Gold World News Flash |

- International Forecaster July 2010 (#3) - Gold, Silver, Economy + More

- Save the Virgins!

- Irrational Gold Selling

- Jim?s Mailbox

- Daily Dispatch: Weekend Edition - July 10, 2010

- Q & a

- The Fed and the IMF say: "Print... or Die!"

- John Embry: U.S. dollar's collapse inevitable

- Oh Canada!

- Commodities Week: Oil and Copper Rise, Natural Gas Falls, Gold Unchanged

- Nature's Golden Standard Is Back

- Double Top for GLD?

- Is gold price manipulation becoming a respectable topic?

- 7 Reasons Why the Euro Is Rallying

- Video: Is Gold About To Rocket and SP500 Tank?

- This Past Week in Gold

- FT's Lex on gold and the BIS: Nothing to see here

- FT's Lex on gold and the BIS: Nothing to see here

- Historical Context: U.S. Oil Production and the Gulf of Mexico

- Thoughts on The Rich Strategically Defaulting and the Merits of Mortgage Cramdowns

- Shrimp Fisherman Exposed To BP Spill Bleeding From The Rectum

- Hedge funds look for a golden edge

- Remobilize Gold To Save The World Economy!

- Trading Week Outlook: July 12 - 16, 2010

- GoldSeek Radio interviews GATA Chairman Bill Murphy

- To King World News, Turk explains disbelief of chances for deflation

- The Financial Con Of The Decade Explained So Simply Even A Congressman Will Get It

- Will Public Austerity Cause Private Sector Paralysis?

- Not A Dip, But A Swan Dive Off Of Niagara Falls Into a Dry River Bed

- Jim's Mailbox

- A Key Piece in the Oil Leak Story: Two Sections of Drill Pipe Lodged in the Blowout Preventer

- Government Trying to Sweep Size of Oil Spill Under the Rug, Just As It Has Tried to Sweep the Economic Crisis, 9/11 and All Other Crises Under the Rug

- Seattle's "Actuarial Valuation" of City Pension Plan Sinks to 62% Funded; I Say It's Far Worse

- Futures positions make gold, silver very bullish again, Butler tells KWN

- More (Yellow) Ink for Bob Prechter

- An Unsustainable Welfare-State Rat Race

- Markets Make Fools of Us All

- The Central Bank Gold “Shell Game” Continues

| International Forecaster July 2010 (#3) - Gold, Silver, Economy + More Posted: 11 Jul 2010 04:30 AM PDT Markets in Europe will return to their historical tribal roots and live naturally. Most countries will be far more prepared to enter a new free market and be comfortable doing so. This would include decentralization and diversity. Getting rid of the euro and the EU will be the best thing in years that has happened to European countries. Needless to say, this won't go over very well with the New World Order crowd. They will again have been unsuccessful. |

| Posted: 11 Jul 2010 04:09 AM PDT Most prevalent among the modern belief systems is that shamans of government and high finance can, by virtue of their Harvard degrees and clearly advanced intellects, effectively manage large economies. The fallacy in this notion should be evident to everyone – here in the U.S., it's as simple as noting how everyone from the Fed chairman to almost all of the nation's political leaders and the best and brightest on Wall Street failed to anticipate the current crisis. Any way you slice it, the lot of them were caught as flatfooted as the crew and passengers on the last voyage of the Morro Castle. |

| Posted: 10 Jul 2010 10:00 PM PDT Last Monday I couldn't believe my eyes when I saw that the price of gold had dropped $44.20, which was weird enough since Kitco was showing the "Gold Price Change due to Weakening dollar" was up by $23.00, meaning gold should be going up thanks to the weakening dollar, while the "Gold Price Change due to Predominant Selling" was down a whopping $67.20! Wow! Selling! |

| Posted: 10 Jul 2010 07:50 PM PDT View the original post at jsmineset.com... July 10, 2010 01:54 PM Bullish Money Flows in Gold CIGA Eric Targeted, fearful headlines, intended to create an emotional response in gold, continue to hide inflows (outflow of short) into weakness from connected players. The operation is coordinated and professional. Gold London P.M Fixed and the Commercial Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest While connected players setup for the next advance, they do so while retail money is clearly on the wrong side of the trade (short). Gold London P.M Fixed and the Nonreportable Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest Are you ready for the unexpected? More…... |

| Daily Dispatch: Weekend Edition - July 10, 2010 Posted: 10 Jul 2010 07:50 PM PDT July 10, 2010 | www.CaseyResearch.com Weekend Edition Dear Reader, Welcome to the weekend edition of Casey's Daily Dispatch, a compilation of our favorite stories from the week for the time-stressed readers. Of course, if you want to read all of the Daily Dispatches from the week, you may do so in the archives at CaseyResearch.com. [B]I Smell a VAT[/B] In past editions of this service, I’ve advocated tuning your personal radar to pick up early indications that the government is taking an active interest in gold. Especially when that interest revolves around terrorists or tax evaders, two popular bogeymen these days. It was, therefore, with more than a little concern that I read an article in our Ed Steer’s Gold & Silver Daily service yesterday on an item slid into the legislation authorizing the government takeover of health care. Here’s a snip from Ed’s letter… [LIST] [*]The... |

| Posted: 10 Jul 2010 07:50 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 10, 2010 02:34 PM Please don’t send anymore questions until the next time we do this. Question - Hi Peter, Glad you are doing this. My question has to do with your last post; if you own gold and the Lonnie, you can sleep well a night. Well thanks to you I own gold and thanks to my birth place, I get paid in loonies. My question is; does it make sense to trade my loonies in for gold when they may appreciate just as much or more when measured against other currencies? How would you*invest if you*were paid in*loonies? Thanks, CJ, Saskatoon,Sk. Canada Answer- You still have the risk of gold going lower versus higher. While gold is no longer "cheap" in my book it still has another 75% -100% upside potential. I think the Loonie has 10%-15% upside potential and nil to the downside versus its terminally ill neighbor south of the border ... |

| The Fed and the IMF say: "Print... or Die!" Posted: 10 Jul 2010 07:50 PM PDT Gold pretty much traded sideways during the Far East session... with the gold's low of the day... such as it was... occurring shortly before 10:00 a.m. Hong Kong time on Friday morning... which translates into shortly before 9:00 p.m. Thursday evening in New York. Once the London a.m. gold fix was in [10:30 a.m. Friday morning] at the close of Hong Kong trading [6:30 p.m. Friday night]... gold was on the move upwards. And, once New York opened, there were several attempts at an up-side breakout... with the first occurring at precisely 9:00 a.m. Eastern. This met with huge selling... as did every subsequent rally attempt from there. Gold's high price for the day [$1,214.80 spot] appeared to be set at the vertical price spike that occurred at 10:20 a.m. Eastern time... shortly after the London p.m. gold fix was in for the day. Although that time could have been the fix itself. Gold volume was pretty decent... around 110,000 contracts net of everything. ... |

| John Embry: U.S. dollar's collapse inevitable Posted: 10 Jul 2010 07:50 PM PDT Sprott Asset Management's chief investment strategist, John Embry, writes for Investor's Digest of Canada that collapse of the U.S. dollar is almost inevitable and gold is about to reassert itself as money in a shocking way. The headline on Embry's commentary is "U.S. Dollar's Collapse Inevitable" and you can find it at the Sprott Asset Management Internet site here: http://www.sprott.com/Docs/InvestorsDigest/2010/MPLID_062510_pg204Emb.pd... ... |

| Posted: 10 Jul 2010 07:50 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! July 10, 2010 04:47 AM The one country in the western world I remain bullish on is Canada. While the rest of the western world did many things wrong, Canada did much right. I would own gold and the Loonie if i wanted to sleep good. Oh Canada! [url]http://www.grandich.com/[/url] grandich.com... |

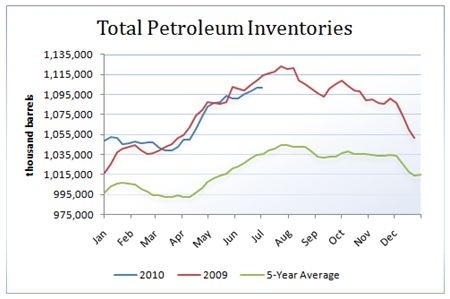

| Commodities Week: Oil and Copper Rise, Natural Gas Falls, Gold Unchanged Posted: 10 Jul 2010 07:08 PM PDT Sumit Roy submits: Energy Crude oil rose 4% this past week, as the commodity took its cues from rebounding equity markets. A fairly uneventful economic calendar allowed for a bit of optimism, with some traders speculating that any potential economic slowdown had already been priced in. Peak-to-trough, the S&P 500 fell nearly 17%, while oil fell 26.3% using the May 20th low and 18.4% using the more recent low put in this Tuesday. Another disappointing ISM figure, this time measuring the service sector, was released on Tuesday. The Index fell from 55.4 to 53.8 in June, which was below the 55 analyst consensus. Though oil and equities attempted to rally in spite of the poor reading, they gave up much of their gains by the end of the session. Indeed, oil settled slightly to the downside. Not to be discouraged, bargain hunters reentered the markets on Wednesday, with a lack of news enabling them to carry markets higher uninterrupted. The positive momentum carried into Thursday’s session, aided by a drop in initial U.S. jobless claims which fell to 454,000 from 475,000 in the prior week. The DOE crude oil inventory data was also released on Thursday, a day later than usual due to the 4th of July holiday. The government reported that in the week ending July 2, 2010, U.S. crude oil inventories decreased by 5 million barrels, gasoline inventories increased by 1.3 million barrels, distillate inventories increased 0.3 million barrels, and total petroleum inventories increased 0.4 million barrels. While the storage figures look bullish on the surface, they are very much in line with the 5-year average. Moreover, approximately 1.4 million barrels of production was shut-in last week due to Hurricane Alex; adjusting for the storm impact yields a 3.6 million barrel crude oil draw and 1.7 million barrels total petroleum build— figures which are slightly more bearish than the 5-year average.

Complete Story » |

| Nature's Golden Standard Is Back Posted: 10 Jul 2010 07:08 PM PDT Katy Delay submits: The news about gold swaps on the back pages of the Bank of International Settlements report made a few waves last week. Some immediately reacted in shock, claiming this is potential bad news for gold bugs because it augurs a future glut of gold supply on the market if and when the swaps fall through. Complete Story » |

| Posted: 10 Jul 2010 07:07 PM PDT Aigail Doolittle submits: Taking a look at the dollar, you know, it’s funny, but charts really never do lie. One month ago when the dollar index was close to $88, I wrote, Complete Story » |

| Is gold price manipulation becoming a respectable topic? Posted: 10 Jul 2010 07:00 PM PDT |

| 7 Reasons Why the Euro Is Rallying Posted: 10 Jul 2010 06:28 PM PDT Andrei Tratseuski submits: Since early-mid June, the euro has been in a fairly aggressive uptrend, after nearly six months of losses. Here are seven reasons why:

Disclosure: No Positions Complete Story » |

| Video: Is Gold About To Rocket and SP500 Tank? Posted: 10 Jul 2010 06:20 PM PDT Last week we saw stocks move sharply higher as traders started to cover their short position which added fuel to an already oversold market ready to bounce. Overall volume was not that strong on the move up which is a bearish sign. On Friday afternoon we saw the SP500 continue to move into the $1075 resistance level on very light volume. This indicates to me that buyers are not willing to pay these higher prices because the market has moved up so quickly and the fact that it's trading at a resistance level. I feel the market will gap higher on Monday just like we say on June 20/21 deep into a resistance level and the big money will short the pop sending it sharply lower. Gold looks to be shifting its momentum from a down trend to an uptrend. It's forming a reverse head & shoulders pattern which is shown in the video posted below. Here is My Technical Trading Report Video Covering:- Gold

iPhone/iPad Video Format: Click Here Weekend Conclusion:In short is looks as thought the market is at a critical pivot point. We could see prices stall out here and continue the down trend or see strong buying step in sending prices higher in the equities market. We need to wait and see what type of price action unfolds in the coming days. If you would like to receive my trading alerts and education checkout my service at www.FuturesTradingSignals.com or my swing trading service at www.TheGoldAndOilGuy.com Chris Vermeulen This posting includes an audio/video/photo media file: Download Now |

| Posted: 10 Jul 2010 06:16 PM PDT

Summary Disclosure |

| FT's Lex on gold and the BIS: Nothing to see here Posted: 10 Jul 2010 05:38 PM PDT 1:32a ET Sunday, July 11, 2010 Dear Friend of GATA and Gold: Last week's pseudonymous "Lex" column in the Financial Times about the recent strange and hidden gold swaps undertaken by the Bank for International Settlements was typical FT -- high-falutin' dismissiveness about gold that avoided any original research, avoided even seeking on-the-record comment from the source, the BIS itself. How does the BIS explain the transaction? Why was it hidden in a footnote in the bank's annual report rather than announced generally? Since commercial banks are not known for maintaining large gold reserves such as those in these swaps, where and how did the commercial banks get the gold? Were the commercial banks fronting somehow for central banks? What's really going on here? Though the failure of the BIS to announce the transaction demonstrated an intent to hide it, Lex and the FT won't ask about it. Rather than investigate, Lex and the FT have lined up in front of the story to shoo curious onlookers away, much like the bumbling detective played by Leslie Nielsen in the fireworks factory scene in the movie "The Naked Gun": http://www.youtube.com/watch?v=rSjK2Oqrgic When it comes to gold and central banking, the FT seems to see its job as being not so much to report the news as to suppress it. The "Lex" column, headlined "The Gold and the BIS," is appended. Now move along. Nothing to see here. CHRIS POWELL, Secretary/Treasurer * * * Gold and the BIS By Lex http://www.ft.com/cms/s/3/27c110da-89a3-11df-9ea6-00144feab49a.html What to make of the news that the central banks' central bank is sitting on 346 tonnes of gold? It is held via gold swaps between the Bank for International Settlements and European commercial banks that have collateralised loans with ingots. Such operations had been rare in recent years but took off in earnest just as the Greek sovereign debt crisis erupted -- so the news, contained in a note to the BIS' annual report, unleashed numerous conspiracy theories. Traders theorised that one or more of the bloc's central banks pawned gold to prop up their groaning banking systems. Spain's regional savings banks, or cajas, and Greek lenders, for example, have sucked in copious liquidity in recent months and are likely to need more. These transactions bore all the hallmarks of a furtive operation to assist a peripheral eurozone central bank unwilling to be seen pawning its reserves. But the swaps raised only $14 billion -- surely not enough for any such sweeping operations. Another tale was that the central banks used swaps for bridging finance pending drawdown of the eurozone rescue package; but again, the numbers fail to stack up. An even more far-fetched explanation has the International Monetary Fund selling reserves to boost its own finances ahead of a bailout. The reality is almost certainly more prosaic, having more to do with the technicalities of the collateralised lending market than with the entry of a big new player. But the far-fetched theories still had a real-world consequence and put the skids under gold: prices slid back to late-May levels on the news. Ironic, really, since it is jitters about the eurozone debt crisis that had fuelled the precious metal's fabulous rise -- up 15 per cent from the start of the year to a nominal high of about $1,265 a troy ounce two weeks ago. ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| FT's Lex on gold and the BIS: Nothing to see here Posted: 10 Jul 2010 05:38 PM PDT 1:32a ET Sunday, July 11, 2010 Dear Friend of GATA and Gold: Last week's pseudonymous "Lex" column in the Financial Times about the recent strange and hidden gold swaps undertaken by the Bank for International Settlements was typical FT -- high-falutin' dismissiveness about gold that avoided any original research, avoided even seeking on-the-record comment from the source, the BIS itself. How does the BIS explain the transaction? Why was it hidden in a footnote in the bank's annual report rather than announced generally? Since commercial banks are not known for maintaining large gold reserves such as those in these swaps, where and how did the commercial banks get the gold? Were the commercial banks fronting somehow for central banks? What's really going on here? Though the failure of the BIS to announce the transaction demonstrated an intent to hide it, Lex and the FT won't ask about it. Rather than investigate, Lex and the FT have lined up in front of the story to shoo curious onlookers away, much like the bumbling detective played by Leslie Nielsen in the fireworks factory scene in the movie "The Naked Gun": http://www.youtube.com/watch?v=rSjK2Oqrgic When it comes to gold and central banking, the FT seems to see its job as being not so much to report the news as to suppress it. The "Lex" column, headlined "The Gold and the BIS," is appended. Now move along. Nothing to see here. CHRIS POWELL, Secretary/Treasurer * * * Gold and the BIS By Lex http://www.ft.com/cms/s/3/27c110da-89a3-11df-9ea6-00144feab49a.html What to make of the news that the central banks' central bank is sitting on 346 tonnes of gold? It is held via gold swaps between the Bank for International Settlements and European commercial banks that have collateralised loans with ingots. Such operations had been rare in recent years but took off in earnest just as the Greek sovereign debt crisis erupted -- so the news, contained in a note to the BIS' annual report, unleashed numerous conspiracy theories. Traders theorised that one or more of the bloc's central banks pawned gold to prop up their groaning banking systems. Spain's regional savings banks, or cajas, and Greek lenders, for example, have sucked in copious liquidity in recent months and are likely to need more. These transactions bore all the hallmarks of a furtive operation to assist a peripheral eurozone central bank unwilling to be seen pawning its reserves. But the swaps raised only $14 billion -- surely not enough for any such sweeping operations. Another tale was that the central banks used swaps for bridging finance pending drawdown of the eurozone rescue package; but again, the numbers fail to stack up. An even more far-fetched explanation has the International Monetary Fund selling reserves to boost its own finances ahead of a bailout. The reality is almost certainly more prosaic, having more to do with the technicalities of the collateralised lending market than with the entry of a big new player. But the far-fetched theories still had a real-world consequence and put the skids under gold: prices slid back to late-May levels on the news. Ironic, really, since it is jitters about the eurozone debt crisis that had fuelled the precious metal's fabulous rise -- up 15 per cent from the start of the year to a nominal high of about $1,265 a troy ounce two weeks ago. ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| Historical Context: U.S. Oil Production and the Gulf of Mexico Posted: 10 Jul 2010 05:37 PM PDT |

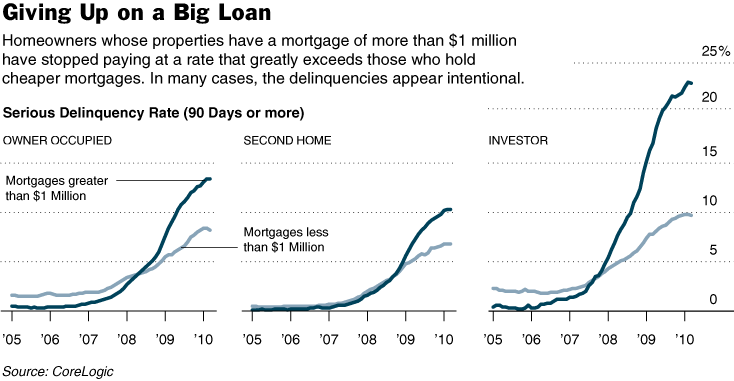

| Thoughts on The Rich Strategically Defaulting and the Merits of Mortgage Cramdowns Posted: 10 Jul 2010 05:29 PM PDT Rortybomb submits: The New York Times had an article on Biggest Defaulters on Mortgages Are the Rich with the above graph (click to enlarge). Yves Smith, Annie Lowrey and Tim Fernholz have more. Complete Story » |

| Shrimp Fisherman Exposed To BP Spill Bleeding From The Rectum Posted: 10 Jul 2010 05:03 PM PDT Shrimpers who were exposed to a mixture of oil and Corexit dispersant in the Gulf of Mexico suffered severe symptoms such as muscle spasms, heart palpitations, headaches that last for weeks and bleeding from the rectum, according to a marine toxicologist who issued the warning Friday on a cable news network. Dr. Susan Shaw, founder and director of the Marine Environmental Research Institute, said during a CNN broadcast that after personally diving the oil spill in late May, a "very fiery sore throat" plagued her from inhaling fumes coming off the water. Because she was covered from head to toe in a protective suit, Dr. Shaw was spared direct exposure. Shrimpers who had bare-skin contact with the mixture of oil and Corexit, she said, were not so lucky. During her segment with anchor Rick Sanchez, Dr. Shaw specified that stories shrimpers had told her were from when BP was deploying "the more toxic" Corexit 9527. BP has allegedly switched to Corexit 9500, which Dr. Shaw has also taken to task in a widely-publicized essay. More Here.. |

| Hedge funds look for a golden edge Posted: 10 Jul 2010 05:01 PM PDT By Sam Jones and Jack Farchy http://www.ft.com/cms/s/0/f1b2691e-8b80-11df-ab4d-00144feab49a.html Not so long ago hedge funds would send their most junior analysts to the seminars that bullion bankers hosted. Gold, for much of the past two decades, was the ultimate dreary asset -- of interest only to central bankers and miners. Now those same bankers are struggling to find time in their diaries to fit in many of the hedge fund industry's biggest players. In mid-town New York funds that employ barely 100 staff are finding themselves with gold holdings larger than those of some developed nations. ... Dispatch continues below ... ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Paulson & Co., one of the world's most successful hedge fund managers, denominates a third of its $33 billion of assets under management in a share class bolstered by huge positions in the gold market. In fact, gold is the firm's largest single position. The $3.4 billion stake in the SPDR Gold Trust, a listed US instrument backed by physical gold, equates to a greater tonnage of the metal than Australia holds. The reason for this is simple. Amid fears that the global economy could be heading for a double-dip recession -- and as financial markets continue to gyrate -- some hedge managers are becoming increasingly bullish about the precious metal. They are drawn to gold's traditional status as a store of value in crises. Paulson & Co. is the largest hedge fund to back gold, but others including Soros Fund Management, Tudor Investment Corp., Greenlight Capital, and Third Point, are now converts. "I have never been a gold bug," Paul Tudor Jones, founder and chairman of Tudor Investment, wrote last year. "It is just an asset that, like everything else in life, has its time and place. And now is that time." The consensus view among the funds is that the price of gold -- trading at around $1,200 an ounce -- will rise to well above $1,500 before it suffers any sizeable correction. This expectation of further prices rises (gold has increased four-fold since 2002) is based in part on the view that bullion provides a hedge against a rise in inflation. Some fund managers believe a sharp jump in inflation is unavoidable as a result of central banks' monetary easing policies, which have, in effect pumped more money into the economy. Historically, they say, the correlation between gold and inflation is hard to ignore. Over the past half century, the gold price has tracked the amount of money in the world -- measured broadly in terms of "M2" monetary supply -- fairly accurately, peaking at times of inflation, such as the mid-1970s and early 1980s. The hedge funds argue that the recent swelling of the monetary base will translate into a spike in monetary supply. When it does, gold prices will follow. "The number of funds who are exposed to gold has increased massively in the last three or four years," says Philip Klapwijk, executive chairman of GFMS, a precious metals consultancy. In common with other investors, hedge funds are also keen to hold their gold in physical form -- either as bars in a vault or as an investment in an exchange-traded fund backed by physical assets. Marcus Grubb, head of investment research at the World Gold Council, an industry-backed body, says the funds are looking to reduce counterparty risk in the event of another crisis: "In the past they might have been happy to just use futures strategy. Now they are looking to have physical investment." Many analysts agree that gold is likely to set fresh nominal all-time highs in the coming months. But they also see the weight of investment in the metal as a warning signal. Mr. Klapwijk says the rush to invest in the metal is not irrational. The motivation is fear about the debasement of paper currencies and of a panic in markets fuelled by any worsening in the eurozone debt crisis. But he also says that gold currently has "elements of a bubble." Jeffrey Currie, head of commodities research at Goldman Sachs, points to a strong historical inverse relationship between gold prices and real interest rates. The time to sell, he says, will be when the economy returns to normal. "It's pretty simple. Just stay long until real rates rise, likely driven by central banks taking liquidity out of the system." "Gold's appeal is clear in this zero-cost-of-carry environment," says Mr Klapwijk. "But what if real interest rates were at 3 per cent? In my view, investor interest would be a good deal lower." At that point, other supply and demand factors may come into play. As the price of gold has risen, jewellery buying in India, typically the backbone of gold consumption, has fallen sharply. So if investors bought gold at a slower rate or became net sellers, the price would probably fall until other sources of demand picked up the slack. "Don't forget: Gold is also a commodity with supply and demand fundamentals that can come into play," says Mr. Klapwijk. Some managers are all to aware of the distinction, and view with derision the bets of their colleagues in a market they know little about. "The problem is that people see it [gold] as both a commodity and a refuge," said the manager of one London-based macro hedge fund. "It is not really a liquid instrument and there's a danger that the market is being cornered." Paulson & Co. remains optimistic that the trade is not crowded. In a presentation to potential investors, salesmen from the firm point out that gold ETF holdings amount to $78.3 billion,a fraction of the $2,849 billion held by U.S. money market funds. The implication is that, with massive unconventional monetary easing under way, gold will become the ultimate store of value. Not all hedge funds are convinced, however. While a third of Paulson & Co.'s assets under management are denominated in gold, most of the holdings are those of its employees, including Mr. Paulson. In spite of having one of the best names in the business, Mr Paulson's dedicated gold fund, which has a capacity of up to $5 billion, has raised just $500 million. Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| Remobilize Gold To Save The World Economy! Posted: 10 Jul 2010 05:00 PM PDT |

| Trading Week Outlook: July 12 - 16, 2010 Posted: 10 Jul 2010 04:45 PM PDT All Things Forex submits: The U.S. corporate earnings, the uncertainty surrounding the stress tests of major EU banks, and a sequence of inflation, industrial activity and consumer spending data from some of the largest economies in the world will be the main factors driving the trends for equities, commodities and currencies in the busy week ahead. Complete Story » |

| GoldSeek Radio interviews GATA Chairman Bill Murphy Posted: 10 Jul 2010 04:29 PM PDT 12:30a ET Sunday, July 10, 2010 Dear Friend of GATA and Gold: GATA Chairman Bill Murphy was interviewed this week by Chris Waltzek of GoldSeek Radio. The interview is eight minutes long and starts at the 88:20 mark at GoldSeek Radio here: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| To King World News, Turk explains disbelief of chances for deflation Posted: 10 Jul 2010 03:44 PM PDT 11:45p ET Saturday, July 10, 2010 Dear Friend of GATA and Gold: Interviewed this week by Eric King of King World News, GoldMoney founder, Freemarket Gold & Money Report editor, and GATA consultant James Turk explains why he believes deflation with the U.S. dollar is impossible. Turk adds that he thinks gold's latest bottom is in. You can listen to the interview at the King World News Internet site here: http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/7/10_J... Meanwhile over at the Freemarket Gold & Money Report, Turk writes that his recent essay asserting that banks have begun to lend money again was in error because of bank accounting gimmickry. Turk's explanation is headlined "Banks Are Not Lending Again" and you can find it here: http://www.fgmr.com/banks-are-not-lending.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php |

| The Financial Con Of The Decade Explained So Simply Even A Congressman Will Get It Posted: 10 Jul 2010 02:13 PM PDT Sometimes, when chasing the bouncing ball of fraud and corruption on a daily basis, it is easy to lose sight of the forest for the millions of trees (all of which have a 150% LTV fourth-lien on them, underwritten by Goldman Sachs, which is short the shrubbery tranche). Luckily, Charles Hugh Smith, of oftwominds.com has taken the time to put it all into such simple and compelling terms, even corrupt North Carolina congressmen will not have the chance to plead stupidity after reading this. Of course, to those familiar with the work of Austrian economists, none of this will come as a surprise.

Charles' conclusion does not need further commentary as it is absolutely spot on:

As for part two of this epic con we are all living through, Charles explains as follows: The Con of the Decade (Part II) meshes neatly with the first Con of the Decade. Yesterday I described how the financial Plutocracy can transfer ownership of the Federal government's income stream via using the taxpayer's money to buy the debt that the taxpayers borrowed to bail out the Plutocracy.

The second part of the con is to mask much of the Power Elites' income streams behind tax shelters and other gaming-of-the-system so the advertised rate appears high to the peasantry but the effective rate paid on total income is much much lower. h/t Andrew |

| Will Public Austerity Cause Private Sector Paralysis? Posted: 10 Jul 2010 01:58 PM PDT As the whole world prepares for years of austerity, now that virtually everyone is aware that sovereign debt levels are unsustainable and the drive to push public sector deficits down has reached a crescendo, one question remains open: what will happen to the private sector deleveraging commenced the world over in the aftermath of the Lehman bankruptcy. Goldman's Jan Hatzius takes a look at this question, and reaches some very unpleasant conclusions. Looking at the closed system of the financial balances of the private sector, the public sector and the rest of the world (i.e., private balance + public balance = current account balance), in which the push for deleveraging in the private sector, the rush to ramp up exports, and the imminent Age of Austerity all signal an upcoming unprecedented "demand shortfall for the economy as a whole", Hatzius concludes gloomily that "given the forces of retrenchment and balance sheet repair, the risks to the growth of aggregate demand?as well as risk-free interest rates?over the medium term are tilted to the downside. Policymakers can provide some relief, but realistically will find it hard to neutralize the headwinds altogether" The economist also looks at what realist fiscal and monetary rabbits are left in the hat of the administration/Fed, and realizes that there is little that can be done to prevent what he dubs a "slowdown" and what everyone else whose bonus isn't tied in with perpetual growth assumptions, a new wave of the Second Great Depression. First, Jan observes the dynamics of the current economic cycle. In case anyone is still confused about it, here is his summation in a nutshell: "Relative to the start of the recession, the level of employment payrolls is now about 8% lower than in the median cycle of the 1954-1982 period. Scaled to the current level of the labor force, this is a shortfall of roughly 10 million jobs. The size of this gap reflects two unusual features of the current cycle? an unusually deep recession and an unusually weak recovery." We recommend the following refresher course in one of the basic laws of economics, which the Obama administration, try hard as it might, will not be able to get the Supreme Court's repeal vote.

Hatzius then muses on what the possible responses to this imminent economic contraction are, on either the fiscal or the monetary side, and to the chagrin of Keynesianites, finds no feasible options.

Jan's conclusion is brief and to the point: the days of deluding ourselves things are getting better, are rapidly coming to an end.

|

| Not A Dip, But A Swan Dive Off Of Niagara Falls Into a Dry River Bed Posted: 10 Jul 2010 12:13 PM PDT I was sitting here trying to find a way to wrap up the week and then, like a bolt of lightning, an idea hit me. Gold expert Jim Sinclair sent me this story: "Federal Budget Deficit Hits $1 Trillion For 1st 9 Months Of FY'10." The story said, "The shortfall, reflecting $2.6 trillion in outlays for the first three quarters and $1.6 trillion in receipts, narrowed slightly compared with the same point in fiscal 2009." So where did the "shortfall" come from? Try the more that 8 million who lost their jobs. The story went on to say, ". . . individual income and payroll tax receipts were down 4% over the nine-month period, suggesting that wages and salaries have not improved to the extent that corporate profits have." Corporate profits have "improved" because they laid-off all those workers!! (Click here for the entire Dow Jones Newswires story) Sinclair says, "Nothing has changed. Nothing has been rescued. The can that is being kicked daily down the path is going to turn around and bite the kickers. Gold is the only insurance." When things get bad enough, there will be more stimulus cash put into the economy and more bank bailouts. Sinclair is like legendary football quarterback Joe Montana–never bet against either of them. More Here.. This posting includes an audio/video/photo media file: Download Now |

| Posted: 10 Jul 2010 09:54 AM PDT Bullish Money Flows in Gold Targeted, fearful headlines, intended to create an emotional response in gold, continue to hide inflows (outflow of short) into weakness from connected players. The operation is coordinated and professional. Gold London P.M Fixed and the Commercial Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest While connected players setup for the next advance, they do so while retail money is clearly on the wrong side of the trade (short). Gold London P.M Fixed and the Nonreportable Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest Are you ready for the unexpected? |

| A Key Piece in the Oil Leak Story: Two Sections of Drill Pipe Lodged in the Blowout Preventer Posted: 10 Jul 2010 09:43 AM PDT On June 30th, I noted that the Department of Energy had found that there were two section of drilling pipe lodge in the blowout preventer. Yesterday, the Times-Picayune gave an update on this story, which includes competing interpretations about where the second section came from and what that means for the relief wells:

The source of the second segment is key to determining the condition of the oil well beneath the seafloor. If Simmons and Bea are proven right, drilling the relief wells will be a lot more challenging.

The second section of drill pipe is key to the oil leak story for another reason. As the Times-Picayune notes, it has contributed to problems in securely capping the leak from the point where it's leaking so that more oil can be captured:

Finally, the two sections of drill pipe are important because they may have been one of the reasons that the blowout preventer failed in the first place.

Even if it turns out that this is one of the causes of the BOP's failure, it might not be the only cause.

|

| Posted: 10 Jul 2010 09:21 AM PDT As I previously pointed out, the Gulf oil spill is very similar to 9/11, because - in both cases - the responders helping with rescue and clean up were getting sick ... but were told they don't need any safety gear. And see this. In addition, the government is keeping scientists away from "ground zero" of the oil spill and - for that reason - scientists cannot accurately measure the size of the oil spill. BP has also tried to cover up its blunders by lowballing spill estimates, keeping reporters out of areas hardest hit by the oil (and see this, this, this and this) and threatening to arrest them if they try to take pictures (and see this), hiding dead birds and other sealife, and using dispersants to hide the amount of spilled oil (the dispersants are only worsening the damage caused by the spill). The government is complicit in all of these cover-ups. Indeed, the Obama administration has made it a felony to get near enough to oiled wildlife and beaches to film them. Similarly, the official 9/11 investigators were themselves largely denied funding, access to the site and the evidence contained there, or even access to such basic information as the blueprints for the world trade center. Indeed, just as the government and BP have consistently underestimated the amount of oil gushing out of the Gulf, the blueprints for the World Trade Center are still to this day being withheld from reporters and the public, and the government agency in charge of the investigation has grossly mischaracterized the structure of the buildings. How are we supposed to improve building safety regulations if the blueprints are still being hidden from engineers and scientists investigating the collapse of world trade center buildings 1, 2 and 7 on September 11th? Moreover, as I previously pointed out:

Of course, the government's response to the economic crisis, torture, the anthrax attacks, and just about every other crisis has been the same: try to sweep it under the rug. It almost seems as if the main activity of government these days is trying to cover up criminal negligence and fraud ... instead of actually solving problems, firing - let alone convicting - the folks who caused the problems, or changing things enough to prevent future crises. |

| Seattle's "Actuarial Valuation" of City Pension Plan Sinks to 62% Funded; I Say It's Far Worse Posted: 10 Jul 2010 08:21 AM PDT Michael Shedlock submits: A new Seattle report says the city will have to increase pension contributions to keep its plan solvent. Please consider Seattle's retirement investments plunge deeply.

Complete Story » |

| Futures positions make gold, silver very bullish again, Butler tells KWN Posted: 10 Jul 2010 08:00 AM PDT 4p ET Saturday, July 10, 2010 Dear Friend of GATA and Gold (and Silver): Silver market analyst Ted Butler tells King World News' Eric King that the latest futures market commitment of traders reports are strongly bullish for gold and silver now that the manipulative commercial traders covered unusually large short positions last week. You can listen to the interview at the King World News Internet site here: http://www.kingworldnews.com/kingworldnews/Broadcast_Gold+/Entries/2010/... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Resources Expects Positive Cash Flow from Blackdome, On May 18, 2010, Sona Resources Corp. (TSXV: SYS, Frankfurt: QS7) announced the release of a preliminary economic assessment for gold production at its flagship Blackdome and Elizabeth properties in British Columbia. Sona Executive Chairman Nick Ferris says: "We view this as a baseline scenario for gold production. The project is highly sensitive to the price of gold. A conservative valuation of gold at $1,093 per ounce would result in a pre-tax cash flow of $54 million. The assessment indicates that underground mining at the two sites would recover 183,600 ounces of gold and 62,500 ounces of silver. Permitting and infrastructure are already in place for processing ore at the Blackdome mill, with a 200-tonne per day throughput over an eight-year mine life. Our near-term goal is to continue aggressive exploration at Elizabeth and develop a million-plus-ounce gold resource, commencing production in 2013." For complete information on Sona Resources Corp. please visit: www.SonaResources.com A Canadian gold opportunity ready for growth |

| More (Yellow) Ink for Bob Prechter Posted: 10 Jul 2010 07:39 AM PDT After getting a renewal notice for my Wall Street Journal subscription that was about four times as much as what I'd paid in recent years, it wasn't too hard a decision to let it lapse (honestly, what did they expect?). By the looks of the comments for Jason Zweig's article this weekend that features fear-mongerer Bob Prechter, you'd think that I'm not the only reader who is no longer a paying subscriber and that the ink is running a little yellow at the WSJ.

Yeah, and gold will never go over $400 as Prechter famously wrote early in the last decade. Damien Hoffman over at Wall Street Cheat Sheet had the far superior Prechter column this week when he asked, Is Elliott Wave Theory High Priest Robert Prechter Certifiably Insane? |

| An Unsustainable Welfare-State Rat Race Posted: 10 Jul 2010 07:15 AM PDT Like a rat on its exercise wheel, the White House keeps on spinning though new spending program ideas without ever determining a finish line. Basically, how to pay for them. If the Obama administration decides to step off the spending wheel too late it's likely to end up with a no-win situation similar to the options pictured below.

An Unsustainable Welfare-State Rat Race originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Posted: 10 Jul 2010 07:06 AM PDT As the Dow Jones Industrial Average advanced further above 10,000 yesterday, gold slipped back below $1,200 an ounce. We are not exactly sure what we think about the stock market's resurgence – or about gold's retreat – but we are pretty sure what we do NOT think. We do not think stocks have vaulted into a new bullish trend; nor do we think gold has slumped into a new bearish trend. Rather, the recent moves feel like short-term, counter-trend noise. This noise might last a few weeks, but we would not mistake it for music. That said, the financial markets could not care less what we say. The financial markets do not even care what Alan Greenspan or Abby Joseph Cohen say. In fact, the financial markets seem to delight in making fools out of sages. For more than a decade, the markets have made a fool out of the conventional "wisdom" that stocks are for buying and holding. During the last eleven and a half years, for example, the S&P 500 Index has delivered a total return of exactly zero. The markets have also made a fool out of the conventional wisdom that gold is a barbarous relic – a monetary artifact. During the identical eleven and a half-year period when stocks were busy doing nothing, the gold price quadrupled! Despite these shockingly contrary investment results, the conventional wisdom remains almost as foolish as ever. Gold is still nothing more than a "trading vehicle," according to Wall Street's professional sages, and stocks are still the greatest investment asset ever devised by Man. We would not dare to argue with the sages (they are sages after all), but we would point out that economic systems are as susceptible to entropy as natural systems. In other words, economies sometimes breakdown, either partially or completely. In the natural realm, the Second Law of Thermodynamics asserts that systems tend toward greater entropy, or disorder. In the economic realm, a similar principal pertains, except that the agents of entropy usually go by the title of "Senator," "Treasury Secretary" or "Federal Reserve Chairman." Here in the American economic system, private enterprises are doing their darnedest to prosper. But at the same time, public institutions are doing their darnedest to roadblock the paths to prosperity. In the name of "stimulating the economy," the Senators are ramping up taxation and deficit-spending, while the Treasury Secretaries are handing out taxpayer money to their friends on Wall Street, without ever asking for the taxpayers' permission. In the midst of the resulting entropy, what's a Federal Reserve Chairman to do? He didn't authorize the hundred-billion-dollar bailouts and he didn't vote for the trillion-dollar budget deficits. Nevertheless, he's the one who's supposed to clean up the mess. He's the one who's supposed to devise and direct a monetary policy that counteracts the ill effects of our nation's reckless fiscal policy. Can't be done. America is spending trillions of dollars it does not have. She is promising to spend tens of trillions more over the next few years. She won't have that money either. But Ben Bernanke has it…and we expect him to spend it. As economic conditions worsen – or fail to improve – and as America's fiscal condition deteriorates, Helicopter Ben is likely to fly to the rescue with a variety of "policy responses" that will all amount to the same thing: dollar-printing. We don't blame Ben. What else can he do? He did not create the mess and no mortal can clean it up. But a printing press might help…at least for a while. We don't make the rules, dear reader; we just try to remember them. And as we remember that economic systems tend toward randomness, we should also remember not to forgot to buy some gold along the way. "I am bullish on gold," declares Rick Rule, a serially successful investor in gold mining companies. "I'm bearish on social promises, and as a consequence, bearish on currencies. I suspect that in the near term gold will do well, because it won't go down. Then gold will start to do well because people will perceive it as going up, rather than merely holding its own in terms of purchasing power. "I came of age in investing in the '70s – a great gold bull market," Rule continues. "Beginning about 1978, when gold began its hyperbolic rise, it was going up from both 'greed buyers' and 'fear buyers.' I'm a fear buyer of gold; I buy it as catastrophe insurance. What happened at the beginning of 1978 was that the fear buyers would buy it, creating momentum that caused the greed buyers to step in. "The uptick then reinforced the fear of the fear buyers, and there was this sort of 'stereo buying' in gold that caused a true hysteria – taking the gold price from $400 to the $850 blow-off. It wouldn't surprise me to see the same set of circumstances take place in the next two or three years." It's hard to say whether fear or greed or "stereo buying" is driving the demand for US Gold Eagles. But whatever the primum movens, demand for all types of gold coinage is soaring. The US Mint's authorized dealers ordered 97,000 US Gold Eagles in June. That's down from May's stratospheric figure, but still one of the strongest months this year. That's also an impressive quantity when you consider that June was the first month this year the Mint offered fractional (half-ounce, quarter-ounce, and one-tenth ounce) Eagles. Sales of Silver Eagles topped three million – the fourth time that's happened this year. (It happened only once in 2009.) Therefore, based on sales for the first half of the year, total sales for 2010 should set another record…easily.

If precious metals prices continue climbing, as Rick Rule expects, the buyers of bullion coins would have plenty of opportunities to pat themselves on the back. Eric Fry Markets Make Fools of Us All originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| The Central Bank Gold “Shell Game” Continues Posted: 10 Jul 2010 07:04 AM PDT We recently reported the Bank for International Settlements (BIS) has been accepting gold like a "pawn shop" for central banks, but the BIS has since changed its tune. It emailed The Wall Street Journal to say the 346 tonnes of gold it has added to its vaults belong to commercial banks and not to central banks. Sure, anything's possible… yet this version of events seems unlikely, and we'll explain why below. For reference, the gold holdings-related content in question comes from page 171 of the June 2010 BIS Annual Report: "Included in 'Gold bars held at central banks' is SDR 8,160.1 million (346 tonnes) (2009: nil) of gold, which the Bank held in connection with gold swap operations, under which the Bank exchanges currencies for physical gold. The Bank has an obligation to return the gold at the end of the contract." This was initially interpreted by The Wall Street Journal as reflecting an increase in gold swaps from central banks looking for cash. However, the WSJ has since corrected itself to say it reflects only gold loaned to the BIS by commercial banks, and not central banks. Today, an interesting potential explanation for the updated phrasing was offered up by gold forecaster Julian Phillips. From GoldSeek.com: "The Wall Street Journal informs us that the B.I.S. did these swaps with commercial banks. We know of no commercial bank that has 382 tonnes of gold on their books. It is likely then that should these commercial banks have been in the deal, they would have been acting for a central bank [or several over time] who wished to remain anonymous." Phillips provides one of the more palatable explanations for the BIS' language update. Commercial banks are largely dependent on income-generating assets and securities, and it doesn't make much sense for them to hold actual physical gold. Further, it does seem logical that a central bank "pawning" its gold would want to make the chain of custody as murky as possible, and involving a commercial bank is a sensible enough way of achieving that end. If it is true — that central banks are still behind this "biggest gold swap in history" — what's the significance of the transaction? Here's Phillips' take: "What is significant about this or these transactions is that gold is being used in international settlements after so many decades of being sidelined in the monetary system! The transaction itself confirms that gold is being used in international settlements, which is a dynamic confirmation of gold's return to the monetary system. "A 'Swap' might be the first desperate step in such a transaction with the swapping bank hoping to repay the foreign exchange, but should it fail, the B.I.S. would have to decide either to keep the gold on its books or to sell it. Again, keeping it on its books is part confirmation that gold is active again on the monetary system, a big boost by itself! Gold is back and alive in the monetary system!" Phillips sees this use of gold in international transactions as being even more important than recent increases in gold net purchasing by central banks. Not only are central banks adding to their stores of the yellow metal, but they are also putting the asset to work as a financial instrument. This story is bound to develop further, and we'll be here to report back as to exactly which shell this golden "pea" crawled out from under. You can also read more details in GoldSeek.com coverage of why gold is back as money. Best, Rocky Vega, The Central Bank Gold "Shell Game" Continues originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Earlier this month, in an interview that was widely circulated online, market analyst Robert Prechter predicted that the Dow Jones Industrial Average will fall below 1000 within the next six years. The Dow promptly surged back above 10000, but it is worth asking whether Mr. Prechter might be right anyway.

Earlier this month, in an interview that was widely circulated online, market analyst Robert Prechter predicted that the Dow Jones Industrial Average will fall below 1000 within the next six years. The Dow promptly surged back above 10000, but it is worth asking whether Mr. Prechter might be right anyway.

No comments:

Post a Comment