saveyourassetsfirst3 |

- Market Doubts Of 3 Fed Hikes This Year Caps Dollar

- More Bad News For The LBMA Silver Price Provides An Opportunity For Overhaul

- Timmins Gold: The Ana Paula Project Will Push The Share Price Significantly Higher Over The Next 2 Years

- The Dance Of The Euro And The U.S. Dollar

- Breaking News And Best Of The Web

- Strong demand surge at the gold ETFs start of year

- Trump’s Economic Disaster Is Here – Mike Maloney

- An Analog for the Gold Stocks Correction

- Gold Smuggling & Counter Party Risk in the Bullion Market

- “For The Time Is Come That JUDGEMENT Must Begin At The House Of God”

- “How to Become An International Gold Smuggler”: Bloomberg Goes Full Cover Story On Dealings of Largest US Gold Refiner

- An Analog for the Gold Stocks Correction

- Jim Willie Issues Warning On Seven Bowls Apocalypse: “HELL ON EARTH!”

- Eric Sprott Breaks Down BRUTAL Week For Gold & Silver Prices

- What This Woman Was Shown About The Future Of The United States Will Shake You To Your Core

- “The Abyss Has Opened”: London Trader Dissects 150 MILLION OZ Silver Massacre

- Elites Call For Return to Gold Standard…IS A SETUP FOR THE MAIN EVENT

- Clif High’s Webbot Says Gold to $4,800/oz By 2018

- “GAME OVER”: 150 Million Oz Silver Takedown “Just Ended Their Own Game” -Holter

| Market Doubts Of 3 Fed Hikes This Year Caps Dollar Posted: 11 Mar 2017 07:59 AM PST |

| More Bad News For The LBMA Silver Price Provides An Opportunity For Overhaul Posted: 11 Mar 2017 07:33 AM PST |

| Posted: 11 Mar 2017 05:49 AM PST |

| The Dance Of The Euro And The U.S. Dollar Posted: 11 Mar 2017 04:30 AM PST |

| Breaking News And Best Of The Web Posted: 11 Mar 2017 01:37 AM PST US stocks up slightly after strong jobs report. Gold and silver at multi-week lows. Bitcoin falls below the price of gold. Fed expected to raise rates at next meeting. Obamacare replacement on the table, facing opposition. Wikileaks drops another bombshell. Best Of The Web Silver market poised for big reversal – SRSrocco Report What […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Strong demand surge at the gold ETFs start of year Posted: 11 Mar 2017 12:05 AM PST USA Gold |

| Trump’s Economic Disaster Is Here – Mike Maloney Posted: 10 Mar 2017 07:05 PM PST Trump’s Economic Disaster Is Here. Mike Moloney says “history shows that once or twice in a generation a global crisis comes along that radically devastates people's way of life. A fundamental shift so big and drastic and overwhelming that it destroys their standard of living and impacts every area of their lives. We are about to experience one of those events…” Mike Maloney explores Trump’s Economic Disaster in a brand new episode of the Hidden Secrets of Money. Mike, formerly Robert Kiyosaki’s (Rich Dad Fame) Precious metals expert says next major event is deflation. And the culprit will be a relatively obscure monetary term that will impact virtually every area of your life: money velocity. You may not know exactly what money velocity means, but we will all soon experience it firsthand. In fact, money velocity will be the culprit of not just deflation, but the resulting inflation—and maybe hyperinflation—that will immediately follow. The good news is, there is a way to protect yourself. You can even profit from these upcoming crises. History shows to those who are aware on the opposite side of every crisis there is an equal opportunity. We live in an economic system purposely made complicated so most people don’t understand it. One of Mike’s great skills is he is able to take this complicated system and put it in easy to understand terms. Mike breaks down these concepts using easy-to-follow analogies, real pages from history, and animations that tie it all together. This is the episode seven (the latest) in Mike’s exploration and examination of The Hidden Secrets of Money. You can view this and all of the other episodes at Hidden Secrets of Money Learn to invest in precious metals from one of the best precious metals experts. Pick up a copy of Mike Maloney’s book Guide To Investing in Gold & Silver: Protect Your Financial Future

Mike Maloney is also the founder of GoldSilver.com one of the first websites to sell bullion online. You can listen to some of the episodes right here at PreciousMetalsInvesting.com: Listen to the Precious Metals Investing Podcast here Or even better you can subscribe to the podcast on iTunes here:Precious Metals investing podcast on iTunes Android Users can subscribe to the Precious Metals Investing Podcast at Google Play here: Precious Metals Investing podcast on Google Play DISCLAIMER: The financial and political opinions expressed in this video are not necessarily of “PreciousMetalsInvesting.com” or its staff. Opinions expressed in this video do not constitute personalized investment advice and should not be relied on for making investment decisions. The post Trump’s Economic Disaster Is Here – Mike Maloney appeared first on PreciousMetalsInvesting.com. |

| An Analog for the Gold Stocks Correction Posted: 10 Mar 2017 04:06 PM PST The Daily Gold |

| Gold Smuggling & Counter Party Risk in the Bullion Market Posted: 10 Mar 2017 03:15 PM PST With Gold & Silver Prices Pounded Relentlessly This Week Ahead of a Fed Rate Hike, Doc & Dubin Break Down the Action, Discussing: Is the PAIN OVER For Gold & Silver? Bullion Market Black Swan? Bloomberg Reports FBI & DOJ Investigating One of the Largest Bullion Firms in US Over Alleged Illegal Gold Smuggling Counter […] The post Gold Smuggling & Counter Party Risk in the Bullion Market appeared first on Silver Doctors. |

| “For The Time Is Come That JUDGEMENT Must Begin At The House Of God” Posted: 10 Mar 2017 03:00 PM PST “To the wicked and sinful church, I say WOE to You, for you will be held more accountable than those who have never known Me, for your greed and your lust, for your idolatries and your deceptions. Great will be your demise, for I will make a show of it, an example, a spectacle of you to the unsaved ones. […] The post “For The Time Is Come That JUDGEMENT Must Begin At The House Of God” appeared first on Silver Doctors. |

| Posted: 10 Mar 2017 02:31 PM PST Bloomberg Has Just Launched A Front Page Expose On Illegal Gold Smuggling Allegedly Involving One of the Largest US Bullion Firms: From Bloomberg: As the minutes ticked by on the afternoon of April 28, 2015, Harold Vilches watched stoically while customs officers at Santiago's international airport scrutinized his carry-on. Inside the roller bag was 44 […] The post “How to Become An International Gold Smuggler”: Bloomberg Goes Full Cover Story On Dealings of Largest US Gold Refiner appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

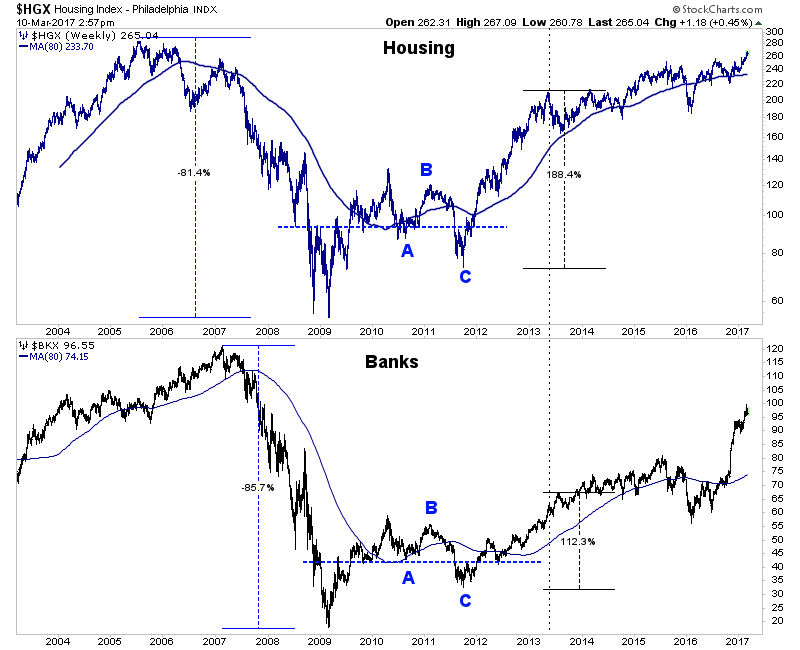

| An Analog for the Gold Stocks Correction Posted: 10 Mar 2017 02:29 PM PST The gold stocks bounced strongly today after the February jobs report confirmed the Federal Reserve will hike interest rates next week. While precious metals rallied strongly following the previous two hikes, I'm not so sure today marks the start of a big rebound. For one, the Federal Reserve could hike rates again in July. Second and more important, the technical setup argues for more back and forth action in the weeks and months ahead. While the current price action in the gold stocks is different from that in the previous cyclical bull markets, we do think we have found one viable comparison for the current correction. Although the gold stocks may rally for a few weeks in the short-term, I see them testing the December lows or close to those lows before retesting their February peaks. If this occurs and the correction that began last summer remains in effect, then what does that mean for the larger picture? Put simply, the gold stocks formed a historic low in January 2016 and are undergoing a sizeable correction (in price and time) to the record advance that took place in the first half of 2016. A long and deep wave 2 correction, though not typical has a few historical examples. In the chart below we plot the housing and banks sectors, which endured a sizeable wave 2 correction (in price and time) in 2010-2011 before exploding higher from late 2011 to early 2013.  Housing & Banks 2004-2017

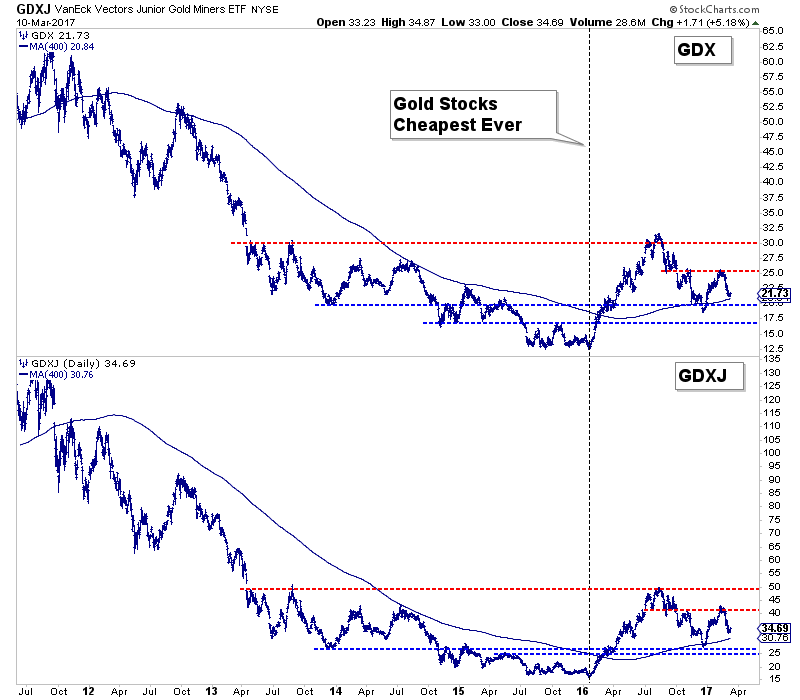

These two sectors share several key similarities to the gold stocks at present. They endured a devastating bear market of more than 80%. (It was the worst bear market in over 80 years). They rebounded strongly from their historic 2009 bottoms. In particular, the banks surged 250% in 12 months. Then both sectors corrected 44% in a correction that lasted 17 months and longer than the initial rebound. Finally, note that the banks and housing sectors experienced a technical breakdown (C leg) in late 2011 that effectively served as a massive bear trap and a tremendous buying opportunity. With respect to the gold stocks, the point is additional technical weakness and a breach of support will likely be a great buying opportunity and not a sell signal. Gold stocks in January 2016 were the cheapest they had ever been. Going forward over the next few months, the closer they trade to those levels, the better buying opportunity it is. Given the historical context, one should not overreact if the miners lose their 400-day moving averages or temporarily break their December lows. Due to the gold stocks being only 15 months removed from such a historic bottom, there simply aren't enough new sellers to drive the sector that much lower.  GDX, GDXJ

The gold stocks appear to be following a rare but viable example of a lengthy bull market correction. Unless they can rally back to their February highs soon then the analog to the housing and banks sectors remain in play. That aligns with our outlook of the spring and summer being a grind. As we noted last week, the way to play this setup is to buy weakness and avoid chasing strength. We are actively looking for bargains that we can buy and hold through this period into the next big move higher. For professional guidance in riding this new bull market, consider learning more about our premium service including our current favorite junior miners. Jordan Roy-Byrne, CMT, MFTA

|

| Jim Willie Issues Warning On Seven Bowls Apocalypse: “HELL ON EARTH!” Posted: 10 Mar 2017 02:16 PM PST Are The 7 Bowls of Wrath Upon Us? Hat Trick Letter Editor Jim Willie Warns The Banksters Are About To Unleash HELL ON EARTH: Submitted by Jim Willie, Golden Jackass: Although finance & economics are the primary themes for the Hat Trick Letter and its related research, it is impossible to ignore the reality […] The post Jim Willie Issues Warning On Seven Bowls Apocalypse: “HELL ON EARTH!” appeared first on Silver Doctors. |

| Eric Sprott Breaks Down BRUTAL Week For Gold & Silver Prices Posted: 10 Mar 2017 02:15 PM PST Support at $1200 and $17 has broken as gold and silver are down 10 days in a row. Is The WORST YET TO COME? From SprottMoney: Buy 90% Junk Silver Coins and Bags Just $0.99/oz Over Spot! The post Eric Sprott Breaks Down BRUTAL Week For Gold & Silver Prices appeared first on Silver Doctors. |

| What This Woman Was Shown About The Future Of The United States Will Shake You To Your Core Posted: 10 Mar 2017 02:06 PM PST “Prepare your houses. Prepare your hearts, for the End is Upon You…” From Michael Snyder: Judgment is coming to America Very Soon. Recently, Julie Whedbee was shown what life will be like for believers in the United States during the Tribulation. She has been having dreams and visions for over 20 years, and she […] The post What This Woman Was Shown About The Future Of The United States Will Shake You To Your Core appeared first on Silver Doctors. |

| “The Abyss Has Opened”: London Trader Dissects 150 MILLION OZ Silver Massacre Posted: 10 Mar 2017 01:45 PM PST From A Wholesale Market Perspective, the Paper Markets Are Clearly Broken, An ABYSS Has Appeared Between the Paper & Physical Markets. A RESET Is Approaching… –> Download Andrew Maguire Mp3 <– Buy 90% Junk Silver Bags at the Best Price Online! Just $0.99/oz Over Spot! The post “The Abyss Has Opened”: London Trader Dissects 150 MILLION OZ Silver Massacre appeared first on Silver Doctors. |

| Elites Call For Return to Gold Standard…IS A SETUP FOR THE MAIN EVENT Posted: 10 Mar 2017 01:06 PM PST EVERYTHING You Are Seeing in the Economic World, Right Now, IS A SETUP FOR THE MAIN EVENT: Submitted by Marshall Swing: The calls for a gold standard are DEAFENING! Despite hundreds of calls, over decades, for a gold standard, by those who espouse Austrian economics and fiscal conservatism, no call for a gold standard can […] The post Elites Call For Return to Gold Standard…IS A SETUP FOR THE MAIN EVENT appeared first on Silver Doctors. |

| Clif High’s Webbot Says Gold to $4,800/oz By 2018 Posted: 10 Mar 2017 01:00 PM PST If You Think $4,800 Gold is Crazy, …Wait Till You Hear What the Webbot Data Says About Bitcoin & Silver Prices: from Greg Hunter: On Sale At SD Bullion The post Clif High’s Webbot Says Gold to $4,800/oz By 2018 appeared first on Silver Doctors. |

| “GAME OVER”: 150 Million Oz Silver Takedown “Just Ended Their Own Game” -Holter Posted: 10 Mar 2017 01:00 PM PST What you just witnessed was an act of Total Desperation. "They" have absolutely tipped their hand and done something so obvious and egregious that they have probably ended their own "game". "GAME OVER" Has Arrived… From Bill Holter, JSMineset: I thought I would put today in perspective for those throwing in the towel on gold […] The post “GAME OVER”: 150 Million Oz Silver Takedown “Just Ended Their Own Game” -Holter appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment