Gold World News Flash |

- Has the Fed Got It Wrong Again?

- Just One Stock: A Payday Lender With Growth Potential to Match the Risks

- Housing: Could Strategic Default Turn Into a Full Blown Movement?

- Is Mattel a Dividend Toy Story?

- Top Ten Reasons to Be Bearish

- Bank Capital Limits in Financial Regulation: A Tangled Web

- What Do You Believe Is America's Biggest Economic Problem?

- Daily Dispatch: The Good News

- We Cannot Afford to Double Dip

- Mathematical Proof that God Exists

- The Euro Crisis Part Deux

- Are We Having Fun Yet?

- Soros Demands Inflation... Myth of a CIA War

- Kent Exploration Making Headway on Diverse Project Portfolio

- The Time Is Nigh For AMI In West Africa

- What The Economist Doesn't Know About Gold

- New Home Sales Decline No Surprise to Some

- LGMR: Gold Slips as Yen Surges on "Risk Aversion"

- A New Plan for Valuing Pensions?

- Gold Seeker Closing Report: Gold and Silver Gain About 1%

- Another Economic Leading Indicator - Do NYT Bestsellers Tell Us More About The Economy Than The Government?

- Stimulus, Austerity, and the Spiral of Decline

- The Business of Home-owning

- European Failout

- GLD Adds 3 Tonnes Of Gold Overnight To New Record, Has Added 124 Tonnes In Past Month Even As Gold Price Remains Unchanged

- Gold Prices Rally Toward $1250, Silver Advances

- US Mint Sales: Gold and Silver Bullion Coins Reach for Records

- Ambrose Evans-Pritchard: Bernanke needs fresh money blitz as U.S. recovery falters

- Wall Street Journal patronizes trend toward taking possession of gold

- What Does Australia’s Election Result Mean For Mining Stocks?

- Capital Gold Group Report: Soros says German budget tightening threatens EU

- In which phase of the gold bull market are we?

- In The News Today

- If the Gold Price Fails to Advance Tomorrow or Monday Above $1245, it Will be Forced to March in Place a While

- Thursday ETF Roundup: VXX Surges, VNQ Tumbles

- Which Way to the G20 Meeting?

- BP's Blowout Preventer is Leaning and Might Fall Over

- Volume expanding as market heads for neckline

- After Hitting 1,100bps In Spread, Greece Finally Relents And Puts (Parts of) Itself Up For Sale

- Ben Bernanke needs fresh monetary blitz as US recovery falters

- Daily Credit Summary: June 24 - Risk Never Left (But Italy Did)

- THURSDAY Market Excerpts

- For the Last Time, Is Gold in a Bubble?

- Russia’s Central Bank Could Boost the Australian and Canadian Dollars

- Wonder What The Fed's Next Move Is?

- CNY “Revaluation”: Indication of Lack of Chinese Confidence in Global Recovery?

- Debunking Five Popular Myths

- This market-leading sector is breaking down

- World's central banks: Gold could be the most important asset to own for the next 25 years

| Has the Fed Got It Wrong Again? Posted: 24 Jun 2010 07:52 PM PDT The economy may not be great, however, it is not that bad either and it certainly does not warrant short tem interest rates at Zero. All this is now doing is sending the wrong signals to the markets and creating fear. The Fed did a good job at containing the financial meltdown two years ago, but it was late in the day when they acted then and they may be late in the day once again by keep interest rates so low. Complete Story » | ||||

| Just One Stock: A Payday Lender With Growth Potential to Match the Risks Posted: 24 Jun 2010 07:36 PM PDT Kerrisdale Capital Management submits:  Several times a week, Seeking Alpha's Jason Aycock asks money managers about their single highest-conviction position - what they would own (or short) if they could choose just one stock or ETF. Sahm Adrangi is the portfolio manager of Kerrisdale Capital Management, a New York-based investment manager of client funds via both limited partnerships and separately managed accounts. Prior to founding Kerrisdale, he was an analyst with Longacre Fund Management, a distressed debt hedge fund in New York. If you could only hold one stock position in your portfolio (long or short), what would it be? Complete Story » | ||||

| Housing: Could Strategic Default Turn Into a Full Blown Movement? Posted: 24 Jun 2010 07:31 PM PDT Garrick Hileman submits: By now many people are aware that the housing sector is showing renewed signs of trouble. In May, traditionally a time of the year when home purchasing activity picks up, both existing and new home sales tanked. And this is happening in spite of the fact that mortgage rates are at their lowest point since the 1950s. Complete Story » | ||||

| Is Mattel a Dividend Toy Story? Posted: 24 Jun 2010 07:19 PM PDT Chuck Carnevale submits: With the release of Toy Story 3, Mattel (MAT) is currently receiving a lot of investor attention. The stock currently commands a P/E ratio of 13.6, and offers an above-average dividend yield of 3.4%. Mattel only has 22% debt on the balance sheet and generates strong, albeit inconsistent, cash flows. At first glance this all sounds rather attractive for the conservative investors seeking dividend income, however, the story is not as sanguine when reviewing Mattel's history. It's a simple and undeniable fact that dividends are a function of earnings. For short periods of time a company can maintain their dividend during a temporary earnings interruption. Over the longer term earnings must manifest in order for the dividend to be safe. The operating history of Mattel, as it relates to its earnings and dividend record, offers a convincing example of the validity of the relationship between dividends and earnings. Complete Story » | ||||

| Posted: 24 Jun 2010 05:42 PM PDT Aigail Doolittle submits: This list tells you why I believe we are in the worst bear market of our collective lifetime. 10. Poor Outlook for Small Businesses – Small businesses make up more than 50% of non-farm GDP, employ about half of the nation’s private sector workforce, and create most of the nation’s new jobs according to the Small Business Administration. For the month of May, the National Federation of Independent Business reported that small business owners had a more negative outlook on job creation, capital expenditure plans, and future sales expectations. Considering that small business owners have more tenuous access to credit and are uncertain about cash outlays for healthcare and unemployment benefits, many are putting growth plans “on hold”. If 50% of GDP and employment remains “on hold”, it points to the strong possibility of a double dip recession and, in turn, another decline in the S&P 500. 9. Cash Outflows Are Trending Poorly – ICI reported that for the week ended June 16, domestic equity mutual funds saw $1.8 billion in outflows for the seventh sequential weekly outflow. Despite net activity of $5.2 billion for 2010 thus far, the first seventeen weeks of the year were comprised of $40.6 billion in inflows while the last seven weeks represented $35.4 billion in outflows. Should this trend continue, it will put managers in an awkward position of having to sell “winners” to meet redemptions due to the low levels of cash on hand. If both of these trends continue, one would have to believe it will have a negative impact on the S&P 500. 8. Tax Cut Expirations – Art Laffer, apparently not one for mincing words, wrote an excellent opinion piece in a recent The Wall Street Journal called, Tax Cuts and the 2011 Economic Collapse. While his title gets at the point rather well, briefly, in summary, Mr. Laffer made the very strong case, in my opinion, for the idea that income and production will be inflated above where it would be otherwise in 2010 since in-the-know individuals and businesses are shifting income, when possible, to 2010 in order to avoid the tax hikes that are coming in 2011. Not only did this happen in 1993 from 1992, but he believes “…this shift in income and demand is a major reason that the economy in 2010 has appeared to be as strong as it has. When we pass the tax boundary of Jan. 1, 2011, [his] best guess is that the train goes off the tracks and we get our worst case nightmare of a severe “double dip” recession.” 7. Deflation – In the most macro-terms possible, and at the risk of being repetitive, until the asset class at the eye of the financial storm – residential housing – heals via stabilized pricing, we are living in a world of deflation. This is reinforced by record low mortgage rates. In more micro-terms, over the last 12 months, the core rate of inflation has risen only 0.9% or well below the 2.0% average annual increase over the past 10 years. In addition, returning to small business owners, 28% reported making price reductions in May, an increase over April, while this price cutting contributed to a high percentage of such owners reporting declining sales. Lastly, the Fed’s extraordinary liquidity efforts of the last two years have led to stagnant money rather than monetary expansion. Should this transform into a true “liquidity trap”, stagflation is the best case scenario but outright deflation is more likely. 6. High Unemployment – 15 million Americans are out of work. Nearly half of those people lost their jobs after December 2007. Private sector hiring appears to be at a standstill with only 41,000 new jobs created in May. 46% of the unemployed have been out of work for more than 6 months or the highest percentage since this record has been kept back in 1946. The real unemployment rate, counting those who have simply stopped looking for a job, is nearly 17%. All in all, a rather bleak picture on the employment situation here in the U.S. and one that will lead consumers to remain on the spending sidelines and especially for houses. 5. Commercial Real Estate “Crash” – Various sources estimate that between $1.3 and $3.5 trillion in commercial loans is coming due in the next 5 years with more of it weighted toward 2012. This could be an ugly event. This is especially true if banks are unwilling or unable to offer new financing to the borrowers since commercial real estate owners will then be put in the awkward position of having to pay for multi-million dollar commercial real estate holdings in cash. While some will be fortunate enough to do so, there are others who will not and this will force mainly small and mid-sized banks, and insurance companies, to write down bad loans and determine what to do with portfolios of commercial real estate in a depressed market. This situation is so grave that chairperson of the Congressional Oversight panel, Elizabeth Warren, said that half of all commercial real estate loans will be underwater by the end of 2010 and the bulk of these loans are concentrated in small- and mid-sized banks. She even went so far as to say that this will devastate small-business lending and create “a downward spiral of economic contraction.” 4. Housing Double Dip – After a year of respite for the U.S. housing market due to the government’s tax credits and MBS purchases, residential housing is set to take another deep dip down. May’s non-government “owned” housing market activity was awful. Housing starts dropped by 10%, permits fell by almost 6%, mortgage applications were down, the homebuilders’ sentiment index dropped, existing home sales fell by 2.2% while new-home sales took a 33% nosedive. However, it is the combination of the S&P/Case-Shiller Index and annual housing starts that demonstrate that the housing market’s direction is down. Complete Story » | ||||

