Gold World News Flash |

- GoldSeek.com Radio Gold Nugget: Keith Schaefer & Chris Waltzek

- Jim?s Mailbox

- Hourly Action In Gold From Trader Dan

- SDR Strawman & Gold-Backed Euro

- European Credit Crisis: Germans Throwing Stones

- Zombies Always Vote

- Economic Spin Cycle

- The Vanishing Of The Gold Basis and...

- Soros Attacks Germany's Hair-Shirt Politics

- John Doody's Doody-Free Picks

- Three Strikes Residential Real Estate is Out

- SDR Strawman & Gold-Backed Euro

- Fannie Screws The Citizens Twice

- Opportunity Of A Lifetime

- Gold and Silver Price Conspiracies Earn Their Weight

- Now The Cops May Be Getting Scammed!

- China Revaluation News Could Spark Short Term Squeeze in Metals

- Gold Correction Tactics Part 2

- Recovery? WHERE?

- LGMR: Gold "Supported by US Fed" as Eurozone Faces 1st July "Liquidity Drought"

- The Farce and The Fact

- Grandich Client Update – Crescent Resources, Down For The Count

- Grandich Client Update – Spanish Mountain Gold

- Gold & Silver Daily: Farewell To All The Emperors - Feb 19, 2010

- The Coming U.S. Real Estate Crash

- Gold Seeker Closing Report: Gold and Silver Fall 0.5% and 2%

- After the Fall

- East Hampton Downgraded By Moody's From Aa3 To A1

- Dollar, Gold, Oil and the SP500's Mid-Week Trading Video

- Jim's Mailbox

- U.S. intelligence debates China's use of bond holdings as weapon

- U.S. intelligence debates China's use of bond holdings as weapon

- But Jeff Christian says central banks hardly ever think about gold

- Architecture for a New World Financial System

- Soros Demands Inflation

- Ridiculed By Americans Everywhere, Krugman Now Threatens, Gives Unsolicited Advice To Germany, Pisses Entire Nation Off

- Congress Punts On Deficit Decisions… Again

- Three Strikes… Residential Real Estate is Out

- WEDNESDAY Market Excerpts

- Advantage, Emerging Markets

- Gold, Inflation & Interest Rates

- Gold: Cup and Handle Formation Update

- John Hancock Eyes Actively Managed Global Balanced ETF

- Apple Bucks the Economic Trend

- This Market Is Stronger Than You Think

- Fed Statement Not So Bullish This Month

- Fraud in the Homebuyer Tax Credit Program?

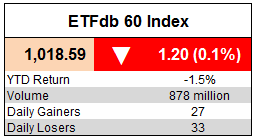

- Wednesday ETF Roundup: DBC Slides, VGK Jumps

| GoldSeek.com Radio Gold Nugget: Keith Schaefer & Chris Waltzek Posted: 23 Jun 2010 07:00 PM PDT |

| Posted: 23 Jun 2010 06:17 PM PDT View the original post at jsmineset.com... June 23, 2010 05:36 PM Jim Sinclair’s Commentary My former Chicago Floor partner, Yra, makes some very important points here. Notes From Underground: The Fed breaks new ground By Yra The FOMC press release did not surprise anyone except some financial television pundits. However, there are two items that are new as we do our scatological analysis of the entrails of FED SPEAK. First is the following line: "Financial conditions have become less supportive of economic growth on balance, largely reflecting developments abroad." This is the only time we can remember the Bernanke Fed explicitly stating its concern about events outside the U.S. Yes, we know the FED extended its DOLLAR SWAP LINES last month but we can't remember anything alluding to weakness abroad as a reason to maintain a soft FED policy. Furthermore, the FED added the words, "prices of energy and other commodities have declined in recent months." This gives ... |

| Hourly Action In Gold From Trader Dan Posted: 23 Jun 2010 06:17 PM PDT |

| SDR Strawman & Gold-Backed Euro Posted: 23 Jun 2010 06:14 PM PDT The world faces challenges and uncertainty these days like perhaps never before in modern history. Broken insolvent banking systems match the insolvent homeowners living in despair but with newfound hope from simply not paying home mortgages in large numbers. Henry David Thoreau could actually run for the US Senate, as his platform of civil disobedience is more widely embraced with each passing month. |

| European Credit Crisis: Germans Throwing Stones Posted: 23 Jun 2010 06:03 PM PDT Edward Harrison submits: Paul Krugman has it right when he says this:

Complete Story » |

| Posted: 23 Jun 2010 05:39 PM PDT What happened to the recovery? This report from AP:

Economists were surprised, say the reports. The feds are still paying buyers $8,000 to buy a house. And still the number of buyers is going down. What this revealed about the housing market was much less interesting than what this revealed about economists, who seem to be completely unaware of what is going on. They think the economy is recovering. So, why aren't more houses selling? Meredith Whitney: "No doubt we have entered a double dip for housing." Well, it may be a surprise to economists. And it's surely a disappointment to most Americans. But to us here at The Daily Reckoning it's just another day in a Great Correction. Housing hasn't been corrected. There are still millions of homeowners with scores to settle. They paid too much. Their houses are now worth less than what they paid. It's just a matter of time until they default...or their debt is restructured. We get our news from CNN en Español on the way to work. We're trying to learn to speak Spanish. We learned this morning that more than a million Hispanic homeowners are in danger of losing their houses. Typically, they bought a little too late in the cycle. Typically too...they lost their jobs in construction or the service industry. Detroit is dealing with its surplus housing issue. "Detroit razing itself," says a news report. Good idea. There are vast areas of Baltimore that should be razed too. Baltimore hit its peak population in the '60s. It's been downhill ever since, with only about half as many people in the city today as in its heyday. But the Great Correction has targeted much more than the housing industry. "For small companies the credit crunch won't go away," says a Wall Street Journal headline. That's what happens in a correction. Banks are reluctant to lend. The banks are holding onto cash. So are other businesses. And smart individuals hold cash too. Few people want to start new businesses or finance them. Because the odds of losing money are too great. The real economy isn't expanding; it's contracting. That means businesses are fighting for market share...and fighting to stay alive. Banks figure they'd rather put their money into a sure thing - US Treasury bonds. And here's another aspect of the Great Correction: "Extremely bad profit margin outlook," says a Bloomberg report. The margin outlook is bad because companies have tried to protect profits by squeezing out unnecessary costs - including employees. But there is only so much of that you can do. Besides, cost-cutting has a negative effect on the economy. One company's costs are another company's top line revenue. So you can see where that leads. One cuts and the other must cut too. Pretty soon, you have a correction...maybe a recession...and maybe a depression. Yesterday, the Dow dropped 148 points. Gold went nowhere. Our guess is that the Dow has a lot more dropping to do. Ambrose Evans- Pritchard, writing in the Telegraph:

Companies are worth what people will pay for them. But a correction drives top line revenues down. Companies are not worth as much as they were when the top line was going up. Gradually a depressive mentality takes over. People begin to doubt that 'recovery' is right around the corner. They begin to wonder why they paid so much for a house...or for stocks. They begin to figure out how to get out of the deal. In the case of the house, they let the mortgage company know that they're not going to continue paying for something that is falling in value. And in the case of stocks, they sell. Stocks and housing keep going down and until they finally reach the dismal, desperate bottom. And more thoughts... How does it feel to be a has-been? Well, we don't feel too bad about it. How about you? Almost all the developed countries are headed for crises, collapse, and used-to-be status. Their debt is still rising. They have made promises to retirees that can't be kept. They have expenses they can't meet...an aging population...uncompetitive industries...and zombies on every street corner. Who has the money? Well, the biggest piles of it are in the hands of Asian nations. Who buys more cars? The Chinese. Who buys more stuff, generally? The emerging markets. Who has the biggest economy? Ah...at least we're not has-beens yet. The developed countries still have the world's biggest economies. But that will change soon. When Goldman Sachs first did a report on the BRICs, it projected out growth rates in India, Brazil, Russia and China and estimated that their economies would overtake the big 4 developed economies by 2040. Now, the estimate is 2027. Developed countries can't grow fast; they can barely grow at all. They have too much debt and too many zombies. Too many retirees who need to be supported. Too many government employees. Too many lobbyists and government contractors. Too many privileges and too many people trying to protect them... Everybody wants something for nothing. As an economy ages, more and more people find a way to get it. On CNN en Español, for example, we learned that a town in Nebraska is trying to prevent illegal aliens from gainful employment. The citizens of Fremont, Nebraska, want try to use the law to prevent others from competing for jobs. Zombies always vote. Regards, Bill Bonner |

| Posted: 23 Jun 2010 05:23 PM PDT  Michael Panzner submits: Michael Panzner submits: (Image: Source) In "80 Percent of Americans Think We're Still in Recession," The Atlantic highlights what I believe is a classic example of the spin that many mainstream media outlets keep feeding us on a regular basis: Complete Story » |

| The Vanishing Of The Gold Basis and... Posted: 23 Jun 2010 05:00 PM PDT |

| Soros Attacks Germany's Hair-Shirt Politics Posted: 23 Jun 2010 04:59 PM PDT Edward Harrison submits:

Below are a few of the comments Soros made: Complete Story » |

| Posted: 23 Jun 2010 04:47 PM PDT Source: Brian Sylvester of The Gold Report 06/23/2010 In the last decade, Gold Stock Analyst Editor John Doody has seen his top-listed equities skyrocket a combined 1,000%, including an eye-popping 130% in 2009. John's tried and true methods have little to do with luck; this student of the gold business rarely fails to find value at any gold price. Subscribers pay a lot for his knowledge and expertise in the Gold Stock Analyst; but in this exclusive interview with The Gold Report, you get a few of his favorites Doody-free. The Gold Report: We're about 1.5 years into the Obama administration's multi-trillion dollar bailouts and expansion of the Fed balance sheet to $2.3 trillion from about $800 billion. What are your thoughts on that? John Doody: I think it's a bailout that continues with $1 trillion-a-year deficits as far as the eye can see. There's no end to it; unless we get some significant tax increases and/or spending cuts, there's no hope to ever to pay down... |

| Three Strikes Residential Real Estate is Out Posted: 23 Jun 2010 04:47 PM PDT The 5 min. Forecast June 23, 2010 01:03 PM by Addison Wiggin & Ian Mathias [LIST] [*] Three strikes and residential real estate is out: A troika of ugly numbers, and what they mean going forward [*] Evidence central banks may continue scarfing up gold [*] Why “the worst is not in yet” for the euro… and what to do about it [*] Congress punts on constitutional duty… Middle-class taxpayers beware [*] Readers write: Central bankers and gold, expatriation and taxes [/LIST] The U.S. real estate market stepped up to the plate this week… and struck out, again. Completely whiffed on three pitches, in fact. Strike one came on Monday… when the Treasury released its latest numbers on the Home Affordable Modification Program. The background: 1.24 million borrowers have enrolled in the program -- which was launched with the hope of helping 4 million. Of those 1.24 million, more than one-third have now failed their “trial modific... |

| SDR Strawman & Gold-Backed Euro Posted: 23 Jun 2010 04:47 PM PDT by Jim Willie CB June 23, 2010 home: Golden Jackass website subscribe: Hat Trick Letter Jim Willie CB, editor of the “HAT TRICK LETTER” Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. The world faces challenges and uncertainty these days like perhaps never before in modern history. Broken insolvent banking systems match the in... |

| Fannie Screws The Citizens Twice Posted: 23 Jun 2010 04:47 PM PDT Market Ticker - Karl Denninger View original article June 23, 2010 12:08 PM First, Fannie Mae ran crooked books for years, got caught, ran insane risk models for years more (80:1 leverage anyone?), got caught again, the second time by the market and essentially forced the government to step in lest they default on over $3 trillion in paper sold to, in large part, the Chinese. Now, having screwed you, the taxpayer, through outright fraud and ridiculous risk-taking and being a prime architect of the housing bubble, they now propose to bend you over again: (Strike-outs original, italics mine.) [INDENT]WASHINGTON, DC — Fannie Mae (FNM/NYSE) announced today policy changes designed to encourage borrowers to work with their servicers and pursue alternatives to foreclosure designed to assrape anyone who does what banks and other commercial entities do every day - intentionally default when it suits them. Defaulting borrowers who walk-away and had the capacity to pay or did not com... |

| Posted: 23 Jun 2010 04:47 PM PDT From the Best of Jim Cook by Jim Cook Last week I had to prepare a two page advertisement promoting silver for Forbes Magazine and U.S. News and World Report. I also spent an hour on Howard Ruff’s conference call to his subscribers talking about silver. It caused me to review all the bullish aspects of silver. Consequently my enthusiasm for silver reached a new high. As I said on the Ruff interview, I’ve committed my personal assets to silver because I believe this is an opportunity like no other. I see it as a fortune builder. I think silver offers a way to get filthy rich. I’ve been studying finance, reading economics, investing in stock, drilling for oil, digging for gold, putting money in start-up companies, buying krugerrands or silver coins and running a business for most of my life. My book on starting a business made it to the best seller list. My novel predicted and described th... |

| Gold and Silver Price Conspiracies Earn Their Weight Posted: 23 Jun 2010 04:47 PM PDT Investigations into the trading at the COMEX have yet to make headlines, but they could uncover what traders have been seeing for a very long time. The price of gold and silver ebb and flow as part of a malicious attempt to corner the industry and create profitable opportunities for investment banks and hedge funds. Mega Banking and Precious Metals It has become a common battle cry among precious metal followers that large traders are manipulating the price to keep the COMEX going. Since the COMEX allows exchange-traded fund shares and other cash equities to be used as a deliverable vehicle for gold, investors believe that the COMEX could actually offer hundred times more gold and silver than actually exists. To keep that kind of leverage going, investment banks and the largest traders are tasked with the job of making sure that the price of gold and silver is kept at a price at which very little physical metal is actually delivered. A gold price of $1250... |

| Now The Cops May Be Getting Scammed! Posted: 23 Jun 2010 04:47 PM PDT Market Ticker - Karl Denninger View original article June 23, 2010 08:39 AM How much longer folks before we start throwing all the crooks in jail? [INDENT] In the e-mail dated June 18, K. Wayne McLeod, who served as CEO of the Federal Employee Benefits Group, Inc., told clients he was terminating the "FEBG Fund," a fund that had been marketed to retired federal law enforcement officers. McLeod said interest payments for the month of June had "been suspended" and "nothing further [would] be sent." In the e-mail, he informed clients that he was praying that they would forgive him at some point in the future. [/INDENT] Forgive him at some point in the future? That sounds like something someone would say at a sentencing hearing. Eh, hope you didn't have any money over there. The key is "didn't have" - not, if this report is correct, "still have."... |

| China Revaluation News Could Spark Short Term Squeeze in Metals Posted: 23 Jun 2010 04:47 PM PDT News that China is open to revaluing its currency could bring about a short term reduction in the price of precious metals. Ahead of important multi-national conversations about the future of global trade and the world economy, China politicized its monetary policy, hoping to push back criticism that it is a global currency manipulator. Earning the title of a currency manipulator could open an easy door for global political leaders to push tariffs on Chinese manufactured goods, allowing for a trade war that would be most destructive to international economic growth, particularly in China. Why it Matters First and foremost, China is one of the largest exporters in the world, producing everything for nearly every country and bringing in hundred billion dollar annual trade surpluses in the process. Since China is such an integral part to physical trade, the value of its currency is something that is universally important. Despite alleging that it does n... |

| Gold Correction Tactics Part 2 Posted: 23 Jun 2010 04:47 PM PDT Stewart Thomson email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] June 22, 2010 1. As the massive head and shoulders pattern on the gold bullion weekly chart was formed, price moved to 1225, then fell to 1045, then hit another in the latest series of new highs on Sunday night, at 1266. From 1033 to now, your “gold boat” has sailed in relatively calm waters, under the protection of the near-at-hand head H&S pattern battleship. 2. The last jobs report, I believe, signalled the start of the theme of gold volatility. Yesterday’s action saw price hammered from 1266 to 1232 in a near-vertical drop. 3. Write this down and paste it to your computer: The further away from the gold 1033 neckline that the gold price moves on the upside, the further away from that “protection” the gold price is. You are on your own, like a gold cork in the ocean away from the mother ship. Monumental volatility is coming. My predict... |

| Posted: 23 Jun 2010 04:47 PM PDT Market Ticker - Karl Denninger View original article June 23, 2010 07:01 AM What sort of abject bullshit have the folks on Tout TV been running? [INDENT]June 23 (Bloomberg) -- Purchases of new homes in the U.S. fell in May to a record low as a tax credit expired, showing the market remains dependent on government support. [/INDENT]The entire economy is dependent on government support. But the government has no money. It is in fact borrowing nearly as much as it takes in via taxes. If you made $20,000 a year, and borrowed another $20,000, for how long would your credit card company allow that to continue? Why does the American Public continue to lap up this crap from CNBS and other media, along with the White House and The Fed? Can you not figure out what would happen to you if you tried to run your personal family budget the way the government does? "Quantitative Easing", "Easy Money", "Zero down mortgages" and all the rest - it is all a scam designed to impov... |

| LGMR: Gold "Supported by US Fed" as Eurozone Faces 1st July "Liquidity Drought" Posted: 23 Jun 2010 04:47 PM PDT London Gold Market Report from Adrian Ash BullionVault 09:10 ET, Weds 23 June Gold "Supported by US Fed" as Eurozone Faces 1st July "Liquidity Drought" THE PRICE OF GOLD in wholesale dealing reversed an earlier 0.6% gain as New York opened for business on Wednesday, slipping back to its overnight range around $1239 an ounce. Broad commodity markets ticked lower as Asian stocks closed the day lower and G7 government bonds rose. The US Federal Reserve was set to announce its latest interest-rate policy – unchanged in 18 months – at 14:15 ET. "There should be few surprises," says Walter de Wet at Standard Bank. Noting the 65% chance of rates staying below 0.25% until May 2011 that's currently signaled by US futures, "We believe [interest rates] will be flat for longer...guided by the Taylor Rule," he says. "[It] still indicates the Fed funds rate should be negative, because inflation is low and unemployment so high. "For this reason, we still see sup... |

| Posted: 23 Jun 2010 04:47 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 23, 2010 06:02 AM June gold options expire tomorrow. Guess what? Those who said I see the b-line down today on the Comex should also know by now that this is the regular thievery that takes place just about every month. The bandits may win an occasional battle but have long ago lost the war (if you listened to people like [url]www.gata.org[/url] you would’ve known this for years) I’ve told you so many times that the world hates gold and you’re never going to see mainstream Wall Street and the media that lives off it be bullish on gold. But every time you hear one of them “pan” gold, just take out this chart and remind your self that since gold became free trading it has greatly outperformed their favorite puppy – the stock market. [url]http://www.grandich.com/[/url] grandich.com... |

| Grandich Client Update – Crescent Resources, Down For The Count Posted: 23 Jun 2010 04:47 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 23, 2010 05:10 AM Crescent Resources is living proof of a saying I’ve uttered a thousand times – Failure is the norm in the junior resource business.* In this particular case it’s a little more hard to swallow as the company never got to the drill stage – something that’s leaving a bad taste in my mouth. The company has terminated my working relationship as of the end of this month. Knowing I’m going to be asked what should one do, my answer would be if it was me I would sell and move on. I wouldn’t allow CRC’s inability to get to the drill stage change one’s mind on the Rattlesnake play. I remain quite optimistic on Evolving Gold’s chances there and elsewhere. [url]http://www.grandich.com/[/url] grandich.com... |

| Grandich Client Update – Spanish Mountain Gold Posted: 23 Jun 2010 04:47 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 23, 2010 05:42 AM Following last week's announcement of the acquisition of the neighbouring Cedar Mountain property, Spanish Mountain Gold provided an update today on its flag ship Spanish Mountain Gold project.* There are positive developments on a few fronts but what caught my attention is the commissioning of the Preliminary Economic Assessment (PEA) for the Spanish Mountain Gold project.* PEA is a project-specific engineering study and is often the first major step in establishing the economic viability of a mining project.** Results are expected in the fourth quarter of 2010.* The study will be stick handled by SPA's new Chief Operating Officer, Ron Halas. SPA also released the results from the on-going metallurgical test work, where no news is great news!* The results so far support a milling process appears very standard with a respectable overall gold recovery of 90% and ... |

| Gold & Silver Daily: Farewell To All The Emperors - Feb 19, 2010 Posted: 23 Jun 2010 04:47 PM PDT Farewell To All The Emperors Well, the rally that began at gold's low on Thursday morning at 4:00 p.m. in Hong Kong's afternoon trading session, had a few legs... and gold was up about $10 or so by 8:30 a.m. in New York. Shortly after that, gold really took off and added another $12 or so onto the price before running into the usual brick wall at the London p.m. gold fix at 3:00 p.m. London time... 10:00 a.m. in New York. From there, gold dipped briefly before running up to another new high, which was the close of trading in London at 4:00 p.m... 11:00 a.m. in New York. Gold sold off about $8 or so from that high... and, wonder or wonders, continued to climb to its absolute high of the day which was at precisely 4:30 p.m. Eastern time when the interest rate news hit the tape. Gold fell $15 in half an hour... and basically closed at that price... which was $1,105.20 spot. And, as I me... |

| The Coming U.S. Real Estate Crash Posted: 23 Jun 2010 04:44 PM PDT

The following are 7 reasons why the U.S. real estate market is already a total nightmare.... #1) In May, sales of new homes in the United States dropped to the lowest level ever recorded. To be more precise, new home sales dropped 32.7 percent to a seasonally adjusted annual rate of 300,000. A "normal" level is about 800,000 a month. New homes have never sold this slowly ever since the U.S. Commerce Department began tracking this data back in 1963. #2) The median price of all new U.S. homes sold in May was $200,900, which represented a 9.6% drop from May 2009. If prices are still falling on new homes that means that the real estate nightmare is not over. #3) New home sale figures for the previous two months were also revised down sharply by the government. Apparently their previous estimates were far too optimistic. But those were supposed to be really good months for home sales with so many Americans taking advantage of the tax credit right before the deadline. So the fact that the data for the previous two months had to be revised downward so severely is a very bad sign. #4) Newly signed home sale contracts in the U.S. dropped more than 10% in May. #5) According to the U.S. Commerce Department, housing starts in the U.S. fell approximately 10 percent in May, which represented the biggest decline since March 2009. #6) Internet searches on real estate websites are down about 20 percent compared to this same time period in 2009. #7) The "twin pillars" of the mortgage industry are a complete and total financial mess. The Congressional Budget Office is projecting that the final bill for the bailouts of Fannie Mae and Freddie Mac could be as high as $389 billion. Both Fannie Mae and Freddie Mac continue to hemorrhage cash at an alarming rate, but the truth is that without them there wouldn't be much of a mortgage industry left in the United States. The following are 7 reasons why things are going to get even worse.... #1) The massive tax credit that the U.S. government was offering to home buyers has expired. This tax credit helped stabilize the U.S. real estate market for many months, but now that it is gone there is no more safety net for the housing industry. #2) Foreclosures continue to set all-time records. In fact, the number of home foreclosures set a record for the second consecutive month in May. Not only that, but the number of newly initiated foreclosures rose 18.6 percent to 370,856 in the first quarter of 2010. A rising tide of foreclosures means that there is going to be a growing inventory of foreclosed homes on the market. As of March, U.S. banks had an inventory of approximately 1.1 million foreclosed homes, which was up 20 percent from a year ago. There is no indication that the number of foreclosed homes that need to be sold is going to decrease any time soon. This is going to have a depressing effect on U.S. home prices. #3) Another giant wave of adjustable rate mortgages is scheduled to reset in 2011 and 2012. This "second wave" threatens to be as dramatic as the first wave that almost sunk the U.S. mortgage industry in 2007 and 2008. Unfortunately, what this is going to cause is even more foreclosures and even lower home prices. #4) Banks and lending institutions have been significantly tightening their lending standards over the past several years. It is now much harder to get a home loan. That means that there are less potential buyers for each house that is on the market. Less competition for homes means that prices will continue to decline. #5) Home prices are still way too high for most Americans in the current economic environment. Based on current wage levels, house prices should actually be much lower. So the market is going to continue to try to push home prices down to a point where people can actually afford to buy them. Right now Americans can't even afford the houses that they already have. The Mortgage Bankers Association recently announced that more than 10% of all U.S. homeowners with a mortgage had missed at least one mortgage payment during the January to March time period. That was a new all-time record and represented an increase from 9.1 percent a year ago. #6) The overall U.S. economy is caught in a death spiral. Unemployment remains at frightening levels, a large percentage of Americans are up to their eyeballs in debt and more than 40 million Americans are now on food stamps. If people don't have jobs and if people don't have money then they can't buy houses. #7) The Gulf of Mexico oil spill is the greatest environmental disaster in U.S. history, and it is threatening to become one of the greatest economic disasters in U.S. history. Already, real estate agents along the Gulf coast are reporting that the oil spill has completely killed the real estate industry in the region. As this disaster continues to grow worse by the day, homes in the southeast United States will continue to look less and less appealing. In fact, many are now projecting that the crisis in the Gulf will actually crush the housing industry from coast to coast. So honestly there is not a lot of reason to think that the housing industry in the U.S. is going to rebound any time soon. In fact, for those waiting for a "rebound" the truth is that we have already seen it. Where we are headed next is the second dip of the "double dip" that so many of the talking heads on CNBC have been talking about. For those seeking to sell their homes this is really bad news, but for those looking to buy a home this is actually good news. Who knows? Home prices may actually come down to a point where many of us can actually afford to purchase a home. |

| Gold Seeker Closing Report: Gold and Silver Fall 0.5% and 2% Posted: 23 Jun 2010 04:00 PM PDT Gold rose in London to see a $6.23 gain at $1246.18 at around 7AM EST before it fell to see a $15.27 loss at $1224.68 by about 10AM EST in New York, but it then rallied back higher in the last few hours of trade and ended with a loss of just 0.5%. Silver climbed to $18.96 and fell to $18.315 before it also rallied back higher, but it still ended with a loss of 2.17%. |

| Posted: 23 Jun 2010 03:57 PM PDT So the mining tax, among other issues, has cost Kevin Rudd his job. As an economic matter, investors might now revalue the miners as if the tax itself is dead, or at least dormant until after the next Federal election. But as fascinating as the domestic political scene is, today's Daily Reckoning begins with an old foe, the U.S. housing market. Why? The current direction of U.S. home prices (down) has been brought about by many of the same economic management principles applied here in Australia. In fact, the whole Keynesian effort to support aggregate demand and "bring forward" demand through tax credits and handouts has been used the world over. And its effects are the same the world over - a temporary spike in economic activity giving the illusion of vitality...and then a crash to earth. Nowhere is this process more advanced than in America's housing market. In first decade of this millennium, it was the prime beneficiary of the cheap money policies of both Alan Greenspan and Ben Bernanke. Bank and non-bank credit creation found its way into an asset class everyone could profit from - residential real estate. But yesterday America's Commerce Department reported that new home sales in the United States fell 33% in the month of May from April. Just over 330,000 new homes were sold across the great land for the entire month. It was the lowest and slowest rate of sales since 1963. And since their peak in 2005, new home sales are down 78%. The good news is that U.S. home prices reaching a clearing level. The median price on a new U.S. castle is just over US$200k. Even without the $8,000 Federal tax credit, the price is just under four times the median U.S. household income of $52,000. So how come no one's buying? Because they're all in! That is, at the peak of the market, homeownership levels in the States reached 70%. When seven out of ten households own a home or have mortgage, there aren't many buyers left. Does this mean there is some theoretic level of homeownership that's achievable AND sustainable in a market? Well, no. But it does mean that when you "bring forward" demand so much in a credit boom, you rob from future demand. That's what's happening now in America. And we suspect that is what will happen too in Australia, when all the various ways of bringing people into the market with grants and tax deductions are exhausted. But what does this have to do with the big picture? There is a good argument to be made that what artificially low interest rates did to America's housing market...they have done to many of the world's stock, commodity, bond, and real estate markets. With the Fed, the Bank of Japan, the European Central Bank, and the Bank of England all setting historically low short-term interest rates, they've provided huge support to markets. And if that support fails? The lack of gimmicks to prop up U.S. house prices is making it likely that there will be a second fall in that market. The knock-on effects on U.S. employment won't be pretty. But the destruction of bank collateral will be uglier still, and that's what poses the biggest risk to the financial system. Yet it's not just America we're talking about. Stock market veteran Richard Russell, who edits the Dow Theory Letter, writes that, "We're now in the process of building one of the largest tops in stock market history. The result, I think, will be the most disastrous bear market since the '30s, and maybe worse." Russell argues that the Fed and its central bank cronies have pumped up stock, commodity, and real estate markets and that they are all now primed for a big fall. He suggests that the disintegration of fiat currencies is what will spark the fall in asset markets. But - assuming you agree with Russell's primary thesis that global stock prices have been pumped up by a sea of central bank liquidity - the catalyst for that fall is anyone's guess. And the timing is unknowable. In theory, though, you CAN know that when interest rates are manipulated lower for the sake of achieving politically mandated GDP growth (or growth for its own sake), they invariably create a bubble somewhere. What we've had - really since 1974 - is a series of ever larger bubbles encompassing more asset classes and more national economies. Finance has aided and abetted this process. So has technology. The digitisation of finance has facilitated global capital flows, making it possible for cheap money borrowed in one currency to charge into assets in another. What all these micro-bubbles have in common is that they inflate asset prices...and when those assets increase household net worth on paper (house and stock prices) it seems like a good thing. What we're about to find out - after all the bad debts are liquidated and asset values - is whether all that money printing has actually created a lasting prosperity, backed by good investments in capital assets or industries with demand not propped up by ever-larger amounts of credit. Or whether we've just enjoyed a one-off period of global growth based on cheap energy and cheap credit that will never be repeated and must now, as credit and money shrink, contract. Incidentally, the Federal Open Market Committee in the US decided to leave rates low. In its statement, the FOMC said, "Financial conditions have become less supportive of economic growth on balance, largely reflecting developments abroad." Europe? But all of these things are connected. And to stretch the thematic connections...the central error of central bank control over interest rates (a non-free market price for money, or the cost of capital) is probably the same error Kevin Rudd made. One man doesn't know better than a market. In a complex system, there are too many moving parts, too many variables, for one man or a small group of men to know what they need to know in order to devise a plan. The Austrian Economist Friederich Hayek called this problem a "knowledge" problem and pointed out no one is ever given enough total knowledge to wisely make a grand plan. Nor, we would humbly suggest, should any man presume to know enough that he tries to put his grand plan in the place of the private plans of millions of others, making their own private calculations based on factors unknown to The Man. It's a big ask. And you set yourself up for a fall when you do it. Of course, in the end, we're all headed for a fall of at least six feet under. But what you do between now and then is a matter of choice. And returning to financial markets, we'd still choose not to be a buyer at these levels. Aussie stocks may get a bounce from the demise of Kevin Rudd and the shelving of his mining tax until after the election. But the larger global issue - as you can see from the fall in U.S. new home sales - is that economic activity supported by credit growth isn't sustainable. Nor are the asset price gains based on easy credit. So what will lead to the Fall? More on that tomorrow... Dan Denning

|

| East Hampton Downgraded By Moody's From Aa3 To A1 Posted: 23 Jun 2010 02:40 PM PDT The irony and the Freudian displacement reaction are simply too much. Since Moody's knows it would be kneecapped and Friend-o'ed the second it downgrades the UK, Germany or France, it has decided to lash out at the very people who will be the cause of the next, and terminal for the rating agency, round of congressional grillings in a year or so, when Europe is bankrupt and Moody's is questioned why it kept England at AAA until two days after the sovereign default. From Moodys: NEW YORK, Jun 23, 2010 -- Moody's Investors Service has assigned an A1 rating with stable outlook to the Town of East Hampton's (NY) $9.5 million Serial Bonds, 2010 Series A; and a MIG 1 rating to $5 million Bond Anticipation Notes, 2010 Series B. At this time, Moody's has also downgraded the town's rating to A1 from Aa3 and revised the outlook to stable from negative affecting $85 million of outstanding parity debt. The rating downgrade reflects depletion of the town's financial reserves following four consecutive operating deficits (2004 through 2007), with further financial deterioration anticipated given a projected operating deficit in fiscal 2008 (unaudited) and fund balance decline driven primarily by management's ongoing efforts to clean up the town's balance sheet in 2009 (year ended December 31, 2009). The rating also factors anticipated financing of the town's accumulated operating fund deficit from proceeds of the current bond issue and an additional authorization of $15 million for deficit reduction bonds that will be utilized to settle previous interfund borrowing from non-operating town funds for operating purposes, and management's plans to restore balanced operations through the implementation of recurring revenue enhancements and expenditure controls, as reflected in the town's fiscal 2009 and 2010 budgets. The rating additionally incorporates the town's sizeable tax base and modest level of debt that is amortized over an average period of time. Moody's stable outlook is based upon our expectation that the town's current financial position will stabilize over the medium-term despite challenges related to ongoing operating pressures facing all New York municipalities, related to contractual salary increases and growing pension costs, in the face of an uncertain economic recovery. These pressures are expected to be addressed through implementation of recurring measures that will provide for the restoration of structurally balanced operations. Further diminishment of the town's financial flexibility beyond that currently projected could lead to downward pressure on the town's rating. Proceeds of the Series 2010A Bonds and 2010B BANs will retire a like amount of Series 2009D BANs maturing June 30, 2010. Series 2009D were originally issued for deficit reduction financing. Outlook |

| Dollar, Gold, Oil and the SP500's Mid-Week Trading Video Posted: 23 Jun 2010 01:58 PM PDT |

| Posted: 23 Jun 2010 01:36 PM PDT Jim Sinclair's Commentary My former Chicago Floor partner, Yra, makes some very important points here. Notes From Underground: The Fed breaks new ground The FOMC press release did not surprise anyone except some financial television pundits. However, there are two items that are new as we do our scatological analysis of the entrails of FED SPEAK. First is the following line: "Financial conditions have become less supportive of economic growth on balance, largely reflecting developments abroad." This is the only time we can remember the Bernanke Fed explicitly stating its concern about events outside the U.S. Yes, we know the FED extended its DOLLAR SWAP LINES last month but we can't remember anything alluding to weakness abroad as a reason to maintain a soft FED policy. Furthermore, the FED added the words, "prices of energy and other commodities have declined in recent months." This gives greater credence to the Bernanke FED being an output gap-oriented FED and it's for that reason the extended period is based on the employment situation and the capacity utilization numbers come in behind. It's interesting that the FOMC actually mentioned energy and other commodities because we doubt that if OIL was $100 a barrel that the FED would have moved to tighten. Who were they trying to assuage with that language? PUT THIS ON YOUR RADAR SCREEN: The British POUND performed well after OSBORNE brought the austerity budget forward. The question must be asked: If the POUND was rewarded for fiscal austerity, is the DOLLAR going to be punished for continual profligacy? Our initial thought that was that Britain would be punished for promoting austerity over growth and that the U.S. might be the recipient of investment money as they went the route of economic growth at all costs. We don't know what the technical picture says about the POUND but from the action we urge those looking for a change in the risk on/risk off paradigm to do their homework.

Dear CIGAs, In response to The Farce and The Fact. I have no quarrel with the posted analysis. In order to finish the analysis and illustrate the complete dominance of capital flows, I suggest that dividends be included when comparing the performance of gold with U.S. equities. The enclosed chart illustrates the relative performance between the two asset classes with dividends included in the total return. The dotted blue line marks the 1971 reference point. Despite the variation of the calculation, the modified relative performance between the two assets does not alter your assertion that gold has and continues to attract capital over equities since 2000. Regards,

Jim, President Clinton acknowledged that he was wrong to take the advice of those advising him against regulating derivatives. "On derivatives, yeah I think they were wrong and I think I was wrong to take [their advice] because the argument on derivatives was that these things are expensive and sophisticated and only a handful of investors will buy them and they don't need any extra protection, and any extra transparency. The money they're putting up guarantees them transparency," Clinton told me. "And the flaw in that argument," Clinton added, "was that first of all sometimes people with a lot of money make stupid decisions and make it without transparency." The former President also said he was also wrong about understanding the consequences if the derivatives market tanked. "The most important flaw was even if less than 1 percent of the total investment community is involved in derivative exchanges, so much money was involved that if they went bad, they could affect a 100 percent of the investments, and indeed a 100 percent of the citizens in countries, not investors, and I was wrong about that." Click here to read the full article… Best regards,

5-Year Treasury Auction Trends No change in participation trends. Direct bidders continue to represent an increasing portion of the accepted bids since 2009. 5-Year Treasury Auction Trends Source: treasurydirect.gov

Jim, "The Australian and Canadian dollars are becoming reserve currencies for central bankers seeking alternatives to deteriorating government credit quality in Europe, the U.S. and Japan." Not good for the US dollars. Best regards, Central Banks Show Euro Losing Reserve Status as Loonie Gains The Australian and Canadian dollars are becoming reserve currencies for central bankers seeking alternatives to deteriorating government credit quality in Europe, the U.S. and Japan. "They'll gain an increasing place in reserves because of diversification," European Central Bank governing council member Christian Noyer said in a June 16 interview with Bloomberg News in Paris. Russia may add the Australian and Canadian dollars to its international reserves for the first time after fluctuations in the U.S. currency and euro, Alexei Ulyukayev, the first deputy chairman of the nation's central bank, said in an interview in Moscow on June 15. The International Monetary Fund may add the Aussie and loonie to a basket of currencies it uses in transactions, strategists at UBS AG, the world's second largest foreign-exchange trader, predict (Bloomberg). |

| U.S. intelligence debates China's use of bond holdings as weapon Posted: 23 Jun 2010 01:13 PM PDT By Emily Flitter http://www.reuters.com/article/idUSN2214670220100623 NEW YORK -- U.S. intelligence officials and top academics last week debated the risk China could wield its massive U.S. debt holdings as a weapon aimed at influencing U.S. foreign policy, according to a person who attended the meeting. At a National Intelligence Council meeting last week, held at a Washington, D.C. hotel, members of U.S. intelligence agencies and China watchers discussed potential outcomes if China chose to sell its $900 billion of U.S. Treasury bond holdings, pushing up interest rates and making life much tougher for U.S. businesses and consumers. While considered a remote possibility, China's tremendous economic stranglehold over the United States remains much-debated as the world's third largest economy grows in leaps and bounds and the number one economy struggles to break free from a deep recession. ... Dispatch continues below ... ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php The meeting took place as the United States prepares to issue a report that could label China a currency manipulator. U.S. lawmakers are also arguing over a bill that would penalize China for any protectionist policies. "The best offense is often a good defense and you must be prepared. This is something that allows the U.S. to consider what policy alternatives they might have when facing threats from the outside," said Paul Markowski, president of the Global Strategies-Analysis Group in New York. "This is one of the government bodies that considers the risks to the United States, economically, geopolitically and militarily," he added. The NIC is a think tank made up of academics and members of the U.S. intelligence community. Its website describes itself as an advisory council to senior policymakers and the President. Some policymakers think China could exercise this power over the United States without mobilizing any military force to influence U.S. policy in areas -- from Taiwan to climate change -- where is has deep interests. "This is obviously considered important," said the person who attended the meeting. "It's been an ongoing topic of conversation since the Chinese started amassing large sums of dollars." A banker at a primary dealer, one of the 18 financial firms authorized to deal directly with the Treasury Department to buy and sell U.S. government debt, said the timing of the discussion seemed practical. "I'm guessing the following: Maybe the U.S. is preparing itself that in the event the Treasury, for example, were to name China as a currency manipulator or Congress were to pass legislation that viewed China as protectionist, this could be how China would respond," said the banker, who did not wish to be named. "So as a way of brainstorming you would want to come up with what you would do." The Chinese government on Saturday announced it would make its currency more flexible, loosening its peg to the U.S. dollar. But financial analysts and lawmakers alike said the change might be too gradual -- or it might not occur at all. U.S. Sen. Charles Schumer, a Democrat from New York who has proposed legislation that would impose trade tariffs on Chinese goods as punishment for China's undervaluation of its currency, vowed on Sunday to move ahead with the legislation, despite China's announcement. China's Treasury holdings rose to $900.2 billion in April according to the Treasury Department reported on June 15. Since it is the biggest player in the Treasury market, any visible move by the Chinese government to buy or sell large quantities of Treasuries could have profound effects on the rest of the market. It would either depress or drive up yields and impact the cost of borrowing for houses, cars and businesses. "In doing that, what options does the Federal Reserve have; what options does the Treasury have?" said Markowski, a China expert. "If China were to be a large, large seller, then they would have to do something more significant." Some China analysts have referred to China using its debt holdings as political leverage as a 'nuclear option,' because quickly selling Treasuries would not only hurt the United States; it would also depress the value of China's reserve holdings and impact its domestic economy. At least one strong advocate for the view that China could indeed influence U.S. politics though Treasury purchasing or selling is Brad Setser, a member of the National Economic Council and the National Security Council. Before joining the Obama Administration in 2009, Setser argued this view on his blog, Follow the Money, and in papers he wrote for the Council on Foreign Relations. Those arguments were discussed at the conference, with no clear resolution, the person said. The NIC meeting was held a month after top U.S. and Chinese government officials met for an annual conference on economic cooperation, the Strategic & Economic Dialogue, held this year in Beijing in late May. Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| U.S. intelligence debates China's use of bond holdings as weapon Posted: 23 Jun 2010 01:13 PM PDT By Emily Flitter http://www.reuters.com/article/idUSN2214670220100623 NEW YORK -- U.S. intelligence officials and top academics last week debated the risk China could wield its massive U.S. debt holdings as a weapon aimed at influencing U.S. foreign policy, according to a person who attended the meeting. At a National Intelligence Council meeting last week, held at a Washington, D.C. hotel, members of U.S. intelligence agencies and China watchers discussed potential outcomes if China chose to sell its $900 billion of U.S. Treasury bond holdings, pushing up interest rates and making life much tougher for U.S. businesses and consumers. While considered a remote possibility, China's tremendous economic stranglehold over the United States remains much-debated as the world's third largest economy grows in leaps and bounds and the number one economy struggles to break free from a deep recession. ... Dispatch continues below ... ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php The meeting took place as the United States prepares to issue a report that could label China a currency manipulator. U.S. lawmakers are also arguing over a bill that would penalize China for any protectionist policies. "The best offense is often a good defense and you must be prepared. This is something that allows the U.S. to consider what policy alternatives they might have when facing threats from the outside," said Paul Markowski, president of the Global Strategies-Analysis Group in New York. "This is one of the government bodies that considers the risks to the United States, economically, geopolitically and militarily," he added. The NIC is a think tank made up of academics and members of the U.S. intelligence community. Its website describes itself as an advisory council to senior policymakers and the President. Some policymakers think China could exercise this power over the United States without mobilizing any military force to influence U.S. policy in areas -- from Taiwan to climate change -- where is has deep interests. "This is obviously considered important," said the person who attended the meeting. "It's been an ongoing topic of conversation since the Chinese started amassing large sums of dollars." A banker at a primary dealer, one of the 18 financial firms authorized to deal directly with the Treasury Department to buy and sell U.S. government debt, said the timing of the discussion seemed practical. "I'm guessing the following: Maybe the U.S. is preparing itself that in the event the Treasury, for example, were to name China as a currency manipulator or Congress were to pass legislation that viewed China as protectionist, this could be how China would respond," said the banker, who did not wish to be named. "So as a way of brainstorming you would want to come up with what you would do." The Chinese government on Saturday announced it would make its currency more flexible, loosening its peg to the U.S. dollar. But financial analysts and lawmakers alike said the change might be too gradual -- or it might not occur at all. U.S. Sen. Charles Schumer, a Democrat from New York who has proposed legislation that would impose trade tariffs on Chinese goods as punishment for China's undervaluation of its currency, vowed on Sunday to move ahead with the legislation, despite China's announcement. China's Treasury holdings rose to $900.2 billion in April according to the Treasury Department reported on June 15. Since it is the biggest player in the Treasury market, any visible move by the Chinese government to buy or sell large quantities of Treasuries could have profound effects on the rest of the market. It would either depress or drive up yields and impact the cost of borrowing for houses, cars and businesses. "In doing that, what options does the Federal Reserve have; what options does the Treasury have?" said Markowski, a China expert. "If China were to be a large, large seller, then they would have to do something more significant." Some China analysts have referred to China using its debt holdings as political leverage as a 'nuclear option,' because quickly selling Treasuries would not only hurt the United States; it would also depress the value of China's reserve holdings and impact its domestic economy. At least one strong advocate for the view that China could indeed influence U.S. politics though Treasury purchasing or selling is Brad Setser, a member of the National Economic Council and the National Security Council. Before joining the Obama Administration in 2009, Setser argued this view on his blog, Follow the Money, and in papers he wrote for the Council on Foreign Relations. Those arguments were discussed at the conference, with no clear resolution, the person said. The NIC meeting was held a month after top U.S. and Chinese government officials met for an annual conference on economic cooperation, the Strategic & Economic Dialogue, held this year in Beijing in late May. Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| But Jeff Christian says central banks hardly ever think about gold Posted: 23 Jun 2010 01:03 PM PDT Central Banks See Growing Reserve Asset Role for Gold By Jack Farchy and Javier Blas http://www.ft.com/cms/s/0/c897518a-7e5f-11df-94a8-00144feabdc0.html Nearly a quarter of central banks believe gold will become the most important reserve asset in the next 25 years, according to an annual poll by UBS. The result highlights the sea-change in attitudes in the official sector towards the yellow metal. For two decades, central banks were net sellers of gold but that trend has reversed as central banks in Europe are scaling down their sales and others, such as China, India, and Russia, are making significant purchases. ... Dispatch continues below ... ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Asked what the most important reserve asset would be in 25 years, about half of officials polled by UBS said the US dollar but 22 per cent pointed to gold. Bullion was the second most popular response, well above others such as Asian currencies or the euro. UBS surveyed more than 80 central bank reserve managers, sovereign wealth funds, and multilateral institutions with over $8,000 billion in assets at its annual seminar for sovereign institutions last week. The results were not weighted for assets under management. The reversal of the trend of central bank gold sales has boosted sentiment toward the metal while removing a significant source of supply. That has helped prices rise 12.5 per cent since the start of the year, hitting a nominal all-time high of $1,264.90 a troy ounce on Monday. The central bank managers believe gold will be the best-performing asset class in the next six months, ahead of equities, bonds, oil, and currencies, according to the poll. Despite their bullish sentiment towards gold, sovereigns are unlikely to start making large-scale purchases, said Terrence Keeley, global head of sovereign client services at UBS. "Reserve managers operate at one speed above reverse," he said. "Decisions to change their investment practices will be taken after great consideration over a long period." Sovereign wealth funds are also turning their attention to gold. China Investment Corporation, Beijing's sovereign wealth fund, earlier this year revealed a small investment in bullion through the New York-listed SPDR Gold Trust, an investment vehicle backed by physical gold. Bankers said other SWFs, including the Abu Dhabi Investment Authority and the Government of Singapore Investment Corp., were looking at gold. GFMS, the precious metal consultancy, estimates central banks last year sold 41 tonnes of gold, down 82 per cent from the low of 2008 and the lowest in 20 years. Philip Klapwijk, chairman of GFMS, said central banks were more likely to be buyers than sellers for the first time in two decades. But he said: "I will be surprised if we see multi-hundred tonnes purchases." There has not been a sustained period of significant central bank gold purchases since the 1960s. About 10 per cent of global central bank reserves is held in gold, according to the World Gold Council, but that belies a sharp difference between central banks in developed economies, which generally hold more than 50 per cent of assets in gold, and those in emerging markets, which have a relatively small proportion of assets in gold. Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Architecture for a New World Financial System Posted: 23 Jun 2010 12:00 PM PDT The present Great Financial Crisis is far from over. In fact, it is getting worse. It can be described as a debt crisis or, at its roots, a belated gold crisis. The landmark year was 1971, when the United States defaulted on its international gold obligations. Now there have been many defaults in history, but the one forty years ago was unique in that it exiled gold from the international monetary system; thereby gold has been prevented from discharging its natural function as the ultimate extin |

| Posted: 23 Jun 2010 12:00 PM PDT This fits into one of our observations - that the EU has been using the threat of deflation as a way to promote "austerity," which is actually a way of further impoverishing and controlling what is left of the European middle classes. But we have also observed that those in charge of the EU and standing behind the EU are likely making a big mistake by pushing so hard and moving so fast to consolidate the EU's authoritarian grip. We have written many times that the fractious tribes of Europe are |

| Posted: 23 Jun 2010 11:37 AM PDT These days it's hard being a religious fanatic, also known as a Keynesian. It is even harder when you are Paul Krugman (sadly, the cornerstone of NYT's entire paywall strategy), and everyone in your own country is already sick and tired of, and openly ignores your constant appeals to drown the world in new and record amounts of debt, thus ignoring your appeals with impunity. So what do you do when nobody takes you seriously for thousands of miles around? Why you go even further - to the core of Europe in fact... where you proceed to threaten, badger, insult and give your unsolicited advice to anyone that listens. That "unlucky soul" in this case happens to be Germany daily Handeslbatt, which ran an interview with the "economist" in which Krugman stick not a foot, but an entire SS-20 nuclear warhead armed ICBM, in his mouth. And since Krugman is unaware, preaching the benefits of record deficit spending in Germany, ever since that little experiment in hyperinflation known as the Weimar Republic, tends to generate adverse reactions. Which is precisely what happened in this case. Luckily, now Krugman is a persona non grata in at least one country. Unfortunately, it is not the one in which his trite platitudes and melancholic remembrances of the golden days of Greenspan's credit bubble are still published on a daily basis. As the WSJ reports:

The verbal lashings of the Bundesbank head will continue until insanity returns:

Yet trust a Keynesian to hope to achieve one thing, yet in reality obtain just an opposite result:

And when unsolicited advice is rightfully ignored, what next but to jump the shark and threaten your way in having someone to listen to your blabbering.

Good work Krugman - you have just gained one more enemy to not just the Fed's monetary lunacy, but the president fiscal imprudence.

Luckily, in Germany people actually have brains and are able to respond to this kind of ridiculous sophistry:

We rarely touch upon the illustrious persona of Mr. Krugman as he tends to do a good job of involuntary self-immolation without our help. That said, we completely agree with the conclusion of the WSJ's Brian Blackstone:

Something tells us the Germans are done with P.K. And since we, unfortunately, are not, perhaps he should adopt the same reverse psychology in the US - just like a Goldman downgrade of something means buy buy buy, should Krugman become rational for a change and espouse a prudent approach of deficit cuts, every normal thinker in the US will be immediately forced to burn their copy of The Road To Serfdom. |

| Congress Punts On Deficit Decisions… Again Posted: 23 Jun 2010 11:00 AM PDT Congress has hit on the perfect way to avoid the problem of a yawning deficit: Hand off the problem to a blue-ribbon panel. "It isn't possible to debate and pass a realistic, long-term budget," says House Majority Leader Steny Hoyer, "until we've considered the bipartisan commission's deficit-reduction plan, which is expected in December. I believe that Congress must take up and vote on that plan." Conveniently, after the election. Congress' refusal to carry out its constitutional duties is one of a number of odd and ominous doings we're seeing with the budget this week…

We warned about this last item in the April issue of Apogee Advisory: "Yes, the president is committed to allowing the cuts to expire for households earning $250,000 a year or more. But they go away for everyone else unless Congress passes a new tax law. The lowest bracket of taxpayers would see its rates go up from 10% to 15% – an effective 50% increase. That's not gonna happen. "So yes, there will be income tax legislation this year. But will it only hit households above the magic $250,000 threshold? Or will the scramble for revenue hit other people as well? And how soon?" Evidently, we won't know until just weeks or even days before the tax cuts expire. The sound you hear is payroll managers everywhere tearing their hair out. Addison Wiggin Congress Punts On Deficit Decisions… Again originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Three Strikes… Residential Real Estate is Out Posted: 23 Jun 2010 10:21 AM PDT The 5 min. Forecast June 23, 2010 01:03 PM by Addison Wiggin & Ian Mathias [LIST] [*] Three strikes and residential real estate is out: A troika of ugly numbers, and what they mean going forward [*] Evidence central banks may continue scarfing up gold [*] Why “the worst is not in yet” for the euro… and what to do about it [*] Congress punts on constitutional duty… Middle-class taxpayers beware [*] Readers write: Central bankers and gold, expatriation and taxes [/LIST] The U.S. real estate market stepped up to the plate this week… and struck out, again. Completely whiffed on three pitches, in fact. Strike one came on Monday… when the Treasury released its latest numbers on the Home Affordable Modification Program. The background: 1.24 million borrowers have enrolled in the program -- which was launched with the hope of helping 4 million. Of those 1.24 million, more than one-third have now failed their “trial modific... |

| Posted: 23 Jun 2010 10:08 AM PDT Gold eases on firmer dollar; Fed reaffirms low rates The COMEX August gold futures contract closed down $6.00 Wednesday at $1234.80, trading between $1225.20 and $1247.40 June 23, p.m. excerpts: see full news, 24-hr newswire… June 23rd's audio MarketMinute |

| Posted: 23 Jun 2010 10:00 AM PDT How does it feel to be a has-been? Well, we don't feel too bad about it. How about you? Almost all the developed countries are headed for crises, collapse, and used-to-be status. Their debt is still rising. They have made promises to retirees that can't be kept. They have expenses they can't meet…an aging population…uncompetitive industries…and zombies on every street corner. Who has the money? Well, the biggest piles of it are in the hands of Asian nations. Who buys more cars? The Chinese. Who buys more stuff, generally? The emerging markets. Who has the biggest economy? Ah…at least we're not has-beens yet. The developed countries still have the world's biggest economies. But that will change soon. When Goldman Sachs first did a report on the BRICs, it projected out growth rates in India, Brazil, Russia and China and estimated that their economies would overtake the big 4 developed economies by 2040. Now, the estimate is 2027. Developed countries can't grow fast; they can barely grow at all. They have too much debt and too many zombies. Too many retirees who need to be supported. Too many government employees. Too many lobbyists and government contractors. Too many privileges and too many people trying to protect them… Everybody wants something for nothing. As an economy ages, more and more people find a way to get it. On CNN en Español, for example, we learned that a town in Nebraska is trying to prevent illegal aliens from gainful employment. The citizens of Fremont, Nebraska, want try to use the law to prevent others from competing for jobs. Zombies always vote. Regards, Bill Bonner Advantage, Emerging Markets originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Gold, Inflation & Interest Rates Posted: 23 Jun 2010 09:48 AM PDT What The Economist doesn't know about Gold... HOW COME GOLD keeps reaching and breaching new all-time highs in the absence of strong 1970s-style inflation? The Buttonwood column in last weekend's Economist is only the latest analysis to miss the point, despite tripping over it, too. "Owning gold is traditionally seen as offering protection against inflation. And inflation is very bad news for owners of government bonds.Ay, there's the rub, as we never tire of telling people here at BullionVault. They tire so quickly of hearing it, however, that even The Economist can't square the circle of rising gold, falling bond yields. But it was never inflation alone that drove people to buy or sell a lump of rare, indestructible metal in the '70s. Instead, it was rather the rate of return offered by cash and bonds – those better competitors as a store of wealth, all things being equal – over and above (or below) inflation.  That's why gold made a terrible inflation hedge in the 1980s and '90s, most especially for Dollar investors. Because no-one needed an inflation hedge. Not with 10-year Treasuries paying 4.3% average over and above CPI inflation. Not when the real Fed Funds rate averaged 3%-plus...leaving gold to drop three-quarters of its real Dollar value inside 20 years...as the real value of cash-on-deposit doubled. Now compare and contrast with the last eight-and-a-half years or so, starting right around the Fed's low-rate response to the DotCom Bust. Consumer price inflation (on the official US measure, at least) has averaged barely half its previous two-decade average. Yet the real returns paid to bonds and cash have collapsed. Adjusted for inflation, in fact, the real Fed Funds rate has now been below zero for 54 of the last 101 months, matching the 54 months of sub-zero real rates which the Fed delivered in the 1970s.  Things are worse still, however, for cash savers. First because the Seventies' 54 months of negative real rates were spread across 10 full years from Jan. 1970. Meaning that second, the overall effect on the average real rate since 2002 has been to drive it lower again. During the 1970s as a whole, the Federal Reserve's key interest rate was 0.01% above inflation. Since 2002, the average real rate has now been 0.12% below. Where next? Short of a revolution in Fed thinking (no sign of that today), the decade starting Jan. 2002 looks set to deliver yet more negative real rates before 2012, if not beyond. Which will continue to mean that:

Because when "risk free" cash keeps paying a guaranteed loss, then a growing number of people will, in due course, start seeking shelter elsewhere. At the same time, holding gold and/or silver has ceased being a burden (bullion storage fees need not be onerous), inviting fresh flows of retained capital, tired of earning nothing or less. Real returns to cash have now been low-to-negative for almost a decade, and so it might not be too long before a far broader, and thus larger, volume of savings turns from cash to the obvious and historic alternatives. Either that or the Fed will hike rates so high, you get 4% and more above inflation. Buying gold couldn't be simpler, safer or cheaper than using BullionVault... |

| Gold: Cup and Handle Formation Update Posted: 23 Jun 2010 09:37 AM PDT |

| John Hancock Eyes Actively Managed Global Balanced ETF Posted: 23 Jun 2010 09:33 AM PDT Michael Johnston submits: Over the last twelve months, dozens of active management powerhouses have begun laying the groundwork for a foray into the ETF industry, leading many to believe that an active ETF growth spurt is on the horizon. One of those firms, Boston-based John Hancock, recently shed some additional light on its plans for the ETF space, revealing that its first fund after receiving approval of its exemptive relief application will consist of both domestic and international equities and fixed income securities. The John Hancock Global Balanced Fund would invest about 60% of its assets in equities, with the remainder in bond securities. But perhaps the more interesting details from the recent SEC filing were in language regarding securities in which the fund will not invest. “Neither the Initial Fund nor any Future Fund relying on the Order will invest in options contracts, futures contracts or swap agreements, except to the extent permitted by the Commission and/or its staff in the future,” reads the recent filing, indicating that Hancock is calling an audible from its ETF playbook in response to the current environment. Complete Story » |

| Apple Bucks the Economic Trend Posted: 23 Jun 2010 09:32 AM PDT Dr. Stephen Leeb submits: Economic reports, especially those relating to the financial health of American citizens, have not been overwhelmingly positive lately. In fact, deflationary fears aren’t subsiding, and more quantitative easing from the Fed may be on the horizon, as evidenced by nuances in today’s statement. The dismal consumer state makes the performance of Growth Portfolio member Apple (AAPL) all the more impressive. While most Americans are struggling to stay employed and pay their bills, Apple is struggling to keep their new offerings on the shelves. Yesterday, the company announced that they have sold 3 million iPads since their new tablet computer was released in early April. The demand has exceeded company and Wall Street expectations alike, and has strained supplies. With an iPad being purchased every two seconds, most retail outlets have resorted to customer waitlists as inventory struggles to catch up to the volume of purchases. Complete Story » |

| This Market Is Stronger Than You Think Posted: 23 Jun 2010 09:28 AM PDT TickerSense submits: In a decidedly undecided day stocks showed an impressive resolve to tread water. There is no question that this morning's New Home Sales data was bad, in fact as shown below it was the worst monthly report ever. By all rights the market should have sold off from 10:00 through the end of the day, obviously the Fed was a distraction, but a 18 months ago we all know how today would have ended. Instead the market bottomed shortly after the data was released and rallied back to peak after the Fed's comments. This morning's market activity should be noted, it will most likely be clouded by the Fed and spun in a negative view by the press, but the turnaround was nonetheless impressive. For those of us watching closely, oil underwent a similar recovery. At 10:30 the August contracts were trading at $75.75 when inventory numbers were released. Crude inventories gained 2,017k barrels when analysts were expecting an 800k barrel decline; on a significantly higher increase in supplies oil bottomed and rallied back for most of the day. Complete Story » |