Gold World News Flash |

- Fannie Screws The Citizens Twice

- Too Many Advertisements for Gold?

- Suiting Up for a Post-Dollar World

- Daily Dispatch: The Lay of the Land

- Gold: A Bubble on the Verge of Bursting?

- Fed Credit, Inflation and the Idiots in the Middle

- How to Legally (and Easily) Hold Gold Offshore

- Jon Hykawy: REEs Explained

- Richard Karn: PM Rudd's Death Warrant—RSPT

- Jim?s Mailbox

- In The News Today

- Hourly Action In Gold From Trader Dan

- Banks "Dodged A Bullet"?

- A Strange Options Expiry

- US Double Dip Depression... Greece Sells Islands?

- BP's Eventual Bankruptcy Certain

- Creso Exploration's IPO and Drilling Success

- LGMR: Gold Seen "Stable in Summer Lull" as Yuan's "Dead-Cert" Rise Questioned

- AEP Chokes On His Neo-Fraudesian Beer

- BI Research on Continental Minerals

- Crude Traders Abstain from a Drop in Sentiment as US Data Tops a Slow Day for Event R

- Crude Oil Volatility Holds Steady, as Stock Volatility Soars; Gold Tries to Regain it

- Will We Have Inflation, Deflation, or Hyperinflation? Part 2

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Barely Lower on the Week

- Commodities Week: Oil and Copper Rally on China, Gold Regains its Footing

- Close But No Cigar!

- Bond Bubble?

- Gold Daily Chart: The Cup and Handle Is Now Fully Formed; Longer Term Projections

- Will The Gold Price Rise Short-Term?

- MUCH Higher Gold and Silver Prices are Coming - Buy, or be Left Behind

- Ben Bernanke: Party's Over We Need More Money

- Even Taxes are Pretty in Pink

- Barney Frank Brings Additional Unclarity On The FinReg Scam, Punts Again On All Fannie/Freddie Questions

- Bull/Bear Weekly Recap

- Health Care and Oil Industries Attacked by Zombies

- FRIDAY Market Excerpts

- Central Bankers expect gold to outperform equities, bonds, currencies – and oil

- Central Bankers expect gold to outperform equities, bonds, currencies – and oil

- Now China sources newly mined gold from the U.S.A.

- Daily ETF Roundup: VXX Falls, UNG Surges

- What's Bearish For Stocks Is Not Be Bearish For All Precious Metals...

- Banking Reform Pushing Financials Lower and Silver Higher

- Crisis In Romania: Constitutional Court Votes Pension Cuts Unconstitutional, IMF Loan In Jeopardy, Presidential Palace Stormed, CDS Blows Out

- Congress passes "diluted" financial reform bill

- Bove: Wall Street Wins, Main Street Loses

- Gold's Rise And The Dow's Fate

- EUR Shorts Return, As Commercial Gold Net Short Positions Hit All Time Record

- Shocking figures show California gov't workers are making unbelievably high salaries

- Bending to the Modern World

- Lawrence Williams: Is China manipulating gold UP?

| Fannie Screws The Citizens Twice Posted: 25 Jun 2010 07:16 PM PDT Market Ticker - Karl Denninger View original article June 23, 2010 12:08 PM First, Fannie Mae ran crooked books for years, got caught, ran insane risk models for years more (80:1 leverage anyone?), got caught again, the second time by the market and essentially forced the government to step in lest they default on over $3 trillion in paper sold to, in large part, the Chinese. Now, having screwed you, the taxpayer, through outright fraud and ridiculous risk-taking and being a prime architect of the housing bubble, they now propose to bend you over again: (Strike-outs original, italics mine.) [INDENT]WASHINGTON, DC — Fannie Mae (FNM/NYSE) announced today policy changes designed to encourage borrowers to work with their servicers and pursue alternatives to foreclosure designed to assrape anyone who does what banks and other commercial entities do every day - intentionally default when it suits them. Defaulting borrowers who walk-away and had the capacity to pay or did not com... |

| Too Many Advertisements for Gold? Posted: 25 Jun 2010 07:16 PM PDT Jordan Roy-Byrne, CMT The latest and most flaccid argument against Gold is the idea that the increase in advertisements for buying and selling Gold are an indication of a crowded market or public involvement. As I explained in an editorial last year, sentiment follows the trend most of the time. As a bull market matures, more and more people come onboard. Sentiment has to be bullish for a bull market to persist and this is most true in the later stages when the crowd arrives. One of the reasons the gold bull market has far more time and room to run is that people have bubble fatigue. With numerous bubbles blowing up in the last ten years, Wall St and the public are quick to declare anything a bubble despite their inability to understand and analyze sentiment. Hence, we hear asinine concerns about too many advertisements. Tell me; are bonds in a bubble only because Pimco is advertised around the clock on CNBC? Unlike these armchair analysts, we use a handful... |

| Suiting Up for a Post-Dollar World Posted: 25 Jun 2010 07:16 PM PDT [FONT=Arial,Helvetica,sans-serif][COLOR=#000000][FONT=Arial][COLOR=#000000]John Browne - Senior Market Strategist, Euro Pacific Capital. [/COLOR][/COLOR][/FONT] The global financial crisis is playing out like a slow-moving, highly predicable stage play. In the current scene, Western governments are caught between the demands of entitled welfare beneficiaries and the anxiety of bondholders who fear they will be stuck with the bill. As the crisis reaches an apex, prime ministers and presidents are forced into a Sophie's choice between social unrest and bankruptcy. But with the "Club Med" economies set to fall like dominoes, the US Treasury market is not yet acting the role we would have anticipated. Our argument has always been that the US benefits from its reserve-currency status, allowing it to accumulate unsustainable debts for an unusually long period without the immediate repercussions of inflation or higher borrowing costs. But this false sense of security m... |

| Daily Dispatch: The Lay of the Land Posted: 25 Jun 2010 07:16 PM PDT June 25, 2010 | www.CaseyResearch.com The Lay of the Land Dear Reader, I would like to kick off today’s missive by congratulating the House and Senate on reaching an agreement on the massive new financial regulations bill that’s all but certain to be passed next week. The details of the bill are readily available on any number of websites so I won’t cover that ground. Notably, in much the same way the hastily assembled and ill-advised Patriot Act launched the behemoth Homeland Security, the financial reform bill creates a massive new consumer protection agency with an annual budget of $850,000,000. Laughably, this new agency will be operated by the Fed, and its mandate will be “Protecting America’s Consumers.” But wait, isn’t that the job of the… The existing agency, it must be pointed out, runs a budget of over $250 million. Then there’s the billion dollars ... |

| Gold: A Bubble on the Verge of Bursting? Posted: 25 Jun 2010 07:16 PM PDT courtesy of DailyFX.com June 25, 2010 03:00 PM Gold has marched steadily higher over the past ten years, with only the reasons behind investors’ demand for the yellow metal changing along the way. Looking ahead however, mounting fundamental and technical evidence suggests that a sharp downturn lies around the corner. GOLD 6-MONTH FUNDAMENTAL FORECAST Real Gold Supply, Demand Pressure Prices Lower The trends in real demand look decidedly lackluster, with gold for the manufacture of jewelry as well for industrial and dental use clearly tracking lower (the former for over a decade and the latter for at least three years). Meanwhile, supply seems to be picking up. Indeed, mine production has snapped a multi-year downtrend with output rising for the first time in close to seven years. Further, gold scrap such as jewelry melted down for its metal content is on the rise as well. Reasonably enough, if real factors were the only forces driving the market, falling demand and ri... |

| Fed Credit, Inflation and the Idiots in the Middle Posted: 25 Jun 2010 07:16 PM PDT A whole series of alarms occurred after I got the news, although I lost the source, that "food stamp usage just soared to a new record high" of 40.2 million persons. This number is alarming in itself because it means that the economy is so bad that more and more hungry people cannot afford to even feed themselves, sort of like teenagers, but with hopefully better manners and dietary choices. And also alarming that the number of people needing government assistance to buy food "soared," which is probably a verb of some kind, which indicates action, which is a signal to me, a real Mogambo Action Hero (MAH) kind of guy, to spring into action with my awesome superhuman power to instantly perceive trends in even random data. Ergo, it made me shriek alarmingly "We're freaking doomed!" which alarmed the other diners in the restaurant. In terms of households, "18.5 million households receive benefits" which means little to me other than the fact that these needy people live in households o... |

| How to Legally (and Easily) Hold Gold Offshore Posted: 25 Jun 2010 07:16 PM PDT By Dr. Steve Sjuggerud Wednesday, June 16, 2010 I got some terrible news yesterday… My friend Glen Kirsch died. I was surprised to hear it… Just three weeks ago, Glen and I were chatting about gold and how to hold it offshore. I wanted his ideas, and I wanted the specifics. Glen, as always, delivered. Glen and his business partner Michael Checkan have been reliable contacts for me in the gold world since I started writing investment newsletters in the 1990s. They run a firm called Asset Strategies International and have helped pioneer a few interesting products, including one called the Perth Mint Certificate Program. I've known about Perth Mint Certificates for many years… I know they're a simple, safe way to hold gold. But I never actually thought of these certificates as legally owning gold outside the U.S. However, that's exactly what they are… and that makes them extremely interesting now. You see, the government really wants to ... |

| Posted: 25 Jun 2010 07:16 PM PDT Source: Brian Sylvester of The Gold Report 06/25/2010 Rare earth elements (REEs) are not all that rare. They are virtually everywhere—even in economic concentrations in safe jurisdictions, says Byron Capital Analyst Jon Hykawy. What's more, the prices for some high-demand metals derived from REE deposits continue to reach new heights, almost daily. These metals are essential to the manufacture of magnets used in hybrid and electric cars and other high-end "green" technology—a thriving market indeed. If that seems like a recipe for investment success, read what Jon has to say about the REE market in this exclusive interview with The Gold Report. It's complicated. Not one REE deposit to date comes without significant baggage. But there's still money to be made if you're willing to settle for a long-term relationship. The Gold Report: You cover the clean technology and alternative energy sector, which depends on constant supplies of rare earth elements or RE... |

| Richard Karn: PM Rudd's Death Warrant—RSPT Posted: 25 Jun 2010 07:16 PM PDT Source: Richard Karn and The Gold Report 06/25/2010 Is the Rudd removal a brilliant political ploy on the part of the Labour Party? Pushing back the September/October federal election they likely would've lost to April 2011 provides them ample time for damage control. But what about the significant, unintended consequence of the RSPT? In this Gold Report exclusive, Richard reveals "the market door has slammed on companies out until the matter is resolved." I was in Sydney yesterday arranging a mine site visit when the announcement was made that Julia Gillard would replace Kevin Rudd as the leader of the Labour Party and Prime Minister of Australia. I used the opportunity of being in Sydney to catch up with Nick Garling at Morning Star Gold, who was memorably outspoken about the Resource Super Profits Tax (RSPT) amounting to Rudd's "death warrant," as well as a variety of other managing directors. Their take on events, which, from what I'm reading largely reflects t... |

| Posted: 25 Jun 2010 07:16 PM PDT View the original post at jsmineset.com... June 25, 2010 08:00 AM Gold, The Formula and Illusion of Recovery CIGA Eric I know much of the media and many individuals have filed the structural deficit under "Who Care’s" and moved on. It is, nevertheless, very important to confidence in and fate of the U.S. dollar. Total revenues collects by the US government continue to lag devaluation in the US dollar. In other words, "real" or gold adjusted total revenues continue to collapse at an alarming rate. Real or Gold Adjusted Federal Total Receipts 12-Month Moving Average (TR12MA) AND Federal Total Receipts 12-Month Moving Average Year-over-Year Change (TW12MA12LN): While Jim’s formula illustrates an anemic bounce, gold’s unabated rise during its uptick is best described as the middle finger gesture to economic recovery illusion. US Federal Budget (Surplus or Deficit As A % of GDP, 12 Month Moving Average) and Gold London P.M. Fixed: Source: fms.tr... |

| Posted: 25 Jun 2010 07:16 PM PDT View the original post at jsmineset.com... June 25, 2010 08:09 AM Jim Sinclair’s Commentary 46 States and growing. There is more trouble in the United States than in the EU. The Formula has overrun the States. States of Crisis for 46 Governments Facing Greek-Style Deficits By Edward Robinson – Jun 25, 2010 Californians don't see much evidence that the worst economic contraction since the Great Depression is coming to an end. Unemployment was 12.4 percent in May, 2.7 percentage points higher than the national rate. Lawmakers gridlocked over how to close a $19 billion budget gap are weighing the termination of the main welfare program for 1.3 million poor families or borrowing more than $9 billion in the bond market. California, tied with Illinois for the lowest credit rating of any state, is diverting a rising portion of tax revenue to service debt, Bloomberg Markets magazine reports in its August issue. Far from rebounding, the Golden State, with a $1.8 tr... |

| Hourly Action In Gold From Trader Dan Posted: 25 Jun 2010 07:16 PM PDT View the original post at jsmineset.com... June 25, 2010 10:29 AM Dear CIGAs, I mentioned in one of my earlier posts this week that bulls would need a Herculean effort to blunt the effects of Monday's big downside reversal day. Guess what – they got exactly that! In one of the more remarkable displays of gritty determination and tenacity that the gold market has seen since it first began its decade long bull market, the longs have completely negated the bearish downside reversal day pattern that emerged on the charts after Monday's significant sell off from a new record high price. This simply does not happen very often, in any market for that matter, and has never occurred in gold since 2001. If you are a short, you have to be reeling in stunned disbelief. There are serious buyers at work in gold. This performance is not merely impressive (that is too mild of a word), it is stupendously rare! Again, at the risk of beating a dead horse, the technical action in gold is telling us... |

| Banks "Dodged A Bullet"? Posted: 25 Jun 2010 07:16 PM PDT Market Ticker - Karl Denninger View original article June 25, 2010 08:08 AM Hmmm..... [INDENT]June 25 (Bloomberg) -- Legislation to overhaul financial regulation will help curb risk-taking and boost capital buffers. What it won't do is fundamentally reshape Wall Street's biggest banks or prevent another crisis, analysts said. [/INDENT]Probably. The ink is not yet dry and there's no vote yet on exactly what this bill actually is and does. I'll be doing my usual analysis once I have an actual stable copy. But what I can tell from watching CSPAN until the wee hours, and following the process as closely as I reasonably can without crawling up Barney Frank's skirt, this is what we got: [LIST] [*]Banks will have to spin off SOME (but not the important parts) of their derivative operations. The parts they care about (and on which they make the most money) are not credit-default swaps, they're interest-rate and FX swaps. Those are pretty much left alone, and that s... |

| Posted: 25 Jun 2010 07:16 PM PDT For an options expiry day, it was about as different as they come. Gold set a double bottom just under $1,230 spot... with the absolute bottom coming at the Comex open at $1,227.50 spot. From that point, gold took off... hitting it's spike-high price of $1,249.60 spot about 11:15 a.m. Eastern time... 15 minutes after the London close. That was all the excitement for the day, as gold got sold off quietly going into the close. But, if you examine the chart below, you'll see that the rally did not go unopposed... as an obvious not-for-profit seller showed up three times during gold's rally... just to prevent the rally from gaining as much momentum as it was obviously capable of. 'Da boyz' were certainly after silver yesterday. The selling pressure began the moment that trading opened in London yesterday morning... with the absolute low [$18.18 spot] coming around 8:32 a.m. in New York. As Ted Butler said on the phone yesterday... they weren't even ... |

| US Double Dip Depression... Greece Sells Islands? Posted: 25 Jun 2010 07:16 PM PDT US Double Dip Depression Friday, June 25, 2010 – by Staff Report Ben Bernanke Ben Bernanke (left) needs fresh monetary blitz as US recovery falters ... Federal Reserve chairman Ben Bernanke is waging an epochal battle behind the scenes for control of US monetary policy, struggling to overcome resistance from regional Fed hawks for further possible stimulus to prevent a deflationary spiral. ... Fed watchers say Mr. Bernanke and his close allies at the Board in Washington are worried by signs that the US recovery is running out of steam. The ECRI leading indicator published by the Economic Cycle Research Institute has collapsed to a 45-week low of -5.7 in the most precipitous slide for half a century. Such a reading typically portends contraction within three months or so. Key members of the five-man Board are quietly mulling a fresh burst of asset purchases, if necessary by pushing the Fed's balance sheet from $2.4 trillion (£1.6 trillion) to unchart... |

| BP's Eventual Bankruptcy Certain Posted: 25 Jun 2010 07:16 PM PDT By James West MidasLetter.com Friday, June 25, 2010 There is no doubt that BP will not emerge from this oil spill disaster intact. Make no mistake – this is the fatal black swan event in BP's life that is going to take investors by the hundreds down with the ship. Its not going to happen immediately. Much like the slow initial fall and eventual breakneck pace of collapse of a giant tree, the giant oil leak is the event that will catalyze the fall of this far flung and storied company. Here's some food for thought in support of my prediction. I also caveat that statement with the possibility that a 'merger' or 'buyout' will be forced and negotiated out of public view to offset political carnage. Either way, shareholders and taxpayers alike will burn. What they're still touting as the 'worst environmental disaster in U.S. history' is quickly growing up into the worst environmental disaster in the history of humanity. With the unprecedented scale and scope of this ast... |

| Creso Exploration's IPO and Drilling Success Posted: 25 Jun 2010 07:16 PM PDT By Claire O'Connor and James West MidasLetter.com Friday, June 25, 2010 Fresh from the completion of their qualifying transaction and $4.6 million brokered financing on June 1st 2010, Creso Exploration Inc. (TSX.V: CXT), formerly Willowstar Capital Inc, is already making waves in mining friendly Ontario. The company's mineral rich Minto project, located half way between Timmins and Sudbury, is only 30 kilometers south-west of NorthGate Mineral Corp's (TSX.V: NXG) Young-Davidson gold deposit. The results from Creso's 2009 diamond drilling program are in, and they're good. Creso currently owns a very large land position of approximately 280 square kilometers in the Shining Tree Area of the Larder Mining Division in Ontario. Made up of a mix of wholly owned properties as well as claims with agreements to earn-in or to joint-venture, the Minto Pro... |

| LGMR: Gold Seen "Stable in Summer Lull" as Yuan's "Dead-Cert" Rise Questioned Posted: 25 Jun 2010 07:16 PM PDT London Gold Market Report from Adrian Ash BullionVault 07:50 ET, Fri 25 June Gold Seen "Stable in Summer Lull" as Yuan's "Dead-Cert" Rise Questioned THE PRICE OF WHOLESALE GOLD held onto Thursday's gains early in London on Friday, trading 0.8% below last week's record weekly finish as world stock markets slipped for the fourth day running. Commodities also held flat, as did silver prices, trading 2.6% down for the week at $18.71 per ounce. The US Dollar rose against the Pound, Yen and Euro – helping push the gold price in Euros back above €32,550 per kilo. But the Dollar was outpaced by the Chinese Yuan, meantime, which rose to a new record as the People's Bank set its daily fix 0.3% higher from Thursday. The PBoC announced its new "flexible" policy on Monday, a move widely seen as trying to deflect accusations of export-stealing at tomorrow's G20 summit of leading economies in Toronto. "Now that revaluation of the CNY has begun," says French ban... |

| AEP Chokes On His Neo-Fraudesian Beer Posted: 25 Jun 2010 07:16 PM PDT Market Ticker - Karl Denninger View original article June 25, 2010 06:19 AM There is nothing more amusing than watching the Neo-Fraudesian economists (that's what so-called "Keynesians" actually are) run into the wall of reality at 120 mph: [INDENT]Federal Reserve chairman Ben Bernanke is waging an epochal battle behind the scenes for control of US monetary policy, struggling to overcome resistance from regional Fed hawks for further possible stimulus to prevent a deflationary spiral. [/INDENT]Really? A "deflationary spiral"? Is that really deflation in your pocket or is it withdrawal and mean-reversion of the outrageous hyperinflationary credit policies of the previous 20 years that is FORCED when the scam runs its course and can't find any more participants for the Ponzi Scheme? Ambrose continues: [INDENT]Key members of the five-man Board are quietly mulling a fresh burst of asset purchases, if necessary by pushing the Fed's balance sheet from $2.4 trillion (£1.... |

| BI Research on Continental Minerals Posted: 25 Jun 2010 07:16 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 25, 2010 03:54 AM Further to my comment earlier this week on Continental Minerals (KMK-TSX-V $1.97) – I was sent this commentary from BI Research and believe it has some very worthy observations on KMK. CONTINENTAL MINERALS* (KMKCF $1.96 OTC BB, +45%); BI Rank = 9.1 – Strong Buy (604) 684-6365 BC [url]www.hdgold.com[/url] (Recommended 3/04) Continental Minerals, which I believe remains a juicy takeover target, is located in Tibetan China and has proven up 220 million tons of measured and indicated reserves in its high grade-porphyry copper-gold Xietongmen deposit grading 0.43% copper and 3.9 grams of gold per ton. This translates into 2 billion pounds of copper and 4.3 million ounces of* gold. In addition, Continental's Newtongmen deposit, a couple thousand feet away and drilled off more recently, sports another 2.8 billion lbs. of copper and 2.3 million ounces of gold plu... |

| Crude Traders Abstain from a Drop in Sentiment as US Data Tops a Slow Day for Event R Posted: 25 Jun 2010 07:16 PM PDT courtesy of DailyFX.com June 24, 2010 03:22 PM With a downshift in fundamental activity between Wednesday and Thursday; we would see a similar shift in the quality of price action for the energy market. At the floor of its rising trend channel and a notable pivot level around $75.50, the benchmark NYMEX crude oil futures contract has found a technical boundary to discourage undue momentum from building without a clear picture of how both risk appetite and economic activity will develop through the near future. Yesterday, both underlying price drivers were in flux. North American Commodity Update Commodities - Energy Crude Traders Abstain from a Drop in Sentiment as US Data Tops a Slow Day for Event Risk Crude Oil (LS NYMEX) - $76.21 // -$0.14 // -0.18% With a downshift in fundamental activity between Wednesday and Thursday; we would see a similar shift in the quality of price action for the energy market. At the floor of its rising trend channel and a notable pivot level ar... |

| Crude Oil Volatility Holds Steady, as Stock Volatility Soars; Gold Tries to Regain it Posted: 25 Jun 2010 07:16 PM PDT courtesy of DailyFX.com June 24, 2010 07:05 PM Crude oil has so far held above the key $75.50 level, but sinking stocks pose a challenge to this formidable 'double support.' Traders should look toward classic trading strategies when approaching gold. Commodities - Energy Crude Oil Volatility Holds Steady, as Stock Volatility Soars Crude Oil (WTI) $76.70 +$0.19 +0.25% In the face of plunging stock markets, crude oil managed to eke out a gain in Thursday’s session. We have been alluding to crude oil’s relative strength, but the commodity’s performance on Thursday was particularly impressive. This divergence was also displayed in volatility; the VIX, which represents implied volatility in nearby S&P 500 index options, soared close to 10%, while the same measure of volatility in oil inched up a little over 2%. Crude oil is clearly reluctant to go down, but more steep losses in stocks will surely spill over into oil, and thus caution is warr... |

| Will We Have Inflation, Deflation, or Hyperinflation? Part 2 Posted: 25 Jun 2010 04:00 PM PDT From The Daily Capitalist

Part 2 The Inflation Argument The argument for inflation rests on the money supply charts. The inflationists show various measures of money supply increasing, including the version used by Austrian theory economists, called True Money Supply (TMS)[1]: Note: The M1 chart shown in Part 1 more clearly shows the trend in the M1 money supply increase. Again, the YoY percentage change is more revealing: The inflationists also point to the Consumer Price Index (CPI) which shows price increases: The YoY rate of change of the CPI clearer: As the chart reveals, prices have been rising since mid-2009. Even the measure of Core CPI (CPI less energy and food, CPILFENS) appears to be rising: The inflationists would say that this effect of inflation, rising prices, is a classic measure that proves new money is hitting the economy and that has caused, among other things, prices to rise. The Deflation Argument The deflationists have a different take on the data. They point to theories by economist Steve Keen which states that first banks make loans, and then the Fed increases money supply to meet demand. According to Keen and Mish, money supply is created first by banks making loans, then by the Fed supplying the money, because you can’t increase money supply without getting it into the economy. If there is no lending the money supply remains unchanged. Thus it is a rise in credit that leads to money supply growth. Mish also argues that excess reserves don’t really exist; they are a fiction created by the Fed, a mere computer entry. If you consider all the loans made by lenders, and the actual or potential defaults of their loans, those losses would absorb all the “excess” reserves. Therefore, those “reserves” are more or less spoken for and don’t represent money for making new loans. Mish also believes that reserves aren’t the problem with banks; rather it is their shaky capital base. Lending is constrained by their lack of capital and financial instability rather than by reserves. The deflationists say that because the size and breadth of the crash in the real estate markets and related debt, the problem is too big for the Fed to handle. Until debt is deleveraged and banks and businesses repair their balance sheets, the Fed’s effort to increase the money supply is like pushing on the proverbial string. The result is that real estate asset prices are declining and that results in deflation. They say it is similar to what the Japanese experienced in the late ‘80s and ‘90s, when they experienced almost zero growth, no inflation, and declining asset values. Banks, they say, are not going to lend until this deleveraging occurs and businesses become solvent and creditworthy. The deflationists say that the current measures of prices are inaccurate because they don’t reflect the declining values of real estate. If real estate was factored in, then prices would be shown as declining. The only measure of real estate in the CPI computation is what is called the real estate rental equivalent which measures the rental value of homes rather than their asset value. They suggest that prices are indeed falling anyway if you look at Core CPI (CPI less energy and food) on a year-over-year percentage change basis: Obviously there is some evidence of declining prices as shown by this chart. Which is it: Inflation or Deflation? Let me suggest a way of looking at the problem. We understand that inflation or deflation is a monetary phenomenon, not just an increase or decrease in prices. And, in order to cause inflation new money must find its way into the economy. There are several ways the Fed can do that. The Fed can make cheap money available by lowering the interest rate on money it lends out, which increases money supply. Even with the Fed Funds rate at 0.18%, effectively zero, this doesn’t seem to be working. The Fed can make it easier for banks to lend. This seems to be a problem for the Fed right now. As we have seen previously, lending is way down, excess reserves are high, and the money multiplier has fallen dramatically. This hasn’t worked either. Yet money supply has been increasing despite the failure of these policies. There is another tool in the Fed’s arsenal called Open Market Operations (OMO) whereby it buys and sells securities with its primary dealers. For example, buying Treasury paper from dealers increases money supply and selling decreases money supply. Starting in January 2009, the Fed began a program of buying mortgage backed securities (MBS) issued by Fannie, Freddie, and Ginnie Mae. At its peak, they bought $1.25 trillion of these assets, pumping up money supply by that amount. The purpose was to get liquidity into the economy and try to revive credit and economic activity. Further it absorbed the risk of these “toxic” assets, relieving the former holders of their bad investment decisions. This form of money inflation does not have the impact of the money multiplier were those funds in the hands of bankers who would lend out the new money, but it does represent a substantial amount of new money injected into the system. This money infusion is being used by the very willing sellers of these toxic assets, the big investment banks or the investment banking operations of the big commercial banks, not so much for making loans, but for their own investment purposes; this money has been driving the financial markets. Deflationists vs. Inflationists vs. Modified Inflationists This is the point where the inflationists and deflationists part. The inflationists believe that the Fed can and will increase the money supply any time they wish through open market operations. The deflationists believe it doesn’t matter what the Fed will do because banks are not in a position to resume lending, thus counteracting the Fed’s attempts at increasing the money supply. I have a different take on this, but it is a bit complicated to explain. To try to put it in a nutshell:

I refer to my position as Modified Inflationism. Predictions and a Decision Tree Here is the problem in trying to forecast what will happen in the future: tell me what the Fed and the government will do. Remember the Freakonomics’ humorous take on forecasting:

Austrian types don’t believe that you can use econometric models to predict the future because such models are usually wrong. You can’t distill millions and millions of economic decisions down to a simple or even complex formula of human behavior because the data set is too vast to be useful. We believe you have to understand why individuals do things in the economy first before you can study data. These were some of the breakthroughs of the great economists Mises and Hayek. To figure out what the Fed might do involves a lot of probabilities. And that is my method of analysis: what are the probabilities that the Fed will do one thing rather than another when faced with different circumstances. It is much like constructing a decision tree to see where they can go. If X happens, then the Fed’s choices are A, B, and C. What are the consequences of each and what is more likely to happen. Stick with me. Tomorrow, Part 3. The double dip economy, the Fed's choices, and their fear of deflation. After Part 4, I will publish the entire article as one downloadable PDF. [1] The True Money Supply (TMS) was formulated by Murray Rothbard and represents the amount of money in the economy that is available for immediate use in exchange. It has been referred to in the past as the Austrian Money Supply, the Rothbard Money Supply and the True Money Supply. The benefits of TMS over conventional measures calculated by the Federal Reserve are that it counts only immediately available money for exchange and does not double count. MMMF shares are excluded from TMS precisely because they represent equity shares in a portfolio of highly liquid, short-term investments which must be sold in exchange for money before such shares can be redeemed. It includes: Currency Component of M1, Total Checkable Deposits, Savings Deposits, U.S. Government Demand Deposits and Note Balances, Demand Deposits Due to Foreign Commercial Banks, and Demand Deposits Due to Foreign Official Institutions. There are different takes on TMS. See http://mises.org/content/nofed/chart.aspx?series=TMS. |

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Barely Lower on the Week Posted: 25 Jun 2010 04:00 PM PDT Gold rose as much as $13.59 to as high as $1258.29 by early afternoon in New York before it fell back off a bit in the last hour of trade, but it still ended with a gain of 0.85% and ended just $1.35 from last Friday's all-time closing high. Silver climbed to as high as $19.13 before it also dropped back a bit, but it still ended with a gain of 2.19%. |

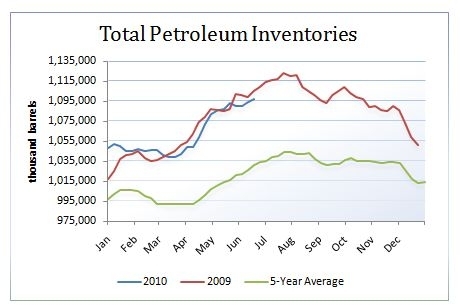

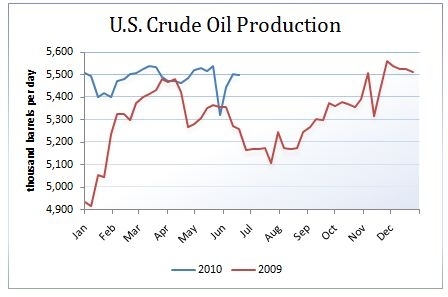

| Commodities Week: Oil and Copper Rally on China, Gold Regains its Footing Posted: 25 Jun 2010 03:19 PM PDT Sumit Roy submits: Energy Despite a down week in broad financial markets, crude oil advanced 2.2% in the period. Early on Monday, prices got a boost from news that China would allow more flexibility in the Yuan/Dollar exchange rate. Traders bid up risk assets, hoping that the move would be a step in the direction of correcting imbalances in the world economy. Moreover, the potential increased purchasing power of the Chinese currency was seen as a positive for commodity demand. As early as late Monday, however, the optimism over the China news gave way to renewed selling, as global economic concerns came back in focus. As the week progressed, weak economic releases out of the U.S—data on housing was downright ugly—kept the pressure on financial markets. The S&P 500 finished the week down 3.6%; the stock index logged only a single up session in the entire period. The dismal performance of stocks highlights just how impressive crude oil’s own performance was during the week. After the washout in May that sent oil prices as low as $64.24/barrel, the commodity has been on a steady upswing. Over the last three sessions, prices have successfully tested the trendline that defines that very upswing. The $75.50 level that corresponds to the trendline, is also former-resistance-turned-support, hence this ‘double support’ is looking like a tough nut to crack. Caution is warranted, however, for further steep losses in equities would surely spill over into crude oil eventually. On the upside, the psychological $80 level is the first level of resistance.  Taking a look at U.S. storage, the EIA reported that in the week ending June 18, crude oil inventories rose 2 million barrels, gasoline inventories fell 0.8 million barrels, distillate inventories rose 0.3 million barrels, and total petroleum inventories rose 2.7 million barrels.  U.S. petroleum inventories are now 6.4% above the 5-year average, down from 6.6% last week. U.S. crude oil production was flat week-over-week. Year-to-date, production is up 3.5% year-over-year. Output levels will be closely watched to see whether the situation in the Gulf of Mexico is having any impact.  After breaking above the level last week, natural gas fell back below $5/mmbtu this week, as prices sank 2.8%. The primary culprit for the latest move was once again weather, as forecasts are calling for a cool down in parts of the East and South going forward. Additionally, a tropical depression heading over the Yucatan peninsula currently, is expected to make its way up toward the Gulf Coast next week, which will have a dampening effect on cooling demand. Complete Story » |

| Posted: 25 Jun 2010 02:59 PM PDT Angela Charlton of the Boston Globe reports, French prime minister urges big cost-cutting:

Feeling the heat, French president Nicolas Sarkozy said cigars are out and perks will be cut ahead of austerity measures:

What are those French ministers smoking? Meanwhile, Reuters reports that the Greek government agreed on Friday the most radical shake-up of its pension system in decades to avert bankruptcy and satisfy foreign lenders despite fierce opposition at home: The reform cuts benefits, curbs widespread early retirement, increases the number of contribution years from 35-37 to 40 and raises women's retirement age from 60 to match men on 65. "We inherited a pension system which had collapsed and we are fixing it," Labour Minister Andreas Loverdos told a news conference after the cabinet approved the cuts. "It is our responsibility to save the country from bankruptcy." The ruling socialists face a battle over the reforms, agreed as part of a 110 billion euro ($147.6 billion) emergency loan package from the EU and IMF. Most voters oppose the reforms and a strike on June 29 will gauge the strength of public discontent as lawmakers start debating the bill. "The draft pension bill ... is slaughtering fundamental pension rights," public sector union ADEDY said in a statement. By contrast, the EU Commision in Brussels praised the overhaul as respecting the loan deal. "We welcome it as a major step towards improving the sustainability of public finances," spokesman Amadeu Altafaj Tardio said. The socialist party has 157 of 300 seats in parliament and the reform is likely to pass despite some criticism from its ranks. Analysts see the Greek pension reform as a test case. It goes beyond tax increases and public wage cuts to tackle a sector which epitomises many of the woes that have caused the country's downfall, including tax evasion, red tape, selective privileges and delayed reforms. And if you think things are bad in Greece and France, here comes Romania where protests are taking place over pension, wage cuts:

As you can see, the global pension war is spreading fast. Change is brutal and workers are angry. Who can blame them? They're seeing banksters get away with billions in bonuses and bailouts, and now that the pension Ponzi is running out of money, they're stuck having to work longer to make up for the shortfall. As for the capitalist ruling class pushing these reforms, they're all saying 'close but no cigar'. If Marx were alive today, he'd be pouring over pension legislation and pension documents, trying to understand how the financial capitalists have stolen trillions from common workers, engineering the greatest transfer of wealth in the history of mankind, and leaving them with massive debts in the form of pension IOUs. |

| Posted: 25 Jun 2010 02:36 PM PDT |

| Gold Daily Chart: The Cup and Handle Is Now Fully Formed; Longer Term Projections Posted: 25 Jun 2010 01:29 PM PDT |

| Will The Gold Price Rise Short-Term? Posted: 25 Jun 2010 01:00 PM PDT The G-8 & G-20 meetings are scheduled for this weekend and the press and observers are disappointed before they have even begun. Division between the U.S. approach to growth and sovereign debt containment and repayment and the European approach should be added to fears that sovereign debt cut backs will not be achieved in the end. |

| MUCH Higher Gold and Silver Prices are Coming - Buy, or be Left Behind Posted: 25 Jun 2010 11:46 AM PDT Gold Price Close Today : 1,255.80Gold Price Close June 11: 1,257.20Change: -1.40 or -0.1%Silver Price Close Today : 19.11Silver Price Close June 11 : 19.175Change -6.50 cents or -0.3%Platinum Price... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! |

| Ben Bernanke: Party's Over We Need More Money Posted: 25 Jun 2010 11:44 AM PDT (snippet) "We're heading towards a double-dip recession," said Chris Whalen, a former Fed official and now head of Institutional Risk Analystics. "The party is over from fiscal support. These hard-money men are fighting the last war: they don't recognise that money velocity has slowed and we are going into deflation. The only default option left is to crank up the printing presses again." Mr Bernanke is so worried about the chemistry of the Fed's voting body – the Federal Open Market Committee (FOMC) – that he has persuaded vice-chairman Don Kohn to delay retirement until Janet Yellen has been confirmed by the Senate to take over his post. Mr Kohn has been a key architect of the Fed's emergency policies. He was due to step down this week after 40 years at the institution, depriving Mr Bernanke of a formidable ally in policy circles. The Fed's statement this week shows growing doubts about the health of the recovery. Growth is no longer "strengthening": it is "proceeding". Financial conditions are now "less supportive" due to Europe's debt crisis. The subtle tweaks in language have been enough to set bond markets alight. The yield on 10-year Treasuries has fallen to 3.08pc, the lowest since the gloom of April 2009. Futures contracts have ruled out tightening until well into next year. |

| Posted: 25 Jun 2010 11:00 AM PDT A new PM likely means new policies, so we won't be too judgemental... yet. Instead, we will let her do the talking. But we don't know which quote to choose:

Even Taxes are Pretty in Pink Ken Henry has redefined himself as the personification of Political Risk. Uncertainty kills economic activity. There is nothing more uncertain than an academic turned bureaucrat with political influence. And speaking of rose coloured glasses, the Labour government has been criticised for its lack of real world experience. Cushy government jobs cover their CVs. But Ken Henry is different. He has no private sector experience at all, according to the Treasury website. So it's fair to say that Ken hasn't contributed to what Bill Bonner would call the "producing" sector of the economy. Instead, he has been toiling away in the parasite sector, living off other's taxes. That's why Henry has been so cordial about the Resource Super Profits Tax furore. It's all pink to him. While the RSPT has brought Labour into election losing territory, with marginal seats swinging enough to hit 6s, Ken has been quietly contemplating how he could make things worse. He managed to do so at a tax conference in Sydney. Yes, a tax conference.

Your editor's reaction to this was an unsavoury one. Deeply unsavoury. But the story only got horrifyingly worse. Displaying his inclinations, the essence of Henry's speech was him "complaining about the difficulty in converting academic ideas on tax into practical policy..." according to David Uren of The Australian. Poor Ken, can't get his rosy classroom dreams into legislation. But does Henry really mean what he said? Tax all company profits beyond the "risk free" yield of a Government bond? Dan reported some details on Tuesday. But the quotes need repeating:

So in Australia, the incentive is to decrease profits! And any clever entrepreneurs, take your idea elsewhere. Forcing the more productive, intelligent and resourceful people in the economy to bear the weight of those who should be going out of business is just stupid. That hasn't stopped countries from trying it. But the IMF points out that most countries abandon it. And what would happen to government revenue when the economy slows? Mr Political Risk has also decided to tell economists to "put down their weapons" and "back the Tax". This is where the rose coloured glasses come off.

It's no surprise that Henry finds disagreement inconvenient for his lofty ideas. But he goes on to criticize just having a debate on the issue! That's right, according to your Treasury Secretary, you shouldn't discuss the RSPT! In fact, your opinion has to be in accordance with government policy, for a while:

Presumably the "for a while" means "until the legislation is enacted". Once the law is passed, you can argue all you want... And the final development in this story is purely an amusing one. If you click on the link here, you get taken to an article entitled "Back the Tax, Henry Tells Economists". Only that isn't what the original title was. Here is the link in full: http://www.theage.com.au/business/keep-shtum-henry-tells-economists-20100621-ysek.html The key words there are "keep-shtum-henry-tells-economists". Stum (pronounced shtum) is the German word for "shut the hell up". The Daily Reckoning Australia would like to congratulate whoever came up with this title. And to whoever changed it, the Gestapo and Mr Henry would be proud. But all this hullabaloo could be about nothing after all:

Where exactly the Government does plan on implementing the tax remains unclear. Perhaps Germany? That would make it more popular down under. It seems Henry will have to stick to academic ideas for now. But with a former communist in charge, who knows? Julia might not even stop to think about the precious housing market, which Dan Denning reported has been hit by the RSPT as well. Lessons in political uncertainty One of the few places to be on par with Ken Henry's "uncertainty boom" is the USA. There, the President has put a six month moratorium on issuing deep water drilling permits, as well as calling for exploratory drilling to stop at 33 oil wells. But now "U.S. District Judge Feldman in a separate order today "immediately prohibited" the U.S. from enforcing the drilling moratorium, finding the offshore companies would otherwise incur "irreparable harm." Oops, irreparable harm! Six months would destroy the oil industry! But wait...

So they won't survive stopping, but won't start until they know whether they are going to go or not... Regardless, the American Petroleum Institute disagrees with Jindal:

But Jindal wasn't finished:

All this reminds your editor of a Beatles song. It probably wasn't about oil, but here goes:

As you know, what investment doesn't like is uncertainty. And, as evidenced by what you have just been singing, that is what it is getting.

So oil investment suffers. And that bodes ill for the broader highway economy of the USA. Another one bites the dust US bank failures continue at a rapid pace. Rapid pace being double that of last year. By the time you read this, the next couple of banks will be joining the 83 on the list so far for 2010. This news is easy to gloss over and laugh about. Depositors get bailed out by the US's insurance scheme anyway... But how did the US end up with such a mess of a banking system? Well, the answer is a long and drawn out one. No doubt you will know that regulation is to blame. But consider this: The safest banking system in history (for depositors) was when there was no regulation at all. Contract and criminal law was about it. There was no central bank and each bank printed as many of its own notes as it liked. Sounds ridiculous, right? So why did it disappear and how did the Americans get it so wrong? Find out more here. Why Greece? An update on Europe's tumour state is due. This article says it best:

We have a socialist in charge of the world's debt troubled country. Wonderful. No wonder Greek CDS spreads are supposedly at an all time high. And Greeks have picked up on their future:

Bummer. But who would have thought they would follow the (formerly) outrageous advice of a German politician and sell their islands? Government in action Hugo Chavez is doing his best to imitate the incompetence of western leaders. Sadly, he is also a genuine socialist, so when he stuffs up, it's big time. And he can't shift the blame onto the free market. Venezuelans Troops have been busy "administrating" the poor of their rice and powdered milk, which they had illegally bought at elevated prices. But it turns out that the food shortages aren't solely due to wealthy elites fuelling inflation and hoarding food (believe it or not):

Oh, is that what they were. The Greenspan Slam According to the former Federal Reserve Chairman, the buck may soon stop for the US government. Literally.

If the Chinese stick to their implied implications and abandon the currency peg, this would further decrease the demand for Treasuries. That's because the Chinese would be selling less Yuan to keep its value down. That means fewer dollars in their coffers to invest in treasuries. But why the deficits anyway? Keynesianism is out of fashion... again.

But Obama isn't listening:

Even the head of "Socialists International" has picked up on the need for austerity. When will Obama? When will he learn what Merkel (and Cameron) already know: "It's not about growth at any price, it's about sustainable" growth. But dissent within the Democratic Party is growing. And it's worth noting that the Dems can be even more concerned about budgets than rival Republicans. In response to out of control borrowing, they have decided not to pass a budget! (Not a joke.) Pretty soon, they will be following Romania's lead and asking for donations to pay down the debt. But nobody can surpass Maywood, California, which has fired all government employees (including the police). Monetary Ignorance Paul Krugman has provided his ever worthless two cents again:

This is infuriating. It was Paul Volker who rescued the US from its last inflationary bout specifically with the policies that Krugman demonises. He probably considers stagflation to be impossible, despite its occurrence just a few decades ago. (That's not a long time for an economist.) Correction Thanks to Raj and the other readers who pointed out my error in last week's edition:

Indeed, Raj and other readers were right to complain. A more accurate explanation would have been to say that the Federal Reserve is a private bank that has a monopoly power on money creation, granted by legislation. The question of who it is accountable to and who controls it is an open one. Thomas Jefferson said in 1802:

We have had the inflationary boom of the bubble years and the deflationary period is upon us. But Jefferson may not have foreseen just how good the central bankers would get at money printing... Until next week, Nickolai Hubble. |

| Posted: 25 Jun 2010 10:22 AM PDT In case you just can't get enough of of Barney Frank simply oozing truth, integrity and unbribable honesty (in other words, everything that defines the American Congressional way) in every interview he does, this Bloomberg TV clip is for you. It is also for everyone else who would rather not read the 2,000 pages of FinReg reform yet wants to get some sense if they will be sued next Monday for lifting a 5MM offer of UK CDS. Overall, Barney mumbles about this and that, discusses whether the bill will make banks less profitable (it won't), clarifies the 3% loophole for JPMorgan's investment in Highbridge, notes the surprising $19 billion bank levy, yet runs like a scolded schoolgirl the second Fannie and Freddie (also known as the one biggest disaster of his career, and the only thing he will be remembered for) are mentioned. "My Republican colleagues like to forget the fact that during the 12 years they controlled Congress, they did nothing about Fannie Mae and Freddie Mac. When the Democrats took power in 2007, we passed a bill that gave them the power to put them into conservatorship. Fannie Mae and Freddie Mac today are not what they were, thanks to a bill passed by a Democratic congress…They are in conservatorship. The notion that we haven't done anything is a lie, and they know that." The more important thing Barney, is that the American are fully aware that any pretense of reform coming from you is a lie, and they most certainly know that.

|

| Posted: 25 Jun 2010 10:03 AM PDT Submitted by UFormula of RCS Investments Bullish US Retail sales come in better than expected and the last two months were revised higher. It seems that many investors may be underestimating the strength of the consumer yet again. The average for both March and April showed an increase of 1.6%. Industrial production rose in April by the most in 3 months. Manufacturing continues to run strong as inventories continue to get replenished and business spending continues. Increases in consumer spending should signal continued gains in production as factories keep up with demand. With very low I/S ratios, any strong and sustainable increase in demand will surely translate directly to increase production and more jobs. The virtuous cycle may be on the verge of starting. US Trade numbers show increasing exports, which bodes well for the S&P500 as 45%+ of earnings come from abroad. Meanwhile the latest increase in imports had a lot to do with increased demand for actual goods and services instead of just oil, meaning that consumer demand is improving in the US, partly because of a stronger dollar. If global trade continues to rebound, this will be a strong help for an advancing stock market. Wholesales inventory report shows that inventory replenishment continues. Sales trends are also increasing and points to increases in production as the Inventory-to-Sales ratio has hit an all-time low. Business inventories show an increase as manufacturing continues to produce, up 5/6 months. Sales meanwhile rose 2.3% meaning that the I/S ratio (an indicator of inventory levels relative to demand) is now at a record low. The stage is set for a monumental inventory bounce. Stay tuned. Small Business may be beginning to see the recovery as the “NFIB Small Business Survey” and “Discover Small Business Watch” show improved sentiment. Bearish Inflation is heating up in China and makes the case for continued tightening of policy, currency or interest rate. Meanwhile Europe, their largest trading partner, is conducting QE operations, which has led to a falling Euro. This will restrain Europe’s ability to import Chinese goods as a falling currency makes foreign goods more expensive. The Shanghai stock market is in a bear market in anticipation of tightening on a recovery that may not be sustainable. Even after the $1 Trillion package, the Euro continues to take it on the chin. Another red flag is that 3-Mth Libor continues to move higher and credit markets overall don’t seem as enthused as stock markets. It seems the euphoria has faded and chaos is back. Is the Greece/Contagion crisis totally behind us or is the end game here? From a global trade perspective, a falling Euro will be an increasing headwind for US and Chinese exporters. In the S&P500, 45%+ of companies earnings come from abroad, while China is still an exporting country and will undoubtedly feel a negative effect. Future prospects for global trade are starting to look very stormy. UCLA Ceridian shows a dip in it’s reading for April. This metric has now been flat for roughly 4 months and points to a potential stall for growth in manufacturing activity in the months ahead. Business executives need to be convinced that end demand growth is sustainable or manufacturers will see little incentive to grow production. The ECRI leading indicator also shows slowing over the next few months. National Federation of Independent Business Survey continues to point to weakness. While sentiment improved from the previous month, it is not consistent with a recovery in the sector responsible for 60%+ of job creation. If small businesses don’t see improving sales trends, recent job gains will not be sustainable. Consumer Sentiment continues to be flat as consumers are too poor to expand their cable package and watch bubblevision all day long. Main Street has not seen a strong recovery and these sentiment numbers are proof. Even worse is that inflation expectations moved higher and out of a range that has latest throughout the recession. Many point to seasonally higher gas prices. Mortgage applications (for purchase) plunged 9.5% as the tax credit expired and reports of falling housing prices are already surfacing. We are seeing the first signs of the inevitable double dip in housing.

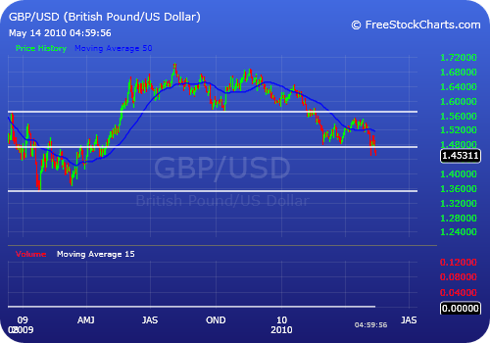

Observations/Thoughts As expected, Treasuries have been steadily keeping up with equity returns this year. The wall of worry remains high and deflation remains as the primary risk in my view. I believe we will see positive returns from this asset class in 2010. No need for extensive commentary here. Just read these two stories and identify what’s wrong with this picture. This isn’t the land of opportunity anymore. What magnitude will the effects will the oil spill have on the economy? Tourism and fishing industries will be hurt. How much will this shave off economic activity? An assumption in my thesis, are the high levels of debt leading towards higher taxes and or reduced spending on the part of gov’t (see here and here). This dynamic is not lost on Pimco’s Mohamed El-Erian…. …However, for the time being, we are clearly experiencing a cyclical recovery (albeit very weak) and the prospect of higher earnings will keep the market from drastically selling off solely due to domestic factors. What is increasing as a headwind are sovereign concerns as despite the bailout agreed on in the past week, the Euro keeps getting pounded. Additionally the British Pound is beginning to become a concern. China is overheating as well. We are in a situation where the high probability of an external shock is beginning to get the market’s attention.

On the technical front Is that a head and shoulders pattern I see? Notice the 2 large distribution days. This is bearish.

(EUR/USD: Daily)

I have yet to see a Bloomberg article on the front page regarding the UK issues. The currency has quietly broken through important support and has a clear shot at the lows from 2009. A UK fiscal crisis would be the icing on the cake for the Keynesian funeral. Mr. Hayek must be nodding his head saying “told ya so”. I’m speculating here: the UK can’t default because they can just print their way out of the problem, but eventually this will end up being a hyperinflationary event as confidence in the fiat currency falls. (DXY: Weekly) I'm putting my contrarian hat on here: I hear about gold and silver being the place to be and the demise of the dollar from all fronts it seems. The trade might be starting to get crowded. I believe that over the longer term, we’ll see a weaker dollar as the US is up to the gills with debt, however, from a technical perspective, the above chart looks very bullish. It’s about to break a downward trend in place for almost a decade. Bob Farrell’s Rule 9 comes to mind. |

| Health Care and Oil Industries Attacked by Zombies Posted: 25 Jun 2010 10:00 AM PDT A letter to the editor of The Financial Times: I am a pensioner and a shareholder in BP. I understand that the board of BP is handing over to the US government $20 billion with no conditions, though the company has no legal obligations to do so. I also understand [that the] representative of the US government who has [the] responsibility for disbursing has said he will "err on the side of the claimant," an invitation to every conman in the southern USA to get his spoon into the pot at my expense. This action by the board of BP is so financially irresponsible that I think not only chief executive Tony Hayward but every other member of the BP board needs to consider his position. Now we will deconstruct this letter following our new Zombie Theory of History. BP is a producer. It is alive. Its flesh is solid. The blood of profits runs through its veins. The zombies are after it. The company was doing fine. But it tripped up in the Gulf of Mexico. The zombies saw an opportunity. In order to buy time…and perhaps save itself…the company paid an enormous ransom…bribe…or tribute to the federal government. Now, 'political risk' – more properly known as 'zombie risk' – is higher in the US than it is in emerging markets. And now the zombies are gathering outside our window. No kidding. Busloads of them. There's a rally by a group called "The Heart of Baltimore." Someone is spending a lot of money on it. Danny Glover is supposed to be out there. Poor man. It's about 100 degrees in the shade. What's going on? "Free & Fair Union Elections" is the order of the day. Ah ha…zombies! One of five Baltimore workers is allegedly working in the health care business. According to the pamphlet, they are struggling to "survive on poverty wages," because they are "without a union." Dear readers may wonder how having a union makes what they do more valuable. We wondered too, for about 2 seconds. Of course, it doesn't. The only way the health care providers could pay higher wages would be if a) the workers were more productive or b) they raised the cost of health care. Health care is already through-the-roof expensive in the US – far more than it is in other countries. Why? Because the zombies have control of it. The US claims to have a free market in health care. It's not true. The whole system is rigged by unions, pharmacy companies, insurance companies, tort lawyers – and regulations, regulations, regulations. We will ask you a simple question. Suppose a group of doctors set up a "McDonald's of Health Care – lowest prices in town." They said: 'We'll treat you. But only if you sign this paper saying you won't sue us.' Without the tort lawyers breathing down their necks they could eliminate their malpractice insurance and cut out all the unnecessary tests. And then…suppose a drug company decided to launch a brand of Free Market Drugs. They offered customers 'unapproved drugs…neither tested nor reviewed by the FDA or anyone else…take them at your own risk!' How long would these companies last? About 24 hours. Too many zombies. Regards, Bill Bonner Health Care and Oil Industries Attacked by Zombies originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Posted: 25 Jun 2010 09:37 AM PDT Gold closes just below all-time high The COMEX August gold futures contract closed up $10.30 Friday at $1256.20, trading between $1241.60 and $1259.50 June 25, p.m. excerpts: see full news, 24-hr newswire… June 25th's audio MarketMinute |

| Central Bankers expect gold to outperform equities, bonds, currencies – and oil Posted: 25 Jun 2010 09:36 AM PDT by Rhona O'Connell This may seem like a long time horizon, but central bankers have to think in the long term as custodians of national wealth (expect, of course, when governments get in the way and insist on, for example, gold disposals with prior publicity). The view underpins the swing in attitudes towards gold in the official sector that has been evolving. Clearly the shifting tides in sentiment are informed by increased concern over fiscal imbalances, currency dislocations and sovereign risk, all of which have escalated over the past eighteen months, and which are therefore helping to change a trend of sales that was most-recently re-established in 1989. [source] |

| Central Bankers expect gold to outperform equities, bonds, currencies – and oil Posted: 25 Jun 2010 09:36 AM PDT by Rhona O'Connell This may seem like a long time horizon, but central bankers have to think in the long term as custodians of national wealth (expect, of course, when governments get in the way and insist on, for example, gold disposals with prior publicity). The view underpins the swing in attitudes towards gold in the official sector that has been evolving. Clearly the shifting tides in sentiment are informed by increased concern over fiscal imbalances, currency dislocations and sovereign risk, all of which have escalated over the past eighteen months, and which are therefore helping to change a trend of sales that was most-recently re-established in 1989. [source] |

| Now China sources newly mined gold from the U.S.A. Posted: 25 Jun 2010 09:26 AM PDT by Lawrence Williams China is already the world's largest gold miner, and many analysts now assume — following the country's announcement last year that it had been building up its gold reserves for six years unknown to the West – that it is still expanding its gold holdings in a way that does not necessarily show the gold going into official reserves. And now it appears to be looking elsewhere to purchase supplies of the yellow metal without overtly impacting the market. What is significant, perhaps, is that this suggests that China's commitment to gold is both ongoing – and likely to increase. The country, through its financial institutions and state television advertising, has been persuading its ever growing middle classes to purchase gold (and silver) as a good investment. There seems little doubt that the state is doing the same thing itself as a means of diversifying its huge reserves… … as my colleague Dorothy Kosich noted in her article today on the company's new Kensington mine in Alaska… "China Gold will be paying upfront, which means that in terms of timing, Coeur will get paid seven days after shipping vs. the typical two-three months that most concentrate producers must wait, while the metal is being processed at the smelter/refinery."

To buy newly-mined gold production at source is thus a clever ploy. It is not interfering with the gold market directly by being seen to buy, but picking up gold which is actually never reaching the market. It can then move the gold into some interim holding capacity which does not have it showing up in its official reserves until, and unless, it wishes to make this statement to the markets. [source] |

| Daily ETF Roundup: VXX Falls, UNG Surges Posted: 25 Jun 2010 09:23 AM PDT ETF Database submits: Equity markets finished flat to end the day, as the Dow finished in the red as the S&P 500 and the Nasdaq both managed to eek out gains. Gold was also flat as the precious metal finished the week at 1,255/oz. However, the big winner on the day was oil, which surged more than $2.55 a barrel to finish the day just above to $79 mark. The flat market was highlighted by a banking overhaul bill which ended up being far less imposing than many had feared. “The bill could have been a lot worse,” said Alan Valdes, vice president at Hilliard Lyons in New York. “It’s a bill we can live with.” [see G-20 Summit, Reform Bill Put Financial ETFs In Focus] Complete Story » |

| What's Bearish For Stocks Is Not Be Bearish For All Precious Metals... Posted: 25 Jun 2010 09:20 AM PDT |

| Banking Reform Pushing Financials Lower and Silver Higher Posted: 25 Jun 2010 09:03 AM PDT |

| Posted: 25 Jun 2010 09:02 AM PDT Several days after the Romanian parliament passed a law to cut pensions by 15% in order to qualify for a critical $20 billion IMF loan, the Romanian Supreme Court found this law was not only unconstitutional, but unappealable (along the lines of what our own SCOTUS will do once the Fed's transparency appeal gets to the very top, resulting in confirmation once and for all that American laws are only made for the benefit of the Federal Reserve). The decision was reached hours after dozens of Romanian citizens stormed the presidential palace "to get an audience with President Traian Basescu." As a result of the Constitutional Court's decision, the IMF loan "may now be delayed, and this will be a big blow to the government of Prime Minister Emil Boc, the BBC's Nick Thorpe reports." Also as a result, Romanian (and by association, neighboring Bulgaria) CDS blew up today and closed +30 to 410 for Dracula's host country, and +20 to 360 bps for the country that served as the reverse engineering center of the former Communist Bloc. From BBC:

Just wait until Greeks get wind of this ruling, and ask the logical question why their own constitution allows their pensions to be cut by as much as 30%. So much for the smooth and glitch-free passage of austerity across all of Europe. Oh, and it is about time, as we have long been claiming, that investors take a long hard look at Eastern European CDS. It is still not too late. |

| Congress passes "diluted" financial reform bill Posted: 25 Jun 2010 08:31 AM PDT From Bloomberg: Legislation to overhaul financial regulation will help curb risk-taking and boost capital buffers. What it won’t do is fundamentally reshape Wall Street’s biggest banks or prevent another crisis, analysts said. A deal reached by members of a House and Senate conference early this morning diluted provisions from the tougher Senate bill, limiting rather than prohibiting the ability of federally insured banks to trade derivatives and invest in hedge funds or private equity funds. Banks “dodged a bullet,” said Raj Date, executive director for Cambridge Winter Inc.’s center for financial institutions policy and a former Deutsche Bank AG executive. “This has to be a net positive.” Hashed out almost two years after the worst financial crisis since the Great Depression, the legislation shepherded by Senate Banking Committee Chairman Christopher Dodd and House Financial Services Chairman Barney Frank places limits on potentially risky activities such as proprietary trading or over-the-counter derivatives and gives regulators new powers to seize and wind down large, complex institutions if needed. The overhaul, which still requires approval from the full Congress, won’t shrink banks deemed “too big to fail,” leaving largely intact a U.S. financial industry dominated by six companies with a combined $9.4 trillion of assets. The changes also do little to solve the danger posed by leveraged companies reliant on fickle markets for funding, which can evaporate in a panic like the one that spread in late 2008. ‘Fig Leaf’ The Standard & Poor’s 500 Financials Index, whose 79 companies include JPMorgan Chase & Co. and Goldman Sachs Group Inc., rose 1.4 percent at 1:02 p.m. in New York. The legislation is “largely a fig leaf,” said Dean Baker, co-director of the Center for Economic and Policy Research in Washington. “Given where we were when this got started, I’d have to imagine the Wall Street firms are pretty happy.” Banks avoided drastic curbs on their highly profitable derivatives businesses. Lenders including JPMorgan and Citigroup Inc. will be required to move less than 10 percent of the derivatives in their deposit-taking banks to a broker-dealer division during the next two years, which may require additional capital. Goldman Sachs and Morgan Stanley, which were the two biggest U.S. securities firms before converting to banks in September 2008, won’t be as affected because they kept most of their derivatives in their broker-dealer units. ‘Pennies’ of Dilution “There’s going to be some adaptation, but I don’t think there’s going to be any colossal impact,” said Benjamin Wallace, an analyst at Grimes & Co. in Westborough, Massachusetts, which manages $900 million and holds stakes in Bank of America Corp., JPMorgan and Wells Fargo & Co. Derivatives rules mean “there’s going to be a capital raise, but the analysis we’ve seen suggests we’re talking in the pennies in terms of dilution” of earnings per share. Senator Blanche Lincoln, a Democrat from Arkansas, had originally advocated forbidding banks that receive federal support such as deposit insurance from trading swaps, a rule that could have required banks to spin off those businesses. The final agreement provides a number of exemptions: Banks can continue trading derivatives used to hedge their risks and can keep trading interest-rate and foreign-exchange contracts. Banks will have up to two years to move other types of derivatives, such as credit default swaps that aren’t standard enough to be cleared through a central counterparty, into a separately capitalized subsidiary. 97% of Market U.S. commercial banks held derivatives with a notional value of $216.5 trillion in the first quarter, of which 92 percent were interest-rate or foreign-exchange derivatives, according to the Office of the Comptroller of the Currency. The five U.S. banks with the biggest holdings of derivatives -- JPMorgan, Goldman Sachs, Bank of America, Citigroup and Wells Fargo -- hold $209 trillion, or 97 percent of the total, the OCC said. The rules are “nowhere as bad as what the banks might have feared as recently as a week ago,” Bill Winters, the London- based former co-chief executive officer of JPMorgan’s investment bank, told Bloomberg Television today. “Banks have pretty much factored in already the idea that most derivatives will have to be cleared through a central clearing counterparty. Not a huge surprise and probably not a huge cost either.” Volcker Rule Derivatives are contracts whose value is derived from stocks, bonds, loans, currencies and commodities, or linked to specific events such as changes in interest rates or weather. They include credit-default swaps, which act like insurance for investors in case a debt issuer can’t repay. Swaps sold by American International Group Inc. that later went sour helped push the insurer to the brink of bankruptcy and triggered a $182 billion federal bailout of the New York-based company during the near collapse of the financial system in 2008. Another portion of the legislation that was amended in the final conference was the so-called Volcker rule, named after Paul Volcker, the former Federal Reserve chairman who championed it. Originally the rule would have prevented any systemically important bank holding company from engaging in proprietary trading, or bets with its own money, as well as investing its own capital in hedge funds or private-equity funds. Goldman Sachs executives have estimated that about 10 percent of the firm’s annual revenue comes from proprietary trading. 3% Rule In the final version, the banks will be allowed to provide no more than 3 percent of a fund’s equity, and will be limited to investing up to 3 percent of the bank’s Tier 1 capital in hedge funds or private equity funds. That represents a ceiling of about $3.9 billion for JPMorgan, $3.6 billion for Citigroup and $2.1 billion for Goldman Sachs, according to the companies’ latest quarterly reports. “I don’t think it will have any impact at all on most banks,” Winters said of the amended Volcker rule. “It’s a pragmatic solution that will result in the banks having no big issues.” While the rule has been watered down, it still represents an important change in direction for a financial industry that had been allocating a larger and larger portion of capital over the last decade to making bets and investments with their own money, said James Ellman, president of San Francisco-based hedge fund Seacliff Capital LLC, which specializes in financial industry stocks. ‘Casino’ Must Go “You’re going to be taking out of the banks areas of investing that every 10 years or so, at certain points in the cycle, tend to have dramatic losses,” Ellman said. “Effectively you’re telling the system: We have to take the casino out of the utility.” While Ellman said the legislation will help to make the financial system safer, he added that “it won’t satisfy anybody who wanted really strict additional regulation of banks.” The new version of the Volcker rule also incorporates changes proposed by Democratic Senators Jeff Merkley of Oregon and Carl Levin of Michigan that aim to curb conflicts of interest by preventing firms that underwrite an asset-backed security from placing bets against the investment. In April, Levin presided over a hearing in which Goldman Sachs executives were accused of betting against some of the same collateralized debt obligations that they underwrote; the executives responded by saying they were acting as market-makers. Market-Based Funding While requirements for an increase in capital will provide banks with a bigger cushion to absorb losses, the legislation does little to reduce banks’ dependence on the markets to finance their balance sheets. It was that market-based funding that made firms like Goldman Sachs and Morgan Stanley vulnerable to the panic that spread in 2008. “Something has to be put in place to cause banks to have deposit-based liabilities and not market-based liabilities,” Grimes & Co.’s Wallace said. The effects of the legislation won’t be seen for several years as new regulations are drafted and implemented, analysts said. New international capital requirements under consideration by the Basel Committee on Banking Supervision, which could be implemented by the end of 2011, will also be important. Investors and analysts including Optique Capital Management’s William Fitzpatrick said bank stock prices have already factored in any likely reduction in revenue from the changes. “Profitability is indeed going to take a hit and we’re going to see more stringent capital requirements,” said Fitzpatrick at Milwaukee-based Optique, which oversees about $800 million including stock in Bank of America, Goldman Sachs and JPMorgan. “The changes are most certainly necessary. They can certainly lead to a more stable and predictable earnings stream.” Still, he added, “this doesn’t remove all of the elements of financial distress that could lead to some of the challenges we had in 2008.” To contact the reporter on this story: Christine Harper in New York at charper@bloomberg.net. More government stupidity: This will be the cause of the 2011 economic collapse Porter Stansberry: This is the biggest threat to your financial future OUTRAGE: Fannie and Freddie could need another $1 trillion taxpayer bailout |