Gold World News Flash |

- Gold Forecaster - Gold is back as money! The BIS 382 tonne Gold Swap - Good or Bad for Gold and Why?

- Daily Dispatch: I Smell a VAT

- In the Shadow of the Dragon

- Complicating Economics

- Gold 07-08

- Consumer Credit: Barf

- Save the EMU?.. Hypocrisy of the Fed

- Why Gold is Falling Despite Global Crises

- Europe: The State of the Banking System

- In The News Today

- China Won't Dump U.S. Treasuries or Pile Into Gold

- Time to Board the Gold Stocks Train?

- Client Update – Crocodile Gold Corp.Keeps Expanding Howley

- Time to Hit the Reset Button on Life

- LGMR: Gold Struggling Near $1200 After "Long Liquidation"

- Seriously Underpriced Silver

- Gold and Silver – There’s bad news and good news!

- Chen Lin: Gold Stocks Poised for Breakout

- In Defense of Economic Depression

- Gold Struggling Near $1200 After "Long Liquidation"…

- She’ll Be Right

- Guest Post: I Smell A Vat

- Julian Phillips: BIS swap shows gold is back as money

- Surreal Macabre Circus Is Now In Session: Stocks Surge In Week When Lipper Reports $11.6 Billion In Equity Fund Outflows

- CNBC Europe interviews Hinde Capital's Davies on gold paper risk

- Gold

- HGNSI at 9.2%

- Gold Prices at $10,000?

- Time And Time Again

- Gold is Back as Money!

- Fed to GSEs – Put it on the Balance Sheet!

- “Myths” Paul Krugman Does Not Want To Talk About

- Must Read Reflections From GMO's Edward Chancellor On The Sovereign Debt Crisis

- BIS and the Gold Swaps: Curiouser and Curiouser

- Central Banks Dumping Gold At A Torrid Pace

- Keep on Buying Toward the Low Side of The Trading Range, 17.85 and $1,185

- Pensions Drinking Themselves Silly?

- Thursday ETF Roundup: UNG Sinks, MOO Rises

- Official Estimates Confirm Zero Hedge Projections That SNB Will Suffer €8 Billion In FX Interventions in Q2

- THURSDAY Market Excerpts

- Harrisburg Chapter 9 Imminent As Controller Tells Debtwire Bankruptcy Best Option

- Legendary trader Gartman: The bear market is back

- Roubini, Bremmer and Whalen: Fixing the Financial System and Double Dipping

- The flow of cheap goods from China could be over soon

- Keeping the Genie in the Bottle

- *NEW* USAGOLD Video RoundTable

- Pre-Feasibility Study Has Minefinders Ready to Realize Value at La Bolsa

- Trader alert: Bearish sentiment is at extremes

| Gold Forecaster - Gold is back as money! The BIS 382 tonne Gold Swap - Good or Bad for Gold and Why? Posted: 09 Jul 2010 01:00 PM PDT In its 2010 annual report, the Bank of International Settlements said that "gold, which the bank held in connection with gold swap operations, under which the bank exchanges currencies for physical gold," stands at 8,160.1 million in special drawing rights, equivalent to 346 tonnes this year, up from nil in 2009." Apparently this amount has now climbed to 382 tonnes since the report was issued. |

| Posted: 08 Jul 2010 05:53 PM PDT July 08, 2010 | www.CaseyResearch.com I Smell a VAT Dear Reader, In past editions of this service, I’ve advocated tuning your personal radar to pick up early indications that the government is taking an active interest in gold. Especially when that interest revolves around terrorists or tax evaders, two popular bogeymen these days. It was, therefore, with more than a little concern that I read an article in our Ed Steer’s Gold & Silver Daily service yesterday on an item slid into the legislation authorizing the government takeover of health care. Here’s a snip from Ed’s letter…[INDENT]The good folks over at numismaster.com report that, starting on January 1st in 2012, U.S. federal law will require coin and bullion dealers to report to the Internal Revenue Service all gold and silver coin purchases and sales greater than $600. The report is written by David L. Ganz and is headlined "$600 Sal... |

| Posted: 08 Jul 2010 05:53 PM PDT [FONT=Arial,Helvetica,sans-serif][COLOR=#000000][FONT=Arial][COLOR=#000000]John Downs - Assistant Manager of the Los Angeles branch of Euro Pacific Capital. [/COLOR][/COLOR][/FONT] Although China is not the biggest economy in the world by GDP, (it is third, after growing a remarkable 8.7 percent last year), its exports are increasingly seen as the needed lifeline for many shaky economies. But as China plots its future as the world's largest exporter, it must be of some concern to them that their top two clients (the US and EU) are broke. As a result, China knows that it will have to look beyond developed markets for continued growth. While a rebalancing of the Chinese economy towards domestic consumption is increasingly evident, the Chinese are also aggressively focusing investments toward emerging markets. By securing precious natural resources, developing infrastructure and deepening trade relations with the developing world, the Chinese are lessening their ... |

| Posted: 08 Jul 2010 05:53 PM PDT A column by Ambrose Evans-Pritchard of The Telegraph, and appearing through blogs.telegraph.co.uk, recently sported the headline "Time to shut down the US Federal Reserve?" Good question! If I were writing about this subject, of course, I would have opened my scathing condemnation of the Federal Reserve with, "Unfortunately, the time to shut down the Federal Reserve was long, long ago. As a result, we're freaking doomed, and the only thing left to do is round these lowlife Fed morons up and punish them severely for their arrogance and incompetence! And Congress, too! And the Supreme Court! A pox on all their houses!" Most people can tell at a glance the difference in our styles when he opens with the line "Like a mad aunt, the Fed is slowly losing its marbles", which I think is a terrific line and shows a lot of subtle-yet-classy wit and wisdom, whereas I would follow this up with something more earthy as regards such monetary insanity, like, "The Federal Reserve is an intellectual c... |

| Posted: 08 Jul 2010 05:53 PM PDT courtesy of DailyFX.com July 08, 2010 06:47 AM Gold has topped. Please see the latest special report for details. Near term, gold is making its way lower and most likely in an impulsive fashion. From a trading standpoint, the next opportunity will come from the short side on completion of wave iv of 3 – which may be underway now. 1215 (former 4th wave extreme) is potential resistance. The level intersects Elliott channel resistance next Wednesday. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... |

| Posted: 08 Jul 2010 05:53 PM PDT Market Ticker - Karl Denninger View original article July 08, 2010 11:40 AM Nothing good to see here. [INDENT]Consumer credit decreased at an annual rate of 4-1/2 percent in May 2010. Revolving credit decreased at an annual rate of 10-1/2 percent, and nonrevolving credit decreased at an annual rate of 1-1/2 percent. [/INDENT]So non-revolving is now declining again, and the decrease in the revolving credit continues apace. There's absolutely nothing encouraging about these numbers from a standpoint of "recovery". Remember, all money is debt (that is, is backed by debt issuance) and so is credit; ergo, if credit is contracting then the economy must follow. That's rather compressed due to the long range of the chart - let's expand it: No growth of any sort in either since the first of 2009, and the rate of decline in revolving (credit-card) debt has not improved one iota in the last six months. There is no more consumer pull-forward capacity in the economy.... |

| Save the EMU?.. Hypocrisy of the Fed Posted: 08 Jul 2010 05:52 PM PDT Save the EMU? Thursday, July 08, 2010 – by Staff Report European Union EMU break-up risks global deflation shock that would dwarf Lehman collapse, warns ING ... A full-fledged disintegration of the eurozone would trigger the worst economic crisis in modern history, devastate every country in Europe including Germany, and inflict a deflationary shock on the US. There would be no winners, warns the Dutch bank ING in a new report "Quantifying the Unthinkable". The end of the Deutschemark was marked in the northern German state Lower Saxony by a funeral. "Complete break-up would have effects that dwarf the post Lehman Brothers collapse. Governments would find themselves having to bail out banks again, worsening already fragile government finances. The risk of at least a temporary break-down in payments systems would be enormous, " said the report by Mark Cliffe, Maarten Leen, and Peter Vanden Houte." – UK Telegraph Dominant Social Theme: No matt... |

| Why Gold is Falling Despite Global Crises Posted: 08 Jul 2010 05:52 PM PDT The 5 min. Forecast July 08, 2010 11:12 AM by Addison Wiggin & Ian Mathias [LIST] [*] Behind the gold takedown… How central banks might have knocked $40-plus off the Midas metal [*] Inside yesterday’s mega rally in stocks… A factor we called three months ago [*] A rerun of gold’s 1980 blowoff rally? Rick Rule on how soon to expect it [*] The Eagle has yet to land… Mint records another month of strong coin sales [*] Marc Faber on a form of diversification too few people consider [/LIST] Mystery solved. We think. Given the news cycle and the buying habits of the world’s central banks of late, we’ve been wondering why gold has traded down nearly $40 bucks from its near-historic high last Thursday. And has stayed there… Today, we believe, despite becoming net buyers of gold for the first year since 1988, central banks are “pawning” that gold at the Bank for International Settlements (BIS) -- the central b... |

| Europe: The State of the Banking System Posted: 08 Jul 2010 05:52 PM PDT We're bombarded with information from the minute we wake up until the second we fall asleep. I was watching a news network last night for 45 minutes and the exact stories started coming back around. Nothing new to report, but the same topics on repeat, with the rare nominal development. When I need something different (and relevant to me), I go to STRATFOR.com. They provide deep insight and explanation of events the networks can't begin to tackle. Today I'm including an extensive article on the banking situation in Europe. Enjoy, and sign up for their free email list to receive weekly reports and special offers. John Mauldin Editor, Outside the Box Europe: The State of the Banking System July 1, 2010 | 1245 GMT PATRIK STOLLARZ/AFP/Getty Images The European Central Bank in Frankfurt, Germany Summary In the last six months, the eurozone has faced its biggest economic challenge to date — one sparked by the Greek debt crisis which has migrated to the... |

| Posted: 08 Jul 2010 05:52 PM PDT View the original post at jsmineset.com... July 08, 2010 07:51 AM Thought For The Morning The US turned 234 years old yesterday, and yet over half of the nation’s money supply was created since Helicopter Ben took over the flight controls four years ago. No wonder gold is in a full-fledged bull market. – David A. Rosenberg, Chief Economist & Strategist, Gluskin Sheff & Associates Inc. Jim Sinclair's Commentary Ski jump recovery. 40 percent of Florida homes sales are foreclosures BY KIMBERLY MILLER Sales of foreclosed homes in Florida made up nearly 40 percent of all purchases in the first part of this year, a “terrifying” statistic, one analyst said, and one that led to deeply discounted prices on distressed properties. In Miami-Dade County, foreclosure sales made up nearly half — 47 percent — of all homes sales in the first five months of 2010, according to a new report from Irvine, Calif.-based RealtyTrac, which aims to m... |

| China Won't Dump U.S. Treasuries or Pile Into Gold Posted: 08 Jul 2010 05:52 PM PDT Unbeknownst to me at the time I sent in yesterday's commentary, the low at the Hong Kong close at 5:30 a.m. Eastern time on Wednesday morning proved to be gold's low price of the day. That time of day, coincidentally, is the precise time of the London a.m. gold fix. Gold subsequently gained and lost about $5 in London trading... but the moment that New York opened, the gold price was off to the races. The price rise even extended into electronic trading after the Comex closed. Gold's low price at the London a.m. fix was a hair below $1,185... a new low for this move down... and the high [$1,205.10 spot] was in electronic trading in New York late on Wednesday afternoon. Volume was pretty chunky with preliminary volume showing around 120,000 contracts traded net of spreads and roll-overs. The silver graph looks suspiciously like the gold graph. Silver's low at the Hong Kong close/London a.m. gold fix was another low for the move down in silver as ... |

| Time to Board the Gold Stocks Train? Posted: 08 Jul 2010 05:52 PM PDT By Jeff Clark, Senior Editor, Casey’s Gold & Resource Report One of the big hints that gold stocks will be ready for take-off is when they stop following the broader markets and strictly track gold, particularly if the market falls and gold stocks don’t. We now have data showing this has just occurred. From April 2009 to April 2010, gold stocks mirrored the S&P. The two markets held hands as often as high school sweethearts; there was very little separation between them. While it wasn’t always a daily connection, any weekly and especially monthly chart showed them moving in tandem. Until now. For the quarterly period of April through June, gold stocks advanced 11%, tracking gold’s gain of 10.7%. The S&P, however, lost 14.1%. We haven’t seen this level of separation between gold stocks and the general stock market since the first quarter of 2009. This demonstrates obvious strength in our sector, and is precisely the kind ... |

| Client Update – Crocodile Gold Corp.Keeps Expanding Howley Posted: 08 Jul 2010 05:52 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 08, 2010 07:50 AM Crocodile Gold issued a press release this morning with some very good drill results from its Howley project in the Northern Territory of Australia including 13.36 g/t Au over 5 meters in hole HSRC142 within a larger mineralized envelope of 1.82 g/t au over 40 meters. Croc is currently mining from Howley which is a series of open pit deposits and expects to mine more than 50,000 ounces from Howley this year as part of the 100,000 ounces they expect to produce by year-end. Highlights of the drill results include: [LIST] [*]Near surface mineralization of 8.93 g/t Au over 6 meters in hole HSRC014; [*]Numerous wider mineralized intersections down dip from existing resources in hole HSRC150 with 5.02 g/t Au (uncut) and 4.78 g/t Au (cut) over 9 meters, in hole HSRC142 with 13.36 g/t Au (uncut) and 7.46 g/t Au (cut) over 5... |

| Time to Hit the Reset Button on Life Posted: 08 Jul 2010 05:52 PM PDT By Dr. Steve Sjuggerud Thursday, July 8, 2010 "We're going to have to write a big check to get out of our house," a friend told me over the Fourth of July weekend. He's moving far away from here. "We close on our house this month," he told me. "I'm trying not to see it as a big loss, though. I figure we're just trading out I figure the house we're buying where we're moving is probably at the same kind of discount." My friend and his family have to recalibrate their lives Back in the real estate bubble, they were living high, hardly working. They'd borrowed heavily and put it into real estate, which gave them a large and ever-increasing net worth until the bubble ended. I'm not sure how much of that net worth has disappeared – but there's a chance that most of it is gone. The regular vacations and extravagant lifestyle are things of the past, for now. He is back to work – hard at work – in a new town, with a new life. With his willingness to change,... |

| LGMR: Gold Struggling Near $1200 After "Long Liquidation" Posted: 08 Jul 2010 05:52 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:20 ET, Thurs 8 July Gold Struggling Near $1200 After "Long Liquidation", But Macro Risks "Make Tactical Case Strong" THE PRICE OF PHYSICAL gold bounced from a new 6-week low early in London on Thursday, but struggled to hold above $1200 an ounce as world stock markets jumped together with commodity prices. Silver prices touched a 1-week high at $18.24 an ounce as the gold price in Dollars rallied from its May 25th low at $1186.16. Neither the European Central Bank or the Bank of England altered their record-low interest rates of 1.0% and 0.5% respectively, leaving government bonds little changed. "Given the wave of buying across the investment spectrum of Gold in recent months, it is not surprising there has been some profit taking," says July's new Metal Matters for clients of bullion-bank Scotia Mocatta. Analyzing last week's broad "correction" in global asset prices, "Long liquidation ma... |

| Posted: 08 Jul 2010 05:52 PM PDT At breakfast I told the kids that I was instituting some new austerity measures around here, and they became so insistent that I heard all about how this was going to "ruin" them and their stupid social lives that I did not have to tell them that I was going to use the money to buy silver, which would have sent them ballistic. The impetus for my New Mogambo Crusade (NMC) to acquire more silver came as a result of reading in Ed Steer's Gold & Silver Daily where he noticed in the Comptroller of the Currency's "Q1/2010 Report on Bank Trading and Derivatives Activities" that "the bottom-line numbers show that two US banks… JPMorgan and HSBC, USA hold between 97% and 99% of all the gold and silver derivatives held by all US banks." Yow! This is a result of naked short selling. Normally, to short something, you would have to borrow it from somebody, and then sell that. Now, to short gold or silver is as simple as getting somebody to pay money for a piece of paper that says it represe... |

| Gold and Silver – There’s bad news and good news! Posted: 08 Jul 2010 05:52 PM PDT “The future ain’t what it used to be”. …..Yogi Berra Judging by several E-mails I’ve received from anxious readers of my articles during the past few days, some of you are wondering if you should have ‘sold in May and gone away.’ Let’s look at a chart from last year and see if that strategy would have worked in 2009. (Charts in this report are courtesy Stockcharts.com unless indicated). Here is the daily bar chart for gold from last year. Selling in May (green rectangle) and going away would not have been a good idea in 2009. The good news is that the best buying opportunities for buying gold and silver usually come in May – June – July. “There can be no other criterion, no other standard than gold. Yes, gold which never changes, which can be turned into ingots bars, coins, which has no nationality and which is eternally and universally accepted as the unalterable fidu... |

| Chen Lin: Gold Stocks Poised for Breakout Posted: 08 Jul 2010 05:52 PM PDT Source: Brian Sylvester of The Gold Report 07/07/2010 Chen Lin is an independent investor living the dream. Since December 2002, he's turned slightly more than $5,000 into nearly $1M through value investing and exceptional market timing. Now he believes gold producer shares are poised for a breakout. "Every gold producer is making an incredible amount of money, and the market doesn't appreciate that much. That's a very interesting phenomenon. One thing will happen—either gold has to come down significantly or gold shares will go up significantly. I believe it's the latter," Lin says. In this exclusive interview with The Gold Report, Lin shares some favorite gold producers and explorers, as well as some pulp and paper stocks he thinks have some upside. The Gold Report: In 2002, you turned a little more than $5,000 into a portfolio worth close to $1 million in 2010. I am sure many people ask how you did that. Do you think you could repeat that success again ... |

| In Defense of Economic Depression Posted: 08 Jul 2010 05:39 PM PDT Warning: serious thinking here... Big rally yesterday. The Dow was up 274 points. Gold went up very slightly and still closed below $1,200. What gives? A big change in direction? It's probably nothing. Markets don't go up or down all in one straight move. They play with investors like a cat with a mouse. They tempt him into bear markets and scare him away when prices are rising. They shake his courage at bottoms and addle his brains at tops. An investor never knows for sure what the market is up to. And he's better off not worrying about it. He should look for acceptable value and nothing more. If he finds a company he likes...if he understands the business model...if he has studied the company's financial picture and satisfied himself that management knows what it is doing...and he can buy it at a price that gives him a fair return on his money...then, he can buy the stock. And then he shouldn't worry if the price goes up or down. Trying to make money by guessing the stock market's direction, on the other hand, is likely to be a losing proposition. It only works, marginally, at the extremes. And we're not at an extreme now. But if we had to guess, we'd say the market is headed down. But we'd rather wait and see what the market has to say for itself. In the meantime, let's turn to the economy where we can have more fun. In the markets, the bulls could be right. Or the bears could be right. Who knows? But the economy seems easier to understand and predict. And economists? That is where our doubts disappear. We know most of them are wrong most of the time. Paul Krugman rants and raves. He thinks governments are making a big mistake. They should forget about saving money and cutting deficits, he says. They can worry about that later. What they need to worry about now is a depression. Unless the feds get on the ball and spend money, we could sink into another Great Depression, he warns. Martin Wolf at The Financial Times in London makes the same point. He mentioned 'depression' yesterday. The private sector is saving; without a lot of 'demand' courtesy of the state, he says, we run the risk of depression. The two of them are so sure a depression would be a bad thing, it makes us wonder. Maybe a depression wouldn't be so bad, after all. The gist of the argument against depression is that people lose their jobs, incomes go down, companies go bankrupt and so forth. Is that all? Well, in general, people have less stuff...and less money to buy more stuff. If that were all there was to it, it would seem like a small price to pay for the benefits of a depression. After all, a depression would wring the debt out of the economy. It would get rid of weak businesses. It would turn spendthrift households into savers. That's got to be worth something. The large presumption behind these worries is that, in a depression, people do not get what they want...they are disappointed. They are poor. They wear shoes with holes in them and drive old cars. They vote for Democrats and start reading Das Kapital. Big deal. What actually causes a depression, anyway? People choose to save rather than spend. Reduced demand causes a drop in sales...an increase in unemployment...falling prices and all the other nasty things we associate with a 'depression.' And yet, behind it is something people really want - savings. And behind the desire for savings are very real calculations and concerns. Without savings, people cannot retire comfortably. Without savings, they cannot withstand financial shocks and setbacks. Without savings, they may not be able to take advantage of opportunities that come their way. In other words, there is a depression because people would rather have savings than a new car, or a new pair of shoes, or a vacation. In other words, people choose to have their cake rather than to eat it. What's wrong with that? Nothing. But it causes the economists' GDP meters to tick over in a direction they don't like...or at least in a direction they think they can do something about. The economists' answer to this is to let the people have their savings...but to counteract the economic affect of higher savings rates with increased government spending. It sounds so neat...so clean...so symmetrical. You might almost think it made sense, if you don't think about it too much. But wait. Where do the feds get any money to spend? They have to take up the savings. They take the cake! And there you have the problem right there. Resources have to come out of some other use - say, inventories, investments, whatever - and be put to use on government projects. We can safely assume that the federal projects are not the angel food, layered and frosted confections that the savers wanted to eat. Otherwise, they would have willingly paid for them themselves and there wouldn't be a downturn in the first place. So, instead of savings and depression, the people get boondoggles and "growth." Only it isn't real growth. It is growth that flatters economists but leaves the rest of us hungry and disappointed. It is empty calories...measurable as "growth" on the economists' GDP meters...but completely phony and not at all what people really wanted. And what happened to their savings? They've been eaten up by the feds and their favored groups. This whole Keynesian stimulus project is scammy from beginning to end. And in the middle too. And more thoughts... We have three sons, more or less all unemployed this summer. We give them projects. We invite them into the family business. But they are not kids anymore. They have ideas of their own. One is pursuing his musical career in a reasonable manner. The others, still in school, have other plans too...but not ones your editor fully understands or necessarily approves. None has a proper "summer job." "When I was your age..." he tells them...followed by tales of unimaginable suffering, hardship and perseverance. "Times have changed, dad," they reply. They have a different attitude... They will work, but only if it 'really makes sense.' What really makes sense? We're not sure...but we hope it includes painting the shutters: "I don't think I fully understood the severity of the situation I had graduated into," The New York Times quotes Scott Nicholson:

Mr. Nicholson turned down a $40,000 job. It wasn't the career he was looking for, he said. Remarkably picky, for an unemployed man. But this generation seems to feel a little cushier than we did.

Optimistic? Turn down work? That's what depressions are supposed to cure! Regards, Bill Bonner |

| Gold Struggling Near $1200 After "Long Liquidation"… Posted: 08 Jul 2010 05:32 PM PDT |

| Posted: 08 Jul 2010 05:17 PM PDT It's the end of the week. Emotions are mixed. Half of us wants to throw our lot in with the "She'll be right" gang, point out that unemployment in Australia has declined to just 5.1%, cite the positive IMF growth forecasts (4.6% for the globe, 9.2% for Chindia, and 3% for Australia) and go have a beer to celebrate how lucky this country is and continues to be. But the other half just can't resist watching the slow-motion decomposition that is the Euro and wonder if Europe's banks are stuffed full of government debt that could make subprime debt look gold-plated. And to be fair, the IMF is also worried that a sovereign debt crisis in Europe is still a threat. In its updated forecast for everything, the agency said a European debt crisis, "Could lead to additional increases in funding costs and weaker bank balance sheets and hence to tighter lending conditions, declining business and consumer confidence and abrupt changes in relative exchange rates." That doesn't sound good. Yesterday we promised to be more offensive. That is, we said that despite an outlook for the world that was full of de-leveraging and falling asset prices, there is a time and a place to go on the attack. But is now that time and is here that place? And how would you attack anyway? Well, there is certainly a place (albeit small) for speculation in any well-diversified portfolio. But it's important to remember that Black Swans - statistically improbable according to conventional models, but with very large consequences - don't always have to be bad things. A big oil find by a small exploration company is a low-probability, high-magnitude event. The same is true with a breakthrough drug by a small bio-tech company. These events don't have to happen often. They just have to happen once. And if you have a small-portfolio of businesses that are exposed to these kinds of events, you are taking an essentially offensive position. You needn't bunker down in your cave, at least all the time. This kind of disposition is another way of telling Mr. Market, "Frankly don't care what you're doing...I'm going to own a portfolio of disruptive technologies and businesses with potential for big returns. And also, relax and quit being so manic." This, for the record, is our strategy as a financial publisher. We have no idea what will happen as the world wakes up from a hangover from one large leveraged boom, although we know what SHOULD happen. But we have tried to build a team of analysts - Alex, Kris, Murray, and Greg - who have their own ideas, their own expertise, and their own plan. We don't know who's right and they don't always agree. But they always make us think. By the way, if you replied to our Super request yesterday, thank you very much! The inbox had several dozen thoughtful letters and offers. It's going to take us a few days to review them. So please be patient. But thanks again. It will be good to have someone on-board who can write about Superannuation. We'll be back on Monday with more from the world of finance. But that will it for today. Friday is the day we write a weekly e-mail update for subscribers to Australian Wealth Gameplan. And with mixed signals about whether China's property sector is headed toward collapse or just slower growth, there's a fair bit of work to do! Until next week. Dan Denning |

| Posted: 08 Jul 2010 04:51 PM PDT By David Galland Via Casey's Daily Dispatch I Smell A Vat In past editions of this service, I’ve advocated tuning your personal radar to pick up early indications that the government is taking an active interest in gold. Especially when that interest revolves around terrorists or tax evaders, two popular bogeymen these days. It was, therefore, with more than a little concern that I read an article in our Ed Steer’s Gold & Silver Daily service yesterday on an item slid into the legislation authorizing the government takeover of health care. Here’s a snip from Ed’s letter…

According to the author of the article Ed references, the rationale for the new regulations is that the taxocrats believe that people conducting off-book trading in precious metals are chiseling them out of $17 billion in lost revenue annually. The net result, however, will be that the government will soon know who’s got the gold. Can’t a person just keep their gold purchases under $600? With the price of gold heading higher, that will increasingly require buying smaller-denomination bullion coins – which typically carry a higher premium. More importantly, a large body of case law gives the government license to charge people for “structuring” – i.e., taking active measures to get around a particular law. Thus, two $500 gold purchases could be construed as active evasion and carry additional penalties. Looking to get a better handle on this matter, our own Jeff Clark of Casey’s Gold & Resource Report – a must-have at just $39 a year – contacted Andy Schectman of the coin dealer Miles Franklin to get his quick take. Here it is…

Continuing our mini-investigation, we reached out to another well-informed source who confirmed that the new regs would apply to all businesses. For example, under the new regime a plumber who does work for you in excess of the $600 threshold would be required to file a 1099 report. That being the case, I have to think that Andy’s got it right – the implications of this move transcend just the precious metals. Rather, this is a deliberate step in the direction of implementing a VAT – once the government has everyone reporting essentially every transaction, taking the next step is a snap. So what are the odds that the movement to have this clause repealed will succeed? In my opinion, given the sheer quantity of new regulations embedded in the new health care legislation, most of which is equally wrong-headed, the administration and its allies are certain to take a hard line about making changes. Simply, once the hard shell of the legislation is cracked open, great swaths of the thing will be subject to being picked apart. I ran that opinion by Don Grove, our man in Washington, and he responded by sending across the following… David, This from Tom Coburn this morning: Jun 08 2010 Drs. Coburn and Barrasso: Congress Should Repeal and Replace Health Law That Will Harm Seniors and Our Future (WASHINGTON, D.C.) - Physicians and U.S. Senators Tom Coburn (R-OK) and John Barrasso (R-WY) released the following statement today regarding how the new health law will affect Americans. “The American people have rejected this plan because they see it not as a series of milestones, but millstones that will trap seniors and future generations in failing programs before drowning them in debt. No amount of rebate checks will plug Medicare's $38 trillion funding gap. In fact, this new law will undermine Medicare even further by cutting benefits rather than waste, increasing premiums, reducing access and rationing care," Dr. Coburn said. "If the President really wants to cut waste, fraud and abuse in America's healthcare system, he'll cancel his misleading multi-million-dollar PR campaign about the new health care law. Instead of selling a bad law, the White House should focus on actually fixing America's health care system. The fact is that the President's new law cuts Medicare, raises costs, kills jobs and burdens seniors' grandchildren with more debt. We need to repeal this new law and replace it with health care reform that helps all Americans," Dr. Barrasso said. I will admit that I did not search the massive tome that is Obamacare for “gold,” “silver,” or “coins,” and even if I had, I would have missed this provision that impacts such transactions. When the government is this desperate to squeeze money out of citizens, it is already well into diminishing returns. This level of busy work does not come without a crippling price. People will rebel and simply not comply. They can’t. It’s impractical. Many will probably not even know they are not complying. Congressman Steve King (R-IA) introduced legislation, a discharge petition, that will completely repeal Obamacare. The brief text of his bill H.R. 4972 “To repeal the Patient Protection and Affordable Care Act” follows:

King said:

H.R.4972 has 95 cosponsors. Rep. Tom Price (R-GA) is circulating a request that members support King’s discharge petition. 74 representatives have signed Price’s request. If a majority sign, Pelosi will have to bring King’s bill to the floor for an up-or-down vote. 218 signatures are needed to force a vote on the House floor. 20 senators have cosponsored Senator Jim DeMint’s S. 3152, the Obamacare repeal bill in the Senate. DeMint’s bill is even shorter: “The Patient Protection and Affordable Care Act, and the amendments made by that Act, are repealed.” DeMint said: “I will continue to work to gain support for full repeal in the Senate, so that together with the efforts in the House, we can save health care freedom for all Americans. ObamaCare is built on a flawed foundation of government-run healthcare and it must be overturned in its entirety.” These efforts for complete repeal would of course encompass Section 9006 of Obamacare imposing the $600 1099s. Meanwhile, Dan Lungren’s (R-CA) HR 5141, the Small Business Paperwork Mandate Elimination Act, has 91 cosponsors and attacks the problem with surgical precision. His bill reads: “Section 9006 of the Patient Protection and Affordable Care Act, and the amendments made thereby, are hereby repealed; and the Internal Revenue Code of 1986 shall be applied as if such section, and amendments, had never been enacted.” I would not write off repeal. As Nancy Pelosi said, “We have to pass the [health care] bill so that you can find out what is in it.” Now it’s passed, and we’re finding out more by the day and don’t like what we find. Regards, Don Clearly, the battle is joined – but, unlike Don, I hold out little hope that any of these attempts at repeal will succeed. The Democrats know this is their Maginot Line. If Obamacare unwinds, then their already dismal chances of holding power after the November elections become dark, indeed. Further, the latest polls show that the health care legislation is gaining popularity and is now approaching a majority. As time passes and November approaches, I think the legislation’s popularity will grow as more and more people decide they want something approaching “free” medical, a want that becomes ever more acute as the economy struggles and unemployment continues to rise. In other words, deep political trenches are being dug on the battlefield of nationalized health care – and the Democrats hold the political high ground, making a retreat unlikely. Back on the specific issue of setting the stage for a VAT, even politicians on the Republicrat side of the aisle are talking about the need for a national sales tax. Get ready for it, it’s coming. Meanwhile, if you are a physical-gold investor in these United States and would like to prepare… a few thoughts:

Since we’re on the topic of gold, I wanted to share an interesting snippet from an interview with James Rickards that ran on the Institutional Risk Analytics site. Russia, Gold & Spies For those of you not familiar with James Rickards, he is a financial consultant who has received a lot of coverage lately for his view that the Russians will be the first sovereign state to pull the trigger on a gold-backed currency. In this interview with Institutional Risk Analytics, he adds some detail on that contention.

You can read the entire interview here. There is a global horse race going on right now. Among the leading contenders are: Totalitarianism, Freedom, Regulation, Taxation, Individualism, Collectivism, Militarism, and Revolution. While the betting is now solidly against Freedom and Individualism, it is too early to rule them out of the race. Not with a growing number of people starting to understand the challenges faced by horses weighed down by the deadweight of the governments on their back. In what is a rare and hopeful sign out of the UK – a nation that is notable for a societal script that has, until just recently, run parallel to that of George Orwell’s 1984 – the new government has launched a well-conceived web site that invites the public to nominate old laws that should be struck from the book. Here’s an excerpt on the topic from an article that ran on the Metro.co.uk site…

Be sure to check out the site. If the Brits keep this up – they have also recently announced some pretty decent cuts to government spending – and if the people don’t chase the new team out of office or take to the streets in mass protests, then the British pound, and stocks, might make a good contrarian bet. Given the poor state that government’s finances are now in, I’m not sure I’d make that bet anytime real soon – but it’s worth watching. And on that positive note, I’ll say farewell for the day… thanking you for reading, and for passing along this service to others, if you think it would be of benefit to them. h/t Adam |

| Julian Phillips: BIS swap shows gold is back as money Posted: 08 Jul 2010 03:39 PM PDT 11:35p ET Thursday, July 8, 2010 Dear Friend of GATA and Gold: To Gold Forecaster editor Julian Phillips, the massive gold swap undertaken (but not really announced) by the Bank for International Settlements signifies at least that gold is back as money at the highest levels of the world financial system. Of course GATA would argue that gold never surrendered that role but rather has suffered decades of camouflage by both central banking and the mainstream financial media. Phillips' new commentary is headlined "Gold Is Back as Money! The BIS 382-Tonne Gold Swap -- Good or Bad for Gold and Why?" and you can find it at GoldSeek here: http://news.goldseek.com/GoldForecaster/1278723600.php CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| Posted: 08 Jul 2010 02:52 PM PDT Today's Lipper/AMG fund flow data confirmed the ICI data disclosed earlier: in the week ended July 7, in which stocks have rallied by who knows how many percent - nobody without Gallium Arsenide logic gates really keeps track of the market anymore, equities saw outflows of $11.6 billion. We'll repeat it because it bears repeating: stocks have surged as mutual funds have seen one of their biggest weekly outflows in 2010. Will someone with a Ph.D. from a reputable institution please explain that one to us. Furthermore, HY fund lows saw yet another exodus, this time of $166 million, following last week's $322 million. On the other hand, things in IG land are back to normal: after seeing their first outflow in 69 weeks last week for a tiny slip of $32 million, investors are back to dumping all their money in investment grade corporates, with inflows of $896 million. And most notably, money market funds saw their biggest inflow in 2010, at $18.5 billion, following last week's outflow of $11.6 billion. So yes, money was actively being allocated to cash yet somehow the powers that be managed to ramp the computerized stock market farce that is the Dow by something like 500 points in 4 days. Whatever. Will the three blind mute retarded monkeys who actually still have any faith left in our ridonculously manipulated market please follow all the other lemmings over the cliff, not forget to pay Goldman Sachs the $200 suicide fee, and shut the light on their way out. Here are some other thoughts from BofA:

And some pretty charts and tables. |

| CNBC Europe interviews Hinde Capital's Davies on gold paper risk Posted: 08 Jul 2010 02:51 PM PDT 10:52p ET Thursday, July 8, 2010 Dear Friend of GATA and Gold: On Tuesday CNBC Europe gave nine minutes to Ben Davies, CEO of Hinde Capital in London, to explain how the exchange-traded funds for gold and the so-called physical gold market are relying on paper gold rather than real metal, how London metals trader Andrew Maguire documented a metals market manipulation to the U.S. Commodity Futures Trading Commission, and how governments want precious metals prices suppressed. As you may recall, Davies lately has been doing heroic work to spread the word of gold price suppression with an appearance on CNBC Europe in May (http://www.gata.org/node/8683) and a report published in June (http://www.gata.org/node/8738). Davies' latest appearance on CNBC Europe is headlined "Potential Gold Bubble Forming?" and you can watch it at the CNBC Internet site here: http://www.cnbc.com/id/15840232/?video=1538347357&lay=1 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| Posted: 08 Jul 2010 02:50 PM PDT So what do you think? Can gold take another little plunk down to 1175? Why sure. Is there less risk now than at 1250 with the gold herd on full lather? Why sure. Will gold rally hard? Who cares? Balance and patience as the D Boys get the limelight. |

| Posted: 08 Jul 2010 02:48 PM PDT

Do you ever hear me pump the gold sector? Do you ever hear me pound the table? No, I clearly state (as clear as riddles can be |

| Posted: 08 Jul 2010 01:37 PM PDT |

| Posted: 08 Jul 2010 01:22 PM PDT Dear Friends, Gold is headed to $1650 and beyond. All your concerns in retrospect will be seen to have been concerns caused by manufactured noise. Time and time again you have seen this. Time and time again gold will not be stopped. Nothing has changed. Nothing has been rescued. The can that is being kicked daily down the path is going to turn around and bite the kickers. Gold is the only insurance. Regards, Federal Budget Deficit Hits $1 Trillion For 1st 9 Months Of FY'10 WASHINGTON -(Dow Jones)- The federal budget deficit for the first nine months of the 2010 fiscal year was just over $1 trillion, the Congressional Budget Office reported Wednesday. The shortfall, reflecting $2.6 trillion in outlays for the first three quarters and $1.6 trillion in receipts, narrowed slightly compared with the same point in fiscal 2009. Receipts were 0.5% higher for the period compared to the first three quarters of 2009, CBO said in its monthly budget review. The rise in revenues was a result of increased corporate tax collections, due to improving economic conditions, and a shift by the Federal Reserve to higher- yielding investments. But individual income and payroll tax receipts were down 4% over the nine- month period, suggesting that wages and salaries have not improved to the extent that corporate profits have. |

| Posted: 08 Jul 2010 01:15 PM PDT |

| Fed to GSEs – Put it on the Balance Sheet! Posted: 08 Jul 2010 12:59 PM PDT The June Federal Reserve Quarterly Mortgages Outstanding report contains some interesting information. I’m not quite sure what to make of it.

|

| “Myths” Paul Krugman Does Not Want To Talk About Posted: 08 Jul 2010 12:56 PM PDT Jim Sinclair's Commentary Gold is headed to and through $1650. Greg Hunter points out a major and present reason why.

Dear CIGAs, I have been telling you for months there is going to be a double dip in the economy. Nobel Prize Winning economist Paul Krugman also thinks the economy is so bad we need to keep on stimulating the economy. In a New York Times Op-Ed piece last week, Krugman said, ". . . somehow it has become conventional wisdom that now is the time to slash spending, despite the fact that the world's major economies remain deeply depressed." In short, cut backs, or austerity, is not what the economy needs right now. (Click here for the complete NYT Op-Ed from Krugman.) In a nutshell, Mr. Krugman thinks America will do no harm in the short term if the U.S. government prints money to prop up the economy until it can stand on its own. He thinks it is a myth to believe in "invisible bond vigilantes" who financially attack countries with sky high debt. Krugman wrote, "Bond vigilantes are investors who pull the plug on governments they perceive as unable or unwilling to pay their debts. Now there's no question that countries can suffer crises of confidence (see Greece, debt of). But what the advocates of austerity claim is that (a) the bond vigilantes are about to attack America, and (b) spending anything more on stimulus will set them off. What reason do we have to believe that any of this is true? Yes, America has long-run budget problems, but what we do on stimulus over the next couple of years has almost no bearing on our ability to deal with these long-run problems." What evidence does Krugman give that America can keep printing money until things get better? Interest rates on government debt are staying low. For example, the 10 year Treasury is paying around 3%. Krugman said, "Far from fleeing U.S. government debt, investors evidently see it as their safest bet in a stumbling economy. Yet the advocates of austerity still assure us that bond vigilantes will attack any day now if we don't slash spending immediately." What Krugman glosses over is the government has spent trillions keeping rates down and the economy going. The Fed has bought at least $1.25 trillion in mortgage backed securities with money printed out of thin air. There has been "quantitative easing" (code for money printing) to the tune of at least $300 billion to buy, what else, government debt. Congress has raised the debt ceiling to more than $14 trillion. That helped fund an $862 billion stimulus plan and a $700 billion TARP bailout for the banks. (Part of TARP has been paid back, but taxpayers are still owed around $296 billion.) Now, the Fed is considering ways to head off another plunge in the economy. A recent Telegraph UK story said, "Fed watchers say Mr. Bernanke and his close allies at the Board in Washingtonare worried by signs that the US recovery is running out of steam. . . .Key members of the five-man Board are quietly mulling a fresh burst of asset purchases, if necessary by pushing the Fed's balance sheet from $2.4 trillion . . .to uncharted levels of $5 trillion." (Click here for the complete Telegraph UK story.) There is also evidence the government is buying its own debt from hedge fund manager Eric Sprott. In December of 2009, Sprott took a hard look at who was buying Treasuries. Sprott discovered a sector the Treasury Department calls "Households" that bought $528 billion in government debt by the third quarter of 2009. The Sprott report said, "We must admit that we were surprised to discover that "Households" had bought so many Treasuries in 2009. They bought 35 times more government debt than they did in 2008. Given the financial condition of the average household in 2009, this makes little sense to us. With unemployment and foreclosures skyrocketing, who could afford to increase treasury investments to such a large degree? . . . -who is the Household Sector? They are a PHANTOM. They don't exist. They merely serve to balance the ledger in the Federal Reserve's Flow of Funds report." (Click here for the Sprott report.) In June of 2010, according to a CNN story, "Households" held nearly $800 billion in Treasuries. This "phantom" buying has people like Eric Sprott thinking, "It makes us wonder if it's all just a Ponzi scheme." Are "Households" and the world really flocking to the safety of Treasuries? Or is the Fed becoming a buyer of last resort? I think it is probably both. When the government buys its own debt, it creates false demand and artificially depresses interest rates. The idea that interest rates are being magically held down by extreme demand for our ballooning debt is the real myth. Krugman fails to recognize any downside of all this money printing. Maybe he has fallen victim to his own prejudices. As Krugman says in the beginning of his Op-Ed piece, "Much of what Serious People believe rests on prejudices, not analysis. And these prejudices are subject to fads and fashions. Milton Freidman, another Nobel Prize winner in economics, summed up the result of a loose monetary policy in his famous quote, "Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output." If the country takes the path Mr. Krugman is suggesting, we might not have a double dip in the economy, but we will have some very big inflation because you just can't have it both ways. |

| Must Read Reflections From GMO's Edward Chancellor On The Sovereign Debt Crisis Posted: 08 Jul 2010 12:41 PM PDT GMO's Edward Chancellor has written what is arguably the coup de grace of papers analyzing the dynamics of soveriegn default, together with the conditions required to succumb to this terminal condition, and is the functional equivalent of months of research and combing through all the recent literature on the topic. By initially highlighting the reasons for government default, which include i) a reversal of capital flows, ii) unwise lending, iii) excessive foreign debts, iv) a poor credit history, v) unproductive lending, vi) rollover risk, vii) weak revenues, and viii) rising interest rates, Chancellor presents the frame of reference in which every potential sovereign default situation should be analyzed. Chancellor also highlights several examples where a sovereign default was all but assured (Britain post the Napoleonic wars, Sweden in the 1990s), analyzes the opportunity cost of hyperinflating instead of pursuing default (when inflation is more convenient, when it resolves political conflicts, when avoiding inflation is a low priority, and when there has been a public credit flameout), and makes an exhaustive analysis using historical parallels of today's sovereign debt crisis. He summarizes the different view of the current sovereign fiasco as follows: i) this time is (really) different, ii) we are not all Greek, iii) posits that the US is not on the verge of a default, iv) that inflation is more likely than default. He concludes by analyzing potential tipping points, which in a herd mentality market such as ours, are all that matters, and suggests that Japan is precisely on the verge of such a tipping point. Yet his two most critical conclusions, in our opinion, are the following: "public finance is a ponzi scheme" and, for all those who are fans of Rosie's thesis that bonds are the go to investment currently, "Current yields on government bonds in most advanced economist are at very low levels. Under only one condition - that the world follows Japan's experience of prolonged deflation - do they offer any chance of a reasonable return. But this is not the only possible future. For other outcomes, long-dated government bonds offer a limited upside with a potentially uncapped downside. As investors, such asymmetric pay-off profiles don't appeal to us." Must read for everyone who wants to have an intelligent opinion on the matter.

h/t Adam |

| BIS and the Gold Swaps: Curiouser and Curiouser Posted: 08 Jul 2010 12:13 PM PDT |

| Central Banks Dumping Gold At A Torrid Pace Posted: 08 Jul 2010 11:43 AM PDT http://www.blacklistednews.com/news-9567-0-13-13--.html Quote: Central Banks Dumping Gold At A Torrid Pace Published on 07-07-2010 Email To Friend Print Version AddThis Social Bookmark Button Source: Business Insider This might explain, in part, the lack of a floor underneath gold prices right now. Central banks, which had been building up their positions, are now dumping it. WSJ: A little-noticed data point at the back of a 216-page report released last week by the BIS shows the international agency has taken 349 metric tons of gold since December—allowing central banks to raise a record $14 billion. The number surprised the market, which had assumed most central banks had retained their holdings of gold. Instead, the BIS data show that they have been entering these gold swaps—exchanging their gold with the BIS in return for cash, agreeing to repurchase the gold at a later date. As the article notes, this has been going on for awhile, and these transactions don't directly impact the open gold market, as it's not as though this is gold just flooding the market. Still, it signals a shift. It also signals a broader setback, perhaps, for advocates of gold-backed, hard currency. The bottom line is that central banks still want flexibility, even if that means potentially-debased "paper" currencies. Gold obviously has its rule, but in crunch time, and at the right price, it also gets sold. |

| Keep on Buying Toward the Low Side of The Trading Range, 17.85 and $1,185 Posted: 08 Jul 2010 11:31 AM PDT Gold Price Close Today : 1198.60Change: 3.80 or 0.3%Silver Price Close Today : 17.979Change 14.6 cents or 0.8%Platinum Price Close Today: 1518.00Change: -5.40 or -0.4%Palladium Price Close... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| Pensions Drinking Themselves Silly? Posted: 08 Jul 2010 11:16 AM PDT Norma Cohen of the FT reports, Unusual spirit to solve pension ills:

This story reminds me of when YRC Worldwide Inc. negotiated with the Teamsters union and its pension fund representatives to postpone cash payments into the plan and replace them with real estate collateral when the company was desperately trying to conserve cash. I think this is another bad idea and I'd be surprised if the Pensions Regulator approves the deal. Valuing the cash generation of a brand spirits is tough in the best of times, and the scheme's trustees could end up getting royally screwed if Diageo goes bankrupt, leaving taxpayers to foot the bill to make up for any shortfall. If pensions want to drink themselves silly, I suggest they focus on the liquidity tsunami driving risks assets higher. Forget Dubai, forget Greece, forget European sovereign debt woes and bank stress tests, forget the "imminent" collapse of China, forget perma bears like Bob Prechter warning you of the Dow plunging to 1,000, forget all of the doom & gloom. There is only one way we're going to get out of this mess. Pension reform, which is going on around the world, and more policies geared at reflating risk assets and introducing some inflation in the economic system. This means expect more stimulus, more quantitative easing (if needed), more volatility, but there is simply no other way to get out of this mess. We need pension reform, rising assets, and rising bond yields (to lower the present value of pension liabilities). Finally, please take the time to carefully read Tony & Rob Boeckh's investment letter, Asset Allocation Thoughts (click here to download). It's a must read letter which analyzes macro themes impacting asset allocation decisions. I wish pension funds used more common sense and less quantitative algorithms in structuring their asset allocation decisions. Oh well, if all else fails, pensions can continue drinking themselves silly, after all taxpayers will be left holding the bag. |

| Thursday ETF Roundup: UNG Sinks, MOO Rises Posted: 08 Jul 2010 10:52 AM PDT ETF Database submits: After trending higher for much of the day, equity markets surged in the final half hour to finish up by close to 1% on the day. The Dow led the major indexes with a gain of 1.2%, followed by a 0.9% gain for the S&P 500 and a slightly smaller gain for the Nasdaq. Commodity markets were relatively flat, as gold dropped by $2.80/oz. and oil jumped higher to finish just under $76/bbl. Markets surged on abating fears regarding the health of the American economy, as the government reported that initial claims for unemployment benefits fell last week to their lowest levels since early May. Claims fell to 454,000, better than the 465,000 forecast by economists polled by Thomson Reuters.

Complete Story » |

| Posted: 08 Jul 2010 10:47 AM PDT A few weeks ago it was speculated on Zero Hedge that the total losses experienced by the SNB as a result of ongoing currency interventions in Q2, were in the €8 billion ball park arena. Today, the FT picks up on this theme and reports that "the Swiss National Bank may have suffered paper losses of up to SFr10bn (€7.5bn) from huge interventions in the currency markets to restrain the value of the franc. The central bank is expected by market observers to report a big loss when it publishes second-quarter accounts in mid-August. Economists cannot make a precise forecast, as the SNB does not reveal when, or at what rates, it has sold francs and bought other currencies – mainly euros – in recent months. However, Martin Neff, chief economist of Credit Suisse, said: “It’s certain there will be a big loss.” And while that may not seem like a large number at first glance, as Bruce Krasting pointed out, "The 8.4b loss for the SNB would be equivalent to a $200 billion loss for the Fed. So actually this is a very big deal." Some more on this from the FT:

And, just like us, the FT is troubled by the complete lack of concern by the market in light of these adverse developments:

While we are confident that at the end of the day the price of gold will surely surge to cover a part of the paper losses, another issue, which we covered yesterday, is that as a result of over $500 billion in CHF denominated loans to Central and Eastern European countries (equivalent to the nominal GDP of the entire country) once loans start being unwound due to the massive strengthening in the swiss franc, leading to a vicious short covering cycle in the CHF, the adverse impact on the Swiss economy will be substantial. And yes, the central bank will have quite a bit to worry about then when coupled with the massive FX losses, the SNB has to turn on the same printing machinery made so popular in the US and the EU. A detailed recent discussion of this critical issue, which has been successfully swept under the rug for the time being, but which will soon be the topic de jour once attention shifts to Europe's strongest economy, can be found here. |

| Posted: 08 Jul 2010 10:18 AM PDT Reviving risk appetite weighs on gold price The COMEX August gold futures contract closed down $2.80 Thursday at $1196.10, trading between $1187.30 and $1208.20 July 8, p.m. excerpts: see full news, 24-hr newswire… July 8th's audio MarketMinute |

| Harrisburg Chapter 9 Imminent As Controller Tells Debtwire Bankruptcy Best Option Posted: 08 Jul 2010 10:16 AM PDT In what will likely be the first major municipal bankruptcy of the New Normal, Harrisburg is likely about to shut the gates. In an interview conducted with restructuring site Debtwire, the City's controller Dan Miller said Harrisburg would be better off filing for Chapter 9 than trying to restructuring finances under Act 47, the Financially Distressed Municipalities Act. He added that the latter has never solver the problems of any municipality that entered the program and the institution of a commuter tax in Harrisburg to avoid a Chapter 9 would be unworkable. On the other hands, "when reached for comment, long-time opponent of a Chapter 9 filing for the city, PA governor Ed Rendell said Harrisburg officials have not given him any indication that they will seek Chapter 9 protection. Rendell said he hopes that the city "will either sell assets or seek Act 47" before making a Chapter 9 filing." Alas, it appears the nearly bankrupt city has run out of options. Selling assets such as parking garages, the City Island amusement center and even the Harrisburg incinerator would leave the city in a worse financial situation than simply filing for Chapter 9, Miller countered. The city has not even received any interest from potential acquirers about the incinerator, according to Bill Cluk, a former Harrisburg Authority board member.

The actual date of the filing would likely be in under 2 months: "Miller said that Harrisburg's decision on whether to file Chapter 9 protection could arise as early as mid-September when the city has to make a $3.7 million bond payments." Yes, you read that right: in some universe parallel to that of the Fed, $3.7 million is still a large number. Considering that total US debt issuance each week is about $100 billion, it is very likely that the Treasury will likely step in on this "one isolated case", followed by another, and another, until the several hundred billion in state and local government underfunding is completely transferred to the Federal balance sheet as well. And why not - it is not like anyone has any illusions that the US can avoid defaulting at this point. |

| Legendary trader Gartman: The bear market is back Posted: 08 Jul 2010 09:54 AM PDT From Pragmatic Capitalism: Don’t be fooled by the near-term bullishness in equities. Dennis Gartman says a bear market is on the horizon. Gartman is very concerned that the Euro/Yen cross is forecasting... Read full article (with video)... More from Dennis Gartman: Must read: Dennis Gartman's rules of trading Legendary trader Gartman: The euro is "doomed" Legendary trader Gartman: Gold is about to go "parabolic" |

| Roubini, Bremmer and Whalen: Fixing the Financial System and Double Dipping Posted: 08 Jul 2010 09:53 AM PDT Edward Harrison submits: Below is the video of Chris Whalen of Institutional Risk Analytics, Nouriel Roubini and Ian Bremmer of the Eurasia Group giving their assessment of the financial system and the overall economy. The group was on CNBC earlier this week talking about the impact of the financial reform bill on the financial sector and the overall economy. It was mostly Whalen making calls during this video. It was interesting to see Chris Whalen doing macro because he comes at this from a banking perspective. He sees a double dip because of a lack of good earning assets for bankers to lend against and continued balance sheet pressure at lending institutions. His view is that the reform bill and its increased capital requirements will be negative for credit growth going forward. He also thinks that bringing all of the shadow banks under the fed’s regulatory umbrella will also be negative for credit growth because of shadow banks’ inexperience in dealing with regulators. He uses GE as an example. Complete Story » |

| The flow of cheap goods from China could be over soon Posted: 08 Jul 2010 09:46 AM PDT From Newsmax: Factory workers demanding better wages and working conditions are hastening the eventual end of an era of cheap costs that helped make southern coastal China the world's factory floor. A series of strikes over the past two months have been a rude wakeup call for the many foreign companies that depend on China's low costs to compete overseas, from makers of Christmas trees to manufacturers of gadgets like the iPad. Where once low-tech factories and scant wages were welcomed in a China eager to escape isolation and poverty, workers are now demanding... Read full article... More on China: China stock massacre continues Why China wants gold to plunge to $800 Today's entertainment: Chinese companies are hiring fake executives from the U.S. |

| Keeping the Genie in the Bottle Posted: 08 Jul 2010 09:45 AM PDT The fiat currency system is elegant and innovative. It has served us well, and might continue to do so if we could as a society change our culture so drastically that we might reign in credit growth — both public and private — responsibly. This would be the fairy-tale solution, one where the paper and electronic money supply behaves as if it were backed by gold, but actually isn't. But that restrictive system would institutionalize mild deflation as the deterrent against runaway credit. Instead, central bankers everywhere aspire to target inflation at a minimal nominal percentage, say 1 to 2 percent. Even so, saying and doing are two very different things. For starters, central bankers cannot address fiscal issues, and their pegging the cost of money at friendly levels encourages the government to pursue policies of cutting taxes and increasing spending simultaneously, which has been the practice since the Reagan era. Central bankers are also trusting the fox to guard the henhouse, for they accept that inflation is low despite considerable tinkering of methodology maintained by the U.S. Commerce Department that may understate it by 3 to 4 percent. However, the built-in bias towards inflation of asset values, such as real estate and stock prices, is not reflected in tame inflation yardsticks. A fiat money supply will forever encourage the amassing of debt by the private sector and the government alike. That, in turn, makes it only a matter of years before another financial calamity destroys the hopes of another generation. We may no longer operate fiat currencies as clumsily as did Massachusetts of 1690 or the French Assembly. Instead, we may be more like the Roman Empire, charted upon a course of slow decline, run by arrogant but physically fit potentates with exceptional or miserable oratorical skills, as you like. In an act of intellectual finesse, in November 2005 the Fed stopped publishing its estimate of M3, the broadest measure of money, at a time when its running three-month growth rate had probed solidly into double-digit territory. It gave up targeting money supply in the mid-1980s, this turning out to be a brief attempt to synthetically replicate a hard currency. Abandoning it succeeded then because (as in the 1920s) overinvestment in commodity production had paved the way for disinflation for years in the 1980s and 1990s. Fed actions also easily kept inflation at bay initially because the systemic growth of credit of today had not yet reached the extreme level where it is now (though some seers at that time thought that it had). In the last decade or so, the additions of tens of millions of low-wage workers from around the globe have lowered manufacturing costs. The bogey of merely restraining inflation was achieved easily. It enabled the banking system to print enormous sums of money, trillions of dollars, seemingly without consequence. But there is never a consequence felt while the bubble is inflating, because interest and principal can be financed by new debt. When debt reaches an untenable height relative to income or equity, the system becomes susceptible to the most minor cyclical downturn, with years of accumulated excess to be purged. What new developments might cause the supposedly $1 trillion to $2 trillion of popularly expected losses from the credit crisis to break the quarantine the Federal Reserve and the Treasury wishes to maintain to such an extent that they would overwhelm the economy? For starters, the savings-rich trading partners of the United States or other investors generally might demand our adoption of a hard currency of some sort. This they could accomplish by rapidly converting their holdings to gold (and not other currencies). It could be that another country, such as Switzerland, might seize the opportunity to operate a new high-level reserve currency. Or, countries such as Japan or the United States might suffer extreme economic contraction from the sharp appreciation of their currencies in the floating foreign exchange markets that, like the gold standard in the 1930s, they would reject the fiat-floating model of trade. Similar to the heresy of going off gold then, today these governments might likewise conclude that floating exchange rates are inexplicably hurting their terms of trade, forcing dramatically lower industrial production and employment relative to currencies that have depreciated greatly. If this were judged to be the root of the problem, governments would jump ship, something they could only do by reverting to gold. Even with a tarnished financial reputation, it is difficult to imagine that the United States would not still be able to capitalize upon its position as the strongest country in the world, even if it lost control of the world's reserve currency. If a consensus between the Fed and the Treasury could be reached, federally chartered banks might back the dollar with gold again, or the issuance of private currency could be authorized. It would be smartest for the Treasury to quietly buy in massive quantities of gold before such a strategy became known. Then like Roosevelt did, it could anchor the dollar at a higher level, perhaps $2,000 or $5,000 per ounce. But as the lessons of the interwar era taught us, this carries a substantial risk and as shown in calculations to follow these prices would excessively trigger gold reserve redemption. Now as then, the correct peg level is unknowable, and the success of such a measure is dependent upon the price central banks of foreign nations would establish (even if they opted for a gold exchange standard). The temptation would be for each country to lock in a trade advantage, which would force deflation and higher interest rates upon the United States, an unwanted outcome. A critical problem to be addressed before such a change could happen would be how to treat the national debt, and for that matter the even greater debt held by the U.S. citizenry. Regards, Bill Baker, [Editor's note: This passage is reprinted from William W. Baker's book, Endless Money: The Moral Hazards of Socialism, with the permission of John Wiley & Sons, Inc (©2010). You can get your own copy of his book here.] Keeping the Genie in the Bottle originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| *NEW* USAGOLD Video RoundTable Posted: 08 Jul 2010 09:43 AM PDT |

| Pre-Feasibility Study Has Minefinders Ready to Realize Value at La Bolsa Posted: 08 Jul 2010 09:36 AM PDT Canadian based gold producer, Minefinders Corp (MFN), released the results of an independently prepared pre-feasibility study (PFS) for its La Bolsa gold and silver project in Sonora, Mexico. The study contemplated conventional open pit mining methods at La Bolsa with low cost heap leach processing, considering two economic projections with both a ‘base case’ (effectively underestimating prices of gold and silver) and a ‘current spot’ case (as name suggests, considers gold and silver price at current spot level). Both of these cases came out with very buoyant results for the project, and accordingly the company expressed their pleasure at the results, indicating it is a significant step in bringing the deposit into production. Going forward, Minefinders are going to consider their options over the next few months to best realize value from the project. Complete Story » |

| Trader alert: Bearish sentiment is at extremes Posted: 08 Jul 2010 09:34 AM PDT From Trader's Narrative: Yesterday I wondered, “Where is the fear?” I guess it depends where you look! In that analysis I was looking at the options data and the fund flows in the leverage ETFs. Today we finally have some definitive signs that traders and investors are very concerned about further market declines. And it comes from sentiment surveys. From a contrarian point of view, this is... Read full article (with charts)... More on sentiment: Sentiment is indicating a market top The biggest threat to the stock market today A second "tech bubble" could be about to burst |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

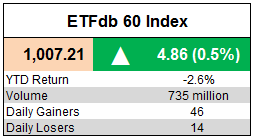

The ETFdb 60 Index, a benchmark measuring the performance of asset classes available through ETFs, climbed higher by 4.86 points, or 0.5%. Trading was relatively light, and winners outnumbered losers by more than three-to-one on the day.

The ETFdb 60 Index, a benchmark measuring the performance of asset classes available through ETFs, climbed higher by 4.86 points, or 0.5%. Trading was relatively light, and winners outnumbered losers by more than three-to-one on the day.

No comments:

Post a Comment