Gold World News Flash |

- Turkey's New Relationship With Russia - And Assad

- Germans "Lose Faith In Banks", Rush To Buy Safes

- Greek 'Thought Police' Prosecute Bishop For (Accurately) Calling 'Refugees', "Illegal Migrants"

- Central Bankers Get Tired of Gold as Falling Exports Reduce Cash

- “Pure Liquidity”

- Exposing the ESTABLISHMENT and its AGENDA

- ARE EMERGING MARKETS ABOUT TO SWITCH US TREASURIES FOR SDR BONDS?

- "There Will Be Blood" - The Whole Game Is About Containing Russia-China

- Most Important Thing to Stock for WROL or for the Collapse

- Yellen Talks Up the Economy at Jackson Hole While US Real-Estate Market Cracks

- Economist Talks Endgame Scenarios: “Physical Precious Metals Markets May Freeze Up… Buying Frenzy… $5,000 Gold Is A Conservative Estimate”

- Gold Price Closed at $1322.90 Up $1.40 or 0.11%

- Weekly Metals Wrap: Buying Opportunity Or Bear Market?

- Banks Are Preparing For A Nuclear Financial Event

- Hugo Salinas Price: The night that is upon us and the dawn of a new era

- The Darwin Awards for Nations

- Fed preparing to monetize 'everything,' Turk tells KWN

- Mexican Cartels Moving Terrorists Across Southern U.S. Border

- Hillary Clinton, ISIS & The Never-Ending War

- Gold Daily and Silver Weekly Charts - What Hump?

- The Power of Price Spikes On Intraday Charts

- The Right Lessons from Obamacare's Meltdown

- Canada Housing Market in Extreme Bubble Territory - Here’s How to Profit

- Late-August Calm a Breeding Ground for Bullion Bank Shenanigans

- Breaking News And Best Of The Web

- Correction in Gold and Silver Underway

| Turkey's New Relationship With Russia - And Assad Posted: 30 Aug 2016 01:00 AM PDT Submitted by Eric Zuesse via Strategic-Culture.org, Until the July 15th US-backed (or so the Turkish government alleges) coup-attempt to overthrow Turkey’s President Tayyip Erdogan, Erdogan was trying to overthrow Syria’s President Bashar al-Assad, whom the US regime likewise wants to overthrow. However, Russia’s President Vladimir Putin saved Erdogan’s Presidency, and probably Erdogan’s life, by contacting him hours prior to the pending coup and thus enabled him to plan and prepare so as to overcome the attempt, and crush the operation. Putin wouldn’t have known ahead-of-time about the coup-plan unless Russian intelligence had provided to him intelligence that it was coming. This intelligence might have included information about whom the source of it was. If Putin had intelligence regarding that matter, then he presumably shared it with Erdogan at that time – prior to the coup. Promptly on July 16th, Erdogan announced that the source of the coup was his long-time foe (but former political supporter) Fethullah Gulen, who in 1999 had relocated himself and the headquarters of his multibillion-dollar Islamic organization to Pennsylvania in the United States. Erdogan said that he would demand Gulen’s extradition to stand trial in Turkey. However, the US State Department said it had not yet received a «formal extradition request». On August 4th, «Turkish Justice Minister Bekir Bozdag said Ankara had submitted a second extradition request», but the US ‘Justice’ Department was «still trying to evaluate if the documents can be considered a formal extradition request». The ‘Justice’ Department is still trying, 16 days later, as of the present writing. Meanwhile, on August 9th, Erdogan flew to Moscow to meet privately with Putin – the man who had saved his Presidency if not his life. Presumably, Erdogan wanted to see all of Russia’s intelligence on the matter. After that meeting, he may be presumed to have seen all of the intelligence on it, both from Turkish and from Russian intelligence agencies. Erdogan continued his demand that the US extradite Gulen. Evidently, after his having seen all of the intelligence from both Turkey and Russia, he remained convinced that Gulen was behind it. Putin is determined to prevent what the American-Saudi-Qatari-Turkish alliance have been demanding on Syria: the ouster of Syria’s President Bashar al-Assad prior to any election being held in Syria. The repeated demand by Putin has instead been that only the Syrian people themselves, in a free and fair internationally monitored election, can decide whether or when to terminate Assad’s present term of office, and that Russia will accept whatever the voters of Syria decide as to the identity of Syria’s President going forward. The UN Secretary General, Ban Ki-moon, has, on at least two occasions, publicly stated that he supports Putin’s position on this, and that there would be no legitimacy for a forced ouster of the current Syrian President. On Saturday August 20th, the AP bannered «Turkey: Assad can be part of transition in Syria», and reported that «Turkish Prime Minister Binali Yildirim said Saturday his country is willing to accept a role for Syrian President Bashar Assad during a transitional period but insisted he has no place in Syria's future… ‘Could Syria carry Assad in the long-term? Certainly not… The United States knows and Russia knows that Assad does not appear to be someone who can bring (the people) together’». Of course, Russia does not «know» that (and, in fact, more than 50 % of Syrians even when polled by western firms, want Assad to continue being President of Syria, and more than 80 % blame the US for backing the jihadists), but Turkey’s statement that Russia does «know» it, will help the Turkish public (whom the Erdogan regime has indoctrinated to consider Assad evil) acclimate to thinking of Assad’s ally Russia as being actually a friend, no foe, of Turkey; and this will, in turn, assist Erdogan going forward, especially if he’s aiming to, for example, remove Turkey from the NATO alliance and align with Russian foreign policy. What’s happening here is the setting of the terms for the next Presidential election in Syria. Washington and its allies (which used to include its fellow-NATO-member Turkey) demand that the Syrian ‘democratic revolution’ (or foreign invasion by fundamentalist-Sunni jihadists hired and armed by the US, Saudi Arabia, Qatar, Kuwait, and UAE) succeed and establish a fundamentalist-Sunni leader for Syria, who will then, perhaps, hold elections, which, perhaps, will be ‘democratic’ instead of imposing Sunni Islamic law. But Assad, and Russia, demand that there be no such overthrow prior to the election; and, now, Turkey has stated that this would be acceptable to them. That’s a big change in Turkey’s international relations. How seriously should one take Turkey’s continuing demand that «Certainly not» could the Syrian people re-elect Assad to be their President? One should take it with a grain of salt that would easily be washed away if Assad does win that election. In other words: Turkey has announced, on August 20th, that, at least on the Syrian issue, it’s no longer an ally of the US An earthquake had thus happened in international relations. * * * And so then, on Monday, August 22nd, the United States government — which demands the overthrow of the internationally-recognized-as-legal government of Syria — officially announced that America’s military forces in Syria will continue to occupy Syrian land, no matter what the Syrian government says, and will shoot down any Syrian planes that fly over U.S. forces there and attack them. As reported on Monday by Al-Masdar News:

This means that the U.S. government will not allow the Syrian government to expel or otherwise eliminate U.S. forces in Syria. The Syrian government never invited U.S. forces into Syria, but the U.S. now officially dares the Syrian government to assert its sovereignty over the areas where America’s troops are located. Al-Masdar continued:

This means that the U.S. not only is at war against the legitimate government of Syria, but that the U.S. government will also be at war against Russia if Russian forces (which the Syrian government did invite into Syria) defend Syrian forces from attacks in Syria by U.S. forces — forces that are illegally there. These U.S. forces number only 300, of whom 250 were sent to Syria on April 24th to serve as advisors to other illegal military forces in Syria. The vast majority of the illegal military forces in Syria are jihadists who had been hired by the Saudi government and the Qatari government, and supplied with U.S. weapons, to overthrow the Syrian government. Most of the other illegal forces in Syria are Kurdish forces, supported by the U.S. government to break Syria apart so as to create a separate Kurdish state in the majority-Kurdish far north-eastern tip of Syria. The primary U.S. goal in Syria is to overthrow the Syrian government, which is led by the Baath Party, Syria’s secular Party. Many Arabs insist upon Sharia, or Islamic law, but Syria’s Arabs are an exception; the Baath Party is and has always been supported by the majority of the Syrian people, including by most of Syria’s Arabs. Most Syrians are strongly opposed to Sharia law. Syria is the most secular nation in the Middle East. For example, when Western-sponsored polls were taken in Syria, after the start in 2011 of the importation of jihadists into Syria, those polls showed that 55% of Syrians want Bashar al-Assad (the current leader of the Baath Party) to remain as Syria’s President, and “82% agree ‘IS [Islamic State] is US and foreign made group’.” Furthermore, only “22% agree ‘IS is a positive influence’,” and that 22% was the lowest level of support shown by Syrians for any of the presented statements, except for, “21% agree ‘Prefer life now than under Assad’” — meaning that Syrians believe that things were better before the U.S.-sponsored jihadists entered Syria to overthrow Assad. Clearly, when “82% agree ‘IS [Islamic State] is US and foreign made group’,” very few people in Syria support the 300 U.S. forces there. Not only is the U.S. an invader, but it (and especially the forces that the U.S. supports in Syria — most especially the jihadists, who are the vast majority of these forces) made life far worse (and far shorter) for virtually all Syrians. Furthermore, that same poll found: “70% agree ‘Oppose division of country’.” Consequently, the Kurdish separatists are likewise opposed by the vast majority of Syrians. The Syrian government, from now on, is in the uncomfortable position of having invaders on its territory, and of being warned that one of them — the U.S. — will be fully at war against Syria if Syria tries to expel them. Russia too is now under warning from the United States, that, if Russia, an ally of Syria, takes any action to expel or kill any of the U.S. invaders in Syria, then the U.S. will also be at war against Russia. The U.S. government is now also daring the Russian government. Perhaps the U.S.strategy here is to force Russia’s President, Vladimir Putin, either to back down, and abandon its Syrian ally, or else to launch a nuclear strike against the United States. If Putin backs down, that would greatly diminish his support from the Russian people, which is above 80% in all polls, including Western-sponsored ones. Perhaps this is the strategy of U.S. President Barack Obama, to drive Vladimir Putin out of office — something that might occur if the U.S. drives Bashar al-Assad out of office. As Seymour Hersh reported, on 7 January 2016, “the Defense Intelligence Agency (DIA) and the Joint Chiefs of Staff, then [in the summer of 2013] led by General Martin Dempsey, forecast that the fall of the Assad regime would lead to chaos and, potentially, to Syria’s takeover by jihadi extremists, much as was then happening in Libya,” and so Dempsey quit, and Lieutenant General Michael Flynn, director of the DIA between 2012 and 2014, was fired over the matter. “The DIA’s reporting, he [Flynn] said, ‘got enormous pushback’ from the Obama administration. ‘I felt that they did not want to hear the truth.’” Flynn is now a foreign-affairs advisor to the Republican Presidential candidate, Donald Trump, who is being criticized by the Democratic Presidential candidate, for being soft on Russia and insufficiently devoted to the U.S. goal of overthrowing Assad. You decide what happens if Hillary is elected... | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Germans "Lose Faith In Banks", Rush To Buy Safes Posted: 30 Aug 2016 12:38 AM PDT It is no secret that one of the most admirable qualities of the German public - in addition to its striking propensity for thrift in the aftermath of Weimar - is its stoic patience and pragmatism when dealing with adversity. However, over the past month, we grew increasingly confident that said patience would be tested, if only when it comes to matters of monetary trust vis-a-vis the local, neighborhood bank. First it was the news that Raiffeisen Gmund am Tegernsee, a German cooperative savings bank in the Bavarian village of Gmund am Tegernsee, with a population 5,767, finally gave in to the ECB's monetary repression, and announced it'll start charging retail customers to hold their cash. Then, just last week, Deutsche Bank's CEO came about as close to shouting fire in a crowded negative rate theater, when, in a Handelsblatt Op-Ed, he warned of "fatal consequences" for savers in Germany and Europe - to be sure, being the CEO of the world's most systemically risky bank did not help his cause. That was the last straw, and having been patient long enough, the German public has started to move. According to the WSJ, German savers are leaving the "security of savings banks" for what many now consider an even safer place to park their cash: home safes. Indeed, as even the WSJ now admits, for years, "Germans kept socking money away in savings accounts despite plunging interest rates. Savers deemed the accounts secure, and they still offered easy cash access. But recently, many have lost faith." We wondered how many "fatal" warnings from the CEO of DB it would take, before this shift would finally take place. As it turns out, one was enough. To be sure, the Germans are merely catching up to where the Japanese were over half a year ago. As we wrote in February, "look no further than Japan's hardware stores for a worrying new sign that consumers are hoarding cash--the opposite of what the Bank of Japan had hoped when it recently introduced negative interest rates. Signs are emerging of higher demand for safes—a place where the interest rate on cash is always zero, no matter what the central bank does.

Now it's Germany's turn. "It doesn't pay to keep money in the bank, and on top of that you're being taxed on it," said Uwe Wiese, an 82-year-old pensioner who recently bought a home safe to stash roughly €53,000 ($59,344), including part of his company pension that he took as a payout. Interest rates' plunge into negative territory is now accelerating demand for impregnable metal boxes. Burg-Waechter KG, Germany's biggest safe manufacturer, posted a 25% jump in sales of home safes in the first half of this year compared with the year earlier, said sales chief Dietmar Schake, citing "significantly higher demand for safes by private individuals, mainly in Germany." Burg-Waechter KG, Germany's biggest safe manufacturer, posted a 25% jump Rivals Format Tresorbau GmbH and Hartmann Tresore AG also report double-digit-percentage German sales increases. "Safe manufacturers are operating near their limits," said Thies Hartmann, managing director of Hamburger Stahltresor GmbH, a family-owned safe retailer in Hamburg, which he says has grown 25% since 2014. He said deliveries take longer from safe makers, some of which are running three production shifts. Thies Hartmann, managing director of the Hamburger Stahltresor store in Hamburg The biggest irony in all of this, as we first pointed out last October, is the epic mistake that central bankers did by unleashing negative rates: instead of forcing savers to spend, it has - at least in the case of Japan and Germany - forced them to not only pull their cash out of the bank, thereby further slowing the velocity of money, but to save even more, forcing central bankers to come up with even more unprecedented "solutions" to a problem of their own creation. As the WSJ adds, in a country where few people buy stocks, the possibility of having to pay fees on deposits has turned savers' world—and their piggy banks—upside down. "The moment the bank tells me I have to pay interest on my deposit I'll take my €50,000 or whatever it is and put it under my pillow, or buy a safe and stick the money inside," said Dagmar Metzger, a 53-year-old entrepreneur in Munich. Alas, with every passing day, that moment gets ever closer. Meanwhile, for those who can't find or afford a safe, there are other options. Ms. Metzger, a game hunter, said she would also consider squirreling cash away in her gun cabinet, which has solid locks. Paying to save is "preposterous," said Marlene Marek, 58, owner of a Frankfurt bistro. "I would rather withdraw my money and stash it at home, or keep it in a safe-deposit box at a bank." She is not the only one - many Germans have a similar idea, which has led to safes selling out, and creating waiting lists for safe-deposit boxes in some big cities as a growing number of Germans prefer self-sufficiency. "When you put money in a safe-deposit box, everyone notices, and you're paying fees," said Mr. Wiese, the Hamburg retiree, who said his new safe is roughly twice the size of a hotel safe. And while one could blame retail savers for being conspiracy theorist nuts, in Germany it is the very biggest corporations who have been, throughout 2016, rebelling against the ECB's idiotic policies. Indeed, banks and other financial institutions themselves are also keeping more cash. As we reported earlier in the year, reinsurance giant Munich Re AG said earlier this year it would cache over €20 million in cash in a safe, alongside gold bars the company stockpiled two years ago. "We are testing that and are happy that this works without any glitches and at reasonable costs," said Chief Financial Officer Jörg Schneider. The reinsurer said it would consider augmenting its cash stash. Finally, in what may be the pinnacle fo practicality over stupidity, Germans are particularly focused on safes because they prefer cash to plastic. "Only cash is real," goes an old saying. Well, yes, until it is confiscated as sad Harvard economists have been urging in recent months. Unlike their more "hip" Scandinavian peers, roughly 80% of German retail transactions are in cash, almost double the 46% rate of cash use in the U.S., according to a 2014 Bundesbank survey. Germans also keep more cash in their wallets and visit ATMs more often, withdrawing on average $256 at a time, the study found. Americans withdraw $103 on average.

And they are absolutely right; we can only wish more Americans showed the same foresight as the ordinary German. Meanwhile, the WSJ concludes, Ms. Metzger is a member of an activist group demanding the existence of cash be guaranteed in Germany's constitution. "I don't want to become completely transparent," she says."I don't want everyone to know whether I buy chocolate, strawberries or mangoes at the store." Alas, if "erudite" Harvard economists like Larry Summers and, now, David Rogoff get their way, Ms. Metzger's, and everyone else's, worst nightmare will soon come true. Until that moment, however, as a final reminder, in a fractional reserve banking system, only the first ten or so percent of those who "run" to the bank to obtain possession of their physical cash and park it in the safe will succeed. Everyone else, our condolences. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greek 'Thought Police' Prosecute Bishop For (Accurately) Calling 'Refugees', "Illegal Migrants" Posted: 29 Aug 2016 11:00 PM PDT Submitted by Maria Polizoidou via The Gatestone Institute,

In coalmines, from 1911 to 1986, canaries operated as an early warning system for the leakage of hazardous gases. Whenever the birds showed signs of distress, the miners knew trouble was coming. Greece has deep problems. Greece is presently in the "coalmine" of an endless economic and immigration crisis. This month, for the first time, there was a request to activate an anti-racist law, passed in September 2014, against a Greek citizen who also has institutional status. The coalition government of Alexis Tsipras (SYRIZA) and Panos Kammenos (Independent Greeks) asked the district attorney to prosecute the Bishop of Chios Island, Markos Vasilakis, because he dared to say, during a sermon, that the thousands of people who recently arrived from Turkey on the island of Chios are illegal migrants, and not Syrian refugees. Chios, the fifth-largest island of Greece, is only 3.5 nautical miles from Turkey, and therefore offers an opportunity to migrants and refugees to cross from Turkey into the European Union. Chios is also one of a few Greek islands that has received the largest waves of migrants. Its population of 51,320 inhabitants now accommodates, according to the latest official data, 3,078 migrants, with more on the way. It seems the government coalition, through the Secretary of Human Rights, has decided that the solution of Greece's migrant/refugee problem will come if the Bishop of Chios Island is prosecuted for incitement to racial hatred, and if the constitutional right of Greek citizens to freedom of speech is overturned. Secretary of Human Rights Kostas Papaioannou asked the district attorney to prosecute Bishop Markos for these specific charges. Is Bishop Markos Vasilakis a Greek Orthodox fanatic or a neo-Nazi? Did the church close its doors to refugees and migrants? Did the bishop try to turn the population of Chios against anyone? Not at all. Bishop Markos is highly educated, with a PhD in Byzantine Philology from the Philosophical and Theological School of Athens University. Since the beginning of the migrant crisis, according to the residents of Chios, Bishop Markos opened all the island's churches to accommodate the refugees and illegal migrants. Under his command, all the available spaces on the island were given to caring for whoever left his homeland and home. He has fought hard to collect clothing, shoes and food for refugees and illegal migrants. His work speaks for itself. If Bishop Markos were such a horrible person, why did Prime Minister Alexis Tsipras met him in his office in November 2015 to discuss the migrant crisis and never express any dissatisfaction him? What, then, did Bishop Markos do to infuriate the Greek government to such an extent that they turned on him? Bishop Markos spoke the truth. He said that the people arriving in Greece were not refugees but illegal migrants. Was it a lie? According to the Hellenic Coast Guard, for the period of July and August 2016, of the 1,950 people who illegally entered Greece from Turkey, only 500 -- or 25% -- were refugees from Syria; all the others were illegal migrants. The Minister for Immigration Affairs himself, repeatedly stated that 50% to 70% of migratory flows to Greece were illegal migrants and the rest were refugees. The illegal migrants come from 77 different countries.

If it is a "racist crime" for a citizen to express accurately the percentages of refugees and illegal migrants entering the country, what will come next, the Thought Police? The real reason for prosecuting Bishop Markos, it seems, at least according to members of the opposition, is that the government expects that Turkey's migration deal with the EU will collapse, and that if it does, the migrant flows in the coming months will increase dramatically. The government, according to some members in the opposition, has no friendly way to manage illegal migration and therefore prefers to impose restrictions on freedom of speech and prosecute anyone who objects. Tsipras's government is leftist; the ideology and the official policy of the SYRIZA party is that of open borders for illegal migrants who wish to settle in Greece. Church groups in Greece believe that the government is targeting the Church in an attempt to change the country's Christian foundation and lead the society into a non-Christian era. The SYRIZA party was always "Christianophobic." Its members do not even enter Christian churches. When a notable priest is giving to migrants and being so unjustly prosecuted, the Greek Orthodox Church cannot help wondering about the government's real intentions on the issue of migrants and refugees. If Bishop Markos is the canary of freedom of speech, then, as many observers believe, the prosecution of people who have a view on migrant/refugee policy that differs from SYRIZA's will continue. If the government believes that prosecuting whoever objects will scare them into silence, as members of the opposition claim, the government is making a big mistake. The government might scare the Bishop of Chios Island by pressing charges against him and trying to stigmatize him as a racist. The government forced him to publish a press release claiming that for him, all people are created in the image of God and that all he had explained to his congregation was the legal difference between refugees and illegal migrants. But the government will still not scare the angry majority of Greeks. In a country suffering seven years of economic downturn, and where each municipality will have to accommodate 1,000 migrants, whether it wants to or not; in a country that sees on the news migrants fight each other, the natives and the police; in a country that has 61 cases of malaria and 12 municipalities already in quarantine because of the migration problem, according to the Health Ministry, and where gun sales increase day by day -- the last thing we need is to abolish the constitutional rights of citizens. Violence and social unrest will then be the next stage in a drama that will have a bad end. In Greece -- the "coalmine" of the Eurozone -- the canary seems to have died. If this is the beginning of a methodical abolition of constitutional rights such as freedom of speech, Greece could turn into a Turkish style of democracy -- like that of Erdogan, which he seems hell-bent on turning into an Islamic caliphate. What a very sad fate that would be for Greece, the nation which gave birth to democracy.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central Bankers Get Tired of Gold as Falling Exports Reduce Cash Posted: 29 Aug 2016 08:51 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 29 Aug 2016 08:33 PM PDT by Bill Holter, JS Mineset, SGT Report:

The Fed recently did a study concluding that a $4 trillion increase in their balance sheet should be enough to reverse a future recession. I would ask several questions: first, 2008 began as a downturn in real estate in the U.S. and quickly spread to financial asset prices and thus institutional balance sheets …

In no way did it begin as “normal” recessions in the past have. It was not about inventory/sales until well into it. Why has the Fed come out with this study now? And why use average recessions as the potential boogeyman rather than the 2008 episode? I would equate their study to relating the response and protocol to treating a head cold and sore throat versus when the patient is prone to stroke and heart attack. I have thought for quite some time, a good analogy for 2008 and the aftermath was like one giant “refinancing”. Think of it as a “cash out” on a home mortgage where money is taken out against equity yet the monthly payment didn’t go up because your interest rate went down. After closing, you feel pretty good because your payment did not go up and you have cash in hand to help you continue making payments. This is exactly what happened but we are again at a point where the monthly payments are starting to “bite” again. In technical terms, liquidity is again becoming very tight on a systemic basis. So here we are again, in the same situation we had in 2007-2008. Too much debt with stretched valuation levels in equities and real estate …and stupid levels in the credit/bond markets as evidenced by “negative rates”. Central banks are again being forced to look at expanded QE while fiscal stimulus is again being eyed with one caveat …the Fed wants you to believe they are going to raise rates! Global central bankers, stuck at zero, unite in plea for help from governments ………… As Fed Nears Rate Hikes, Policymakers plane for ‘Brave New World’ I ask you this, in a world where economic activity is clearly decelerating …and has more debt to GDP/equity than ever before, how can the Fed raise rates? In the short term, raising rates would strengthen the dollar versus other fiat currencies (and tighten dollar liquidity). Is this what the U.S./world needs? And how exactly will the existing leverage affect the underlying asset pricings? Will this be good for stocks or real estate not to mention the mathematics affecting bonds? The big one (and an entire writing for another day) is the derivatives market. How will these fare? I cannot imagine having a put on a carry trade using dollars, higher rates and a higher dollar is a disaster waiting to happen. In my opinion, we are again at a point in time where “liquidity” is more important than anything else. Whether for an individual, corporation, or state, “liquidity” will soon be ALL IMPORTANT! Just as in 2008-2009, “counter party risk” will take center stage and any hint of the lack of liquidity will attract sharks. What exactly is “liquidity” and why is it important. Briefly, liquidity is the immediate availability of capital to run your business and pay current expenses and interest. I am going to add a twist here because what some to believe to be liquid …may not be at the point in time it is most needed. You see, what if you had a large cash/credit balance with a bank or institution that is forced to close either temporarily or permanently? “Liquid” means it is available to you NO MATTER WHAT happens. Or what if you had some sort of unencumbered bill/note/bond and the credit standing of the issuer came into question? Would this be liquid? If you are bearish on where the world is financially, the above questions should have already entered your mind topped off with the question of “who” is your counterparty? I would suggest the goal right now should be twofold, return OF capital and the ability to “use” it whenever you need to. In other words, “pure liquidity”. If for any reason whatsoever your capital may not be available to you, you do not have “pure liquidity”. Pointing out the obvious, the only “asset” on the planet that is pure liquidity is gold (and silver to a lesser extent). You don’t believe me or want to argue with this? First and most obviously, gold (silver) are no one else’s liability and thus cannot go “bankrupt”. Yes they can and do fluctuate in value versus fiat currencies but in a world where solvency and liquidity has become primary concerns, do you believe gold will become less desirable versus the liabilities of nations? If you still don’t believe me, Alan Greenspan explained the virtues of gold back in 1966 http://www.constitution.org/mon/greenspan_gold.htm . He went several steps further than liquidity and discussed gold as a medium of exchange, gold as money and a return to the gold standard. Never mind the supply and demand imbalances or the fact that gold is counterfeited on a daily basis where the supply gets diluted many times over, gold can ALWAYS be used to settle a transaction. The key word here is “always”. I say this because 24/7, 365 days per year, gold is liquid and thus available to settle any trade …if you are fortunate enough to own it in physical and unencumbered form. Please note the bolded words, as long as you own real gold with no one or entity between you and your gold …you have pure liquidity rivaled by nothing man made. Pure wealth to be sure but more importantly in a world where massive additions of liquidity have not been enough and showing signs of drying up …pure liquidity! Standing watch, Bill Holter | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exposing the ESTABLISHMENT and its AGENDA Posted: 29 Aug 2016 08:15 PM PDT by TC, SGT Report:

Enclosed is a summary of the OUTSTANDING 2+ Hour documentary Shadowring which fully exposes the ESTABLISHMENT and its Globalist Agenda. Once learning the truth – regardless of whether voters love TRUMP or not – they should HATE the ESTABLISHMENT and understand that TRUMP is our only hope!

In my opinion, it should be required viewing to graduate High School. If you agree, I was hoping that you could also make a video that summarized the ESTABLISHMENT and its AGENDA. This is my summary – I actually mailed a version of this to TRUMP and was hoping that you could improve and share it with your subscribers. SUGGESTIONS FOR DONALD TRUMP I have two suggestions that I believe would help TRUMP capture some additional undecided votes.

https://www.youtube.com/watch?v=7LYRUOd_QoM

The ESTABLISHMENT – (Oligarchy) a relatively small group of people that have control over the US government (which includes law enforcement) irrespective of the wishes of the people. The Big BANKS, Military Industrial Complex, Big MED, Big PHARMA, Mainstream Media (MSM), and Multinational companies are all part of TheESTABLISHMENT and control our government. The ESTABLISHMENT is a “REVERSE ROBIN HOOD”- stealing from the poor and giving to the rich! They are responsible for bankrupting the USA ($19T Debt and $103T Unfunded Liabilities) – the US Dollar has lost over 98% of its purchasing power vs. gold since the origination of the FED in 1913 and 97% of its purchasing power vs. gold since closing the Gold window in 1971. They are also responsible for the murders of hundreds of thousands of US soldiers and millions of civilians worldwide. Since the Spanish American War (1898) – the USA has not been involved in any legitimate war where we were attacked unprovoked. (Ex.- Spanish-American War – sinking of the Maine – false flag, WW1- sinking of the Lusitania – instigated false flag, WW2 – Pearl Harbor – instigated false flag, Vietnam War – Gulf of Tonkin – fake false flag, War on Terror 9/11 – false flag, and (forthcoming) WW3 – instigating Russia.) *Let me know if you’d like DOCUMENTATION showing that all of these were “inside jobs” – including 9/11?

Wars = Debt = Death Winners – ESTABLISHMENT BANKS, Military Industrial Complex, and Globalists. Losers – The People.

The ESTABLISHMENT controls BOTH the Democratic and Republican parties.Consequently, the ESTABLISHMENT does not care which party wins as long as it is one of their ESTABLISHMENT “puppets”. Their election campaigns promises may differ butonce in office they will promote the same Establishment Globalist Agenda. Mainstream Media (MSM) – is controlled by the ESTABLISHMENT. Six major corporations control virtually all of MSM – including FOX News (There are a few”truthers” at Fox). MSM are not news organizations. They are propaganda organizations for the Establishment Globalist agenda. The ESTABLISHMENT also controls most of the POLLS! Their agenda is to make it appear that Hillary is way ahead to discourage Trump voters and encourage political donations. The ESTABLISHMENT (GLOBALIST) Agenda is to control the world – by creating a one world government with the ESTABLISHMENT in charge. The Council on Foreign Relations (CFR), Group of 30, Trilateral Commission, and Bilderberg Group are the primary organizations that create Globalist policy and perpetuate the Globalist Agenda via controlling politicians, MSM, academia, and Hollywood.. Many of the top MSM correspondents and many of the upper and lower level Cabinet positions within the US Government belong to the 4900 member Council on Foreign Relations.

SOME STEPS for the ESTABLISHMENT GLOBALISTS to CONTROL the WORLD – these puppets are NOT as stupid as we think – they are evil and have an agenda!

CONNECTING THE DOTS How is it possible for that a Community Organizer or a Criminal could become POTUS? Because they were the “chosen” ESTABLISHMENT puppets! Why is Hillary NOT in jail? Because she is the “chosen” ESTABLISHMENT puppet! Why you think that MSM so biased against TRUMP? MSM are ESTABLISHMENT puppets! Why does MSM perpetuate lies against TRUMP? MSM are ESTABLISHMENT puppets! Why does MSM ignore the Clinton Crimes? MSM are ESTABLISHMENT puppets!

Why do you think the Big Banks were bailed out after they created the 2008 meltdown under BUSH? Because BIG BANKS and BUSH(S) are ESTABLISHMENT PUPPETS! Why were no bankers jailed under OBAMA? Because they are ESTABLISHMENT PUPPETS! Why do you think the USA is continually at war worldwide? For the benefit of the BANKS (Wars = Debt) and Military Industrial Complex. Also, world destruction is a necessity for the future globalization agenda of the ESTABLISHMENT. Many believe that the USA created ISIS by supplying them with weapons – via Benghazi – Did Obama/Hillary hope to “destroy the evidence” for creating ISIS by hanging Christopher Stevens and his staff and protectors out to dry?http://www.trueactivist.com/must-watch-putin-blows-the-whistle-on-who-really-created-isis-and-how-it-continues-to-grow/ . If you don’t believe Putin – listen to Rand Paul https://www.youtube.com/watch?v=BpEoHRdgyRo&feature=em-uploademail Was the purpose of Hillary’s personal email server to hide the fact that Benghazi was a weapons supplying operation for ISIS to murder Gaddafi or was it to hide the criminality of the Clinton Foundation, or both? Why are some prominent and not so prominent Republicans not fully committing to TRUMP ex. Cruz, Gingrich, McCain, Bush(s), Ryan, Romney, Rove, etc.? Because they are (signifying) ESTABLISHMENT PUPPETS! Why are many Billionaires and Corporate Titans ex. Bloomberg, Buffet, Koch(s),Gates, Whitman, Cuban, Cook, etc. not supporting TRUMP? Because they are (signifying) ESTABLISHMENT PUPPETS! Why don’t we win wars? The ESTABLISHMENT GLOBALIST agenda is to perpetuate wars to benefit the BANKS and Military Industrial Complex – ultimately leading to society destruction and an ESTABLISHMENT Globalist controlled world. Does the ESTABLISHMENT have regard for human life? – No, they are evil psychopaths and responsible for millions of unnecessary deaths (murders) worldwide over the last 120 years. They view the masses as “worthless eaters”. Why does the Libertarian Party have an anti-gun VP candidate who was a former Chairman of the CFR? Because the Libertarian Party is an Establishment PUPPET! Why do we make such lousy trade deals? The ESTABLISHMENT GLOBALIST agenda is the destruction of economies- ultimately leading to an ESTABLISHMENTGlobalist world. Why is the Obama/Clinton administration provoking PUTIN and CHINA? TheESTABLISHMENT GLOBALIST agenda is to instigate WW3 – society destruction – ultimately leading to an ESTABLISHMENT Globalist world. Please understand, Hillary Clinton is a puppet of the Rothschild international banking cartel and she literally poses a threat to all of humanity, James Corbett explains: https://www.youtube.com/watch?v=0EGBOMvBrZw Thanks for reading, please spread the truth to everyone you know. MUST WATCH RELATED: Hardcore TRUTH About The Globalist Agenda & Globalization of War — Prof. Michel Chossudovsky

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ARE EMERGING MARKETS ABOUT TO SWITCH US TREASURIES FOR SDR BONDS? Posted: 29 Aug 2016 08:04 PM PDT by JC Collins, Philosophy of Metrics.com:

A second issuance of SDR bonds will take place through the China Development Bank. The purpose of both issuances is multiform.

First, SDR denominated bonds will allow for the diversification of the currency composition of foreign exchange reserves. This will allow the governments of emerging markets, whose central banks have carried the bulk of US Treasury bond debt for decades, to minimize their exposure to the single currency Treasury Bonds and exchange rate pressures. Second, it will provide Chinese investors with an alternative which will slow capital outflows and could even potential reverse and lead to large capital inflows. Most emerging markets suffer higher risk by the large accumulation of US Treasuries. The USD based exchange rate regime which most of these nations follow allows for destructive exchange rate swings when the Federal Reserve decides to raise interest rates. The Chinese monetary authorities have been very vocal over the last few years about the Fed not raising rates. This has provided time for the renminbi to be added to the SDR basket composition and to implement the SDR bond framework which is now being utilized. As official foreign exchange reserves are diversified from US Treasuries to SDR bonds this risk is minimized. This SDR diversification serves the purpose of both China (and other emerging markets) and the United States. The US is in a situation where increasing interest rates will cause large ripples in the international monetary and financial systems. This could potentially even lead to a financial crisis in China. The substitution of Treasuries for SDR bonds will provide the Federal Reserve with just enough wiggle room to move forward on modest interest rate increases. As the transition from US Treasuries to SDR bonds takes place across the emerging world, the pressure on both the US and emerging nations in regards to interest rate increases will decrease. US interest rate increases could leapfrog with foreign exchange reserve diversification. A decrease in demand for US Treasuries, which is already happening, will help push up interest rates at home. This will also align with the interest rate paid on SDR bonds. The Federal Reserve will not be able to keep the interest rate lower if it wishes to keep the dollar relative and compete with the yields provided on SDR bonds. But the increases must align with the larger dynamic of foreign exchange diversification and substitution. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| "There Will Be Blood" - The Whole Game Is About Containing Russia-China Posted: 29 Aug 2016 07:55 PM PDT Authored by Pepe Escobar, originally posted op-ed via SputnikNews.com, The next BRICS summit, in Goa, is less than two months away. Compared to only two years ago, the geopolitical tectonic plates have moved with astonishing speed. Most BRICS nations are mired in deep crisis; Brazil’s endless political/economic/institutional debacle may yield the Kafkaesque impeachment of President Dilma Rousseff. BRICS is in a coma. What’s surviving is RC: the Russia/China strategic partnership. Yet even the partnership seems to be in trouble – with Russia still attacked by myriad metastases of Hybrid War. The – Exceptionalist – Hegemon remains powerful, and the opposition is dazed and confused. Or is it? Slowly but surely – see for instance the possibility of an ATM (Ankara-Tehran-Moscow) coalition in the making – global power continues to insist on shifting East. That goes beyond Russia’s pivoting to Asia; Germany’s industrialists are just waiting for the right political conjunction, before the end of the decade, to also pivot to Asia, conforming a BMB (Berlin-Moscow-Beijing) coalition. Germany already rules over Europe. The only way for a global trade power to solidify its reach is to go East. NATO member Germany, with a GDP that outstrips the UK, Canada, Australia and New Zealand, is not even allowed to share information with the “Five Eyes” secret cabal. President Putin, years ago, was keen on a Lisbon-to-Vladivostok emporium. He may eventually be rewarded – delayed gratification? – by BMB, a trade/economic union that, combined with the Chinese-driven One Belt, One Road (OBOR), will eventually dwarf and effectively replace the dwindling post-WWII Anglo-Saxon crafted/controlled international order. This inexorable movement East underscores all the interconnections – and evolving connectivity – related to the New Silk Roads, the Shanghai Cooperation Organization (SCO), the BRICS’s New Development Bank (NDB), the Asian Infrastructure Investment Bank (AIIB), the Eurasia Economic Union (EEU). The crux of RC, the Russia-China strategic partnership, is to make the multipolar, post-Atlantic world happen. Or, updating Ezra Pound, to Make It New. Containing RCRussia’s pivot to Asia is of course only part of the story. The core of Russia’s industries, infrastructure, population is in the west of the country, closer to Europe. BMB would allow a double pivot – simultaneously to Europe and Asia; or Russia exploiting to the max its Eurasian character. Not accidently this is absolute anathema for Washington. Thus the predictable, ongoing no holds barred exceptionalist strategy of preventing by all means necessary closer Russia-Germany cooperation. In parallel, pivoting to Asia is also essential because that’s where the overwhelming majority of Russia’s future customers – energy and otherwise – are located. It will be a long, winding process to educate Russian public opinion about the incalculable value for the nation of Siberia and the Russian Far East. Yet that has already started. And it will be in full fruition by the middle of the next decade, when all the interpolated New Silk Roads will be online. “Containment” of RC will continue to be the name of the exceptionalist game – whatever happens on November 8. As far as the industrial-military-security-surveillance-corporate media complex is concerned, there will be no reset. Proxies will be used – from failed state Ukraine to Japan in the East China Sea, as well as any volunteering Southeast Asian faction in the South China Sea. Still the Hegemon will be in trouble to contain both sides of RC simultaneously. NATO does not help; its trade arm, TPP, may even collapse in the high seas before arriving on shore. No TPP – a certainty in case Donald Trump is elected in November – means the end of US economic hegemony over Asia. Hillary Clinton knows it; and it’s no accident President Obama is desperate to have TPP approved during a short window of opportunity, the lame-duck session of Congress from November 9 to January 3. Against China, the Hegemon alliance in fact hinges on Australia, India and Japan. Forget about instrumentalizing BRICS member India – which will never fall into the trap of a war against China (not to mention Russia, with which India traditionally enjoys very good relations.) Japan’s imperial instincts were reawakened by Shinzo Abe. Yet hopeless economic stagnation persists. Moreover, Tokyo has been prohibited by the US Treasury Dept. to continue unleashing quantitative easing. Moscow sees as a long-term objective to progressively draw Japan away from the US orbit and into Eurasia integration. Dr. Zbig does Desolation RowThe Pentagon is terrified that RC is now a military partnership as well. Compared to Russia’s superior high-tech weaponry, NATO is a kindergarten mess; not to mention that soon Russian territory will be inviolable to any Star Wars-derived scheme. China will soon have all the submarines and “carrier-killer” missiles necessary to make life for the US Navy hell in case the Pentagon harbors funny ideas. And then there are the regional details – from Russia’s permanent air base in Syria to military cooperation with Iran and, eventually, disgruntled NATO member Turkey. No wonder such exceptionalist luminary ideologues as Dr. Zbig “Grand Chessboard” Brzezinski – foreign policy mentor to President Obama – are supremely dejected. When Brzezinski looks at progressive Eurasia integration, he simply cannot fail to detect how those “three grand imperatives of imperial geostrategy” he outlined in The Grand Chessboard are simply dissolving; “to prevent collusion and maintain security dependence among the vassals, to keep tributaries pliant and protected, and to keep the barbarians from coming together.” Those GCC vassals – starting with the House of Saud – are now terrified about their own security; same with the hysteric Baltics. Tributaries are not pliant anymore – and that includes an array of Europeans. The “barbarians” coming together are in fact old civilizations – China, Persia, Russia – fed up with upstart-controlled unipolarity. Unsurprisingly, to “contain” RC, defined as “potentially threatening” (the Pentagon considers the threats are existential) Brzezinski suggests – what else – Divide and Rule; as in “containing the least predictable but potentially the most likely to overreach.” Still he doesn’t know which is which; “Currently, the more likely to overreach is Russia, but in the longer run it could be China.” Hillary “Queen of War” Clinton of course does not subscribe to Brzezinski’s “could be” school. After all she’s the official, Robert Kagan-endorsed, neocon presidential candidate. She’s more in tune with this sort of wacky “analysis”. So one should definitely expect Hillary’s “project” to be all-out hegemony expansion all across Eurasia. Syria and Iran will be targets. Even another war on the Korean Peninsula could be on the cards. But against North Korea, a nuclear power? Exceptionalistan only attacks those who can’t defend themselves. Besides, RC could easily prevent war by offering some strategic carrots to the Kim family. In many aspects, not much has changed from 24 years ago when, only three months after the dissolution of the USSR, the Pentagon’s Defense Planning Guidance proclaimed: “Our first objective is to prevent the reemergence of a new rival…This requires that we endeavor to prevent any hostile power from dominating a region whose resources would, under consolidated control, be sufficient to generate global power. These regions include Western Europe, East Asia, the territory of the former Soviet Union and southwest Asia.” Talk about a prescient road map of what’s happening right now; the “rival”, “hostile” power is actually two powers involved in a strategic partnership: RC. Compounding this Pentagon nightmare, the endgame keeps drawing near; the next manifestations and reverberations of the never-ending 2008 financial crisis may eventually torpedo the fundamentals of the global “order” – as in the petrodollar racket/tributary scam. There will be blood. Hillary Clinton smells it already – from Syria to Iran to the South China Sea. The question is whether she – and virtually the whole Beltway establishment behind her – will be mad enough to provoke RC and buy a one-way ticket to post-MAD (Mutual Assured Destruction) territory. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Most Important Thing to Stock for WROL or for the Collapse Posted: 29 Aug 2016 06:20 PM PDT from SouthernPrepper1: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yellen Talks Up the Economy at Jackson Hole While US Real-Estate Market Cracks Posted: 29 Aug 2016 06:00 PM PDT from The Daily Bell:

Why buy gold? The economic numbers are looking better and fedgov never lies, right? However, there is this from ZeroHedge:

What ZeroHedge reports is that mom and pop auction buyers were taking the place of institutional investors. Also, retail prices for home goods and furniture were imploding. Finally, there's a lot less house-buying traffic. Traditionally, housing prices are among the first to suffer in an emergent downturn. And in this case, it's not just the ordinary housing market. The luxury market has dropped precipitously. Sales of luxury houses and units in the Hamptons have been halved and prices of what's selling have been dramatically chopped. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 29 Aug 2016 06:00 PM PDT ShtfPlan | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1322.90 Up $1.40 or 0.11% Posted: 29 Aug 2016 05:32 PM PDT

Franklin Sanders Daily commentary is now only available via email. FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||

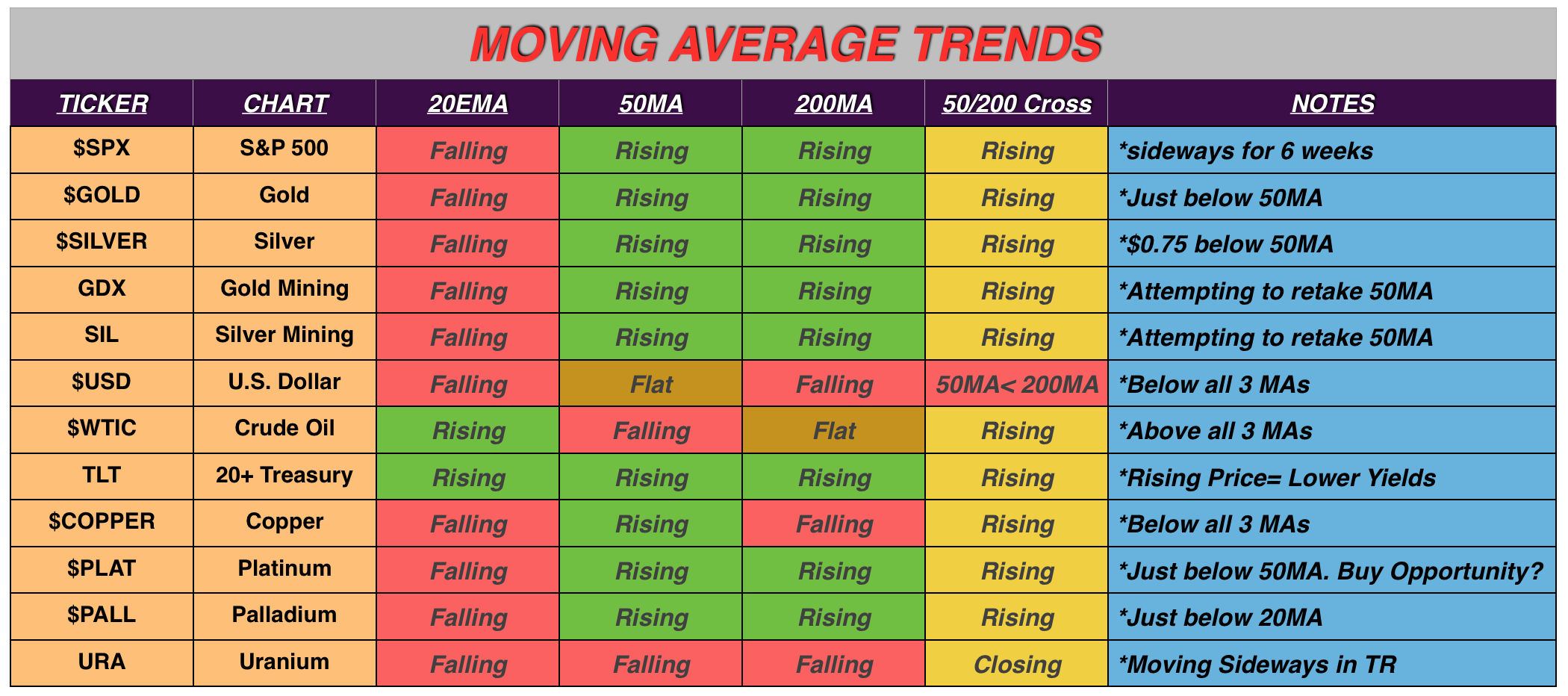

| Weekly Metals Wrap: Buying Opportunity Or Bear Market? Posted: 29 Aug 2016 05:20 PM PDT Welcome to Follow the Money's Weekly Metals Report for the week of August 28! by Stephen Penny, FTM Daily:

That said, the point of this weekly report is not to rehash all of the blatant corruption in the financial system, but rather to analyze and interpret the data and trends to better identify entry points for acquiring physical metal, become more profitable traders, and to plan wisely for the unwinding of this debt-based monetary system. While the corruption is loathsome, the objective here is to properly analyze the data and respond accordingly. So, with the short-term trend back to down, is it time to lock-in recent profits or are we being presented with an opportunity? More on that in the charts below. It is my hope that this report provides value for both the "stacker" attempting to hedge against the prevalent lunacy of central planners as well as for those desiring to trade profitably. It's frequently said that "attempting to trade a manipulated market is a fools errand." While that may be true for some, applying wisdom, proper discipline, and prudent risk management combined with a proven system and guidance from a successful veteran can make trading a lucrative additional income source for many. As usual, there's much occurring behind the scenes not being reported by the mockingbird media that has important implications for everyday people. Metals Related News and TrendsBelow is a brief synopsis of several stories that highlight and expand upon some of the trends being tracked at Follow the Money.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Banks Are Preparing For A Nuclear Financial Event Posted: 29 Aug 2016 04:49 PM PDT Australia's private homes sales decline by 9.7%. 10,000 retail employees might lose their jobs. Spending declines as the collapse take hold. Dallas Fed declines which is flashing red warning lights that we are now entering into a deep recession. US Government/central bank pushing for a ... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hugo Salinas Price: The night that is upon us and the dawn of a new era Posted: 29 Aug 2016 04:00 PM PDT 7p ET Monday, August 29, 2016 Dear Friend of GATA and Gold: In an address to the Association of Mining Engineers meeting last week in Durango, Mexico, Hugo Salinas Price, president of the Mexican Civic Association for Silver, reflected on the possibility of the return of a gold standard as the mechanism of liberation of the world from U.S. dollar imperialism. Salinas Price's address is titled "The Night That Is upon Us and the Dawn of a New Era" and it's posted at the association's Internet site here: http://plata.com.mx/Mplata/articulos/articlesFilt.asp?fiidarticulo=293 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 29 Aug 2016 03:40 PM PDT by Jeff Thomas, International Man:

Of course, Darwin's premise was that, through natural selection, those who are born weaker, deformed, or otherwise less capable of survival are less likely to live long enough to procreate, thus assuring an ever-stronger, more adaptable species. This same premise can be applied to banks that follow unsound business practices. They're more likely to go under as a result. This invariably causes suffering for those individuals who chose to do business with the irresponsible bank, but it can also be argued that those who believe empty promises by an irresponsible bank need to learn the lesson of economic prudence. Winnowing out those banks and their clients results in the responsible banks being stronger. Of course, when we declare any bank to be "too big to fail," we assure that the bank in question (and other banks) will behave irresponsibly, as they are assured that they will be bailed out by the taxpayer. And the premise applies also to governments. Any government that behaves irresponsibly (promising entitlements to the populace, waging war and increasing the size of the government itself, without any plan as to how it will all be paid for) can be expected to exit the gene pool of nations. The problem is that, unlike the personal Darwin Awards, in which the imbecile in question is likely to meet his end soon after his error, nations tend to suffer for an extended period from poor economic and militaristic steps taken by governments before they collapse. Worse, they take their people down with them when they go. As an example, in the twentieth century, the UK poured money into two world wars, ultimately impoverishing the country and ending their dominance as the world's foremost empire. The UK still limps along as a nation, but is greatly diminished from what it was in the nineteenth century. Across the pond in the U.S., the Federal Reserve was created in 1913, in part, to rob the American people, through regular inflation over an extended period of time. It worked well. Not understanding what inflation means, the American people have lost over 97% of the value of their dollar over the last one hundred years. At around the same time, the U.S. instituted income tax. It started out small (as income taxes always do), then, like Topsy, it just grew. As a result, people who receive lower wages in a no-tax jurisdiction are likely to have a far better standard of living than those in the U.S. (and other countries that have income tax). And that's not to say that the UK and U.S. are unique. Quite the opposite. In fact, it's the norm for any country's politicians to make promises of largesse to their people just prior to an election. And with each election, the promises need to become larger, to inspire the people to vote for the promisers. Along the way, politicians use warfare as a tool to both distract the voters from political misdeeds and to convince them to give up their rights in times of war. Today, the concept of perpetual war allows a more frequent removal of rights. Each of the above works to the advantage of the political class (regardless of whether they claim to be Tory or Labour, Democrat or Republican.) It does however mean that, at some point, economic, social and political collapse will take place when the abnormalities become so excessive that the system can no longer bear their weight. We're passing through an unprecedented period in history, in which quite a few of those nations that were once the most prosperous; the most free; the most forward-thinking, are all headed downward at the same time, and for the same reasons. Hence, we shall in the near future be observing the removal from the gene pool of nations many of the most powerful (and formerly most desirable) countries. It should be stressed that this does not necessarily mean that these countries will come to an end. Their geography will remain, but they may be crisscrossed with new boundary lines, should any of them be cut up. For others, it will mean retaining the name of the country, but they will be "under new management." However, existence within these geographical locations will be changed dramatically. Once a country collapses economically/socially/politically, it's likely to take a long time to recover. That means that those who are getting by in those jurisdictions (or may even be doing well) may find their well-being curtailed – possibly dramatically. Japan is overdue for a Darwin Award, as are the countries of the EU. They represent a buffer for countries such as the U.S. and Canada. Once the first dominoes topple, the others will soon fall. We're taught to believe that we're married to the country of our birth and would be "deserters" if we were to leave. But, if our country of birth doesn't represent how we wish to live, we're living in the wrong neighbourhood. Most people understand that, if they don't like their neighbourhood, they'd be stupid not to leave for a better neighbourhood. But what if that "neighbourhood" is the country of your birth? Is the concept not the same? If someone we know foolishly tempts fate by putting his head in a crocodile's mouth, very few of us would follow his lead. Yet, people in their millions have, throughout history, watched their countries reach the point of self-destruction and have simply gone along – accepting their fate as the failing country carries them over the cliff. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fed preparing to monetize 'everything,' Turk tells KWN Posted: 29 Aug 2016 03:28 PM PDT 6:25p ET Monday, August 29, 2016 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk, interviewed by King World News, says the Federal Reserve is preparing to monetize "everything" and he sees signs of hyperinflation in certain divergences in stock market sector prices. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/alert-james-turk-issues-dire-warning-as-fed-to-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mexican Cartels Moving Terrorists Across Southern U.S. Border Posted: 29 Aug 2016 02:58 PM PDT According to Judicial Watch, for some time Mexican drug cartels have been helping Islamic terrorists now living in Mexico to cross the U.S. border in order to explore possible areas of attack in the United States. The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary Clinton, ISIS & The Never-Ending War Posted: 29 Aug 2016 02:11 PM PDT Scott Bennett with Joyce Riley in The Power Hour, August 29, 2016. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - What Hump? Posted: 29 Aug 2016 01:30 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Power of Price Spikes On Intraday Charts Posted: 29 Aug 2016 11:31 AM PDT Last week ended on a very positive note for those who follow and trade filtered price spikes. What is a filtered price spike? In short, I scan pre-market, and post-market trading hours’ price charts of SPY, QQQ, IWM, GLD, and GDX for a very special odd tick in the market which creates a spike on the chart. These spikes could be to the upside or downside, does not matter. What they tell me is the direction which the market (market makers) are going to try and move the market in then next 48 hours. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Right Lessons from Obamacare's Meltdown Posted: 29 Aug 2016 10:55 AM PDT The decision of several major insurance companies to cut their losses and withdraw from the Obamacare exchanges, combined with the failure of 70 percent of Obamacare's health insurance "co-ops," will leave one in six Obamacare enrollees with only one health insurance option. If Obamacare continues on its current track, most of America may resemble Pinal County, Arizona, where no one can obtain private health insurance. Those lucky enough to obtain insurance will face ever-increasing premiums and a declining choice of providers. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Canada Housing Market in Extreme Bubble Territory - Here’s How to Profit Posted: 29 Aug 2016 05:18 AM PDT There’s trouble brewing in the Great White North. Jared Dillian, former Lehman Brothers trader and noted financial writer, says that low oil prices have hurt the Canadian economy and the real estate market is near the peak of a massive bubble. In a video interview with Mauldin Economics, Dillian notes he shorted the Canadian dollar almost three years ago, and has profited a great deal since then. He also says the structure of the Canadian mortgage market means that when the bubble bursts, it will look quite different than the sharp and sudden 2008 crisis in the US. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Late-August Calm a Breeding Ground for Bullion Bank Shenanigans Posted: 29 Aug 2016 01:00 AM PDT Precious metals specialist discusses the recent correction in the gold market and the moves by bullion banks behind them. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 28 Aug 2016 05:37 PM PDT Odds of rate hike go up after Yellen speech. US Q2 GDP lowered, expected to rise in Q3. World trade continues to contract. Gold and US stocks fall post-Yellen. Negative interest rates getting a lot of attention, mostly critical. Europe doesn’t seem fixable. Trump hires new people, keeps falling in polls. Clinton emails remain major […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Correction in Gold and Silver Underway Posted: 27 Aug 2016 01:00 AM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The 2008 Great Financial Crisis came about because we began to hit “debt saturation” levels. The crisis was one of solvency but was attended to with added liquidity. Sovereign treasuries still had the ability to add debt to their balance sheets which was done in unprecedented amounts. Now, we are again bumping up against debt saturation levels as sovereign treasuries by and large have little room left to add more debt in efforts to reflate. The root problem of solvency was never addresses, only postponed to another day. That “day” seems to be in sight.

The 2008 Great Financial Crisis came about because we began to hit “debt saturation” levels. The crisis was one of solvency but was attended to with added liquidity. Sovereign treasuries still had the ability to add debt to their balance sheets which was done in unprecedented amounts. Now, we are again bumping up against debt saturation levels as sovereign treasuries by and large have little room left to add more debt in efforts to reflate. The root problem of solvency was never addresses, only postponed to another day. That “day” seems to be in sight. In my past life I was a successful insurance broker and learned that “people tend to buy what they understand”.

In my past life I was a successful insurance broker and learned that “people tend to buy what they understand”. The first issuance of SDR denominated bonds in the Chinese market is being implemented by the World Bank. Let that sink in for a moment. The World Bank, the great bastion of the western banking elite, will be providing SDR bonds specifically for the Chinese market. This is a major defeat for all of those who repeatedly promoted the idea that wealthy interests within China were attempting to overthrow the western banking structure or implement a competing system.

The first issuance of SDR denominated bonds in the Chinese market is being implemented by the World Bank. Let that sink in for a moment. The World Bank, the great bastion of the western banking elite, will be providing SDR bonds specifically for the Chinese market. This is a major defeat for all of those who repeatedly promoted the idea that wealthy interests within China were attempting to overthrow the western banking structure or implement a competing system.

Gold hits near 5-week low after Fed strikes hawkish note … Gold slid to a near five-week low on Monday after comments from top Federal Reserve officials fuelled speculation that U.S. interest rates would rise sooner rather than later, weighing on the dollar. Speaking at a meeting of leading central bankers in Jackson Hole, Wyoming, Fed chair Janet Yellen said on Friday that an improvement in the economy and the labour market in recent months had boosted the case for hiking rates. -CNBC

Gold hits near 5-week low after Fed strikes hawkish note … Gold slid to a near five-week low on Monday after comments from top Federal Reserve officials fuelled speculation that U.S. interest rates would rise sooner rather than later, weighing on the dollar. Speaking at a meeting of leading central bankers in Jackson Hole, Wyoming, Fed chair Janet Yellen said on Friday that an improvement in the economy and the labour market in recent months had boosted the case for hiking rates. -CNBC It didn't take long for the potential selloff discussed last week to materialize with silver breaking down from its 8-week trading range and subsequently bouncingprecisely off of the $18.50 level. Gold was also down on the week, but remained within the confines of its $1308-$1375 two-month trading range. There were several instances of large sellers dumping huge amounts of futures contracts to get the ball rolling to the downside. Normal profit-taking is to be expected, but logic dictates that a "for profit" seller would not simply

It didn't take long for the potential selloff discussed last week to materialize with silver breaking down from its 8-week trading range and subsequently bouncingprecisely off of the $18.50 level. Gold was also down on the week, but remained within the confines of its $1308-$1375 two-month trading range. There were several instances of large sellers dumping huge amounts of futures contracts to get the ball rolling to the downside. Normal profit-taking is to be expected, but logic dictates that a "for profit" seller would not simply

The fellow in the photo above is taking a bit of a risk. If all does not go well for him, he may become a candidate for the annual Darwin Awards – an award given to those who have inadvertently taken themselves out of the gene pool.

The fellow in the photo above is taking a bit of a risk. If all does not go well for him, he may become a candidate for the annual Darwin Awards – an award given to those who have inadvertently taken themselves out of the gene pool.

No comments:

Post a Comment