heller estimates that he'll be filling out between 10,000 and 20,000 tax forms per year after the new law takes effect. "I'll have to hire two full-time people just to track all this stuff, which cuts into my profitability," he said. An issue that combines gold coins, the Obama health care law, and the IRS is bound to stir passions. Indeed, trading in gold coins and bars has surged since the financial crisis unfolded and Obama took office, metal dealers said. The buying of actual gold, as opposed to futures or options tied to the price of gold, has been a particularly popular trend among Tea Party supporters and others who are fearful of Obama's economic policies, gold industry members such as Heller and Piret said. Conservative/libertarian commentators, such as Fox News Channel's Glenn Beck, routinely tout precious metal on the air as being a safe, shrewd investment in an environment in which the financial system -- and paper money backed by the rest of the world's faith in the U.S. government's credit -- is viewed as increasingly fragile. The recently revealed investigation by California authorities into consumer complaints against Goldline International, which has used Beck as a pitchman, and Superior Gold Group (which has not) has put a spotlight on what one liberal-leaning politician, Rep. Anthony Weiner, D-N.Y., calls the "unholy alliance" between gold coin sellers, such as Goldline, and conservative talk personalities, such as Beck. Beck, who through his spokesman, Matt Hiltzik, declined to comment for this story, and Goldline marketers portray gold coins as a better alternative to owning bullion in the event that the U.S. government ever decides, as it did under FDR in 1933, to make it illegal for private citizens to own physical gold. At that time, the U.S. dollar was still pegged to the price of gold; the gold standard was abandoned during the Nixon administration. Rep. Daniel Lungren, R-Calif., has introduced legislation to repeal the section of the health care bill that would trigger the new tax reporting requirement because he says it's a burden on small businesses. "Large corporations have whole divisions to handle such transaction paperwork but for a small business, which doesn't have the manpower, this is yet another brick on their back," Lungren said in a statement e-mailed to ABCNews.com. "Everyone agrees that small businesses are job creators and the engine which drives the American economy. I am dumfounded that this administration is doing all it can to make it more difficult for businesses to succeed rather than doing all it can to help them grow." The ICTA's Piret says identity theft is another concern because criminals may set up shops specifically to extract personal information that would accompany the filing out of a 1099. The office of the National Taxpayer Advocate, a citizens ombudsman within the IRS, issued a report June 30 that said the new rule "may present significant administrative challenges to taxpayers and the IRS." Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php | ||||

| When Does the Unusual Become the Usual? Posted: 21 Jul 2010 05:07 PM PDT Chairman Bernanke took to Capitol Hill yesterday to discuss the economic and monetary policy outlook for the country. His remarks were, typically, fairly unremarkable. Some observers had expected him to signal a change from what had recently been discussed in the FOMC minutes – the unusual quiet among Fed speakers led to speculation that they were avoiding cluttering the message. Presumably, the change they expected was towards a softer policy, edging more towards a second round of quantitative easing. At least, the response of equities to a fairly dull testimony – they dove – seems to suggest that investors wanted more. The only real nugget in his prepared statement was that the Chairman referred to the “unusually uncertain” economic outlook. These days, one might argue, “unusually uncertain” is pretty normal. The implication for monetary policy is that extra caution is warranted, because the Committee can be less sure of the effects of their actions. Complete Story » | ||||

| Posted: 21 Jul 2010 05:04 PM PDT Gold trading in London declined in June as average daily volumes fell 16 percent, according to the London Bullion Market Association. Silver trading dropped 19 percent. An average of 20.8 million ounces of gold traded daily, down from 24.7 million in May, the LBMA said today in an e- mailed statement. Silver turnover fell to a daily average of 85 million ounces, from 104.3 million ounces. | ||||

| Posted: 21 Jul 2010 03:56 PM PDT DR editor Dan Denning is beavering away on the July issue of the Australian Wealth Gameplan. Filling is today is Diggers and Drillers editor Dr. Alex Cowie. Here's a question for you: What do you call credit ratings agencies without any credit ratings? The answer? Standard & Poor's, Moody's or Fitch. An unexpected last minute change in the US Financial Reform Bill, being signed by President Obama this week, means that the credit rating agencies are now going to be accountable for the ratings they issue. This means that if any of their ratings are too high, too low, or just plain wrong, then investors can sue. According to the press release:

So, the law is now taking away the credit rating agencies' immunity from the law, and what they all do in response? They weigh up the potential cost of litigation and sent a message to all their clients: DO NOT USE OUT RATINGS! It's all beer and skittles dishing out ratings willy-nilly, but the music stops suddenly when they have to put their money where their mouth is. That says a lot about how good they think their stuff really is. An absence of ratings also removes one of the central benchmarks within the debt markets, for everything from municipal notes, to corporate bonds, and sovereign debt. As you can imagine, parts of the debt markets have just ground to a halt as a result. It's a bit like when both the metric and imperial systems were suddenly outlawed. What do you measure with then? What is your mutual point of reference with business partners? That bathroom renovation just got a whole load more stressful. The only problem with this analogy is that the metric and imperial systems are efficient and honest. Whereas the credit ratings agencies are a bunch of shonky power-trippers on the pay-roll of the investment banks. It was always going to be a disaster putting that much quasi-regulatory power into the hands of profit-making private businesses. The temptation to overlook problems, do a sloppy job or take back-handers was there from the start. It has often been said that the guys working in the credit ratings agencies were the people who weren't smart enough to make Wall St. When the B-minus students are given the power to downgrade entire government's credit ratings, but with no accountability, what could we expect? A quick recalculation and yes, we're going to downgrade Portugal's credit rating this morning. After a long lunch we might do Greece as well. What's that, they're having some problems at the moment? Whatever. Downgrade the UK soon? Hmmm it's probably about time isn't it! We'll see what kind of kick backs they're offering first shall we? These are the same guys that gave investment grade ratings to Mortgage Backed Securities that were nothing more than sub-prime mortgages put through the blender, baked at 240'C for 30 minutes, and then sold in expensive looking packaging. The subprime mortgages were pretty much given to anyone that could sign their signature, as well as some that couldn't. But with the seal of approval from Standard & Poor's, Moody's or Fitch, brokers could sell the resulting mortgage backed securities to institutional-investors world-wide. The rating agencies have a lot to answer for. So, like the teenager who has been told in the future they will pay for home repairs after house-parties, the ratings agencies are so terrified about the potential costs they have told their buddies they are not going to have any more parties. Until now, they have been one of the very few 'financial gatekeepers' that have not been exposed to litigation. It is a quirk of the system. If a bank manager gave his most unscrupulous customers great ratings and massive loans, his days of long lunches and lifelong golf membership would be cut short. It is simple human nature: the threat of reprisals keeps your actions honest. You play with fire, you get burned. Without the feedback loop, players can get sloppy. So what happens next? This is hot off the press so it's hard to see. What happens at the next sovereign debt issue if the ratings agencies have told the government issuer that they can't use their AAA rating? You'd like to think that it would be a case of the ratings agencies going back to business, whilst embracing the principles of honesty and transparency. That would clearly take a major cultural change, so don't hold your breath. Similar Posts: | ||||

| Wall Street "Reform" For Neanderthals, Or Donk Goes Full Retard Posted: 21 Jul 2010 02:04 PM PDT The White House has released a video (in HD cause its so damn cool, and with subtitles for those immigrants among you who don't quite understand the Enlgish) for idiots who still don't grasp that Wall Street reform is nothing but a farce almost as unabashedly idiotic as the early Friday release of the Farce Test coming out of a thoroughly bankrupt Europe, which will find that of 91 banks on the old continent, only 10x bankrupt Hypo is undercapitalized, and all the Greek banks are perfectly solvent. Right. Whatever. And in keeping with the tradition of Keynesianism for Kretins (sic) released previously by the Goldman HoldCo better known as the New York Fed, the administration has now realized that the only way to touch its intellectually challenged constituency is by summarizing its achievements in cartoon format, easily viewable on an iPhone. Coming soon - "Why Shutting Down Tendentious Blogs Is Great For The Children" in 3-D IMAX. The explanation provided by the "White House" for this pathologically moronic cartoon is: "A quick and simple animated explanation of how Wall Street Reform will work and what the strongest consumer protections in history will mean for you and your family." And yes, this comes from your ruling elite.

| ||||

| New Gold-Backed Currency Could be in Use Next Month Posted: 21 Jul 2010 01:57 PM PDT Malaysia, well, at least its northern state of Kelantan, is putting the Islamic gold dinar and silver dirham into circulation as legal tender and it could be implemented as early as mid-August. It won't be the first nation using gold coins — Indonesia has already minted about 25,000 pieces for use in Australia, Malaysia, and Singapore — but, they are going to be useable in a rather comprehensive fashion. According to The Guardian: "If information on its website is to be believed, the council has the blessing of the state's Islamist government, Parti Islam SeMalaysia (Pas), to kickstart the dinar in three moves. First, the state will pay a quarter of its public servants' salaries using the dinar. Second, all state companies will accept dinar payments. Lastly, some 600 commercial enterprises will also embrace this currency. "Inspired by selective religious sources and backed by historical precedents within the annals of Islamic history, the gold dinar system is touted by certain fiercely proud Muslims as the Islamic answer to thwart capitalism's woes. "The idea was first mooted by Malaysia's former prime minister, Mahathir Mohamad, in the aftermath of the 1997 Asian financial crisis. He argued that the coins would never hang their possessor out to dry in the same way that paper money had. As precious metals with intrinsic value, gold and silver are more resistant to market fluctuations and devaluation compared to the US dollar – an argument he took to the Organisation of the Islamic Conference as a tool to battle western hegemony." In and of itself, choosing a gold-backed currency as a tool "to thwart capitalism's woes" seems a bit wrongheaded. Its use could raise the ire of capitalist public accustomed to paper money, but there are many true-blue capitalists that would sing the praises of a gold-backed US dollar, for instance, given the opportunity. The concept of a gold-backed currency other than the dollar, in this case the dinar, could conceptually offer a threat to the dollar's reserve currency resilience, but not without a global endorsement of its usefulness in international trade. Anything's possible, but it seems unlikely even China, with its particular reserves quandary, is going to rush to support a Malaysian reserve currency anytime soon. You can read more details about the gold dinar and silver dirham in The Guardian's coverage of whether or not Malaysia's Islamic currency will be able to thwart capitalism. Best, Rocky Vega, New Gold-Backed Currency Could be in Use Next Month originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. | ||||

| 2010 Proof Gold Eagle Production Likely? Posted: 21 Jul 2010 01:54 PM PDT

As a reminder, the 2009 versions of these numismatic coins were canceled as the United States Mint focused its resources and available coin blank or plantchet supplies on producing bullion coins. During the hearing, U.S. Mint Director Ed Moy spoke of his support for legislation that would redirect a portion of silver planchets from legally mandated bullion coins to discretionary proof and uncirculated silver dollars. (Read Proof Silver Eagles Possible.) Subcommittee members and panelists voiced no opposition in amending current law to make them possible…. Read the rest of 2010 Proof Gold Eagle Production Likely? (659 words) © 2010 CoinNews Media Group LLC | ||||

| Laurel Kamper Appointed Marketing Director of Rare Coin Wholesalers Posted: 21 Jul 2010 01:54 PM PDT

Contursi generated international headlines in May when he sold his unique 1794 specimen Flowing Hair silver dollar for a record $7.85 million…. Read the rest of Laurel Kamper Appointed Marketing Director of Rare Coin Wholesalers (115 words) © 2010 CoinNews Media Group LLC | ||||

| Jay Taylor interviews GoldMoney’s James Turk on many gold and silver topics Posted: 21 Jul 2010 01:54 PM PDT 8p ET Wednesday, July 21, 2010 Dear Friend of GATA and Gold (and Silver): Newsletter editor Jay Taylor (http://www.miningstocks.com/) this week did a comprehensive interview with GoldMoney founder, Freemarket Gold & Money Report editor, and GATA consultant James Turk, covering GoldMoney's remonetization of gold, the gold price suppression scheme and GATA's work exposing it, the failure of mining stocks to keep up with the rise in the gold price, the gold-silver ratio, capital controls and the prospects of government confiscation of gold, and much more. The interview is in two parts and you can listen to it here: http://www.miningstocks.com/radio/radio_archives/taylor20100720-3.mp3 And here: http://www.miningstocks.com/radio/radio_archives/taylor20100720-4.mp3 CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| China steps up global mining buys Posted: 21 Jul 2010 01:54 PM PDT By Phred Dvorak http://online.wsj.com/article/SB1000142405274870372410457537920328357559… In the global hunt for mining assets, China has emerged as the buyer to beat: Just a few years after suffering high-profile failures to close big acquisitions, Chinese buyers of all sizes are sealing more sophisticated deals at a higher rate of success. Companies based in China or Hong Kong participated in $13 billion of outbound mining acquisitions and investments last year—100 times the level in 2005, according to data tracker Dealogic. China-based companies are on a similar pace in 2010. Last week, Shandong Iron & Steel Group Co. announced a $1.5 billion investment into an African Minerals Ltd. iron-ore project in Sierra Leone, the latest of 76 outbound mining deals announced by China-based buyers so far this year, valued at $8.3 billion, according to Dealogic. China's hunger for metals and minerals will be a principal driver in boosting its overall outbound investment to more than $100 billion in 2014, predicts Derek Scissors, a Heritage Foundation researcher who has built a database to track those deals. China's success in snapping up makers of iron ore, nickel, molybdenum and other minerals has come as much of the world smarted from the global financial crisis. In 2009, China accounted for one-third of the value of all crossborder mining mergers and acquisitions, up from 7.4% in 2007 and less than 1% in 2004, Dealogic found. In Australia, historically a major destination for Chinese mining investments, Chinese acquirers accounted for nearly 40% of all inbound mining deals last year, according to PricewaterhouseCoopers annual review of mining M&A. In Canada, a newer market for Chinese buyers, the number was around one-quarter. The latest deals introduce a new class of suitors. In years past, Chinese buyers of overseas oil and ore assets tended to be big, state-owned enterprises that favored outright takeovers and got reputations for ham-handed deal making—suffering a series of public rejections, such as China Minmetals Corp.'s failed attempt to buy Canadian miner Noranda Inc. in 2005. These days, potential investors range from private manufacturers to Hong Kong investors to China's sovereign-wealth fund, China Investment Corp. China deal trackers say those investors are savvier and more flexible than they were a few years ago, experimenting with joint ventures and minority stakes. Just a year ago, Hong Kong-based CST Mining Group Ltd. was China Sci-Tech Holdings Ltd., a 15-person Hong Kong public company investing principally in real estate. Earlier this year, it bought two copper miners for $380 million—one Canadian, one Australian—hired a bunch of Western mining veterans to run them, raised $600 million through a private share placement and changed its name to CST Mining Group Ltd. Chinese investors are finding "more and more kinds of ways to get business from the world," says Amy Cheng, CST's banker and the mining-team leader for BOC International, the investment banking arm of state-owned Bank of China Ltd. Ms. Cheng estimates Chinese mining investors were successful last year at closing around three-quarters of the deals they attempted; a few years ago, she says, they were rebuffed nearly all of the time. The financial crisis provided an opening. "Every project [that wants money] looks at Chinese companies," she said. The Chinese government hasn't made a public push for these acquisitions, but the explosion of deals in recent years, many by state-owned companies, suggests they are a priority. China already consumes one-third of the world's copper and 40% of its base metals, and produces half of the world's steel. Though demand for commodities has eased a bit as the pace of China's growth has slowed this year, it is expected to stay strong in the long term. China has complained that foreign companies have charged too much for iron ore and other commodities, a concern that became acute in 2007 when the world's No. 1 miner, BHP Billiton Ltd., attempted to buy Rio Tinto in a deal that promised to create a united minerals supplier with enormous pricing power. The bid failed, but shortly afterward China made what remains its biggest overseas acquisition in minerals, Chinalco's $14 billion purchase of 9% of Rio Tinto. Buoyed by that investment, Hong Kong and Chinese firms conducted a record $17.5 billion in outbound mining M&A in 2008, according to Dealogic. China's buying binge could eventually increase the global supply of many minerals and ores, says Tim Goldsmith, the Australia-based global mining leader for PricewaterhouseCoopers, who says his job now requires him to spend a week every month in China. If China's demand stays strong, and other economies like India's grow rapidly as well, the added supply could help to temper commodity-prices rises, he says. Weaker global demand could lead to a drop in prices, a scenario Mr. Goldsmith calls less likely. Big global miners should make out well either way, he says, since their mines tend to be more profitable, with higher expected returns, than those many Chinese firms are investing in. Some Chinese investors are buying companies with mines that are at earlier stages of development or exploration, a riskier but potentially more profitable proposition. "There was a time when they wouldn't invest in anything that wasn't producing already," says Howard Balloch, a former Canadian ambassador to China who founded a Beijing-based investment-banking boutique, the Balloch Group, in 2001. Now, "the Chinese are willing to be more creative in their investments and willing to move a little up the ladder to higher levels of risk." That is bringing more would-be Chinese deal makers to Toronto and Vancouver, where much of the world's capital-raising for mining exploration takes place. "On the Chinese side, it's almost like someone flipped a switch a few years ago and interest went from zero to significant investment in Canadian firms," says David Redford, a Vancouver-based lawyer in the mining practice of Goodmans LLC. The interest is reciprocal: Mr. Redford estimates some 80% of his current mining clients are looking for investment from Chinese sources. Three years ago, he says, one-third or fewer were. The Canadian copper miner purchased by CST, Toronto-based Chariot Resources Ltd., found itself looking eastward for investment after its long-time lenders pulled the plug on future financing at the end of 2008, amid the financial crisis. The company had just finished a feasibility study on its copper assets in Peru and needed several hundred million dollars to build a mine. But Western bankers weren't willing to lend to a company with no revenue or operations, says Ulli Rath, the CEO at the time. In October 2009, Chariot's board decided to put the company up for sale. The firm hired RBC Capital Markets, the investment banking arm of Royal Bank of Canada, to look for suitors. On the side, one of Chariot's directors also phoned some contacts in China: BOC International's Ms. Cheng, and a private adviser named Ken Wang, a Chinese geologist who had worked for years in Canada. Mr. Wang had helped broker three other deals between North American miners and Chinese investors in the past two years. Ms. Cheng had started BOC International's mining group in Hong Kong in 2005; she knew all the big Chinese investors as well as the state-owned mining firms. Within a month, Ms. Cheng and Mr. Wang had arranged meetings between five potential investors and Chariot directors in Hong Kong. The most aggressive suitor was CST, which was just starting to transform itself into a mining operator. Last year, the company had bought a gold mine in Indonesia from struggling Australian miner Oz Minerals Ltd., and hired former Rio Tinto executive Owen Hegarty to run it. CST directors wanted to jump into copper mining as well, and saw Chariot as a good entry, says Mr. Hegarty, who's now vice chairman of the company. In February, CST proffered an all-cash bid of around C$245 million—67 Canadian cents per share. That's double what Chariot had been trading at a few months before on the Toronto Stock Exchange, and a better deal than other offers collected by RBC Capital Markets, says Mr. Rath, who stepped down in June when the deal closed. RBC Capital Markets declined comment. In March, CST announced the purchase of the Australian copper miner; by the end of June it had raised $600 million through private placements to fund its purchases as well as mine development. Ms. Cheng hired Mr. Wang in late June to work full-time with her on resource deals. * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Ted Butler: Now it’s when, not if, for metals position limits Posted: 21 Jul 2010 01:54 PM PDT 5p ET Wednesday, July 21, 2010 Dear Friend of GATA and Gold (and Silver): Silver market analyst Ted Butler notes that the financial regulation law enacted today with President Obama's signature requires the U.S. Commodity Futures Trading Commission to do what Butler has been urging it to do for years: establish position limits in precious metals futures trading. Butler credits CFTC Chairman Gary Gensler, but it seems likely that CFTC Commissioner Bart Chilton, the commission's most outspoken advocate of position limits, had much to do with the new law's requirements as well — as did the thousands of ordinary U.S. investors who heeded the calls of Butler and GATA to write to the CFTC in support of position limits. Now, Butler notes, the CFTC has to act, and the question becomes the level of position limits. Butler again argues for a limit of 1,500 contracts. His commentary is headlined "When, Not If" and you can find it at GoldSeek's companion Internet site, SilverSeek, here: http://news.silverseek.com/SilverSeek/1279732290.php CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Gold Coins Facing IRS Scrutiny? Posted: 21 Jul 2010 01:54 PM PDT Kurt Brouwer submits: This could get ugly. An amendment that did not get much notice in the health care legislation will bring government scrutiny to gold and silver coin dealers and all those who sell coins and bullion. From this report from ABC News, we find out the recent health care legislation had a rather sneaky provision hidden in it [emphasis added]:

