Gold World News Flash |

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week

- Anybody Here a "Silver Snowball" Member?

- Re-Animating a Debt Dog

- Charles Oliver: Gold Headed to $2,000 in Two Years

- Gold for Defense. Gold Stocks for...?

- Navigating the Other Side of the Storm

- Peter Grandich on the Korelin Economics Report

- Jim?s Mailbox

- The Cross Currents In Gold

- In The News Today

- This Morning?s Blatant Gold Intervention

- A look at some stock market "echoes"

- BP’s Continued Existence Seen Coming Under Threat as Gulf Oil Spill Continues

- GLD ETF Adds Another 684,832 Troy Ounces

- Buffett Warns of Municipal Debt Meltdown.. Chaos of the Bilderbergers?

- How To Stop The Contagion HERE

- LGMR: Gold Jumps on Euro Slump, "Spanish Flu" Banking Fears, and Poor US Jobs Data

- John Dennis: Conservative Challenges Pelosi

- US Total Government Debt Reaches 130% of GDP - FDIC In Deep

- What will happen to Gold Supply if Demand is very high?

- Paul Krugman and P. Diddy...Together in a Movie??

- "The Bankers have Decided to Bomb Gold and Silver" - What's that Mean ?

- Unemployment: Propaganda vs. Fact; And Some Senatorial Chart Porn

- The Setup: Expect Gas to Hit $6-$8 Per Gallon

- FRIDAY Market Excerpts

- Friday ETF Roundup: VXX Soars, VNQ Falls

- Stimulating What?

- Euro plunges to lowest level since 2006

- Debt crisis spreading: Hungary in "very grave situation"

- 3 Days Into The Month = $169 Billion Of Debt Redeemed

- Interview: Jim Rogers on Currencies and Inflation

- Hourly Action In Gold From Trader Dan

- Honohan, Meet Havenstain

- Gold's Record-Breaking May Madness and What Lies Ahead

- Why Incomes Are So Much More Important Than Jobs

- Urbanization a Key to Consumption in Asia

- Forecasting Bank Earnings

- Quote of the Day?

- ETF Pipeline: White Metals, Synthetic Reverse Convertibles

- Commodities & Futures – Keynotes for the Week Ahead

- With Ongoing Joblessness Bankruptcy Filings Near a 5-Year High

- HSKAX: Two Out Of Two In Crash Prediction

- Does Reserve Currency Status Entitle the U.S. to Deficit Spend?

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week Posted: 04 Jun 2010 04:00 PM PDT Gold dropped down to as low as $1196.62 in London and spiked up to as high as $1209.00 following the release of the jobs report in early New York trade before it fell back to $1197.18 by about 10AM EST, but it then climbed to a new session high of $1218.50 a little after noon EST and closed with a gain of 0.68%. Silver pretty much ignored gold's late session rise and instead fell throughout most of trade in New York to end the day with a loss of 3.34%. |

| Anybody Here a "Silver Snowball" Member? Posted: 04 Jun 2010 02:39 PM PDT I was just curious if any of you are "Silver Snowball" members? If not, it's a program where you can earn free silver eagle coins by signing people up online, through a website they provide you. You have to pay about $40 per month and you receive 1 silver eagle per month. The rest of the money is for paying for the admin costs like the website they provide for you to send traffic to. For each member you sign up, you get an additional free silver eagle coin. The only problem I see is that most people who sign up for the "Silver Snowball Program", they fail because they don't know how to drive traffic to their site so that others sign up. If you are a silver snowball member or are interested in silver snowball, would a set of free videos on how to drive traffic to your silver snowball site be something of interest to you? I'm just asking because I'm in the process of providing such information and want to get some feedback. |

| Posted: 04 Jun 2010 01:55 PM PDT I have discovered that I am never, ever too drunk not to be instantly angry at the mere mention of the neo-Keynesian halfwit morons who are, despite mountains of evidence proving its complete failure, still clinging to that same, silly meth-based economic theory which I originally meant to write as "same, silly math-based economic theory" but, due to a typo, came out as "same, silly meth-based economic theory." "Meth-based economic theory" is, of course, an accident of the keyboard, now that I think about it, but the horrors of methedrine addiction and overdoses are probably much more descriptive, and would have more impact, than the terrific editorial cartoon I had just drawn, where I had depicted an old, ugly dog, which was obviously a Frankenstein-monster that had been reanimated after being stitched together out of pieces of various other dogs, and it had bare electrical wires leading to its ugly, misshapen head, and they were making sputtering noises like "Zzzzt! Zzzzzzzzzzzt" a... |

| Charles Oliver: Gold Headed to $2,000 in Two Years Posted: 04 Jun 2010 01:55 PM PDT Source: Brian Sylvester of The Gold Report 06/04/2010 Sprott Asset Management's Charles Oliver not only makes some bold predictions in this exclusive interview with The Gold Report, he backs them up. "I expect gold to be at $2,000 roughly two years from today. . .if I'm wrong I'll shave the hair off my head," Oliver says. As an unwavering believer in the yellow metal, Oliver is well positioned as co-manager of several Sprott investment funds, some of which hold bullion. One of those—Sprott's Gold and Precious Minerals Fund—climbed 114% in 2009, and claimed the 2010 Lipper Fund Award for Best Fund Over One Year in the precious metals category. Oliver shares some of the secrets of his success in this one-on-one interview. The Gold Report: What's your view on the European bailout? Charles Oliver: The big problem that's going on is that there's too much leverage, too much debt, and people spending beyond their means. We had the financial crisis in 2008; the ... |

| Gold for Defense. Gold Stocks for...? Posted: 04 Jun 2010 01:55 PM PDT by Adrian Ash BullionVault Friday, 4 June 2010 Gold stocks stopped beating gold in 2005. They've lagged it since 2007... IF GOLD'S GOING UP, then gold-miner stocks will rise further and faster. Right? "Gold mining stocks [are] a more risky but more profitable way to invest in gold," says Alix Steel at TheStreet.com in New York. "Gold bullion is defense. On the offensive side," agrees Charles Oliver of Sprott Asset Management in Toronto, "if you want capital gains, [you want] gold stocks. "We're in a bull market in gold and, generally speaking, most of the time gold stocks will outperform bullion." Thing is, that period of time – "most", as Oliver says – sits oddly inside the last 10 years of rising gold prices. TV football pundits would call it a game of two halves (football being a game of foot and ball, of course, rather than helmets, armor and cheerleaders). Because over the first half of the bull market to date, gold stocks far o... |

| Navigating the Other Side of the Storm Posted: 04 Jun 2010 01:55 PM PDT By Doug Hornig, Editor, Casey Research The trillions in U.S. federal debt now exceed 85% of gross domestic product – and that's not counting unfunded liabilities. Unemployment is breaking 20% as the government used to calculate it. The Federal Reserve is printing money like the paper it is. And the supposedly recovering housing market sees as many foreclosures in a month as new builds. Few would argue that a major storm is on the horizon. But it's hard to know how to batten down the hatches. No wonder so many investors are simply giving up, taking the term "bear market" to heart and heading for hibernation. For true sailors, however, the words "batten down the hatches" are a call to action, and in that spirit Casey Research assembled 20 experts in Las Vegas last month. They came from every field of investing. Attendees at our 2010 Crisis & Opportunity Summit, headlined "Out of the Eye of the Storm," testified enthusiastically to its value. But we didn... |

| Peter Grandich on the Korelin Economics Report Posted: 04 Jun 2010 01:55 PM PDT |

| Posted: 04 Jun 2010 01:54 PM PDT View the original post at jsmineset.com... June 04, 2010 08:47 AM CIGA Eric, I wrote a book in the early 1980s on just this subject. It was predicted in this book that China and Russia would control the market on strategic materials. I called on the West to stockpile these key elements. The title was "The Strategic Metals War," available new and used on Amazon. The result will not just be higher prices all down the line, but the inability to actually manufacture certain hi tech equipment more or less without permission via supply availability of both sovereign entities. Regards, Jim China tightens stranglehold on rare earth minerals CIGA Eric Despite the fact that few are playing attention, China is beginning to play their hand as the economic transition approaches. China is to further tighten its stranglehold on the mining of rare earth metals essential for the manufacture of high-tech products from iPods to wind turbines and military missiles Source: telegraph.co.uk... |

| Posted: 04 Jun 2010 01:54 PM PDT View the original post at jsmineset.com... June 04, 2010 08:58 AM Dear Friends, If you want to know the cross currents that are at work in gold, consider the following chart of the CCI (Continuous Commodity Index). One can clearly see that there has been a rather significant bout of selling across the entire commodity complex as speculators have pared back their long side bets out of concerns that the sovereign debt issues in Europe are going to have a negative effect on the overall global economy. The fear is that credit contraction will dampen demand for commodities as growth slows. That in conjunction with a rising Dollar which results in dollar-priced commodities becoming more expensive for many end users has sent the complex down into levels on the charts which have tripped the hedge fund algorithms into the sell mode, and gold gets impacted by that selling. The flip side however is that these same fears and especially the woes of the Euro, have induced strong buying of physi... |

| Posted: 04 Jun 2010 01:54 PM PDT View the original post at jsmineset.com... June 04, 2010 09:44 AM Dear CIGAs, I would like to introduce you to our newest Volo/Sinclair addition in Africa. Jim Sinclair’s Commentary CIGA Green Hornet suggests I add my home state to the busted list. Connecticut Bond Rating Cut by Fitch as It Accumulates Debt June 03, 2010, 7:22 PM EDT By Michael McDonald June 3 (Bloomberg) — Connecticut, the wealthiest U.S. state, had its bond rating lowered one level to AA by Fitch Ratings after it borrowed money to cover budget deficits as tax collections fell following the recession. The state has $13.7 billion of bonds outstanding, according to New York-based Fitch. It is preparing to borrow $600 million this month, according to data compiled by Bloomberg. Standard & Poor's yesterday rated Connecticut AA, which is two steps below the top level, and Moody's Investors Service ranked it an equivalent Aa2 on May 27. All three companies assigned a stable outlook to the cr... |

| This Morning?s Blatant Gold Intervention Posted: 04 Jun 2010 01:54 PM PDT View the original post at jsmineset.com... June 04, 2010 09:52 AM Dear CIGAs, If you do not see the hand of intervention in the gold market early this morning you are either wearing welders gear or are simply inept in this field. Like the euro intervention being useless in the grand scheme of things, so is the gold intervention this morning. Above $1224 the manipulators will lose their influence in the price of gold. We sure witnessed that last US night in the euro. The real numbers now that you will not hear on F-TV are $1.19 and then $1.10, below which the euro will collapse. This will return us to the dark ages in Forex, but will be good for the business of Forex trading. With regards to our newest sovereign problem, if you were Hungarian would you prefer to own gold or paper of any kind? That is assuming you had any money in the first place to buy gold.... |

| A look at some stock market "echoes" Posted: 04 Jun 2010 01:54 PM PDT I'd like to return to a theme we were discussing last week concerning our expectations for this year's upcoming 4-year cycle bottom. We touched on this in a recent commentary and we'll discuss it some more here. The theme I'd like to emphasize is that in years when the 4-year cycle bottoms (which always occurs in late September/early October) and the stock market takes a significant hit prior to the 4-year cycle time low, the bottom is in most cases made well before the late September/early October period and the market usually ends up outperforming for the rest of the year. For instance, the last time the 4-year cycle bottomed in October 2006, the S&P barely even acknowledged the cycle low as stocks were on a rip-and-tear after a particularly hard correction in the spring of that year. I think we might have seen something similar with last month’s panic sell-off. This correction was sorely needed and will do much to clear the air, so to speak. The ma... |

| BP’s Continued Existence Seen Coming Under Threat as Gulf Oil Spill Continues Posted: 04 Jun 2010 01:54 PM PDT The continued failure of BP's efforts to stop the Gulf oil spill and mounting political pressure are putting the very future of the British-based oil giant in question. BP shares plunged again on Tuesday, wiping $17 billion off the market capitalization of the company. Premiums on credit default swaps to insure the company's debt soared 75% to $178,000 for $10 million as analysts began to question whether the company can survive the financial and reputational costs of the Deepwater Horizon catastrophe. A former Clinton cabinet member, ex-Labor Secretary Robert Reich, now an economist at Berkeley, went so far as to urge the nationalization of BP by the U.S. government so that authorities could take direct control of the efforts to stop the spill and clean up the damage to the environment. The existential threat to one of the largest companies in the world hits a company whose origins date back to the discovery of oil in the Middle East. BP began life in 1908 as... |

| GLD ETF Adds Another 684,832 Troy Ounces Posted: 04 Jun 2010 01:54 PM PDT If you needed further proof that the gold and silver markets are made in New York trading and nowhere else... you got it on Thursday. As I mentioned in my closing commentary in yesterday's column, volume in both precious metals had been microscopic by mid-morning in London... and I expected any serious price action to occur during Comex hours. Well... it did. But, having said that, the gold chart clearly shows that the high water mark yesterday was at the London open... at just under $1,225 spot. Then... about 8 hours and $10 later... [at precisely 11:30 a.m. in New York] with gold down to about $1,215... the rug got pulled and gold dropped to its low of the day [$1,200.10 spot] at precisely 12:30 p.m. Eastern time. 'Normal' trading action resumed at that point, but the price wasn't allowed to recover much... as volume dropped to next to nothing into the close of electronic trading at 5:15 p.m. But, as usual, it was silver that really got it in the neck. Th... |

| Buffett Warns of Municipal Debt Meltdown.. Chaos of the Bilderbergers? Posted: 04 Jun 2010 01:54 PM PDT Buffett Warns of Municipal Debt Meltdown Friday, June 04, 2010 – by Staff Report Warren Buffett Buffett: Municipal Debt Meltdown Will Hit US ... Add investment legend Warren Buffett (left) to the list of those who warn of a municipal debt meltdown. Many municipalities have promised overly generous retirement and health benefits to public workers without any viable plans to bring in the money necessary to pay for those benefits. They have assumed unrealistic returns in their pension fund investments and unrealistic revenue from taxes. The Pew Center on the States recently estimated that as of the end of 2008 budget years, states had $1 trillion less than needed to pay for future pensions and medical benefits. And that number doesn't even reflect much of the losses suffered by pension fund investments in the second half of 2008. "There will be a terrible problem, and then the question becomes will the federal government help," Buffett said at a hearing of... |

| How To Stop The Contagion HERE Posted: 04 Jun 2010 01:54 PM PDT Market Ticker - Karl Denninger View original article June 04, 2010 08:39 AM This is an unpopular set of prescriptions. Nonetheless, it is the only thing that will work, and either our President grows a set of clankers between his legs and forces this through one way or another or we will suffer a self-fulfilling collapse when our turn comes - and it will. [*] [*] [*] [*] [*] [*] [*] [*] ... |

| LGMR: Gold Jumps on Euro Slump, "Spanish Flu" Banking Fears, and Poor US Jobs Data Posted: 04 Jun 2010 01:54 PM PDT London Gold Market Report from Adrian Ash BullionVault 08:45 ET, Fri 4 June Gold Jumps on Euro Slump, "Spanish Flu" Banking Fears, and Poor US Jobs Data THE PRICE OF GOLD in spot wholesale dealing bounced from its lowest US-price in nine sessions on Friday lunchtime in London, rallying from a dip to $1200 as the Euro currency sank to a new four-year low vs. the Dollar. New data showed US payrolls rising by 431,000 in May – fewer than expected. Some 400,000 of those jobs are temporary hires for the government Census. Gold priced in Euros jumped 2.0% inside an hour, rising back above €32,100 per kilo. British investors looking to buy gold at wholesale prices saw it cut this week's 2.3% drop in half, briefly touching £830 an ounce. "Upside momentum is fading [but] we believe this will be temporary," says Walter de Wet at Standard Bank. "We expect movements lower in gold to be bought. Investment demand remains healthy." New York's SPDR Gold Trust... |

| John Dennis: Conservative Challenges Pelosi Posted: 04 Jun 2010 01:54 PM PDT Market Ticker - Karl Denninger View original article June 04, 2010 04:13 AM Join us Monday at 3:30 for a stunning hour with John Dennis who is challenging Nancy Pelosi in the primary Tuesday! We'll hit on all the major Market Ticker points, including: [LIST] [*]Blatant, unpunished and ridiculous lawlessness by the banks, The Fed, and Congress - including usurpation of Appropriation by The Fed, the lack of an "or else" in regulatory statutes and the outrageous and unpunished acts of "the many" in the financial industry, including bid rigging in the municipal market, Jefferson County and more. [*]The inevitable path we are on to fiscal insolvency if we do not change course, including the budgetary picture of The United States, its sobering facts, and the entitlement boondoggle. [*]The fiscal reality of liberalism as now expressed in Health Care, immigration and other related issues. [*]Energy - including but not limited to the gulf oil spill. [/LIST] And of course more! ... |

| US Total Government Debt Reaches 130% of GDP - FDIC In Deep Posted: 04 Jun 2010 01:02 PM PDT |

| What will happen to Gold Supply if Demand is very high? Posted: 04 Jun 2010 01:00 PM PDT Investment demand for gold has never been so high and it is likely to rise still further. Normally when a commodity is in high demand supply is accelerated and holders of that commodity often take profits, thereby increasing supply. Economic history tells us the same, "rising prices and high demand should result in rising supply. When it comes to gold all rules have to be re-written. That's because gold is only part commodity. |

| Paul Krugman and P. Diddy...Together in a Movie?? Posted: 04 Jun 2010 12:32 PM PDT By Static Chaos

Since a moderator during a discussion at the London School of Economics once introduced him as "rock star", perhaps this is just one attempt of Krugman to cement that image. Or he probably thought it was a documentary about the Greek debt crisis. |

| "The Bankers have Decided to Bomb Gold and Silver" - What's that Mean ? Posted: 04 Jun 2010 12:07 PM PDT from Harvey Organ's blog - "Tomorrow is the big jobs number, and as usual, the bankers have decided to bomb gold and silver as a setup to this big monthly report." http://harveyorgan.blogspot.com/ HOW do the bankers bomb gold & silver ? I gather it has something to do with "shorts". What is a short ? Is it an offer to sell at a lower price, call it price "X". Or is it some kind of paper contract, where, if the price does not fall, and the customer asks for delivery, the holder of the short has to buy the physical metal at the lower price ... which could be very expensive if the price spikes. Also, what are the legitimate uses of a short ? I can understand a silver manufacturer wanting to make a contract to deliver at price "Y", which might be lower than the current market price. I can also understand a dealer like APMex sitting on 1 Million ounces of silver and wanting to protect themselves against a fall in price. So they buy an option of some kind. If the price falls, the option pays off. It the price doesn't fall, well then you're in the enviable position of having 1 million ounces of silver with a higher price, and your options are worthless. So if anyone would care to take a stab at any of these 3 questions, I'd appreciate it. |

| Unemployment: Propaganda vs. Fact; And Some Senatorial Chart Porn Posted: 04 Jun 2010 11:39 AM PDT In light of today's [abysmal|terrific] NFP report, it is probably not a bad idea to take on unemployment propaganda, but from a slightly different angle. Below, courtesy of madatoms, is a chart summarizing the truth and myth about unemployment.Of course if you are Obama, unemployment is really employment, which brings this chart to a whole new level of David Lynch appreciation. And for those really bored on Friday night, here is a terrific chart (not sure these two words belong together in this context but whatever) of the chronology of the US Senate, as well as a timeline of key laws passed, and which Senators were responsible for said passage, courtesy of timeplots. |

| The Setup: Expect Gas to Hit $6-$8 Per Gallon Posted: 04 Jun 2010 11:22 AM PDT Oily tar balls hit the sands of the Florida Panhandle Friday even as BP engineers adjusted a sophisticated cap over the Gulf of Mexico oil spill. The containment cap is the latest attempt to plug the worst oil spill in U.S. history, triggered when the Deepwater Horizon rig exploded April 20, killing 11 people. Whenever the spill is eventually contained, and the best estimates are still in the "months" category, the BP disaster has major implications for the environment, America's energy policy, and consumers. "The implications for the American consumer and our society and the domestic United States are very seriously at the front of what I think about," says our guest John Hofmeister, former president of Shell Oil and author of Why We Hate the Oil Companies. The BP disaster has raised questions about halting risky, domestic oil extraction procedures altogether, including deep-water programs. But Hofmeister -- a longtime advocate of more domestic drilling -- says Americans simply can't afford to stop drilling. (America's net imports of foreign oil have jumped to 58.2 percent in 2007 from 34.8 percent in 1973, accoding to the latest annual figures from the U.S. govermment.) Prices Could "Skyrocket" "While we dream about a new energy system that is decades in the future, the prices that consumers will have to pay for things like gasoline, electricity, and diesel would just skyrocket" if America halts offshore driller, Hofmeister tells Aaron and Henry in the accompanying segment. "Prices could get to the point where fixed-income and low-income people are simply taken out of the personal mobility marketplace, which would be a shock and unnecessary because of our unwillingness to produce domestic resources." This posting includes an audio/video/photo media file: Download Now |

| Posted: 04 Jun 2010 11:16 AM PDT Gold reverses losses after jobs data The COMEX August gold futures contract closed up $7.70 Friday at $1217.70, trading between $1198.10 and $1220.60 June 4, p.m. excerpts: see full news, 24-hr newswire… June 4th's audio MarketMinute |

| Friday ETF Roundup: VXX Soars, VNQ Falls Posted: 04 Jun 2010 09:50 AM PDT ETF Database submits: Equity markets tumbled to close out the holiday-shortened week, as fears over a lack of private sector job creation and a possible continuation of the sovereign debt crisis in Hungary spooked investors. The major indexes were all down more than 3%, with the Nasdaq slumping by 3.6% on the day. In commodity markets, oil tumbled more than 4.6%, while gold managed to finish the day slightly higher to close out at $1,217/oz. as investors continued to flock to safe havens. The sharp losses on Wall Street came as the May jobs report was unveiled, showing that government hires (which were mostly for the census) outpaced private sector hires by a pace of 10 to 1. Additionally, long-term unemployment is beginning to become a serious problem; the number of people out of work six months or longer reached a record high in May of 6.76 million, which helped to send stocks lower from start to finish to close out the week.

Complete Story » |

| Posted: 04 Jun 2010 09:48 AM PDT Stimulating What? Its official, "the economy is still on life support."

Peter Martin at The Age does quite a good job of outlining just how miserable things really are. His last line is rather out of place:

So it turns out stimulus spending works. Governments paying people to dig holes can make GDP jump. Who cares if the real economy is tanking? Strangely enough, while the government was telling its employees (or contractors) to dig holes, it told the mining industry to stop digging them. More on that below. We're sticking with the "digging holes for economic stimulus", not the "digging holes to provide something of value to someone". The King of Stimulus was of course Lord John Maynard Keynes. And here is what he had to say about digging holes:

The problem with all this is that it ruins the economy in the long run. Devoting capital, resources and employment to digging up a finite amount of money hidden in glass bottles can leave you suddenly empty handed and looking very stupid. So the governments would have to bury more bottles. Pretty soon, your economy would consist of filling glass bottles with paper (money), burying them, unburying them and paying your paper to the government in tax to be buried again. Presto, full employment and a great GDP figure. If the economy tries to revert back to providing something of value, it will notice that capital, resources and employment will have to be reallocated. This is not a fun process. It is called a depression. But if you don't have the depression, you will continue to misallocate the capital into malinvestments, which turn out to be worthless to the economy in real terms. To be fair to Keynes, he also mentioned to following:

So, the allocation of resources could be more sensible than digging up dollars. But the issues are the same. If houses aren't being built by the private sector, it is because this would be a malinvestment; a misallocation of capital, resources and employment that would later be exposed as unsustainable, causing turmoil in that industry. So if the government builds houses anyway, you end up with that malinvestment and the resulting turmoil. A malinvestment remains a malinvestment. The joyous part in all this is that Keynes advocates government stimulus just when the economy goes into a depression. In other words, just when the malinvestments from previous stimulus are being cleaned out of the system and capital, resources and employment are being allocated to a better cause. Stimulus doesn't save an economy. It bashes it back on track to ruin. The Uncertainty Country The other way to ruin an economy pretty quickly is to introduce uncertainty. It's taken Kevin 07 several years to pick up on it, but better late than never. Strangely enough, announcing the Resources Super Profits Tax (RSPT) had a damaging effect, even before Kevin fully understood what it actually is. So now the miners are reacting and it's a bluffers game of Russian roulette with dice thrown in for good measure: Monday: Top miners dig in against resource tax (The Australian) So how will it end? Nobody knows - which is exactly the problem. Investment doesn't like uncertainty and the government is giving it plenty. Mining investment is especially sensitive because of the delay in payoffs from the initial investment. Sadly, political risk has been brought up and is likely to stay. So long, lucky country... Debt Doom The steady flow of debt rating downgrades continued last Friday with Spain as the latest victim. But what changed? How come the rating was downgraded after the austerity measures were announced? Surely being thrifty is good for your balance sheet? Dan explained on Monday that "ratings agency Fitch said [the austerity] measures would damage Spanish growth prospects." Harvard's economics historian Niall Ferguson has a good grasp on certain aspects of the crisis, but on this issue he seems to side with the ratings agency. He uses the sovereign debt racked up during World War 2 in his explanation of the three ways to get out of debt. You can grow out of it, decrease government spending, or raise taxes. Which do you think is most politically viable? But sadly, government driven growth gives you fake growth, as explained above. It leads to more of the same problems down the road. The strange thing is that Niall Ferguson is fully aware of this. He "would not be at all surprised to see another crisis in a relatively short time" because all the solutions to the crisis have only made the problems worse. He gives moral hazard as an example. And yet he supports government action to prevent a depression. So, having a worse depression somewhere down the track is apparently better than having one now. Ferguson is also a fan of Keynes, but it's unlikely that the King of Stimulus would have approved of how his theories are interpreted. It seems the mainstream is advocating ruining the long run for the sake of the government statistic known as GDP. But there may be more important things than GDP for governments to prop up. Themselves for example. If a government can't borrow enough to keep GDP at the levels it deems appropriate, then the economy could really be in trouble. Even the legitimate services of government would suffer. So what does Daily Reckoning Editor Dan Denning think about the implications of European nations struggling to fund themselves? He explained on Tuesday that the consequences of a sovereign debt crisis in Europe would hit banks holding that debt hard. And there aren't many safe assets to sure up your capital base, so what do you do? Hold cash? Not while Bernanke and Trichet are behind the printing presses! Degrading the Debt Downgraders The EU has completely misinterpreted the Latin phrase "quis custodiet ipsos custodes?" (Who guards the guards?). Their latest plan is to "create a watchdog to curb credit rating agencies". There will also be a "review of the way banks are managed". So after basing bank capital adequacy laws on ratings given by companies paid to give good ratings, the government sees room for more meddling. Paul McCulley from PIMCO agrees with their analysis:

McCulley is right at the top of our least favourite people, so we will keep this short. The party got out of hand because the Federal Reserve was handing out free drinks. Holding the interest rates that bankers borrow at below the rate of inflation is like handing out cocaine at a rehab centre. Free thrills. Supposedly "financial gain affects the same pleasure centres of the brain that are activated by certain narcotics," so the metaphor is quite apt. But of course nothing is free and the hangover had to come around. It didn't last long, as interest rates went to 0 and the drinks began to flow again. Can you guess how this will end? One noteworthy aspect of the EU plan to regulate credit ratings agencies is the timing of the announcement. Just as the sovereign debt crisis begins to spread and countries begin to see their bonds getting downgraded, they decide to extend their power over the rating agencies... Going for Gold ... going going gone According to Zero Hedge, the US mint is out of gold and silver American Eagles (coins). Unprecedented demand happens to be the reasoning. People all around the world are paying significantly over the spot price of gold for their coin investments, just to get their hands on something. Speaking of which, your editor has been reliably informed by an attractive local "expert" that Argyle Diamonds just happen to be good alternative to gold as an inflation hedge. Some analysts believe that China is avoiding purchasing gold from the IMF, as this would give the gold price an unstable boost. Instead, their purchases are more covert, but still substantial. Quotes of the week Warren Buffet before Congress:

Dan Denning, reading the Australian Financial Review, murmured the following:

Until next week, Nickolai Hubble. |

| Euro plunges to lowest level since 2006 Posted: 04 Jun 2010 09:30 AM PDT From Bloomberg: U.S. and European stocks and commodities slid, while Treasuries rallied, as lower-than- estimated American job growth and a worsening government debt crisis fueled concern the global economic recovery will slow. Hungary’s currency, equities and bonds plummeted. The Standard & Poor’s 500 Index tumbled 3.2 percent, the most since May 20, at 3:22 p.m. in New York and the Dow Jones Industrial Average fell below 10,000. The Stoxx Europe 600 Index lost 1.8 percent. Oil fell 3.5 percent to near $72 a barrel, while tin sank 9.5 percent. Ten-year Treasury yields decreased 16 basis points to 3.20 percent. The euro slid below $1.20 for the first time since March 2006 and the yen strengthened against 16 major counterparts... Read full article... More on the euro: Euro in freefall: At lowest levels in 14 months Trader alert: The euro is setting up for a quick reversal Germany could be preparing for a complete euro collapse |

| Debt crisis spreading: Hungary in "very grave situation" Posted: 04 Jun 2010 09:26 AM PDT From Bloomberg: Hungary’s economy is in a “very grave situation,” a government official said, adding to concern about Europe’s sovereign debt crisis, weakening the euro and pushing the forint to a 12-month low. “It’s clear that the economy is in a very grave situation,” Peter Szijjarto, spokesman for Prime Minister Viktor Orban, said today in Budapest. “I don’t think it’s an exaggeration at all” to talk about a default. The comments sparked concern that Europe’s debt crisis would spread to eastern Europe. European governments crafted a 750 billion-euro ($904 billion) financial backstop for the euro area last month after Greece’s widening budget deficit threatened to shatter confidence in the single currency. Hungary is “in no way near default,” former Finance Minister Peter Oszko said today. Public debt was 78 percent of gross domestic product last year, compared with 115 percent for Greece. The new government’s communication is “part of short- term political tactics,” and loosening fiscal policy “would escalate panic” among investors, Oszko said in an interview. Orban, who took office May 29 after winning elections with pledges to cut taxes and stimulate the economy, yesterday failed to get European Union approval to widen the budget deficit. “I’m staggered by these comments,” said Tim Ash, global head of emerging-market research and strategy at Royal Bank of Scotland Group Plc, referring to Szijjarto’s statements. “It’s ridiculous, remarkable and extremely dangerous. What message does this send to foreign bondholders? You will look to protect your investments.” Forint Falls The forint fell as much as 2.8 percent and was down 1.8 percent at 286.71 per euro as of 5:06 p.m. in Budapest. The currency dropped 2.5 percent yesterday after Lajos Kosa, a deputy chairman of Orban’s Fidesz party, said Hungary had a “very slim” chance to avoid a Greece-like situation. The benchmark BUX stock index fell 4.4 percent, and credit-default swaps on Hungarian government debt rose 69 basis points to 391.5, according to CMA DataVision. Societe Generale SA, Unicredit SpA and Raiffeisen International Bank Holding AG led European banks lower on concern the sovereign-debt crisis may spread to Hungary and other central and eastern European countries. Societe Generale fell as much as 9.1 percent and traded down 7.7 percent at 31.54 euros by 4:54 p.m. in Paris. Raiffeisen dropped 8.4 percent to 31.12 euros in Vienna, and Unicredit declined 4.9 percent to 1.572 euros in Milan. The previous government, which pledged to narrow the budget gap to 3.8 percent of gross domestic product this year, “manipulated” figures and “lied” about the state of the economy, Szijjarto said. ‘Moment of Truth’ A fact-finding panel appointed by Orban’s government will probably present preliminary figures on the state of the economy this weekend, Szijjarto said. The government will prepare an action plan within 72 hours after the report, based on its findings, he said. “The moment of truth has already arrived in Greece and it has yet to come to Hungary,” Szijjarto said. “The government is prepared to avoid the road that Greece has been down; in other words, we won’t hesitate to act after the truth becomes known.” Hungary, which needed a bailout to avert a default in 2008, is in its fifth year of cost cutting and reduced the deficit to 4 percent of GDP last year from 9.3 percent in 2006, the EU’s widest at the time. ‘Uncomfortable Measures’ Orban has vowed to end austerity and cut taxes to accelerate economic growth after the worst recession in 18 years. He pledged to “fight” the deficit after meeting European Commission President Jose Manuel Barroso yesterday. The government may be preparing to backtrack on earlier commitments, said Zoltan Torok, an analyst at Raiffeisen Research in Vienna. “The doomsday words of Fidesz politicians about the dire state of the budget are designed to cool down the expectations of the voters and to prepare them for potentially uncomfortable measures,” Torok said in a note to clients. Hungary’s debt level may reach 79 percent of GDP this year, on par with Germany and making it the most indebted eastern EU member, according to the European Commission. The forecast compares with 80 percent for the EU as a whole, 86 percent for Portugal, 118 percent Italy and 125 percent for Greece. “Investors are losing their patience,” Gyorgy Barta, a Budapest-based economist at Intesa Sanpaolo SpA, said in a phone interview. “This is part of a communications strategy that wants to tell voters one thing and the markets another. It’s getting too complicated, and the government now needs to come clean and present a convincing plan of fiscal consolidation.” Szijjarto said Hungary will seek to improve the fiscal balance and boost the economy’s competitiveness at the same time. The government won’t give up plans to lower taxes, even if the budget deficit is about 7 percent of gross domestic product, as State Secretary Mihaly Varga indicated earlier. “The directions are clear: tax cuts, simplifying the tax system, supporting economic growth and boosting competitiveness,” Szijjarto said. To contact the reporter on this story: Edith Balazs in Budapest at ebalazs1@bloomberg.netZoltan Simon in Budapest at zsimon@bloomberg.net. More on the debt crisis: The sovereign debt crisis moves closer to the U.S. "Dr. Doom" Roubini: Euro debt crisis will spread to the U.S. Forget the Eurozone... this country could be the next to suffer a massive debt crisis |

| 3 Days Into The Month = $169 Billion Of Debt Redeemed Posted: 04 Jun 2010 09:13 AM PDT Three days into the month, and the Treasury has already redeemed $169 billion in debt, of which $137 billion in Bills. Run-rated (for Bills alone) this is about $5.5 trillion annually, or basically 63% of all marketable US debt. And somehow the Treasury is lowering the amount of new bond issuance beginning next week. We wonder just where Tim Geithner will get the much needed cash to plug not only the increasing daily deficit spending (today alone the US burned $21 billion net of debt transfers, gross the number was even worse), as well as to fund daily rolls once rates start eventually increasing. This is financial suicide, although the Treasury knows that all too well. It is now stuck in a corner and has no way out than to hope for the best. Total US debt today was $13.06 trillion. Total debt on March 6, 2009 was $10.95 trillion. The government has spent $2.1 trillion dollars to create a bear market rally which has now fizzled, and to fund a fiscal stimulus that is now dancing its death rattle. GDP will now gradually roll over, the unemployment rate will once again start increasing, diffusion indices, manufacturing and all other economic output will begin declining, but not before the bill is in. It cost Americans $2.1 trillion in debt to generate a 14 months sugar high (for which all will promptly receive a much higher tax bill). Luckily, we will never pay this debt off, so perhaps "the joke is on them" after all. |

| Interview: Jim Rogers on Currencies and Inflation Posted: 04 Jun 2010 09:09 AM PDT

We are pleased to present the following exclusive interview with legendary international investor, best selling author, adventurer and family man Jim Rogers, Chairman of Rogers Holdings and founder of the Rogers International Commodity Index (RICI). Complete Story » |

| Hourly Action In Gold From Trader Dan Posted: 04 Jun 2010 09:07 AM PDT |

| Posted: 04 Jun 2010 09:00 AM PDT One of the most puzzling questions from history is why smart people do such moronic things. Bonaparte was warned; it seemed obvious to anyone who knew the lay of the land that the Russian campaign was foolhardy. In WWI, both sides should have called it quits by 1917. And what was Rudolf von Havenstain thinking? The president of the Reichsbank printed up billion-mark notes; surely he must have known they would cause trouble. But people come to think what they must think when they must think it. One decision leads to another one. Each one is rational, as far as it goes. But put them together and you are on your way to hell. Von Havenstain was just trying to keep the economy from collapsing. In the pageant of unwelcome possibilities, he judged inflation less ugly than a Bolshevik uprising. The US central bank had its Havenstain moment last year, in March, when it began buying private sector securities – effectively adding billions to the world's money supply. A worldwide bull market followed. Equities rose about 70%. At the end of March a year later, the "quantitative easing" program came to an end. After spending $1.2 trillion, the feds withdrew and the bull market ended. Since then, the S&P has lost 8% of its value. The Shanghai stock market has just hit a 12-month low and is now down 60% below its January 2008 high. Now we see both how our modern monetary system began…and how it will end. In the sunny days of August, 1971, Richard Nixon was merely solving another problem caused by another solution. The solution to the world's problems in the '60s was to spend money on the war in Vietnam and the War on Poverty. The spending of the '60s created the debts that Nixon had to reckon with – particularly to the French. Rather than pay the foreigners in gold, as had been customary for hundreds of years, the Nixon team defaulted. They changed the world's monetary system, beginning the monetary equivalent of Napoleon's march on Moscow. They thought they were doing the world a favor. A more 'flexible' currency system would give financial authorities another powerful weapon with which to fight downturns. Instead of holding gold as their main monetary reserve, nations switched to holding each other's paper. Henceforth, one's reserve assets were another's liabilities – all netting out to zero. With this new weapon in their hands the feds won every battle – from the Latin American debt crisis of the '80s to the mini recession of 2001. But the trouble with money that grows on trees is that you are soon raking it off your lawn. The pile of international reserves, other than gold, grew from under $300 billion in 1971 to more than $8.5 trillion today. Prices rose too. As measured in Britain, consumer prices rose as much in the last 40 years as in the entire preceding 700. According to Alan Newman, daily trading volume has ballooned more than 25 times since the 1970s. The financial industry has gone from a minor activity representing only 3% of GDP in the '70s, to a substantial 7.5% of GDP today…and its single major source of profits. This financial dervish produced plenty of dust but less and less forward motion. Net private investment in the US hit a high in 1978 at about 8% of GDP. It has been declining ever since, recently hitting zero. After WWII, wages and real GDP increased steadily. But without investment in new plants and equipment, hourly wage gains stopped in the 1970s, while real GDP gains declined. People kept up appearances by borrowing heavily. But that only caused another problem. The private sector is now solving the problem of too much debt by cutting back. Consumer credit is falling. Commercial and industrial loans are falling. The money supply, as measured by M3, is deflating at the fastest rate since the Great Depression – more than 9% annually. And prices – as measured by the US core CPI – are going up at the slowest paces since 1966. This correction is natural and normal. But the feds want to stop it anyway. What can they do? ECB council member Patrick Honohan, from Ireland, has the answer. He applauds an "important new weapon," referring to the very same hot cannon that blew up in Rudolf von Havenstain's face 9 decades ago. The ECB has begun its own program of quantitative easing. It bought 35 billion euros of bonds in the first 3 weeks of the program. "Restoring market confidence in the solidity of governments' finances is absolutely crucial," Honohan said. Mr. Honohan is neither evil nor stupid. He is merely putting one foot in front of the other. He judges the need for confidence greater than the risk of inflation. Reasonable…as far as it goes. But where does it lead? The Rhine, the Niemen, and the Volga have all been breached. Sooner or later, he will be on the banks of the Berezina. Bill Bonner Honohan, Meet Havenstain originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Gold's Record-Breaking May Madness and What Lies Ahead Posted: 04 Jun 2010 08:58 AM PDT Adrian Ash submits: It's pretty rare for gold to make a new monthly high for the year in May, let alone for all time. But when it does (or so history suggests), new buyers might expect better-still prices come Christmas – and gold in 2010 just happened to finish May with a new record monthly close against all major currencies, bar the Japanese yen and Australian dollar. Only ten previous Mays since 1968 have finished with the best monthly close of the year so far. More typically, the "summer doldrums" had already begun, with prices peaking in March or April, before dipping or moving sideways and then picking up as autumn drew on. Complete Story » |

| Why Incomes Are So Much More Important Than Jobs Posted: 04 Jun 2010 08:49 AM PDT After today's NFP number, even the most rosy-eyed optimists know that the jobs situation in the US is if not openly reverting into a double dip yet, then certainly scraping the bottom. What many are confused about is just why Obama and Biden were touting today's NFP so aggressively: the massive disappointment in the market post the announcement leaves only two possible explanations: 1) the president's advisors are all truly incompetent and have no idea what the market perceives as good or bad news, or 2) this was a calculated move to send markets lower, which in turn would hit the euro. If the latter is indeed the case, the question remains whether this is a benevolent (assist European exporters) or malevolent (throw Europe into unfixable turmoil) move. The response should be made clear long before the mid-term elections. Yet even with all these open items, the bottom line is that today's BLS report was very much irrelevant. As David Rosenberg highlights, it is not the actual employment, it's the income that this employment generates, that is important. And as he observes: "real organic income is still not growing and down nearly $500 billion from pre-recession levels." More from Rosie on the topic:

Rosie follows up with two anecdotes on the actual labor situation which provide a far more precise glimpse of what is happening in the country than the administration's daily show:

Lastly, and off topic, here is some interesting insight from David on gold supply:

|

| Urbanization a Key to Consumption in Asia Posted: 04 Jun 2010 08:43 AM PDT Frank Holmes submits: Urban populations are growing in Asia and may hold the key to the region’s future economic growth. The global urban population is expected to grow by 1.6 billion people by 2025, 40 percent of that coming from China and India alone. By 2025, China’s urban population is expected to be three times that of the U.S. and India’s is expected to be double. Complete Story » |

| Posted: 04 Jun 2010 08:30 AM PDT Foreclosure activity is crucial to the outlook for bank earnings. Mortgage losses will continue to be a growing problem for bank stocks in 2010. Since the suspension of mark-to-market accounting, banks have gained much more control over timing their credit losses, but they cannot get away with completely ignoring them when the evidence is overwhelming that credit losses are real. From Mark Hanson Advisers:

It's fairly obvious that the backlog of foreclosures has built up like water behind a dam. Once the dam gives way, the market may be shocked at how quickly the headline foreclosure numbers accelerate. A saying you often hear in the banking business is: The first loss is the best loss. Dan Amoss Forecasting Bank Earnings originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Posted: 04 Jun 2010 08:05 AM PDT "Like I said earlier, my wrong call on the dollar - so far - is analogous to being a foot or two off the mark in horseshoes and handgrenades. But I could care less. You see gold today? That's the effect of the euro collapsing and every European who can fog a mirror trying to buy some gold. If the dollar spikes up because the euro is being used to fuel furnaces in northern Germany, that's not good even for dollar holders." |

| ETF Pipeline: White Metals, Synthetic Reverse Convertibles Posted: 04 Jun 2010 08:04 AM PDT Michael Johnston submits: The pace of new fund launches may have slowed in the ETF industry in recent weeks, but there’s no shortage of behind-the-scenes activity filling the product pipeline with more intriguing ideas. Continuing the trend of innovation in the ETF space, most of the recent filings outline unique products not currently available in ETF form, and most of these more targeted ideas are coming from the relatively small players. A Different Precious Metals ETF Complete Story » |

| Commodities & Futures – Keynotes for the Week Ahead Posted: 04 Jun 2010 08:03 AM PDT Bruce Greig submits: For the week ahead, the grain markets look to stabilize, if not drift lower as world supplies and the US crop conditions continue to conspire to maintain a slightly bearish tone to the market. Wheat, in particular should continue to test contract lows. In addition, net sales remain lower for corn, soybeans, and cotton. Weather forecasts for the intermediate-term still linger over some of the softs, such as orange juice and sugar. Look for these markets to experience increased volatility in the weeks ahead. Cattle remains volatile, as it seeks a trading level in the face of declining beef sales as reported by the USDA. Copper’s downward trend remains strong even though China has forecasted increased GDP for the remainder of the year. Precious metals are looking for footing as they are still experiencing profit-taking and slightly bearish fundamentals. Complete Story » |

| With Ongoing Joblessness Bankruptcy Filings Near a 5-Year High Posted: 04 Jun 2010 08:00 AM PDT Unsurprisingly, an "improving" economy that doesn't include any jobs growth isn't going to help anyone pay their bills. As a result, bankruptcy filings continued to increase in May to one of the highest daily levels we've seen in about five years. According to Reuters: "There were 133,459 U.S. bankruptcy petitions filed in May, 10 percent more than a year earlier, according to preliminary data released Thursday by Automated Access to Court Electronic Records, or AACER. "While filings fell 9 percent from April's 146,209, this was because there were just 20 business days in May compared with 22 in April. Average filings per day edged up to 6,673 from 6,646. Experts say bankruptcies typically peak in an economic cycle between six and 18 months after an economy bottoms out. This is in part because many people and businesses seek other means to work off their debts before seeking court protection. "U.S. gross domestic product rose at a 3 percent annual rate from January to March, the Commerce Department said last week, after a 5.6 percent growth pace in the fourth quarter of 2009. 'Just because the economy gets better doesn't mean that consumers can work off cascading debt problems that surfaced earlier,' AACER President Mike Bickford said in an interview." Americans are still having difficulty paying off the years of debt they've racked up. This is especially true given the difficulties in the labor market. It remains tough to see how the economy is "recovering" when companies aren't hiring and there's too little work to go around. You can visit Reuters to read more coverage of how the US bankruptcy filing rate is nearing a five-year high. Best, Rocky Vega, With Ongoing Joblessness Bankruptcy Filings Near a 5-Year High originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| HSKAX: Two Out Of Two In Crash Prediction Posted: 04 Jun 2010 07:54 AM PDT It is pretty difficult to argue with deleveraging market neutrals, of which the HSKAX is the most indicative example, supported by the entire infrastructure of the JPM-Fed complex. Just like a month ago, so our post two days earlier that HSKAX is predicting something bad was about to occur, was disregarded by some... Probably the same ones who could have saved themselves a 4% drop in the S&P. And with the deleveraging continuing, we invite all skeptics to keep ignoring this one very critical signal. |

| Does Reserve Currency Status Entitle the U.S. to Deficit Spend? Posted: 04 Jun 2010 07:53 AM PDT Thomas J. Gordon submits: As a civic minded citizen, you may be wondering why the US has been able to consistently, on average, run significant federal deficit since 1987 with no bad effects. Other than a brief period of time at the end of the Clinton administration, the US government has run considerable deficits, and there have been none of the bad effects that I would expect from extreme deficit spending – inflation, high interest rates, weak currency. To flip this question on its head, if the US can run deficits with no bad effects, then I would argue the US government should make everyone in the US a millionaire tomorrow. Those of us who belong to the “no free lunch” crowd, feel deficit spending must have bad effects, and since we have been deficit spending since Reagan was president, enough time has elapsed (bonds have come due) to see the bad effects. Complete Story » |

| You are subscribed to email updates from Gold World News Flash To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

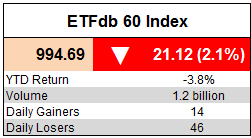

The ETFdb 60 Index, a benchmark measuring the performance of asset classes available through ETFs, slid 21.12 points, or 2.1%, to close at 994.69. Only 14 index components were in positive territory on the day, most of them fixed income products.

The ETFdb 60 Index, a benchmark measuring the performance of asset classes available through ETFs, slid 21.12 points, or 2.1%, to close at 994.69. Only 14 index components were in positive territory on the day, most of them fixed income products.

No comments:

Post a Comment