Gold World News Flash |

- GoldSeek.com Radio Gold Nugget: Peter Schiff & Chris Waltzek

- Does The Gulf Of Mexico Oil Spill Mean That The U.S. Is Headed For Gas Lines, Higher Food Prices And A Broken Economy?

- Gold and Silver Price Conspiracies Earn Their Weight

- Why Many Analysts See Gold Going As High As $10,000

- Hourly Action In Gold From Trader Dan

- Crude Oil Relatively Strong, Gold May Retest Highs

- What G20 will not discuss this weekend (but probably should)

- ECRI Forecasting Weak GDP Growth?

- Cliffhanger

- Two Decade of Greed - The Unraveling

- Golden Peacocking

- Architecture for a New World Financial System

- Crude Oil May Become Rangebound, Gold Has Potential Key Reversal

- Gold 06-22

- Golden Times

- 'Da Boyz' Are Back in Town... But For How Long?

- China's Potemkin Stock Market... Is Gold Really in a Bubble?

- LGMR: Gold Sits Tight vs. Rising Dollar After Outside Day

- Uh Huh - So It IS A Liability-Limiting Thing

- Looking Behind the Saudi Gold Holdings Increase

- Two Opposing Opinions On The Yuan Depegging

- Gold Seeker Closing Report: Gold and Silver End With Slight Gains

- BP Net CDS Hits Another Record, As APC Weekly Change Is Flat, Implying BP-APC Pair Trade Overhyped

- Osborne Seems to Have Read the BoomBustBlog UK Financial Analysis, His U.K. Deficit Cuts May Rattle His Coalition But He Has Little Choice

- Vision is Not a Four Letter Word

- Louisiana Judge Held RIG Stock; N.C. Rep. Mel Watt Holds BofA Stock: Which Is Worse?

- Prepare for Global Pension War?

- The Women Come Out Swinging: First Merkel, Now McMorris Rodgers Joins The Contra-Geithner Chorus

- The Case for Microsoft

- Understanding the M.A.D. China/U.S. Relationship

- Good Time to Re-Short the EUR/DLR?

- New Record For GLD Gold Holdings (+5 Tonnes)

- T-Minus 7 Days To A LIBOR-Induced Liquidity Crunch?

- As Long As The Gold Price Remains Above $1,190 It Stays In An Uptrend.

- TUESDAY Market Excerpts

- Fed's Next Move is To Ease

- The American Dream, Revisited

- General Stanley McChrystal Resigns

- Federal judge overturns U.S. deepwater drilling ban

- Merrill Lynch: The 3 big reasons gold and silver will soar

- These sectors could be the big winners from China's currency move

- New Record For GLD Gold Holdings (+5 Tonnes); Gold On Its Way To Validate Goldman's $1,400/Oz Prediction

- Even the Fed Can't Get Credit-Card Language Right

- Want a Yuan Play? Look to Commodities

- Commercial Metals Company F3Q10 (Qtr End 05/31/10) Earnings Call Transcript

- The Truth Behind China’s Latest Currency Move

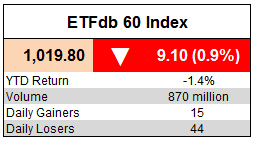

- Tuesday ETF Roundup: IYT Sinks, GLD Rallies Again

- Bank Lending: A Look at the Numbers

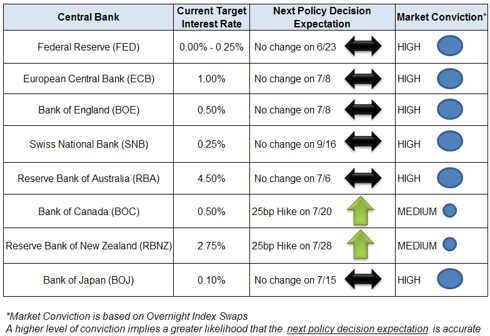

- Central Bank Watch: Getting Ready to Parse the Fed Statement

- Adobe Delivers Solid Quarter, Cites Creative Suite Upgrade

| GoldSeek.com Radio Gold Nugget: Peter Schiff & Chris Waltzek Posted: 22 Jun 2010 07:00 PM PDT | ||||

| Posted: 22 Jun 2010 06:15 PM PDT

The American people certainly have a negative view on the impact that this oil spill will have on the economy. According to a new poll, about eight out of every 10 Americans expect the oil spill to damage the U.S. economy and drive up the cost of gas and food. But is a new 1970s-style energy crisis really a possibility? Could we actually soon be headed for blackouts and gas lines? Well, former Shell executive John Hofmeister believes that is exactly what we are headed for.... "Within a decade I predict the energy abyss looks like brownouts, blackouts and gas lines." In fact, Hofmeister claims that some of his fellow energy industry insiders expect things to be even worse than he is projecting in the years ahead. Why? Hofmeister says that the problem is the U.S. government.... "Our federal government, when it comes to energy and the environment, is dysfunctional, it's broken, and it's unfixable in its current form." Without a doubt, the oil spill will have a chilling effect on offshore drilling. But does that mean that we are going to be facing a shortage of oil in the future? Well, that is what the advocates of peak oil would have us believe. But the truth is that there are actually a TON of untapped reserves throughout the United States that could provide everything that we need for decades and more. Nobody is really supposed to talk about it, but the reality is that there are massive deposits of oil in Alaska, the Colorado Rockies and in the Bakken formation in Montana and the Dakotas that are larger than anything found in Saudi Arabia. So we will only have an "energy crisis" if that is what oil industry insiders and the U.S. government want. You see, the oil industry likes to keep the supply of oil down because it means much larger profits for them, and these days the folks in Washington D.C. like anything that causes the U.S. public to use less oil, so higher energy prices are just fine with them. In fact, rather than focusing on getting the crisis in the Gulf solved, Barack Obama has been exploiting this oil spill to really push his economy-killing climate bill. It seems like Barack Obama would do just about anything to foist his "cap and trade" carbon tax scheme on the American people. Energy issues aside, the impact that this oil spill is having on other areas of the Gulf coast economy is very significant. For example, the Gulf oil spill is absolutely playing havoc with real estate prices in the region. Real estate agent Linda Henderson recently put it this way.... "I can tell you that things have pretty much dropped to dead." After all, who is going to pay top dollar for beachfront property down there at this point? Nobody. Not only that, but obviously the oil spill is devastating the seafood industry in the Gulf as well. The Wall Street Journal recently reported that the average wholesale price for Gulf brown shrimp has jumped by more than half since the crisis began. In addition, oyster prices are up 33% since the beginning of the oil spill, and as oil continues to spew into the Gulf of Mexico the price increases are only going to become more dramatic. In fact, many are wondering if the seafood industry in the Gulf will ever recover from all of this. The truth is that fishermen in Cordova, Alaska are still struggling 21 years after the 1989 Exxon Valdez oil spill devastated the fishing industry in that area. Some local shrimpers in Louisiana are already predicting that it will be seven years before they can set to sea again, but even that actually may prove to be too optimistic. Some scientists are warning that the massive quantities of methane that are being spewed into the Gulf of Mexico from the "oil volcano" could create "dead zones" where oxygen is so depleted that literally nothing lives. So if the oil continues to flow for several more months could very large portions of the Gulf of Mexico become dead zones? That is a legitimate question at this point. In addition, the oil spill in the Gulf of Mexico is completely destroying tourism along the Gulf coast. The truth is that nobody wants to visit places where the beaches are coated with oil and where breathing the air makes your kids want to gag. Public Service Commissioner Benjamin Stevens recently described what this is going to mean for beaches in his area.... "You get hit by a hurricane and you can rebuild. But when that stuff washes up on the white sands of Pensacola Beach, you can't just go and get more white sand.'' Hotel Owner Dodie Vegas was even more blunt in describing what this crisis means for her business.... "It's just going to kill us. It's going to destroy us." But not everyone has been ruined economically by this oil spill. In fact, it turns out that BP CEO Tony Hayward cashed in about a third of his BP stock one month before the well on the Deepwater Horizon exploded. Not only that, it has been revealed that Goldman Sachs sold 58% of its shares in BP between January and March of this year. Isn't it amazing how the elite always seem to have such perfect timing? Even if Tony Hayward resigns as a result of this crisis, he is going to get a 10.8 million pound ($16 million) golden parachute. No, the true losers in all of this are going to be those living along the Gulf of Mexico who have had their lives, their businesses and the beautiful environment around them destroyed. We are literally watching an entire region of America slowly die, and Barack Obama still refuses to accept any of the international assistance that is being offered. If what is happening in the Gulf of Mexico is not enough to get the American people angry, then what will? This crisis has been so badly mismanaged that it is absolutely mind blowing. Let's just hope that someone can find a way to stop the oil soon. | ||||

| Gold and Silver Price Conspiracies Earn Their Weight Posted: 22 Jun 2010 06:05 PM PDT Investigations into the trading at the COMEX have yet to make headlines, but they could uncover what traders have been seeing for a very long time. The price of gold and silver ebb and flow as part of a malicious attempt to corner the industry and create profitable opportunities for investment banks and hedge funds. | ||||

| Why Many Analysts See Gold Going As High As $10,000 Posted: 22 Jun 2010 06:03 PM PDT My first reaction when I read an article on this site by Arnold Bock - articulating why gold would go to $10,000 – by 2012 no less - was amazement. Who in their right mind would suggest that gold would eventually reach $2,500, let alone $5,000 or even $10,000? Well, I did some investigation and, believe it or not, Bock is in lofty company. | ||||

| Hourly Action In Gold From Trader Dan Posted: 22 Jun 2010 06:00 PM PDT View the original post at jsmineset.com... June 22, 2010 09:49 AM Dear CIGAs, In one of the more marvelous market displays I have seen in many years, gold was able to shrug off a major technical reversal sign and actually attract enough buying to not only minimize downside movement but actually bounce higher. Considering the extent of speculative long side exposure, and the nature of today's computer algorithms, its ability to remain firm is astonishing and probably says more about the overall psychology towards the metal than any comments I could make. Investors and traders at the Comex are not panicking out of gold in spite of the formidable technical resistance that surfaced yesterday. The same goes for the HUI which moved higher while the broader equity market moved lower based on the action of the S&P 500. Again – this is remarkable stuff for gold. While the record high of yesterday's session is serving as our new upside technical resistance level and holding price in check fo... | ||||

| Crude Oil Relatively Strong, Gold May Retest Highs Posted: 22 Jun 2010 05:46 PM PDT courtesy of DailyFX.com June 22, 2010 07:51 PM Oil prices may fall if the bearish API survey is any indication of what we will see in the official government numbers released on Wednesday, while gold traders ponder whether another retest of the all-time highs is in the works. Commodities - Energy Crude Oil Relatively Strong Crude Oil (WTI) $77.38 -$0.47 -0.60% Crude oil is down again after losing close to 1% on Tuesday, but the commodity is significantly outperforming other risk assets. The S&P 500 shed 1.6% on Tuesday; such a large reversal would typically be good for $2-4 drop in crude oil, but that was not to be. This price action is even more surprising considering oil has rallied extremely strongly off the lows under $70.00, thus one would have expected prices to easily sell off a few dollars from these levels. Tomorrow we get news on U.S. petroleum inventories and if the API survey is any indication, a bearish report is due (API: Crude +3685K, Gaso... | ||||

| What G20 will not discuss this weekend (but probably should) Posted: 22 Jun 2010 05:46 PM PDT By James G. Rickards There's a growing sense that the current global economic "Plan A", i.e. substitute public debt for private debt and use fiscal stimulus to keep economies afloat until private demand kicks in, has failed. Not surprising to many of us; it was destined to fail, but now the reality of that is becoming undeniable so leaders are scrambling for Plan B. For the U.S., Plan B is to double-down on Plan A. Others are not so sure. One problem is timing. There are several Plan B's, but they all take 5-7 years to implement, e.g. yuan as reserve asset, SDR's as a new liquidity source, etc. The two-tier Euro plan is just another Plan B although it might possibly be implemented in 2-3 years rather than 5-7. None of these plans is totally ridiculous, but they all suffer from the same weakness which is that they depend on continued faith in paper money in a world where that faith is rapidly eroding. So the meta-political question b... | ||||

| ECRI Forecasting Weak GDP Growth? Posted: 22 Jun 2010 05:46 PM PDT A number of reports have been made about the rapid drop in the ECRI (Economic Cycle Research Institute) WLI (Weekly Leading Index). One good summary was given last weekend by Steven Hansen in his weekly economic review here on Seeking Alpha. Steve quotes Lakshman Achuthan, ECRI director, as saying the drop in WLI is not yet sustained enough to indicate the onset of a recession. Two graphs from David Rosenberg, Chief Economist at Gluskin Sheff, are interesting. It is worthwhile to look at the details of the data behind the 0.8% annual growth rate highlighted by Rosenberg for GDP. This has been done by estimating the quarter of the ECRI WLI falling into the -5% to -10% annual growth rate window from Chart 1 (above) and then obtaining the real GDP growth values from the Fred data base at the St. Louis Fed. There were ten occurrences where the ECRI WLI fell into the window. These are shown in the following tables (click to enlarge): The last column in the upper ... | ||||

| Posted: 22 Jun 2010 05:46 PM PDT Excerpt from the Hussman Funds' Weekly Market Comment (6/21/10): [INDENT]If one thinks of the data as telling a story, the picture here would most decidedly be a cliffhanger - where our hero dangles from a steep precipice, clutching a rock of uncertain strength, and where the evidence is not clear about what outcome will prevail. One outcome is a continuity, and the other is an abrupt discontinuity. It's possible that things will resolve sufficiently well, but we have to consider the possibility that they will not. I am not suggesting that readers and shareholders deviate from careful discipline or well-diversified investment plans. Instead, I am urging them to make sure that a significant market decline would not derail their financial security or future plans, or cause them to abandon their discipline after the fact - something that I've seen investors do far too frequently over the past decade. These considerations are particularly importan... | ||||

| Two Decade of Greed - The Unraveling Posted: 22 Jun 2010 05:46 PM PDT We are currently in the midst of a Fourth Turning. This twenty year Crisis began during the 2005 – 2008 timeframe with the collapse of the housing bubble and subsequent repercussions on the worldwide financial system. It is progressing as expected, with the financial crisis deepening and leading to tensions across the world. It will eventually morph into military conflict, as all prior Fourth Turnings have. The progression from High to Awakening through the Unraveling took from 1946 until 2006. The most treacherous period of the Saeculm is upon us. The intensity of a Crisis is very much dependent upon how a country and its citizens prepare for the Crisis during the final years of the Unraveling. The last Unraveling period in U.S. history from 1984 through 2005 was symbolized by Boomer greed, materialism, debt and selfishness. When Michael Lewis graduated from Princeton University in 1985 and joined Salomon Brothers, I’m sure he didn’t realize that he woul... | ||||

| Posted: 22 Jun 2010 05:46 PM PDT The 5 min. Forecast June 22, 2010 11:59 AM by Addison Wiggin & Ian Mathias [LIST] [*] The latest gold trend… Freud would be proud [*] The 5 digests two high-profile Op-Eds… Greenspan & Krugman never cease to amaze! [*] Frank Holmes with a nasty BP spill side effect… Byron King on how you can profit from it [*] Plus, your public servants at work: 8 congressmen under investigation for financial services fundraising [/LIST] Today, we add a new phrase to our gold bubble lexicon: “Peacocking.” How else would you explain this: Saudi Arabia “restated” its gold reserves yesterday, right as the spot price found an all-time high of $1,265. Last week, SAMA, the shady Saudi sovereign wealth fund, held 143 tons of gold. Today -- 322 tons! The Saudis gave little explanation other than a humble “adjustment of the SAMA’s gold accounts.” Heh, 100+%? That’s some adjustment. China did the same thing roughly a year ag... | ||||

| Architecture for a New World Financial System Posted: 22 Jun 2010 05:46 PM PDT An adaptation of the keynote address delivered at the European BANKERS Symposium June 9 - 10, Hall in Tirol, Austria Antal E. Fekete Historical background The Symposium was held at the historic town of Hall in Tirol, Austria, for a good reason. Hall in Tirol (just east of Innsbruck) had been the “monetary capital” of Europe for centuries. It all started in 1477 with the moving of the Mint from Meran in South Tirol (now part of Italy) where it had been operating since 1271, to Burg Hasegg in Hall, by Archduke Sigismund of Austria (1427-1496). At the same time the Archduke instituted important monetary reforms. He opened the Mint to silver. As a result, silver mining was revived in the valleys of Tirol, and new mining methods and technology were developed. Ultimately, the much-debased coinage of Medieval Europe was replaced by sound currency that brought heretofore unprecedented prosperity to the people of Renaissance Europe. The ... | ||||

| Crude Oil May Become Rangebound, Gold Has Potential Key Reversal Posted: 22 Jun 2010 05:46 PM PDT June 21, 2010 09:42 PM As more shocks out of Europe fail to materialize, oil traders are of the buy the dips mentality. However, because risks remain and physical fundamentals are quite poor, the market may simply be rangebound. Commodities - Energy Crude Oil May Become Rangebound Crude Oil (WTI) $77.39 -$0.43 -0.55% Despite a late day stock market reversal on Monday, crude oil was able to eke out yet another gain. Prices have now risen in five of the last six sessions. The bottom line right now is that crude oil has bottomed out and traders will be looking to buy dips rather than sell rallies. The move from $87 to the mid-$60’s was largely a function of fear that the world economy would experience substantial slow down, with major economies potentially falling into a second recession, a double dip. At least so far, these bearish fears have not come to fruition, thus prices naturally rise as selling pressure exhausts itself. That said, crude inv... | ||||

| Posted: 22 Jun 2010 05:46 PM PDT June 22, 2010 07:04 AM Gold has traded to a new high and near term objectives are 1276 and 1300. 1276 is where wave v would equal wave i (1050-1147). 1300 is where wave c of v would equal wave a of v (the rally from 1050 is a diagonal, consisting of 3 wave movements) and where wave v equals 61.8% of waves i through iii. Trading below 1216 would signal that a top is probably in place. Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Friday evenings), technical analysis of currency crosses on Monday, Wednesday, and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forum. He is the author of Sentiment in the Forex Market. Follow his intraday market commentary and trades at DailyFX Forex Stream. Send requests to receive his reports via email to [EMAIL="jsaettele@dailyfx.com"]jsaettele@dailyfx.com[/EMAIL].... | ||||

| Posted: 22 Jun 2010 05:46 PM PDT Aden Article By Mary Anne & Pamela Aden June 21, 2010 Courtesy of www.adenforecast.com Gold is amazing. It’s been very strong, hitting record highs last week. Its bullish price action means investors and governments know it’s time to be in safe assets. The result is, gold continues to benefit as the world’s #1 safe haven. GOLD IS MONEY We’re also seeing first hand gold’s role in the monetary system. Few people understand gold’s importance over other forms of wealth but if there was ever a doubt, it’s been erased by gold’s reaction to ongoing financial developments. Gold is money. Most governments regard gold as a monetaryinstrument, and it has been the international currency for thousands of years. BIG PICTURE: Gold is best Considering the big picture, there’s no doubt gold is the best investment. The mega trend changed when the new century began. Aclear shift away from paper assets (like ... | ||||

| 'Da Boyz' Are Back in Town... But For How Long? Posted: 22 Jun 2010 05:46 PM PDT Gold didn't do much early in the Monday trading day until around 1:00 p.m. in Hong Kong when a rally worthy of the description began to take shape. This lasted until precisely 9:00 a.m. in London... when it got hit at its spike high of the day... around $1,267 spot. The subsequent rally got hit again at precisely 1:00 p.m. in London... shortly before the Comex opened in New York. Then 'da boyz' really got serious around 12:45 p.m. when they pulled their bids. The low of the day [$1,229.80 spot] was at 4:00 p.m. in New York. Silver's price path was very similar to gold's... except silver's high [around $19.48 spot] was at 1:00 p.m. in London trading... shortly before the Comex opened. Silver's low was also at 4:00 p.m. in New York... $18.67 spot. The dollar had about a 30 basis point gap down opening as Asia began trading on Monday morning... with the dollar bottoming around 2:30 a.m... shortly before both gold and silver began to head south.... | ||||

| China's Potemkin Stock Market... Is Gold Really in a Bubble? Posted: 22 Jun 2010 05:46 PM PDT China's Potemkin Stock Market Tuesday, June 22, 2010 – by Staff Report China has become the world's third largest stock market, the country's securities regulator said. According to the China Securities Regulatory Commission, the total market value of the Shanghai and Shenzhen markets hit 3.07 trillion dollars as of the end of May. The total market value so far was up 393.76 percent compared to the 2003 level, Xinhua news agency reports. The United States has two of the top three exchanges based on market value. The New York Stock Exchange (NYSE) is the largest exchange by far with a market value of $9.57 trillion, while NASDAQ exchange has a market value of $2.77 trillion. – Economic Times Dominant Social Theme: The brilliance of China ... Free-Market Analysis: The Chinese miracle plays on. The yuan pushes up against the dollar now that Chinese leaders are letting the yuan float. Chinese stock markets are soaring. Meanwhile, Senator Jose... | ||||

| LGMR: Gold Sits Tight vs. Rising Dollar After Outside Day Posted: 22 Jun 2010 05:46 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:05 ET, Tues 22 June Gold Sits Tight vs. Rising Dollar After "Outside Day"; US Rates Seen Staying "Lower for Longer" THE PRICE OF GOLD held tight vs. a rising US Dollar on London's wholesale market early Tuesday, trading back down from $1240 to last night's two-session low of $1232 an ounce. World stock markets caught up with Wall Street's late fall, and commodity markets also fell. Crude oil lost 1.5% to $76.60 per barrel. "Gold's price action [on Monday] was quite bearish," says the latest technical analysis from Scotia Mocatta. The bullion bank notes how the Dollar gold price yesterday recorded "an outside day" on its candle-stick chart, starting above Friday's finish but ending beneath Friday's low. Also spotting "key reversals in riskier assets such as the Euro and the S&P500," today's market-note from Japanese metals conglomerate Mitsui agrees that "the yellow metal [could have] put in... | ||||

| Uh Huh - So It IS A Liability-Limiting Thing Posted: 22 Jun 2010 05:45 PM PDT Market Ticker - Karl Denninger View original article June 22, 2010 08:40 AM If you're wondering why BP "agreed" to the $20 billion escrow fund, wonder no more.... [INDENT]In the end, one aim of the fund—and a prime reason BP agreed to it—will be to minimize lawsuits against the company. To do that, Mr. Feinberg will offer big lump-sum payments to workers and businesses as an enticement to stay out of court. "At some point, I will have to make an offer—'You take this amount in full satisfaction of your claim, but only if you waive your right to future litigation,'" Mr. Feinberg said. "And if I package it right, people will see that it makes no sense to fight it out in court." [/INDENT]Ding ding ding ding. Now there's the reason for it folks. There was never a reason for BP to agree to this fund unless they got something in return. Now we know what it was - a means to cap off liability claims against the company, which could otherwise bankrupt them. If you remember, on t... | ||||

| Looking Behind the Saudi Gold Holdings Increase Posted: 22 Jun 2010 05:35 PM PDT | ||||

| Two Opposing Opinions On The Yuan Depegging Posted: 22 Jun 2010 04:50 PM PDT Yesterday's mega news on the CNY depegging, which went so far as to make headlines out of something as mundane as the PBoC yuan fixing, has now been fully priced in. And before we put the matter to rest, we would like to present two diametrically opposing opinions on this issue: one from Goldman's Sven Jari Stehn, which is full of contained optimism about the future of the world, and one from Gary Shilling, who in a Bberg TV interview, says that the Chinese decision could not have come at a worse time, and that it risks destabilizing the precarious global balance achieved at the cost of so many trillions in stimuli. First, here is Goldman's traditional bullishness:

Next, a far more dire narrative, courtesy of economist Hary Shilling:

On whether China's central bank made a timing mistake in allowing the yuan to strengthen: “[China's central bank] probably is [making the wrong move]. They run a stop-go economic policy. The last time they tried to slow things down was 2007. The timing couldn't have been worse as it came right on the eve of the '08 global recession. " "Now they’re trying to slow things down and letting the yuan go up against the dollar is part of that tightening move. They’re worrying about inflation, but they’re really trying to tighten down after all their massive stimulus last year. The timing is probably going to be terrible because we’re getting the eurozone crisis spreading globally and that may give us the sequel to what sub-prime mortgages did in 08.” On conditions in the Eurozone: “I don’t think it’s the end of the world but it’s mainly financial. It isn’t so much in trade although obviously if Europe is in weak conditions, they’re not going to be able to buy much of anything including our exports, but the point is that US banks have 48% of their global exposure -1 ½ trillion dollars in the Euro zone plus the UK - so there’s a lot of involvement there. I think we’re probably going to end up restructuring, meaning lower value on the debts, sovereign and private debts, in Greece and probably Spain and a few other of the picks.” "There's a difference between technical default and actual default…but I think it's coming." On the European Central Bank owning Greek and Spanish debt:

| ||||

| Gold Seeker Closing Report: Gold and Silver End With Slight Gains Posted: 22 Jun 2010 04:00 PM PDT | ||||

| BP Net CDS Hits Another Record, As APC Weekly Change Is Flat, Implying BP-APC Pair Trade Overhyped Posted: 22 Jun 2010 03:41 PM PDT According to DTCC, BP net notional CDS has hit another weekly record, coming in at $1.794 billion on 2,590 contracts as of June 18. This is a change from past week's $1.677 billion net notional outstanding, and 2,072 contracts: an increase of $117 million in net notional derisking as an increasing number of bets on BP's bankruptcy are made. Another very popular name, Anadarko, came in at $1.630 billion net with 3,051 contracts: the exact same notional as the prior week (which however saw 2,877 contracts outstanding). In other words, even as traders derisked in BP, they were flat in Anadarko, implying that a short risk BP - long risk APC trade was not being actively put on in the past week, contrary to media reports of this being a prevalent pair trade. Instead speculators took on unhedged short risk exclusively in BP. Alternatively, we could see accelerated derisking in APC soon as the long risk leg of a possible BP-APC pair trade catches up with FV. | ||||

| Posted: 22 Jun 2010 03:16 PM PDT In the British chapter of our tome on the Pan-European Sovereign Debt Crisis, the UK is going according to plan. Subscribers should feel pride (and hopefully profit) in having read about these actions months before they occurred. From Bloomberg: Osborne’s U.K. Deficit Cuts May Rattle Coalition June 22 (Bloomberg) — U.K. Chancellor of the Exchequer George Osborne’s plans to cut spending by the most since the 1980s in an emergency budget today may test the durability of the six-week old coalition and the strength of union opposition. The prospect of an increase in value-added tax may lead some Liberal Democrat lawmakers to rebel against the Conservative led-coalition, as unions oppose steps to cut jobs, public workers’ pay and welfare. The spending reductions and tax increases also risk tipping the economy back into recession. … The austerity plan will set the size of the budget while leaving details of cuts until Osborne maps out departmental plans in the fall. Fitch Ratings said June 8 the U.K. needs to speed deficit cuts to guard its top credit rating. The U.K.’s Office of Budget Responsibility last week estimated debt would rise to 74 percent of GDP in 2015 from 62 percent in the current year. The deficit will be 10.5 percent of GDP this year. “It’s going to be bad everywhere, and the removal of public demand could be nasty” said Shamik Dhar, an economist at Aviva Plc, which has 262 billion euros ($323 billion) under management. “I don’t think the structural deficit is going to be as bad, and interest rates at near zero are going to help.” The pound declined against the dollar and gilts advanced as some investors anticipated the spending cuts would prompt the Bank of England to maintain its record-low benchmark interest rate of 0.5 percent. … Some economists and opposition parties say current government forecasts of 2.6 percent growth in 2011 and 2.8 percent in 2012 may be scaled back as Osborne’s measures suck resources out of the economy. As he battled to stave off defeat during this year’s election campaign, Labour Prime Minister Gordon Brown said immediate spending cuts sought by Conservatives risked a double-dip recession. Alistair Darling, Osborne’s Labour Party predecessor, said Osborne is overplaying the risk of a sovereign debt crisis to shrink the size of the state. Darling yesterday told reporters in London yesterday that he would be “astonished’ if Osborne holds back from increasing VAT to 20 percent from 17.5 … To cushion the impact of spending cuts, Osborne will propose raising the ceiling at which the lowest rate of income tax is levied by 1,000 pounds to 7,475 pounds, exempting 880,000 low earners from payment, said a person with knowledge of the plans. He’ll also seek to maintain spending on schools, hospital buildings and other infrastructure projects. Part of the effort to sell the austerity measures to voters will include a levy on banks’ assets or liabilities that will raise at least 2 billion pounds a year, according to three people with knowledge of the plans. Osborne told the British Broadcasting Corp. June 20 that he’ll press ahead with plans to increase capital-gains tax to prevent rich people from declaring earned income, which is subject to as much as 50 percent tax, as a capital gain that is liable to an 18 percent tax. … Of the U.K.’s current 704 billion-pound annual budget, more than a quarter, or 196 billion pounds, is targeted for ‘‘social protection” measures, including welfare and pensions. Total public-sector pay totals about 160 billion pounds a year. Osborne said in his BBC interview that the welfare budget is “out of control” and that it discourages people from working because they can rely on state handouts. The effort to trim the deficit will also focus on the public-sector workforce, Osborne said. He told the BBC that many of Britain’s 6.1 million employees face a wage freeze extending beyond this year. The last Labour government added 900,000 workers to the state payroll during its 13 years in power, more than a third of them in the past two years to help counter the recession. The government now accounts for one in five jobs in Britain. I’d like to take this time to share page 4 of our subscription-based analysis of the UK’s predicament (subscribers, see

You see, things are materially worse than Britain is letting on. Now, if we were to reverse the exaggerations, optimistic assumptions and outright lies (speaking of which, reference Lies, Damn Lies, and Sovereign Truths: Why the Euro is Destined to Collapse!)…

… and in terms of government balance over-optimism???

Those interest in our higher end analysis can access our subscription services by registering here. | ||||

| Vision is Not a Four Letter Word Posted: 22 Jun 2010 02:53 PM PDT | ||||

| Louisiana Judge Held RIG Stock; N.C. Rep. Mel Watt Holds BofA Stock: Which Is Worse? Posted: 22 Jun 2010 02:47 PM PDT Some of the more traffic challenged aggregators are going all aflutter with disclosure that the New Orleans judge who overturned Obama's impromptu decision to bar deepwater drilling held energy stocks as recently as 2008. As this was two years ago and took place in the gulf region, this seems like an earnest effort to create page views out of loud headlines, and nothing else. Static Chaos provides some additional sense on this issue. Not much to add here, suffice it to say, or rather ask: is it worse that a Judge may have owned under $15k in a potentially conflicted stock years ago, or that North Carolina Congressman Mel Watt, ardent supporter of all Fed endeavours, and a Representative who is currently under investigation for holding a fundraiser immediately after passing a materially watered down Fin Reg reform, not to mention prominent lobbyist of all sorts of banking interests (including those of home state based Bank of America) held and still holds between $15,001 and $50,000 of Bank of America stock (and between $1,001 and $15,000 in BB&T stock) according to his May 14, 2010 disclosure. This is a rhetorical question. Mel Watt's 2009 Financial Disclosure Statement

This posting includes an audio/video/photo media file: Download Now | ||||

| Prepare for Global Pension War? Posted: 22 Jun 2010 02:09 PM PDT Mary Williams Walsh of the NYT reports, In Budget Crisis, States Take Aim at Pension Costs:

Politics & pensions are never a good mix. And if you think this is just a US problem, think again. In Ireland, Fiona Reddan of the Irish Times reports that three-quarters of defined-benefit pension schemes in red. In England where Chancellor George Osborne just announced draconian 25% budget cuts, Tim Shipman of the Mail reports, Prepare for war of strikes over pay freeze and pensions say the public sector brothers. I've been warning all of you to prepare for global pension war. It will hit private and public sector pensions, ruining retirement dreams, forcing workers to work longer than they planned for, solidifying deep antipathies that common workers have with the financial oligarchs who got away with billions in bonuses and bailouts. Politicians at the G20 be warned: hell hath no fury like a pensioner scorned. | ||||

| The Women Come Out Swinging: First Merkel, Now McMorris Rodgers Joins The Contra-Geithner Chorus Posted: 22 Jun 2010 02:00 PM PDT Earlier today we noted that German Chancellor Angela Merkel ridiculed Geithner's declining influence ahead of the upcoming G-20 by not only openly ignoring his call to Keynesian arms, but saying that what he is doing is tantamount to long-term economic suicide: “If we don’t get onto a path of sustainable economic growth but have rather a growth bubble, then if the next crisis comes we won’t be able to pay for it." Well, as the joke goes, women once again demonstrate more testicular fortitude than their XY companions: shortly after this announcement, Rep. Cathy McMorris Rodgers (R-WA), who previously warned against the $100 billion U.S. burden to bail out Europe via the IMF, is now blasting Geithner's "Spend and Borrow" policies to be advocated at the G20 summit in a letter sent to the tax-challenged Keynesianite (enclosed), further saying that the "president is doubling down on the path to bankruptcy.” “I have deep, grave concerns about the President’s handling of the global economy,” said Rep. McMorris Rodgers. “Last month, President Obama worked behind the scenes to craft a $900 billion bailout of the European Union – a bailout which will cost U.S. taxpayers between $50-100 billion. Even supporters of the bailout - such as German Chancellor Angela Merkel - acknowledged that the bailout would only ‘buy time’ to get European governments off their spend-and-borrow addiction. Now, incredibly, the Obama Administration – standing alone, against our European allies – is working to facilitate that addiction by vocally opposing much-needed austerity measures. While Europe - to its credit - may be learning its lesson, the President is doubling down on the path to bankruptcy.” In her letter to Secretary Geithner, Rep. McMorris Rodgers wrote, “We are disturbed to know that despite Europe’s growing debt crisis the United States continues to push policies in the international community that promote unsustainable global government borrowing and spending… Despite the Administration’s efforts to spend the nation back into growth and prosperity, we now face record annual deficits, a record debt level of more than $13 trillion, and an unemployment rate that hovers just below 10%...Debt problems cannot be solved with more debt. Just look at Greece.” McMorris Rodgers and Rep. Mike Pence previously introduced a Congressional Resolution, H. Con. Res 279, which opposed US participation in the European bailout. Obviously, it did not pass. Below is a copy of the letter sent by the Congresswoman to the SecTres.

| ||||

| Posted: 22 Jun 2010 01:56 PM PDT Bret Jensen submits: The market provided another good example today of why we are currently risk averse. The euro fell as concerns about Europe resurfaced once again. In addition, housing sales were poor, the market reacted badly to the administration’s continued pursuit of a drilling moratorium despite court setbacks, and the Baltic index declined for the 17th straight day; hardly the harbinger of expanding economic growth. This all contributed to significant losses across the board. In this type of environment it pays to stay defensive. Stick to those equities with pristine balance sheets, rock solid business models, reasonable valuations, and decent dividend yields. Most of the stocks that we are finding using these criteria are in the Large Cap Blue Chip area - Vodafone (VOD), Pfizer (PFE), Johnson & Johnson (JNJ), Exxon Mobile (XOM), etc. The next selection we would like to highlight is Microsoft (MSFT). Overview: Microsoft is the world's largest software maker, primarily as a result of its near monopoly position in desktop operating systems and its Office productivity suite. The combination of these two strongholds pose a formidable barrier to entry for competitors, in our opinion. MSFT has used the strong cash flows from these businesses to fund research and development of other markets, including home entertainment consoles and Internet online advertising. The company has five operating business divisions: Windows and Windows Live, Server and Tools, Online Services Business, Microsoft Business, and Entertainment and Devices. Prognosis: The stock price is about where it was nine years ago despite more than doubling earnings in that timeframe, a rising dividend yield and being in the early stages of some important new launches. It also is making some good progress with its Bing search engine; which continues to gain market share as well as its XBox Platform. We believe the stock is ready to outperform the market over the next 12 to 18 months. We based this on the following: Valuation: MSFT is selling for approximately 12.5 times this year’s consensus earnings. It has a dividend yield of two percent and over $3.50 per share of net cash on its balance sheet. It also has a triple AAA rated balance sheet. Catalysts: There are several factors that we believe should provide support for a higher stock price in the near and medium term: 1. Rollout of Windows 7 has been well received and is in the early stages of adoption. Many corporations passed on Vista, so this should be a large upgrade cycle. Office 2010 should also contribute significant revenue growth when it rolls out. 2. Bing continues to improve and take market share slowly in the search market 3. Corporate balance sheets are in fantastic shape compared with consumer balance sheets and with their historical averages as far as cash available for investments 4. Consensus is for even more revenue growth in 2011 than in 2010 and earnings are expected to hit $2.30 a share Recommendation(s): We believe the stock should be trading at a more appropriate 14-15 times next year’s projected earnings of $2.30. Given stock’s prospects and solid dividend yield, our target Price is $32-$35, up from the current price of $25.77.

Complete Story » | ||||

| Understanding the M.A.D. China/U.S. Relationship Posted: 22 Jun 2010 01:46 PM PDT Surly Trader submits: The big news this week has been the revaluation of the Chinese Renminbi (Yuan) against the US Dollar. The markets were euphoric early Monday morning, but have since tapered off. The reason for the tepid response is due to the rather tricky relationship between the United States and China. For the last 23 months, China has kept a peg of 6.8267CNY per $1. US lawmakers are continuously blaming the peg of the Yuan as the main cause for high unemployment in the US, manufacturing moving overseas, a stagnating world economy, high debts in the United States, and anything else you would like to blame on someone else. The truth is quite a bit more complicated. In order to maintain the fixed peg against the dollar, the Peoples Bank of China (PBOC) must supply the necessary renminbi to purchase dollars to hold the currency fixed. China’s significant current surplus, recently increased by strong capital inflows, means that significant quantities of base money are required to make this peg work. Without some sort of offset, this rapid expansion of the domestic money supply would create massive inflation. The PBOC “sterilizes this money creation by issuing short term bills and increasing the reserve ratio of the local banking system to soak up the excess liquidity and decrease the amount of lending that the banking system can affect. Complete Story » | ||||

| Good Time to Re-Short the EUR/DLR? Posted: 22 Jun 2010 12:57 PM PDT The EUR/CHF is opening in Asia at few pips under 1.36 while the EUR/USD is at 1.2275. It is not surprising that the Swiss is strong against the Euro. The SNB has let the cross go. They were last seen at 1.40 where they made a big stand. But to me it is surprising to see this sharp appreciation of the Franc while the dollar lost 3% to the Euro. Proving once again that the business of forecasting FX markets is tricky stuff. The Euro was (is?) oversold. The open short interest has been cut sharply in the past 10 days. There has not been any “Really-really bad” news out of the EU either. In fact some of the austerity talk seems to have traction. Austerity is a popular theme. So the back up in the Euro is justified. It’s easy to predict that there will be more bad news from the EU in the next few months. With that as a backdrop the current market level looks attractive to shorten up on the EUR/DLR. But I am smelling a rat on that trade. It was not that long ago that the short dollar trade was popular. The reasons were obvious. The US fiscal issues were overwhelming. Growth prospects (I think that relative growth drives FX) in the States was questionable. That was six months ago. What can you say about those issues today? Nothing is being accomplished on the fiscal side. Bernanke intends to continue ZIRP forever. Everyday we see new evidence that a slowdown is likely in the months ahead. The fact that the US will not even raise the issue of an austerity budget until 2011 is going to become a drag. With all of Europe’s problems there is evidence that they are coming to terms with their budgets. In the US it is still full steam ahead. This week we may get another $50b to extend unemployment and keep the states alive for another four months. As many have recently pointed out, the municipal finance problems in the US could overwhelm the bad news from the EU. That story is going to explode as of July 1. We are at an interesting juncture in FX. Either the trend to a weaker Euro comes back into line soon or we may have a surprise ending. The appreciation of the CHF against all currencies is a sign to me that this is a market against the dollar, not just the Euro crosses. While it may look tempting to re-short the Euro it could also be a trap. Keep your eyes on the other crosses. If the Yen/DLR weakens or we see a decisive breakout in gold to the upside look up. The weak dollar carry trade could come back into vogue. | ||||

| New Record For GLD Gold Holdings (+5 Tonnes) Posted: 22 Jun 2010 12:43 PM PDT On June 17, we wondered whether the "parabolic blow off in gold accumulation by ETFs is about to cause a gold price explosion?" Sure enough, yesterday, Goldman Sachs came out with a bullish report on gold in which the firm stated that should gold purchasing by ETFs continue at the recent pace, then gold at $1,400 is a virtual certainty. A quick look at the closing NAV in the gold holdings of GLD, as a proxy of the broader Gold ETF community, indicates that $1,400 – here we come. Just overnight, GLD added another 5.2 tonnes of gold, bringing its new total to a fresh all time high of 1,313.13 tonnes, a whopping 76 tonnes higher than a month ago. As the indexed chart below demonstrates, what we thought could become a positive feedback loop whereby non-physical ETFs scramble to at least catch up to a par NAV, is already in process: the ETF accumulation by GLD, which is now the 6th largest gold-owning entity in the world, has become a self-fulfilling prophecy. If the ETF is indeed purchasing said gold in the open market, there is no way this would not be moving the price much higher, absent massive synthetic shorting by the LBMA. Yet at some point, internal risk controls at even a firm with infinite margin like JPMorgan will take over, and force the bank to cover its record short exposure. When that happens, the already disclosed demand by entities such as ETFs and Central Banks, will catch up with the most manipulated and distorted supply curve in the history of economics. | ||||

| T-Minus 7 Days To A LIBOR-Induced Liquidity Crunch? Posted: 22 Jun 2010 12:02 PM PDT Zero Hedge has been discussing the ongoing liquidity constriction around the world over the past month, focusing on Europe and China, where conditions range from icy to outright frozen. One country that has been largely ignored, is our very own USA, where despite the Fed's ongoing liquidity flood, the last few days have seen short-term secured funding in the form of Top Tier Commercial Paper once again jumping to near 2010 highs at 0.43% (see chart). This is in stark contrast with ultra short-dated Treasuries, where 30 Day Bills are just barely yielding 0.05% (and were as low as 0.02% a few days prior). Yet for all domestic jitters, it appears that the next source of an (il)liquidity crunch will once again come from Europe. As Barclays' Joseph Abate notes, there is one event is on the horizon which could send Libor rates as high as 50% higher. And that event will occur on July 1 - the 1 year anniversary of the ECB's Long-Term Refinancing Operation. This 371 Day LTRO was created just under a year ago by the ECB to add €442 billion in liquidity to front-end markets. It is precisely this LTRO that facilitated not only the decline in the FRBNY's FX swaps, but the gradual drop in dollar Libor to all time lows. The program was so successful that the ECB followed it up with two other one-year LTROs, yet both much smaller: one for €75 and one for €97 billion. Yet the Halcyon days of well over half a trillion in excess CB-provided liquidity are ending on July 1, and the roll off will be a critical event, which could set off yet another liquidity crunch first in Europe, and then everywhere else. The first consideration is that the facility will not roll into a comparable unlimited 1 Year tender, but instead into a much shorter 3 month operation. As Abate points out: "Market attention is focused on how much of the €442bn stays at the ECB and how much leaves the program: currently there is about €300bn “surplus” liquidity in the euro area market, and so a full rollover is not theoretically needed." And as nobody but JCT really knows what quality collateral is pledging any one euro of circulating money, especially post the complete loosening of A-rating triggers to pledging sovereign debt post the Greece bankruptcy (unlike the broader media, we don't mind calling a spade a spade), the willingness to unwind the facility will speak volumes about Europe's banks:

Yet no matter how much of the full amount rolls off, there will be an immediate "cliff" event in liquidity needs as the public funding market will be replaced by the private: sorry, Jean-Claude, you can't have your public cake and have the private sector eat it (the cake, not the sector).

Another way of looking at why Libor is set to surge is based on expectations of what is happening behind the scenes, as nobody still have any idea what is really held by the ECB, either in its LTRO, or any other Operational facilities:

And the piece de resisance is that the imminent disclosure of the European "Stress Tests" will backfire, as they will be announced at a time when liquidity tensions are soaring, and Libor is starting to surge once again.

Will all this be sufficient to cause an interbank lending crisis in the US, comparable to that enveloping Spain and soon other European countries? At this point it is still difficult to make a determination, although the two opposing forces of Fed reliquification, and private market stress escalation, will once again certainly be locked in a duel, which will definitely have an impact on all risk assets. Perhaps it is this that tension that has been keeping the market on edge. Either way, keep an eye out on Libor, CP (both US and European), and ultra short dated Bills: despite the Fed's interventions, the broader market will overwhelm a liquidity intervention any day, and the Fed may soon find itself with little if any options to restore liquidity in the broader capital markets, increasingly losing any and all credibility, precisely courtesy of seemingly endless Central bank intervention. | ||||

| As Long As The Gold Price Remains Above $1,190 It Stays In An Uptrend. Posted: 22 Jun 2010 10:52 AM PDT Gold Price Close Today : 1239.90Change: -0.20 or -0.0%Silver Price Close Today : 18.896Change 9.4 cents or 0.5%Platinum Price Close Today: 1583.00Change: -6.05 or -0.4%Palladium Price Close Today:... This is a summary only. Visit GOLDPRICE.ORG for the full article, gold price charts in ounces grams and kilos in 23 national currencies, and more! | ||||

| Posted: 22 Jun 2010 10:24 AM PDT Gold rests before Fed statement The COMEX August gold futures contract closed up $0.10 Tuesday at $1240.80, trading between $1233.00 and $1244.00 June 22, p.m. excerpts: see full news, 24-hr newswire… June 22nd's audio MarketMinute | ||||

| Posted: 22 Jun 2010 10:02 AM PDT | ||||

| Posted: 22 Jun 2010 10:00 AM PDT I have a cousin and two very personal friends who decided to leave America permanently to reside in France. They sold everything they owned and moved to France with just one suitcase. Within two years, all three returned to America. Summing it up, they said, "You just don't have any idea what it is like to live in another country until you actually do it. If you think politics are bad in the US, you should try living somewhere else. You just can't believe the nonsense that goes on in France regarding jobs, politics, and social programs." ——————————– I became a free man on Nov. 17, 2007 when I renounced my US citizenship at the Consulate in Panama at the ripe age of 65. I figured that after a lifetime of obeying the law and paying the tax, I could at least spend my remaining days as a free man – both politically and financially. Since that day, I have seen absolutely nothing at all to make me regret my decision. In fact, the course of the US over the past 2 1/2 years leaves me with the smug feeling that not only did I do the "right" thing for me (and by extension, my wife, 5 children and 11 grandchildren), I also struck a tiny blow by denying the failing American experience my financial support. Ayn Rand had the right idea – if you stay, you prop up the system. If you withdraw, you have hastened the day when the final collapse will come, and a serious effort can be made to return the nation to its roots. ——————————– Your article on Expatriation is right on… I have recently taken my family and moved to Bolivia. Yes… Bolivia… The second poorest country in the world next to Haiti. Why move to such a poor country? In the States we were rats in a maze; the dead ends were getting more common and the cheese was getting far more scarce. Here we live like royalty… Do you need a better reason? Actually, we moved here just over three years ago when I foresaw the inevitable crash that was coming. We sold our home just before the bottom fell out and used that money to re-establish ourselves comfortably here. We were fortunate. ——————————– In 2008, my husband started looking at Costa Rica. I got rather excited and started researching whether I could take my pistol there! (I can, but a few hoops must be jumped through…which is, unfortunately, pretty much the same here in the good ol' USA.) I don't think the already-retired hubby's really serious about getting out of dodge, but as I am more than a decade his junior, I very well may consider it down the road (if it's not too late!). I am still working and wish to work for a bit longer. Truthfully, the jury's still out. I must say, though, I am extremely concerned about the future of this country. I have three kids and one granddaughter whose occupational and financial futures are very uncertain. Not only that, the rotting social fabric of America scares me. These "kids" growing up today have no respect for property, individual liberty, or personal responsibility. They don't even respect themselves! I'm only 50 years old and hardly a prude, but as a college professor I occasionally see firsthand the absolute failure of the family and the public school system. I do not want these people responsible for running the country when I'm in my declining years. I DO still believe in American Exceptionalism because there is still no greater economic and social foundation than the one dreamed of by our Founders. The foundation has termites (or worse), yes indeed, but I truly wish to continue believing that there are true patriots who will bring us back to some semblance of past greatness. ——————————– Long time reader, first time mailer I had to write you in response to the top ten reasons to expatriate. I just repatriated back to the US from three years in Bermuda – a legendary low tax jurisdiction. While your list of 10 are true about the hassles of living in the US, you neglect the hassles of living outside the US. I'm a CPA so I think I know my taxes well, and I paid more in taxes while in Bermuda than I did in the US. I should mention I am unfortunately not one of your millionaire readers, so I was able to shelter most of my foreign income from US taxes through the Foreign Earned Income Exclusion. That plus the Foreign Housing Exclusion meant that I paid ZERO US taxes over the three years I was in Bermuda, again probably because I wasn't a millionaire. However, the point you miss is that foreign countries like Bermuda also tax their citizens. They might not call it an income tax, but I paid over 5% of my income in a "payroll tax", plus 30%+ in duties on anything I purchased. Net-net the tax situation was a wash for a low six figure income between the US and (supposedly) tax-friendly Bermuda. This aside leaves you with the hassle of being a foreigner with limited rights in a populace that isn't always welcoming. Want to buy property in Bermuda – nope…not if you're a foreigner. Want to vote for those who spend your taxes – nope…not if you're a foreigner. Want to speak your mind freely – nope…not if your a foreigner and need a work visa. Want to protect your property/life with a handgun – nope. ——————————– How could something so insignificant have pushed me over the edge? After 20 agonizing years of owning and operating a mid-sized construction company in Los Angeles, my wife and I moved (along with our two small kids) to a 15-acre farm in southwestern Argentina, intent on discovering the joys of the 'simple life.' Five long years with no phone and no electricity sent us back to the States 'permanently.' Naturally enough, we blamed our failure on geography. We would continue the pursuit of our dream of a small, self-sufficient farm back home in the good ol' USA. Chelsea, Vermont to be exact…good and far from the maddening crowds of California, but not so far that I had to buy hardware in metric units. Chelsea is small…a population of about 500. And very rural…small farms everywhere. Live and let live attitude. Perfect spot, it seemed. We bought 40 acres at the end of a dirt road well out of town and began planning our little homestead. A small clearing in the woods pretty much in the center of the property seemed a likely site for our little house-to-be. But, rather than rush right into building, we figured it would be smart to put up a temporary roof and test the spot for weather exposure (sun, wind, snow, etc). A 9' by 12' canvas tent was purchased for the purpose. I then built a wood deck to keep it up off the ground, assembled the tent, and stuck a couple of beds in it so we could spend the night occasionally. Well, about a month later I get a visit from the county tax assessor's office…they'd come to inquire about my recent property improvements. Naturally I didn't have any idea what they were talking about. But the fellow was kind enough to explain that it had been reported to his office that I had completed a new structure on the property and that it was his job to assess it for the tax rolls. I told him I had nothing on the property but a tent, but that he was welcome to walk the place and see for himself. So we started off through the woods and after about 10 minutes came to the clearing where the tent stood. After studying it for a moment he gets out his tape measure and begins to calculate the square footage! I asked what he was doing and he tells me that any structure with a permanent floor (in my case the wood deck) is considered a real property improvement and that I'd be getting a supplemental tax bill…not only that…I'd have to go to the planning office in town and get a permit and pay fines for having built without having permits in place before beginning work. Within 6 months of the assessor's visit we sold the property, packed all of our worldly goods into a 40 ft. container and moved back to Argentina. That was 8 years ago. But this time we have electricity (a small hydroelectric turbine beside the stream), phone and Internet (satellite), and The Daily Reckoning every evening! ——————————– Two of the best moves of my life were made on 11 January. On that date in 1975 I married Janet. Exactly thirty years later, we renounced US citizenship at the consulate in Auckland. I have been delighted by both moves. We have been in New Zealand for eleven years. Our only child lives around the corner from us with her kiwi husband and two sons. In the early '90s, we began to be uneasy about the political direction of the US. The Clinton, Bush and Obama administrations have strongly confirmed that unease. I feel that living in the US today would probably be like living in Germany in the early '30s. As the fiat currencies continue to degenerate, stresses will be induced in American society that I expect will make it more and more like post-Weimar Germany. It will not be pretty. In my youth, I was a nationalistic little turkey that volunteered to be an artillery lieutenant in Vietnam. I have since gradually awakened. One of the beauties of living in a nation of only four million people is that we cannot succumb to the delusion that we can rule the world, or that our paradigm must be inflicted on everyone on the planet. Our taxes are too high, and we are too socialized, but the rule of law is strong and I feel free here. NZ has recently been assessed as the most peaceful and least corrupt country on earth. It has been rated as the third most business friendly. My great-great-grandfather was killed at Gettysburg trying to get rid of Washington. I have accomplished his objective and had a good time doing it. ——————————– I live in Rochester, MI, which is a suburb of Metro Detroit. Things here are bad and getting worse. I've lived in this area for 25 years and I've never seen so many empty storefronts, especially in downtown Rochester. Malls in neighboring Rochester Hills that have lost big stores are unable to fill the buildings. And at least 13% of the people in Metro Detroit don't know where their next meal is coming from. On the other hand, people are trying to help each other out. Churches and community organizations are opening food banks, individuals are making donations of money and time and stuff (including handmade stuff), and my local library (which is terrific) has been offering services and classes for people in financial trouble. Since the 1980s, Detroit has been ground zero for the new economy, so if you want to see America's "Christmas Future," this is the place to watch. I'm not attached to this area (I grew up around Chicago), but I am attached to the US. America took my parents in when they were running from the Nazis, and my father always considered it a privilege to pay his taxes. I think we're moving towards a new kind of economic life, whether we want to or not. Any government that refuses to take care of its own ends up paying a very steep price, and Americans are already starting to step back from our government and start doing more for ourselves. The steps are small and mainly unnoticeable, but I have always had great faith in the ability of (most) people to behave well under adversity. And our adverse times are just beginning. The Daily Reckoning Readership, The American Dream, Revisited originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||

| General Stanley McChrystal Resigns Posted: 22 Jun 2010 09:55 AM PDT General Stanley McChrystal, who commands 142,000 troops in Afghanistan from the U.S. and 45 partner nations, has offered his resignation to Barack Obama. The reason for the departure is a profile of the general in Rolling Stone which shows the general as critical of the handling of the Afghanistan war. Bloobmerg reports: "The comments by McChrystal and aides reported in Rolling Stone magazine threaten to fracture a unified front that President Barack Obama has sought to build for the war and distract efforts to hold together an international coalition doing the fighting. Obama reacted with anger upon reading the article, his spokesman said, and officials from the White House to the Pentagon to Congress called McChrystal’s remarks a serious lapse in judgment." The problem is that no matter how the McChrystal situation is resolved, there will be a major power vacuum in Afghanistan, and the extraction of the country's $1 quadrillion (rounded up) in gold and other precious metals as per the recently disclosed "Opium Bonanza" could get slightly problematic... not to mention running the whole Taliban sideshow. More from Bloomberg:

Here is the full Rolling Stone article for those who may have missed it. | ||||

| Federal judge overturns U.S. deepwater drilling ban Posted: 22 Jun 2010 09:52 AM PDT From Bloomberg: A New Orleans federal judge lifted the six-month moratorium on deepwater drilling imposed by President Barack Obama following the largest oil spill in U.S. history. Drilling services shares jumped on the news. Obama temporarily halted all drilling in waters deeper than 500 feet on May 27 to give a presidential commission time to study improvements in the safety of offshore operations. More than a dozen Louisiana offshore service and supply companies sued U.S. regulators to lift the ban. The U.S. said it will appeal the decision. U.S. District Judge Martin Feldman today granted a preliminary injunction, halting the moratorium. He also “immediately prohibited” the U.S. from enforcing the ban. Government lawyers told Feldman that ban was based on findings in a U.S. report following the sinking of the Deepwater Horizon rig off the Louisiana coast in April. “The court is unable to divine or fathom a relationship between the findings and the immense scope of the moratorium,” Feldman said in his 22-page decision. “The blanket moratorium, with no parameters, seems to assume that because one rig failed and although no one yet fully knows why, all companies and rigs drilling new wells over 500 feet also universally present an imminent danger.” Separate Order “The court cannot substitute its judgment for that of the agency, but the agency must ‘cogently explain why it has exercised its discretion in a given manner,’” Feldman said, citing a previous ruling. “It has not done so.” Feldman in a separate order today “immediately prohibited” the U.S. from enforcing the drilling moratorium, finding the offshore companies would otherwise incur “irreparable harm.” White House press secretary Robert Gibbs said that “continuing to drill at these depths without knowing what happened does not make any sense.” Transocean Ltd., which leased the Deepwater Horizon to BP Plc, jumped as much as 3.5 percent in New York trading after the decision was announced. Hornbeck Offshore Services Inc., which brought the suit, surged as much as 11 percent. The U.S. argued that the moratorium was necessary to assure public safety. “We need to make sure deepwater drilling is as safe as we thought it was the day before this incident,” Brian Collins, a lawyer for the government, told Feldman in a court hearing June 21. “It is crucial to take the time because to fail to do so would be to gamble with the long-term future of this region.” Biggest Quantity BP has two pipes collecting oil and gas from the ocean floor. They collected 25,830 barrels of oil yesterday, the biggest quantity diverted from the Gulf of Mexico since the April 20 spill began, London-based BP said in a statement. BP spokesman David Nicholas declined to comment on the ruling, saying the company was not a party to the case. Lawyers for the drilling companies told Feldman the moratorium illegally sidesteps a required industry comment period. They also said regulators failed to tell Obama that all active deepwater rigs passed an immediate re-inspection after the Deepwater Horizon exploded and sank, with only two rigs reporting minor violations and the rest getting approval to continue operations. Henry Dart, special counsel for the Louisiana attorney general, told Feldman that federal regulators failed to consult with state officials about the impact of the drilling ban, allegedly violating U.S. law. Jobs in Danger “Even after the catastrophic events of Sept. 11, the government only shut down the airlines for three days,” Louisiana said in court papers seeking to lift the ban. Lawyers for the state and oilfield companies told Feldman that the ban could cost as many as 20,000 jobs if the moratorium lasted 18 months. “The defendants trivialize such losses by characterizing them as merely a small percentage of the drilling rigs affected, but it does not follow that this will somehow reduce the convincing harm suffered,” Feldman said. He said the economic impacts of the ban would “clearly ripple throughout the economy of this region.” Feldman granted the injunction after finding it likely the oilfield companies will succeed in proving “the agency’s decision was arbitrary and capricious,” which violates federal law governing policy decisions. ‘Immeasurable’ Effect “An invalid agency decision to suspend drilling of wells in depths over 500 feet simply cannot justify the immeasurable effect on the plaintiffs, the local economy, the Gulf region, and the critical present-day aspect of the availability of domestic energy in the country,” Feldman said. “Today’s ruling by U.S. District Court Judge Martin Feldman is an important step in returning thousands of oil service workers to their jobs,” Royal Dutch Shell Plc spokesman Bill Tanner said in an e-mailed statement. “Shell remains confident in its expertise and procedures to safely drill and complete deepwater wells.” Shell’s safety standards often exceed regulatory requirements and include including a rigorous training program for well engineers, Tanner said. Kjersti Torgersen, a spokeswoman for Statoil ASA in Houston, did not immediately respond to a telephone call seeking comment. Todd M. Hornbeck, CEO of Hornbeck Offshore, didn’t immediately return a call for comment. Little Change Realistically, not a lot has changed, said Jud Bailey, an analyst at Jefferies & Co. in Houston. “It’s a small victory for the industry, but clearly the administration has dug in its heels and is going to try to keep this moratorium, come hell or high water,” Bailey said today in a telephone interview. “Investors, as it relates to the drillers, are for the most part staying away. There’s too much uncertainty, too much headline risk.” Bailey said he doesn’t think many operators would run out and immediately try to resume operations. “You run the risk of this getting overturned by the appellate court,” he said. The case is Hornbeck Offshore Services LLC v. Salazar, 2:10-cv-01663, U.S. District Court, Eastern District of Louisiana (New Orleans). To contact the reporters on this story: Laurel Brubaker Calkins in Houston at laurel@calkins.us.com and; Margaret Cronin Fisk in Southfield, Michigan, at mcfisk@bloomberg.net. More on energy: This clean energy sector could be set to soar Don't touch oil services stocks before you see this... Dan Ferris: This could be the best chance you'll ever get to buy these stocks | ||||

| Merrill Lynch: The 3 big reasons gold and silver will soar Posted: 22 Jun 2010 09:36 AM PDT From Mineweb: Merrill Lynch metals analysts maintain gold will hit a US$1,500 per ounce target by the end of next year as investor demand pushes gold prices higher. In research published Monday, analysts Michael Widmer, Francisco Blanch, and Alex Tonks are predicting average gold price forecasts of US$1,200/oz this year, $1,350/oz in 2011, and $1,400/oz in 2012, up from $1110/oz, $1179/oz and $1109/oz. respectively. "We also believe that silver has further upside and see prices averaging..." Read full article... More on gold: Gold closes at a new all-time high This is what deflation could do to gold This classic chart pattern says gold could make a big move higher | ||||

| These sectors could be the big winners from China's currency move Posted: 22 Jun 2010 09:34 AM PDT From Pragmatic Capitalism: “One of the most widely expected events this year is a RMB revaluation. We believe that there will be slightly more RMB/Asian currencies revaluation than is discounted by the markets. ...The winners. The last time the RMB revalued (in July 2005), Japan outperformed 25% in the subsequent six months (and we think it could outperform again with 55% of exports going to NJA: we like... Read full article... More on China: Why China wants gold to plunge to $800 Meet the junior mining stocks China is targeting now Frank Curzio: This tiny stock could solve China's biggest problem | ||||

| Posted: 22 Jun 2010 09:26 AM PDT On June 17, we wondered whether the "parabolic blow off in gold accumulation by ETFs is about to cause a gold price explosion?" Sure enough, yesterday, Goldman Sachs came out with a bullish report on gold in which the firm stated that should gold purchasing by ETFs continue at the recent pace, then gold at $1,400 is a virtual certainty. A quick look at the closing NAV in the gold holdings of GLD, as a proxy of the broader Gold ETF community, indicates that $1,400 - here we come. Just overnight, GLD added another 5.2 tonnes of gold, bringing its new total to a fresh all time high of 1,313.13 tonnes, a whopping 76 tonnes higher than a month ago. As the indexed chart below demonstrates, what we thought could become a positive feedback loop whereby non-physical ETFs scramble to at least catch up to a par NAV, is already in process: the ETF accumulation by GLD, which is now the 6th largest gold-owning entity in the world, has become a self-fulfilling prophecy. If the ETF is indeed purchasing said gold in the open market, there is no way this would not be moving the price much higher, absent massive synthetic shorting by the LBMA. Yet at some point, internal risk controls at even a firm with infinite margin like JPMorgan will take over, and force the bank to cover its record short exposure. When that happens, the already disclosed demand by entities such as ETFs and Central Banks, will catch up with the most manipulated and distorted supply curve in the history of economics. | ||||

| Even the Fed Can't Get Credit-Card Language Right Posted: 22 Jun 2010 09:24 AM PDT Felix Salmon submits: CardHub.com has an interesting survey of the literature surrounding penalty interest rates on credit cards. Many of the biggest card issuers rank as “poor,” on the quality and transparency of their disclosures, although Wells Fargo stands out as being particularly good. Most distressingly, the Federal Reserve itself, in its sample statement language, fails on some key points. For instance, the Fed’s model flyer says this: Complete Story » | ||||

| Want a Yuan Play? Look to Commodities Posted: 22 Jun 2010 09:22 AM PDT IndexUniverse submits: By Lara Crigger Maybe the best way to play the Chinese yuan is to not play it at all. Matt Hougan is right when he says that taking a direct stance in the newly "flexible" Chinese currency via the WisdomTree Dreyfus Chinese Yuan ETF (CYB) or the Market Vectors Chinese Renminbi/USD ETN (CNY) isn't exactly instant gratification. As Matt points out, these funds offer exposure to currency futures, not spot yuan. So if you're trying to access near-term appreciations in China’s currency, you're bound to be disappointed, because these are markets where expectations for prices several months in the future often matter more than any short-term central bank decision. Complete Story » | ||||

| Commercial Metals Company F3Q10 (Qtr End 05/31/10) Earnings Call Transcript Posted: 22 Jun 2010 09:06 AM PDT Commercial Metals Company (CMC) F3Q10 (Qtr End 05/31/10) Earnings Call Transcript June 22, 2010 11:00 am ET Complete Story » | ||||