Gold World News Flash |

- Is gold price manipulation becoming a respectable topic?

- Irrational Gold Selling

- SP 500 and Gold still have a good bit of downside to come?

- Daily Dispatch: Meanwhile, Rome Burns

- Gold's Seasonal Cycle: Time to Buy?

- Porter Stansberry's Theories of Relativity

- Richard Karn: Strange Bedfellows-Australia's Labour Party & the Big 3 Miners

- How a Bad Economy Can Be Good for You

- Two Stories that Should Scare the Heck Out of You

- In The News Today

- Hourly Action In Gold From Trader Dan

- Jim Rogers Says: 'Sell Bonds, Buy Precious Metals'

- Endeavour Set To Become A Gold Producer

- LGMR: Gold & Silver Rally, Scrap Sales "Dry Up"

- Update

- Gold 07-09

- The Bullion Banks Go Short Another 24.3 Million Ounces of Silver - Mar 13, 2010

- Grandich Client Update – Strathmore Minerals, The Plan Remains production

- Crude Oil Back To Middle of Range, Gold Caution Warranted

- IMF tells Europe to inject more stimulus

- ?Myths? Paul Krugman Does Not Want To Talk About

- Time And Time Again

- Gold fund manager Ben Davies praises GATA in King World News interview

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Slightly Higher on the Week

- What To Do

- $15.89

- Gold is Back as Money!

- A Scenario

- RPI or RIP British Pensioners?

- Empire Center: NY spending $15.6M an hour

- Honest Money Gold and Silver Report: Market Wrap Week Ending 7/02/20

- The Case for Imminent Upside Explosion in the Gold Complex

- FRIDAY Market Excerpts

- Jeff Nielson: How the banksters serve the gold buyers

- Presenting The Wall Of Worry: The 50 Ugliest Facts About The US eCONomy

- Both Gold and Silver Prices Made Bottoms on Wednesday and Confirmed Those Bottoms Yesterday

- Free Gold/Silver Webinar!

- John Embry: U.S. dollar's collapse inevitable

- John Embry: U.S. dollar's collapse inevitable

- Gold to Be Supported by Massive Fiscal Challenges Facing U.S. and Western Economies

- Commercial Real Estate Loans – Extend and Pretend

- ECRI Weekly Index Growth Rate Now -8.3

- This could be the best news for gold in 30 years

- Friday ETF Wrap-Up: GDX Jumps, VXX Sinks

- This plan could prevent the coming U.S. crash

- A BIG sign gold stocks could be ready to take off

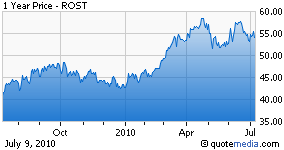

- Ross: The Future Looks Bright for Discount Retail

| Is gold price manipulation becoming a respectable topic? Posted: 09 Jul 2010 05:31 PM PDT 1:30a ET Saturday, July 10, 2010 Dear Friend of GATA and Gold: If Friday's edition of The Gartman Letter, perhaps the leading daily commodity market letter, is any indication, either GATA is getting respectable or, perhaps more likely, central banking is quickly losing what remains of its respect. Of course for years The Gartman Letter's editor, Dennis Gartman, has been sneering at GATA particularly and gold bugs generally. But Friday he wrote that "every once in a while the folks at GATA do make some sense" and he proceeded to quote at length from a recent GATA Dispatch. (See http://www.gata.org/node/8795.) ... Dispatch continues below ... ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Gartman wrote: "Gold is a bit weaker, but in U.S. dollar terms remains at or near $1,200/oz. Much is still being made of the announcement of the Bank for International Settlements' 'swap' of gold for cash reported earlier this week, with the conspiratorialists having a field day. But every once in a while the folks at GATA do make some sense, and their insights into what has gone on in this instance are worth our time. "GATA's Chris Powell reports that while 'news reports describe the BIS gold swaps as a means for central banks to 'raise cash,' central banks are able to create money out of nothing; they don't have to sell or lend anything to create money, or at least not to create their own money. They might have to sell or lend something to obtain the currency of some other nation. "'For example, other nations might have to sell or lend gold to obtain U.S. dollars. But the U.S. Federal Reserve lately has made all sorts of currency swap arrangements with other central banks so that they all can have plenty of dollars to use for market intervention. Other central banks have been able to obtain plenty of dollars just by creating more of their own currency and exchanging it with the Fed. In effect all the major Western central banks now are able to create dollars at will. "'So why did any central bank have to lend or pawn its gold to get dollars? Was there some agreement among central banks, or some insistence by the United States, that more gold had to be put into the market to defend currencies, government bonds, and low interest rates, to augment the quiet gold sales recently undertaken in London every month by the International Monetary Fund? The IMF too is supposedly selling gold to 'raise cash,' even as it is part of the central banking system that can 'raise cash' just by creating it. "'Have the Western central banks more or less re-established the price-suppressing London Gold Pool of the 1960s, only this time surreptitiously? Given the BIS' traditional interest in 'the provision of international credits and joint efforts to influence asset prices (especially gold and foreign exchange) in circumstances where this might be thought useful,' the BIS-arranged gold swaps must be suspected as part of a scheme to manipulate the gold market. In any case why is the mystery, the lack of official explanation of these transactions, accepted as the natural order of things?" Over at GATA Chairman Bill Murphy's proprietary Internet site of market commentary, LeMetropoleCafe.com, a daily gold market analyst remarks of Gartman's favorable reference to GATA: "While this is a graceful concession in what has not always been an amiable controversy, this development is important analytically. The Gartman Letter evidently feels that it is no longer dangerous among its substantial institutional following to comment sympathetically on the gold price manipulation concept." So if gold price suppression now can be discussed seriously at The Gartman Letter and respectable financial institutions, maybe its end is nigh and GATA can prepare to move on to other challenges, like proving the existence of UFOs or the Abominable Snowman. The latter is frequently sighted over at Kitco. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Posted: 09 Jul 2010 05:08 PM PDT Last Monday I couldn't believe my eyes when I saw that the price of gold had dropped $44.20, which was weird enough since Kitco was showing the "Gold Price Change due to Weakening dollar" was up by $23.00, meaning gold should be going up thanks to the weakening dollar, while the "Gold Price Change due to Predominant Selling" was down a whopping $67.20! Wow! Selling! Since most of the problems with my medications regimen seem to be finally solved, what could I do but laugh, although weakly, in a kind of dull, sedated babble, "Hahahahahahaha!" at the sheer incongruity of it all, instead of going off on a Manic Mogambo Tangent (MMT) of some kind, probably either about how the Federal Reserve has destroyed the dollar by creating too many of them, or, on a more timely topic, about what idiots the sellers of gold are. Apparently, these market-timing geniuses have failed to understand that that this is the Perfect Freaking Time (PFT) to buy gold, because here they are, selling! Hahaha! Obs... |

| SP 500 and Gold still have a good bit of downside to come? Posted: 09 Jul 2010 05:08 PM PDT Back on June 30th, I updated my subscribers that I was looking for an interim bounce in the SP 500 from the 1007 Fibonacci Pivot point to about 1071-1074, followed by much further downside. The chart is included here from June 30th for reference: So far the market hit the 1010 area on the SP 500 and has bounced exactly to 1071, the 50% retracement of the most recent downleg from 1130-1110. This market has been acting in clear Elliott Wave patterns since my Mid-April prediction of a 5 wave 13 month top being in place. My theory was we would then correct in a Zig Zag fashion over about 3-5 months to as low as 920-970 on the SP 500 from 1220. Right now the market could climb a few percent higher, but is likely to rollover and break the 1010 lows, and drop to the 940 area before the completion of this Bull market correction comes to an end. Crowds move in very reliable behavioral patterns and I use those patterns to work around major pivot tops and bottoms to help w... |

| Daily Dispatch: Meanwhile, Rome Burns Posted: 09 Jul 2010 05:08 PM PDT July 09, 2010 | www.CaseyResearch.com Meanwhile, Rome Burns Dear Reader, In something of a change-up, I’d like to kick things off today with some excerpts from recent emails from you, dear readers. [LIST] [*]“Any support (whatsoever) for Rush Limbaugh completely discredits everything else you have sent me (or will attempt to send me in the future).” “Galland finally declared himself as being who I long suspected him to be! But to come to the defense of the likes of psychos such as Beck and the sociopathic Rush is too much. Furthermore, to suggest that I am a socialist/populist because of my disgust and contempt for what those two mental midgets convey publically says more about Galland than me.” [/LIST] And then there were these… [LIST] [*]“In light of this extremely offensive bullshit liberal crap from David Galland, he can shove his anarchist position and derisive comments a... |

| Gold's Seasonal Cycle: Time to Buy? Posted: 09 Jul 2010 05:08 PM PDT by Adrian Ash BullionVault Friday, 9 July 2010 Buying gold in July or August only failed to pay once by year's-end since this bull market began... SO WE GOT an abrupt switch in the short-Euro, long-gold trade last week. Widely recommended as it continued to win, the position delivered 22% gains between end-March and end-June, and it looked closely held as Q2 finished, no doubt so funds could highlight it in their quarterly client reports. Since July 1st, in contrast, a lot of recent inflows to gold are going to be asking whether the summer's drop-to-date is just a dip, a seasonal lull, or the beginning of the end for gold's 10-year bull market. We'd split the difference, and see what's behind that curtain in the middle. Yes, the summer lull has arrived later than usual. Since 1968, only 2005 saw June set a new high for the year (daily basis; the chart above tracks month-end prices). And yes, there's reason to doubt one key driver of gold's se... |

| Porter Stansberry's Theories of Relativity Posted: 09 Jul 2010 05:08 PM PDT Source: By Karen Roche of The Gold Report 07/09/2010 Stansberry & Associates Investment Research founder Porter Stansberry, who built his reputation on finding safe-value investments poised to give his followers years of exceptional returns and also has a reputation as an independent thinker with a penchant for "out-of-consensus" viewpoints, has tweaked his toolkit to help investors hedge a bit against volatility while protecting themselves against the collapsing fiat currency system. In this exclusive Gold Report interview, he shares some of the techniques that you might consider Porter's own theories of relativity. Buy gold stocks when they're cheap compared to the price of bullion. Stock up on silver when the silver-to-gold relationship soars well past its historic 15:1 ratio. Pick up corporate bonds when they trade at a big discount relative to par. The Gold Report: In late June, the markets dropped on the news of China downgrading the European debt. The European C... |

| Richard Karn: Strange Bedfellows-Australia's Labour Party & the Big 3 Miners Posted: 09 Jul 2010 05:08 PM PDT Source: The Gold Report 07/08/2010 The Gold Report's boots-on-the-ground correspondent in Australia, Richard Karn (managing editor, The Emerging Trends Report), updates us on the death of the Resource Super Profits Tax (RSPT) proposal and the birth of a new tax, the Mineral Resources Rent Tax (MRRT). Supposedly a "fair share" for all, but Karn is not convinced. Read on for his take on the new tax's implications for Australian mining. The Gold Report: So what's the latest "down under" on the resource tax situation? Richard Karn: On Friday July 2, 2010, new prime minister Julia Gillard announced that the Resource Super Profits Tax (RSPT) proposal was dead and that the Labour Party had negotiated a new Mineral Resources Rent Tax (MRRT) agreement with the "Big Three" miners—BHP Billiton Limited (NYSE:BHP; OTCPK:BHPLF), Rio Tinto Ltd. (LSE:RIO; NYSE:RTP; AUS:RIO) and Xstrata PLC (LSE:XTA)—that offered "a fair share" for all concerned. And indeed, it certainl... |

| How a Bad Economy Can Be Good for You Posted: 09 Jul 2010 05:08 PM PDT The 5 min. Forecast July 09, 2010 10:33 AM by Addison Wiggin & Ian Mathias [LIST] [*] Government debt, excess regulation, a sickly dollar… and why Chris Mayer is not discouraged [*] Where no gold miner has gone before… A unique microcap opportunity [*] Another reason for gold’s $40 drop: John Paulson? [*] Consumer deleverages, market celebrates… Huh? [*] Latest Chinese moves to consolidate control of energy, metals [/LIST] “I don't think the U.S. economy is in good shape” -- Chris Mayer kicks off The 5 this morning with some candid advice he also gave to Capital & Crisis readers. “I am most discouraged when I consider the bloated and out-of-control federal and state governments. They spend too much. They are in too much debt. They are far too powerful. And I think it is fair to say that current administration is hostile to business. I think the U.S. dollar is a sick currency.” But “here is the thing,&r... |

| Two Stories that Should Scare the Heck Out of You Posted: 09 Jul 2010 05:08 PM PDT View the original post at jsmineset.com... July 09, 2010 09:01 AM Jim Sinclair's Commentary Here are two points to consider when your emotions on gold threaten to overtake you. Dear CIGAs, I was sitting here trying to find a way to wrap up the week and then, like a bolt of lightning, an idea hit me. Gold expert Jim Sinclair sent me this story: "Federal Budget Deficit Hits $1 Trillion For 1st 9 Months Of FY'10." The story said, "The shortfall, reflecting $2.6 trillion in outlays for the first three quarters and $1.6 trillion in receipts, narrowed slightly compared with the same point in fiscal 2009." So where did the "shortfall" come from? Try the more that 8 million who lost their jobs. The story went on to say, ". . . individual income and payroll tax receipts were down 4% over the nine-month period, suggesting that wages and salaries have not improved to the extent that corporate profits have." Corporate profits have "improved"because they laid... |

| Posted: 09 Jul 2010 05:08 PM PDT View the original post at jsmineset.com... July 09, 2010 09:03 AM Jim Sinclair's Commentary QE to infinity! U.S. marks 3rd-largest, single-day debt increase $166 billion jump spurs concerns over policy By Stephen Dinan 8:36 p.m., Wednesday, July 7, 2010 The nation’s debt leapt $166 billion in a single day last week, the third-largest increase in U.S. history, and it comes at a time when Congress is balking over higher spending and debt has become a key policy battleground. The one-day increase for June 30 totaled $165,931,038,264.30 – bigger than the entire annual deficit for fiscal year 2007 and larger than the $140 billion in savings the new health care bill will produce over its first 10 years. The figure works out to nearly $1,500 for every U.S. household, or more than 10 times the median daily household income. Daily debt calculations jump and fall, and big shifts are common. But all three of the biggest one-day debt increases have occurred u... |

| Hourly Action In Gold From Trader Dan Posted: 09 Jul 2010 05:08 PM PDT |

| Jim Rogers Says: 'Sell Bonds, Buy Precious Metals' Posted: 09 Jul 2010 05:08 PM PDT Gold didn't do a whole heck of a lot in Far East trading once again... and its high price of the day [around $1,208 spot] came at 8:00 a.m. in London yesterday morning. From there it declined gently until the U.S. bullion banks pulled their bids about fifteen minutes before the London p.m. gold fix at 10:00 a.m. Eastern time. Gold's low of the day [$1,186.50 spot] occurred moments before the London close. Gold rallied a bit after that, but was still down about five bucks from Wednesday's close when all was said and done. Volume wasn't overly heavy... under 100,000 contracts net of roll-overs and spreads. Not that 'da boyz' want to make themselves conspicuous... but you will carefully note, dear reader, that the U.S. bullion banks pulled their bids at exactly the same time on Tuesday as they did yesterday... as the sky-blue line so clearly indicates. Silver's high [around $12.20 spot] was at 11:00 a.m. during Hong Kong trading... then the price gen... |

| Endeavour Set To Become A Gold Producer Posted: 09 Jul 2010 05:08 PM PDT Richard (Rick) Mills Ahead of the Herd As a general rule, the most successful man in life is the man who has the best information An innovative merchant bank focused on the natural resource sector Endeavour Financial Corporation (EDV-TSX) has seen its stock price double in the last 12 months on the heels of some astute junior gold mining acquisitions. Yet today Endeavour has a P/E ratio of just one. That’s not a typo. In Q3 2010 EDV’s basic earnings per share were $2.20 and it’s currently trading at $2.20. On June 25th 2010, Endeavour announced the signing of a US$100 million revolving line of credit provided by UniCredit Bank. "We're pleased to have access to this facility which provides Endeavour with financial flexibility to fund new acquisitions." Endeavour CEO Neil Woodyer Three days later EDV announced that they were entering into a definitive arrangement to acquire all of the remaining outstanding shares of Etruscan Resources (EE... |

| LGMR: Gold & Silver Rally, Scrap Sales "Dry Up" Posted: 09 Jul 2010 05:08 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:35 ET, Fri 9 July Gold & Silver Rally, Scrap Sales "Dry Up"; Investment & Central-Bank Buying Seen Strong on Loose Western Policy Rates SPOT-MARKET PRICES for wholesale gold crept back above $1200 an ounce in London on Friday, recovering half of this week's 2.2% drop as world stock markets pushed higher again. The US Dollar and Japanese Yen both rose against the Euro and British Pound, while German bunds and UK gilts rose on weak inflation data, nudging yields lower. Commodity markets held flat, with US crude oil contracts above $75 per barrel. Silver prices rose above $18 an ounce, adding 0.7% from last Friday's finish. "The appetite for gold arises partly from the paltry, uncertain returns from more conventional investments," says today's Economist magazine in a special briefing. "Monetary policy has been keeping official interest rates, and thus the opportunity cost of holding gold, low...... |

| Posted: 09 Jul 2010 05:07 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 09, 2010 05:34 AM U.S. Stock Market – While I don’t believe I could be any clearer on my outlook, some people still don’t seem to grasp my view (their constant emails suggest this). While there shall be rallies and sell-offs, it’s my belief that the U.S. stock market will go nowhere fast and end up like the Japanese market did from 1989 on. That’s why I haven’t shorted the market despite signalling the end of the counter-trend major rally. It’s just mainly an avoid as far as I’m concerned until further notice. U.S. Bonds -I wouldn’t touch with a ten foot pole Gold – I couldn’t agree more with this article that this BIS news is actually tremendously bullish. Gold is indeed the most valuable asset over paper. As note previously, the $1,185 was the downside risk and we traded ... |

| Posted: 09 Jul 2010 05:07 PM PDT courtesy of DailyFX.com July 09, 2010 05:50 AM Gold has topped. Please see the latest special report for details. Near term, gold is making its way lower and most likely in an impulsive fashion. From a trading standpoint, the next opportunity will come from the short side on completion of wave iv of 3 – which may be underway now. 1215 (former 4th wave extreme) is potential resistance. The level intersects Elliott channel resistance next Wednesday. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| The Bullion Banks Go Short Another 24.3 Million Ounces of Silver - Mar 13, 2010 Posted: 09 Jul 2010 05:07 PM PDT The Bullion Banks Go Short Another 24.3 Million Ounces of Silver Well, as I mentioned in my closing comments in my column yesterday, the gold price rolled over the moment that the London a.m. gold fix was in at 5:30 Eastern time on Friday morning... 10:30 a.m. in London. From there it didn't do much until exactly 8:30 a.m. in New York when the selling pressure resumed. The low of the day was about 12:40 p.m. at $1097.70 spot. From that point, gold traded sideways for the rest of the New York trading session. The high price of the day was at the London a.m. gold fix... around $1,119 spot. The price action for silver was the same as for gold... although the high price for day looked like a tie, as the silver price hit $17.35 the ounce at the London a.m. gold fix... and at 8:30 a.m. in New York... just moments before the bullion banks began selling off both metals in earnest. Silver's low price was at the same time as gold's... with the low price of the da... |

| Grandich Client Update – Strathmore Minerals, The Plan Remains production Posted: 09 Jul 2010 05:07 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 09, 2010 03:44 AM The United States operates 104 nuclear power plants which consume approximately 55 million lbs of uranium per year, yet the US produces only 4 million lbs of uranium per year. Secondary sources from the decommissioning of old nuclear weapons and imports from other producing countries make up the supply deficit. Unlike oil and gas, the United States has the capability to become self-sufficient in uranium production. Strathmore Minerals Corp's primary goal is to become a leading uranium producer in the United States by providing the much needed future supply of uranium. Strathmore is a pure uranium development play. The Company is focused on advancing two core uranium development projects towards production: Roca Honda in New Mexico and the Gas Hills in Wyoming. In 2007, Roca Honda was joint ventured with Sumitomo Corp of... |

| Crude Oil Back To Middle of Range, Gold Caution Warranted Posted: 09 Jul 2010 05:07 PM PDT courtesy of DailyFX.com July 08, 2010 09:10 PM While Thursday's DOE inventory figures look bullish on the surface, they are very much in line with the 5-year average. Nevertheless, it has been quite some time since inventory figures had any lasting impact on crude oil prices. Rather prices will continue to be driven by other notable factors. Commodities - Energy Crude Oil Gravitates Toward Middle of Recent Range Crude Oil (WTI) $75.73 +$0.29 +0.38% Commentary: Crude oil was up in yesterday’s overnight session on the back of bullish API figures, which showed a 7 million barrel crude oil draw. That strength continued into the New York open outcry session, with oil registering its high of the day in the moments before the release of the EIA inventory data. Immediately after the report, oil sold off about $1.50, but by the end of the day, prices had rebounded back near the highs. The DOE inventory figures were disappointing relative to expectation... |

| IMF tells Europe to inject more stimulus Posted: 09 Jul 2010 05:07 PM PDT |

| ?Myths? Paul Krugman Does Not Want To Talk About Posted: 09 Jul 2010 05:07 PM PDT View the original post at jsmineset.com... July 08, 2010 04:56 PM Jim Sinclair's Commentary Gold is headed to and through $1650. Greg Hunter points out a major and present reason why. Dear CIGAs, I have been telling you for months there is going to be a double dip in the economy. Nobel Prize Winning economist Paul Krugman also thinks the economy is so bad we need to keep on stimulating the economy. In a New York Times Op-Ed piece last week, Krugman said, ". . . somehow it has become conventional wisdom that now is the time to slash spending, despite the fact that the world's major economies remain deeply depressed." In short, cut backs, or austerity, is not what the economy needs right now. (Click here for the complete NYT Op-Ed from Krugman.) In a nutshell, Mr. Krugman thinks America will do no harm in the short term if the U.S. government prints money to prop up the economy until it can stand on its own. He thinks it is a myth to believe in "invi... |

| Posted: 09 Jul 2010 05:07 PM PDT View the original post at jsmineset.com... July 08, 2010 05:22 PM Dear Friends, Gold is headed to $1650 and beyond. All your concerns in retrospect will be seen to have been concerns caused by manufactured noise. Time and time again you have seen this. Time and time again gold will not be stopped. Nothing has changed. Nothing has been rescued. The can that is being kicked daily down the path is going to turn around and bite the kickers. Gold is the only insurance. Regards, Jim Federal Budget Deficit Hits $1 Trillion For 1st 9 Months Of FY’10 WASHINGTON -(Dow Jones)- The federal budget deficit for the first nine months of the 2010 fiscal year was just over $1 trillion, the Congressional Budget Office reported Wednesday. The shortfall, reflecting $2.6 trillion in outlays for the first three quarters and $1.6 trillion in receipts, narrowed slightly compared with the same point in fiscal 2009. Receipts were 0.5% higher for the period compared to the first three quarters ... |

| Gold fund manager Ben Davies praises GATA in King World News interview Posted: 09 Jul 2010 04:53 PM PDT 12:52a ET Saturday, July 10, 2010 Dear Friend of GATA and Gold: Interviewed Friday by Eric King of King World News, Hinde Capital CEO Ben Davies credited GATA for "a fantastic job" alerting gold fund managers like himself to the necessity of buying real metal rather than paper claims to it like exchange-traded funds. GATA, Davies remarked, consists of "extremely courageous individuals" who have been "maligned and ridiculed" and possibly even "terrorized by certain institutions." (He seems to have been thinking of investment houses, central banks, and intelligence organizations rather than the usual collection agencies.) Davies also speculated on the prospects for the U.S. dollar and the ability of Russia and other resource-rich countries to create a gold-backed reserve currency that might quickly replace the dollar, an idea perhaps first expressed recently by James G. Rickards of the Omnis consulting firm. (See http://www.gata.org/node/8787.) You can listen to the interview with Davies at the King World News Internet site here: http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/7/10_B... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Slightly Higher on the Week Posted: 09 Jul 2010 04:00 PM PDT Gold traded near unchanged in Asia and London and then surged higher in early morning New York trade before it pared its gains a bit in the last few hours of trade, but it still ended near its midmorning high of $1213.40 with a gain of 1.19%. Silver followed a similar pattern and ended near its session high of $18.20 with a gain of 1.01%. |

| Posted: 09 Jul 2010 02:56 PM PDT

So what is the answer? What should people do about this coming economic collapse? Well, when I attended law school I was taught that there is a two word answer to almost any question that someone can ask about the law.... It depends. And while there are some fundamental principles which we should all follow in getting prepared for the coming economic crisis (which I will share below), the truth is that each and every person has very different circumstances that they are facing, so when someone asks what they should do I give them that same answer.... It depends. If you have a family you are going to prepare much differently than if you are single. If you live along the coast you are going to prepare much differently than if you live in the mountains or in the city. If you are wealthy you are going to prepare much differently from someone who only possesses limited resources. If you are dependent on a job you are going to prepare much differently from someone who is self-employed. If you live on a farm you are going to prepare much differently from someone who lives in an apartment building and has never even grown a garden. The truth is that there are a ton of variables and there just is not a "one size fits all" answer. However, there are some fundamental principles that we should all be following as we prepare for the coming economic collapse.... Get Out Of Debt It is always, always, always a good idea to get out of debt, but this is particularly true during a time of economic crisis. During an economic collapse, it will be very difficult to get work, money will be tight, and the last thing you will want to be doing is to be making monthly payments on some debt that you accumulated five years ago. The reality is that when we borrow money we become a servant, and debt is a very cruel master. You especially want to get rid of debt that is at high interest rates (such as credit card debt). There are very few things that are as good at bleeding your finances as credit card debt is. For example, according to the credit card repayment calculator, if you have a $6000 balance on a credit card with a 20 percent interest rate and only pay the minimum payment each time, it will take you 54 years to pay off that credit card. During those 54 years you will pay $26,168 in interest rate charges on that credit card balance in addition to the $6000 in principal that you are required to pay back. That is before any fees or penalties are even calculated. Can you see how financially debilitating that can be? The truth is that if you haven't already started, now is the time to develop a plan for how to get out of debt. Paying off debt can be very painful, but it will put you in a much, much better position to weather the financial storms that are ahead. Reduce Your Expenses Along the same lines, it is a very good idea to start reducing your expenses right now. The truth is that you cannot be sure that you will always have the same job or the same level of income. Times are going to be very tight in the future. Now is the time to start the belt tightening. Yes, the truth is that the cost of everything seems to be going up these days, and most American families are already finding it increasingly difficult to get by each month. But if your household is spending $5000 a month right now, are there ways that you could get that down to $4000 or maybe even $3000? If we all start learning to live with less right now, it will be much easier to do when times really get hard. Increase Your Income Yes, this is much easier said than done. Especially considering the fact that it seems like there are hardly any jobs out there right now. But the truth is that we are all going to have to work a lot harder and become a lot less dependent on employers. It is going to become increasingly difficult to get good jobs in the months and years ahead. The big global corporations are figuring out that they really don't need us after all. In many ways, it is much easier for them to hire a workforce from the other side of the world. So where does that leave us? Well, fortunately there are still a lot of ways to make money in America. How long that will last is uncertain, but for now we should work while the working is good. We are all going to have to start becoming a lot more entrepreneurial. Nobody is going to hand you anything in this life. If you just settle for your job ("just over broke") you aren't going to get too far in today's world. Many people start developing an extra income during their spare time in the evenings after work. Yes, that would mean that you would have less time to sit on the couch and watch people talk about who LeBron James is going to play basketball for, but did you think that we were going to be able to get through this without making sacrifices? Now is the time to rise up off the sofa and figure out how to make some more money. There is still a little more time to get prepared. If you keep putting off what you know needs to be done, eventually it will be too late. In addition, learning to do things like growing a garden is another way of "increasing" your income. All of the fruit and vegetables that you grow will mean that you won't have to spend as much at the grocery store. Stock Up On Essentials There are tons of supplies still in the stores, and prices are still relatively low right now (especially compared to what they will be in the future). So it is time to stock up on essentials while the getting is good. In a previous article entitled "20 Things You Will Need To Survive When The Economy Collapses And The Next Great Depression Begins", we listed 20 of the things that you will need in the event of a major disaster, an emergency or an economic collapse. These are the things that you are going to want to make sure that you have ready right now, because after the crisis begins it may be too late to prepare.... #1) Storable Food #2) Clean Water #3) Shelter #4) Warm Clothing #5) An Axe #6) Lighters Or Matches #7) Hiking Boots Or Comfortable Shoes #8) A Flashlight And/Or Lantern #9) A Radio #10) Communication Equipment #11) A Swiss Army Knife #12) Personal Hygiene Items #13) A First Aid Kit And Other Medical Supplies #14) Extra Gasoline (But Be Very Careful How You Store It) #15) A Sewing Kit #16) Self-Defense Equipment #17) A Compass #18) A Hiking Backpack #19) A Community #20) A Backup Plan In the comments to that article, our readers suggested the following additional items.... A K-Bar Fighting Knife Salt Extra Batteries Medicine A Camp Stove Propane Pet Food Heirloom Seeds Tools An LED Headlamp Candles Clorox Calcium Hypochlorite Ziplock Bags Maps Of Your Area Binoculars Sleeping Bags Rifle For Hunting Extra Socks Gloves Gold And Silver Coins For Bartering Of course there are probably many more items you could put on the list. The point is to get educated, get informed and start getting prepared. When things get really hard, that brand new pool table isn't going to do you much good, but having a good supply of food and clean water will make all the difference. Not that things are going to totally fall apart overnight. It is going to be a process. But you don't start preparing when the storm is already on top of you. Most of us know what is coming. Now we need to start taking action. This is how Americans got through the Great Depression of the 1930s - they tightened their belts, they were resourceful, and they did whatever they needed to do to provide for their families. Now it is our turn. Sure some people will laugh as many of us adjust our lifestyles in preparation for hard economic times, but it is those same people who will come knocking on your door when the rain does start pouring. |

| Posted: 09 Jul 2010 02:40 PM PDT I had to start over because there was people who didn't understand the meaning of a lower price, they came to troll my topic, and act like its all my fault. When we discuss lower prices its not because we want a crash, but we want to find a bottom. Finding a bottom is more important than finding a top. The reason I'm focusing on $15.89 is because my bearish indicator, it being summer, says there is a chance we will see it one more time. Without acting silly please tell me why you would like to see it one more time. To buy more? To make money on the downside? To find a bottom and shore up Silver? What do you feel is a time frame for this to happen. If you don't feel its going to happen please go post in a cheerleading topic. (no changing my title, please) |

| Posted: 09 Jul 2010 02:39 PM PDT http://www.24hgold.com/english/news-...D.+W.+Phillips Gold is Back as Money! July 09th, 2010 The BIS 382 tonne Gold Swap - Good or Bad for Gold and Why? Background In its 2010 annual report, the Bank of International Settlements said that "gold, which the bank held in connection with gold swap operations, under which the bank exchanges currencies for physical gold," stands at 8,160.1 million in special drawing rights, equivalent to 346 tonnes this year, up from nil in 2009." Apparently this amount has now climbed to 382 tonnes since the report was issued. Swaps - What are they and who does them? Swaps are financial instruments that allow for the exchange of one asset for another, in this case, gold for currency. They are not gold leasing, futures or options [which the 1999 and 2004 Central Bank Gold Agreement states would not be increased - The 2009 did not contain the statement]. Swaps could be undertaken by the signatories of the CBGA. as these were not included in any of the three Agreements. Gold swaps are usually undertaken between central banks: One central bank exchanges foreign exchange deposits (or other reserve assets) for gold with an agreement that the transaction be unwound at an agreed future date, at an agreed price. The monetary authority acquiring the foreign exchange will pay interest on the foreign exchange received, the rate of which is currently very low. Gold swaps are usually undertaken when the cash-taking central bank may want foreign exchange but does not wish to sell outright its gold holdings. The Wall Street Journal informs us that the B.I.S. did these swaps with commercial banks. We know of no commercial bank that has 382 tonnes of gold on their books. It is likely then that should these commercial banks have been in the deal, they would have been acting for a central bank [or several over time] who wished to remain anonymous. The B.I.S. received the gold into its safekeeping for the nation that required the foreign exchange for the swap period. Swaps of this nature are renewable once the time runs out, so it is impossible to say how long the swap will last for. The central bank that undertook the swap would have to be certain that it could return the currencies to get the gold back at some point in the future. If that country defaulted, then and only then could the B.I.S. go ahead and sell this gold. Any sale in the open market would be trumpeted loudly to all as well as reported in the Press or by the World Gold Council, B.I.S. or I.M.F. Why use gold and not currency? The financial crisis has led to a decline in the number of credit-worthy counterparties and a reduction in credit lines these counterparties can offer. This is significant in a world where credit risk and debt problems have been the subject of banker's fears since the appearance of the Greek debt crisis. For someone in the trouble Greece is, gold swaps allow a central bank's reserves to be lent in a credit-secure fashion. In other words, a gold swap allows the lender of currency to benefit from greatly reduced credit risk, as the gold can be held in an allocated account, usually at the Bank of England. The currency deposit is secured with gold throughout the life of the deposit. Any country such as Ireland, Portugal, Spain, Italy, the U.K. and the U.S.A. can follow this route. Yes, sales may not be permitted for fiscal reasons under Eurosystem rules, but these are not sales, but swaps. So, of the utmost importance is just who swapped this gold? Could it be one of the countries we just mentioned? If so, their situation is far graver than previously thought. The implication is that the collateral they offered just wasn't good enough, so they had to use their gold. This is major news for the monetary system. The Significance of the Transaction[s] What is significant about this or these transactions is that gold is being used in international settlements after so many decades of being sidelined in the monetary system! The transaction itself confirms that gold is being used in international settlements, which is a dynamic confirmation of gold's return to the monetary system. A "Swap" might be the first desperate step in such a transaction with the swapping bank hoping to repay the foreign exchange, but should it fail, the B.I.S . would have to decide either to keep the gold on its books or to sell it. Again, keeping it on its books is part confirmation that gold is active again on the monetary system, a big boost by itself! Gold is back and alive in the monetary system! What appears to have really happened is that one nation or more needed foreign exchange to counter some shortfall in its accounts and raised these funds as a short-term liquidity measure, believing that it would be able to return the currency and receive its gold back. The gold would then be returned at the conclusion of the swap period in return for the currencies swapped. If it fails to return these funds to the BIS, then the BIS could discreetly place the gold with another central bank, should it not want to keep the gold. If it did so, the BIS would simply report its disposal of the gold, the originating central bank would report the drop in its gold reserves and the gold buying bank would report its increase in the reserves. This puts the transaction into an entirely different category. It seems that one or more of the developed world's central bank's credit is not good enough for other governmental institutions. If word got out as to which this country is, then the financial markets would go into quite a spin, shaking the global financial system to its core. No wonder the B.I.S. is keeping such a low profile! Julian D. W. Phillips Gold/Silver Forecaster – Global Watch GoldForecaster.com |

| Posted: 09 Jul 2010 02:04 PM PDT |

| RPI or RIP British Pensioners? Posted: 09 Jul 2010 01:56 PM PDT Macer Hall of the Express reports, Millions facing 25% Cut in Their Pension:

Norma Cohen of the FT reports, Experts relieved on pension indexing:

Indeed, the exact implications remain to be determined but this technical switch will make future pensioners worse off because their pensions will be indexed to CPI, which not as comprehensive as the RPI in measuring inflation. Let's say we get a deflationary episode, and CPI is falling but RPI is still rising. Pensioners will get screwed. Worse still, if all the quantitative easing sparks a major inflationary episode, then expect the gap between RPI and CPI to widen, and again pensioners will feel the pain. Of course, the effects of these policy changes are typically exaggerated in the media, but what's truly amazing is how policymakers are trying to curb benefits by quietly cutting into pension savings. I guess they thought nobody would notice, but when austerity hits tight pocketbooks of retirees, they notice and are right to feel concerned. They didn't work hard all their lives to have some government bureaucrat conjure up sneaky ways to cut into their retirement savings. And it's not just private pensions that are feeling the squeeze. Louisa Peacock of the Telegraph reports, Pension reform must be accepted by public sector unions and workers:

Pension tension is a recurring theme on my blog. People should take notice of what's going on in the UK, Greece and elsewhere. If they think it can't happen here, they're only deluding themselves. I tell everyone to work as long as they can, and to save as much as they can. |

| Empire Center: NY spending $15.6M an hour Posted: 09 Jul 2010 01:09 PM PDT By the time you read this, New York will have spent about $259,703. That's according to the Empire Center for New York State Policy's "Spend-O-Meter." The Empire Center said the meter is calibrated to the state Division of Budget's estimated $136.5 billion spending plan for fiscal year 2010-11 According to the meter, New York spends: • $4,328 a second • $259,703 a minute • $15,582,192 an hour • $373,972,603 a day •$2,625,000,000 a week. • $10,983,333,333 a month At the time of this writing, $37.209 billion and change had been spent so far this fiscal year. "Under this year's budget, our state government will spend more every hour than 200 typical New York families earn in a year," said E.J. McMahon, the center's director. "The Spend-O-Meter continues to spin at a faster rate every year, even though our economy is crashing." The center has had the meter for several years. "It's certainly gotten bigger and faster," said Lise Bang-Jensen, a senior policy analyst at Empire Center. "The Spend-O-Meter's running at a much faster pace because we're spending more money more quickly. As we're talking, we're spending tens of thousands of dollars. Probably by the end of the conversation it will be much more—millions." The meter is similar to the national debt meter on display in New York City. "The hope is to raise people's attention to how much money New York state is spending," Bang-Jensen said. "People have commented that they like it. They like it but they hate it." |

| Honest Money Gold and Silver Report: Market Wrap Week Ending 7/02/20 Posted: 09 Jul 2010 11:42 AM PDT |

| The Case for Imminent Upside Explosion in the Gold Complex Posted: 09 Jul 2010 10:42 AM PDT It's coming much sooner than anyone expected. We learned yesterday that John Paulson's funds took a fairly big hit in June and saw quite a few redemptions. Now consider that Paulson isn't only the top holder of SPDR Gold Shares (GLD) (which is used as a hedge due to the fact that he also prices his funds in gold), but that he also owns many gold equities as well. In all, gold-related investments make up about 30% of his $33 billion in assets according to 13F filings. Thus, if the reports of $2 billion or more in redemption requests for Paulson's funds at the end of June are correct, then the recent plunge in gold and the weakness in gold equities that has occurred (all peculiarly in the face of the dollar's recent weakness) could certainly, at least in part, be explained by this one hedge fund being forced to liquidate various gold-related investments in order to meet redemption requests. When we combine this information with the fact that sentiment is extremely bearish in gold at the moment, it's further evidence of a setup for a rocket-like rally to develop soon in both gold and the gold equities, which is also not so coincidentally what normally follows a "Pre-Print Panic" in the gold complex. Let me explain… Consider that the Hulbert Gold Newsletter Sentiment Index (HGNSI) collapsed 14.3 points on Wednesday to just 9.2%, or just 9.2 points from indicating most gold timers are actually net short gold. The last time this sentiment index was this low was on August 28, 2009, which was just two business days before gold exploded on September 2 and rallied $200 over the next three months. Even Market Vane's bullish consensus has collapsed to 63% after never even sniffing the levels that it normally does at typical intermediate peaks in gold. And by what I suspect is not a coincidence, the last time this particular sentiment indicator was at this level was also August of 2009. In other words, we may actually surprise a large number of veteran gold bulls that are currently underexposed to the gold complex due to their reliance on seasonal tendencies for gold that are normally a function of the seasonal nature of Indian jewelry demand. However, investment demand is currently the primary driver of the gold market, not Indian demand. Indian demand has actually been weak all year, just as it was last year. Combine all of that with a weak dollar and a Fed that's going to need to start printing money again soon (see the Washington Post for another not-so-subtle hint from Bambi as to what is coming), and we have all the ingredients for an upside explosion to develop in gold much sooner than most are expecting (including myself). I hadn't actually expected any sort of wild upside for gold and gold stocks until after the FOMC in August, where presumably the Fed would indicate that it was returning to more money printing operations, even though my expectation was that gold and gold stocks would likely move higher in anticipation of that Fed announcement. However, in light of all this new information regarding sentiment and the fact that forced sales by this single hedge fund may have been largely responsible for gold's recent divot, upside acceleration for gold and gold stocks could come a lot sooner than I've been expecting. http://www.minyanville.com/businessm.../2010/id/29101 |

| Posted: 09 Jul 2010 10:28 AM PDT Gold pops back above $1200, ends week up 0.2% The COMEX August gold futures contract closed up $13.70 Friday at $1209.80, trading between $1194.60 and $1214.10 July 9, p.m. excerpts: |

| Jeff Nielson: How the banksters serve the gold buyers Posted: 09 Jul 2010 10:03 AM PDT 6p ET Friday, July 9, 2010 Dear Friend of GATA and Gold: At Bullion Bulls Canada, Jeff Nielson writes that gold's biggest buyers don't want any spike in the gold price but rather want gold repeatedly knocked down so they can accumulate it more easily. Nielson's commentary is headlined "How the Banksters Serve the Gold Buyers" and you can find it at Bullion Bulls Canada here: http://www.bullionbullscanada.com/index.php?option=com_content&view=arti... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Presenting The Wall Of Worry: The 50 Ugliest Facts About The US eCONomy Posted: 09 Jul 2010 10:02 AM PDT As we close on another week replete with ugly economic data and the usual bizarro counterintuitive market, here is a summary of the 50 most underreported facts about the state of the US economy, courtesy of the Coto report. After reading these it almost makes sense that the market has become completely desensitized to the sad reality now pervasive in this country. Readers are encouraged to add their own observations to this list. Surely if the list is doubled, the market will go up to 72,000 instead of just 36,000.

#50) In 2010 the U.S. government is projected to issue almost as much new debt as the rest of the governments of the world combined. #49) It is being projected that the U.S. government will have a budget deficit of approximately 1.6 trillion dollars in 2010. #48) If you went out and spent one dollar every single second, it would take you more than 31,000 years to spend a trillion dollars. #47) In fact, if you spent one million dollars every single day since the birth of Christ, you still would not have spent one trillion dollars by now. #46) Total U.S. government debt is now up to 90 percent of gross domestic product. #45) Total credit market debt in the United States, including government, corporate and personal debt, has reached 360 percent of GDP. #44) U.S. corporate income tax receipts were down 55% (to $138 billion) for the year ending September 30th, 2009. #43) There are now 8 counties in the state of California that have unemployment rates of over 20 percent. #42) In the area around Sacramento, California there is one closed business for every six that are still open. #41) In February, there were 5.5 unemployed Americans for every job opening. #40) According to a Pew Research Center study, approximately 37% of all Americans between the ages of 18 and 29 have either been unemployed or underemployed at some point during the recession. #39) More than 40% of those employed in the United States are now working in low-wage service jobs. #38) According to one new survey, 24% of American workers say that they have postponed their planned retirement age in the past year. #37) Over 1.4 million Americans filed for personal bankruptcy in 2009, which represented a 32 percent increase over 2008. Not only that, more Americans filed for bankruptcy in March 2010 than during any month since U.S. bankruptcy law was tightened in October 2005. #36) Mortgage purchase applications in the United States are down nearly 40 percent from a month ago to their lowest level since April of 1997. #35) RealtyTrac has announced that foreclosure filings in the U.S. established an all time record for the second consecutive year in 2009. #34) According to RealtyTrac, foreclosure filings were reported on 367,056 properties in March 2010, an increase of nearly 19 percent from February, an increase of nearly 8 percent from March 2009 and the highest monthly total since RealtyTrac began issuing its report in January 2005. #33) In Pinellas and Pasco counties, which include St. Petersburg, Florida and the suburbs to the north, there are 34,000 open foreclosure cases. Ten years ago, there were only about 4,000. #32) In California’s Central Valley, 1 out of every 16 homes is in some phase of foreclosure. #31) The Mortgage Bankers Association recently announced that more than 10 percent of all U.S. homeowners with a mortgage had missed at least one payment during the January to March time period. That was a record high and up from 9.1 percent a year ago. #30) U.S. banks repossessed nearly 258,000 homes nationwide in the first quarter of 2010, a 35 percent jump from the first quarter of 2009. #29) For the first time in U.S. history, banks own a greater share of residential housing net worth in the United States than all individual Americans put together. #28) More than 24% of all homes with mortgages in the United States were underwater as of the end of 2009. #27) U.S. commercial property values are down approximately 40 percent since 2007 and currently 18 percent of all office space in the United States is sitting vacant. #26) Defaults on apartment building mortgages held by U.S. banks climbed to a record 4.6 percent in the first quarter of 2010. That was almost twice the level of a year earlier. #25) In 2009, U.S. banks posted their sharpest decline in private lending since 1942. #24) New York state has delayed paying bills totalling $2.5 billion as a short-term way of staying solvent but officials are warning that its cash crunch could soon get even worse. #23) To make up for a projected 2010 budget shortfall of $280 million, Detroit issued $250 million of 20-year municipal notes in March. The bond issuance followed on the heels of a warning from Detroit officials that if its financial state didn’t improve, it could be forced to declare bankruptcy. #22) The National League of Cities says that municipal governments will probably come up between $56 billion and $83 billion short between now and 2012. #21) Half a dozen cash-poor U.S. states have announced that they are delaying their tax refund checks. #20) Two university professors recently calculated that the combined unfunded pension liability for all 50 U.S. states is 3.2 trillion dollars. #19) According to EconomicPolicyJournal.com, 32 U.S. states have already run out of funds to make unemployment benefit payments and so the federal government has been supplying these states with funds so that they can make their payments to the unemployed. #18) This most recession has erased 8 million private sector jobs in the United States. #17) Paychecks from private business shrank to their smallest share of personal income in U.S. history during the first quarter of 2010. #16) U.S. government-provided benefits (including Social Security, unemployment insurance, food stamps and other programs) rose to a record high during the first three months of 2010. #15) 39.68 million Americans are now on food stamps, which represents a new all-time record. But things look like they are going to get even worse. The U.S. Department of Agriculture is forecasting that enrollment in the food stamp program will exceed 43 million Americans in 2011. #14) Phoenix, Arizona features an astounding annual car theft rate of 57,000 vehicles and has become the new “Car Theft Capital of the World”. #13) U.S. law enforcement authorities claim that there are now over 1 million members of criminal gangs inside the country. These 1 million gang members are responsible for up to 80% of the crimes committed in the United States each year. #12) The U.S. health care system was already facing a shortage of approximately 150,000 doctors in the next decade or so, but thanks to the health care “reform” bill passed by Congress, that number could swell by several hundred thousand more. #11) According to an analysis by the Congressional Joint Committee on Taxation the health care “reform” bill will generate $409.2 billion in additional taxes on the American people by 2019. #10) The Dow Jones Industrial Average just experienced the worst May it has seen since 1940. #9) In 1950, the ratio of the average executive’s paycheck to the average worker’s paycheck was about 30 to 1. Since the year 2000, that ratio has exploded to between 300 to 500 to one. #8) Approximately 40% of all retail spending currently comes from the 20% of American households that have the highest incomes. #7) According to economists Thomas Piketty and Emmanuel Saez, two-thirds of income increases in the U.S. between 2002 and 2007 went to the wealthiest 1% of all Americans. #6) The bottom 40 percent of income earners in the United States now collectively own less than 1 percent of the nation’s wealth. #5) If you only make the minimum payment each and every time, a $6,000 credit card bill can end up costing you over $30,000 (depending on the interest rate). #4) According to a new report based on U.S. Census Bureau data, only 26 percent of American teens between the ages of 16 and 19 had jobs in late 2009 which represents a record low since statistics began to be kept back in 1948. #3) According to a National Foundation for Credit Counseling survey, only 58% of those in “Generation Y” pay their monthly bills on time. #2) During the first quarter of 2010, the total number of loans that are at least three months past due in the United States increased for the 16th consecutive quarter. #1) According to the Tax Foundation’s Microsimulation Model, to erase the 2010 U.S. budget deficit, the U.S. Congress would have to multiply each tax rate by 2.4. Thus, the 10 percent rate would be 24 percent, the 15 percent rate would be 36 percent, and the 35 percent rate would have to be 85 percent. h/t Teddy KGB |

| Both Gold and Silver Prices Made Bottoms on Wednesday and Confirmed Those Bottoms Yesterday Posted: 09 Jul 2010 10:02 AM PDT Gold Price CloseToday : 1,209.60Gold Price Close2nd July : 1,207.40Change: 2.20 or 0.2%Silver Price Close Today : 1805.3Silver Price Close 2nd July : 1769.8Change 35.50 or 2.0%Platinum Price Close... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| Posted: 09 Jul 2010 10:01 AM PDT My publishers and I will be hosting a CME-Sponsored Webinar. It is free and you can signup here. Here is a final list of the webinar outline: Part I: History & Background Part II: Today's Gold Market Part III: Macro Driving Forces Part IV: Gold Companies Part V: Trading & Investing Seasonals, COT & Public Opinion Polls Technical Trends Risks & Expectations 2010-2011 Hope to see you there! |

| John Embry: U.S. dollar's collapse inevitable Posted: 09 Jul 2010 09:51 AM PDT 5:51p ET Friday, July 9, 2010 Dear Friend of GATA and Gold: Sprott Asset Management's chief investment strategist, John Embry, writes for Investor's Digest of Canada that collapse of the U.S. dollar is almost inevitable and gold is about to reassert itself as money in a shocking way. The headline on Embry's commentary is "U.S. Dollar's Collapse Inevitable" and you can find it at the Sprott Asset Management Internet site here: http://www.sprott.com/Docs/InvestorsDigest/2010/MPLID_062510_pg204Emb.pd... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| John Embry: U.S. dollar's collapse inevitable Posted: 09 Jul 2010 09:51 AM PDT 5:51p ET Friday, July 9, 2010 Dear Friend of GATA and Gold: Sprott Asset Management's chief investment strategist, John Embry, writes for Investor's Digest of Canada that collapse of the U.S. dollar is almost inevitable and gold is about to reassert itself as money in a shocking way. The headline on Embry's commentary is "U.S. Dollar's Collapse Inevitable" and you can find it at the Sprott Asset Management Internet site here: http://www.sprott.com/Docs/InvestorsDigest/2010/MPLID_062510_pg204Emb.pd... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| Gold to Be Supported by Massive Fiscal Challenges Facing U.S. and Western Economies Posted: 09 Jul 2010 09:44 AM PDT Mark O'Byrne submits: Gold Gold fell $2.50 to $1195.30/oz yesterday and is now down 1% on the week. It traded sideways in Asia and down in early European trading. Another lower weekly close will again be bearish technically and would suggest that further retrenchment and consolidation may take place. A higher close today and on the week would help reverse the technical damage done recently. Complete Story » |

| Commercial Real Estate Loans – Extend and Pretend Posted: 09 Jul 2010 09:40 AM PDT Richard Suttmeier submits: Stocks were cheap as the week began and I projected market stability. It seems like the July pattern will be similar to April, anticipate solid earnings then sell the event on April 26th. The yield on the 10-Year failed between 2.999 and 2.813 as expected. Comex gold is consolidating off the June record high at $1266.5 as expected. Nymex crude oil held $71.71 as expected with my annual pivot at $77.05. The euro stabilized as the catalyst in the Capital Markets mix. The Dow ratcheted higher, first above my weekly pivot at 9,856 and ended Thursday above its 21-day simple moving average at 10,124. Commercial real estate remains the Achilles Heel for the banking system and hence the economy.

Complete Story » |

| ECRI Weekly Index Growth Rate Now -8.3 Posted: 09 Jul 2010 09:33 AM PDT Edward Harrison submits:

Complete Story » |

| This could be the best news for gold in 30 years Posted: 09 Jul 2010 09:31 AM PDT From Mineweb: In its 2010 annual report, the Bank of International Settlements said that "gold, which the bank held in connection with gold swap operations, under which the bank exchanges currencies for physical gold," stands at 8,160.1 million in special drawing rights, equivalent to 346 tonnes this year, up from nil in 2009." Apparently this amount has now climbed to... Read full article... More on gold: This is what deflation could do to gold Merrill Lynch: The 3 big reasons gold and silver will soar Gov't HORROR: IRS to begin tracking gold and silver coin purchases |

| Friday ETF Wrap-Up: GDX Jumps, VXX Sinks Posted: 09 Jul 2010 09:31 AM PDT ETF Database submits: After staying rangebound for much of the trading day, equity markets surged higher in the final hour of trading to finish the holiday-shortened week sharply in the green. The Dow and S&P 500 jumped higher by 0.6% and 0.7% respectively while the Nasdaq was up by close to 1% on the day. In commodity markets, oil continued its surge higher as the important commodity added 1% on the day to finish above $76/bbl. while gold rebounded above the $1,200/oz mark after jumping close to $14/oz. in Friday trading. This ends another choppy week of trading for the markets which made back most of the losses that they suffered in the previous week. “It’s time to determine if this is just a soft patch in the recovery or if it’s the beginning of a second leg down. That’s what the market is struggling with,” said Dan Deming, a trader with Stutland Equities in Chicago. One of the biggest gainers on the day was the Market Vectors TR Gold Miners Fund (GDX) which soared by 2.3%. This spike came after gold dipped below the critical $1,200/oz. barrier which prompted bargain buying from investors around the world who were anxious to buy the metal off of its highs which were at the $1,260 mark. Some investors are also cautious in regards to the upcoming bank stress tests being performed in Europe next week which helped create some safe haven buying in the final hour of trading. (Click to enlarge) Complete Story » |