Gold World News Flash |

- Breaking: CIA Prepares For Cyberwar With Russia

- Trump Takes on The New World Order - Jim Fetzer & Preston James

- Bank of England warns UK's elected officials that it runs the country

- China moves closer to coming off U.S. currency watch list

- Perth Mint 'tests out' Indian gold import excise abuse

- The Fed’s Legacy: Asset Bubbles and Lost Confidence

- Gold Stocks Screaming Buy

- Brace Yourself for the Quadrillion-Dollar Reckoning

- Economists predict a recession is coming

- “Gold Is A Great Hedge Against Politicians†– Goldman Sachs

- How Could Helicopter Money Affect the Gold Market?

- World War III On The Brink: War Will Continue Until It Triggers Economic Collapse

- Jim’s Mailbox

- LBMA 2016 Singapore: Gold Market Preview

- Two Ways to Collapse

- How to Spot a Major Market Correction

- PhD thesis stirs up a $1 billion gold-price trial for global banks

- The Gold Manipulators Will Be Punished

- Jim Willie Are We Weeks Away From The Worst Global Crisis In History

- Gold is Oversold on Misplaced Expectations of a 2016 Rate Hike

- Breaking News And Best Of The Web

- Tiptoeing Back into the Gold Miners

| Breaking: CIA Prepares For Cyberwar With Russia Posted: 14 Oct 2016 05:17 PM PDT The US is really trying to push Putin over the edge on purpose. They want a war. War brings society kneeling to the government, looking for guidance. They want to take your guns, control you, scare you, and make you 100% reliant on them. The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Trump Takes on The New World Order - Jim Fetzer & Preston James Posted: 14 Oct 2016 03:15 PM PDT Jeff Rense, Jim Fetzer & Preston James - Trump Takes on The New World Order Clip from October 13, 2016 - guest Jim Fetzer, Preston James & David John Oates on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Bank of England warns UK's elected officials that it runs the country Posted: 14 Oct 2016 02:23 PM PDT Carney: Bank of England Will Tolerate Higher Inflation for the Sake of Growth By Szu Ping Chan and Tim Wallace The Bank of England is prepared to tolerate higher inflation over the next few years and will keep interest rates low to support economic growth, according to Governor Mark Carney. Mr. Carney told an audience in Nottingham that the current environment of low inflation was "going to change" with the drop in the value of the pound likely to push up prices across the economy. He said food prices were likely to be affected first, signalling that the situation was "going to get difficult" for those on the lowest incomes as the United Kingdom moves "from no inflation to some inflation." Speaking later in Birmingham, Mr. Carney defended the bank's independence, insisting that policymakers would not "take instruction" from politicians on how to do their jobs. "The objectives are what are set by the politicians, the policies are done by technocrats," he said. "We are not going to take instruction on our policies from the political side." ... ... For the remainder of the report: http://www.telegraph.co.uk/business/2016/10/14/carney-bank-of-england-wi... ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| China moves closer to coming off U.S. currency watch list Posted: 14 Oct 2016 02:16 PM PDT By Shawn Donnan The Obama administration has taken a step toward dropping China from a U.S. currency manipulation watchlist even as Republican candidate Donald Trump promises to declare Beijing a manipulator on Day 1 of his presidency. Mr. Trump has accused China repeatedly of currency manipulation and using the policy to suck jobs out of the United States. He has vowed to impose punitive tariffs on its imports into the U.S. in a move economists fear could set off a trade war between the world's two biggest economies. But the U.S. Treasury said today that by its reckoning China now met just one of the three criteria for inclusion on a currency watch list after its current account surplus fell below 3 percent of gross domestic product in the year to June. Under Treasury's current guidelines that means that, if nothing changes, Beijing could fall off the watch list as soon as next year. For their twice-yearly foreign exchange report to Congress Treasury officials also monitor a country's trade balance with the US as well as any "persistent one-sided intervention" in currency markets. ... ... For the remainder of the report: https://www.ft.com/content/9bb2e3ee-9246-11e6-a72e-b428cb934b78 ADVERTISEMENT K92 Mining Begins Gold Production at Kainantu Mine Company Announcement K92 Mining Inc. is pleased to announce that gold production has commenced from the Irumafimpa gold deposit. Ian Stalker, K92 Chief Executive Officer, says: "This milestone is highly significant for our company, and for this region of Papua New Guinea. A great deal of thanks goes to the entire team on site in PNG in achieving production ahead of schedule and on budget. The rehabilitation of the Irumafimpa gold mine, process plant, and associated infrastructure commenced in late March and is now complete. As an enhancement of the processing facility, we are also pleased to note that the installation of a new drum scrubber is also nearing completion and commissioning of this will be completed by the end of the month. ..." ...For the remainder of the announcement: http://www.k92mining.com/2016/10/6077/ Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Perth Mint 'tests out' Indian gold import excise abuse Posted: 14 Oct 2016 02:10 PM PDT By Paul Garvey The Perth Mint sent an estimated $1 billion worth of gold to India for refining without the apparent consent of its Australian customers, with the West Australian government-owned refiner being dragged into a court case examining the alleged abuse of an Indian excise rebate scheme. The Weekend Australian can reveal that the Mint arranged for semi-refined gold -- or dore -- from its mining customers to be sold to a third party for export into India to "test out" an Indian excise scheme. This is despite the mint having earlier complained to the Indian and Australian governments about the "unfairness" of the excise discount. India in 2013 introduced a scheme that saw the excise charged on gold dore cut by 2 percentage points compared to the excise charged on the refined pure gold produced by the Perth Mint and other international refiners. The excise discount drove a surge in gold refining activity in India -- the world's second-biggest market for gold -- boosting the prospects of the mint's refining rivals there and prompting several Australian gold miners to consider exporting their dore directly to India. ... ... For the remainder of the report: http://www.theaustralian.com.au/business/mining-energy/mint-tests-out-in... ADVERTISEMENT A Lone Congressional Candidate Is Campaigning on the Gold Standard The New York Sun just endorsed Connecticut Republican congressional candidate Daria Novak, based on her support for restoring the gold standard: http://www.nysun.com/editorials/a-prosperity-heroine/89742/ Daria needs us to contribute $1,000, $500, $250, $100, $50, or whatever we can afford in the fiat money that is sleeping in our checkbooks. As the Sun wrote, "She vows to crusade" on the gold standard "as key to getting job creation, economic security, and upward mobility back at a sizzling rate." Novak has been endorsed by gold standard and sound money advocates George Gilder, Lawrence Kudlow, Jimmy Kemp (Jack Kemp's son), and Jeffrey Bell ... along with Steve Forbes, who calls Ms. Novak "the prosperity heroine." To donate to Daria's campaign, please visit: http://novakforcongress.org/donate/ Daria will personally thank all contributors. Daria Novak is gold's lonely champion. Give her your backing and put a voice for gold in Congress. This message was authorized by Daria Novak for Congress. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The Fed’s Legacy: Asset Bubbles and Lost Confidence Posted: 14 Oct 2016 02:05 PM PDT This post The Fed's Legacy: Asset Bubbles and Lost Confidence appeared first on Daily Reckoning. For most experts, failure is a learning experience that leads to a search for new methods. That's not true for central bankers. When their policies fail, they try more of the same in the vain hope that quantity will make up for the lack of quality in their ideas. In the past seven years, major central banks have created over $15 trillion of new money, mostly through purchases of government bonds. These money printing and bond purchase programs have been called QE1, QE2 and QE3 in the U.S., Euro-QE in Europe and QQE (quantitative and qualitative easing) in Japan. All of these programs and exotic variations such as "Operation Twist" have failed to achieve self-sustaining growth anywhere near former trends, and have failed to achieve the 2% inflation targets of those central banks. When investors ask, "Where's the inflation after all this money printing?" my answer is, "Don't look at the supermarket shelf; look at the stock market." In other words, we have not had much consumer price inflation, but we have had huge asset price inflation. The printed money has to go somewhere. Instead of chasing goods, investors have been chasing yield. Part of this asset bubble inflation has to do with a flawed theory of bond/equity "parity." The theory says that once you adjust for credit risk and term premium, bonds and stocks should yield about the same. Right now, safe ten-year Treasury notes yield about 1.65%. Many stocks have dividend yields of 3% to 5%. Investors know that stocks are riskier than safe bonds, but how much riskier? Under the parity theory, investors can keep bidding up the price of stocks until their dividend yields get closer to 2%, leaving a small margin over bond yields to cover "risk." There are many flaws in this theory (including the fact that companies go bankrupt all the time, and boards of directors can and do cut dividends in recessions). But one of the biggest flaws is the complete disconnect between what's driving bond yields in the first place. If bond yields are falling because deflation is ruining the Fed's plans to reflate the economy, is that a reason for stocks to go up? If bond yields are signaling recession, should you really be bidding up stock prices to extreme levels based on a theory of yield "parity?" This behavior defies common sense and economic history, but it's exactly what we're seeing in the markets today. At some point, probably sooner than later, the reality of central bank impotence and looming recession will sink in and stock valuations will collapse. The drop will be violent, perhaps 30% or more in a few months. You don't want to be over-allocated to stocks when that happens. This analysis applies to more than just stocks. It applies to a long list of risky assets including residential real estate, commercial real estate, emerging markets securities, junk bonds and more. It only takes a crash in one market to spread contagion to all of the others. The inability of central banks to deal with crisis and the complete loss of confidence by investors in the efficacy of central bank policy. The last two global liquidity panics were 1998 (caused by emerging markets currencies, Russia, and Long-Term Capital Management) and 2008 (caused by sub-prime mortgages, Lehman Brothers and AIG). Another smaller liquidity panic arose in 2010 due to problems in Middle Eastern and European sovereign debt (caused by Dubai, Greece, Cyprus and the European periphery). In all three cases, central bank money printing combined with government and IMF bail-outs were enough to restore calm. But these bailouts came at a high cost. Central banks have no room to cut rates or print money in a future crisis. Taxpayers are in full revolt against more bailouts. Governments are experiencing political polarization and there's political gridlock around the world. There is simply no will and no ability to deal with the next panic or recession when it hits. Consumer inflation expectations have fallen to the lowest level since late 2010 (not long after the last crisis) and the trend is clearly down, toward levels not seen since the depths of the panic in 2008: With central banks around the world doing everything possible to cause inflation (QE, ZIRP, NIRP, helicopter money, currency wars, forward guidance, etc.), what does it say about confidence in central banks that inflation expectations are falling, not rising? The systemic dangers are clear. The world is moving toward a sovereign debt crisis because of too much debt and not enough growth. Declining productivity is the last nail in the coffin in terms of countries' ability to deal with the debt. Inflation would help diminish the real value of the debt, but central banks have proved impotent at generating inflation. Now central banks face the prospect of recession and more deflation without any policy options to fight it. The impact of deflation and the strong dollar have caused a shortage of liquidity around the world. Since private debt has expanded faster than central bank balance sheets, a dollar shortage has arisen as debtors scramble for dollars to pay back debts. This raises the prospect of a new liquidity crisis and financial panic worse than 2008. Persistent low rates have not caused inflation, but they have caused asset bubbles, which threaten to pop and unleash a financial panic on their own — independent of tight financial conditions. When this new panic hits (either from a liquidity shortage or bursting asset bubbles), investors will have no confidence in the ability of central banks to limit the panic. Unlike 1998 and 2008, the next panic will be unstoppable without extreme measures — including IMF money printing, lock-downs of banks and money market funds, and possible martial law in response to money riots. You should have gold and other hard assets to weather this storm. You should never go "all in" on any one asset class including gold, which is why I recommend putting only 10% of your investable assets in gold. But you want to own gold now, before the next crisis strikes. It could be here much faster than you think. Regards, Jim Rickards Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post The Fed's Legacy: Asset Bubbles and Lost Confidence appeared first on Daily Reckoning. |

| Posted: 14 Oct 2016 12:43 PM PDT The gold miners’ stocks are suffering from universal and overwhelming bearishness today, with nearly everyone expecting further selling. That’s the natural reaction following this sector’s recent massive correction, which climaxed in one of its biggest daily plummets ever witnessed. But within bull markets, there’s no better time to buy aggressively than deep in a major selloff that’s riddled with great doubt and fear. The core mission of speculation and investment is so simple even children can easily grasp it, buy low sell high. The great challenges arise not from understanding, but execution. Actually buying low then selling high in real markets is exceedingly unnatural and uncomfortable. It requires traders to overcome their own greed and fear to do the exact opposite of everything their own instincts are screaming to do. |

| Brace Yourself for the Quadrillion-Dollar Reckoning Posted: 14 Oct 2016 12:37 PM PDT The ever more extreme antics of our central bankers keep forcing us to find new ways to describe them. My good friend Danielle DiMartino Booth does this by drawing an interesting historical parallel. Danielle takes us back to the 20th-century era of World Wars and draws upon Liaquat Ahamed’s. The Lords of Finance. His work was inspired by that 1999 Time magazine cover story “The Committee to Save the World.” You may recall it: the lovely mugs of Alan Greenspan, Robert Rubin, and Larry Summers up there, grinning like the Cheshire Cat. |

| Economists predict a recession is coming Posted: 14 Oct 2016 11:56 AM PDT FBN's Gerri Willis, Stifel Nicolaus Chief Economist Lindsay Piegza and 'Making Money' Host Charles Payne discuss the state of the economy and whether it will hit a recession within the next four years. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| “Gold Is A Great Hedge Against Politicians†– Goldman Sachs Posted: 14 Oct 2016 11:25 AM PDT Gold has risen another 1.7% in British pound terms this week and is 1.8% higher in euro terms and is again acting as a hedge against currency devaluations, Brexit, eurozone and heightened political and geo-political risk in the UK, EU, U.S. and most of the world. Gold is marginally higher in dollar terms this week after surging on the open in Asia on Sunday night. Gold quickly rose 1% from $1,251/oz to $1,264/oz as China and the Shanghai Gold Exchange (SGE) began trading again after being closed for the Chinese Golden Week. |

| How Could Helicopter Money Affect the Gold Market? Posted: 14 Oct 2016 11:20 AM PDT Since the NIRP has not yielded the expected results – it could have actually weakened the condition of the banking sector and its ability to expand lending – a hot debate about the use of another weapon in the central banks’ heroic struggle with the deflationary pressure started. We mean of course helicopter money, also called monetary finance or money-financed fiscal programs. Supporters argue that it is a necessary option to revive economic growth and generate inflation, while opponents consider it a fancy name for printing money and monetizing fiscal deficits. Who is right and what does it imply for the gold market? |

| World War III On The Brink: War Will Continue Until It Triggers Economic Collapse Posted: 14 Oct 2016 11:09 AM PDT One of the main Shemitah Trends of late 2016 is the emerging war in the Middle East. It has every indication of turning into a conflict resembling World War III and day-by-day is becoming more dangerous and extreme. This could be the war that finally triggers the great economic collapse being planned. Certainly, the storm clouds of war are gathering, as we’ve been covering. |

| Posted: 14 Oct 2016 10:07 AM PDT Jim/Bill, Well worth keeping in mind. CIGA Wolfgang Rech HSBC: Gold Stands To Benefit From Trade ProtectionismOctober 14, 2016 Gold could benefit from growing protectionist views toward free trade globally, says HSBC. For starters, calls for protectionism suggest the masses are not happy with government policies. “Gold prices tend to rise during periods of contraction... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| LBMA 2016 Singapore: Gold Market Preview Posted: 14 Oct 2016 09:09 AM PDT Bullion Vault |

| Posted: 14 Oct 2016 06:52 AM PDT This post Two Ways to Collapse appeared first on Daily Reckoning. Suddenly or SlowlyA collapse can happen at any time due to the scale, density and inherent instability of the financial system. The immediate cause of such a sudden loss of confidence is unknowable. It could be a war, natural disaster or epidemic. It could also be a less visible dynamic such as a change in the amount of liquidity a small group of investors wants that cascades out of control. Markets will go "no bid" as asset bubbles burst all around. The cause doesn't matter. What matters is that it can happen quickly. None of us will know the hour or the day. Your only safe haven is to prepare now and be vigilant for indications and warnings. This sudden collapse scenario is definitely possible (and you need to prepare for it). Still, it is not necessarily the most likely way for the dollar to fail as the leading reserve currency. A more likely path (and the one the elites are planning) is a slow, steady, step-by-step decline. In many ways, the slow collapse is more dangerous to your financial health than the swift crash. In a sudden collapse, you'll know it's happening. Even if you're not prepared today, there may still be time to join the scramble for gold (albeit at a higher entry point). When the ship is sinking, you don't have to be the first person in the lifeboat; just don't be among those who find the last lifeboat is gone. A slow decline is more dangerous because you won't know it's happening. Policymakers, leaders and media will keep up the pretense that all is well. You may be lulled into keeping your wealth in markets that are going nowhere. Elites will be pulling the props out from under the dollar, but you may not see it coming. This is not a hypothetical scenario. There is ample evidence for it. Consider the Japanese Nikkei stock index. It was 40,000 in December 1989. Today, it's about 20,000, down 50% almost 30 years after the crash. Or, take the U.S. Nasdaq stock index. It was 5,000 in January 2000 and is about 5,100 today. That index has gone almost nowhere in 15 years. TV talking heads and Wall Street wealth managers ignore such unpleasant truths. They tell you that stocks are up 200% since the lows of March 2009. That's fine if you woke up from a 10-year nap in 2009 with a huge pile of cash, invested everything in stocks and sold them all yesterday. Nice job! Far more common is an investor who rode the wave down, rode it back up again and completed a nerve-wracking round trip with his retirement savings but is no further ahead after fees and inflation. Even more likely is an investor who sold near the 2009 lows, bought back in at recent highs and is ready to be fleeced again by Wall Street in the next collapse. Sound familiar? Hopefully, that's not you, but it could be someone you know. Bond markets don't offer much relief. Short-term Treasuries have almost no yield. Long-term Treasuries offer 2% if you're prepared to bet on no inflation for 10 years. If inflation comes, you'll be crushed. You can score some capital gains on 10-year notes if rates fall in the short run (which I expect), but that's a trading strategy, not a retirement plan. High-yield corporate debt is loaded with credit risk at this stage of the cycle. The defaults will pile up as we enter a global growth recession in early 2016. Yet, despite this dismal investment landscape, financial cheerleaders still wave their pompoms and urge you to buy stocks and bonds "for the long run." Their assurances that all is well have been echoing for 20 years and may echo for 20 more. Meanwhile, the financial foundation built on the dollar is rotting away… The Dollar Has Already Had Its "1914 Moment"The historical precedent for the slow loss of reserve currency status is the strange case of sterling. The story begins with an event far removed from the counting rooms of London: The assassination of Archduke Franz Ferdinand, heir to the throne of the Austro-Hungarian Empire, by a Serbian terrorist in Sarajevo on June 28, 1914. That act of political terrorism set in motion a chain of ultimatums and mobilizations that resulted in World War I. Over 16 million people were killed for no ascertainable reason. The Russian, Ottoman, German and Austro-Hungarian empires all collapsed as a direct consequence of the war. But one empire that did not fall, at least right away, was the British Empire. In June 1914, the world viewed from Westminster was a global enterprise zone in which British military, diplomatic and financial power reigned supreme. There were competing powers, of course, but the U.K. was the most powerful politically. Also, London was the unquestioned financial capital of the world. The pound sterling was the leading global reserve currency. And it was backed with gold held by the Bank of England. Sterling was "money good" on five continents. When World War I began, all of the major belligerents immediately suspended the conversion of their currencies into gold except the U.K. The conventional view was that countries needed to hoard gold and print money to pay for the war, which is why they suspended convertibility. The U.K. took a different approach. By maintaining the link to gold, London maintained its credit standing. This enabled the U.K. to borrow to pay for the war. It was John Maynard Keynes who convinced the U.K. to remain on the gold standard. And it was Jack Morgan, son of J.P. Morgan, who organized massive loans in New York to support the British war effort. Initially, there were huge outflows of gold from the U.S. to the U.K. Even though the U.K. remained on the gold standard, investors sold stocks, bonds and land in the U.S. Then they converted the proceeds into gold and shipped the gold to the Bank of England. But this gold outflow from the U.S. soon ran its course. There were only so many portfolio assets that the British could sell to get gold. The House of Morgan saw to it that gold flows remained orderly and the U.S. lived up to its financial obligations. Then, in November 1914, the flow of gold suddenly reversed. The British needed U.S. exports of food, wool, cotton, oil and weapons. All of this had to be paid for in either gold or pounds sterling that could be converted into gold. The gold that had flowed east from New York to London now began to flow west from London to New York. From November 1914 until the end of the war in November 1918, there were massive gold inflows to the Federal Reserve Bank of New York and its private member banks. It was at this stage that the dollar emerged as a new global reserve currency to challenge the supremacy of sterling. The process of the dollar replacing sterling began in November 1914. But there was no immediate or sudden collapse of sterling. Throughout the 1920s, the dollar and sterling competed side by side for the role of leading reserve currency. Scholar Barry Eichengreen has documented how the dollar and sterling took turns in the leading role, with the lead shifting back and forth several times. But by 1931, the race was becoming one-sided. The dollar was starting to pull away. Winston Churchill had blundered by pegging sterling to gold at an unrealistic rate in 1925. The super-strong sterling that resulted decimated U.K. trade. It also put the U.K. in a depression three years before the rest of the world. U.K. trade deficits caused Commonwealth trading partners such as Australia and Canada to get stuck with huge unwanted reserves in sterling. The rise of the dollar and the steady decline of sterling continued through the 1930s until the start of World War II, in 1939. At that point, the U.K. suspended the convertibility of sterling into gold. The international monetary system broke down for the second time in 25 years. Normal trade, currency exchange and gold convertibility remained suspended until the international monetary system could be reformed. This reform took place at the Bretton Woods international monetary conference held in New Hampshire in July 1944. That conference marked the final ascendency of the dollar as the leading global reserve currency. From 1944–1971, major currencies, including sterling, were pegged to the dollar. The dollar was pegged to gold at $35.00 per ounce. Bretton Woods was the definitive end to the role of sterling as the leading reserve currency. The conference enshrined the dollar in that role — a position it has held ever since. The point of this history is to show that the replacement of sterling by the dollar as the leading reserve currency was not an event, but rather a process. The process played out over 30 years, from 1914–1944. It involved a seesaw dynamic in which sterling would try to reclaim the crown only to lose it again. With hindsight, it is possible to see that the turning point took place in November 1914, when gold outflows from the U.S. reversed and became inflows. Those inflows continued until 1950 despite two world wars and the Great Depression. Yet no one saw the collapse at the time. From the Bank of England's perspective, November 1914 may have seen gold outflows, but no one believed the process of decline was inevitable or irreversible. The belief in London was that Britain would win the war, maintain the empire and preserve sterling's position as the most valued currency in the world. Britain did win the war, but the cost was too great. They lost the empire, and sterling lost its role as the leading reserve currency. The question for you today is whether the U.S. dollar has already had its November 1914 moment. Is it possible that the collapse of the U.S. dollar as the leading reserve currency has already begun? Yes it has. Looking at the massive flows of gold (that were reported here) to China, the rise of a dollar competitor in the form of the Special Drawing Rights (SDR), or world money, and the inclusion of the Chinese yuan in the SDR basket, it is difficult not to conclude that the dollar collapse has already begun. Yet like the collapse of sterling a century ago, the decline of the dollar will not necessarily happen overnight. It will likely be a slow, steady process (at least in the beginning stages). Regards, Jim Rickards Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post Two Ways to Collapse appeared first on Daily Reckoning. |

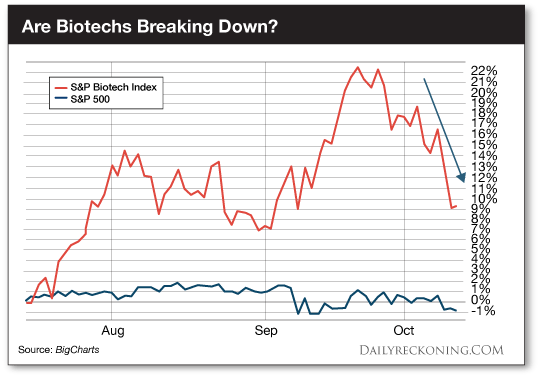

| How to Spot a Major Market Correction Posted: 14 Oct 2016 06:34 AM PDT This post How to Spot a Major Market Correction appeared first on Daily Reckoning. Stocks bounced off their September lows yesterday. Despite the recovery, the chop is still in control of the major averages. And like most traders, we're stuck in a holding pattern as we wait for the market to give us some direction. This week's volatile action tore down a lot of positive momentum that was bubbling up under the market's surface. As recently as Monday, our thesis has been that the market has quietly shifted to "risk-on" mode while most investors are cowering the corner. The evidence was all around us. Investors were ditching safety plays like utilities and consumer staples stocks that were so popular earlier in the year. Even the price of gold fell off a cliff… Tuesday's swoon was enough to coax skittish investors to pound the sell button. Now that the dust has settled, our job is to figure out whether this move lower is the final shake before a year-end rally—or the beginning of a bigger drawdown. Here are three key indicators we're watching to help us navigate an angry (and unpredictable) market: 1. Hedge Fund Hotels Earlier this month, we told you how performance was beginning to "trickle-up" to some of the biggest, most recognizable names on the market. The gigantic stocks that held the major averages together over the past 24 choppy months were taking back the wheel… These megacaps are the bread and butter investments of some of the biggest funds on the Street. Yesterday, many of these "hedge fund hotels" tagged their 50-day moving averages and popped higher. That's a sign that the big, institutional buyers are swooping back in. Facebook, Google, and Alibaba all posted nice bounces off their respective 50-day moving averages. That's a positive sign as we barrel toward the end of the trading week. We'll be keeping an eye on these charts to see if the moves stick… 2. Speculative Biotechs While most investors were throwing in the towel yesterday, we noticed a bright spot of green on the screen. Biotechs were catching a bid. While the Dow was off by almost 150 points early Thursday, biotech stocks were sneaking into positive territory. Biotech stocks are quickly becoming one of the market's big "tells." The biotech sector was one of the hardest-hit areas of the market over the past couple of years. But it enjoyed a nice summer rally. Over the past three months, biotechs were incredibly strong. These stocks led the major averages in a big way. They've now endured some selling over the past couple of weeks.

Now we're treated to a true test of biotech's strength. Can these stocks hold up under fire? We would like to see this group of speculative stocks retain its leadership position as we head into earnings season. Yesterday's bounce was a good start… 3. Small-caps Small-cap and microcap names were also finding new life and spanking the major averages just a few short weeks ago. But this was another group of speculative stocks that took a beating earlier this week as the market tanked. Over the past three trading days, the S&P 500 has dropped less than 1.5%. The small-cap Russell 2000 has lost 2.8% over that same timeframe. Small-caps dropped a collective 1% yesterday while the major averages recovered from their morning losses. We're going to need to see these stocks bounce to regain some confidence in the market moving forward… Remember, most investors are incredibly bearish this month. They don't believe stocks have anywhere to go but down. A surprise recovery would catch almost everyone off guard, potentially leading to the year-end rally we've been waiting for… Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post How to Spot a Major Market Correction appeared first on Daily Reckoning. |

| PhD thesis stirs up a $1 billion gold-price trial for global banks Posted: 14 Oct 2016 05:32 AM PDT By Andrew Burrell http://www.theaustralian.com.au/business/mining-energy/phd-thesis-stirs-... PERTH, Australia -- An Australian academic's discovery of global gold price collusion has sparked a looming US trial in which four of the world's major banks are being sued for up to $1 billion over claims they rigged the price of the precious metal at the expense of investors over a decade. Perth-based Andrew Caminschi can be revealed as the academic who unwittingly exposed a scandal during a painstaking study of tens of millions of gold transactions that took him 18 months. ... Dispatch continues below ... ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... "It was needle in the haystack-type stuff," Associate Professor Caminschi said yesterday of the anomalies he discovered in the data. "But once we found it, it was pretty damning." In a key development, a US judge ruled last week that the four banks -- Barclays, Bank of Nova Scotia, HSBC and Societe Generale -- had a case to answer and that a lawsuit filed by investors would proceed to trial. Germany's Deutsche Bank was also accused of manipulation but settled its case in April and has agreed to help the plaintiffs in their claims against the remaining defendants. Assistant Professor Caminschi, 42, said he would act as an expert consultant at the trial in New York and admitted he was surprised his otherwise obscure PhD thesis at the University of Western Australia -- for which he had to build his own server -- had damaged the banks and led to a shake-up of the century-old gold pricing system. "I never thought it would get to this," he said. "I didn't go out cartel-busting or bank-bashing -- it was more like the data was just yelling at me." During his research, the academic discovered apparent manipulation during the twice-daily meetings held by banks in London that determined the benchmark price of gold, which was then used by dealers, central banks and mining companies to trade the precious metal. The analysis of 14 years of raw data found that during these meetings, and before the benchmark price became known, trading volumes in gold derivatives would rise substantially. This suggested the banks were trading on, and potentially profiting from, information that was not available to the wider market -- a theory that had been rumoured for years but never proven. "I went into my supervisor's office and I had this heat map and there was a thin white line which runs through the heat map which symbolised areas of very, very intense trading," Associate Professor Caminschi recalled. "We were only expecting to see that white line when the news came out, when people would adjust their positions based on the news. "When I showed it to my supervisor, and after I explained it, he said, 'Oh shit'." The research was first published in an academic journal in 2013. It was later picked up by industry publications and financial news provider Bloomberg, sparking attention from regulators and leading to scores of lawsuits. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The Gold Manipulators Will Be Punished Posted: 14 Oct 2016 05:03 AM PDT The Gold Manipulators Will Be Punished |

| Jim Willie Are We Weeks Away From The Worst Global Crisis In History Posted: 14 Oct 2016 03:09 AM PDT Jim Willie is highly regarded as one of the leading experts on the gold and silver market, for his forecasts on currency related collapses, bank defaults and predictions for gold and silver prices. He is the editor of the Hat Trick Letter and he joins Sheila for a cutting edge analyses on whats... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold is Oversold on Misplaced Expectations of a 2016 Rate Hike Posted: 14 Oct 2016 12:10 AM PDT Gold Stock Bull |

| Breaking News And Best Of The Web Posted: 13 Oct 2016 07:37 PM PDT Corporate earnings season off to a brutal start, stocks falling. China exports decline. Several banks now predicting recession. Deutsche Bank still trying to negotiate a lower fine with the US while raising capital on extremely unfavorable terms. Gold and silver speculative longs continue to unwind. Trump threatens to jail Clinton if he wins. Clinton now […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Tiptoeing Back into the Gold Miners Posted: 13 Oct 2016 08:50 AM PDT Precious metals expert Michael Ballanger explains why he sees a "bottom in the cards," and outlines a trading plan to capitalize on the turnaround. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment