Gold World News Flash |

- Deutsche Bank CEO Returns Home Empty-Handed After Failing To Reach 'Deal' With DOJ: Bild

- RED ALERT -- Top Bank In Canada ATM Cards Just Went Dark

- Ray Dalio Warns A 1% Rise In Yields Would Lead To Trillions In Losses

- Hitler's New World Order alive in the markets - FX History Lesson 28

- What The Market Says - Trump Wins If...

- Globalization Is Done

- Putin Issues No Fly Zone, Puts Obama On Notice!

- NEW WIKILEAKS: HILLARY WANTS TO ENFORCE GUN CONTROL VIA EXECUTIVE ORDER. 2ND AMENDMENT

- PUTIN STANDS HIS GROUND IN MIDDLE EAST

- The Video Hillary Clinton wouldn't want SEEN - Anonymous 2016

- STEVE QUAYLE : VOTE DONALD TRUMP

- No central bank investigates any 'flash crash' in gold

- Dutch gold finds a new home

- Gold Bugs Great News - COT Report Playing Out As Usual, Means Lower Then Much Higher Prices Coming

- The Market’s Set to Be Trumped!

- Breaking News And Best Of The Web

| Deutsche Bank CEO Returns Home Empty-Handed After Failing To Reach 'Deal' With DOJ: Bild Posted: 08 Oct 2016 09:00 PM PDT Following the seemingly endless procession of short-squeeze-fueling trial balloons last week - from settlement rumors to German blue-chip bailouts to Qatari investors - Germany's Bild newspaper confirms the rumors that sparked weakness on Friday: Deutsche bank CEO John Cryan has failed to reach an agreement with the US Justice Department. Having soared over 25% off the briefly single-digit price levels thanks to well-chosen rumor headlines of an "imminent settlement", news and facts on Friday started to eat away at that confidence...

And now, as Bloomberg reports, Deutsche Bank's Chief Executive Officer John Cryan failed to reach an agreement with the U.S. Justice Department to resolve a years-long investigation into its mortgage-bond dealings during a meeting in Washington Friday, Germany’s Bild newspaper reported.

Cryan, a Briton who speaks fluent German, has sought for the last three weeks to reassure investors that Deutsche Bank can weather the formidable obstacles to its financial health. His arsenal of strawmen include: denials of bailouts, blaming speculators, rumors of informal capital raising talks with Wall Street firms, rumors of capital injections from Germany's blue-chip corporations, rumors (denied) of Qatari sovereign wealth fund investments, and the sale of key assets and elimination of thousands of jobs.

So what happens next?Three things: 1) The "settlement-imminent"-driven 25% short-squeeze in stocks - completely decoupled from credit market's less optimistic perspective - is going to end badly...

2) Deutsche Bank will need to raise more capital and that just became more problematic after the bank quietly raised $3bn in a senior unsecured bond issue on Friday at a very wide concession...

3) A "bail-in" is more likely than a 'bailout', and as we detailed earlier, and here's how it can be done... Jonathan Rochford, PM of Australian hedge fund Narrow Road Capital, explains that despite all the recent confidence-building rhetoric and posturing, Deutsche Bank will need a bail-in. In the following analysis he explains how it would (and should) be done.

ConclusionDeutsche Bank’s position is currently marginal as it is woefully undercapitalised and has no clear prospect of becoming meaningfully profitable. As the world’s largest derivative trader and Europe’s most systemically important bank this is untenable. Deutsche Bank is three times larger than Lehman Brothers, making the possibility of an unexpected and uncoordinated failure completely unacceptable. Deutsche Bank needs substantial time and capital to execute a turnaround, neither of which it now has. It does not have the profitability to grow its capital base quickly or to support a capital raising of the size it needs. Deutsche Bank needs either a bail-in or a bailout. An orderly bail-in process would deliver Deutsche Bank the additional time and capital it needs. In the first instance, the bank should be declared non-viable with all equity, additional tier 1 and subordinated debt written off. By converting 63.1% of long term senior debt to new equity the leverage ratio would increase to an unquestionably strong 9%. Based on recent peer comparisons, bailed-in senior debt holders would receive a recovery of at least 94% of their current position. Using an IPO model, where management develops and presents a new strategy to potential investors over a 2-3 month period, would allow the recipients of newly issued equity an orderly process to sell-down their equity. It also creates the possibility of a substantial recovery for subordinated debt, additional tier 1 and equity investors. * * * If the Lehman playbook continues to play out as it has done - denials of any problems... blame speculators... unleash short-squeeze on heels of rumors of foreign sovereign wealth fund investments... and finally acceptance - this will not end well... RED ALERT -- Top Bank In Canada ATM Cards Just Went Dark Posted: 08 Oct 2016 08:26 PM PDT |

| Ray Dalio Warns A 1% Rise In Yields Would Lead To Trillions In Losses Posted: 08 Oct 2016 07:18 PM PDT Last week, we shared with readers a fascinating presentation that Bridgewater's Ray Dalio made to NY Fed staffers at the 40th Annual Central Banking Seminar held on Wednesday, October 5, 2016. In it, Dalio pointed out that thoughts which dared to question the economic orthodoxy, and which were once relegated to the fringe blogs, have become the norm, pointing out that it is no longer controversial to say that:

He further notes that the debt bubble which was not eliminated during the financial crisis of 2008, has since grown to staggering proportions, and notes that "the biggest issue is that there is only so much one can squeeze out of a debt cycle and most countries are approaching those limits." Alas, while the underlying symptoms are clear, that does not make the solution of the problem any easier. Quite the contrary. As Dalio further adds, "when we do our projections we see an intensifying financing squeeze emerging from a combination of slow income growth, low investment returns and an acceleration in liabilities coming due both because of the relatively high levels of debt and because of large pension and health care liabilities. The pension and health care liabilities that are coming due are much larger than the debt liabilities in most countries because of demographics – i.e., due to the baby-boom generation moving from working and paying taxes to getting their retirement and health care benefits." Here the Bridgewater head provides a simple explanation for why the system is unsustainable: debt is fundamentally a liability even though it is treated as an asset by those who "own" it. As a result, "holders of debt believe that they are holding an asset that they can sell for money to use to buy things, so they believe that they will have that spending power without having to work. Similarly, retirees expect that they will get the retirement and health care benefits that they were promised without working. So, all of these people expect to get a huge amount of spending power without producing anything. At the same time, workers expect to get spending power that is equal in value to what they are giving. They all can't be satisfied." How does the Fed react to this inconsistency? By a familiar tool: financial repression.

What does that mean in practical terms? Well, in short: lots of pain for holders of duration: "If interest rates rise just a little bit more than is discounted in the curve it will have a big negative effect on bonds and all asset prices, as they are all very sensitive to the discoun rate used to calculate the present value of their future cash flows. That is because with interest rates having declined, the effective durations of all assets have lengthened, so they are more price-sensitive." And the punchline"

Consider that Ray Dalio's most stark crash warning to date. Of course, it is not new to regular readers becuase this is precisely what we warned about back in June, when we showed the massive duration exposure on the market, and explaining "Why The Fed Is Trapped: A 1% Increase In Rates Would Result In Up To $2.4 Trillion Of Losses" As we showed using Goldman calculations, in 1994, the average yield on the bond index was 5.6%, vs. 2.2% currently. Lower bond coupons means that proportionately more of the bond cashflows now comes from principal, which tends to be distributed towards the end of the bond lifetime. Here is the math of how much in just bond losses a 1% increase in rates would lead to: The total face value of all US bonds, including Treasuries, Federal agency debt, mortgages, corporates, municipals and ABS, is $40 trillion (Securities Industry and Financial Markets Association). The Barclays US aggregate is a smaller number, $17 trillion, as the index excludes some categories of debt, such as money markets, with low duration. Using either measure, total debt outstanding has grown by over 60% in real Dollars since 2000.

For conservative purposes, we use the lower debt estimate, and get that when combining a duration estimate of 5.6 years with a total notional exposure of $17trn, and current Dollar price of bonds of $105.6, indicates that, to first order, a 100bp shock to interest rates - the same one that Dalio envisions - would translate into a $1trn market value loss. That is using the more conservative estimate of the bond market. Using the broader, and more accurate, bond market sizing of $40trn, the market value loss estimate would be $2.4 trillion. While the largest number would be stunning, even the smaller $1 trillion loss estimate is massive: it would amount to over 50% larger than the market value lost in the 1994 bond market selloff in inflation-adjusted terms, and larger than the cumulative credit losses experienced to date in the non-agency residential mortgage backed securities market. This is what Goldman concludes in early June when delivering its own stark forecast of massive losses should rates spike:

Now we know that it certainly is on the very short list of scenarios monitored by the world's biggest hedge fund. So what, if any, recommendations does Dalio have now that virtually all the "smartest men in the room" admit the Fed is not only trapped, but that a spike in yields would lead to the worst crash in 35 years:

Needless to say, we are eagerly waiting for precisely that inflection point. |

| Hitler's New World Order alive in the markets - FX History Lesson 28 Posted: 08 Oct 2016 06:19 PM PDT As explained in our groundbreaking best-seller Splitting Pennies - the world isn't as it seems; in fact, the world is a lot simpler and less complex than perceived. We're victim of "Perception Deception" - as explained eloquently in David Icke's book. If we can for a moment, de-politicize, de-emotionalize, and 'de' all the programming, advertising, and other 'noise' designed to distract us from reality; a different picture begins to emerge on the planet. We're talking about Forex, so let's look at what happened this week in FX:

So Bloomberg gets one of their London based FX customers on the line, Kit Jukes from SocGen, and asks him candidly about what happened. He says that, Forex markets (and many other markets - too) are going to be volatile until a "New World Order" is implemented. Or to quote him verbatim "Price discovery will be an issue as we move to a New World Order." The "NWO" he is referring to, is some sort of market panacea, where price discovery is so efficient, well - that's not a market! Let's remember how all this Forex started, going back to a small hotel in New England, Bretton Woods:

Fast forward, it's 10-8-2016, and leading FX strategists are telling us that markets are waiting for a "New World Order" - wasn't that what was agreed at Bretton Woods? Was Nixon in on this plot, was he tricked, was it a coincidence that Kissinger was with Nixon at Camp David (and who knows, who else) the weekend before they created their 'plan' to default on Bretton Woods? No one knows, but we can certainly analyze current data. For a little perspective, we must understand the history of the world from an American perspective, after World War 2. WW2 was the defining event that shaped the 20th and 21st century. The best perspective for any American businessman, investor, or trader - is to READ THIS BOOK: IBM and the Holocaust. This book is a MUST READ for any Forex trader, stock investor, or anyone who wants to understand how the world 'really' works: IBM and the Holocaust. This is New York Times Bestseller with well over 1 Million copies sold. It's a well documented, research gold mine. After reading this book, you can say that you understand more about world politics than Political Science professors. This is the reality of the way the world really works, which is NOT taught in school. Through the book, you'll see how the founder of IBM (Watson) not only enabled the Nazi regime to expand economically and manage the holocaust, he was Hitler's personal friend (if you can say, Hitler had a friend), receiving the 2nd most prestigious medal of honor offered by the Nazi's in that time. So what does this have to do with Forex? Two things. First, this laid the foundation for Bretton Woods and the Euro. The Euro is practically a derivative of the US Dollar. That's why countries such as the United Kingdom, Switzerland, Norway, and others - stayed out of the Euro. The Euro is the financial end result of the Marshall Plan which was designed to ensure the US Dollar was THE world reserve currency. Second, by seizing Germany as a vassal state, the US-UK "Axis" cemented its control over Europe, the highest economic prize across the pond. That's because in Europe itself, Germany has always been the 'strongest' state, being the biggest producer and economic leader of Northern countries, whereas Southern Europe has been plagued by debt, complicated politics, and other issues (like African refugees floating to 'the promised land' or the Mafia hiding Nuclear waste in Italy & Ukraine, Terrorism (Real terrorism, not this 'fabricated' terrorism, etc.) To add to the spoils of war, Project Paperclip brought top Nazi scientists (most notably, Von Braun) without which NASA programs in the past 60 years would not have been possible. Interestingly, this was also a period where the CIA was created, leading to the current global survelleince society we have today. Planned and organized in London, executed and accounted for in New York & Washington, all for the benefit of various international multi-ethnic owners (some American, some Dutch, Swiss, French, Italian, German, Russian, British, Israeli, etc.) Fast forward to 2016 - during World War 2, IBM, the most sophistocated, largest, powerful computer company in the world was feeding the Nazi war machine. What are computer companies (think Google, Facebook, Microsoft) doing today in Europe? In London? Google, Facebook, Microsoft, all have strong relationships with the DOD (Department of Defense). It was Hitler that first wrote famously the words "New World Order" - and now this same 'goal' is the solution to market microstructure illiquidity, volatility, wide spreads, and huge price swings? It seems that over the past 100 years really, not much has really changed, it is the same group of banks pulling our nose (historically speaking), whether they're funding Hitler or Clinton, whoever wins, nothing seems to change. In war there are no winners, only victims. There's a popular banking advertisement 'banks compete - you win' - it should be 'When countries compete, banks win' - and this is most obvious in the Forex market, where such a move in the GBP/USD can be a quick 10 or 20 yard-bagger for a major bank who is on the front of the order. And all this commotion- banking profits all the way to the New World Order! To learn more about Forex history, and how it impacts us today, checkout Splitting Pennies - Understanding Forex - or checkout Fortress Capital Trading Academy, who offers a great Introductory course. Forex = The reality of how the world works.  |

| What The Market Says - Trump Wins If... Posted: 08 Oct 2016 05:50 PM PDT While the variance across the mainstream media's presidential election polls remains high, the trend in the last week appears to have been one of Trump losing ground to Hillary. While the two campaigns lob headline-grenades at one another, we leave it to the markets to decide what it will take to lead Trump to victory... It appears that markets - Stocks, Bonds, and FX - are leading indicators of the gap between good or bad, or the lesser of two evils, depending on your perspective. The positive trend for Hillary appears to be catching up to stocks...

Treasury yields have swung (lower) in the direction of Hillary's gains recently...

And The US Dollar Index's srecent strength is supportive of Hillary...

So to summarize - S&P needs to hit 2,000; 30Y yields top 2.50%, and/or USD Index weakness is all that is needed for markets to imply a Trump win (that or a Peso collapse of course). |

| Posted: 08 Oct 2016 05:20 PM PDT Submitted by Raul Ilargi Meijer via The Automatic Earth blog, I read a lot, been doing it for years, about finance and affiliated topics (a wide horizon of them), which means I’ve inevitably seen a wholesale lot of nonsense fly by. But for some reason, and I think I know why, Q3 2016 has been gunning for a top -or bottom- seat in that regard, and Q4 is looking to do it one better/worse. Apart from the fast increasingly brainless political ‘discussions’ that don’t deserve the name, in the US and UK and beyond, there are the transnational organizations, NATO, IMF, EU and all those things, all suffocating in their own hubris, things I’ve dealt with before in for instance Globalization Is Dead, But The Idea Is Not and Why There is Trump. But none of it still seems to have trickled through anywhere that I can see. The end of growth exposes the stupidity and ignorance of all but (and even that’s a maybe) a precious few (of our) ‘leaders’. There is no other way this could have run, because an era of growth simply selects for different people to float to the top of the pond than a period of contraction does. Can we agree on that? ‘Growth leaders’ only have to seduce voters into believing that they can keep growth going, and create more of it (though in reality they have no control over it at all). Anyone can do that. So ‘anyone’ who’s sufficiently hooked on power games will apply. ‘Contraction leaders’ have a much harder time; they must convince voters that they can minimize the ‘suffering of the herd’. Which is invariably a herd that no-one wants to belong to. A tough sell. Any end to growth will and must therefore inevitably change the structure of a democracy, any democracy, any society for that matter. It will lead to new leaders, and new parties, coming to the front. And it should not surprise anyone that some of these new leaders and parties will question the very structure of the democracy they are part of, if only because that structure is already undergoing change anyway. The tight connection between an era of economic growth (and/or contraction) and the politicians that ‘rule’ during that era is reflected in Hazel Henderson’s“economics is nothing but politics in disguise”. On the one hand you have the incumbent class seeking to hold on to their waning power, churning out false positive numbers and claiming that theirs is the only way to go (just more of it), and on the other hand you have a loose affiliation – to the extent there’s any affiliation at all- of left and right, individuals and parties, who smell change that they can use to their own benefit. They just mostly don’t know how to use it yet. But they’ll find out, or some of them will. Blaming people and groups of people for what’s gone wrong will be a major way forward, because it’s just so easy. It’s another reason why the incumbents class, the traditional parties, will go the way of the dodo: they will be blamed, and rightly so in most cases, for the fall of the economic system. That’ll be the number one criteria: if you’re -perceived as- part of the old guard, you’re out. Not at the flick of a switch, but nevertheless the rise of Trump and Farage and all those folks has been much faster than just about anyone would have thought possible until very recently. They feed on discontent, but they can do so only because that discontent has been completely ignored by the ruling classes everywhere. Which has a lot to do with the rulers in all these instances we see pop up now still being well-off, while the lower rungs of societies definitely are not. Moreover, if most people still had comfortable middle-class lives, the dislike of immigrants and refugees would have been so much less that Trump and Wilders and Le Pen and Alternative for Deutschland could never have ‘struck gold’. It’s the perception that the ‘new’ people are somehow to blame for one’s deteriorating living conditions that makes it fertile ground for whoever wants to use it. And since the far left can’t go there, the right takes over by default. Bernie Sanders and Jeremy Corbyn have brave ideas on redistribution of wealth, but there is still too much resistance, at the moment, to that, from the incumbent class and their voters, to have much chance of getting anywhere. Of course the traditional right wing smells the opportunity too, so Hillary (yeah, she’s right wing) and Theresa May and Sarkozy and Merkel are all orchestrating sharp turns to the right, away from their once comfortable seats in the center. They all sense that power will not be emanating from the center going forward, and it’s power, much more than principles, that they are after. But enough about politicians and their parties, who can and will all be voted out of power. Much harder to get rid of will be the transnational organizations, like the EU and IMF (there are many more), though they represent the ‘doomed construction’ perhaps even more than mere local or national power-hungries. The leading principle is simple: What has all the centralization led to? To today’s contracting economies. To that end, let’s just tear into a recent random Bloomberg piece on this week’s IMF meeting, and the ‘expert opinions’ on it: Existential Threat To World Order Confronts Elite At IMF Meeting

Oh, but we do have consensus, Louis: Ever more people don’t want what they have now. That too is consensus. And since you said that what it takes is consensus, we should be fine then, right?! Also, I find the term ‘elevated markets’ interesting, even if I don’t know what it’s supposed to mean. I can only guess.

I can see how a vote against the likes of Hollande, Hillary or Cameron constitutes a “the backlash against globalization”. What I don’t see is how that has now become the same as the anti-trade movement. When did Trump express any feelings against trade? Against international trade deals as they exist and are further prepared, yes. But those deals don’t define ‘trade’ to the exclusion of all other definitions. As for ‘protectionism’, that’s just a term designed to make something perfectly fine and normal look bad. Every single society on the planet should protect its basic necessities from being controlled by foreigners, either for money or for power. Nothing good can come of relinquishing that control for any society, ever. There‘s not a thing wrong with protecting your control of your own water and food and shelter, and these are indeed things that should never be traded or negotiated in global markets. So claiming that ‘do no harm’ equals NOT protecting your basics is nothing but a self-serving and dangerous kind of baloney coming your way courtesy of those people whose sociopathic plush seats and plusher bank accounts depend on your ongoing personal loss of control over what you need to survive. It’s what any ‘body’ does that has reached the limits of its growth: it starts feeding on its host. Be it a cancerous tumor, the Roman Empire or our present perennial-growth driven economic models, they’re all the same same thing because they are fueled by the same -thoughtless- principle.

In case you didn’t catch it, “..the continent’s old certainties” is a goal-seeked term. Old in this case means not older than, say, 1950, if that. Look back 100 years and “the continent’s old certainties” dress in a whole other meaning.

I have addressed the misleading use of the term ‘populism’ before. In its core, it simple means something like: for, and by, the people. How that can be presented as somehow being a threat to democracy is a mystery to me. They should have picked another term, but settled on this one. And in the western media consensus, it comprises anything from Trump to Beppe Grillo, via Hungary’s Orban and Nigel Farage, Spain’s Podemos, Greece’s Syriza and Germany’s AfD. All these completely different movements have one thing only in common: they protest the failed and fast deteriorating status quo, and receive a lot of support from their people for doing that. Because it’s the people that bear the brunt of the failure, not the leadership; even Greece’s politicians still pay themselves a comparatively lush salary. As for Britain, it’s the textbook example of utter blindness. Those who were/are well provided for, be they politically left or right, missed out on what was happening around them so much they had no idea Brexit was a real option. And in the 15 weeks since the Brexit vote, all anyone has done in the UK is seeking to blame someone, anyone but themselves for what they all failed to see coming.

These ‘experts’ seem to have an idea there’s something amiss, but they don’t have the answers. Which is impossible to come and say out loud if you’re an expert. Experts must pretend to know it all, or at least know why they don’t know. “There was agreement on globalization before the crisis”, and now it’s no longer there. That they see. That they ain’t coming back, neither the agreement on it nor globalization itself, is a step too far for them. To publicly acknowledge, at least. That Blanchard expresses surprise about ‘anemic demand’ at the same time that interest rates are equally anemic is something else. That both are two sides of the same coin, or at least may be, is something he should at least mention. That is to say, low rates induce deflation, though they are allegedly supposed to induce the opposite. Economists are mostly very misguided people.

Please allow me to chip in here. ‘Lessening of drags’ in a nonsense term. And so is the idea that “..recessions in Brazil and Russia are set to come to an end”. That’s all goal-seeked day-dreaming. Smoke or drink something nice with it and you’ll feel good for a few hours, but that doesn’t make it real.

I really like this one, because off the bat I thought Stockton had it all wrong. What I think is the appropriate metaphor, is not “a driverless car that’s stuck in the slow lane”, but one of those cars in a carousel at a carnival, a merry-go-round, where you can sit in it forever and you always end up in the same spot. And the only one who’s in control in the boss who hollers that you need to pay another quarter if you want to keep on riding. Or, alternatively, and to stay at the carnival, it’s a bumper car, which allows you to hit other cars and get hit, but never to leave the rink. That’s the global economy. Not getting anywhere, and running out of quarters fast.

Globalization is done. And while we can discuss whether that’s of necessity or not, and I continue to contend that the end of growth equals the end of all centralization including globalization, fact is that globalization was never designed to share anything at all, other than perhaps wealth among elites, and low wages amon |

| Putin Issues No Fly Zone, Puts Obama On Notice! Posted: 08 Oct 2016 01:40 PM PDT Alex Jones breaks down how a US response to Russia could lead to WW3. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| NEW WIKILEAKS: HILLARY WANTS TO ENFORCE GUN CONTROL VIA EXECUTIVE ORDER. 2ND AMENDMENT Posted: 08 Oct 2016 01:14 PM PDT Imperious Hillary doesn't want guns, so what. If it was good enough for the founding fathers then there must have been a reason and that reason was to protect ourselves from people like her. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| PUTIN STANDS HIS GROUND IN MIDDLE EAST Posted: 08 Oct 2016 12:42 PM PDT Albert Pike's war plan of 1861 is coming to pass as we stand by and do next to nothing . Obama is a droning war criminal and should be impeached , tried , and shot for treason . The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Video Hillary Clinton wouldn't want SEEN - Anonymous 2016 Posted: 08 Oct 2016 11:39 AM PDT Hillary Clinton strange behaviorWe are Anonymous.We are Legion.We do not forgive.We do not forget.Expect us. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| STEVE QUAYLE : VOTE DONALD TRUMP Posted: 08 Oct 2016 10:00 AM PDT Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money "a righteous man" If any man should claim that he is righteous, let it be known that this man is a liar that God does not acknowledge him, and will... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| No central bank investigates any 'flash crash' in gold Posted: 08 Oct 2016 08:07 AM PDT Maybe because central banks know very well where gold 'flash crashes' come from. * * * Carney Calls for Inquiry into Sterling 'Flash Crash' By Szu Ping Chan and Tim Wallace The Bank of England has launched an investigation into the "flash crash" in sterling that saw the pound plunge against the dollar and euro. Mark Carney, the bank's governor, has asked Guy Debelle, chairman of the markets committee at the Bank for International Settlements, to examine the sudden drop in the value of the pound in thin Asian trading on Friday morning. ... Dispatch continues below ... ADVERTISEMENT ..... BEAT THE BANKERS AT THEIR OWN GAME ..... A free Webinar gives you all the details. Just click here: http://tinyurl.com/z4dj89k The fall in sterling, which saw it drop by as much as 6.1 percent against the dollar and 3.4 percent against the euro, could be discussed at the next meeting of the Financial Policy Committee, which is in charge of maintaining UK financial stability, on Nov 23. ... ... For the remainder of the report: http://www.telegraph.co.uk/business/2016/10/07/carney-calls-for-inquiry-... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 08 Oct 2016 07:45 AM PDT From New Europe, Brussels, Belgium The Dutch Central Bank will move the country's gold reserves from downtown Amsterdam to defence ministry premises near Zeist. The same "Cash Center" will be used as a distribution hub for banknotes. The new arrangement will resolve both security and traffic issues that emerged after 2011. ... ... For the remainder of the report: https://www.neweurope.eu/article/dutch-gold-finds-new-home/ ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold Bugs Great News - COT Report Playing Out As Usual, Means Lower Then Much Higher Prices Coming Posted: 08 Oct 2016 07:43 AM PDT This year’s recovery in precious metals prices – and the sudden spike in gold/silver mining stocks – convinced a lot of people that a new bull market had begun. Last week’s brutal smack-down scared the hell out of many of the same folks. The latest commitment of traders (COT) report implies that we should all relax. Things are playing out pretty much according to a script that’s been in place for decades — and which points to happy times by early next year. |

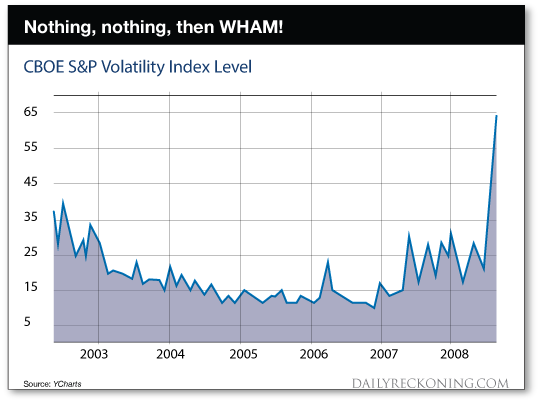

| The Market’s Set to Be Trumped! Posted: 08 Oct 2016 07:00 AM PDT This post The Market's Set to Be Trumped! appeared first on Daily Reckoning. The market's melt-up since the Feb. 11 interim low has been positively surreal. But there's nothing sustainable about it. This latest rebound was the work of eyes-wide-shut day traders and robo-machines surfing on a thinner and thinner cushion of momentum. What comes next, in fact, is exactly what happens when you stop pedaling your bicycle. Momentum gets exhausted, gravity takes over and the illusion of stability is painfully shattered. The simple truth is, the Fed's long-running interest rate repression policies have caused systematic, persistent and massive falsification of prices all along the yield curve and throughout all sectors of the financial market. The Fed is just systematically juicing the gamblers, and thereby fueling ever greater mispricing of financial assets and ever more dangerous and explosive financial bubbles. What we're seeing now is the illusion of stability. During this year's final pulse of the great stock market bubble of 2009–2016, the illusion of stability was reflected in the complete collapse of the VIX Index or, as it is often called, the fear gauge. It spiked above 18 briefly in mid-September… but it's back down now. Take a look at a chart from the last cycle, culminating in the crash of 2008:

The Greenspan housing, credit and stock market bubbles were inflating. At the same time, volatility was steadily drained out of the market by increasingly more bullish and complacent traders. Accordingly, between the stock market's bottom in September 2002 and the first hints of the subprime crisis in February 2007, the VIX Index dropped relentlessly. In fact, it was then down by 75% to a bottom index value of 10.2 on the eve of the mortgage crisis. When the financial bubbles began to implode, however, the VIX exploded. By Oct. 28, 2008 it had risen by 550%. Traders who saw it coming and got long volatility, or "vol," made a fortune. It just so happens that recently, the VIX came close to its early 2007 low, touching 10.8 on an intraday basis. That meant that it had declined by 62% from its Feb. 11 level — and it had declined by 58% from its dramatic late-June spike at the time of the Brexit surprise. In a word, by mid-August, the casino had become so complacent and fearless that you needed a motion detector to identify signs of life. At approximately noon on Aug. 16, in fact, the VIX Index literally did not move for upward of an hour. Things were almost laughably quiet. September was a bit of a roller-coaster month for market volatility. And as we enter the final months of the year, there are potential catalysts that could trigger an ever bigger spike in volatility before year-end. The election is a big one. But the larger question is why a tiny bump in interest rates should even matter at all. After seven years of zero or next to zero interest rates, it must be truly wondered how supposedly rational adults can obsess over whether the another tiny smidgen of a rate increase should be permitted this year or next, or whether the economy can tolerate a rise in the funds rate from 38 bps to 63 bps when it finally does move. The difference is just irrelevant noise to the main street economy. It can't possibly impact the economic calculus of a single household or business! But then, again, the Fed doesn't serve the main street economy. It lives to pleasure Wall Street. Having pinned the money market rate at the zero bound for so long and with such an unending stream of ever-changing and silly excuses, the occupants of the Eccles Building are truly lost. They do not even fathom that they are engaging in a word-splitting exercise no more meaningful to the main street economy than counting angels on the head of a pin. Indeed, if they weren't mesmerized by their own ritual incantation they would not presume for a moment that fractional changes of the money market rate away from ZIRP would have any impact on main street borrowing, spending, investing and growth. So why does the Fed persist in this farcical minuet around ZIRP? The principal reasons are not at all hard to discern. In the first instance, the Fed is caught in a time warp and fails to comprehend that the game of bicycling interest rates to heat and cool the macro-economy is over and done. The credit channel of monetary transmission has fallen victim to "Peak Debt." This means that the main street economy no longer gets a temporary pick-me-up from cheap interest rates because with tapped out balance sheets they have no further ability to borrow. The only actual increases in household debt since the financial crisis has been for student loans, which are guaranteed by Uncle Sam's balance sheet, and auto loans which are collateralized by over-valued vehicles. Stated differently, home equity was tapped out last time and wage and salary incomes have been fully leveraged for years. So households have nothing else left to hock. Accordingly, they now only spend what they earn, meaning that the Fed's interest rate manipulations — which had potency 40 years ago — have no impact at all today. Keynesian monetary policy through the crude tool of money market rate pegging was always a one-time parlor trick. Then why on earth do our monetary central planners cling so desperately to ZIRP? The answer is they appear to believe that cheap money might still do a smidgen of good. Besides, it hasn't caused any consumer price inflation, or at least that's what they contend — so where is the harm? Well, yes. Doing a rain dance neither causes harm nor rain. Yet there is a huge difference. Zero interest rates are not even remotely harmless. They amount to a colossal economic battering ram because they transform capital markets into gambling casinos. And the complacent casino is being set up for a fall when the battering ram hits. The Fed is out of dry powder and out of time. Now that Janet Yellen punted on a September hike, October will be 94 months crouched on the zero bound. By the Fed's own faulty lights, it will have no excuse not to raise rates by 25 basis points in November or December. Especially if it continues to be deluded by the false and lagging indicators of the BLS jobs report. But the market will sell off violently if the Fed goes ahead and raises rates. This has been recently suggested by its key rate strategist and Goldman man on the case, Bill Dudley, president of the New York Fed. On the other hand, if it punts until another time, that decision will come with new concerns. Concerns that continuing headwinds from China, Europe and the rest of the world have the potential to seriously harm the struggling domestic recovery. Even the day traders and robo-machines must know that the Fed is out of dry powder. It cannot go to subzero interest rates without triggering a Donald Trump-led domestic political conflagration. Nor can it abruptly shift to a huge new round of QE without confessing that $3.5 trillion of the same has been for naught. In short, if it fails to raise rates and even hints at the risk of domestic recession, there will be pandemonium in the casino. The gamblers recognize that there will be no monetary fire brigade waiting at the exits. Meanwhile, if the Fed raises rates in December, we could face the day of reckoning. This time, I believe that the Fed's desperate last resort to verbal intervention will fail, causing a market now living off the fumes of momentum to hit the skids. In the short-term, an improved Trump showing at the next debate could trigger volatility as well. I was disappointed in his first performance. The results of this debate could rattle the market because at the moment Hillary Clinton is considered to be a shoo-in. I beg to differ and have some personal experience with respect to what might be an October surprise. Back in 1980 I was actually Ronald Reagan's sparring partner in his Jimmy Carter debate rehearsals. I saw what can happen when a candidate finally gets the pulse of the country and scores big in the Presidential debates. Reagan did that and came from way behind to win. There is no telling how Donald Trump will do next time, but at this stage of the game there is absolutely no reason to think that the market has it right and that Hillary has it in the bag. But don't get too comfortable. This market is just waiting to get TRUMPED! Regards, David Stockman Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post The Market's Set to Be Trumped! appeared first on Daily Reckoning. |

| Breaking News And Best Of The Web Posted: 07 Oct 2016 07:37 PM PDT Another pretty good US jobs headline, followed by critical analyes. Deutsche Bank is planning to raise capital. British pound suffers flash crash. Global debt soars. Wells Fargo draws abuse for consumer fraud. Gold and silver down hard on stronger dollar. OPEC agrees to output cut, oil price jumps. Trump misogyny and Clinton Wall Street speeches […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment