Gold World News Flash |

- Gold and Silver Divergence, Report 5 Feb, 2017

- Quebec: The Crisis Of The West

- Why Trump’s Economic Justice Warriors Will Crash The US Dollar

- How a Geert Wilders victory in Dutch elections could cause the EU to IMPLODE

- The CIA Tool George Soros not Well & Joe Biden Warns the World about the Collapse at Davos

- Deutsche Bank purchases ads to apologize for 'serious errors'

- Trump Rising Unemployment Not making America Great Again -- Peter Schiff

- US Dollar Bulls Surrender?

- China stocked up on Swiss gold as turbulent year came to a close

- London gold traders to open vaults in transparency push

- Why Trump’s Economic Justice Warriors Will Crash The US Dollar

- US Dollar Bulls Surrender?

- Breaking News And Best Of The Web

- Gold Price Closed at $1205.60 Down $3 or -0.25%

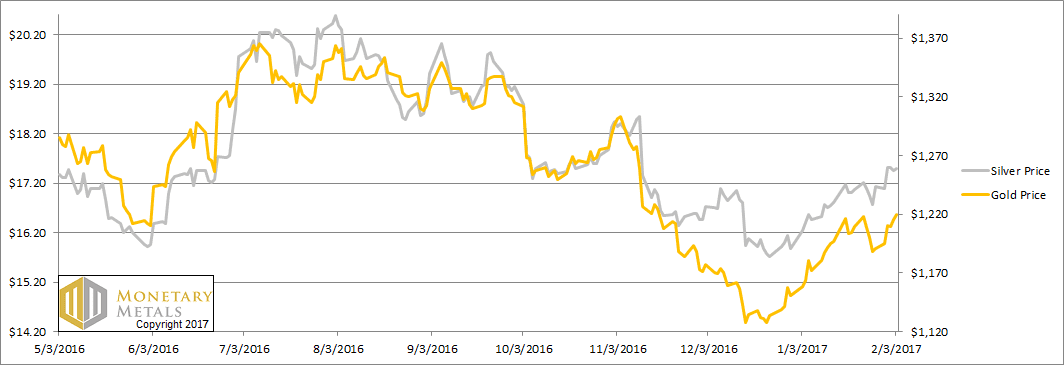

| Gold and Silver Divergence, Report 5 Feb, 2017 Posted: 05 Feb 2017 11:14 PM PST This week, the prices of the metals went up, with the gold price rising every day and the silver price stalling out after rising 42 cents on Tuesday. The gold-silver ratio went up a bit this week, an unusual occurrence when the prices are rising. Everyone knows that the price of silver is supposed to outperform—the way Pavlov's Dogs know that food comes after the bell. Speculators usually make it so. This will be a brief Report this week, as we are busy working on something new and big. Below, we will show the only true picture of the gold and silver supply and demand fundamentals. But first, the price and ratio charts. The Prices of Gold and Silver

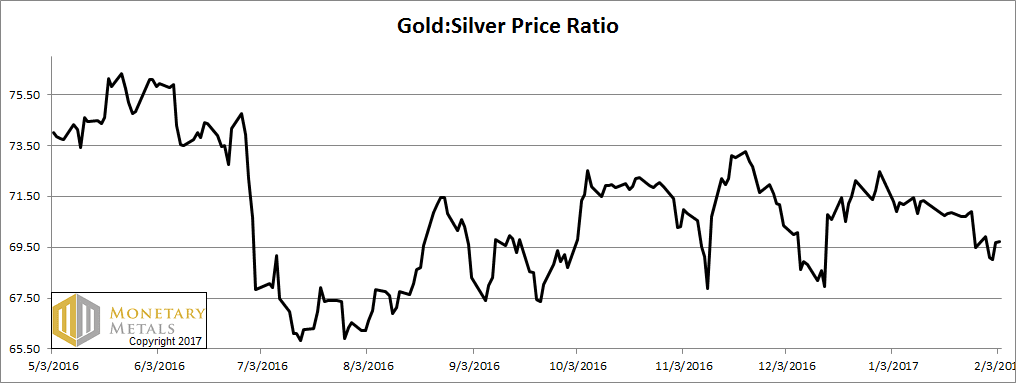

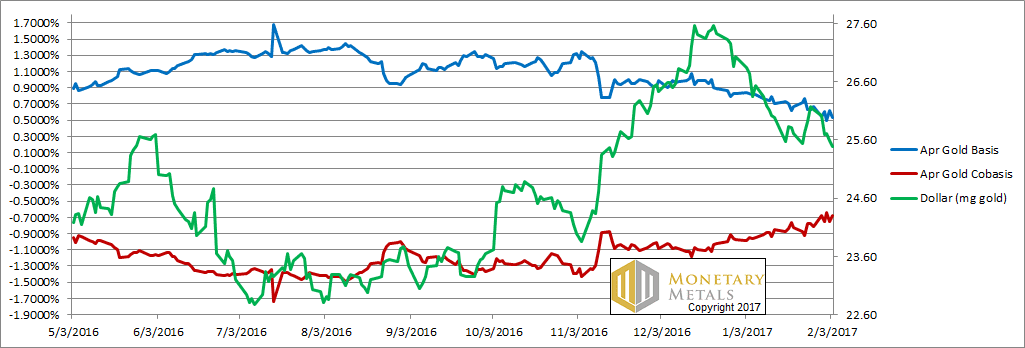

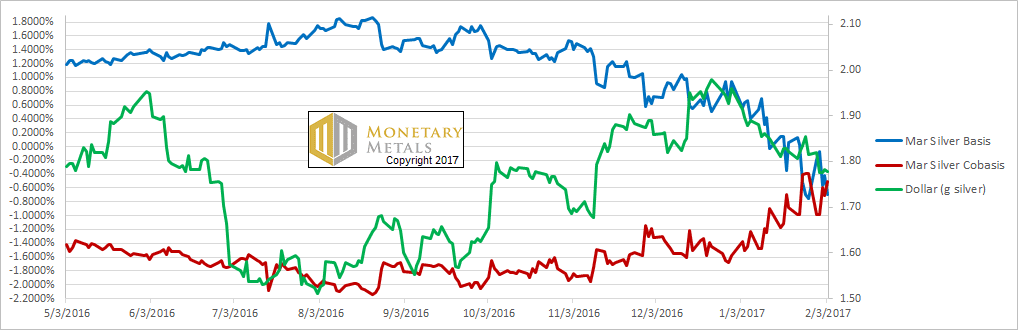

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose slightly this week. The Ratio of the Gold Price to the Silver Price For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red. Here is the gold graph. The Gold Basis and Cobasis and the Dollar Price Do we have rising price of gold, up $25 (i.e. falling dollar, from 26mg to 25.5mg gold)? Yes. Do we have rising scarcity of gold (i.e. the cobasis, our measure of scarcity)? Why yes, we do. This resumes the pattern that began the last week of December. The price of gold made a low of $1,127 (i.e. the dollar made a high of 27.6mg). Since then, the price of gold has been rising (i.e. the dollar has been falling) while the scarcity of gold has been rising. Not a lot. Not Defcon 5, gold is going to spike to $10,000 (i.e. the dollar is going to crash to 3mg gold). Not a big obvious crisis-looking sort of move. Just a gradual move from -100bps to -68bps. What makes it significant is that it occurred with rising price. Gold is becoming scarcer as its price rises. So far, this move has been driven by buyers of physical metal. Our calculated fundamental price is up $40 to stay about $100 over the market price. Now let's look at silver. The Silver Basis and Cobasis and the Dollar Price In silver, there is quite a bit more volatility in the basis. And though the March cobasis is up, farther contracts do not show the same move. Our calculated fundamental price did move up a bit—15 cents. However, it did not keep up with the market move. So now it's basically even with the market price. It turns out speculators did think that silver ought to outperform gold, and they tried. They caught up to and passed the buyers of physical metal. We note that in the futures market, the open interest in gold turned down sharply starting last week. However, silver open interest diverged, and continued to skyrocket. © 2016 Monetary Metals | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quebec: The Crisis Of The West Posted: 05 Feb 2017 11:00 PM PST Submitted by Giulio Meotti via The Gatestone Institute,

Violence can be the consequence of societal convulsions, as in the 2011 massacre on Norway's island of Utoya, in a country that prided itself of being ultra-secularized, and part of the global "good society". Quebec, also, like the entire West, is facing an existential demographic and religious crisis. George Weigel, writing in the American publication, First Things recently called Quebec "Catholicism's Empty Quarter". "There is no more religiously arid place," he wrote, "between the North Pole and Tierra del Fuego; there may be no more religiously arid place on the planet". Sandro Magister, one of Italy's most prominent journalists on Catholic affairs, wrote, "while Rome talks, Quebec has already been lost". Quebec's Catholic buildings are empty; the clergy is aging. Today, inside the Church of Saint-Jude in Montreal, personal fitness trainers take the place of Catholic priests. The Théatre Paradoxe in Montreal now sits where the church of Notre-Dame-du-Perpétuel-Secours was before it shut. The former Christian nave is now used for concerts and conferences, while Christian hymns on Sundays are replaced by disco shows.

The Catholic Diocese of Montreal sold 50 churches and other religious buildings in the last 15 years. On May 24, 2015, the last Mass was celebrated in the famous Church of St. John the Baptist, dedicated to the patron of French Canadians. The Auxiliary Bishop of Quebec, Gaetan Proulx, said that "half of the churches in Quebec" will close in the next ten years. In Denys Arcand's film "The Barbarian Invasions," there is a moment when a Catholic priest surveys the worthless religious art kitsch with which his diocese is burdened, to point to the irrelevance. The old priest says:

"Man without history, without culture, without country, without family and without civilization is not free: he is naked and condemned to despair", writes Quebec's philosopher, Mathieu Bock-Côté. The state of Catholicism in Quebec today is indeed desperate. In 1966, there were 8,800 priests; today there are 2,600, most of whom are elderly; many live in nursing homes. In 1945, weekly mass was attended by 90% of the Catholic population; today it is 4%. Hundreds of Christian communities have simply disappeared. The Quebec Council of the Religious Heritage has reported that in 2014 alone, a record 72 churches closed. The situation is even worse in the Archdiocese of Montreal. From 257 parishes in 1966, there were 250 in 2000, and in 2013 only 169 parishes. Christianity seemed at the risk of extinction; the Archbishop of Montreal, Christian Lépine, launched a moratorium on the sale of the churches. While Quebec's authorities used an aggressive secularism as a tool to advance multiculturalism, Quebec witnessed a dramatic rise in the number of young Muslim men who joined the Islamic State. Terror attacks were committed by converts to Islam -- people who rejected Canadian relativism to embrace Islamist fanaticism. "Quebec's secularist fundamentalism has gone so far as to impose on all state and private schools -- the first instance of its kind in the world -- an obligatory course on 'ethics and religious culture'", Sandro Magister wrote. An academic report concluded:

Quebec's demographic decline is also telling. The birth rate has fallen from an average of four children per couple to just 1.6 -- well below what demographers call the "replacement rate". Quebec was unique compared to developed nations in the intensity and speed with which total fertility rates dropped. Quebec's death spiral is explicitly linked with the calls for increased immigration. Canada's Prime Minister Justin Trudeau, who put an end to the military campaign against the Islamic State, just called on Muslim migrants to come to his country. According to demographers, the province of Quebec alone needs between 70,000 and 80,000 immigrants a year to compensate for its low birth rate. But to compensate for a demographic fall, what happens when one of the most famous Catholic territories in the world undergoes such a cultural and religious revolution? Resistance to Quebec's dramatic collapse does not necessarily require a new embrace of an old Catholicism, but it certainly does need a sane rediscovery of what a Western democracy should be. That includes also the appreciation of the Western identity and Judeo-Christian values -- everything that Trudeau's government and much of Europe apparently refuse to accept. Half of Trudeau's ministers were not sworn in with a religious oath. They refused even to say "so help me God". Quebec's motto is: "Je me souviens": I remember. But what, exactly? In "Catholicism's empty quarter", will the winner be Islam? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Trump’s Economic Justice Warriors Will Crash The US Dollar Posted: 05 Feb 2017 10:00 PM PST for the last eight years we've seen the 0:08 rise of the social justice warriors sjw 0:11 as they had lobbied there man Obama to 0:14 the political power required to direct 0:16 the force of government in the name of 0:18 their own relativist brand of social 0:20 justice while they are still... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How a Geert Wilders victory in Dutch elections could cause the EU to IMPLODE Posted: 05 Feb 2017 07:00 PM PST Mr Wilders in the Netherlands and Ms Le Pen in France, are the silver lining of the EU cloud. Mr Wilders would be likely to take the country out of the bloc, Marine Le Pen the Front National leader would be likely to follow suit, leaving Germany faced with the prospect of funding the cash... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The CIA Tool George Soros not Well & Joe Biden Warns the World about the Collapse at Davos Posted: 05 Feb 2017 04:00 PM PST The World is Changing dramatically, CIA tool George Soros is not well and will be sacrificed by the International Central Bankers of Fake Money. Joe Biden just gave the Warning at Davos yesterday, telling the Truth. . case rested too long to change / photo 0:09 that they have to... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deutsche Bank purchases ads to apologize for 'serious errors' Posted: 05 Feb 2017 03:03 PM PST By Tino Andresen Deutsche Bank AG bought full-page ads in all major German newspapers over the weekend to apologize for "serious errors" after two years of losses that cost the lender billions of euros. Legal cases that date back many years cost the Frankfurt-based company "reputation and trust" in addition to about 5 billion euros ($5.4 billion) since John Cryan took over as chief executive officer in 2015, the ad said, blaming the "misconduct of a few" employees. Cryan, who signed on behalf to the executive board, expressed "our deep regret" that "the conduct of the bank didn't follow our standards" in relation to the U.S. mortgage business in 2005 to 2007 and was "unacceptable." ... ... For the remainder of the report: https://www.bloomberg.com/politics/articles/2017-02-05/block-of-travel-b... ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump Rising Unemployment Not making America Great Again -- Peter Schiff Posted: 05 Feb 2017 12:00 PM PST 2017 Economic Collapse -- Rising Unemployment Is Just The Excuse The Fed's Been Waiting For Peter Schiff is a well-known commentator appearing regularly on CNBC, TechTicker and FoxNews. He is often referred to as "Doctor Doom" because of his bearish outlook on the economy and the U.S.... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 05 Feb 2017 11:29 AM PST The US dollar has now closed lower for 6 weeks in a row which is testing the patience of the bulls. This week the price action cracked the top rail of the horizontal trading range which is a negative, but not confirmation yet the trend has reversed down. There are several more layers of support that will need to be hit before I throw up the white flag and surrender to the bears. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China stocked up on Swiss gold as turbulent year came to a close Posted: 05 Feb 2017 07:43 AM PST By Wendy Wu http://www.scmp.com/news/china/economy/article/2068101/china-stocked-swi... China's gold imports from Switzerland soared at the end of last year when Beijing was struggling to defend the yuan and incoming U.S. President Donald Trump was casting grave doubts about Sino-U.S. economic ties. The Swiss Federal Customs Administration said in January that its gold bullion exports to China rose to 158 tonnes in December from 30.6 tonnes in November, according to GoldSeek.com, a website for gold investors. ... Dispatch continues below ... ADVERTISEMENT K92 Mining Drills Multiple High-Grade Gold Intersections Company Announcement K92 Mining Inc. (TSXV–KNT) announces the latest results from the ongoing grade control drilling program at its high-grade Kainantu Gold Mine in Papua New Guinea. K92 is ramping up the Kainantu gold mine toward commercial production, with its longest continuous production run to date now commenced. In September 2016 K92 began a campaign of close-spaced underground diamond drilling as part of a comprehensive grade-control strategy. The current grade-control drilling program is focused on the areas of Irumafimpa and is designed to bring a high degree of confidence to the production planning and scheduling. K92 plans to mine this area in the coming six months. The closed-space drilling pattern of approximately 15 metres by 15 meters has significantly increased the confidence in this sparsely drilled area, with most holes recording high-grade intersections. Approximately 80 percent of the holes completed to date have recorded multiple high-grade intersections indicating the presence of multiple parallel to sub parallel high-grade veins. ... ... For the remainder of the announcement: http://www.k92mining.com/2017/01/k92-drills-multiple-high-grade-gold-int... Switzerland owns the world's major gold refineries, with India and China its top export destinations. The Swiss customs data did not reveal details about the buyers in China. However, economists said rising corporate and individual demand ahead of the Lunar New Year and a possible purchase by the central bank -- to diversify foreign reserves and counter any adverse impact from Trump's remarks -- could explain the surge. Meanwhile, China's gold consumption dropped 6.7 per cent to 975.4 tonnes from the previous year, though it still remains the world's top gold consumer and largest producer. The yuan's depreciation in 2016, the bear stock market in China, as well as external shocks such as Britain's vote to leave the European Union and Trump's surprising victory as an unconventional presidential candidate have all contributed to the steady demand for gold as a safe-haven asset. "It is possible that the central bank is increasing gold reserves and reducing dollar holdings as a measure to adjust the composition of its foreign exchange reserve to counter any economic woes between Beijing and Washington," said Zhang Baoqiang, a Beijing-based gold researcher. "The central bank started to increase gold reserves in 2014," Zhang said. But it is widely believed that the gold reserve data released by the People's Bank of China does not show the full extent of the central bank's holdings. PBOC data showed gold reserves staying unchanged for the last three months of last year, at 1,678 tonnes. However, World Gold Council data pegged China's official gold holdings at 1,843 tonnes at the end of 2016, with the value of the gold accounting for 2.2 per cent of China's forex reserves. Gold prices are very sensitive to geopolitical turmoil and the monetary policies of major economies. The September 11 terrorist attack in 2001 drove gold prices up, as did the quantitative easing policies of the US Federal Reserve following the global financial crisis in 2008. Trump's plan to build a wall on the border with Mexico and his ban on Muslim immigration triggered strong protests in the United States and led to a drop in global markets and the greenback. The lingering risks of a U.S. trade war against China will add further turbulence to financial markets. "Trump is a special factor for the rise in gold purchases, but China had started to diversify its foreign reserves long before, increasing its holdings of non-U.S.-dollar currencies and gold, and increasing holdings of other strategic assets, such as oil," said Tan Yaling, the head of the China Forex Investment Research Institute. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| London gold traders to open vaults in transparency push Posted: 05 Feb 2017 07:33 AM PST "Open vaults"? Hardly. The LBMA will issue reports that no independent auditor will be permitted to check and confirm. Those reports will not account for gold swaps and leases with central banks and other bullion banks that allow gold to be counted multiple times. And the data will be three months old besides. These failings are obvious but, being a mere public-relations agency for the financial industry, the Financial Times can't bring itself to question them. It's all pathetic but this at least shows that the gold gangsters are getting nervous. * * * London Gold Traders to Open Vaults in Transparency Push By Henry Sanderson https://www.ft.com/content/8c816eac-e9ff-11e6-967b-c88452263daf London's centuries-old gold market is to usher in an era of transparency with plans to reveal how much bullion is held in vaults in and around the city, including those controlled by the Bank of England. The move is being led by the London Bullion Market Association, which will provide data for the first time on how much gold is traded in the Square Mile. ... Dispatch continues below ... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Some of the world's biggest banks are trying to shift trading of the precious metal on to an exchange. By providing greater transparency and data, the LBMA, whose members include HSBC and JPMorgan, hopes to head off the challenge and persuade regulators that banks trading bullion should not have to face more onerous funding requirements. In London most gold is traded "over-the-counter," or directly between buyers and sellers, so there is little data on how much changes hands. Estimates from the LBMA suggest that about $26 billion of gold is traded daily in the City but there are no official figures. The LBMA plans to release the monthly vault data on a three-month lag, according to people involved in the process. It will show gold bars held by the Bank of England, the gold clearing banks, and those operated by the security companies such as Brink's, which are also members of the LBMA, according to a person involved in setting up the programme. The LBMA declined to comment. London's vaults hold billions of dollars of gold, one of the largest stashes. Vaults owned by HSBC are used to back the largest gold exchange traded fund, the SPDR Gold Shares. The vaults, in secret locations within the M25 orbital motorway, are normally equipped with extreme security measures such as blast doors and fingerprint sensors that detect the flow of blood to prevent the use of severed digits. Access is rarely granted to members of the public. An estimated 400,000 large gold bars are stored at the Bank of England's vaults in the City, worth some $150 billion, according to the LBMA. The Bank of England holds the most gold because it acts as a custodian for the holdings of other central banks. Last year a gold vault owned by Barclays, which can house $80 billion of bullion, was bought by China's ICBC Standard Bank. Since the financial crisis, policymakers have been pushing for financial instruments to be traded on exchanges and cleared through centralised systems. Last year the London Metal Exchange and the World Gold Council announced plans for a gold futures contract backed by a consortium of banks including Goldman Sachs and ICBC. HSBC and JPMorgan, London's biggest bullion banks, are backing the initiatives by the LBMA to improve transparency. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Trump’s Economic Justice Warriors Will Crash The US Dollar Posted: 05 Feb 2017 06:50 AM PST For the last eight years we’ve seen the rise of the Social Justice Warriors (SJW’s), as they had lobbied their man, Obama, for the political power required to direct the force of government in the name of their own peculiarly relativist brand of “social justice.” While they are still busy demonstrating the violent soul of what is inherent in all brands of statism by breaking storefront windows (masked), under the Trump epoch a new type of statist “warrior” has emerged… let’s call them the Economic Justice Warriors (EJW’s). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 05 Feb 2017 06:36 AM PST The US dollar has now closed lower for 6 weeks in a row which is testing the patience of the bulls. This week the price action cracked the top rail of the horizontal trading range which is a negative, but not confirmation yet the trend has reversed down. There are several more layers of support that will need to be hit before I throw up the white flag and surrender to the bears. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 05 Feb 2017 01:37 AM PST Fed leaves rates unchanged, Yellen says optimistic things. US stocks jump after good jobs data, gold and silver up on weakening dollar. President Trump bans immigration from several countries, fires acting attorney general for refusing to enforce ban, names supreme court nominee. Marine Le Pen catches another break. Best Of The Web Weekly commentary: […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1205.60 Down $3 or -0.25% Posted: 01 Feb 2017 05:01 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment