saveyourassetsfirst3 |

- The 'Nuclear Options': Oil Pinned Below $30/Barrel, U.S. Dollar Rising

- CARNAGE As Gold’s, Miners’ Stops Run

- Alasdair Macleod’s Market Report: MASSIVE Drop In Precious Metals

- Breaking News And Best Of The Web

- Jack Chan: This Past Week in Gold

- GOLD MARKET FLASH NOTE: Ending With a Bang, Not a Whimper

- RT Minerals Is Cheap and the Empire Just Ended

- Video: Gold Stocks Next Low in October..?

- Is a Dollar Crash Imminent After the Senate Overrides Obama Veto on Saudi 9/11 Bill and September 30th D-Day Approaches?

- 90-Day Nightmare

- Gold Price 2011-2012 Trendline is all that Matters

- TriStar Gold, Another Wits-Lookalike in Brazil

- 26 Incredible Facts About The Economy That Every American Should Know For The Trump-Clinton Debate

- This Past Week in Gold

- Gold and Gold Stocks Corrective Action Continues Despite Dovish Federal Reserve

- Gold Price at 5 Year Trendline for 3rd Consecutive Month

- Silver Price Forecast: Higher Silver Prices For Many Years To Come

- Mickey Fulp Comments on Gold, Junior Explorers, Uranium & 2016 Election Impact

- Video: Inflation Bubbling Under the Surface…?

| The 'Nuclear Options': Oil Pinned Below $30/Barrel, U.S. Dollar Rising Posted: 09 Oct 2016 12:30 PM PDT |

| CARNAGE As Gold’s, Miners’ Stops Run Posted: 09 Oct 2016 09:00 AM PDT CARNAGE. Gold, silver, and their miners' stocks plummeted out of the blue this week, shattering their bull-market uptrends. Gold-futures speculators had been holding excessive long positions for months, weathering all kinds of selling catalysts. But once gold slipped through key support, long-side futures stop losses started to trigger unleashing cascading selling. Understanding this event and […] The post CARNAGE As Gold's, Miners' Stops Run appeared first on Silver Doctors. |

| Alasdair Macleod’s Market Report: MASSIVE Drop In Precious Metals Posted: 08 Oct 2016 09:01 PM PDT Precious metals suffered a torrid week, with silver particularly hard hit: From Alasdair Macleod, GoldMoney: Gold fell from last Friday's close of $1312 to $1250 at the lowest point yesterday, a fall of 4.7%, and silver fell from $19.16 to $17.11, down 10.7%. In early European trade this morning, prices were steadier, but given […] The post Alasdair Macleod’s Market Report: MASSIVE Drop In Precious Metals appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 08 Oct 2016 07:37 PM PDT Another pretty good US jobs headline, followed by critical analyes. Deutsche Bank fails to negotiate a lower fine with the US, may have to raise capital on extremely unfavorable terms. British pound suffers flash crash. Global debt soars. Gold and silver down hard on stronger dollar, speculator longs unwinding. OPEC agrees to output cut, oil […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Jack Chan: This Past Week in Gold Posted: 08 Oct 2016 04:00 PM PDT The Gold Report |

| GOLD MARKET FLASH NOTE: Ending With a Bang, Not a Whimper Posted: 29 Sep 2016 01:00 AM PDT |

| RT Minerals Is Cheap and the Empire Just Ended Posted: 29 Sep 2016 01:00 AM PDT |

| Video: Gold Stocks Next Low in October..? Posted: 28 Sep 2016 02:50 PM PDT In this video we share a few sector charts of the gold stocks and make the case the short-term outlook is bearish. If that plays out as we expect then look for a potential low in October. The post Video: Gold Stocks Next Low in October..? appeared first on The Daily Gold. |

| Posted: 28 Sep 2016 11:55 AM PDT  President Obama is well on his way to having his first veto override of his entire presidency today, as the Senate voted today to override his veto of the 9/11 victims bill, Justice Against Sponsors of Terrorism Act (JASTA). The House is also expected to override this week, and may do so as soon as […] President Obama is well on his way to having his first veto override of his entire presidency today, as the Senate voted today to override his veto of the 9/11 victims bill, Justice Against Sponsors of Terrorism Act (JASTA). The House is also expected to override this week, and may do so as soon as […] |

| Posted: 28 Sep 2016 08:49 AM PDT Last week, we groaned when the FOMC again failed to raise the Fed Funds rate. Why? Because we knew this meant 90 more days of seemingly endless Fed Goon jawboning. And now look what we have. It matters little what the Fed did last week. Apparently, all the matters is what the Fed might do in December. Just another chapter in the ridiculous con and scam of The Bullion Bank Paper Derivative Pricing Scheme. |

| Gold Price 2011-2012 Trendline is all that Matters Posted: 27 Sep 2016 11:45 AM PDT |

| TriStar Gold, Another Wits-Lookalike in Brazil Posted: 27 Sep 2016 01:00 AM PDT |

| 26 Incredible Facts About The Economy That Every American Should Know For The Trump-Clinton Debate Posted: 25 Sep 2016 09:21 PM PDT

#1 When Barack Obama entered the White House, the U.S. government was 10.6 trillion dollars in debt. Today, the U.S. government is 19.5 trillion dollars in debt, and Obama still has several months to go until the end of his second term. That means that an average of more than 1.1 trillion dollars will be added to the national debt during his presidency. We are stealing a tremendous amount of consumption from the future to make the economy look much, much better than it otherwise would be, and we are systematically destroying the future in the process. #2 As Obama prepares to leave office, the rate at which we are adding to the national debt is actually increasing. During the fiscal year that is just ending, the U.S. government has added another 1.36 trillion dollars to the national debt. #3 It isn’t just the federal government that is on a massive debt binge. Total U.S. corporate debt has nearly doubled since the end of 2007. #4 Default rates on U.S. corporate debt are the highest that they have been since the last financial crisis. #5 Corporate profits have fallen for five quarters in a row, and it is being projected that it will be six in a row once the final numbers for the third quarter come in. #6 During the month of August, commercial bankruptcy filings were up 29 percent compared to the same period a year ago. #7 The rate of new business formation in the United States dropped dramatically during the last recession and has hovered at that new lower level ever since. #8 The Wall Street Journal says that this is the weakest “economic recovery” since 1949. #9 Barack Obama is on track to be the only president in all of U.S. history to never have a single year when the U.S. economy grew by at least 3 percent. #10 In August, the Cass Freight Index dipped to the lowest level that we have seen for that month since 2010. What this means is that the total amount of stuff being shipped around the country by air, by rail and by truck is really dropping, and this is a clear sign that real economic activity is slowing down in a major way. #11 Capital expenditure growth has turned negative, and history has shown that this is almost always followed by a new recession. #12 The percentage of Americans with a full-time job has been sitting at about 48 percent since 2010. You have to go back to 1983 to find a time when full-time employment in this country was so low. #13 The labor force participation rate peaked back in 1997 and has been steadily falling ever since. #14 The “inactivity rate” for men in their prime working years is actually higher today than it was during the last recession. #15 The United States has lost more than five million manufacturing jobs since the year 2000 even though our population has become much larger over that time frame. #16 If you can believe it, the total number of government employees now outnumbers the total number of manufacturing employees in the United States by almost 10 million. #17 One study found that median incomes have fallen in more than 80 percent of the major metropolitan areas in this country since the year 2000. #18 According to the Social Security Administration, 51 percent of all American workers make less than $30,000 a year. #19 The rate of homeownership in the U.S. has fallen every single year while Barack Obama has been in the White House. #20 Approximately one out of every five young adults are currently living with their parents. #21 The auto loan debt bubble recently surpassed the one trillion dollar mark for the first time ever. #22 Auto loan delinquencies are at the highest level that we have seen since the last recession. #23 In 1971, 61 percent of all Americans were considered to be “middle class”, but now middle class Americans have actually become a minority in this nation. #24 One recent survey discovered that 62 percent of all Americans have less than $1,000 in savings. #25 According to the Federal Reserve, 47 percent of all Americans could not even pay an unexpected $400 emergency room bill without borrowing the money from somewhere or selling something. #26 The number of New Yorkers sleeping in homeless shelters just set a brand new record high, and the number of families permanently living in homeless shelters is up a whopping 60 percent over the past five years. Despite all of the facts that you just read, the truth is that there is one particular group of people that have been doing quite well during the Obama years. I really like how Charles Hugh Smith made this point in one of his recent articles…

By recklessly creating money out of thin air and pumping it into the financial markets, the Federal Reserve has greatly enriched the elite, but they have also dramatically increased the gap between the very wealthy and the rest of us. Since he has been in the White House during this time, Barack Obama has gotten the credit for this temporary stock market bubble, and most of the elite love Obama anyway. But in the process the stage has been set for the greatest economic and financial implosion in U.S. history, and the pain that is coming is going to affect every man, woman and child in this country. During the debate, Trump and Clinton will talk a lot about tinkering with tax rates and regulations, but those measures are essentially going to be meaningless when compared to the massive economic tsunami that is coming. The next president is going to inherit the biggest economic problems that this nation has ever faced, and it is going to take a miracle of Biblical proportions to turn the U.S. economy in the right direction. |

| Posted: 24 Sep 2016 01:00 AM PDT |

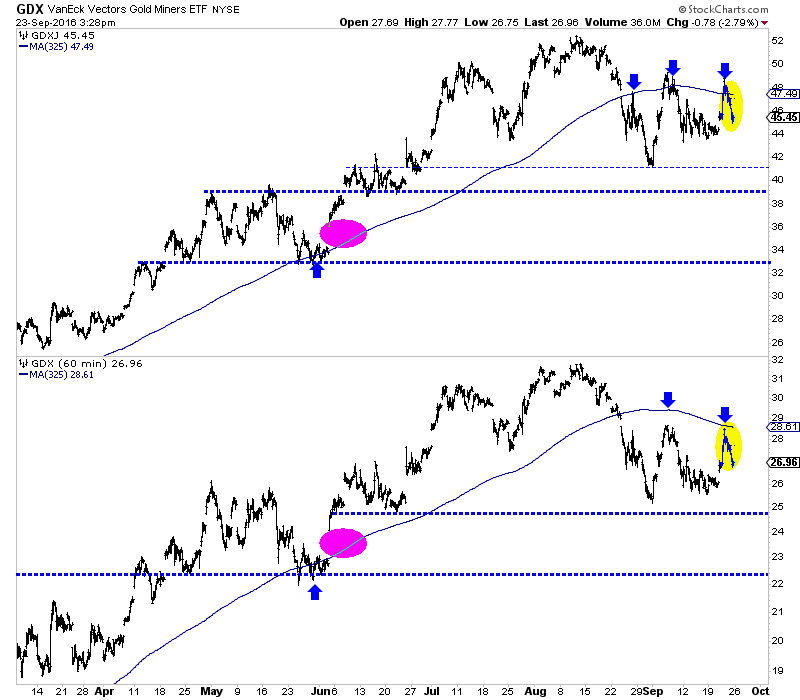

| Gold and Gold Stocks Corrective Action Continues Despite Dovish Federal Reserve Posted: 23 Sep 2016 01:57 PM PDT There were some hopes that a non-move by the Fed would end the current correction in precious metals and spark a move to new highs. Unfortunately, the Federal Reserve cannot override the supply and demand component of the market. Gold and gold stocks popped higher but less than two days later the sector (and specifically the miners) has given those gains back. That tells us plenty of sellers remain and this sector needs more time and perhaps lower prices before this correction ends. The hourly charts, seen below show the miners selling off after testing their 50-day moving averages. GDX showed a bit more strength on this pop as it reached its 50-dma before retreating. GDXJ nearly touched $49, which is within 10% of the recent high before reversing those gains quickly. The miners could test recent lows before retesting their 50-day moving averages.  Miners hourly charts

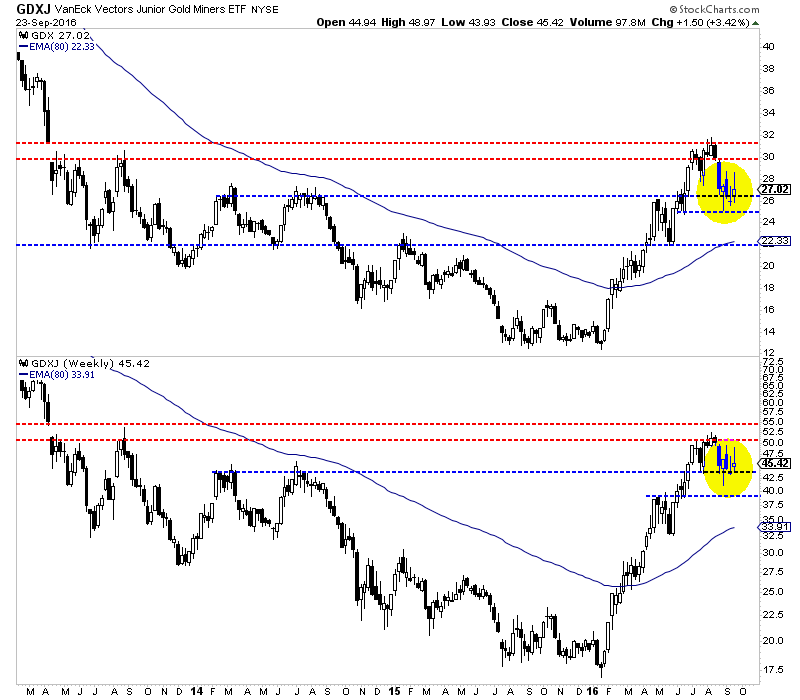

The weekly charts indicate the correction can be deemed bearish consolidation. The candles from the past three weeks have not been remotely bullish. The miners had one solid down week followed by two weeks in which the market failed to hold its gains. GDX (top) has key support at $25 while GDXJ (bottom) is trying to hold above $44. Weekly closes below $26 and $44 could usher in more losses in the short-term.  Miners weekly charts

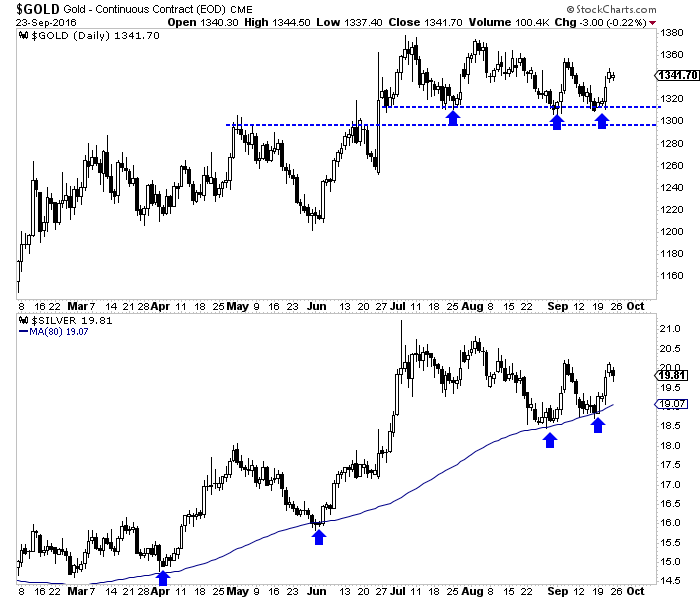

Turning to the metals, we find more encouraging signs as Gold and Silver have maintained support quite well. The daily candle charts for Gold and Silver can be seen below. For the third time in the past few months Gold was able to hold support at $1300-$1310. Meanwhile, Silver held its August low and has shown more strength than Gold recently. That is positive.  Gold & Silver Daily Candles

The precious metals sector remains in correction mode but the longer the sector can hold and digest recent gains without significant price deterioration then the more likely a bullish outcome becomes. The strength in the metals is a healthy sign but the relative weakness in the miners and failure to hold gains is a signal that the correction will definitely continue in terms of time. Traders and investors should wait for either this market to become oversold or the correction to mature. In the meantime, focus on the opportunities scattered amongst individual companies rather than the sector itself. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform into 2017.

Jordan Roy-Byrne, CMT, MFTA The post Gold and Gold Stocks Corrective Action Continues Despite Dovish Federal Reserve appeared first on The Daily Gold. |

| Gold Price at 5 Year Trendline for 3rd Consecutive Month Posted: 22 Sep 2016 12:24 PM PDT |

| Silver Price Forecast: Higher Silver Prices For Many Years To Come Posted: 21 Sep 2016 02:08 AM PDT This means we are likely to have rising silver prices for many years to come. |

| Mickey Fulp Comments on Gold, Junior Explorers, Uranium & 2016 Election Impact Posted: 20 Sep 2016 08:52 PM PDT Listen Here.... The Mercenary Geologist Michael S. "Mickey" Fulp is a Certified Professional Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has 35 years experience as an exploration geologist and analyst searching for economic deposits of base and precious metals, industrial minerals, coal, uranium, oil and gas, and water in North and South America, Europe, and Asia.

Topics by Time (Click to Go Directly to specific time)… [00:29]: Introduction [02:10]: Mickey’s Comments on the Conference [03:30]: Mickey’s General Thoughts on the Sector [05:45]: Does There Need to be a Catalyst for Exploration Companies? [09:30]: Impact of Presidential Election on Resource Sector [12:30]: Timing of Uranium Rebound [14:30]: US Infrastructure Rebuild [16:30]: Mickey’s Concluding Comments

Mickey’s Contact Info & Website Website: MercenaryGeologist.com

The post Mickey Fulp Comments on Gold, Junior Explorers, Uranium & 2016 Election Impact appeared first on The Daily Gold. |

| Video: Inflation Bubbling Under the Surface…? Posted: 20 Sep 2016 12:44 PM PDT In this video we look at the CPI and the strength in the core CPI and sticky CPI. A rise in commodity prices could push inflation up to 3-4%. The post Video: Inflation Bubbling Under the Surface…? appeared first on The Daily Gold. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment