saveyourassetsfirst3 |

- Sprott’s October Gold Update

- Gold is Oversold on Misplaced Expectations of a 2016 Rate Hike

- Fundamentally Understanding What Drives The Price Of Gold

- Gold Stocks Corrections in Bull Markets

- Tiptoeing Back into the Miners

- Rob Kirby Provides the TIMELINE OF COLLAPSE

- India’s Gold Demand Gets Rolling – An “Unofficial” Bottom?

- Bank of America Warns of Imminent Recession: “Market So Fragile…It’s Downright Scary”

- Derivatives Pricing For Gold and Silver May Be Nearing THE END – John Embry

- Dollars Leaving China’s Shores! – Harvey Organ

- Red Flag Could Be Telling Us The RESET Is HERE! – Jim Willie:

- It’s BIGGER Than Silver – Bill Murphy

- Rick Rule On The Catalyst for Higher Gold Prices

- Breaking News And Best Of The Web

- Gold Price Drop Not Complete

| Posted: 14 Oct 2016 01:00 PM PDT What a way to start October… Buy 90% Silver Halves Online From Sprott’s Thoughts: Gold slipped mightily, easily falling through US$1,300 on Oct. 4th to bottom at US$1,269 per oz. before closing the day at US$1,283, down 2.3%. That took it back to pre-Brexit levels, erasing a move that had been […] The post Sprott’s October Gold Update appeared first on Silver Doctors. |

| Gold is Oversold on Misplaced Expectations of a 2016 Rate Hike Posted: 14 Oct 2016 12:57 PM PDT  Gold investors know that the metal has been under pressure due to expectations of a FED rate hike in 2016. Many believe that an increase in the FED funds rate would support the dollar and send prices for precious metals lower. This has been a key driver of the decline in the gold price to support […] Gold investors know that the metal has been under pressure due to expectations of a FED rate hike in 2016. Many believe that an increase in the FED funds rate would support the dollar and send prices for precious metals lower. This has been a key driver of the decline in the gold price to support […] |

| Fundamentally Understanding What Drives The Price Of Gold Posted: 14 Oct 2016 12:47 PM PDT |

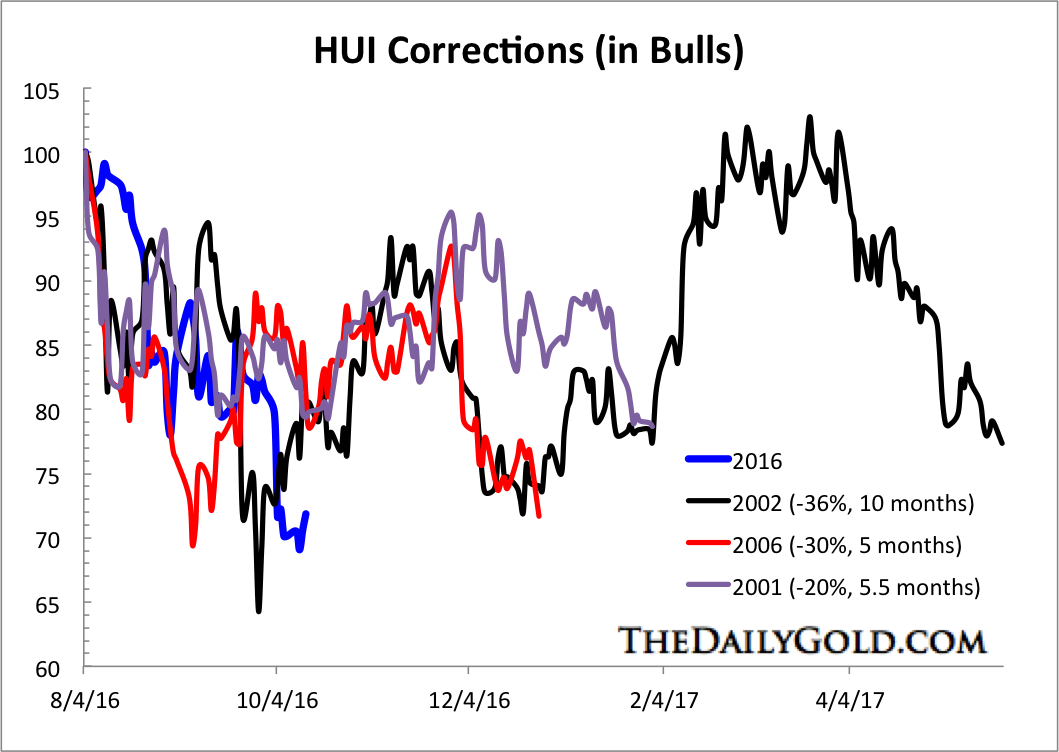

| Gold Stocks Corrections in Bull Markets Posted: 14 Oct 2016 12:20 PM PDT The gold stocks are clearly in correction mode. The large caps (HUI, GDX) have corrected 30% while the juniors (GDXJ) have held up well in comparison by correcting the same amount. Given a number of factors (the size of the previous advance, the recent technical damage, stronger US$ index and rising yields) the gold stocks should continue to correct and consolidate in a larger sense. To gauge a potential path forward we present a new analog chart and compare the current correction to those from past markets. The chart below plots the current correction in the HUI index in comparison to the corrections in 2001, 2002 and 2006. Each correction followed very strong advances. The 2001 and 2002 periods are the best comparison to today. The recent rebound originated from a potential secular low (like 2001) and lasted six to seven months (like 2001). However, the rebound was much stronger than in 2001 and reached an extreme overbought point (like 2002). The HUI has already corrected 31%, which is much closer to the 2002 correction. Only time will tell how long the correction lasts but my view is it is more likely to last around six months than the 10 months seen in 2002.  Gold Stocks Correction Analog

The other important point to mention is every correction formed a typical A-B-C or down-up-down pattern. In other words, each correction served investors two buying opportunities (and three in the case of 2002). While we are likely at a short-term buying opportunity now, probability tells us that another one is coming in the next several months. A variety of technical indicators (various moving averages, pivot points, Fibonacci retracements) gave us downside targets of GDX $22 and GDXJ $34-$35. That degree of downside is inline with the correction analog chart. While it may take another week for the sector to find a short-term low, the outlook over the next several weeks appears positive. Continue to accumulate on weakness and don't be afraid to exercise some patience as more buying opportunities will be ahead. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform into 2017.

Jordan Roy-Byrne, CMT, MFTA

The post Gold Stocks Corrections in Bull Markets appeared first on The Daily Gold. |

| Tiptoeing Back into the Miners Posted: 14 Oct 2016 12:00 PM PDT Precious metals expert Michael Ballanger explains why he sees a “bottom in the cards,” and outlines a trading plan to capitalize on the turnaround. Buy 90% Silver Halves Online Submitted by Streetwise Reports: Cutting directly to the chase, the correction in the gold and silver stocks and, more importantly for us, the miners (GDXJ) […] The post Tiptoeing Back into the Miners appeared first on Silver Doctors. |

| Rob Kirby Provides the TIMELINE OF COLLAPSE Posted: 14 Oct 2016 11:15 AM PDT In this Exclusive SD Interview, Derivatives Expert Rob Kirby warns the system is headed toward Global Reset… Rob Kirby joins Silver Doctors to discuss the deteriorating political system and the collapsing economy. Kirby says the presidential election is turning into a dark Pythonesque comedy show. The Republican Party seems to be sabotaging their nominee's campaign, Wikileaks […] The post Rob Kirby Provides the TIMELINE OF COLLAPSE appeared first on Silver Doctors. |

| India’s Gold Demand Gets Rolling – An “Unofficial” Bottom? Posted: 14 Oct 2016 11:00 AM PDT I say "unofficial" bottom to this 9-week manipulated take-down in the price of gold because we don't know to what extent the western Central Banks will throw paper at the NY and London gold "markets." But based on the latest Commitment of Traders report, the bullion banks are covering their shorts fairly aggressively while the […] The post India's Gold Demand Gets Rolling – An "Unofficial" Bottom? appeared first on Silver Doctors. |

| Bank of America Warns of Imminent Recession: “Market So Fragile…It’s Downright Scary” Posted: 14 Oct 2016 10:00 AM PDT Prepare yourself for the worst and divest in your dependence upon the system as much as possible. From Mac Slavo, SHTFPlan: An official wave of "recession" is nigh, and the potential for financial fallout and further hard times is perhaps imminent. The Fed's disastrous rescue plan after the 2008 financial crisis has left the […] The post Bank of America Warns of Imminent Recession: "Market So Fragile…It's Downright Scary" appeared first on Silver Doctors. |

| Derivatives Pricing For Gold and Silver May Be Nearing THE END – John Embry Posted: 14 Oct 2016 08:41 AM PDT John Embry fills in for Eric Sprott on today’s Gold and Silver Market Update, and breaks down “the ridiculous market action” in gold and silver. Will the paper derivative market always determine the gold and silver price? Embry explains why he believes gold and silver derivatives pricing may be nearing THE END… From SprottMoney: […] The post Derivatives Pricing For Gold and Silver May Be Nearing THE END – John Embry appeared first on Silver Doctors. |

| Dollars Leaving China’s Shores! – Harvey Organ Posted: 14 Oct 2016 08:19 AM PDT Stocks in Europe: ALL IN THE RED Offshore yuan trades 6.7362 yuan to the dollar vs 6.7275 for onshore yuan.THE SPREAD BETWEEN ONSHORE AND OFFSHORE WIDENS QUITE BIT AS MORE USA DOLLARS LEAVE CHINA'S SHORES GOLD RISES $3.00 BUT SILVER FALLS 5 CENTS/CHINA DEVALUES HUGELY LAST NIGHT TO OVER 6.723 YUAN/DOLLAR/CHINESE EXPORTS SINK/WELL OVER […] The post Dollars Leaving China’s Shores! – Harvey Organ appeared first on Silver Doctors. |

| Red Flag Could Be Telling Us The RESET Is HERE! – Jim Willie: Posted: 14 Oct 2016 08:05 AM PDT We might be witnessing a pretext in action, to cover for the rejection of the USDollar, the refusal to accept USTreasury Bills at ports in return for cargo delivery. At risk is the stoppage of all goods shipped from Asia to the United States. The stakes have risen. The Asians are out of patience. The […] The post Red Flag Could Be Telling Us The RESET Is HERE! – Jim Willie: appeared first on Silver Doctors. |

| It’s BIGGER Than Silver – Bill Murphy Posted: 14 Oct 2016 08:00 AM PDT The Cartel’s Manipulation is MUCH BIGGER Than Silver… The post It’s BIGGER Than Silver – Bill Murphy appeared first on Silver Doctors. |

| Rick Rule On The Catalyst for Higher Gold Prices Posted: 14 Oct 2016 07:00 AM PDT According to Sprott’s Rick Rule, in 2017, the catalyst for bullion going higher is this: From Sprott’s Thoughts: At the recent Mines and Money Conference, Kitco interviewed Rick Rule, asking about commodities, stocks, and the most likely catalyst to drive gold prices higher. What a year so far, and in the words of Warren […] The post Rick Rule On The Catalyst for Higher Gold Prices appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 13 Oct 2016 07:37 PM PDT Corporate earnings season off to a brutal start, stocks falling. China exports decline. Several banks now predicting recession. Deutsche Bank still trying to negotiate a lower fine with the US while raising capital on extremely unfavorable terms. Gold and silver speculative longs continue to unwind. Trump threatens to jail Clinton if he wins. Clinton now […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Posted: 13 Oct 2016 01:46 PM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment