Gold World News Flash |

- Tesla, Are You Kidding Me?

- Randgold shares plummet after production problems at key gold mines

- China Dumps $30M into Weather Modification Program, Seeding Clouds with Chemicals

- 10 Facts The Mainstream Media Won’t Tell You About The War In Syria

- Is Deutsche Bank as Dangerous to Financial Stability as Citigroup Was in 2008?

- Money Supply Arguments Are Flawed

- Hyperinflation Defined, Explained, and Proven

- Gold Price Closed at $1356.10 Down $8.30 or -0.61%

- Gold Miners at the Last Resistance Zone

- Bank of England Rates Decision Thursday Morning... Stock Market Remains Lateral...

- No one can be sure that Fed doesn't meddle with futures or ETFs

- Gold and Silver, Guns & Ammo

- One Step Closer to the New World Order

- Behind Closed Doors at the IMF

- Gold Daily and Silver Weekly Charts - Hang On

- Bitcoin Price Flashes Important Signal

- US Dollar Analysis And New Trading Opportunity

- Gold Sector - Is it time to Back up the Truck? – Mortgage the Farm?

- Bond king Gross favors gold and real estate now

- Pokémon GO–LD

- Better Than Gold: Book 60% on This Astonishing Trade!

- Exclusive Interview With Jim Rogers – Part II

- 'Real Money Show' interviews GATA secretary on gold market rigging

- Bitcoin worth $72 million stolen from Bitfinex exchange in Hong Kong

- Ronan Manly: GLD evades SEC request for subcustodian details

- European Banking System on Verge of Collapse; 'No Confidence' in Italian Bank Rescue

- Gold Bullion – The Ultimate Monetary Solution

- Top Ten Videos — August 3

- You Can’t Eat Gold!

| Posted: 04 Aug 2016 02:00 AM PDT By Chris at www.CapitalistExploits.at Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing. Welcome to this week's edition of "World Out Of Whack" where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all it's glorious insanity.

While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the "World Out Of Whack" as your double thick armour plated side impact protection system in a financial world littered with drunk drivers. Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live. Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar - because, after all, I'm a capitalist. In this week's edition of the WOW we're covering Tesla MotorsLet's revisit a business school 101 lesson - just to re-establish a sound footing, if you know what I mean. A business can be one of two things: it can make and sell a product or it can provide a service. When it does this the difference between its revenues and its expenses determines whether it survives or fails. No matter the revenue it generates, if its expenses exceed its revenues, it goes out of business. Profits allow for sustainability. Enter Tesla Motors which in 13 years of operation has not once made a profit. How can this be? According to many analysts covering the stock they will yell and scream at me that, "No, indeed Tesla did in fact make profits." But what I'm talking about is a real profit, not some accounting, non-GAAP "fustercluck of numbers", pretending to be anything other than obfuscation. Since I'm short the stock I thought I'd bring it to your attention. In a strange set of coincidence, two days after I took out a small short position, a buddy who I spoke with here pinged me saying he was going short. Usually when we come to the same conclusion it's a good thing. Time will tell... Now to be clear, I've been burned by Tesla before. I shorted them in mid-2013 and was stopped out as Tesla screamed higher. The reason I've gone short again is based on the probability of 3 things. But note that I don't need all three to take place:

The problem I mentioned over 3 years ago is that Tesla relies in no small part to generous subsidies. Take those away and it's hard to see how they would manage to make a go-kart, much less the super slick machines that roll of the production line, and believe me, they are slick. The product looks amazing, but then again, Concorde was an amazing machine too. Take these subsidies away and Mr. Musk would be sweating worse than Mike Tyson in a spelling bee. You see, Musk is no fan of Trump and a Trump victory could be very bad for Tesla (remember those subsidies?). Perhaps this is why Musk is seeking Chinese tax payer subsidies? One needs a plan B after all... Market participants, knowing that the game is rigged and understanding that it's often easier to "join em when you can't beat em", have in turn invested heavily into the company's equity. Other investors are just following momentum and CNBC and so they buy Tesla blindly. The MarriageI really did scratch my head when first hearing about the marriage between Tesla and SolarCity. Setting aside the fact that Musk owns 22% of SolarCity and his cousin runs the company - red flags if ever there were any. When asked about why the deal is being sold to investors, Musk has floated this idea that it's better when Tesla customers can get solar installation and battery installation in a seamless way and tied together to their cars. Huh?! Now for starters, they should just hire me and I'll put together a solid JV deal for them, saving them millions in transaction costs, and Tesla customers will get all the "seamless installation" they can handle. I'll take 10% of the cost savings as a fee. It's a win-win for everyone. Secondly, taking two hemorrhaging companies with opaque accounting and blending them together like one of Brad Pitt's newly adopted ethnic children increases the leverage and risk with no identifiable upside. No, it's far more likely that there are problems at Tesla that can be covered up with this deal. What we do know is that SolarCity have been struggling to raise equity and Tesla solves this problem for them because Tesla is still a Wall Street darling. Just focusing on the deal, it quite makes no sense for Tesla at all. If it's not a bailout then I don't know what is. To give you a sense of how absurd some of the accounting is: SolarCity has forecast it will generate "positive cash" by year's end. But if we go read the Q1 shareholder letter, we realise that "positive cash" doesn't really mean "positive cash". It's neither positive nor is it cash. What it is in fact is cash obtained via financing sources such as "tax equity", cash equity", and "non-recourse debt". I've been doing this all wrong - working away investing, trading, building businesses, and doing it all for cashflow. Enlightened I am now! What I do know is this is a crappy deal for Tesla shareholders as Tesla will issue 0.11 shares for each SolarCity share. The mainstream media are reporting this as a deal with an equity value of about $2.6 billion. But the true cost is much higher. Why? In the last reported financials we can see that sitting quietly on SolarCity's balance sheet is a concoction that few sane investors would want to take on, at least not at the current price being offered. Namely, $1.3 billion in long-term debt, over $200 million in so-called solar bonds, then there is about $900 million in convertible debt, and another $625 million in solar "asset-backed notes". "Ok, Chris but that's the liability side. What about the other side of the ledger?" Well, considering SolarCity's cash burn of $65 million per month (based on 2015 operating cashflow numbers of -$790 million) and the $362 million that was in cash in March of this year, I'd say that this looks like a terrible deal. Tally it all up and it's more like a $5.2bn deal, not a $2.6bn deal. Like the rest of the accounting, it's all smoke and mirrors. Quite simply, I don't see how Tesla can survive without:

In my research where I was trying to actually find bullish arguments for Tesla in order to stress-test my bias, I came across some excellent Tesla research done by the Devonshire Research Group. I don't know these guys but the analysis is very good. One thing that they mention which I'd not considered or thought about is that Tesla will need desperately to squeeze its supply chain. But this is unlikely since sophisticated suppliers (most notably, Panasonic) will fight for their share of the profit. Also, current suppliers of numerous, strategic high-tech components have little IP and export to the US. Tesla has exactly zero patents held on these components. They also make the point that many Chinese suppliers are vulnerable to patent infringement accusations and could face ITC injunctions. QuestionI'm curious what are your thoughts on Tesla. Cast your vote here and also see what others think. Investing and protecting our capital in a world which is enjoying the most severe distortions of any period in mans recorded history means that a different approach is required. And traditional portfolio management fails miserably to accomplish this. And so our goal here is simple: protecting the majority of our wealth from the inevitable consequences of absurdity, while finding the most asymmetric investment opportunities for our capital. Ironically, such opportunities are a result of the actions which have landed the world in such trouble to begin with. - Chris "Really pay attention to negative feedback and solicit it, particularly from friends. ... Hardly anyone does that, and it's incredibly helpful." — Elon Musk Disclaimer: I'm short Tesla but, as is my right, I can and will change this whenever I please and for whatever reason. You've been warned. Do your own due diligence. ============ Liked this article? Don't miss our future articles and podcasts, and get access to free subscriber-only content here. ============ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Randgold shares plummet after production problems at key gold mines Posted: 04 Aug 2016 01:37 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Dumps $30M into Weather Modification Program, Seeding Clouds with Chemicals Posted: 03 Aug 2016 11:30 PM PDT by Daniel Barker, Natural News:

The Chinese government is hoping that the cloud seeding operations will ease drought conditions and lessen the impact of weather-related disasters, which claim hundreds of lives each year. Cloud seeding technology was developed in the United States during the late 1940s, and involves the use of chemicals, such as silver iodide crystals, which are dispersed in the air to create rainfall. When cloud seeding chemicals are introduced into the atmosphere, they cause raindrops within a cloud to form more quickly, making rain fall sooner than it normally would. The Chinese plan involves the use of aircraft, guns and rockets to fire salt-and-mineral “bullets” into the sky to stimulate rainfall in drought-stricken regions. The Ministry of Finance hopes to create an extra 60 billion cubic meters of rain each year by 2020 through the use of the technology. At least 52 countries currently pursuing weather modification programsChina is not the only country currently implementing weather modification projects. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10 Facts The Mainstream Media Won’t Tell You About The War In Syria Posted: 03 Aug 2016 11:00 PM PDT Submitted by Darius Shahtahmasebi via TheAntiMedia.org, Corporate media regularly attempts to present Bashar al-Assad’s regime in Syria as solely responsible for the ongoing conflict in the region. The media does report on events that contradict this narrative — albeit sparingly — but taken together, these underreported details shine a new light on the conflict. 10: Bashar al-Assad has a higher approval rating than Barack Obama Despite Obama’s claims Assad is illegitimate and must step down, the fact remains that since the conflict erupted in 2011, Assad has held the majority support of his people. The elections in 2014 – which Assad won by a landslide with international observers claiming no violations – is a testament to the fact that although Assad has been accused of serious human rights violations, he continues to remain reasonably popular with the Syrian people. Obama, on the other hand, won elections in 2012 with a voter turnout of a mere 53.6 percent of the American public; only 129.1 million total were votes cast. This means approximately 189.8 million American people did not vote for Obama. His current approval rating sits at about 50 percent. 9: The “moderate” opposition has been hijacked There is no longer such a thing as “moderate” opposition in Syria – if there ever was. The so-called Western-backed Free Syrian Army (FSA) has been dominated by extremists for years. The U.S. has known this yet has continued to support the Syrian opposition, despite the fact the New York Times reported in 2012 that the majority of weapons being sent to Syria have been ending up in the hands of jihadists. A classified DIA report predicted the rise of ISIS in 2012, stating:

Further, an FSA commander went on record not only to admit his fighters regularly conduct joint operations with al-Nusra (al-Qaeda in Syria), but also that he would like to see Syria ruled by Sharia law. Apparently, moderate can also mean “al-Qaeda affiliated fanatic.” 8: Assad never used chemical weapons on his own people A U.N. investigation into the first major chemical weapons attack committed in early 2013 — an atrocity the West immediately pinned on Assad — concluded the evidence suggested the attack was more likely committed by the Syrian opposition. A subsequent U.N. investigation into the August 2013 attack never laid blame on anyone, including Assad’s forces. In December 2013, Pulitzer prize-winning journalist Seymour Hersh released an article highlighting deficiencies in the way the situation was handled:

7: Toppling the Syrian regime was part of a plan adopted shortly after 9/11 According to a memo disclosed by 4-star General Wesley Clark, shortly after 9/11, the Pentagon adopted a plan to topple the governments of seven countries within five years. The countries were Iraq, Lebanon, Libya, Somalia, Sudan, Syria, and Iran. As we know, Iraq was invaded in 2003. American ally Israel tried its hand at taking out Lebanon in 2006. Libya was destroyed in 2011. Prior to this intervention, Libya had the highest standard of living of any country in Africa. In 2015, alone, it dropped 27 places on the U.N. Human Development Index rating. U.S. drones fly over Somalia, U.S. troops are stationed in South Sudan — Sudan was partitioned following a brutal civil war — and Syria has been the scene of a deadly war since 2011. This leaves only Iran, which is discussed below. 6: Iran and Syria have a mutual defense agreement Since 2005, Iran and Syria have been bound by a mutual defense agreement. The Iranian government has shown they intend to fully honor this agreement and has provided the Syrian regime with all manner of support, including troops, a $1 billion credit line, training, and advisement. What makes this conflict even more dangerous, however, is the fact Russia and China have sided with Iran and Syria, stating openly they will not tolerate any attack on Iran. Russia’s military intervention in Syria in recent months proves these are not idle threats – they have put their money where their mouth is. Iran has been in the crosshairs of the U.S. foreign policy establishment for some time now. George W. Bush failed to generate the support needed to attack Iran during his time in office — though not for lack of trying — and since 2012, sanctions have been the go-to mantra. By attacking and destabilizing Iran’s most important ally in the region, the powers that be can undermine Iranian attempts to spread its influence in the region, ultimately further weakening Iran. 5: Former Apple CEO is the son of a Syrian refugee The late Steve Jobs, founder of Apple, was the son of a Syrian who moved to the United States in the 1950s. This is particularly amusing given the amount of xenophobia, Islamophobia, racism and hatred refugees and migrants seem to have inspired — even from aspiring presidents. Will a President Donald Trump create the conditions in which future technological pioneers may never reach the United States? His rhetoric seems to indicate as much. 4: ISIS arose out of the U.S. invasion of Iraq, not the Syrian conflict ISIS was formerly known as al-Qaeda in Iraq, which rose to prominence following the U.S.-U.K. led invasion of Iraq in 2003. It is well-known that there was no tangible al-Qaeda presence in Iraq until after the invasion, and there is a reason for this. When Paul Bremer was given the role of Presidential Envoy to Iraq in May 2003, he dissolved the police and military. Bremer fired close to 400,000 former servicemen, including high-ranking military officials who fought in the Iran-Iraq war in the 1980s. These generals now hold senior ranking positions within ISIS. If it weren’t for the United States’ actions, ISIS likely wouldn’t exist. ISIS was previously known by the U.S. security establishment as al-Qaeda in Iraq (AQI), but these fighters ultimately became central to Western regime change agendas in Libya and Syria. When the various Iraqi and Syrian al-Qaeda-affiliated groups merged on the Syrian border in 2014, we were left with the fully-fledged terror group we face today. 3: Turkey, Qatar, and Saudi Arabia wanted to build a pipeline through Syria, but Assad rejected it In 2009, Qatar proposed a pipeline to run through Syria and Turkey to export Saudi gas. Assad rejected the proposal and instead formed an agreement with Iran and Iraq to construct a pipeline to the European market that would cut Turkey, Saudi Arabia, and Qatar out of the route entirely. Since, Turkey, Qatar, and Saudi Arabia have been staunch backers of the opposition seeking to topple Assad. Collectively, they have invested billions of dollars, lent weapons, encouraged the spread of fanatical ideology, and helped smuggle fighters across their borders. The Iran-Iraq pipeline will strengthen Iranian influence in the region and undermine their rival, Saudi Arabia — the other main OPEC producer. Given the ability to transport gas to Europe without going through Washington’s allies, Iran will hold the upper-hand and will be able to negotiate agreements that exclude the U.S. dollar completely. 2: Leaked phone calls show Turkey provides ISIS fighters with expensive medical care Turkey’s support for hardline Islamists fighting the Syrian regime is extensive. In fact, jihadists regularly refer to the Turkish border as the “gateway to Jihad.” In May 2016, reports started emerging of Turkey going so far as to provide ISIS fighters with expensive medical treatment. Turkey is a member of NATO. Let that sink in for a moment. 1: Western media’s main source for the conflict is a T-shirt shop in Coventry, England This is not a joke. If you follow the news, you most probably have heard the mainstream media quote an entity grandiosely called the “Syrian Observatory for Human Rights” (SOHR). This so-called “observatory” is run by one man in his home in Coventry, England — thousands of miles away from the Syrian conflict — yet is quoted by most respected Western media outlets (BBC, Reuters, The Guardian, and International Business Times, for example). His credentials include his ownership of a T-shirt shop just down the road, as well as being a notorious dissident against the current Syrian president. * * * Despite the fact much of the information in this article comes from mainstream outlets, those circulating it refuse to put all of the storylines together to give the public an accurate picture of what is going on in Syria. Assad may be brutal — and should face trial for allegations of widespread human rights abuses — but this fact alone does not make the other circumstances untrue or irrelevant. People have the right to be properly informed before they allow themselves to be led down the road of more war in the Middle East, and consequently, more terror attacks and potential conflicts with Russia and China. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is Deutsche Bank as Dangerous to Financial Stability as Citigroup Was in 2008? Posted: 03 Aug 2016 09:30 PM PDT by Pam Martens and Russ Martens, Wall Street On Parade:

That Deutsche Bank (which is highly interconnected to other major Wall Street banks and locked and loaded with tens of trillions of dollars in derivatives) is now showing the same kind of stresses as Citigroup back in 2008, raises the obvious question about just how effectively the Obama administration has reined in systemic financial risk after six years of reassurances that Dodd-Frank financial reform was getting the job done. On this date a year ago, Deutsche Bank's stock closed at $34.88. Its share price at the open this morning on the New York Stock Exchange was $12.56, a loss of 64 percent in one year's time. But from June 1 of 2007, prior to the onset of the financial crisis, Deutsche Bank has lost a whopping 90 percent of its share value, right on par with Citigroup. As of this morning's open, Deutsche Bank has a measly $17.32 billion in equity capital versus a portfolio of derivatives amounting to just shy of $50 trillion notional (face amount) as of December 31, 2015. This is how we reported Citigroup's situation on November 24, 2008: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Money Supply Arguments Are Flawed Posted: 03 Aug 2016 08:18 PM PDT by Keith Weiner

It goes without question, among economists of the central planning mindset, that if a central bank can just set the right quantity of dollars[1], then the price level, GDP, unemployment, and everything else will be right at the Goldilocks Optimum. One such approach that has become popular in recent years is nominal GDP targeting. How does a central bank affect the quantity of dollars? In discussing a nominal income targeting, Wikipedia gives the usual laundry list of how to do their magic: "…interest rate targeting or open market operations, unconventional tools such as quantitative easing or interest rates on excess reserves and expectations management…" Other than expectations management—which is just telling the market "blah blah blah"—managing an income aggregate is about manipulating one interest rate or another. In the real economy, people don't factor the quantity of dollars into their economic calculations. If you are in the grocery store to buy apples, you do not think about M0 money supply. Whether you are a farmer or miner, whether you operate a factory or trucking company, or even a bank or insurer, the money supply is irrelevant to you. By contrast, the interest rate figures in every economic calculation in the economy. How much to borrow, how much to save, and how to assess the tradeoff between consumption and investment are all dependent on interest. The rate of interest is a factor in every price and the relationship between all prices in the economy. For example, to grow apples you need land and you must plant trees. Then you have to wait for the trees to mature before they bear fruit. This requires an investment up front, in expectation of earning a return in the future. How high does this return need to be? It depends on the interest rate. This decision, made by thousands of current and potential apple farmers, determines the price of apples in the grocery store. And this, in turn, determines the decisions of consumers to buy apples, to buy something else, or to do without fruit if they cannot afford it. Whether the interest rate is manipulated upwards, whether it is forced downwards, or whether it is artificially locked in stasis, every price in the economy is affected and everyone's decisions are altered by the rate of interest. I have written a lot on the perverse incentives caused by interest rate manipulation, but today I want to focus on a different aspect of the problem. So, let's perform a little thought experiment. Suppose a business must pay 20% interest on its capital. If it somehow manages to eke out a 21% rate of profit, it forks over 95 percent of what it earns to its lenders. If it can't earn at least 20 percent, then it ends up feeding its capital to its creditors.

Now consider a perverse world where enterprises can borrow at -5 percent. They literally repay investors less capital than they borrow. This case is the opposite of the one above; Lenders feed their capital to enterprises. If interest is too high, the Fed is sacrificing entrepreneurs to investors. If interest is too low, then investors are sacrificed to entrepreneurs. Either way, our monetary planners pervert lending into a win-lose deal. So what's the right rate of interest? Only a market to determine that. Central planners have never gotten it right, are not right now, and will never get it right. They do, however, inflict collateral damage. Market Monetarism—the idea of central planning of credit based on a GDP target—promises improved outcomes over what would happen in a free market. However, it's no better than conventional Keynesianism or Monetarism. We should not be debating different approaches to central planning. We should be rediscovering the idea of a free market in money and credit. [1] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hyperinflation Defined, Explained, and Proven Posted: 03 Aug 2016 06:37 PM PDT

Hyperinflation Defined, Explained, and Proven

Regular readers already know that hyperinflation is not merely an economic "threat" looming in our near future, it is a certainty. Indeed, it has already occurred. Sadly, the term "hyperinflation" is still widely misused, and thus widely misunderstood. Definition of terms is required. The reason why the term "hyperinflation" is widely misused/misunderstood is a very simple one. It is because the term "inflation" is widely misused/misunderstood. If one does not have a clear grasp of the concept of inflation, obviously it is impossible to have an adequate comprehension of hyperinflation. Inflation is an increase in the supply of money. That is the economic definition of the term. It is the only correct definition of the term. It is a derivative of the verb "inflate": to increase (i.e. inflate) the supply of money. The term "inflation" is widely, erroneously, and (in the case of central bankers) deliberately misused as meaning an increase in the price of goods. But this price inflation is merely the direct and inevitable consequence of the initial act of inflation: the increase in the supply of money. Thanks to decades of brainwashing (and the fraudulent "inflation" statistics which came along with that), this simple but important distinction is almost beyond the comprehension of most readers. Yet it is a concept which is already well-understood in the realm of our markets. It is the concept of dilution. When a company prints up a new share, it has diluted its share structure, and the value of all shares in circulation falls commensurately/proportionately. This is nothing more than elementary arithmetic. If a company which originally had a share base of 1,000,000 increases the number of shares to 2,000,000, the value of all those shares decreases by 50%. If we priced the world in terms of the value of our shares (rather than the bankers' paper), the dilution of the share structure would automatically result in proportionate price inflation. This concept applies directly and identically to our monetary system. If a central bank prints up a new unit of its (un-backed) fiat currency, it dilutes its monetary base, and the value of all units of currency already in existence falls. It is the fall in the value of the currency through diluting that currency which directly translates into higher prices: price inflation. Yet incredibly (thanks to our brainwashing) this elementary concept is not accepted. A simple allegory is necessary. Let us all journey to Gilligan's Island: a closed system, and a small population – ideal for our purposes. But let us change one detail. For the sake of mathematical convenience, we will assume that there are ten "castaways" on the island rather than only seven. Even among the residents of the island, some commerce takes place. Mr. Howell, the island's resident banker, suggests that they create their own currency, on the hand-operated printing press he happened to have in his luggage. He dubs this currency the Coconut Dollar, and each resident is issued ten Coconut Dollars. No new currency is created, i.e. the monetary base is perfectly flat. Under these circumstances, there would never and could never be any (price) "inflation" on Gilligan's Island – ever. Initial prices (in Coconut Dollars) would be determined by the relative preferences of the residents, and unless those preferences changed, prices would remain absolutely stable, because the amount of currency in circulation was not increasing – i.e. there was no inflation. Then circumstances change. Mr. Howell, now the island's central banker, tells the island's residents that they should not have to endure such a meager standard of living. He tells the other residents he can raise their standard of living by printing more Coconut Dollars, in order to create "a wealth effect". He issues all the residents 40 more Coconut Dollars. The island's residents now all have 50 Coconut Dollars. They all feel much "wealthier". But what happens on the island? The residents' preferences for goods have not changed. Mary Ann bakes one of her highly-prized, coconut-cream pies, slices it into ten pieces, and (as she always does) offers slices for sale. After months/years of baking and selling pies, the standard price for each slice has always been one Coconut Dollar. The Skipper, who has a much larger appetite than the other residents, and now five times as many Coconut Dollars in his pocket decides he wants to increase his own share of slices. He offers Mary Ann two Coconut Dollars for a slice. But all the other residents also have five times as many Coconut Dollars in their pockets, and they match the Skipper's price, in order to maintain their own level of consumption. The "price" for a slice of coconut-cream pie is now two Coconut Dollars. The Skipper, with still a large surplus of Coconut Dollars in his pocket tries again to increase his share, by raising his 'bid' to three Coconut Dollars. The other residents again match that offer, and the price-per-slice increases to three Coconut Dollars. This process continues until a new price equilibrium is established for coconut-cream pies, as well as all the other goods bought/sold by the residents. With the supply of goods on the island being fixed, the island's residents would soon allocate all of their additional Coconut Dollars, and new (much higher) "standard" prices would emerge. Naturally, no increase in their standard of living ever takes place. The "wealth effect" is purely an illusion. At that point; there would never be any additional price inflation, unless/until Mr. Howell printed even more Coconut Dollars – and "inflated" the monetary base, again. Inflation does not appear out of thin air, conjured by magical fairies, as the lying central bankers would have us believe. It is Skeptics and (central bank) Apologists will remain unconvinced. They will point out that "the real world" is a place which is much more complex than Gilligan's Island, and thus the allegory carries no weight. Yes and no. Yes, the real world is much more complex than Gilligan's Island. No, the allegory loses none of its validity as a result, because the underlying principles can be (easily) incorporated into the real world. Our real world is a world with a steadily increasing population, and a steadily increasing supply of goods to meet the needs of that growing population. But it is still a fixed system. It is not Gilligan's Island, it is the Island of Earth. This is how the dynamics of our previous allegory translate onto the Island of Earth. While our population is growing at an alarming rate (from a long term perspective), the annual rate of growth is a low, single-digit number, generally in the 1 – 2% range. The supply of goods increases at a roughly parallel rate – to meet the demand of this (slightly) growing population. In economic terms; this is known as "the natural rate of growth". Equally, it can be described as the sustainable rate of growth. In a finite system, with fixed resources, growth beyond that "natural" rate is both artificial and unsustainable. In our monetary system; if the central bankers restrain their level of money-printing to this natural rate of growth, i.e. if central bank inflation matches this rate of growth, then there would, could, and should be no price inflation in the world. The rate of growth in the supply of currency matches the rate of growth in population/goods, and thus price equilibrium can be maintained. It is very interesting to note that over the long term, the increase in the global supply of gold has always roughly paralleled the natural rate of growth. This is but one of many reasons why a gold standard, i.e. a gold-backed monetary system, is the optimal basis for our monetary system. Robbed of our gold standard in 1971, by Paul Volcker and his lackey Richard Nixon, the central bankers have been free to print their fraudulent paper currencies at will. The "Golden Handcuffs" so despised by John Maynard Keynes have been removed. Cautiously, at first, and then with steadily more-reckless abandon, the central bankers have accelerated their money-printing. This has culminated with what readers have already seen on many occasions: the Bernanke Helicopter Drop.

As has been explained before; this is the literal, mathematical representation of hyperinflation: the exponential, out-of-control expansion of a nation's money supply. As readers now know, the monetary base of any legitimate economy (and monetary system) is supposed to be a horizontal line, as we see with the U.S. monetary base (and other currencies) in all the decades during which we operated under some form of gold standard. As soon as the last remnant of our gold standard had been eliminated, the horizontal line began to acquire an upward slope. This in itself was visual/mathematical proof that the U.S. dollar, now just an un-backed fiat currency, was being diluted to worthlessness – at a linear (i.e. gradual) rate. Then came the Crash of '08. What was an upward sloping line became a vertical line: conjuring new currency into existence at literally a near-infinite rate. When the horizontal line of a nation's monetary base is transformed into a vertical line, this is absolute, conclusive proof that hyperinflation has already taken place: the extreme and irreversible dilution of a currency to worthlessness. Again, the Skeptics and Apologists have their obvious retort. If the U.S. dollar has already and "irreversibly" been diluted to worthlessness, why has its exchange rate not fallen to zero/near-zero? The glib and succinct reply to that question comes in two words: currency manipulation. The Big Bank crime syndicate has been criminally convicted of manipulating all of the world's currencies, going back to at least – you guessed it – 2008. However, this is only a small portion of the complete answer to that question. A more comprehensive reply will be the starting point of the next installment of this series.

Please email with any questions about this article or precious metals HERE

Hyperinflation Defined, Explained, and Proven

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1356.10 Down $8.30 or -0.61% Posted: 03 Aug 2016 05:24 PM PDT

Stocks managed a twitch, but that's it. Dow Industrials rose 41.23 (0.23%) to 18,355.00. S&P500 twitched a bit harder, up 2.18 (0.31%) to 2,163.79. A cynical nat'ral born durned fool from Tennessee would say they're only twitchin' from the shock of falling through that upper megaphone boundary & 20 DMA, twitchin' before they die. US dollar index was twitchy, too. Remember yesterday it poked through 95.50 support like a fist poking through a kitchen wall in a trailer? Also fell beneath the 50 DMA, the last one before oblivion. So it bounced today, climbing 54 basis points (0.57%) to 95.53. All the same, it still looks sick as a puking monkey. Watch the 95 level. Go look for yourself, http://schrts.co/OkJ5UT Dollar Index is composed 57% of the Euro, so whatever the dollar index does, the euro usually does the reciprocal. It fell 0.59% to $1.1151. Count me an unbeliever in the euro. Yen fell back 0.36% to 98.77. Given Japan's persistently loony monetary policies, now working on their 26th year, one wonders why anybody would buy yen. Apparently in you own yuan or euros, the yen looks good -- if you're scared enough. Might be working on a double top about 100. On Comex today, where they take no prisoners, Gold tumbled $8.30 (0.6%) to $1,356.10., silver fell harder, 23¢ (1.1%) to 2043.6¢. Gold's problem is drawing near the Kryptonite of that last high at $1,377.50 Today's high hit $1,373.40, yesterday's $1,374.20. Gold must crack this wall to advance, and most likely will. Chart's here, http://schrts.co/Eyyuq1 Gold has, I remind y'all, already crossed above its upper channel boundary, confirming the breakout from the bullish flag. MACD still argues for more rally, but volume is drying up and the RSI pointing down. In other words, all this action blows hot & cold out of both sides of its mouth. Positive, but not enthusiastic. As always with life and markets, if you're not advancing you'll soon be retreating. Gold needs to stop fiddlin' and shoot up. Silver's RSI was overbought for half of July, and only 1-1/2 weeks of decline pulled it down. Yesterday it hit the overbought line again, & is pointing down. Today's action says little, but from the last two days' highs, the barrier to breach is 2080¢. Silver is possibly drawing out a bearish rising wedge, but weight is still pushing upward. We ran a special on those gold US $5 commemoratives not long ago. They were minted from 1986 - 2008, and contain 0.2418 troy ounce of pure gold. We can still sell them at about 3.5% over their melt value, which is eye-popping cheap compared to a one ounce American Eagle at 7.5%, or 1/4 American Eagle at 9.7%. We can sell the US$5 at $12 over melt value. It's a fractional US gold coin about the same price as an Austrian 100 corona. Shipping is $30 per order. Call us at (888) 218-9226 or (931) 766-6066. Only reason the market is offering this opportunity is that it's the dead summertime and there's so little action. THAT should come as August closes, and end the bargains. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Miners at the Last Resistance Zone Posted: 03 Aug 2016 05:16 PM PDT Miners are in the process of breaking through the last resistance level. Once this is cleared they have an unimpeded shot to 380. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank of England Rates Decision Thursday Morning... Stock Market Remains Lateral... Posted: 03 Aug 2016 05:09 PM PDT There is a potential market mover pre-market tomorrow morning when Europe's Bank of England decides whether they will once again cut rates. Yes, I said cut, not raise. The endless world of low rates, and sometimes even negative rates continues. The expectation is for an actual .25 rate cut. Hard to believe, but that's the world we are living in now. How low can rates go? It seems there is no end to it all. We don't have to understand or agree with it, but that's the real world. It's true insanity. I'm not sure how they can get away with this garbage, but I think their market would collapse if they didn't do another rate cut in the world of endlessly low rates. I can't wrap my mind logically around it, but they seem to have no problem doing so. It shows the truth of how bad things are economically. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| No one can be sure that Fed doesn't meddle with futures or ETFs Posted: 03 Aug 2016 04:52 PM PDT 8:03p ET Wednesday, August 3, 2016 Dear Friend of GATA and Gold: Financial letter writer and technical analyst Steve Saville contends today that the Federal Reserve couldn't possibly be intervening directly in the stock market by purchasing stock index futures or exchange-traded funds because evidence of such transactions would show up on the Fed's public books: http://tsi-blog.com/2016/08/does-the-fed-support-the-stock-market/ There are a few problems with this assertion, quite apart from Saville's failure ever to put a critical question to a central bank. 1) First is that Saville's proposition is misleading. Saville acknowledges that the Fed could seek to support equity prices through "monetary policy and 'jawboning.'" But the Fed also could undertake futures and ETF purchases through intermediaries, just as the Treasury Department could undertake such purchases through its Exchange Stabilization Fund or through intermediaries. ... Dispatch continues below ... ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. 2) Contrary to Saville's suggestion, not all important Federal Reserve records and transactions are public. The Federal Reserve Bank of New York operates a massive trading room executing transactions for itself and the Treasury Department that are not individually disclosed. 3) Most of the Fed's gold transaction records are secret, as established in 2009 by GATA's partially successful freedom-of-information litigation against the Fed, litigation that extracted an acknowledgment from a member of the Fed's Board of Governors that the Fed has secret gold swap arrangements with foreign banks: Just a few months ago the president of the Federal Reserve Bank of New York, William Dudley, taking questions after a presentation to a group of economists meeting at the Virginia Military Institute, clumsily evaded a question about those gold swaps, and his publicist at the New York Fed refused even to acknowledge a follow-up question about the swaps: http://www.gata.org/node/16341 So what are the Fed and its partner central banks and other banks doing with the swapped gold? Are they just filling gaps in their collection of refiner hallmarks? Or are they facilitating secret interventions by each other in the markets? Saville hasn't asked and doesn't seem to want to know. 4) The ESF is fully authorized by law, the Gold Reserve Act of 1934 as amended in the 1970s, to trade secretly in any market, domestically and around the world: https://www.treasury.gov/resource-center/international/ESF/Pages/esf-ind... The New York Fed well may execute ESF trades but they would belong to the ESF and not necessarily appear on the Fed's public books. Indeed, New York Fed President Dudley purported not to be able to answer the gold swap question at the Virginia Military Institute because it involved "individual customer transactions," though it didn't. The question was simply whether the Fed is involved with gold swaps. 5) According to documents filed with the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission, some governments and central banks have at least prepared themselves to trade all U.S. futures contracts in secret -- not just financial futures but commodity futures as well -- by arranging volume discounts for their trading with the operator all the major futures exchanges in the United States, CME Group: http://www.gata.org/node/14385 http://www.gata.org/node/14411 The Fed or the Treasury could be undertaking such trades directly or through intermediaries. 6) The Fed undertakes frequent transactions with at least 23 investment banks designated as primary dealers in U.S. government securities. These transactions effectively direct money in various directions that are not all formally specified in public. The investment banks have a huge interest in deploying the Fed's money in ways that will please the Fed and keep the money flowing to the investment banks. The primary dealers are required to "participate consistently in open market operations to carry out U.S. monetary policy pursuant to the direction of the Federal Open Market Committee and provide the New York Fed's trading desk with market information and analysis helpful in the formulation and implementation of monetary policy": https://www.newyorkfed.org/markets/pridealers_current.html Is Saville privy to all that communication and the market activity to which it leads? He is not listed as a primary dealer. 7) The chairman of the Federal Reserve, Janet Yellen, and New York Fed President Dudley are members of the Board of Directors of the Bank for International Settlements in Basle, Switzerland, the central bank of the central banks: https://www.bis.org/about/board.htm?m=1%7C2%7C2 According to its annual report, the BIS regularly undertakes secret transactions in various markets for its member central banks: https://www.bis.org/publ/arpdf/ar2016e_ec.pdf In 2008 the BIS actually advertised to potential new central bank members that its services include secret interventions in the currency and gold markets and "off-balance-sheet" asset management: http://www.gata.org/node/11012 Is Saville privy to that stuff too? One way Saville could test his confidence that the Fed isn't involved, directly or indirectly, with index futures or ETFs would be to try to attend a meeting of its Board of Governors or Federal Open Market Committee. Of course anyone who did that would be arrested, but maybe something like that would be the only antidote to Saville's credulity -- if it is credulity and not just another contrived defense of financial newsletters that provide technical analysis of markets that were commandeered by the government long ago. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Aug 2016 04:00 PM PDT The Gold Report | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| One Step Closer to the New World Order Posted: 03 Aug 2016 02:47 PM PDT This post One Step Closer to the New World Order appeared first on Daily Reckoning. Jim Rickards' fellow panelists chuckled and guffawed when he talked about special drawing rights (SDRs) at a 2012 conference at the Milken Institute. They’re not laughing now… "IMF and China Accelerate Creation of New Global Reserve Currency," blared a recent headline from The Epoch Times. China has long fussed that the SDR should replace the U.S. dollar as the world's reserve currency. And this month, it could become one step closer to reality… For the uninitiated: The SDR is a sort of "super money," or global reserve currency, issued by the IMF to circulate among central banks. It's a basket of currencies comprising the dollar, euro, yen, pound and, as of last November, the Chinese renminbi (yuan). The renminbi won't formally be included in the basket until Oct. 1 of this year. But SDRs are hardly new… The IMF has issued SDRs on three separate occasions since their creation over 40 years ago. Each responded to a dollar crisis… The first was after 1969. The U.S. was printing dollars by the bushel to finance the guns and butter for Vietnam and the Great Society. Foreign governments could still exchange dollars for gold in those days — and they did. They depleted the U.S. gold vaults. The IMF created the SDR in response, issuing over 9 billion SDRs through 1972. In 1979, U.S. inflation soared past 14%. Oil-producing countries were alarmed that inflation was destroying the value of their dollar reserves. The IMF issued 12 billion SDRs through 1981. The IMF then issued 182 billion SDRs during August and September of 2009, in response to the Panic of 2008. And it's fixin' for an even greater role… In 2011, the IMF released one of those obscure reports read only by a few eggheads read: Enhancing International Monetary Stability — A Role for the SDR? Its vision, according to Jim: A multiyear, multistep plan to position the SDR as the leading global reserve asset. The study recommends increasing the SDR supply to make them liquid and more attractive to potential private-sector market participants… The IMF study recommends that the SDR bond market replicate the infrastructure of the U.S. Treasury market. "If there were political willingness to do so," the report states, SDRs "could constitute an embryo of global currency." Jim Rickards said that conclusion is "highly significant, because it is the first time the IMF has publicly moved beyond the idea of the SDR as a liquidity supplement and presented it as a leading form of world money… The IMF is poised to realize its one-world, one-bank, one-currency vision exercise its intended role as the central bank of the world." Now back to China… According to the South China Morning Post, "Mainland media group Caixin reported that the World Bank planned to issue bonds denominated in special drawing rights in China as early as the end of this month. It said policy bank China Development Bank was also planning an SDR bond issue." The Nikkei Asian Review claims (as reported in Epoch Times) the total issue "will be between $300 and $800 million and some Japanese banks are interested in taking up a stake. According to Nikkei, some other Chinese banks are also planning to issue SDR bonds." This would be only the second platform of its type in the world. (The only current SDR trading platform is inside the IMF itself.) A small step, really. And it's not clear if a market for these issues will fully develop. But as the classic Confucian Tao Te Ching has it, a journey of 1,000 miles must begin with a single step… G-20 finance ministers met in Chengdu, China, late last month. And they support China's SDR issue: "We support examination of the broader use of the SDR… and the potential issuance of SDR-denominated bonds, as a way to enhance resilience [of the financial system]." Why should China defer to the IMF? It's important to note that China doesn't want to replace the dollar with the yuan, according to Jim Rickards. It just wants a "seat at the table." And SDRs would give them that seat: "The most important thing for you to understand is that China does not want to rock the boat — they want to join the club. This means the IMF's special club of SDR members. The future world reserve currency is not the dollar or the yuan. It's the SDR." Jim says you won't hear much about SDRs until the next great financial crisis. The Fed used up all its powder to fight the last one. It's all gone. Next time, it'll be the IMF and its SDRs to the rescue: Since Federal Reserve resources were barely able to prevent complete collapse in 2008, it should be expected that an even larger collapse will overwhelm the Fed's balance sheet… The logic leads quickly from one world to one bank to one currency for the planet… The task of re-liquefying the world will fall to the IMF because the IMF will have the only clean balance sheet left among official institutions. The IMF will rise to the occasion with a towering issuance of SDRs, and this monetary operation will effectively end the dollar's role as the leading reserve currency. SDRs would be inflationary because the dollar would be devalued against them. Private citizens wouldn't be able to own SDRs, so they wouldn't make the connection. Jim again: The genius of the scheme is that the SDRs would create inflation… but ordinary people wouldn't know SDRs were causing it. Any inflation caused by massive SDR issuance would not be immediately apparent to citizens. The inflation would show up eventually at the gas pump or the grocery, but national central banks could deny responsibility with ease and point a finger at the IMF. And so ends the dollar standard — not with a bang, but a whimper. And a truckload of inflation. Below, Jim Rickards takes you behind the scenes at the IMF to show you its plans for the world's monetary system. Read on. Regards, Brian Maher Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE.

The post One Step Closer to the New World Order appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Behind Closed Doors at the IMF Posted: 03 Aug 2016 02:17 PM PDT This post Behind Closed Doors at the IMF appeared first on Daily Reckoning. The Washington, D.C., area is thick with secret agencies with"three-letter names," such as CIA, FBI, NSA and less well-known outfits such as the Defense Intelligence Agency (DIA) and the Director of National Intelligence (DNI). One of the most powerful, and also most secretive, of these agencies is an institution that is not even part of the U.S. government. It's an autonomous part of an emerging scheme of global governance accountable only to a small elite of central bankers, finance ministers and heads of state. That institution is the International Monetary Fund, or the IMF. Everything about the IMF is designed to deceive you—beginning with the name. The IMF is not really a "fund" in the sense of an endowment or mutual fund; it functions as the central bank of the world, taking deposits, called "borrowings," from countries around the world and making loans to its members. It prints money like most central banks, but this world money has the opaque name of special drawing right, or SDR. Now, when I say world money, it sounds kind of spooky or scary, but it actually has a funny name. It's called the special drawing right, or SDR. The global financial elites pick strange They have in the past— there's nothing new about it. SDRs were created in 1969, and hundreds of billions of them have been issued over the years. But the IMF only issues them when there's a financial panic. They don't issue them every day or when times are good. You will not be able to use them, touch them or feel them. You will not be able to spend them. You will not have them. SDRs are not going to be walking-around money. You'll still have dollars, but the dollars will be a local currency, not a global reserve currency. So for example, when I go to Turkey, I cash in some dollars and get some Turkish lira. I use the lira to pay for taxis in Turkey. Then when I leave, I cash them out again. That will be how the dollar is used. You'll use the dollar when you come to the United States, but it'll be like Mexican pesos: something you use when you go there. The dollar won't be the important global reserve currency. The SDR will be used for the settlement of the balance of payments between countries, the price of oil and perhaps the financial statements of the 100 largest global corporations. The impact on everyday investors will be inflationary. The difference, however, is that, right now if we have inflation, everyone blames the Fed. In the future, however, you'll have inflation coming from SDRs. That means when people try to blame the Fed, the Fed will say it's not us; it's those guys over there on G Street in Northwest Washington. Go blame them. No one even knows where the IMF is. So the SDR is just a way to get inflation through the back door. The IMF has a convoluted governance structure in which the highest decision-making body, the Board of Governors, has little power because the votes are weighted in favor of the largest economies, such as the U.S. Actual power rests with the blandly named International Monetary and Financial Committee, the IMFC. Everything about the IMF is designed to make it difficult Given this culture and history, it was surprising to see the publication a few years back of a book by Liaquat Ahamed, Money and Tough Love—On Tour With the IMF. The book is the most detailed account yet from behind the scenes at IMF headquarters. The author also reports on an IMF annual meeting in Tokyo and goes on the road with IMF "missions" as they monitor large and small governments around the world. These missions are the key to forcing governments to conform to the "rules of the game" as established by the global monetary elites. Ahamed had difficulty getting the cooperation of the IMF and access to IMF meetings and missions he needed to write the book. In the opening section, he writes, he soon discovers that gaining access to the world behind its doors will not be easy. The fund is the repository of many secrets, which it guards ferociously. It does its work behind the scenes, out of the public eye, and has a history of being wary of the press… The fund benefits from a certain mystique that could be lost by too much openness. In the end, Ahamed was granted access by IMF Managing Director Christine Lagarde. What follows is a revealing account that is part history, part economics and part James Bond as Ahamed travels from Washington to Tokyo; Dublin; and Maputo, Mozambique. He describes IMF interactions with other members of the global power elite as well as the IMF's member Importantly, the book is highly accessible. Ahamed avoids the arcane jargon that fills most accounts of the IMF as well as the IMF's official publications and reports. Anyone with the One of the book's main takeaways is the demonstration that the IMF is just as powerful as the military and CIA when it comes to forcing regime change in governments that do not follow U.S. orders. Of course, the IMF does this without firing a shot. They use money as a weapon just as effectively as the military uses special operations or the CIA uses drones. Second, if Western nations lose votes in the IMF and those votes are given to communist China, then the IMF money weapons may be aimed at the U.S. in the future. In recent decades, the emerging markets and southern Europe have needed IMF bailouts. In the future, the U.S. may be the one that needs to be bailed out, and we may have to accept conditions imposed by China using the IMF as its monetary agent. The book is also timely. While the IMF has always been opaque, its importance to global finance has waxed and waned over the decades. Now the IMF is about to enter its most powerful stage yet. Central banks bailed out the world in 2008. The next financial panic will be bigger than the ability of central banks to put out the fire. At that point, the only source of global liquidity will be the IMF itself. The issuance of 5 trillion of SDRs, equal to $7.5 trillion, to paper over the next financial panic will be highly inflationary. The difference between this coming inflation and those in the past is that few investors will know where the inflation is coming from. Politically, it will not be easy to hold the U.S. Treasury or the Federal Reserve accountable, because they will just point a finger at the IMF. The one true advantage of SDRs is that very few people understand them, and there's no political accountability. This book will make you better acquainted than most with this hidden source of inflation. Ahamed's book is a good chance to meet the financial world's fire department before the next great fire. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away.

The post Behind Closed Doors at the IMF appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Hang On Posted: 03 Aug 2016 01:19 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bitcoin Price Flashes Important Signal Posted: 03 Aug 2016 12:50 PM PDT In short: short speculative positions; stop-loss at $657; initial target at $527. Does Bitcoin correlate to gold? This is the kind of question Bitcoin enthusiasts pose to themselves. As it turns out, the question might be surprising to a lot of people who claim that the two are very similar. In an article on CoinDesk, we read: An analysis of historical market data conducted by ARK Invest's Chris Burniske failed to illustrate a strong relationship between the two. Burniske's analysis revealed that when examined on a weekly basis, the one-year rolling correlation of bitcoin and gold's returns was positive for nearly the entire period between 30th December, 2011, and 20th June, 2014. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar Analysis And New Trading Opportunity Posted: 03 Aug 2016 12:46 PM PDT Investor optimism in stocks is becoming more widespread. Last week’s NAAIM Exposure Index rose to 101, which is the highest level since December of 2013. The trading sentiment composite has moved to a “Sell Signal” and last week saw an 11 on the VIX. Excessive optimism is universal. We are entering an interesting time of the year for investors. Is this stock market going to break out to the upside and rally to further new highs, or will this latest lull be followed by a painful reversal of fortune? Historically, the August/September timeframe is the “Danger Zone” for the stock market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Sector - Is it time to Back up the Truck? – Mortgage the Farm? Posted: 03 Aug 2016 12:28 PM PDT Technical Analysis of the gold sector reveals a number of red flags, such as negative COT numbers and a mining sector that is at least temporarily overbought, having more than doubled since January. And yet……. Sometimes a market that is overbought can remain that way for longer than anyone anticipated. Remember the ‘Dotcom’ bull market of the 1990s? It became overbought and kept on rising for many months. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bond king Gross favors gold and real estate now Posted: 03 Aug 2016 09:53 AM PDT ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Gross Says 'I Don't Like Bonds, Most Stocks,' Favors Real Assets By John Gittelsohn Money manager Bill Gross says investors should favor gold and real estate while avoiding most stocks and bonds trading at inflated prices. "I don't like bonds. I don't like most stocks. I don't like private equity," Gross, who runs the $1.5 billion Janus Global Unconstrained Bond Fund, wrote in his monthly investment outlook Wednesday. "Real assets such as land, gold, and tangible plant and equipment at a discount are favored asset categories." ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-08-03/gross-says-i-don-t-lik... Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Aug 2016 09:41 AM PDT Pokémon GO–LD | ||||||||||||||||||||||||||||||||||||||||||||||||||||

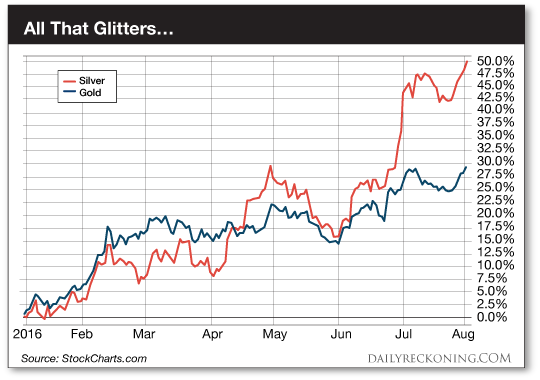

| Better Than Gold: Book 60% on This Astonishing Trade! Posted: 03 Aug 2016 08:40 AM PDT This post Better Than Gold: Book 60% on This Astonishing Trade! appeared first on Daily Reckoning. Grab a friend or family member. Ask him this question: What is the best performing investment of 2016? He might guess Apple. Or Facebook. If he reads the Wall Street Journal, he might say gold. Wrong, wrong, and wrong. We can do better. Just look at silver… In late June, we told you silver was ready to make a run at $20 for the first time in nearly two years. In only a few days, the poor man's precious metal blasted through $20 and barely looked back. It's been on a historic run ever since… Now that silver's 5-year bear market is over, it's taking no prisoners. It's up nearly 50% so far in 2016—easily topping even gold's impressive run higher.

Today, I want you to take advantage of silver's powerful move by booking gains just shy of 60% on one of our strongest trades… To be clear, I don't think silver's epic rebound is anywhere near finished. But as with all trades, there comes a time to take money off the table. That's what the market's telling us right now. And when the market speaks, we're all ears. Before we get to the details, here's how silver went from dud to stud this year: Earlier this year, gold hogged the precious metals spotlight since it started ripping higher in February—and deservedly so. After all, gold surprised nearly everyone with its impressive move off its lows. It's up more than 28% year-to-date. To put that move in perspective, the mighty S&P 500 is up just about 5% on the year after yesterday's swoon. But silver hasn't earned much ink from the financial press. Sure, silver kept pace with gold for the first six weeks of the year. But in mid-February gold started to outshine its less lustrous cousin. At the time, gold and other metals were making the most dramatic moves. Earlier this year, we also had the opportunity to book gains on aluminum producers and miners as other precious metals surged. Meanwhile, silver consolidated. Silver didn't jump to new highs until mid-April (that's when we first hopped onboard). After another sharp pullback in May, silver roared back. Its bull run accelerated after the Brexit bottom. That's when silver officially left gold in the dust… Of course, the best way to play silver's move has been the miners. They've been the most straightforward trades on the market for months—and the most profitable. What's even more impressive is how you've had the opportunity to double silver's gains just by playing the miners. Today, we're taking gains on Silver Wheaton Corp. (NYSE:SLW). We hopped onboard this play back on April 20th. Since then, it's gained nearly 60%, compared to a 22% gain in silver's spot price. It has now risen an impressive six trading days in a row. That's gives us the perfect opportunity to take some money off the table today. The new bull market in precious metals has treated us well this year. Along with our SLW sell, we're booking 20% gains on two other metals plays today [check out how PRO members got access to these trade ideas]. When silver sets up for a trade after it blows off some steam, you have yet another chance to book gains like these in a matter of weeks. Stay tuned… Sincerely, Greg Guenthner P.S. Make money in ANY market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post Better Than Gold: Book 60% on This Astonishing Trade! appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exclusive Interview With Jim Rogers – Part II Posted: 03 Aug 2016 08:17 AM PDT This post Exclusive Interview With Jim Rogers – Part II appeared first on Daily Reckoning. Central banks have pushed interest rates negative… There's now more than $11 trillion of global debt with negative yields… With cash earning no return, investors are in a desperate search for yield… That's boosted asset prices. Stocks hit new highs on a regular basis… But this shell game, like all others, will eventually come to an end. And history shows that central bank manipulation always ends in disaster. Today, you'll find out how one of the world's greatest investors is preparing for the coming collapse… Priceless Wisdom From a Market LegendIn the second installment of my exclusive interview with legendary investor Jim Rogers, he gives you an inside look at how he's positioned for a market meltdown. Let's be clear: Jim claims no magical ability to see the future. He doesn't know when the central bank house of cards will crash. But he is a student of history. And he's made a fortune being on the right side of major market events throughout his storied career. So when Jim talks, savvy investors listen. And right now, he sees a massive market correction as inevitable. And in today's interview, you'll hear Jim's thoughts and plans for the fallout, including… Why the market may still go up BIG from here… Which currency he owns more than any other in the world… Which sectors he's shorting… What to do about gold and silver… Why the market may decline up to 80%… Why you should move to North Korea… And those are just some of the topics covered in Part II of my exclusive interview with Jim Rogers. Click on the video below to watch the entire thing. Please send me your comments to coveluncensored@agorafinancial.com. Let me know what you think of my conversation with Jim Rogers. Regards, Michael Covel The post Exclusive Interview With Jim Rogers – Part II appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 'Real Money Show' interviews GATA secretary on gold market rigging Posted: 03 Aug 2016 05:18 AM PDT 8:19a ET Wednesday, August 3, 2016 Dear Friend of GATA and Gold: "The Real Money Show" on Toronto's 50,000-watt talk radio station, CFMJ, interviewed your secretary/treasurer last Saturday about market rigging by central banks, its impairment of human progress around the world, and gold's prospects for breaking free and restoring free markets and defeating totalitarianism. The segment with your secretary/treasurer is about 25 minutes long and begins at the 12:08 mark here: http://omnyapp.com/shows/640-toronto/real-money-show-july-30th-2016 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bitcoin worth $72 million stolen from Bitfinex exchange in Hong Kong Posted: 03 Aug 2016 05:12 AM PDT By Clare Baldwin HONG KONG -- Nearly 120,000 units of digital currency bitcoin worth about $72 million were stolen from the exchange platform Bitfinex in Hong Kong, rattling the global bitcoin community in the second-biggest security breach ever of such an exchange. Bitfinex is the world's largest dollar-based exchange for bitcoin, and is known in the digital currency community for having deep liquidity in the U.S. dollar/bitcoin currency pair. Zane Tackett, director of community and product development for Bitfinex, told Reuters that 119,756 bitcoin had been stolen from users' accounts and that the exchange had not yet decided how to address customer losses. "The bitcoin was stolen from users' segregated wallets," he said. ... ... For the remainder of the report: http://www.reuters.com/article/us-bitfinex-hacked-hongkong-idUSKCN10E0KP ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||