Gold World News Flash |

- Is Now a Good Time to Buy Gold?

- The Dodd-Frank Bill: What People Are Saying and Why Most Are Wrong

- NY Fed's Paper on the Shadow Banking System of Vast Importance

- Seagate: The Hard Disk Industry Looks Attractive

- China Should Cut U.S. Treasury Holdings And Buy Gold: Economist

- Goldman: Oil Over $100 in 2011; Gold to $1,335

- Grandich Willing to Risk Total Shame

- Raising Taxes to Combat Recession: The Ultimate Fiscal Folly

- Proof of gold price suppression -- gold and the U.S. dollar

- Batteries Are the Shocking Truth about Electric Cars

- Geordie Mark: Glowing Reviews for Uranium Plays

- Preliminary Scoping Study Pending, Opawica Continues Drilling In Ontario

- Jim?s Mailbox

- In The News Today

- Gold Reality Charts Update

- The Trade of the Decade is Off!

- All Gold To Be Tracked?.. Document Reveals Taliban Reintegration

- Gold Technicals for July 20th

- Malaysia: The Gold Dinar and Silver Dirham

- LGMR: Gold, Silver & Oil "Stuck for Summer" as Stimulus vs. Austerity Debate Rages

- Crack Smoking Is Getting More Popular

- Very Worthy Gold Article

- Crude Oil Held Steady by Two Opposing Forces, Gold Breaks $1185 Support

- Hungary's IMF revolt augurs ill for Greece

- Will the Real Inflation Rate Please Stand Up

- Did The Credit Agencies Just Go Extinct?

- Gold Seeker Closing Report: Gold and Silver Gain Almost 1%

- Looking Beyond The Latest (And Last) Fiscal Stimulus For The Unemployed

- Social Security to Tackle State Pension Woes?

- Japan: Land of the Rising Debt

- Central banks care mainly about saving big banks, Sprott tells King World News

- The Bare Realities, an Update

- US Jobs Data: One Reason Why It Might Not Be Getting Better

- More HAMP Cancellations = Less Debt Slaves

- Trade of the Decade Update

- Adrian Douglas: Proof of gold price suppression -- gold and the U.S. dollar

- On Energy, China Argues Against Western Expertise… Again

- TUESDAY Market Excerpts

- Hoyer says House will debate China currency manipulation bill

- The big problem with electric cars

- Michigan begins using alternative currencies, gold, and silver as money

- The six best sources of capital to start a small business

- Top analyst Shilling: Euro will fall to parity with dollar

- Inflation Or Deflation?

- Eric Sprott Interview By King World News: Must Hear

- Its The End Of The World As We Know It

- Where Is the Silver?

- 10 Year, 2s10s Both Suggest Manic-Depressive Stocks 70 Points Too Rich

- IMF to Asia: Change economic habits

| Is Now a Good Time to Buy Gold? Posted: 20 Jul 2010 07:07 PM PDT | |||||||||||||||||||||||

| The Dodd-Frank Bill: What People Are Saying and Why Most Are Wrong Posted: 20 Jul 2010 05:53 PM PDT  Tom Brown submits: Tom Brown submits: The looming enactment of the misbegotten Dodd-Frank bill, all 2,300-plus pages of it, may count as a legislative victory for the White House and Democrats in Congress, but evidence that it’s a political victory is scant. (Fully 80% of those surveyed by Bloomberg say they have little or no confidence the bill will prevent or even soften a future financial crisis.) Nor will the bill be a big win for the economy. If anything, it will hinder the recovery and weaken the financial system. Complete Story » | |||||||||||||||||||||||

| NY Fed's Paper on the Shadow Banking System of Vast Importance Posted: 20 Jul 2010 05:50 PM PDT Annaly Salvos submits: For those who missed it (and we had, until we were tipped by James Aitken, thank you very much), a vital paper was posted to the New York Fed’s website in the beginning of the month. “Shadow Banking,” a staff report authored by Zoltan Pozsar, Tobias Adrian, Adam Ashcraft and Hayley Boesky, attempts to explain the so-called “shadow banking” system that developed over the last two decades. The shadow banking system is the financing system that developed in parallel to the traditional banking system: Complete Story » | |||||||||||||||||||||||

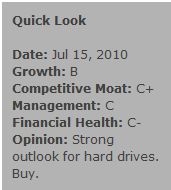

| Seagate: The Hard Disk Industry Looks Attractive Posted: 20 Jul 2010 05:26 PM PDT Steve Alexander submits:

Most computer files were small, text-based word processing or spreadsheet documents that could easily be backed up onto floppy drives, Zip drives, or CD-ROM disks. Back in 2000, the largest hard drives you could find were about 80 gigabytes (GB) in size, and most computers had disk drives in the 20-40 GB range. Complete Story » | |||||||||||||||||||||||

| China Should Cut U.S. Treasury Holdings And Buy Gold: Economist Posted: 20 Jul 2010 05:14 PM PDT China should cut its holdings of U.S. Treasury securities when market demand is strong, a prominent economist said in remarks published on Monday. Beijing reduced its Treasury holdings in May by $32.5 billion to $867.7 billion, but it actually bought a net $3 billion in long-term Treasuries and remained the largest single holder of U.S. government debt, the Treasury reported on Friday. Yu Yongding, a former academic adviser to the central bank and now a professor with the Chinese Academy of Social Sciences, said Beijing should invest in assets denominated in other currencies as well as other financial instruments and real goods."Although assets in other currencies and forms are not an ideal replacement for U.S. Treasury bonds, diversification should be a basic principle," Yu wrote in the China Securities Journal. More Here.. Competing Currency, Like Silver, Being Accepted Across Mid-Michigan More Here.. | |||||||||||||||||||||||

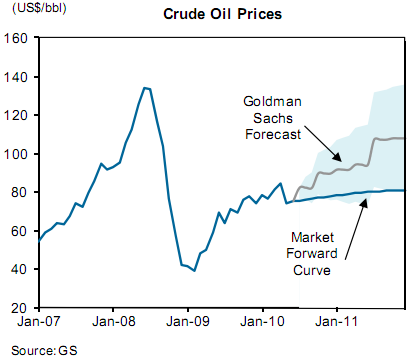

| Goldman: Oil Over $100 in 2011; Gold to $1,335 Posted: 20 Jul 2010 04:56 PM PDT The Pragmatic Capitalist submits: Goldman remains a long-term commodities bull. Their latest projections follow:

Complete Story » | |||||||||||||||||||||||

| Grandich Willing to Risk Total Shame Posted: 20 Jul 2010 04:42 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 20, 2010 04:55 PM Just the site of my head on top of a Vancouver Canucks jersey gives me the hebbie gibbies. Earlier today, a good friend of mine and I were discussing gold and my largest personal holding, Silver Quest Resources. I was telling him how I believed gold would make a new high before the year is out and that SQI can minimally have a one dollar handle on it long before we bring in the new year. He asked how confident was I? I said enough that I would risk total shame on my part and wear a Canucks Jersey (ugh). He asked would I be willing to say so publicly and wear it among a crowd. I said yes. So here’s the deal; if either gold doesn’t make a new high or SQI minimally trade for at least a buck before years end, I must wear the jersey for one day at the Vancouver Gold Show in January, 2011 Lord have mercy o... | |||||||||||||||||||||||

| Raising Taxes to Combat Recession: The Ultimate Fiscal Folly Posted: 20 Jul 2010 04:42 PM PDT When I saw that Illinois cleverly solved its budget crisis by just not paying its bills, I knew that the end is near, or would be, if we still had a dollar that was not a stupid fiat currency, because nowadays it would be child's play for the Federal Reserve to just create as money as any state wanted! And they can do it in less time than it takes to tell you about it, too! And then the Federal Reserve can turn right around and use that money to buy up all the state debt out there! Wipe debt completely out! And flood the economy with money!!! The more astute Junior Mogambo Rangers (JMRs) out there noticed the rare triple exclamation point, which is a Secret Mogambo Code (SMC) for, "We're freaking doomed, and you need to buy gold and silver with all the money you have left over from building a fortified bunker in the backyard to protect yourself from the starving, rioting, desperate people who did not!" because all this new money created by the Federal Reserve and spent by the Obama C... | |||||||||||||||||||||||

| Proof of gold price suppression -- gold and the U.S. dollar Posted: 20 Jul 2010 04:42 PM PDT GATA board member Adrian Douglas, editor of the Market Force Analysis letter (http://www.MarketForceAnalysis.com), examines the ratio between the supply of gold and the U.S. dollar and concludes that the dollar's gold backing has fallen to a mere 2.3 percent and that the real dollar value of gold now approaches $53,000 per ounce. Douglas' new study is headlined "Proof of Gold Price Suppression: Gold and the U.S. Dollar," and you can find it in PDF format with a chart at GATA's Internet site here: [URL]http://www.gata.org/files/AdrianDouglasProofOfGoldPriceSuppression-07-20-2010.pdf[/URL]... | |||||||||||||||||||||||

| Batteries Are the Shocking Truth about Electric Cars Posted: 20 Jul 2010 04:42 PM PDT Can white elephants come in green? President Barack Obama flew to Holland, Mich., on Thursday to attend groundbreaking ceremonies for a new lithium-ion battery plant, which the White House advertised as an example of federal stimulus grants at work and a gateway to a clean-energy future. Great stuff — if you don't look too hard. Indeed, the Holland plant, effusively hailed by Michigan Gov. Jennifer Granholm as creating 300 jobs, and 62,000 "green" jobs down the road, will produce batteries in America. But Compact Power Inc., which received $151 million from a federal stimulus program to open the $303 million plant, isn't American and neither is its technology: It's a subsidiary of the giant South Korean conglomerate LG Chem, and its technology is Asian. Also that age-old bugaboo for electric cars — range and battery life — is still a work in progress. General Motors says its Chevy Volt will go up to 40 miles on a single charge and will have a range-... | |||||||||||||||||||||||

| Geordie Mark: Glowing Reviews for Uranium Plays Posted: 20 Jul 2010 04:42 PM PDT Source: Brian Sylvester of The Energy Report 07/20/2010 You don't hear a lot of talk about uranium these days. It's just not as sexy as gold or silver. But with a host of reactors slated for construction, the sector is rife with opportunities. Haywood Securities Analyst Geordie Mark visits numerous uranium projects each year, researching plays at all levels. In this exclusive interview with The Energy Report, Geordie tells us why he's given "sector outperform" ratings to no less than 11 companies. It could be the most comprehensive global roundup of uranium plays anywhere. The Energy Report: The spot price for uranium was $40.75 a pound on June 21, when the long-term price for uranium was $58—a spread of $17.25, or 42%. What's poised to support a 42% price increase? Geordie Mark: The spot price actually moved up to $41.75 that night, the first move to the upside in quite a number of months. It's a positive response to demand coming onstream. The long-term cont... | |||||||||||||||||||||||

| Preliminary Scoping Study Pending, Opawica Continues Drilling In Ontario Posted: 20 Jul 2010 04:42 PM PDT By Claire O'Connor James West MidasLetter.com Tuesday, July 20, 2010 Opawica Explorations Inc. (TSX.V: OPW) has just completed 4 of the first 6-hole drilling program on the company's 100% owned Atikwa Lake gold and copper project with significant results revealing an extension of mineralization in the Footwall Zone. Opawica plans to recommence drilling by early July and anticipates results of a preliminary scoping study by mid July, 2010. The purpose of this study is to determine if economics may exist for initially up to 1000 tpd for a minimum eight year mine life, using the historical footprint and infrastructure of the past producing Maybrun-Atikwa Lake mine. Atikwa Lake The Atikwa Lake Project is a former 500 tonne per day producing gold and copper mine that has been on stand-by care and maintenance since 1973. Located 120 kilometers sou... | |||||||||||||||||||||||

| Posted: 20 Jul 2010 04:42 PM PDT View the original post at jsmineset.com... July 20, 2010 09:16 AM A hidden world, growing beyond control CIGA Eric There is only one constant and that is the greater the size of government, the lower the production of nation wealth. Martin Armstrong, Can the Euro Survive a Sovereign Debt Crisis. So much for openness and transparency. The American public remains on a need to know basis as the Government grows with impunity. The top-secret world the government created in response to the terrorist attacks of Sept. 11, 2001, has become so large, so unwieldy and so secretive that no one knows how much money it costs, how many people it employs, how many programs exist within it or exactly how many agencies do the same work. Source: projects.washingtonpost.com More Mailbox CIGA Eric Hi Eric, I believe that, it’s just that with the recent attacks it’s hard to believe that Gold can climb 475 points in 6 months. This experience can become very unnerving... | |||||||||||||||||||||||

| Posted: 20 Jul 2010 04:42 PM PDT View the original post at jsmineset.com... July 20, 2010 11:58 AM Dear CIGAs, Goldman Sachs reported a significant miss in earnings. The rest of the financials are looking as if their earning will stink as well. Do you need any more proof that the financials’ earnings were in the great majority paper profits produced by the FASB’s capitulation to political pressure to allow crap to be blessed as valuable? Profits from a marked up position constituted most of the earnings via the trading department in terms of reporting. Do you need more proof that the outrageous bonuses were created because this is a generational last dip at the profit well? Now that the derivative gang has ruined the world (see today’s illustration) they are cannibalizing their own firms. They kill everything they touch. * Jim Sinclair’s Commentary Ireland, Spain and Greece debt sales saw solid demand today. Now the question is who were the buyers, and how are the advertised tril... | |||||||||||||||||||||||

| Posted: 20 Jul 2010 04:42 PM PDT Stewart Thomson email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] July 20, 2010 1. "Sell everything, it's 2008 again". – a growing number of investors in the gold community, July 19, 2010. 2. "A rally is coming, how long it will last, nobody knows, but we shall be selling into that strength from the most recent trading buying." – GoldLion, world's greatest juniors gold stock trader and substantial gold bullion dealer and trader, July 19, 2010. 3. GoldLion's lowest fill into the July 7th lows of $1185 was around $1188. His highest sells as I wrote my article "rushing the $1215 line" were in the $1217 area. 4. Now we have new lows of 1178 (barely) and new buys for us, and new "sell everything" calls from many investors outside the community, and from within, sadly. 5. Strategy wins wars. Not panic or price plopped paranoia. I said yesterday, "It's too late to short gold. Now is the time to cover shorts and buy longs, not enter new shorts or sell ... | |||||||||||||||||||||||

| The Trade of the Decade is Off! Posted: 20 Jul 2010 04:42 PM PDT The 5 min. Forecast July 20, 2010 11:08 AM by Addison Wiggin & Ian Mathias [LIST] [*] Trade of the Decade Update: Short U.S. debt at your own risk! [*] Chris Mayer and Frank Holmes identify TWO “cheap” buying opportunities [*] A contrarian call for the rest of 2010: Brace for a housing rebound [*] Plus, will the jobless go hungry? Senate in stalemate over benefits extension [/LIST] Breaking news: Our New Trade of the Decade Is Off! Well, half of it… temporarily. “This is what we got dead wrong,” Rob Parenteau candidly admitted on the top floor of the Fairmont Hotel Vancouver last night, where we gathered for the second annual meeting of the Richebacher Society. “Capital flight out of the eurozone this year has been a huge benefit for the U.S. Treasury market,” Rob continued. “Though temporary, demand for low default risk has suppressed Treasury yields, and could continue to ... | |||||||||||||||||||||||

| All Gold To Be Tracked?.. Document Reveals Taliban Reintegration Posted: 20 Jul 2010 04:42 PM PDT All Gold To Be Tracked? Tuesday, July 20, 2010 – by Staff Report Why the Self-Employed Might Owe OfficeMax a 1099 ... Small businesses and self-employed workers, look out: There is a blizzard of new tax paperwork on the horizon. The reason? To help fund the health-care changes, lawmakers passed a provision aimed at stopping cheats responsible for a big chunk of our "tax gap," the $300 billion-plus of revenue lost to tax evasion every year. ... Starting in 2012, businesses could have to file hundreds of millions of new 1099 information reports with the Internal Revenue Service. The forms will be due whenever a firm buys more than $600 a year in goods or services from a vendor, even when the vendor is a giant company like Staples. They are designed to stop people and businesses from underreporting income. The new rules drastically expand current reporting requirements, and they apply to all businesses. But critics say the compliance burden will fall s... | |||||||||||||||||||||||

| Posted: 20 Jul 2010 04:42 PM PDT courtesy of DailyFX.com July 20, 2010 07:49 AM Gold has topped. Please see the latest special report for details. Near term, gold is making its way lower and in an impulsive fashion. I wrote last week to “look for gold to form a low next week as wave 5 comes to an end. Expectations will then be for a move back to 1220.” A low appears to be in place. Look higher towards the mentioned level. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... | |||||||||||||||||||||||

| Malaysia: The Gold Dinar and Silver Dirham Posted: 20 Jul 2010 04:42 PM PDT Nothing much happened in Far East trading on Monday... but shortly before 10:00 a.m. in London [which was gold's high price of the day around $1,194 spot] downward pressure on the gold price began. Once New York opened, the selling pressure intensified... and moments before London closed for the day, the bottom was in at $1,176.70 spot. From that low, gold drifted higher into the close of electronic trading at 5:15 p.m. Eastern time... gaining back almost $8 from its low. Volume was pretty decent. Silver's price path was very similar... with low of the day occurring at the same time as gold's... moments before the London close at $17.48 spot. Both metals set new low prices for this move down on Monday... and, with out doubt, more leveraged long positions held by the technical funds and small traders were sold... all of which were gobbled up by grateful bullion banks. Silver broke below, and closed below, its 200-day moving average for the fir... | |||||||||||||||||||||||

| LGMR: Gold, Silver & Oil "Stuck for Summer" as Stimulus vs. Austerity Debate Rages Posted: 20 Jul 2010 04:42 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:10 ET, Tues 20 July Gold, Silver & Oil "Stuck for Summer" as Stimulus vs. Austerity Debate Rages THE PRICE OF GOLD in wholesale dealing slipped towards new multi-week lows against all major currencies on Tuesday, dropping beneath $1178 an ounce for Dollar investors as European stock markets extended yesterday's fall. G7 government bonds rose as the US Dollar held steady against the Japanese Yen, and rose to a 3-day high vs. the Euro and a 1-week high vs. the Pound. Crude oil meantime traded near $77 per barrel, but "could be stuck in this range for the summer," according to one broker, while silver held above Monday's 6-week low of $17.50 an ounce. Gold priced in Euros edged back below €29,500 per kilo, almost 13% below last month's record high. UK investors looking to buy gold today saw the price dip to £773.50 an ounce – its lowest level since the General Election of May 6th. "Investors ... | |||||||||||||||||||||||

| Crack Smoking Is Getting More Popular Posted: 20 Jul 2010 04:42 PM PDT Market Ticker - Karl Denninger View original article July 20, 2010 04:43 AM You have to chuckle at this bit of nonsense... [INDENT]"While some countries deserve to have their creditworthiness doubted, others, including the United States, do not. The United States is not another Greece, and the likelihood of default or any dire consequences from the present run-up of Treasury debt is minimal. [/INDENT]Uh huh. See, this is the argument that is always run. For instance, after WWII it was argued thus. But what's forgotten is that the post-WWII environment was one of ramping industrial output and thus massive GDP growth. Indeed, during the 1950s we recorded insane growth numbers on an aggregate basis. This, of course, provides tax revenues, which in turn brings the debt-to-GDP numbers into some reasonable resemblance of balance. But this is no longer true. Now we have massive debt increases and decreasing tax revenues, with no reasonable expectation of 7, ... | |||||||||||||||||||||||

| Posted: 20 Jul 2010 04:42 PM PDT | |||||||||||||||||||||||

| Crude Oil Held Steady by Two Opposing Forces, Gold Breaks $1185 Support Posted: 20 Jul 2010 04:42 PM PDT courtesy of DailyFX.com July 19, 2010 08:10 PM Recent quiet trading in crude oil is not indicative of what to expect going forward. Gold is trending lower, but no panic is evident. Commodities - Energy Crude Oil Held Steady by Two Opposing Forces Crude Oil (WTI) $76.76 +$0.26 +0.34% Commentary: Just as crude oil inched lower throughout the latter half of last week, the commodity is inching higher to start this week. While on the surface it looks as if crude oil has found a comfort level, the reality is that the commodity is being pushed and pulled by two very powerful, opposing forces. Pushing crude to the upside is the outlook for Gulf of Mexico production and the outlook for world oil demand. Although the courts have recently struck down the offshore drilling moratorium, the damage has already been done. The number of rigs drilling for oil in the Gulf of Mexico has fallen sharply, with many rigs already contracted to leave the region. With regard to d... | |||||||||||||||||||||||

| Hungary's IMF revolt augurs ill for Greece Posted: 20 Jul 2010 04:42 PM PDT | |||||||||||||||||||||||

| Will the Real Inflation Rate Please Stand Up Posted: 20 Jul 2010 04:36 PM PDT So does power come from being rich and prosperous? Or you get rich and prosperous by being hard working and frugal? Power comes from living beneath your means? Hmm. We take up yesterday's question of where power comes from. In China - now the world's largest energy consumer according to the International Energy Agency - most of the power comes from coal (about 65%). The rest comes from a combination of renewables, geothermal, nuclear, gas, oil and hyrdo electricity. When you're the world's largest consumer of energy, every little bit helps. But how about a look in pictures to literally change your perspective? The chart below shows the world in terms of nuclear energy generated for domestic electricity consumption. On this map, which is based on 2005 figures, you can see that Australia is a virtual non-entity, dwarfed even by New Caledonia...the yellow blob of French origin to the right of the map. The map shows what proportion of total global electricity production from nuclear occurs in each country.  Source: www.worldmapper.org You could argue that Australia is underepresented here because its share of total electricity production from nuclear is very small in the global context. And in that, you would be at least partially right. Australia's share of total production is so small because it doesn't produce any electricity from nuclear and apparently has no plans too. Aside from the public policy short-sigtedness of this - especially if you believe that coal is killing the planet - what's the investment story? There are energy exporters in Australia who can profit from China's new energy pre-eminence. Among them are the coal companies - BHP, Rio, Centennial Coal, Whitehaven - the gas companies, the oil companies, the LNG companies, and the uranium companies. If a single, over-priced, energy-efficient, short-lived flourescent globe is never lit by electricity from nuclear power in Australia, we reckon you could still make money from the global growth of nuclear That's the subject we've taken up in the July issue of Australian Wealth Gameplan. And it's why today's notes will be brief. We're going to try to meet a deadline for once. But first, there's a puzzle to solve. Today's papers are full of stories on how the Reserve Bank of Australia will have to raise interest rates when it meets August 3rd, just 18 days before the Federal Election. The notes from the recent RBA meeting revealed two nuggets of...interest. The first is that the RBA expects inflation to rise. Putting aside the fact that it would know this already since it's responsible for inflation by keeping the real cost of capital below the market cost, the notes report that, "Headline inflation was expected to rise, owing to the effects of some tax increases, with the year-ended increase in the CPI rising above 3 per cent. The important question for the Board at its next meeting would be whether the new information materially changed the medium-term outlook for inflation." The "new information" is the reading on inflation for the June quarter. That data is due on next Wednesday. But here's a prediction: the RBA will not look at asset markets to find inflation. Of course, it need look no further than house and share prices, which have been propped up by various means. Without inflationary policies supporting asset markets, share and house prices would already be a lot lower. But if the RBA instead looks at consumer prices, you never know what you're going to get. The calculations, with their seasonal adjustments, never seem to address the fact that most of us know intuitively: the cost of living is going up faster than wages. The RBA chooses not to report this because it shows that deliberately targeting 2-3% inflation a year as the bank does is another way of saying you're going to reduce purchasing power (sound and honest money) as a matter of policy. If you put it that way, people would rightly punch you in the nose. But let us not forget what inflation is: theft. When you are allowed to purchase goods and services with newly created money that you get to use first, you are trading paper for real goods. The creators of paper money - central banks, commercial banks, and the government, get to use that money before it dilutes the purchasing power of all the other money in circulation. It's a good deal if you can get it. But then, any time you can legally steal the productivity of others - getting the fruits of their labour at a discount - it's a good deal, even if it's deeply immoral and unethical. The other interesting note from the notes is the extended discussion of the stress tests of European banks. The RBA is trying to sort out if more bank failures or higher capital requirements in Europe could threaten Australian banks that source a lot of their lending overseas. To us, this is an implicit concession that the cost of capital in Australia is not really determined by the cash rate set by the RBA. It's determined by the global cost of capital. What does that mean? Tune in tomorrow for more discussion. By the way, how do you know the real rate of inflation is understated? Check out the table below from the Treasury's updated budget review for 2011 earlier this month. Notice that Treasury is forecasting 9.25% nominal GDP growth in the next fiscal year. This generous forecast is part of what's expected to bring the budget back into surplus (along with high commodity prices and a historically high terms of trade). But riddle us this: if the real GDP figures is just 3% and the nominal figure is 9.24%, doesn't that mean that inflation is running at closer to 6.25%? Dan Denning | |||||||||||||||||||||||

| Did The Credit Agencies Just Go Extinct? Posted: 20 Jul 2010 04:13 PM PDT The recently passed Donk (Dodd-Frank) Finreg abomination, which nobody has yet read is finally starting to disclose some of the interesting side effects of its harried passage. Such as that the rating agencies may have suddenly become extinct. As the WSJ's Anusha Shrivastava discloses: "The nation's three dominant credit-ratings providers have made an urgent new request of their clients: Please don't use our credit ratings." The Moodies of the world suddenly have good reason to not want their name appearing next to those three A letters (at least in Goldman CDO and bankrupt sovereign cases) out there: "The new law will make ratings firms liable for the quality of their ratings decisions, effective immediately." In other words, "advice by the services will be considered "expert" if used in formal documents filed with the Securities and Exchange Commission. That definition would make them legally liable for their work, meaning that it will be easier to sue an firm if a bond doesn't perform up to the stated rating." And since ratings are officially a part of a vast majority of Reg-S filed documentation, the response by issuers has been a complete standstill in new issuance, especially asset-backed underwriting and non-144A high yield issues, as the raters evaluate how to proceed. Alas, as there is no easy fix, underwriters' counsel and issuers will promptly uncover new loopholes and ways to issue bonds without the rating agencies' participation. Did Moody's and S&P just become extinct? More from the WSJ:

For those who are still confused as to just how our reptilian legislative system works, here it is. Moody's found out the hard way. Of course, the fact that those short the stock are about to make a killing likely had no bearing in the final outcome of Donk:

And just like the "scientists" used by BP to validate that the seep caused by the Macondo is not really from the Macondo (until it is proven beyond a reasonable doubt it is from the Macondo, but with sufficient dilution of responsibility that nobody will be impacted), so the rating agencies have been a useful idiot for all the other lazy idiots who refused to do an iota of work an relied on Moodys and S&P. It appears these same dumb money charlatans will once again have to learn what leverage and coverage ratios are.

One possible resolution is for the entire underwriting process to go the private route:

Alas, as this will immediately cut off a major portion of the end demand market (the Reg-S, non-144A), the supply-demand equilibrium will likely shift, forcing issuers to offer greater concessions or more generous new issue yields and coupons. And since most companies are beyond stingy when it comes to their balance sheet, this option will likely not be seen as realistic, forcing companies to discover new and improved ways to entirely bypass the MCOs of the world. And that, much more than any latent Wells Notice, will likely be the end of the rating agency paradigm. h/t Steven | |||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Gain Almost 1% Posted: 20 Jul 2010 04:00 PM PDT Gold traded slightly higher in Asia before it fell off in London and saw a $6.40 loss at $1175.50 a little after 8AM EST, but it then stormed back higher for most of trade in New York and ended near its late morning high of $1193.50 with a gain of 0.88%. Silver fell to as low as $17.405 before it also rallied back higher and ended near its late morning high of $17.755 with a gain of 0.74%. | |||||||||||||||||||||||

| Looking Beyond The Latest (And Last) Fiscal Stimulus For The Unemployed Posted: 20 Jul 2010 03:18 PM PDT Those collecting unemployment checks can rest easy - the Senate has just extended unemployment benefits through November 30 in another attempt to round up a few straggling votes for the mid-term elections. The fact that instead of creating jobs, the administration is still stuck with perpetuating the sugar high that achieves nothing but merely adds tens of billions more to the US debt, is just as appalling as the fact that this little sham is supposed to incite populist support for the president. Yet even as Europe is just starting out on its farstatic voyage, ours is slowly coming to its end: this latest fiscal stimulus could well be the last one. Here are the thought's of Goldman's Alec Phillips on just how great of an economic deterioration and slow down we should expect as a result of the eventual elimination of various fiscal stimuli. The End of the Road for Fiscal Stimulus? Today the Senate moved forward on a renewal of extended unemployment benefits through November 30. The good news is that this will avoid further income disruption for those who had expected to receive benefits, thereby reducing any additional drag on growth from fiscal policy in 2H2010. The bad news is that this latest extension of fiscal stimulus may be the last. Congress looks increasingly unlikely to extend ay more fiscal aid to state governments, despite ongoing shortfalls in state revenues, and they have already let several other items lapse. We are therefore removing from our estimates an assumption of further fiscal stimulus beyond the policies in law (including this week’s unemployment extension), though we continue to expect extension of most of the expiring 2001/2003 tax cuts. This adds almost a full percentage point to the drag on growth from Q4 2010 to Q4 2011 to what we had already estimated.

above assumptions over the next year: 2. Congressional appetite to delay offsets to near-term stimulus. Resistance to additional stimulus measures has grown along with public concern over the budget deficit. A possible solution is to legislate additional stimulus now with offsetting savings a few years hence. This is easiest done with savings through mandatory spending cuts or tax increases, though some lawmakers have proposed offsetting the cost of state fiscal aid with a rescission of stimulus funds not expected to be spent until 2012. If such middle ground is eventually found, fiscal policy could result in slightly less of a drag on growth in 2011 than we expect, with more of a drag in subsequent years. 4. Legislative gridlock. The one area in which our assumptions rely on congressional action is tax policy. If Congress is unable to reach an agreement on the expiring tax provisions before the end of the year, rates will increase across the board on January 1, 2011, increasing the tax burden by an equivalent of 1.4% of GDP beyond what is now shown in the exhibit. There is general bipartisan agreement on about 75% of these provisions (measured by revenue), so the risk is mainly that gridlock results in a temporary hiccup in early 2011 that Congress takes a few months to correct. Still, this is likely to become an increasing concern as we approach the end of the year. | |||||||||||||||||||||||

| Social Security to Tackle State Pension Woes? Posted: 20 Jul 2010 02:45 PM PDT Mary Williams Walsh of the NYT reports, Facing Pension Woes, Maine Looks to Social Security:

It's interesting to note how some states are now looking at Social Security as an answer to their pension woes. What I don't get is why weren't these state pension funds allocating more into "conservative Treasury securities" before the crisis hit? Instead, they were taking stupid risks trying to achieve unrealistic returns based on rosy investment projections. Moreover, they were all being advised by the same pension consultants with absolutely no skin in the game, telling them to invest more in public equities and alternative investments like hedge funds, private equity, and real estate. Pension funds are not just about making huge gains, it's also about protecting the downside. And in a zero-interest rate (ZIRP) environment, good old government bonds are about the only thing that will protect you, especially if a protracted period of debt deflation is what lies ahead. My theory is plain and simple: the Fed will do everything it takes (including buying stocks) to make sure this outcome never happens. Their policy is to keep interest rates at zero as long as possible, reflate risks assets, and hope that mild inflation creeps back into the economic system. How does this work? You keep interest rates at zero for as long as possible, let banks borrow at next to nothing, and let them trade away in their prop desks, investing those funds in all sorts of risk assets all around the world that can deliver higher yields. What else? Banks can borrow at at historic low rates and develop their credit card business, locking in a nice spread as they fleece consumers. Unfortunately, with ZIRP, banking is all about trading and spreads and very little goes to actually lending money to businesses that need it. Anyways, back to Social Security. Mary Williams Walsh of the NYT also reports that Social Security is paying roughly $50 million a year too much to people who collect state pensions but fail to declare that income. No wonder a majority of Americans are losing confidence in Social Security. Susan Page of USA Today reports, Faith in Social Security system tanking:

Most people are reeling following the 2008 financial crisis. They got screwed in the stock market, and they fear Social Security will not be there to support them during their retirement years. However misplaced those fears are, they're real, and states are now looking to tap into Social Security to deal with their pension woes? They should first look at bolstering the governance of their public pension plans (read Forbes article, Self-Dealing Threatens Florida Pensions). Social Security is already stretched, and tackling state pension woes is the last thing it should be called upon to do. | |||||||||||||||||||||||

| Japan: Land of the Rising Debt Posted: 20 Jul 2010 02:32 PM PDT

I promised to forward an article I wrote on Japan for Institutional Investor, and here it is. I also wanted to share pictures with you from the Value Investing Seminar in Italy (follow links to see pictures). I went to Italy with my brother Alex. We spent a few days in Rome, then took a train to Naples (from where we took a day trip to Capri, Pompeii and Sorrento), and finally ended up in Trani – a small town on the Adriatic Sea where the conference was held. Trani is a little gem. The people were warm, there were very few tourists, and the food was incredible. Few people spoke English; but unlike Parisians, who may well speak English, but refuse to do so, I got along fine with Italians, maybe because they speak with their hands (I do too). The seminar was an amazing experience. Ciccio Azzollini, who organized it with Whitney Tilson, is a terrific host and a wonderful human being, and he is solely responsible for me gaining five pounds. I cannot wait to go back next year! Japan: Land of the Rising DebtInvestors are understandably scared of the sovereign debt crisis unfolding in Europe. Amid their angst, however, they are ignoring a more likely, and significantly larger, debt catastrophe that is about to hit the nation with the second-largest economy in the world — Japan. Two decades of stimulative, low-interest-rate fiscal policy have made Japan the most indebted nation in the developed world, and as new Prime Minister Naoto Kan recently said, in his first address to Parliament, that situation is not sustainable. Japan has little choice but to raise interest rates substantially, with dire consequences far beyond its shores. | |||||||||||||||||||||||

| Central banks care mainly about saving big banks, Sprott tells King World News Posted: 20 Jul 2010 01:13 PM PDT 9:10p ET Tuesday, July 20, 2010 Dear Friend of GATA and Gold (and Silver): Interviewed by Eric King of King World News, Sprott Asset Management Chairman Eric Sprott argues that central banking's primary objective is saving big banks, that the subdued rise in the gold price is evidence of central bank intervention against gold, that fiat currencies are steadily depreciating, and that investors should feel comfortable keeping well more than 5 or 10 percent of their wealth in real metal. You can find the interview with Sprott at King World News here: http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/7/20_E... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php | |||||||||||||||||||||||

| Posted: 20 Jul 2010 12:38 PM PDT Are supermodels like Argentina's Yamila Diaz-Rahi or Brazil's Gisele Bündchen able to provide valuable investment insight? The answer may surprise you! Every winter, as arctic temperatures descend upon the Northeast, Sports Illustrated contributes a welcome dose of sunshine to our frigid landscape by releasing its infamous "swimsuit issue." Each issue contains the usual tiresome collection of impossibly beautiful women wearing - or not wearing - exotic bikinis in exotic locales. To which your editors respond, "Ho-hum." For dispassionate financial types such as ourselves, for whom scantily clad models are but so many inadequately dressed Homo sapiens, the swimsuit issue nevertheless offers a particular allure - investment guidance. A few years back, your editors discovered an improbable connection between the nationality of the model appearing on each cover of the SI swimsuit issue and the subsequent direction of share prices on the national stock exchange of her home country. After rigorous research, we concluded, "When a bikini-clad supermodel is the first from her country to grace the cover of Sports Illustrated, her appearance kicks off a four-year bull run in the stock market of her native land." Is this indicator a mere fluke or a can't-miss barometer of global investment trends? Let the reader decide. In 2001, Sports Illustrated placed the beautiful and talented Elsa Benitez on the cover of its swimsuit issue, making her the first Mexican to claim the honor. Now that the indicator has four years under its g-string, let's check the results. Despite a very rough time for the stock market here north of the border since the early days of 2001, the Mexican bolsa has doubled since Elsa adorned the SI cover. Sure, this strong performance might seem purely coincidental. But facts are facts. Let's briefly review: In 1978, Brazil's Maria Joao became the first foreign-born supermodel to appear on the cover of SI's swimsuit issue. Four years later, her country's Bovespa index had soared an astounding 465%. Next up, in 1986, the stunning Australian model, Elle MacPherson, made her first of several cover appearances. Over the ensuing four years, the Australian Stock Exchange's 50 Leaders Index rose 75%. The swimsuit edition continued to deliver eye-pleasing results into the 1990s. In the very first year of this new decade, the bonita Spanish senorita, Judit Masco, landed on the Sports Illustrated cover. Four years later, Spain's IBEX index had appreciated 21%. When the Swedish beauty Vendela Kirsebom graced the cover of the magazine in 1993, the OMX-Stockholm index rose to the occasion by appreciating 161% over the next four years. "Kiwi model Rachel Hunter might not have lasted with Rod Stewart," we observed in our original report, "but her appearance on the 1994 cover kept SI's winning streak alive - barely. New Zealand's Top 40 Index rose a mere 6% over the next four years." Four years later, German "über-model" Heidi Klum adorned the swimsuit cover, which presaged an eye-pleasing 24% gain for the German Dax Index between 1998 and 2002. Then, in 2002, Sports Illustrated gave the nod to Argentina, birthplace of the stunning cover model, Yamila Diaz-Rahi. We admit; we were skeptical. Argentina seemed a very dicey investment proposition, given the country's travails at the time. Fresh on the heels of a wrenching currency devaluation and amidst mounting economic difficulties, Argentina did not seem like a red-hot investment destination. But Yamila's appearance in a swimsuit consisting only of silver and jade argued persuasively to the contrary. "Riches await" seemed to be the message to intrepid investors in Argentine stocks. Once again, the Argentinean stock market has delivered on Yamila's implicit promise. Over the following four years, Argentina's Merval more than tripled. Perhaps these remarkably favorable results are no mere accident. After all, as we noted in our original report, "What better way to strike patriotic fervor and self-confidence in the heart of a nation - and stimulate its economy - than by splashing one of its bathing beauties on the cover of Sports Illustrated? When the Czech supermodel Paulina Porizkova first appeared in 1984, her native land was in the grip of Communist rule and had no stock exchange. Today, freedom rings in the Czech Republic and its vibrant economy is the backbone of central Europe." The parting of the iron curtain exposed the Czech Republic's considerable indigenous assets - assets which are now attracting acute interest from the West. In 2000, Daniela Pestova became the first Czech to appear on the SI cover since the Prague stock exchange opened for business. Thus, for purposes of evaluating the indicator, we consider her the "first" Czech to appear. The investment consequences did not disappoint. Four years after Pestova's appearance, the Prague PX50 Index had advanced 36% - a remarkable feat considering the fact that most other world markets fell during the same time-frame. Pestova's Czech comrades, Petra Nemcova and Veronica Varekova, claimed the SI covers for the homeland in 2003 and 2004 respectively. Accordingly, the PX50 continued to advance into late 2007. Which foreign bourse or bolsa should the philogynistic global investor now consider? Israel perhaps? Bar Rafaeli, an Israeli supermodel, graced the cover of SI's 2009 Swimsuit Edition. Since then, the Israeli stock market has nearly doubled. Weird, huh? Eric J. Fry | |||||||||||||||||||||||

| US Jobs Data: One Reason Why It Might Not Be Getting Better Posted: 20 Jul 2010 12:23 PM PDT No time to write today. We're getting on a plane for Vancouver...and experiencing technical difficulties. Back in the '50s, TV screens would frequently go into test pattern mode. An announcement would come on saying the station was 'experiencing technical difficulties.' We were surprised. It seemed like a miracle that the 'idiot box' would work at all. Dow up 56 yesterday. Gold down $6. Deflation stalks markets and economies. Don't believe us? Just look at the 10-year T note. It's about the only thing that is going up. It means people want safety, safety and more safety. Of course, they will find little safety in T-debt. But that's a long story...and it's what makes markets so entertaining. This note from The New York Times...and then we're signing off. If the rich won't spend, who will?

*** And here's an interesting item that is going around the Internet: If July has ides, this is it. Ever had a job? A chart that showed past presidents and the percentage of each president's cabinet appointees who had previously worked in the private sector - you know, a real life business, not a government job? Remember what that is? A private business?

And the Chicken Dinner Winner is.........................

This is the guy who wants to tell YOU how to run YOUR life! ONLY ONE IN TWELVE in the Obama Cabinet HAS EVER HAD A JOB. *YEP, EIGHT PERCENT! And these are the guys holding a "job summit"; going to tell us how to run our businesses, make our decisions for us? Do you want to trust them with every aspect of your life? Regards, Bill Bonner | |||||||||||||||||||||||

| More HAMP Cancellations = Less Debt Slaves Posted: 20 Jul 2010 11:14 AM PDT CNN/Money reports on the latest data from the government's mortgage modification program where the number of canceled loan modifications now exceeds the number of permanent ones. When you think about it, this is probably a good thing because all the permanent loan mods really do is lock the borrowers into years of debt servitude.

It's not clear what part of median back-end debt-to-income ratios of 64 percent for permanent loan mods is sustainable but, apparently, they're sustainable for the time being. | |||||||||||||||||||||||

| Posted: 20 Jul 2010 11:00 AM PDT Breaking news: Our New Trade of the Decade Is Off! Well, half of it…temporarily. "This is what we got dead wrong," Rob Parenteau candidly admitted on the top floor of the Fairmont Hotel Vancouver last night, where we gathered for the second annual meeting of the Richebacher Society. "Capital flight out of the eurozone this year has been a huge benefit for the US Treasury market," Rob continued. "Though temporary, demand for low default risk has suppressed Treasury yields, and could continue to do so through the end of the year. "Some fear a double-dip recession forming in 2011," Mr. Parenteau told the attendees, "when taxes climb higher. There are also people talking about more quantitative easing from the Fed, too, which I find unfathomable, but you never know…those guys [the Fed] are lunatics. "All this has bond bulls foaming at the mouth. But I would not short Treasuries until the end of the year." OK, it is the "Trade of the Decade." Rob is comfortable shorting US debt over a 10-year period…just maybe not right this second. Still, with the yield on a 10-year note still below 3%…it is tempting. Ian Mathias Trade of the Decade Update originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||||||||||||||||||||||

| Adrian Douglas: Proof of gold price suppression -- gold and the U.S. dollar Posted: 20 Jul 2010 10:22 AM PDT 6:15p ET Tuesday, July 20, 2010 Dear Friend of GATA and Gold: GATA board member Adrian Douglas, editor of the Market Force Analysis letter (http://www.MarketForceAnalysis.com), examines the ratio between the supply of gold and the U.S. dollar and concludes that the dollar's gold backing has fallen to a mere 2.3 percent and that the real dollar value of gold now approaches $53,000 per ounce. Douglas' new study is headlined "Proof of Gold Price Suppression: Gold and the U.S. Dollar," and you can find it in PDF format with a chart at GATA's Internet site here: http://www.gata.org/files/AdrianDouglasProofOfGoldPriceSuppression-07-20... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth

This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||

| On Energy, China Argues Against Western Expertise… Again Posted: 20 Jul 2010 10:00 AM PDT China, ever growing in power (no pun intended) and influence, is again questioning Western experts inclined to tell it where it stands on the global stage, this time in terms of energy usage. On Monday, the Paris-based International Energy Agency (IEA) announced China had overtaken the US as the world's largest energy consumer. By Tuesday, China's National Energy Administration had promptly shot down the allegation, suggesting that the IEA lacks understanding of China's "energy conservation and renewable energy." According to the Financial Times: "China on Tuesday dismissed claims that it was the world's largest energy consumer, calling the latest estimates from the International Energy Agency 'not very credible.' [...] Zhou Xian, head of the general office of the National Energy Administration, dismissed the numbers. 'When the IEA came to China to publish its energy outlook a couple of days ago, they also overestimated China's energy consumption and carbon dioxide emissions,' he said. 'We think that is because of a lack of knowledge about China, especially about China's latest developments of energy conservation and renewable energy…' "…The IEA estimates that China consumed 2,265m tonnes of oil equivalent in 2009, whereas preliminary data from China's National Bureau of Statistics puts consumption at about 3,100m tonnes of coal equivalent during the same period. That is about 2,170m tonnes of oil equivalent based on back-of-the-envelope conversions – lower than the IEA's estimate but almost the same as US energy consumption during the same period. China's 2009 energy use is still lower than that of the US between 2004 and 2008, according to the IEA. "The IEA has in the past said that it hopes China will eventually join the organisation. This year's statistical review by BP, which is the most widely followed economic review by any company, also found China's energy use to have surpassed that of the US. BP calculated China had consumed 2.2bn tonnes of oil equivalent last year compared to the US's 2.17bn." It's generally going to be difficult for different organizations to pull together numbers at this scale that all agree with one another, especially given China's behemoth size and limited infrastructure. It doesn't help that the IEA translates all sources of energy usage into oil equivalent units while China uses a coal equivalency. Further, China is still not, as of yet, one of the IEA's 28 member states. Discrepancies are bound to crop up. However, it remains notable that China is increasingly taking its own unilateral (and almost US-like) stance on issues that previously have been only considered legitimate when delivered by globally-recognized, and generally Western, bodies. There has been similar disagreement with Google over internet usage in China. Yet, perhaps more poignantly, it's also happened with Beijing-based Dagong Global Credit Rating Co.'s recent downgrade of US debt. Not only did the newly-founded assessment by a clearly not "nationally-recognized" rating organization drop the US two grades with a negative outlook, but it also went ahead and squeezed an upgraded and stable-outlook China in above it. For better or for worse, China is now insistent on having its own unique version of reality heard. You can read more details in Financial Times coverage of China denying the accuracy of the IEA's estimate of its energy consumption. Best, Rocky Vega, On Energy, China Argues Against Western Expertise… Again originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | |||||||||||||||||||||||

| Posted: 20 Jul 2010 09:58 AM PDT Gold price rebounds on bargain hunting The COMEX August gold futures contract closed up $9.80 Tuesday at $1191.70, trading between $1175.10 and $1193.70 July 20, p.m. excerpts: | |||||||||||||||||||||||

| Hoyer says House will debate China currency manipulation bill Posted: 20 Jul 2010 09:57 AM PDT July 20 (Bloomberg) — The U.S. House will debate legislation to authorize trade sanctions against China for currency manipulation as part of a package of measures to promote U.S. manufacturing, House Majority Leader Steny Hoyer said.

The measure, sponsored by Representative Tim Ryan, an Ohio Democrat, would authorize imposition of countervailing duties on China's exports to the U.S. if authorities determined that the renminbi is undervalued by at least 5 percent on average for 18 months. Similar currency legislation sponsored by Democratic Senator Charles E. Schumer of New York is pending in the Senate. Schumer said last month he would move "shortly" to force a vote on the measure. [source] RS View: Here's the situation, more or less. Sizing up the trade flows, after equal values of tangibles flowing in opposite directions are cancel out, we are a net recipient of tangibles, paid for with paper. We've been doing this versus the various parts of the world for decades. In truth, we are akin to a nation of dragons — not quite the fireworks-poppin' Asian dragons, rather more like the treasure hoarding D&D-style dragons of Norse mythology. Doesn't it therefore seem odd, coming from this 'vantage point where we are the ones able to stuff our lairs with treasure while doling out "fire breath" and smoking paper to the rest of the world, that our Congressional leaders spend so much oratory energy and making a big stink as though WE are the ones getting the bitter end of the deal? Is it a simple case of employing reverse psychology with our trading partners who are being thus tangibly depleted? Or is it evidence that a significant change (monetary restructuring) is approaching and therefore everyone is throwing elbows trying to stake out the best possible position ahead of the NEW reality? That latter alternative certainly makes more sense than what would otherwise have our Congressmen oddly fighting for the losing side of a currency battle that had already been "won" long ago by their predecessors. (That victory taking the form of setting up the Dollar-based IMF monetary architecture of the world.) If you agree that change is surely coming, then be sure to use this time to add some gold to your personal 'lair' — while the unique advantages of this skewed field of play still favor us 'Western dragons' in our ability to do so. | |||||||||||||||||||||||

| The big problem with electric cars Posted: 20 Jul 2010 09:56 AM PDT From OilPrice.com: Can white elephants come in green? President Barack Obama flew to Holland, Mich., on Thursday to attend groundbreaking ceremonies for a new lithium-ion battery plant, which the White House advertised as an example of federal stimulus grants at work and a gateway to a clean-energy future. Great stuff — if you don’t look too hard... Read full article... More on autos: The Toyota recall story you haven't heard What GM didn't tell you about their electric car What GM didn't tell you about their electric car, Part II | |||||||||||||||||||||||

| Michigan begins using alternative currencies, gold, and silver as money Posted: 20 Jul 2010 09:55 AM PDT From Zero Hedge: ... As ConnectMidMichigan reports, "New types of money are popping up across Mid-Michigan and supporters say it's not counterfeit, but rather a competing currency. Right now, you can buy a meal or visit a chiropractor without using actual U.S. legal tender." The plan is so simple, it just may work... Read full article... More on currencies: Marc Faber's favorite currency Gold moves one step closer to real currency status These charts show gold is the world's new currency of choice | |||||||||||||||||||||||

| The six best sources of capital to start a small business Posted: 20 Jul 2010 09:37 AM PDT From Money Crashers: Do you have a great idea for a startup but don’t have the money to get it started? Well, don’t let that stop you! Now is a great time to start your own business. Commercial banks may have cut down on lending to small businesses that need capital, but there are a number of places that you can turn to for much needed funding for your business idea... Read full article... More on money: The No. 1 strategy for getting out of debt fast More great ways to make money without a job You may be owed thousands... and have no idea | |||||||||||||||||||||||

| Top analyst Shilling: Euro will fall to parity with dollar Posted: 20 Jul 2010 09:35 AM PDT From Pragmatic Capitalism: Gary Shilling is as optimistic as ever. Unfortunately, he’s one of the few people who has accurately called for deflation and continued economic woes. Thus far, he’s been right and, if he proves prescient, we could be in for a lot more pain. Schilling on re-affirming his call for Euro parity: “I think this is the calm between two storms and we’re having a lot of storms. But right now... Read full article... More on the euro: Top French bank: "No chance" euro bailout will succeed George Soros: Germany could cause the euro to collapse Currency trade: Top strategist says euro is headed much lower | |||||||||||||||||||||||

| Posted: 20 Jul 2010 09:16 AM PDT By Nic Lenoir of ICAP The jury is out: I have been in the deflation camp personally for the last 2 years, but I hear the arguments for Zimbabwean hyperinflation, or the case of the oscillation in no man's land as governments and central banks stop us on our way to the deflationary Kondratieff winter at each market collapse with a new round of monetization. Maybe this last cynic remake of the Japanese lost decades is the most obvious way to bet on the demagogy of our modern "capitalist" system where government are helpless against deflation and will therefore sacrifice our future and the planet if they have to in order to save whatever face they have left. | |||||||||||||||||||||||

| Eric Sprott Interview By King World News: Must Hear Posted: 20 Jul 2010 09:06 AM PDT King World News presents another great interview, this time with innovative hedge fund manager, and financial skeptic, Eric Sprott, best known recently for bringing an alternative to the GLD and SLV paper domination, with his innovative gold and silver physical ETFs. In the below interview, Sprott shares a wealth of insight into Keynesianism, on the staggering and rising debt load, on the collapse in every single economic metric and the imminent arrival of the double dip (sorry Apple fans, iPad sales are not a leading indicator; at best they serve as a delinquent mortgage tracker), on QE1 and the upcoming QE2. Sprott's view that "nobody has a solution here, nor should they have a solution here: I think we need to rid ourselves of the theory we need to keep adding debt all the time to keep growing." Sprott agrees with the Zero Hedge principle, that when dealing with broken Keynesian economics, you need to shock the system - "you need to hit bottom." As Sprott says: "You need to really shake the system in order for the system to change, and so far there has been absolutely no change in the system." And, of course, Sprott discusses gold, gold manipulation, and paper gold. 30 minutes of must hear observations. Full interview can be found here. Highlights from the King World News interview: On the failure of Keynesian principles: "One of the studies concluded that whereas we used to get something like 60 cents back on the dollar of government expenditures, today it’s negative 40 cents. So it’s pretty dismal when you think that everyone’s expectation is that this government’s going to bail us out, and as they are trying to bail us out, we’re actually losing ground because at the end of the year you still have the debt.” On the inevitability of QE2 and on the $10 billion a week debt issuance clip: “I’m debating whether QE2 is happening while we speak, because the Fed’s balance sheet continues to grow, even though they said they are going to stop buying most instruments at the end of March. But every week it keeps growing by $10 billion. I mean $10 billion a week is half a trillion dollars a year.” On the economic double dip: “You know we’ve had to go from obviously greenshoots, to what we’re looking at today is almost like cliff diving. And some of the data points are just so shockingly bad...Consumer confidence numbers...The rate of decline was just awful, the rate of decline was incredible...We have obviously hit the wall.” On the ongoing collapse in the jobs market: “Here we haven’t had any net employment increases and now we’re starting a waterfall down. So if we keep losing jobs and their are no policy tools left, how could anyone imagine that you turn it back up again.” | |||||||||||||||||||||||

| Its The End Of The World As We Know It Posted: 20 Jul 2010 09:06 AM PDT First of all, despite clamping down on immigration, our population grew by 2.6M people last year. Unfortunately, not only did we not create jobs for those 2.6M new people but we lost about 4M jobs so what are these new people going to do? Not only that, but nobody is talking about the another major job issue: People aren't retiring! They can't afford to because the economy is bad - that means there are even less job openings… The pimply-faced kid can't get a job delivering pizza because his grandpa's doing it. (snippet) How does one decrease the cost of labor in America? Well first, you have to bust the unions. Check. Then you have to create a pressing need for people to work - perhaps give them easy access to credit and then get them to go so deeply into debt that they will have to work until they die to pay them off. Check. It also helps if you push up the cost of living by manipulating commodity prices. Check. Then, take away people's retirement savings. Check. Lower interest rates to make savings futile and interest income inadequate. Check. And finally, threaten to take away the 12% a year that people have been saving for retirement by labeling Social Security an "entitlement" program - as if it wasn't money Americans worked their whole lives to save and gave to the government. More Here.. This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||

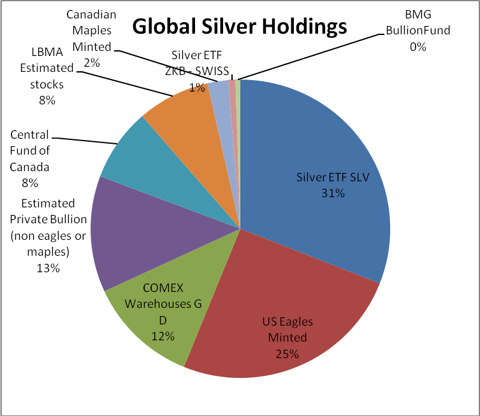

| Posted: 20 Jul 2010 08:32 AM PDT Chris Mack submits: With the price of gold hovering near 67 times the price of silver, a logical deduction must be that silver is much more abundant, and easy to acquire than silver. To the contrary, evidence proves otherwise. In fact there is very little silver to be found anywhere.

Complete Story » | |||||||||||||||||||||||

| 10 Year, 2s10s Both Suggest Manic-Depressive Stocks 70 Points Too Rich Posted: 20 Jul 2010 08:31 AM PDT There was a time when stocks, bonds, gold, dollar, oil, correlations, and pretty much anything that isn't nailed down, going up concurrently would make at least some market participants frown. Not so much any more - with the average "trader" an 18 year old pustular math whiz-kid with the personality of a paper clip and a Ph.D. from a prestigious institution to boot, with no idea of just the level of death and destruction their "sentient", "self-aware" and "learning" programs are about bring to the market, nobody cares about that little thing called logic. Yet going off that, and basing observations on the last rational market indicator, i.e. bonds, it appears stocks continue to be about 70 points rich and have a fair value around 1,020 as implied by 10 Year Yields. As the deranged schizophrenic computer algos were blowing threw vacuum tubes like Ukranian hookers go through crack on any given Hamptons weekend, they totally forgot to bring bond yields higher for validation. Which is why the stocks-bonds (10 Year) convergence is now more pronounced than ever. Sell stocks, Sell bonds (Long Yields) and wait for the big Mahwah collocation facility black out that will eliminate 80% of binary market participants that will allow the spread to close. And another validation comes from the 2s10s, which is essentially a replic of the 2s10s as the 2s has no more place to tighten.

| |||||||||||||||||||||||

| IMF to Asia: Change economic habits Posted: 20 Jul 2010 08:27 AM PDT July 21, 2010 (Reuters) Beijing — … The IMF needs Asia on its side. As the fastest-growing part of the world economy, the region will wield more clout at global institutions like the IMF and provide more of their funding. The problem, to put it bluntly, is that Asia does not need the IMF or like the IMF, whose invasive policy prescriptions are blamed in the region for having exacerbated the 1997/98 meltdown. Hence the charm offensive by the fund's managing director, Dominique Strauss-Kahn, at a big conference in the central South Korean city of Daejon last week. "Let me be candid: we have made some mistakes," he said. "We have learned the importance of focusing on essential policies, and of protecting the most vulnerable, when tackling a crisis." Declaring that he wanted Asian countries to see the IMF as a second home, Strauss-Kahn added: "Asia's time has come in the global economy, and so it must be at the IMF." … In a nutshell, Strauss-Kahn seemed to be saying, the IMF is ready to change. Is Asia? … Yet some [...] wonder whether Asia really can change its spots. The most striking imbalance in Asia is that it saves too much, and a major reason for that thriftiness is beyond the control of governments: the bulk of Asians are in their prime working years when people salt away money for their old age. [source] RS View: The run-of-the-mill economic commentators like to characterize the Asian savings-minded culture as something problematic, and that the world would be better off if the West (especially the U.S.) would start behaving more like the saving Asians while at the same time the Asians should start behaving more like the Westerners. Hey, here's a thought — let's just swap labels! Everyone living in the Western Hemisphere will now be called "Asian" and everyone living in the Eastern Hemisphere will be called "Westerners". Problem solved! Or not. Of course not. The whole exercise of swapping names just goes to dispel the superficial notion that the world's current economic dysfunctions are due to the strong savings affinity of one group of people or another. At fault, rather, is a terribly skewed perception of value engendered by a nebulously floating international monetary system that for four decades has collectively obscured the its relative position to any rational benchmark ("benchmark" as a rational point of reference because I'm very reluctant here to say "anchor") within the realm of its global population of end users (confused economists being among them). |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Think back a decade ago to mid-2000. The average person probably owned a single desktop computer and accessed the Internet through AOL (

Think back a decade ago to mid-2000. The average person probably owned a single desktop computer and accessed the Internet through AOL (

Gold rose today, bouncing off two-month lows as investors sought to buy at a discount from recent high prices. While some speculative investors have liquidated their holdings in gold recently as equities and currency markets stabilised, there is still enough worry about the global financial system to keep support under prices, said Stephen Platt, analyst with Archer Financial Services. "I think people are still relatively concerned about the future," Mr Platt said…

Gold rose today, bouncing off two-month lows as investors sought to buy at a discount from recent high prices. While some speculative investors have liquidated their holdings in gold recently as equities and currency markets stabilised, there is still enough worry about the global financial system to keep support under prices, said Stephen Platt, analyst with Archer Financial Services. "I think people are still relatively concerned about the future," Mr Platt said…

No comments:

Post a Comment