| Bank Capital Limits in Financial Regulation: A Tangled Web Posted: 24 Jun 2010 05:26 PM PDT BlindReason submits: Just a couple quick comments about bank capital limits and the financial regulation reform effort in Congress that is wrapping up in conference:

When you let Congress come up with complicated regulations, you get what you deserve. Lots of unintended consequences and a complete mess. Disclosure: No positions Complete Story » | ||||

| What Do You Believe Is America's Biggest Economic Problem? Posted: 24 Jun 2010 05:22 PM PDT

#1) The Gulf Of Mexico Oil Spill - The Gulf of Mexico oil spill is already the worst environmental disaster in U.S. history. Is it also about to become the worst economic disaster in U.S. history? #2) The Derivatives Bubble - The total value of all derivatives worldwide is estimated to be well over a quadrillion dollars. In fact, the danger from derivatives is so great that Warren Buffet has called them "financial weapons of mass destruction". Will the derivatives bubble end up being the major cause of the next depression? #3) The Housing Crash - Last month, sales of new homes in the United States dropped to the lowest level ever recorded. Also, the number of U.S. home foreclosures set a record for the second consecutive month in May. Very few Americans are buying houses right now. The subprime mortgage crisis brought the U.S. financial system to the brink of ruin in 2007 and 2008. Is it about to happen again? #4) The Federal Reserve - Instead of printing and issuing their own currency, the U.S. government actually has to go into more debt before any new currency is created. But the problem is that the money to pay the interest on that debt is not created at that time, so in order to pay that interest the U.S. government will need to create even more currency in the future. That means going into even more debt. Thus the U.S. government is caught in an endless debt spiral that has now become impossible to escape. By basing our economy on mountains of debt and paper money that is backed by nothing, have we essentially guaranteed that our economic system will totally fail someday? #5) The European Sovereign Debt Crisis - Greece, Spain, Italy, Portugal and a number of other European nations are in real danger of actually defaulting on their debts. If a wave of national defaults starts sweeping the globe, will it end up wiping out the U.S. economy as well? #6) The Growing Welfare State - For the first time in U.S. history, more than 40 million Americans are on food stamps, and the U.S. Department of Agriculture projects that number will go up to 43 million Americans in 2011. More than 1 in 5 American children now live below the poverty line. Nearly 51 million Americans received $672 billion in Social Security benefits in 2009. How many people can the U.S. government possibly support financially before it finally collapses under the weight? #7) Illegal Immigration- There are an estimated 30 million illegal immigrants now living in the United States. Not only is this a very serious economic burden, but it is a huge national security issue as well. Federal agents and local law enforcement officials along the border are now openly telling the media that they are outgunned, outmanned and are increasingly being shot at by the Mexican drug cartels that are openly conducting military operations inside the United States. There is now significant Latin American gang activity in almost every large and mid-size city in the United States. Meanwhile, Barack Obama continues to leave the border wide open. #8) Corruption On Wall Street- The corrupton in the financial system that has been revealed in 2010 has been absolutely mind blowing. Goldman Sachs, Morgan Stanley, Bank of America, Citigroup, JPMorgan Chase, Lehman Brothers and Wachovia are all being investigated by the government at this point. The rampant manipulation of the gold and silver markets was completely blown open by an industry insider, and the U.S. government has finally been convinced to take a look at it. It seems like the more the layers are peeled back, the more corruption we find in the financial community. So how long can the U.S. financial system survive when corruption is seemingly everywhere? #9) War In The Middle East - The U.S. government has spent hundreds of billions of dollars fighting the war in Iraq. The U.S. government has spent over 247 billion dollars on the war in Afghanistan, and yet June 2010 has now become the deadliest month of the Afghan war for coalition troops. Now there is a very real possibility that war could erupt with Iran. How long can the U.S. government continue to afford to pour hundreds of billions of dollars into wars in the Middle East? Not only that, but if a war with Iran cuts off the flow of oil from the Persian Gulf, what would that do to our economic system that is so highly dependent on oil? #10) Barack Obama's Health Care "Reform" - Barack Obama's pet project is actually the biggest tax increase in U.S. history, it is going to cause the premature retirement of thousands upon thousands of American doctors, and it is going to drive health insurance premiums through the roof. Health insurance companies are going to do very well (they actually helped write the bill), but the rest of us are going to be absolutely crushed by this brutal legislation. So what will happen when the U.S. healthcare system implodes? #11) Barack Obama's "Cap And Trade" Carbon Tax Scheme- Rather than focusing all of his attention on fixing the massive oil leak in the Gulf of Mexico, Barack Obama has been busy playing golf and figuring out how he can use this crisis as an opportunity to get his "cap and trade" carbon tax scheme pushed through the U.S. Congress. But will Barack Obama's obsession with "global warming" end up totally wrecking the U.S. economy? #12) Globalism - Most American workers had no idea that free trade would mean that they would suddenly be competing for jobs against workers in the Philippines and Malaysia. Today, corporations often find themselves having to choose whether to build a factory in the United States or in the third world. But in the third world workers often earn less than 10% of what American workers earn, corporations are often not required to provide any benefits to workers, and there are usually hardly any oppressive government regulations. How can American workers compete against that? #13) The Moral Decline Of America - An economy stops working efficiently when people stop feeling safe and when they stop trusting one another. As greed, selfishness, lust, pride, theft and violence continue to explode, how much longer will the U.S. economy be able to function normally? #14) Genetic Modification - Scientists around the globe have now produced "monster salmon" which grow three times as fast as normal salmon, corn that has been genetically modified to have a pesticide grow inside the corn kernel, cats that glow in the dark and goats that produce spider silk. Is it possible that all of this genetic modification could unleash an environmental hell that could destroy not only the economy but also our entire society? #15) Unemployment - Tens of millions of Americans are out of work and nearly a million people have lost their unemployment benefits because the U.S. Senate has once again failed to pass a bill that would extend those benefits. In some areas of the United States unemployment has been pushing up towards depression-era levels. For example, a while back the mayor of Detroit said that the real unemployment rate in his city is somewhere around 50 percent. So is the biggest problem that the U.S. economy is facing the fact that so many millions of willing American workers simply cannot find work? #16) The U.S. National Debt - As of June 1st, the U.S. National Debt was $13,050,826,460,886. According to a U.S. Treasury Department report to Congress, the U.S. national debt will top $13.6 trillion this year and climb to an estimated $19.6 trillion by 2015. The total of all government, corporate and consumer debt in the United States is now about 360 percent of GDP. The United States has piled up the biggest mountain of debt in the history of the world. So how long will it be before this mountain of debt collapses? So of the 16 economic problems listed above, which one do you believe is the biggest threat to the U.S. economy? Please feel free to leave a comment with your vote.... | ||||

| Posted: 24 Jun 2010 05:14 PM PDT June 24, 2010 | www.CaseyResearch.com The Good News Dear Reader, As investors, it’s essential to understand that for the near to medium term, the economic and investment outlook is the polar opposite of the rosy picture painted by officialdom and the quislings on Wall Street. Because that understanding is so important to your wealth protection, we have taken it upon ourselves in these musings to dispel the dangerous fictions with countervailing facts and, hopefully, informed opinion. Depending on how long you have been a dear reader, you have heard us warn – for months now – that the recession wasn’t over; that gold was one of the few secure asset classes and was going higher; that residential real estate would stumble again, and much more that is now becoming apparent to a wider audience. That said, while it is important to view the immediate outlook for the economy through a justifiably... | ||||

| We Cannot Afford to Double Dip Posted: 24 Jun 2010 05:14 PM PDT By Alex Daley, Senior Editor, Casey Research Talk of a double-dip recession is seemingly increasing these days. Home sales have dropped like a brick since the end of the special tax breaks for buyers. Weekly job reports are showing much larger rises in unemployment claims than previously expected by whoever it is that decides what exactly is expected – 427,000 new filings in just the last weekly report. The problem this time around, however, is not just the economy itself. The problem is that our supposed saviors are all out of tools to help the economy climb out of the deep, dark hole we now find it in. The tool belt of any monetary regime is limited to begin with. Nothing more than loosening up the debt purse strings with unrestrained interest rate policy and some additional lending from the central coffers to add to liquidity. These tools are the economic equivalent of performing reconstructive dentistry with a sledgehammer and monkey wrench, effect... | ||||

| Mathematical Proof that God Exists Posted: 24 Jun 2010 05:14 PM PDT (No math higher than pre-algebra required.) Silver Stock Report by Jason Hommel, June 24th, 2010 I first began to take the Bible seriously after a personal 6 month study of the topic of creation vs. evolution. I did this in the year 1998, about 2 years after I graduated from college. I started the study because I was feeling guilty about the way I was living my life, because of what I knew from the Bible. I felt I could cast off the guilt if the Bible were not true, and if man evolved. I actually wanted God to not be there. But after looking to see if he was there or not, I found Him. After independent study, after going to a college that emphasized critical thinking skills, and with an adult brain, and actually looking into the matter, I could not deny the mathematical truth that God created the universe and man, and that man did not evolve as they taught in college. Basically, it boils down to two choices, not an infinite array; either the Creator made us, ... | ||||

| Posted: 24 Jun 2010 05:14 PM PDT The 5 min. Forecast June 24, 2010 10:52 AM by Addison Wiggin & Ian Mathias [LIST] [*] Greece tragedy reprise: The Hellenic Republic fares little better than our favorite South American dictatorship [*] Like lambs to slaughter… households pile into municipal bonds [*] Why the Fed’s getting more cautious on the “recovery” talk [*] Fannie’s crackdown on strategic defaults, and other nonsensical housing news [*] Readers offer back story on new home sales, take us to task for “inconsistent thinking” [/LIST] Maybe it’s just the summer heat roiling Agora Financial headquarters in Baltimore this week. But from here, the world looks a bit screwy when the world’s strongest assets are gold and the British pound. So what’s going on? Let’s dive in… The euro is down big today. Not against the dollar (it stands at $1.23 as we write), but against nearly everything else. It hit an 18-month low against t... | ||||

| Posted: 24 Jun 2010 05:14 PM PDT Gold didn't do much until London opened for trading on Wednesday morning. From that point, gold rose to its high of the day [around $1,247 spot] during the London lunch hour... shortly before New York opened for business. But once that high was in, it was all virtually straight down from there... with the low of the day [$1,223.60 spot] coming at the London p.m. gold fix... which was minutes before 10 a.m. in New York. From that low, the selling pressure disappeared... and gold rose back to within a couple of bucks of Tuesday's close. Volume, once again, was not overly heavy. The silver price followed exactly the same path as gold... with the high of the day just under $19 during the London lunch hour. But [like gold] once the Comex opened, the bullion banks pulled their bids and the price cratered... with the low of the day [$18.32 spot] coming about a half hour after the London p.m. gold fix. Unlike gold, silver was not allowed to recover much, ... | ||||

| Soros Demands Inflation... Myth of a CIA War Posted: 24 Jun 2010 05:14 PM PDT Soros Demands Inflation Thursday, June 24, 2010 – by Staff Report George Soros Soros tells Germany to step up to its responsibilities, or leave EMU ... Legendary investor George Soros (left) has called on Germany to leave the euro unless it willing to embrace a growth strategy, describing Berlin's austerity doctrine as a threat to democracy and political stability in Europe. Mr Soros saw the political effects of wage cuts first-hand during the Great Depression, and narrowly survived the Holocaust as a Jewish boy in Nazi-controlled Budapest. He has since dedicated much of his wealth to philanthropic works promoting freedom and pluralism across the globe, mostly through Open Society institutes. His comments reflect growing alarm in influential circles on both sides of the Atlantic over the 1930s-style policies of wage cuts and debt-deflation being imposed up the Club Med bloc, Ireland, and parts of Eastern Europe by the EU authorities, at the behest o... | ||||

| Kent Exploration Making Headway on Diverse Project Portfolio Posted: 24 Jun 2010 05:14 PM PDT ByClaire O'Connor and James West MidasLetter.com Wednesday, June 23, 2010 Kent Exploration Inc. (TSX.V: KEX) has just completed an eight hole diamond drill program on the company's Gnaweeda Gold Project in Western Australia. The company is also awaiting IP results from the Alexander River Gold Project in New Zealand and is just one small step away from going into production on a high-grade barite property in Washington. All the while battling the highly controversial Australian Super Profit Tax proposition, Kent Exploration believes it has the goods to ride out this particularly cumbersome political storm. Super Profit Tax, Not So Super Announced in early May 2010, Australia's planned 40% tax on mining profits is due to come into effect in mid 2012, should it survive the elections in October of this year. Some argue that the tax is justified an... | ||||

| The Time Is Nigh For AMI In West Africa Posted: 24 Jun 2010 05:14 PM PDT By Claire O'Connor and James West MidasLetter.com Thursday, June 24, 2010 In West Africa, nestled amongst Anglogold Ashanti (NYSE:AU), Newmont Mining (NYSE:NEM) and Goldfields (NYSE:GFI), lies BC based junior AMI Resources (TSX.V: AMU). With an impressive land package in mining friendly Ghana and on-going drill results released from land adjacent to gold-producing Semafo (TSX:SMF) in Niger, AMI is inching closer to being a possible take over target. Regarding ounces, the company has already proven up 327,000 ounces of gold in Ghana and 130,000 ounces in Niger. In January of this year AMI entered into an option agreement with Newmont Mining under which Newmont has the right to earn an initial 51% interest in the 126 sq km Anuoro License by spending US$2 million in work expenditures and property payments during the first 3 year period. The An... | ||||

| What The Economist Doesn't Know About Gold Posted: 24 Jun 2010 05:14 PM PDT by Adrian Ash BullionVault Wednesday, 23 June 2010 Two things happen to cash savers (meaning pretty much everyone) when real interest rates get stuck below zero... HOW HAS GOLD reached and breached new all-time highs in the absence of strong 1970s-style inflation? The Buttonwood column in last weekend's Economist is only the latest analysis to miss the point, and despite tripping right over it, too. "Owning gold is traditionally seen as offering protection against inflation. And inflation is very bad news for owners of government bonds. "But the ten-year Treasury bond yields just 3.3%, a level that is towards the low end of the historical range...You would expect the performance of gold and Treasury bonds to be inversely correlated. When gold was at its real all-time high in 1980, the ten-year Treasury-bond yield was 10.8%. Fixed-income investors had suffered years of negative real returns in the 1970s." But there's the rub, as we never tire of tel... | ||||

| New Home Sales Decline No Surprise to Some Posted: 24 Jun 2010 05:14 PM PDT U.S. Census Bureau report (.pdf) for new house sales in May shocked all the experts except for some investors, who sold off home builders' stocks over the past two months producing price declines of 20% to 50% and the people who trade lumber who sold off the CME lumber contract (LB) by nearly 43% in the same time period. See Tuesday's article. Calculated Risk published the following graph which shows that the latest data establishes a new record low for new home sales since the data base was started almost 50 years ago. The data looks somewhat different (and more damaging economically) when new home sales are normalized by total population. This is done in the following graph, which shows the limiting upper and lower values for sales prior to the housing bubble. For those that like symmetries, note that we have now exceeded the previous lows by an amount nearly as large as the previous highs were exceeded. Is that an indication that we are approaching a sal... | ||||

| LGMR: Gold Slips as Yen Surges on "Risk Aversion" Posted: 24 Jun 2010 05:14 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:45 ET, Thurs 24 June Gold Slips as Yen Surges on "Risk Aversion"; Central Banks Hoarding Gold as Governments Accused of "New Dark Age" THE PRICE OF GOLD fell again but held above yesterday's 1-week low on Thursday in London, trading 2.2% below last week's finish as world stock markets fell for the third day running. The Euro held below $1.23 as gold prices slipped and Sterling retreated from an early jump to $1.50. The Japanese Yen rose to a 5-week high vs. the Dollar. "Gold is back to trading in line with the Euro," says one London dealer today. "It will be interesting to see if a return to risk aversion means gold breaks away from this correlation once again." Silver prices fell 3.4% meantime from Wednesday's peak as crude oil fell through $76 per barrel. Major economy Treasury bonds rose after new data showed Japan's trade balance, Eurozone industrial orders, and US durable goods ord... | ||||

| A New Plan for Valuing Pensions? Posted: 24 Jun 2010 04:08 PM PDT Mary Williams Walsh of the NYT reports, A New Plan for Valuing Pensions:

| ||||

| Gold Seeker Closing Report: Gold and Silver Gain About 1% Posted: 24 Jun 2010 04:00 PM PDT Gold saw slight gains in Asia before it fell in London and saw a $5.88 loss at $1227.92 by a little after 8AM EST, but it then rallied higher throughout most of trade in New York and ended near its late morning high of $1248.26 with a gain of 0.88%. Silver followed a similar patter and ended near its late session high of $18.798 with a gain of 1.25%. | ||||

| Posted: 24 Jun 2010 03:39 PM PDT Some pretty off the wall, and damn original, observations from ConvergEx's Nicholas Colas. Nikki Sixx and Barbara Bush – NYT Best Sellers as Economic Indicators

This posting includes an audio/video/photo media file: Download Now | ||||

| Stimulus, Austerity, and the Spiral of Decline Posted: 24 Jun 2010 03:38 PM PDT In an economic decline, mediocre governments typically bounce back and forth between "stimulus" and "austerity." They are the ketchup and mustard of bad recession policy. "Stimulus" - favored by the left-leaning politicians - rarely amounts to more than a form of welfare spending. This is appreciated in hard times, but it tends to be extremely expensive and does little for the economy as a whole. Deficit worries increase. Then comes the "austerity," often favored by conservative politicians. "Austerity" usually means spending cuts and tax hikes. But, it does not take long before politicians, bureaucrats, public employees and corporate cronies all agree that they don't actually want to cut spending. Usually, they take some unpleasant swipes at welfare programs and services - in other words, the only programs that actually do some good, and which are especially important in a recession. This also happens to be the only government expenditure that does not land in the pockets of politicians, bureaucrats, public employees and corporate cronies. These spending cuts rarely amount to much, so the government relies more and more on tax hikes for their "austerity" plans. The results of the tax hikes are typically an even worse economy, and often no appreciable increase in tax revenue. As the economy contracts further, demands on the government increase. "Austerity" becomes unpopular, and is postponed until some future date "after the economy recovers." (The tax hikes remain, however.) If the government has not exceeded its debt carrying capacity, it lurches back toward "stimulus" and large deficits. Japan has been though this cycle probably a half-dozen times by now. If the government can no longer credibly issue debt, the typical next step is a double helping of "austerity." There is talk of huge spending cuts, which rarely materialize. What usually happens next is minor spending cuts and huge tax hikes. This often begins the final implosion, when businesses give up completely, and tax evasion soars as the government has lost all legitimacy. Default may follow soon after. Britain's government is near this point now. "Stimulus" is no longer tenable. Out come the tax hikes. The talk now is of raising the capital gains tax from 18% to 40%, and even 50% in some situations. This would be on top of an increase in the VAT to around 20% from 17.5%. It was 15% in 2009. In November 2008, Britain's government raised the top income tax rate from 40% to 45%, and in 2009 it increased to 50%. In his 1932 election campaign, Herbert Hoover boasted that more public works had been built in the four years of his administration than in the previous thirty. Federal spending ballooned from $2.9 billion in 1929 to $4.4 billion in 1931, a 52% increase. Part of this gusher of cash went to build the Hoover Dam on the Colorado River. This spending binge, in the midst of recession, brought huge deficits. Hoover then tried to address the deficit with a huge tax hike. In 1932, the top income tax rate in the US rose from 25% to 63%. He also tried to implement a national sales tax, but this was defeated. This followed the infamous Smoot-Hawley Tariff of 1930, which put a 60% tariff on more than 3,200 products. After 1933, the Roosevelt administration pursued much the same approach. By 1935, Federal expenditures had grown to $6.4 billion, and in 1940 they hit $9.5 billion - over three times the level in 1929. That year, the top personal income tax rate was 79%. President Roosevelt's Treasury Secretary, Henry Morgenthau, described the results in May 1939: "We have tried spending money. We are spending more than we have ever spent before and it does not work. ...We have never made good on our promises... I say after eight years of this Administration we have just as much unemployment as when we started... And an enormous debt to boot." The cycle of "stimulus" and "austerity" eventually leads to more spending and higher taxes. It doesn't work. So what's the solution? A better strategy is less spending and lower taxes. In 1976, Britain was so hard up that it had to go to the IMF for a loan. Without this assistance, the government would have likely defaulted. The IMF insisted on its usual "austerity" plan, with spending reductions and higher taxes of course. In 1979, Margaret Thatcher became prime minister. Thatcher is remembered today for her sweeping reorganization of government, in which public employees, subsidies and state-run businesses were slashed or discarded. She crushed the influence of public unions in the face of widespread strikes. Despite this, in the 1983 general elections, only 39% of union members voted for the opposing Labor Party. Thatcher was popular. Why? The other side of her strategy was tax cuts. She immediately moved to lower top income tax rates from 83% to 60%. By 1986, the top income tax rate was 40%, and the basic rate had fallen to 25%. Capital gains tax rates were reduced from 75% to 30%, and indexed to inflation. The corporate tax rate was reduced from 52% to 35%. Ronald Reagan, in the US, had much the same strategy: tax cuts and spending cuts. During his presidency, the top US income tax rate fell from 70% to 28%. His attempts to reduce spending floundered in the Democrat-controlled Congress. Ideally, spending reductions should focus on the waste, theft and graft - the politicians, bureaucrats, public employees and corporate cronies - not on the public services which are the government's primary reason for existence. Britain still has its National Health system. I find that these sorts of policies are accompanied by a certain change in mood. The political focus shifts from parasitic self-enrichment to one of national success and failure. If your initial premise is to find a way to strip-mine the populace for wealth, and then distribute your gains among your cronies, then tax hikes and spending increases are the natural conclusion. Politicians find the answers when they start to ask the questions. Thatcher studied conservative texts, and actually read Friedrich Hayek's The Road to Serfdom from cover to cover. You can sense this change in mood when the terms "stimulus" and "austerity" disappear from discussion. Politicians start to talk about "national greatness," as Vladimir Putin did in 2000 when he introduced Russia's amazing 13% flat income tax. In the explosive recovery that followed, the Russian government's income tax revenues soared. In 2001, the first year of the new tax system, income tax revenues increased by an astonishing 46%! This had nothing to do with oil prices, which finished that year at $19.33 per barrel. In 2002, income tax revenues increased another 40%, and crude oil finished the year at $29.42. By 2007, income tax revenues were 624% higher than they were in 2000, and Russia was once again a major world power. This can be a wonderful time for investors. Sometimes, governments never pull out of their spiral of decline. During the 16th century, Spain was the wealthiest and most powerful state in Europe, with a world empire stretching from California and Peru in the west to the Philippines in the east - not to mention Portugal and most of Italy and the Netherlands. By the early 17th century, native Spaniards were fleeing to the Americas to escape crushing taxes. In his wonderful book, For Good and Evil: the Impact of Taxes on the Course of Civilization, Charles Adams notes an observer in early 17th century Madrid who said: "The galleons left on the 28th of last month; I am assured that in addition to the persons who sailed for business reasons, more than 6,000 Spaniards have passed over to America for the simple reason that they cannot live in Spain." Four hundred years later, Spain remains a nice place for a sunny vacation. Nathan Lewis | ||||

| Posted: 24 Jun 2010 03:28 PM PDT

We keep saying the same thing here at The Daily Reckoning. Not because we lack imagination... It's because things are still the same. "Outlook for home prices grows darker," says The Wall Street Journal. Well, yes. Much darker. Bloomberg:

Hey, what happened to that $12 trillion worth of stimulus spending, guarantees and bailouts? We said it wouldn't work from the get-go. They said 'yes, it will.' We said 'no, it won't.' Can we have our money back? Last week's report showed that used or existing houses were not selling. Now we find that new houses are selling even worse. The tax credit doesn't really expire until the end of this month. But you can't build a new house in 4 weeks, so the May new house data reflects the end of the credit. You've heard the expression, 'bad money after good'? Well, stimulus money was bad money from the beginning. It headed down the drain the minute it left the bank. Trillions of dollars wasted. And for what? That's the interesting thing. The feds couldn't really stop the process of de-leveraging. They could make-believe...with federal spending projects that looked a little like real work...and handouts that looked like real income. But all they could really do was rob Peter to pay off Paul...or rip off them both with debts they couldn't pay and phony money they couldn't back with anything real. All they did was make sure some people were hurt worse than others. Shareholders, for example, lost trillions as stocks fell. The market has recovered much of the loss, but US stock market investors are still out more than $3 trillion. Homeowners lost big, too. Clip 20% to 50% off the value of America's housing stock and you've erased as much as $10 trillion. We don't know yet. The housing market moves slowly. It discovers what things are worth...but only by fits and starts. After the latest housing news, our guess is that house buyers are going to squeeze their nickels even harder. And house sellers are going to be even more desperate. Between the reluctance of the buyers and the eagerness of the sellers, house prices will probably come down another 10% to 20% - maybe more - before they finally reach bottom. But thanks to the generosity or stupidity of the US government, bondholders have done pretty well. Instead of letting the whole capital structure collapse, so that it might be rebuilt on a more solid foundation, the feds bailed out the bondholders...who just happen to be very cozy with Wall Streets big banks and federal authorities. Then, of course, the feds congratulated themselves. They avoided a disaster. They saved the world. They brought the world economy back from the brink of catastrophe. At least that is how they and the press spun the story. For our part, we would have preferred to see the whole thing go over the edge. Not that we know what kind of catastrophe would have resulted. But we wanted to find out. And whatever it was, we doubt that it would have cost $12 trillion. In fact, the price would have probably been only a fraction of that amount... For every bondholder who would have taken a loss there was a debtor somewhere who would have been relieved of a burden he couldn't pay. In the present case, the debtor was relieved of his burden. The feds took it over from him. Now, it's on all our backs! And more thoughts... Yesterday, we went over to Mondawmin Mall to renew a driver's license. Mondawmin is in a part of Baltimore that is 100% black. We drove by abandoned wrecks...and some tidy neighborhoods with attractive row houses. Blacks seem to have disappeared in America. In the '60s and '70s, they were the center of attention. How come they hadn't integrated better, people wanted to know? How come there was such an income gap? What kind of racism still lurked in American society and how could we get rid of it? But then, Barack Obama was elected. Now, no one seems interested in racism...or in blacks. 'If a black man can be elected president, the rest of the them can stop their bellyaching,' people seem to say. 'If they don't succeed, it's their own damned fault.' At least, that seems to be the temper of the times. Instead, the media seems more interested in Hispanics. One of them is shot dead at the border. A town passes a law preventing illegal immigrants from working. The great state of Arizona reserves the right to ask for their papers at any moment. "Are you a citizen?" says the policeman. "Prove it." Blacks and whites have been zombified. The brown man has not. Blacks and whites have the right papers. They get their checks, and their free food, and their government jobs. They carry the phone number of a tort lawyer in their pocket and hope someone hits them. Illegal aliens are practically the only real Americans left. They don't have any contact with the zombie administration. (We don't know that this is true, by the way...we're just imagining...) They don't register to vote...or to get food stamps...and they don't complain when their employers harass them. They're afraid of being deported! But back in the Mondawmin Mall the clerks were black, the customers of the Maryland Department of Transportation were black. Everyone was black but your editor. Of course, your editor grew up in the tobacco fields. In some ways, he is probably more black than most of the blacks at the mall, even though he is lilywhite. Our father came from an Irish family; they were fairly recent immigrants from Donegal. But our mother's family had been in Tidewater Maryland since the reign of Queen Anne. Families - black and white - that have been in southern Maryland for 3 centuries are almost all related to each other. When we were growing up, a distant cousin, Geoffrey, lived across the road in a tenant shack. We weren't supposed to know or mention that he was a cousin. He was black. But Geoffrey grew up, went to medical school and became a doctor, now practicing in North Carolina. We're probably as big an embarrassment to him now as he was to us then. Later, we moved to a Baltimore inner city. It was the lure of architecture that led us thither - big beautiful houses built by Jews in the 19th century. We bought one in 1983 for $27,000. We fixed it up and lived there for 10 years. One of our favorite neighbors went by the name, Simms. That he had a first name or a last one, we were sure. What they were we never discovered. Simms was reliable. He would get rip-roaring drunk every Saturday night. In warm weather, he would get together a group of cronies and sit on the stoop and sing. "You are sooooo beautiful..." was one of his favorites. As he got drunker and drunker he would forget more and more of the words. 'You are so beautiful' was all he was left with at the end. Then, he'd fall dead asleep in a wheelbarrow so it was easy to cart him out of the way. But in the '80s the inner city didn't get better. It got worse. And when our children started growing up, we realized that we couldn't let them out on the streets. It was too dangerous. So we moved out. The people in the Mondawmin Mall were all polite. We wouldn't say that they were efficient. Efficiency did not seem to be something they were interested in. Many were probably unemployed or marginally employed. Time is not that precious when you are out of work. A process that should have taken 5 minutes dragged out for an hour. The young men all seemed to have tattoos...and pants down below their derrieres. One had to pull up his pants to keep them from falling around his ankles. The women often had tattoos too. Almost all the women over the age of 25 were huge. Many had clothing styles and hairstyles that your editor had never seen before. We took a number and sat down. From what we could figure there were 157 people waiting ahead of us. Another number was called every minute or so. It was going to be a long wait. Next to us sat a big man who looked like he might be a bricklayer or a mover. He was sturdy...with thick legs and arms. On the other side, a woman and her daughter kept up a conversation. The daughter was there to get a learner's permit. Their accents were so strong, we had a hard time following the conversation. These were not Southern Maryland blacks. These were Baltimore ghetto blacks with an accent of their own. Mother: "Get off dat phone...you bin talkin' all afternoon." Daughter: "I'm talkin' to daddy." Mother: "Well, tell that son of a b*** to give me some money." Daughter: "You gonna haf to tell him dat yosef." Regards, Bill Bonner | ||||

| Posted: 24 Jun 2010 03:15 PM PDT Let's not forget that in all the ruckus about the mining tax in Australia, the global back story favours certain resources. Why? Well, our view is that the slow-motion disintegration of fiat money systems and the debt that backs paper money will place an even higher premium on real, tangible assets. This would be true even if these assets were necessary for the growth of emerging market nations. A case in point is the $914 million stitch up between Riversdale Mining of Australia and Wuhan Iron of China. Overnight, the pair announced a memorandum of understanding in which Wuhan would pay for the right to receive 40% of the coking coal from Riversdale's Zambezi coking coal project in Africa. Wuhan, which is China's third-largest steel maker, would also get an 8% equity stake in Riversdale. The deal requires the permission of both the Chinese government and the Mozambique government. But if it gets approval, you'll have an Australian company finding and developing a world-class resource in Africa, financed by Chinese capital with the aim of resource security for China's steel industry. That's a scenario Australian investors can profit from. We know that to be true because Diggers and Drillers editor Alex Cowie tipped Riversdale in late March. We wouldn't normally give away what Alex is recommending to paid subscribers. But suffice it to say his recommended entry price was a fair bit lower than yesterday's close at $11.35. Not coincidentally, Alex has just returned to Melbourne from a short trip to Africa to view the mine sites of several other companies. He also investigated a few new prospects working on precious metals projects. And if he was able to shake off his jet lag, he told us he was headed to last night's meeting of the Melbourne Mining Club, where the focus was on the Resource Super Profits Tax. D&D subscribers can get Alex's full Africa update in his weekly e-mail, which goes out later today. You wonder what they said the Mining Club about the RSPT. One of Julia Gillard's first moves as the new Prime Minister of Australia was to suspend the government's media campaign for the tax. The mining industry agreed to the truce and pulled its advertising, too. The new Prime Minister had promised actual negotiations and just "consultation." In the short-term, this just means more uncertainty for resource shares. You wouldn't expect the PM to try and push the tax through before the election. But you wouldn't expect her to abandon it either. Earlier in the month she told the ABC, "We still want the people who work in mining to earn good money. We want miners to earn good profits and the nation to get a fair share." The rhetoric of fairness, then, isn' t going away. It just has a more attractive, likeable, and red-headed spokesman. She'll be a tough foe for the miners, especially since she'll enjoy a honey-moon with the public. But in substance, Julia Gillard is probably more committed to the ideology of wealth redistribution than Kevin Rudd ever was. It's not just her hair that is red. It's her politics too. But that is a debate for the politicians. At the very least, Australia now has a clear choice between two people who have genuine differences of opinion about the relationship between the people and their government. In their own way, both Tony Abbott and Julia Gillard believe they have Australia's best interests at heart. That's what makes ALL politicians so dangerous. But in the end, you get the government you deserve. It's an election year. One factor that neither the miners nor the new Prime Minister may be expecting is the possibility that by the time a new government is elected and ready to roll on a revised RSPT, the world's economy will have entered the second dip of a double dip recession. The underlying assumptions of the RSPT would vanish then, or at least be much less compelling in an economic sense (although it might actually be easier to sell to the public in hard times). Stock markets are certainly telling us that things aren't good. The S&P 500 fell by nearly 1.7% overnight. It's fallen by four percent over the last four days. Sentiment is bad and valuations are not attractive. It doesn't mean you can't get a rally from here. But worries about debt default in Europe just won't go away. Credit default swaps on sovereign Greek debt blew out to all time highs in European trading overnight. That means the cost of insuring Greek government debt from default has never been higher. That doesn't mean Greece WILL default on its debt. But it does bring us back to the question we ended yesterday's Reckoning with: what event could trigger the big fall in asset prices that the uber bears fear the most? Richard Russell said it could be the disintegration of the fiat currencies. If Greece defaults, will it cause a crisis in the Euro? Will it mean the end of the Euro? This is one of those questions that is either dismissed as the absurd speculation of a kook-job, or dismissed because it is just too ugly to think about it. But think about it! In practical terms, with Greece CDS rates over 1,000 basis points, it would cost you $1 million to insure $10million worth of five-year Greek debt from default. This is the markets way of saying that Greek debt is simply not going to be repaid, or repaid at par. This is also why you can expect regulators in Europe and the US to shut down the CDS markets in order to prevent a market price from communicating information about how bad sovereign finances are. But they are bad. And the other indication that this is so is in precious metals prices. We mentioned earlier in the week the increased central bank holdings of gold. And to be honest, that is just the sort of news that freaks us out. A contrarian mind immediately suspects a gold correction is imminent when the bankers are buying it. However, if the carefully managed Greek bailout turns into a "failout" the next moves in gold could be big. And they probably won't be down. Hopefully Alex will have more ways to benefit from this when he briefs us on his Africa trip later today. We'll let you know next week. Were you worn out by all the politics this week? At least one reader has had enough of us and our calling out of the socialist zombies in charge of the Welfare State. One reader writes in:

Why is it you read the Daily Reckoning again? Dan Denning | ||||

| Posted: 24 Jun 2010 03:06 PM PDT GLD claims to have added another 3 tonnes of gold to a fresh new all time record of 1,316.18 tonnes as of close of business today. In the meantime the fixing price of gold is back to near record levels... which is where it was on May 11, when GLD held over 124 tonnes of gold less. In other words, the world's biggest real time acquiror of the precious metal has added more than all central banks purchased in Q1 (if one ignores that whole Saudi Arabia snafu which we posted first last week), and the price of gold has not budged by a penny. Well played JPMorgan, well played. | ||||

| Gold Prices Rally Toward $1250, Silver Advances Posted: 24 Jun 2010 01:18 PM PDT

Metals were mixed as group. Silver jumped 1.5 percent. Platinum and palladium fell 0.4 percent and 0.9 percent, respectively. In other markets, crude oil futures prices rose slightly while U.S. stocks finished lower with major indexes dropping between 1.4 percent and 1.7 percent. (…) © CoinNews.net for Coin News, 2010. | | ||||

| US Mint Sales: Gold and Silver Bullion Coins Reach for Records Posted: 24 Jun 2010 01:16 PM PDT

The U.S. Mint updated sales figures for those coins Thursday morning, and a few areas draw attention:

(…) © Mike Unser for Coin News, 2010. | | ||||

| Ambrose Evans-Pritchard: Bernanke needs fresh money blitz as U.S. recovery falters Posted: 24 Jun 2010 01:15 PM PDT By Ambrose Evans-Pritchard http://www.telegraph.co.uk/finance/economics/7852945/Ben-Bernanke-needs-… Federal Reserve chairman Ben Bernanke is waging an epochal battle behind the scenes for control of US monetary policy, struggling to overcome resistance from regional Fed hawks for further possible stimulus to prevent a deflationary spiral. Fed watchers say Mr Bernanke and his close allies at the board in Washington are worried by signs that the US recovery is running out of steam. The ECRI leading indicator published by the Economic Cycle Research Institute has collapsed to a 45-week low of -5.7 in the most precipitous slide for half a century. Such a reading typically portends contraction within three months or so. Key members of the five-man board are quietly mulling a fresh burst of asset purchases, if necessary by pushing the Fed's balance sheet from $2.4 trillion (L1.6 trillion) to uncharted levels of $5 trillion. But they are certain to face intense scepticism from regional hardliners. The dispute has echoes of the early 1930s when the Chicago Fed stymied rescue efforts. "We're heading towards a double-dip recession," said Chris Whalen, a former Fed official and now head of Institutional Risk Analystics. "The party is over from fiscal support. These hard-money men are fighting the last war: They don't recognise that money velocity has slowed and we are going into deflation. The only default option left is to crank up the printing presses again." Mr Bernanke is so worried about the chemistry of the Fed's voting body — the Federal Open Market Committee (FOMC) — that he has persuaded vice-chairman Don Kohn to delay retirement until Janet Yellen has been confirmed by the Senate to take over his post. Mr Kohn has been a key architect of the Fed's emergency policies. He was due to step down this week after 40 years at the institution, depriving Mr Bernanke of a formidable ally in policy circles. The Fed's statement this week shows growing doubts about the health of the recovery. Growth is no longer "strengthening"; it is "proceeding." Financial conditions are now "less supportive" due to Europe's debt crisis. The subtle tweaks in language have been enough to set bond markets alight. The yield on 10-year Treasuries has fallen to 3.08 percent, the lowest since the gloom of April 2009. Futures contracts have ruled out tightening until well into next year. Yet the statement may understate the level of angst at the board. New home sales crashed 33 percent in May to an all-time low of 300,000 after the homebuyer tax-credit expired, confirming fears that the housing market has been propped up by subsidies. Unemployment is stuck at 9.7 percent. Manufacturing capacity use is at 71.9 percent. The Fed's "trimmed mean" index of core inflation is 0.6 percent on a six-month basis, a record low. "The US recovery is in imminent danger of stalling," said Stephen Lewis, from Monument Securities. "Growth could be negative again as soon as the fourth quarter. There is no easy way out since fiscal stimulus has already been pushed as far as it can credibly go without endangering US credit-worthiness." Rob Carnell, global strategist at ING, said the Obama fiscal boost peaked in the first few months of this year. It will swing from a net stimulus of 2 percent of GDP in 2010 to a net withdrawal of 2 percent in 2011. "This is very substantial fiscal drag. On top of this the US Treasury is talking of a 'Just War' against the banks, which will further crimp lending. It is absolutely the wrong moment to do this." Kansas Fed chief Thomas Hoenig dissented from Fed calls for ultra-low rates to stay for an "extended period", arguing that loose money risks asset bubbles and fresh imbalances. He recently called for interest rates to be raised to 1 percent by the autumn. While he has been the loudest critic, he is not alone. Philadelphia chief Charles Plosser says the Fed has blurred the lines of monetary and fiscal policy by purchasing bonds, acting as a Treasury without a legal mandate. Together with Richmond chief Jeffrey Lacker they represent a powerful block of opinion in the media and Congress. Mr Bernanke has fought off calls from FOMC hawks for moves to drain stimulus by selling some of the Fed's $1.75 trillion of Treasuries, mortgage securities, and agency bonds bought during the crisis. But there is little chance that he can secure their backing for further purchases at this point. "He just has to wait until everybody can see the economy is nearing the abyss," said one Fed watcher. Gabriel Stein from Lombard Street Research said the US is still stuck in a quagmire because Mr Bernanke has mismanaged the quantitative easing policy, purchasing the bonds from banks rather than from the non-bank private sector. "This does nothing to expand the broad money supply. The trouble is that the Fed does not understand broad money and ascribes no importance to it," he said. The result is a collapse of M3, which has contracted at an annual rate of 7.6 percent over the last three months. Mr Bernanke focuses instead on loan growth but this has failed to gain full traction in a cultural climate of debt repayment. The Fed is pushing on the proverbial string. The jury is out on whether or not his untested doctrine of "creditism" will work. "We are now walking on deflationary quicksand," said Albert Edwards from Societe Generale. * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Wall Street Journal patronizes trend toward taking possession of gold Posted: 24 Jun 2010 01:15 PM PDT But it's going to bite them and their friends soon enough. * * * For Gold Investors Who Want It 'To Go' By Liam Pleven and Carolyn Cui http://online.wsj.com/article/SB1000142405274870422730457532722232408814… The bull market in gold has sparked a new growth industry: providing a venue for investors to buy and store their personal stash. Individual investors are increasingly demanding to take possession of their gold holdings, rather than just owning shares in a mining company or a gold-related fund. That has garnered the attention of major players in the gold industry and start-up firms, which see an opportunity catering to this breed of gold enthusiast. Banks and others are scrambling to find vault space to meet mounting demand. The firms typically let clients buy gold through them and squirrel it away in the U.S. or abroad, while also allowing investors to demand actual delivery. The developments reflect the years-long gold rally, which has pushed prices to record highs. On Thursday, gold for June delivery settled at $1,245.50 per troy ounce in New York trading, up $11.40, or 0.92%. This year, gold has risen 13.72% and reached a record $1,257.20 an ounce on June 18. Traders in the futures market are also increasingly opting to take delivery of the metal, rather than simply buying and selling contracts for paper profits. At CME Group's Comex, the largest precious-metals exchange, investors took delivery of 39% more gold so far this year, compared with a year ago. At the same time, the exchange says its vaults now are holding a record 10.9 million troy ounces, up 11% this year. But many investors don't trade in the futures market, and have traditionally kept their gold coins and bars in safe-deposit boxes or private vaults, or even stashed under mattresses. Some are skeptical of storing gold with major banks in the wake of the global financial crisis, presenting a business opportunity for smaller investment firms. The World Gold Council, a trade group backed by gold miners, has joined the throng. This week, the council announced an investment of more than $9 million in BullionVault, a 5-year-old, London-based firm that stores about $800 million of gold on behalf of clients. The council already runs the largest gold exchange-traded fund, SPDR Gold Shares, which is backed by bullion but doesn't let average investors take physical possession of their share. Another firm, Gold Bullion International, is officially launching Friday with the aim of selling gold and vaulting services through financial advisers. Among the main financial backers is a major player in the gold market: Tocqueville Asset Management, which managed about $1.6 billion in gold-focused investments as of March 31. Funds that give investors direct ownership of gold also are flourishing. Sprott Physical Gold Trust, run by Sprott Asset Management in Toronto, recently added about 250,000 ounces to its holdings at the Royal Canadian Mint. The fund allows investors to redeem shares and take possession of bullion. Firms serving this niche often offer to keep the gold in so-called allocated accounts, which means that investors own a specific chunk of gold. In concept, it is similar to having money in a safety-deposit box at a bank, rather than a checking account. Vaulting firms, such as Via Mat International of Switzerland and Argentina-based Ocasa, are considering expansion. Ocasa is planning to open a 165,000 square-foot vault in New York this summer, which would become one of the largest in the country. Big banks also are beefing up their gold storage space, with J.P. Morgan Chase & Co. saying it will open a new vault in Singapore and Barclays Capital seeking to expand its space in London. "There's much more demand from gold investors for allocated gold," said Jonathan Spall, product manager of precious metals at Barclays. "People are attracted to hard assets outside the banking system which do not represent a credit risk to anyone." Nonbanks have arrangements with vault operators, such as Via Mat and FideliTrade Inc., of Wilmington, Del., to store gold in various places. The choices can include countries such as Switzerland and Canada, seen by some as posing fewer geopolitical risks. The option appeals to some investors who fear their holdings would be at risk if a bank encounters financial troubles. "They want it in a vault somewhere," said John Hathaway, senior managing director of New York-based Tocqueville. "That's just a sign of the level of distrust that people have with the banking system." The ownership of gold stored in regulated banks also can be subject to disclosure between governments, which makes some people uncomfortable, even if their holdings are legitimate, according to Jeffrey Christian, founder of CPM Group, a gold consultant. At the same time, other storage options can carry risks. In the early 1980s, investors with a firm called International Gold Bullion Exchange lost tens of millions of dollars after it was discovered that the company's vault contained wood bars painted gold. Firms try to contend with those fears by having their gold audited by outside monitors. Gold Bullion International, for instance, says its holdings will be checked quarterly. But owning a personal piece of gold can come at a cost. Colbert Narcisse, a Merrill Lynch veteran who heads Gold Bullion International, says the gold it sells will cost "nominally more" than shares in SPDR Gold Shares. And, while investors can take delivery of their gold, Mr. Narcisse doesn't recommend it. He says it's "most prudent" to keep it with the company because private insurance could cost more and investors would have to have the gold reauthenticated if they wanted to sell it later. * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

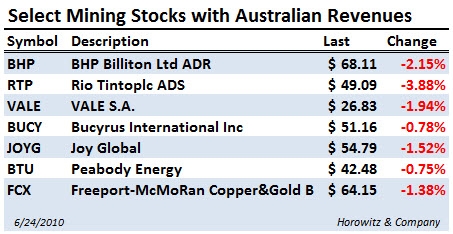

| What Does Australia’s Election Result Mean For Mining Stocks? Posted: 24 Jun 2010 01:15 PM PDT

| ||||

| Capital Gold Group Report: Soros says German budget tightening threatens EU Posted: 24 Jun 2010 01:15 PM PDT AP

Forcing Europe's governments to slash its budgets could push the continent "into a period of prolonged stagnation or worse," Soros said in Berlin . "That will, in turn, generate discontent and social unrest." Coming at a time when the Chinese "Unfortunately, Germany doesn't realize what it's Should the European countries go forward with a Germany, Chancellor Angela Merkel has urged other European President Barack Obama Soros sharply criticized Germany's The treaty imposes the 16 countries "Now these countries are expected to He warned that it is hard to predict how anger and "In Soros, a 79-year old hedge fund manager and He also suggested that the European Central Bank should Soros Capital Gold Group, gold group, gold, gold prices, gold news, gold coins, gold bullion, gold IRA, IRA | ||||

| In which phase of the gold bull market are we? Posted: 24 Jun 2010 01:15 PM PDT Gold is seen as transitioning from phase 2 to phase 3 in an ongoing bull market which still has some way to run | ||||

| Posted: 24 Jun 2010 12:58 PM PDT Dear CIGAs, My advice to gold and gold share holders is, in the vernacular of the times, to "CHILL."

Jim Sinclair's Commentary The G20 script caste against present circumstances. 1. EC members terrified by the power of OTC derivatives to destroy national bond markets are running scared. The strategy is twofold. Intervention at $1.19 to $1.20 in the euro and massive PR concerning strong currency initiatives weakened the dollar from its highs and took the euro so far into its $1.24-$1.25 key resistance. 2. Bernanke as a student of the Great Depression organizes a strong argument for continued coordinated monetary expansion with the US Treasury. 3. Monetarism fails miserably when applied in an open system. That is its major weakness. Bernanke's thesis demands the entire Western World be on the same page of Monetarism for without it new lows in the history of this period will be established. A return to locked credit markets is a reasonable assumption 4. Media seems to have slowed down on its revelations of EU weak states. 5. There seems to be a slight pickup in media discussion of the dire condition of US states heading towards bankruptcy. Keep in mind that in this new global economy a problem anywhere is a problem everywhere. As any currency in the Western World comes under attack, Gold has become the asset of choice. Be ready for more violence in the USD/EU equation. Violence regardless of direction will be gold positive. This move is to $1650 and beyond.

Jim Sinclair's Commentary An event to keep in mind: More than a million people are expected to run out of benefits this month, according to the National Employment Law Project.

Jim Sinclair's Commentary The is a clear and present danger when a competitor holds your future in their hands. The story that China would suffer as much is total crap when you see them cultivating Asian trading partners, internal consumptive power and cornering world hard assets. China's holding of US Treasuries is a strategic move and a weapon of mass financial destruction if it should be used in a manner other than as an investment. U.S. intelligence community debates China's bond holdings NEW YORK, June 23 (Reuters) – U.S. intelligence officials and top academics last week debated the risk China could wield its massive U.S. debt holdings as a weapon aimed at influencing U.S. foreign policy, according to a person who attended the meeting. At a National Intelligence Council meeting last week, held at a Washington, D.C. hotel, members of U.S. intelligence agencies and China watchers discussed potential outcomes if China chose to sell its $900 billion of U.S. Treasury bond holdings, pushing up interest rates and making life much tougher for U.S. businesses and consumers. While considered a remote possibility, China's tremendous economic stranglehold over the United States remains much-debated as the world's third largest economy grows in leaps and bounds and the number one economy struggles to break free from a deep recession. The meeting took place as the United States prepares to issue a report that could label China a currency manipulator. U.S. lawmakers are also arguing over a bill that would penalize China for any protectionist policies. "The best offense is often a good defense and you must be prepared. This is something that allows the U.S. to consider what policy alternatives they might have when facing threats from the outside," said Paul Markowski, president of the Global Strategies-Analysis Group in New York.

Jim Sinclair's Commentary Back towards crisis levels. How about to worse than recent crisis levels in this Ski Jump Virtual Recovery. Deutsche Bank: U.S. Financial Conditions Just Collapsed Back To Crisis Levels Deutsche Bank has a new and improved index of U.S. financial conditions, and this index just slumped back towards the lows of our recent crisis. Deutsche Bank's Peter Hooper: Financial conditions appear to have worsened substantially in recent quarters based on our update of the broad index of US financial variables presented earlier this year at the US Monetary Policy Forum. In the wake of recent developments in Europe, increased stress in financial markets has pushed that index halfway back to its immediate post- Lehman crisis lows. The index is built from an array of financial indicators such as U.S. treasury yields, the volatility index (VIX), the stock market, Broker-Dealer leverage, among others. It's a bit of a black box, but it's calculation is giving a similar reading to what we saw during the worst of the financial crisis.

Jim Sinclair's Commentary In Africa's Riff Valley this happened to a large lake, and as the level rose the methane bubble popped the top, flowed with the wind and killed an entire town. Methane in Gulf "astonishingly high": U.S. scientist (Reuters) – As much as 1 million times the normal level of methane gas has been found in some regions near the Gulf of Mexico oil spill, enough to potentially deplete oxygen and create a dead zone, U.S. scientists said on Tuesday. Texas A&M University oceanography professor John Kessler, just back from a 10-day research expedition near the BP Plc oil spill in the gulf, says methane gas levels in some areas are "astonishingly high." Kessler's crew took measurements of both surface and deep water within a 5-mile (8 kilometer) radius of BP's broken wellhead. "There is an incredible amount of methane in there," Kessler told reporters in a telephone briefing. In some areas, the crew of 12 scientists found concentrations that were 100,000 times higher than normal. "We saw them approach a million times above background concentrations" in some areas, Kessler said.

Jim Sinclair's Commentary CIGA Will asks if this is a plus for employment, and therefore will be heralded as a sign of an improved economy. Bank of America Boosts Staff Handling Troubled Loans Bank of America Corp., the second- largest U.S. home lender, added 2,000 employees since April to work with borrowers having trouble paying their mortgages, a senior executive said. The lender now has more than 18,000 workers in "default management," a 60 percent increase since January 2009, Barbara Desoer, president of Bank of America's home-loan and insurance unit, said in testimony prepared for a congressional hearing on U.S. housing policy tomorrow. Those workers handle 100,000 calls a day, she said. Wells Fargo & Co., the largest U.S. home lender, Bank of America and other companies have hired thousands of employees or shifted staff from other departments to work with borrowers who have lost jobs or experienced declining incomes. Banks repossessed a record 257,944 homes in the first quarter, 35 percent more than a year earlier, according to Irvine, California-based RealtyTrac Inc. More than a fifth of U.S. mortgage holders owed more than their homes were worth, Seattle- based real estate data provider Zillow.com reported last month. "Given the depth of the nation's recessionary impacts on homeowners, a considerable number of customers will transition from homeownership over the next two years," Desoer said in the testimony. "We must compassionately and responsibly help those customers who have exhausted all their options and can no longer afford to stay in their homes." Handling More Calls Bank of America, based in Charlotte, North Carolina, handles almost 14 million home loans, or about one of every five U.S. mortgages, more than any other U.S. servicer, Desoer said. Payments on 1.4 million loans are more than 60 days late, she said. Investors or government-sponsored entities such as Freddie Mac and Fannie Mae own most of those loans and pay servicers fees to handle billing and collection. | ||||

| Posted: 24 Jun 2010 12:01 PM PDT Gold Price Close Today : 1245.50Change: 11.40 or 0.9%Silver Price Close Today : 18.731Change 27.7 cents or 1.5%Platinum Price Close Today: 1567.30Change: -2.70 or -0.2%Palladium Price Close Today:... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! | ||||

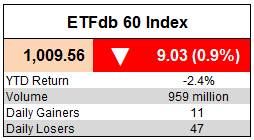

| Thursday ETF Roundup: VXX Surges, VNQ Tumbles Posted: 24 Jun 2010 11:40 AM PDT Michael Johnston submits: Equity markets dove sharply in Thursday trading as retailers and bankers led on the downside. This sharp drop led to a 145 point loss on the Dow with the Nasdaq and the S&P 500 both losing more than 1.6% as well. Gold and oil both sank marginally as investors fled to U.S. Treasuries. Mortgage rates fell to their lowest levels since the statistics started in 1971. However, many have been reluctant to take advantage of the scenario due to the struggling economy. “As long as prospective homebuyers are still concerned about their jobs and financial well-being, many will be reluctant to take the plunge, even though affordability has never been better,” said Greg McBride, senior financial analyst with Bankrate.com.

Complete Story » | ||||

| Posted: 24 Jun 2010 11:23 AM PDT What would you do if you were a rent-a-cop working security at the G20 meeting and you saw a car like this tooling around the streets of Toronto in close proximity to where the collective political and economic brain trust was about to gather?

According to this report in the Globe and Mail, they pulled the guy over and started asking a few questions. Good move. Shown below is what they found inside that homemade storage container deftly attached to his Subaru (I think that's a Subaru – it's Canada). Let's see … a crossbow with five arrows, a sledgehammer, a pickax, lots of gasoline and, of course, a baseball bat. Nah, nothing to see here … move along.

The driver, a gray haired man in his 50s, was said to be disoriented when police stopped him and took him into custody. On a related note, have a look at this Spiegel Online story about how German Chancellor Angela Merkel is standing her ground against the uber-Keynsians across the Atlantic. Note the link behind the word "shrill" in the first paragraph – it goes back to this report from the other day about Paul Krugman and, for those of you who haven't already figured out why this is so amusing, the word "shrill" is a favorite of another uber-Keynesian, Brad DeLong. | ||||