| ||||

| Silver Prices Take Tea with 200dma Posted: 21 Jul 2010 01:44 PM PDT The summer doldrums have descended upon us as evidenced by the lackluster performance of the producers, however, this should be thought of as the bargain hunting season, especially for silver bugs. | ||||

| Guest Post: Proof Of Gold Price Suppression Posted: 21 Jul 2010 01:43 PM PDT Adrian Douglas, board member of GATA, once again takes a long hard look at the gold market and provides evidence of gold price manipulation. His conclusions:

The solution? Buy physical - "The sick joke of the Gold cartel is that whether you hold dollars or unallocated gold you only have 2.3% of gold backing! However, the trade of the century is to buy actual physical metal with your dollars, or if you have unallocated gold to demand physical delivery. In this way you can trade something with 2.3% gold backing for an investment that is 100% gold." Proof Of Gold Price Suppression, Submitted by Adrian Douglas of Market Force Analysis

This posting includes an audio/video/photo media file: Download Now | ||||

| Obama's Next Focus of Reform: Housing Finance Posted: 21 Jul 2010 01:29 PM PDT By Zachary A. Goldfarb After President Obama signs into law an overhaul of financial regulation at a ceremony set for Wednesday, his administration will turn to reforming an area at the root of the financial crisis: the U.S. housing market. Responding to the collapse in home prices and the huge number of foreclosures, the Obama administration is [...] |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

A House of Representatives subcommittee hearing on Tuesday revealed better odds in minting proof and uncirculated 2010 American Silver Eagle coins. But what about 2010 proof American Gold Eagles?

A House of Representatives subcommittee hearing on Tuesday revealed better odds in minting proof and uncirculated 2010 American Silver Eagle coins. But what about 2010 proof American Gold Eagles? Laurel Kamper has been appointed Marketing Director of Rare Coin Wholesalers (RCW) of Irvine, California.

Laurel Kamper has been appointed Marketing Director of Rare Coin Wholesalers (RCW) of Irvine, California.

No comments:

Post a Comment