Gold World News Flash |

- Leading Indicators, WLI, and the Sox

- Why the Market Is Never Right

- International ETFs: Two Roses Among the Thorns

- Hourly Action In Gold From Trader Dan

- Dow, Gold & Oil are Breaking Out or Bouncing

- Daily Dispatch: Run to the Canadian Border

- Jack Lifton: North America Doesn't Need China's Rare Earths

- Tarsis Building On Exploration Success For A Bright Future

- Shout Bubble From the Mountains

- Consumer deleveraging: the new “wall of worry”

- Got Gold Report – Gold Poised to Make History

- Gold Bubble? What Bubble?

- West Struggles With Non-Recovery... UK Militarizes Its Big Society

- In The News Today

- LGMR: Gold Hits $1265 Record as Central Banks & Investors Choose "Ultimate Safe Haven

- Heh, Look! It's Ridiculous Bank BS Again! (Spain)

- Na,Na, Na, Na, Hey, Hey, Hey, Good-Bye!

- China ETFs and Asia ETFs Rise the Most on Yuan News

- Tuesday Morning Links

- Wall Street Breakfast: Must-Know News

- Prospect Capital Reduces Its Distribution

- Alpine's Total Dynamic Dividend Fund: Overdosing on Financial Engineering

- Two ETFs for Any Season: Gold, Oil

- Time to Focus on Silver

- 4 Small Cap Stock Ideas for Uncertain Economic Times

- A Two-Tier Euro?

- Keep Your Eyes on Silver

- As Forecasted: Virtual Pay For Real Work

- Inflation Update

- If They Don’t Own Gold, Don’t Trust Their Opinion on Gold

- Charting Gold

- Getting Outta Dodge

- The Zombies and the Oil Man

- Zombie Bureaucratic Socialists Attack in Daylight

- Why Has Barack Obama Refused To Accept International Help To Clean Up The Oil Spill In The Gulf Of Mexico?

- Jim Rickards: How the world likely will get back to gold

- Gold Seeker Closing Report: Gold and Silver Fall About 1.5%

- Florida Rolling the Dice with Pensions?

- Shorting into a Buying Stampede

- A Summer Of Discontent

- The story that's GATA be told

- The story that's GATA be told

- The Banking System Is Closing In On Collapse

- Finding Gold in the Mainstream

- Saudi Arabia’s “Restated” Reserves Double its Gold

- China & the Gold Price

- 2010 Boy Scouts Proof Silver Dollar Coins Sold Out

| Leading Indicators, WLI, and the Sox Posted: 22 Jun 2010 12:08 AM PDT Robert Castellano submits: I’ve been using and refining our proprietary leading indicators (LI) for fifteen years as a correlation with the semiconductor and semiconductor equipment markets which we analyze. Recently I took a look at the ECRI (Economic Cycle Research Institute – businesscycle.com) WLI (U.S. Weekly Leading Indicator), a widely read and publicized LI to see if there is any correlation with the semiconductor space. I could find none, and the staff at ECRI confirmed that others have tried in the past with no success. Complete Story » | |

| Posted: 22 Jun 2010 12:07 AM PDT Now that the Efficient Market Hypothesis has been soundly beaten to death by the 2008 crisis, I'll let you in on a little secret: the market is never right. If the current price is the best estimate of future expectations, how can the future expectation change 5% during the day without any new information? The only logical conclusion: the future expectation is a crap shoot. Complete Story » | |

| International ETFs: Two Roses Among the Thorns Posted: 21 Jun 2010 11:52 PM PDT Christian Wagner submits: Success lies in being “Country Specific”. Shift to the “Fiscally Responsible”. While MSCI EFAE (NYSE:EFA) seems to be the default option for many advisors and brokers, most don’t understand that this ETF is comprised of 88.54% developed Europe and Japan. These nations are obviously faced with significant problems with debt and the austerity measures needed to correct the problem that they find themselves in. The 1-year return on EFA is not one to ignore at 53.92%. While the 3-year return is -7.07%. Play good defense with 1 year gains. Complete Story » | |

| Hourly Action In Gold From Trader Dan Posted: 21 Jun 2010 11:47 PM PDT View the original post at jsmineset.com... June 21, 2010 09:52 AM Dear CIGAs, Welcome to the first day of summer. What a start! It goes without much saying that the news out of China dominated today's 24 hour trading period. The hedge funds went wild in the commodity complex early on with the thinking that any appreciation in the yuan will stimulate economic activity and thus be good for business globally. They scarfed up tangibles and unloaded gold on the thought that there is no longer any need for a safe haven. All of this is longer term stuff but that does not matter in today's markets where the entire business cycle is now complete in 24 hours. Funds unload positions in a matter of hours or reload them in the same period of time. Today they were unloading gold. Sadly for the friends of gold, the spike into a new record high overnight followed by a drop down below Friday's low on the price charts has resulted in a bearish downside reversal day. The candlestick charts refer to ... | |

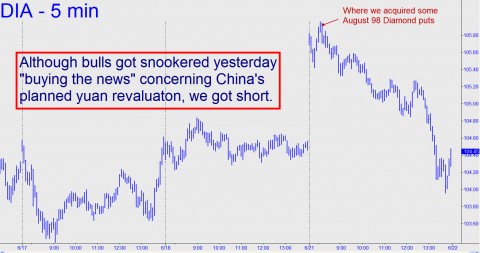

| Dow, Gold & Oil are Breaking Out or Bouncing Posted: 21 Jun 2010 11:47 PM PDT Over the years we have seen the stock market make some pretty exciting moves for share holders. This year alone there have been some interesting events unfold causing wild market swings which most of us did not think could happen. Things like countries going bankrupt and the May flash crash. Also the BP Oil well leak which looks as though its about to kill not only businesses around the world but a large population of animals and fish which our planet will never be able to get back… It’s been a crazy year! It sure would be nice if the financial situations between all he countries could be resolved, and if we could have some proper regulations on banks and the financial system to minimize fraud and manipulation. From the looks of everything we have a few years still before things get sorted out, fixed and some what stabilized. Below are some charts showing where the Dow, Gold and Oil are currently trading and my thoughts on them. DIA – Dow Jone... | |

| Daily Dispatch: Run to the Canadian Border Posted: 21 Jun 2010 11:47 PM PDT June 21, 2010 | www.CaseyResearch.com Run to the Canadian Border Dear Reader, The bigger a financial crisis, the more dramatic the fireworks it produces. And so, seated comfortably in chairs made of gold, we watch, much as we do on New Year’s, for the time to arrive when it’s out with the old and in with the new. New financial regulations, new taxes, new governments, new currency regimes are all on the way. On the latter point, over the weekend the Chinese announced that they were going to allow the yuan to adjust in value. Note that they didn’t say they were going to allow the yuan to float – which is to say, let the free market decide its value. That decision will remain firmly in the hands of the communist cadre commanding the heights overlooking China’s fiscal and monetary policies. Instead, the Chinese will break the current peg to the U.S. dollar and allow some modest appreciati... | |

| Jack Lifton: North America Doesn't Need China's Rare Earths Posted: 21 Jun 2010 11:47 PM PDT Source: Sally Lowder of The Gold Report 06/21/2010 Everybody's talking about rare earth elements (REEs), but does anyone truly understand them? With nearly 50 years in the industry, independent Metals Consultant Jack Lifton sure does. The educational powerhouse in this burgeoning space returns to The Gold Report with a look toward future trends and a plan to emancipate North America from China's REE monopoly. The Gold Report: Jack, since our first interview over a year ago, the rare earth space has received a lot of ink. You were one of the first to talk about these minor metals and their strategic importance to manufacturing and electronics. Could you give our readers a little refresher about some of these metals and their uses? Jack Lifton: I define a rare metal by its production rate, because it doesn't matter how much of a metal there is in the earth's crust—or even how much of it is concentrated enough in accessible ore deposits to be, theoretically, rec... | |

| Tarsis Building On Exploration Success For A Bright Future Posted: 21 Jun 2010 11:47 PM PDT By Jonathan T. Orr and James West MidasLetter.com Monday, June 21, 2010 Tarsis Resources Ltd. (TSX.V: TCC) is a company that knows the power of depth and diversity when it comes to building a promising portfolio of mining properties and maintaining a tight share structure which gives Tarsis shareholders plenty of opportunity for a win. Tarsis has exposure to gold, silver, copper, lead and zinc, and its projects are in the favourable exploration areas of the Yukon and Mexico. With their triumvirate of Prospector Mountain, Erika and MOR, they look forward to continuing to create wealth for investors by bringing these projects online with a highly experienced management team and the proven ability to negotiate the strategic partnerships needed to thrive as an exploration company. Tarsis has a varied portfolio of discovery possibilities includin... | |

| Shout Bubble From the Mountains Posted: 21 Jun 2010 11:47 PM PDT www.preciousmetalstockreview.com June 19, 2010 It’s now official, Gold has broken it’s perfect cup and handle formation. It’s heading much higher here and now, with a very high degree of confidence. To buy or not to buy is the question. I’ve always liked to buy on weakness. Gold is not weak right now. That being said, trading the move may be a great way to increase that pile of cash and buy all the more oz’s once gold does exhibit some weakness. Surprisingly the all-time high gold prices are attracting little more than a headline, or if a story is done it’s usually bearish. That’s bullish! Sentiment is abysmal. If this were tech stocks, it would be touted everywhere and talk of a bubble would not even be tolerated, let alone given credence. Let the bears reign in the headlines and say we are in the biggest bubble of our time. Let them sing it from the mountains, and let the populous believe them! I’d love to see... | |

| Consumer deleveraging: the new “wall of worry” Posted: 21 Jun 2010 11:47 PM PDT Everywhere one turns it seems that fear lurks just behind the corner, just waiting to pounce. Every day we’re bombarded by fear in the news headlines, be it from a financial, economic or geopolitical perspective. Nowhere is this more apparent than the current fear campaign over the U.S. debt situation, specifically, consumer deleveraging. The Wall Street Journal recently published a commentary on consumer deleveraging. The article pointed to the sluggish job growth trend in spite of a bounce-back in corporate earnings and assigned the principle blame for this on consumer debt-cutting. The Fed announced earlier this week that consumer credit outstanding fell by $1 billion in April to $2.45 trillion, representing the 17th monthly decline in the past two years. WSJ points out that this is an unprecedented record in the 67-year history of the data set. "Just getting debt down to 18%," says the WSJ, "would require households to shed an additional $1.4 tril... | |

| Got Gold Report – Gold Poised to Make History Posted: 21 Jun 2010 11:47 PM PDT By Gene Arensberg Esse quam videri – To be rather than to seem. Usual "suspects" not aggressively selling up to now. HOUSTON – Gold and silver are both poised to make history this coming week, but will they? We suspect that the Big Sellers (BS) of both will certainly attempt vigorous opposition. They already have. The question is whether the buying pressure will overwhelm the "hedgers," the question is if the numbers of buyers and the volume they wield will overrun the BS as it did in October of 2005, as it did in July of 2007, in December of 2008, in December of 2009 and again in April, earlier this year. Or, if the BS will prevail at gold's new resistance, sending us into a summer correction. The Big Sellers (BS) are the commercial futures traders the Commodities Futures Trading Commission (CFTC) favors with massive position size and accountability exemptions for what the sell side and the CFTC calls "hedging," while restricting any o... | |

| Posted: 21 Jun 2010 11:47 PM PDT We continue to hear pundits describe gold as a bubble. Certainly it will turn into a bubble before this is all over but we are hardly in the bubble stage yet. In order for a bubble to form you need the public to come into an asset class. The public is pretty dim and it can take 15-20 years before they "catch on". It took 18 before they noticed the tech bubble. Once they do start to "get it" we will have about a year to a year and a half as gold enters the parabolic stage before the bubble pops. See the Nasdaq chart below from late 98 to March of 2000. At gold's top, half of your neighbors will be buying gold (not selling like they are doing now). At the top there will be lines outside the the local coin dealer waiting for the next shipment of gold to come in. At the top 7 of 10 billboards you see driving down the highway will have something to do with precious metals. At the top the guy standing next to you in the grocery store will tell you how many thousands... | |

| West Struggles With Non-Recovery... UK Militarizes Its Big Society Posted: 21 Jun 2010 11:47 PM PDT West Struggles With Non-Recovery Monday, June 21, 2010 – by Staff Report Ben Bernanke Spotlight on response to signs of recovery ... In a week light on data releases, the focus of the markets is likely to be on policymakers as they grapple with how best to respond to the tentative global economic recovery. The British government will attempt to walk a path that neither stifles growth nor imperils the country's fiscal position when it unveils an emergency Budget tomorrow. In the US, the Federal Reserve holds a two-day interest rate-setting meeting with an announcement on Wednesday. And the leaders of the Group of 20 industrialised countries will meet over the weekend as they try to reach agreement on reforms to reduce the systemic risk in the financial sector. The debt difficulties in the eurozone that have buffeted global markets and sapped confidence are likely to make central bankers and politicians more cautious as they wind down the policies put... | |

| Posted: 21 Jun 2010 11:47 PM PDT View the original post at jsmineset.com... June 21, 2010 09:28 AM Jim Sinclair’s Commentary This FT article has a good comment on the implication of the larger than accepted gold reserves of Saudi Arabia. Gold at new record high after Saudi reserves double By Javier Blas in London Published: June 20 2010 21:06 | Last updated: June 21 2010 10:39 Gold prices hit on Monday a fresh record high of almost $1,265 a troy ounce following the revelation that Saudi Arabia, the world's largest oil exporter, is sitting on more than twice as much gold as previously thought, according to new estimates. The disclosure points to the revival of bullion as part of emerging economies' official reserves and comes as investors pour money into the yellow metal. The weakness of the dollar following China's decision to make the yuan more flexible, gave bullion further momentum, analysts said. A stronger yuan makes the cost of gold for Chinese buyer cheaper, potentially increasing demand. ... | |

| LGMR: Gold Hits $1265 Record as Central Banks & Investors Choose "Ultimate Safe Haven Posted: 21 Jun 2010 11:47 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:40 ET, Mon 21 June Gold Hits $1265 Record as Central Banks & Investors Choose "Ultimate Safe Haven" THE PRICE OF WHOLESALE gold bullion rose to a second all-time high vs. the Dollar in two days overnight Monday, touching $1265 an ounce as world stock markets rose sharply on China's weekend promise to "enhance [the] exchange rate flexibility" of its Yuan. The AM Gold Fix in London was set at $1259.50 an ounce, some 13% higher for 2010 to date. "Pull backs [in gold] should be shallow," says one London dealer. "Whenever the metal reaches new highs, we might see some profit-taking and producer selling," agrees Walter de Wet at Standard Bank. "[But] with gold above $1250, we believe the path is now set for the metal to test $1280." Over in the bond market on Monday, German and US government debt slipped in price as equities rose, nudging 10-year yields up to 2.75% ad 3.28% respectively. The E... | |

| Heh, Look! It's Ridiculous Bank BS Again! (Spain) Posted: 21 Jun 2010 11:47 PM PDT Market Ticker - Karl Denninger View original article June 21, 2010 05:39 AM There's nothing like bubble-blowing, irresponsible lending and trying to goad people into levering up into things they can't afford, right? [INDENT]Spain has one of the world's most-troubled housing markets, yet some buyers are suddenly able to get mortgages with 100% financing, and developers are building new homes on empty lots despite a huge glut. [/INDENT]Heh, what could possibly go wrong when you do things like that? Doesn't anyone remember our "subslime" housing mess? [INDENT]The reason: Spain's banks took possession of a large inventory of homes, buildings and land two years ago, forgiving the debt in hopes of heading off defaults. The plan was to resell the properties when the market bounced back and evade the worst impact of the looming housing crisis. [/INDENT]Translation: They lied. Just like our banks. They "took possession" while refusing to recognize the mark to the market, ... | |

| Na,Na, Na, Na, Hey, Hey, Hey, Good-Bye! Posted: 21 Jun 2010 11:47 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 21, 2010 04:16 AM I’ve urged, pleaded and begged readers to avoid listening to known gold perma-bears (who have been bearish on gold for years and from hundreds of dollars lower) and the latest forecaster to call a top in gold and/or it’s in a bubble (yada, yada, yada). Besides the usual nitwits (Bill Murphy rightfully calls Tokyo Rose that name), and flip-flopper’s like Gartman (who’s timing reminds you of the poor guy who invented Preparation G), I’ve to remind some of you of others because they seemingly caused you enough grief to get all worked up when the media did their thing and promoted their bearish gold forecasts. These 4 go into my Hall of Shame: [LIST] [*]Robert Prechter – I actually like Robert as a person but he has been bearish on gold foe literally years. [*]Barclay’s Capital who the media flooded us with at the beginning... | |

| China ETFs and Asia ETFs Rise the Most on Yuan News Posted: 21 Jun 2010 11:45 PM PDT  Gary Gordon submits: Gary Gordon submits: China hints that it’s willing to let its currency appreciate in value against a basket of world currencies. Did the Chinese cave to G-20 leader pressure? Or do the Chinese know something that developed world leaders do not? Unless your arrogance prevents you from seeing the big picture, the answer is the latter. China knows that its economy is in far better shape than a “stabilizing Europe” or an “improving U.S.” China knows that a rising renminbi (yuan) tames mainland inflation, keeps the Chinese stock and housing markets out of “bubble-land” as well as increases the purchasing power of its citizens. Complete Story » | |

| Posted: 21 Jun 2010 11:25 PM PDT MUST READS MARKETS/INVESTING MISCELLANY | |

| Wall Street Breakfast: Must-Know News Posted: 21 Jun 2010 11:18 PM PDT

Today's Markets

Tuesday's Economic Calendar

Seeking Alpha's Market Currents team contributed to this post. Complete Story » | |

| Prospect Capital Reduces Its Distribution Posted: 21 Jun 2010 11:08 PM PDT Nicholas Marshi submits: As we have long expected and predicted, Prospect Capital (ticker: PSEC) has reduced its dividend distribution level. Our skepticism about the company's ability to maintain its policy of ever increasing dividends was based upon the very substantial gap between Prospect's Net Investment Income Per Share and the dividend: 11 cents a share. That's after Prospect harvested many of the benefits of acquiring Patriot Capital at a discount, as well as getting the one time benefit of repricing three loans last quarter. Here's the language from the last Earnings Report which explains this item:

Complete Story » | |

| Alpine's Total Dynamic Dividend Fund: Overdosing on Financial Engineering Posted: 21 Jun 2010 10:49 PM PDT Dan Plettner submits: Shareholders of Alpine Total Dynamic Dividend Fund (AOD) may soon get crushed by a falling house of cards. Sadly, there are nearly 220 million shares in public hands and while some may understand the danger in owning a Closed-End Fund trading 31.45% above its Net Asset Value, few if any are cognizant that collapse may be imminent. AOD’s Financial Engineering Game Complete Story » | |

| Two ETFs for Any Season: Gold, Oil Posted: 21 Jun 2010 10:34 PM PDT John Nyaradi submits: With the last few years’ volatility and major indexes still below highs last seen more than ten years ago at the beginning of “The Tech Wreck,” many investors are wondering if there are any “safe harbors” or investments that can still generate a decent return on investment for the long term. While there’s no “sure thing,” one can look back over the last ten years and find various asset classes that have steadily outperformed the S&P 500 and might continue to do so in the future. Complete Story » | |

| Posted: 21 Jun 2010 09:53 PM PDT It is not exactly groundbreaking analysis to say that what's good for gold is generally good for silver. As observers of the precious metals know, silver tends to lag gold but eventually catches up quickly. In the long-term sense, silver is still a year or two behind gold as gold has broken above all resistance levels. Technically speaking, we do favor gold over the next few months, but ultimately, silver is poised to catch up with vengeance. Here is a great 40-year silver chart from Nick Laird at sharelynx.com, with my annotations. Complete Story » | |

| 4 Small Cap Stock Ideas for Uncertain Economic Times Posted: 21 Jun 2010 09:43 PM PDT Bradley Safalow submits: At PAA Research, we are firm believers in Edward Leamer's thesis that "housing is the business cycle". The findings from our most recent report, "A View from the Frontlines of Housing" backed by a survey of approximately 1,000 residential real estate brokers indicates that the housing market is unlikely to recover any time soon. The expiration of the housing tax credit and other fiscal stimulus measures are likely to result in a much slower growth trajectory for the US economy over the next 12-months, perhaps longer. Additionally, the ongoing threat of sovereign debt defaults in Europe, the prospects for slower growth in China, the absence of job growth, and spiraling municipal budget deficits imply that economic growth in the US and for the rest of the world could be below trend for the next several years. In an environment of lackluster economic growth and capital markets uncertainty we think it is most prudent to focus on individual stocks rather than sectors or even markets. The time for "beta" plays has passed and we think those who can consistently generate "alpha" over the next several years will deliver strong returns. At PAA Research during this period of economic uncertainty we continue to focus on companies that will benefit from secular growth, operate in acyclical end-markets, or are in the midst of a turnaround. To be clear, we're not recommending to pile into consumer staples, healthcare, and Treasuries and to turn off the lights. We still think there will be plenty of companies that deliver strong revenue, earnings, and free cash flow growth over the next several years. We're avoiding names with significant exposure to Europe, China, and the housing market. Complete Story » | |

| Posted: 21 Jun 2010 09:22 PM PDT The Telegraph has a fascinating report on France and Germany considering a two-tier Euro. It's very exploratory at this stage, but such an effort, even if purely cursory, does not just pop up. The motivation is Spain.

Complete Story » | |

| Posted: 21 Jun 2010 07:43 PM PDT Wall Street Cheat Sheet submits: By Jordan Roy-Byrne It is not exactly groundbreaking analysis to say that what's good for Gold (NYSE: GLD) is generally good for Silver (NYSE: SLV). As observers of the precious metals know, Silver tends to lag Gold but eventually catch up quickly. In the long-term sense, Silver is still a year or two behind Gold as Gold has broken above all resistance levels. Technically speaking, we do favor Gold over the next few months, but ultimately, Silver is poised to catch up with vengeance. Complete Story » | |

| As Forecasted: Virtual Pay For Real Work Posted: 21 Jun 2010 06:16 PM PDT UPDATE: | |

| Posted: 21 Jun 2010 06:08 PM PDT The best web-based presentation of US money supply data is located at http://trueslant.com/michaelpollaro/austrian-money-supply/. That's where we obtained the following chart, which shows the year-over-year (YOY) percentage changes for TMS1, TMS2 and M2. Note that "TMS2" is what we normally refer to as TMS (True Money Supply), whereas "TMS1" is a narrower definition of money supply that doesn't count savings deposits. | |

| If They Don’t Own Gold, Don’t Trust Their Opinion on Gold Posted: 21 Jun 2010 05:47 PM PDT | |

| Posted: 21 Jun 2010 05:37 PM PDT | |

| Posted: 21 Jun 2010 05:17 PM PDT Thoughts from U.S. Daily Reckoning Readers... Were I without family ties, I might consider expatriating to one of the quiet, out-of-the-way towns in Central- or South America that I drove my VW bus through in 1977-1978. Spending a year and a half living life at a slower pace and speaking in a second language was world view- opening for this California born American. Through it all, I met many wonderful, amazingly generous people. Unfortunately, I also saw a lot of grinding poverty and misery. I finally lost count of how many times I stared into the barrel of a loaded submachine gun held by an edgy 19 year-old soldier at some border crossing or roadblock. My experience was life-changing, and made me appreciate the blessings of life in the United States - such as they were then. Thirty years later, I am not sure what I would feel coming home from such an adventure. I am saddened that governments at all levels have completely lost self-control. I am distressed that corporations now find it more profitable to pay off politicians for special subsidies and protections than to compete. I am depressed that Americans now walk away from commitments and belly up to the entitlement bar without any compunctions. We have spent the last forty years eating our seed corn and frittering away our wealth on trifles. I am having great difficulty facing my young adult children with the news that their lives will be harder than mine has been...that college might have been a waste of time and money...that funding my granddaughter's college savings fund may be an exercise in futility...that saving and deferred gratification were cruel jokes that a manipulated stock market, zero interest rates, and future inflation will render worthless. My family is here, so I'm resigned to remaining here to see whatever fate delivers. I feel strongly that we're close to the tipping point, after which collapse is inevitable. While a real, final dot.gov crash will make for very hard times, in the end it may be the only way to break the fever that is killing the country. Perhaps then we can dust off the Constitution and rebuild. ******************** I enjoyed reading the "The Persistent Myth of American Economic Dominance" as I enjoy reading many of the articles on dailyreckoning.com. Anyway, it was asked, in this article, for us to share our stories with you on "Getting out of Dodge." I went down to Chile in 2008 with the idea of just vacationing and learning Spanish. I found to my surprise that Chile is a great country and an economic power in its own way. It has low government debt, etc. Anyway, I found a job with a tech company making about 15% less than I was making in the US, but my money went so much further. I was able to buy a 2-bedroom 2-bath condo with all the amenities and 24/7 security for about $120,000 US dollars. There was also no income tax. Basically you just pay a 19% sales tax on everything. It was just so simple to live there. The government left you alone and expected you to work for what you got. They also have a privatized retirement plan where you pay 12.5% of your check to a company who manages your stock portfolio for you. Then you pay 7% for your private medical care comparable to US health care. It was nice to never have to fill out any tax forms and to keep roughly 80% of my paycheck every pay period. My wife and I came back to the US after a few years there to give my wife, who is Chilean, the experience of living in the US. I think what I learned from my experience in Chile is there are lots of other countries who understand much better the importance of freedom and keeping government intrusion to a minimum if you want a healthy economy. ******************** My wife and I recently expatriated. We are fortunate that although we were both born in the USA, due to accidents of birth, we hold passports of EU countries allowing us to live and work in the EU freely. Getting a foreign citizenship (and passport) is essential prior to expatriation; this is totally legal in the USA and you do not have to forfeit your US citizenship as a consequence. However, very few will be able to get a foreign passport so easily. The hard way is to live in a new host country for a long period of time and apply for citizenship. Some countries are rumored to sell passports, but this smacks of fraud and I'd be very suspicious of the utility of such a passport if push came to shove. A better way is if your parents or grandparents were foreign born, to check out whether this could entitle you to a grant of citizenship. Germany for one, grants automatic citizenship to children of German nationals born abroad (until recently this only applied to German fathers, not mothers); this is the best way possible since your foreign citizenship is not something you have to apply for - you already have it and perhaps are just not aware of it. Ireland grants citizenship to grandchildren of Irish nationals regardless of where born, but genealogical proof is required. Expect these rights and programs to become more limited or even to vanish over the coming years, so your readers should investigate the opportunities as soon as possible and avail themselves quickly; there is no downside to having a foreign passport 'at the ready', and it makes international travel much easier even if you do not expatriate. We thought long and hard about giving up our citizenships, but in the end we could fathom no logical reason for hanging on, other than blind inertia. As your article points out, the US government has made it very difficult on expatriates in many ways and it's hard to justify blind loyalty when your own country treats you like a criminal. The act of expatriation is disarmingly simple and quick, but best handled by an attorney in a foreign country who specialized in this. You have to be living overseas to do this, and you have to have a foreign passport otherwise you would become stateless, and as a result the embassy people won't let you renounce your US citizenship. ******************** If there were a poll on the issue I think eighty percent of Americans would want to stay put, while twenty percent would pack for an offshore destination. I don't think the issue is as clear-cut as staying in the US or leaving it. Staying or leaving is a shadow issue cut in half. Half the problem is that too many of those who would stay - regardless of how unlivable the US becomes - are confessing apathy and resignation to the rapacity of a government that considers itself too big to fail. The other half of the problem is that those who would choose to leave the US would be confessing to surrender of all hope for the US. The only ones who seem to know where they want America to go are the Progressives, the Socialists, the statists, and the one-world control freaks, who, if floated head to toe, would form a gooey bridge from Brussels through Ivy League campuses to the White House and Congress. The real issue is for Americans to realize that America has been hijacked by the most cynical and diabolical crowd ever assembled in Washington, DC. After that realization dawns, we must re-dream America. We must not settle for pretenders representing us in our nation's top offices. We must re-claim, renew, and reorient America. That's the issue. ******************** I would leave next week if I could liquidate my rental portfolio and personal residence that fast. I'm fed up! I think it will get much worse. If I don't leave soon, they may not let anyone out of the country at all. It's sad because I just found the perfect place to live in the US. ******************** I can only share a perspective of a small business owner. We are a manufacturing company with approximately 25 full time and 8 part time employees. We have been in business 26 years and my sons represent the third generation. I do not expect business to be easy and we don't mind working hard. But I don't understand this feeling that I get from the current administration that we are the enemy. I would repent if someone would tell me what I have done wrong. Hugh Smith Of Two Minds recently quipped that one would have to be insane or a masochist to hire an employee in America. I wonder how long we can remain insane enough to keep this up. ******************** A few years ago I lost my job of 31 years at a mid-size bank, and, to carry me over to retirement, I took a job as a store cashier. It was my trip to the real world. I live and work in Cleveland and the clientele flowing through our store daily is enough to give one pause. A large number of customers are on the food stamp card. Or, as I prefer to call it, the Junk Food Card. The big game is for two people to live together - one with some income and the other drawing unemployment or welfare (or even both drawing welfare). It is very common for food card purchases to consist entirely of pop, candy, ice cream, etc. Then out comes the big wad of cash for the beer and cigarettes. With most of these people it seems very likely that they have no inclination to work at all, and gaming the system is how they wish to live. Then there are the folks drawing disability. Most of them look quite healthy enough to be working - maybe not at a job they had been doing previously, but still capable of gainful employment. Many of our other customers are older people on fixed incomes. People who are working steady jobs are in the minority. The problem here is obviously that the failure to maintain entitlement programs - which truly cannot continue to be funded given today's local, state, and federal government deficits - will almost certainly result in anarchy. The thought of where Cleveland will be in a few years is absolutely frightening. Making things worse, the intelligencia has all fled the city, leaving opportunists to run the government. Every week the news reports are highlighting another local politician that is under investigation for fraud in office. I don't think I'll be moving to a foreign country, but I'll definitely be selling my house in Cleveland and moving to some small town somewhere that has all the amenities I require - with more favorable demographics. And I can understand that moving to a foreign country could be an even better alternative in the long run. So, basically, I'm all for "getting out of Dodge"! ******************** I left the mortgage industry in 2003 and started a stone masonry business. My clientele are wealthy and still spending money. They are moving further out into the countryside and a few are building hardened shelters under their homes as well as installing generators with over capacity propane storage, chickens, gardens, trout ponds, orchards, and enough land to isolate and hide the operation from passersby. A one to one and a half hour ride to town is not out of the norm. They are not all retirees. My employees, friends and family are involved part time (full time, 2nd shift) in food production. We pasture raise broiler hens, beef, pigs, and vegetables. Canning and dehydrating is back in vogue. We are preparing for the worst hoping for the best, raising children, and trying our best to stay in God's grace. Regards, The Daily Reckoning Readership | |

| Posted: 21 Jun 2010 05:14 PM PDT Poor Tony Hayward. The man was devoured by zombies last week. Now that we've figured out how history works, we're begging to see the forces of history at work all around us - an eternal fight between the zombies and the producers. We're surrounded by zombies. They are all around us. Tort lawyers. Bureaucrats. Politicians. Welfare slaves. Chiselers. Layabouts. Whiners. On the way to work, on the Washington beltway, there are so many lobbyists, we have to put up the windows and lock the doors. But let's look at the economy for a moment. Today is the longest day of the year in the northern hemisphere. That means the year is almost half over. Stimulus measures are winding down...joblessness is creeping up again. Houses seem to be getting ready for another tumble. David Rosenberg:

Hey, don't say we didn't warn you. It's a Great Correction, not a recovery. Stocks began last week with a swagger...but by the end of the week, they were barely crawling forward. Gold ran up day after day, adding another $9 on Friday. It looks as though it is aiming for the $1,300 mark. Meanwhile, the zombies are gaining ground. Last Thursday must have seemed like the longest day to Tony Hayward. "Congress mauls BP chief," is the way The Financial Times put it. Mr. Hayward was confronted by a panel of zombies in Congress. They chained him to a rock so the members of the energy committee could take turns feeding on his internal organs. For 7 hours, the BP CEO was asked the same questions, over and over again. No matter how many times he was asked, the answers were always the same. No, he wasn't an expert on the bonding properties of sub-sea cement. No, he wasn't there when the rig exploded. No, he didn't know exactly what went wrong; he was waiting for the results of the experts' inquiry, along with everyone else. But the zombies didn't really care about getting to the bottom of things. They were going for the jugular. And the right arm. And the liver. From the reports we've read, Mr. Hayward held up pretty well. He played his part. He did not wander from the script. He remained calm as he was dismembered. His voice did not quake or complain as his liver was removed. The politicians on the committee, meanwhile, were disappointing. Even for zombies. Hayward was the straight man. The zombies had the TV audience on their side. They should have made us laugh and cry. But for all their theatrical skills they seemed unable to do more than summon up a worn-out look of mock indignation. Like a man who wants to get rid of his wife and then catches her in flagrante delicto; their outrage seemed more stagey than authentic. Neither Hayward, nor the leading zombies, Henry Waxman and Bart Stupak, will win Oscars. Still, they mostly performed as you'd expect. Hayward said what he had to say. His tormentors feigned profound concern for the fishes and fowl, the flora and fauna of the Gulf area, not to mention the oilmen idled by Barack Obama. What disturbed us was the crowd reaction. There was a time when Americans had a sense of fair play. At least, we'd like to think so. In a fight between a group of zombies and a real producer, their sympathies should be with the oil man. After all, when they drive into the filling station, it's not the Congressional Record that they pump into their fuel tanks. And when they heat their homes, it's not tort lawyers whom they look to for fuel. Gasoline is valuable. They know it. And they know that someone has to get it. In fact, so keen is their demand for octane, and so high is the price, that the producers are lured farther and farther away from dry land. No one would drill a mile below the water for oil unless a lot of people wanted it badly. Sooner or later, one of the rigs was bound to spring a big leak. You'd think the public would have more sympathy for the people who risk their lives and their money bringing oil to market. And more thoughts... "Have you seen this?" asks a colleague. "Bill Gates, Melinda Gates and Warren Buffett are asking the nation's billionaires to pledge to give at least half their net worth to charity, in their lifetimes or at death. "Can you imagine what these people will do with all this money ($600 billion) if they stop trying to make a profit with it and start trying to improve everyone's lives? It'll be no small wonder if I'm still able to breathe without the help of all the bureaucrats and billionaires, after they start throwing all that money around." It's just more evidence of creeping zombification. Rich people are acting like the government; handing out their money...turning otherwise sensible and hardworking people into rent-seeking parasites. And here are more euro-zombies:

Regards, Bill Bonner | |

| Zombie Bureaucratic Socialists Attack in Daylight Posted: 21 Jun 2010 05:02 PM PDT In the movie Zombieland with Woody Harrelson, there are certain rules you must follow in order to survive in a world taken over by Zombies. The first rule is "cardio." Zombies are slow. You can outrun them. But only if you're in shape. Start running. The second rule is to always shoot a Zombie twice in the head to be sure you've killed it. The third rule is to beware of bathrooms. You can never let your guard down. The fourth rule is to always wear a seat belt. Zombies are hungry, but not smart. They will crash right through a windshield if you hit the brakes. The fifth rule is to have no attachments. These rules are worth reviewing because an army of wealth-stealing Zombies from the government are now on the march. They walk amongst us in broad daylight. And their ludicrous proposals to impose super taxes on every industry and to bludgeon free people into unthinking submission are starting to become a real threat to personal freedom and your ability to achieve financial independence. In today's and future Daily Reckonings, we're going to try and come up with some rules for defeating these Zombies. But first, what about financial markets? The optimism that China's de-pegging of the Yuan would benefit everything was short lived. U.S. markets were up triple digits during the day, but closed lower. Gold was off to as traders took profits and reassessed the currency landscape. Will Chinese investors use a stronger Yuan to buy more gold? That's one possibility. You don't imagine they would be using the stronger currency to buy more U.S. Treasury bonds. This is one reason we believe long-term U.S. rates are headed up. In the shorter-term, though, what would happen if the Chinese bought fewer U.S. Treasury bonds? Keep in mind the U.S. government has nearly $4 trillion in new debt to sell in the next three years. It's a combination of new deficits run up by the free-spending Obama Administration and short-term debts run up by the free-spending Bush Administration. If the Chinese don't buy it, the Fed will. But if the Fed does, it will be more quantitative easing...which is USD bearish. And you wonder why other central banks are adding to their gold holdings right now. The World Gold Council reported over the weekend that Russia's central bank bought 26.6 metric tons of gold in the past quarter, taking holdings to 668.6 tons. The Philippines increased holdings by 9.5 tons in March to 164.7 tons. The Saudi Arabian Monetary Authority reported last quarter that it "modified from first quarter 2008" its holdings to 322.9 tons. That was an upward adjustment from 143 tons. All of this should suggest that the current state of the world economy is not nearly as placid as the vapid press releases from public officials would lead you to believe. Behind the scenes, governments know that paper isn't money. They're accumulating precious metals as a hedge against the inevitable debt monetisation in Europe, the U.K., and the U.S. Meanwhile, here in Australia, Treasurer Ken Henry has again gone on the front foot regarding super profits tax. Zombie hungry for greater share of national wealth. Zombie smash! Zombie frustrated! Henry apparently wants to hit all Australian businesses with a "super profits tax", according to today's Australian. According to the paper: Background papers prepared for the Henry review explain that this [super tax applied to all businesses] would allow companies to earn a return on their equity investment, which should be no greater than the government bond rate. Profits higher than this would be treated as a super profit or economic rent, and would be taxed at a higher rate." Is this guy for real? They would "allow" companies a certain return on their equity investment. Quick. Someone check Lenin's tomb. What you're seeing here is the counter-attack of the Zombie bureaucratic class (the people that run the Welfare State) to the global financial crisis. Like Kevin Rudd, Henry would like to use the crisis as an excuse to indict the failures of the free market and expand the power of the State in the economy and public life. That, at least, is what it looks like to us. But it is not shopped that way. The Prime Minister and the Treasurer call this "reform." It's not reform at all, though. It's legislated robbery. The government is effectively seizing anything it considers to be surplus profits in the economy. There is nothing modest, sensible, or even-handed about this. It is a power grab. To be fair, it is more of a money grab. This is a move driven by an institution (the Nation State) that has too many liabilities and only one way to pay for them (taxes, coercion, theft, thuggery, and shakedowns). These people are mad. And bold. Incredibly, Henry is frustrated that people and corporations don't willingly go along to their own financial slaughter. At a conference in Sydney he lamented that so many people are being so fussy about the whole tax thing. "Whenever an idea is ventured publicly by a person," he said, "whether that person is a policy adviser or whether it's a government minister, there's at least a handful of academics who will contest it." Heaven forbid far-reaching wealth-destroying tax proposals should be contested in a free and democratic society. Honestly, what sensible person would dare to question the judgment of a career bureaucrat and a career diplomat? Aren't both (Henry and Rudd) in a better position to know what's best for man, economy, and State? "I've seen it on both sides of politics - this is not a partisan comment at all. But for governments, government ministers who are seeking to get ideas legislated, it is unbelievably frustrating, incredibly frustrating...'It is a great strength of economics as a discipline … But I think there are occasions on which economists might, at least for a period, put down their weapons and join a consensus." Bring that big noggin over here you tax animal. Just lay our head right over here on the chopping block if you would. That's it. Hold on...could you expose your neck...I can't get quite the right angle to chop your head off. Ahh...there you go. Henry's comments display a shocking level of certitude that it's right and better for the civil service and the government to be so deeply involved in the economy. Speaking as an outsider and an American, we find this kind of easy-going reasonable tone about such a radical role for government to be quite shocking (and infuriating). We can hardly take it seriously that someone really believes any corporate profits above the long-term bond rate are "super profits" and should be confiscated by the government. If this kind of confiscatory, centrally-planned, Statist, nanny-state thinking is typical of the Australian civil service or of Australian politicians, then the country is a lot further down the road to serfdom than we ever imagined. With policy leaders like Ken Henry, Australia will quickly become a failed experiment in some bogus "third" way socialism that leads to capital flight and lower standards of living. Maybe we've misunderstood the Treasurer's comments, though. And if so, it's our fault. But if we've understood him correctly, then you should have a cold chill running down your spine. It means the government of Australia doesn't want you to get rich. And if you are rich, it doesn't want you to stay that way for long. And meanwhile, an interesting side effect of the RSPT is that it's effectively driving Australian miners, hat in hand, into the hands of state-owned Chinese enterprises with the cash to finance projects that banks and debt markets will no longer touch (thanks to the government's greedy, grasping fingers). This might seem like an odd conclusion to reach after the government presided over the signing of $10 billion in deals between Chinese partners and mostly Australian resource companies. That would seem to vindicate the Prime Minister in saying that the RSPT would not affect foreign investment in Australian resource projects. But Chinese investment in Australian projects has never been about delivering a profit to Australian shareholders. It's been about resource supply security for Chinese steel makers. The coal and iron ore projects will deliver reliable and low-cost steel-making ingredients to Chinese producers. When you're not investing with the goal of making a profit, the super-tax isn't an issue; it's an opportunity to get a lower price because you're competing with fewer investors. Nice work, comrade. Not that we're bashing the Chinese for sewing up a good deal. You'd expect them to look after their own interests, just as you'd expect the Prime Minister to look after Australia's interests. But if the goal of the Rudd tax was to deliver more of the profits from rising resource prices to Australians, yesterday's deals didn't help. Quite the contrary. In its current trajectory, Australia's resource industry could become a subsidiary of China Inc., run to meet the needs of Chinese companies, not Australian investors or businesses. You always got the feeling that Kevin Rudd wasn't, in his heart of hearts, ever opposed to a back-door nationalisation of the resource industry (which is what the RSPT accomplishes). But we always thought the Australian government would be the principal partner. Not the Chinese. Yesterday we promised to show you how the RSPT could also affect the availability of housing finance in Australia. We haven't forgotten. But we've rambled on too long already. We'll get to it tomorrow. Dan Denning | |

| Posted: 21 Jun 2010 04:59 PM PDT

The truth is that 13 different countries have offered to help clean up the oil in the Gulf of Mexico. Barack Obama turned all 13 of them down. So let's get this straight.... We are dealing with the greatest environmental disaster in U.S. history by far, and yet we completely refuse any assistance? What kind of insanity is that? In fact, it is being reported that just three days after the Deepwater Horizon sank to the floor of the Gulf of Mexico the Dutch government contacted Barack Obama and offered to loan BP ships outfitted with special oil-skimming booms. In addition, the Dutch had a plan to quickly build sand barriers to protect the vulnerable marshlands along the Louisiana coast. Needless to say, those plans were not implemented. According to one Dutch newspaper, the European oil companies that offered to help said that they could have completely cleaned all of the oil from the Gulf of Mexico in just four months. But now Obama is telling us that the crisis in the Gulf of Mexico could last for years. So what would keep Barack Obama from accepting international offers of help? Well, Obama is using something called "the Jones Act" as an excuse. Howard Portnoy recently described what is going on this way.... In order to accept the offers, which have come from Belgian, Dutch, and Norwegian firms that claim to possess some of the world's most advanced oil skimming ships, Obama would need to waive the Merchant Marine Act of 1920 (P.L. 66-261). Also known as the Jones Act, the law requires essentially that all commercial acts conducted in U.S.-controlled waters be performed by "U.S.-flag ships, constructed in the United States, owned by U.S. citizens, and crewed by U.S. citizens and U.S. permanent residents." So why not simply waive the act? Other presidents have under similar circumstances. George W. Bush waived the Jones Act following Hurricane Katrina, allowing foreign ships into Gulf waters to aid in the relief effort. The truth is that the Jones Act is not a barrier to receiving assistance at all and Barack Obama knows this. There would be absolutely no problem with waiving the Jones Act in these circumstances. So Barack Obama has no excuse. Either he is completely and totally incompetent or he has been trying to make this crisis worse than it should be. You see, this is not the first catastrophic oil spill in the history of the world. There have been others, and we have learned quite a bit about cleaning up oil from those events. Anthony G. Martin recently described what happened during one particularly brutal oil spill in 1993 and 1994.... In 1993 and '94 the Saudis faced an oil spill of historic proportions in the Arabian Gulf as four leaking tankers and two oil gushers threatened to spur a catastrophic event that was 65 times worse than the Exxon-Valdez spill. An American engineer, Nick Pozzi, was part of a task force charged with developing a solution to the looming disaster. Pozzi had used various methods to clean up oil spills prior to this event. However, the time was short, and an effective solution was needed post-haste. That's when Pozzi decided that the huge, empty oil tankers, sitting in the dock, could be used to simply vacuum up the oil right off of the top of the water. The result was that 85% of the oil was recovered. In a recent interview with Esquire, Pozzi explained that cleaning up the oil in the Gulf of Mexico should not be that complicated.... Keep in mind that what supertankers typically do is they sit in the middle of the ocean waiting for all the traders to come up with the right price. When they feel that the price is right, the tankers that are full, they take off, and they can be anywhere in the world in a few days. Right now there are probably 25 supertankers, waiting for orders, full of oil. So all they got to do is come to Texas, in the Gulf, unload the oil, and then turn around and suck up all this other stuff and pump it onto shore into on-shore storage. It's not rocket science. It's so simple. So why won't Barack Obama and BP implement the "supertanker method"? When asked about it they just brush it off. Are they that incompetent? Or is something else going on? If this crisis had been handled properly, oil would not currently be blanketing our pristine Gulf coast beaches. An increasing number of Gulf coast residents have become so frustrated that they have decided to take it upon themselves to stop the oil that is headed towards their homes and businesses. But BP and the Obama administration have been running around trying to keep anyone else other than themselves from doing anything about this oil spill. In fact, Barack Obama has authorized the deployment of more than 17,000 National Guard members along the Gulf coast to be used "as needed" by state governors, and BP is being allowed to use private security contractors to keep the American people away from the oil cleanup sites. If they used as much energy cleaning up the oil as they are in keeping the American people away from the spill they might actually be accomplishing something. Meanwhile, CBS News is reporting that there could be as much as 1 billion barrels of oil under the damaged BP oil well in the Gulf of Mexico and that it could keep flowing for more than a decade. Apparently BP made one of the biggest oil discoveries in history, but the problem is that oil is now coming out of there at such high pressure that we simply do not have the technology to control it. In addition, experts have discovered a massive gas bubble which is estimated to be 15 to 20 miles across and "tens of feet high" under the floor of the Gulf of Mexico. So what in the world is going to happen if that thing blows? Also, there are reports of fissures and cracks appearing on the ocean floor around the damaged wellhead. If this thing goes from a "leak" to an "eruption" it could be a catastrophe beyond anything any of us could even imagine. So let's hope that nothing like that happens. But there is another very serious threat that we need to keep an eye on. Some environmentalists are now warning that North America could be facing years of toxic rain because of the highly toxic chemical dispersants that BP is using to control the Gulf of Mexico oil spill. Because it is so poisonous, the UK's Marine Management Organization has completely banned Corexit 9500, so if there was a major oil spill in the UK's North Sea, BP would not be able to use it. So BP really needs to start explaining why they are dumping so much of it into the Gulf of Mexico - especially since so much of it could end up raining down on us. Meanwhile, Barack Obama and Joe Biden are busy playing golf and BP chief executive Tony Hayward has been busy watching his yacht race. Well, considering the fact that Tony Hayward is set for a massive 10.8 million pound ($16 million) payout if he chooses to step down, perhaps he is not too concerned about exactly how things turn out. As for Barack Obama, his main concern in all this seems to be advancing his climate agenda. During a recent interview, Obama directly compared the current crisis in the Gulf to 9/11, and indicated that he believed that it would fundamentally change the way that we all look at energy issues from now on. But the truth is that cleaning up the oil in the Gulf has nothing to do with the "cap and trade" carbon tax scheme that Obama is trying to foist on all of us. What Obama needs to do is to accept all the help that is being offered, get everybody working together on cleaning up this mess, and find a way to stop all that oil from coming out of the ground. Until he makes some progress on those things, the American people are not likely to want to hear the first thing about all of the new taxes, rules and regulations that he is so eager to impose on all of us. The Gulf of Mexico is literally being destroyed, and already this disaster has been so horrific that the effects will be felt for decades. If Barack Obama cares one ounce about the American people he needs to start doing his job instead of playing politics with this crisis. | |

| Jim Rickards: How the world likely will get back to gold Posted: 21 Jun 2010 04:13 PM PDT 12:12a ET Tuesday, June 22, 2010 Dear Friend of GATA and Gold: In an essay posted at King World News, James G. Rickards of Virginia consulting firm Omnis Inc., as good a strategic thinker as inhabits the Western markets, outlines the world's likely return, in rather spastic fashion, to gold-backed currency. Rickards' essay is headlined "What G20 Will Not Discuss This Weekend (But Probably Should) and you can find it at the King World News Internet site here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2010/6/21_Ji... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |

| Gold Seeker Closing Report: Gold and Silver Fall About 1.5% Posted: 21 Jun 2010 04:00 PM PDT Gold rose to a new all-time intraday high of $1265.07 in Asia before it fell back to around unchanged in London, but it then dropped even further in the last couple of hours of trade in New York and ended near its late session low of $1237.83 with a loss of 1.41%. Silver climbed to as high as $19.443 by about 8AM EST, but it then fell back off for most of the rest of trade and ended near its late session low of $18.665 with a loss of 1.62%. | |

| Florida Rolling the Dice with Pensions? Posted: 21 Jun 2010 03:25 PM PDT Kris Hundley of the St-Petersburg Times reports, Florida rolls the dice with chunk of pension funds:

There are so many points to cover here. First, I am not against hedge funds or other alternative investments, however, I don't think they're a panacea that many claim. And in the hands of incompetent pension fund managers chasing the latest 'hot" fund, these alternatives can come back to haunt you for years. Let's say you followed the pension herd and invested billions in private equity at the top between 2005 and 2007, then you got creamed on those investments. Sure, if you hold these investments long enough, you might realize some gains, but the likelihood is that you will underperform the S&P500 over this period. (See Private Equity Returns: Myth and Reality). As for hedge funds, there are some that focus on illiquid strategies, but be careful. They will sing you a whole song & dance and how they "exploit market inefficiencies", but the reality is they're locking up pension money, collecting 2% management fee, and if a liquidity crisis hits them, their portfolios will get whacked hard. Again, tread very carefully with illiquid hedge fund strategies. Lots more hype than substance behind these strategies. In the environment we're in, which could last a very long time, I prefer liquid hedge fund strategies (global macros, CTAs, Long/Short Equity). I would be very selective with illiquid strategies, committing only a fraction of my hedge fund portfolio in this strategies. In fact, I would group illiquid hedge fund strategies with my private equity portfolio, allocating no more than 5%-7% of my total pension fund portfolio there. Back to Florida's SBA. They're doing exactly what every other large US public pension fund is doing, allocating more into alternative investments to meet their required rate of return with supposedly less risk. But taking on illiquidity risk is a huge risk, one that might end up costing Florida taxpayers billions in taxes to make up the shortfall. Let's call a spade a spade and stop using the same marketing pitch that hedge fund and private equity managers use when fighting for a piece of the pension pot.

| |

| Shorting into a Buying Stampede Posted: 21 Jun 2010 03:09 PM PDT By Rick Ackerman, Rick's Picks Opening up a bearish position yesterday morning not long after trading began, we caught a fine breeze that allowed us to short the Diamonds just pennies off their hysteria-driven, opening-hour high. Here's the trading recommendation exactly as it went out to subscribers the night before: "Buy four August 98 puts if DIA gets within 0.05 points of the next Hidden Pivot resistance above, 105.92. You should be prepared to buy four more August 98 puts later if the Diamonds get past 105.92, since that will imply they're going to at least 106.73 before a top is in. We are going out to August because the remaining life of the July options will be shortened not only by their July 15 expiration date, but by a holiday weekend." As it happened, the Diamonds took a powerful leap at the bell, responding to ostensibly bullish news that China will allow its currency, the yuan, to rise. We were in luck to have bet against the crowd, since the rally ultimately went no farther than 105.96 – just four ticks above our target. That gave us a perfect opportunity to get short at the height of the short-squeeze, moments before DaBoyz pulled the plug on frenzied buyers. Look at the chart below if you want to see what a classic bull trap looks like, especially when its sprung on a Monday morning on news that has been timed for maximum effect:

Because we had anticipated the rally top very precisely with Hidden Pivot analysis, we were able to buy August 98 puts for 1.28, three cents off their intraday low. Later in the day, we took a partial profit on the position as is our custom, selling half of the put options for 1.50. This effectively reduced the costs basis of the puts we still hold to 1.06. Here's the trading recommendation that went out to subscribers at 12:42 p.m. EDT via an intraday bulletin: "Using a 1.50 offer, exit half of the puts purchased earlier this morning for 1.28. With DIA trading 105.10, the puts are currently reflected at 1.47-1.52." We needn't have hastened, since, with the Diamonds falling like a brick, the puts were streaking toward an intraday high of 1.73 (a "12000% annualized gain!!!!!" in the promotion-speak of some of our guru competitors, by the way.) Few Winners We routinely take partial profits early in a put trade because, in the 37 years we have been trading options both on and off the exchange floor, we can recall only a couple of instances when a retail customer we knew actually made money holding puts. Even when stocks crashed in 1987, those who had bought puts for the ride were so busy patting themselves on the back that they got crushed when stocks trampolined higher with a vengeance on Tuesday, October 20. Moreover, in all of those 37 years, there have probably been no more than one or two periods lasting longer than two days during which those who held puts felt anything even remotely like exhilaration. And that is why we are quick to take at least a partial profit on all option trades, but especially on put-option trades. As a result of yesterday's refreshing little frisson, we still hold half the original position, with a cost basis of 1.06 per put option against yesterday's closing price of 1.70. Our timely entry will make it hard to lose, but we are obliged to warn you that options trading is a very tricky game, and that most of those who attempt it lose their shirts. Nor should past performance be construed as a guarantee of future success. (If you'd like to have Rick's Picks commentary delivered free each day to your e-mail box, click here.) Rick's Picks is a trading newsletter for stock, gold, silver and mini-indexes. All trades are based on the proprietary Hidden Pivot technical analysis method. © Rick Ackerman and www.rickackerman.com, 2010. | |