saveyourassetsfirst3 |

- Physical gold demand slid to 7-year low in 2016, GFMS says

- Dow/Gold Ratio Near 9-Year High, Up, Up! Says Trump as Dow 20,000 Sees GLD Below 800 Tonnes of Bullion

- GATA Chairman Explains Why Cartel Goes To So Much Effort To Manipulate Gold & Silver

- “We Won, You Lost – Get Over It”

- Apple Should Buy Disney: Creating A Trillion-Dollar Mousetrap

- Here’s How to Profit From Trumponomics

- 1/26/17 – The Day NAFTA Died? Mexico Cancels White House Meeting Following Trump’s “Wall Ultimatum”

- Dow 20,000: Peter Schiff Asks, Milestone or Bubble?

- The Democratic Party is Out of Ideas & is About to Quadruple Down on Failed Identity Politics

- The US Dollar Is Now Overvalued Against Almost Every Currency In The World

- US Stocks Are Now the Most Overpriced Since the 2000 Crash

- The Deep State in the Age of Trump

- Switzerland’s Gold Exports To China Surge To 158 Tons In December

- China Has Run Into A Bit Of A Problem With Their Gold Stock Piling Efforts – Alasdair Macleod

- Gold maintains long-term prospects as Dow breaks 20,000 following Trump’s executive decisions

- Breaking News And Best Of The Web

- 2017 Could Be Transformative for Integra Gold

- Is It Just A Coincidence That The Dow Has Hit 20,000 At The Same Time The National Debt Is Reaching $20 Trillion?

- Two Gold Ratios You Should Watch

- GATA chairman notes smashing of gold on eve of options expiration

- Two Gold Ratios You Should Watch

- Rise Buys $40 Million Mine for $2 Million

| Physical gold demand slid to 7-year low in 2016, GFMS says Posted: 26 Jan 2017 01:24 PM PST GATA |

| Posted: 26 Jan 2017 01:19 PM PST Bullion Vault |

| GATA Chairman Explains Why Cartel Goes To So Much Effort To Manipulate Gold & Silver Posted: 26 Jan 2017 01:05 PM PST What Exactly Is The Point Of Throwing $Billions Down The Drain Suppressing Gold & Silver Prices? From Rory Hall, The Daily Coin: Bill Murphy – Gold & Silver: Why Does the Banking Cabal Go to All this Effort? Over the past several months the gold and silver markets have received some much needed attention. The […] The post GATA Chairman Explains Why Cartel Goes To So Much Effort To Manipulate Gold & Silver appeared first on Silver Doctors. |

| “We Won, You Lost – Get Over It” Posted: 26 Jan 2017 01:00 PM PST “We won, you lost. Get over it!” – Donald J. Trump, or Barack Obama? From PM Fund Manager Dave Kranzler: The full quote from Obama when he was confirmed the new President was, "Elections have consequences. We won, you lost. Get over it." The Democrats hiding out in their safe spaces and seeking solace […] The post "We Won, You Lost – Get Over It" appeared first on Silver Doctors. |

| Apple Should Buy Disney: Creating A Trillion-Dollar Mousetrap Posted: 26 Jan 2017 12:55 PM PST |

| Here’s How to Profit From Trumponomics Posted: 26 Jan 2017 12:00 PM PST Want to Profit From Donald Trump’s Game-Changing Paradigm Shift to America First? Here’s How: Submitted by Streetwise: While Donald Trump’s election has altered a number of aspects of the economy, investors cannot ignore economic trends that were in place before the election, says Joe McAlinden, founder of McAlinden Research Partners and former chief global strategist with […] The post Here’s How to Profit From Trumponomics appeared first on Silver Doctors. |

| 1/26/17 – The Day NAFTA Died? Mexico Cancels White House Meeting Following Trump’s “Wall Ultimatum” Posted: 26 Jan 2017 11:30 AM PST Mexico now finds itself in a double bind, squeezed not only by Trump, but also by its partner Canada, which has left Mexico on its own. From Mac Slavo: It's official. Mexico's President Pena Nieto has pulled out of his scheduled White House meeting for later this month. Earlier this morning President Trump tweeted that […] The post 1/26/17 – The Day NAFTA Died? Mexico Cancels White House Meeting Following Trump's "Wall Ultimatum" appeared first on Silver Doctors. |

| Dow 20,000: Peter Schiff Asks, Milestone or Bubble? Posted: 26 Jan 2017 11:30 AM PST Dow 20,000 is finally here. Famed investor and Fed critic Peter Schiff looks ahead: Will Renewed QE Send the Dow Towards a Hyper-inflationary 100,000, Or Is A Deflationary Crash Next? The post Dow 20,000: Peter Schiff Asks, Milestone or Bubble? appeared first on Silver Doctors. |

| The Democratic Party is Out of Ideas & is About to Quadruple Down on Failed Identity Politics Posted: 26 Jan 2017 11:00 AM PST Yes, of course, Trump winning the GOP nomination marks the end of the party as we know it. After all, some neocons are already publicly and actively throwing their support behind Hillary. While this undoubtably represents a major turning point in U.S. political history, many pundits have yet to appreciate that the exact same thing is happening […] The post The Democratic Party is Out of Ideas & is About to Quadruple Down on Failed Identity Politics appeared first on Silver Doctors. |

| The US Dollar Is Now Overvalued Against Almost Every Currency In The World Posted: 26 Jan 2017 11:00 AM PST The old saying in investing is "Buy Low, Sell High." It also works the other way: "Sell High, Buy Low." And that is precisely the opportunity right now: to SELL overvalued US dollars at their 14-year high, and BUY top quality, undervalued foreign assets at their record lows. From Simon Black, Sovereign Man: In […] The post The US Dollar Is Now Overvalued Against Almost Every Currency In The World appeared first on Silver Doctors. |

| US Stocks Are Now the Most Overpriced Since the 2000 Crash Posted: 26 Jan 2017 10:00 AM PST It's not the fact that the Dow hit 20,000 that makes US stocks so expensive. The price of a stock alone doesn't tell you much. It's important to look at the price of the stock relative to other important metrics, like cash flow, book value, sales, earnings, etc. US stocks right now are selling at […] The post US Stocks Are Now the Most Overpriced Since the 2000 Crash appeared first on Silver Doctors. |

| The Deep State in the Age of Trump Posted: 26 Jan 2017 09:00 AM PST The Deep State Has Entered the Age of Trump: Submitted by James Hall: Politics as usual, especially the party version of Republicans and Democrats is the latest endangered species to hit the bone yards of extinction. Now, that does not mean that competing power factions have all merged into a collegian stew of some […] The post The Deep State in the Age of Trump appeared first on Silver Doctors. |

| Switzerland’s Gold Exports To China Surge To 158 Tons In December Posted: 26 Jan 2017 09:00 AM PST gold.ie |

| China Has Run Into A Bit Of A Problem With Their Gold Stock Piling Efforts – Alasdair Macleod Posted: 26 Jan 2017 08:30 AM PST China Has Run Into A Bit Of A Problem According to London Expert Alasdair Macleod, And The Only Thing That Will Likely Alleviate The Stress Is Price… From Rory Hall: China launched the One Belt One Road (OBOR) project 5+ years ago and made their first rail delivery in February 2016. China has been stock […] The post China Has Run Into A Bit Of A Problem With Their Gold Stock Piling Efforts – Alasdair Macleod appeared first on Silver Doctors. |

| Gold maintains long-term prospects as Dow breaks 20,000 following Trump’s executive decisions Posted: 26 Jan 2017 03:05 AM PST |

| Breaking News And Best Of The Web Posted: 26 Jan 2017 01:37 AM PST US stocks up, gold and silver down. President Trump begins with flurry of changes to Obamacare and NAFTA. Earnings season starting well for banks and miners. Global debt continues to soar, especially in China. Fake news debate rages. Brexit hits speed bumps. Best Of The Web These are the countries with the biggest debt […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| 2017 Could Be Transformative for Integra Gold Posted: 26 Jan 2017 12:00 AM PST |

| Posted: 25 Jan 2017 05:57 PM PST

For example, when Ronald Reagan took office in 1991, the U.S. national debt had just hit 994 billion dollars and the Dow was sitting at 951. And as you can see from this chart by Matterhorn.gold via David Stockman, roughly that same ratio has held true throughout subsequent presidential administrations… During the Clinton years the Dow raced out ahead of the national debt, but an “adjustment” during the Bush years brought things back into line. The cold hard truth is that we have been living way above our means for decades. Our “prosperity” has been fueled by the greatest debt binge in the history of the world, and we are greatly fooling ourselves if we think otherwise. We would never have gotten to 20,000 on the Dow if Barack Obama and Congress had not gotten us into an extra 9.3 trillion dollars of debt over the past eight years. Unfortunately, most people do not understand this, and the mainstream media is treating “Dow 20,000″ as if it is some sort of great historical achievement…

Since Donald Trump’s surprise election victory, the Dow has now climbed by approximately 2150 points. And it took just 64 calendar days for the Dow to go from 19,000 to 20,000. That is an astounding pace, and financial markets around the rest of the planet are doing very well right now too. In fact, global stocks rose to a 19 month high on Wednesday. So where do we go from here? Well, if Donald Trump wants to see Dow 30,000 during his presidency, then history tells us that he needs to take us to 30 trillion dollars in debt. Of course that would be absolute insanity even if it was somehow possible. Each additional dollar of debt destroys the future of our country just a little bit more, and at some point this colossal bubble is going to burst. But you can’t tell most of the “financial experts” these things. Most of them simply believe that the “market always goes higher over time”…

My hope is that the market will continue to go up. But nobody can deny that valuations are already at absurdly high levels, and the only way that this party can keep going is to continue to fuel it with more and more debt. But for the moment, there is a tremendous amount of optimism out there, and most experts expect the Dow to continue to set new highs. In fact, CNBC says that whenever the Dow crosses a new threshold like this it usually means good things for investors…

But as USA Today has explained, not all Americans are benefiting from this stock market rally…

Hopefully the good times will continue to roll for as long as possible. But there is no possible way that they can keep going indefinitely. For decades, our debt has been growing much faster than our GDP has. By definition, this is an unsustainable situation. At some point we will have accumulated so much debt that our financial system will no longer be able to hold up under the strain. Many were convinced that we would reach that point before the U.S. national debt hit 20 trillion dollars, and yet here we are. So how much higher can we go before the bubble bursts? That is a very good question, and I don’t know if anyone has the right answer. But for President Trump, this is going to present him with quite a dilemma. Either he can keep the debt party going for as long as possible, or he can try to get us to take some tough financial medicine right now. If an attempt is made to deal with our debt problems now, we will experience severe economic pain almost immediately. But if the can keeps being kicked down the road, our long-term prognosis is just going to keep getting worse and worse. And if we try to delay the inevitable indefinitely, at some point the laws of economics are going to make our hard choices for us. So let us celebrate “Dow 20,000″, but let us also understand that it is far more likely that we will see “Dow 10,000″ again before we ever see “Dow 30,000″. |

| Two Gold Ratios You Should Watch Posted: 25 Jan 2017 04:06 PM PST The Daily Gold |

| GATA chairman notes smashing of gold on eve of options expiration Posted: 25 Jan 2017 03:22 PM PST GATA |

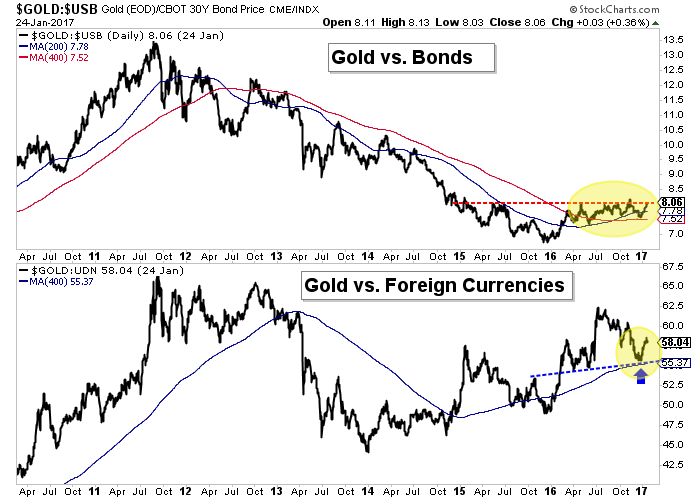

| Two Gold Ratios You Should Watch Posted: 25 Jan 2017 02:55 PM PST As Gold and gold mining stocks approach strong resistance, we wonder if the outcome will be a sharp selloff or a period of bullish consolidation. While there are a handful of things we can examine (sentiment, momentum, relative strength, etc), today we will focus on Gold and its relative strength against two key markets. How Gold fares against Bonds and foreign currencies in the weeks ahead could be a hint of its trend heading into spring. Below we plot Gold against Bonds and Gold against Foreign Currencies (FC). Gold against the 30-year bond is shown with the 200 and 400-day moving averages while Gold against FC and the 400-day moving average is plotted at the bottom. As we can see, the Gold/Bonds ratio is attempting to breakout from two-year resistance. The ratio has consolidated for the past nine months and now the moving averages are aligned in bullish fashion. Meanwhile, Gold/FC is trading above support but like Gold itself faces resistance from early autumn.  Gold vs. Bonds, Gold vs. Foreign Currencies

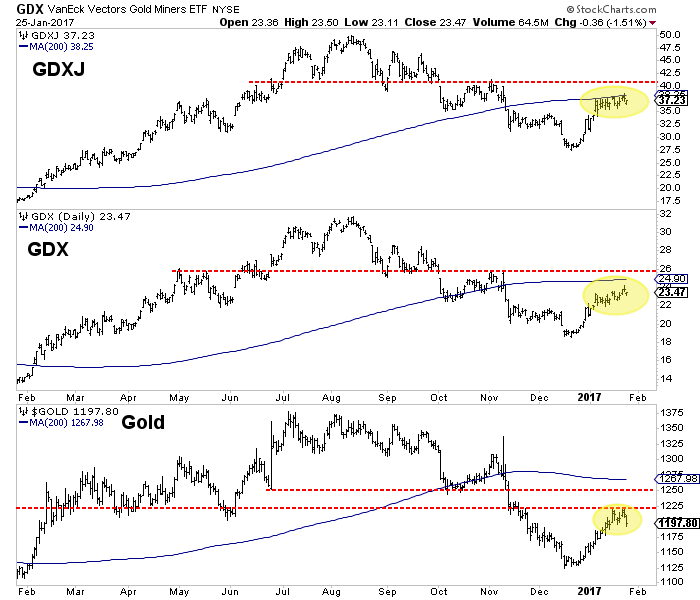

Gold has been lagging the miners recently and that is a good thing. The miners should lead. However, as Gold nears resistance (potentially at $1250/oz) it is important for it to show relative strength against the other asset classes and in particular Bonds and FC. A breakout in the Gold/Bonds ratio would signal that Gold would be less affected by weakness in Bonds (and rising yields). Meanwhile, continued strength for Gold/FC would signal that Gold would be less impacted by a rising US Dollar. When focusing on the very short-term we see that Gold has been turned back at $1220/oz while the miners have continued to grind higher. They opened lower Wednesday but managed to close at the highs of the day. Their rebound is getting long in the tooth but there is a chance they could grind higher towards the red lines.  GDX, GDXJ, Gold Daily Bar Charts

As Gold and gold mining stocks approach resistance we will keep an eye on their performance relative to the movements in other asset classes. A pullback from resistance is very likely but the question is if the pullback evolves into a deeper correction or a bullish consolidation. In the meantime we have focused on buying quality and value in the junior space while maintaining some cash. The good buying opportunity we noted a month ago has passed but another one will come soon one way or another. For professional guidance in riding the bull market in Gold, consider learning more about our premium service including our favorite junior miners for 2017.

Jordan Roy-Byrne, CMT, MFTA Jordan@TheDailyGold.com

The post Two Gold Ratios You Should Watch appeared first on The Daily Gold. |

| Rise Buys $40 Million Mine for $2 Million Posted: 25 Jan 2017 12:00 AM PST |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment