Gold World News Flash |

- Guest Post: Will you answer JFK’s call?

- A Modest Proposal: Fed Looking to Purchase More Assets? Don't

- China's Currency Change Isn't Necessarily a Win for the United States

- Trading Week Outlook: June 28 - July 2, 2010

- Is discovering the gold fraud worse than the fraud itself?

- Worlds Collide

- Bear Market Race Week 141: Gold & Silver’s Advancing & Declining Lines

- GLD Up... Again. SLV Down... Again.

- Trader Dan Comments On This Week?s COT Report

- Gold: A Bubble on the Verge of Bursting?

- Expect Markets to Trade Within Range

- James Turk: People are starting to distinguish between paper gold and real gold

- As 1.3 Million Americans Are About To Lose Their Jobless Benefits This Week, The Unemployment Rate Will Surge To 10.5%

- Protesters Set fires, Smash Windows in Violent G20 Demonstration

- Toronto G-20 Protests, Police Car On Fire, And More

- For the Last Time, Is Gold in a Bubble?

- US Mint Sales: Silver Eagles Sail, Boy Scouts Coins Hit 350,000 Max

- Silver Prices Surge, Narrowing Weekly Loss

- Bullion Prices & Business Weekend Recap – June 26, 2010

- 220 Pound Gold Coin “Disappoints” And Only Sells For $4.02 Million

- Adrian Douglas: Is discovering the gold fraud worse than the fraud itself?

- Physical demand overpowering COT, Ted Butler tells Eric King

- Lawrence Williams: Is China manipulating gold UP?

- "New Austerity" Threatening Global Recovery?

- Guest Post: Is UTA's James Galbraith A True Economist?

- The Wise Investor - June 2010 Newsletter From Sundaram BNP Paribas Asset Management

- Presenting The Key H2 Milestones To Observe As The Economy Begins Its Next Pre-Stimulus Contraction Cycle

- Alex Becomes First Named Tropical Storm Of Atlantic Hurricane Season

- Alf Field "World's Best Gold Analyst": Gold Going to $10,000

- Whats Bearish For Stocks Is Not Be Bearish For All Precious Metals…

- Jim Rogers Would Rather Buy Silver, Hold Gold

- U.S. Financial CDS Prices Post-FinReg

- Gold, Silver, How High? When?

- Compendium 3 Now Available!

- Trader Dan Comments On This Week's COT Report

- GLD, GDX and SLV: Does November 2009 Repeat in July 2010?

| Guest Post: Will you answer JFK’s call? Posted: 26 Jun 2010 07:51 PM PDT "Ask not what your country can do for you. Ask what you can do for your country." That wasn't just another cheap talking point from a politician's speechwriter. It was the last real president's attempt to remind the American people of the need to self-govern, to play our part in keeping the republic, rather than being passive, submitting to the rising banking/corporate/military empire, and becoming debt servants. Will we finally heed his call? This video explains some of the things JFK might ask us to do today–the "to do" list some of you have been asking for. It also points out the nexus between economics and our psychology and spirituality. Our current economic system, driven by the predatory financial system, has profoundly impacted both in negative ways. It imposes destructive, controlling energy from the top-down. We need to respond from the bottom-up with positive energy rather than the incessant negativity we typically see. I think it's the only real hope of changing things, given the level of control in the system at this point. Some of you may already be shouting "impossible!" Well, it would require nothing less than the next Enlightenment…certainly no small task. But hardly impossible. Join us at the Council on Renewal and the Council's blog after the video. This posting includes an audio/video/photo media file: Download Now | ||||

| A Modest Proposal: Fed Looking to Purchase More Assets? Don't Posted: 26 Jun 2010 06:34 PM PDT Annaly Salvos submits: Some recent economic data (like Friday’s downwardly-revised “final” reading on 1Q 2010 GDP) have suggested that the economic recovery is waning. Not surprisingly, talk of additional stimulus has started to show up. A widely circulated column from Friday’s UK Telegraph titled “Ben Bernanke Needs Fresh Monetary Blitz as US Recovery Falters” theorizes that the Fed is debating further asset purchases. The rationale is that since there is reduced appetite for further fiscal stimulus, the Fed will pick up the baton and expand its balance sheet, possibly to $5 trillion. Our modest proposal? Don’t. Complete Story » | ||||

| China's Currency Change Isn't Necessarily a Win for the United States Posted: 26 Jun 2010 06:12 PM PDT Carnegie Endowment submits: China recently announced that it would allow greater flexibility in its currency. In a video Q&A, Yukon Huang, former country director for the World Bank in China, explains the significance of the timing, what a flexible currency will mean for China and the West, and whether the renminbi is likely to rise or fall. While China was ready to introduce greater flexibility for some time, the political pressure from the West actually delayed movement as Beijing didn’t want to be seen as bending to outside demands. Huang says that the upcoming G20 meeting likely influenced the specific timing of the announcement, but the collapse of the euro offered a good opportunity for change. This signals Beijing’s emphasis on increasing domestic consumption and alleviating income disparity, but Huang cautions that it won’t necessarily be beneficial for the United States. Complete Story » | ||||

| Trading Week Outlook: June 28 - July 2, 2010 Posted: 26 Jun 2010 06:07 PM PDT All Things Forex submits: In the aftermath of a sequence of ugly housing market data and the Fed’s renewed commitment to keep interest rates low for an “extended period”, the U.S. Non-Farm Payrolls and Employment Situation report scheduled for release in the week ahead, should add another piece to the economic puzzle that could reveal further weakness in the recovery of the largest economy in the world. Complete Story » | ||||

| Is discovering the gold fraud worse than the fraud itself? Posted: 26 Jun 2010 05:56 PM PDT By Adrian Douglas Saturday, June 26, 2010 Friday's commentary by MineWeb's Lawrence Williams, "Now China Sources Newly Mined Gold from the USA" (http://www.mineweb.co.za/mineweb/view/mineweb/en/page33?oid=106850&sn=De...), cited in a GATA Dispatch yesterday (Lawrence Williams: Is China manipulating gold UP? | Gold Anti-Trust Action Committee), incensed me, for it was disingenuous for Williams to suggest that China's buying gold assets off-market could be construed as manipulating the gold price up. If it wanted to manipulate the market, China would need only to buy 30,000 gold contracts on the Comex and stand for delivery. I was so upset by Williams' nonsense that I went looking for other recent articles written by him. I came across a comment Williams made on Twitter of May 10: http://babybulltwits.wordpress.com/2010/05/10/lawrence-williams-what-gol... In this commentary, in a reference to my expose of the unallocated metal accounts maintained by London Bullion Marke... | ||||

| Posted: 26 Jun 2010 05:56 PM PDT www.preciousmetalstockreview.com June 26, 2010 World leaders are meeting in Toronto, Canada, this weekend and the protests have begun. They’ll be discussing how they can manage to save the global economy. Gold will be a topic, but not admitted. Rest assured the outcomes will not benefit the general population, only the global elite even though it may seem at first that it is them being penalized. Any further costs will trickle down to the consumer, that’s us. Talk of the oil spill has been put on the back-burner, but a tropical storm is now approaching the gulf. The situation will continue to worsen until the company goes bankrupt or is taken over. When it comes down to it though, the US taxpayer will pick up a large portion of the tab. It’s the same old story of the corporatocracy being in control. Once day though the people will rise again. That day is getting closer and closer as anger spreads. ... | ||||

| Bear Market Race Week 141: Gold & Silver’s Advancing & Declining Lines Posted: 26 Jun 2010 05:56 PM PDT The 1929 & 2007 Bear Market Race to The Bottom Week 141 of 149 Gold & Silver’s Advancing & Declining Lines Mark J. Lundeen [EMAIL="mlundeen2@Comcast.net"]mlundeen2@Comcast.net[/EMAIL] 25 June 2010 Color Key to text below Boiler Plate in Blue Grey New Weekly Commentary in Black Below is my BEV chart for the Bear Race. It’s that time of the week where I have to come up with something to say, that if not pure genius, then at least something insightful. Humm, give me a moment. Ahh! If the DJIA in the chart above breaks below its BEV -30% Line next week, it’s not good. Okay, so in Wk 141, I didn’t blow away my readers with dazzling brilliance, but it’s the truth. And I’ll say something else that while not genius, is the truth too. When the DJIA is South of its BEV -30% Line, the DJIA is closer to its BEV -40% Line, than it is to its BEV -20% Line. Believe me; that matters quite a bit. In the 125 year history ... | ||||

| GLD Up... Again. SLV Down... Again. Posted: 26 Jun 2010 05:56 PM PDT The gold price didn't do much of anything in Far East trading on Friday. But, at the Hong Kong close at 6:30 p.m. local time, which just happens to occur at the same moment as the London a.m. gold fix at 10:30 a.m. Friday morning in London... all that changed. Gold set its low price of the day [around $1,242 spot] and continued to climb in fits and starts until it got to its high of the day around half-past lunchtime in New York. That high was $1,259.50 spot. From there it sold off about four bucks into the close at 5:15 p.m. Eastern time. Volume was incredibly light... well under 90,000 contracts net of all spreads and roll-overs. This was far lighter than the volume on Thursday... which was no great shakes, either. Silver followed a very similar price path to gold. The only big difference was that silver's price rally came to an end with a 20 cent price spike just before lunch in New York... and basically traded sideways for the rest of the New... | ||||

| Trader Dan Comments On This Week?s COT Report Posted: 26 Jun 2010 05:56 PM PDT View the original post at jsmineset.com... June 25, 2010 11:47 PM Dear Friends, This week's Commitment of Traders reports details pretty much what we have come to expect in gold over the years; fund buying and bullion bank and swap dealer selling. What is interesting is the fact that gold soared into an all time record high with neither the Managed Money camp setting a record for a net long position nor the producer/merchant/processor/user and Swap Dealer camp setting a record for their respective net short positions. Considering the sell off on Monday's downside reversal day was included in the statistics, it is all the more remarkable that the Managed Money camp witnessed an INCREASE in their net long position. Apparently, the move lower Monday and the early dip overnight into Tuesday attracted more buying from this camp instead of selling. The running off the long side was done by the "other reportables" crowd which includes CTA's and other large players. The small investor, ... | ||||

| Gold: A Bubble on the Verge of Bursting? Posted: 26 Jun 2010 05:56 PM PDT courtesy of DailyFX.com June 25, 2010 03:36 PM Gold has marched steadily higher over the past ten years, with only the reasons behind investors’ demand for the yellow metal changing along the way. Looking ahead however, mounting fundamental and technical evidence suggests that a sharp downturn lies around the corner. GOLD 6-MONTH FUNDAMENTAL FORECAST Real Gold Supply, Demand Pressure Prices Lower The trends in real demand look decidedly lackluster, with gold for the manufacture of jewelry as well for industrial and dental use clearly tracking lower (the former for over a decade and the latter for at least three years). Meanwhile, supply seems to be picking up. Indeed, mine production has snapped a multi-year downtrend with output rising for the first time in close to seven years. Further, gold scrap such as jewelry melted down for its metal content is on the rise as well. Reasonably enough, if real factors were the only forces driving the market, falling demand and ri... | ||||

| Expect Markets to Trade Within Range Posted: 26 Jun 2010 05:23 PM PDT David I. Templeton submits: If history doesn't repeat itself perfectly, it often looks similar. As the below chart from Chart of the Day details, it is not uncommon for the market to trade within a range after a strong recovery off of a significant bear market. On top of this, the market tends to be choppy during the summer months. If the presidential election cycle market plays itself out, a better market environment may be upon us beginning in the fourth quarter and carrying over into early next year. Click to enlarge: Complete Story » | ||||

| James Turk: People are starting to distinguish between paper gold and real gold Posted: 26 Jun 2010 04:06 PM PDT 12:03a ET Sunday, June 27, 2010 Dear Friend of GATA and Gold (and Silver): In a 16-minute interview with Eric King of King World News, GoldMoney founder and GATA consultant James Turk says that the near-term outlook for gold is exciting, that people shouldn't take risks with their gold, that in large part because of GATA's work people are beginning to understand the difference between real metal and paper gold, and that the key moment in the long-running gold rally may have come a year ago when the Greenlight Capital hedge fund managed by David Einhorn shifted its investment from the GLD exchange-traded fund into bullion. The interview with Turk is 16 minutes long and you can find it at King World News here: http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2010/6/26_J... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: New Orleans Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Posted: 26 Jun 2010 03:24 PM PDT As we reported on Friday, a critical bill that was unable to pass this past week was the extension of unemployment benefits to millions of Americans currently collecting a $1,200 average monthly stipend from the US government for sitting on their couch and not paying their mortgage. As a result of this huge hit to endless governmental spending of future unearned money, the WSJ reports that "a total of 1.3 million unemployed Americans will have lost their assistance by the end of this week." Furthermore, the cumulative number of people whose extended benefits are set to run out absent this extension, will reach 2 million in two weeks, and continue rising: as a reminder the DOL reported over 5.2 million Americans currently on Extended Benefits and EUC (Tier 1-4). The net result is yet another hit to the US ledger, as soon 2 million Americans will no longer recycle $1,200 per month into the economy. In other words, beginning in July, there will be $2.4 billion less spent each month by America's jobless on such necessities as LCD TVs (that critical 4th one for the shoe closet), iPads and cool looking iPhones that have cool gizmos but refuse to hold a conversation the second the phone is touched the "wrong" way. As the number of jobless whose benefits expire grows, the full impact of lost money will progressively increase, and absent some last minute compromise, the monthly loss will promptly hit $5 billion per month. Annualized this is a hit of $60 billion to "consumption", and represents roughly 120 million iPads not purchased, and about half a percentage point of GDP (ignoring various downstream multiplier effects). Worst of all, as these people surge back into the labor force, the unemployment rate is about to spike by nearly 1%, up to 10.5%. From the WSJ:

And like every other stimulus program, there are those who focus on possible cons from the program end...

and pros...

In our view, what will happen is that the 1.3 million who had gotten used to receiving benefits (and for whom we certainly feel sorry, as once again expectations and reality under the current administration diverge in a dramatic fashion) and had no desire to look for work, will immediately flood back into the labor force to find some job, any job, that pays even remotely as well as what the government did. What this means is that the total labor force (which incidentally dropped by 322,000 From April to May) of 154.393 million, is about to grow by at least 1.3 million, and as much as 2 million, in July. And since census employment peaked, and the number of employed will stay flat (at best) at 139.420 million, the expansion in the total labor force, will increase the unemployment rate by almost 1% in just a month, growing from 9.7% in May to 10.5% in July. That number will be reported in late August. But by then the sequel to the Great Depression v2 movie will be playing in every theater across the land, and this number will be the least of our worries. Appendix A: average monthly benefits check as per the Daily Treasury Statement and the DOL's weekly claims report. Appendix B: For an extended discussion of jobless benefits, how they work, and how their expiration will adversely impact the economy, read As Extended And Emergency Unemployment Benefits Finally Begin Expiring, A Much Different Employment Picture Emerges | ||||

| Protesters Set fires, Smash Windows in Violent G20 Demonstration Posted: 26 Jun 2010 01:09 PM PDT TORONTO — Downtown Toronto was in chaos Saturday as roving bands of G20 protesters set fire to police vehicles and smashed windows despite a $1-billion security tab and thousands of police at the ready. A core group of militant protesters, dressed in black balaclavas and using what's referred to as a Black Bloc tactic, remained at large more than four hours after their campaign of violence began. Police in riot gear marched through city streets, pounding their shields in warning as they tried to restore order in a city under siege. A newspaper photographer has been shot with a rubber bullet in the backside, while another had an officer point a gun in his face despite identifying himself as a member of the media. The violence came as leaders of the world's G20 nations met behind the steel and concrete barrier that has earned the city the moniker "Fortress Toronto." | ||||

| Toronto G-20 Protests, Police Car On Fire, And More Posted: 26 Jun 2010 12:07 PM PDT Toroto's G-20 meeting is shaping up as the most impotent yet most confrontational of all recent summits so far. As Bloomberg reports, "Group of 20 leaders will agree to targets to tackle deficits in their final statement without prescribing when nations should begin to move to balance their books, according to officials with knowledge of the document." Due to the escalating schism between US and Europe, or Geithner and Merkel (incidentally, for definitive proof Merkel is spot on, Argentina just joined the pro-Keynesian chorus saying Europe's focus on cutting deficits is "absolutely wrong" - and if anyone knows anything about top notch economic policy, it is surely Argentina), it is likely that neither will push their own agenda on others, and with the yuan's recent symbolic depegging, everyone will be able to go home pretending victory was achieved. Yet despite the complete lack of consensus, somehow the leaders have decided to cut deficits in half by 2013, even though this target is beyond ridiculous, coming at a time when the entire world is spending with a profligacy that would make a drunk sailor blush (even one that has access to Bernanke's printer). "The draft of the statement includes targets championed by Canadian Prime Minister Stephen Harper to have countries halve deficits by 2013 and start to stabilize their debt-to-output ratios by 2016, the officials said. There is a consensus to maintain stimulus now with the focus on deficits in the “medium- term,” Harper said in a June 21 interview." In other words, nothing will change, and eventually, when the entire world has over 5 times its entire GDP encumbered in real cash debt (as opposed to the $1.2 quadrillion in pseudo-metaphysical debt), and interest payments alone account for well over 30% or more of economic production, the G-20 might, just might, consider debt cutting approaches. In the meantime, initial protests which had been largely peaceful, quickly turned violent as over 30 arrests have been made in Toronto so far, coupled with burning police cars, the use of gas masks, and direct police-protest engagements. Below is a video from RT showing some of the festivities

And another:

And some more:

Courtesy of Reuters, some pictures that capture the antiglobalization mood. If you look closely, you will find the Americans in the crowd, closely following the riots on their iPads.

Those who wish to follow's Reuters live-coverage of the G-20 summit can do so here. | ||||

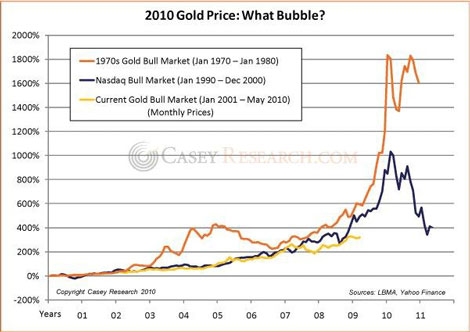

| For the Last Time, Is Gold in a Bubble? Posted: 26 Jun 2010 09:14 AM PDT While a few mainstream outlets are coming around to at least acknowledging gold's stellar run, most remain skeptical or outright bearish. And the blasphemy they purport is that gold is in a bubble. Let's settle it, right now, and shut these naysayers up.

Gold returned 10 (and as much as 14) times your money in the 1970s bull market, and the NASDAQ advanced over 1,900% during its run. Our current gold price is up about 400% (when measured on a daily basis, not monthly as in the chart). In fact, the NASDAQ gained 182% in the final year of its peak, and gold surged 80% in four weeks during the blow-off top of January 1980. None of this is happening to our current gold price. Note to doubters: we've got a long way to go before we start legitimately using the "bubble" word. Besides, the fact that these skeptics aren't buying – and don't even own any gold in the first place – is further proof we're not in a bubble. Ever notice none of them claim to own it? And they definitely need to catch up on world affairs. The World Gold Council (WGC) reported that Russia, Venezuela, the Philippines, and Kazakhstan all bought gold in the first quarter. Central bank sales, meanwhile, remain depressed. Russian President Medvedev won't quit his quest to move international reserve assets away from the dollar. And his country's central bank is backing up his words; it increased its gold reserves by $1.8 billion and decreased its currency reserves by $6.6 billion so far this year. China, the world's largest gold producer, already buys all the gold produced within its country. But the WGC recently forecasted that overall gold consumption in China could double in the coming decade, a demand that production certainly won't be able to match. The Iran/Israel showdown appears closer almost every week. As further evidence that each side is preparing for conflict, Saudi Arabia recently agreed to permit Israel to use a narrow corridor of its airspace to shorten the distance for a bombing run on Iran – all done with the agreement of the US government. Simultaneously, the UN Security Council imposed a new round of sanctions on Tehran. Nobody appears to be backing down. And the current run in gold is with no inflation. Core CPI has fallen to the lowest level since the mid-1960s – but what happens when inflation does set in? And what if it's as bad or worse as the 14% rate we got in the '70s? Sure, deflation is the immediate concern, but with a US federal debt of $13 trillion, unfunded future liabilities exceeding $50 trillion, and a current budget deficit of over 10% of GDP, a massive debasement of the dollar is virtually ensured, triggering an onslaught of inflation. It's coming. With all these concerns, these guys don't want to own gold? Bubble, schmubble. Stocks are vulnerable, bonds are toast, currencies are fiat. Other than cash, where are you going to put money right now? Gold could correct, of course, and I frankly hope it does. I'm not counting on it, though. The price is just as likely to head the other direction. But if it does temporarily fall, while the bubble-heads are smirking, I'll be buying. Someday I think we'll be reversing roles. Regards, Jeff Clark For the Last Time, Is Gold in a Bubble? originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." More articles from The Daily Reckoning…. | ||||

| US Mint Sales: Silver Eagles Sail, Boy Scouts Coins Hit 350,000 Max Posted: 26 Jun 2010 09:04 AM PDT Sales for U.S. Mint silver products were mixed last week, according to the most recent United States Mint statistics. Two out of five numismatic products outperformed their prior increases, and Silver Eagle bullion coins were hot as authorized buyers stocked up their inventory. | ||||

| Silver Prices Surge, Narrowing Weekly Loss Posted: 26 Jun 2010 09:04 AM PDT U.S. silver prices surged on Thursday and Friday, paring sharp prior day declines to significantly narrow the metal's weekly loss. | ||||

| Bullion Prices & Business Weekend Recap – June 26, 2010 Posted: 26 Jun 2010 09:04 AM PDT

The yellow metal edged a touch lower than last Friday's record high, narrowly halting a weekly winning streak that began in mid-May. Bullion's sprint pared losses in other metals, although palladium was least affected having fallen the furthest. In other markets, crude oil soared to close at a seven-week high while U.S. and European stocks ended with a down week as major indexes plunged between 2.35 percent and 4.54 percent. (…) © CoinNews.net for Coin News, 2010. | | ||||

| 220 Pound Gold Coin “Disappoints” And Only Sells For $4.02 Million Posted: 26 Jun 2010 09:00 AM PDT The Vienna auction house Dorotheum has sold the world's largest gold coin, a Canadian Maple Leaf manufactured by the Royal Canadian Mint in 2007. It is listed in the Guinness Book of World Records and carries a face value of one million Canadian dollars (800,000 euros, 970,000 US dollars) measuring 53 centimetres (21 inches) in diameter and weighing 100 kilograms (220 pounds).

Mr. von Welsbach is in police custody and faces possible charges of embezzlement and fraud in connection with the company's collapse. AvW had acquired the coin in 2007, joining an exclusive club of owners including Queen Elizabeth, who is also displayed on one side of the coin, two unidentified investors in Dubai and one who is so reclusive even his or her residence is unknown. The bidding started at 3.27 million euros, with Oro Direct, a Spanish gold-trading firm being the lone bidder. It is reported that up to 8 different bidders had registered but no counter bids were made. The auction room was packed with more journalists than potential buyers. The auction price disappointed Michael Beckers, Dorotheum's coin expert who oversaw the sale. He had predicted that the price could go as high as €4 million "on a good day". "I'm a little disappointed. I had hoped and expected to achieve more," he said, minutes after the hammer fell. The Royal Canadian Mint manufactured and launched the coin in 2007 to showcase its production facilities and steal the entry in the Guinness Book of Records for the world's biggest gold coin. That title had previously been held by the Austrian mint, who in 2004 produced fifteen 100,000-euro coins weighing 1,000 troy ounces (31.1 kg) to celebrate the 15th anniversary of its best-selling Philharmonics coin. Valencia-based Oro Direct's managing director Michael Berger said his firm intends to use the coin in its marketing efforts, . "We believe in gold, and therefore also believe we have made a great investment. We believe that going forward, gold will offer the only real safe haven in this uncertain economic environment," Related posts:

| ||||

| Adrian Douglas: Is discovering the gold fraud worse than the fraud itself? Posted: 26 Jun 2010 08:59 AM PDT By Adrian Douglas Friday's commentary by MineWeb's Lawrence Williams, "Now China Sources Newly Mined Gold from the USA" (http://www.mineweb.co.za/mineweb/view/mineweb/en/page33?oid=106850&sn=De…), cited in a GATA Dispatch yesterday (http://www.gata.org/node/8767), incensed me, for it was disingenuous for Williams to suggest that China's buying gold assets off-market could be construed as manipulating the gold price up. If it wanted to manipulate the market, China would need only to buy 30,000 gold contracts on the Comex and stand for delivery. I was so upset by Williams' nonsense that I went looking for other recent articles written by him. I came across a comment Williams made on Twitter of May 10: http://babybulltwits.wordpress.com/2010/05/10/lawrence-williams-what-gol… In this commentary, in a reference to my expose of the unallocated metal accounts maintained by London Bullion Market Association members, Williams endorses the view that the bullion banks have sold much more bullion than they have. Williams wrote: "It does also seem that the feeling that the bullion banks — and even reserves held by central banks — may not be all they are held out to be is gaining credence. While some of the wilder theories are almost certainly wide of the mark, suggesting that the banks are trading far more gold than they hold title to may well be correct. Banks have nearly always operated in this manner with cash. While they probably feel that they have the collateral to cover their potential commitments at current gold prices, it may not be quickly available. Thus a run on physical gold would leave them very exposed indeed and likely unable to meet the demand — or so the theory goes! A run would also inevitably drive the yellow metal to huge heights as the banks struggle to cover — indeed perhaps to the extent that even the best-financed institutions would be bankrupted. The financial turmoil which would accompany such a run could be bloody indeed, so one has to hope that it never happens." It is comical that Williams hopes that, for the benefit of humanity, the fraud being committed by the bullion banks is never exposed. Perhaps Williams also wishes that Bernie Madoff's scam had never been exposed, or that Enron had been better at lying and we had never discovered that the company was a sham, or that we had never learned about the toxic derivatives of AIG. Of course Williams is not alone in thinking that the huge financial scandals are best left alone because they are so damaging when exposed. After all, this seems to have been the attitude of the U.S. Securities and Exchange Commission, some of whose employees preferred to watch Internet pornography than to regulate, and the U.S. Commodity Futures Trading Commission, which has taken almost two years to investigate silver market manipulation in a classic example of how to whistle in the wind. Williams then has the audacity to intimidate the smart investor who tries to protect himself from the corruption of the bullion banks and the complicity of the regulators. He writes: "Even the slightest prospect that such a circumstance could materialise might lead again to political confiscation of gold similar to that instituted by Roosevelt in an attempt to pre-empt the turmoil which would ensue." So according to Williams not only are the bullion banks corrupt in selling gold they don't have and the regulators are asleep, but if investors ask for enough of the real stuff that it exposes the scam, the government might take the real stuff back and give investors a piece of paper gold instead. And then Williams has the temerity to accuse China of manipulating the gold market? The Chinese government is encouraging its people to buy gold. But nothing the Chinese can do to buy real gold could be remotely close to the manipulative effect of selling more gold than there is gold left to be mined. Williams has missed his vocation as a defense trial lawyer in coming up with the wonderful justification for allowing the gold market manipulation to continue because the consequences of stopping it are just too tumultuous. —– Adrian Douglas is publisher of the Market Force Analysis letter (www.MarketForceAnalysis.com) and a member of GATA's Board of Directors. Join GATA here: New Orleans Investment Conference * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Physical demand overpowering COT, Ted Butler tells Eric King Posted: 26 Jun 2010 08:59 AM PDT 1p ET Saturday, June 26, 2010 Dear Friend of GATA and Gold (and Silver): Silver market analyst Ted Butler tells Eric King of King World News that the commitment of traders reports in gold and silver did not get much more negative last week despite the rally in the precious metals, and he increasingly feels that the configuration of trading positions is losing influence over prices as physical demand for the metals increases. You find the interview at the King World News Internet site here: http://www.kingworldnews.com/kingworldnews/Broadcast_Gold+/Entries/2010/… CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Lawrence Williams: Is China manipulating gold UP? Posted: 26 Jun 2010 08:59 AM PDT 4:02p ET Friday, June 25, 2010 Dear Friend of GATA and Gold: MineWeb's Lawrence Williams today has posted excellent and incisive commentary about China's agreement to buy gold concentrates from a Coeur d'Alene mine in Alaska, seeing it as evidence that China cannot obtain all the gold it wants from domestic production and wants to build its gold reserves without the market-exploding publicity that might result from buying gold from the International Monetary Fund. But Williams concludes with a puzzling reference to GATA: "The move has to be seen as long-term bullish for the gold price and is yet another way of limiting downside risk for gold investors. GATA has for a long time been railing against what it sees as gold price suppression by the gold banks and governments, but probably none of this has the potential impact for control of the gold market which can be and probably is being exerted by the Chinese. But because this is broadly positive for gold it may not be in that organisation's interests to comment. Yet it is an equally manipulative policy if indeed it is in effect!" In the context of its work, GATA would define "manipulative" as involving interference against a free market — like the coordinated dishoarding of gold by central banks at strategic moments to knock gold's price down, or the sale of more promises of gold than can realistically be delivered or more gold than even exists. GATA has documented this sort of market manipulation: http://www.gata.org/taxonomy/term/21 Is it "manipulative" for a buyer to try to arrange his buying so it doesn't proclaim the danger of shortages and invite front-running by other buyers? Not in the sense of what GATA has complained about. As Williams notes, China's careful acquisition of gold is hugely bullish for the long term and spells doom for the Western central bank gold price suppression scheme — eventually, when China thinks it has adequately hedged its huge dollar reserve exposure, but not necessarily soon. But if China means to get all the gold it can and has decided to stagger its purchases to minimize their market impact, such a policy just as easily can be said to be manipulatively suppressive. In any case China's gold policy seems somewhat more transparent than that of the U.S. Treasury and Federal Reserve, whose determined secrecy in gold matters probably secures for them for all time the prize for gold market manipulation. Williams' commentary is headlined "Now China Sources Newly Mined Gold from the USA" and you can find it at MineWeb here: http://www.mineweb.co.za/mineweb/view/mineweb/en/page33?oid=106850&sn=De… CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| "New Austerity" Threatening Global Recovery? Posted: 26 Jun 2010 05:53 AM PDT Earlier this week, George Soros said German fiscal policy endangers the European currency union:

Collapse of the euro? Obviously Soros is short euros, but he's not the only one concerned about Europe's fiscal policies. In counterpunch's weekend edition, Michael Hudson writes, Europe's Fiscal Dystopia: the "New Austerity" Road:

| ||||

| Guest Post: Is UTA's James Galbraith A True Economist? Posted: 26 Jun 2010 05:49 AM PDT Submitted by Taylor Conant at Economic Policy Journal Is UTA's James Galbraith A True Economist? It's hard to arrive at that conclusion after listening to an hour long interview/debate on Scott Horton's Antiwar Radio program between Austrian economist Robert Higgs and Keynesian "economist" James Kenneth Galbraith. | ||||

| The Wise Investor - June 2010 Newsletter From Sundaram BNP Paribas Asset Management Posted: 26 Jun 2010 05:10 AM PDT Submitted by Sundaram BNP Paribas Asset Management

This posting includes an audio/video/photo media file: Download Now | ||||

| Posted: 26 Jun 2010 04:54 AM PDT Goldman's Andrew Tilton has laid out a useful framework of the most relevant factors to keep an eye on as the double dip unfolds in its entirety. While Goldman's bias is traditionally bullish, we are confident that as more and more economic indicators surprise to the downside (and June so far has been an unmitigated disaster - we will post Goldman's macroeconomic "surprise" tracker as soon as the latest version is released - it will be a bloodbath), which will eventually pull H2 GDP far below the administration's expectations for a number well north of 2%, and even Goldman's more tame forecast of 1.5%. Our thesis from the beginning of the bear market rally has consistently been that both the economic "rebound" and the market surge have all been a dollar for dollar translation of fiscal and monetary largesse, which in turn is just borrowing from future growth, via assorted credit mechanisms and an adherence to a Keynesian philosophy that eventually growth pick up will be large enough to overtake the incremental debt funding costs. We know from Reinhart and Rogoff's studies that this is no longer the case when you get into stratospheric sovereign debt levels. And as this is a closed loop, there is no way to get out of this Keynesian toxic spiral without inflicting terminal damage on the economy - perhaps in September 2008 there may have been a different outcome, but now it is too late. Which is why anyone looking for any modest economic bounce will be satisfied for only a quarter or two, as yet another greater stimulus flows through the economy. However, with the marginal utility of any new debt at or below zero, even the government's fiscal stimulus is now becoming useless (even when assuming a perfectly efficient distribution system, which in this corrupt political environment is a stretch). Which only leaves monetary stimulus as the last bastion of the reflation attempt, and we are certain it will be abused over and over by Bernanke, as America slowly careens to the unwinding of the current iteration. Which is why fiat paper will become increasingly worthless, and tangible, undilutable assets: vice versa. Macro convictions aside, below we present Tilton's checklist for the key items that none other than Ben Bernanke is looking at most intently. We suggest readers use this list not so much as a guideline of when the economy will rebound (never in its current form), but when Bernanke will finally decide to pull the trigger on another $2+ trillion QE episode. Once the negative surprises become sufficiently dramatic, he will have no other choice. And since Obama will be forced to blame the inability of this most recent reflation attempt to heal the economy precisely on the Fed head, the one good outcome from this event, would be the Chairman's (and soon thereafter, the Fed's) exit, stage left, from the US policymaking arena. Alas, it will be too late.

| ||||

| Alex Becomes First Named Tropical Storm Of Atlantic Hurricane Season Posted: 26 Jun 2010 03:58 AM PDT Tropical Storm Alex has officially been promoted. According to the NHC, the cyclone, which is due to pass over the Yucatan Peninsula in 12-24 hours, and once in the Gulf of Mexico is expected to become a hurricane by the end of the forecast period. Trajectory projection maps are still inconclusive as to just how much of an impact the hurricane would have on BP clean up operations.The chart below provides a snapshot of the three major storms currently in both the Atlantic and Pacific, where both hurricanes Celia and Darby appear to be no major threat.

As for Alex, here is the latest update from the NHC: WTNT41 KNHC 261446 SINCE WE DO NOT HAVE A RELIABLE CENTER LOCATION...THE INITIAL MOTION CONTINUES TO BE UNCERTAIN. THE BEST ESTIMATE IS 290 DEGREES AT 9 KNOTS. ALEX IS CURRENTLY LOCATED ON THE SOUTH SIDE OF A SUBTROPICAL RIDGE EXTENDING WESTWARD FROM THE BAHAMAS ACROSS THE GULF OF MEXICO. THIS RIDGE WILL KEEP ALEX MOVING ON THE SAME GENERAL WEST-NORTHWEST TRACK FOR THE NEXT 24 TO 48 HOURS. THEREAFTER...THE RIDGE IS FORECAST TO WEAKEN AND ALEX SHOULD DECREASE ITS FORWARD SPEED. HOWEVER...MOST OF THE GLOBAL MODELS SHOW THAT THE RIDGE WILL BE STRONG ENOUGH TO KEEP THE CYCLONE ON A GENERAL WEST-NORTHWEST TRACK OVER THE SOUTHERN PORTION OF THE GULF OF MEXICO. IN FACT...THE GFDL/HWRF PAIR WHICH PREVIOUSLY MOVED ALEX ON A MORE NORTHERLY COMPONENT ACROSS THE GULF HAVE SHIFTED SOUTHWARD AND ARE NOW SHOWING A MORE WESTERWARD TRACK LIKE MOST OF THE GLOBAL MODELS. And some preliminary forecast snapshots: As we have wondered before, how "value investors" are in the business of finding relative value in hurricane-variable situations where the downside is 100%, is just beyond us. | ||||

| Alf Field "World's Best Gold Analyst": Gold Going to $10,000 Posted: 26 Jun 2010 03:21 AM PDT Note: Left is the baltic dry rate index: plunging. My first reaction when I read an article on this site by Arnold Bock - articulating why gold would go to $10,000 – by 2012 no less - was amazement. Who in their right mind would suggest that gold would eventually reach $2,500, let alone $5,000 or even $10,000? Well, I did some investigation and, believe it or not, Bock is in lofty company. Many respected individuals, such as David Rosenberg, Peter Schiff, Harry Schultz, Rob McEwen and many others, have come to the same conclusion. Below is a partial list of such individuals with sound reasons to substantiate their views. 1. Peter Schiff: As President & Chief Global Strategist of Euro Pacific Capital, Schiff correctly called the current bear market before it began. As a result of his accurate forecasts on the U.S. stock market, economy, real estate, the mortgage meltdown, credit crunch, subprime debacle, commodities, gold and the dollar, he is becoming increasingly more renowned. He recently was reported in Business Week as saying that "People are afraid of the debasement of all the currencies. What's surprising is that gold is still as low as it is ... Gold could reach $5,000 to $10,000 per ounce in the next 5 to 10 years." Source: Here.. 2. David Rosenberg: Rosenberg, the former Merrill Lynch North American Economist and current Chief Economist and Strategist for Gluskin Sheff, an independent investment firm for high net worth individuals, believes that "$3000 an ounce on gold may yet prove to be a conservative forecast." He went on to say: - "if the gold price to world GDP ratio were to ever scale up to the peak three decades ago, it would imply an ultimate peak for gold of $5,300 an ounce. - if the relationship between gold and the M3 money measure where to revert to the 1990 high, then gold would move to $5,700 an ounce. - if gold were merely put on the same footing as the CPI, and head back to the previous peaks in this ratio, it would suggest $2,300 as the peak in gold — only a double from here. - if the gold price-M1 ratio was used then gold would go to $3,100 per ounce under the proviso that prior highs get re-established." Source Here.. 3. Alf Field: Alf Field has been called the "world's best gold analyst." He is well known for his many spot-on predictions in the precious metals market and these are some of his determinations regarding the future price of gold; More Here..Look Where GOLD and Silver is Going! Here.. This posting includes an audio/video/photo media file: Download Now | ||||

| Whats Bearish For Stocks Is Not Be Bearish For All Precious Metals… Posted: 26 Jun 2010 02:00 AM PDT | ||||

| Jim Rogers Would Rather Buy Silver, Hold Gold Posted: 26 Jun 2010 01:43 AM PDT | ||||

| U.S. Financial CDS Prices Post-FinReg Posted: 26 Jun 2010 01:25 AM PDT  Hickey and Walters (Bespoke) submit: Hickey and Walters (Bespoke) submit: With the House and Senate reaching a deal on financial regulation early this morning, we checked up on credit default swap prices of key US financial companies to see what -- if any -- impact the deal had. Default risk climbed quite a bit for the financials in the early stages of the recent market correction, but it then eased quite a bit in the middle part of this month as shares rebounded. This week's decline in the market once again caused default risk for the sector to spike, however. Yesterday's market decline coincided with a big jump in financial CDS prices. The financial sector was one area of strength in the market today as investors tried to dissect the impact of the rules that did and didn't make it into the proposed legislation (at least those in the 2,000+ page document that people have been able to read). But the strength in financial shares today didn't really carry over into the CDS market, as default risk pretty much held steady. As shown in the CDS prices (in basis points) of six major US financial firms below, today's move was a very small blip lower. So while stock investors saw the finreg agreement as somewhat of a positive for financials, the swap market is still be trying to make up its mind. Complete Story » | ||||

| Posted: 26 Jun 2010 12:11 AM PDT | ||||

| Posted: 25 Jun 2010 08:27 PM PDT Dear CIGAs, At long last we are now offering Compendium Version 3 for sale. There will also be a very limited printing of Compendium Version 1 and 2 for sale as well. If you want a copy I suggest you order it while you have the chance. We release Compendiums every couple years to help cover the operating costs of running a site like JSMineset. Over the years we have gotten quite large and these costs have grown substantially. If you like what we do here please purchase a copy – you will be supporting a good cause and allow us to continue providing this service free of charge. **PLEASE NOTE YOU DO NOT NEED A PAYPAL ACCOUNT TO PURCHASE ANY OF THE COMPENDIUM SETS. COMPENDIUMS SHOULD ARRIVE WITHIN 2-4 WEEKS DEPENDING ON YOUR LOCATION** What you will receive with each set: **NEW** Compendium Version 3 ($80 USD): Included in this two DVD set is a DVD Rom (accessible by computer DVD drive only) that is a searchable database of nearly two thousand articles over the last two years from Jim Sinclair, Trader Dan, Monty Guild and a collection of other JSMineset contributors. This is one of the largest collections of articles related to the Gold market available today on DVD and includes all charts we have posted over the last year and a half. The second DVD is the much anticipated CIGA Meeting in Toronto from February 2010. This DVD includes over 3 hours of discussions with Jim Sinclair himself and is playable in any DVD player. **NEW** Compendium Version 1-3 Package ($210 USD): This package includes Compendium 1 & 2 listed below and the new Compendium 3 above. Compendium Version 2 ($80 USD): Compendium Version 2 includes all articles posted from December 2005 to the end of October 2008. All articles are categorized and presented in HTML format and are PC and Mac compatible. Several thousand articles are again included in this archive disc which makes up literally thousands of pages of market commentary from Jim himself. Compendium Version 2 also includes an hour long DVD video commentary on financial markets by Jim Sinclair. This disc is playable in any DVD player and any computer that supports DVD playback. Compendium Version 1 ($50 USD): Compendium Version 1 includes all articles posted from the inception of JSMineset in 2002 to December 2005. It comes packaged as a searchable PDF database and includes several thousand articles on Gold and financial markets. As a bonus, a separate Technical Analysis video disc by Jim Sinclair is included in the package. This video is viewable on a computer only and is both PC and Mac compatible. Compendium Version 1 & 2 Package ($130 USD): This package includes both compendium 1 & 2 which are shown above. As you have noticed by this point, JSMineset does not subsidize costs with garbage advertising nor do we ever promote products through our free eblast system. If you feel JSMineset has helped you over the years, purchase Compendiums 1, 2 and/or 3 and help keep us alive! For the price you pay the information you receive is unbeatable and you know it is going to a good cause. All prices are in US dollars and include shipping and handling. Thank you all for your continued support! Dan Duval | ||||

| Trader Dan Comments On This Week's COT Report Posted: 25 Jun 2010 07:47 PM PDT Dear Friends, This week's Commitment of Traders reports details pretty much what we have come to expect in gold over the years; fund buying and bullion bank and swap dealer selling. What is interesting is the fact that gold soared into an all time record high with neither the Managed Money camp setting a record for a net long position nor the producer/merchant/processor/user and Swap Dealer camp setting a record for their respective net short positions. Considering the sell off on Monday's downside reversal day was included in the statistics, it is all the more remarkable that the Managed Money camp witnessed an INCREASE in their net long position. Apparently, the move lower Monday and the early dip overnight into Tuesday attracted more buying from this camp instead of selling. The running off the long side was done by the "other reportables" crowd which includes CTA's and other large players. The small investor, the general public, did what the big managed money crowd did; they too increased their net long positions. Based on this alone, we will need to see a CLOSE below Tuesday's low near $1,233 to generate any large scale long liquidation. A close of such nature will indicate that the speculative long side is not buying the dip but is instead liquidating. A push above $1262 will force short covering on the part of the "Other reportables" camp and some of the small specs. Click chart to enlarge in PDF format | ||||

| GLD, GDX and SLV: Does November 2009 Repeat in July 2010? Posted: 25 Jun 2010 06:55 PM PDT Last week I offered some analysis using the True Strength Index indicator on the daily and hourly charts of GLD, GDX and GDXJ. This week I would like to offer what I believe to be a realistic look at what could be headed our way in the upcoming month of July. The GLD, GDX and SLV charts in this article were made using the publically available software at FreeStockCharts.com. The best way to understand the big picture is to look at the big picture, so let's do that. What follows is a weekly chart of GLD. I set the time frame back over a year and use the True Strength Index indicator below the weekly price data. What you will notice is that the current setup for GLD is practically identical to that which existed in November 2009. Not only can we say that of the price movement, but also the movement of the green colored True Strength Index (TSI) indicator below price. Click on the chart to ENLARGE. I have taken the liberty of hand drawing the green TSI indicator line and its accompanying white 3 week moving average with what I believe may be the likely outcome in July. I have also drawn straight white trend lines under the GLD price and attempted to render its possible direction for next month, as well. One of the things I will be looking for in the upcoming weeks is whether or not the green TSI line fails to continuously make new highs. Any failure to do so will spell likely failure of the potential parabolic pattern. The other thing I will look for is the relative distance between the green TSI line and its white moving average counterpart. If the green momentum indicator gets too far apart, a pull back in price will occur. For example, one can observe in the GLD chart above that this is precisely what happened during the latter weeks in May. If a pullback is mild, lasts only a week, maybe two, and does not violate the 3 week moving average, the parabolic move can remain intact. And by the way, this price scenario – the red candle pull backs to the trend line – is when the bull throws off a few of his overly emotional riders. Keep your eye on the bigger picture of the trend line and the TSI and you will ride the bull until he tires. Next, let's take a look at the miners as represented by the GDX ETF. On this weekly chart I also took the liberty of offering a hand drawn hypothetical outcome for the month of July. I also offer some indicator measurement details to highlight how sell signals are given when negative divergences between price and the TSI occur. The sell signal is simply this: when price makes a new high and the TSI concurrently makes a lower high, that is usually when the party is over. That is the time to sell. I say usually because there is a scenario, seen in both the upcoming GDX and SLV charts, where a second rally occurs in a retest attempt of the previous highs, before heading into a painful correction. The setup required for this to happen occurs when the TSI value is reading much much higher than ZERO. Theoretically, the only time the TSI indicator is guaranteed to be correct on price heading south is when the indicator is BELOW zero. With the indicator far above the zero level but falling, there is time on the shot clock for another rally attempt, as the indicator will not fall from a very high reading to the zero line for some time. Rally attempts in this situation are simply doomed to fail. You will notice this occurred in the GDX chart below on the second week of January 2010. Click on the chart to ENLARGE. The key I will be eyeing for the next 4-6 weeks is whether the TSI continues to make higher highs. So long as it does, the rally still has legs. Today's reading of .17 surpassed the high TSI reading of .16 six weeks ago, and that tells me GDX is still going higher. Now to SLV. Silver, from my True Strength Index understanding, has got itself in a tricky situation. The problem is that the last high reading was .18 and today's reading is only .12. That means any higher high in price from here on out must be accompanied by a TSI reading in excess of .18, or it will be a negative divergence and create a sell signal. To avoid this sell signal, either SLV is going to now trade sideways some, allowing the TSI to nudge higher while not scoring a new price high…… then SLV is going to have to put its foot to the pedal and simply scream higher week after week until the weekly TSI reading exceeds the previous high's reading of .18. This is the scenario I envision – some sideways movement, then a moon shot higher. Click on the chart to ENLARGE. I invite you to visit my website at www.theTSItrader.blogspot.com. I usually offer a few posts each day on my market observations, often comment on the particular stocks I am currently trading, and try to show ways to use the True Strength Index indicator to make some sense of where the precious metals and their miners are heading. You may comment at my blog or contact me at: TSItrader@gmail.com Thank you for reading my thoughts. I look forward to hearing some of yours. Wishing you a profitable week, John Townsend Website: The TSI Trader Email: TSItrader@gmail.com |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

U.S. gold futures prices rushed toward their all-time high on Friday, capping a second day of gains and trimming losses from earlier in the week. A weaker dollar, stronger investor demand, and safe-haven buying were cited factors for lifting prices.

U.S. gold futures prices rushed toward their all-time high on Friday, capping a second day of gains and trimming losses from earlier in the week. A weaker dollar, stronger investor demand, and safe-haven buying were cited factors for lifting prices. According to the Wall Street Journal,The coin was sold as part of the liquidation of the assets of bankrupt Austrian investment firm AvW Group, founded by Wolfgang Auer von Welsbach, the great-grandson of a 19th century Austrian nobleman and industrialist who invented the lighter flint and gas mantle.

According to the Wall Street Journal,The coin was sold as part of the liquidation of the assets of bankrupt Austrian investment firm AvW Group, founded by Wolfgang Auer von Welsbach, the great-grandson of a 19th century Austrian nobleman and industrialist who invented the lighter flint and gas mantle.

No comments:

Post a Comment