Gold World News Flash |

- Special GSR Gold Nugget: Peter Grandich & Chris Waltzek

- Seeking Collateral, Escaping Recourse

- Sean Brodrick: Bull Market for Gold and Silver

- Doug Casey: Education of a Speculator, Part Two - June 2, 2010

- In The News Today

- Gold Hurdles to New Record Highs

- Give unto Caesar - What to Pay When You're Selling

- Daily Dispatch: The Sure Thing

- Into the Abyss: The Cycle of Debt Deflation

- Leading Indicators Indicate a Lagging Economy

- Open Letter to Bill Murphy

- Not All Metals Firms Are Interested in Your Success

- Pigs-Less Euro At The Door

- The article from Bill Murphy’s website with permission

- The Ultimate Hedge in Economic Crisis

- Monthly Action In Gold From Trader Dan

- Gold in Europe Closes Over €1,000 for the First Time

- Oil and Red Ink

- LGMR: Gold Should Continue to Rise as World Stock Markets Fall Amid Volatility

- Government-Sponsored Housing Fraud

- Things

- No Escaping Deflation’s Fatal Drag on Economy

- A Primer: Sovereign Debt Defaults = Social Unrest + Much Higher Gold Prices

- Finding Gold and SP500 Low Risk Setups

- Good News for the Grandchildren, Part II

- Golden Savings

- Debating Bartlett: Would Raising Taxes Reduce Our Trade Deficits?

- Universal Display, A Standout in a Tough Tape

- Gold Seeker Closing Report: Gold and Silver Fall Slightly While Stocks Gain Over 2%

- Pricing in Uncertainty

- How Soon Might Greece Default?

- Europe’s Media Warn of Global Social Unrest

- Piigs-Less Euro at the Door

- Warren Buffett on the Housing Bubble

- Keynes For Kindergarteners

- Look how easy it is to manipulate a London futures market

- Euro-Risky Asset Decoupling Redux

- Strategic Defaults: Is It Morally Right To Decide To Simply Stop Paying Your Mortgage?

- Peter Grandich: An open letter to GATA Chairman Bill Murphy

- Sony: Help Wanted, No UNEMPLOYED CANDIDATES Will Be Considered AT ALL!

- US Mint Out Of Not Only Silver But Gold American Eagles As Well

- Fiscal and monetary tightening to crash global stock markets?

- UK Research Center Tells Greece to Quit the Euro

- WEDNESDAY Market Excerpts

- Why More Econ Majors Are Republicans Rather Than Democrats

- Four Letters To Rosie

- Jim's Mailbox

- Good News for Your Grandchildren, Part II

- 10 Reasons to Avoid Baidu.com

- Guest Post: Give Unto Caesar - What To Pay When You're Selling

| Special GSR Gold Nugget: Peter Grandich & Chris Waltzek Posted: 02 Jun 2010 07:00 PM PDT |

| Seeking Collateral, Escaping Recourse Posted: 02 Jun 2010 06:52 PM PDT Stacy Summary: Well, you have savers vs speculators and you have speculators vs speculators. This is a bit of both. Looks like investors/lenders are trying to secure the collateral that allegedly backs the $600 trillion in debts they 'own,' while debtors are trying to escape the debts they 'owe.'

|

| Sean Brodrick: Bull Market for Gold and Silver Posted: 02 Jun 2010 06:05 PM PDT |

| Doug Casey: Education of a Speculator, Part Two - June 2, 2010 Posted: 02 Jun 2010 06:04 PM PDT Conversations With Casey June 2, 2010 | Visit Online Version | www.CaseyResearch.com • About Casey • Forward this email • New? Free sign up for Conversations With Casey • CaseyResearch.com (Interviewed by Louis James, Editor, International Speculator) [Ed. Note: When we left our intrepid hero last week, he was hanging off the edge of a golden cliff...] [COLOR=#243f93]L:[/COLOR] So what did you do after cashing in, in the '80s? Doug: That's when I started getting into the mining stocks you now cover. I liked their incredible volatility. But it took me quite a while to really understand the way the game was played. Even though the third thing I wanted to be when I was a kid was a geologist, it took me years to get geologically active, so to... |

| Posted: 02 Jun 2010 06:04 PM PDT View the original post at jsmineset.com... June 02, 2010 05:07 PM Dear CIGAs, Just review the 13 reasons why OTC derivative are a criminal act in the " Pocketbook of Gold." This is just like suggesting a review of naked shorting which is against both civil and criminal law. Maybe murder should be reviewed and accepted only when dirty tricksters are identified. Goldman Suit Makes Wall Street Question Derivatives Sales By Christine Harper – Jun 1, 2010 Wall Street's biggest firms are considering the suitability of selling opaque financial products to governments, endowments and not-for-profit institutions after the contracts magnified credit-market losses that plunged the U.S. into a recession. "There is no distinction among very different groups of investors, and this is where things might change," said Dino Kos, a managing director at Portales Partners LLC in New York and former head of the Federal Reserve Bank of New York's open market operations. "Wall Street... |

| Gold Hurdles to New Record Highs Posted: 02 Jun 2010 06:04 PM PDT FGMR - Free Gold Money Report June 1, 2010 – Numerous records continue to be broken by gold, including some longstanding ones that go back to the January 1980 peak. Gold closed the month of May at a new record high against every major world currency except the Japanese yen. Various charts of the gold price in terms of major currencies can be found by clicking this link. Here is a long-term gold chart in terms of US dollars. The important point of this chart is that gold is climbing in a major uptrend, which is denoted by the rising green trendline under gold’s price. Note too that the deep 2008 correction following the Lehman Brothers collapse did not move gold back to the uptrend line, which is a clear sign of strength. Since its correction in 2008, gold has been moving away from the trendline. This development means that gold’s upside trajectory is accelerating, which is another sign of strength. It is not difficult to understand why gold&... |

| Give unto Caesar - What to Pay When You're Selling Posted: 02 Jun 2010 06:04 PM PDT By: Jeff Clark, Senior Editor, Casey's Gold & Resource Report Proper planning with your finances is incomplete until you consider the endgame consequences of your investment decisions today. So, what are the tax consequences of selling gold, gold ETFs, and gold stocks? There's lots of conflicting and inaccurate tax information on the Internet about this. We know of one site that claims the sale of silver Eagles is exempt from capital gains tax due to some obscure law (not true). So, let's nail down the current tax rules for selling gold in the U.S. [The following information pertains to U.S. taxpayers only and is not intended as nor should be considered personal tax advice. Always consult a financial planner and/or tax professional before investing.] ►The IRS considers gold a "collectible" and will tax your capital gains at a 28% rate. This designation includes all forms of gold (other than jewelry), such as... • All denominations of gold bulli... |

| Daily Dispatch: The Sure Thing Posted: 02 Jun 2010 06:04 PM PDT June 02, 2010 | www.CaseyResearch.com The Sure Thing Dear Reader, Digging through the entrails of the fundamentals associated with the global economy and markets, it increasingly strikes me that there is really only one investment I’d now consider a “sure thing” – and that is buying gold on dips. In support of that contention, a quick review of the other primary asset classes is in order. The broader stock market. Now, I can’t speak for all the world’s stock markets, but will say that with the S&P 500 currently selling at a P/E of 18.29 and with a dividend yield of a miserly 2%, it’s hard to say that these stocks are selling on the cheap. Especially when you consider that during the depths of the deep recession lasting from 1980 to 1982, the P/Es hit below 7 (averaged 8.4) while dividend yields reached above 6% (averaged 5.4%)... levels we’ve been nowhere near hitting at any poin... |

| Into the Abyss: The Cycle of Debt Deflation Posted: 02 Jun 2010 06:04 PM PDT By Ron HeraJune 2, 2010 ©2010 Hera Research, LLC One of the most famous quotations of Austrian economist Ludwig von Mises is that "There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion or later as a final and total catastrophe of the currency involved." In fact, the US economy is in a downward spiral of debt deflation despite the bold actions of the federal government and of the US Federal Reserve taken in response to the financial crisis that began in 2008 and the associated recession. Although the vicious circle of debt deflation is not widely recognized, precisely what von Mises described is happening before our eyes. A variety of positive economic data has been reported in recent months. Retail sales rose 0.4% in April 2010 as consumer spending rose and the US gross domestic product (GDP... |

| Leading Indicators Indicate a Lagging Economy Posted: 02 Jun 2010 06:04 PM PDT The Conference Board's Leading Economic Index for the US declined 0.1% in April, which was not too bad, especially since it followed a 1.3% gain in March, which is not to mention a 0.4% rise in February. This is, being that it is the Leading Economic Index and is supposed to forecast the future six to nine months out, not very good news, although the Coincident Index (a measure of current economic conditions) was up a paltry 0.3% in April, following a negligible 0.1 percent increase in March, and a 0.1% increase in February, which kind of zero each other out. The Conference Board's Lagging Index is the one that keeps me interested, as this is where inflations and burdens lurk, and which increased 0.1% in April, following a 0.1% increase in March, and a 0.2% rise in February, which is in a kind of continual upward pattern, as far as I can tell just by looking at three numbers and doing no more work than that. Bill Bonner here at The Daily Reckoning is apparently unimpressed with my l... |

| Posted: 02 Jun 2010 06:04 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 02, 2010 01:46 PM Billy Boy, I look forward to seeing you and the GATA gang in Vancouver this weekend. I couldn’t help but chuckle after reading this in your daily letter today: [B]Speaking of Jeff Christian, the latest from the very visible Dennis Gartman this morning, good grief…[/B] [B]Finally, we strongly urge everyone to read a truly brilliant article listed on Kitco.com's website written by the always interesting, keenly insightful, historically well informed and inordinately wise Mr. Jeffrey Christian of the CPM Group, as he rebuts the nonsense put forth by GATA regarding gold market manipulation. Mr. Christian is far more courageous than we, for he accepted GATA's demands to debate this issue. We have long refused to do so, for although we are very good friends with Mr. Murphy, GATA's President, we have seen what GATA's supporters are like as they shout ... |

| Not All Metals Firms Are Interested in Your Success Posted: 02 Jun 2010 06:04 PM PDT Thanks to the surge in precious metals prices, we've seen quite a few new businesses enter the scene to either buy your gold or silver, or to sell you gold or silver. Some are reputable, honest, and actually care about what you get for your precious metals. Others are sly, overpriced, and likely riddled with salespeople far too interested in their own commission. The Buy Gold Trend Before the TV was dominated with offers wanting to sell you gold or silver, it was first overwhelmed with institutions wanting to buy your gold or silver for recycling. Of the most well known might have been Cash4Gold, a fly-by-night gold buyer that bought scrap metals through the mail. While the commercials may have been frequent (even appearing in the Super Bowl), the company is no fairer or more honest than any other gold dealer. Consumer complaints galore, most customers report that the average price Cash4Gold was willing to pay was right around 15-20% of the actual gold val... |

| Posted: 02 Jun 2010 06:04 PM PDT by Jim Willie CB June 2, 2010 home: Golden Jackass website subscribe: Hat Trick Letter Jim Willie CB, editor of the "HAT TRICK LETTER" Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. Natural forces are at work in Europe, powerful forces, in fact forces that are not evident. It is amazing how little the financial analysts notice the force... |

| The article from Bill Murphy’s website with permission Posted: 02 Jun 2010 06:04 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here February 26, 2010 08:21 AM Stay up to date on Grandich's MODEL PORTFOLIO. He is constantly updating it! COMEX INVENTORY DATA REVEAL AN ALARMING TREND By Adrian Douglas For more than 6 months I have been gathering data released daily by the COMEX concerning delivery notices and inventory levels of gold and silver. This data must be captured and recorded each day as there is no database of historical data available to the general public. Studying data on a daily basis is not conducive to seeing the big picture so I have just completed a study of what can be discerned by looking at the entire 6 months of data. The results are very revealing. First of all for those who are not familiar with the delivery process of the COMEX I will summarize some key information. Only a small fraction of the contracts, less than 1%, that are bought or sold on COMEX ever go into the delivery process.... |

| The Ultimate Hedge in Economic Crisis Posted: 02 Jun 2010 06:04 PM PDT This week we have a really counter-intuitive Outside the Box. I was talking with the editor of Breakthrough Technology Alert, Patrick Cox about health care costs and he made some very interesting observations from new research about health care. It seems healthy people pay more for health care than sick people. I asked him to do a write-up for us. Despite the new health care bill that passed, health care costs are going to go up, not down. And that's a good thing, as Pat explains. You really want to read this. Some of you may not be aware that a few months ago I wrote that I was buying stocks for the first time in 12 years, and specifically smaller, transformational biotech stocks. As I wrote at the time, I think that we could see a real bubble in biotech in the latter part of this decade, and just once, please God, I want to be at the beginning of a bubble. Pat is one (and maybe the best) of my "go-to" sources for investment ideas in the biotech space. I have been very pleased w... |

| Monthly Action In Gold From Trader Dan Posted: 02 Jun 2010 06:04 PM PDT |

| Gold in Europe Closes Over €1,000 for the First Time Posted: 02 Jun 2010 06:04 PM PDT All in all, gold didn't do a lot during Tuesday's trading day... and volume wasn't very heavy, either. The low of $1,217 spot was around 2:00 p.m. in Hong Kong trading... and from there, gold rose in fits and starts to its high of the day [$1,229.90 spot] shortly before 11:00 a.m. Eastern time in New York. From that high-water mark, gold got sold off five bucks and stayed at $1,225 spot for the rest of the Tuesday trading session. However, it appeared that three mini break-out attempts during New York trading were quietly, but firmly, sold off. It didn't appear that gold was going to be allowed over $1,230 spot... and it wasn't. Here's the New York trading session on its own. Maybe I'm looking for black bears in dark rooms that aren't there? But I don't think so. Silver's path was similar to gold's... right up until the Zurich and London open at 8:00 a.m. Then silver, platinum and palladium all got it in the neck at precisely the same moment... as go... |

| Posted: 02 Jun 2010 06:04 PM PDT Excerpt from the Hussman Funds' Weekly Market Comment (6/1/10):[INDENT]As we observe the recent oil spill in the Gulf of Mexico, the recent banking crisis, and the ongoing concerns about sovereign debt in Europe, one of the things that strikes me is that few analysts are much good at assessing probabilities for worst case scenarios. We typically refer to the probability of some event Y as P(Y), and write the probability of Y, given some information X, as P(Y|X). So for example, the probability of a vehicle being a school bus might be only 1%, but given some extra information, like "the vehicle is yellow and full of children," the estimated "conditional" probability would go up enormously. ... Similarly, before the housing crisis, it might have been tempting to shrug off mortgage defaults as relatively isolated events, since the price of housing had generally experienced a long upward trend over time. Indeed, historically, sustained declines in home ... |

| LGMR: Gold Should Continue to Rise as World Stock Markets Fall Amid Volatility Posted: 02 Jun 2010 06:04 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:30 ET, Weds 2 June Gold "Should Continue to Rise" as World Stock Markets Fall Amid "Temporary Volatility" THE PRICE OF GOLD in wholesale dealing held near two-week highs against the major reserve currencies in London trade on Wednesday, creeping 0.1% higher from yesterday morning's AM Gold Fix as world stock markets fell for the eighth time in 11 sessions. US Treasury bonds eased back but German and UK debt rose again. Crude oil, base metal and silver prices were little changed. "It took 5 days of trying, but [gold] finally broke above 1218, the 61.8% retracement of the 1249 to 1167 down move," says bullion bank Scotia Mocatta in its latest note, pointing to what technical analysts call a Fibonacci level. "The break of 1218 opens up the potential for a 100% retracement to 1249." "Gold should continue to rise, provided that it stays above its two-month support line [now at] 1179.44," says... |

| Government-Sponsored Housing Fraud Posted: 02 Jun 2010 06:04 PM PDT Market Ticker - Karl Denninger View original article June 02, 2010 06:58 AM It just never ends, does it: [INDENT]The proposed rule would also establish a method for evaluating and rating Enterprise performance in each underserved market for 2010 and subsequent years and describes the transactions and activities that would be considered for compliance. The Enterprises would be evaluated on four statutory assessment factors: 1) the development of loan products new ways to rip people off, more flexible underwriting guidelines willful blindness to unsustainable debt-service ratios, and other innovative approaches to providing financing other ways to rob the taxpaying and homeowning public; 2) the extent of outreach to qualified loan sellers and other market participants; 3) the volume of loans purchased relative to the market opportunities available, subject to the statutory condition that FHFA not establish specific quantitative targets; and 4) the amount of investments and gra... |

| Posted: 02 Jun 2010 06:04 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here June 02, 2010 06:31 AM [LIST] [*]I’ve spoken for months about two geopolitical problems that were at the time not being priced into the market but IMHO would be. One is now staring to (Middle East) and one I expect will later his summer and fall. [*]No such thing my eye [*]Read Tokyo Rose to know what “not” to do and read Jim for some good technical analysis. [*]After 8 straight up days, gold is in need of a short pause. New all-time highs before months end IMHO. [*]The one “western” country I’ve beat the bullish drum about continues to outshine all others. But still no hope for it’s most western major city to ever see Stanley Cup in our lifetime. [*]There’s still hope for America’s greatest neglect to be fixed But how many more must died before this utter nonsense of neglect ends? [/LIST] [url]http://www.grandich.com/[/url] gr... |

| No Escaping Deflation’s Fatal Drag on Economy Posted: 02 Jun 2010 06:00 PM PDT |

| A Primer: Sovereign Debt Defaults = Social Unrest + Much Higher Gold Prices Posted: 02 Jun 2010 05:42 PM PDT |

| Finding Gold and SP500 Low Risk Setups Posted: 02 Jun 2010 05:35 PM PDT |

| Good News for the Grandchildren, Part II Posted: 02 Jun 2010 04:48 PM PDT Excerpted from his presentation to the Ira Sohn Investment Research Conference on May 26, 2010 We should have learned by now that every credit - no matter how unthinkable its failure would be - has risk and requires capital. Just as trivial capital charges encouraged lenders and borrowers to overdo it with AAA rated CDOs, the same flawed structure in the government debt market encourages and therefore practically ensures a repeat of this behavior - leading to an even larger crisis. (Greenlight continues to hold short positions in the common stock of the rating agencies, Moody's and McGraw Hill [owners of S&P]). I remember hearing that the rating agencies would never downgrade MBIA or Fannie Mae...I don't believe a US debt default is inevitable. On the other hand, I don't see the political will to make voluntary efforts to steer the country away from crisis. If we wait until the markets force action, as they have in Greece, we might find ourselves negotiating austerity programs with foreign creditors. Some believe this could be avoided by printing money. Despite Mr. Bernanke's promises not to print money or "monetize" the debt, when push comes to shove, there is a good chance the Fed will do so, at least to the point where significant inflation shows up even in government statistics. That the recent round of money printing has not led to headline inflation may give central bankers confidence additional quantitative easing can be put in place without inflationary consequences. However, printing money can only go so far without creating inflation. Now, government statistics are about the last place one should look to find inflation, as they are designed to not show much. Over the last 35 years the government has changed the way it calculates inflation several times. For example, under the current method, when the price of chocolate bars goes up, the government assumes people substitute peanut bars. So chocolate gets a lower weighting in the index when its price rises. Even though some of the changes may be justifiable, the overall effect has been a dramatic reduction in calculated inflation. According to Shadowstats.com, using the pre-1980 method CPI would be over 9%, today compared to about 2% in the official statistics. While the truth probably lies somewhere in the middle, this doesn't even take into account inflation we ignore by using a basket of goods that does not match the real world cost of living. For example, we all now know that healthcare, which is certainly a consumer good, is about one-sixth of our economy and its cost has been growing at a rapid pace. So what is the weighting of healthcare in the CPI? About 6%. The government doesn't count the part which the consumer doesn't pay out of pocket. So, if your employer has to pay more for your health insurance, it doesn't count, even if it means you have to accept lower wages. Similarly, Medicare cost increases don't count, even though everyone has to pay higher taxes to fund them. Income and payroll taxes, which are part of the cost of living, are not counted in the CPI either. On the other hand, one-fourth of the index is comprised of something called owners'-equivalent-rent. This isn't something that anyone actually pays for. If you own your house, the government assumes you are foregoing rental income. The amount that you could receive from a hypothetical renter - the government implicitly assumes you rent it to yourself - is counted in the basket. So, rising taxes, which you do pay, don't count; the fast rising cost of healthcare, which someone else pays on your behalf, doesn't count; but hypothetical rents which you don't pay, and conveniently don't rise very quickly, have a huge weighting. The simple fact is that if your goal is to never see inflation, you won't see it until it is rampant. Low official inflation benefits the government by reducing inflation- indexed payments including Social Security and Treasury Inflation- Protected Securities. Lower official inflation means higher reported real GDP, higher reported real income and higher reported productivity. Subdued reported inflation also enables the Fed to rationalize easy money. The Fed wants to have an accommodative monetary policy to fight unemployment, which in a new trickle-down theory it believes can be addressed through higher stock prices. The Fed hopes that by keeping rates low, it will deny savers an adequate return in risk-free assets like savings deposits and force them to speculate in stocks and other "risky assets" to generate sufficient income to meet their retirement needs. This speculation drives stock prices higher, which creates a "wealth effect" where the lucky speculators decide to spend some of the gains on goods and services. The purchases increase aggregate demand and lead to job creation. Easy money also aids the banks. Arguably, we still have many inadequately capitalized or insolvent banks. There has been so much accounting forbearance and extend-and-pretend loan collection that it is difficult to get an accurate gauge on the health of the system. However, each week the FDIC seizes more failed banks and when it does so, there are very large losses to the deposit insurance fund. In most cases, the failed banks' most recent financial statements claim that they were solvent which implies that the banks' balance sheets are not stated conservatively. It probably isn't just the banks that fail that are taking advantage of accounting forbearance. As a result, the Fed prefers to keep rates extraordinarily low in an effort to help banks earn back their unacknowledged losses. However, this discourages banks from making new loans. If banks can lend to the government, with no capital charge and no perceived risk and earn an adequate spread walking down the yield curve, then they have little incentive to lend to small businesses or consumers. Higher short-term rates could very well stimulate additional lending to the private sector. Given the enormous gains in the prices of bank stocks, it might be quicker to have banks deal with their questionable assets through additional equity offerings and more aggressive loss reserving than waiting for years for profits from an easy money policy to repair the balance sheets. Easy money also helps the fiscal position of the government. Lower borrowing costs mean lower deficits. In effect, negative real interest rates are indirect debt monetization. Allowing borrowers including the government to get addicted to unsustainably low rates creates enormous solvency risks when rates eventually rise. I believe that the Japanese government has already reached the point where a normalization of rates would create a fiscal crisis. While one can debate where we are in the recovery, one thing is clear - the worst of the last crisis has passed. Nominal GDP growth is running in the mid-single digits. The emergency has passed and, yet, the Fed continues with an emergency zero-interest rate policy. Perhaps, an accommodative policy is still appropriate, but zero-rate policy creates enormous distortions in incentives and increases the likelihood of a significant crisis later. Further, it was not lost on the market that during this month's sell-off, with rates around zero, there is no room for further cuts should the economy roll over. Easy money policy has negative consequences in addition to the obvious inflation of goods and services and currency debasement risks. It can feed asset bubbles, such as the internet bubble and the housing bubble. We know that when such bubbles collapse, there are terrible consequences. Nonetheless, the Fed has a preference to inflate bubbles. Sometimes Fed officials tell us that there is no bubble or that bubbles are hard to identify. Afterwards, they tell us that monetary policy was not to blame. Earlier this year, Mr. Bernanke said that the housing bubble was not caused by monetary policy. Essentially, he did a statistical analysis which found that there are many times when extraordinarily easy monetary policy has not led to a housing bubble. As a result, he argued that one can't generalize that easy monetary policy causes housing bubbles in all circumstances. From this, he reached the dubious conclusion that easy monetary policy was not responsible for the housing bubble he presided over. He must feel it is important to disclaim responsibility for the last bubble at a time where the Fed appears to have a desire to foment a fresh asset bubble. In recent years, we have gone from one bubble and bailout to the next. Each bailout reinforces moral hazard, by rewarding those that acted imprudently. This encourages additional risky behavior feeding the creation of a succession of new, larger bubbles, which then collapse. The Fed bailed out the equity markets after the crash of 1987, which fed a boom ending with the Mexican crisis and bailout. That Treasury financed bailout seeded a bubble in emerging market debt, which ended with the Asian currency crisis and Russian default. The resulting organized rescue of LTCM's counterparties spurred the internet bubble. After that popped, the rescue led to the housing and credit bubble. The deflationary aspects of that bubble popping created a bubble in sovereign debt despite the fiscal strains created by the bailouts. The Greek crisis may be the first sign of the sovereign debt bubble popping. Our gold position reflects our concern that our fiscal and monetary policies are not sufficiently geared toward heading off a possible crisis...We own gold and some gold stocks for our investors and ourselves. We will worry about the grandchildren later. David Einhorn |

| Posted: 02 Jun 2010 04:42 PM PDT Gold is still getting up. Hemlines are going down. That's all you need to know. Gold rose toward $1,230 yesterday. Why? Reports said investors were worried about Europe. Well...yes...Europe...and Asia...and North America... The problem in the world economy is debt. There's too much of it. Investors who aren't delusional know that too much debt spells trouble. And when government adds more debt it's not really going to make things better. It's going to make them worse. What kind of trouble will it cause? Well, that's what we're going to find out. Inflation...deflation...bankruptcies...defaults...bear markets...our guess is that we're going to see it all. But not necessarily in that order. Gold buyers are stocking up on insurance against trouble. They're using GLD - a gold ETF - as a kind of "people's central bank." It's a way of maintaining do-it-yourself monetary reserves. (More on the vernacular gold standard...below...) The private sector is now de-leveraging - getting itself out of debt. Banks are building up their own reserves. Corporations are cutting spending and beefing up profit margins. Households are cutting back too. Everybody wants reserves. But reserves take money out of the active economy...causing the symptoms that are so disturbing to economists and politicians - unemployment, bear markets, and deflation. Doesn't bother us. We like corrections. They wipe away mistakes and set the stage for new growth. And as near as we can tell everything is still happening as it should. The private sector went too far into debt. Now, it's straightening itself up. We were puzzled when savings rates declined earlier this year. It looked like our de-leveraging hypothesis might be wrong after all. But why shouldn't savings go down. Consumers are probably as confused as Nobel prize-winning economists, Fed chairmen and the US Treasury Secretary. They probably thought the economy really was recovering. So why not spend? But then, the savings rates rose again...and de-leveraging was back on course. The next problem is in the public sector. As expected, governments reacted to the debt problem by going deeper into debt! And now, they're in trouble too. Small sovereign governments...as well as state governments - have already begun to de-leverage too. The bond market told them to cut back; who were they to argue? Meanwhile, investors who are paying attention are selling. Alan Abelson reports that the smart money is getting out of stocks. Insiders are selling 3,933 shares for every one they buy, he says. This sends stocks lower too. Yesterday saw another 112-point drop in the Dow, for example. But investors should be more careful. When they dive into the bushes for cover, they roll right into the poison ivy. They try to protect themselves from stocks and Greek debt by buying US debt. They feel safe. For a while, they are safe. Then, they start to itch! And more thoughts... We asked Henry what he was going to do this summer. "Get a job" is the normal answer. But where? The New York Times:

- If you think gold is moving up now...just wait. A dear reader from Slovenia reports: "The Greek Central Bank is selling one ounce gold equivalents as high as $1,700 (40% over spot), and prices on the black markets are even higher. The punchline, as Athens slowly returns to a forced gold standard: 'A popular spot for street vendors to sell their coins is near the Athens Stock Exchange. There the traders wait for citizens to bring payments received from unloading their paper assets like stocks and bonds.' "I've just spoken with the head of Slovenia's (historically) first and biggest bullion dealer and got the info, that demand is so big that waiting time for acquiring the physical stuff is about 3 weeks long and that reserves are at an all time low. In her words, the situation is comparable if not even more dire than the last time this happened, which was in 2008." - This is an email from yesterday from neighboring Austria: "i am sorry that i have to tell you that it is now not possible for me to order gold coins, they told me that maybe in september it is possible again. "But we have the chance that a customer will sell us the coins you would like to have! So i will give you information when i have the desired coins." - Our own ace researcher for the family office, Charles Delvalle, seems to have his eye on other things. The "Hemline Index" was first developed by technical analyst/economist George Taylor in 1926. It gained popularity around the 1929 stock market crash. The theory states that the stock market rises and falls with women's hemlines. Below is a famous graphic depicting the stock market and hemlines from 1897 to 1990 constructed by Alan Shaw's legendary technical analysis group at Smith Barney. If this theory still holds, the story below is a bearish indicator for the stock market.  From The New York Times:

Regards, Bill Bonner |

| Debating Bartlett: Would Raising Taxes Reduce Our Trade Deficits? Posted: 02 Jun 2010 04:35 PM PDT Howard Richman submits: In a recent blog entry (The National Debt and National Security), conservative economist Bruce Bartlett advocates raising taxes in order to reduce our trade deficits so that we can stop borrowing so much money from China. Bartlett is clearly thinking about the right problems. In this blog entry he shows that he understands the negative national security implications of borrowing money from China. He also shows that he understands that trade deficits slow our economic growth. He thinks that raising taxes would balance our budgets which would cause us to borrow less money from China. His goal is to enhance domestic investment, specifically: Complete Story » |

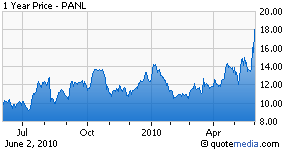

| Universal Display, A Standout in a Tough Tape Posted: 02 Jun 2010 04:32 PM PDT The Inflection Point submits: I visited Universal Display (PANL) about 14 months ago when I wrote in a Seeking Alpha article that “Universal Display should ride the growth in OLED TV monitors.” In recent days, Universal Display is gaining traction but its potential is driven more by the OLED mobile market than by the OLED TV monitor market. The company’s move into the OLED TV market still might happen, but Universal may be gaining more momentum in the mobile market where its partner Samsung is expanding rapidly. According to a report June 1st from analysts Jonathon Dorsheimer and Josh Baribeau at Canaccord, “Samsung expects to ship 600 million small area mobile displays by 2015.” The analysts also noted that Samsung should play an important role for this growth as “OLED technology has become the standard” and that Universal “owns the key patent.” The analysts at Canaccord have a $22.50 price target on the stock and rate it a buy. Insider activity at Universal Display is notable since one director, Lawrence Lacerte, seems to have been especially prescient over the years, buying shares between $5 and $14, and selling some between $15 and $20. This time since the stock has moved above $15, Mr. Lacerte has not yet sold. The average analyst estimate for 2011 is for an EPS loss of $0.10 and revenues of $35.3 million. Canaccord analysts are more bullish with their 2011 EPS estimates at +$0.66 on revenues of $68 million. In 2012, Canaccord estimates EPS of $1.50 on revenues of $112 million.  What is interesting to note is that the shorts have taken a fairly substantial position against the stock with about 5.5 million shares or 20% of the float short the stock. Putting myself in their shoes, they likely think that a company with small revenues and one that has lost money and continues to do so is a stock that could fall. There is some validity to these points, as the company has shown promise for years but the OLED market has not yet met its full potential. The company is burning through cash, has inconsistent revenues, and its future revenues will depend on how well companies that use Universal’s patents sell their products. Other risks include competition from Kodak (EK) and Fuji (FUJI). Universal Display also has negative trailing twelve month EBITDA of about $15 million even as trailing twelve month revenues have risen by 50% to $17 million. Universal Display has no debt and around $60 million in cash. What is interesting to note is that the shorts have taken a fairly substantial position against the stock with about 5.5 million shares or 20% of the float short the stock. Putting myself in their shoes, they likely think that a company with small revenues and one that has lost money and continues to do so is a stock that could fall. There is some validity to these points, as the company has shown promise for years but the OLED market has not yet met its full potential. The company is burning through cash, has inconsistent revenues, and its future revenues will depend on how well companies that use Universal’s patents sell their products. Other risks include competition from Kodak (EK) and Fuji (FUJI). Universal Display also has negative trailing twelve month EBITDA of about $15 million even as trailing twelve month revenues have risen by 50% to $17 million. Universal Display has no debt and around $60 million in cash.However, the company and stock reminds me of a biotech stock: one that has decent insider ownership, with great technology, but small revenues and a cash burn. If the OLED mobile market takes off and if Universal forges financially beneficial relationships with mobile device makers like Samsung that use Universal’s OLED patents, then Universal could have strong potential. From the 2009 10-k, Universal Display “entered into license agreements with Showa Denko, Konica Minolta, Samsung SMD, DuPont Displays and Seiko Epson.” In 2009, it sold proprietary phosphorescent OLED materials to Samsung SMD, LG Display and Tohoku Pioneer for use in commercial OLED display products.” The one spoiler has always been the timing. For years, OLED technology was supposed to be a hit, but it and Universal’s day always seemed distant. Now, the potential seems closer than ever to be materializing. The mobile market, and Universal Display’s relationship with Samsung (SSNLF.PK), could be the catalyst to drive the company and the stock forward. - By Tom Henderson, Strategist JBH Capital. Information sources include the Edgar web site, SEC From 4 web site, and Yahoo Finance. Disclosure: No position Complete Story » |

| Gold Seeker Closing Report: Gold and Silver Fall Slightly While Stocks Gain Over 2% Posted: 02 Jun 2010 04:00 PM PDT Gold fell back off in London to as low as $1213.85 by about 10AM EST before it rallied back to almost unchanged near $1225 at around noon, but it then fell back off into the close and ended with a loss of 0.41%. Silver fell to as low as $18.075 by about 9AM before it climbed back higher for most of the rest of trade, but it still ended with a loss of 1.35%. |

| Posted: 02 Jun 2010 03:55 PM PDT How about that? The "explosive short-term rally" we wrote about yesterday exploded overnight in New York. It's exploding here in Australia right now. The Dow was up 2.3% and Aussie stocks are already up nearly 2% before noon. Does this mean stocks are good value for money at these prices? Not according to the charts published in the Reserve Bank of Australia's most recent chart book. The first chart below shows that the price-to-earnings ratio on an index of Australian stocks actually exceeded all other peaks late last year and early this. Stocks were definitely not cheap.  Now it's not clear if the P/E ratios above are based on trailing or forward earnings. It's most likely forwards earnings estimates. And if that's the case, it tells you how useless earnings estimates are. If analysts get it wrong using P/E ratios to tell you if stocks are cheap doesn't help you much. What's more, the way modern accounting works, earnings can be pretty much whatever you want them to be. What about dividends? Stocks are usually a buy when yields peak. For one, at bear market bottoms when no one wants to own stocks, companies forced to pay out more in earnings to attract equity buyers. Secondly, economic troughs are accompanied by higher interest rates. The higher interest rates in the real economy are usually matched with higher yields on corporate bonds and larger dividends. But as you can see from the second RBA chart below, yields above six percent on Aussie stocks are a kind of buy signal. Of course yields DID spike above six percent last year, but this was more a function of the crash in shares than a genuine cyclical bottom. You can also see that last year's spike in yields was much more abrupt compared to the previous peak over six percent prior to the bull run of the early 1990s. Why?  In a normal economy - one without so much interest rate intervention - the economy would move from boom to bust more gradually. With GDP and earnings growth investors would pay a premium for stocks offering capital gains. During recessions or periods of slower growth, they'd shift to more defensive yield plays. But we live in an abnormal financial world. Interest rates are whipsawed up and down as central banks try to prevent deflation in asset markets and inflation in consumer prices (which would alert the public to the nature of the fiat money scam). In other words, last year's spike in yields did not indicate that stocks were cheap. What would? Well you'd have to look at something more fundamental like intrinsic value. For example, we read this paper earlier today by Societe General analyst Dylan Grice. He makes the quite compelling argument that certain risk assets are most prone to the inflationary effects of quantitative easing programs by central banks (which he assumes we'll see a lot more of). But which risk assets? Equities? You bet. But only equities that are relatively undervalued on an intrinsic value to price ratio (IVP). Without going into the mechanics of the IVP (which presumably includes price divided by something like net equity or net tangible asset value), it's worth noting that many of the stocks Grice flagged up as trading at or below intrinsic value were in oil and gas or metals and mining. Why are those stocks trading below intrinsic value? Hmm. It could be the huge uncertainty hanging over both industries as a result of new regulatory threats (the threat to offshore drilling from the BP fiasco in the Gulf of Mexico and threat to miners from other governments replicating the Rudd assault and battery on mining profits). So there is intrinsic value at a discount. And that, as our friend Greg Canavan pointed out in his latest alert, gives you some margin of safety. But it doesn't guarantee prices will go up. Grice adds that, "Buying expensive risk assets on the view that they're going to become more expensive is a dangerous game to play, but since government funding crises hammer risk assets while printing money inflates them, such funding crises should present decent value opportunities to buy into beaten up assets before the inflation ride." Grice is essentially saying stocks are a hedge against inflation. If true, certainly puts yesterday's market rally into perspective. But it also shows you the inherently speculative nature of investing in stocks when asset markets are rigged by central bank money printing policies. It also points out that gold has intrinsic value in the sense that it is intrinsically scarcer than paper money. For what it's worth, Grice's formulation does sound right. He writes that, "With government balance sheets in such a mess across the developed world (even with yields at historically unprecedentedly low levels), government funding crises are likely to be a recurring theme in the future. Since banks hold so much 'risk free' government debt, those funding crises point towards more banking crises which point towards more money printing." When and how it stops is a good question. But arguably, it's just begun. The money printing, that is. And if that's the case, equities are a theoretic but highly speculative hedge against inflation. When you think about it, though, that doesn't much sound like stocks are a fundamentally good investment now, does it? Even if they are a good trade. Meanwhile, the debate about RuddTax continues. Last night over pasta and prawns and a bottle of beer we read our friend Dr. Marc Faber's latest report in which he writes:

Mmm hmm. It makes sense intuitively that higher mining taxes will lower production, although the government has claimed the opposite. Dr. Faber's contention that higher global taxes on mining will also lead to lower production of commodities is arguably bullish for resource prices, but only for the companies that can afford to stay in business to produce them. His main point, though, is that high taxes might boost short-term government revenue. But that higher taxes - no matter how good they may feel to impose if you like sticking it to the miners in the name of the people - don't and can't increase long-term standards of living in Australia. Only wealth creation and increases in productivity can elevate standards of living. No amount of government wealth redistribution will change that. The more of present production the government consumes, the poorer it makes everyone over time. Dan Denning |

| How Soon Might Greece Default? Posted: 02 Jun 2010 03:54 PM PDT Felix Salmon submits: I spent most of this afternoon attending a fascinating discussion looking at Greece from the perspective of emerging-market veterans who are used to sovereign debt default and restructurings. There was quite a lot of consensus on the panel, and not in a good way: everybody agreed that the bailout of Greece was only postponing the inevitable, and many people reckoned that it wasn’t going to postpone it very long: one pair of hedge fund managers in the audience reckoned that it would last about six months before the default finally happens. The form of the default, too, seemed pretty clear: an act of parliament in Greece would do most of the work, given that most Greek debt is issued under Greek law. It will be a par exchange — the new bonds will have the same face value as the old bonds, but with lower coupons and extended maturities — so that with a bit of accounting fudgery, no banks would need to mark their Greek debt to market and take a huge loss. And Greece, in a fiscal bind, will probably at some point start issuing its own scrip alongside the formal national currency of the euro, much as California did in 2009. Complete Story » |

| Europe’s Media Warn of Global Social Unrest Posted: 02 Jun 2010 03:27 PM PDT When Karl Marx wrote in the Communist Manifesto that "a spectre is haunting Europe," he did so on the eve of the revolutionary eruptions that began in Italy and France in 1848 and engulfed much of the European continent. In recent days, a number of media commentaries have predicted a similar eruption of social unrest of revolutionary dimensions as a direct result of the worsening economic crisis. These warnings are accompanied by dire predictions that Europe will suffer the return of nationalist tensions, the emergence of fascist movements and even war. Writing in the Financial Times May 24, for example, historian Simon Schama stated, "Far be it for me to make a dicey situation dicier but you can't smell the sulphur in the air right now and not think we might be on the threshold of an age of rage.… in Europe and America there is a distinct possibility of a long hot summer of social umbrage." Schama notes that there is often a "time-lag between the onset of economic disaster and the accumulation of social fury," but after an initial period of "fearful disorientation," there comes the danger of the "organised mobilisation of outrage." This outrage will be directed against the super-rich and those seen to be responsible for the crisis, he writes, comparing "our own plutocrats" with the financiers so memorably targeted during the French Revolution of 1789 as "rich egoists." In the Observer of May 30, Will Hutton, its former editor and now an advisor to the British Conservative-Liberal Democrat coalition government on cutting public sector pay, declares, "The future of Europe is in the balance. The potential disintegration of the euro will be a first-order economic and political disaster. Economically, it will plunge Europe into competitive devaluations, debt defaults, bank bailouts, frozen credit flows, trade protection and prolonged stagnation. (snippet) Celente explains, "What's happening in Greece will spread worldwide as economies decline.… We will see social unrest growing in all nations which are facing sovereign debt crisis, the most obvious being Spain, Ireland, Portugal, Italy, Iceland, the Ukraine, Hungary, followed by the United Kingdom and the United States." Calliol states, "This crisis is directly connected to the end of the world order as we know it since 1945—and even earlier since the European colonisation process. Therefore, the whole global fabric centred on the US for 60 years is slowly collapsing, generating turmoil of all sorts." Asked where social unrest will end, she replies, "War. It's as simple and as horrifying as that." |

| Posted: 02 Jun 2010 02:56 PM PDT

home: Golden Jackass website subscribe: Hat Trick Letter Jim Willie CB, editor of the "HAT TRICK LETTER"

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Natural forces are at work in Europe, powerful forces, in fact forces that are not evident. It is amazing how little the financial analysts notice the forces at all. Since the year 2007, a hidden force began to put pressure on the European Union financial underpinning. Like any fiat currency, the foundation resorts to debt. It came to my attention almost three full years ago that Spanish EuroBonds had a yield slightly higher than the benchmark German. Commentary swirled that the EuroBonds were not homogeneous, and therefore the Euro currency was badly flawed. They were identifiable by the markings on the bond IDs. German EuroBonds carry an 'X' in the ID. So the arbitrage professionals went to work, buying the German and selling the Spanish bonds. The flaw was to the structural foundation to the Euro currency, not the market that traded them, surely not the alert speculators. In time, the Greek, Italian, and Portuguese bonds, even the Irish bonds, showed significant separation from the German benchmark. Last December, the Greek bond broke first. Its arrival to the crisis was not part of evolution (natural selection) as much as European tribal leader selection. Greeks are neither Latins nor Teutonics. The bust of the EuroBond structure invites the arrival of a gold-backed currency, urgently needed to provide stability.

A second natural force has arrived in the gigantic bond marketplace. While as many political analysts as financial analysts promote the wisdom of a preserved European Union, and a shared Euro currency across that union, a natural force works to separate the entire group of PIGS nations. Refer to Portugal, Italy, Greece, and Spain. As much force comes from the Nordic Core power center to push the PIGS nations away from the common European financial structure, as does the force from the PIGS nations to sever ties and go it alone. A German banker contact has repeated an important point on numerous occasions. The European Monetary Union experiment has cost the nation of Germany over $300 billion per year, all for what clearly appears to be a welfare program directed toward the benefit of wasteful inefficient nations not deserving of a low bond yield. After ten years, the cost has been $3 trillion to Germany. It is not a matter of German willingness to continue the Southern Europe Welfare Program, as much as their ability to continue. They cannot continue. They cannot afford it.

My forecast made since January was that Germany would not aid Greece, but would say all the right things. Their leaders did occasionally show human tendencies, like when some critics claimed Greece possessed innate specialty in dance, drink, and song. My longer standing forecast is that all PIGS nations would revert to their former currencies, the Greeks to the Drachma, the Italians to the Lira, the Spanish to the Peseta, and the Portuguese to the Escudo. The forecast is of decentralization and increased local autonomy. However, and very importantly, the path is a very slow one with political obstacles, face saving requirements, economic pressures, and social pressures too. Notice the Germans appeared to be cooperative in aiding Greece, but when money had to be committed, arguments ensued surprisingly. Not a surprise to the Jackass. The German High Court will surely reject both the Greek aid and the Euro usage itself, all in time.

ADVANTAGES OF REVERTED CURRENCY The political ideals of a unified Europe are all well and good, but might be fantasy built upon folly in ignorance of practicality. The national differences are significant in work habits, industrial efficiency, tax structure, credit practices, federal bureaucracy load, economic diversity, educational depth, native intelligence, demographic makeup, arable land & sunny climate, and more. The pursuit of a unified Europe has proved elusive for a millennium. Not gonna go there here. The pope in the Dark Ages had the most success, except that its church accumulated an outsized collection of wealth, even in the form of gold, enough to be a clandestine global player.

Enter the London financial analysts and economics brain trust. They have entered the room with some interesting counsel, not the typical self-serving defense of their system. Instead, a prominent think tank suggests to Athens leaders a debt default and return to the Drachma currency. Greece is urged to leave the Euro currency. We are moving gradually toward a restructure of Greek Govt debt, and a corresponding stimulus to the Greek Economy via devalued currency. When tied to the Euro currency yoke, such a Greek stimulus is impossible. British economists advise Athens to abandon the Euro and default on its €300 billion debt under the basic motive to save its economy. The Centre for Economics & Business Research (CEBR) out of London has warned Greek Govt officials of the horrible bind. The CEBR believes Greece will be unable to escape a debt trap without devaluing their own currency to boost exports. Greece must pursue economic expansion, but cannot with the Euro straitjacket. The only workable path is for Greece to return to its own currency, the Drachma. To date, the EU Bailout is a poorly disguised rescue for German and French banks, even London banks. The dirty secret across Europe is that the major nations all own a huge raft of PIGS debt, and each nation within the PIGS pen all own a huge raft of the same debt. Any departure by Greece from the Euro would create a grand shock for banks across all of Europe, cause great disruption, and subvert the banker plan for their latest welfare program in continuation of public governmental adoption. It all ends in ruin.

Doug McWilliams is chief executive of the CEBR. He said "Leaving the Euro would mean the new currency will fall by a minimum of 15%. But as the national debt is valued in Euros, this would raise the debt from its current level of 120% of GDP to 140% overnight. So part of the package of leaving the Euro must be to convert the debt into the new domestic currency unilaterally… The only question is the timing. The other issue is the extent of contagion. Spain would probably be forced to follow suit, and probably Portugal and Italy, though the Italian debt position is less serious." McWilliams called the move virtually inevitable (in his words) but he minimizes the devaluation potential. See the Business Times article (CLICK HERE).

The advantages are as numerous as they are deep, all significant.

Defaulted Restructured Debt: A return to the Drachma currency would enable a restructure of the Greek Govt debt. Look for at least a 50% debt reduction, but against a currency devaluation. The Athens leaders can win a very large portion of debt forgiveness, or else threaten default. European banks will choose a writedown rather than a total wipeout loss. These bankers will realize the futility of carrying full debt on their books, all too aware of the poison pill nature of the compulsory austerity programs heaped upon Greece.

Economic Stimulus: A return to the Drachma currency would enable a strong stimulus to the Greek Economy. Nothing is free, however. Currency devaluation is a double-edged sword. The benefit to be realized with cheaper exports (including tourism) will be offset by higher energy costs and other import costs (like cars, cellphones, and machine equipment). The historical effective tool is for a currency devaluation, one that leads to valid stimulus but with a steady dose of price inflation. Greece, like other European nations, is no stranger to socialist solutions to spread the misery.

Poison Pill Revenge: A return to the Drachma currency would enable a national rejection of the IMF/EU poison pill solution. The austerity measures have no precedent of effectiveness. They are ruinous, lead to greater federal deficits, worse unemployment, and more social disorder, yet the Banker Elite continue to push such non-solutions. Rejection of the austerity programs would incite a national rally of pride and celebration. Obviously, when Greek reverses the austerity cuts, the maneuver would ensure a second thump one year afterwards. Bloated government payrolls would remain, at a heavy cost. The Drachma would suffer a continued devaluation later on. Stimulus would be required in additional doses. The shared pain from price inflation would follow.

Autonomy & Control: A return to the Drachma currency would enable a national movement for the Greek people to take control of their fate. Their population feels on the receiving end of dictums and forced solutions, complete with massive job layoffs and budget cuts. They detect duplicity, since other nations in Europe are in violation of guidelines. Nevermind that something like 11% or 12% of all Greek jobs are located within the government sector. Turn a deaf ear to the rampant tax evasion and other corruption that might be more prevalent than Italy. The psychological benefit to a reversion to the Drachma is to spit in the faces of bankers and to take the reins of national control. This has a value in national pride and spirit, which ironically would avoid most internal reform.

PRECURSOR TO NEW NORTHERN EURO Prepare next for a Euro currency with a more trim look, one with the PIGS fat trimmed off. The next three big big shoes are about to hit the floor, with severe crises erupting much worse for Spain, Portugal, and Italy. Banks in those nations will suffer failures, liquidations, stock declines, CDSwap contract rises, rescue requests, mergers in desperation, and more. These three nations represent the remainder of the famed PIGS descriptor, as Greece has captured far too much news and attention. When the Greek Govt debt news broke out and was developed from February through May, was Spain deeply committed to reform? NO! Was Spain deeply involved in liquidations and bank asset writedowns? NO! They delayed. Attention turns to the other PIGS in distress. Greece has served to distract attention not just from the other PIGS nations but from the United States and United Kingdom as well. Sovereign debt default will not end as a story until the USTreasurys and UKGilts default, even if technical defaults. All four PIGS nations will be removed from formal Euro currency participation. Economics and nationalism dictate it.

Prepare next for a Euro currency with a more trim look, one with the PIGS fat trimmed off. As the PIGS sovereign debt is discharged, written down, and defaulted, the demand will increase for the survivor Euro core, the healthy strong core. The new Northern Euro currency will initially be comprised of a PIGS-less Euro, which awaits on the other side of the door, here and now. The PIGS-less Euro currency will have much less debt to refinance in the short horizon. The PIGS-less Euro currency will have much stronger fundamentals with smaller annual deficits and better looking debt ratios versus economic size. The PIGS-less Euro currency will have a much healthier trade surplus picture. The PIGS-less Euro currency will realize much greater respect in a faith-based fiat world. But it is a transition vehicle.

The events in the next few months regarding the European Monetary Union are set to accelerate rapidly. |

| Warren Buffett on the Housing Bubble Posted: 02 Jun 2010 02:34 PM PDT During today's Financial Crisis Inquiry Commission hearing on the role of the ratings agencies in the financial crisis, the Oracle of Omaha looks back at the housing bubble. Buffett: "The early Cassandras do look foolish … when your next door neighbor is making money very easily by buying a second house with a very small downpayemnt, after a while it sort of gets to you and maybe you figure you should be doing it too." |

| Posted: 02 Jun 2010 02:17 PM PDT The ECB has released what appears to be a manga-like brainwashing cartoon geared at kindergarteners which in 8 minutes seeks to explain "price stability" within a Keynesian framework (i.e. inflation in the 0-2% range). We assume this is a failsafe precaution, just in case the religious Keynesian teachings during Econ 101 over at Harvard and Cambridge happen to occur at the not so malleable age of 18+. After all, what better way to preempt Hayek's terrorist influence on young and tender minds than to enslave them real early. We wonder if this is not also a post-facto attack at German politicians who are now openly accusing the ECB of pursuing monetization policies which every now and then tend to lead to a Weimar-like conclusion. Keynes: for ages 8 to 80. h/t Nicholas |

| Look how easy it is to manipulate a London futures market Posted: 02 Jun 2010 02:11 PM PDT Broker Fined for Market Abuse in FSA Crackdown By Javier Blas http://www.ft.com/cms/s/0/16e786d4-6e93-11df-ad16-00144feabdc0.html A commodities broker was fined for market abuse on Wednesday in the first such action by the Financial Services Authority. The move is a sign that the City regulator is starting to crack down on price manipulation in the London-based raw materials markets. The UK is home to the world's second-largest commodities centre, after New York, with trading in important benchmarks including Brent oil, copper, aluminium, gold, silver, white sugar, cocoa, and coffee. ... Dispatch continues below ... ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php The UK watchdog's move comes after the US regulator, the Commodity Futures Trading Commission, toughened its approach. The FSA said it had fined Andrew Kerr, a former broker at Sucden Financial, L100,000 and banned him from working in the financial industry. Mr Kerr has agreed to settle the case. The regulator said Mr Kerr "deliberately manipulated" the Liffe robusta coffee futures and options markets on August 15, 2007, on behalf of a client, which it did not identify. It is unclear whether the FSA will take action against the client, but coffee market participants said it was likely to do so. Mr Kerr organised a series of trades during a key period of the day, which serves to price options, to boost artificially the price of coffee futures, the FSA said. Mr Kerr moved the market to $1,752 a tonne, up from about $1,145. The "small size of the coffee futures market meant that it was particularly vulnerable to price manipulation," the FSA said. "Mr Kerr's financial benefit from the market manipulation was limited to his commission," the regulator said. But it added he was "doubtless motivated" by a desire to attract further business. Brokers estimated the commission at as low as $100 and no more than $500. Sucden Financial is owned by sugar trading house Sucres et Denrées of France. Tariq Ahmad, director of strategy, said that Mr Kerr left 15 months ago. "The FSA had no criticism of Sucden Financial's supervision, or internal procedures." * * * Join GATA here: World Resource Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Coming Friday-Sunday, June 11-13, at the Dallas-Fort Worth Airport Marriot: The conference will explore the dangers and opportunities in today's bullion markets and the need for investors to diversify bullion holdings outside of bullion banking and commodities markets. Speakers will include David Morgan of Silver-Investor.com, Gold Anti-Trust Action Committee Chairman Bill Murphy, and Duncan Cameron and Philip Judge of Anglo Far-East Bullion Co. The earliest conference attendees on Saturday will be able to schedule one-on-one interviews for personal consultation with Anglo-Far East's experts on Sunday. To learn more about and register for the Anglo Far-East Bullion conference, please visit: http://www.anglofareast.com/seminar-registration/ |

| Euro-Risky Asset Decoupling Redux Posted: 02 Jun 2010 01:51 PM PDT Last night's decoupling (albeit subsequent recoupling) between the Euro and risky assets (in our case the ES) was the second time in as many weeks that the European currency has openly decoupled from the rest of the risky market. Granted, last night the decoupling lasted for just 12 hours, and the resultant spread collapse generated some 70 bps in P&L. We were not the only ones who noticed the original schism: here is Bank of America's Hans Mikkelsen discussing this increasingly more frequent decoupling event. To date, the decouplings have been temporary. Which is the case until it isn't: any time a trade looks too good to be true, it isn't. Unless one is trading against a retarded army of Dark Avenger-infected 80286s.

|

| Strategic Defaults: Is It Morally Right To Decide To Simply Stop Paying Your Mortgage? Posted: 02 Jun 2010 01:18 PM PDT

The truth is that the answers to these questions are not easy. In the past year it is estimated that at least a million Americans who can afford to stay in their homes simply walked away. Take a moment and think about that. A million Americans that have simply walked away from their homes. This is something that is absolutely unprecedented in American history. In fact, 31 percent of all foreclosures in March were deemed to be "strategic defaults" by researchers at the University of Chicago and Northwestern University. That is up from just 22 percent in March 2009. So the strategic default trend is accelerating. And with more than 24% of all homes with mortgages in the United States underwater as of the end of 2009, it is likely that we are going to see a whole lot more strategic defaults. This is particularly true in areas that were hurt the worst by the real estate crash. In Arizona for example, it is estimated that 50 percent of all homes are underwater, and in Nevada it is estimated that a whopping 65 percent of all homes are underwater. That is a whole lot of families that have some very hard decisions to make. But it just isn't families that are making these kinds of decisions. Even the biggest financial institutions in the United States have committed strategic defaults. For example, Morgan Stanley walked away from five San Francisco office buildings they bought at the height of the real estate boom. But is it the right thing to do? Well, let's look at both sides of the issue. Why many would say that strategic defaults are morally acceptable.... Many Americans have no problem at all walking away from their mortgages. After all, they would argue, they never agreed to pay twice what a house is worth. If they signed up for a $400,000 mortgage, they would argue that they expect to be making payments on a house that is worth somewhere around $400,000. So is that unreasonable? After all, if a $400,000 house goes down to $200,000, there are many that would argue that it represents an unforeseen circumstance that negates the deal. Others would argue that bankers tricked millions of Americans into accepting mortgages that they could not possibly afford, and therefore nobody should be crying for the bankers when people quit paying on those mortgages. In essence, the argument is that the bankers created this mess so the bankers should be the ones to pay the penalty. Still other Americans are choosing strategic defaults because it enables them to provide for their families during these hard economic times. For many Americans, often the choice is between paying the mortgage and putting food on the table. And because of the massive delays in processing foreclosures these days, many people are finding that they can live in their homes "rent free" for months on end after they stop making payments. In fact, Bank of America's credit loss mitigation executive, Jack Schakett, has even acknowledged that many home owners have a huge financial incentive to walk away: "there is a huge incentive for customers to walk away because getting free rent and waiting out foreclosure can be very appealing to customers." So how much "free rent" are those who have walked away from their mortgages getting? According to LPS Applied Analytics, the average home owner in foreclosure has been delinquent for 438 days before actually being evicted. That is up from 251 days in January 2008. The truth is that especially in states where the foreclosure process must go through the courts, the systems are simply being overloaded. For example, in Pinellas and Pasco counties, which include St. Petersburg, Florida and the suburbs to the north, there are 34,000 open foreclosure cases. Ten years ago, there were only about 4,000. But there are others that would argue that strategic defaults are 100 percent morally wrong. Why many would say that strategic defaults are morally wrong.... Those who would say that strategic defaults are wrong would argue that no one put a gun to the head of anyone signing up for a mortgage. They would argue that "a contract is a contract" and that Americans should fulfill their obligations, no matter how hard it hurts. The truth is that once upon a time in America, a "strategic default" would have been unimaginable to most people. Back then, a man was only as good as his word. Even today, to purposely break a contact is on the same level as purposely telling a lie to many people. Not only that, but the reality is that a strategic default will ruin your credit for years to come. Many would argue that it is immoral to ruin your family credit for the simple convenience of getting out of a bad mortgage. In addition, many would argue that it is wrong to take advantage of the banks by exploiting the delay in foreclosure processing - no matter how evil the banks have been. After all, do two wrongs make a right? Plus, in some states there may be additional financial penalties even after you walk away. Kyle Lundstedt, the managing director of Lender Processing Service's analytics group says that those who do willingly walk away from their homes are playing a very dangerous financial game.... "These people are playing a dangerous game. There are processes in many states to go after folks who have substantial assets postforeclosure." Plus, those who do commit strategic defaults raise borrowing costs on the rest of us. In the future, banks are going to have to charge all of us higher interest rates on our mortgages in order to factor in the risk that many Americans will simply walk away from their mortgages if their house values go down. So is it right for everyone else to suffer in the future so that some can get out of bad mortgages right now? The truth is that it is not the purpose of this article to answer these questions. The purpose of this article is simply to raise these questions. We live in unprecedented economic times, and we are all going to be faced with very hard decisions as we move into a very uncertain future. Strategic defaults pose some very interesting moral dilemmas, and if you ask 10 different people about strategic defaults you are likely to get 10 different opinions. So what do you think about strategic defaults? Is it morally right to decide to simply stop paying your mortgage? Feel free to leave a comment with your opinion.... |

| Peter Grandich: An open letter to GATA Chairman Bill Murphy Posted: 02 Jun 2010 12:44 PM PDT 8:40p ET Wednesday, June 2, 2010 Dear Friend of GATA and Gold: Prompted by a critical reference to GATA from Dennis Gartman in his market letter today, market analyst Peter Grandich has written "Open Letter to Bill Murphy" crediting GATA's chairman with keeping him riding the gold bull. You can find Grandich's commentary at his Internet site here: http://www.grandich.com/2010/06/open-letter-to-bill-murphy/ Grandich also today gave an interview to GoldSeek Radio's Chris Waltzek, warning gold investors that they should give up looking for mainstream financial media commentary favorable to gold, the media's livelihood being drawn from interests antithetical to gold. Grandich's interview with GoldSeek Radio is 27 minutes long and you can listen to it here: http://radio.goldseek.com/nuggets.php CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy to Become Coal Producer This Year Prophecy Resource Corp. (TSX.V: PCY) announced on May 11 that it has entered into a mine services agreement with Leighton Asia Ltd. to begin coal production this year. Production will begin with a 250,000-tonne starter pit as planned in August, with production advancing to 2 million tonnes per year in 2011. Prophecy is fully funded to production and its management team includes John Morganti, Arnold Armstrong, and Rob McEwen. For Prophecy's complete press release about its production plans, please visit: http://www.prophecyresource.com/news_2010_may11.php Join GATA here: World Resource Investment Conference * * * Support GATA by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Coming Friday-Sunday, June 11-13, at the Dallas-Fort Worth Airport Marriot: The conference will explore the dangers and opportunities in today's bullion markets and the need for investors to diversify bullion holdings outside of bullion banking and commodities markets. Speakers will include David Morgan of Silver-Investor.com, Gold Anti-Trust Action Committee Chairman Bill Murphy, and Duncan Cameron and Philip Judge of Anglo Far-East Bullion Co. The earliest conference attendees on Saturday will be able to schedule one-on-one interviews for personal consultation with Anglo-Far East's experts on Sunday. To learn more about and register for the Anglo Far-East Bullion conference, please visit: http://www.anglofareast.com/seminar-registration/ |