Gold World News Flash |

- William Cooper Prophecy : America will Collapse into utter Chaos

- Gold Price Down 2% and Silver Price Down 4.6% this Week

- What is The Deep State by Cif High

- Preppers Stuck In Cities: Elite Chartering "Getaway Boats In Case Of Manhattan Emergency"

- The International Banking Cartel Exposed - G. Edward Griffin

- Welcome To Totalitarian America, President Trump!

- States Consider Removing Income and Sales Taxes from the Monetary Metals

- Gold Mining Stocks Q4 2016 Fundamentals

- How The Black Market Is Saving Two Countries From Their Governments

- SIGNS OF THE END PART 281 - LATEST EVENTS MARCH 2017

- Gold Seeker Weekly Wrap-Up: Gold and Silver Fall About 2% and 5% on the Week

- States Consider Removing Income and Sales Taxes from the Monetary Metals

- COT Gold, Silver and US Dollar Index Report - March 10, 2017

- Indian government mobilizes 6.4 tonnes of gold under paperization scheme

- Hugo Salinas Price: The World Will Hyperinflate Into A Gold Standard

- Breaking! Bill To Use Silver and Gold As Money 2017 Ron Paul Testimony

- TF Metals Report interviews London metals trader Maguire on gold's 'reset'

- America on The Verge of Civil War -- Tensions ERUPT between Trump PROTESTERS and #TRUMP Supporters in BERKLEY (FOOTAGE ONLY)

- Gold Miners’ Q4’16 Fundamentals

- Gold Miners’ Q4’16 Fundamentals

- Trump's First Month and Gold

- Egon von Greyerz meets with Grant Williams

- A Gold Market Update From Andrew Maguire

- GoldSeek Radio interviews GATA Chairman Bill Murphy

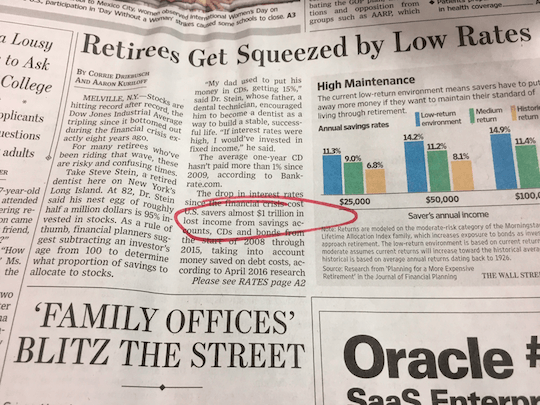

- MISSING: $1 Trillion “Kidnapped” From American Retirees…

- James Rickards: Gold Price $10,000 Long-Term Forecast

- Seven Bowls – Current Threat - Personal & Financial Protection Shield

- Gold $10,000 Coming – “Time To Prepare Is Now”

- Gold – It Is Still All About The US Dollar

- Breaking News And Best Of The Web

- Exponential Solar Power Growth Means Fossil Fuels Are Toast

- Bitcoin ( BTCUSD ) Warning Stage

| William Cooper Prophecy : America will Collapse into utter Chaos Posted: 10 Mar 2017 10:00 PM PST Such chaos is planned chaos. The government could just as well issue food Stamps instead of an electronic card. They won't. Best to be prepped than sorry. It's not if, it's when. No doubt the elite are buying up properties, it also seems that a lot of them are also selling properties almost... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Down 2% and Silver Price Down 4.6% this Week Posted: 10 Mar 2017 08:10 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What is The Deep State by Cif High Posted: 10 Mar 2017 08:00 PM PST Cif High: Deep State Power Struggle, MSM Collapse, More Chaos.. Clif is beating around the bush- as they say. The Deep State is HUGE. It started long before the time he suggests. We, as individuals, must break out of the program and brainwashing... including all of the pseudo-religious aspects.... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preppers Stuck In Cities: Elite Chartering "Getaway Boats In Case Of Manhattan Emergency" Posted: 10 Mar 2017 07:40 PM PST Authored by Mac Slavo via SHTFplan.com, There is an inherent dilemma for most of the people living in cities. Even those who are aware of the extremely fragile fabric of society are often stuck living urban lives. Perhaps they plan to retire to a country abode, or construct a hideaway to escape to if the need ever arises, but for now, they are stuck in the city making a living. This is true even for the rich, but now, they have a back-up plan. The biggest of American cities, and one of the most gridlocked, is New York City, with Manhattan and Long Island both isolated islands – trapped during emergencies from the rest of the world. That’s why those with means, and forethought, are now chartering emergency charters to get out of the city – probably a good idea, especially if the helicopter is out of your price range. via NY Post:

Interesting concept, and the fact that this has become a business model is also telling of the times. Estimates have placed evacuation from major coastal cities at more than 24 hours: For Long Island, where millions of New Yorkers live, it would be 20-29 hours to get off the island – during that time, people will lose their patience, run out of gas, become hungry, be denied access to medications and drugs, need emergency services, resort to crime, etc. The one percenters have long been serious about their prepping, for they know too well about the very real dangers being constructed, and the house of cards that is ever poised to collapse. There has been a steady rise in the upper class investment into underground bunker communities – typically decked out with furnishings and amenities that nearly compare with above-ground living. They have also been the high profile investors buying up getaway farms in places like New Zealand or South America, and hedging with mountain retreats and fortified safe rooms. While the amount of money they are spending remains mostly pocket change the biggest players, it represents a serious consideration of the high risk for social disruption, chaos and mega-disasters, such as the collapse of the power grid. The good news is that while the rich may indeed be living the high life, with escape hatches built in, there are many steps that the average, and more modest, individual can also take to increase your chances of survival during modest times. Todd Savage, who specializes in strategic relocation, says that finding balance is key. For some, a permanent move isn’t possible because of work, medical needs or family life:

When it comes to elite prepping, you have to always ask yourself: ‘Do they know something that I don’t know?‘ Considering their access to power, and their insider vision of human affairs, the chances are very good that they may. Boats and hideaway properties can be arranged at lower prices as well, or DIY. If you’re not on an island, there are likely some back roads that can save your life, and keep you out of the major chaos. Plan your escape route, with several alternate routes, that avoid the major intersections with highways, bridges and other points at which the majority of traffic is forced to flow, at a slow, grinding and dangerous pace. Safe rooms can been adapted to almost any space, and for relatively little money, and fortifications can be retrofitted where ever you need them. Just food for thought, better now than too late. Something big is coming. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The International Banking Cartel Exposed - G. Edward Griffin Posted: 10 Mar 2017 06:00 PM PST Corporations already think they rule the world. It is up to the 'we the people' we have to prove to them they don't. Author and Filmmaker G. Edward Griffin is interviewed by Australian entrepreneur Marcus Denning on the global central banking scam. Topics covered include: gold and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Welcome To Totalitarian America, President Trump! Posted: 10 Mar 2017 06:00 PM PST If there had been any doubt that the land of the free and home of the brave is now a totalitarian society, the revelations that its Chief Executive Officer has been spied upon while campaigning for that office and during his brief tenure as president should now be allayed. President Trump joins the very crowded list of opponents of the American State which includes the Tea Party, tax resistors, non-interventionists, immigration opponents, traditional family advocates, and a host of others who have been spied upon, persecuted and badgered by federal “intelligence” authorities. While Congress conducted some feeble hearings and investigations of the shenanigans of the US spy agencies during the interminable Obummer Administration, no real action or reform was taken to reign in the eavesdropping and spying by the national security state on American citizens. Hopefully, the surveillance of President Trump will change his outlook on the US “intelligence community” especially in regard to those courageous souls who have spoken out and risked life and limb to alert the public about their rulers’ nefarious activities. Edward Snowden should be among the first to receive a pardon while the person who provided him sanctuary from his American persecutors, the reviled Vladimir Putin, should be commended for his noble act, a rarity among world leaders in this democratic age. President Trump has demonstrated throughout his life loyalty to those who have supported him. He should, therefore, do all in his power to extricate Julian Assange from the Ecuadoran Embassy in Great Britain and provide him with safe conduct to the US or any destination in which the heroic whistleblower prefers. Without the deluge of Wikileaks during last fall’s presidential contest exposing the massive corruption of the Clintonistas, it is unlikely that Trump would have ever prevailed never mind winning by an electoral landslide. Not only has candidate and President Trump been monitored, but just about every American citizen is under surveillance, the data of which can be used against them at the appropriate time if and when they should challenge the American Leviathan. NSA whistleblower William Binney confirmed what has been long known in government circles and by those Americans awake to Washington’s tyranny. Binney confirmed Trump’s suspicion about surveillance to Fox News, “I think the president is absolutely right. His phone calls, everything he did electronically was being monitored.” He added that, “Everyone’s conversations are being monitored and stored.” Ironically, it has been the immense wealth generated by a relatively free market in America that has provided the means for the government to create, expand, and maintain such a sophisticated and dangerous spying apparatus that is now being used on the very people funding it. That such a situation could emerge under the supposed “checks and balances” of the US Constitution demonstrates again how truly worthless the document is in the protection of individual rights. While reform of the current system has proven to be futile and without any constitutional restraint, it, unfortunately, will mean that spying and the murderous US empire of which it is a part will continue as long as the economy does not collapse and the dollar retains its world reserve status. A silver lining, therefore, from a dollar crisis, would mean a decline in the US military and security state. Of course, the demise of the US spy and military establishment will not be a simple process, but will be fraught with tremendous social and political upheaval and more than likely bloodshed as the Deep State will do everything in its power to protect its turf. While a collapse may be a ways off, it is hoped that the spying on President Trump will move him to rethink his position on the Deep State which wants to sabotage his every move that goes against its interests most notably a potential detente with Russia. Talk of deescalation of American military presence in world affairs is anathema to the powers that be. In his Inaugural Address, President Trump repeatedly promised to put America first. The nation’s intelligence agencies do not share that vision, but instead owe their allegiance to the New World Order. If the President has not figured this out after having been secretly monitored, there is little hope for the near future. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| States Consider Removing Income and Sales Taxes from the Monetary Metals Posted: 10 Mar 2017 05:40 PM PST Precious metals markets can certainly be volatile from week to week, but over time they are a more reliable store of value than Federal Reserve Notes. Gold and silver remain the world’s most enduring and most widely recognized form of money. And, as spelled out in the U.S. Constitution, gold and silver coins are legal tender. Individual states thus can formally recognize gold and silver coins as legal tender alternatives to Federal Reserve Note dollars. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Mining Stocks Q4 2016 Fundamentals Posted: 10 Mar 2017 05:35 PM PST The gold miners’ stocks have corrected hard in recent weeks, hammered by a gold pullback driven by soaring Fed-rate-hike odds. Like any considerable selloff, this has spawned serious bearish sentiment. But the gold miners’ underlying operating fundamentals remain quite strong, proving the recent selling was purely psychological. This sector’s just-reported fourth-quarter results are impressive, very bullish. Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by securities regulators, these quarterly results are exceedingly important for investors and speculators. They dispel all the sentimental distortions surrounding prevailing stock-price levels, revealing the underlying hard fundamental realities. They serve to re-anchor perceptions. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How The Black Market Is Saving Two Countries From Their Governments Posted: 10 Mar 2017 04:30 PM PST Authored by Shaun Bradley via TheAntiMedia.org, Ever since governments began banning and licensing different parts of the economy, the black market has made sure people still have access to the things they need. Unstable governments always turn on their own citizens by using price controls, heavy taxes, and even the threat of imprisonment to prop up their failing systems. As conditions inevitably deteriorate, as they have in Venezuela and Greece, the underground economy becomes invaluable to those living through the crisis. The shadow economy refers to more than just the trade of illegal goods. A grey market, for example, provides legal products that have become difficult to find. Since basic things like toilet paper, medicine, and even food have disappeared from store shelves in Venezuela, the peer-to-peer network has become the only reliable way to secure life’s necessities. In desperate situations like this, the existence of independent merchants can mean the difference between life and death. Even the value of Venezuela’s currency has started to move away from the government’s control. At one point, the official exchange rate was fraudulently set at 10 bolivars per U.S. dollar, while on the black market it was trading at 1,000 to one. This action hurt millions by suppressing wages across the country and eroding any remaining trust. Inflation has quickly become the most imminent threat to the Venezuelan people, stealing the value of their labor and savings. For years, the bolivar has experienced hyperinflation, increasing the cost of living almost exponentially. The State’s desperate response was to institute price controls, but that has only led to shortages across the board. Luckily, the unregulated markets have been able to determine the true value of goods and provide vital support for the struggling communities. Many people think that so-called price gouging is unethical, but isn’t it better to buy what you need at twice the price than to not be able to get it at all? Greece is going through a transformation of its own — but in response to a very different set of circumstances. The Greek people have endured a series of tax increases and pension cuts over the past several years to fund debts owed to the European Union. These austerity measures have created a dire situation for those trying to secure their financial independence. The result has been widespread tax evasion, which has helped grow Greece’s underground economy to nearly 25% of the country’s GDP.

Surprisingly, it’s not only the poor who are utilizing the shadow economy in Greece, but also the professional class. Those earning large amounts of money are subjected to extremely high tax rates, driving many business owners and entrepreneurs to either seek better opportunities abroad or take steps to conceal their income. By persecuting the most successful members of society and not allowing them to keep what they earn, authorities are only encouraging disregard for the law. Without the grey market in Greece, many more skilled workers would have already left the country. Even though the black market is consistently blamed for taking away tax revenues, it ironically may be the only thing keeping the debt crisis from spiraling even further out of control. Scarcity is more than just a mindset; it’s a harsh reality that people born in developed nations rarely see firsthand. But any time a bankrupt government seizes control over their citizens’ lives and the economy, the end result is always despotism. The consolidation of power into the hands of a few is rationalized during chaotic times but ultimately puts the rights of all citizens at risk. Just last year, Venezuelan law enforcement carried out raids that killed 245 people. There was no accountability regarding whether the shootings were justified, but reports claim that many of the victims posed no threat and some were even killed after being taken into custody. Such violent crackdowns are the inevitable result of governments attempting to maintain control amid the chaos of broken economic systems. In 2011, Robert Neuwirth wrote a report for Foreign Policy that highlighted the importance of this untaxed, unlicensed, and unregulated global marketplace. He called it “System D.”

The nanny state has done an excellent job attacking anything outside of the government’s jurisdiction, but a lack of regulation is what allows for the most rapid growth and productivity. Legislators notoriously overestimate their influence on the millions of people they attempt to rule over, but ultimately, grassroots decisions made by individuals have the greatest impact. People who rely on their own skills and reputation rather than a bureaucratic stamp of approval are labeled criminals, but they’re the ones providing real value to society in many cases. Merchants in these off-grid markets are often associated with danger and violence, but in reality, they provide the purest form of voluntary transactions. Negative aspects, like organized crime, are only made possible because of the profits created as a result of prohibition. Without the State intimidating the public at gunpoint, there would be no incentive for people to seek out the services of nefarious organizations. These organic free markets are only strengthened with the circulation of assets like cash, bitcoin, and precious metals. Anonymity mixed with technology is empowering people in ways never imagined. The adoption of cryptocurrencies is bringing the shadow economy into the digital age and expanding its reach internationally. This new economic system represents a very real threat to the current financial and political structures. However, innovators in this environment have to be careful, and after the Silk Road was taken down, real legal implications became apparent. Most famously, Silk Road co-founder Ross Ulbricht was sentenced to life in prison and targeted specifically for challenging the existing system. The growing progression towards decentralization he attempted to catalyze is on a direct collision course with the central banks and their war on cash. As the public’s faith in fiat money continues to wane, there will be more and more opportunities to show the benefits that come from peer-to-peer networks over central planning. Those who recognize the inherent extortion of the old system have to lead by example and educate others, regardless of which tactics of intimidation are deployed against them. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIGNS OF THE END PART 281 - LATEST EVENTS MARCH 2017 Posted: 10 Mar 2017 03:59 PM PST end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Weekly Wrap-Up: Gold and Silver Fall About 2% and 5% on the Week Posted: 10 Mar 2017 01:52 PM PST Gold fell $6.90 to $1195.00 in Asia before it jumped up to $1206.30 at about 9AM EST and then drifted back below $1200 in the next few hours of trade, but it then rallied back higher into the close and ended with a gain of 0.21%. Silver rose to as high as $17.079 and ended with a gain of 0.41%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| States Consider Removing Income and Sales Taxes from the Monetary Metals Posted: 10 Mar 2017 12:58 PM PST Precious metals markets can certainly be volatile from week to week, but over time they are a more reliable store of value than Federal Reserve Notes. Gold and silver remain the world's most enduring and most widely recognized form of money. And, as spelled out in the U.S. Constitution, gold and silver coins are legal tender. Individual states thus can formally recognize gold and silver coins as legal tender alternatives to Federal Reserve Note dollars. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COT Gold, Silver and US Dollar Index Report - March 10, 2017 Posted: 10 Mar 2017 12:31 PM PST COT Gold, Silver and US Dollar Index Report - March 10, 2017 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indian government mobilizes 6.4 tonnes of gold under paperization scheme Posted: 10 Mar 2017 11:35 AM PST From the Press Trust of India NEW DELHI -- The government has collected 6.4 tonnes of gold under the scheme for monetising the metal, Parliament was informed today. Launched in November 2015, the scheme intends to mobilise idle gold held by households and institutions so that the wealth can be put to productive use. The scheme also intends to reduce the current account deficit by lowering country's reliance on gold imports to meet the domestic demand, Minister of State for Finance Arun Ram Meghwal said in a written reply in the Lok Sabha. ... ... For the remainder of the report: http://economictimes.indiatimes.com/news/economy/finance/government-mobi... ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hugo Salinas Price: The World Will Hyperinflate Into A Gold Standard Posted: 10 Mar 2017 11:00 AM PST I would like to take this chance to share a few of my thoughts on this. To me it is pretty clear that the American gold is encumbered. Not because of the usual reasons found on the web but because America defaulted on its gold under the Nixon administration. There are still, many foreign claims on that gold. If America starts to use that gold officially, the gold vultures, like the bond vulture funds, will be out en masse and with force. So it is in America's best interest to ignore that gold – and gold in general. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking! Bill To Use Silver and Gold As Money 2017 Ron Paul Testimony Posted: 10 Mar 2017 09:45 AM PST Ron Paul gives testimony in bill to encourage use of Gold and silver as money. Part 1 of 2 parts. Bill passes Senate Finance committee. Moves on to final approval. This bill could end the federal reserve's monopoly on money. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report interviews London metals trader Maguire on gold's 'reset' Posted: 10 Mar 2017 09:07 AM PST 12:10p ET Friday, March 10, 2017 Dear Friend of GATA and Gold: The TF Metals Report today interviews London metals trader Andrew Maguire about why he thinks a "reset" is coming in the price of gold as "the physical market is quickly sucking the liquidity out of the paper market." The interview is 51 minutes long and can be heard at the TF Metals Report here: http://www.tfmetalsreport.com/podcast/8208/gold-market-update-andrew-mag... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT K92 Mining is producing much more gold than planned Company Announcement Wednesday, March 1, 2017 K92 Mining Inc. is pleased to report that mining production has shown a steady ramp up over the last three months with ore tonnes mined being over 50 percent above budget in January while contained gold ounces were almost 20 percent above budget. The company mined more than 8,000 ore tonnes by February 24 and is on target to achieve 10,000 tonnes by month end, which is 40 percent above February budget. The increased ore production is in part due to significant lower-grade ore being identified outside the planned ore envelope, which was identified by our ongoing grade-control program, highlighting the importance and success of this program. ... ... For the remainder of the announcement: http://www.k92mining.com/2017/03/k92-provides-operational-update/ Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Mar 2017 09:05 AM PST America on The Verge of Civil War -- Tensions ERUPT between Trump PROTESTERS and TRUMP Supporters in BERKLEY (FOOTAGE ONLY) Here some clips compiled together featuring the conflicts in Berkley during the March 4 Trump rally. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Miners’ Q4’16 Fundamentals Posted: 10 Mar 2017 09:00 AM PST Zealllc | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Miners’ Q4’16 Fundamentals Posted: 10 Mar 2017 08:57 AM PST The gold miners' stocks have corrected hard in recent weeks, hammered by a gold pullback driven by soaring Fed-rate-hike odds. Like any considerable selloff, this has spawned serious bearish sentiment. But the gold miners' underlying operating fundamentals remain quite strong, proving the recent selling was purely psychological. This sector's just-reported fourth-quarter results are impressive, very bullish. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Mar 2017 08:33 AM PST Trump has been president for more than a month. What has he done so far and how will it affect the gold market? Trump's presidency has begun like no other - four weeks of conflict and chaos: travel ban, war with media and intelligence agencies, and the resignation of Flynn as a national security advisor. However, beneath the noise, Trump has been steadily fulfilling his campaign promises, or so it seems. The pace of actions has been very intense - so far, Trump has signed more than 20 executive orders or memoranda, submitted a few bills, nominated one Supreme Court justice, and talked to several foreign leaders. However, investors should be aware that there is a huge gap between what the new administration has said and what it has done in reality - most of Trump's orders have not changed the reality in any significant way (for example, take the order authorizing the construction of a border wall - without Congress' approval of funding for that purpose, the order is meaningless). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Egon von Greyerz meets with Grant Williams Posted: 10 Mar 2017 08:04 AM PST THE MATTERHORN INTERVIEW – Jan 2017: Grant Williams speaks to Egon von Greyerz on RealVisionIn this fascinating interview on RealVision TV, Grant Williams and Egon von Greyerz cover a very broad range of subjects from gold, wealth preservation to debt, interest rates, Brexit, the EU and much more.

The interview was recorded in London at the end of 2016 … Read the rest | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Gold Market Update From Andrew Maguire Posted: 10 Mar 2017 08:00 AM PST On Thursday, we finally had a chance to catch up again with Andrew Maguire. After making waves two weeks ago with his forecast of a pending "reset" in the price of gold, this podcast allowed Andy to go into greater detail regarding the condition of the physical versus paper markets and why he is so confident that a breakdown is inevitable and coming soon. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GoldSeek Radio interviews GATA Chairman Bill Murphy Posted: 10 Mar 2017 07:57 AM PST 11a ET Friday, March 10, 2017 Dear Friend of GATA and Gold: GATA Chairman Bill Murphy today is interviewed by Chris Waltzek of GoldSeek Radio, discussing the gold cartel's renewed attention to the silver market for price suppression. The interviewed can be heard at GoldSeek Radio here: http://radio.goldseek.com/nuggets.php CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MISSING: $1 Trillion “Kidnapped” From American Retirees… Posted: 10 Mar 2017 05:30 AM PST This post MISSING: $1 Trillion “Kidnapped” From American Retirees… appeared first on Daily Reckoning. You’ll have to forgive my tone today… Frankly, I’m pissed off (please excuse my language). I’m angry because of the war being waged against savers… A war that has left retirees collectively 1 trillion dollars poorer. And a war that has placed retirees in harm’s way, vulnerable to a pullback in today’s inflated stock market. The war on savers made the front page of the Wall Street Journal this week. The article showcased just how hard it has become for responsible savers to set aside enough money to cover retirement. Check out $1 trillion figure below… That’s money that has been taken away from retirees thanks to the paltry interest rates savers are receiving on their deposits…

So how exactly has this money been taken away from retirees? Well it all goes back to the Fed’s experiment with a zero (or near-zero) interest rate policy. We all know that the Fed lowered interest rates in an attempt to stimulate the economy and bail out the big banks. (Mostly to bail out the big banks). But that was nearly 10 years ago! And since that time, there have only been two tiny interest rate hikes. Which means savers are earning next to nothing from the money they worked so hard to set aside. The WSJ article cites a Swiss Re research report showing that savers have lost $1 trillion in potential interest income thanks to these lower rates. But the damage is actually much worse! That’s because the study offsets retirees’ losses by the benefit of lower interest rates on debt balances. (In other words, if you’re carrying a large amount of debt, you’ll supposedly pay less in interest expense.) But that makes absolutely no sense for retirees. Because if you’re a responsible saver and you’ve set aside money for retirement, chances are good that you’ll have very little debt to pay interest on. So retirees get virtually no benefit from lower interest expenses, and all of the pain from lower interest on savings. So the problem is actually bigger than the $1 trillion headline number stated! Retirees Are Getting DesperateOne of the ways retirees are “fighting back” against this low interest rate policy is by investing in speculative stocks. The idea here is that as long as the market continues to trade higher, these speculative stocks will offer big gains. And those big gains will hopefully offset the $1 trillion of interest the Fed has stolen. Sounds good, right? But what happens when the market trades lower? We know from history that eventually the market will decline. Stocks don’t simply go up indefinitely in a straight line. Unfortunately, the ebb and flow of the market will hit retirees especially hard. That’s because retirees need cash flow today to cover life expenses. As a retiree (or future retiree), you may not have years and years to wait for the market to rebound. You need income to be able to eat — and to enjoy your retirement years — today! But unfortunately, the Fed’s zero interest rate policy has pushed retirees out on a limb — a limb that is dangerously close to snapping. Wall Street’s Financial “Advisors” Are No HelpHas your financial advisor told you about the “rule of 100” yet? Here’s how the “rule of 100” works1:

So if you’re 60 years old, you should have 40% of your savings in stocks. (100 minus age 60 equals 40 percent). And if you’re 80 years old, you should allocate 20% of your income to stocks. Are you kidding me?? All the Harvard MBA’s, the Yale post-graduate degrees, and Stanford University business alumni in the industry… And all they could come up with is a formula that my second-grade twins could knock out without even using their fingers? (No offense to second grade students). The financial advisor industry is a joke! These guys are no help when it comes to finding creative ways to generate income… or when it comes to protecting your wealth. All they’re concerned about is getting more of your money under their management so they can charge bigger fees. They can hardly be troubled to run a second grade calculation and toss your hard-earned money into Wall Street’s rigged casino — I mean stock market. Don’t Leave Your Retirement to ChanceYou’ve worked hard to set aside money for retirement. You’ve made sacrifices along the way, in the name of being responsible and planning ahead. And now, the Fed is slowly stealing your wealth by holding interest rates down and limiting your income. Today, I want to encourage you to take matters into your own hands. Don’t trust your money with that financial “advisor” counting his fingers and using the “rule of 100.” Don’t invest in speculative stocks that could lose half their value in the next market pullback. And don’t let your money sit idly by in a bank account earning next to nothing. Instead, take a balanced approach to investing. Place a portion of your savings in solid dividend-paying stocks with stable businesses. Invest in high-yield bonds that give you legally guaranteed income (and trade separately from the stock market’s swings). And consider using a non-traditional income-generating strategy to pull instant cash payments from the market. (You can find out more about this conservative income strategy here.) In short, it’s time to take control of your retirement and fight back against the trillion-dollar war on savers. And I’m making it my mission to help uncover new ways for you to build and protect your retirement in these turbulent times. Here’s to growing and protecting your wealth!

Zach Scheidt The post MISSING: $1 Trillion “Kidnapped” From American Retirees… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| James Rickards: Gold Price $10,000 Long-Term Forecast Posted: 10 Mar 2017 05:14 AM PST James Rickards: Long-Term Forecast For $10,000 Gold James Rickards, geopolitical and monetary expert and best selling author of the ‘The New Case for Gold’ has written an interesting piece for the Daily Reckoning on why he believes gold will reach $10,000 in the long term. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seven Bowls – Current Threat - Personal & Financial Protection Shield Posted: 10 Mar 2017 05:06 AM PST Although finance & economics are the primary themes for the Hat Trick Letter and its related research, it is impossible to ignore the reality of widespread coordinated aggravated attempts to destroy our lovely blue orb, planet Earth. The globalists are hell-bent on ruining the entire biosphere for the home to humanity. Gold & Silver might be the best protection for the financial and economic deterioration, if not destruction, as individuals and financial entities work to ensure the preservation of their assets. However, Gold & Silver should be part of any concerted effort toward preparedness in emergency supply. The Jackass has diverted in this one article instance from the primary newsletter themes in order to warn people about the threat to the entire human species. The common theme among the perpetrators is the Satanism practiced by the Western Elite, who are gradually being exposed for their pedophilia and child sacrifice rituals. Their symbols are all through the corporate signposts, from Proctor & Gamble to HSBC and much deeper. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold $10,000 Coming – “Time To Prepare Is Now” Posted: 10 Mar 2017 05:01 AM PST gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold – It Is Still All About The US Dollar Posted: 10 Mar 2017 04:00 AM PST In my original article I made the following statements: “It means that holders of any non-USD currency who want to exchange it for gold, must first exchange it for US dollars and then exchange the US dollars for gold. When anyone is selling gold, the proceeds are always paid in US dollars. The dollars can be held as such, or they can be exchanged for other currency.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 10 Mar 2017 01:37 AM PST US stocks up slightly after strong jobs report. Gold and silver at multi-week lows. Bitcoin back above the price of gold. Fed expected to raise rates at next meeting. Obamacare replacement on the table, facing opposition. Wikileaks drops another bombshell. Best Of The Web Silver market poised for big reversal – SRSrocco Report What […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exponential Solar Power Growth Means Fossil Fuels Are Toast Posted: 09 Mar 2017 08:46 PM PST With all the oil-related headlines we’re exposed to each day, you might assume that “black gold,” along with other fossil fuels like coal and natural gas, matter to humanity’s future. You’d be wrong. Like Keynesian economics and fiat currencies, fossil fuels are near the end of their run. From here on out, solar is the story. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bitcoin ( BTCUSD ) Warning Stage Posted: 09 Mar 2017 06:47 PM PST Bitcoin Review Last year , Bitcoin was still considered as a fading project and many expected its price to keep dropping and break below $100. However in the recent months, the crypto-currency kept rising significantly and finally managed to make new all time high and break above $1200 last week ! That’s only $50 short of the equivalence to 1 ounce of GOLD which could have a big impact in the future . |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment