saveyourassetsfirst3 |

- JPM Silver Rigging Case Must Undergo Discoveries! – Harvey Organ

- Breaking News And Best Of The Web

- US Mint Bullion Gold & Silver Coin Sales

- Silver Just Did Something That “Shocked” Billionaire Investor Eric Sprott

- Death By China: The REAL Fireworks Begin When Trump Turns His Attention to China!

- Gold maintains long-term prospects as Dow breaks 20,000 following Trump’s executive decisions

- 2017 Could Be Transformative for Integra Gold

- Is It Just A Coincidence That The Dow Has Hit 20,000 At The Same Time The National Debt Is Reaching $20 Trillion?

- Two Gold Ratios You Should Watch

- Parliamentary vote causes pound drop and gold fall

- Rise Buys $40 Million Mine for $2 Million

| JPM Silver Rigging Case Must Undergo Discoveries! – Harvey Organ Posted: 05 Feb 2017 07:49 AM PST THE BIG STORY OF THE WEEK: JPMORGAN MUST UNDERGO DISCOVERIES AS APPEALS COURT OVERTURNS A PRIVATE SILVER RIGGING CASE AGAINST THEM… FOR 3RD STRAIGHT DAY , BOTH GOLD AND SILVER AMOUNTS STANDING INCREASE PER DAY/GOLD AND SILVER ADVANCE TODAY WITH AN UPSIDE OUTSIDE DAY REVERSAL/DEUTSCHE BANK TO SLASH MORE JOBS AS TRADING IN FIXED INCOME […] The post JPM Silver Rigging Case Must Undergo Discoveries! – Harvey Organ appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 05 Feb 2017 01:37 AM PST Fed leaves rates unchanged, Yellen says optimistic things. US stocks jump after good jobs data, gold and silver up on weakening dollar. President Trump bans immigration from several countries, fires acting attorney general for refusing to enforce ban, names supreme court nominee. Marine Le Pen catches another break. Best Of The Web Weekly commentary: […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| US Mint Bullion Gold & Silver Coin Sales Posted: 04 Feb 2017 09:01 PM PST When American investors buy physical gold and silver bullion, it's often in the form of these American Eagle 1-ounce coins. Gold's first new bull market since 2011 last year was overwhelmingly driven by stock investors flooding into gold ETFs. Traditional physical bar-and-coin demand was actually quite weak, falling considerably year-over-year. Nevertheless, it's still important to […] The post US Mint Bullion Gold & Silver Coin Sales appeared first on Silver Doctors. |

| Silver Just Did Something That “Shocked” Billionaire Investor Eric Sprott Posted: 04 Feb 2017 08:54 PM PST Eric Sprott Has Good News For Silver Bugs: It Looks Like 2016 All Over Again – It’s A Great Time To Be In the Game! The Billionaire Explains Silver Just Did Something That “Shocked” Him: From SprottMoney: On Sale At SD Bullion These Specials End Monday, February 6th at 10:00 AM EST The post Silver Just Did Something That “Shocked” Billionaire Investor Eric Sprott appeared first on Silver Doctors. |

| Death By China: The REAL Fireworks Begin When Trump Turns His Attention to China! Posted: 04 Feb 2017 08:00 PM PST Craig Hemke Joins the Show For A Powerful Analysis of the Trump Administration & Global Currency Markets, Discussing: Death By China: It’s Only A Matter Of Time Before Trump Turns Attention to China… …That’s When The REAL Fireworks Begin! Declaring China A Currency Manipulator Will Put An After-Burner On Precious Metals! Will China Pre-empt Trump […] The post Death By China: The REAL Fireworks Begin When Trump Turns His Attention to China! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Gold maintains long-term prospects as Dow breaks 20,000 following Trump’s executive decisions Posted: 26 Jan 2017 03:05 AM PST |

| 2017 Could Be Transformative for Integra Gold Posted: 26 Jan 2017 12:00 AM PST |

| Posted: 25 Jan 2017 05:57 PM PST

For example, when Ronald Reagan took office in 1991, the U.S. national debt had just hit 994 billion dollars and the Dow was sitting at 951. And as you can see from this chart by Matterhorn.gold via David Stockman, roughly that same ratio has held true throughout subsequent presidential administrations… During the Clinton years the Dow raced out ahead of the national debt, but an “adjustment” during the Bush years brought things back into line. The cold hard truth is that we have been living way above our means for decades. Our “prosperity” has been fueled by the greatest debt binge in the history of the world, and we are greatly fooling ourselves if we think otherwise. We would never have gotten to 20,000 on the Dow if Barack Obama and Congress had not gotten us into an extra 9.3 trillion dollars of debt over the past eight years. Unfortunately, most people do not understand this, and the mainstream media is treating “Dow 20,000″ as if it is some sort of great historical achievement…

Since Donald Trump’s surprise election victory, the Dow has now climbed by approximately 2150 points. And it took just 64 calendar days for the Dow to go from 19,000 to 20,000. That is an astounding pace, and financial markets around the rest of the planet are doing very well right now too. In fact, global stocks rose to a 19 month high on Wednesday. So where do we go from here? Well, if Donald Trump wants to see Dow 30,000 during his presidency, then history tells us that he needs to take us to 30 trillion dollars in debt. Of course that would be absolute insanity even if it was somehow possible. Each additional dollar of debt destroys the future of our country just a little bit more, and at some point this colossal bubble is going to burst. But you can’t tell most of the “financial experts” these things. Most of them simply believe that the “market always goes higher over time”…

My hope is that the market will continue to go up. But nobody can deny that valuations are already at absurdly high levels, and the only way that this party can keep going is to continue to fuel it with more and more debt. But for the moment, there is a tremendous amount of optimism out there, and most experts expect the Dow to continue to set new highs. In fact, CNBC says that whenever the Dow crosses a new threshold like this it usually means good things for investors…

But as USA Today has explained, not all Americans are benefiting from this stock market rally…

Hopefully the good times will continue to roll for as long as possible. But there is no possible way that they can keep going indefinitely. For decades, our debt has been growing much faster than our GDP has. By definition, this is an unsustainable situation. At some point we will have accumulated so much debt that our financial system will no longer be able to hold up under the strain. Many were convinced that we would reach that point before the U.S. national debt hit 20 trillion dollars, and yet here we are. So how much higher can we go before the bubble bursts? That is a very good question, and I don’t know if anyone has the right answer. But for President Trump, this is going to present him with quite a dilemma. Either he can keep the debt party going for as long as possible, or he can try to get us to take some tough financial medicine right now. If an attempt is made to deal with our debt problems now, we will experience severe economic pain almost immediately. But if the can keeps being kicked down the road, our long-term prognosis is just going to keep getting worse and worse. And if we try to delay the inevitable indefinitely, at some point the laws of economics are going to make our hard choices for us. So let us celebrate “Dow 20,000″, but let us also understand that it is far more likely that we will see “Dow 10,000″ again before we ever see “Dow 30,000″. |

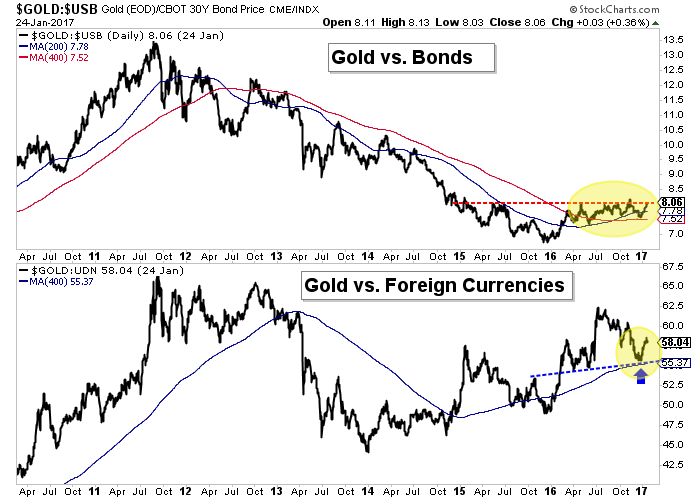

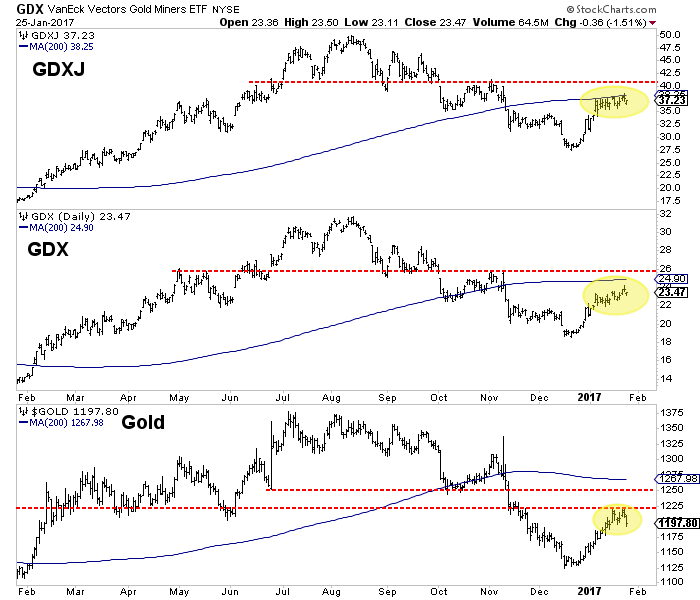

| Two Gold Ratios You Should Watch Posted: 25 Jan 2017 02:55 PM PST As Gold and gold mining stocks approach strong resistance, we wonder if the outcome will be a sharp selloff or a period of bullish consolidation. While there are a handful of things we can examine (sentiment, momentum, relative strength, etc), today we will focus on Gold and its relative strength against two key markets. How Gold fares against Bonds and foreign currencies in the weeks ahead could be a hint of its trend heading into spring. Below we plot Gold against Bonds and Gold against Foreign Currencies (FC). Gold against the 30-year bond is shown with the 200 and 400-day moving averages while Gold against FC and the 400-day moving average is plotted at the bottom. As we can see, the Gold/Bonds ratio is attempting to breakout from two-year resistance. The ratio has consolidated for the past nine months and now the moving averages are aligned in bullish fashion. Meanwhile, Gold/FC is trading above support but like Gold itself faces resistance from early autumn.  Gold vs. Bonds, Gold vs. Foreign Currencies

Gold has been lagging the miners recently and that is a good thing. The miners should lead. However, as Gold nears resistance (potentially at $1250/oz) it is important for it to show relative strength against the other asset classes and in particular Bonds and FC. A breakout in the Gold/Bonds ratio would signal that Gold would be less affected by weakness in Bonds (and rising yields). Meanwhile, continued strength for Gold/FC would signal that Gold would be less impacted by a rising US Dollar. When focusing on the very short-term we see that Gold has been turned back at $1220/oz while the miners have continued to grind higher. They opened lower Wednesday but managed to close at the highs of the day. Their rebound is getting long in the tooth but there is a chance they could grind higher towards the red lines.  GDX, GDXJ, Gold Daily Bar Charts

As Gold and gold mining stocks approach resistance we will keep an eye on their performance relative to the movements in other asset classes. A pullback from resistance is very likely but the question is if the pullback evolves into a deeper correction or a bullish consolidation. In the meantime we have focused on buying quality and value in the junior space while maintaining some cash. The good buying opportunity we noted a month ago has passed but another one will come soon one way or another. For professional guidance in riding the bull market in Gold, consider learning more about our premium service including our favorite junior miners for 2017.

Jordan Roy-Byrne, CMT, MFTA Jordan@TheDailyGold.com

The post Two Gold Ratios You Should Watch appeared first on The Daily Gold. |

| Parliamentary vote causes pound drop and gold fall Posted: 25 Jan 2017 02:30 AM PST |

| Rise Buys $40 Million Mine for $2 Million Posted: 25 Jan 2017 12:00 AM PST |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment