Gold World News Flash |

- Gulf Coast Conservatives Seek Government Solution

- The Difference This Time The Hedgies And Dirty Tricksters Return

- In The News Today

- Grandich Client Timmins Gold

- Gold Tactics In The Correction

- Who Will Profit from the Oil Spill

- Germans are Voting with Their Pocketbook

- Daily Dispatch: Sheeple Awakening

- Government Desperate. Gold Tax Imminent?

- Carmel Daniele: Put Cash in Colombia's Oil and Brazil's Iron

- A New Euro to Save the Old One?.. Israel Faces Off With Iran

- Interview: Jim Rogers on Currencies and Inflation

- Why Gold Is a Better Bet Than Oil Right Now

- Gold and Gold Stock Update

- What’s Next for the Energy Sector

- Gold's 200-Day Moving Average Climbs Above $1,100

- Hourly Action In Gold From Trader Dan

- LGMR: Gold Slips as Stocks Rally; Scrap Selling "Fizzles Out"

- Grandich Client Update – Silver Quest Resources kicks Off it’s Busiest Season Ever!

- We Have a New Gold Standard: Marc Faber

- The Goldsmiths—Part CXLIV

- Sean Brodrick: Bull Market for Gold and Silver

- Dollar Reappraisal : Gold Vanishing into Private Hoards

- Wall Street and Government Revolving Door Spins at 'Dizzying' Pace

- The Purchasing Power Preservation Of Precious Metals

- All Quiet on the Fronts

- Gold Seeker Closing Report: Gold and Silver Fall Almost 1% and 2%

- Got Gold? Head Of IMF Policy-Steering Committee Says Fund Needs $320 Billion To Be "Properly Resourced"

- U.S. Dollar Is The New 'Tulip'

- Credit Ratings Offensive?

- Dallas Fed's Fisher Rages Against TBTF, Says Only Way To Remove Systemic Risk Is Shrinking The Megabanks

- U.S. National Debt 2010

- Gold Holdings In GLD Surge To All Time Record

- THURSDAY Market Excerpts

- Recapping The SEC's HFT Panel

- What you need to know about gold and your taxes

- These charts suggest stocks could fall another 60%

- Economy Is Growing, But It's Like Watching Cement Dry

- Guest Post: Who Will Profit From The Oil Spill

- Spain’s Dropout Generation

- Fed's Central Bank Swaps Increase By $5.4 Billion To $6.6 Billion

- The 'Safe' Treasury Play Isn't as Good as It Looks

- The Coming 5 Years of “Mainstream” Finance Hell

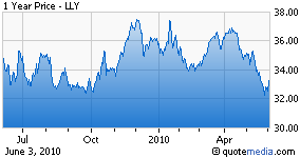

- Eli Lilly's 6% Yield Is Tempting ...

- Hedging Inflation With ETFs

- Rethinking the Inflation vs Deflation Debate

- Guest Post: Confirming The Flash Crash Omen

- Can We Get Ourselves Off Gas?

- Why I Believe This Panic Is Over

| Gulf Coast Conservatives Seek Government Solution Posted: 03 Jun 2010 07:04 PM PDT Stacy Summary: Too bad the US government is the same Big Business that caused the disaster and that, even with their high tech equipment (golf balls, tires and saws) is unable to fix the problem they created. In coastal Mississippi, Republican state Rep. Steven Palazzo has been critical of the federal government, including what he sees as an intrusive role in a health care overhaul that he – like many conservatives – calls "Obamacare." As he runs for Congress in a district that relies on shipbuilding, tourism and the seafood industry, Palazzo says Washington should do all it can to protect the Gulf of Mexico. He said his stance does not contradict his advocacy of limited government. "This is not only an economic nightmare but it's an ecological one as well," Palazzo said. "We cannot spare any resource." | ||||

| The Difference This Time The Hedgies And Dirty Tricksters Return Posted: 03 Jun 2010 06:58 PM PDT View the original post at jsmineset.com... June 03, 2010 02:18 PM Dear Jim, Gold traded inversely to the dollar last week (directionally, but not tick for tick). Now the weak euro is a drag on the gold price. Why are we now seeing this type of behavior and when can we expect gold to resume its appreciation? Thanks, CIGA Brian S. Dear Brian, Your question reflects, I am sure, what people are worrying about. The cold hard fact is that the hedgies, driven by momentum algorithms, have reduced their position, continue to sell or have gone short gold. This week the hedgies made a pass at gold shares, from major to junior, increasing or re-establishing their short position. The community still follows those that call tops. So far each top call has failed to do anything but take people out of their position. There are three factors to think about right now: The euro is seeking it lows again from which intervention has come, and from which intervention must continue to com... | ||||

| Posted: 03 Jun 2010 06:58 PM PDT View the original post at jsmineset.com... June 03, 2010 04:40 PM Dear CIGAs, Euro intervention #5 is taking place at this moment. There have been four taps on the critical $1.2150 level since we last talked. It is one thing to stand at $1.215 but it is infinitely more important to scare the shorts into covering. So far the intervention on the first four taps at $1.215 has failed to run the euro shorts. If no follow through is accomplished this time, I am certain that the intervention will fall to the $1.205 level which will signal failure to the marketplace. Failure on euro intervention #5 will make the hedgies and dirty tricksters very uncomfortable in their present short of gold position. That event should make them very nervous because in a global economy a crisis anywhere is a crisis everywhere. This time the risk is greater for the Hedgie and dirty trickster short positions than for the insurance longs of gold. Jim Sinclair’s Commentary Exactly what ... | ||||

| Posted: 03 Jun 2010 06:58 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 03, 2010 06:01 PM Listen Below is a commentary on Timmins Gold by one of favorite newsletter writers and someone you should read: Victor Goncalves, Equities and Economics Report (06/01/10) comments on Timmins Gold “There is something to be said about a company that can do what most can’t. Timmins Gold has successfully made the leap from being an exploration company to being a producing company. Timmins managed to acquire the past-producing San Francisco Mine several years ago, and in a very short time has brought the mine back into production. The plant has a capacity of over 100,000 ounces per year, and to this point has been fully refurbished and made operational.Based on the current studies that have been conducted, the mine will operate at a $412/oz. cost. With today’s gold prices of $1,200/oz., that means $100M earnings (before tax). This... | ||||

| Gold Tactics In The Correction Posted: 03 Jun 2010 06:58 PM PDT Stewart Thomson email: [EMAIL="s2p3t4@sympatico.ca"]s2p3t4@sympatico.ca[/EMAIL] June 1, 2010 1. From time to time, I mention the possibility of major Mid-East war. Yesterday, a group of my subscribers, who consult regularly to Fortune 500 company directors, led by a retired fighter pilot, and who never talk war with me, sent me a shocking email. They believe the odds of a major Mid-East war are 90%, in the next 30-60 days. The blasting of the Turkish-flagged ship by Israel, regardless of the facts of the incident, appear to me as the equivalent of the killing of ArchDuke Ferdinand, the incident that triggered World War One. 2. I’ve maintained all along that just the ongoing geopolitical situation of the world, alone, warrants a $1000 an ounce gold price. I still do. Gold’s function as a real safe haven from real disaster, not just asset price declines in markets, justifies that... | ||||

| Who Will Profit from the Oil Spill Posted: 03 Jun 2010 06:57 PM PDT By Charles S. Brant, Energy Correspondent, Casey’s Energy Opportunities The disaster in the Gulf of Mexico may be the best thing that’s ever happened to green energy producers in the U.S – but the one that benefits the most will probably surprise you. As the damaged Deepwater Horizon well continues to pump out 5,000 barrels of oil per day into the Gulf, all the major stakeholders are scrambling to find a way to contain the damage. Investors in BP, Anadarko, Transocean, and Halliburton have had a rough few weeks and should be nervous about the future. The growing political firestorm that’s accompanied this ecological disaster is drastically reshaping the energy landscape in the U.S. There’s huge money to be made from the biggest structural change to the energy markets in the past 50 years, if you know where to look. The political and economic fallout from this accident is starting to take shape, with the executives from ... | ||||

| Germans are Voting with Their Pocketbook Posted: 03 Jun 2010 06:57 PM PDT FGMR - Free Gold Money Report June 3, 2010 – Icelanders voted in a referendum to address their debt problem. Germans have a problem too, but they are voting with their pocketbook. They are dumping the euro and buying physical gold, the demand for which is soaring in Germany. The problem Germans face is a broken promise. Despite all the rhetoric and assurances that it would be a prudent and wise monetary authority, the European Central Bank is not managing the euro in the judicious way the Bundesbank managed the Deutschemark. Most importantly, in stark contrast to the steadfast independence from government influence that marked Bundesbank decisions, it is now clear that the ECB is controlled by EU politicians. After repeated promises not to buy government bonds, the ECB recently announced that they would buy government bonds, obviously bowing to pressure from political leaders. Germans of course know from hard-learned experience the consequences of this foolh... | ||||

| Daily Dispatch: Sheeple Awakening Posted: 03 Jun 2010 06:57 PM PDT June 03, 2010 | www.CaseyResearch.com Sheeple Awakening Dear Reader, Chris here. David turned the reins of this missive over to me for today. He’ll be back with you tomorrow. Before diving into today’s stories, I would like to make a couple of quick notes first. For one, as you may know from my introduction last Thursday, I’ve been keeping a close eye on the situation in the Gulf and how it is affecting my hometown of New Orleans, which I plan to move back to in the not-too-distant future. Sort of on that subject, I came across a Popular Mechanics article this morning, titled “How Oil Breaks Down in Water” that is well worth the read. The link is here. Also, I’d like to mention an article on South African gold mining our own Ed Steer linked to in his column yesterday. Here’s what Ed said about it:[INDENT] … The next gold-related ... | ||||

| Government Desperate. Gold Tax Imminent? Posted: 03 Jun 2010 06:57 PM PDT To show you how things get around, I get this from Ed Steer's Gold & Silver Daily, which linked to an essay by Adrian Ash, at bullionvault.com, posted over at safehaven.com, and bearing the title "Gold Gets All Political." The thrust is that, as Mr. Steer says, "Adrian floats the disturbing possibility that governments, looking around for easy sources of revenue, may decide to tax the private ownership of gold." Well, I am happy to be the "go-to guy" when it comes to questions like this, and I am happy that I can put Adrian's fears to rest. He can rest assured that the government will tax the private ownership of gold, and everything else, too, highly reminiscent of the phrase in the Declaration of Independence that reads that the government "has erected a multitude of new offices, and send hither swarms of officers to harass our people, and eat out their substance" which, at this point in time since 1789, is 1 out of 5 workers who are paid from the collection of taxes, and a lar... | ||||

| Carmel Daniele: Put Cash in Colombia's Oil and Brazil's Iron Posted: 03 Jun 2010 06:57 PM PDT Source: Brian Sylvester and Karen Roche of The Energy Report 06/03/2010 Financial guru Carmel Daniele is none too concerned with the euro debt crisis, hemorrhaging oil in the Gulf or depressed natural gas. She's too busy making money. Whether it's oil in Colombia or potash in Peru, she's always looking for ways to improve the fortunes of her namesake CD Capital Private Equity Natural Resources Fund. In this straightforward interview with The Energy Report, Daniele shares with us her favorite emerging markets and investment opportunities for those willing to place some faith in London's commodity queen. The Energy Report: What effect will the debt crisis in Europe have on oil prices? Carmel Daniele: I have to say that the debt crisis in Europe has been blown completely out of proportion. Nearly 70% of the euro-area economy is made up of three countries: France, Germany and Italy. So unless the sovereign debt crisis derails their economies, I just can't see how the ... | ||||

| A New Euro to Save the Old One?.. Israel Faces Off With Iran Posted: 03 Jun 2010 06:57 PM PDT A New Euro to Save the Old One? Thursday, June 03, 2010 – by Staff Report Why a 'new euro' could be the saviour of the European dream ... Once unthinkable, the possible demise of the euro is now very much up for debate. Well, among market participants – the politicians will not countenance it, despite the tectonic shifts in the eurozone. Put simply, the authorities' view is that the euro must be retained – not only for the survival of governments and financial institutions, but also to keep intact the dream of a United States of Europe. So central is the currency to the ideal of the single economic bloc – an economy to compete with the US and Asia's emerging titans – that the notion the euro could fail is a great unmentionable in these circles. ... But even if the official view is that the euro cannot fail, surely it is inconceivable that the politicians and policy-makers have not given any thought to what might need to happen should it collapse. So what secre... | ||||

| Interview: Jim Rogers on Currencies and Inflation Posted: 03 Jun 2010 06:57 PM PDT By Ron Hera June 3, 2010 ©2010 Hera Research, LLC The Hera Research Newsletter (HRN) is pleased to present the following exclusive interview with legendary international investor, best selling author, adventurer and family man Jim Rogers, Chairman of Rogers Holdings and founder of the Rogers International Commodity Index (RICI).Jim Rogers’ commentaries on economics and finance have been featured in Time, The Washington Post, The New York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The Financial Times and other major publications, and he appears regularly on television networks around the world. After growing up in Demopolis, Alabama, and earning degrees from Yale and Oxford Universities, where he studied politics, philosophy and economics, Jim Rogers co-founded the Quantum Fund in 1970, which gained 4200% over a 10-year period, during which the S&P advanced approximately 47%. After retiring at age 37, he managed his own portfolio ... | ||||

| Why Gold Is a Better Bet Than Oil Right Now Posted: 03 Jun 2010 06:57 PM PDT By Matt Badiali, editor, S&A Resource Report Thursday, June 3, 2010 Last month, ExxonMobil saw $38 billion erased from its market cap in just two weeks… more value than the entire market cap of most oil companies. More value than Nike's market cap. As many DailyWealth readers know, ExxonMobil is one of the best-managed companies in the world… and one of the safest oil investments ever. The only time you'll ever see such a big chunk of hide torn from ExxonMobil is when you have a three-day period like May 4 through May 6, 2010. During those days, NYMEX crude oil futures fell $9.08 per barrel… 10.5%. It was the largest three-day percentage decline in crude oil since June 1998. It also highlights the central problem commodity investors face right now… Commodities have entered a bear market. Commodities are "cyclical assets," meaning they tend to go through huge booms and busts. When folks see the price of a commodity shooting higher, th... | ||||

| Posted: 03 Jun 2010 06:57 PM PDT Gold Gold remains on track (as far as our template). Here is the potential bullish outcome. The longer Gold holds above $1160 and that trendline, the more likely the bullish outcome. Sentiment remains supportive. See the GLD put-call below. Also, public opinion from sentimentrader.com is 69% bulls. Interim tops have occurred at 75% while significant tops at 85%. Consolidation for another month or two would leave public opinion near 60% bulls. Gold Stocks This is an interesting juncture for the gold stocks. There is enough evidence to make a case that the recent low will hold. Note that the bullish percent index is at 45% (neutral to slightly oversold). Note that the 7-day GDX put-call is at a level consistent with bottoms. Note the put-call spike on Friday. Consider that gold stocks are performing well in real terms. Also consider that the HUI has twice recently held above both the 100 & 200 day-MA’s. Initial support is 425-430, with very s... | ||||

| What’s Next for the Energy Sector Posted: 03 Jun 2010 06:57 PM PDT The 5 min. Forecast June 03, 2010 10:37 AM by Addison Wiggin & Ian Mathias [LIST] [*] After Tuesday’s slaughter, Wednesday’s resurrection: What’s next for energy [*] Two strategies to play the deep-water drilling ban [*] The Eagle has soared… U.S. Mint sells most gold coins in a decade, most silver in two [*] A lover scorned: Iran dumps the euro after embracing it [*] Readers get in a few choice words about Buffett, BP [/LIST] We hope you took Byron King’s words to heart yesterday. At the very moment he declared to The 5 that oil and oil service stocks were “way oversold,” a huge rally was getting under way. Folks who panicked and dumped their positions on Tuesday after BP conceded the “top kill” effort in the Gulf of Mexico had failed? They missed out big-time yesterday. Consider the case of the OSX -- the Philadelphia Oil Service Index, comprising 15 companies, thr... | ||||

| Gold's 200-Day Moving Average Climbs Above $1,100 Posted: 03 Jun 2010 06:57 PM PDT Gold declined in fits and starts all through Far East and London trading on Wednesday... and then got hit pretty hard going into the London p.m. gold fix at 10:00 a.m. New York time. That was gold's low for the day at $1,212.90 spot. From the p.m. fix, gold rallied about $11 before running into a resolute seller... and closed in after hours trading down about a dollar from Tuesday's close. Volume was extremely light Thursday's trading activity is the red line on this chart. Silver's price was more or less steady throughout Far East and London trading but, it too, got smacked at the Comex open in New York... with the absolute low price [$18.07 spot] coming at 9:00 a.m. Eastern time right on the button. From that low, silver struggled back and finished electronic trading down 7 cents from Tuesday's close. Silver's trading volume yesterday was not light... but it was certainly lower than average. Once again, the red trace is Wednesday's trading. The dollar... | ||||

| Hourly Action In Gold From Trader Dan Posted: 03 Jun 2010 06:57 PM PDT | ||||

| LGMR: Gold Slips as Stocks Rally; Scrap Selling "Fizzles Out" Posted: 03 Jun 2010 06:57 PM PDT London Gold Market Report from Adrian Ash BullionVault 10:10 ET, Thurs 3 June Gold Slips as Stocks Rally; Scrap Selling "Fizzles Out", Developed-World "Indiscipline to Support Prices" THE PRICE OF GOLD in wholesale professional dealing slipped back to yesterday's two-day low in London on Thursday, trading at $1215 an ounce as New York's financial markets opened to find world equities extending Wednesday's sharp rally. Major-economy government bonds eased back, pushing the yield offered to new buyers gently higher from this week's new 2010 lows. Both the Euro and Sterling gave back overnight gains vs. the Dollar, holding the price of gold above €31,900 per kilo and £831 per ounce respectively. Crude oil crept back above $73 per barrel, unwinding one quarter of the last month's drop. "Gold selling fizzles out," says Thursday's Commodities Daily from South Africa's Standard Bank. "Large amounts of scrap and other physical selling in the gold market co... | ||||

| Grandich Client Update – Silver Quest Resources kicks Off it’s Busiest Season Ever! Posted: 03 Jun 2010 06:57 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 03, 2010 06:03 AM After chatting with CEO Randy Turner, I can tell you no one is more eager to see the fruits of SQI’s labor than I. Yes, it does have something to do with the fact that I own 2 million shares and am a compensated consultant, but it’s also has to do with the fact that my long standing belief that management is the key to any junior appears ready to be proven by mining veteran Randy Turner. I’m absolutely convinced Randy has placed SQI in its best possible possible to greatly enhance shareholder value. Trust me, not only will some throw that back in my face if proven wrong, but it will hurt fiscally as well – and that’s just from my family! Randy has also been aggressively accumulating a very significant personal shares holding with his own monies. This is not common in the juniors and another good sign IMHO. I would pay attention to ... | ||||

| We Have a New Gold Standard: Marc Faber Posted: 03 Jun 2010 06:57 PM PDT I wouldn't read a thing into yesterdays price action in gold. It spent the entire day range-bound between $1,120 and $1,130. The highs and lows aren't worth mentioning. Nothing to see here, folks! It was the same for silver. There's nothing to talk about in this chart. The dollar has been an interesting case study over the last couple of days. A rally started about 2:00 a.m. Eastern time on Wednesday morning... and, in fits and starts, added about 80 basis points to its price over the next 36 hours... yet the precious metals prices barely reacted at all. In times past, a dollar rally of this magnitude would have resulted in a rather significant sell-off in both gold and silver. It certainly didn't happen this time... and as I mentioned in my column yesterday... we've see a lot more of that kind of action recently, where the gold price is not necessarily tied to the dollar action. As other commentators have pointed out... the precious metals are now bac... | ||||

| Posted: 03 Jun 2010 06:03 PM PDT One of the predictable things consistently held in the Goldsmiths is a coming great economic and monetary collapse in the United States which will precipitate a confiscation of certainly gold and very possibly silver as well. When this fall arrives, it will be the greatest fall of any nation in world history. | ||||

| Sean Brodrick: Bull Market for Gold and Silver Posted: 03 Jun 2010 05:41 PM PDT | ||||

| Dollar Reappraisal : Gold Vanishing into Private Hoards Posted: 03 Jun 2010 05:30 PM PDT | ||||

| Wall Street and Government Revolving Door Spins at 'Dizzying' Pace Posted: 03 Jun 2010 04:33 PM PDT  Michael Panzner submits: Michael Panzner submits: (Image: Source) For those who want to know why hardly anybody in the financial industry has been called to account (or fired or locked up) for the role they played in bringing about the worst financial crisis this century, or why the meltdown we experienced in 2007-2008 hasn't spawned the kinds of reforms that past crises have, look no further than the following Washington Post article, "Report: More than 1,400 Former Lawmakers, Hill Staffers Are Financial Lobbyists": Complete Story » | ||||

| The Purchasing Power Preservation Of Precious Metals Posted: 03 Jun 2010 04:05 PM PDT My business partner, Dean, came up with this example of how silver has maintained its purchasing power over time. This is a picture of pre-1965 silver quarter, which was made from 90% silver and 10% copper: In 1964, this coin was worth 25 cents. Back then you could use this coin to buy a gallon of gasoline. Today, if you take this same coin to a gas station, you can buy about 1/10th of a gallon of gas. HOWEVER, if you stop by your local coin dealer, he will pay you roughly the silver-melt value of this coin, which is $3.24 with spot silver a $17.95. You can then take the proceeds to the gas station and buy a little more than a gallon of gasoline. As you can see, the face value of a quarter has declined since 1964 by 90%. But the silver-melt value of that same quarter has maintained its purchasing power over those 46 years. With an ounce of gold, this example is even more dramatic. Back in 1964, the price of an ounce of gold was fixed at $35. Today, that same ounce of gold is worth $1210. If you do the math, you will find that the value of the U.S. dollar in relation to gold has declined by nearly 98% since 1964. Got gold? Got silver? This posting includes an audio/video/photo media file: Download Now | ||||

| Posted: 03 Jun 2010 04:02 PM PDT It's quiet....too quiet. Stocks in New York were mostly unchanged over night. So now what? Well yesterday Aussie stocks were up 2.5%. The question is whether this the leading edge of a liquidity driven rally in shares...or just an old-fashioned but impressive short squeeze. One thing to keep your eye on is the G-20 finance ministers in Busan, South Korea this weekend. They will get together and agree to do nothing urgent. The one thing they will definitely NOT be doing is raising interest rates. They are too creeped out about a sovereign debt crisis in Europe leading to another liquidity crisis, according to Bloomberg. Of course we're already reading some reports in the press that Europe is not Lehman and that the stock market rally is a signal that Europe's debt woes won't put a lid on stocks for the rest of this year. But Simon Kennedy and Shamim Adam of Bloomberg report that, "Group of 20 central bankers are delaying their withdrawal of emergency stimulus as Europe's debt crisis shakes financial markets and threatens to hinder the global recovery." (Mmmm....gushers of free cash to boost bank profits. Yummy). There's a global recovery? How did we miss this? Just for the record, we reckon it's going to be very hard for economies in Europe, America, the UK, and Japan to put up big annual growth numbers when they are saddled with so much public debt. The servicing of this debt is going to consume a larger and larger share of tax revenues, which will struggle to grow as it is. "China property risk worse than in US," reports Geoff Dyer in the Financial Times. "The problems in China's housing market are more severe than those in the US before the financial crisis because they combine a potential bubble with the risk of social discontent, according to an adviser to the Chinese central bank." "The housing market problem in China is actually much, much more fundamental, much bigger than the housing market problem in the US and the UK before your financial crisis," Professor Li Daokui told the FT. By now you might be thinking we see housing bubbles everywhere we look. That might be true. You can never predict where credit will go during a credit bubble. It picks an asset class that is accessible to the public and whose boom benefits multiple groups. This article by Fan Gang, a professor of economics in Beijing, shows that China's credit bubble was driven by local government borrowing. Local government's borrowed big to achieve double digit growth rates. Part of that growth came from infrastructure spending (resource bullish) and housing development. With Europe's troubles and America's oil spill (yet another example of how the modern centralised State is increasingly ineffective in dealing with a crisis), the prospect of a bubble blow out in China has receded from the investment landscape. But it hasn't gone away. Here in Australia the big news yesterday was Xstrata's decision to cancel jobs and spending on coal projects in Queensland. Xstrata deemed that those projects would be adversely affected by the Resource Super Profits Tax. It canned them. Some analysts think the re-rating of mining and oil shares (for different reasons) has already made both sectors attractive. Value investor David Dreman says, "We think the proposed 40 percent Australian tax is likely to come down some...And since both Rio Tinto and BHP have gone down very significantly, we think there's some value there." He continued by saying, "We also think there's a good deal of value in some of the exploration and development companies in the United States that have been going down since this enormous BP spill...I think there's value in some of these natural resource stocks now." Both Kris Sayce and Alex Cowie seem to agree, although both are being cautious about managing risk right now. And finally, some reader mail in response to the mostly constructive criticism we received last week. Have a great weekend! Similar Posts: | ||||

| Gold Seeker Closing Report: Gold and Silver Fall Almost 1% and 2% Posted: 03 Jun 2010 04:00 PM PDT Gold saw a $4.22 gain at $1224.22 in Asia and then fell back off in London and New York to as low as $1201.28 by a little after noon EST before it rallied back higher in the last hour of trade, but it still ended with a loss of 0.98%. Silver fell to as low as $17.80 before it also bounced back higher in late trade, but it still ended with a loss of 1.81%. | ||||

| Posted: 03 Jun 2010 03:06 PM PDT Those observing the emperor's lack of clothing are multiplying. Earlier today, someone opened their mouth, and remarked on the blatantly obvious. Next thing you know Hungarian CDS was 30% wider, Romanian bond auctions were failing, the euro was tumbling, the PPT was scrambling, US markets closed green with nobody trading, etc. Yet the "letting the genie out of the bottle" award of the day has to go to the head of IMF's policy-steering committee, Youssef Boutros-Ghali who said that the IMF is essentially insolvent in its current form of being the go to backstop for a European bailout. "If we are going to start including funds made available to Europe, then the IMF is not properly resourced," Youssef Boutros-Ghali told Reuters, adding that IMF members were talking of doubling the amount of SDRs. The means the IMF is $318 billion short of solvency. And what is the IMF long? Why gold...3,005 worth.

What does this mean in English? The IMF currently has 204 billion in allocated SDR to member countries (or $318 billion). Boutros-Ghali has basically said that in order to preserve its front-man status as a world bailout force (just because the Fed knows that the political whiplash of it being the bailout provider of last resort would mean the end of it, thus needing a strawman such as the IMF), the IMF will need to raise another $318 billion. Where will the IMF get that money? Here's an idea: the IMF holds 3,005 tons of Gold. At today's fixing, this equates to just over $116 billion (and much more should the price of gold mysteriously skyrocket). Of course, any fiction that the SDR is backed by gold will then disappear, but it's not as if anyone even remotely pretends that any fiat currency (and the SDR is no exception) has any value left whatsoever. And since the US will end up having to fund the bulk of the SDR allocation, at least US taxpayers would be on the hook for a far more manageable $200 billion that the IMF needs in order to fully bail out Greece and everyone else in Europe. | ||||

| U.S. Dollar Is The New 'Tulip' Posted: 03 Jun 2010 03:06 PM PDT (snippet) There was a second reason why this "currency" was doomed to fail, in spectacular fashion. Once the Dutch people acquired the knack for growing tulips, they could essentially be produced in infinite quantities. The Dutch people were about to learn an important lesson about money: in order for any form of money to hold its value over the long term, it must be "precious" or rare. Again referring to tulips, when they first became money, they were both rare and precious. They were originally few in number and since they were originally traded as flowers they were also beautiful (or "precious"). However, when the Dutch began to produce tulips in vast quantities and they also ceased to be "precious" (because they were now traded as bulbs), tulips lost the essential qualities of "good money" - and quickly became worthless. Regular readers will recall that I have previously provided the criteria for "good money" in previous commentaries. There are four necessary qualities which all money must possess, or else thousands of years of history teaches us that such "money" is doomed to fail as a currency. In addition to being "precious" or rare, good money must also be uniform, evenly divisible, and "a store of value". The properties of being "uniform" and "evenly divisible" are basically self-explanatory, but I will spend a moment to illustrate the importance of money as a "store of value". This refers to the requirement that "good money" must retain the wealth of the holder. For example, over a span of centuries, an ounce of gold has been sufficient to buy a fine, man's suit. Conversely, the foolish Dutchman who traded his bed, a suit of clothes, and a thousand pounds of cheese for a tulip bulb, suddenly woke up one morning and realized that all he was holding as a replacement for that wealth was one, common flower. When discussing money as a "store of value", we cannot fail to discuss how the U.S. dollar – the world's "reserve currency" - has performed as a store of value. In the less than 100 years since the Federal Reserve was created to "protect" the dollar, it has lost more than 95% of its value. Put simply, the dollar of today is not "a store of value", and thus not good money. The question then becomes: was the dollar ever "good money", and (if so) what has changed over the last 100 years? More Here.. E*TRADE Requires Your Passport, Alien, or Government ID Number to Activate a New Account More Here.. | ||||

| Posted: 03 Jun 2010 03:05 PM PDT David Charter and Patrick Hosking of the Times report, Europe launches credit ratings offensive:

Don't get me started on credit rating agencies. Loved what Buffett said on incentives and how CEOs and Boards of financial institutions have to feel significant pain when their firms fail and the government has to bail them out, but the Oracle of Omaha didn't convince me that the current model for credit rating agencies is the best we can do. | ||||

| Posted: 03 Jun 2010 02:10 PM PDT In a speech before the SW Graduate School of Banking, Dallas Fed's Richard Fisher comes out swinging, blasting his boss Ben Bernanke and his policy of globalized moral hazard: "Let me make my sentiments clear: It is my view that, by propping up deeply troubled big banks, authorities have eroded market discipline in the financial system. It is not difficult to see where this dynamic leads—to more pronounced financial cycles and repeated crises." And just in case listeners missed the point, he followed up: "Just this morning, the Washington Post summarized the impasse that inevitably blocks treatment of the TBTF pathology. In an article on preparation for this weekend’s Group of 20 talks on bank reform, it was noted that “some” participants “remain hesitant to lean too hard on banks they consider vital to their national economies.” This hesitancy only perpetuates the problem: The longer authorities delay the process, the more engrained behemoth financial institutions become; the more engrained they become, the less extricable they are. And so the debilitating disease of TBTF spreads. What appears “vital” becomes “viral” and grows ever more threatening to financial stability and economic stability." Fischer implicitly supports Ted Kaufman's proposal, which failed in the corrupt and Chris Dodd subservient Senate, that had proposed a very sensible size limitation on banks:

Unfortunately, in preserving the dictatorial nature of the Federal Reserve system, Ben Bernanke will neither listen to Hoenig, who earlier said a rate hike to 1% by the end of the summer is critial, nor to Fisher, whose suggestion will destroy any hope of Bernanke's true employers can ever have of reaping the kinds of bonuses they are used to, and hope to extract from the middle class at least one more time before the ponzi house of cards collapses once and for all. Richard W. Fisher Financial Reform or Financial Dementia? I understand from Scott MacDonald that tonight is the 53rd annual keynote address and banquet of the SW Graduate School of Banking—an impressive anniversary, which reminds me of a story. A couple is deciding where to dine on their 10th wedding anniversary. They settle on the Ocean View Restaurant because that is where the beautiful, hard-bodied people go. On their 20th anniversary, they discuss where to celebrate, and they agree again on the Ocean View because the wines and the food are superb. For their 30th, they return to the Ocean View once more, having agreed that, as they sit there in silence, the view from the terrace is second to none. On their 40th anniversary, they agree that the Ocean View is just right because it has wheelchair access and an elevator to get them to the porch overlooking the ocean. On their 50th, they want to do something truly special to celebrate. So they decide to go to the Ocean View … because they have never been there before. Most of you are bankers—many, graduates or future graduates of this fine school. My message to you tonight is to remember where we have been. We have collectively been to hell and back. Let’s not go there again. Let’s remember that bankers should never succumb to what is trendy or fashionable or convenient but should instead focus on what is sustainable and in the interest of providing for the long-term good of their customers. You gather tonight on the eve of a conference of key members of the House of Representatives and the Senate of the United States seeking to agree upon legislation to foster financial reform.[1] This evening, I am going to discuss this reform initiative. I do so, as always, speaking my own mind, making clear that I speak for nobody else at the Fed (something that is usually patently clear). I do so as one of only a few members of the Federal Open Market Committee who have been practicing commercial bankers. And I do so in the belief that it is always best to speak the truth to political convention. In their unicameral sessions, the House and Senate have cleared away a lot of the underbrush of who does what to whom. As it now stands—due in significant part to the efforts of Sen. Hutchison of Texas and her colleague Sen. Klobuchar of Minnesota—my colleagues and I at the Federal Reserve will have responsibility for regulating, in some fashion, banking organizations across the spectrum, from community and regional banks to money center banks to thrift holding companies. I believe we are best suited for such responsibility. We have been battle hardened by the crises of both the 1980s here in Texas and this most recent episode, which threatened to bring the system of market capitalism to the brink. Yet, at the same time, I have some concerns about our ability to deal with the most vexing of the issues presented by the recent crisis: the issue of institutions that are considered “too big to fail” (or, if you prefer the acronym that has become commonplace, TBTF). The Not-So-Shadow System Take, for example, one of the most well-known and problematic phenomena of the shadow banking world: structured investment vehicles, or SIVs. Despite repeated claims to the contrary, SIVs were not distinct from commercial banks. Many SIVs actually originated from the very core of the commercial banking system—dominated in size by the largest banks—where bank regulation was presumably the strongest. Make no mistake: Big banks created SIVs. They supported SIVs with credit and liquidity enhancements. They marketed and invested in SIVs. And once the crisis hit, big banks were forced to bring SIVs onto their balance sheets. In this way, the presumed distinction between the commercial banking system and the so-called shadow banking system is false. It is also a widely held misperception that SIVs escaped regulatory treatment. Regulators knew about them and even applied capital requirements to them. Unfortunately, those regulatory requirements were woefully inadequate. The favorable regulatory treatment granted to many of these vehicles was, in many cases, what accounted for their existence. The vehicles were created not so much for an economic purpose, but rather to minimize regulatory capital requirements. SIVs and other programs sponsored by big banks were also exposed to runs. In contrast to other members of the shadow banking system—like hedge funds—SIVs had inadequate mechanisms in place to protect their liquidity. I do not wish to single out SIVs. They are just one example of the excess to which large institutions succumbed. We are well aware of the alphabet soup of acronyms, including CDOs and CLOs, that contributed to the crisis, along with an excessive degree of faith in the ability of complex statistical models to mathematize risk taking. Dealing with TBTF We might have expected a similar treatment of big banks. But we would have been wrong. Regulators have, for the most part, tiptoed around these larger institutions. Despite the damage they did, failing big banks were allowed to lumber on, with government support. It should come as no surprise that the industry is unfortunately evolving toward larger and larger bank size with financial resources concentrated in fewer and fewer hands. Based on these considerations, coupled with studies suggesting severe limits to economies of scale in banking, it seems that mostly as a result of public policy—and not the competitive marketplace—ever larger banks have come to dominate the financial landscape. And, absent fundamental reform, they will continue to do so. As a result of public policy, big banks have become indestructible. And as a result of public policy, the industrial organization of banking is slanted toward bigness. Big banks that took on high risks and generated unsustainable losses received a public benefit: TBTF support. As a result, more conservative banks were denied the market share that would have been theirs if mismanaged big banks had been allowed to go out of business. In essence, conservative banks faced publicly backed competition. Let me make my sentiments clear: It is my view that, by propping up deeply troubled big banks, authorities have eroded market discipline in the financial system. The system has become slanted not only toward bigness but also high risk. Consider regulators’ efforts to impose capital requirements on big banks. Clearly, if the central bank and regulators view any losses to big bank creditors as systemically disruptive, big bank debt will effectively reign on high in the capital structure. Big banks would love leverage even more, making regulatory attempts to mandate lower leverage in boom times all the more difficult. In this manner, high risk taking by big banks has been rewarded, and conservatism at smaller institutions has been penalized. Indeed, large banks have been so bold as to claim that the complex constructs used to avoid capital requirements are just an example of the free market’s invisible hand at work. Left unmentioned is the fact that the banking market is not at all free when big banks are not free to fail. It is not difficult to see where this dynamic leads—to more pronounced financial cycles and repeated crises. This is the threat that legislators are now attempting to address in the financial reform bill. A widely noted feature of this legislative effort is the fairly broad scope for regulatory discretion. For instance, under the proposed legislation If the Board and FDIC find the plan deficient, the bill calls for the company to resubmit an alternative approach within a set time frame. Failure to resubmit the resolution plan could result in the imposition of more stringent capital, leverage or liquidity requirements or restrictions on growth and activities. Furthermore, the Board and FDIC, in consultation with the council, may direct the firm “to divest certain assets or operations identified by the Board of Governors and the [FDIC], to facilitate an orderly resolution.”[3] The legislation also requires that a Credit Exposure Report be submitted “periodically” on “the nature and extent to which the company has credit exposure to other significant nonbank financial companies and significant bank holding companies; and … the nature and extent to which other significant nonbank financial companies and significant bank holding companies have credit exposure to that company.”[4] The new Financial Stability Oversight Council is directed to “make recommendations to the [Fed’s] Board of Governors concerning the establishment of heightened prudential standards for risk-based capital, leverage, liquidity, contingent capital, resolution plans and credit exposure reports, concentration limits, enhanced public disclosures, and overall risk management” for systemically important institutions.[5] The name of the game, here, is regulatory discretion. There are—as there always are—criticisms. Some feel, for instance, that while regulators are being given more authority, they are also being given ambiguous, if not conflicting, directives that would leave the specter of TBTF lurking in the background. For instance, the bill states that it seeks “to provide the necessary authority to liquidate failing financial companies that pose a significant risk to the financial stability of the United States in a manner that mitigates such risk and minimizes moral hazard.”[6] It also directs the FDIC to “ensure that the shareholders of a covered financial company do not receive payment until after all other claims … are fully paid.”[7] However, the bill goes on to state that in the disposition of assets, the FDIC shall “to the greatest extent practicable, conduct its operations in a manner that … mitigates the potential for serious adverse effects to the financial system.”[8] Language that includes a desire to minimize moral hazard—and directs the FDIC as receiver to consider “the potential for serious adverse effects”—provides wiggle room to perpetuate TBTF. Criticisms aside, this is the path our legislative powers have laid out for dealing with the issue of TBTF. Regulators must now decide exactly how they will travel down that path. There appear to be three major ways to navigate proposed policy making toward big banks: (1) the regulate ’em camp, (2) the resolve ’em camp and (3) the shrink ’em camp. Let’s examine these one by one. Regulate ’Em To be blunt: Simple regulatory changes in most cases represent a too-late attempt to catch up with the tricks of the regulated—the trickiest of whom tend to be large. In the U.S. financial system, what passed as “innovation” was in large part circumvention, as financial engineers invented ways to get around the rules of the road. There is little evidence that new regulations, involving capital and liquidity rules, could ever contain the circumvention instinct. The history of regulatory capital requirements is not a distinguished one:[9]

| ||||

| Posted: 03 Jun 2010 01:26 PM PDT

But hey, if you are feeling especially generous today, the federal government is actually taking online donations that will go towards paying off the national debt. Yes, it is true. Please try to resist the urge to laugh. This request comes from the same government that spent $2.6 million tax dollars to study the drinking habits of Chinese prostitutes and $400,000 tax dollars to pay researchers to cruise six bars in Buenos Aires, Argentina to find out why gay men engage in risky sexual behavior when drunk. Perhaps they should not hold their breath while waiting for our donations to show up. Or perhaps they should get their own house in order before expecting donations. But the truth is that they continue to recklessly spend our money as if they have not learned anything. This year, it is projected that the U.S. government will issue nearly as much new debt as the rest of the governments of the world combined. Yes, getting into debt is another thing that we Americans dominate the rest of the world in. It is estimated that the U.S. government will have a budget deficit of approximately 1.6 trillion dollars in 2010. Now remember, when Ronald Reagan took office, the U.S. national debt was only about 1 trillion dollars. So, from the founding of the United States until Reagan took office we accumulated a total of about 1 trillion dollars in debt. In just the last 30 years we have accumulated 12 trillion dollars more. You know, the truth is that it is really, really hard to even spend one trillion dollars. If right this moment you went out and started spending one dollar every single second, it would take you more than 31,000 years to spend one trillion dollars. Hopefully that gives you an idea just how fast the U.S. government is getting us into debt. And now we are officially in the danger zone. According to Dr. Jerome Corsi, the U.S. national debt is now equal to 90 percent of gross domestic product. Most economists consider a level of 100 percent debt to GDP to be an absolute nightmare scenario. But things look even worse when you total up all forms of debt in the United States. The total of all government, corporate and consumer debt in the United States is now equal to 360 percent of GDP. That is far greater than at any point during the Great Depression. Yes, we are in a LOT of trouble. So can we just raise taxes on everybody just a little bit and get rid of this budget deficit? Well, unfortunately no. According to the Tax Foundation's Microsimulation Model, to erase the U.S. budget deficit for 2010, the U.S. Congress would have to multiply the tax rate for every American by 2.4. That would mean that the 10 percent tax rate would become 24 percent, the 15 percent tax rate would become 36 percent, and the 35 percent tax rate would have to be 85 percent. Would you like to pay 85 percent of your income in taxes? And that would not reduce the national debt one penny - all that would do is eliminate the U.S. budget deficit for this year. The truth is that it is simply not possible to pay off the national debt. Most economists realize this and speak of more realistic goals such as getting our debt growth down to a level that is "sustainable". But the reality is that we are way beyond being able to get this debt under control. If the U.S. government cut spending enough to make a real difference it would crush the economy and tax revenue would take a sharp nosedive. If the U.S. government borrows even more money and increases government spending even more it will help the economy in the short-term, but it will make our long-term problems even worse. No, the truth is that we have created an economic nightmare from which there simply is no escape under the current system. The national debt will never be repaid and the never ending spiral of debt and paper money that we have created is doomed to failure. So what will happen someday when the current economic system does collapse? That will be for the American people to decide. Hopefully they will learn from our mistakes and will return to our constitutional roots and devise a financial system based on solid economic principles. | ||||

| Gold Holdings In GLD Surge To All Time Record Posted: 03 Jun 2010 11:27 AM PDT The total gold tonnage making up the GLD NAV has just hit an all time high, at 1,289.8 tonnes, even as the actual fixing price of both gold and of the the GLD ETF have been relatively flat after hitting an all time high on May 12, incidentally a day when GLD had 80 less tonnes in holdings than it does today. In less than a month GLD alone has presumably acquired 80 tonnes of gold backing up its intrinsic value. Also notable is that today GLD increased its gold holdings by 21.3 tonnes, despite a decline in both PM fix and GLD. Keep in mind that global weekly gold mine production is estimated at 30 tonnes. Did GLD acquire 66% of all gold produced in the last week today alone? We wonder if the WSJ article debating where demand for gold comes, and going as far as blaming gold to be a ponzi, is aware of this fact. As for the question of how a seemingly relentless desire to acquire gold, translating in a 21 tonne increase in GLD gold holdings translates into a drop in the price of gold, we will just leave that one open. Chart of absolute GLD price and GLD Net Asset Value Gold Tonnage. And the same chart indexed to a 100% starting point. | ||||

| Posted: 03 Jun 2010 10:25 AM PDT Returning risk appetite weighs on gold price The COMEX August gold futures contract closed down $12.60 Thursday at $1210.00, trading between $1202.40 and $1226.50 June 3, p.m. excerpts: | ||||

| Posted: 03 Jun 2010 10:14 AM PDT Yesterday's SEC panel discussion on HFT was largely uncovered by the media, as it was for the most part a one-sided, lobbying effort of the HFT industry to make it seem that all is good with the market and to make it explicit that "once in a lifetime" events like the May 6th 1,000 point crash don't really occur and what was experienced (and will be again quite soon) was a statistical impossibility. Tell that to all those who got stopped out by the market's arbitrary 60% cut off for DK'ed trades and lost millions. For a good, clean, simplistic perspective on HFT, we present this most recent summary piece by the Daily Finance's Peter Cohan, called "What you need to know about HFT." As Cohan summarizes it, "All this so-called liquidity, which generally makes it possible for buyers and sellers to meet, suddenly disappeared because the high-frequency traders' books became too imbalanced. So the HFTs stopped trading, the liquidity dried up and the market plunged." For more sophisticated readers who wish to dig between the lines of naive explanations of industry participants whose primary goal is to escape scapegoating in this time of regulatory upheaval, here is the link to the SEC panel on HFT, which among other industry participants, includes Themis Trading's Sal Arnuk, arguably one of the most objective voices of caution when it comes to broken market structure. In the attached clip, Sal's prepared remarks begin 3 minutes into the video. And for those short on time, here is Sal's summary of events from his point of view, as posted on the Themis Trading blog.

| ||||

| What you need to know about gold and your taxes Posted: 03 Jun 2010 09:33 AM PDT From Jeff Clark, Senior Editor, Casey’s Gold & Resource Report: Proper planning with your finances is incomplete until you consider the endgame consequences of your investment decisions today. So, what are the tax consequences of selling gold, gold ETFs, and gold stocks? There’s lots of conflicting and inaccurate tax information on the Internet about this. We know of one site that claims the sale of silver Eagles is exempt from capital gains tax due to some obscure law (not true). So, let’s nail down the current tax rules for selling gold in the U.S... Read full article... More on taxes: The best thing you'll read about taxes this week Tax horror: Congress could triple dividend tax rates Astonishing chart shows how high taxes could surge | ||||

| These charts suggest stocks could fall another 60% Posted: 03 Jun 2010 09:17 AM PDT From The Money Game: We highlighted these charts earlier in our feature on the end of the bull market, but a reader submitted them, and they're so beautiful that we wanted to bring them to your attention. What you see below (and you can click one each to enlarge) are two carefully annotated charts showing... Read full article... More on stocks: This unusual stock is dirt-cheap and highly leveraged to gold Legendary short seller Chanos: The 4 big reasons to sell stocks Porter Stansberry: 90% of our readers could be making a terrible mistake | ||||

| Economy Is Growing, But It's Like Watching Cement Dry Posted: 03 Jun 2010 09:16 AM PDT Michelle Galanter Applebaum submits: More Optimism, Less Strength The May Institute of Supply Management ((ISM)) survey indicated that steel buyers are becoming more optimistic about their future in most aspects while their current business fundamentals are deteriorating. The good news in the survey remained inventories, which remain lean; 100% of respondents in May indicated inventory levels at less than three months for the first time since November 2009. Likewise some 21% of respondents expect to increase their inventories in the next six months, a dramatic pickup from zero in April and the highest reading since July 2006. Better Employment Outlook, But Receipts/Shipments Deteriorates There was meaningfully good news on the employment outlook with 50% of respondents indicating plans to hire, up from 40% in April and 7% in February for the highest level since December 2007. However, the bad news was that for the first time in nearly a year, not a single buyer reported that current receipts are ahead of current shipments – this is a key forward-looking metric that has been steadily deteriorating the last few months. Optimism in the outlook was quite evident, however, with some 36% of respondents – the highest level since August 2009 – expecting receipts in the next three months to be ahead of current levels. Buyers Seeking More Foreign While overall the numbers remain tepid, interest in foreign steel hit the highest level since last fall, with 15% of buyers saying they plan on increasing their reliance on foreign steel in the next six months, up from zero last month. An interesting dichotomy exists though because buyers are also reporting that foreign mills are less active seeking domestic business, with no buyers reporting “more” active in May, after 22% reported increased activity in April. Outlook – Economy’s Growth Watching Cement Dry This is an economy of fits and spurts and while the bright spot in the economy – automotive – continues at a surprising pace, the weakness from non-residential construction markets has only worsened. The export economy has held a potential bright spot but now with the recent deterioration of the euro, that bright spot may be fading fast. We expect to see domestic steel demand pickup the pace in a slow and steady recovery in coming months, with pricing spurred by higher cost raw materials despite weak demand. Disclosure: N/A Complete Story » | ||||

| Guest Post: Who Will Profit From The Oil Spill Posted: 03 Jun 2010 09:08 AM PDT Submitted by Charles Brant at Casey's Energy Opportunities The disaster in the Gulf of Mexico may be the best thing that’s ever happened to green energy producers in the U.S – but the one that benefits the most will probably surprise you. As the damaged Deepwater Horizon well continues to pump out 5,000 barrels of oil per day into the Gulf, all the major stakeholders are scrambling to find a way to contain the damage. Investors in BP, Anadarko, Transocean, and Halliburton have had a rough few weeks and should be nervous about the future. The growing political firestorm that’s accompanied this ecological disaster is drastically reshaping the energy landscape in the U.S. There’s huge money to be made from the biggest structural change to the energy markets in the past 50 years, if you know where to look. The political and economic fallout from this accident is starting to take shape, with the executives from BP, Transocean, and Halliburton being paraded in front of Congress for a public chastising. Predictably, politicians are making stern promises of tighter regulations in the future. At this point, it’s a guessing game as to what the new permanent regulations will be. So far, a temporary moratorium has been put in place on the issuance of new offshore oil and gas drilling permits. In addition, the Department of the Interior plans to restructure the federal Minerals Management Service (MMS) to eliminate the conflict of interest inherent in its role of monitoring safety, managing offshore leasing, and collecting royalty income. The Department of the Interior has plans to make offshore drilling rig inspections much stricter. Interior Secretary Ken Salazar has also promised tighter environmental restrictions for onshore as well as offshore exploration and production. Lastly, in a knee-jerk reaction to the oil spill, the Senate Climate Bill gives states the right to veto offshore projects within 75 miles of shore. Although these regulatory changes aren’t set in stone yet, it’s a foregone conclusion that any company involved in offshore drilling will feel some pain. Any exploration and production company that continues to operate offshore will face reduced margins from a higher-cost structure from increased taxes, regulation, and insurance. Offshore production supplies a large amount of oil and gas to the U.S. The U.S. Energy Information Agency estimates that U.S. offshore reserves account for 17% of total U.S. proved reserves for crude oil, condensate, and natural gas liquids, as the illustration below shows.

The sheer size of offshore reserves guarantees exploration and production will never be completely abandoned in the U.S., but don’t expect any growth. In fact, the Gulf of Mexico disaster probably destroyed any hope of any future drilling in environmentally sensitive areas, like the Arctic National Wildlife Reserve. The market has reacted strongly to the spill, punishing the stocks of every company involved in offshore drilling. Now many are suggesting it might be an overreaction that could benefit your investment portfolio if you dare buy in now. However, there are better ways to work this news to your benefit. The oil spill will be a very expensive setback for all the players involved in offshore production; we’ve already seen that reflected in their stock prices. In the near term, offshore exploration and production companies and the oil services companies will show margin erosion as they digest higher costs. In the medium term, some companies will pull up stakes and move completely into non-U.S. offshore projects, as they’ll realize the cost of doing business in the U.S. outweighs any potential gains. The market might be overreacting, but we’re not convinced these depressed stocks represent good value. While it’s possible there are some good bargains, it’s still too early to consider speculating in any offshore-related companies. Specifically, the threat of increased regulation, massive tax increases, and rising insurance costs will create a hostile environment for these companies going forward. Instead of risking your capital on so many unknowns, a prudent alternative is to look at energy producers in the renewable energy sector. The oil spill has only strengthened the current administration’s resolve to make greener energies supply a larger chunk of America’s energy needs in lieu of traditional fossil fuels. Congress is doing its part by giving huge subsidies to companies in this field. There are a lot of renewable options that will benefit from the subsidies and political wrangling, but our current favorite by a long shot is geothermal power. Of all the renewables, we think geothermal has the best upside potential. Based on economics and efficiency alone – unlike wind and solar energy, geothermal is reliable for round-the-clock generation and is already price competitive with fossil fuels without any subsidies – geothermal outperforms competing renewable technologies. Add the government subsidies on top of the existing good economics and the pot gets even sweeter in the short term. Once the spill is finally contained, attention will shift to previously low-key renewables, like geothermal, and soon after the market will recognize geothermal as the clear winner. We’ve researched companies up and down the geothermal supply chain and we’re seeing value in a number of quality companies that we think are poised to outperform. With the coming flood of money and attention that will be focused on green energy, you’ll want to move quickly before these bargains go away | ||||

| Posted: 03 Jun 2010 09:00 AM PDT In the last two decades in Mediterranean Europe, and especially in Spain, a new social group has emerged, called jovenes (youngsters). Members of this group exhibit several specific characteristics. First, jovenes are usually male, aged 25-35, although some members are in their 40s. Second, they are in a perpetual state between graduation and their first job. Third, they usually live with their parents to save money, allowing them to go out at least three times a week. Fourth, they occasionally work a part-time job – if only due to the pressure imposed by their parents. Last, and most important, they receive unemployment benefit credits and renew their membership on the "unemployment list" from time to time, so that the state subsidies don't run out during their "temporary" hibernation. It would be very unfair to put all the blame on them for their lack of initiative. They play a vital part in what is called the "Atlas generation." They have the weight of the world on their shoulders, and they are going to be the ones in charge of paying for the economic sins of their parents. It is important to analyze the reasons why this social group has appeared, what the situation is like today, and what the consequences will be of this phenomenon in the future. For the last ten years, and especially since the recent financial crisis started, Spanish unemployment has risen astronomically, reaching a record of around 20%. This, of course, does not count the thousands of illegal immigrants, who don't appear in the official state statistics. Aside from the vast number of unemployed, another significant group of people work in part-time jobs with "garbage contracts" or very low salaries. Members of this group are called mileuristas (those who earn only €1,000/month). This group appears above the jovenes in the social pyramid. Mileuristas normally live at home and dream of becoming economically sufficient eventually, or they live in cheap rented apartments funded by state money, which comes directly from taxpayers' pockets. Finally, we find a smaller group at the top of the pyramid. This group is formed by either a lucky few, or in some cases, hardworking and generally outstanding young people. This group has very decent jobs (normally around €2,000/month starting salary) and are the sons and daughters of wealthy families that normally receive a more-or-less high-quality private education. They end up employed in the family business or in some firm where their parents or family members have contacts. Outside of this pyramid we will also find a group of people that decide to study for an "oposición" (state exam) in order to work for the government. Depending on the complexity of their education, and their success on the exam, they will end up working for the first time between the ages of 26 and 35 and will be decently, or even very well paid, for the rest of their lives. It is also very important to give special attention to the number of years that people are called "students" in Spain. The quality of a university graduate has been devalued in recent years to the point where an employer will no longer be impressed at all by an undergraduate degree in a job interview. Consequently, at least a master's degree or some kind of postcollege specialization accompanied by proficiency in at least three languages is demanded. This, of course, means more years spent as a student and, for the most privileged ones, a year or two living and exploring foreign languages abroad. Not so long ago in Spain, it was an honor to have a college degree and even more prestigious to hold a graduate degree, which only a few people could achieve due to the expense and hard work that it involved. Now it is almost free to study in a Spanish public university. This is viewed as a great accomplishment that gives opportunities to people from lower classes, who will sometimes end up forming part of the group of "hard working and outstanding young people." But, to be honest, this group is quite small. The effort to make it easier to be a student is largely a way for the government to lower the unemployment rate. In order to explain why it is so hard for recent graduates to obtain a decent job in Spain, it is important to know that labor costs are very high for employers – a consequence of strict laws that protect workers. Four weeks' vacation a year is the mandatory minimum. An artificially high minimum wage places a floor under the supply of workers and the demand for jobs, creating a devastating imbalance. This means there is a huge demand for jobs and little desire on the part of employers to fulfill it. Additional reasons for the lack of job offers in Spain include the excessive finiquito, the final pay a worker is entitled to under Spanish law when fired: 45 days of salary for each year worked at the company. Furthermore, taxes on employers are very high – at least a 50 percent of each worker's annual salary, which means that if someone is paid €20,000 a year, it costs their employer at least €30,000 a year to hire them. All this makes an employer very reluctant to hire an employee, which creates a high rate of unemployment and a huge number of "garbage contracts." These taxes also promote black-market activity, which either sidesteps the established rules or ignores them altogether. The taxes on employee wages are very high as well, which brings us back to the mileurista social status. These taxes create a substitution effect: firms have become desperate for new technologies to reduce labor inputs. One recent example in Spain is McDonald's move to start substituting workers with new machines that take the order for the customer, reducing the number of workers. The goal is to leave only two sets of employees – the ones in the kitchen and ones that hand the food to you at the counter. Spain's misfortunes have been complicated since joining the eurozone. The ability to obtain very low interest rates to borrow money – the same interest rates as in more powerful and savings-oriented economies like Germany – worked as an incentive for companies to borrow money for infrastructure and housing construction. Around 800,000 houses have been built each year in Spain, more than France, Germany, and England combined. This meant a surge in the supply of jobs in construction industries. Unfortunately, this demand for labor was met mostly by immigrants who now find themselves unemployed with few possibilities. Huge loans to finance this housing boom, especially from the Spanish "cajas" (saving banks) now cannot be paid back and have resulted in a huge government bailout. As a result, the Spanish government has undertaken an increasingly large debt, financed by the continual issuance of new bonds. This borrowing has strained Spain's public finances, lowered its bond rating, and reduced the demand investors have to continue funding this deficit spending. At the same time, the bust has caused a severe decline in tax receipts, especially in taxes like the IVA (value-added tax). Consequently the state has received less income and in response is now increasing consumption taxes to cover the shortfall (effective next month). These increased taxes will, in the end, translate to less spending and more constrained profits for all producers. They will also make Spain a very unattractive place for companies worldwide to start or continue their business. All these effects will ultimately mean more unemployment, which takes us back to the young "Atlas generation." Ironically, many members of this generation have complete faith in the government to take care of all these issues for them. They choose to stay at home until they are middle-aged and delay getting married and creating a family until their mid-to-late 30s. They also have an increasingly huge debt issue, which they will eventually have to take care of. If current trends continue, within a few short years in Spain each employee will have to pay for one pensioner on social security. Only 40 years ago, ten employees took care of one pensioner through their social-security contributions. The Atlas generation, by putting off marriage and children, has worsened this worker-pensioner imbalance. The yearly rate of births per fertile woman in Spain is only 1.2, one of the lowest in the world, and it will likely decline in coming years. The only way to solve this problem would be to lower taxes, especially employment taxes, dramatically. Doing so would encourage employers to offer more jobs and employees to have larger families. Unfortunately, this option isn't of much interest for the politicians in Spain, who prefer to maintain the socialist status quo regardless of which political party is in power. Jaime Levy Moreno Spain's Dropout Generation originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||

| Fed's Central Bank Swaps Increase By $5.4 Billion To $6.6 Billion Posted: 03 Jun 2010 08:48 AM PDT The Fed lent out $6.6 billion in liquidity swaps this week to foreign banks, of which the biggest beneficiary was the ECB, with a 1 week swap of $5.4 billion and an 84 day swap of $1.0 billion. The only other bank receiving Fed aid was the Bank of Japan, which got $210 million. What is funny is that the ECB is now an example of just how large the FX imbalance in Europe is: the ECB has had to lend out $6.4 billion in dollars even as banks have hoarded €320 billion in euro deposits with the ECB, a new all time record. In other words, nobody wants euros, and everybody is dying to get their hands on dollars. But somehow the market is supposed to believe the funding situation in Europe is ok. Lastly, the $6.6 billion in total Fed liquidity swaps $5.4 billion greater than the prior week's $1.2 billion. We wonder what spin will be applied to explain the 500% increase in world dollar funding requirements.

| ||||

| The 'Safe' Treasury Play Isn't as Good as It Looks Posted: 03 Jun 2010 08:45 AM PDT Brian Rezny submits: As the old saying goes, “sell in May and go away.” Well, investors did exactly that last month. To some extent, that’s understandable. Given all the recent turmoil, market participants were inclined to lighten their equity positions before a long holiday weekend. And the result: the Dow made headlines when it finished its worst May since 1940, falling 7.9% for the month. And the S&P 500 lost 8.2% (its worst May since 1962). And, of course, as the stock market faltered, investors fled to Treasuries for cover. Last week, the Treasury sold $42 billion in two-year notes at the lowest yield on record (.769%). And meanwhile, the yield on 10-year bonds hit a one-year low of 3.06% (before ending the week at 3.30%). Treasury prices and yields have an inverse relationship – as prices go up, yields go down. This means that when jittery investors ran for shelter in Treasuries, prices were driven up and yields down. (Click to enlarge) 10-Year Treasury Bond Yield  Source: finance.yahoo.com This makes sense. Last week, stocks were dodgy, Spain kept the eurozone crisis in the limelight and tensions were escalating on the Korean peninsula. All of this makes Treasuries look like a refuge. But just how much of a refuge are they? If you ask Moody’s, it’s questionable. Last week, the rating agency issued another warning, hinting at a possible credit downgrade for the U.S. In a statement, the agency said that our AAA rating may come under pressure if the deficit is not reduced: “The ratios of general government debt to GDP and to revenue are deteriorating sharply, and after the crisis they are likely to be higher than the ratios of other AAA-rated countries.” And what will that mean for us? The report went on to say “the risks include waning investor confidence and the government’s future access to liquidity and flexibility." Now, this is just the latest warning, and threats delivered in a series look idle. None the less, genuine or not, the threats are deserved. Our deficit, and our total debt, is beyond unsustainable. And we have no room to talk when matched up against the debt-ridden countries of the eurozone. Portugal’s deficit stands at 9.4% of GDP… ours is 10.3%. And Portugal’s total government debt is 85% of GDP (and ours will reach 90% by 2020). And the U.S. governments total marketable debt? A record $7.9 trillion. But… there is a key difference between the U.S. and the euro zone: they are forcing harsh austerity measures, and have a timetable for deficit reduction. And we just keep on spending. Will the U.S. Treasury ever have to pay the piper? Could investors lose enough confidence that the Treasury won’t have access to the funds it needs? Some would say yes. As Minyanville’s Yaron Sadan wrote: “One day (I believe soon) there will be a failed auction. By failed I don’t mean that the Chinese (or the Japanese or Middle East block) won’t show up at all, just that they won’t bid aggressively…they need to spend that money domestically, not lend it to the U.S. so that we can lend it to Greece”. We have already seen indications of this: in March, China was a net buyer of Treasuries, but that’s the only time in the last six months. We have seen the lowest 2-year note yield on record in the midst of the highest deficit on record. They only way those two things can occur simultaneously is in an environment of great economic uncertainty. But at some point, the fear trade will be over. And Treasuries will decline in due course. And then what could happen? We’ll see. The fact is there are other countries that could supplant the U.S. as a safe bet in the future (Canadian banks have been voted the most financially sound in the world by the World Economic Forum…and their oil reserves are second only to Saudi Arabia). And Australia doesn’t look too bad, either: it’s nearly tied with Canada for the highest GDP forecast in the Organization for Economic Cooperation and Development ((OECD)). The bottom line: if you want to play the bond market, stay away from Treasuries…especially long-term bonds. And avoid high-yield (junk) bonds: I’ve warned readers before about high-yield funds, and they have taken a hit lately (iShares iBoxx $ High Yield Corporate Bond ETF (HYG) was down 4.7% for May). One way I would invest in the bond market right now is in short term or medium term under 5-year maturity, investment grade corporate debt. Long term bonds and bond funds carry substantial risk from rising interest rates, stay away! At some point High Yield Bonds will be an opportunity, but for now they are too expensive…again, stay away! Take a look at iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD); this fund provides medium-term exposure to corporate debt. Disclosure: Positions in HYG and LQD Complete Story » | ||||