saveyourassetsfirst3 |

- More 'Dollar' Details In Autos

- Financial Collapse Ahead – Will Gov’t Confiscate or Tax Gold & Silver? – Jim Willie

- There Has NEVER Been a Bigger Fundamental Reason to Own Physical Gold and Silver Than THIS:

- Golden Nuggets of Truth

- Hesitant Longs, Fearful Shorts, And What Friday's Move Means For The Gold Market

- Fueling Gold Stocks' Next Upleg

- Gold Bull Correction: Not an If, but When

- Gold against Foreign Currencies Update

- Breaking News And Best Of The Web

- Gold against Foreign Currencies Update

- *Breaking: China & BIS Negotiating Deal to Settle Global Contracts in GOLD at $5,000/oz! – Jim Willie

- Fastest Growing Bullion Dealer Offers Insider’s Look into Mechanics of Gold and Silver Coin Market

- Is the World Headed For a “Mad Max” Future? “We Are Going to Have a Reset of the System” – Bill Holter

- COMEX GOLD DEFAULT AHEAD! – Jim Willie

- What’s Next for the Metals? Eric Sprott’s Thoughts On Gold, Silver, & the Shares

- Famed Trader: Gold And Silver Are Headed For New Highs

| More 'Dollar' Details In Autos Posted: 13 Aug 2016 12:54 PM PDT |

| Financial Collapse Ahead – Will Gov’t Confiscate or Tax Gold & Silver? – Jim Willie Posted: 13 Aug 2016 12:00 PM PDT Hat Trick Letter Editor Jim Willie believes a complete economic collapse is on the horizon. Will the government attempt to confiscate gold and silver coins? Are 90% junk silver coins the best physical option to prepare? In the Must Listen interview below, Jim Willie looks ahead to the days and weeks AFTER the US financial collapse… […] The post Financial Collapse Ahead – Will Gov’t Confiscate or Tax Gold & Silver? – Jim Willie appeared first on Silver Doctors. |

| There Has NEVER Been a Bigger Fundamental Reason to Own Physical Gold and Silver Than THIS: Posted: 13 Aug 2016 11:00 AM PDT With Gold and Silver Prices Smashed Through Significant Levels After the London Close This Afternoon, Craig Hemke Joined the Show to Analyze the Brutal Take-Down: Gold and Silver Absolutely SMASHED – Timing Suggests Tightness in London Physical Market Price Manipulation is like Pornography – Its Hard to Define, But You Know it When You See […] The post There Has NEVER Been a Bigger Fundamental Reason to Own Physical Gold and Silver Than THIS: appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Posted: 13 Aug 2016 10:00 AM PDT We spend most of our time here at SD discussing topics related to Sound Money – physical gold and silver. In this new series, we’re going to delve into a commodity that is more valuable than even gold and silver – Truth… caveat: This article and this series in general isn’t for […] The post Golden Nuggets of Truth appeared first on Silver Doctors. |

| Hesitant Longs, Fearful Shorts, And What Friday's Move Means For The Gold Market Posted: 13 Aug 2016 09:07 AM PDT |

| Fueling Gold Stocks' Next Upleg Posted: 13 Aug 2016 07:03 AM PDT |

| Gold Bull Correction: Not an If, but When Posted: 13 Aug 2016 01:00 AM PDT |

| Gold against Foreign Currencies Update Posted: 12 Aug 2016 08:11 PM PDT The Daily Gold |

| Breaking News And Best Of The Web Posted: 12 Aug 2016 06:44 PM PDT Retail sales weaker than expected. Gold and oil pop. US government debt now has negative yield for foreign investors. More good earnings reports from precious metals miners. A major bitcoin hack throws crypto-currency world into turmoil. China, Japan and Russia rattle their sabers. Trump attempts to salvage his campaign, is failing. Best Of The […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

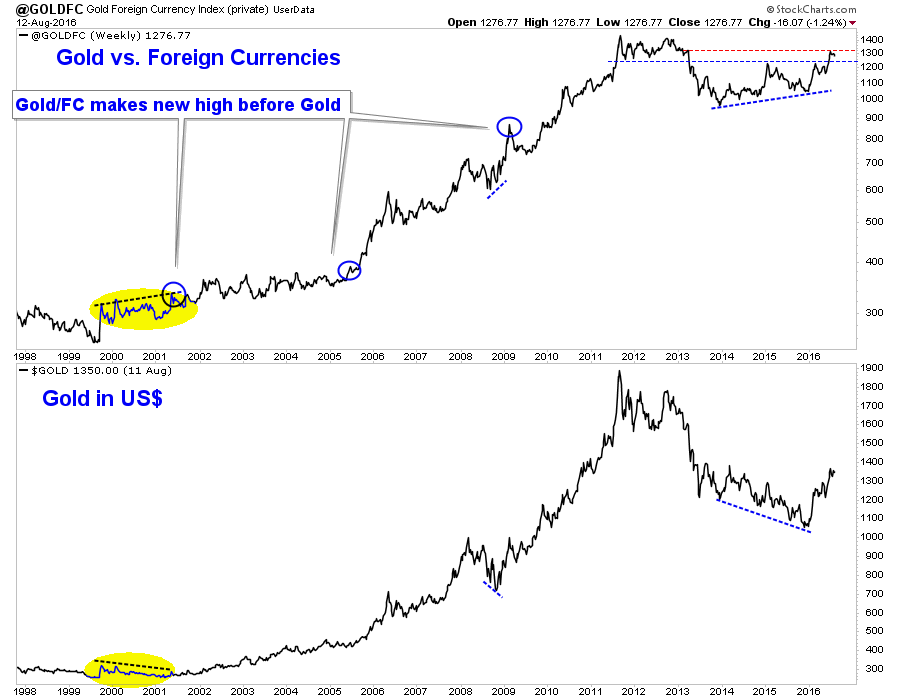

| Gold against Foreign Currencies Update Posted: 12 Aug 2016 06:40 PM PDT It is the dog days of summer. The metals are trading below their recent highs while the miners continue to be on the cusp of their next leg higher. In any event we remain bullish as we expect the next big move to be higher not lower. One reason, among many is Gold remains strong against foreign currencies and that often is a leading indicator for the sector at large. This is something we track often and we wanted to provide an update during the slowest period of the year. In the chart below we plot Gold against foreign currencies and Gold in normal, US$ terms. To be clear Gold against foreign currencies (Gold/FC) is Gold against the currency basket that comprises the US$ index. Since the new millennium Gold/FC has been an excellent leading indicator for the sector. Note that Gold/FC has made new highs ahead of Gold and made positive divergences before the three most important lows of the past 16 years (2016, 2008, 2001). In fact, the action from 2014-2015 shows strong similarities to 1999-2000. Moreover, note that at its peak a few weeks ago, Gold/FC was within 8% of its all time high. That is the equivalent of nearly $1750/oz in US$ terms.  Gold, Gold vs. Foreign Currencies

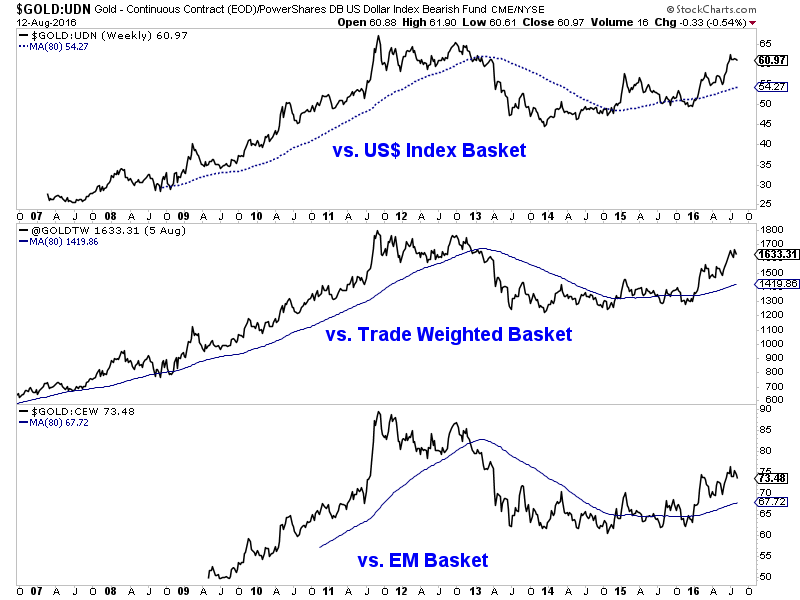

In the next chart we look at different iterations of Gold against foreign currencies. The top plot is the same version shown above while the middle plot shows Gold against the US$ trade weighted basket. The bottom plot shows Gold against emerging market currencies. In every case Gold remains firmly in bull market territory and stronger than Gold in US$'s.  Gold vs. Foreign Currencies

Tracking Gold's performance against foreign currencies is essential as we can glean quite a bit more information about what is really going on in the market. Many newsletters purporting to be analysts fear monger over the stability of the US$ as a reason for people to buy Gold. However, note that the US$ index is essentially flat compared to 10 and 20 years ago while Gold denominated in any and every currency is much higher. In other words, if Gold is going up only because of a falling US$, that is a US$ bear market, not a Gold bull market. A Gold bull market is Gold rising against the majority of currencies. In the same vein, a Gold bear market is Gold falling against the majority of currencies. The charts show that actually ended well before the final low at the end of 2015. On the mining side, most Gold and Silver comes from outside of the USA and many (but not all) companies are exposed to foreign or local currencies and not the US Dollar. Many companies in Canada and Australia bottomed a full year ahead of the sector because the Gold price in those currencies was very strong (even though Gold in US$ had yet to bottom). Summing it up, Gold's strength in foreign currencies confirms its global bull market status and provides a hint that more gains for Gold in US$ terms are likely ahead. We view any weakness in the weeks ahead as a buying opportunity. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

| Posted: 12 Aug 2016 02:05 PM PDT Has the END-GAME Begun? BIG NEW DEVELOPMENT ON GLOBAL FRONT Chinese finance officials and the Basel-based BIS are NEGOTIATING A GLOBAL REFORM OF ALL BILATERAL CONTRACTS. They strive to alter US Dollar based contracts, and CHANGE THE CONTRACT TERMS TO GOLD SETTLEMENT. THE CHINESE & BIS ARE WORKING ON A GLOBAL CONTRACT AT THE $5000 GOLD PRICE… By […] The post *Breaking: China & BIS Negotiating Deal to Settle Global Contracts in GOLD at $5,000/oz! – Jim Willie appeared first on Silver Doctors. |

| Fastest Growing Bullion Dealer Offers Insider’s Look into Mechanics of Gold and Silver Coin Market Posted: 12 Aug 2016 02:03 PM PDT It was great fun to visit with my pal, The Doc, President of Silver Doctors and SD Bullion today – one of the fastest growing gold and silver dealers, and recently named to Inc. 500’s fastest growing companies in America. It was also highly informative as we discussed the dynamics of being a bullion dealer and how this […] The post Fastest Growing Bullion Dealer Offers Insider’s Look into Mechanics of Gold and Silver Coin Market appeared first on Silver Doctors. |

| Posted: 12 Aug 2016 02:02 PM PDT Is the world headed for a "Mad Max" future? Financial writer Bill Holter says, "I think the chances are better than a coin flip that we have societal breakdown. People are not going to trade real eggs or real tomatoes for dollars. They will say I want something real for something real. That's where your dollar […] The post Is the World Headed For a “Mad Max” Future? “We Are Going to Have a Reset of the System” – Bill Holter appeared first on Silver Doctors. |

| COMEX GOLD DEFAULT AHEAD! – Jim Willie Posted: 12 Aug 2016 02:00 PM PDT Switzerland has suddenly begun exporting a RECORD amount of gold bullion into the US. Hat Trick Letter Editor Jim Willie reads the handwriting on the wall, and warns a COMEX GOLD DEFAULT IS AHEAD… Buy 90% Junk Silver Bags at SD Bullion As Low As $1.29/oz Over Spot! View Today's Data: The post COMEX GOLD DEFAULT AHEAD! – Jim Willie appeared first on Silver Doctors. |

| What’s Next for the Metals? Eric Sprott’s Thoughts On Gold, Silver, & the Shares Posted: 12 Aug 2016 01:03 PM PDT After being slaughtered last Friday on the BLBS Goosing, gold, silver, and the HUI mining shares index are up 1%, 2%, and 4% on the week respectively. “Not Too Shabby” according to Billionaire PM Legend Eric Sprott. What’s next for the metals? Are gold and silver prices now set for a run to New 2016 […] The post What’s Next for the Metals? Eric Sprott’s Thoughts On Gold, Silver, & the Shares appeared first on Silver Doctors. |

| Famed Trader: Gold And Silver Are Headed For New Highs Posted: 12 Aug 2016 12:53 PM PDT Famed oil trader Andy Hecht has this to say about the current set-up in gold and silver: "I have been trading precious metals since 1981, and I have never seen an environment where both the technical and fundamental states of the metals have lined up as they have in 2016. I believe that we may be in […] The post Famed Trader: Gold And Silver Are Headed For New Highs appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment