Gold World News Flash |

- GoldSeek Radio Nugget: Bill Murphy and Chris Waltzek

- Historical Official Records Reveal Gold’s Value Should Be 20 Times Higher

- Italy's Bank Rescue Foreshadows Nationalization of More EU Banks

- Two Gold Ratios You Should Watch

- America's Putin Derangement Syndrome

- Trump & Yellen's Collision Course

- New York Sun: The 20,000 Dow

- GATA chairman notes smashing of gold on eve of options expiration

- Excessive leverage promises disaster for financial system, Embry says

- The Challenges in Reforming the Left #JusticeDemocrats

- Dow 20K? We’re Moving On Already

- Gold Seeker Closing Report: Gold Falls Back Towards $1200 While Dow Tops 20,000

- Trump Missed His Biggest Chance to Drain the Swamp

- Silver in 2017: The Year of the Wild Card

- Trump issues Orders on Border Wall, Immigration Crackdown

- Too Big To Fail – It’s Happening Again

- While Gold Crawls, This Metal Powers Higher

- Putin's sanctioned ally may win mine with a quarter of Russian gold resources

- Gold Bars Demand in China Jumps as Yuan Falls, No.1 Miner for 10th Year

- Gold Market Insider David Smith: Turning Points Appear Suddenly, So Must Be Prepared...

- TLT Update…US Bonds and Gold an Odd Couple

- Breaking News And Best Of The Web

- Rise Buys $40 Million Mine for $2 Million

- Jeffrey Christian on the Short and Long Term Future of Gold

| GoldSeek Radio Nugget: Bill Murphy and Chris Waltzek Posted: 26 Jan 2017 07:12 AM PST Bill Murphy of GATA.org and the host discuss the prospects for the PMs sector in 2017. According to Bix Weir, a 1/1 gold / silver ratio is merely a matter of time as emerging technologies increasingly rely on silver. Case in point, silver is key to smog correction devices, which are in high demand in China due to the rise of the increasingly affluent middle class. |

| Historical Official Records Reveal Gold’s Value Should Be 20 Times Higher Posted: 26 Jan 2017 07:08 AM PST According to historical official records, the price of gold should be 20 times higher than the current market price. While many precious metals investors have heard about the revaluation of gold to back the outstanding fiat currency, my analysis focuses on monetary gold stocks versus global GDP (Gross Domestic Product). |

| Italy's Bank Rescue Foreshadows Nationalization of More EU Banks Posted: 26 Jan 2017 07:06 AM PST On December 7, 2016, Italy's Prime Minister Matteo Renzi resigned following defeat in a national referendum, that he had supported, that would have changed the country's parliamentary system. The development, which represents just the latest sign of anti-EU sentiment spreading throughout Europe, was felt acutely by Italy's troubled banking sector. In particular, the Banca Monte dei Paschi di Siena (MdP) has been teetering on the brink of collapse and now may stand as a case study that may be encountered by other EU member nations. |

| Two Gold Ratios You Should Watch Posted: 26 Jan 2017 07:05 AM PST As Gold and gold mining stocks approach strong resistance, we wonder if the outcome will be a sharp selloff or a period of bullish consolidation. While there are a handful of things we can examine (sentiment, momentum, relative strength, etc), today we will focus on Gold and its relative strength against two key markets. How Gold fares against Bonds and foreign currencies in the weeks ahead could be a hint of its trend heading into spring. |

| America's Putin Derangement Syndrome Posted: 25 Jan 2017 11:00 PM PST Submitted by Daniel Lazare via The Strategic Culture Foundation, Last week as Donald Trump was preparing to take office, The New York Times — reeling from Trump’s interview in which he said he didn’t “really care” if the European Union holds together and described NATO as “obsolete” — declared that “the big winner” of the change in U.S. presidents was Vladimir Putin.

Russian President Vladimir Putin, following his address to the UN General Assembly on Sept. 28, 2015. (UN Photo) Why? Because Putin “has been working assiduously not just to delegitimize American democracy by interfering with the election but to destabilize Europe and weaken if not destroy NATO, which he blames for the Soviet Union’s collapse.” And based on what Trump has been saying about the alliance and the E.U., it appears that, as of noon on Friday, Putin has a co-thinker in the White House. The Times may be right about Putin coming out on top, but its bill of indictment against him is over the top. The Russian president is not working to delegitimize America democracy – the U.S. is doing the job just fine on its own – and he’s not destabilizing Europe either since the forces undermining the E.U. are essentially generated by the West (traceable to the austerity medicine administered after the 2008 financial collapse and to the refugee flows created by the U.S.-led invasions of Afghanistan, Iraq and Libya and the “regime change” project in Syria, none of which were initiated by Putin). But the Times is entirely correct in pointing out that Putin is now riding high. He has a friend in Washington, he’s calling the shots in the Middle East, and it looks like he’ll soon be in a position to hammer out a rapprochement with Europe. So the big question facing the world is: how did he do it? The answer is not by blackmailing Trump, hacking the Democratic National Committee, or any other such nonsense put out by disappointed Clintonites. Rather, Putin prevailed through a combination of skill and luck. He played his cards well. But he also had the good fortune of having an opponent who played his own hand extremely poorly. Russia won because America lost. Years from now, as historians gather to discuss the great U.S. foreign-policy debacles of the early Twenty-first Century, they’ll have much to debate – the role of oil, Zionism and Islam; the destabilizing effects of the 2008 financial meltdown; and so forth. But one thing they’ll agree on will be the impact of hubris. The U.S. emerged after the fall of the Berlin Wall as history’s first “hyperpower,” a country whose military strength dwarfed that of the rest of the world combined. It celebrated by engaging in a series of jolly little wars in Panama, the Balkans, and the Persian Gulf that seemed to confirm its invincibility. But then it made the mistake of invading Afghanistan and Iraq and found itself in serious trouble. What Went Wrong?Historians of the future will also no doubt agree that Obama might have averted catastrophe if he had decisively broken with Washington’s pro-war foreign-policy establishment. Plainly, a change of course was urgent if catastrophe was to be avoided. But the more realistic among them will note that any such correction would have been both difficult and disruptive. It would have meant abandoning some allies and hammering out new relationships with others, changes that would have elicited howls of protest from Washington to Riyadh.

President Barack Obama waits backstage before making his last address at the United Nations General Assembly in New York, Sept. 20, 2016. (Official White House Photo by Pete Souza) So Obama, an ardent compromiser by nature, decided to fine-tune the existing policy instead by shifting from the direct military intervention of the George W. Bush era to more indirect means. This was an understandable reaction to the excesses of the previous administration, but it only made matters worse. Exhibit A is Syria, the great bleeding wound in the side of the Middle East. After calling on Bashar al-Assad to step down in August 2011, Obama could conceivably have followed up by sending in hundreds of thousands of U.S. troops to throw out the Baathists and install a pro-American regime in their place. None of Washington’s allies would have objected. But since any such adventure was unthinkable in the wake of Afghanistan and Iraq, he opted for something more oblique. He ordered the CIA to begin working in secret to support the anti-Assad forces and sent Secretary of State Hillary Clinton to persuade such “Friends of Syria” as Saudi Arabia, Qatar, and the United Arab Emirates to back up the insurgency with money and arms. Most of the foreign policy establishment agreed. After all, Israel, Turkey and the Gulf kingdoms were of one mind that Assad should go, as were the intelligence agencies back home in Washington. As long-time Syria watcher Joshua Landis of the University of Oklahoma observed, the Assad government had long been in America’s crosshairs:

Digging DeeperYet the more the Obama administration tried to make its strategy work, the more it fell prey to a fatal contradiction. The reason was simple. Obama claimed to favor a democratic solution, yet the people he counted on to impose it, i.e. the Gulf kingdoms, are the most autocratic states on earth. The more money and aid they channeled to the opposition, therefore, the more undemocratic it became.

Secretary of State John Kerry with Samantha Power, U.S. ambassador to the U.N., during the general debate of the General Assembly, Sept. 20, 2016 (UN Photo) Although the White House continued to cling to the myth of a “moderate” insurgency, it soon became obvious that the worst barbarians – bigoted Sunni fundamentalists, head-chopping “Takfiris,” even outright cannibals – were in control. Warning flares went up but were ignored. In August 2012, the U.S. Defense Intelligence Agency reported that the Muslim Brotherhood, Al Qaeda and assorted Salafists were “the major forces driving the insurgency” and that their aim was to foment an anti-Shi‘ite sectarian war and establish a “Salafist principality in Eastern Syria,” the same area where Islamic State would establish its caliphate two years later. Yet the administration refused to adjust its strategy. In October 2014, Vice President Joe Biden complained in a talk at Harvard that America’s Gulf allies “were so determined to take down Assad and essentially have a proxy Sunni-Shia war” that “they poured hundreds of millions of dollars and tens of thousands of tons of military weapons into anyone who would fight against Assad except the people who were being supplied were Al Nusra and Al Qaeda and the extremist elements of jihadis coming from other parts of the world.” (Quote starts at 53:25.) Obama’s response was to order him to telephone various Gulf leaders and apologize for telling the truth. Secretary of State John Kerry’s remarks to pro-rebel Syrian exiles last September were even more revealing. In the course of a 30-minute meeting at the United Nations, he volunteered that the U.S. goal was not to combat Islamic State as had been long claimed. Rather, it was to use ISIS (also known as ISIL and Daesh) to put pressure on Assad and force him to accede to a pro-U.S. government. Referring to Putin’s decision to intervene in Syria in November 2015, Kerry said:

Using the TerroristsThe remarks, the subject of a misleading New York Times article by Anne Barnard and a smart analysis by longtime U.N. correspondent Joe Lauria, sums up all that was self-defeating about the Obama administration’s strategy. While the U.S. claimed to oppose ISIS, it was in fact happy to use it as a lever to pry Assad from power.

Journalist James Foley shortly before he was executed by an Islamic State operative While the official line was that Russia only intervened to prop up Assad, Kerry freely admitted that the chief reason was to prevent ISIS from marching into Damascus. One could reasonably conclude from Kerry’s comments that Russia was more interested in combatting Islamic State than the U.S. was (although the opposite claim was often made by the Times and other mainstream news outlets). Somehow Kerry had gotten it into his head that after pummeling Assad to the floor, ISIS would then politely step aside to allow pro-U.S. moderates to take over. The idea is every bit as delusional as George W. Bush’s belief in 2003 that he could romp into Iraq with 380,000 troops, smash things up a bit, and then go home, confident that a compliant pro-U.S. regime would maintain order in his absence. Rather than acceding to Kerry’s request, ISIS would no doubt have told him to get lost and taken power itself. If so, the consequences would have caused even the most sang-froid realists to shudder in fear. “Were ISIS to have ensconced itself in Damascus,” observes Landis, “Lebanon would surely have fallen and Jordan would’ve been up against it.” Saudi Arabia, already the sick man of the Middle East, would also have come under threat. Instead of a million refugees streaming toward Europe, there would have been five or ten times that number. Is this really what Obama wanted? It’s hard to believe, yet that’s precisely what his policies were leading to. Although Obama predicted that Putin would find himself in a Vietnam-style “quagmire”, Putin was careful to limit the operation and avoid making promises he couldn’t keep. Even The New York Times was impressed by Putin’s calculated actions. The climax came some 14 months later when Syrian government troops, backed by Russian airpower, finally drove Al Qaeda and its supporters out of their East Aleppo stronghold. Recognizing that the writing was on the wall, Turkey effectively switched sides, patching up relations with Moscow and engaging in joint bombing forays against rebel forces inside Syria. The Kurds, reliant on U.S. backing, were left dangling in the wind. So were the pseudo-moderates of the U.S.-backed Free Syrian Army. Why Putin WonThis is why Putin came out on top: not because he’s a latter-day Svengali manipulating candidates and overturning elections, but because U.S. policy was leading to disaster and no one else was in a position to clean up the mess. In Kerry’s conversation at the U.N., the Secretary of State conceded that once Putin opted to intercede, there was little the Obama administration could do.

Syrian President Bashar al-Assad “Instead of negotiating, he [Assad] got… Putin in to support him,” Kerry said in obvious frustration. After stumbling into Russia’s checkmate, the Obama administration could do little but fume from the sidelines. At a White House press conference a few days after the Russian intervention, a reporter asked why the U.S. had allowed itself to be out-maneuvered. The response, which went on for a good five minutes or so, was pure Obama – charming, humorous, yet almost eerily detached. America is strong, he said: “…we’re the strongest advanced economy in the world… our approval ratings have gone up, we are more active on more international issues and forge international responses on everything from Ebola to countering ISIL.” But Russia, he continued, is weak: “their economy’s contracting four percent this year. They are isolated in the world community subject to sanctions applied not just by us but by what used to be some of their closest trading partners. Their main allies in the Middle East were Libya and Syria … and those countries are falling apart. And he’s now just had to send in troops and aircraft in order to prop up this regime at the risk of alienating the entire Sunni world.” In other words, Obama was saying that Russia is a loser; its friends are losers; and it was foolishly plunging into Syria in a last-ditch effort to bolster a loser who was clearly in his death throes. Obama thus ignored his own role in destroying Libya and Syria or provoking a confrontation over the eastern Ukraine. He refused to consider how his own policies were making matters worse and worse or why Putin felt he had no alternative but to step in after all. Now the shoe is on the other foot. Russia is the dominant power in the Middle East at the moment – apart from Israel, that is – while the U.S. is in disarray as a dangerous rightwing buffoon ensconces himself in the White House. The Democrats should take a long hard look in the mirror if they want to know who the real loser is. But they won’t. They prefer to blame Putin and Russia. |

| Trump & Yellen's Collision Course Posted: 25 Jan 2017 07:05 PM PST Submitted by Kevin Muir via The Macro Tourist, Although the stock market is giddy from President Trump’s pro-growth policies, there is another constituent not quite so enamoured with recent developments. Although a few years ago Fed officials were begging for some help from fiscal policy, with employment now running at a “perceived” tight pace, FOMC participants have switched to viewing fiscal stimulus as a potential inflationary concern that needs to be offset with tighter monetary policy. Case in point - have a look at the comments from the most dovish member of the FOMC - über dove Lael Brainard (all quotes from Bloomberg): September 16, 2016

January 17th, 2017

Brainard is the most dovish member of the Federal Open Market Committee, yet she is openly warning about higher rates. Other FOMC members are even going so far as to signal upcoming balance sheet reductions and even higher rates than the market has currently priced in. Chair Yellen is also making some hawkish chirping noises. Have a look at the first paragraph from her recent Stanford speech:

“Labour utilization is close to its estimated longer-run normal level, and we are closing in on our 2 percent inflation objective” is the key line. In this speech, Yellen then goes on to sketch out the basic formula for setting rates. It’s a boring econometrics discussion, but the important point is that she is setting out how the Federal Reserve will go about raising rates. Make no mistake - rates are going higher. Probably a lot higher than the market realizes. Just look at this comment buried in Yellen’s speech:

In the coming quarters, the Federal Reserve will march rates higher. But more importantly, the more Trump pushes on the fiscal accelerator, the harder the Fed will lean on the brake. The stock market has risen on each pro-business executive order Trump signs. In fact, this latest push to new highs is the direct result of Trump’s following through with his promised plans. Although the stock market is screaming higher, the bond market is not at all happy. Not only does the bond market need to deal with the threat of increased inflation from Trump’s policies, but also a Federal Reserve intent on tightening monetary policy to offset the fiscal stimulus. I think the Federal Reserve is too eager to raise rates (and also reduce the size of the balance sheet). They continue to fight the last battle and don’t realize that in a balance sheet constrained global financial system, inflation is not the main worry. They run the risk of becoming another Japan with an economy littered with false starts. I don’t know if it is a political bias, or they would have been just as quick on the trigger for a Democratic President, but it really doesn’t matter. Nor does my opinion about the Fed being better off letting the economy run hot for a while mean two shits. All of these thoughts should just be discarded in the dustbin of not worrying about what should be and instead focusing on trading what will be. It seems obvious the Federal Reserve is intent on withdrawing monetary accommodation until something breaks. There is no sense fighting it. And it is also clear President Trump will follow through with his fiscal stimulus plans. Many pundits thought Trump’s actions might not follow his rhetoric, but the market is quickly realizing that Trump means what he says. These two different forces are on a collision course. More fiscal stimulus translates into more monetary tightness. And Trump isn’t going to back down anytime soon, so all that is left is an expanding fiscal environment with a Federal Reserve desperately trying to apply some brakes. This economic expansion is already running long in the tooth, and there is a pattern of recessions occurring in the first year of office for newly elected Presidents, so an overly aggressive Fed is a worrisome development. Ironically, Trump’s fiscal stimulus might be the trigger that ushers in the next economic slowdown. Many strategists believed Trump might ask Yellen to step down and appoint someone more hawkish. They mistakenly confused Trump’s campaign complaint about low interest rates killing the economy as future policy. Well, Trump will do no such thing. In fact, I suspect before Yellen’s term is complete in 2018, Trump will be blaming her for all his problems when the economy rolls over. I am not sure if Trump is this smart, but keeping Yellen around for exactly this task would be the wise move. In the mean time, Trump will keep pushing forward with more fiscal stimulus, and Yellen & Co. will push back with tighter monetary policy. This interplay between Trump and Yellen makes for a shitty environment for bonds, and also as real rates head higher, gold and other commodities. Eventually this giant debt disaster will need to be inflated away, but I am afraid this FOMC is not yet scared enough to let that happen. As this plays out, be careful with your precious metals and other commodity long positions. Higher real rates are not conducive for precious metal bull markets. As long as the Fed keeps pressing on the brake, it will be tough for these commodities to get up off the mat. It won’t be until something breaks in the financial system that you want to own them. But at that point, you should be buying with both fists. |

| Posted: 25 Jan 2017 05:25 PM PST From the New York Sun "Great!" tweets President Trump in respect of the Dow, which closed above 20,000 for the first time in history. Then again too, his excitement is fair enough. That the Dow has been moving higher since his election has to be, at some hard-to-quantify level, an optimistic bet on the prospects for his own presidency. We don't mind saying that we share that optimism, particularly as the signals mount that the president intends to follow through on his pro-growth campaign promises. For the record, though, the Dow, calculated in the classical measure of value, is nowhere near its high, even if it has been moving in the right direction. That was made recently by a point made by the Web site PricedinGold.com. It maintains, among other things, a chart of the Dow measured in gold. Its all-time low was the equivalent of 1.3 ounces of gold, struck at 1980, just as Americans were preparing to step back a bit from Keynesian principles and elevate Ronald Reagan to the White House. ... ... For the remainder of the commentary: http://www.nysun.com/editorials/the-20000-dow/89880/ ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| GATA chairman notes smashing of gold on eve of options expiration Posted: 25 Jan 2017 05:15 PM PST 8:14p ET Wednesday, January 25, 2017 Dear Friend of GATA and Gold: GATA Chairman Bill Murphy, interviewed by GoldSeek Radio's Chris Mullen, notes that the gold price today was driven below $1,200 on the eve of futures option expiration, a maneuver undertaken for years by the "gold cartel" without comment from mainstream financial market analysts. The inauguration of a new president, Murphy adds, has changed nothing about the rigging of the monetary metals market, but he senses that this year still will be a good one for the metals. Murphy's interview is 12 minutes long and can be heard at GoldSeek Radio here: http://radio.goldseek.com/nuggets/murphy01.25.17.mp3 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Excessive leverage promises disaster for financial system, Embry says Posted: 25 Jan 2017 04:57 PM PST 7:57p ET Wednesday, January 25, 2017 Dear Friend of GATA and Gold: The world financial system is heading toward disaster because of excessive leverage, Sprott Asset Management's John Embry tells King World News today. Embry says: "With the enormous increase in what I call 'financial innovation' -- high-frequency trading, algorithms, staggering quantities of derivatives, etc. -- the amount of leverage that has been introduced into the global financial system in the last couple of decades ensures a horrific ending." Embry's interview is excerpted at KWN here: http://kingworldnews.com/a-horrific-ending-as-the-world-moves-one-day-cl... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT At 3 Aces Project, Golden Predator Finds 7.5 Meters of 33 Grams-Per-Tonne Gold Company Announcement Thursday, January 19, 2017 VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V: GPY; OTCQX: NTGSF) is pleased to report assay results for the first 13 holes of a total of 54 holes completed in the winter 2016 drill program at the 3 Aces Project in southeastern Yukon Territory. Drilling has demonstrated an extension of high-grade gold at the Ace of Spades zone, as well as the exciting discovery of a blind vein and the occurrence of significant assay values in stockwork zones. Significant results reported at true width include: -- Hole 3A16-RC-032 intersected 7.54 meters of 32.86 grams per tonne gold from a depth of 16.76 meters, including 0.54 meters of 252 grams per tonne gold; and a new blind vein at a depth of 71.63 meters returned 3.23 meters of 10.04 grams per tonne gold. (The hole ended in mineralization. ... For the remainder of the announcement: http://www.goldenpredator.com/_resources/news/nr_2017_01_19.pdf Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The Challenges in Reforming the Left #JusticeDemocrats Posted: 25 Jan 2017 04:00 PM PST The nine points needed to be understood to make the American Left a competitive party again. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Dow 20K? We’re Moving On Already Posted: 25 Jan 2017 02:09 PM PST This post Dow 20K? We're Moving On Already appeared first on Daily Reckoning. OK, can everyone just shut up about Dow 20,000 finally? The Dow Jones industrial average crested the big round number for the first time this morning, minutes after the open. CNBC saw fit to send an alert to my iPad — in ALL CAPS, no less, to convey the magnitude of this development. Never mind the Big Board is merely playing catch-up to the S&P 500 and Nasdaq, which posted record closes yesterday. We won't waste your time speculating about whether the renewed "Trump bump" this week can be sustained or whether we're overdue for a pullback. You can read or watch that anywhere. Let the mainstream obsess about "the market"; we're on the hunt for specific opportunities that can zoom higher during the Trump era no matter what the stock indexes do. The hot money flowing into stocks today is flowing out of bonds and gold. As the markets closed, the Dow ended up at 20,068. Treasury prices are climbing down, pushing yields higher; the yield on a 10-year note is back up to 2.5%. And gold has surrendered the $1,200 level, the bid $1,196 at last check. Naturally, traders are keeping an eye on Trump's latest executive orders — including the one for the Mexico border wall. Contrary to his campaign promises about making Mexico pay for it, the president now plans to use your money to build it and then send Mexico a bill for reimbursement. Even if Mexico comes through with payment, we strongly suggest you don't hold your breath waiting for a rebate on your income taxes. Heh… "The main driver of the gold rally of 2017 will be a weaker U.S. dollar," says Jim Rickards. "After all, the dollar price of gold is simply the inverse of the dollar itself. A strong dollar means a lower dollar price for gold, and a weak dollar means a higher dollar price for gold. It's that simple. "Gold is money. The dollar price of gold is just another cross-rate like the euro-dollar cross-rate or the dollar-sterling cross-rate. The strong dollar was killing the U.S. economy through the loss of exports and export-related jobs. A strong dollar also imports deflation to the U.S. and is a major head wind for the Fed's inflation goals. "Investors are looking past the March 2017 Fed rate hike (highly likely, in my view) to a Fed that will probably have to ease monetary conditions with forward guidance by May. That easing means a weaker dollar and a higher dollar price for gold. Markets discount the future, so events likely to play out from May–September are being priced in today. The time to participate is right now, before the markets fully correct for the November-December 2016 drawdown." "There's another factor driving gold higher, which is good news coming out of Europe," Jim goes on. "After the Brexit shock and the Trump shock, mainstream media decided more shocks were in store and began predicting nationalist, protectionist victories in coming elections in the Netherlands, France and Germany this year. "Oops, wrong again. While the nationalists won in the U.K. and U.S., it appears the more conservative and centrist parties will prevail in European elections." For instance, Marine Le Pen's nationalist party in France is poised to pick up seats, but not enough to form a government. Based on his extensive sources, Jim even believes Germany's unpopular Chancellor Angela Merkel will emerge victorious in elections this September. "The result," he says, "will be a stronger euro to satisfy inflation-phobic German voters. A stronger euro means a weaker dollar, which means a higher dollar price for gold. Everything's connected." The bottom line is that the great 2017 gold price rally has just begun, and it's not too late to get in on the action. Kind regards, Dave Gonigam The post Dow 20K? We're Moving On Already appeared first on Daily Reckoning. |

| Gold Seeker Closing Report: Gold Falls Back Towards $1200 While Dow Tops 20,000 Posted: 25 Jan 2017 02:03 PM PST Gold fell $16.55 to $1193.35 in midmorning New York trade before it bounced back higher into the close, but it still ended with a loss of 0.81%. Silver slipped to as low as $16.775 and ended with a loss of 0.7%. |

| Trump Missed His Biggest Chance to Drain the Swamp Posted: 25 Jan 2017 02:01 PM PST This post Trump Missed His Biggest Chance to Drain the Swamp appeared first on Daily Reckoning. [Ed. Note: To see exactly what this former Reagan insider has to say about Trump and specifically what he believes must be done, David Stockman is sending out a copy of his book Trumped! A Nation on the Brink of Ruin… And How to Bring It Back out to any American willing to listen. To learn how to get your free copy CLICK HERE.] Janet Yellen insists that she would serve out her full term (until January 2018) and has rather cheekily lectured Congress about the dangers of political interference with the central bank. Oh, my. Before December — after the election — the Fed spent the past year sitting hard on interest rates for no plausible reason whatsoever. The main reason was to perpetuate the stock market bubble and thereby ensure the election of Hillary Clinton and a perpetuation of the current Wall Street/Washington regime. To his credit, Donald Trump called her out on this blatant political meddling during the campaign, calling it “shameful” and designed to keep the stock averages levitated through November 8th. He was exactly right. Yet notwithstanding his shocking victory, Yellen has the temerity of a pot calling the kettle black. Her Keynesian-statist party has been rebuked by the American public, but the terminally grating school marm who occupies the big chair in the Eccles Building petulantly insists that her right to rule has not been diminished by an iota. Moreover, this wasn’t just more of the self-serving oratory about the purportedly sacrosanct “independence” of the Fed that we had come to expect from Yellen and her predecessors. To the contrary, it was a shot across-the-bow of the then president-elect, current president. It amounted to saying that the election was immaterial to the arrogant monetary mandarins who run the nation’s central bank, and that in any event, the Fed had nothing to do with the crushing economic failures that brought a majority of the voters to the Trump column in 85% of the counties in Flyover America. Oh, yes it did. In the great scheme of things the destruction of honest price discovery in the financial markets and the transformation of corporate America’s C-suites into dens of financial engineering and stock pumping is exactly what has caused American capitalism to slide toward the ditch. Indeed, the Fed’s massive money pumping and financial repression has been many times more harmful than excessive taxation, regulation and all the other government intrusions into the free market that have long been with us. That’s because insanely low interest rates triggered a mad scramble for yield among bond managers, who in turn have spent the last 7 years bidding up the price of corporate bonds and other debt. But artificially cheap capital did not generate an investment boom on main street per the Keynesian catechism. The geniuses in the Eccles Building did not reckon with the fact that when you falsify some financial asset prices, like the yield on bonds, you create a chain reaction of additional distortions, falsifications and malinvestments. The stock market is so egregiously over-valued — probably 50% or more — that it has become an agent of capitalist destruction, rather than an efficient forum for raising and allocating equity capital. Needless to say, the so-called conservative economists advising Trump — and the Congressional GOP, as well — miss this point entirely. Reading from their Adam Smith 101 — without noticing that free central bank money ruins free markets and destroys their rules. The massive financial engineering it's created is a hideous deformation of central bank driven Bubble Finance. It represents the highest and best use of mis-priced debt, not the allocation of capital which would have occurred on the free market. In that context, so-called conservative economists also keep yapping about tax rates being too high — and that is true in the abstract because by definition all taxes are too high. But on the immediate issue of why business investment and good job creation have stalled out in corporate America — it’s not because the IRS has sucked them dry. In fact, the General Accounting Office (GAO) studied the tax returns of all large U.S. companies in depth for 2008 through 2012 and found that 20% of large profitable companies paid no US corporate income tax at all. Moreover, profitable large U.S. companies as a whole paid only 14% of their pretax income in U.S. corporate income taxes. That’s not even close to the 35% statutory rate or even the 22% effective rate often cited by tax experts. But that latter rate includes foreign, state and local taxes, which wouldn’t change even if the U.S. statutory rate were dropped to zero. Don’t get me wrong here. The entire U.S. corporate income tax is a stupid, inefficient and essentially uncollectable relic of an earlier age. After all, in today’s world of instantly mobile capital, technology, product and service sourcing and even plant and warehouse facilities — which can be rented or contracted out anywhere on the planet on short notice — the tax man will never keep up. The corporate income tax generated just $300 billion in FY2016 or 1.6% of GDP — compared to 8-9% back in the heyday of the 1950s where it might have made marginal sense. But today, it’s just an accountants, lawyers and consultants full employment act. And that’s to say nothing of the Wall Street bonanza stemming from all of these “inversion” and other tax jurisdiction hopping deals which have zero economic merit. So sharply reducing to 15% — or even eliminating entirely — the corporate income tax is a wonderful idea because it will reduce the deadweight cost of today’s vast corporate infrastructure of tax compliance/dodging. And in time, the freed-up resources — including recycled tax lawyers — will contribute to enhanced productivity and growth of the U.S. economy. But in the near-term this type of tax reduction alone will not contribute much to reviving corporate investment in productive assets, growth and jobs. The real job killers in American business today are the CEOs, CFOs and other top executives who occupy the C-suites. Yet here’s the thing. They are creatures of the incentive system and the capital(mis)-pricing environment which is controlled lock, stock and barrel by the Fed. So as long as the current crop of Keynesian coddlers of the stock market remain in charge, there will be no investment boom to make America great again. Instead, lower corporate taxes will go into stock buybacks and other forms of financial engineering designed to goose stock prices and the value of C-suite stock options. Likewise, the ballyhooed “tax holiday” designed to bring an alleged $2 trillion of off-shore corporate cash back to the U.S. — will also result in more stock buybacks, dividends and deals just like it did in 2004. In short, there are no tax or regulatory policy initiatives that can restart growth until the stock market crashes and is purged entirely of the toxic regime of free money driven speculation that has turned it into a rank casino. So for the incipient Trump administration to leave Janet Yellen, and her insufferable Keynesian colleague, Vice Chairman Stanley Fischer, in power would be the height of folly. The effect would be to keep this giant Wall Street bubble levitated just long enough for its inexorable collapse to be blamed on Donald Trump. As I've been saying, the time to lance the boil is now! Then president-elect Trump should have demanded that their resignations be on his desk on January 20th. That simple but decisive command would have caused an immediate, thundering collapse of the lunatic bubbles now hovering over Wall Street. But that’s exactly the point, and is consistent with the way Ronald Reagan played it back in 1981. If Trump is exceptionally good at anything, it’s in creating political piñatas that can then be whacked over and over. He could have laid the political blame for the necessary purge of the casino squarely on the doorstep of the Obama White House. And while he was at it he should have slammed good and hard the posse of elitist monetary central planners at the Fed who have pumped up bubble after bubble — even as they have drained capital, investment, growth, jobs and purchasing power out of the main street economy. That’s how Trump could have started draining the swamp. He didn't do it. Regards, David Stockman The post Trump Missed His Biggest Chance to Drain the Swamp appeared first on Daily Reckoning. |

| Silver in 2017: The Year of the Wild Card Posted: 25 Jan 2017 01:03 PM PST |

| Trump issues Orders on Border Wall, Immigration Crackdown Posted: 25 Jan 2017 12:30 PM PST David Rubin, former mayor of Shiloh, Israel, on President Trump's possible restrictions on refugees coming to America. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Too Big To Fail – It’s Happening Again Posted: 25 Jan 2017 08:20 AM PST This post Too Big To Fail – It’s Happening Again appeared first on Daily Reckoning. Too big to fail is returning with a vengeance. The same risk that major Wall Street banks posed in the 2008 crisis when they were too complex, too big and too risky to the global economy to be allowed to fail is alive and well. According to a recent Bloomberg report the hedge fund industry has officially gone over $3.02 trillion in global assets under its management. To put that into perspective, that figure is nearly six times the amount that it took for Lehman Brothers to crash and throw the world into financial calamity in 2008. Not only have big banks morphed into a too big to fail ponzi, but now hedge fund managers are pushing global asset numbers into the same stratosphere. The risk to the global economy is alarming. The threat is real. Jim Rickards sends the alert saying, "Right now investors are skittish, numerous shocks are waiting to happen and the system is highly unstable due to overleverage and nontransparency." Jim Rickards is a Daily Reckoning contributor who was on general council for Long Term Capital Management (LTCM) as a negotiator for its bailout in 1998. He knows the bailout system on Wall Street better than most. In his analysis of the markets pricing the new White House administration Rickards remarks that, "despite Trump's best efforts and positive policies, a collapse could happen any day unless radical steps are taken to prevent it — such as breaking up big banks and banning derivatives." The threat of "too big to fail" is even more grave when looking at derivatives in the global market. Put simply, a derivative is a security with an attributed value that is then "derived" from one or more assets. Think of it as a bet on a bet. The biggest global banks are using derivatives to hedge speculation on companies, currency options and nearly anything that can be traded. Derivatives and Too Big to FailAs seen in the chart below from a little known report released in March 2016 by the Office of the Comptroller of the Currency (OCC), one of the primary government regulators of national banks, a shocking review of the derivative standings in the United States was given. The report found that the top bank holding derivatives Citigroup, the same bank in 2008 that saw its toxic derivatives and subprime debts explode, has over $55.6 trillion in holdings. Along with its fellow big six banks, the figures found are astronomical – and growing larger. That figure might be opaque, but when breaking it down it is outright abhorrent and dangerous. According to the OCC of the $55.6 trillion in overall notional (the face value) of its derivatives that are exposed, more than $52.9 trillion of them are sitting in banking institutions that are FDIC insured. That means that not only are Citigroup and banks of its size and complexity holding a massive amount of money being speculatively bet, but that the risks are being backed by the U.S government. As former Wall Street managing director, Nomi Prins tells us, "We don't like it, but certain big banks won't be allowed to fail." She goes on to tell her story that, "When I was working on Wall Street, I saw the inner behavior of how bankers react in a crisis. Here's the most important lesson that I can pass on to you from my time there: Bankers don't care about how their actions impact you." While Donald Trump might have lit a fire of hope for many on the right, the world of big finance extends beyond partisan politics. Now that deregulation is anticipated, the financial world is watching and expects to reap the benefits. Discussion over Treasury Secretary prospective, Steven Mnuchin introducing a "21st Century Glass-Steagall" type bill has been tossed around. Any progress on that was immediately squashed after his statement that "Separating out banks and investment banks right now under Glass-Steagall would have very big implications." Why would a former Goldman Sachs partner and major financier that is suddenly turned into a government leader want to redirect the ship? It’s bad for business. After all it was a former Goldman Sachs banker turned Treasury Secretary in 1999 that was so constructive in inhibiting President Clinton to demolish the remainder of Glass-Steagall regulation. As too big to fail enters a new year, it also enters a new government. The expectations of any policy reversal are short lived and any sweeping policy to reduce the dangerous banking practices are virtually non-existent. In the face of the next crisis, rest assured that the threat of too big to fail will only raise the stakes. And heighten the fall. Leaving the government, and by virtue, the taxpayer to pick up the bill. Thanks for reading, Craig Wilson, @craig_wilson7 The post Too Big To Fail – It’s Happening Again appeared first on Daily Reckoning. |

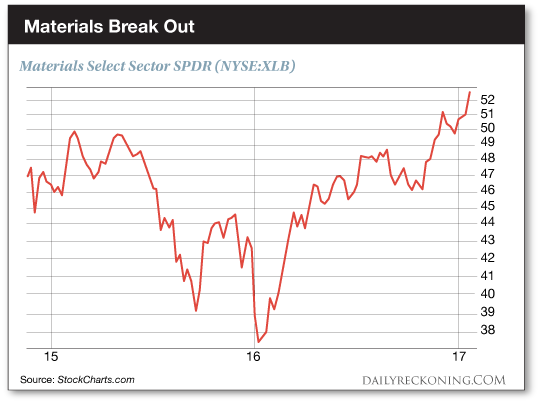

| While Gold Crawls, This Metal Powers Higher Posted: 25 Jan 2017 08:11 AM PST This post While Gold Crawls, This Metal Powers Higher appeared first on Daily Reckoning. Yesterday's rally was a big, fat win for the stock market. The S&P 500 shot to an all-time closing high on Tuesday. So did the Nasdaq Composite. But the sheer magnitude of the move wasn't that impressive. The major averages have been stuck in such a tight range over the past few weeks that a 0.5% move in the Dow was enough to get traders to bust out the champagne But you won't find anyone dusting off a Dow 20,000 hat. The media blew through its canned Dow 20K stories way back in December. It's all too fitting that financial journalists have nothing left to say about this arbitrary milestone now that the market is finally knocking on the door… Of course, the real moves under the surface of the major averages have earned even less attention. That's too bad. Because if you want to actually profit from the next thrust higher, you have to know what stocks are fueling the fire. Yesterday, the market gave us some clues. And since most folks refused to pay attention, I have no doubt they'll miss out on this next lucrative trade that's hiding in plain sight. Just barely scratching below the market's surface reveals a couple of key sectors helping stocks up over the hump. One of these is materials. The Materials Select Sector SPDR (NYSE:XLB) is sprinting to new all-time highs. These industrial, chemical, and metals companies are reaching out to grab the torch as new market leaders.

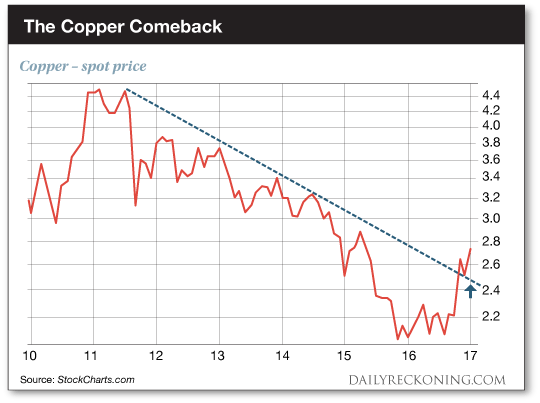

"This is one of the most economically-sensitive parts of the market and is closely tied to the direction of commodity prices," John Murphy explains over at his Stockcharts.com blog. "Today’s record is a vote of confidence in the global economy. It’s also a bet on higher economically-sensitive commodity prices and shows that the reflation trade is alive and well." Out of all the materials stocks, the metals are top dogs. They could even outperform our gold miner trade over the next few weeks… While the world is distracted by presidential press conferences, no one's paying attention to the commodity space. Most folks still aren't interested in a commodity market that's produced nothing but losses over the past several years. But the market says it's time for these forgotten industrial metals to shine once again. And we can't ignore the breakouts in copper, steel and aluminum Copper quietly jumped to prices not seen since 2015 yesterday. Meanwhile, aluminum giant Alcoa is set to rip higher today after beating earnings estimates. Copper has endured a painful downtrend for six years. The metal has now exploded out of its long-term downtrend after building a solid base last year. It's time to get ready for some explosive gains…

The next leg of the metals rally starts now. You won't want to miss it… Sincerely, Greg Guenthner The post While Gold Crawls, This Metal Powers Higher appeared first on Daily Reckoning. |

| Putin's sanctioned ally may win mine with a quarter of Russian gold resources Posted: 25 Jan 2017 06:53 AM PST By Yuliya Fedorinova Russia's auction of its giant Sukhoi Log gold field this week pits a long-time ally of President Vladimir Putin against a rival bidder with little background in mining. The resource in the isolated Irkutsk region of Siberia is one of the world's largest untapped gold fields, making up a quarter of Russian reserves. It has held an allure for miners since Soviet geologists surveyed it in the 1970s. Yet BCS Global Markets strategist Kirill Chuyko and Societe Generale SA analyst Sergey Donskoy say one bidder is an overwhelming favorite to win the sale. Their bets are on state-owned Rostec Corp., run by Sergey Chemezov, 64, whose relationship with Putin dates to the 1980s. The company has tied up with Russia's biggest miner of the metal, Polyus PJSC. Competition comes from a grouping of state bank VTB and businessman Ibrahim Palankoev. ... ... For the remainder of the report: https://www.bloomberg.com/news/articles/2017-01-25/putin-s-sanctioned-al... ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold Bars Demand in China Jumps as Yuan Falls, No.1 Miner for 10th Year Posted: 25 Jan 2017 06:24 AM PST Bullion Vault |

| Gold Market Insider David Smith: Turning Points Appear Suddenly, So Must Be Prepared... Posted: 25 Jan 2017 06:22 AM PST Mike Gleason: It is my privilege now to welcome back David Smith, senior analyst at The Morgan Report and regular contributor to MoneyMetals.com. Well David, happy new year, my friend and thanks for joining us again. How are you? David Smith: I'm doing good, Mike. Looking forward to a very exciting year. I think we're going to have all sorts of interesting things to be watching and reacting to. |

| TLT Update…US Bonds and Gold an Odd Couple Posted: 25 Jan 2017 02:07 AM PST Lets start by looking at a weekly chart for TLT, 20 year bond etf, which shows it built out a H&S top last summer. That H&S top is a reversal pattern that showed up at the end of its bull market which has been ongoing for many years. There is a big brown shaded support and resistance zone that has been offering support. |

| Breaking News And Best Of The Web Posted: 25 Jan 2017 01:37 AM PST US stocks up, gold and silver down. President Trump begins with flurry of changes to Obamacare and NAFTA. Earnings season starting well for banks and miners. Global debt continues to soar, especially in China. Fake news debate rages. Brexit hits speed bumps. Best Of The Web These are the countries with the biggest debt […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Rise Buys $40 Million Mine for $2 Million Posted: 25 Jan 2017 12:00 AM PST |

| Jeffrey Christian on the Short and Long Term Future of Gold Posted: 24 Jan 2017 04:00 PM PST |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment