saveyourassetsfirst3 |

- Gold And Silver Stock Ideas For The Remainder Of 2016

- The Dollar Will Be Removed From International Trade, Will Send SHOCK WAVES Through The US – Jim Willie

- Blood Continues To Flow As Precious Metals Rally

- New Silver Buyers Are Forcing the Endgame – Rob Kirby

- Pope Francis Now Openly Promoting A One World Religion Or A New World Order

- The Burrito Index: Consumer Prices Have Soared 160% Since 2001

- This Is The Weakest US Economic ‘Recovery’ Since 1949

- Gold Silver Ratio Set to Enter New Trading Range – Stewart Thomson

- Beginning of A Major Upside Move in Silver?

- Alasdair Macleod On Brexit Post-Mortem

- Gold is Not Going to $10000 – Keith Weiner

- June U.S. Consumer Spending and Gold

- Donald Trump Warns Americans To Get Out Of The Stock Market As The Dow Falls For A 7th Day In A Row

- Top Ten Videos — August 3

- Silver Kangaroo Coins – Sales Surge To Over 10 Million

- The Upside Potential in Junior Gold Stocks

- Monetary Metals Closes First Gold Fixed-Income Deal at 5%

- Gold Price - Support is Lower

- The Broad Market, Helicopters and Gold

- Silver Price Analysis: This Confirms The Continuation Of Silver’s Rally

| Gold And Silver Stock Ideas For The Remainder Of 2016 Posted: 03 Aug 2016 01:06 PM PDT |

| Posted: 03 Aug 2016 01:05 PM PDT In this extended interview, Hat Trick Letter Editor Jim Willie Warns A Financial Storm of Historic Proportions is Set to be Unleashed… Buy Gold Bars at SD Bullion Most Trusted Bullion Dealer is Now the Lowest Price, Period! Lowest Priced US Mint Silver Eagles The post The Dollar Will Be Removed From International Trade, Will Send SHOCK WAVES Through The US – Jim Willie appeared first on Silver Doctors. |

| Blood Continues To Flow As Precious Metals Rally Posted: 03 Aug 2016 01:00 PM PDT Many analysts have been forecasting a huge deflation with falling gold and silver prices. I don't think this will happen. Gold and silver may have different plans, especially if we see more problems coming out of the European banks. Investors need to prepare themselves for the coming collapse of most paper assets and real estate […] The post Blood Continues To Flow As Precious Metals Rally appeared first on Silver Doctors. |

| New Silver Buyers Are Forcing the Endgame – Rob Kirby Posted: 03 Aug 2016 12:00 PM PDT ALERT: America is importing gold from Switzerland for the first time in decades. Rob Kirby sounds the alarm: Jim Sinclair just blew the whistle that the amount of Gold imported into the US in May 2016 mirrors almost to the ounce the gold demanded for physical delivery on COMEX. Shocking "coincidence" or inconvenient fact exposing […] The post New Silver Buyers Are Forcing the Endgame – Rob Kirby appeared first on Silver Doctors. |

| Pope Francis Now Openly Promoting A One World Religion Or A New World Order Posted: 03 Aug 2016 12:00 PM PDT Pope Francis is setting the stage for a one world religion and a new world order. Merging all of the countries of the world into a giant superstate and merging all of the religions of the world into a single faith may sound like a good idea to many, but the truth is that it […] The post Pope Francis Now Openly Promoting A One World Religion Or A New World Order appeared first on Silver Doctors. |

| The Burrito Index: Consumer Prices Have Soared 160% Since 2001 Posted: 03 Aug 2016 11:00 AM PDT Calculating the REAL inflation rate… Buy 90% Junk Silver Bags at SD Bullion As Low As $1.49/oz Over Spot! Submitted by Charles Hugh Smith, Peak Prosperity: In our household, we measure inflation with the “Burrito Index”: How much has the cost of a regular burrito at our favorite taco truck gone up? Since we keep detailed records of […] The post The Burrito Index: Consumer Prices Have Soared 160% Since 2001 appeared first on Silver Doctors. |

| This Is The Weakest US Economic ‘Recovery’ Since 1949 Posted: 03 Aug 2016 10:00 AM PDT Most of us have never witnessed an economic "recovery" this bad. The homeownership rate in the United States has dropped to the lowest level ever. This is not what a recovery looks like. Instead, it very much appears that a new economic downturn has already begun… Buy 90% Junk Silver Bags at SD Bullion As Low […] The post This Is The Weakest US Economic 'Recovery' Since 1949 appeared first on Silver Doctors. |

| Gold Silver Ratio Set to Enter New Trading Range – Stewart Thomson Posted: 03 Aug 2016 10:00 AM PDT I think all members of the Western gold community should own some silver bullion. It doesn't have to be a large amount, but owning some is a very good idea. Here's why: Lowest Priced US Mint Silver Eagles Submitted by Stewart Thomson, Graceland Updates: For the Western gold community, the main theme for […] The post Gold Silver Ratio Set to Enter New Trading Range – Stewart Thomson appeared first on Silver Doctors. |

| Beginning of A Major Upside Move in Silver? Posted: 03 Aug 2016 09:00 AM PDT Silver does not appear quite as dynamic as the gold charts, yet it continues to quietly outperform relative to gold. We mention the small gap apparent on this chart because little gaps can signify the beginning of an eventual major move, to the upside in this case… Buy 90% Junk Silver Bags at SD Bullion […] The post Beginning of A Major Upside Move in Silver? appeared first on Silver Doctors. |

| Alasdair Macleod On Brexit Post-Mortem Posted: 03 Aug 2016 08:00 AM PDT The EU's economic and financial trajectory is a genuine crisis, and the whole project is liable to collapse. If so, Britain remaining in the EU would have amounted to a sacrifice of Britain's relatively free trade values in the interests of the EU's lemming-like self-destruction. If the British or European economies tank, it will have […] The post Alasdair Macleod On Brexit Post-Mortem appeared first on Silver Doctors. |

| Gold is Not Going to $10000 – Keith Weiner Posted: 03 Aug 2016 07:45 AM PDT Apparently gold is going to be priced at $10,000. Jump on the bandwagon now, while it's still cheap and a bargain at a mere $1,350! Our view is, well, not so fast… Buy 90% Junk Silver Bags at SD Bullion As Low As $1.49/oz Over Spot! Submitted by Keith Weiner, Monetary Metals: The prices […] The post Gold is Not Going to $10000 – Keith Weiner appeared first on Silver Doctors. |

| June U.S. Consumer Spending and Gold Posted: 03 Aug 2016 06:21 AM PDT SunshineProfits |

| Donald Trump Warns Americans To Get Out Of The Stock Market As The Dow Falls For A 7th Day In A Row Posted: 02 Aug 2016 05:37 PM PDT

What Trump told Fox Business earlier today was actually right on the money. Our financial markets have been artificially inflated by the Federal Reserve, and all artificial bubbles of this nature eventually burst. The following comes from a Bloomberg article that was posted on Tuesday entitled “Trump Urges Exit From Market Boosted by 'Artificially Low' Rates“…

Trump’s comments come at a time when we are getting a whole host of bad news about the U.S. economy. We just learned that U.S. GDP grew at a meager 1.2 percent annual rate during the second quarter, the rate of homeownership in the United States just hit an all-time record low, and corporate earnings have now been falling for five quarters in a row. But perhaps most alarming of all is what is happening to the price of oil. As I discussed yesterday, the price of oil has plunged well over 20 percent since June 8th, and it was down again on Tuesday. As I write this article, the price of U.S. oil is sitting at just $39.66. The psychologically-important 40 dollar barrier has been broken, but the price of oil doesn’t even have to go down another penny to do immense damage to the U.S. economy. If it just stays at this price, we are going to bleed more energy industry jobs, more energy companies are going to default on their debts, and more financial institutions that are exposed to the energy industry are going to get into serious trouble. All the ingredients are there for a major financial crisis, and perhaps that explains why so many investors are flocking to precious metals such as gold and silver right now. The price of gold has gone up for six trading days in a row, and silver is approaching 21 dollars an ounce. Meanwhile, things continue to unravel on the other side of the planet. In Europe, let’s just say that the recent bank stress tests did not go as well as many were hoping…

It is funny – every time I write a major article about Deutsche Bank, their stock goes to a new record low. And it has just happened again. Less than a week ago, I posted this article, and on Tuesday Deutsche Bank plummeted to a brand new record low as renewed fears about the health of the bank spooked investors. Problems at Deutsche Bank and Credit Suisse are now becoming so obvious that even mainstream analysts are admitting that they are “causing some anxiety”…

In Europe nobody is waiting for financial stocks to crash, because they are already crashing. A “too big to fail” crisis is rapidly unfolding across the entire continent, but most Americans are totally oblivious to what is going on over there. Instead, our major news outlets are feeding us an endless barrage of negative headlines about Donald Trump and a steady stream of positive headlines about Hillary Clinton. I wonder who they want to win the election? Of course I am being sarcastic. The days when the mainstream media at least pretended to be “independent” are long gone. But as far as the stock market is concerned, I am quite confident that Donald Trump will be vindicated. And if you don’t want to believe Donald Trump, I would encourage you to consider what Jeffrey Gundlach, the chief executive of DoubleLine Capital, has been saying. He has been right about the markets in recent years over and over again, and just a few days ago he publicly stated that “stocks should be down massively” and that now is the time to “sell everything“. Unfortunately, very few people are likely to change course at this stage. Most of those that could see the warning signs have already gotten out of the market, and those that prefer to have blind faith in the system are not likely to listen to warnings from men like Trump and Gundlach. So now it is just a waiting game. We shall see if Trump and Gundlach are right, and those that end up on the correct side of the equation are probably going to make a boatload of money during the months ahead. |

| Posted: 02 Aug 2016 05:15 PM PDT Clinton Cash, the movie. Gold and silver from several angles. Monetary sickness and creditism have replaced capitalism. What’s next after Brexit. Thomas Frank on what’s wrong with the Democrats. The post Top Ten Videos — August 3 appeared first on DollarCollapse.com. |

| Silver Kangaroo Coins – Sales Surge To Over 10 Million Posted: 02 Aug 2016 05:03 AM PDT gold.ie |

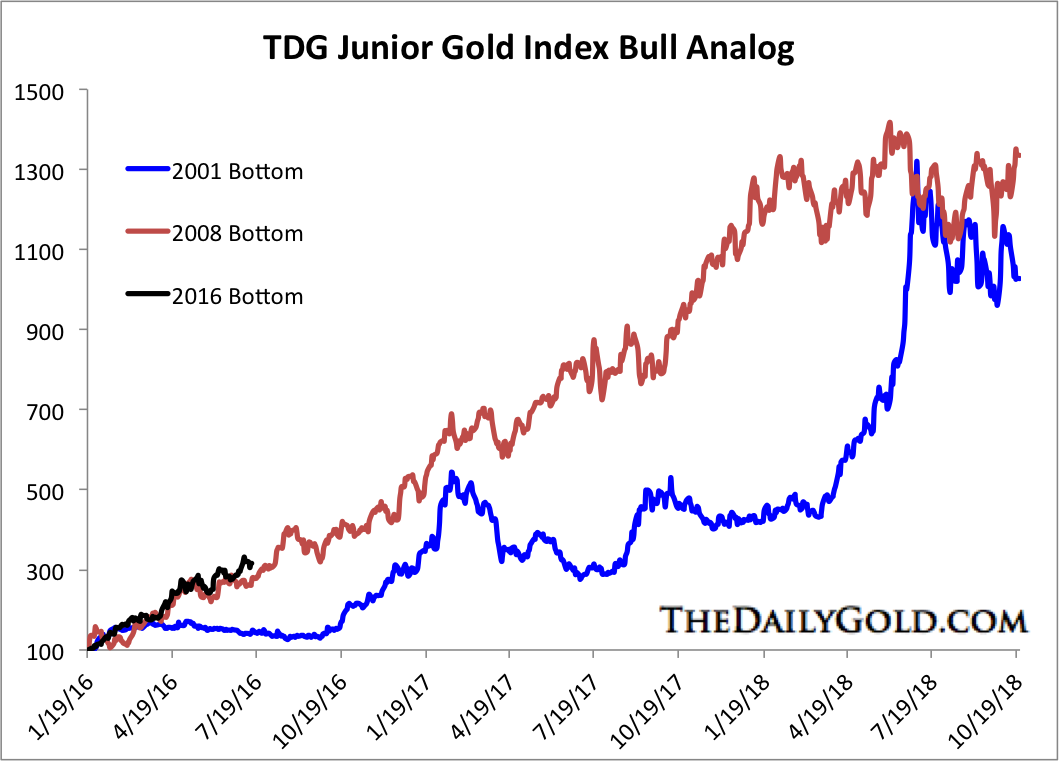

| The Upside Potential in Junior Gold Stocks Posted: 15 Jul 2016 02:19 PM PDT Our research continues to argue that the current, record rebound in gold stocks will continue. Every time we've predicted a correction, the weakness in the sector has been only a fraction of what we expected in both price and time. New bull markets that follow epic bear markets typically show exceptional strength in their first year. This bull has been no different. Thus, we expect the strong performance to continue. Today, we share a few reasons why the junior sector is poised to outperform in nominal and real terms. Juniors typically outperform once the new bull is established and metals prices are trending higher. The large cap miners perform best at the very beginning of the new bull. Later on, their performance in relative terms (against metals and juniors) weakens. Naturally, once the trend is established and sentiment improves, investors take on more risk. That benefits the junior sector. Moreover, that point time is when larger companies have the financial strength and optimism to acquire the smaller or junior companies. That is another positive for juniors. The current rebound in juniors as compared to the past still has plenty of upside potential. Take a look at the bull analog chart below. My junior gold index currently contains 18 companies and has a median market capitalization of ~$350 Million. It has been reconstructed several times dating back to 2000. While the index has already gained 200% in the past six months, if it follows the previous two bull cycles it could potentially double in the next seven months and then double again after that!

Junior Gold Stocks Bull Analog

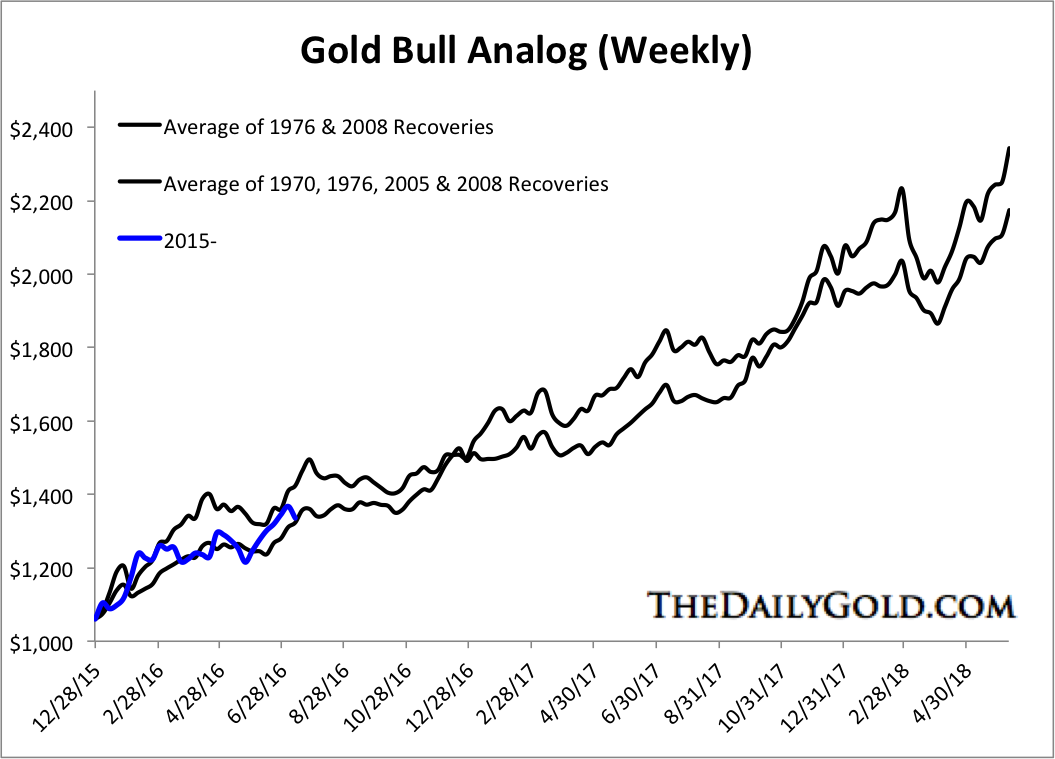

The junior sector should see an increased benefit if $1300-$1400 Gold becomes a floor and Gold continues to rise. The weekly Gold bull analog below shows that Gold's recovery has been following the weaker of the two analogs. If that continues, Gold could retest its all time high by the end of next year!

Gold Bull Analog

Be advised that no one can predict the future and these are projections based on a limited history. That being said, we believe the fundamentals for the junior sector have never been better and there is a strong precedent for the sector to go gangbusters in the years ahead. We did not even mention the full blown mania of the late 1970s and the mini-mania that occurred from 1993 to 1996. In short, we believe the precious metals sector continues to offer upside potential but that the junior space both in real and nominal terms offers the best risk/reward potential. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

| Monetary Metals Closes First Gold Fixed-Income Deal at 5% Posted: 15 Jul 2016 07:04 AM PDT What was that about gold being a sterile asset? FREEDOMFEST LAS VEGAS, Nev., July 15, 2016—At FreedomFest, Monetary Metals announces that it has closed its first gold fixed-income deal, to finance the gold working inventory of Valaurum. The initial amount of gold meets Valaurum's current needs, with room for expansion driven by its growth. The interest rate is 5 percent of the gold, paid in gold. Read more here and check out the revamped Monetary Metals website. |

| Posted: 14 Jul 2016 12:58 PM PDT |

| The Broad Market, Helicopters and Gold Posted: 14 Jul 2016 01:00 AM PDT |

| Silver Price Analysis: This Confirms The Continuation Of Silver’s Rally Posted: 13 Jul 2016 12:46 PM PDT The existence of this pattern, and its recent breakout confirm that the December 2015 bottom in silver is actually the bottom for the correction since 2011. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment