saveyourassetsfirst3 |

- Remember The Hunt Brothers? The Silver Market Is Now Cornered Again

- Inevitable Global Ruin: Top Hedge Fund Managers Sound the Alarm

- Uncensored RAW VIDEO: Russian Ambassador Assassinated In Turkey

- Caution: The Gold Correction Continues – Jack Chan

- “Gold Is Now Effectively Illegal” In India – Jayant Bhandari

- Why the Mainstream Press is FREAKING OUT

- Will Gold & Silver Be Declared “Fake Money” Next?

- CBS News Caught Lying And Slandering WeAreChange and Free Speech

- China Will Determine the Price of Gold! – Egon von Greyerz

- Higher Interest Rates: Bad For Gold & Badder For Silver?

- Credit, Crisis, & COLLAPSE – BILL HOLTER

- Federal Reserve and Stronger Real Rates Cause Breakdown in Gold

- Breaking News And Best Of The Web

- The War on Cash and Then on Gold

- Fed Rate Hike Causes Gold Price Drop, Report 18 December, 2016

- Short Term Gold cycles rotating back to bullish

- The Real Reason Why America Has Been Given A Reprieve

- Federal Reserve & Stronger Real Rates Cause Breakdown in Gold

- TheDailyGold Premium Update #496

- Jack Chan: This Past Week in Gold

| Remember The Hunt Brothers? The Silver Market Is Now Cornered Again Posted: 19 Dec 2016 12:03 PM PST |

| Inevitable Global Ruin: Top Hedge Fund Managers Sound the Alarm Posted: 19 Dec 2016 12:00 PM PST When monetary control is centralized, as it is today, prosperity withers. The Wall Street Journal just surveyed top hedge fund managers and found a significant belief that full-fledged, global ruin is on its way. Submitted by Jeff Berwick: Tamper with freedom, monetarily or otherwise, and you end up facing catastrophe. That's just where we […] The post Inevitable Global Ruin: Top Hedge Fund Managers Sound the Alarm appeared first on Silver Doctors. |

| Uncensored RAW VIDEO: Russian Ambassador Assassinated In Turkey Posted: 19 Dec 2016 11:20 AM PST *BREAKING The Russian ambassador to Turkey, Andrey Karlov, has been assassinated by a Turkish Police Officer while speaking at a press conference: Courtesy SHTFPlan: Russian Ambassador Andrei Karlov has been shot dead in Turkey. Initial reports indicate the assassin is a Turkish police offer. The assassination comes just days before Russia was set to host a […] The post Uncensored RAW VIDEO: Russian Ambassador Assassinated In Turkey appeared first on Silver Doctors. |

| Caution: The Gold Correction Continues – Jack Chan Posted: 19 Dec 2016 11:10 AM PST Technical analyst Jack Chan charts the latest moves in the gold and silver markets, noting a bull market has emerged for the U.S. dollar. Submitted by Streetwise: Our proprietary cycle indicator is down again, confirming price action. The gold sector is on a long-term buy signal. Long-term signals can last for months and years and […] The post Caution: The Gold Correction Continues – Jack Chan appeared first on Silver Doctors. |

| “Gold Is Now Effectively Illegal” In India – Jayant Bhandari Posted: 19 Dec 2016 11:05 AM PST “The situation is getting worse by the day… people are desperate” Gold Bullion Is Now Effectively Illegal… From Tyler Durden: Jayant Bhandari warns “there are clear signs that in a very convoluted way, possession of gold for investment purposes will be made illegal” as he discusses India’s attempts to create a cashless society (and […] The post “Gold Is Now Effectively Illegal” In India – Jayant Bhandari appeared first on Silver Doctors. |

| Why the Mainstream Press is FREAKING OUT Posted: 19 Dec 2016 11:00 AM PST One Nation, Under Control… From Charles Hugh Smith: In its panicky rush to demonize the independent media via baseless accusations of “fake news,” the mainstream press has sunk to spewing “fake news” of its own. Here’s The Washington Post’s criminally false “fake news” article in case you missed it: Russian propaganda effort helped spread 'fake news' […] The post Why the Mainstream Press is FREAKING OUT appeared first on Silver Doctors. |

| Will Gold & Silver Be Declared “Fake Money” Next? Posted: 19 Dec 2016 10:00 AM PST Greg Mannarino warns They Can’t Have REAL Money Competing With Fake Money… The post Will Gold & Silver Be Declared “Fake Money” Next? appeared first on Silver Doctors. |

| CBS News Caught Lying And Slandering WeAreChange and Free Speech Posted: 19 Dec 2016 09:00 AM PST The Propaganda Ministry’s War On REAL News Is Heating Up… The post CBS News Caught Lying And Slandering WeAreChange and Free Speech appeared first on Silver Doctors. |

| China Will Determine the Price of Gold! – Egon von Greyerz Posted: 19 Dec 2016 07:01 AM PST For those distraught over the COMEX paper futures price of gold plunging towards $1,000/oz, Switzerland’s Egon von Greyerz has some information for you: From Greg Hunter: I am not upset because I know one day, COMEX will default. The futures market will default. The banks will not be able to deliver the paper gold […] The post China Will Determine the Price of Gold! – Egon von Greyerz appeared first on Silver Doctors. |

| Higher Interest Rates: Bad For Gold & Badder For Silver? Posted: 19 Dec 2016 07:00 AM PST Are higher interest rates bad for gold and badder for silver? Are we close to capitulation in the metals? Submitted by Keith Weiner: The price action was not what most of those in the gold community hoped for (or predicted). The price of gold dropped another $24 and that of silver nearly a whole […] The post Higher Interest Rates: Bad For Gold & Badder For Silver? appeared first on Silver Doctors. |

| Credit, Crisis, & COLLAPSE – BILL HOLTER Posted: 19 Dec 2016 06:00 AM PST JS Mineset’s Bill Holter is back to break down the credit crisis that will lead us directly to a collapse of the entire banking system. Subscribe for free to the SD YouTube channel The post Credit, Crisis, & COLLAPSE – BILL HOLTER appeared first on Silver Doctors. |

| Federal Reserve and Stronger Real Rates Cause Breakdown in Gold Posted: 19 Dec 2016 02:02 AM PST The Daily Gold |

| Breaking News And Best Of The Web Posted: 19 Dec 2016 01:37 AM PST US stocks, interest rates, dollar at recent and/or record highs. Worries about valuation are spreading. US housing starts plunge as higher mortgage rates begin to bite. Italian banks restructuring and raising capital as government begins bail-out. Gold and silver recover slightly from post-Fed decline. The “fake news”/Russian hacking debate intensifies. Best Of The Web […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| The War on Cash and Then on Gold Posted: 19 Dec 2016 12:00 AM PST |

| Fed Rate Hike Causes Gold Price Drop, Report 18 December, 2016 Posted: 18 Dec 2016 10:11 PM PST Monetary Metals |

| Short Term Gold cycles rotating back to bullish Posted: 18 Dec 2016 10:10 PM PST Commodity Trader |

| The Real Reason Why America Has Been Given A Reprieve Posted: 18 Dec 2016 08:49 PM PST

Compared to much of the rest of the world, America appears to have been blessed over the past year and a half. Our financial markets have performed extremely well, the U.S. dollar is the strongest that is has been in over a decade, and jobs are coming back to the United States. None of this was supposed to happen. In fact, our financial system was in such bad shape a year and a half ago that it was being projected that the U.S. would be on the bleeding edge of the next crisis. But instead here we stand safe, prosperous and seemingly secure. How in the would can we explain this? What I am about to share with you I have previously shared on national television down at Morningside, but it has been brought to my attention that I have never shared this with my readers on The Economic Collapse Blog. I apologize for this, because the past year and a half doesn’t make any sense until you understand these things. When people look back at September 2015, they always forget the most critical event. In addition to everything else that was going on that month, France had a UN Security Council resolution all ready to go that would have permanently divided the land of Israel, that would have given formal UN Security Council recognition to a Palestinian state for the very first time, and that would have given East Jerusalem to the Palestinians as the capital of their new state. The rest of the UN Security Council was ready to go along with the French resolution, but there was just one country standing in the way. The United States has veto power on the UN Security Council, and so the Obama administration had the power to potentially block the resolution. After carefully considering the matter, the Obama administration decided that it was not the time for such a resolution, and so France never submitted it for a vote. Just about everything else that Barack Obama did throughout his entire presidency was bad, but in this instance he got something completely right. The decision whether or not to divide the land of Israel was in his hands, and he made the right call. Once this decision was made, it was almost as if someone hit a “pause button”. None of the bad things that people were forecasting ending up happening, and since that decision America has been blessed compared to the rest of the world. And this is perfectly consistent with what God said that He would do. Starting in Genesis 12 and continuing all throughout the Scriptures, God promises to bless those that bless Israel and to curse those that curse Israel. In this case, Barack Obama blessed Israel by preventing the UN Security Council from dividing the land, and so we were blessed as a result. But of course there have been many other instances over the past several decades when we have been cursed as a nation for attempting to take steps toward the division of the land of Israel. One of the most notable instances took place in 1991 when George H. W. Bush got the Israelis and the Palestinians together for the very first time to discuss the dividing of the land of Israel into two states… At that conference, the New York Times reported that Bush told Israel that “territorial compromise is essential for peace”. Needless to say, this upset a lot of people… At the exact same time that conference was going on, the “Perfect Storm” was raging in the North Atlantic. Three major storms merged together, and instead of canceling one another out, they formed the kind of storm that is normally only seen once in a lifetime. If you will remember, Hollywood made a big blockbuster with George Clooney that was based on this storm. This gigantic storm went 1000 miles the wrong direction and slammed directly into the home of George H. W. Bush while he was at the Madrid conference talking about the need to divide the land of Israel… Another very notable example of this phenomenon came in 2005. At that time, George W. Bush (the son of George H. W. Bush) had convinced Israel that it should pull all of the settlers out of Gaza and turn it entirely over to the Palestinians. According to the New York Times, the last of the settlers was evacuated on August 23, 2005… On that exact same day, a little storm that came to be known as Hurricane Katrina formed over the Bahamas. It shocked forecasters by turning directly toward New Orleans, and it ultimately became the costliest natural disaster in all of U.S. history up until that time. There are dozens more examples like this, and men like John McTernan, William Koenig and David Brennan have done a great job documenting them. Today, 137 nations have already recognized a Palestinian state. The holdouts are mostly in North America and Europe… France and most of the rest of Europe have been eager and ready to recognize a Palestinian state for quite a while now, but they don’t really want to move forward without the United States. And of course they can’t officially do anything at the UN Security Council without U.S. approval. Barack Obama had been hoping to achieve something through direct negotiations between the Israelis and the Palestinians, but those totally broke down and there is no hope that there will be any new negotiations any time soon. So Barack Obama knows that his only shot at “leaving a legacy” in the Middle East is at the United Nations, and earlier this year he said that a UN Security Council resolution that would recognize a Palestinian state was “on the table” for the very first time… At that time he did not indicate which way that he would go, and although there have been rumblings that something might happen, he has not taken any action yet. But now time is running out for Obama, because his term is scheduled to end on January 20th. The advocates of a “two state solution” are becoming increasingly desperate, because they know that Donald Trump has already promised not to support a UN Security Council resolution that would divide the land of Israel. So they know that if something is going to be done, it has got to be done now. A UN Security Council resolution would be legally binding on both the Israelis and the Palestinians, and it would be something that Donald Trump would not be able to undo. Another vote of the UN Security Council would be required to revoke a resolution once it has been passed, and the votes would not be there to do that. So the next month is absolutely critical. The UN Security Council still has time to take action while Obama is still in office, and we know that such a move is actively being considered. For much, much more on this, please see the following articles that I have recently authored… -“John Bolton Warns That Obama May Divide The Land Of Israel At The UN Before The Inauguration” -“The Danger Zone: Why Israel Greatly Fears Barack Obama's Last Few Months In Office” -“The New York Times Calls For Obama To Support A UN Resolution That Would Divide The Land Of Israel” If we can get to January 20th and the land of Israel has not been divided by the UN Security Council and Donald Trump successfully takes office, perhaps our reprieve will be extended for a while. But if Barack Obama very foolishly allows the land of Israel to be divided at the UN Security Council before January 20th, the “pause button” will be unpaused, our blessing will be turned into a curse, and all hell will break loose in America. |

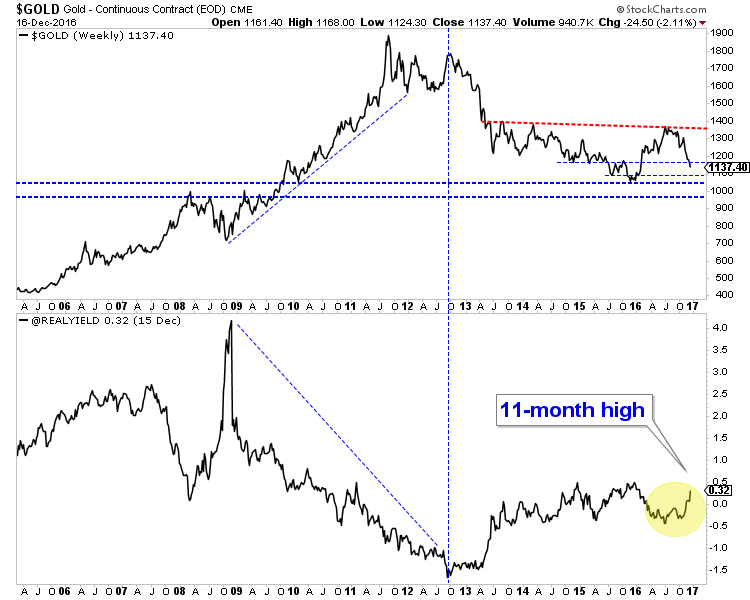

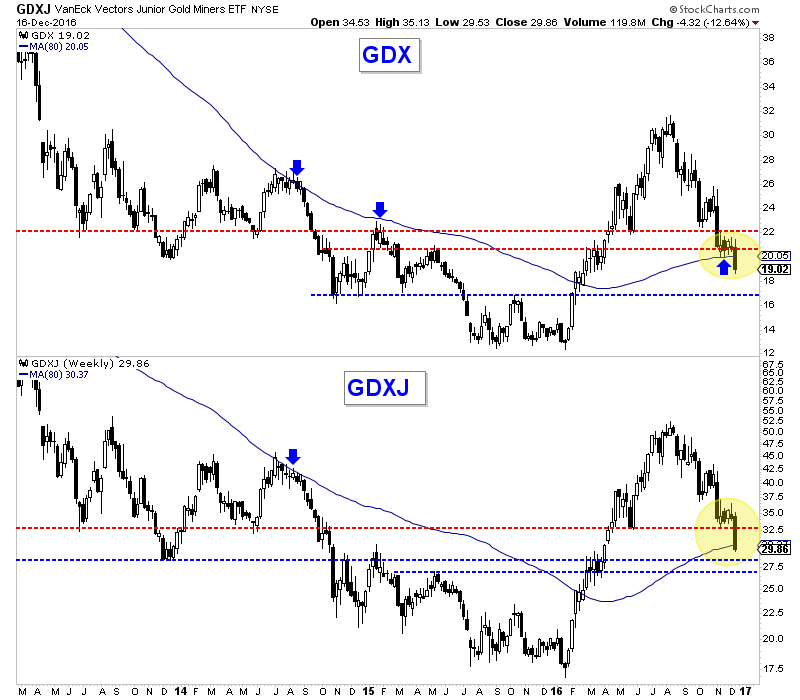

| Federal Reserve & Stronger Real Rates Cause Breakdown in Gold Posted: 18 Dec 2016 03:34 PM PST Gold and gold mining stocks were setting up for a rebound until the market suddenly priced in tighter policy from the Federal Reserve. Both nominal and real yields surged and that pushed an already oversold sector below key support. Gold lost support in the mid $1100s while gold stocks (GDX) lost a critical support level. While the sector is oversold and likely to rebound as 2017 begins, the primary trend remains lower. Our first chart plots Gold and the real yield on the 5-year TIP security. The US Treasury provides daily data and it gives us a look at day to day changes in real yields. The real 5-year tips year yield closed last week at an 11-month high. Stronger real yields hurt Gold's desirability as an investment. This is why Gold and gold stocks have sold off.  Gold & Real 5-Year Tips Yield

We had expected Gold to rebound from the $1140/oz to $1155/oz range but it declined to as low as $1124/oz. Its next weekly support is from $1085/oz to $1095/oz. An immediate rebound to resistance at $1155/oz could setup a decline down to $1085/oz. The other scenario is Gold immediately dumps down to $1085-$1095/oz before beginning a sustained rebound. Turning to the gold stocks, we see that GDX broke below a key level at the end of last week. It had been holding above $20, which was a confluence of strong support. The weekly candle shows a clear breakdown below that support. GDX could snapback to the breakdown point near $20 which would setup a decline to support at $17. The other scenario is it plunges to $17 this week. GDXJ lost support at $32.50 and dumped 12% last week. Its next strong support is around $27.  GDX, GDXJ Weekly Candles

Although Gold and gold stocks are very oversold and sentiment indicators are bullish, the breakdown in price signals that more selling could occur before the sector rebounds. A big rally in Gold is more likely to begin from $1095-$1095/oz than from $1120/oz. The gold stocks could also test lower levels before a sizeable rebound begins. We had expected a rebound but the sector brokedown. We were wrong. However, our bearish big picture view remains on target. We reiterate that we do not want to buy investment positions until we see sub $1100 Gold coupled with an extreme oversold condition and bearish sentiment. For professional guidance in riding the bull market in Gold, consider learning more about our premium service including our favorite junior miners for 2017.

Jordan Roy-Byrne, CMT, MFTA

The post Federal Reserve & Stronger Real Rates Cause Breakdown in Gold appeared first on The Daily Gold. |

| TheDailyGold Premium Update #496 Posted: 18 Dec 2016 02:17 AM PST Prior to Sunday morning we emailed out TDG #496, a 32-page update to subscribers. The update includes updated bear analog charts for Gold and Silver. (This is now the longest bear market ever for Gold). The update also includes numerous gold charts including charts of Gold against stocks, foreign currencies, bonds and the US$ index. Finally we charted many of our favorite stocks and how low they could go if the bearish outlook of $1050 Gold plays out.

Click Here to Learn More About & Subscribe to Our Premium Service

The post TheDailyGold Premium Update #496 appeared first on The Daily Gold. |

| Jack Chan: This Past Week in Gold Posted: 17 Dec 2016 12:00 AM PST |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment