Gold World News Flash |

- Gerald Celente-Trends In The News-TREND ALERT: Numbers Don’t Lie, Markets Do. Gold To Glow

- ANOTHER DEAD DNC STAFFER? People Still Missing After DC Apartment Explosion

- 96% Of Clinton “Charity” Donations Went To… The Clinton Foundation

- Full Speech: Donald Trump Holds Rally in Altoona, PA 8/12/16

- The emperor wears no clothes but who else dares to say so?

- North American Life Insurers "Accidentally" Pile Up Massive Distressed Debt Holdings

- Gold Price Closed at $1335.80 Down $6.70 or -0.5%

- Surging Precious Metals Prices & U.S. Energy Inventories… One Is Good, The Other Isn’t

- US Government Just Went Into Overdrive Pushing War

- Is Trump Deliberately Throwing The Election To Clinton?

- Gold 2.0: How to Profit from the Current Gold Bull Market

- It's TIME For A Big Change In This Presidential Campaign

- SAIS and Your Inside Connection to the IMF

- EXPOSED: The Great Power Grab

- Gold Daily and Silver Weekly Charts - Not Too Obvious - The Devil's Tower

- Gold Price Has Now Entered Its Strongest Seasonal Period

- Fueling Gold Stocks’ Next Upleg

- Von Greyerz, Embry discuss prospects for monetary metals

- Egon von Greyerz meets with John Embry – August 2016

- This “Safe” Investment Could Blow Up Your Portfolio

- Negative Interest Rate Money “Madness†Sees Gold Buying Surge

- STRANGE WEATHER EVENTS WORLD WIDE 2016

- Goldman Sachs up against JPMorgan in gold battle in London

- Nuclear War 2016: Putin's Dire Warning

- Planned Fracturing of EU Jubilee Year Continues: Greece, Italy, Spain Consider Exiting

- Gold 2.0: How to Profit from the Current Gold Bull Market

- The Coming Global Silver Production Collapse & Skyrocketing Price

- Breaking News And Best Of The Web

| Gerald Celente-Trends In The News-TREND ALERT: Numbers Don’t Lie, Markets Do. Gold To Glow Posted: 12 Aug 2016 11:00 PM PDT from TrendsJournal: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ANOTHER DEAD DNC STAFFER? People Still Missing After DC Apartment Explosion Posted: 12 Aug 2016 09:58 PM PDT from DAHBOO77: At least two people died and several remained missing after a natural gas explosion and fire leveled an apartment building late Wednesday in the Washington suburb of Silver Spring, Md., fire officials said. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 96% Of Clinton “Charity” Donations Went To… The Clinton Foundation Posted: 12 Aug 2016 09:25 PM PDT from Zero Hedge:

We now know the answer: as page 29 of the tax return reveals, of the $1,042,000 in charitable cash contributions, exactly $1 million went to, you guessed it, the Clinton Family Foundation, whose expenses pay among others those Clinton family members and friends employed by the foundation, like Chelsea Clinton who happens to be the foundation’s Vice Chair. Is this the ultimate Clinton reacharound?

Here is a list of some of the other key employees at the foundation:

And the Board of Directors:

The other $42,000 went to the Desert Classic Charities, which hosts an annual gold event. As reported earlier, the Clinton Foundation is allegedly under investigation for corruption by the US Attorney General. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full Speech: Donald Trump Holds Rally in Altoona, PA 8/12/16 Posted: 12 Aug 2016 08:30 PM PDT Friday, August 12, 2016: Full replay of the Donald J. Trump for President rally in Altoona, PA at the Blair County Convention Center. Full Speech: Donald Trump Holds Rally in Altoona, PA 8/12/16 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The emperor wears no clothes but who else dares to say so? Posted: 12 Aug 2016 07:59 PM PDT 11:15p ET Friday, August 12, 2016 Dear Friend of GATA and Gold: Somebody smashed the gold price out of the blue today, with no particular news developments to explain it: http://www.chartseeker.com/images/AU-24HR-LG.png?r=463917316745.4918 Zero Hedge asserts that the smash was accomplished by the dumping of $5 billion in paper gold: http://www.zerohedge.com/news/2016-08-12/european-close-sparks-selling-p... King World News charges that it was done by the Bank for International Settlements -- http://kingworldnews.com/alert-bis-intervened-in-the-gold-market-to-assi... -- and while KWN offers no particular evidence for its charge, that the BIS is intervening surreptitiously in the gold market nearly every day on behalf of its client central banks long has been documented well enough by the bank's annual reports -- http://www.gata.org/node/12717 -- by statements by BIS officers -- http://www.gata.org/node/11304 -- and by the BIS' own advertising: http://www.gata.org/node/11012 Putting it all together best today may have been market analysts John Brimelow and James McShirley, who contribute frequently to GATA Chairman Bill Murphy's daily "Midas" commentary on the gold market at LeMetropoleCafe.com. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Brimelow, editor of the John Brimelow Gold Jottings letter, today reminisced about the failure in the 1990s of the 200-day moving average as a market indicator: "Gold veterans will remember that it was in the mid-90s that the Frank Veneroso school judged there to be persistent central bank intervention in gold and began to wonder how far it extended into other markets. This concept is less controversial now than it was 20 years ago." McShirley wrote: "The last two months have been a microcosm of the past five years. Gold is being mugged in plain sight, right in front of the cops, with no media bothering to report the crime. It sounds like a broken record but clearly this rigging is untenable. Epic rallies come from markets that have become distorted. Gold and silver aren't merely being distorted; they are being suppressed to small fractions of their true net worth. Tsunamis come to mind when predicting the outcome." For years GATA's premise has been that this market rigging could be defeated if it was documented, exposed, and publicized well enough. But while many people in the monetary metals industry have come to understand what is happening, few have acknowledged it in public. And while the documentation has been presented and explained to many financial news organizations, none in the mainstream have dared to pursue it seriously. Even some mainstream financial news organizations that have approached GATA professing an interest in the subject have dropped it quickly and fled upon realizing how sensitive governments are about it. Yet at least two major governments, those of Russia and China, have acknowledged knowing all about gold price suppression and even about GATA's work particularly: http://www.gata.org/node/10380 http://www.gata.org/node/10416 So GATA presses on in the morning, even as the market rigging couldn't get more obvious. For it won't matter that the emperor wears no clothes until more people in his audience have the courage to exclaim that he's naked. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North American Life Insurers "Accidentally" Pile Up Massive Distressed Debt Holdings Posted: 12 Aug 2016 06:25 PM PDT Accommodative monetary policy by the Fed has crushed bond income for insurers. According to Bloomberg, 2015 investment income at North American insurers dropped below 2011 levels.

Unsurprisingly, in their stretch for yield, insurers added to energy bond positions in 2015 to offset the funding gap. Now, the collapse of oil prices has apparently left North American life insurers in a bit of a pickle with distressed debt holdings having doubled in a matter of 6 months as IG energy bonds turned to junk.

Per a portfolio manager at Prudential, energy bonds appeared cheap back in 2014 due their conservative debt-to-asset ratios. Well, that's probably true if you just assume that prevailing market prices for commodities are right and ignore long-term supply/demand fundamentals.

But don't worry about the rising risk of bond portfolios at the insurers. Regulators are already working on a plan to relax capital requirements to accommodate increasing risk appetites at America's insurers. Guess moving down the quality curve is one way to combat a low-interest rate environment.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1335.80 Down $6.70 or -0.5% Posted: 12 Aug 2016 06:09 PM PDT

Franklin Sanders Daily commentary is now only available via email. FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Surging Precious Metals Prices & U.S. Energy Inventories… One Is Good, The Other Isn’t Posted: 12 Aug 2016 06:02 PM PDT by Steve St. Angelo, SRS Rocco Report:

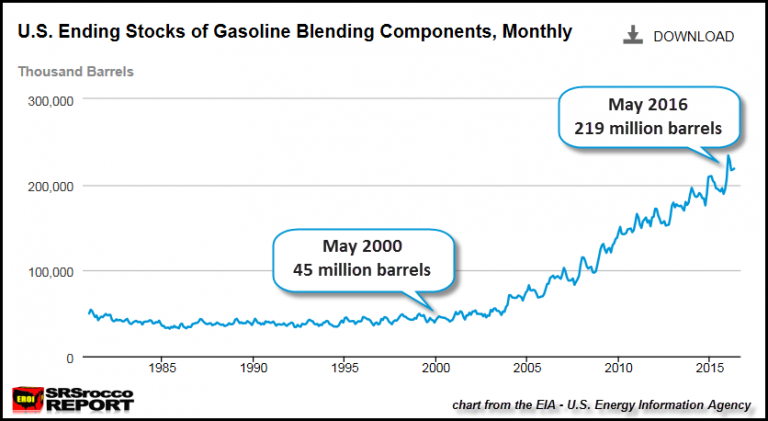

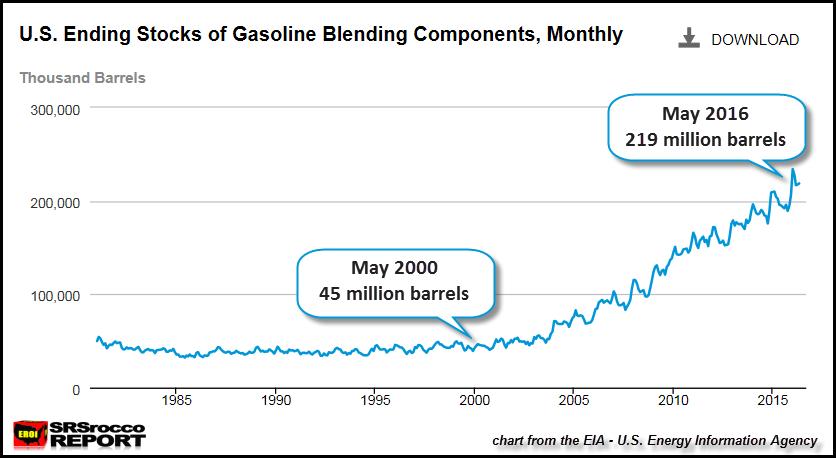

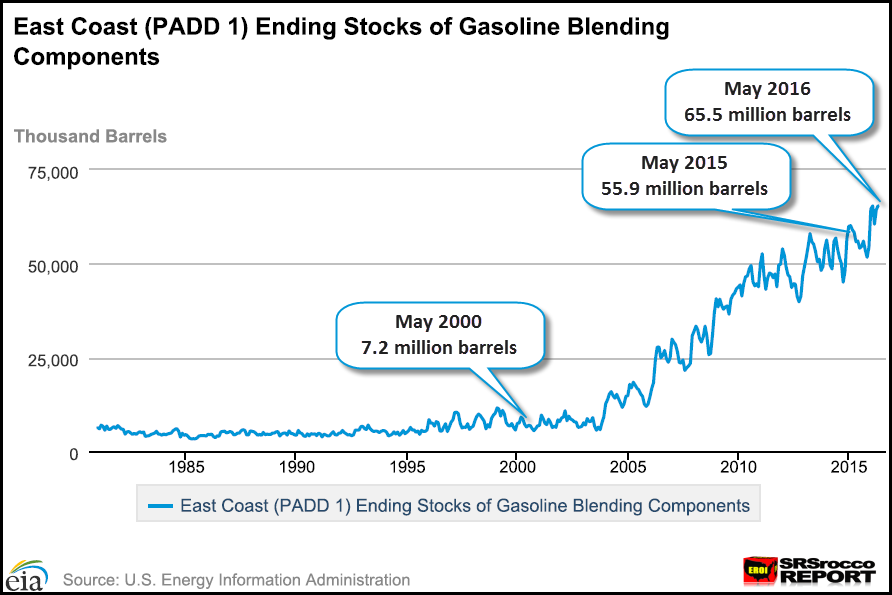

For example, the price of oil continues to rally on the back of rising U.S. and world petroleum stocks. This is especially true in the United States. Not only are total U.S. Gasoline stocks higher this May compared to the same period last year, they are up considerably over the past decade:

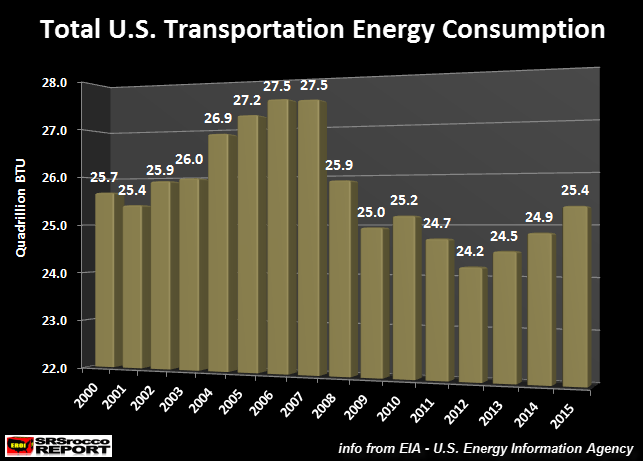

Total U.S. Gasoline (Blending) stocks hit a record high for the month of May, reaching 219 million barrels. Last year, total U.S. Gasoline stocks were 196 million barrels… 23 million barrels less. Now, if we go back to May 2000, total U.S. Gasoline stocks were five times less at 45 million barrels. Of course, some folks would quickly reply that this is due to Americans driving more and consuming more gasoline. Well, that would be correct if it were true. Unfortunately, it isn't. I went to the EIA – U.S. Energy Information Agency and looked at total U.S. Transportation consumption going back until 1950. The chart below only provides data since 2000. However, we can see a troubling sign here:

The U.S. Transportation fuel consumption is shown as Quadrillion BTU's. That's a lot of energy. For example, total U.S. energy consumption in 2015 was 97.5 Quad BTU's. The Petroleum percentage of U.S. Transportation consumption of 25.4 Quad BTU's represented 26% of total energy consumption by the country. Regardless, as we can see from the chart above, total U.S. transportation energy consumption was actually higher in 2000 (25.7 Quad BTU's) than it was in 2015 (25.4 Quad BTU's). Furthermore, we can see that U.S. Transportation energy consumption peaked in 2006 & 2007 at 27.5 Quad BTU's. Ever since the 2008 U.S. Investment Banking and Housing Market collapse, total transportation consumption has never surpassed its previous peak. So, the important question needs to be asked… why are U.S. petroleum gasoline stocks continuing to rise to record levels??? Is it because the U.S. Energy Industry wants to make sure that Americans have plenty of extra fuel in storage if there is some BLACK SWAN EVENT? I hardly doubt it. These companies survive on making profits, not being altruistic. Correct… it's due to falling demand. Again, total U.S. Gasoline stocks are 23 million barrels higher in May than they were during the same month last year. Moreover, the situation is even worse in the East Coast (PADD 1). Let's look at the disaster taking place in the East Coast Gasoline inventories:

East Coast Gasoline stocks hit a new record for the month of May by surpassing 65 million barrels. This is up nearly 10 million barrels from the same month last year. While total U.S. Gasoline stocks are up 12% from last year, East Coast Gasoline stocks are up a whopping 17%. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Government Just Went Into Overdrive Pushing War Posted: 12 Aug 2016 06:00 PM PDT from X22Report: Episode 1046b. Germany proposes tougher security laws. Russia stopped a coup in Crimea. Now Ukraine moves troops to the Crimean border. US responds to what happen in Crimea, we no nothing. Russia presents facts to the US but the US orchestrated the operation. The US and Kiev are preparing for a major offensive in Ukraine. Erdogan is moving closer and closer to Russia and is going moving towards dumping the dollar. Russian forces bombed the US controlled terrorist chemical factory. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is Trump Deliberately Throwing The Election To Clinton? Posted: 12 Aug 2016 05:10 PM PDT "There is an adage in politics: Don't get in the way of a train wreck," said Democratic strategist Bob Shrum, a top campaign aide to presidential candidates Al Gore in 2000 and John Kerry in 2004. And, as Reuters reports, Clinton's advisers say they see little benefit in her going toe-to-toe with Trump over every personal accusation, generating sound bites that would dominate cable news broadcasts. Rather, they are happy for him to be embroiled in controversy while Clinton focuses on policy.

And perhaps there is more to that 'strategy' than means the eye. As Brent Budowsky asks at The Hill - Is Trump deliberately throwing the election to Clinton?

As we concluded a year ago when the topic of Trump's false-flag presidential run came up...

If this becomes the case then all is lost America as The Deep State's control is more complete than anyone could have imagined. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold 2.0: How to Profit from the Current Gold Bull Market Posted: 12 Aug 2016 04:00 PM PDT The Gold Report | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| It's TIME For A Big Change In This Presidential Campaign Posted: 12 Aug 2016 03:55 PM PDT We previously noted the ironic timing of TIME magazine's Trump "meltdown" cover - as Trump's poll number have stabilized and improved in the last few days. This got us thinking... what happened after each of the last 8 Hillary/Trump TIME magazine covers... It appears to us that when the Democrats, Hillary, or The Establishment are "TIME-covered", Hillary's poll number stop rising (and even fall)... But when Trump is "TIME-covered", his poll numbers stop falling (and in most cases rise). Underlying Chart Source: RealClearPolitics.com; h/t @Pater_Atwater So - is it TIME for a big swing this Presidential Campaign? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SAIS and Your Inside Connection to the IMF Posted: 12 Aug 2016 03:35 PM PDT This post SAIS and Your Inside Connection to the IMF appeared first on Daily Reckoning. The International Monetary Fund (IMF) is one of the most powerful institutions in the world. It acts as the de facto central bank of the world. The IMF makes loans to countries in distress, raises funds from its member nations and issues its own world money called the special drawing right (SDR). It also acts as the regulatory and policy arm of the Group of Twenty, or G-20. The G-20 is a multilateral club that includes both the richest nations in the world (the U.S., Japan, the U.K., Germany, etc.) and the most populous emerging economies (China, India, Brazil) among others. The G-20 has no permanent staff or bureaucracy, so it outsources policy tasks to the IMF. These combined roles as the world's central bank and the G-20's eyes and ears make the IMF the center of gravity for policy in the international monetary system. Yet for such a powerful institution, the IMF is incredibly opaque and unaccountable. My favorite way to describe the IMF is "transparently nontransparent." What I mean by that is the IMF is transparent in terms of making resources available for interested parties to learn about what it is doing. The IMF website is loaded with links to position papers, financial statements and facts and figures about its missions and personnel. The IMF publishes a value for the SDR every business day. Even the IMF's plan to replace the dollar with SDRs as the global reserve currency is available. The problem is that all of this material is written in highly technical jargon that requires specialized training to interpret. That's where the "nontransparent" part comes in. Reading the IMF website is like picking up an advanced textbook on quantum physics. You may be able to read the words in a row, but unless you have specialized training, it might not make much sense. Where is such specialized training available, and who has it? There are a number of fine schools teaching international economics, but the leading center of learning for working at the IMF is undoubtedly the School of Advanced International Studies, SAIS, part of the Johns Hopkins University located in Washington, D.C. SAIS offers graduate programs in international economics as well as American foreign policy, area studies, languages and other courses in diplomacy, intelligence and strategy. It has many distinguished graduates, including former secretary of state Madeleine Albright and CNN anchor Wolf Blitzer. In addition to its graduates, SAIS has an outstanding faculty, including many visiting scholars drawn from the Washington, D.C., policy community. Former secretary of the Treasury Hank Paulson was in residence at SAIS after leaving the Bush administration. For purposes of understanding the international monetary system today, the two most important SAIS connections are former secretary of the Treasury Timothy Geithner and former head of the IMF John Lipsky. Geithner is a SAIS graduate, and Lipsky is a visiting scholar at SAIS today. Geithner (who worked at the IMF before joining the Treasury) presided over the aftermath of the Panic of 2008 and was one of the architects of the IMF/G-20 process that started the currency wars in 2010. Lipsky ran the IMF in the dangerous period after the abrupt resignation of IMF head Dominique Strauss-Kahn amidst a sexual-assault scandal in May 2011. Lipsky performed a crucial role in organizing the first bailout of Greece after the sovereign debt crisis erupted in 2010. When it comes to global bailouts and their aftermath, the imprint of SAIS through players such as Paulson, Geithner and Lipsky is everywhere.  Former U.S. Treasury secretary Timothy Geithner (left) is a graduate of the School of Advanced International Studies (SAIS) in Washington, D.C. Former head of the International Monetary Fund John Lipsky (right) is currently a distinguished visiting scholar at SAIS. Fortunately, as a Daily Reckoning reader, you have your own SAIS connection. I graduated from SAIS in 1974, just after Wolf Blitzer and a decade ahead of Tim Geithner. For all intents and purposes, SAIS is the intellectual boot camp for the IMF. Many SAIS graduates go directly into the IMF. Other leading career choices are banking, the foreign service and the national security community. My class marked a turning point. Many observers believe the gold standard of Bretton Woods ended on Aug. 15, 1971, when President Nixon gave his surprise speech shutting the gold window. That is not quite correct. Nixon ordered the conversion of dollars into gold to be "temporarily" suspended. It was expected that the world might be able to return to some kind of gold standard once new parities of paper money to gold were established. Of course, that never happened. In 1975, the IMF declared that gold was dead as a form of money. Yet from 1971-74, the world of international finance still considered gold to be money. That's when I received my technical graduate training. Mine was the last class to study gold as a form of money in international finance.  Your correspondent as a 23-year-old graduate student in international economics at the School of Advanced International Studies, class of 1974. This was the last class to study gold as a monetary asset in international reserve positions. Today, for the first time in decades, gold is once again being discussed as an international reserve asset. This is because Russia, China, Iran and other nations have been acquiring thousands of tons of gold to add to their reserves. Equally important, other central banks that already have gold, such as Germany, France, Italy and the U.S., have completely stopped selling. The scramble for gold is back after decades of official dumping by the central banks. Another topic that is in the news is the role of the SDR. Financial blogs and newsletters are filled with dire prognostications about how the SDR is poised to replace the dollar as the global reserve currency. Even more digital ink has been spilled on the topic of including the Chinese yuan in the so-called "basket" of currencies that make up the SDR. The technical nature of SDRs has led to ill-informed speculation, hysteria and dire forecasts that have no basis in reality. This is not surprising. Most of the people who are expert on SDRs actually work at the IMF or finance ministries of IMF member nations. They have no interest in commenting publicly about what is really going on. Most of those who are commenting lack the expertise to know what they are talking about. This is why the blogs are filled with misinformation and hyperbole that only serves to alarm and confuse investors. There are almost no sources readers can turn to for expert opinion willing to discuss these matters publicly. Fortunately, at Rickards' Strategic Intelligence, we specialize in these topics and report on them in a way that's accessible. We provide the most timely and accurate information on the IMF and SDRs. SDRs are the coming reserve currency of the world. Massive issuance of SDRs in a future liquidity panic will be highly inflationary. These outcomes have enormous implications for investors with assets in U.S. dollars. Yet the process will be gradual and proceed in ways that markets barely notice, at least at first. Commentators who "cry wolf" about SDRs are doing a disservice to investors because markets may be complacent by the time the wolf actually arrives. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away.

The post SAIS and Your Inside Connection to the IMF appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 12 Aug 2016 03:20 PM PDT This post EXPOSED: The Great Power Grab appeared first on Daily Reckoning. Better to be occasionally fooled than perpetually suspicious, an optimist once said. But when it comes to the globalist elite, nothing less than perpetual suspicion will do… Daily Reckoning contributor John Mauldin recently posted an article by veteran economic analyst Charles Gave. And it was enough to give our curmudgeonly suspicions a real day at the races. Would these monetary elites intentionally inflict economic chaos on millions of people… to increase their own power? An impertinent question, no doubt. Might as well ask if they'd put scorpions in babies' cribs. But a former governor of the Bank of England says "yes!" It's happened. Gave: Mervyn King, the former governor of the Bank of England, wrote in his recent book The End of Alchemy that European leaders pushed for the adoption of the euro as a single currency knowing that it would cause an economic disaster in southern Europe. The idea was that the impact of weakened economies would force national politicians to accept "reforms" imposed by Brussels. Put simply, Lord King argues that these elites consciously organized a huge decline in living standards in the expectation that it would undermine the legitimacy of local politicians. Why do you smash the other fellow's head against the wall, asks the thug before answering his own question. Because it feels so good to him when you stop. Here, the blueprint for European unity, sketched by the high priests of diabolism: Smash the cretins' heads against the wall, stop when they're half-dead. Then give 'em some aspirin. We remind you this isn't the tale of some tinfoil hat-wearing loony-tunes. This is a former governor of the Bank of England. He might know a thing or three about the ways of his fellow tradesmen. Key takeaway: The chief concern of the global elite… is the global elite. It's out to butter its own parsnips, first and last. At all times and all places. And the societies they're supposed to serve can go scratching. Gave shakes his head in violent agreement: "Our "experts" (the brilliant men of Davos) have thus been shown to protect their own particular tribal interests, rather than the common good. The really worrying thing with these demonstrably incompetent institutions is their continued power grab without any proper authority." Incompetent institutions? Here Gave trains his guns on the IMF: "[Recently,] the International Monetary Fund's independent watchdog offered a scathing assessment of the agency's handling of the eurozone crisis with the allegation that staffers willfully ignored fatal flaws in the euro project due to an emotional attachment. It became a totem of IMF thinking that in a common payment area, there could not be a solvency crisis. Moreover, the "solutions" imposed on Greece hurt the most vulnerable part of society, causing a collapse in living standards. In an indictment of the IMF's competence, its assessments (forecasts) about the impact its policies would have on the Greek economy were shown to border on the ridiculous. To boot, the processes followed by IMF staff were shown to be unprofessional, with decisions being taken without proper discussion and documentation." Incompetence is one thing. Power lust yet another. Mix the two ingredients and you've got the Department of Justice. Or the EU. Or the IMF… Jim Rickards warns that when the next great financial crisis strikes, the central banks won't be able to contain the fire. They've already created so much funny money to put out the last fire, they're out of water. And then it'll be the IMF — that IMF — to the rescue: "Central banks bailed out the world in 2008. The next financial panic will be bigger than the ability of central banks to put out the fire. At that point, the only source of liquidity will be the IMF itself." Then the global elites would have us all by the snout. He who pays the piper calls the tune, after all. We only hope they'd treat America kinder than they've treated Greece… Regards, Brian Maher Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post EXPOSED: The Great Power Grab appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Not Too Obvious - The Devil's Tower Posted: 12 Aug 2016 01:19 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Has Now Entered Its Strongest Seasonal Period Posted: 12 Aug 2016 12:41 PM PDT My analysis indicates that gold will be implemented in order to protect ‘global purchasing power’ and to minimize losses during our upcoming periods of ‘market shock’. It serves as a high-quality, liquid asset to be used whereas selling other assets would cause losses. Central Banks of the world’s largest long-term investment portfolios use gold to mitigate portfolio risk, in this manner, and have been net buyers of gold since 2010. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fueling Gold Stocks’ Next Upleg Posted: 12 Aug 2016 12:35 PM PDT Gold stocks’ new bull market this year has already proven breathtaking. This obscure sector has nearly tripled within a matter of months, yielding immense profits for the smart contrarians who bought in low. But after such a blistering surge, what’s going to fuel gold stocks’ next upleg? Heavy gold investment buying driving its price much higher will greatly boost gold-mining profitability, attracting in far more capital. Gold stocks’ new bull run in recent months has been massive. Their leading benchmark HUI gold-stock index skyrocketed 182.2% higher in just 6.5 months between mid-January and early August! No other sector in all the markets is even remotely close to challenging this commanding performance. Yet this mighty gold-stock bull still remains young and small, with the great majority of its gains still left to come. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Von Greyerz, Embry discuss prospects for monetary metals Posted: 12 Aug 2016 10:22 AM PDT ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com 1:21p ET Friday, August 12, 2016 Dear Friend of GATA and Gold: Gold fund manager Egon von Greyerz interviews Sprott Asset Management's John Embry, discussing the prospects of the monetary metals, the overvaluation of financial assets, and the increasing weaknesses of currencies, among other topics. The interview is 23 minutes long and can be viewed at Gold Switzerland's Internet site here: https://goldswitzerland.com/egon-von-greyerz-meets-with-john-embry-augus... CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Egon von Greyerz meets with John Embry – August 2016 Posted: 12 Aug 2016 09:01 AM PDT THE MATTERHORN INTERVIEW – 8 August 2016: John Embry – Egon von Greyerz“Can Silver reach $1,000?"In this 23-minute video, recorded in London a few days ago, John and Egon discuss an eclectic range of extremely important issues relevant to preserving capital, including:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This “Safe” Investment Could Blow Up Your Portfolio Posted: 12 Aug 2016 09:00 AM PDT This post This "Safe" Investment Could Blow Up Your Portfolio appeared first on Daily Reckoning. A prominent trader just shared an inside story with me… He's a well-known trend following fund manager. And he says financial advisors are ringing his phone off the hook. They're in a state of panic and need his immediate help. You see, a sector of the "safe" investment universe is in danger of blowing a hole in investors' portfolios… and advisors are desperate for a solution. It's an extremely precarious problem purposefully hidden from most mainstream investors. And advisors are in a feeding frenzy trying to fix it before investors freak out over the truth… Bonds Are BrokenFor decades, Wall Street has put nearly all investors into the traditional 60/40 split between stocks and bonds… The sales pitch is simple… Stocks are the portfolio workhorse, bringing in growth and capital appreciation. You want them as the largest potion of your portfolio to maximize gains. But you also need to offset the downside risk of stocks, i.e. the S&P 500 index has cratered 50% twice in the last 16 years. And that's where bonds come in… Bonds are the so-called "sleepy" part of your portfolio. They're designed to provide safe, reliable income, acting as a hedge against stock price volatility. The decades old Wall Street pitch is that clients can collect their 5% yield on their bonds with almost zero risk. Forty-percent of your portfolio is thus rainbows and unicorns, so just relax with happy thoughts… Every last boomer is sold that fantasy. But now the rug is being ripped out from under their feet. And nobody is sending the memo that "low risk" bonds will leave you in dire straits. Look, after more than seven-plus years of zero rates and, more recently, negative rates, bond yields are a historical artifact. Central bankers' unprecedented debt purchases have further eaten up supply and left investors with few options. That's jacked up bond prices and lowered yields. (Bond prices have an inverse relationship to yields.) Yet with so much fear and uncertainty in the markets, investors at the direction of nefarious forces keep flooding into "safe" bonds …and that puts even more downward pressure on yields. The predicament is that investors are set up for huge losses the moment rates go up even a little from current levels — and they will rise. To borrow from Nassim Taleb, there is nothing "antifragile" about bonds. Bonds will not benefit from a shock nor will they thrive when exposed to coming volatility, randomness and disorder—not at these yields. How rough will it get? Bank of America calculates that a mere half-percentage point rate increase will result in more than $1.6 trillion of bond market losses. If that sounds low risk to you, can I suggest that perhaps you are Dorothy skipping down the yellow brick road singing to yourself? The bottom line: Bonds are broken. They offer all danger and no yield. And advisors are in a do-or-die race to find any alternative. An Easy FixSo why are financial advisors contacting my friend, a trend following fund manager, for help with their bond problem? At first blush, there doesn't appear to be any connection between these two investments. However, any advisor worth a damn knows trend following offers an understandable risk profile along with significant return… a profile bonds used to have before central bank bastardization. Trend following has stable benefits because it diversifies across an extremely broad range of markets, including stocks, ETFs, bonds, currencies, futures and commodities, i.e. gold, coffee, Tesla — you name it. You see, different market sectors react differently to the same events. If some sectors are down, others will be up to offset those losses — the trend following secret to profits. Plus, trend following invests in up or down markets, riding waves both higher and lower for gains. So with 40% of your portfolio now in peril, let me be very blunt: You will not get trend following benefits AFTER the bond blowout. This is why some "awake" financial advisors are learning through sheer despair that trend following is an immediate alternative to massive bond risk. Yeah, I get it, it sucks. You were sold the "Big Lie" about bonds. But I am throwing you a life preserver. Catch. Please send me your comments to coveluncensored@agorafinancial.com. Let me know what you think about today's issue. Regards, Michael Covel The post This "Safe" Investment Could Blow Up Your Portfolio appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Negative Interest Rate Money “Madness†Sees Gold Buying Surge Posted: 12 Aug 2016 07:36 AM PDT Gold buying surged to record levels in H1, 2016 due to increasing concerns about the political, economic and monetary outlook. In particular, deepening concerns about the negative interest rate money “madness” of central banks today. Heike Hofmann sells fruit and vegetables in Germany. She reacted to negative rates by cutting spending & buying gold bars. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STRANGE WEATHER EVENTS WORLD WIDE 2016 Posted: 12 Aug 2016 05:54 AM PDT STRANGE WEATHER EVENTS WORLD WIDE 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goldman Sachs up against JPMorgan in gold battle in London Posted: 12 Aug 2016 05:32 AM PDT Henry Sanderson and Neil Hume http://www.ft.com/cms/s/0/739a8284-5eea-11e6-bb77-a121aa8abd95.html Some of the world's largest banks are battling over plans to make London's $5 trillion-a-year gold market more transparent in the biggest shake-up of global bullion trading for decades. A consortium that includes Goldman Sachs, arguably the most influential bank in commodity markets, and ICBC, the big Chinese lender, are backing plans to bring the trading of precious metals on to an exchange early next year in a shift that reflects that of oil in the 1970s. ... Dispatch continues below ... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Such a move is intended to bring more transparency to the trading of gold, silver and other precious metals -- a centuries-old process conducted privately through banks that has been criticised for being opaque. As recently as 18 months ago, the price of gold was still set, or "fixed," twice a day by a small group of banks conferring by telephone with clients. That century-old method has now been replaced by an electronic system but the majority of spot gold trading in London is still done directly, privately "over the counter." The Goldman-backed consortium faces opposition from HSBC and JPMorgan, big bullion banks that want to maintain the current system and are supporting a rival initiative by the London Bullion Market Association to improve transparency. The battle for London's bullion market comes as gold enjoys renewed popularity. Prices have rallied 26 per cent this year as investors, nervous about falling interest rates and shocks such as Brexit, have ploughed billions of dollars into exchange traded funds. Whether gold continues to be traded directly between buyers and sellers, or moves on to an exchange, both sides agree the London market is at a key moment. London faces increasing competition from China, the world's largest consumer of the metal, where trading volumes have been surging. Earlier this year the Shanghai Gold Exchange launched a daily pricing benchmark, similar to a process conducted in London since 1919. The issue of regulation also has come to the fore after the benchmark-rigging scandals that rocked foreign exchange and interest rate markets after the financial crisis. In response, regulators and policymakers have been pushing for a shift in markets in general towards trading assets on exchanges and clearing transactions through centralised systems. Raj Kumar, head of precious metals strategic development at ICBC Standard Bank, said: "There's been a decline in liquidity within the London market. It's clear the market hasn't evolved for decades. With regulatory changes likely in the future the market is at risk of declining without suitable solutions." Garry Jones, chief executive of the London Metal Exchange, said the plans to shake up the bullion market will address problems of transparency and introduce cost savings for banks. This view is echoed by Aram Shishmanian of the World Gold Council, which has led the project known as LME Precious. "What is causing banks to leave commodities is the amount of capital they need to put up," said Mr Jones. "London is the largest OTC bullion market and this is trying to make sure it remains front and centre." However, many market participants are suspicious. They say the World Gold Council is not involved in bullion trading, and that many banks have taken equity stakes in the new platform so they can profit from harnessing some of the London trade flows. "This is a chance for the WGC to get involved in another revenue stream," said one big gold investor. The London-based lobby group introduced gold-backed exchange traded funds and continues to generate most of its income from a sponsorship deal with one of the biggest vehicles. For that reason many support the approach of the LBMA, set up by the Bank of England in 1987 to regulate London's bullion market. One gold investor said: "The LBMA is advancing with the ear of and the co-operation of regulators. The changes that have been done in the OTC gold market have been done with the implicit if not explicit approval of regulators. The steps they are taking seem to be very sensible." Other banks that have not initially signed up to the new contracts said they might be willing to use the platform because it will provide competition for Comex, the New York exchange that boasts a highly liquid gold futures contract. "There are some positives to have competition in the market," said the head of commodities at one investment bank. "Transactions costs are exploding because so much of the regulation is designed to push people toward exchange traded, cleared venues." History, however, suggests the LME will struggle to make the project a success, much like an early foray into gold trading that flopped in the 1980s. Known as the London Gold Futures Market and run out of the LME's old headquarters in Plantation House, it failed because considerable trading in gold futures was already under way on the Comex exchange in New York, participants said at the time. John Wolff, a chairman of the LME in 1990, said: "The futures market in New York was working very well and the London bullion market itself was working very well, so there just wasn't room for a futures market in London." Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nuclear War 2016: Putin's Dire Warning Posted: 12 Aug 2016 04:44 AM PDT Vladimir Putin has a warning for the rest of the world as the globalists push us closer and closer to nuclear war. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Planned Fracturing of EU Jubilee Year Continues: Greece, Italy, Spain Consider Exiting Posted: 12 Aug 2016 02:49 AM PDT When we started The Dollar Vigilante in 2010 we stated that the worldwide central banking fiat money system would collapse within the decade. It was just math. Government debt continues to mount and the only way to pay interest on the debt is to print more money. The US government, alone, has doubled its debt in the last eight years, from under $9 trillion to now well over $19 trillion. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold 2.0: How to Profit from the Current Gold Bull Market Posted: 12 Aug 2016 02:36 AM PDT After five years of a brutal bear market, gold and gold miners are finally having a huge rebound, and investor Chen Lin, writer of the popular newsletter What is Chen Buying? What is Chen Selling?, sees the parallels to 2009. He highlights nearly a dozen mining companies that have weathered the downturn and are in position to ride the wave higher. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Coming Global Silver Production Collapse & Skyrocketing Price Posted: 11 Aug 2016 10:00 PM PDT Gains Pains & Capital | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 11 Aug 2016 06:44 PM PDT Retail sales weaker than expected. Gold pops, oil stable. US government debt now has negative yield for foreign investors. More good earnings reports from precious metals miners. A major bitcoin hack throws crypto-currency world into turmoil. China, Japan and Russia rattle their sabers. Trump attempts to salvage his campaign, is failing. Best Of The […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

When we showed the

When we showed the

As the precious metals prices surged this year, so did U.S. petroleum inventories. While rising gold and silver prices are a positive sign for the precious metals industry, the surging U.S. petroleum stocks are extremely negative. However, the prices of the metals and energy are currently not trading based on the fundamental values.

As the precious metals prices surged this year, so did U.S. petroleum inventories. While rising gold and silver prices are a positive sign for the precious metals industry, the surging U.S. petroleum stocks are extremely negative. However, the prices of the metals and energy are currently not trading based on the fundamental values.

No comments:

Post a Comment